Form 424B2 CITIGROUP INC

Prospectus Supplement and Prospectus each dated May 11, 2021

Structured Investments A Guide for Investors Citigroup Global Markets Holdings Inc. Filed Pursuant to Rule 424(b)(2) Registration Statement Nos. 333 - 255302 and 333 - 255302 - 03 The securities discussed by this product summary supplement are unsecured debt securities issued by Citigroup Global Markets Holdings Inc. and guaranteed by Citigroup Inc. Thus all payments on the securities are subject to the credit risk of Citigroup Global Markets Holdings Inc. and Citigroup Inc. The securities are not bank deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other govern - mental agency, nor are they obligations of, or guaranteed by, a bank. Investing in the securities involves risks not associated with an investment in conventional debt securities. See “Selected Risks and Considerations of Structured Investments” on page 4 for more information. The securities will not be listed on any securities exchange. The information in this product summary supplement is not complete and may be changed. This product summary supplement is not an offer to sell these securities and it is not soliciting an offer to buy the securities in any jurisdiction where the offer or sale is not permitted. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities or determined that this product summary supplement and the accompanying prospectus supplement and prospectus are truthful or complete. Any representation to the contrary is a criminal offense. The prospectus supplement and prospectus referenced below contain certain general terms of securities that we may offer. The specific terms of any offering of securities will be set forth in a pricing supplement and/or product or index supplement for that offering, which may add, update or modify any information in this document or the prospectus supplement or prospec - tus. If any information in the applicable pricing supplement and/or product or index supplement is inconsistent with the other offering documents, including this document, you should rely on the information in that pricing supplement and/or product or index supplement. You should read the applicable pricing supplement and any applicable product or index supplement together with the prospectus supplement and prospectus before making a decision to invest in any securities described herein. You may access the prospectus supplement and prospectus on the SEC website at www.sec.gov by clicking on the hyperlink below: Prospectus Supplement and Prospectus each dated May 11, 2021

Citigroup Global Markets Holdings Inc. 2 Some structured investments provide for the repayment of the full amount of principal at maturity, subject to the issuer’s credit risk. Others provide for a payment at maturity that may be less than principal (and possibly zero) depending on the performance of the underlying index or asset. What Are Structured Investments? Investor Repaid $1,000 principal Interest Y ear s I ss uer Traditional Bonds A bond is a loan that an investor makes to the issuer for a specified amount of time, e. g. 5 years. In return for the use of these proceeds, and to compensate the investor for the risk that the issuer will not return principal, traditional bonds pay periodic fixed coupons to the holder of the bond. Lends $1,000 principal Investor Repaid $1,000 principal Y ear s I ss uer Structured Investments A structured investment is also a loan that an investor makes to the issuer for a specified amount of time, e. g. 5 years. In contrast to traditional bonds, rather than receiving fixed income, structured investments offer a return that is contingent on the performance of an underlying index or asset, e. g. the S&P 500 ® Index. Lends $1,000 principal M ar k e t - L i n k ed Returns

Citigroup Global Markets Holdings Inc. 3 Access Structured Investments can be used to gain exposure to hard to reach underlyings, such as: • International equities • Commodities • Rates • Currencies Structured Investments can also be used to gain exposure to algorithmic trading strategies, e. g. proprietary indices. Tactical Investment Structured Investments can be tailored to fit a specific market view. For example a moderately bullish view on emerging markets with some risk appetite can translate to a structured investment linked to emerging markets equities, with increased participation on the upside subject to a maximum return, coupled with some protection on the downside . Portfolio Allocation When used in a portfolio, Structured Investments can potentially provide additional benefits such as: • Additional growth potential • Additional protection • Additional yield potential • Diversification of assets and risk/return profiles → potentially leading to greater risk adjusted returns Different structured investments offer different risk/return tradeoffs, and not all offer the potential benefits described above. You should consider the potential benefits of structured investments together with the risks associated with structured investments, as described on the next page and in the applicable pricing supplement. Why Purchase Structured Investments? Access Portfolio Allocation Tactical In v e s t m ent s

