Form 424B2 BARCLAYS BANK PLC

|

Preliminary Pricing Supplement No. 4168 (To the Prospectus dated August 1, 2019, the Prospectus Supplement dated August 1, 2019, the Prospectus Supplement Addendum dated February 18, 2021 and the Product Supplement EQUITY INDICES LIRN-1 dated August 1, 2019) |

Subject to Completion Amendment No. 1 dated September 21, 2021 Preliminary Pricing Supplement dated September 2, 2021 |

Filed Pursuant to Rule 424(b)(2) Registration Statement No. 333-232144 |

| Units $10 principal amount per unit CUSIP No.  |

Pricing Date* Settlement Date* Maturity Date* |

September , 2021 September , 2021 September , 2027 | |||

| *Subject to change based on the actual date the notes are priced for initial sale to the public (the “pricing date”) | |||||

|

Capped Notes Linked to the Dow Jones Industrial Average® § Maturity of approximately six years § 1-to-1 upside exposure to increases in the Index, subject to a capped return of [40.00% to 50.00%] § 1-to-1 downside exposure to decreases in the Index beyond a 20.00% decline, with up to 80.00% of your principal at risk § All payments occur at maturity and are subject to the credit risk of Barclays Bank PLC § No periodic interest payments § In addition to the underwriting discount set forth below, the notes include a hedging-related charge of $0.075 per unit. See “Structuring the Notes”. § Limited secondary market liquidity, with no exchange listing § The notes are our unsecured and unsubordinated obligations and are not deposit liabilities of Barclays Bank PLC. The notes are not covered by the U.K. Financial Services Compensation Scheme or insured by the U.S. Federal Deposit Insurance Corporation or any other governmental agency or deposit insurance agency of the United States, the United Kingdom, or any other jurisdiction. | |||||

The notes are being issued by Barclays Bank PLC (“Barclays”). There are important differences between the notes and a conventional debt security, including different investment risks. See “Risk Factors” beginning on page TS-7 of this term sheet, beginning on page PS-7 of product supplement EQUITY INDICES LIRN-1 and beginning on page S-7 of the prospectus supplement.

Our initial estimated value of the notes, based on our internal pricing models, is expected to be between $8.85 and $9.16 per unit on the pricing date, which is less than the public offering price listed below. See “Summary” on the following page, “Risk Factors” beginning on page TS-7 of this term sheet and “Structuring the Notes” on page TS-13 of this term sheet.

Notwithstanding and to the exclusion of any other term of the notes or any other agreements, arrangements or understandings between Barclays and any holder or beneficial owner of the notes, by acquiring the notes, each holder and beneficial owner of the notes acknowledges, accepts, agrees to be bound by, and consents to the exercise of, any U.K. Bail-in Power by the relevant U.K. resolution authority. All payments are subject to the risk of exercise of any U.K. Bail-in Power by the relevant U.K. resolution authority. See “Consent to U.K. Bail-in Power” on page TS-3 and “Risk Factors” beginning on page TS-7 of this term sheet.

_________________________

None of the Securities and Exchange Commission (the “SEC”), any state securities commission, or any other regulatory body has approved or disapproved of these securities or determined if this Note Prospectus (as defined below) is truthful or complete. Any representation to the contrary is a criminal offense.

_________________________

| Per Unit | Total | |

| Public offering price(1) | $ 10.00 | $ |

| Underwriting discount(1) | $ 0.25 | $ |

| Proceeds, before expenses, to Barclays | $ 9.75 | $ |

| (1) | For any purchase of 300,000 units or more in a single transaction by an individual investor or in combined transactions with the investor’s household in this offering, the public offering price and the underwriting discount will be $9.95 per unit and $0.20 per unit, respectively. See “Supplement to the Plan of Distribution” below. |

The notes:

| Are Not FDIC Insured | Are Not Bank Guaranteed | May Lose Value |

BofA Securities

September , 2021

| Capped Notes Linked to the Dow Jones Industrial Average®, due September , 2027 |

Summary

The Capped Notes Linked to the Dow Jones Industrial Average®, due September , 2027 (the “notes”) are our unsecured and unsubordinated obligations and are not deposit liabilities of Barclays. The notes are not covered by the U.K. Financial Services Compensation Scheme or insured by the U.S. Federal Deposit Insurance Corporation or any other governmental agency or deposit insurance agency of the United States, the United Kingdom or any other jurisdiction. The notes will rank equally with all of our other unsecured and unsubordinated debt. Any payments due on the notes, including any repayment of principal, will be subject to the credit risk of Barclays and to the risk of exercise of any U.K. Bail-in Power (as described herein) or any other resolution measure by any relevant U.K. resolution authority. The notes provide you a 1-to-1 return, subject to a cap, if the Ending Value of the Market Measure, which is the Dow Jones Industrial Average® (the “Index”), is greater than the Starting Value. If the Ending Value is equal to or less than the Starting Value but greater than or equal to the Threshold Value, you will receive the principal amount of your notes. If the Ending Value is less than the Threshold Value, you will lose a portion, which could be significant, of the principal amount of your notes. Any payments on the notes will be calculated based on the $10 principal amount per unit and will depend on the performance of the Index, subject to our credit risk. See “Terms of the Notes” below.

On the cover page of this term sheet, we have provided the estimated value range for the notes. This range of estimated values was determined based on our internal pricing models, which take into account a number of variables, including volatility, interest rates and our internal funding rates, which are our internally published borrowing rates, and the economic terms of certain related hedging arrangements. This range of estimated values may not correlate on a linear basis with the range of Capped Value for the notes. The estimated value of the notes calculated on the pricing date is expected to be less than the public offering price and will be set forth in the final term sheet made available to investors in the notes.

