Form 10-Q REATA PHARMACEUTICALS For: Jun 30

1

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

(Mark One)

For the quarterly period ended

OR

For the transition period from to

Commission File Number:

(Exact Name of Registrant as Specified in its Charter)

|

||

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer |

|

|

|

|

||

(Address of principal executive offices) |

|

(Zip Code) |

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, an emerging growth company, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

☒ |

|

Accelerated filer |

|

☐ |

|

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

|

Emerging growth company |

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

As of August 2, 2022, the registrant had

TABLE OF CONTENTS

- |

|

|

|

|

Page |

1 |

||

3 |

||

PART I. |

|

|

Item 1. |

4 |

|

|

4 |

|

|

5 |

|

|

6 |

|

|

7 |

|

|

8 |

|

Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

17 |

Item 3. |

44 |

|

Item 4. |

44 |

|

PART II. |

|

|

Item 1. |

45 |

|

Item 1A. |

45 |

|

Item 2. |

45 |

|

Item 3. |

45 |

|

Item 4. |

45 |

|

Item 5. |

45 |

|

Item 6. |

46 |

|

47 |

||

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements that involve substantial risks and uncertainties. We make such forward-looking statements pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. In this Quarterly Report on Form 10-Q, all statements, other than statements of historical or present facts, including statements regarding our future financial condition, future revenues, projected costs, prospects, business strategy, and plans and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “believe,” “will,” “may,” “might,” “estimate,” “continue,” “anticipate,” “intend,” “target,” “project,” “model,” “should,” “would,” “plan,” “expect,” “predict,” “could,” “seek,” “goals,” “potential,” and similar terms or expressions that concern our expectations, strategy, plans, or intentions. These forward-looking statements include, but are not limited to, statements about:

1

Any forward-looking statements in this Quarterly Report on Form 10-Q reflect our current views with respect to future events or to our future financial performance and involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by these forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

You should read this Quarterly Report on Form 10-Q and the documents that we have filed as exhibits to this Quarterly Report on Form 10-Q completely and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future.

2

DEFINED TERMS

Unless the context requires otherwise, references to “Reata,” “the Company,” “we,” “us,” or “our” in this Quarterly Report on Form 10-Q refer to Reata Pharmaceuticals, Inc. and its subsidiaries. We also have used several other terms in this Quarterly Report on Form 10-Q, most of which are explained or defined below.

Abbreviated Term |

|

Defined Term |

AbbVie |

|

AbbVie Inc. |

ADPKD |

|

Autosomal dominant polycystic kidney disease |

ADL |

|

Activities of Daily Living |

AE |

|

Adverse event |

ALS |

|

Amyotrophic lateral sclerosis |

ATP |

|

Adenosine triphosphate |

bardoxolone |

|

Bardoxolone methyl |

BXLS |

|

Blackstone Life Sciences, LLC |

CKD |

|

Chronic kidney disease |

CMC |

|

Chemistry manufacturing controls |

COVID-19 |

|

Coronavirus disease |

CRL |

|

Complete Response Letter |

CRO |

|

Contract research organization |

DPNP |

|

Diabetic peripheral neuropathic pain |

eGFR |

|

Estimated glomerular filtration rate |

EMA |

|

European Medicines Agency |

ESKD |

|

End stage kidney disease |

Exchange Act |

|

Securities Exchange Act of 1934 |

FA-COMS |

|

Clinical Outcome Measures in Friedreich’s ataxia |

FDA |

|

United States Food and Drug Administration |

FXN |

|

Frataxin |

GFR |

|

Glomerular filtration rate |

GGT |

|

Gamma-glutamyl transferase |

Kyowa Kirin |

|

Kyowa Kirin Co., Ltd. |

LTIP Plan |

|

Second Amended and Restated Long Term Incentive Plan |

MAA |

|

Marketing Authorization Application |

mFARS |

|

Modified Friedreich’s Ataxia Rating Scale |

MMRM |

|

Mixed Model Repeated Measures |

NDA |

|

New Drug Application |

PGIC |

|

Patient global impression of change |

PK |

|

Pharmacokinetic |

registrational trial |

|

An adequate and well-controlled trial designed to be sufficient to apply for regulatory approval of a drug candidate, although notwithstanding the Company’s design a regulatory agency may determine that further clinical studies or data are required |

RSU |

|

Restricted Stock Unit |

SAE |

|

Serious adverse event |

SEC |

|

U.S. Securities and Exchange Commission |

U.S. GAAP |

|

Accounting principles generally accepted in the United States |

3

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements.

Reata Pharmaceuticals, Inc.

Consolidated Balance Sheets

(in thousands, except share data)

