Form 424B2 CREDIT SUISSE AG

The information in this preliminary

pricing supplement is not complete and may be changed. This preliminary pricing supplement is not an offer to sell these securities and

it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion dated May 27, 2022.

| Preliminary Pricing Supplement No. IR-148 To Product Supplement No. IR-I dated November 10, 2020 Prospectus Supplement dated June 18, 2020 and Prospectus dated June 18, 2020 |

Filed Pursuant to Rule 424(b)(2) Registration Statement No. 333-238458-02 May 27, 2022 |

|

Structured |

Credit Suisse Floating Rate Notes due June 3, 2025 Linked to the Performance of Compounded Daily SOFR |

| · | At maturity, you will receive a cash payment of $1,000 for each $1,000 principal amount of notes that you hold, plus accrued but unpaid interest payable on the Maturity Date. Any payment on the notes is subject to our ability to pay our obligations as they become due. |

| · | We will pay interest quarterly in arrears at a variable rate per annum equal to Compounded Daily SOFR, as described under “Key Terms” herein, subject to the Minimum Interest Rate of 3.00% per annum. |

| · | Senior unsecured obligations of Credit Suisse maturing June 3, 2025. |

| · | Minimum purchase of $1,000. Minimum denominations of $1,000 and integral multiples of $1,000 in excess thereof. |

| · | The notes are expected to price on or about May 31, 2022 (the “Pricing Date”) and the notes are expected to settle on or about June 3, 2022 (the “Settlement Date”). Delivery of the notes in book-entry form only will be made through The Depository Trust Company. |

| · | The notes will not be listed on any exchange. |

Investing in the notes involves a number of risks. See “Selected Risk Considerations” beginning on page 2 of this pricing supplement, “Risk Factors” beginning on page PS-3 of the accompanying product supplement and “Risk Factors” beginning on page S-1 of the prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the notes or passed upon the accuracy or the adequacy of this pricing supplement or the accompanying product supplement, the prospectus supplement and the prospectus. Any representation to the contrary is a criminal offense.

| Price to Public(1) | Underwriting Discounts and Commissions(2) | Proceeds to Issuer | |

| Per security | $1,000 | $ | $ |

| Total | $ | $ | $ |

(1) Certain fiduciary accounts may pay a purchase price of $990 per note, and the placement agents with respect to sales made to such accounts will forgo any discounts and commissions.

(2) J.P. Morgan Securities LLC, which we refer to as JPMS LLC, and JPMorgan Chase Bank, N.A. will act as placement agents for the notes. The placement agents will forgo discounts and commissions for sales to fiduciary accounts. The total discounts and commissions represent the amount that the placement agents receive from sales to accounts other than such fiduciary accounts. The placement agents will receive discounts and commissions from Credit Suisse or one of our affiliates that will not exceed $10 per $1,000 principal amount of notes. For more information, see “Supplemental Plan of Distribution” in this pricing supplement.

The notes are not deposit liabilities and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency of the United States, Switzerland or any other jurisdiction.

J.P. Morgan

Placement Agent

May , 2022

Key Terms

| Issuer: | Credit Suisse AG (“Credit Suisse”), acting through its London Branch |

| Payment at Maturity: | At maturity, you will receive a cash payment of $1,000 for each $1,000 principal amount of notes that you hold, plus accrued but unpaid interest payable on the Maturity Date. Any payment on the notes is subject to our ability to pay our obligations as they become due. |

| Interest Rate: | The notes will bear interest at a variable rate per annum equal to the Reference Rate applicable to such Interest Period, subject to the Minimum Interest Rate. |

| Reference Rate: | For each Interest Period, the Reference Rate will be Compounded Daily SOFR as of the Interest Determination Date relating to such Interest Period, determined by the calculation agent as set forth below. |

| Compounded Daily SOFR: |

With respect to any Interest Period and the related Interest Determination Date, the rate of return of a daily compounded interest investment (with the SOFR Reference Rate as the reference rate for the calculation of interest) as calculated by the calculation agent at 5:00 p.m., New York City time (the “Relevant Time”) on such Interest Determination Date in accordance with the following formula (and the resulting percentage will be rounded, if necessary, to the nearest one hundred-thousandth of a percentage point, 0.000005 being rounded upwards):

|

|

where:

“d” means the number of calendar days in the relevant Observation Period.

“do” means for any Observation Period, the number of U.S. Government Securities Business Days in the relevant Observation Period.

“i” is a series of whole numbers from one to do, each representing the relevant U.S. Government Securities Business Days in chronological order from (and including) the first U.S. Government Securities Business Day in the relevant Observation Period.

“ni” means for any U.S. Government Securities Business Day “i” in the relevant Observation Period, the number of calendar days from (and including) such U.S. Government Securities Business Day “i” up to, but excluding, the following U.S. Government Securities Business Day (“i+1”).

“Observation Period” means for any Interest Period, the period from, and including, the date falling five U.S. Government Securities Business Days prior to the first date in such Interest Period to, but excluding, the date falling five U.S. Government Securities Business Days prior to the Interest Payment Date for such Interest Period.