The economic terms of the notes (including the Capped Value) are based on our internal funding rates, which may vary from the levels at which our benchmark debt securities trade in the secondary market, and the economic terms of certain related hedging arrangements. The difference between these rates, as well as the underwriting discount, the hedging-related charge and other amounts described below, will reduce the economic terms of the notes. For more information about the estimated value and the structuring of the notes, see “Structuring the Notes” on page TS-13.

| Terms of the Notes | Redemption Amount Determination | |

| Issuer: | Barclays Bank PLC (“Barclays ”) | On the maturity date, you will receive a cash payment per unit determined as follows: |

| Principal Amount: | $10.00 per unit |  |

| Term: | Approximately six years | |

| Market Measure: | The Dow Jones industrial Average® (Bloomberg symbol: “INDU”), a price return index | |

| Starting Value: | The closing level of the Market Measure on the pricing date | |

| Ending Value: | The average of the closing levels of the Market Measure on each calculation day occurring during the Maturity Valuation Period. The scheduled calculation days are subject to postponement in the event of Market Disruption Events, as described beginning on page PS-20 of product supplement EQUITY INDICES LIRN-1. | |

| Threshold Value: | 80% of the Starting Value, rounded to two decimal places. | |

| Participation Rate: | 100% | |

| Capped Value: | [14.00 to $15.00] per unit, which represents a return of [40.00% to 50.00%] over the principal amount. The actual Capped Value will be determined on the pricing date. | |

| Maturity Valuation Period: | Five scheduled calculation days shortly before the maturity date. | |

| Fees Charged: | The public offering price of the notes includes the underwriting discount of $0.25 per unit as listed on the cover page and a hedging-related charge of $0.075 per unit described in “Structuring the Notes” on page TS-13. | |

| Calculation Agents: | Barclays and BofA Securities, Inc. (“BofAS”). | |

| Capped Notes | TS-2 |

| Capped Notes Linked to the Dow Jones Industrial Average®, due September , 2027 |

The terms and risks of the notes are contained in this term sheet and the documents listed below (together, the “Note Prospectus”). The documents have been filed as part of a registration statement with the SEC, which may, without cost, be accessed on the SEC website as indicated below or obtained from Merrill Lynch, Pierce, Fenner & Smith Incorporated (“MLPF&S”) or BofAS by calling 1-800-294-1322:

| § | Product supplement EQUITY INDICES LIRN-1 dated August 1, 2019: http://www.sec.gov/Archives/edgar/data/312070/000095010319010198/dp110112_424b3-lirn.htm |

| § | Prospectus supplement addendum dated February 18, 2021: http://www.sec.gov/Archives/edgar/data/312070/000095010321002483/dp146316_424b3.htm |

| § | Series A MTN prospectus supplement dated August 1, 2019: http://www.sec.gov/Archives/edgar/data/312070/000095010319010190/dp110493_424b2-prosupp.htm |

| § | Prospectus dated August 1, 2019: http://www.sec.gov/Archives/edgar/data/312070/000119312519210880/d756086d424b3.htm |

Before you invest, you should read the Note Prospectus, including this term sheet, for information about us and this offering. Any prior or contemporaneous oral statements and any other written materials you may have received are superseded by the Note Prospectus. Capitalized terms used but not defined in this term sheet have the meanings set forth in product supplement EQUITY INDICES LIRN-1. Unless otherwise indicated or unless the context requires otherwise, all references in this document to “we,” “us,” “our” or similar references are to Barclays.

Consent to U.K. Bail-in Power

Notwithstanding and to the exclusion of any other term of the notes or any other agreements, arrangements or understandings between us and any holder or beneficial owner of the notes, by acquiring the notes, each holder and beneficial owner of the notes acknowledges, accepts, agrees to be bound by, and consents to the exercise of, any U.K. Bail-in Power by the relevant U.K. resolution authority.

Under the U.K. Banking Act 2009, as amended, the relevant U.K. resolution authority may exercise a U.K. Bail-in Power in circumstances in which the relevant U.K. resolution authority is satisfied that the resolution conditions are met. These conditions include that a U.K. bank or investment firm is failing or is likely to fail to satisfy the Financial Services and Markets Act 2000 (the “FSMA”) threshold conditions for authorization to carry on certain regulated activities (within the meaning of section 55B FSMA) or, in the case of a U.K. banking group company that is a European Economic Area (“EEA”) or third country institution or investment firm, that the relevant EEA or third country relevant authority is satisfied that the resolution conditions are met in respect of that entity.

The U.K. Bail-in Power includes any write-down, conversion, transfer, modification and/or suspension power, which allows for (i) the reduction or cancellation of all, or a portion, of the principal amount of, any interest on, or any other amounts payable on, the notes; (ii) the conversion of all, or a portion, of the principal amount of, any interest on, or any other amounts payable on, the notes into shares or other securities or other obligations of Barclays or another person (and the issue to, or conferral on, the holder or beneficial owner of the notes such shares, securities or obligations); (iii) the cancellation of the notes and/or (iv) the amendment or alteration of the maturity of the notes, or amendment of the amount of any interest or any other amounts due on the notes, or the dates on which any interest or any other amounts become payable, including by suspending payment for a temporary period; which U.K. Bail-in Power may be exercised by means of a variation of the terms of the notes solely to give effect to the exercise by the relevant U.K. resolution authority of such U.K. Bail-in Power. Each holder and beneficial owner of the notes further acknowledges and agrees that the rights of the holders or beneficial owners of the notes are subject to, and will be varied, if necessary, solely to give effect to, the exercise of any U.K. Bail-in Power by the relevant U.K. resolution authority. For the avoidance of doubt, this consent and acknowledgment is not a waiver of any rights holders or beneficial owners of the notes may have at law if and to the extent that any U.K. Bail-in Power is exercised by the relevant U.K. resolution authority in breach of laws applicable in England.