|

|

June 30, 2022 |

|

|

December 31, 2021 |

|

||

|

|

(unaudited) |

|

|

|

|

||

Assets |

|

|

|

|

|

|

||

Cash and cash equivalents |

|

$ |

|

|

$ |

|

||

Marketable debt securities |

|

|

|

|

|

|

||

Prepaid expenses and other current assets |

|

|

|

|

|

|

||

Total current assets |

|

|

|

|

|

|

||

Property and equipment, net |

|

|

|

|

|

|

||

Operating lease right-of-use-assets |

|

|

|

|

|

|

||

Other assets |

|

|

|

|

|

|

||

Total assets |

|

$ |

|

|

$ |

|

||

Liabilities and stockholders’ equity |

|

|

|

|

|

|

||

Accounts payable |

|

$ |

|

|

$ |

|

||

Accrued direct research liabilities |

|

|

|

|

|

|

||

Other current liabilities |

|

|

|

|

|

|

||

Operating lease liabilities, current |

|

|

|

|

|

|

||

Deferred revenue |

|

|

|

|

|

|

||

Total current liabilities |

|

|

|

|

|

|

||

Other long-term liabilities |

|

|

|

|

|

|

||

Operating lease liabilities, noncurrent |

|

|

|

|

|

|

||

Liability related to sale of future royalties, net |

|

|

|

|

|

|

||

Total noncurrent liabilities |

|

|

|

|

|

|

||

|

|

|

|

|

|

|||

Stockholders’ equity: |

|

|

|

|

|

|

||

Common stock A, $ |

|

|

|

|

|

|

||

Common stock B, $ |

|

|

|

|

|

|

||

Additional paid-in capital |

|

|

|

|

|

|

||

Accumulated deficit |

|

|

( |

) |

|

|

( |

) |

Total stockholders’ equity |

|

|

|

|

|

|

||

Total liabilities and stockholders’ equity |

|

$ |

|

|

$ |

|

||

See accompanying notes.

4

Reata Pharmaceuticals, Inc.

Unaudited Consolidated Statements of Operations

(in thousands, except share and per share data)

|

|

Three Months Ended |

|

|

Six Months Ended |

|

||||||||||

|

|

June 30 |

|

|

June 30 |

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||

Collaboration revenue |

|

|

|

|

|

|

|

|

|

|

|

|

||||

License and milestone |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Other revenue |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total collaboration revenue |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Research and development |

|

|

|

|

|

|

|

|

|

|

|

|

||||

General and administrative |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Depreciation |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total expenses |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Other income (expense), net |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Loss before taxes on income |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Benefit from (provision for) taxes on income |

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|||

Net loss |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

Net loss per share—basic and diluted |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

Weighted-average number of common shares used in |

|

|

|

|

|

|

|

|

|

|

|

|

||||

See accompanying notes.

5

Reata Pharmaceuticals, Inc.

Unaudited Consolidated Statements of Stockholders’ Equity

(in thousands, except share and per share data)

|

|

Three Months Ended June 30, 2022 |

|

|||||||||||||||||||||||||

|

|

Common Stock A |

|

|

Common Stock B |

|

|

Additional |

|

|

Total |

|

|

Total |

|

|||||||||||||

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Equity |

|

|||||||

Balance at March 31, 2022 |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

||||||

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Compensation expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Exercise of options |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||||

Issuance of common stock |

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

||||

Conversion of common |

|

|

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Balance at June 30, 2022 |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

||||||

|

|

Six Months Ended June 30, 2022 |

|

|||||||||||||||||||||||||

|

|

Common Stock A |

|

|

Common Stock B |

|

|

Additional |

|

|

Total |

|

|

Total |

|

|||||||||||||

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Equity |

|

|||||||

Balance at December 31, 2021 |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

||||||

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Compensation expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Exercise of options |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||||

Issuance of common stock |

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

||||

Conversion of common |

|

|

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Balance at June 30, 2022 |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

||||||

|

|

Three Months Ended June 30, 2021 |

|

|||||||||||||||||||||||||

|

|

Common Stock A |

|

|

Common Stock B |

|

|

Additional |

|

|

Total |

|

|

Total |

|

|||||||||||||

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Equity |

|

|||||||

Balance at March 31, 2021 |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

||||||

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Compensation expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Exercise of options |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|||

Issuance of common stock |

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|||

Conversion of common |

|

|

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Balance at June 30, 2021 |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

||||||

|

|

Six Months Ended June 30, 2021 |

|

|||||||||||||||||||||||||

|

|

Common Stock A |

|

|

Common Stock B |

|

|

Additional |

|

|

Total |

|

|

Total |

|

|||||||||||||

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Equity |

|

|||||||

Balance at December 31, 2020 |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

||||||

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Compensation expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Exercise of options |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|||

Conversion of common |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Issuance of Common Stock |

|

|

|

|

|

— |

|

|

|

( |

) |

|

|

|

|

|

— |

|

|

|

|

|

|

— |

|

|||

Balance at June 30, 2021 |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

||||||

See accompanying notes.

6

Reata Pharmaceuticals, Inc.

Unaudited Consolidated Statements of Cash Flows

(in thousands)