Citigroup Global Markets Holdings Inc. 4 Potential for Loss The terms of certain investments provide that the full principal amount is due at maturity, subject to the issuer’s credit risk. However, if an investor sells such investment prior to maturity, the investor may receive an amount less than his/her original investment. The terms of certain investments provide that the payment due at maturity could be significantly less than the full principal amount and, for certain investments, could be zero. In these cases, an investor may receive an amount significantly less than his/her original investment and may receive nothing at maturity of the investment. No or Contingent Interest Certain investments do not pay interest or any other amounts prior to maturity. Others may pay interest that is contingent on the performance of an underlying asset or index. In the latter case, if the applicable condition to payment of interest is not met, these investments will not pay interest on one or more, or any, interest payment dates. Appreciation May Be Limited Depending on the investment, an investor’s appreciation may be limited by a maximum amount payable, and therefore may be less than the performance of the underlying asset or index. Other investments do not offer any participation in any appreciation of the underlying asset or index. Potential for Lower Comparable Yield The effective yield on any investment may be less than that which would be payable on a conventional fixed - rate debt security of the same issuer with comparable maturity . No Dividends Holders of structured investments will not receive the dividends that would be paid on a direct investment in the underlying index or asset. Issuer Credit Risk All payments on structured investments are dependent on the issuer’s or guarantor’s ability to pay all amounts due on these investments, including any principal due at maturity, and therefore investors are subject to the credit risk of the issuer and guarantor . The United States Federal Tax Consequences of Owning Structured Investments May Be Uncertain There is no direct legal authority regarding the proper U.S. federal tax treatment of certain Structured Investments, and we do not plan to request a ruling from the Internal Revenue Service (the “IRS”). Consequently, significant aspects of the tax treatment of those investments are uncertain. Investors should refer to the applicable offering document(s) for each Structured Investment regarding its U.S. federal tax treatment. However, no assurance can be given that the IRS will agree with the treatment described within the offering document(s) for a particular Structured Investment. Citigroup Inc., its affiliates, and employees do not provide tax or legal advice. Investors should consult with their own professional advisor(s) on such matters before investing in any Structured Investment. Secondary Market Structured investments generally will not be listed on any securities exchange. Therefore, there may be little or no secondary market for the securities and an investor may not be able to sell them prior to maturity. Resale Value of a Structured Investment May be Lower than the Initial Investment The value of structured investments prior to maturity will fluctuate based on the price and volatility of the underlying asset or index and a number of other factors, including dividend yield on the underlying, interest rates generally, the time remaining to maturity and the issuer’s creditworthiness. The value of the securities at any time prior to maturity may be significantly less than the issue price. Conflicts of Interest The issuer and its affiliates may have a number of conflicts of interest with investors in the securities as a result of their hedging, trading and other business activities. These risks are not intended to be an exhaustive list of the risks associated with a particular structured investment offering. Before you invest in any structured investment you should thoroughly review the particular investment’s pricing supplement and any applicable product or index supplement together with the prospectus supplement and prospectus for a comprehensive description of the risks and considerations associated with the particular investment. Selected Risks and Considerations of Structured Investments

