Form 20-F Advanced Health Intellig For: Jun 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM

OR

For the fiscal year ended

OR

For the transition period from _________ to __________

OR

Date of event requiring this shell company report ___________

Commission file number

(Exact name of Registrant as specified in its charter and translation of Registrant’s name into English)

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

Non-executive Chairman

(Name, telephone, e-mail and/or facsimile number and address of company contact person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Emerging growth company |

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange

Act.

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | International Financial Reporting Standards as issued by the International Accounting Standards Board | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No

INTRODUCTION

Advanced Health Intelligence Ltd (formerly known as Advanced Human Imaging Ltd) was incorporated on October 1, 2014 as “Shrinkme Pty Ltd” under the Corporations Act (Australia). On February 17, 2015 we changed our name to “MyFiziq Pty Ltd” and on June 12, 2015 we changed our name to “MyFiziq Limited” and accordingly changed our status to a public company. On March 5, 2021, we changed our name to “Advanced Human Imaging Ltd”. On December 8, 2022, we changed our name to “Advanced Health Intelligence Ltd”.

We have developed and patented a proprietary measurement/dimensioning technology that enables a User to check, track, and accurately assess their body dimensions and chronic disease risk markers privately using only a smartphone. We refer to this physical measurement and analytics tool as “BodyScan.” We have global customers/partners (“Partners”) who utilize our technology through Software Development Kits (“SDKs”). Our global Partners have substantial audiences that they address, and from those underlying audiences, individual User(s) (“User(s)”) gain access via the Partners’ software programs/apps that embed our technology components.

Our global Partners currently include companies within the following sectors: (i) mobile health (“mHealth”), Telehealth, and Wellness; (ii) Life and Health Insurance; and (iii) Fitness Industry.

The principal listing of our ordinary shares and listed options to purchase our ordinary shares is on the Australian Securities Exchange, or ASX. Since November 2021, our American Depository Shares, or ADSs, have traded on the NASDAQ Capital Market under the symbol “AHI”. The Bank of New York, acting as depositary, issues American Depository Receipts, or ADRs, each of which evidences an ADS, which in turn represents seven (7) of our ordinary shares. As used in this annual report, the terms “we,” “us,” “our”, “the Company”, “AHI” and “Advanced Health Intelligence” mean Advanced Health Intelligence Ltd (formerly known as Advanced Human Imaging Ltd) and its subsidiaries, unless otherwise indicated.

Our financial statements have been prepared in accordance with Australian Accounting Standards (“AASB”). The AASB has adopted both the International Accounting Standards (“IAS”) as well as the International Financial Reporting Standards (“IFRS”), as issued by the IASB.

Australian Disclosure Requirements

Our ordinary shares are primarily quoted on the ASX in addition to our listing of our ADSs on the NASDAQ Capital Market (“NASDAQ”). As part of our ASX listing, we are required to comply with various disclosure requirements as set out under the Australian Corporations Act 2001 and the ASX Listing Rules. Information furnished under the sub-heading “Australian Disclosure Requirements” is intended to comply with the ASX Listing Rules and Corporations Act 2001 disclosure requirements and is not intended to fulfill information required by this Annual Report on Form 20-F.

In this annual report, all references to “U.S. dollars” or “U.S.$” are to the currency of the United States, and all references to “Australian dollars” or “A$” are to the currency of Australia.

Statements made in this annual report concerning the contents of any contract, agreement or other document are summaries of such contracts, agreements or documents and are not complete descriptions of all their terms. If we filed any of these documents as an exhibit to this annual report or to any registration statement or annual report that we previously filed, you may read the document itself for a complete description of its terms.

Forward-Looking Statements

Except for the historical information contained in this annual report, the statements contained in this annual report are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and the Private Securities Litigation Reform Act of 1995, as amended, with respect to our business, financial condition and results of operations. Such forward-looking statements reflect our current view with respect to future events and financial results. We urge you to consider that statements which use the terms “anticipate,” “believe,” “do not believe,” “expect,” “plan,” “intend,” “estimate,” and similar expressions are intended to identify forward-looking statements. We remind readers that forward-looking statements are merely predictions and therefore inherently subject to uncertainties and other factors and involve known and unknown risks that could cause the actual results, performance, levels of activity, or our achievements, or industry results, to be materially different from any future results, performance, levels of activity, or our achievements expressed or implied by such forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Except as required by applicable law, including the securities laws of the United States, we undertake no obligation to publicly release any update or revision to any forward-looking statements to reflect new information, future events or circumstances, or otherwise after the date hereof. We have attempted to identify significant uncertainties and other factors affecting forward-looking statements in the Risk Factors section that appears in Item 3.D. “Key Information-Risk Factors.”

TABLE OF CONTENTS

i

ii

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

| A. | [Reserved] |

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

| D. | Risk Factors |

Investing in our securities involves a high degree of risk and uncertainty. You should carefully consider the risks and uncertainties described below before investing in our securities. Additional risks and uncertainties not presently known to us or that we believe to be immaterial may also adversely affect our business. If any of the following risks actually occurs, our business, prospects, financial condition and results of operations could be harmed. In that case, the daily price of our securities could decline, and you could lose all or part of your investment. These risk factors include:

Summary Risk Factors

The below is a summary of principal risks to our business and risks associated with our company. It is only a summary. You should read the more detailed discussion of risks set forth below and elsewhere in this annual report for a more complete discussion of the risks listed below and other risks.

| ● | We operate in a highly competitive industry, and if we are not able to compete effectively, our business and results of operations will be harmed. | |

| ● | We may not reach the scale in our business or generate revenue to the level outlined in our business plan. | |

| ● | We may be unable to successfully execute our growth initiatives, business strategies, or operating plans. | |

| ● | If we fail to effectively manage our growth and organizational change, our business and results of operations could be harmed. | |

| ● | If security measures in connection with our platforms and services are breached or unauthorized access to patient’s or client’s data is otherwise obtained, our solutions may be perceived as not being secure, clients may reduce the use of or stop using our software solutions, and we may incur significant liabilities. | |

| ● | If we do not continue to innovate and provide services that are useful to customers and users, we may not remain competitive, and our revenue and results of operations could suffer. | |

| ● | The recent global pandemic of COVID-19 could harm our business, results of operations, and financial condition. | |

| ● | We rely on third-party providers for web services/cloud services, computing infrastructure, databases and other technology-related services needed to deliver our cloud solutions. Therefore, a change of contractual relationship with such third-party providers or disruption of the services provided by them could adversely affect our business and subject us to liability. | |

| ● | Technology changes rapidly in our business, and if we fail to anticipate new technologies, the quality, timeliness, and competitiveness of our products may suffer. | |

| ● | Our business success depends on our ability to properly utilize and protect our intellectual property and non-infringement of intellectual property of third parties, both in the U.S. and in other countries, we plan to expand to. |

1

| ● | We are an “emerging growth company” and as such, we are subject to exemptions from certain disclosure requirements. | |

| ● | We are subject to certain risks associated with currency fluctuations which can impact our operations. | |

| ● | We are subject to certain risks associated with ADSs. | |

| ● | There may be a significant dilution and loss of value of our Ordinary Shares as a result of certain outstanding convertible notes, outstanding performance rights and options which are exercisable into Ordinary Shares. | |

| ● | Your rights to pursue claims arising under the deposit agreement are limited by the terms of the deposit agreement, including limited choice of forum, and jury trial waiver. |

Risks Related to our Business

We may not reach the scale in our business or generate revenue to the level outlined in our business plan.