|

|

Six Months Ended |

|

|||||

|

|

June 30 |

|

|||||

|

|

2022 |

|

|

2021 |

|

||

Operating activities |

|

|

|

|

|

|

||

Net loss |

|

$ |

( |

) |

|

$ |

( |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

||

Depreciation |

|

|

|

|

|

|

||

Amortization of debt issuance costs and imputed interest |

|

|

|

|

|

|

||

Non-cash interest expense on liability related to sale of future royalty |

|

|

|

|

|

|

||

Stock-based compensation expense |

|

|

|

|

|

|

||

Amortization of discount (premium) on marketable debt securities |

|

|

( |

) |

|

|

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

||

Income tax receivable and payable |

|

|

|

|

|

|

||

Prepaid expenses, other current assets and other assets |

|

|

( |

) |

|

|

( |

) |

Accounts payable |

|

|

( |

) |

|

|

|

|

Accrued direct research, other current and long-term liabilities |

|

|

( |

) |

|

|

( |

) |

Operating lease obligations |

|

|

|

|

|

|

||

Deferred revenue |

|

|

( |

) |

|

|

( |

) |

Net cash used in operating activities |

|

|

( |

) |

|

|

( |

) |

Investing activities |

|

|

|

|

|

|

||

Purchases of property and equipment |

|

|

( |

) |

|

|

( |

) |

Purchases of marketable securities |

|

|

( |

) |

|

|

|

|

Net cash used in investing activities |

|

|

( |

) |

|

|

( |

) |

Financing activities |

|

|

|

|

|

|

||

Exercise of options |

|

|

|

|

|

|

||

Net cash provided by financing activities |

|

|

|

|

|

|

||

Net decrease in cash and cash equivalents |

|

|

( |

) |

|

|

( |

) |

Cash and cash equivalents at beginning of year |

|

|

|

|

|

|

||

Cash and cash equivalents at end of period |

|

$ |

|

|

$ |

|

||

Non-cash activity: |

|

|

|

|

|

|

||

Right-of-use assets obtained in exchange for lease obligations |

|

$ |

|

|

$ |

|

||

Purchases of equipment in accounts payable, accrued direct research, other current, and long-term liabilities |

|

$ |

|

|

$ |

|

||

Acquisition of property and equipment through tenant improvement allowance |

|

$ |

|

|

$ |

|

||

See accompanying notes.

7

Reata Pharmaceuticals, Inc.

Notes to Unaudited Consolidated Financial Statements

1. Description of Business

Reata Pharmaceuticals, Inc.’s (Reata, the Company, we, us, or our) mission is to identify, develop, and commercialize innovative therapies that change patients’ lives for the better. The Company focuses on small-molecule therapeutics with novel mechanisms of action for the treatment of severe, life-threatening diseases with few or no approved therapies. The Company’s lead programs are omaveloxolone in a rare neurological disease called Friedreich’s ataxia (FA) and bardoxolone methyl (bardoxolone) in rare forms of chronic kidney disease (CKD). Both of the Company’s lead product candidates activate the transcription factor Nrf2 to normalize mitochondrial function, restore redox balance, and resolve inflammation. Because mitochondrial dysfunction, oxidative stress, and inflammation are features of many diseases, the Company believes omaveloxolone, bardoxolone, and our next-generation Nrf2 activators have many potential clinical applications. Reata possesses exclusive, worldwide rights to develop, manufacture, and commercialize omaveloxolone, bardoxolone, and our next-generation Nrf2 activators, excluding certain Asian markets for bardoxolone in certain indications, which are licensed to Kyowa Kirin Co., Ltd. (Kyowa Kirin). In addition, we are developing RTA 901, the lead product candidate from our Hsp90 modulator program, in neurological indications. We are the exclusive licensee of RTA 901 and have worldwide commercial rights.

The Company’s consolidated financial statements include the accounts of all majority-owned subsidiaries. Accordingly, the Company’s share of net earnings and losses from these subsidiaries is included in the consolidated statements of operations. Intercompany profits, transactions, and balances have been eliminated in consolidation.

Prior period reclassifications

Certain prior period amounts in the consolidated financial statements have been reclassified to conform to the current period presentation. Specifically, Operating lease obligations have been reclassed out of Accrued direct research, other current and long-term liabilities in prior periods to conform with the current period presentation on the consolidated statements of cash flows.

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States (U.S. GAAP) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and notes required by U.S. GAAP for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring adjustments) considered necessary for a fair presentation have been included. Operating results for the six months ended June 30, 2022 are not necessarily indicative of the results that may be expected for the year ending December 31, 2022. The consolidated balance sheet at December 31, 2021, has been derived from the audited consolidated financial statements at that date but does not include all of the information and footnotes required by U.S. GAAP for complete financial statements. For further information, refer to the annual consolidated financial statements and footnotes thereto of the Company.

Summary of Significant Accounting Policies

The significant accounting policies used in the preparation of these condensed consolidated financial statements for the six months ended June 30, 2022 are consistent with those discussed in Note 2 to the consolidated financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021.

8

Investments in Marketable Securities and Cash Equivalents

The Company invests excess cash balances in marketable debt securities and classifies its investments as held-to-maturity on facts and circumstances present at the time the Company purchased the securities. At each balance sheet date presented, the Company classified all of its investments in debt securities as held-to maturity and as current assets as they represent the investment of funds available for current operations.

The Company’s marketable debt securities are classified as cash equivalents if the original maturity, from the date of purchase, is 90 days or less, and as marketable debt securities if the original maturity, from the date of purchase, is in excess of 90 days. The carrying amount of cash equivalents approximate fair value. As of June 30, 2022 and December 31, 2021, cash and cash equivalents comprise funds in cash, money market accounts, and treasury securities. For the marketable debt securities, the Company performs its own review of prices received from the independent pricing services by comparing these prices to other sources and for our marketable debt securities, the Company confirms those securities are trading in active markets.

The Company considers all available evidence to evaluate if an impairment loss exists, and if so, marks the investment to market through a charge to the Company’s consolidated statements of operations and comprehensive loss. The Company did not record any impairment charges related to our marketable debt securities during the six months ended June 30, 2022.

3. Collaboration Agreements

Subsequent to the 2019 reacquisition of certain rights originally licensed to AbbVie Inc. (AbbVie) (see “AbbVie,” below), the Company’s collaboration revenue and deferred revenue have been generated primarily from licensing fees and reimbursements for expenses received under our exclusive license with Kyowa Kirin (the Kyowa Kirin Agreement).

