Form 253G2 Jamestown Invest 1, LLC

Post-Qualification Offering Circular Amendment No. 2

File No. 024-11102

As filed with the Securities and Exchange Commission on September 24, 2021

OFFERING CIRCULAR

Jamestown Invest 1, LLC

Sponsored by

Jamestown, L.P.

Up to $46,033,490 in Common Shares

Jamestown Invest 1, LLC is a Delaware limited liability company formed to acquire and manage a portfolio consisting of real estate investments in urban infill locations in the path of anticipated growth. Possible asset classes could include mixed or single use properties incorporating office, retail, multifamily, for-sale residential, parking, unimproved land, warehouse/flex, or hotels in the Atlanta, Georgia metropolitan statistical area (“MSA”) as well as other MSAs primarily in the Southeast such as Raleigh, North Carolina and Charleston, South Carolina. We may also invest in other major MSAs across the United States, which would generally have populations equal to or greater than 500,000 residents. Our sponsor, Jamestown, L.P., or “Jamestown,” believes that our targeted properties and geographies have displayed strong performance and are expected to be well positioned to see continued healthy rent growth moving forward. While we intend primarily to invest in the targeted properties and target geographies outlined above, we may invest in other asset classes as well as other locations, depending on the availability of suitable investment opportunities. We may make our investments through majority-owned subsidiaries, and we may acquire minority interests or joint venture interests in subsidiaries. Additionally, affiliates of Jamestown may be interest holders in the joint ventures and subsidiaries in which we hold a majority or minority interest, which could cause potential conflicts of interests. See “Conflicts of Interest – Affiliate Investments.” The use of the terms “Jamestown Invest 1”, the “Company”, the “Fund”, “we”, “us” or “our” in this offering circular refer to Jamestown Invest 1, LLC unless the context indicates otherwise.

Headquartered in Atlanta, our sponsor, Jamestown L.P., or “Jamestown,” is a design-focused real estate investment and management company with $12.4 billion of assets under management as of June 30, 2021, a track record of 35+ years, nearly 80,000 German individual, U.S., and international institutional investors, 32 realized funds, and a clear mission: to transform spaces into hubs for innovation and community. With projects ranging from small retail properties to major adaptive reuse projects, Jamestown has both the in-house experience and the external relationships in the commercial real estate world to take advantage of investment opportunities in Atlanta. In addition to having significant experience in Atlanta, many of Jamestown’s key executives and management team live in Atlanta, reside in in-town neighborhoods and have extensive market experience and relationships in Atlanta. With Jamestown Invest 1, LLC, Jamestown intends to bring its expertise, previously only available to institutional investors and German retail investors, to individual U.S. investors. Jamestown intends to provide its quality investment discipline and asset management expertise to the Fund. This offering will provide an opportunity to invest directly in the Fund without upfront fees paid by the investors. As with previous funds, Jamestown has made a co-investment to ensure that it is fully aligned with the interests of the Jamestown Invest 1, LLC investors. As of June 30, 2021, Jamestown has made co-investments totaling $2,000,000, including $865,500 in a private placement prior to the initial offering statement being declared “qualified” by the SEC.

We are externally managed by our Manager, a wholly-owned subsidiary of our sponsor. Jamestown operates an online investment portal at jamestowninvest.com that allows investors to become equity holders in real estate opportunities that may have been historically difficult to access for some investors. Through the use of the investment portal on the Jamestown website, investors can view details of an investment and sign legal documents online. We qualify as a real estate investment trust, or REIT, for U.S. federal income tax purposes commencing with our first taxable year of operations.

On November 26, 2019, we qualified up to $50,000,000 in shares of our common shares for issuance in this public offering, which represent limited liability company interests in the Company. As of June 30, 2021, we have sold 395,643 shares of our common shares in this public offering for total gross offering proceeds of approximately $3,966,510, including 113,450 shares or $1,134,500 purchased by our sponsor. Accordingly, as of June 30, 2021, the total maximum amount of shares available for issuance is $46,033,490. Also, we have sold 550,100 of our common shares at the initial per share price of $10.00 per share, including approximately 86,550 common shares purchased by our sponsor, in a private placement prior to the initial offering statement being declared “qualified” by the SEC.

The current price of our common shares is $10.35 per share. The minimum investment in our common shares for initial purchases is $2,500 in shares for individuals, $5,000 in shares for persons investing through a self-directed retirement account, and $50,000 in shares for entity investors. We expect to offer common shares until the earlier of (x) May 25, 2023, 180 days after the third anniversary of the initial qualification date or (y) the date on which we raise the maximum amount being offered, unless the offering is terminated by our Manager at an earlier time. The per share purchase price for our common shares in this offering is currently $10.35 per share, based on the greater of (i) $10.00 and (ii) our NAV per share as of June 30, 2021 of $10.35. The per share purchase price in this offering will be adjusted at the beginning of each fiscal quarter (or as soon as commercially reasonable thereafter), and will be equal to the greater of (i) $10.00 per share or (ii) our NAV divided by the number of shares outstanding as of the close of business on the last business day of the prior fiscal quarter. Our Manager will adjust our per share purchase price as of the date the new NAV is announced, not the date when such NAV is determined, and investors will pay the most recent publicly announced purchase price as of the date of their subscription. Solely by way of example, if an investor submits a subscription on April 2, such investor will pay the per share purchase price previously announced in January, not the per share purchase price that would be expected to be announced at a later date in April. Although we do not intend to list our common shares for trading on a stock exchange or other trading market, we intend to adopt a redemption plan designed to provide our shareholders with limited liquidity on a quarterly basis for their investment in our shares.

The Company has not registered, and does not intend to register, under the U.S. Investment Company Act of 1940, as amended (the “Investment Company Act”), in reliance upon the exemptions described in the “Investment Company Act Considerations” section. Investors will not have the benefits and protections arising out of registration under the Investment Company Act.

We intend to continue to distribute our shares primarily through an investment portal on the Jamestown website (though we may distribute our shares through other online portals as deemed appropriate by our Manager). North Capital Private Securities will serve as our broker-dealer and will provide escrow services.

_________________________________

Investing in our common shares is speculative and involves substantial risks. You should purchase these securities only if you can afford a complete loss of your investment. See “Risk Factors” beginning on page 14 to read more about the significant risks you should consider before buying our common shares. These risks include the following:

•We depend on our Manager to select our investments and conduct our operations. We will pay fees and expenses to our Manager and its affiliates that were not determined on an arm’s length basis, and therefore we do not have the benefit of arm’s length negotiations of the type normally conducted between unrelated parties. These fees increase your risk of loss.

•We have a limited operating history. The prior performance of our sponsor and its affiliated entities may not predict our future results. Therefore, there is no assurance that we will achieve our investment objectives.

•This is a “blind pool” offering because we have not identified a significant number of investments to acquire with the net proceeds of this offering. You will not be able to evaluate a significant number of our investments prior to purchasing shares.

•Our Manager’s executive officers and key real estate professionals are also officers, directors, managers and/or key professionals of our sponsor and its affiliates. As a result, they will face conflicts of interest, including time constraints, allocation of investment opportunities and significant conflicts created by our Manager’s compensation arrangements with us and other affiliates of our sponsor.

•Our sponsor may sponsor other companies or funds that compete with us, and our sponsor does not have an exclusive management arrangement with us. However, our sponsor has adopted a policy for allocating investments between different companies with similar investment strategies that it sponsors.

•This offering is being made pursuant to recently adopted rules and regulations under Regulation A of the Securities Act of 1933, as amended, or the Securities Act. The legal and compliance requirements of these rules and regulations, including ongoing reporting requirements related thereto, are relatively untested as compared to traditional registered securities offerings.

•If we raise substantially less than the maximum offering amount, we may not be able to acquire a diverse portfolio of investments and the value of your shares may vary more widely with the performance of specific assets.

•We may change our investment guidelines without shareholder consent, which could result in investments that are different from those described in this offering circular.

•Our distributions are dependent on cash flow from operations and we may not declare distributions in the future. On March 31, 2021, the Manager of the Company declared a quarterly cash distribution of $0.075 per share for shareholders of record as of the close of business on March 31, 2021. Subsequently, on June 30, 2021, the Manager of the Company declared a quarterly cash distribution of $0.075 per share for shareholders of record as of the close of business on June 30, 2021. We originally anticipated distributions would commence in the first half of 2022. We declared our first and second dividend sooner based on leasing at Southern Dairies, which increased its cash flow from operations. While our goal is to pay distributions from our cash flow from operations, we may use other sources to fund distributions, including offering proceeds, borrowings or sales of assets. We have not established a limit on the amount of proceeds from our public offering we may use to fund distributions. If we pay distributions from sources other than our cash flow from operations, we will have fewer funds available for investments and your overall return may be reduced. In any event, we intend to make annual distributions as required to comply with the REIT distribution requirements and avoid U.S. federal income and excise taxes on retained income.

•We will calculate our NAV on a quarterly basis using valuation methodologies that involve subjective judgments and estimates. As a result, our NAV may not accurately reflect the actual prices at which our commercial real estate assets and investments, including related liabilities, could be liquidated on any given day.