For more information, please see “Risk Factors” below as well as “U.K. Bail-in Power,” “Risk Factors—Risks Relating to the Securities Generally—Regulatory action in the event a bank or investment firm in the Group is failing or likely to fail could materially adversely affect the value of the securities” and “—Under the terms of the securities, you have agreed to be bound by the exercise of any U.K. Bail-in Power by the relevant U.K. resolution authority” in the accompanying prospectus supplement.

The preceding discussion supersedes the discussion in the accompanying prospectus and prospectus supplement to the extent it is inconsistent therewith.

| Capped Notes | TS-3 |

| Capped Notes Linked to the Dow Jones Industrial Average®, due September , 2027 |

Investor Considerations

You may wish to consider an investment in the notes if:

| § | You anticipate that the Index will increase moderately from the Starting Value to the Ending Value. |

| § | You are willing to risk a loss of principal and return if the Index decreases from the Starting Value to an Ending Value that is below the Threshold Value. |

| § | You accept that the return on the notes will be capped. |

| § | You are willing to forgo the interest payments that are paid on traditional interest bearing debt securities. |

| § | You are willing to forgo dividends or other benefits of owning the stocks included in the Index. |

| § | You are willing to accept a limited or no market for sales prior to maturity, and understand that the market prices for the notes, if any, will be affected by various factors, including our actual and perceived creditworthiness, the inclusion in the public offering price of the underwriting discount, the hedging-related charge and other amounts, as described on page TS-2. |

| § | You are willing to assume our credit risk, as issuer of the notes, for all payments under the notes, including the Redemption Amount. |

| § | You are willing to consent to the exercise of any U.K. Bail-in Power by U.K. resolution authorities. |

The notes may not be an appropriate investment for you if:

| § | You believe that the Index will decrease from the Starting Value to the Ending Value or that it will not increase sufficiently over the term of the notes to provide you with your desired return. |

| § | You seek 100% principal repayment or preservation of capital. |

| § | You seek an uncapped return on your investment. |

| § | You seek interest payments or other current income on your investment. |

| § | You want to receive dividends or other distributions paid on the stocks included in the Index. |

| § | You seek an investment for which there will be a liquid secondary market. |

| § | You are unwilling or are unable to take market risk on the notes or to take our credit risk as issuer of the notes. |

| § | You are unwilling to consent to the exercise of any U.K. Bail-in Power by U.K. resolution authorities. |

We urge you to consult your investment, legal, tax, accounting, and other advisors before you invest in the notes.

| Capped Notes | TS-4 |

| Capped Notes Linked to the Dow Jones Industrial Average®, due September , 2027 |

Hypothetical Payout Profile

The graph below is based on hypothetical numbers and values.

|

Capped Notes

|

This graph reflects the returns on the notes, based on the Participation Rate of 100%, a Threshold Value of 80% of the Starting Value and a Capped Value of $14.50 per unit (the midpoint of the Capped Value range of [$14.00 to $15.00]). The green line reflects the returns on the notes, while the dotted gray line reflects the returns of a direct investment in the stocks included in the Index, excluding dividends.

This graph has been prepared for purposes of illustration only.

|

Hypothetical Payments at Maturity

The following table and examples are for purposes of illustration only. They are based on hypothetical values and show hypothetical returns on the notes. The following table is based on a hypothetical Starting Value of 100, a hypothetical Threshold Value of 80, the Participation Rate of 100% and a hypothetical Capped Value of $14.50 per unit. It illustrates the effect of a range of Ending Values on the Redemption Amount per unit of the notes and the total rate of return to holders of the notes. The actual amount you receive and the resulting total rate of return will depend on the actual Starting Value, Threshold Value, Ending Value, Capped Value and term of your investment. The following examples do not take into account any tax consequences from investing in the notes.

For recent actual levels of the Market Measure, see “The Index” section below. The Index is a price return index and as such the Ending Value will not include any income generated by dividends paid on the stocks included in the Index, which you would otherwise be entitled to receive if you invested in those stocks directly. In addition, all payments on the notes are subject to issuer credit risk.

|

Ending Value |

Percentage Change from the Starting Value to the Ending Value |

Redemption Amount per Unit |

Total Rate of Return on the Notes |

| 0.00 | -100.00% | $2.00 | -80.00% |

| 50.00 | -50.00% | $7.00 | -30.00% |

| 60.00 | -40.00% | $8.00 | -20.00% |

| 70.00 | -30.00% | $9.00 | -10.00% |

| 80.00(1) | -20.00% | $10.00 | 0.00% |

| 85.00 | -15.00% | $10.00 | 0.00% |

| 90.00 | -10.00% | $10.00 | 0.00% |

| 97.00 | -3.00% | $10.00 | 0.00% |

| 100.00(2) | 0.00% | $10.00 | 0.00% |

| 102.00 | 2.00% | $10.20 | 2.00% |

| 105.00 | 5.00% | $10.50 | 5.00% |

| 110.00 | 10.00% | $11.00 | 10.00% |

| 120.00 | 20.00% | $12.00 | 20.00% |

| 130.00 | 30.00% | $13.00 | 30.00% |

| 145.00 | 45.00% | $14.50(3) | 45.00% |

| 150.00 | 50.00% | $14.50 | 45.00% |

| 155.00 | 55.00% | $14.50 | 45.00% |

| 160.00 | 60.00% | $14.50 | 45.00% |

| (1) | This is the hypothetical Threshold Value. |

| (2) | The hypothetical Starting Value of 100 used in these examples has been chosen for illustrative purposes only, and does not represent a likely actual Starting Value for the Market Measure. |

| (3) | The Redemption Amount per unit cannot exceed the hypothetical Capped Value. |

| Capped Notes | TS-5 |

| Capped Notes Linked to the Dow Jones Industrial Average®, due September , 2027 |