Kyowa Kirin

In December 2009, the Company entered into an exclusive license with Kyowa Kirin to develop and commercialize bardoxolone in the licensed territory. The terms of the agreement include payment to the Company of a nonrefundable, up-front license fee of $

The up-front payment and regulatory milestones are accounted for as a single unit of accounting. The Company regularly evaluates its remaining performance obligation under the Kyowa Kirin Agreement. Accordingly, revenue may fluctuate from period to period due to changes to its estimated performance obligation period and variable considerations. The Company began recognizing revenue related to the up-front payment upon execution of the Kyowa Kirin Agreement.

In March 2021, the Company’s performance obligation period under the Kyowa Kirin Agreement was extended to June 2022, which decreased quarterly revenue recognition by approximately $

On July 27, 2021, Kyowa Kirin submitted a New Drug Application (NDA) in Japan to the Ministry of Health, Labour and Welfare for bardoxolone for improvement of renal function in patients with Alport syndrome. Based on this submission, the Company earned a $

9

AbbVie

In September 2010, the Company entered into a license agreement with AbbVie (the AbbVie License Agreement) for an exclusive license to develop and commercialize bardoxolone in the Licensee Territory (as defined in the AbbVie License Agreement).

In December 2011, the Company entered into a collaboration agreement with AbbVie (the Collaboration Agreement) to jointly research, develop, and commercialize the Company’s portfolio of second and later generation oral Nrf2 activators.

In October 2019, the Company and AbbVie entered into an Amended and Restated License Agreement (the Reacquisition Agreement) pursuant to which the Company reacquired the development, manufacturing, and commercialization rights concerning its proprietary Nrf2 activator product platform originally licensed to AbbVie in the AbbVie License Agreement and the Collaboration Agreement. In exchange for such rights, the Company agreed to pay AbbVie $

The Company recognized interest expense related to the Reacquisition Agreement of approximately $

4. Liability Related to Sale of Future Royalties

On June 24, 2020, the Company closed on the Development and Commercialization Funding Agreement with an affiliate of Blackstone Life Sciences, LLC (BXLS), which provides funding for the development and commercialization of bardoxolone for the treatment of CKD caused by Alport syndrome, autosomal dominant polycystic kidney disease (ADPKD), and certain other rare CKD indications in return for future royalties (the Development Agreement). The Development Agreement includes a $

In addition, concurrent with the Development Agreement, the Company entered into a common stock purchase agreement (the Purchase Agreement) with affiliates of BXLS to sell an aggregate of

The Company concluded that there were

10

The following table shows the activity within the liability related to sale of future royalties for the six months ended June 30, 2022:

|

Liability Related to Sale of Future Royalties |

|

|

|

(in thousands) |

|

|

Balance at December 31, 2021 |

$ |

|

|

Non-cash interest expense recognized |

|

|

|

Balance at June 30, 2022 |

|

|

|

Less: Unamortized transaction cost |

|

( |

) |

Carrying value at June 30, 2022 |

$ |

|

|

5. Marketable Debt Securities

During the quarter ended June 30, 2022, the Company invested its excess cash balances in marketable debt securities and, at each balance sheet date presented, the Company classified all of its investments in debt securities as held to maturity and as current assets as they mature within 12 months and represent the investment of funds available for current operations.

The following tables summarize our marketable debt securities (in thousands), as of June 30, 2022:

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Amortized |

|

|

Gross |

|

|

Gross |

|

|

Fair Value (1) |

|

||||

Marketable debt securities: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

U.S. treasury securities |

|

|

|

|

|

|

|

( |

) |

|

|

|

||||

Total |

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|||

(1)

6. Other Income (Expense), Net

|

|

Three Months Ended |

|

|

Six Months Ended |

|

||||||||||

|

|

June 30 |

|

|

June 30 |

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||

|

|

(in thousands) |

|

|||||||||||||

Other income (expense), net |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Investment income |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Interest expense |

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

Non-cash interest expense on liability |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Other income (expense) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Total other income (expense), net |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

Investment Income

Interest income consists primarily of interest generated from our cash and cash equivalents and marketable debt securities.

11

Interest Expense

Interest expense consists primarily of the imputed interest from the amount due to AbbVie under the Reacquisition Agreement.

Non-Cash Interest Expense on Liability Related to Sale of Future Royalties

Non-cash interest expense consists of recognition of interest expense based on the Company’s current estimate of future royalties expensed to be paid over the estimated term of the Development Agreement.

Other Income (Expense)

Other income (expense) consists primarily of gains and losses on foreign currency exchange.