“SOFRi” means for any U.S. Government Securities Business Day “i” in the relevant Observation Period, SOFR with respect to that day “i”.

“U.S. Government Securities Business Day” means any day, except for a Saturday, Sunday or a day on which the Securities Industry and Financial Markets Association or any successor organization recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in U.S. government securities. | |

| For more information, see “Additional Information about the SOFR Reference Rate” in this pricing supplement. |

| Interest Periods: |

Each quarterly interest period for the notes will begin on and include each Interest Payment Date and end on but exclude the next succeeding Interest Payment Date, provided that the initial Interest Period will begin on and include the Settlement Date and end on but exclude the first Interest Payment Date.

For the avoidance of doubt, if an Interest Period is adjusted due to the adjustment of an Interest Payment Date as described below, the corresponding Observation Period will be determined based on such Interest Period, as adjusted. |

| Interest Payment Dates: |

Quarterly on the 3rd day of each March, June, September and December, beginning on September 3, 2022; provided that if any such day (other than the Maturity Date) is not a Business Day, that interest payment will be payable on the first following Business Day, and interest will accrue, and be payable with respect to such payment for the period from the originally scheduled Interest Payment Date to such following Business Day, except that if such following Business Day falls in the next calendar month, the Interest Payment Date will be the immediately preceding Business Day, and interest will accrue to, and be payable on, such preceding Business Day.

Interest will be payable to the holder of record at the close of business on the Business Day immediately preceding the applicable Interest Payment Date, provided that the interest payment payable on the Maturity Date will be payable to the person to whom the Payment at Maturity is payable. |

| Interest Determination Dates: | For each Interest Period, the fifth U.S. Government Securities Business Day prior to the Interest Payment Date on which the relevant Interest Period ends. |

| Day Count Convention: | Interest on the notes will be calculated on the basis of the actual number of days in each Interest Period and a 360-day year. |

| Business Day: | Any day that is not a Saturday or Sunday and that is not a day on which banking institutions are generally authorized or obligated by law, regulation or executive order to close in The City of New York. |

| Calculation Agent: | Credit Suisse International |

| Minimum Interest Rate: | 3.00% per annum |

| Maturity Date: | June 3, 2025. If the scheduled Maturity Date is not a Business Day, the required payment of interest or principal shall be made on the next succeeding Business Day with the same force and effect as if made on the date such payment was due, and interest shall not accrue and be payable with respect to such payment for the period from and after the Maturity Date to the date of such payment on the next succeeding Business Day. |

| Events of Default and Acceleration: |

In case an event of default (as defined in the accompanying prospectus) with respect to any notes shall have occurred and be continuing, the amount declared due and payable upon any acceleration of the notes (in accordance with the acceleration provisions set forth in the accompanying prospectus) shall be an amount in cash equal to the stated principal amount plus accrued but unpaid interest.

With respect to these notes, the first bullet of the first sentence of “Description of Debt Securities— Events of Default” in the accompanying prospectus is amended to read in its entirety as follows:

· a default in payment of the principal or any premium on any debt security of that series when due, and such default continues for 30 days; |

| CUSIP: | 22553PZF9 |

Additional Terms Specific to the Notes

You should read this pricing supplement together with the product supplement dated November 10, 2020, the prospectus supplement dated June 18, 2020 and the prospectus dated June 18, 2020, relating to our Medium-Term Notes of which these notes are a part. You may access these documents on the SEC website at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

| · | Product Supplement No. IR-I dated November 10, 2020: |

https://www.sec.gov/Archives/edgar/data/1053092/000095010320021949/dp139998_424b2-iri.htm

| · | Prospectus Supplement and Prospectus dated June 18, 2020: |

https://www.sec.gov/Archives/edgar/data/1053092/000110465920074474/tm2019510-8_424b2.htm

In the event the terms of the notes described in this pricing supplement differ from, or are inconsistent with, the terms described in the product supplement, the prospectus supplement or prospectus, the terms described in this pricing supplement will control.

Our Central Index Key, or CIK, on the SEC website is 1053092. As used in this pricing supplement, “we,” “us,” or “our” refers to Credit Suisse.

This pricing supplement, together with the documents listed above, contains the terms of the notes and supersedes all other prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, fact sheets, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of ours. We may, without the consent of the registered holder of the notes and the owner of any beneficial interest in the notes, amend the notes to conform to its terms as set forth in this pricing supplement and the documents listed above, and the trustee is authorized to enter into any such amendment without any such consent. You should carefully consider, among other things, the matters set forth in “Selected Risk Considerations” in this pricing supplement and “Risk Factors” in the product supplement, “Foreign Currency Risks” in the accompanying prospectus, and any risk factors we describe in the combined Annual Report on Form 20-F of Credit Suisse Group AG and us incorporated by reference therein, and any additional risk factors we describe in future filings we make with the SEC under the Securities Exchange Act of 1934, as amended, as the notes involve risks not associated with conventional debt securities. You should consult your investment, legal, tax, accounting and other advisors before deciding to invest in the notes.