We may be unable to achieve our expected growth or go-live with our product in the anticipated timelines, based on factors outside of our control. We have only generated very minimal recurring revenues to date as our partner releases have only commenced in late 2020 and there is a degree of uncertainty associated with predicting future revenue with a broader understanding of adoption and retention. Until we have ascertained the level of uptake with already contracted partners, this will form part of our focus and process.

We have historically incurred significant losses and there can be no assurance as to when, precisely, we will achieve breakeven or maintain profitability, despite our low overhead expenditure.

During the 12 months ended June 30, 2022, we realized a net loss of A$20,076,843 compared with a net loss of A$14,060,992 for the 12 months ended June 30, 2021. Because of the numerous risks and uncertainties associated with the development of our products and business, we are unable to predict with absolute certainty the extent of any future losses or when we will become profitable. While our overheads are quite low, maintaining operating losses in the future will have an adverse effect on our cash resources, shareholders’ equity and working capital. Our failure to become and remain profitable could depress the value of our stock and impair our ability to raise capital, expand our business, maintain our development efforts, diversify our portfolio of partner companies, or continue our operations. A decline in our value could also cause you to lose all or part of your investment in our Company.

We will need to raise additional capital to meet our business requirements in the future, which could be challenging, potentially highly dilutive and may cause the market price of our Ordinary Shares and ADSs to decline.

While we are transitioning to a point of breakeven, we may need to raise additional capital in order to meet our business objectives. Future capital raises may not be available on reasonable terms, if at all. Additional capital would be used to accomplish the following:

| ● | Finance our current operating expenses; |

| ● | Pursue growth opportunities; |

| ● | Hire and retain qualified employees; |

| ● | Respond to competitive pressures; |

| ● | Comply with regulatory requirements; and |

| ● | Maintain compliance with applicable laws. |

To the extent that we raise additional capital through the sale of equity or convertible debt securities, the issuance of such securities could result in substantial dilution for our current shareholders. The terms of any securities issued by us in future capital transactions may be more favorable to new investors, and may include preferences, superior voting rights and the issuance of warrants or other derivative securities, which may have a further dilutive effect on the holders of any of our securities then-outstanding. We may issue additional Ordinary Shares or securities convertible into or exchangeable or exercisable for our Ordinary Shares in connection with hiring or retaining personnel, option or warrant exercises, future acquisitions or future placements of our securities for capital-raising or other business purposes. The issuance of additional securities, whether equity or debt, by us, or the possibility of such issuance, may cause the market price of our Ordinary Shares to decline and existing shareholders may not agree with our financing plans or the terms of such financings.

In addition, we may incur additional costs in pursuing future capital financing, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we issue, such as convertible notes and warrants, which may adversely impact our financial condition.

Furthermore, any additional debt or equity financing that we may need may not be available on terms favorable to us, or at all. If we are unable to obtain such additional financing on a timely basis, we may have to curtail our development activities and growth plans, which would have a material adverse effect on our business, financial condition and results of operations.

2

The success of our business is highly dependent on market acceptance of our technology and timely release of our technology which is embedded in our partners’ customer facing applications. If the end consumer does not accept our product, or our customers fail to go live with their applications (with our technology embedded), our financial performance will be materially adversely affected.

We expect to derive most of our revenue by charging fees in connection with the usage of our applications and technologies. We must make product rollout decisions and commit significant resources well in advance of the anticipated introduction of new applications and technologies. The release of our applications and technologies by our customers (we are ‘business-to-business’ (“B2B”), while our customers have the relationship with the end user) may be delayed, may not succeed, or may have a shorter life cycle than anticipated. If the applications are not released when anticipated or do not attain wide market acceptance, our revenue growth may never materialize, we may be unable to fully recover the resources we have committed, and our financial performance will be harmed.

As a B2B company, we are substantially dependent on our customers to design, integrate and price our technology effectively within their applications.

Whilst we establish commercial contracts with our customers that includes: pricing charges, SDK integration audits, and implementation services, and include various options for customer to select from to integrate our technology within their applications to meet their unique business requirements and user experience in our product offering, as well as provide our own design resources to supplement customer design and product teams, we have limited control over what price customers offer the integrated solution to end users, as well as where and how our products are integrated into their applications. As a result, customers may set pricing points too high for end users, or design / integrate our application in a sub optimal way that users cannot easily find or use our products, which may substantially impact our ability to generate recurring revenue at the level that we expect.

As a B2B company, we are substantially dependent on our customers to release our integrated products on agreed timelines.

Whilst we establish commercial contracts with our customers that includes indicative release timing, we have limited to no control over when, if ever, customers choose to release integrated products. Delays in customer release schedules may have a significant impact on our future cash flow and ability to generate recurring revenue, and / or significantly damage our brand reputation.

As a B2B company, we are substantially dependent on our customers to market our integrated product to their end users.

Whilst we provide marketing incentives to customers to, depending on the customer size, match their marketing spend on integrated product marketing, provide part marketing spend, as well as assist with marketing activities, including generation and monitoring of marketing strategies and campaigns as well as the development of joint marketing assets, we have limited to no control over how and when customers market our integrated products. Ineffective, inadequate, or nonexistent marketing of our integrated product may have a significant impact on our future cash flow and ability to generate recurring revenue at the level that we expect.

Damage to our or our customers’ reputation or lack of acceptance of our brand or our customers’ brands in existing and new markets could negatively impact our business, financial condition and results of operations.

We intend to build a strong reputation for the quality of our technology, and we must protect and grow the value of our brand to be successful. Any incident that erodes consumer affinity for our brand or our customers’ brands, could significantly reduce our brand value and damage our business. If end users perceive or experience a reduction in quality, or in any way believe we or our customers fail to deliver a consistently positive experience, our brand value could suffer, and our business may be adversely affected.

In addition, our ability to successfully sign new partners in new markets may be adversely affected by a lack of awareness or acceptance of our brand or our existing partners brands in these new markets. To the extent that we are unable to foster name recognition and affinity for our brand in new markets, our growth may be significantly delayed or impaired.

As a result, adverse economic conditions in any of these areas could have a material adverse effect on our overall results of operations. In addition, other factors that could have a material adverse effect on our business and operations include but are not limited to; local strikes, terrorist attacks, increases in energy prices, adverse weather conditions, hurricanes, droughts or other natural or man-made disasters.

3

Technology changes rapidly in our business, and if we fail to anticipate new technologies, the quality, timeliness, and competitiveness of our products may suffer.