7. Leases

The Company headquarters is located in Plano, Texas, where it leases approximately

On February 4, 2022, the Company

On March 8, 2022, the Company

The Company has an additional lease of a single-tenant, build-to-suit building of approximately

For the six months ended June 30, 2022, the Company paid $

Supplemental balance sheet and other information related to the Company’s operating leases is as follows:

|

|

|

|

As of June 30, |

|

|||||

|

|

|

|

2022 |

|

|

2021 |

|

||

Weighted-average remaining lease term (in years) |

|

|

|

|

|

|

||||

Weighted-average discount rate |

|

|

|

|

% |

|

|

% |

||

12

Maturities of lease liabilities by fiscal year for the Company’s operating leases:

|

|

As of June 30, 2022 |

|

|

|

|

(in thousands) |

|

|

2022 (remaining six months) |

|

$ |

|

|

2023 (1) |

|

|

|

|

2024 |

|

|

|

|

2025 |

|

|

|

|

Thereafter |

|

|

|

|

Total lease payments (1) |

|

|

|

|

Less: Imputed interest |

|

|

( |

) |

Present value of lease liabilities |

|

$ |

|

|

(1)

8. Income Taxes

The following table summarizes income tax benefit expense and effective income tax rate:

|

|

Three Months Ended |

|

|

Six Months Ended |

|

||||||||||

|

|

June 30 |

|

|

June 30 |

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||

|

|

(in thousands, except for percentage data) |

|

|||||||||||||

Benefit from (provision for) taxes on income |

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|||

Effective income tax rate |

|

|

% |

|

|

% |

|

|

% |

|

|

% |

||||

The Company’s effective tax rate for the three months and six months ended June 30, 2022, varies with the statutory rate primarily due to changes in the valuation allowance related to certain deferred tax assets generated or utilized in the applicable period.

Deferred tax assets are regularly reviewed for recoverability by jurisdiction and valuation allowances are established based on historical and projected future taxable losses and the expected timing of the reversals of existing temporary differences. The Company has recorded valuation allowances against the majority of its deferred tax assets as of June 30, 2022, and the Company expects to maintain these valuation allowances until there is sufficient evidence that future earnings can be achieved, which is uncertain at this time.

9. Stock-Based Compensation

The following table summarizes time-based and performance-based stock compensation expense reflected in the consolidated statements of operations:

|

|

Three Months Ended |

|

|

Six Months Ended |

|

||||||||||

|

|

June 30 |

|

|

June 30 |

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||

|

|

(in thousands) |

|

|||||||||||||

Research and development |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

General and administrative |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total stock compensation expense |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

13

Restricted Stock Units (RSUs)

The following table summarizes RSU activity as of June 30, 2022, under the Second Amended and Restated Long Term Incentive Plan (LTIP Plan):

|

|

Number of |

|

|

Weighted-Average |

|

||

Outstanding at January 1, 2022 |

|

|

|

|

$ |

|

||

Granted |

|

|

|

|

|

|

||

Vested |

|

|

( |

) |

|

|

|

|

Forfeited |

|

|

( |

) |

|

|

|

|

Outstanding at June 30, 2022 |

|

|

|

|

$ |

|

||

As of June 30, 2022, total unrecognized compensation expense related to RSU and performance-based RSU awards that were deemed probable of vesting was approximately $

Stock Options

The following table summarizes stock option activity as of June 30, 2022, under the LTIP Plan and standalone option agreements:

|

|

Number of |

|

|

Weighted- |

|

||

Outstanding at January 1, 2022 |

|

|

|

|

$ |

|

||

Granted |

|

|

|

|

|

|

||

Exercised |

|

|

( |

) |

|

|

|

|

Forfeited |

|

|

( |

) |

|

|

|

|

Expired |

|

|

( |

) |

|

|

|

|

Outstanding at June 30, 2022 |

|

|

|

|

$ |

|

||

Exercisable at June 30, 2022 |

|

|

|

|

$ |

|

||

As of June 30, 2022, total unrecognized compensation expense related to stock options was approximately $

The total intrinsic value of all outstanding options and exercisable options as of June 30, 2022 was $

The number of weighted average options that were not included in the diluted earnings per share calculation because the effect would have been anti-dilutive represented

14

10. Employee Benefit Plans

In 2010,

11. Commitments and Contingencies

Litigation

From time to time, the Company is a party to legal proceedings in the course of its business, including the matters described below. The outcome of any such legal proceedings, regardless of the merits, is inherently uncertain. In addition, litigation and related matters are costly and may divert the attention of our management and other resources that would otherwise be engaged in other activities. If the Company were unable to prevail in any such legal proceedings, its business, results of operations, liquidity and financial condition could be adversely affected. The Company recognizes accruals for litigations to the extent that it can conclude that a loss is both probable and reasonably estimable and recognizes legal expenses as incurred.

Bardoxolone Securities Litigation

In late 2021 and early 2022, certain putative stockholders of the Company filed complaints in the United States District Court for the Eastern District of Texas alleging violations of the federal securities laws against the Company and certain of its executives, including its Chief Executive Officer; its Chief Operating Officer, Chief Financial Officer, and President; and its Chief Innovation Officer (in one of the suits). On April 22, 2022, the suits were consolidated and a lead plaintiff was appointed. On June 21, 2022, the lead plaintiff filed a complaint against the Company, the aforementioned executives, certain current and former member of the Company’s Board of Directors, and underwriters in connection with secondary offerings of Company stock in 2019 and 2020. The complaint alleges, among other things, that the Company made false and misleading statements regarding the sufficiency of the Phase 2 and Phase 3 CARDINAL studies to support an NDA for bardoxolone in the treatment of CKD caused by Alport syndrome, and the Company’s interactions with the FDA concerning potential approval for bardoxolone. The complaint asserts claims under the Securities Act of 1933 and the Securities Exchange Act of 1934 (Exchange Act). The plaintiffs seek, among other things, a class action designation, an award of damages, and costs and expenses, including attorney fees and expert fees. The Company believes that the allegations contained in the complaint are without merit and intends to defend the case. The Company cannot predict at this point the length of time that this action will be ongoing or the liability, if any, which may arise therefrom.