You may revoke your offer to purchase the notes at any time prior to the time at which we accept such offer on the date the notes are priced. We reserve the right to change the terms of, or reject any offer to purchase the notes prior to their issuance. In the event of any changes to the terms of the notes, we will notify you and you will be asked to accept such changes in connection with your purchase. You may also choose to reject such changes in which case we may reject your offer to purchase.

1

Selected Risk Considerations

An investment in the notes involves material risks. These risks are explained in more detail in the “Risk Factors” section of the accompanying product supplement.

Risks Relating to the Notes Generally

| · | THE NOTES WILL PAY INTEREST AT A VARIABLE RATE WHICH MAY BE NO GREATER THAN THE MINIMUM INTEREST RATE — The amount of interest payments you receive will depend on the Reference Rate, subject to the Minimum Interest Rate. Accordingly, there can be no assurance that you will receive an interest payment on any Interest Payment Date at a per annum rate greater than the Minimum Interest Rate. Thus, the notes are not a suitable investment for investors who require regular fixed income payments at a rate greater than the Minimum Interest Rate, since the interest payments are variable. Any payment on the notes is subject to our ability to pay our obligations as they become due. |

Furthermore, regardless of the amount of any payment you receive on the notes you may nevertheless suffer a loss on your investment in the notes, in real value terms. This is because inflation may cause the real value of any payment you receive on the notes to be less at maturity than it is at the time you invest, and because an investment in the notes represents a forgone opportunity to invest in an alternative asset that generates a higher real return. You should carefully consider whether an investment that may provide a return that is lower than the return on alternative investments is appropriate for you.

Risks Relating to the Reference Rate

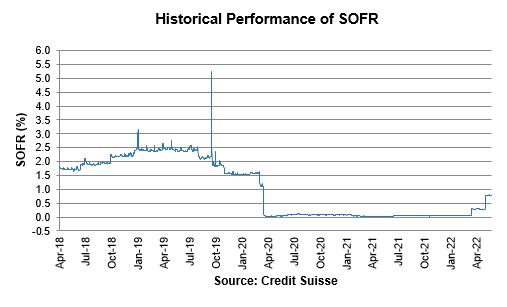

| · | THE NOTES WILL HAVE AN INTEREST RATE DETERMINED BY REFERENCE TO THE SECURED OVERNIGHT FINANCING RATE, A RELATIVELY NEW MARKET INDEX WITH LIMITED HISTORY, AND FUTURE PERFORMANCE CANNOT BE PREDICTED BASED ON HISTORICAL PERFORMANCE — The interest rate for the notes will be determined by reference to the Secured Overnight Financing Rate (“SOFR”). The publication of SOFR began in April 2018, and, therefore, it has a limited history. The future performance of SOFR cannot be predicted based on the limited historical performance. The level of SOFR during the term of the notes may bear little or no relation to the historical actual or historical indicative data. Prior observed patterns, if any, in the behavior of market variables and their relation to SOFR, such as correlations, may change in the future. While some pre-publication historical SOFR data has been released by The Federal Reserve Bank of New York (“FRBNY”), production of such historical indicative SOFR data inherently involves assumptions, estimates and approximations. |

No future performance of SOFR may be inferred from any of the historical actual or historical indicative SOFR data. Hypothetical or historical performance data are not indicative of, and have no bearing on, the potential performance of SOFR. Changes in the levels of SOFR will affect the return on the notes and the trading price of the notes, but it is impossible to predict whether such levels will rise or fall. There can be no assurance that SOFR will be positive.

| · | SOFR MAY BE VOLATILE AND MAY BE MORE VOLATILE THAN OTHER BENCHMARK OR MARKET INTEREST RATES — SOFR is subject to volatility due to a variety of factors affecting interest rates generally, including, but not limited to: |

| o | sentiment regarding underlying strength in the U.S. and global economies; |

| o | expectations regarding the level of price inflation; |

| o | sentiment regarding credit quality in U.S. and global credit markets; |

| o | central bank policy regarding interest rates; and |

| o | performance of capital markets. |

Since the initial publication of SOFR, daily changes in the rate have, on occasion, been more volatile than daily changes in other benchmark or market rates, such as USD LIBOR, during corresponding periods. In addition, although changes in Compounded Daily SOFR generally are not expected to be as volatile as changes in SOFR, the return on, value of and market for the notes may fluctuate more than floating rate debt securities with interest rates based on less volatile rates.

2

| · | ANY FAILURE OF SOFR TO MAINTAIN MARKET ACCEPTANCE COULD ADVERSELY AFFECT THE NOTES — SOFR may fail to maintain market acceptance. SOFR was developed for use in certain U.S. dollar derivatives and other financial contracts as an alternative to the U.S. dollar London Interbank Offered Rate (“LIBOR”) in part because it is considered a good representation of general funding conditions in the overnight U.S. Treasury repurchase agreement market. However, as a rate based on transactions secured by U.S. Treasury securities, it does not measure bank-specific credit risk and, as a result, is less likely to correlate with the unsecured short-term funding costs of banks than competing replacement rates for LIBOR that reflect bank-specific credit risk. This may mean that market participants would not consider SOFR a suitable substitute, replacement or successor for all of the purposes for which LIBOR historically has been used (including, without limitation, as a representation of the unsecured short-term funding costs of banks), which may, in turn, lessen market acceptance of SOFR. Further, other index providers are developing products that are perceived as competing with SOFR. It is possible that market participants will prefer one of these competing products and that such competing products may become more widely accepted in the marketplace than SOFR. To the extent market acceptance for SOFR as a benchmark for floating-rate notes declines, the return on and value of the notes and the price at which investors can sell the notes in the secondary market could be adversely affected. Investors in securities linked to SOFR may not be able to sell those securities at all or may not be able to sell those securities at prices that will provide them with a yield comparable to similar investments that continue to have a developed secondary market, and may consequently suffer from increased pricing volatility and market risk. |