•Our operating agreement does not require our Manager to seek shareholder approval to liquidate our assets by a specified date, nor does our operating agreement require our Manager to list our shares for trading. No public market currently exists for our shares.

•Other funds sponsored by Jamestown have the first right to invest in any investment opportunity. We will invest in opportunities that such funds have chosen not to pursue.

•If we fail to continue to qualify as a REIT for U.S. federal income tax purposes and no relief provisions apply, we will be subject to entity-level U.S. federal income tax and, as a result, our cash available for distribution to our shareholders and the value of our shares could materially decrease.

•Real estate investments are subject to general downturns in the industry as well as downturns in specific geographic areas. We cannot predict what the occupancy level will be in a particular building or that any tenant will remain solvent. We also cannot predict the future value of our properties. Accordingly, we cannot guarantee that you will receive cash distributions or appreciation of your investment or that you we will receive your initial investment back.

•Disruptions in economic activity, a decline in commercial activity and decreased consumer activity arising out of the COVID-19 pandemic has and may continue to adversely affect our financial condition and results of operations.

•The outbreak of COVID-19 and the economic impact arising from the virus and the actions taken to mitigate its spread have and may continue to impact the value of our assets, and there can be no assurance that the NAV will be accurate on any given date.

•Our intended investments in commercial real estate in Atlanta (though we may also invest in other major MSAs across the United States, which would generally have populations equal to or greater than 500,000 residents), will be subject to risks relating to real estate investments generally. These investments are only suitable for sophisticated investors with a high-risk investment profile.

•Investing in a limited number of regions carries the risks associated with significant geographical concentration. Geographic concentration of properties exposes our projects to adverse conditions in the areas where the properties are located, including general economic downturns and natural disasters occurring in such markets. Such major, localized events in areas where our properties are located could adversely affect our business and revenues, which would adversely affect our results of operations and financial condition.

The United States Securities and Exchange Commission does not pass upon the merits of or give its approval to any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering circular or other solicitation materials. These securities are offered pursuant to an exemption from registration with the Commission, and the Commission has not made an independent determination that the securities offered are exempt from registration.

The use of projections or forecasts in this offering is prohibited. No one is permitted to make any oral or written predictions about the cash benefits or tax consequences you will receive from your investment in our common shares.

| Sales through NCPS (3) | ||||||||

| Per Share | Total Maximum (2) | |||||||

| Public Offering Price (1) | $ | 10.00 | $ | 46,033,490 | ||||

| Placement Agent Commissions (3) | 0.60 | % | $ | 300,000 | ||||

| Proceeds to Us from this Offering to the Public (4) | $ | 10.00 | $ | 46,033,490 | ||||

(1)As of June 30, 2021, the current price per share is $10.35. The per share purchase price in this offering will be adjusted at the beginning of each fiscal quarter (or as soon as commercially reasonable thereafter), and will be equal to the greater of (i) $10.00 per share or (ii) our NAV divided by the number of shares outstanding as of the close of business on the last business day of the prior fiscal quarter. Investors will pay the most recent publicly announced purchase price as of the date of their subscription.

(2)This is a “best efforts” offering. Subscription proceeds from this offering will be placed into an escrow account with our broker-dealer and will be released to us upon a closing. Closings will be held at our Manager’s discretion, but will be held at least once a month as long as there have been any subscription proceeds deposited into the escrow account during this offering. Investors will become shareholders with respect to the subscription proceeds held in the escrow account after our Manager holds a closing. If our offering is terminated before a closing is held and there are subscription proceeds in the escrow account, such proceeds will be refunded to investors. See “How to Subscribe”.

(3)Investors will not pay upfront selling commissions in connection with the purchase of our common shares. Therefore, the “Proceeds to Us from this Offering to the Public” will not be reduced by any Placement Agent Commissions. North Capital Private Securities, our broker-dealer, will be paid a fee for their services, including the solicitation of investors. For common shares sold by, and trades executed by, North Capital Private Securities (“NCPS”), our Manager shall pay NCPS a commission equal to 0.60% of the proceeds from the sale of such common shares, except as noted below. This commission will be paid by our Manager and will not be charged separately to our investors. See “Plan of Distribution” for further information and details regarding compensation payable to placement agents in connection with this Offering. See “Management Compensation” for a description of additional fees and expenses that we will pay our Manager.

(4)On November 26, 2019, we qualified up to $50,000,000 in shares of our common shares for issuance in this public offering, which represent limited liability company interest in the Company. As of June 30, 2021, we have sold 395,643 shares of our common shares in this public offering for total gross offering proceeds of approximately $3,966,510, including 113,450 shares

or $1,134,500 purchased by our sponsor. Accordingly, as of June 30, 2021, the total maximum amount of shares available for issuance is $46,033,490. Also, we have sold 550,100 or $5,501,000 of our common shares at the initial per share price of $10.00 per share, including approximately 86,550 common shares or $865,500 purchased by our sponsor, in a private placement prior to this offering statement be declared “qualified” by the SEC. As such, including what we have sold to-date in this public offering and the private placement totaling $9,467,510, plus the remaining maximum shares available for issuance of $46,033,490, the total estimated amount of proceeds available to us may be $55,501,000.

We will offer our common shares on a best efforts basis primarily through the online investment portal on the Jamestown website (though we may distribute our shares through other online portals as deemed appropriate by our Manager). Other offerings of our common shares may be made pursuant to exemptions under the Securities Act other than Regulation A. Also, we have sold 550,100 of our common shares at the initial per share price of $10.00 per share in a private placement prior to this offering statement being declared “qualified” by the SEC.

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

__________________________________

This Offering Circular follows the Form S-11 disclosure format.

The date of this amended offering circular is September 24, 2021.

IMPORTANT INFORMATION ABOUT THIS OFFERING CIRCULAR

Please carefully read the information in this offering circular and any accompanying offering circular supplements, which we refer to collectively as the offering circular. You should rely only on the information contained in this offering circular. We have not authorized anyone to provide you with different information. This offering circular may only be used where it is legal to sell these securities. You should not assume that the information contained in this offering circular is accurate as of any date later than the date hereof or such other dates as are stated herein or as of the respective dates of any documents or other information incorporated herein by reference.

This offering circular is part of an offering statement that we filed with the SEC, using a continuous offering process. Periodically, as we make material investments, update our quarterly NAV, or have other material developments, we will provide an offering circular supplement that may add, update or change information contained in this offering circular. Any statement that we make in this offering circular may be modified or superseded by any inconsistent statement made by us in a subsequent offering circular supplement, which will take precedence over this offering circular. The offering statement we filed with the SEC includes exhibits that provide more detailed descriptions of the matters discussed in this offering circular. You should read this offering circular and the related exhibits filed with the SEC and any offering circular supplement, together with additional information contained in our annual reports, semi-annual reports and other reports and information statements that we will file periodically with the SEC. See the section entitled “Additional Information” below for more details.

The offering statement and all supplements and reports that we have filed or will file in the future can be read at the SEC website, www.sec.gov, or on the investment portal on the Jamestown website, jamestowninvest.com. The contents of the investment portal on the Jamestown website (other than the offering statement, this offering circular and the appendices and exhibits thereto) are not incorporated by reference in or otherwise a part of this offering circular.

Our sponsor and those selling shares on our behalf in this offering will be permitted to make a determination that the purchasers of shares in this offering are “qualified purchasers” in reliance on the information and representations provided by the shareholder regarding the shareholder’s financial situation. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

TABLE OF CONTENTS

STATE LAW EXEMPTION AND PURCHASE RESTRICTIONS

Our common shares are being offered and sold only to “qualified purchasers” (as defined in Regulation A under the Securities Act). As a Tier 2 offering pursuant to Regulation A under the Securities Act, this offering will be exempt from state law “Blue Sky” review, subject to meeting certain state filing requirements and complying with certain anti-fraud provisions, to the extent that our common shares offered hereby are offered and sold only to “qualified purchasers” or at a time when our common shares are listed on a national securities exchange. “Qualified purchasers” include: (i) “accredited investors” under Rule 501(a) of Regulation D and (ii) all other investors so long as their investment in our common shares does not represent more than 10% of the greater of their annual income or net worth (for natural persons), or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural persons). Accordingly, we reserve the right to reject any investor’s subscription in whole or in part for any reason, including if we determine in our sole and absolute discretion that such investor is not a “qualified purchaser” for purposes of Regulation A.

To determine whether a potential investor is an “accredited investor” for purposes of satisfying one of the tests in the “qualified purchaser” definition, the investor must be a natural person who has:

1. an individual net worth, or joint net worth with the person’s spouse, that exceeds $1,000,000 at the time of the purchase, excluding the value of the primary residence of such person; or

2.earned income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year.

If the investor is not a natural person, different standards apply. See Rule 501 of Regulation D for more details.