Rapid technology changes require us to anticipate which technologies and/or distribution platforms our products must take advantage of in order to make them competitive in the market at the time they are released. Therefore, we usually start our product development with a range of technical development goals that we hope to be able to achieve. We may not be able to achieve these goals, and even though we have global patent protection, our competition may be able to achieve them more quickly than we can. If we cannot achieve our technology goals within the original development schedule of our products, this may impact the manner in which users experience our product, which in turn could impact recurring revenue. It may also provide an opportunity for competitors to catch up to us.

We rely upon third parties to provide distribution for our applications, and disruption in these services could harm our business.

We currently utilize, and plan on continuing to utilize over the current fiscal year, third-party networking providers and distribution through companies including, but not limited to, Apple and Google to distribute our technologies. If disruptions or capacity constraints occur, we may have no means of replacing these services, on a timely basis or at all. This could cause a material adverse condition for our operations and financial earnings.

We rely on third-party hosting and cloud computing providers to operate certain aspects of our business. Any failure, disruption or significant interruption in our network or hosting and cloud services could adversely impact our operations and harm our business.

Our technology infrastructure is critical to the performance of our products and customer satisfaction. Our products run on a complex distributed system, or what is commonly known as cloud computing. We own, operate and maintain elements of this system. However, elements of this system are operated by open-source code and third party owned and operated software that we do not control, and which would require significant time to replace. We expect this dependence on third parties to continue. In particular, a portion of the data storage, data processing and other computing services and systems is hosted by cloud computing providers. Any disruptions, outages and other performance problems relating to such services, including infrastructure changes, human or software errors and capacity constraints, could adversely impact our business, financial condition or results of operations.

We could be harmed by improper disclosure or loss of sensitive or confidential company, employee, associate or customer data, including personal data.

In connection with the operation of our business, we plan to store, process and transmit data, including personal information, about our employees, customers, customers’ end users, associates and candidates, a portion of which is confidential and/or personally sensitive. Unauthorized disclosure or loss of sensitive or confidential data may occur through a variety of methods. These include, but are not limited to, systems failure, employee negligence, fraud or misappropriation, or unauthorized access to or through our information systems, whether by our employees or third parties, including a cyberattack by computer programmers, hackers, members of organized crime and/or state-sponsored organizations, who may develop and deploy viruses, worms or other malicious software programs.

Such disclosure, loss or breach could harm our reputation and subject us to government sanctions and liability under our contracts and laws that protect sensitive or personal data and confidential information, resulting in increased costs or loss of revenues. It is possible that security controls over sensitive or confidential data and other practices we and our third-party vendors follow may not prevent the improper access to, disclosure of, or loss of such information. The potential risk of security breaches and cyberattacks may increase as we introduce new services and offerings, such as mobile technology. Further, data privacy is subject to frequently changing rules and regulations, which sometimes conflict among the various jurisdictions in which we provide services. Any failure or perceived failure to successfully manage the collection, use, disclosure, or security of personal information or other privacy related matters, or any failure to comply with changing regulatory requirements in this area, could result in legal liability or impairment to our reputation in the marketplace.

Our business operations and future development could be significantly disrupted if we lose key members of our management team.

The success of our business continues to depend to a significant degree upon the continued contributions of our senior officers and key employees, both individually and as a group. Our future performance will be substantially dependent, in particular, on our ability to retain and motivate our Chief Executive Officer, and certain of our other senior executive officers. The loss of the services of our Chief Executive Officer, senior officers or other key employees could have a material adverse effect on our business and plans for future development. We have no reason to believe that we will lose the services of any of these individuals in the foreseeable future; however, we currently have no effective replacement for any of these individuals due to their experience, reputation in the industry and special role in our operations. We also do not maintain any key man life insurance policies for any of our employees.

4

Our business operations are conducted in multiple languages and could be disrupted due to miscommunications or translation errors.

The success of our business continues to depend on our marketing efforts globally, with a majority of customer head offices in the USA, Europe and Asia Pacific, each of which may be conducted in the local language. Miscommunications or inaccurate foreign language translations could have a material adverse effect on our business operations and financial conditions. Additionally, contracts, communications and complex technical information may be required to be accurately translated into foreign languages.

We may not be able to adequately protect our Intellectual Property (IP) or avoid third party IP, which, in turn, could harm the value of our brands and adversely affect our business.

Our ability to implement our business plan successfully depends in part on our ability to build brand recognition using our patents, service marks and other proprietary intellectual property, including our names and logos. We have patents in selected global jurisdictions, with prior art dating back to December 4, 2014. We have been issued 12 patents, 1 of each in Australia, China, Hong Kong, Canada, and the USA, 2 in South Korea, and Singapore, and 3 in Japan. We have 9 patent-pending submissions; 1 each in China, Hong Kong, Singapore, South Korea, Europe, India, and 3 in New Zealand, and updated applications to our existing issued patents to further protect our IP in process. No assurance can be given that our patent-pending submissions or the additional patent applications which is in process will be approved. If our patent-pending submissions or the additional patent applications which is in process are not approved, our ability to expand or develop our business may be negatively affected.

We have established trademarks to protect our brand globally in key jurisdictions including: the USA, China, the EU, the UK, Japan, and Australia.

Third parties may also oppose our trademark or patent applications, or otherwise challenge our use of the trademarks or patents. In the event that our trademarks or patents are successfully challenged, we could be forced to rebrand our goods and services or redesign our technology, which could result in loss of brand recognition, and could require us to devote resources to advertising and marketing new brands and products.

If our efforts to register, maintain and protect our intellectual property are inadequate, or if any third party misappropriates, dilutes or infringes on our intellectual property, the value of our brands may be harmed, which could have a material adverse effect on our business and might prevent our brands from achieving or maintaining market acceptance. We may also face the risk of claims that we have infringed third parties’ intellectual property rights. If third parties claim that we infringe upon their intellectual property rights, our operating profits could be adversely affected. Any claims of intellectual property infringement, even those without merit, could be expensive and time consuming to defend, require us to rebrand our services, if feasible, divert management’s attention and resources or require us to enter into royalty or licensing agreements in order to obtain the right to use a third party’s intellectual property.

Any royalty or licensing agreements, if required, may not be available to us on acceptable terms or at all. A successful claim of infringement against us could result in our company being required to pay significant damages, enter into costly license or royalty agreements, or stop the sale of certain products or services, any of which could have a negative impact on our operating profits and harm our future prospects.

We may not be able to continue to obtain licenses to third-party software and intellectual property on reasonable terms or at all, which may disrupt our business and harm our financial results.

We license third-party software and other intellectual property for use in product deployment, research and development and, in several instances, for inclusion in our products such as with FaceScan and DermaScan. These licenses may need to be renegotiated or renewed from time to time, or we may need to obtain new licenses in the future. Third parties may stop adequately supporting or maintaining their technology, or their technology may be acquired by our competitors. If we are unable to obtain licenses to these third-party software and intellectual property on reasonable terms or at all, we may not be able to sell the affected products, our customers’ use of the products may be interrupted, or our product development processes and professional services offerings may be disrupted, which could in turn harm our financial results, our customers, and our reputation. The inclusion of third-party intellectual property in our products can also subject us and our customers to infringement claims. Although we seek to mitigate this risk contractually, we may not be able to sufficiently limit our potential liability. Regardless of outcome, infringement claims may require us to use significant resources and may divert management’s attention. Some of our products and technology, including those we acquire, may include software licensed under open-source licenses. Some open-source licenses could require us, under certain circumstances, to make available or grant licenses to any modifications or derivative works we create based on the open-source software. Although we have tools and processes to monitor and restrict our use of open-source software, the risks associated with open-source usage may not be eliminated and may, if not properly addressed, result in unanticipated obligations that harm our business.