Redemption Amount Calculation Examples

| Example 1 | ||

| The Ending Value is 50.00, or 50.00% of the Starting Value: | ||

| Starting Value: 100.00 | ||

| Threshold Value: 80.00 | ||

| Ending Value: 50.00 | ||

|

Redemption Amount per unit

|

|

| Example 2 |

| The Ending Value is 97.00, or 97.00% of the Starting Value: |

| Starting Value: 100.00 |

| Threshold Value: 80.00 |

| Ending Value: 97.00 |

| Redemption Amount (per unit) = $10.00, the principal amount, since the Ending Value is less than the Starting Value but equal to or greater than the Threshold Value. |

| Example 3 | |

| The Ending Value is 102.00, or 102.00% of the Starting Value: | |

| Starting Value: 100.00 | |

| Ending Value: 102.00 | |

|

= $10.20 Redemption Amount per unit |

|

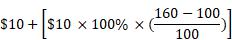

Example 4

| |

| The Ending Value is 160.00, or 160.00% of the Starting Value: | |

| Starting Value: 100.00 | |

| Ending Value: 160.00 | |

|

= $16.00, however, because the Redemption Amount for the notes cannot exceed the Capped Value, the Redemption Amount will be $14.50 per unit |

| Capped Notes | TS-6 |

| Capped Notes Linked to the Dow Jones Industrial Average®, due September , 2027 |

Risk Factors

There are important differences between the notes and a conventional debt security. An investment in the notes involves significant risks, including those listed below. You should carefully review the more detailed explanation of risks relating to the notes in the “Risk Factors” sections beginning on page PS-7 of product supplement EQUITY INDICES LIRN-1 and page S-7 of the Series A MTN prospectus supplement identified above. We also urge you to consult your investment, legal, tax, accounting, and other advisors before you invest in the notes.

Structure-related Risks

| § | Depending on the performance of the Index as measured shortly before the maturity date, your investment may result in a loss; there is no guaranteed return of principal. |

| § | Your return on the notes may be less than the yield you could earn by owning a conventional fixed or floating rate debt security of comparable maturity. |

| § | Your investment return is limited to the return represented by the Capped Value and may be less than a comparable investment directly in the stocks included in the Index. |

Issuer-related Risks

| § | Payments on the notes are subject to our credit risk, and any actual or perceived changes in our creditworthiness are expected to affect the value of the notes. If we become insolvent or are unable to pay our obligations, you may lose your entire investment. |

| § | Payments on the notes are subject to the exercise of U.K. Bail-in Power by the relevant U.K. resolution authority. As described above under “Consent to U.K. Bail-in Power,” the relevant U.K. resolution authority may exercise any U.K. Bail-in Power under the conditions described in such section of this term sheet. If any U.K. Bail-in Power is exercised, you may lose all or a part of the value of your investment in the notes or receive a different security, which may be worth significantly less than the notes and which may have significantly fewer protections than those typically afforded to debt securities. Moreover, the relevant U.K. resolution authority may exercise its authority to implement the U.K. Bail-in Power without providing any advance notice to the holders and beneficial owners of the notes. By your acquisition of the notes, you acknowledge, accept, agree to be bound by, and consent to the exercise of, any U.K. Bail-in Power by the relevant U.K. resolution authority. The exercise of any U.K. Bail-in Power with respect to the notes will not be a default or an Event of Default (as each term is defined in the senior debt securities indenture relating to the notes). The trustee will not be liable for any action that the trustee takes, or abstains from taking, in either case, in accordance with the exercise of the U.K. Bail-in Power with respect to the notes. See “Consent to U.K. Bail-in Power” above as well as “U.K. Bail-in Power,” “Risk Factors—Risks Relating to the Securities Generally—Regulatory action in the event a bank or investment firm in the Group is failing or likely to fail could materially adversely affect the value of the securities” and “—Under the terms of the securities, you have agreed to be bound by the exercise of any U.K. Bail-in Power by the relevant U.K. resolution authority” in the accompanying prospectus supplement for more information. |

Valuation- and Market-related Risks

| § | The estimated value of your notes is based on our internal pricing models. Our internal pricing models take into account a number of variables and are based on a number of subjective assumptions, which may or may not materialize, typically including volatility, interest rates, and our internal funding rates. These variables and assumptions are not evaluated or verified on an independent basis and may prove to be inaccurate. Different pricing models and assumptions of different financial institutions could provide valuations for the notes that are different from our estimated value. |

| § | The estimated value is based on a number of variables, including volatility, interest rates and our internal funding rates. Our internal funding rates may vary from the levels at which our benchmark debt securities trade in the secondary market. As a result of this difference, the estimated value referenced in this term sheet may be lower if such estimated value was based on the levels at which our benchmark debt securities trade in the secondary market. |

| § | The estimated value of your notes is expected to be lower than the public offering price of your notes. This difference is expected as a result of certain factors, such as the inclusion in the public offering price of the underwriting discount, the hedging-related charge, the estimated profit, if any, that we or any of our affiliates expect to earn in connection with structuring the notes, and the estimated cost which we may incur in hedging our obligations under the notes, as further described in “Structuring the Notes” on page TS-14. If you attempt to sell the notes prior to maturity, their market value may be lower than the price you paid for the notes and lower than the estimated value because the secondary market prices take into consideration the levels at which our debt securities trade in the secondary market but do not take into account such fees, charges and other amounts. |

| § | The estimated value of the notes will not be a prediction of the prices at which MLPF&S, BofAS or its affiliates, or any of our affiliates or any other third parties may be willing to purchase the notes from you in secondary market transactions. The price at which you may be able to sell your notes in the secondary market at any time will be influenced by many factors that cannot be predicted, such as market conditions, and any bid and ask spread for similar size trades, and may be substantially less than our estimated value of the notes. Any sale prior to the maturity date could result in a substantial loss to you. |

| § | A trading market is not expected to develop for the notes. We, MLPF&S, BofAS and our respective affiliates are not obligated to make a market for, or to repurchase, the notes. There is no assurance that any party will be willing to purchase your notes at any price in any secondary market. |

| Capped Notes | TS-7 |

| Capped Notes Linked to the Dow Jones Industrial Average®, due September , 2027 |