For purposes of determining whether a potential investor is a “qualified purchaser,” annual income and net worth should be calculated as provided in the “accredited investor” definition under Rule 501 of Regulation D. In particular, net worth in all cases should be calculated excluding the value of an investor’s home, home furnishings and automobiles.

QUESTIONS AND ANSWERS ABOUT THIS OFFERING

The following questions and answers about this offering highlight material information regarding us and this offering that is not otherwise addressed in the “Offering Summary" section of this offering circular. You should read this entire offering circular, including the section entitled “Risk Factors,” before deciding to purchase our common shares.

Q: What is Jamestown Invest 1, LLC?

A: Jamestown Invest 1, LLC is a Delaware limited liability company formed on August 3, 2018 to acquire and manage a portfolio consisting of real estate investments in urban infill locations in the path of anticipated growth. Possible asset classes could include mixed or single use properties incorporating office, retail, multifamily, for-sale residential, parking, unimproved land, warehouse/flex, or hotels in the Atlanta, Georgia metropolitan statistical area (“MSA”) as well as other MSAs primarily in the Southeast such as Raleigh, North Carolina and Charleston, South Carolina. We may also invest in other major MSAs across the United States, which would generally have populations equal to or greater than 500,000 residents. Our sponsor, Jamestown, L.P., or “Jamestown,” believes that our targeted properties and geographies have displayed strong performance and are expected to be well positioned to see continued healthy rent growth moving forward. While we intend primarily to invest in the targeted properties and target geographies outlined above, we may invest in other asset classes as well as other locations, depending on the availability of suitable investment opportunities. We may make our investments through majority-owned subsidiaries, and we may acquire minority interests or joint venture interests in subsidiaries. Additionally, affiliates of Jamestown may be interest holders in the joint ventures and subsidiaries in which we hold a majority or minority interest, which could cause potential conflicts of interests. See “Conflicts of Interest - Affiliate Investments.” The use of the terms “Jamestown Invest 1”, the “Company”, the “Fund”, “we”, “us” or “our” in this offering circular refer to Jamestown Invest 1, LLC unless the context indicates otherwise.

Q: Who is Jamestown?

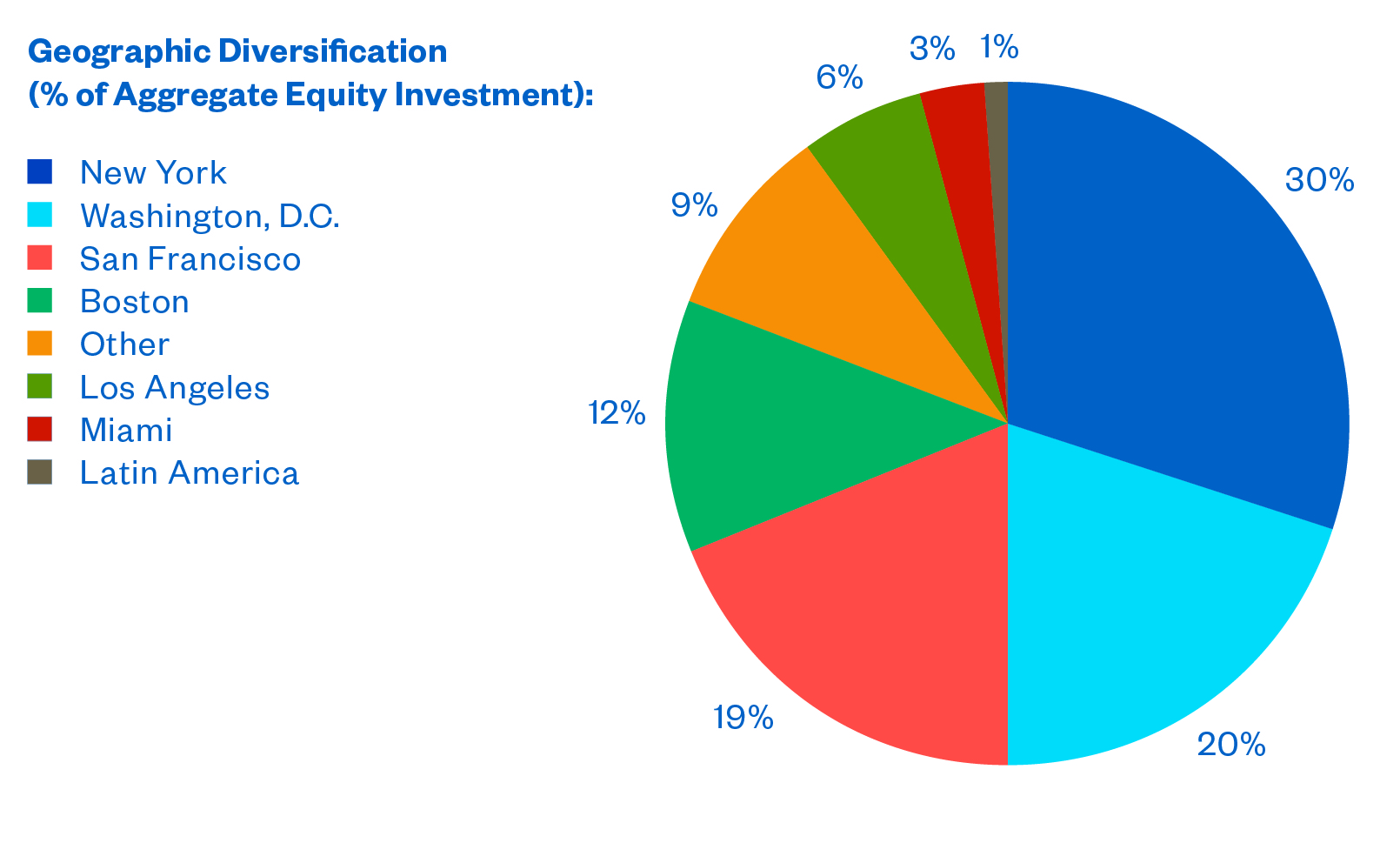

A: Our sponsor, Jamestown was established in 1983. Headquartered in Atlanta, Jamestown is a design-focused real estate investment and management company with $12.4 billion of assets under management as of June 30, 2021, a track record of 35+ years, nearly 80,000 German individual, U.S., and international institutional investors, 32 realized funds, and a clear mission: to transform spaces into hubs for innovation and community. Jamestown’s capabilities include but are not limited to: acquisitions and capital markets, asset management, retail leasing, design, marketing, construction and project management, property management, legal and risk management, accounting and tax, sustainability, fundraising, and portfolio management. Jamestown has U.S. offices in New York, NY, Boston, MA, Los Angeles, CA, and San Francisco, CA, along with affiliate offices in Bogotà, Colombia, Amsterdam, Netherlands, London, England, and Madrid, Spain. Jamestown’s sister company, Jamestown US-Immobilien GmbH, located in Cologne, Germany, sponsors the Jamestown German Retail funds, which are offered and sold to individuals who are not US persons and are predominantly residents of Germany. Jamestown US-Immobilien GmbH’s two core functions include portfolio management and risk management, in addition to investor relations and solicitation.

Jamestown operates an online investment platform through jamestowninvest.com.

Q: Who will choose which investments you make?

A: We are externally managed by Jamestown Invest Manager, L.P., or our “Manager,” which is a wholly owned subsidiary of our sponsor, Jamestown. Our Manager, together with our Investment Committee, will make all of our investment decisions.

Q: What is the investment portal on the Jamestown website?

A: The Jamestown website hosts an online investment platform for commercial real estate. The portal is operated by Jamestown and runs on a white label platform owned by a third-party. The investment portal on the Jamestown website gives investors in us the ability to:

•access commercial real estate investment opportunities provided by Jamestown;

•invest completely online, through digital legal documentation, funds transfer, and ownership recordation; and

•manage and monitor investments easily through the online platform and periodic financial reporting, while receiving automated distributions and/or interest payments.

i

Q: What is a real estate investment trust, or REIT?

A: In general, a REIT is an entity that:

•combines the capital of many investors to acquire a portfolio of real estate investments under professional management;

•is able to qualify as a “real estate investment trust” under the Internal Revenue Code of 1986, as amended, the Code, for U.S. federal income tax purposes and is therefore generally entitled to a deduction for the dividends it pays and not subject to U.S. federal corporate income taxes on its taxable net income that is distributed to its shareholders. This treatment substantially eliminates the “double taxation” (i.e., taxation at both the corporate and shareholder levels) that generally results from investments in a corporation; and

•generally pays distributions to investors of at least 90% of its annual ordinary taxable income.

In this offering circular, we refer to an entity that qualifies to be taxed as a real estate investment trust for U.S. federal income tax purposes as a REIT. We believe we have qualified as a REIT for U.S. federal income tax purposes commencing with our first taxable year of operations.

Q: What competitive advantages do we achieve through our relationship with our sponsor?

A: Our Manager will utilize the personnel and resources of our sponsor to select our investments and manage our day-to-day operations. Our sponsor’s corporate, investment and operating platforms are well established, which we believe will allow us to realize economies of scale and other benefits including the following:

•Track Record - Across Jamestown’s 32 realized real estate funds, the aggregate cash distributed from each fund exceeded the original aggregate capital contributed to each fund. This prior performance is not a guarantee of future results.