Derivative Lawsuit

An alleged stockholder of the Company filed a derivative action in the Court of Chancery of the State of Delaware against certain current and former directors of the Company and naming the Company as a nominal defendant. The plaintiff asserts claims in the complaint of breach of fiduciary duty and unjust enrichment concerning the alleged payment of excessive compensation to the non-employee directors of the Company between fiscal years 2019 and 2021. The plaintiff seeks, among other things, an order awarding damages and costs and expenses, including attorneys and expert fees, and directing the Board of Directors to reform and improve its corporate governance and internal procedures relating to the award of non-employee director compensation.

The defendants believe that the allegations contained in the complaint are without merit and intend to defend the case. The Company cannot predict at this point the length of time that this action will be ongoing or the liability, if any, which may arise therefrom.

15

Indemnifications

Accounting Standards Codification 460, Guarantees, requires that, upon issuance of a guarantee, the guarantor must recognize a liability for the fair value of the obligations it assumes under that guarantee.

As permitted under Delaware law and in accordance with the Company’s bylaws, officers and directors are indemnified for certain events or occurrences, subject to certain limits, while the officer or director is or was serving in such capacity. The maximum amount of potential future indemnification is unlimited; however, the Company has obtained director and officer insurance that limits its exposure and may enable recoverability of a portion of any future amounts paid. The Company believes the fair value for these indemnification obligations is minimal. Accordingly, the Company has not recognized any liabilities relating to these obligations as of June 30, 2022.

The Company has certain agreements with licensors, licensees, collaborators, and vendors that contain indemnification provisions. In such provisions, the Company typically agrees to indemnify the licensor, licensee, collaborator, or vendor against certain types of third-party claims. The Company accrues for known indemnification issues when a loss is probable and can be reasonably estimated. There were

16

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion and analysis of our financial condition and results of operations together with our consolidated financial statements and related notes and other financial information appearing in this Quarterly Report on Form 10-Q. Some of the information contained in this discussion and analysis or set forth elsewhere in this Quarterly Report on Form 10-Q, including information with respect to our plans and strategy for our business, operations, and product candidates, includes forward-looking statements that involve risks and uncertainties. Factors that may cause actual results to differ materially from current expectations include, among other things, those described under the headings “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” and discussed elsewhere in this Quarterly Report on Form 10-Q.

Overview

We are a clinical-stage biopharmaceutical company focused on identifying, developing, and commercializing innovative therapies that change patients’ lives for the better. We concentrate on small-molecule therapeutics with novel mechanisms of action for the treatment of severe, life-threatening diseases with few or no approved therapies. Our lead programs are omaveloxolone in Friedreich’s ataxia and bardoxolone in rare forms of CKD. Both of our lead product candidates activate the transcription factor Nrf2 to normalize mitochondrial function, restore redox balance, and resolve inflammation. Because mitochondrial dysfunction, oxidative stress, and inflammation are features of many diseases, we believe omaveloxolone, bardoxolone, and our next-generation Nrf2 activators have many potential clinical applications. We possess exclusive, worldwide rights to develop, manufacture, and commercialize omaveloxolone, bardoxolone, and our next-generation Nrf2 activators, excluding certain Asian markets for bardoxolone in certain indications, which are licensed to Kyowa Kirin. In addition, we are developing RTA 901, the lead product candidate from our Hsp90 modulator program, in neurological indications. We are the exclusive licensee of RTA 901 and have worldwide commercial rights.

Recent Key Developments

Omaveloxolone for Friedreich’s Ataxia

The U.S. Food and Drug Administration (FDA) has granted Fast Track Designation, Orphan Drug Designation, and Rare Pediatric Disease Designation to omaveloxolone for the treatment of Friedreich’s ataxia. In March 2022, we completed rolling submission of an NDA to the FDA for omaveloxolone for the treatment of patients with Friedreich’s ataxia. In May 2022, the FDA accepted our NDA for filing and granted Priority Review. We recently completed a mid-cycle communication meeting with the FDA and submitted additional data and analyses to the FDA. See “Programs in Neurological Diseases – Omaveloxolone in Patients with Friedreich’s Ataxia – Regulatory Guidance and Regulatory Interactions in the U.S.” below.

The FDA advised us that it is planning to hold an advisory committee meeting to discuss the application. The Prescription Drug User Fee Act (PDUFA) date, the FDA action date for the application, is scheduled for November 30, 2022.

We are continuing to complete the regulatory procedures and submissions required prior to filing a Marketing Authorization Application (MAA) in Europe for approval of omaveloxolone for the treatment of patients with Friedreich’s ataxia. We have received a positive opinion from the Pediatric Committee on our Pediatric Investigation Plan with a commitment to seek scientific advice for additional input on the protocol design, and we also received European Medicines Agency (EMA) Follow-Up Protocol Assistance feedback regarding our nonclinical and chemistry manufacturing controls (CMC) programs. The EMA feedback indicated that there were no identified impediments to our planned MAA submission and included agreement that certain nonclinical studies, including 2-year carcinogenicity study data, may be submitted after approval. We plan to submit an MAA to the EMA for omaveloxolone in the fourth quarter of 2022.