Conflict-related Risks

| § | Our business, hedging and trading activities, and those of MLPF&S, BofAS and our respective affiliates (including trading in securities of companies included in the Index), and any hedging and trading activities we, MLPF&S, BofAS or our respective affiliates engage in for our clients’ accounts, may affect the market value and return of the notes and may create conflicts of interest with you. |

| § | There may be potential conflicts of interest involving the calculation agents, one of which is us and one of which is BofAS. We have the right to appoint and remove the calculation agents. |

Market Measure-related Risks

| § | The Index sponsor may adjust the Index in a way that affects its level, and has no obligation to consider your interests. |

| § | You will have no rights of a holder of the securities included in the Index, and you will not be entitled to receive securities or dividends or other distributions by the issuers of those securities. |

| § | While we, MLPF&S, BofAS or our respective affiliates may from time to time own securities of companies included in the Index, we, MLPF&S, BofAS and our respective affiliates do not control any company included in the Index, and have not verified any disclosure made by any company. |

Tax-related Risks

| § | The U.S. federal income tax consequences of the notes are uncertain, and may be adverse to a U.S. investor of the notes. See “Tax Considerations” below. |

| Capped Notes | TS-8 |

| Capped Notes Linked to the Dow Jones Industrial Average®, due September , 2027 |

The Index

All disclosures contained in this term sheet regarding the Index, including, without limitation, its make-up, method of calculation and changes in its components, have been derived from publicly available sources, without independent verification. This information reflects the policies of, and is subject to change by, S&P Dow Jones Indices LLC (the “Index sponsor” or “S&P Dow Jones”). The Index was developed by the Index sponsor and is calculated, maintained and published by the Index sponsor. The Index sponsor has no obligation to continue to publish, and may discontinue publication of, the Index. The consequences of the Index sponsor discontinuing publication of the Index are discussed in the section entitled “Description of LIRNs—Discontinuance of an Index” beginning on page PS-21 of product supplement EQUITY INDICES LIRN-1. None of us, the calculation agents, MLPF&S or BofAS accepts any responsibility for the calculation, maintenance or publication of the Index or any successor index.

General

The Index is reported by Bloomberg L.P. under the ticker symbol “INDU.”

The Index is a price-weighted index that seeks to measure of the performance of 30 U.S. blue-chip companies. The Index covers all industries with the exception of transportation and utilities.

The Index is price-weighted rather than market capitalization-weighted, which means that weightings are based only on changes in the stocks’ prices, rather than by both price changes and changes in the number of shares outstanding. The value of the Index is the sum of the primary exchange prices of each of the 30 component stocks included in the Index divided by a divisor. The divisor used to calculate the price-weighted average of the Index is not simply the number of component stocks; rather, the divisor is adjusted to smooth out the effects of stock splits and other corporate actions. While this methodology reflects current practice in calculating the Index, no assurance can be given that S&P Dow Jones will not modify or change this methodology in a manner that may affect the amounts payable on the notes at maturity.

Index Construction and Maintenance

The Index is maintained by a committee, which is currently composed of three representatives of S&P Dow Jones and two representatives of The Wall Street Journal (the “Averages Committee”). The Averages Committee meets at least semi-annually. At each meeting, the Averages Committee reviews pending corporate actions that may affect Index constituents, statistics comparing the composition of the Index to the market, companies that are being considered as candidates for addition to the Index, and any significant market events. In addition, the Averages Committee may revise index policy covering rules for selecting companies, treatment of dividends, share counts or other matters.

The Index universe consists of securities in the S&P 500® Index, excluding stocks classified under Global Industry Classification Standard (GICS®) code 2030 (Transportation) and 55 (Utilities). While stock selection is not governed by quantitative rules, a stock typically is added only if the company has an excellent reputation, demonstrates sustained growth and is of interest to a large number of investors. Since the Index is price weighted, the Averages Committee evaluates stock price when considering a company for inclusion. The Averages Committee monitors whether the highest-priced stock in the Index has a price more than 10 times that of the lowest. Maintaining adequate sector representation within the Index is also a consideration in the selection process for the Index. Changes to the Index are made on an as-needed basis. There is no annual or semi-annual reconstruction. Rather, changes in response to corporate actions and market developments can be made at any time. Companies should be incorporated and headquartered in the United States, and a plurality of revenues should be derived from the United States.

Corporate Actions

The table below summarizes the types of index maintenance adjustments and indicates whether or not an index divisor adjustment is required.

|

Corporation Action |

Adjustment Made to the Index |

Divisor Adjustment? |

| Spin-off | The price of the parent company is adjusted to the price of the parent company minus (the price of the spun-off company/share exchange ratio). Any potential impacts on Index constituents are evaluated by the Averaging Committee on a case by case basis. | Yes |

| Rights Offering | The price is adjusted according to the terms of the rights offering. | Yes |

| Stock dividend, stock split, reverse stock split | The price is adjusted according to the terms of the stock split or dividend. | Yes |

| Share Issuance, Share Repurchase, Equity Offering or Warrant Conversion | No impact. | No |

| Special dividends | Price of the stock making the special dividend payment is | Yes |

| Capped Notes | TS-9 |

| Capped Notes Linked to the Dow Jones Industrial Average®, due September , 2027 |

| reduced by the per share special dividend amount after the close of trading on the day before the dividend ex-date | ||

| Constituent Change | Deletions due to delistings, acquisition or any other corporate event resulting in the deletion of the stock from the Index will be replaced on the effective date of the drop. | Yes |

| Capped Notes | TS-10 |

| Capped Notes Linked to the Dow Jones Industrial Average®, due September , 2027 |

The following graph shows the daily historical performance of the Index in the period from January 1, 2011 through September 20, 2021. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On September 20, 2021, the closing level of the Index was 33,970.47.