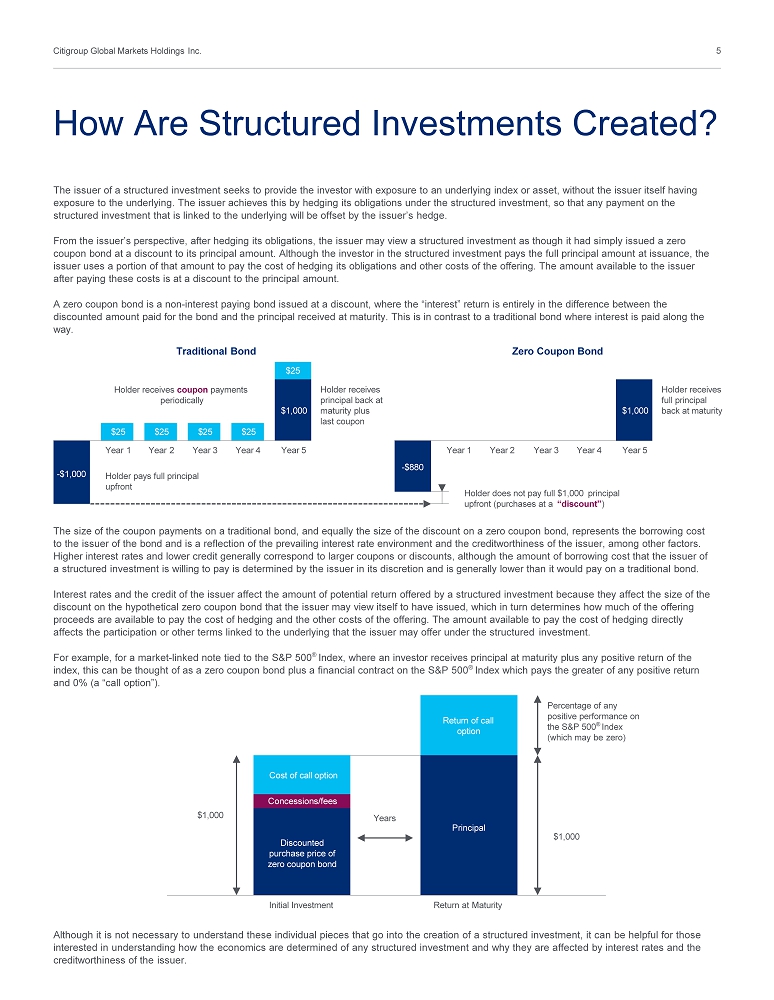

Citigroup Global Markets Holdings Inc. 5 Although it is not necessary to understand these individual pieces that go into the creation of a structured investment, it can be helpful for those interested in understanding how the economics are determined of any structured investment and why they are affected by interest rates and the creditworthiness of the issuer . How Are Structured Investments Created? $25 - $1,000 $1,000 $25 Holder receives principal back at maturity plus last coupon Holder receives coupon payments periodically $1,000 The size of the coupon payments on a traditional bond, and equally the size of the discount on a zero coupon bond, represents the borrowing cost to the issuer of the bond and is a reflection of the prevailing interest rate environment and the creditworthiness of the issuer, among other factors. Higher interest rates and lower credit generally correspond to larger coupons or discounts, although the amount of borrowing cost that the issuer of a structured investment is willing to pay is determined by the issuer in its discretion and is generally lower than it would pay on a traditional bond. Interest rates and the credit of the issuer affect the amount of potential return offered by a structured investment because they affect the size of the discount on the hypothetical zero coupon bond that the issuer may view itself to have issued, which in turn determines how much of the offering proceeds are available to pay the cost of hedging and the other costs of the offering. The amount available to pay the cost of hedging directly affects the participation or other terms linked to the underlying that the issuer may offer under the structured investment. For example, for a market - linked note tied to the S&P 500 ® Index, where an investor receives principal at maturity plus any positive return of the index, this can be thought of as a zero coupon bond plus a financial contract on the S&P 500 ® Index which pays the greater of any positive return and 0% (a “call option”). Percentage of any positive performance on the S&P 500 ® Index (which may be zero) Initial Investment Return at Maturity Return of call option $1,000 Cost of call option Years Principal C onces si ons/fees Discounted purchase price of zero coupon bond $25 $25 $25 Year 1 Year 2 Year 3 Holder pays full principal upfront Year 4 Year 5 The issuer of a structured investment seeks to provide the investor with exposure to an underlying index or asset, without the issuer itself having exposure to the underlying. The issuer achieves this by hedging its obligations under the structured investment, so that any payment on the structured investment that is linked to the underlying will be offset by the issuer’s hedge. From the issuer’s perspective, after hedging its obligations, the issuer may view a structured investment as though it had simply issued a zero coupon bond at a discount to its principal amount. Although the investor in the structured investment pays the full principal amount at issuance, the issuer uses a portion of that amount to pay the cost of hedging its obligations and other costs of the offering. The amount available to the issuer after paying these costs is at a discount to the principal amount. A zero coupon bond is a non - interest paying bond issued at a discount, where the “interest” return is entirely in the difference between the discounted amount paid for the bond and the principal received at maturity. This is in contrast to a traditional bond where interest is paid along the way. Traditional Bond Zero Coupon Bond Year 1 - $880 $1,000 Holder receives full principal back at maturity Holder does not pay full $1,000 principal upfront (purchases at a “discount” ) Year 2 Year 3 Year 4 Year 5