5

Information technology system failures or breaches of our network security could interrupt our operations and adversely affect our business.

We will rely on our computer systems and network infrastructure across our operations. Our operations depend upon our ability to protect our computer equipment and systems against damage from physical theft, fire, power loss, telecommunications failure or other catastrophic events, as well as from internal and external security breaches, viruses, worms and other disruptive problems. Any damage or failure of our computer systems or network infrastructure that causes an interruption in our operations could have a material adverse effect on our business and subject us to litigation or actions by regulatory authorities. Although we employ both internal resources and external consultants to conduct auditing and testing for weaknesses in our systems, controls, firewalls and encryption and intend to maintain and upgrade our security technology and operational procedures to prevent such damage, breaches or other disruptive problems, there can be no assurance that these security measures will be successful.

Any actual or perceived failure by us to comply with our privacy policy or legal or regulatory requirements in one or multiple jurisdictions could result in proceedings, actions or penalties against us.

Any failure or perceived failure by us to comply with federal, state or foreign laws or regulations, industry standards, contractual obligations or other legal obligations, or any actual or suspected security incident, whether or not resulting in unauthorized access to, or acquisition, release or transfer of personal data or other data, may result in governmental enforcement actions and prosecutions, private litigation, fines and penalties or adverse publicity and could cause our customers to lose trust in us, which could have an adverse effect on our reputation and business. Any inability to adequately address privacy and security concerns, even if unfounded, or comply with applicable laws, regulations, policies, industry standards, contractual obligations or other legal obligations could result in additional cost and liability to us, damage our reputation, inhibit sales and adversely affect our business.

Evolving and changing definitions of what constitutes “Personal Information” and “Personal Data” within the EU, the United States and elsewhere, may limit or inhibit our ability to operate or expand our business, including limiting technology alliance partners that may involve the sharing of data.

If we are perceived to cause, or are otherwise unfavorably associated with, violations of privacy or data security requirements, it may subject us or our customers to public criticism, financial penalties and potential legal liability. Existing and potential privacy laws and regulations concerning privacy and data security and increasing sensitivity of consumers to unauthorized processing of personal data may create negative public reactions to technologies, products and services such as ours. Public concerns regarding personal data processing, privacy and security may cause some of our customers’ end users to be less likely to visit their venues or platforms, or otherwise interact with them. If enough end users choose not to visit our customers’ venues of platforms, or otherwise interact with them, our customers could stop using our platform. This, in turn, may reduce the value of our service, and slow or eliminate the growth of our business, or cause our business to contract.

Around the world, there are numerous lawsuits in process against various technology companies that process personal information and personal data. If those lawsuits are successful, it could increase the likelihood that our company may be exposed to liability for our own policies and practices concerning the processing of personal data and could hurt our business. Furthermore, the costs of compliance with, and other burdens imposed by laws, regulations and policies concerning privacy and data security that are applicable to the businesses of our customers may limit the use and adoption of our technologies and reduce overall demand for it. Privacy concerns, whether or not valid, may inhibit market adoption of our technologies. Additionally, concerns about security or privacy may result in the adoption of new legislation that restricts the implementation of technologies like ours or require us to make modifications to our existing services and technology, which could significantly limit the adoption and deployment of our technologies or result in significant expense.

We will continue to incur costs and be subject to various obligations as a result of being a public company.

We will continue to incur significant legal, accounting and other expenses as a result of being a public company. Although we will incur costs each year associated with being a publicly traded company, it is possible that our actual costs of being a publicly traded company will vary from year to year and may be different than our estimates. In estimating these costs, we take into account expenses related to insurance, legal, accounting and compliance activities.

Furthermore, the need to maintain the corporate infrastructure demanded of a public company may divert management’s attention from implementing our growth strategy, which could prevent us from improving our business, results of operations and financial condition. We have made, and will continue to make, changes to our internal controls and procedures for financial reporting and accounting systems to meet our reporting obligations in order to become a U.S. publicly traded company. However, the measures we take may not be sufficient to satisfy our obligations as a publicly traded company.

6

Any future or current litigation could have a material adverse impact on our results of operations, financial condition and liquidity.

From time to time we may be subject to litigation, including, among others, potential shareholder derivative actions. Risks associated with legal liability are difficult to assess and quantify, and their existence and magnitude can remain unknown for significant periods of time. To date we have obtained directors and officers liability (“D&O”) insurance to cover some of the risk exposure for our directors and officers. Such insurance generally pays the expenses (including amounts paid to plaintiffs, fines, and expenses including attorneys’ fees) of officers and directors who are the subject of a lawsuit as a result of their service to us. There can be no assurance that we will be able to continue to maintain this insurance at reasonable rates or at all, or in amounts adequate to cover such expenses should such a lawsuit occur. Our Constitution requires us to indemnify our officers and directors involved in such a legal action to the extent permitted by the Corporations Act 2001 (Cth), or the “Corporations Act”. Without D&O insurance, the amounts we would pay to indemnify our officers and directors should they be subject to legal action based on their service to us could have a material adverse effect on our financial condition, results of operations and liquidity. Such lawsuits, and any related publicity, may result in substantial costs and, among other things, divert the attention of management and our employees. An unfavorable outcome in any claim or proceeding against us could have a material adverse impact on our financial position and results of operations for the period in which the unfavorable outcome occurs, and potentially in future periods.

Further, any settlement announced by us may expose us to further claims against us by third parties seeking monetary or other damages which, even if unsuccessful, would divert management attention from the business and cause us to incur costs, possibly material, to defend such matters, which could have a material adverse impact on our financial position.

Federal, state and local or Australian tax rules may adversely impact our results of operations and financial position.

We are subject to federal, state and local taxes in the U.S., as well as federal and state taxes in Australia in respect to our operations in Australia. Although we believe our tax estimates are reasonable, if the Internal Revenue Service or other taxing authority disagrees with the positions, we have taken on our tax returns, we could face additional tax liability, including interest and penalties. If material, payment of such additional amounts upon final adjudication of any disputes could have a material impact on our results of operations and financial position. In addition, complying with new tax rules, laws or regulations could impact our financial condition, and increases to federal or state statutory tax rates and other changes in tax laws, rules or regulations may increase our effective tax rate. Any increase in our effective tax rate could have a material impact on our financial results.

Our management, board and advisors control a large block of our Ordinary Shares.