| · | THERE IS NO GUARANTEE THAT SOFR WILL BE A COMPARABLE SUBSTITUTE, SUCCESSOR OR REPLACEMENT FOR LIBOR — In June 2017, FRBNY’s Alternative Reference Rates Committee (the “ARRC”) announced the Secured Overnight Financing Rate as its recommended alternative to U.S. Dollar LIBOR. However, the composition and characteristics of SOFR are not the same as those of LIBOR. SOFR is a broad Treasury repo financing rate that represents overnight secured funding transactions and is not the economic equivalent of LIBOR. While SOFR is a secured rate, LIBOR is an unsecured rate, and while SOFR is an overnight rate, LIBOR represents interbank funding for a specified term. As a result, there can be no assurance that SOFR will perform in the same way as LIBOR would have at any time, including, without limitation, as a result of changes in interest and yield rates in the market, bank credit risk, market volatility or global or regional economic, financial, political, regulatory, judicial or other events. For the same reasons, there is no guarantee that SOFR will be a comparable substitute, successor or replacement for LIBOR. |

| · | SOFR AND THE MANNER IN WHICH IT IS CALCULATED MAY CHANGE IN THE FUTURE — Interest rates and indices that are deemed to be “benchmarks,” including those in widespread and long-standing use, have been the subject of recent international, national and other regulatory scrutiny and initiatives and proposals for reform. Some of these reforms are already effective while others are still to be implemented or are under consideration. There can be no assurance that the method by which SOFR is calculated will continue in its current form. Any changes in the method of calculation could have a negative impact on any payment on the notes and on the value of the notes in the secondary market. |

| · | THE ADMINISTRATOR OF SOFR MAY MAKE CHANGES THAT COULD ADVERSELY AFFECT THE LEVEL OF SOFR OR DISCONTINUE SOFR AND HAS NO OBLIGATION TO CONSIDER YOUR INTEREST IN DOING SO — SOFR is published by the Federal Reserve Bank of New York, as the administrator of SOFR, based on data received from other sources. As such, we have no control over its determination, calculation or publication. FRBNY (or a successor), as administrator of SOFR, may make methodological or other changes that could change the value of SOFR, including changes related to the method by which SOFR is calculated, eligibility criteria applicable to the transactions used to calculate SOFR, or timing related to the publication of SOFR. In addition, the administrator may alter, discontinue or suspend calculation or dissemination of SOFR (in which case a fallback method of determining the interest rate on the notes will apply). The administrator has no obligation to consider your interests in calculating, adjusting, converting, revising or discontinuing SOFR. These changes may result in a reduction of the amount of interest payable on the notes, which may adversely affect the trading prices of the notes. |

3

| · | THE AMOUNT OF INTEREST PAYABLE WITH RESPECT TO EACH INTEREST PERIOD WILL BE DETERMINED NEAR THE END OF THE RELEVANT INTEREST PERIOD — The interest rate with respect to any Interest Period will only be capable of being determined near the end of the relevant Interest Period. Consequently, it is not possible for investors in the notes to estimate in advance the amount of interest that will be payable on the notes for a given Interest Period. |

| · | IF SOFR IS DISCONTINUED, THE NOTES WILL BEAR INTEREST BY REFERENCE TO A DIFFERENT BASE RATE, WHICH COULD ADVERSELY AFFECT THE VALUE OF AND YOUR RETURN ON THE NOTES; THERE IS NO GUARANTEE THAT ANY BENCHMARK REPLACEMENT WILL BE A COMPARABLE SUBSTITUTE — If we or the Benchmark Replacement Agent determine that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to SOFR, then the interest rate on the notes will be determined by reference to a different rate, which will be a different benchmark than SOFR (a “Benchmark Replacement”), plus a spread adjustment (the “Benchmark Replacement Adjustment”), as further described under “Additional Information about the SOFR Reference Rate” in this pricing supplement. |