Historical Performance of the Index

This historical data on the Index is not necessarily indicative of the future performance of the Index or what the value of the notes may be. Any historical upward or downward trend in the level of the Index during any period set forth above is not an indication that the level of the Index is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the levels of the Index.

License Agreement

The Index is a product of S&P Dow Jones, and has been licensed for use by us. Dow Jones®, DJIA®, Dow Jones Industrial Average®, and The Dow® are trademarks of Dow Jones Trademark Holdings LLC (“Dow Jones”). These trademarks have been licensed to S&P Dow Jones and its affiliates and sublicensed to us for certain purposes.

The notes are not sponsored, endorsed, sold or promoted by S&P Dow Jones, Dow Jones or any of their respective affiliates (collectively, “S&P”). S&P does not make any representation or warranty, express or implied, to the holders of the notes or any member of the public regarding the advisability of investing in securities generally or in the notes particularly or the ability of the Index to track general market performance. S&P’s only relationship to us with respect to the Index is the licensing of the Index and certain trademarks, service marks and/or trade names of S&P and/or its licensors. The Index is determined, composed and calculated by S&P without regard to us or the notes. S&P has no obligation to take our needs or the needs of holders of the notes into consideration in determining, composing or calculating the Index. S&P is not responsible for and has not participated in the determination of the prices, and amount of the notes or the timing of the issuance or sale of the notes or in the determination or calculation of the equation by which the notes are to be converted into cash, surrendered or redeemed, as the case may be. S&P has no obligation or liability in connection with the administration, marketing or trading of the notes. There is no assurance that investment products based on the Index will accurately track the performance of the Index or provide positive investment returns. S&P Dow Jones is not an investment advisor. Inclusion of a security within the Index is not a recommendation by S&P to buy, sell, or hold such security, nor is it considered to be investment advice. In addition, CME Group Inc. and its affiliates may trade financial products which are linked to the performance of the Index. It is possible that this trading activity will affect the level of the Index and the value of the notes.

S&P DOES NOT GUARANTEE THE ADEQUACY, ACCURACY, TIMELINESS AND/OR THE COMPLETENESS OF THE INDEX OR ANY DATA RELATED THERETO OR ANY COMMUNICATION (INCLUDING BUT NOT LIMITED TO, ORAL OR WRITTEN COMMUNICATION (INCLUDING ELECTRONIC COMMUNICATIONS)) WITH RESPECT THERETO. S&P SHALL NOT BE SUBJECT TO ANY DAMAGES OR LIABILITY FOR ANY ERRORS, OMISSIONS, OR DELAYS THEREIN. S&P MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIMS ALL WARRANTIES, OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE OR AS TO RESULTS TO BE OBTAINED BY US, HOLDERS OF THE NOTES, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE INDEX OR WITH RESPECT TO ANY DATA RELATED THERETO. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT WHATSOEVER SHALL S&P BE LIABLE FOR ANY INDIRECT, SPECIAL, INCIDENTAL, PUNITIVE, OR CONSEQUENTIAL DAMAGES INCLUDING BUT NOT LIMITED TO, LOSS OF PROFITS, TRADING LOSSES, LOST TIME OR GOODWILL, EVEN IF THEY HAVE BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES, WHETHER IN CONTRACT, TORT, STRICT LIABILITY, OR OTHERWISE. THERE ARE NO THIRD PARTY BENEFICIARIES OF ANY AGREEMENTS OR ARRANGEMENTS BETWEEN S&P AND US, OTHER THAN THE LICENSORS OF S&P.

| Capped Notes | TS-11 |

| Capped Notes Linked to the Dow Jones Industrial Average®, due September , 2027 |

Supplement to the Plan of Distribution

Under our distribution agreement with BofAS, BofAS will purchase the notes from us as principal at the public offering price indicated on the cover of this term sheet, less the indicated underwriting discount.

BofAS has advised us that MLPF&S will purchase the notes from BofAS for resale, and will receive a selling concession in connection with the sale of the notes in an amount up to the full amount of underwriting discount set forth on the cover of this term sheet.

We may deliver the notes against payment therefor in New York, New York on a date that is greater than two business days following the pricing date. Under Rule 15c6-1 of the Securities Exchange Act of 1934, trades in the secondary market generally are required to settle in two business days, unless the parties to any such trade expressly agree otherwise. Accordingly, if the initial settlement of the notes occurs more than two business days from the pricing date, purchasers who wish to trade the notes more than two business days prior to the original issue date will be required to specify alternative settlement arrangements to prevent a failed settlement.

The notes will not be listed on any securities exchange. In the original offering of the notes, the notes will be sold in minimum investment amounts of 100 units. If you place an order to purchase the notes, you are consenting to MLPF&S and/or one of its affiliates acting as a principal in effecting the transaction for your account.