•Vertically-Integrated Operating Platform - The multidisciplined in-house team of over 230 professionals in acquisitions and capital markets, asset management, retail leasing, design, marketing, construction and project management, property management, legal and risk management, accounting and tax, sustainability, fundraising, and portfolio management collaborates from acquisition through disposition to maximize opportunities and minimize risks.

•Proactive Management - Jamestown believes that experienced, hands-on asset management provides for better quality of service. Through focused on-site operations, Jamestown remains in close contact with its tenants which allows for proactive identification and resolution of tenant concerns, resulting in greater tenant satisfaction.

•Distinguished Reputation - Jamestown’s cultivation of longstanding relationships and partnerships with key industry leaders, along with its reputation for moving quickly to execute transactions, generates a significant number of off-market investment opportunities, as evidenced by the direct sourcing of nearly half of Jamestown’s core and core-plus fund investments through non-competitive channels.

•Sources of Capital - Jamestown’s experience with previous funds has shown that there are often unexpected opportunities to increase project cash flow, but that additional capital, sometimes in significant amounts, is necessary. For subsequent value creation and other liquidity needs, the use of additional capital could make sense. Therefore, Jamestown may provide us with access to additional capital in the future. This additional capital could take the form of equity, debt, or a combination of the two, in one or more transactions. Jamestown may, but is not obligated to, provide equity capital in a total amount of up to $20,000,000 in one or more transaction, with the price per common share equal to the then current public offering price per share. To date, Jamestown has invested $2,000,000 at a price per share of $10.00. Shares purchased by Jamestown or its affiliates will be for investment purposes only and not for resale. Loans provided to us by Jamestown would each have a term of zero to seven years, non-amortizing and bear interest equal to the then-current “prime rate,” as published in The Wall Street Journal.

ii

Q: Why should I invest with a company that is primarily focused on real estate projects in the Fund’s target geographies?

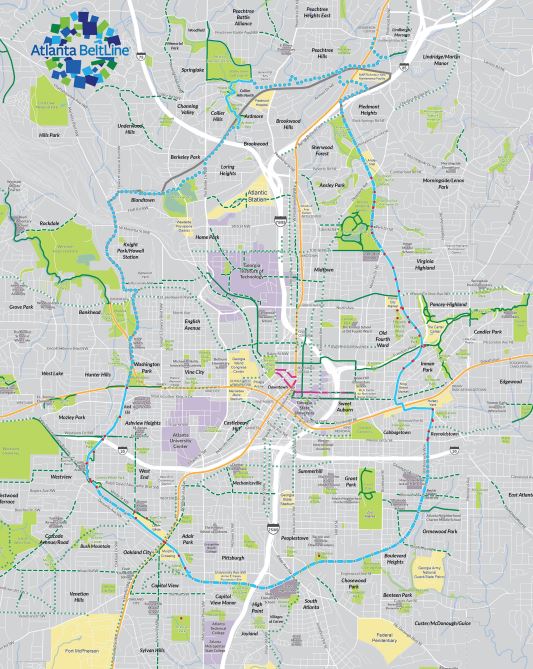

A: Jamestown has historically been focused on major MSAs, including Atlanta where the company is headquartered. Atlanta has seen continued growth in the last five years, including the addition of more than 785,000 residents over the past decade ending December 31, 2020, surpassing a population of 6 million. This continued growth, alongside a number of major corporations that have long been headquartered in Atlanta, means there is potential for real estate values to continue to rise with the increased demand within the city. Jamestown believes real estate buoyed by the physically constrained and growing markets of major MSAs with populations equal to or greater than 500,000 residents can produce predictable and growing income with the potential for improvements to enhance both the stable income from the property and increase the overall value of the asset.

We believe our focus on real estate in the Atlanta, Georgia MSA (though we may also invest in other major MSAs across the United States, which would generally have populations equal to or greater than 500,000 residents) as well as other MSAs primarily in the Southeast such as Raleigh, North Carolina and Charleston, South Carolina can provide you with:

•the opportunity for capital appreciation;

•the opportunity for a reasonably predictable and stable level of current income from the investment; and

•diversification of your portfolio, by investing in an asset class that historically has not been correlated with the stock market.

Q: What kind of offering is this?

A: We are primarily offering through Jamestown’s online investment platform, jamestowninvest.com, a maximum of $50,000,000, or $46,033,490 remaining maximum as of June 30, 2021, in our common shares to the public on a “best efforts” basis.

This offering is being conducted as a continuous offering pursuant to Rule 251(d)(3) of Regulation A, meaning that while the offering of securities is continuous, active sales of securities may happen sporadically over the term of the offering. Further, the acceptance of subscriptions, whether via the investment portal on the Jamestown website or otherwise, may be briefly paused at times to allow us to effectively and accurately process and settle subscriptions that have been received.

Other offerings of our common shares may be made pursuant to exemptions under the Securities Act other than Regulation A. Also, we have sold 550,100 of our common shares at the initial per share price of $10.00 per share, including the approximately 86,550 common shares purchased by our sponsor, in a private placement prior to this offering statement being declared “qualified” by the SEC. As of June 30, 2021, we have sold 395,643 common shares in this public offering totaling $3,966,510, including 113,450 shares or $1,134,500 purchased by our sponsor (excluding shares purchased in a private placement).

Q: How is an investment in your common shares different from investing in shares of a listed REIT?

A: The fundamental difference between our common shares and a listed REIT is the daily liquidity available with a listed REIT. Although we intend to adopt a redemption plan that may allow investors to redeem shares on a quarterly basis, for investors with a short-term investment horizon, a listed REIT may be a better alternative than investing in our common shares. However, we believe our common shares are an alternative way for investors to deploy capital into one or more real estate assets, with a lower correlation to the general stock market than listed REITs.

While listed REITs are subject to more demanding public disclosure and corporate governance requirements than we are, we still are subject to the scaled reporting requirements of Regulation A.

Q: How is an investment in your common shares different from investing in shares of a traditional non-exchange traded REIT?

A: We do not charge any upfront fees, saving investors formation expenses as compared to a traditional non-exchange traded REIT. Traditional non-exchange traded REITs use a highly manpower-intensive method with hundreds to thousands of sales brokers calling on investors to sell their offerings. Our sponsor is primarily using a lower-cost digital platform to conduct this offering, thus reducing the financial burdens to us of offering our common shares. We are one of the few investment opportunities offered online that is sponsored by an institutional real estate investment manager.

iii

Q: How do I buy shares?

A: You may purchase our common shares in this offering by creating a new account, or logging into your existing account, at the investment portal on the Jamestown website. You will need to fill out a subscription agreement like the one attached as Exhibit 4.1 to the offering statement for a certain investment amount and pay for the shares at the time you subscribe.

Q: What is the purchase price for your common shares?

A: Our current offering price is $10.35 per share. The per share purchase price in this offering will be adjusted at the beginning of each fiscal quarter (or as soon as commercially reasonable thereafter), and will be equal to the greater of (i) $10.00 per share or (ii) our NAV divided by the number of shares outstanding as of the close of business on the last business day of the prior fiscal quarter. Our Manager will adjust our per share purchase price as of the date the new NAV is announced, not the date when such NAV is determined, and investors will pay the most recent publicly announced purchase price as of the date of their subscription. Solely by way of example, if an investor submits a subscription on April 2, such investor will pay the per share purchase price previously announced in January, not the per share purchase price that would be expected to be announced at a later date in April. Our website, jamestowninvest.com, will identify the current NAV per share. If our Manager learns of a material event that occurs in between quarterly updates of NAV that could cause our NAV per share to change by 5% or more from the last disclosed NAV, we will disclose the event and the updated NAV in an offering circular supplement as promptly as reasonably practicable, and will update the NAV information provided on our website. Any such adjustments to our NAV will be estimates of the market impact of specific events as they occur, based on assumptions and judgments that may or may not prove to be correct, and may also be based on the limited information readily available at that time. See “Description of Our Common Shares - Quarterly Share Price Adjustments” for more details.

Q: How will your NAV be calculated?

A: Our NAV will be calculated at the end of each fiscal quarter by our internal process that reflects several components, including (1) estimated values of each of our commercial real estate assets and investments, including related liabilities, based upon (a) market capitalization rates, comparable sales information, interest rates, net operating income, and (b) in certain instances reports of the underlying real estate provided by a valuation expert, (2) the price of liquid assets for which third party market quotes are available, (3) other assets and liabilities valued at book value, (4) accruals of our periodic distributions and (5) estimated accruals of our operating revenues and expenses (including the projected Participation Allocation). In instances where our Manager determines that an appraisal of the real estate asset is necessary, we will engage an appraiser that has expertise in appraising commercial real estate assets, to act as our valuation expert. The valuation expert will not be responsible for, or prepare, our quarterly NAV. The final determination of our quarterly NAV will be made by our Manager. See “Description of our Common Shares - Valuation Policies” for more details about our NAV and how it will be calculated.