If a particular Benchmark Replacement or Benchmark Replacement Adjustment cannot be determined, then the next-available Benchmark Replacement or Benchmark Replacement Adjustment will apply. These replacement rates and adjustments may be selected, recommended or formulated by (i) the Relevant Governmental Body (such as the ARRC), (ii) the International Swaps and Derivatives Association, Inc. or (iii) in certain circumstances, us or the Benchmark Replacement Agent (if any). In addition, if we or the Benchmark Replacement Agent (if any) determine that (A) changes to the definitions of Business Day, Compounded Daily SOFR, Day Count Convention, Interest Determination Date, Interest Payment Date, Interest Period, Observation Period, the SOFR Reference Rate or U.S. Government Securities Business Day or (B) any other technical changes to any other provision of the terms of the notes necessary in order to implement the Benchmark Replacement, the terms of the notes expressly authorize us to amend such definitions and other provisions without the consent or approval of the holders of the notes. The determination of a Benchmark Replacement, the calculation of the interest rate on the notes by reference to a Benchmark Replacement (including the application of a Benchmark Replacement Adjustment), any amendments to the provisions of the terms of the notes determined by us or the Benchmark Replacement Agent, as the case may be, to be necessary in order to implement the Benchmark Replacement and any other determinations, decisions or elections that may be made under the terms of the notes in connection with a Benchmark Transition Event could adversely affect the value of the notes, the return on the notes and the price at which you can sell your notes, if any.

Any determination, decision or election described above will be made in the sole discretion of us or the Benchmark Replacement Agent (if any). Any exercise of such discretion by us may present us with a conflict of interest. In addition, if an affiliate of us is appointed as the Benchmark Replacement Agent, any exercise of such discretion may present us or such affiliate with a conflict of interest.

In addition, (i) the composition and characteristics of the Benchmark Replacement will not be the same as those of SOFR, the Benchmark Replacement will not be the economic equivalent of SOFR, there can be no assurance that the Benchmark Replacement will perform in the same way as SOFR would have at any time and there is no guarantee that the Benchmark Replacement will be a comparable substitute for SOFR (each of which means that a Benchmark Transition Event could adversely affect the value of the notes, the return on the notes and the price at which you can sell your notes, if any), (ii) any failure of the Benchmark Replacement to gain market acceptance could adversely affect the notes, (iii) the Benchmark Replacement may have a very limited history and the future performance of the Benchmark Replacement cannot be predicted based on historical performance, (iv) the secondary trading market for notes linked to the Benchmark Replacement may be limited and (v) the administrator of the Benchmark Replacement may make changes that could change the value of the Benchmark Replacement or discontinue the Benchmark Replacement and has no obligation to consider the interests of holders of the notes in doing so.

Risks Relating to the Issuer

4

| · | THE NOTES ARE SUBJECT TO THE CREDIT RISK OF CREDIT SUISSE — Investors are dependent on our ability to pay all amounts due on the notes and, therefore, if we were to default on our obligations, you may not receive any amounts owed to you under the notes. In addition, any decline in our credit ratings, any adverse changes in the market’s view of our creditworthiness or any increase in our credit spreads is likely to adversely affect the value of the notes prior to maturity. |

| · | CREDIT SUISSE IS SUBJECT TO SWISS REGULATION — As a Swiss bank, Credit Suisse is subject to regulation by governmental agencies, supervisory authorities and self-regulatory organizations in Switzerland. Such regulation is increasingly more extensive and complex and subjects Credit Suisse to risks. For example, pursuant to Swiss banking laws, the Swiss Financial Market Supervisory Authority (FINMA) may open resolution proceedings if there are justified concerns that Credit Suisse is over-indebted, has serious liquidity problems or no longer fulfills capital adequacy requirements. FINMA has broad powers and discretion in the case of resolution proceedings, which include the power to convert debt instruments and other liabilities of Credit Suisse into equity and/or cancel such liabilities in whole or in part. If one or more of these measures were imposed, such measures may adversely affect the terms and market value of the notes and/or the ability of Credit Suisse to make payments thereunder and you may not receive any amounts owed to you under the notes. |

Risks Relating to Conflicts of Interest

| · | POTENTIAL CONFLICTS — We and our affiliates play a variety of roles in connection with the issuance of the notes, including acting as calculation agent and as agent of the issuer for the offering of the notes and hedging our obligations under the notes. In performing these duties, the economic interests of us and our affiliates are potentially adverse to your interests as an investor in the notes. Further, hedging activities may adversely affect any payment on or the value of the notes. Any profit in connection with such hedging activities will be in addition to any other compensation that we and our affiliates receive for the sale of the notes, which creates an additional incentive to sell the notes to you. |

Risks Relating to the Value and Secondary Market Prices of the Notes

| · | UNPREDICTABLE ECONOMIC AND MARKET FACTORS WILL AFFECT THE VALUE OF THE NOTES — The terms of the notes at issuance and the value of the notes prior to maturity may be influenced by factors that impact the value of fixed income securities and options in general, such as: |

| o | the expected and actual volatility of the Reference Rate; |

| o | the time to maturity of the notes; |

| o | changes in U.S. interest and swap rates; |

| o | supply and demand for the notes; |

| o | interest and yield rates in the market generally; |

| o | investors’ expectations with respect to the rate of inflation; |

| o | geopolitical conditions and economic, financial, political, regulatory, judicial or other events that affect the interest and yield rates or markets generally; and |

| o | our creditworthiness, including actual or anticipated downgrades in our credit ratings. |

Some or all of these factors may influence the price that you will receive if you choose to sell your notes prior to maturity. The impact of any of the factors set forth above may enhance or offset some or all of any change resulting from another factor or factors.