As of June 30, 2022, members of our management team and board beneficially own approximately 31.4% of our outstanding Ordinary Shares, Performance Rights and Options. In addition, two shareholders own between them approximately 19.4% of our outstanding Ordinary Shares and Performance Rights. As such, management and these shareholders own approximately, in the aggregate, 28.5% of our voting power. As a result, management and the aforementioned shareholders may have the ability to control substantially all matters submitted to our shareholders for approval including:

| ● | Election of our directors; |

| ● | Removal of any of our directors; |

| ● | Amendment of our Constitution; and |

| ● | Adoption of measures that could delay or prevent a change in control or impede a merge, takeover or other business combination involving us. |

In addition, management’s and the aforementioned shareholders’ stock ownership may discourage a potential acquirer from making a takeover offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our shareholders from realizing a premium over our stock price.

7

Risks Related to Ownership of our ADSs

We are subject to risks associated with currency fluctuations, and changes in foreign currency exchange rates could impact our results of operations.

Our Ordinary Shares are quoted in Australian dollars on the ASX and the ADSs are quoted in U.S. dollars. In the past year, the Australian dollar has generally weakened against the U.S. dollar; however, this trend may not continue and may be reversed. As such, any significant change in the value of the Australian dollar may have a negative effect on the value of the ADSs in U.S. dollars. In addition, if the Australian dollar weakens against the U.S. dollar, then, if we decide to convert our Australian dollars into U.S. dollars for any business purpose, appreciation of the U.S. dollar against the Australian dollar would have a negative effect on the U.S. dollar amount available to us. While we engage in limited hedging transactions to manage our foreign exchange risk, these activities may not be effective in limiting or eliminating foreign exchange losses. To the extent that we need to convert U.S. dollars into Australian dollars for our operations, appreciation of the Australian dollar against the U.S. dollar would have a negative effect on the Australian dollar amount we would receive from the conversion. Consequently, appreciation or depreciation in the value of the Australian dollar relative to the U.S. dollar would affect our financial results reported in U.S. dollar terms without giving effect to any underlying change in our business or results of operations. As a result of such foreign currency fluctuations, it could be more difficult to detect underlying trends in our business and results of operations.

Australian takeover laws may discourage takeover offers being made for us or may discourage the acquisition of a significant position in our Ordinary Shares the ADSs.

We are incorporated in Australia and are subject to the takeover laws of Australia. Among other things, we are subject to the Corporations Act. Subject to a range of exceptions, the Corporations Act prohibits the acquisition of a direct or indirect interest in our issued voting shares if the acquisition of that interest will lead to a person’s voting power in us increasing to more than 20%, or increasing from a starting point that is above 20% and below 90%. Australian takeover laws may discourage takeover offers being made for us or may discourage the acquisition of a significant position in our Ordinary Shares. This may have the ancillary effect of entrenching our Board and may deprive or limit our shareholders’ opportunity to sell their Ordinary Shares and may further restrict the ability of our shareholders to obtain a premium from such transactions.

Our Constitution and Australian laws and regulations applicable to us may adversely affect our ability to take actions that could be beneficial to our shareholders.

As an Australian company we are subject to different corporate requirements than a corporation organized under the laws of the United States. Our Constitution, as well as the Corporations Act, sets forth various rights and obligations that apply to us as an Australian company and which may not apply to a U.S. corporation. These requirements may operate differently than those of many U.S. companies. You should carefully review the summary of these matters set forth under “Description of Share Capital” as well as our Constitution, which is included as an exhibit to this annual report.

We currently report our financial results under IFRS, which differs in certain significant respect from U.S. generally accepted accounting principles, or U.S. GAAP.

Currently we report our financial statements under IFRS. There have been and there may in the future be certain significant differences between IFRS and U.S. Generally Accepted Accounting Principles (“U.S. GAAP”), including differences related to revenue recognition, intangible assets, share-based compensation expense, income tax and earnings per share. As a result, our financial information and reported earnings for historical or future periods could be significantly different if they were prepared in accordance with U.S. GAAP. In addition, we do not intend to provide a reconciliation between IFRS and U.S. GAAP unless it is required under applicable law. As a result, you may not be able to meaningfully compare our financial statements under IFRS with those companies that prepare financial statements under U.S. GAAP.

As a foreign private issuer, we are exempt from a number of rules under the U.S. securities laws and are permitted to file less information with the SEC than a U.S. company.

We are a foreign private issuer, as defined in the SEC’s rules and regulations and, consequently, we are not subject to all of the disclosure requirements applicable to public companies organized within the United States. For example, we are exempt from certain rules under the Exchange Act that regulate disclosure obligations and procedural requirements related to the solicitation of proxies, consents or authorizations applicable to a security registered under the Exchange Act, including the U.S. proxy rules under Section 14 of the Exchange Act. In addition, our senior management and directors are exempt from the reporting and “short-swing” profit recovery provisions of Section 16 of the Exchange Act and related rules with respect to their purchases and sales of our securities. Moreover, while we currently make annual and semi-annual filings with respect to our listing on the ASX and expect to file financial reports on an annual and semi-annual basis, we will not be required to file periodic reports and financial statements with the SEC as frequently or as promptly as U.S. public companies and will not be required to file quarterly reports on Form 10-Q or current reports on Form 8-K under the Exchange Act. In addition, foreign private issuers are not required to file their annual report on Form 20-F until 4 months after the end of each fiscal year. Accordingly, there may be less publicly available information concerning our company than there would be if we were not a foreign private issuer.

8

As a foreign private issuer, we are permitted to adopt certain home country practices in relation to corporate governance matters that differ significantly from Nasdaq corporate governance listing standards and these practices may afford less protection to shareholders than they would enjoy if we complied fully with Nasdaq corporate governance listing standards.

As a foreign private issuer listed on NASDAQ, we will be subject to their corporate governance listing standards. However, NASDAQ rules permit foreign private issuers to follow the corporate governance practices of its home country. Some corporate governance practices in Australia may differ from NASDAQ corporate governance listing standards. For example, we could include non-independent directors as members of our Remuneration and Nomination committees, and our independent directors may not necessarily hold regularly scheduled meetings at which only independent members of the Board are present. Currently, we intend to follow home country practice to the maximum extent possible. Therefore, our shareholders may be afforded less protection than they otherwise would have under corporate governance listing standards applicable to U.S. domestic issuers. For an overview of our corporate governance practices, see “Management.”

We may lose our foreign private issuer status in the future, which could result in significant additional cost and expense.

While we currently qualify as a foreign private issuer, the determination of foreign private issuer status is made annually on the last business day of an issuer’s most recently completed second fiscal quarter and, accordingly, our next determination will be made on June 30, 2022. In the future, we would lose our foreign private issuer status if we to fail to meet the requirements necessary to maintain our foreign private issuer status as of the relevant determination date. For example, if 50% or more of our securities are held by U.S. residents and more than 50% of our senior management or directors are residents or citizens of the United States, we could lose our foreign private issuer status. As of June 30, 2022, approximately 13% of our outstanding Ordinary Shares (including Ordinary Shares in the form of ADSs) are held by U.S. residents.