Q: How exact will the calculation of the quarterly NAV per share be?

A: Our goal is to provide a reasonable estimate of the market value of our common shares as of the end of each fiscal quarter. Our internal valuation of our real estate assets is subject to a number of judgments and assumptions that may not prove to be accurate. The use of different judgments or assumptions would likely result in different estimates of the value of our real estate assets. Moreover, although we evaluate and provide our NAV per share on a quarterly basis, our NAV per share may fluctuate daily, so that the NAV per share in effect for any fiscal quarter may not reflect the precise amount that might be paid for your shares in a market transaction. Further, our published NAV per share may not fully reflect certain material events to the extent that they are not known or their financial impact on our portfolio is not immediately quantifiable. Any resulting potential disparity in our NAV per share may be in favor of either shareholders who redeem their shares, or shareholders who buy new shares, or existing shareholders. See “Description of our Common Shares - Valuation Policies.”

iv

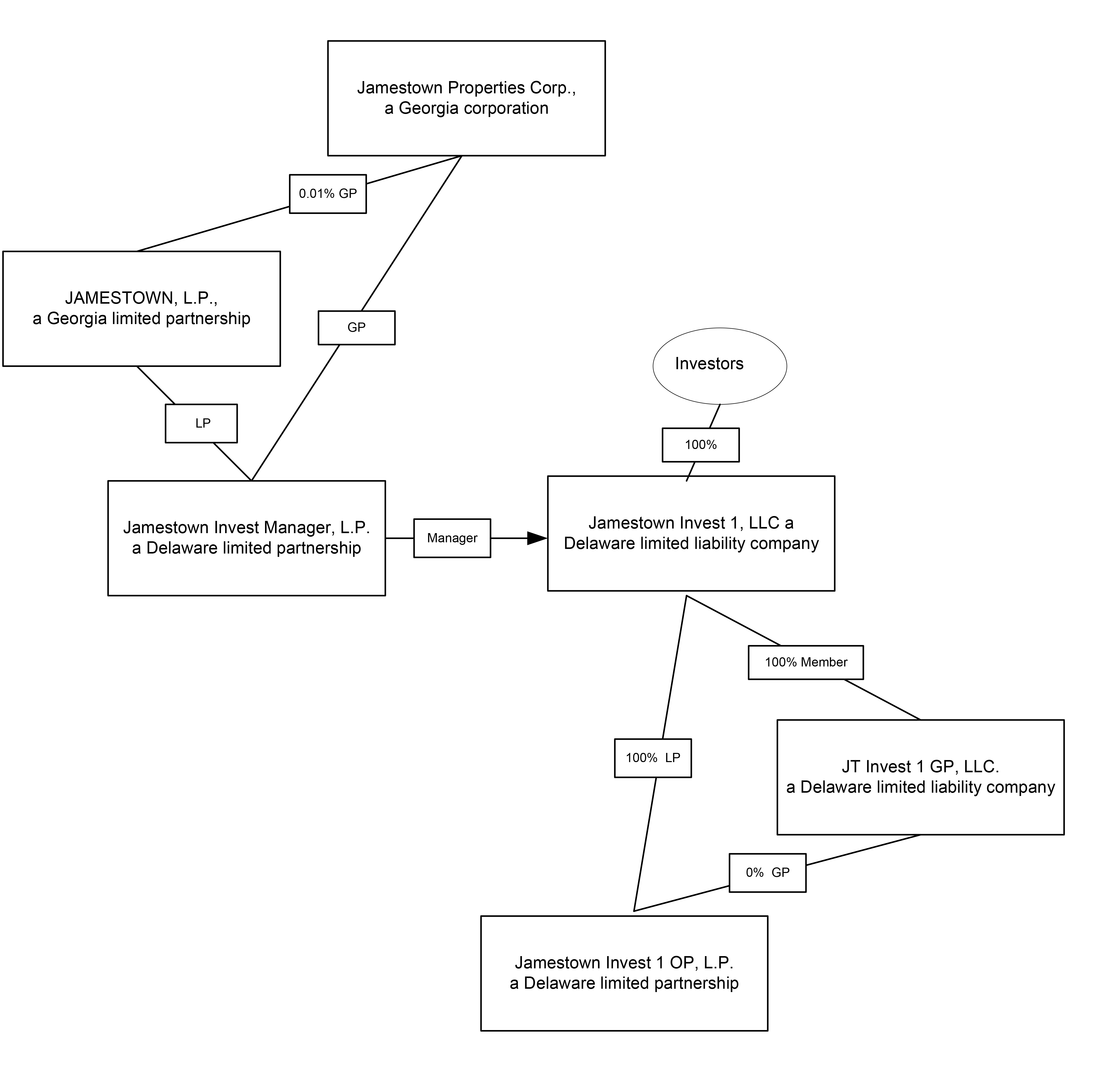

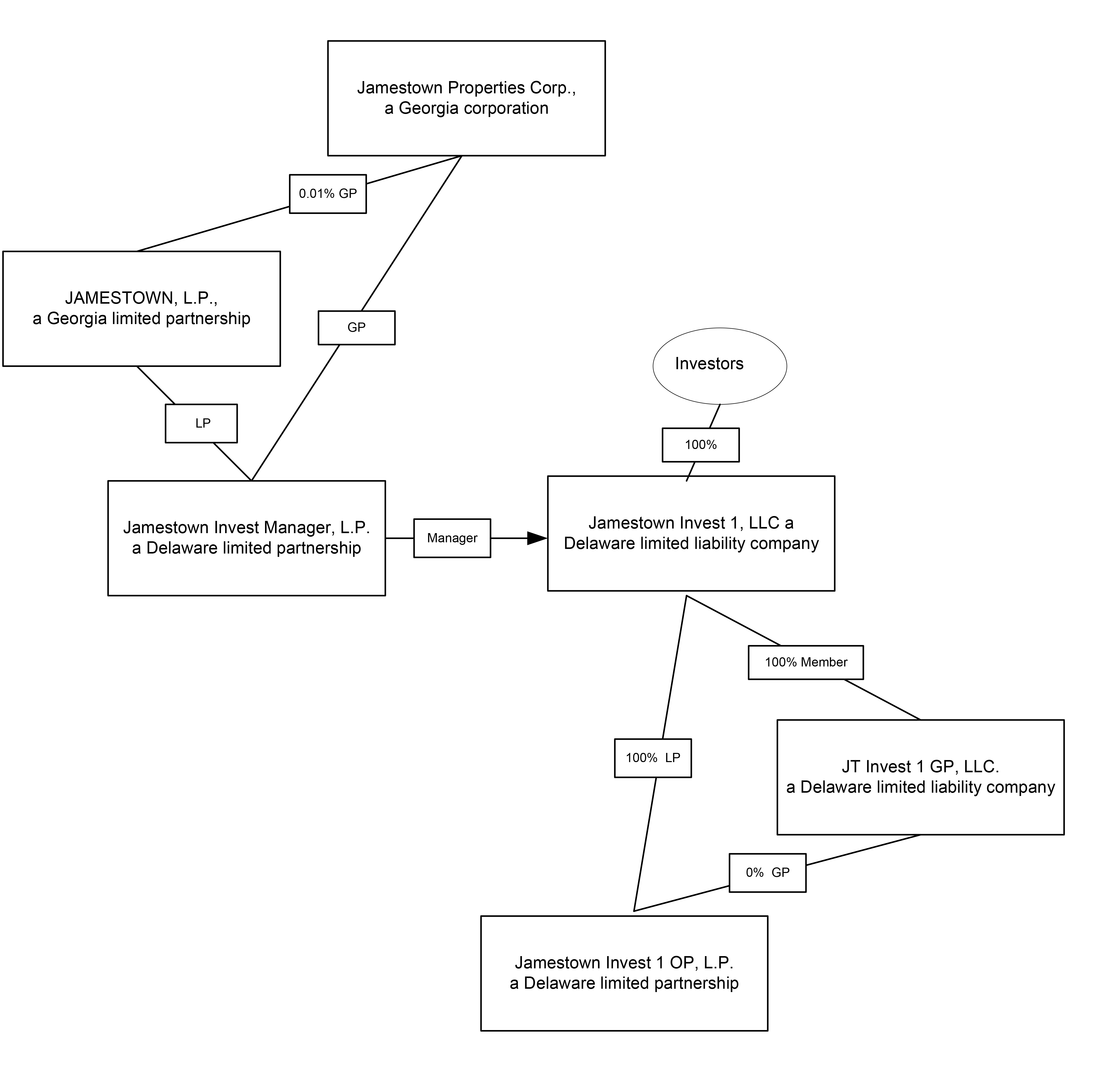

Q: What is your contemplated ownership structure?

A: We are a Delaware limited liability company wholly owned by our investors. Jamestown Invest Manager, L.P., a wholly owned subsidiary of Jamestown, is our Manager. We wholly own Jamestown Invest 1 OP, L.P. (the “Operating Partnership”), through which we will acquire and hold our assets.