| · | CERTAIN BUILT-IN COSTS ARE LIKELY TO ADVERSELY AFFECT THE VALUE OF THE NOTES PRIOR TO MATURITY — While the Payment at Maturity described in this pricing supplement will be based on the full principal amount of your notes, the Price to Public of the notes includes the placement agent’s commission and the cost of hedging our obligations under the notes through one |

5

or more of our affiliates. As a result, the price, if any, at which Credit Suisse (or its affiliates), will be willing to purchase notes from you in secondary market transactions, if at all, will likely be lower than the Price to Public, and any sale prior to the Maturity Date could result in a substantial loss to you. The notes are not designed to be short-term trading instruments. Accordingly, you should be able and willing to hold your notes to maturity.

| · | LACK OF LIQUIDITY — The notes will not be listed on any securities exchange. Credit Suisse (or its affiliates) intends to offer to purchase the notes in the secondary market but is not required to do so. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the notes when you wish to do so. Because other dealers are not likely to make a secondary market for the notes, the price at which you may be able to trade your notes is likely to depend on the price, if any, at which Credit Suisse (or its affiliates) is willing to buy the notes. If you need to sell your notes prior to maturity, you may not be able to do so or you may have to sell them at a substantial loss. |

6

Supplemental Use of Proceeds and Hedging

We intend to use the proceeds of this offering for our general corporate purposes, which may include the refinancing of existing debt outside Switzerland. Some or all of the proceeds we receive from the sale of the notes may be used in connection with hedging our obligations under the notes through one or more of our affiliates. For additional information, see “Supplemental Use of Proceeds and Hedging” in the accompanying product supplement.

7

Additional Information about the SOFR Reference Rate

“SOFR Reference Rate” means, with respect to any U.S Government Securities Business Day:

| (1) | the Secured Overnight Financing Rate for such U.S. Government Securities Business Day appearing on the New York Federal Reserve’s Website on or about the Relevant Time on the U.S. Government Securities Business Day immediately following such U.S. Government Securities Business Day; or |

| (2) | if the Secured Overnight Financing Rate with respect to such U.S. Government Securities Business Day does not appear as specified in paragraph (1), unless we or the Benchmark Replacement Agent, if any, determines that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to the Secured Overnight Financing Rate on or prior to the Relevant Time on the U.S. Government Securities Business Day immediately following such U.S. Government Securities Business Day, the Secured Overnight Financing Rate with respect to the last U.S. Government Securities Business Day for which such rate was published on the New York Federal Reserve’s Website; or |

| (3) | if the Secured Overnight Financing Rate with respect to such U.S. Government Securities Business Day does not appear as specified in paragraph (1) and we or the Benchmark Replacement Agent, if any, determines that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to the then-current Benchmark on or prior to the Relevant Time on the U.S. Government Securities Business Day immediately following such U.S. Government Securities Business Day (or, if the then-current Benchmark is not the Secured Overnight Financing Rate, on or prior to the Alternative Relevant Time on the Relevant Date), then (subject to the subsequent operation of this clause (3)) from (and including) the U.S. Government Securities Business Day immediately following such U.S. Government Securities Business Day (or the Relevant Date, as applicable) (the “Affected Day”), “SOFR Reference Rate” shall mean, with respect to any U.S. Government Securities Business Day, the applicable Benchmark Replacement for such U.S. Government Securities Business Day appearing on, or obtained from, the Relevant Source at the Alternative Relevant Time on the Relevant Date. |

If the Benchmark Replacement is at any time required to be used pursuant to paragraph (3) above, then in connection with determining the Benchmark Replacement:

| (a) | we or the Benchmark Replacement Agent, as applicable, shall also determine the method for determining the rate described in clause (a) of paragraph (1), (2) or (3) of the definition of “Benchmark Replacement,” as applicable (including (i) the page, section or other part of a particular information service on or source from which such rate appears or is obtained (the “Relevant Source”), (ii) the time at which such rate appears on, or is obtained from, the Relevant Source (the “Alternative Relevant Time”), (iii) the day on which such rate will appear on, or is obtained from, the Relevant Source with respect to each U.S. Government Securities Business Day (the “Relevant Date”), and (iv) any alternative method for determining such rate if it is unavailable at the Alternative Relevant Time on the applicable Relevant Date), which method shall be consistent with industry-accepted practices for such rate; |

| (b) | from (and including) the Affected Day, references to the Relevant Time shall be deemed to be references to the Alternative Relevant Time; |

| (c) | if we or the Benchmark Replacement Agent, as applicable, determines that (i) changes to the definitions of Business Day, Compounded Daily SOFR, Day Count Convention, Interest Determination Date, Interest Payment Date, Interest Period, Observation Period, SOFR Reference Rate or U.S. Government Securities Business Day or (ii) any other technical changes to any other provision of the securities are necessary in order to implement the Benchmark Replacement (including any alternative method described in subclause (iv) of paragraph (a) above) as the Benchmark in a manner substantially consistent with market practices (or, if we or the Benchmark Replacement Agent, as the case may be, decides that adoption of any portion of such market practice is not administratively feasible or if we or the Benchmark Replacement Agent, as the case may be, determines that no market practice for use of the Benchmark Replacement exists, in such other manner as we or the Benchmark Replacement Agent, as the case may be, determines is reasonably necessary), such |

8

definitions or other provisions will be amended to reflect such changes, which amendments shall become effective without consent or approval of the holders of the notes or any other party; and

| (d) | we will give notice or will procure that notice is given as soon as practicable to the calculation agent, trustee and the holders of the notes, specifying the Benchmark Replacement, as well as the details described in paragraph (a) above and the amendments implemented as contemplated in paragraph (c) above. |

“Benchmark” means the Secured Overnight Financing Rate, provided that if a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to the Secured Overnight Financing Rate or such other then-current Benchmark, then “Benchmark” means the applicable Benchmark Replacement.