MLPF&S and BofAS may repurchase and resell the notes, with repurchases and resales being made at prices related to then-prevailing market prices or at negotiated prices, and these prices will include MLPF&S’s and BofAS’s trading commissions and mark-ups or mark-downs. MLPF&S and BofAS may act as principal or agent in these market-making transactions; however, neither is obligated to engage in any such transactions. BofAS has advised us that, at MLPF&S’s and BofAS’s discretion, for a short, undetermined initial period after the issuance of the notes, MLPF&S and BofAS may offer to buy the notes in the secondary market at a price that may exceed the estimated value of the notes at the time of purchase. Any price offered by MLPF&S or BofAS for the notes will be based on then-prevailing market conditions and other considerations, including the performance of the Index, the remaining term of the notes and our creditworthiness. However, none of us, MLPF&S, BofAS nor any of our respective affiliates is obligated to purchase your notes at any price, or at any time, and we cannot assure you that we, MLPF&S, BofAS or our respective affiliates will purchase your notes at a price that equals or exceeds the initial estimated value of the notes.

The value of the notes shown on your account statement produced by MLPF&S will be based on BofAS’s estimate of the value of the notes if BofAS or another of its affiliates were to make a market in the notes, which it is not obligated to do. That estimate will be based upon the price that BofAS may pay for the notes in light of then-prevailing market conditions, and other considerations, as mentioned above, and will include transaction costs. At certain times, this price may be higher than or lower than the initial estimated value of the notes.

The distribution of the Note Prospectus in connection with these offers or sales will be solely for the purpose of providing investors with the description of the terms of the notes that was made available to investors in connection with their initial offering. Secondary market investors should not, and will not be authorized to, rely on the Note Prospectus for information regarding Barclays or for any purpose other than that described in the immediately preceding sentence.

An investor’s household, as referenced on the cover of this term sheet, will generally include accounts held by any of the following, as determined by MLPF&S in its discretion and acting in good faith based upon information then available to MLPF&S:

| · | the investor’s spouse (including a domestic partner), siblings, parents, grandparents, spouse’s parents, children and grandchildren, but excluding accounts held by aunts, uncles, cousins, nieces, nephews or any other family relationship not directly above or below the individual investor; |

| · | a family investment vehicle, including foundations, limited partnerships and personal holding companies, but only if the beneficial owners of the vehicle consist solely of the investor or members of the investor’s household as described above; and |

| · | a trust where the grantors and/or beneficiaries of the trust consist solely of the investor or members of the investor’s household as described above; provided that, purchases of the notes by a trust generally cannot be aggregated together with any purchases made by a trustee’s personal account. |

Purchases in retirement accounts will not be considered part of the same household as an individual investor’s personal or other non-retirement account, except for individual retirement accounts (“IRAs”), simplified employee pension plans (“SEPs”), savings incentive match plan for employees (“SIMPLEs”), and single-participant or owners only accounts (i.e., retirement accounts held by self-employed individuals, business owners or partners with no employees other than their spouses).

Please contact your Merrill financial advisor if you have any questions about the application of these provisions to your specific circumstances or think you are eligible.

Prohibition of Sales to UK Retail Investors

The notes are not intended to be offered, sold or otherwise made available to, and should not be offered, sold or otherwise made available to, any retail investor in the United Kingdom (“UK”). For these purposes, a UK retail investor means a person who is one (or more) of: (i) a retail client as defined in point (8) of Article 2 of Regulation (EU) No 2017/565 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 (as amended, the “EUWA”); (ii) a customer within the meaning of the provisions of the Financial Services and Markets Act 2000 (as amended, the “FSMA”) and any rules or regulations made under the FSMA to implement Directive (EU) 2016/97, where that customer would not qualify as a professional client as defined in point (8) of Article 2(1) of Regulation (EU) No 600/2014 as it forms part of UK domestic law by virtue of the EUWA; or (iii) not a qualified investor as defined in Article 2 of Regulation (EU) 2017/1129 as it forms part of UK domestic law by virtue of the EUWA (as amended, the “UK Prospectus

| Capped Notes | TS-12 |

| Capped Notes Linked to the Dow Jones Industrial Average®, due September , 2027 |

Regulation”). Consequently, no key information document required by Regulation (EU) No 1286/2014 as it forms part of UK domestic law by virtue of the EUWA (as amended, the “UK PRIIPs Regulation”) for offering or selling the notes or otherwise making them available to retail investors in the United Kingdom has been prepared and therefore offering or selling the notes or otherwise making them available to any retail investor in the United Kingdom may be unlawful under the UK PRIIPs Regulation.

Prohibition of Sales to EEA Retail Investors

The notes are not intended to be offered, sold or otherwise made available to, and should not be offered, sold or otherwise made available to, any retail investor in the European Economic Area (“EEA”). For these purposes, an EEA retail investor means a person who is one (or more) of: (i) a retail client as defined in point (11) of Article 4(1) 2014/65/EU (as amended, “MiFID II”); (ii) a customer within the meaning of Directive (EU) 2016/97, as amended, where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or (iii) not a qualified investor as defined in Regulation (EU) 2017/1129 (as amended, the “EU Prospectus Regulation”). Consequently, no key information document required by Regulation (EU) No 1286/2014 (as amended, the “EU PRIIPs Regulation”) for offering or selling the notes or otherwise making them available to retail investors in the European Economic Area has been prepared and therefore offering or selling the notes or otherwise making them available to any retail investor in the European Economic Area may be unlawful under the EU PRIIPs Regulation.

The preceding discussion supersedes the discussion in the accompanying prospectus and prospectus supplement to the extent it is inconsistent therewith.

| Capped Notes | TS-13 |

| Capped Notes Linked to the Dow Jones Industrial Average®, due September , 2027 |

Structuring the Notes

The notes are our debt securities, the return on which is linked to the performance of the Index. As is the case for all of our debt securities, including our market-linked notes, the economic terms of the notes reflect our actual or perceived creditworthiness at the time of pricing. The economic terms of the notes are based on our internal funding rates, which are our internally published borrowing rates based on variables such as market benchmarks, our appetite for borrowing, and our existing obligations coming to maturity. Our internal funding rates may vary from the levels at which our benchmark debt securities trade in the secondary market. Our estimated value on the pricing date will be based on our internal funding rates. Our estimated value of the notes may be lower if such valuation were based on the levels at which our benchmark debt securities trade in the secondary market.