Jamestown Invest 1, LLC Entity Organizational Chart

See “Conflicts of Interest” for additional descriptions of potential conflicts associated with the Fund structure.

v

Q: Will I have the opportunity to redeem my common shares?

A: While you should view this investment as long-term, we have adopted a redemption plan whereby, on a quarterly basis, an investor may obtain liquidity. The Manager has designed our redemption plan with a view towards providing investors with an initial period in which to decide whether a long-term investment in the Company is right for them. In addition, despite the illiquid nature of the assets expected to be held by the Company, the Manager believes it is best to provide the opportunity for quarterly liquidity in the event shareholders need it in the form of a discounted redemption price prior to year six. Any economic benefit resulting from the discounted redemption price will benefit us and will indirectly accrue to shareholders who have not requested redemption and to the Manager.

Pursuant to our redemption plan, shareholders may request that we redeem not less than 25% of their shares. The redemption plan is subject to certain liquidity limitations, which may fluctuate depending on the nature of the real estate assets held by us.

For the first eighty-nine (89) days following the purchase of the common shares subject to the redemption request (the “Introductory Period”), the per share redemption price will be equal to the purchase price of the shares being redeemed less the aggregate sum of distributions paid and declared but unpaid with respect to such shares, rounded down to the nearest cent. In other words, a shareholder would receive back their original investment amount, from the redemption price paid, prior distributions received and distributions that have been declared (and that will be received when paid), but would not receive any amounts in excess of their original investment amount.

Beginning on the ninetieth (90th) day following the purchase of the common shares subject to the redemption request (the “Post-Introductory Period”), the per share redemption price will be calculated based on a declining discount to the NAV per share in effect at the time the redemption request is made without any reduction for distributions paid or declared and rounded down to the nearest cent.

| Holding Period from Date of Settlement | Effective Redemption Price (as percentage of NAV per share) Before Deduction of any Participation Allocation and Third- Party Costs (1) | |||||||||||||

| Less than 90 days (Introductory Period) | 100.0%(2) (3) | |||||||||||||

| 90 days until 3 years | 97.0% (4) | |||||||||||||

| 3 years to 4 years | 98.0% (5) | |||||||||||||

| 4 years to 5 years | 99.0% (6) | |||||||||||||

| More than 5 years | 100.0% (7) | |||||||||||||

(1)The Effective Redemption Price will be rounded down to the nearest $0.01.

(2)The per share redemption price during the Introductory Period is calculated based upon the purchase price of the shares, not the per share price in effect at the time of the redemption request.

(3)The Effective Redemption Price during the Introductory Period will be reduced by the aggregate sum of distributions paid or payable on such shares, the amount of which we are unable to calculate at this time.

(4)For shares held at least ninety (90) days but less than three (3) years, the Effective Redemption Price includes the fixed 3% discount to the NAV per share in effect at the time of the redemption request.

(5)For shares held at least three (3) years but less than four (4) years, the Effective Redemption Price includes the fixed 2% discount to the NAV per share in effect at the time of the redemption request.

(6)For shares held at least four (4) years but less than five (5) years, the Effective Redemption Price includes the fixed 1% discount to the NAV per share in effect at the time of the redemption request.

(7)For shares held at least five (5) years, the Effective Redemption Price does not include any discount to the NAV per share in effect at the time of the redemption request.

vi

Proceeds to investors from any redemption will be further reduced by the Participation Allocation payable to the Manager in connection with such redemption, except that there is no Participation Allocation payable for redemptions made during the Introductory Period. (see “Management Compensation” for more details on the Participation Allocation). The effect of the participation allocation for shareholders will be to generally reduce appreciation on investments by 20%. If our NAV, without reduction for the accrued Participation Allocation, as of the date the redemption is paid, increased by capital distributions and dividends paid or accrued, is $10 or less a share, no Participation Allocation will be deducted from the redemption price. Additionally, a shareholder requesting redemption will be responsible for reimbursing us for any third-party costs incurred as a result of the redemption request, including but not limited to, bank transaction charges, custody fees, and/or transfer agent charges. See “Description of Our Common Shares—Quarterly Redemption Plan” for more details. Any applicable bank transfer or wire fees incurred as a result of the redemption will be calculated on a transaction by transaction basis. The redeeming investor will be informed of the third-party costs prior to the redemption being effected, which will be the third-party costs generated as a result of the redemption. We will not waive any third-party costs for any redeeming investor.

The following example illustrates how we would calculate our Manager’s Participation Allocation for a redemption for a single share prior to any deductions for third-party costs after the Introductory Period based on the assumptions set forth in rows A through E of the table below. Actual results may differ materially from the following example.

A.NAV (without reduction for any accrued Participation Allocation) as of the redemption date: $14.60

B.Aggregate capital distributions and dividends paid or accrued: $4.40

C.Aggregate value is equal to the total amount of (A) increased by (B): $19.00

D.The initial purchase price: $10.00

E.Appreciation is equal to the total amount of (C) less (D): $9.00

F.Participation Allocation is equal to 20% of (E): $1.80

Q: Will there be any limits on my ability to redeem my shares?

A: During each 12-month period, we will honor redemption requests for up to a total of 5.0% of the number of our common shares outstanding at the beginning of such 12-month period. We will not honor redemption requests during such 12-month period if it would cause us to redeem more than 5.0% of our outstanding common shares as of the beginning of such 12-month period. In accordance with the SEC’s current guidance on redemption plans contained in T-REIT Inc. (June 4, 2001) and Wells Real Estate Investment Trust II, Inc. (Dec. 3, 2003), we are prohibited from redeeming more than 5.0% of the number of our common shares outstanding at the beginning of each 12-month period. Accordingly, we presently intend to limit the number of shares to be redeemed during any calendar quarter to 1.25% of the common shares outstanding, with any excess capacity carried over to later calendar quarters in that 12-month period.

For investors who hold common shares with more than one record date, redemption requests will be applied to such common shares in the order in which they settled, on a last in first out basis-meaning those common shares that have been continuously held for the shortest amount of time will be redeemed first. We intend to limit common shareholders to one (1) redemption request outstanding at any given time, meaning that, if a common shareholder desires to request more or less shares be redeemed, such common shareholder must first withdraw the first redemption request, which may affect whether the request is considered in the “Introductory Period” or “Post-Introductory Period”.

Notwithstanding anything contained herein to the contrary, with the exception of honoring redemption requests up to the previously described limitation, we are not obligated to redeem common shares under the redemption plan.

Further, our Manager may in its sole discretion, amend, suspend, or terminate the redemption plan at any time without notice for any reason, including to protect our operations and our non-redeemed shareholders, to prevent an undue burden on our liquidity, to preserve our status as a REIT, following any material decrease in our NAV, or for any other reason. However, in the event that we amend, suspend or terminate our redemption plan, we will file an offering circular supplement and/or Form 1-U, as appropriate, to disclose such amendment, suspension, or termination. The Manager may also, in its sole discretion, decline any particular redemption request if it believes such action is necessary to preserve our status as a REIT. See “Description of Our Common Shares - Quarterly Redemption Plan” for more details.

vii

Q: Will I be charged upfront selling commissions?

A: No. Investors will not pay upfront selling commissions as part of the price per common share purchased in this offering. Additionally, there is no dealer manager fee or other service-related fee paid by investors in connection with the offering and sale of our common shares through an investment portal on the Jamestown website. North Capital Private Securities, our broker-dealer, will be paid a fee for their services, including the solicitation of investors. For Common Shares sold by, and trades executed by, North Capital Private Securities (“NCPS”), our Manager shall pay NCPS a commission equal to 0.60% of the proceeds from the sale of such Common Shares. This commission will be paid by our Manager and will not be charged separately to our investors. See “Plan of Distribution” for further information and details regarding compensation payable to placement agents in connection with this Offering.

Q: Who will pay our administration, organization and offering costs?

A: Our Manager or its affiliates will pay all costs incurred in connection with our administration, organization and the offering of our shares. See “Estimated Use of Proceeds” for more information about the types of costs that may be incurred, including those expenses described in the next paragraph. We will pay our Manager a quarterly Fund Administration Fee equal to 0.60% per annum, which, beginning on April 1, 2020, is based on our NAV at the end of the prior quarter, in part to pay our Manager for certain administration costs.

Q: What fees and expenses will you pay to our Manager or any of its affiliates?

A: We will pay our Manager a quarterly asset management fee at an annualized rate of 1.25%, which, beginning on April 1, 2020, will be based on our NAV at the end of each prior quarter. See “Management Compensation” for the additional fees we will pay our Manager and its affiliates for our operation.

We will also pay our Manager and its affiliates for certain operating expenses. See “Management Compensation” for more details regarding the expenses that will be paid to our Manager and its affiliates. Additionally, we will reimburse our Manager for out-of-pocket expenses paid to third parties in connection with providing services to us. In addition, we will reimburse our Manager and its affiliates for expenses incurred in the performance of certain services for us. Furthermore, we will not, directly or indirectly, reimburse our Manager or any of its affiliates for any fees paid to North Capital Private Securities.