RTA 901 for Neurological Indications, Including Diabetic Peripheral Neuropathic Pain

In the first quarter of 2022, we initiated additional Phase 1 clinical pharmacology studies of RTA 901, including a drug-drug interaction study which has been fully enrolled. Following completion of these Phase 1 studies, we plan to initiate a randomized, double-blind placebo-controlled Phase 2 trial of RTA 901 in diabetic patients with peripheral neuropathic pain in the fourth quarter of 2022.

17

Bardoxolone in Patients with CKD Caused by Alport Syndrome

We received a Complete Response Letter (CRL) from the FDA in February 2022 with respect to its review of our NDA for bardoxolone in the treatment of patients with CKD caused by Alport syndrome. The CRL indicated the FDA cannot approve the NDA in its present form. We have recently requested a Type C meeting to discuss the program and continue to work with the FDA to confirm our next steps on our Alport syndrome program.

In October 2021, we submitted an MAA to the EMA for bardoxolone in the treatment of patients with CKD caused by Alport syndrome. In the first quarter of 2022, we received the 120-day list of questions from the EMA. We are in the process of preparing our responses. We previously requested a 90-day extension for our responses which was granted by the EMA. We plan to submit additional long term extension data from the ongoing EAGLE trial to address the comments and questions raised by the EMA and have been granted a further 30-day extension to complete our responses.

Bardoxolone in Patients with Autosomal Dominant Polycystic Kidney Disease (ADPKD)

We are currently enrolling patients in FALCON, a Phase 3, international, multi-center, randomized, double-blind, placebo-controlled trial studying the safety and efficacy of bardoxolone in patients with ADPKD, randomized one-to-one to active drug or placebo. FALCON is enrolling 850 patients in a broad range of ages with an estimated glomerular filtration rate (eGFR) between 30 and 90 mL/min/1.73 m2. The primary endpoint is eGFR change from baseline at Week 108 (8 weeks after planned drug discontinuation at Week 100). More than 580 patients are currently enrolled in the trial.

Background: Our Programs

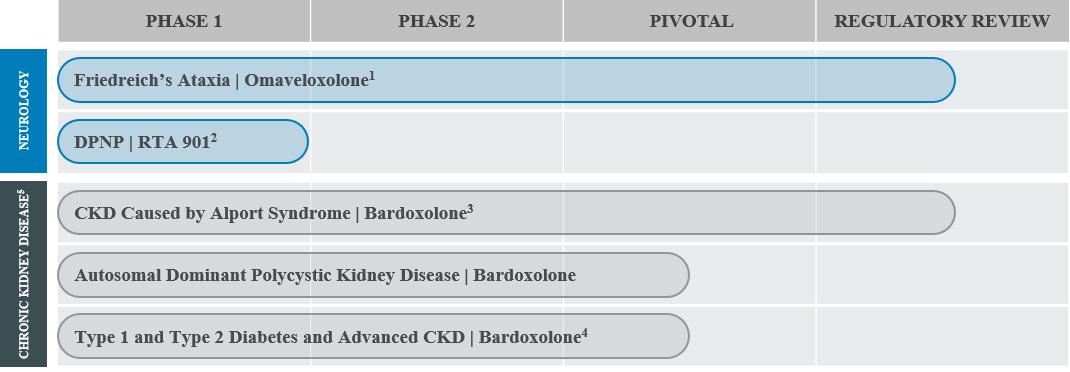

The following chart outlines each of our programs by indication and phase of development:

1NDA accepted for filing in May 2022, granted Priority Review, and assigned a PDUFA date of November 30, 2022.

2DPNP: Diabetic peripheral neuropathic pain.

3On February 25, 2022, we received a CRL from the FDA. We have recently requested a Type C meeting to discuss the program and continue to work with the FDA to confirm our next steps on our Alport syndrome program. MAA in the European Union is under review.

4AYAME trial conducted in Japan by our strategic collaborator in CKD, Kyowa Kirin. Kyowa Kirin expects the last patient visit to occur in the second half of 2022.

5Based on the outcome of AYAME and FALCON trials, and our discussions with the FDA regarding the bardoxolone program, we will decide future development plans for bardoxolone in additional forms of CKD.

Programs in Neurological Diseases

We are developing omaveloxolone for the treatment of patients with Friedreich’s ataxia, an inherited, debilitating, and degenerative neuromuscular disorder that is usually diagnosed during adolescence and can ultimately lead to premature death. In May 2022, the FDA accepted for filing our NDA for omaveloxolone for the treatment of patients with Friedreich’s ataxia and granted Priority Review.

Because mitochondrial dysfunction is a key feature of many neuromuscular diseases, we believe omaveloxolone may be broadly applicable to treat neurological diseases by activating Nrf2 to normalize and improve mitochondrial

18

function and adenosine triphosphate (ATP) production. We plan to pursue the development of omaveloxolone and our other Nrf2 activators for one or more additional neurological diseases.

We are also developing RTA 901 for the treatment of neurological diseases. RTA 901 is a highly potent and selective C-terminal modulator of Hsp90, which has a critical role in mitochondrial function, protein folding, and inflammation. RTA 901 has demonstrated profound efficacy in a wide range of animal models of neurological disease, including diabetic neuropathy, neuroinflammation, and neuropathic pain. We plan to initiate a randomized, placebo-controlled Phase 2 trial in DPNP in the fourth quarter of 2022.