The regulatory and compliance costs to us under U.S. securities laws as a U.S. domestic issuer may be significantly more than costs we incur as a foreign private issuer. If we are not a foreign private issuer, we will be required to file periodic reports and registration statements on U.S. domestic issuer forms with the SEC, which are more detailed and extensive in certain respects than the forms available to a foreign private issuer. We would be required under current SEC rules to prepare our financial statements in accordance with U.S. GAAP rather than IFRS, and modify certain of our policies to comply with corporate governance practices required of U.S. domestic issuers. Such conversion of our financial statements to U.S. GAAP would involve significant time and cost. In addition, we may lose our ability to rely upon exemptions from certain corporate governance requirements on U.S. stock exchanges that are available to foreign private issuers such as the ones described above and exemptions from procedural requirements related to the solicitation of proxies.

We are an “emerging growth company” under the JOBS Act and will be able to avail ourselves of reduced disclosure requirements applicable to emerging growth companies, which could make our Ordinary Shares or the ADSs less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act, and we intend to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies,” including not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act, for complying with new or revised accounting standards. We will not take advantage of the extended transition period provided under Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards.

We cannot predict if investors will find the Ordinary Shares or ADSs less attractive because we may rely on these exemptions. If some investors find the Ordinary Shares or ADSs less attractive as a result, there may be a less active trading market for the Ordinary Shares or ADSs and the price of the Ordinary Shares or ADSs may be more volatile. We may take advantage of these exemptions until such time that we are no longer an emerging growth company. We would cease to be an emerging growth company upon the earliest to occur of (i) the last day of the fiscal year in which we have more than US$1.07 billion in annual revenue; (ii) the last day of the fiscal year in which we qualify as a “large accelerated filer”; (iii) the date on which we have, during the previous three-year period, issued more than US$1.0 billion in non-convertible debt securities; and (iv) the last day of the fiscal year in which the fifth anniversary of our IPO occurred.

If we are a passive foreign investment company, there could be adverse U.S. federal income tax consequences to U.S. holders.

Based on the nature and composition of our income, assets, activities and market capitalization for our taxable year ended June 30, 2020, we believe that we were not classified as a passive foreign investment company, or “PFIC”, for the taxable year ended June 30, 2020. Based on the nature and composition of our income, assets, activities and market capitalization for our taxable year ended June 30, 2021, we believe that we would not be classified as a PFIC for the taxable year ended June 30, 2021. However, there can be no assurance that we will not be considered a PFIC in any past, current or future taxable year. A separate determination must be made after the close of each taxable year as to whether we are a PFIC for that year. As a result, our PFIC status may change from year to year. Our status as a PFIC will depend on the composition of our income (including whether we receive certain grants or subsidies and whether such amounts will constitute gross income for purposes of the PFIC income test) and the composition and value of our assets, which may be determined in large part by reference to the market value of the ADSs and our Ordinary Shares, which may be volatile, from time to time. Our status may also depend, in part, on how quickly we utilize the cash proceeds from our IPO in our business. Our U.S. counsel expresses no opinion regarding our conclusions or our expectations regarding our PFIC status.

9

Under the Code, a non-U.S. company will be considered a PFIC for any taxable year in which (1) 75% or more of its gross income consists of passive income or (2) 50% or more of the average quarterly value of its assets consists of assets that produce, or are held for the production of, passive income. For purposes of these tests, passive income includes dividends, interest, gains from the sale or exchange of investment property and certain rents and royalties. In addition, for purposes of the above calculations, a non-U.S. corporation that directly or indirectly owns at least 25% by value of the shares of another corporation is treated as if it held its proportionate share of the assets and received directly its proportionate share of the income of such other corporation. If we are a PFIC for any taxable year during which a U.S. holder (as defined below in the section titled “Material United States Federal Income Tax and Australian Tax Considerations—Material United States Federal Income Tax Considerations”) holds our Ordinary Shares or ADSs, we will continue to be treated as a PFIC with respect to such U.S. holder in all succeeding years during which the U.S. holder owns the Ordinary Shares or ADSs, regardless of whether we continue to meet the PFIC test described above, unless the U.S. holder is eligible to make and makes a mark-to-market election or makes a specified election once we cease to be a PFIC. If we are classified as a PFIC for any taxable year during which a U.S. holder holds our Ordinary Shares or ADSs, the U.S. holder may be subject to adverse tax consequences regardless of whether we continue to qualify as a PFIC, including ineligibility for any preferred tax rates on capital gains or on actual or deemed dividends, interest charges on certain taxes treated as deferred, and additional reporting requirements. For further discussion of the PFIC rules and the adverse U.S. federal income tax consequences in the event we are classified as a PFIC, see “Material United States Federal Income Tax and Australian Tax Considerations—Material United States Federal Income Tax Considerations.”

If a United States person is treated as owning at least 10% of our Ordinary Shares, such holder may be subject to adverse U.S. federal income tax consequences.

If a U.S. holder is treated as owning, directly, indirectly or constructively, at least 10% of the value or voting power of our Ordinary Shares or ADSs, such U.S. holder may be treated as a “United States shareholder” with respect to each “controlled foreign corporation” in our group, if any. Our current U.S. subsidiary and any future newly formed or acquired U.S. and non-U.S. subsidiaries will be treated as controlled foreign corporations, regardless of whether we are treated as a controlled foreign corporation. A United States shareholder of a controlled foreign corporation may be required to annually report and include in its U.S. taxable income its pro rata share of “Subpart F income,” “global intangible low-taxed income” and investments in U.S. property by controlled foreign corporations, regardless of whether we make any distributions. An individual that is a United States shareholder with respect to a controlled foreign corporation generally would not be allowed certain tax deductions or foreign tax credits that would be allowed to a United States shareholder that is a U.S. corporation. Failure to comply with controlled foreign corporation reporting obligations may subject a United States shareholder to significant monetary penalties. We cannot provide any assurances that we will furnish to any United States shareholder information that may be necessary to comply with the reporting and tax paying obligations applicable under the Controlled Foreign Corporation Rules of the Code. U.S. holders should consult their tax advisors regarding the potential application of these rules to their investment in our Ordinary Shares or ADSs.

Our failure to meet the continued listing requirements of NASDAQ could result in a delisting of the ADSs.

If, after listing, we fail to satisfy the continued listing requirements of NASDAQ, such as the corporate governance requirements or the minimum closing bid price requirement, NASDAQ may take steps to delist the ADSs. Such a delisting would likely have a negative effect on the price of the ADSs and would impair your ability to sell or purchase our ADSs when you wish to do so. In the event of a delisting, we can provide no assurance that any action taken by us to restore compliance with listing requirements would allow the ADSs to become listed again, stabilize the market price or improve the liquidity of our common stock, prevent the ADSs from dropping below the NASDAQ minimum bid price requirement or prevent future non-compliance with NASDAQ’s listing requirements.

We have received a notice from NASDAQ of non-compliance with its minimum bid price rules.