The payment by us of fees and expenses will reduce the cash available for investment and distribution and will directly impact our quarterly NAV. See “Management Compensation” for more details regarding the fees that will be paid to our Manager and its affiliates.

Our Manager, as the recipient of these fees determined that it was in the best interest of the Fund’s shareholders to refund such 2020 calendar year fees totaling $142,149, which had a favorable impact on Q4 2020 NAV per share.

Q: What is your intended leverage policy?

A: We may selectively employ leverage to enhance total returns to our shareholders through a combination of senior financing and other financing transactions. Our target leverage at stabilization is 60% at the fund level and may be up to 70% on an individual investment calculated as a percentage of the greater of cost (before deducting depreciation or other non-cash reserves) or fair market value of our assets. We seek to secure conservatively structured leverage that is long term and non-recourse to the extent obtainable on a cost-effective basis. Our Manager may from time to time modify our leverage policy in its discretion. We cannot exceed the leverage limit of our leverage policy unless any excess in borrowing over such level is approved by our Manager’s Investment Committee (see “Management - Investment Committee of our Manager” for additional detail on our Investment Committee).

Q: How often will I receive distributions?

A: While our goal is to pay distributions from our cash flow from operations, we may use other sources to fund distributions. Until the proceeds from our public offering are invested and generating operating cash flow, some or all of our distributions may be paid from other sources, including the net proceeds of this offering, cash advances by our Manager, borrowings in anticipation of future operating cash flow and the issuance of additional securities. Once we begin to make distributions, we expect that dividends declared by our Manager will be made on a quarterly basis, or less frequently as determined by our Manager. Any distributions we make will be at the discretion of our Manager, and will be based on, among other factors, our present and reasonably projected future cash flow.

viii

The REIT distribution requirements generally require that we make aggregate annual distributions to our shareholders of at least 90% of our REIT taxable income, computed without regard to the dividends paid deduction and excluding net capital gain. Moreover, even if we make the required minimum distributions under the REIT rules, we will be subject to U.S. federal income or excise taxes on our undistributed taxable income and gains. As a result, the Manager intends to make additional distributions, beyond the minimum required distribution under the REIT rules, to avoid such taxes. See “Description of Our Common Shares - Distributions” and “U.S. Federal Income Tax Considerations.”

The REIT distribution requirements generally require that we make aggregate annual distributions to our shareholders of at least 90% of our REIT taxable income, computed without regard to the dividends paid deduction and excluding net capital gain. Moreover, even if we make the required minimum distributions under the REIT rules, we will be subject to U.S. federal income or excise taxes on our undistributed taxable income and gains. As a result, the Manager intends to make additional distributions, beyond the minimum required distribution under the REIT rules, to avoid such taxes. See “Description of Our Common Shares - Distributions” and “U.S. Federal Income Tax Considerations.”

Any distributions that we make will directly impact our NAV, by reducing the amount of our assets.

Q: What will be the source of your distributions?

A: While our goal is to pay distributions from our cash flow from operations, we may use other sources to fund distributions. Until the proceeds from our public offering are invested and generating operating cash flow, some or all of our distributions may be paid from other sources, including the net proceeds of this offering, cash advances by our Manager, borrowings in anticipation of future operating cash flow and the issuance of additional securities. Use of some or all of these sources may reduce the amount of capital we invest in assets and negatively impact the return on your investment and the value of your investment. We have not established a limit on the amount of proceeds from our public offering we may use to fund distributions. We can provide no assurances that future cash flow will support payment of distributions or maintaining distributions at any particular level or at all.

Q: Will the distributions I receive be taxable as ordinary income?

A: Unless your investment is held in a qualified tax-exempt account or we designate certain distributions as capital gain dividends, distributions that you receive generally will be taxed as ordinary income to the extent they are from current or accumulated earnings and profits. The portion of your distribution in excess of current and accumulated earnings and profits is considered a return of capital for U.S. federal income tax purposes and will reduce the tax basis of your investment, rather than result in current tax, until your basis is reduced to zero. Return of capital distributions made to you in excess of your tax basis in our common shares will be treated as sales proceeds from the sale of our common shares for U.S. federal income tax purposes. Distributions we designate as capital gain dividends will generally be taxable at long-term capital gains rates for U.S. federal income tax purposes. For noncorporate shareholders, dividends that we do not classify as capital gains and that do not otherwise qualify for capital gains treatment generally will qualify for a 20% deduction for tax years beginning before January 1, 2026, that will reduce the effective rate of tax on such dividends. However, because each investor’s tax considerations are different, we recommend that you consult with your tax advisor. You also should review the section of this offering circular entitled “U.S. Federal Income Tax Considerations,” including for a discussion of the special rules applicable to distributions in redemption of shares and liquidating distributions.

Q: May I reinvest my cash distributions in additional shares?

A: While we have not adopted a distribution reinvestment plan whereby investors may elect to have their cash distributions automatically reinvested in additional common shares, so long as this offering remains ongoing, you may choose to use the proceeds of any distribution to purchase additional shares hereunder. Note, however, that under the rules applicable to us under Regulation A, we are only permitted to publicly offer up to $50,000,000 of our common shares in any twelve-month period.

ix

Q: Who might benefit from an investment in our shares?

A: An investment in our shares may be beneficial for you if you:

•seek to diversify your personal portfolio with a real estate investment vehicle formed to acquire and manage a portfolio consisting of real estate investments in urban infill locations in the path of anticipated growth (possible asset classes could include mixed or single use properties incorporating office, retail, multifamily, for-sale residential, parking, unimproved land, warehouse/flex, or hotels in the Atlanta, Georgia metropolitan statistical area (“MSA”) (we may also invest in other major MSAs across the United States, which would generally have populations equal to or greater than 500,000 residents)) as well as other MSAs primarily in the Southeast such as Raleigh, North Carolina and Charleston, South Carolina;

•seek to preserve capital; and

•are able to hold your investment for a time period consistent with our liquidity strategy.

On the other hand, we caution persons who require immediate liquidity or guaranteed income, or who seek a short-term investment, that an investment in our shares will not meet those needs.

Q: Are there any risks involved in buying our shares?

A: Investing in our common shares involves a high degree of risk. If we are unable to effectively manage the impact of these risks, we may not meet our investment objectives. Therefore, you should purchase these securities only if you can afford a complete loss of your investment. See “Risk Factors” for a description of the risks relating to this offering and an investment in our shares.

Q: How does a “best efforts” offering work?

A: When common shares are offered to the public on a “best efforts” basis, we are only required to use our best efforts to sell our common shares. Neither our sponsor, Manager nor any other party has a firm commitment or obligation to purchase any of our common shares; however, our sponsor purchased approximately $865,500 of common shares in a private placement prior to the initial offering statement being declared “qualified” by the SEC, and has purchased an additional $1,134,500 of common shares in this offering. In aggregate, our sponsor has purchased 200,000 shares of our common shares totaling $2,000,000.

Q: Who can buy shares?

A: Generally, you may purchase shares if you are a “qualified purchaser” (as defined in Regulation A under the Securities Act). “Qualified purchasers” include:

•“accredited investors” under Rule 501(a) of Regulation D; and

•all other investors so long as their investment in our common shares does not represent more than 10% of the greater of their annual income or net worth (for natural persons), or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural persons).

Net worth in all cases is calculated excluding the value of an investor’s home, home furnishings and automobiles. We reserve the right to reject any investor’s subscription in whole or in part for any reason, including if we determine in our sole and absolute discretion that such investor is not a “qualified purchaser” for purposes of Regulation A. Please refer to the section above entitled “State Law Exemption and Purchase Restrictions” for more information.

Q: How do I buy shares?

A: You may purchase our common shares in this offering by creating a new account, or logging into your existing account, at the investment portal on the Jamestown website. You will need to fill out a subscription agreement like the one attached to the offering statement as Exhibit 4.1 for a certain investment amount and pay for the shares at the time you subscribe.

x

Q: Is there any minimum investment required?

A: Yes. If you are an individual investor, you must purchase at least $2,500 in common shares in this offering, at the initial purchase and at any additional purchase of common shares in this offering. If you are investing through a self-directed retirement account, you must purchase at least $5,000 in common shares in this offering, at the initial purchase and at least $2,500 at any additional purchase of common shares in this offering. If you are an entity investor, you must purchase at least $50,000 in common shares in this offering at the initial purchase and at least $2,500 at any additional purchase of common shares in this offering.

Q: May I make an investment through a tax-deferred retirement account?

A: Generally, yes. We currently accept investments through self-directed retirement accounts maintained with certain custodians, although we intend to limit the amount of IRA investments to less than 25 percent of our shares. However, tax-deferred retirement accounts that invest in our shares generally are subject to tax on any “unrelated business taxable income” under the Code.

Q: What will you do with the proceeds from your offering?