Citigroup Global Markets Holdings Inc. 6 Traditional asset allocation allows investors to choose between (a) Bonds, which are generally relatively low risk and low return and (b) Equities, which are generally relatively higher risk with higher return potential. The vast majority of structured investments target a risk - return profile between that of bonds and equities. “Equity - like” investments with added protection against downturns “Bond - like” investments with added risk to achieve potentially higher returns Structured Investments and Risk - Return B onds Equities Ca s h Market Linked S e c ur iti es Income S e c ur iti es Growth S e c ur iti es Risk / Standard Deviation Growth Securities Growth Securities are generally the most “equity like” structured investments. They typically offer upside participation in the underlying it is linked to (excluding dividends), sometimes limited by a maximum return, with downside exposure subject to some partial or contingent protection. Examples include Buffer Securities, Upturn Securities and Barrier Securities Income Securities Income Securities are generally a bit more in between bond and equity in their style. Typically this type of security will offer some periodic coupon potential, which is generally higher than anything achievable in the traditional debt market, but with the tradeoff of having equity exposure as a downside risk. The coupon itself may also be contingent. Examples include ELKS and Autocallable Contingent Coupon Securities Market Linked Securities Market Linked Securities are generally the most “bond - like”. These investments generally protect an investor's full principal at maturity, subject to the credit risk of the issuer, with some market participation on the upside. Despite being comparable to a bond, investors are generally forgoing interest to achieve market returns, and thus are generally still riskier than a traditional debt product of the same credit quality. Return Potential