“Benchmark Replacement” means, with respect to the then-current Benchmark, the first alternative set forth in the order presented below that can be determined by us or the Benchmark Replacement Agent, if any, as of the Benchmark Replacement Date with respect to the then-current Benchmark:

| (1) | the sum of: (a) the alternate rate of interest that has been selected or recommended by the Relevant Governmental Body as the replacement for the then-current Benchmark for the applicable Corresponding Tenor, as applicable, and (b) the Benchmark Replacement Adjustment; or |

| (2) | the sum of: (a) the ISDA Fallback Rate and (b) the Benchmark Replacement Adjustment; or |

| (3) | the sum of: (a) the alternate rate of interest that has been selected by us or the Benchmark Replacement Agent, if any, as the replacement for the then-current Benchmark for the applicable Corresponding Tenor, provided that, (i) if we or the Benchmark Replacement Agent, as the case may be, determine that there is an industry-accepted replacement rate of interest for the then-current Benchmark for U.S. Dollar-denominated floating rate notes at such time, it shall select such industry-accepted rate, and (ii) otherwise, it shall select such rate of interest that it has determined is most comparable to the then-current Benchmark, and (b) the Benchmark Replacement Adjustment. |

“Benchmark Replacement Adjustment” means, with respect to any Benchmark Replacement, the first alternative set forth in the order below that can be determined by us or the Benchmark Replacement Agent, if any, as of the Benchmark Replacement Date with respect to the then-current Benchmark:

| (1) | the spread adjustment, or method for calculating or determining such spread adjustment, which may be a positive or negative value or zero, that has been selected or recommended by the Relevant Governmental Body for the applicable Unadjusted Benchmark Replacement; |

| (2) | if the applicable Unadjusted Benchmark Replacement is equivalent to the ISDA Fallback Rate, the ISDA Fallback Adjustment; |

| (3) | the spread adjustment, which may be a positive or negative value or zero, that has been selected by us or the Benchmark Replacement Agent, if any, to be applied to the applicable Unadjusted Benchmark Replacement in order to reduce or eliminate, to the extent reasonably practicable under the circumstances, any economic prejudice or benefit (as applicable) to holders of the notes as a result of the replacement of the then-current Benchmark with such Unadjusted Benchmark Replacement for purposes of determining the SOFR Reference Rate, which spread adjustment shall be consistent with any industry-accepted spread adjustment, or method for calculating or determining such spread adjustment, applied to such Unadjusted Benchmark Replacement where it has replaced the then-current Benchmark for U.S. Dollar-denominated floating rate notes at such time. |

“Benchmark Replacement Agent” means any affiliate of us or such other person that has been appointed by us to make the calculations and determinations to be made by the Benchmark Replacement Agent, so long as such affiliate or other person is a leading bank or other financial institution that is experienced in such calculations or determinations. We may elect, but are not required, to appoint a Benchmark Replacement Agent at any time.

9

“Benchmark Replacement Date” means, with respect to the then-current Benchmark, the earliest to occur of the following events with respect thereto:

| (1) | in the case of clause (1) or (2) of the definition of “Benchmark Transition Event,” the later of (a) the date of the public statement or publication of information referenced therein and (b) the date on which the administrator of the Benchmark permanently or indefinitely ceases to provide the Benchmark; or |

| (2) | in the case of clause (3) of the definition of “Benchmark Transition Event,” the date of the public statement or publication of information referenced therein. |

For the avoidance of doubt, if the event giving rise to the Benchmark Replacement Date occurs on the same day as, but earlier than, the Relevant Time with respect to any determination, the Benchmark Replacement Date will be deemed to have occurred prior to the Relevant Time for such determination.

“Benchmark Transition Event” means, with respect to the then-current Benchmark, the occurrence of one or more of the following events with respect thereto:

| (1) | a public statement or publication of information by or on behalf of the administrator of the Benchmark announcing that such administrator has ceased or will cease to provide the Benchmark, permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Benchmark; |

| (2) | a public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark, the central bank for the currency of the Benchmark, an insolvency official with jurisdiction over the administrator for the Benchmark, a resolution authority with jurisdiction over the administrator for the Benchmark or a court or an entity with similar insolvency or resolution authority over the administrator for the Benchmark, which states that the administrator of the Benchmark has ceased or will cease to provide the Benchmark permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Benchmark; or |

| (3) | a public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark announcing that the Benchmark is no longer representative. |

“Corresponding Tenor” means, with respect to a Benchmark Replacement a tenor (including overnight) having approximately the same length (disregarding any applicable business day convention) as the applicable tenor for the then-current Benchmark.