On June 24, 2022, we received a written notification (the “Notice Letter”) from NASDAQ indicating that we were not in compliance with NASDAQ Listing Rule 5450(a)(1), as the closing bid price for our Common Stock was below the $1.00 per share requirement for the last 30 consecutive business days. The Notice Letter stated that we have 180 calendar days, or until December 21, 2022 (the “Initial Compliance Period”), to regain compliance with the minimum bid price requirement. In accordance with NASDAQ Listing Rule 5810(c)(3)(A), we can regain compliance if the closing bid price of our Common Stock is at least $1.00 for a minimum of 10 consecutive business days.

In the event that we do not regain compliance with Listing Rule 5450(a)(1) prior to the expiration of the compliance period, we will receive written notification that our securities are subject to delisting. At that time, we may appeal the delisting determination to a hearings panel pursuant to the procedures set forth in the applicable NASDAQ Listing Rules. A delisting of our Common Stock would have an adverse effect on the market liquidity of our Common Stock and, as a result, the market price for our Common Stock could become more volatile. Further, a delisting also could make it more difficult for us to raise additional capital. We intend to monitor the closing bid price of our common stock and may conduct a reverse stock split, if necessary, to regain compliance with the NASDAQ bid price rule.

10

ITEM 4. Information on the Company

| A. | History and Development of the Company |

Our legal and commercial name is Advanced Health Intelligence Ltd (formerly known as Advanced Human Imaging Ltd). We were incorporated on October 1, 2014 as “Shrinkme Pty Ltd” under the Corporations Act (Australia). On February 17, 2015 we changed our name to “MyFiziq Pty Ltd” and on June 12, 2015 we changed our name to “MyFiziq Limited” and accordingly changed our status to a public company. On March 5, 2021, we changed our name to “Advanced Human Imaging Ltd.” On December 8, 2022, we changed our name to “Advanced Health Intelligence Ltd”.

Our registered office and our principal executive offices and headquarters are located at 71-73 South Perth Esplanade, Unit 5, South Perth, WA 6151, Australia and our phone number is +61 8 9316 9100. We maintain a corporate website at www.ahi.tech. The information in our website is not incorporated by reference into this annual report.

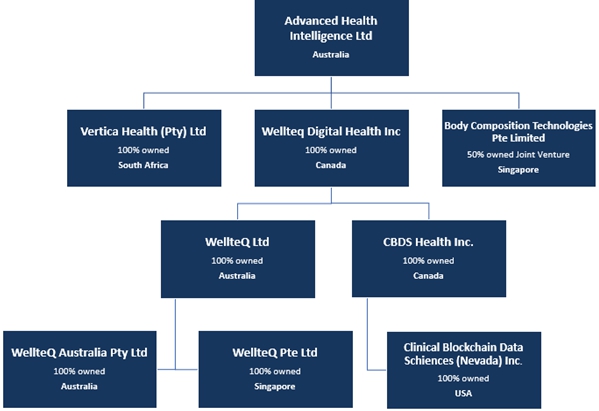

Subsequent to year end, AHI entered into a definitive arrangement agreement (the “Arrangement Agreement”) with wellteq Digital Health Inc. (CSE: WTEQ) (OTCQB: WTEQF), (“wellteq”), on September 2, 2022, whereby AHI will acquire all of the outstanding shares of wellteq in an all-share acquisition (the “Transaction”). Pursuant to the terms of the Arrangement Agreement, wellteq shareholders will receive one (1) ordinary share of AHI (an “AHI Share”) for every six (6) wellteq common shares (a “wellteq Share”) held (or 0.1667 AHI Shares for every 1 wellteq Share). AHI will issue a total of approximately 17,811,508 AHI shares in total consideration for 100% of wellteq’s issued shares. Following completion of the Transaction, wellteq shareholders in aggregate will hold approximately 9.573% of AHI’s issued capital.

Pursuant to the terms of the Arrangement Agreement, AHI will acquire 100% of the outstanding wellteq Shares by way of a plan of Arrangement (the “Arrangement”) under the Business Corporations Act (British Columbia). In consideration for the wellteq Shares, AHI will issue one (1) AHI Share for every six (6) wellteq Shares outstanding at the effective time of the Arrangement, equal to 0.1667 AHI Shares for every one (1) wellteq Share.

On November 24, 2022, a special meeting of wellteq shareholders voted 100% of the votes cast to approve the Arrangement. Following this over whelming vote of wellteq shareholders, on November 30, 2022, the Supreme Court of British Columbia, Canada, approved the Transaction.

The wellteq Arrangement Agreement was completed on December 6, 2022, which saw the issue of 17,804,587 ordinary shares in the Company on December 6, 2022, in favour of the wellteq shareholders as consideration shares valued at A$1,673,631. At November 30, 2022, wellteq had an (unaudited) net liability position of A$741,061, suggesting provisional intangible assets acquired of A$2,414,692. Given the proximity of transaction completion to the date of the financial report, included in this annual report, the initial accounting for the business combination, including the determination of the fair value of any identifiable intangible assets acquired, is incomplete.

On February 2, 2022, AHI announced that it had entered into a binding term sheet with digital health provider Vertica Health (PTY) Ltd (“Vertica”) in relation to the integration of AHI’s CompleteScan SDK with Vertica’s digital health products.

Further details of Vertica’s products and the proposed integration with AHI’s CompleteScan are set out in the February 2, 2022 announcement.

The proposed integration is progressing well, and AHI has acquired Vertica to bring Vertica’s software products into AHI for use with other B2B customers and partners of AHI.

The consideration payable by AHI for the proposed acquisition will comprise:

| ● | cash payments totaling US$600,000, comprising: |

| o | US$100,000 payable on closing; |

| o | US$250,000 payable 1 year from closing; and |

| o | US$250,000 payable 2 years from closing; and |

| ● | 1,500,000 AHI shares, escrowed for 24 months from issue. |

AHI concluded a share sale agreement on August 5, 2022 to acquire 100% of Vertica Health.

Given the value of the consideration payable, AHI doesn’t consider that the acquisition is material (in the context of AHI’s market capitalization and net asset position) to warrant an announcement to the market under LR 3.1. However, as part of the consideration involves an issue of shares, AHI released an Appendix 3B to the market to satisfy LR 3.10.3.

The projected increase in consolidated total assets due to the Vertica transaction is equal to the value of the proposed consideration payable to acquire Vertica, comprising US$100,000 in cash on closing (offset by a corresponding reduction in AHI’s existing cash to pay this amount), US$500,000 in deferred cash consideration and 1,500,000 AHI shares (subject to 24 months voluntary escrow) valued at the current market price of 12c per share.

11

AHI is budgeting for an increase of approximately A$80,000 per month to working capital costs as a result of the Vertica transaction. Vertica does not currently generate material revenues or profits, so AHI does not forecast any material increases to these numbers in its P&L statement in the near term as a result of the proposed acquisition of Vertica.

On February 15, 2022 the Company appointed Nick Prosser as the interim Non-executive Chairman. Additionally, Katherine Iscoe Ph.D., Co-Founder, and former Chief Executive Officer of the Company was appointed as Executive Director and Chief Executive Officer. Concurrently, Vlado Bosanac left his role as Chief Executive Officer and moved to a full-time strategic role as Head of Strategy and Revenue Growth.