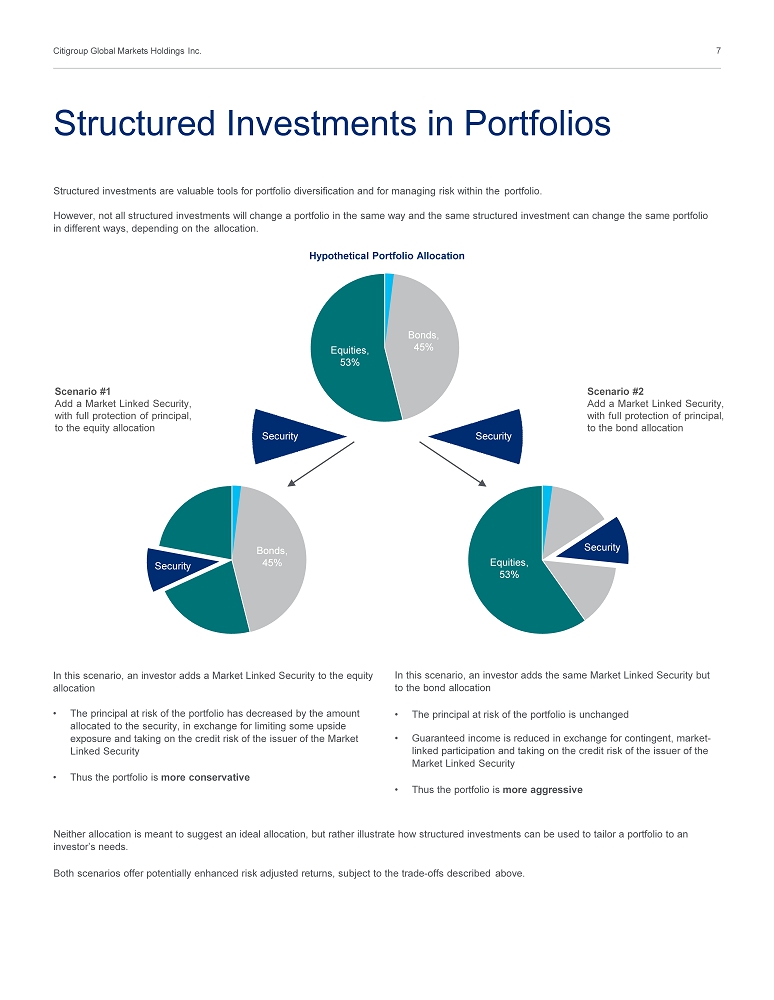

Citigroup Global Markets Holdings Inc. 7 Neither allocation is meant to suggest an ideal allocation, but rather illustrate how structured investments can be used to tailor a portfolio to an investor’s needs. Both scenarios offer potentially enhanced risk adjusted returns, subject to the trade - offs described above. Structured Investments in Portfolios Structured investments are valuable tools for portfolio diversification and for managing risk within the portfolio. However, not all structured investments will change a portfolio in the same way and the same structured investment can change the same portfolio in different ways, depending on the allocation. Hypothetical Portfolio Allocation E qu iti e s , 53% B ond s , 45% S e c ur ity S e c ur ity B ond s , 45% E qu iti e s , 53% Scenario # 1 Add a Market Linked Security, with full protection of principal, to the equity allocation Scenario # 2 Add a Market Linked Security, with full protection of principal, to the bond allocation In this scenario, an investor adds a Market Linked Security to the equity allocation • The principal at risk of the portfolio has decreased by the amount allocated to the security, in exchange for limiting some upside exposure and taking on the credit risk of the issuer of the Market Linked Security • Thus the portfolio is more conservative In this scenario, an investor adds the same Market Linked Security but to the bond allocation • The principal at risk of the portfolio is unchanged • Guaranteed income is reduced in exchange for contingent, market - linked participation and taking on the credit risk of the issuer of the Market Linked Security • Thus the portfolio is more aggressive S e c ur ity S e c ur ity

Citigroup Global Markets Holdings Inc. 8 Any figures or terms provided in this product summary supplement are sample product terms, illustrative and are no indication of what final terms or actual returns will be. This product summary supplement does not consider the effect taxes and fees will have on your returns. The terms of each product vary from offering to offering. For terms relating to particular offerings, including direct and indirect risks and other material considerations, you should refer to that product’s disclosure documents. Citigroup Global Markets Inc. and its affiliates (“Citi”) do not guarantee that a secondary market will develop in any structured product you purchase. If a secondary market does develop it may not be liquid and may not continue for the term of the product. If the secondary market is limited there may be few buyers should you choose to sell the product prior to maturity and this may reduce the price you receive. There is no guarantee that investors wishing to liquidate an investment in such products prior to the stated maturity will receive a price equal to or in excess of the initial principal amount invested. The value of structured products may rise as well as fall during the term of the product and the return on any product may be lower than what could be earned on a conventional investment of similar duration and credit risk. For each product, investors assume the full credit risk of the issuer and guarantor of issuer’s obligations. Products may provide for adjustments to be made to their final terms during their term due to certain events including corporate actions, mergers and acquisitions, divestitures, price source disruption, trading suspension or material change in index formula and/or index content. Citi may at any time hold long or short positions. Accordingly, Citi may actively trade these and related securities for its own account and those of its customers and, at any time, may have long or short positions in and buy and sell, the securities, commodities, futures, options, derivatives or other instruments and investments identical with or related to those mentioned in this product summary supplement. Before making an investment in a specific product, you should obtain and carefully read the pricing supplement and any product or index supplement relating to that product offering, which will contain additional information needed to evaluate the investment and provide important disclosures regarding risks, fees and expenses. Additionally, such legal documents will contain the only complete description, and final terms, of the terms and conditions of that product. Before making any commitment to invest, you should take whatever business, legal, tax, accounting or other advice you consider necessary given your particular circumstances. If you invest in a structured product, you are responsible for any tax lawfully due from you on the income or gains arising from such investment. Citi does not provide business, legal, tax or accounting advice and makes no representation in respect of any of them. Structured investments are not deposits and are neither obligations of nor guaranteed by Citibank, or any governmental entity or agency. If you have any doubt about the suitability of these investments, you should contact your own advisers for advice. Additional Information

©2021 Citigroup Global Markets Inc. All rights reserved. Citi and Citi and Arc Design are trademarks and service marks of Citigroup Inc. or its subsidiaries and are used and registered throughout the world. Learn More Please contact your Investment Professional if you are looking to potentially buy Structured Investments. Financial Advisors and Distribution partners may contact our sales professionals at: +1 (212) 723 - 3916 (Citi private banking channel) +1 (212) 723 - 7288 (Citi consumer banking channels) +1 (212) 723 - 3136 (external channels) At Citi, our talented professionals are dedicated to delivering innovative value added investments and services to our clients across the globe.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Citi Upgrades Sirius XM Radio (SIRI) to Neutral, 'risk-reward is balanced at prevailing levels'

- Tesla (TSLA) PT Raised to $182 at Citi

- Wabtec Delivers First Quarter 2024 Results; Raises Full-Year Guidance

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

CitiSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share