The Redemption Amount payable at maturity will be calculated based on the $10 principal amount per unit and will depend on the performance of the Index. In order to meet these payment obligations, at the time we issue the notes, we may choose to enter into certain hedging arrangements (which may include call options, put options or other derivatives) with BofAS or one of its affiliates. The terms of these hedging arrangements are determined by seeking bids from market participants, including MLPF&S, BofAS and its affiliates or our affiliates, and take into account a number of factors, including our creditworthiness, interest rate movements, the volatility of the Index, the tenor of the notes and the tenor of the hedging arrangements. The economic terms of the notes and their estimated value depend in part on the terms of these hedging arrangements, any estimated profit that we or any of our affiliates expect to earn in connection with structuring the notes, and estimated costs which we may incur in hedging our obligations under the notes.

BofAS has advised us that the hedging arrangements will include a hedging related charge of approximately $0.075 per unit, reflecting an estimated profit to be credited to BofAS from these transactions. Since hedging entails risk and may be influenced by unpredictable market forces, additional profits and losses from these hedging arrangements may be realized by us, BofAS or any third party hedge providers.

For further information, see “Risk Factors—General Risks Relating to LIRNs” beginning on page PS-7 and “Use of Proceeds and Hedging” on page PS-17 of product supplement EQUITY INDICES LIRN-1.

| Capped Notes | TS-14 |

| Capped Notes Linked to the Dow Jones Industrial Average®, due September , 2027 |

Tax Considerations

You should review carefully the sections in the accompanying prospectus supplement entitled “Material U.S. Federal Income Tax Consequences—Tax Consequences to U.S. Holders—Notes Treated as Prepaid Forward or Derivative Contracts” and, if you are a non-U.S. holder, “—Tax Consequences to Non-U.S. Holders.” The following discussion, when read in combination with those sections, constitutes the full opinion of our special tax counsel, Davis Polk & Wardwell LLP, regarding the material U.S. federal income tax consequences of owning and disposing of the notes. The following discussion supersedes the discussion in the accompanying prospectus supplement to the extent it is inconsistent therewith.

Based on current market conditions, in the opinion of our special tax counsel, it is reasonable to treat the notes for U.S. federal income tax purposes as prepaid forward contracts with respect to the Index. Assuming this treatment is respected, upon a sale or exchange of the notes (including redemption at maturity), you should recognize capital gain or loss equal to the difference between the amount realized on the sale or exchange and your tax basis in the notes, which should equal the amount you paid to acquire the notes. This gain or loss on your notes should be treated as long-term capital gain or loss if you hold your notes for more than a year, whether or not you are an initial purchaser of notes at the original issue price. However, the IRS or a court may not respect this treatment, in which case the timing and character of any income or loss on the notes could be materially and adversely affected. In addition, in 2007 the U.S. Treasury Department and the IRS released a notice requesting comments on the U.S. federal income tax treatment of “prepaid forward contracts” and similar instruments. The notice focuses in particular on whether to require investors in these instruments to accrue income over the term of their investment. It also asks for comments on a number of related topics, including the character of income or loss with respect to these instruments; the relevance of factors such as the nature of the underlying property to which the instruments are linked; the degree, if any, to which income (including any mandated accruals) realized by non-U.S. investors should be subject to withholding tax; and whether these instruments are or should be subject to the “constructive ownership” regime, which very generally can operate to recharacterize certain long-term capital gain as ordinary income and impose a notional interest charge. While the notice requests comments on appropriate transition rules and effective dates, any Treasury regulations or other guidance promulgated after consideration of these issues could materially and adversely affect the tax consequences of an investment in the notes, possibly with retroactive effect. You should consult your tax advisor regarding the U.S. federal income tax consequences of an investment in the notes, including possible alternative treatments and the issues presented by this notice.

Treasury regulations under Section 871(m) generally impose a withholding tax on certain “dividend equivalents” under certain “equity linked instruments.” A recent IRS notice excludes from the scope of Section 871(m) instruments issued prior to January 1, 2023 that do not have a “delta of one” with respect to underlying securities that could pay U.S.-source dividends for U.S. federal income tax purposes (each an “Underlying Security”). Based on our determination that the notes do not have a “delta of one” within the meaning of the regulations, we expect that these regulations will not apply to the notes with regard to non-U.S. holders. Our determination is not binding on the IRS, and the IRS may disagree with this determination. Section 871(m) is complex and its application may depend on your particular circumstances, including whether you enter into other transactions with respect to an Underlying Security. If necessary, further information regarding the potential application of Section 871(m) will be provided in the pricing supplement for the notes. You should consult your tax advisor regarding the potential application of Section 871(m) to the notes.

U.S. Federal Estate Tax Treatment of Non-U.S. Holders. Subject to estate tax treaty relief, a note may be subject to U.S. federal estate tax if an individual Non-U.S. Holder holds the note at the time of his or her death. The gross estate of a Non-U.S. Holder domiciled outside the United States includes only property situated or deemed situated in the United States. Individual Non-U.S. Holders should consult their tax advisors regarding the U.S. federal estate tax consequences of holding the notes at death.

| Capped Notes | TS-15 |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Oil prices flat as markets await more economic cues; US inventories shrink

- Blackstone (BX) to Acquire Tropical Smoothie Cafe

- European stocks rise; Tesla earnings boost global sentiment

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

BarclaysSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share