“ISDA Definitions” means the 2006 ISDA Definitions published by the International Swaps and Derivatives Association, Inc. or any successor thereto, as amended or supplemented from time to time, or any successor definitional booklet for interest rate derivatives published from time to time by the International Swaps and Derivatives Association, Inc.

“ISDA Fallback Adjustment” means, with respect to any ISDA Fallback Rate, the spread adjustment, which may be a positive or negative value or zero, that would be applied to such ISDA Fallback Rate in the case of derivatives transactions referencing the ISDA Definitions to be effective upon the occurrence of an index cessation event with respect to the then-current Benchmark for the applicable tenor.

“ISDA Fallback Rate” means, with respect to the then-current Benchmark, the rate that would apply for derivatives transactions referencing the ISDA Definitions to be effective upon the occurrence of an index cessation date with respect to the Benchmark for the applicable tenor excluding the applicable ISDA Fallback Adjustment.

“New York Federal Reserve’s Website” means the website of the Federal Reserve Bank of New York currently at http://www.newyorkfed.org, or any successor website of the Federal Reserve Bank of New York.

“Relevant Governmental Body” means the Board of Governors of the Federal Reserve System and/or the Federal Reserve Bank of New York, or a committee officially endorsed or convened by the Board of Governors of the Federal Reserve System and/or the Federal Reserve Bank of New York or any successor thereto.

10

“Secured Overnight Financing Rate” means, with respect to any U.S. Government Securities Business Day, the daily secured overnight financing rate for such U.S. Government Securities Business Day as provided by the Federal Reserve Bank of New York, as the administrator of such rate (or any successor administrator of such rate).

“Unadjusted Benchmark Replacement” means the Benchmark Replacement excluding the Benchmark Replacement Adjustment.

If we appoint a Benchmark Replacement Agent and such Benchmark Replacement Agent is unable to determine whether a Benchmark Transition Event has occurred or, following the occurrence of a Benchmark Transition Event, has not selected the Benchmark Replacement as of the related Benchmark Replacement Date, then, in such case, we shall make such determination or select the Benchmark Replacement, as the case may be.

If we or the Benchmark Replacement Agent, if any, have determined that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to the then-current Benchmark, any determination, decision or election that may be made by us or the Benchmark Replacement Agent pursuant to this section, including any determination with respect to a tenor, rate or adjustment or of the occurrence or non-occurrence of an event (including such determination that a Benchmark Transition Event and its related Benchmark Replacement have occurred with respect to the then-current Benchmark), circumstance or date and any decision to take or refrain from taking any action or any selection:

| · | will be conclusive and binding absent willful misconduct, bad faith and manifest error; and |

| · | will be made in the sole discretion of us or the Benchmark Replacement Agent, as the case may be, acting in good faith and in a commercially reasonable manner. |

This pricing supplement is subject to the Terms of Use posted at newyorkfed.org. The Federal Reserve Bank of New York is not responsible for publication of this pricing supplement by Credit Suisse, does not sanction or endorse any particular republication, and has no liability for your use. Credit Suisse is not affiliated with FRBNY. FRBNY does not sanction, endorse, or recommend any products or services offered by Credit Suisse.

11

Historical Information

The following graph sets forth the historical percentage levels of the Secured Overnight Financing Rate for the period from April 3, 2018 to May 24, 2022. The Secured Overnight Financing Rate on May 24, 2022 was 0.78%. The historical levels of the Secured Overnight Financing Rate should not be taken as an indication of its future performance. We obtained the information in the graph below from Bloomberg, without independent verification.

12

Material United States Federal Income Tax Considerations

In the opinion of our tax counsel, Davis Polk & Wardwell LLP, the notes should be treated for U.S. federal income tax purposes as variable rate debt instruments that are issued without original issue discount.

Both U.S. and non-U.S. persons considering an investment in the notes should read the discussion under “United States Federal Tax Considerations” in the accompanying product supplement for more information.

13

Supplemental Plan of Distribution

Under the terms of distributor accession confirmations with JPMS LLC and JPMorgan Chase Bank, N.A., each dated as of June 18, 2008, JPMS LLC and JPMorgan Chase Bank, N.A. will act as placement agents for the notes. The placement agents will receive discounts and commissions from Credit Suisse or one of our affiliates that will not exceed $10 per $1,000 principal amount of notes and will forgo discounts and commissions for sales to fiduciary accounts. For additional information, see “Underwriting (Conflicts of Interest)” in any accompanying product supplement.

We expect to deliver the notes against payment for the notes on the Settlement Date indicated herein, which may be a date that is greater than two business days following the Pricing Date. Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in two business days, unless the parties to a trade expressly agree otherwise. Accordingly, if the Settlement Date is more than two business days after the Pricing Date, purchasers who wish to transact in the notes more than two business days prior to the Settlement Date will be required to specify alternative settlement arrangements to prevent a failed settlement.

14

Credit Suisse

15

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Credit SuisseSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share