Our capital expenditures for 2022, 2021, and 2020 amounted to approximately A$86,269, A$23,453 and A$62,372, respectively. These expenditures were primarily for IT equipment. Since the start of the 2017 financial year, AHI has incurred R&D expenses in excess of A$8.0 million, relating to the development of our applications and technologies. We intend to continue to invest in our R&D capabilities to extend our platform and bring our measurement and biometrics technologies to a broader range of applications.

| B. | Business Overview |

Overview

AHI delivers scalable health assessment, risk stratification and digital triage to healthcare providers, insurers, employers and government agencies.

Since 2014, AHI has been delivering Health-tech innovation using smartphones, starting with the world's first on-device body dimensioning capability. AHI has developed and been issued global patents in all major markets, securing and bringing forth the next frontier in digitising healthcare with a suite of componentized solutions.

AHI has assembled a world-class team of machine learning, AI, and computer vision experts along with medically trained data scientists to develop the world's most comprehensive mobile-phone-based risk assessment tool culminating in:

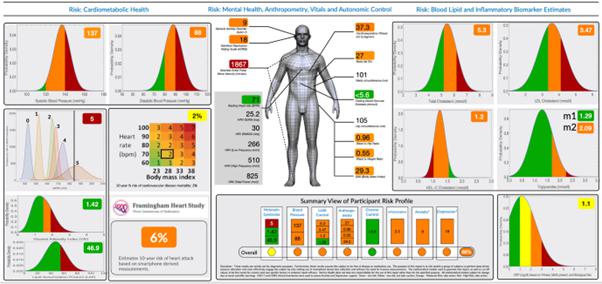

| ● | Body dimension and composition assessment to identify the comorbidities of obesity, such as diabetes risk estimates. |

| ● | Blood biomarker prediction, including HbA1C, HDL, LDL, and 10-year mortality risk. |

| ● | Transdermal Optical Imaging to return vital signs and cardiovascular disease risk estimates. |

| ● | On-device dermatological skin identification with over 588 skin conditions across 133 categories (Inc. Melanoma). |

| ● | Personalised therapeutic and non-therapeutic health coaching to improve daily habits and build health literacy. |

With a focus on impact at scale, AHI is proud to showcase this milestone in digital healthcare transformation, delivering a biometrically-driven triage solution, all accessible on and via a smartphone. With these advanced technologies, AHI helps its partners escalate high-risk patients into right-care pathways for proactive health management at a population scale.

This delivery of proprietary capabilities ushers forth an era of cost-effective health accessibility for billions of smartphone users worldwide. In doing so, AHI endeavours to put the power of possibilities in the hands of global communities, empowering people to take control of their journey to better health outcomes.

We have developed and patented a proprietary measurement/dimensioning technology that enables a User to check, track, and accurately assess their body dimensions and chronic disease risk markers privately using only a smartphone. We refer to this physical measurement and analytics tool as “BodyScan.” We have global customers/partners (“Partners”) who utilize our technology through our proprietary SDKs. Our global Partners have substantial audiences that they address, and from those underlying audiences, individual User(s) (“User(s)”) gain access via, the Partners’ software programs/apps that embed our technology components. Our global Partners currently include companies within the following sectors: (i) mobile health (“mHealth”), Telehealth, and Wellness; (ii) Life and Health Insurance; and (iii) Fitness Industry.

12

Our patented technology allows our Partners to supply individual Users, via our automated technology, the ability to take a series of images of themselves using a smartphone, which delivers accurate and repeatable measurements across an individual’s entire body. These measurements allow the individual to understand his/her dimensions and the physical changes that they are undergoing through, exercise and lifestyle modification. Further, the images that we capture also provide the individuals with an understanding of their potential health risks related to certain chronic diseases (including but not limited to obesity and diabetes) and using the global standards measurements set by the World Health Organization (“WHO”), and the International Diabetes Federation (“IDF”). Once the image capture sequence is completed, it supplies those measurements to the Partner’s application, whose contract with the User then determines the manner in which it analyzes/reports the data and/or the potential health risk to the User. We are distributing our technology globally to assist individuals, communities and populations live healthier lives via our B2B2C capabilities.

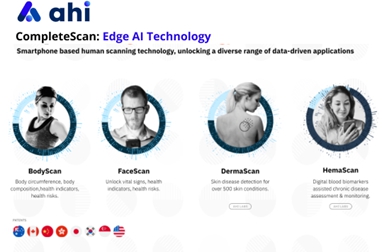

The above images illustrate the various AHI technologies.

Recent technology advances have provided opportunities for complex mathematical problems to be solved directly on a User’s smartphone, rather than limiting that computation to the Cloud. Modern devices produced by companies such as Apple, Samsung and Google now have AI-focused chipsets utilizing platforms such as CoreML and Tensorflow to process data at lightning speeds. We see the opportunity to harness these ongoing technology improvements to lower latency, increase security and privacy, improve reliability and reduce operational costs of our core services. Our overarching technology strategy has been to take advantage of this hardware-accelerated performance, specifically by utilizing on-device general purpose Graphic Processing Units (“GPU”) found on today’s modern devices.

In Cloud-based systems, data transfer/retention is a potential impediment. Data must be sent to, and then processed in, the Cloud, thus adding additional latency and disclosure risk to the overall process. On-device computing eliminates the necessity of a roundtrip to the Cloud and permits near zero-latency. This process greatly improves User experience and allows for near real-time interaction with the service. Running directly on-device additionally negates the side-effects of Cloud-based interference. In areas where connectivity is sub-optimal, such as rural areas, having analytic models on-device means that processing results can be generated locally, quickly and securely.

As sensitive data does not need to be sent or maintained in the Cloud, there are fewer opportunities to exploit any potential vulnerabilities, thereby providing increased security and privacy for Users. This security is critically important in a world where data sovereignty, residency, and retention are a major concern for Users and under increased protective global legislation.

13

By focusing on leveraging the estimated 3.7 billion devices capable of running AI inference and analysis on-device, we are able to slash the costs associated with Cloud-based analytics and inference, bandwidth and retention/storage concerns. As our user base scales, implementing machine learning on-device will mitigate the expense of expertise and time needed to implement and maintain a Cloud-based solution.

In 2022 AHI acquired South African based Vertica Health and CSE listed wellteq Digital Health Inc. AHI has expanded its ability to deliver a non-invasive, highly accurate and privacy-sensitive healthcare and biometric solutions that generate results to the user within seconds. We leverage the power of machine-learning and computer vision to analyze images, detect pose and joint features, and create non-personally identified data for measurement estimation relating to health risk for early triaging of health risk. We further take advantage of dedicated GPU libraries such as TensorFlow Lite (Android) and Metal (Apple) to run prediction models, which have been trained with a substantial and diverse human data set from around the globe and which are able to process multiple captured images in fractions of a second. The result is a solution that runs on-device and does not sacrifice speed, security or privacy. Images and private information never leave the phone, ensuring security and privacy standards are met across global regions. This process allows us to produce what we believe to be exceptional results and simplify the output of useful, reliable, digital assessments based on an individual’s data captured privately and conveniently on their own device.