A: We used and expect to continue to use substantially all of the proceeds from this offering to acquire and manage a portfolio consisting of real estate investments in urban infill locations in the path of anticipated growth. Possible asset classes could include mixed or single use properties incorporating office, retail, multifamily, for-sale residential, parking, unimproved land, warehouse/flex, or hotels in the Atlanta, Georgia MSA as well as other MSAs primarily in the Southeast such as Raleigh, North Carolina and Charleston, South Carolina. We may also invest in other major MSAs across the United States, which would generally have populations equal to or greater than 500,000 residents. While we intend primarily to invest in the targeted properties and target geographies outlined above, we may invest in other asset classes as well as other locations, depending on the availability of suitable investment opportunities. We may make our investments through majority-owned subsidiaries, and we may acquire minority interests or joint venture interests in subsidiaries. Additionally, affiliates of Jamestown may be interest holders in the joint ventures and subsidiaries in which we hold a majority or minority interest, which could cause potential conflicts of interests. See “Conflicts of Interest - Affiliate Investments.” We expect that any expenses or fees payable to our Manager for its services in connection with managing our daily affairs, including but not limited to, the selection and acquisition or origination of our investments, will be paid from cash flow from operations. If such fees and expenses are not paid from cash flow they will reduce the cash available for investment and distribution and will directly impact our quarterly NAV. See “Management Compensation” for more details regarding the fees that will be paid to our Manager and its affiliates.

We may not be able to promptly invest the proceeds of this offering in commercial real estate and other select real estate-related assets. In the interim, we may invest in short-term, highly liquid or other authorized investments. Such short-term investments will earn a lower return than we expect to earn on our real estate-related investments.

Q: How long will this offering last?

A: We expect to offer common shares until the earlier of (x) May 25, 2023, 180 days after the third anniversary of the initial qualification date or (y) the date on which we raise the maximum amount being offered, unless the offering is terminated by our Manager at an earlier time. We reserve the right to terminate this offering for any reason at any time.

Subscription proceeds from this offering will be placed into an escrow account with our broker-dealer and will be released to us upon a closing. Closings will be held at our Manager’s discretion but will be held at least once a month as long as there have been any subscription proceeds deposited into the escrow account during this offering. Investors will become shareholders with respect to the subscription proceeds held in the escrow account after our Manager holds a closing. If our offering is terminated before a closing is held and there are subscription proceeds in the escrow account, such proceeds will be refunded to investors.

Q: How long will this fund last?

A: We currently expect that this fund will begin to explore liquidity options five to seven years from the end of this offering. While we expect to seek a liquidity transaction in this time frame, there can be no assurance that a suitable transaction will be available or that market conditions for a transaction will be favorable during that time frame. Therefore, investors may have to hold their shares indefinitely.

xi

Q: Will I be notified of how my investment is doing?

A: Yes, we will provide you with periodic updates on the performance of your investment in us, including:

•an annual report;

•a semi-annual report;

•current event reports for certain material events within four business days of their occurrence;

•supplements to the offering circular, if we have material information to disclose to you; and

•other reports that we may file or furnish to the SEC from time to time.

We will provide this information to you by posting such information on the SEC’s website at www.sec.gov, on the investment portal on the Jamestown website at jamestowninvest.com, via e-mail, or, upon your request, via U.S. mail.

Q: When will I get my detailed tax information?

A: Your IRS Form 1099-DIV tax information, if required, will be provided by January 31 of the year following each taxable year.

Q: Who can help answer my questions about the offering?

A: If you have more questions about the offering, or if you would like additional copies of this offering circular, you should contact us by email at info@jamestowninvest.com or by mail at:

Jamestown, L.P.

675 Ponce de Leon Avenue, NE 7th Floor

Atlanta, GA 30308

xii

OFFERING SUMMARY

This offering summary highlights material information regarding our business and this offering that is not otherwise addressed in the “Questions and Answers About this Offering” section of this offering circular. Because it is a summary, it may not contain all of the information that is important to you. To understand this offering fully, you should read the entire offering circular carefully, including the “Risk Factors” section before making a decision to invest in our common shares.

Jamestown Invest 1, LLC

Jamestown Invest 1, LLC is a Delaware limited liability company formed to acquire and manage a portfolio consisting of real estate investments in urban infill locations in the path of anticipated growth. Possible asset classes could include mixed or single use properties incorporating office, retail, multifamily, for-sale residential, parking, unimproved land, warehouse/flex, or hotels in the Atlanta, Georgia metropolitan statistical area (“MSA”) as well as other MSAs primarily in the Southeast such as Raleigh, North Carolina and Charleston, South Carolina. We may also invest in other major MSAs across the United States, which would generally have populations equal to or greater than 500,000 residents. Our sponsor, Jamestown, L.P., or “Jamestown,” believes that our targeted properties and geographies have displayed strong performance and are expected to be well positioned to see continued healthy rent growth moving forward. While we intend primarily to invest in the targeted properties and target geographies outlined above, we may invest in other asset classes as well as other locations, depending on the availability of suitable investment opportunities. We may make our investments through majority-owned subsidiaries, and we may acquire minority interests or joint venture interests in subsidiaries. Additionally, affiliates of Jamestown may be interest holders in the joint ventures and subsidiaries in which we hold a majority or minority interest, which could cause potential conflicts of interests. See “Conflicts of Interest – Affiliate Investments.” We intend to operate in a manner that will allow us to continue to qualify as a REIT for U.S. federal income tax purposes. Among other requirements, REITs are required to distribute to shareholders at least 90% of their annual REIT taxable income (computed without regard to the dividends paid deduction and excluding net capital gain).

Our office is located at 675 Ponce de Leon Avenue NE, 7th Floor, Atlanta, GA 30308. Our telephone number is (404) 490-4950. Information regarding the Company is also available on our sponsor’s web site at www.jamestownlp.com.

Recent Developments

Capital Raised

Through June 30, 2021, our offering has raised an aggregate of approximately $3,966,510 in capital pursuant to Regulation A, including 341,985 shares at a share price of $10.00 per share, 25,525 shares at a share price of $10.02, and 28,133 shares at a share price of $10.34 per share (not including the approximately 550,100 shares totaling $5,501,000 received in a private placement prior to the initial offering being declared effective). Of the 395,643 shares sold in this offering, 113,450 totaling $1,134,500 were sold to our sponsor, a related party.

Southern Dairies Joint Venture

On August 18, 2021, Jamestown, L.P. sold its 49% membership interest in JT Invest 1 Dairies, LLC (the “Dairies JV”) to JT Altera Dairies, L.P., a joint venture between a Jamestown, L.P. subsidiary and Altera Southern Dairies PA, LLC. The transaction was reviewed and approved by an Independent Representative (as defined below) prior to the closing. Jamestown, L.P. maintains a sponsor co-investment of 200,000 shares in Jamestown Invest 1, LLC, which owns the 51% controlling position in JT Invest 1 Dairies, LLC.

The Company owns a 51% controlling interest in the Dairies JV, which owns a five-building office campus located in Atlanta, Georgia known as Southern Dairies. Southern Dairies has approximately 80,000 rentable square feet and is approximately 88% leased to ten tenants. See "Investment Objectives and Strategy - Acquired Investments” for more information.

Lease at Southern Dairies

On August 18, 2021, our Manager executed a 12-year lease for 25,400 SF in the A Building of Southern Dairies @ Ponce City Market with a publicly traded, global entertainment company. The lease execution brings the Property’s leased occupancy from approximately 74% to approximately 92% and extends weighted average lease term from approximately 4.2 years to approximately 7.6 years as of August 31, 2021.

1

Net Asset Value per Share as of June 30, 2021

Our NAV per share of our common shares is $10.35 as of June 30, 2021. The purchase price of our common shares was adjusted on July 13, 2021 to $10.35, $0.01 above the previously effective per share price of our common shares, and will be effective until updated by us on September 30, 2021, or within a commercially reasonable time thereafter, unless updated by us prior to that time.

Share Redemption Plan Status

Through the date of this offering circular, we received and fulfilled redemption requests for 950 commons shares.

COVID-19

A pandemic of a novel strain of coronavirus (COVID-19) emerged in 2019 and spread globally during 2020. Although it is not possible to reliably estimate the length or severity of this pandemic and hence its financial impact, the Company could be materially and possibly adversely affected by the risks, or the public perception of the risks, related to the recent pandemic of COVID-19. In addition, restrictions from federal, state and local authorities to mitigate the spread of COVID-19 has and may continue to negatively impact the Company’s business. The Company holds an asset in Georgia, which, as of September 24, 2021, is subject to state and/or local governmental restrictions that limit the use of the Company's asset. The extent of the impact of COVID-19 on the Company’s operational and financial performance will depend on future developments, including the duration and spread of the pandemic.

Investment Objectives

Our investment objectives are to invest in assets that will enable us to:

•generate attractive risk-adjusted returns through a combination of cash distributions, NOI growth and capital appreciation over an expected five to seven year hold period;

•preserve, protect and return invested capital;

•provide an investment alternative for people seeking to allocate a portion of their long-term investment portfolios to commercial real estate; and

•create value for investors, tenants and community through socially responsible management practices.