Omaveloxolone in Patients with Friedreich’s Ataxia

Patients with Friedreich’s ataxia experience progressive loss of coordination, muscle weakness, and fatigue, which commonly progress to motor incapacitation and wheelchair reliance. Based on literature and proprietary research, we believe Friedreich’s ataxia affects approximately 5,000 children and adults in the United States and 22,000 individuals globally. According to data provided by IQVIA in 2020, there are approximately 4,000 projected patients diagnosed with Friedreich’s ataxia in the United States. The FDA has granted Orphan Drug Designation, Fast Track Designation, and Rare Pediatric Disease Designation to omaveloxolone for the treatment of Friedreich’s ataxia. The European Commission has granted Orphan Drug Designation in Europe to omaveloxolone for the treatment of Friedreich’s ataxia.

Diagnosis of Friedreich’s ataxia typically occurs by genetic testing, and most people in the United States with Friedreich’s ataxia are diagnosed in their teens and early twenties. Patients with Friedreich’s ataxia experience progressive loss of coordination, muscle weakness, and fatigue that commonly results in motor incapacitation, with patients requiring a wheelchair in their twenties. The mean age of death for patients with Friedreich’s ataxia is in the mid-thirties. Childhood-onset Friedreich’s ataxia can occur as early as age five, is more common than later-onset Friedreich’s ataxia, and normally involves more rapid disease progression. Currently, there are no approved therapies for the treatment of Friedreich’s ataxia.

MOXIe Part 2 Trial Results

Part 2 of our Phase 2 trial, called MOXIe (MOXIe Part 2), was an international, multi-center, double-blind, placebo-controlled, randomized, registrational trial that enrolled 103 patients with Friedreich’s ataxia at 11 trial sites in the United States, Europe, and Australia. MOXIe Part 2 was one of the largest global, interventional trials ever completed in Friedreich’s ataxia. Patients were randomized one-to-one to omaveloxolone or placebo. MOXIe Part 2 was completed in October 2019. The primary analysis population excluded patients with severe pes cavus (n=82), a musculoskeletal foot deformity that may interfere with the patient’s ability to perform some components of the neurological exam used to score the primary endpoint of the trial. Safety analyses were evaluated in the all-randomized population (n=103).

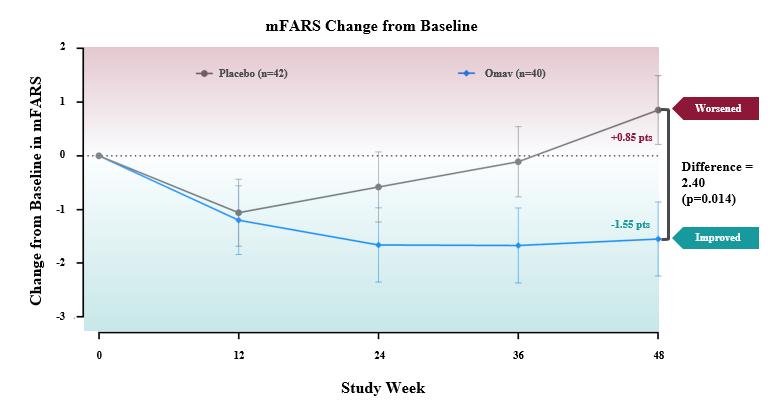

The primary endpoint for the trial was the change in the Modified Friedreich’s Ataxia Rating Scale (mFARS) score for omaveloxolone relative to placebo after 48 weeks of treatment. Omaveloxolone treatment demonstrated statistically significant evidence of efficacy for the primary endpoint of the trial, producing a placebo-corrected -2.40 point mean improvement in mFARS (n=82; p=0.014). Patients treated with omaveloxolone experienced a mean improvement in mFARS of -1.55 points from baseline, while patients treated with placebo experienced a mean worsening in mFARS of +0.85 points from baseline. Further, the observed placebo-corrected improvements in mFARS were time-dependent, increasing over the course of treatment with the largest improvement observed after 48 weeks of treatment.

19

Additionally, all secondary endpoints either favored the omaveloxolone arm or were neutral. Patients on omaveloxolone experienced a nominal improvement in the Activities of Daily Living (ADL) questionnaire, with all nine questions favoring the omaveloxolone arm. On average, ADL scores for patients on omaveloxolone did not change from baseline, while placebo-treated patients worsened. Both patient global impression of change (PGIC) and clinical global impression of change numerically favored omaveloxolone, and improvement in PGIC correlated with the observed improvement in mFARS.

Omaveloxolone was reported to be generally well-tolerated. Four (8%) omaveloxolone patients and two (4%) placebo patients discontinued trial drug due to an adverse event (AE). The reported AEs were generally mild to moderate in intensity, and the most common AEs (i.e., reported in > 10% of omaveloxolone-treated patients) observed more frequently (>5% difference) in omaveloxolone compared to placebo were headache, nausea, increased aminotransferases, fatigue, abdominal pain, diarrhea, oropharyngeal pain, muscle spasms, back pain, and decreased appetite. Increases in aminotransferases are a pharmacological effect of omaveloxolone. In preclinical studies, omaveloxolone has been shown to increase production of aminotransferases in vitro, which we believe are related to restoration of mitochondrial function. In MOXIe Part 2, the aminotransferase increases were associated with improvements (reductions) in total bilirubin and were not associated with any evidence of liver injury.

In MOXIe Part 2, the overall rate of serious adverse events (SAEs) was low, with five patients in the omaveloxolone group and three patients in the placebo group reporting SAEs. No new safety signals were identified, and the reported SAEs were sporadic and generally expected in Friedreich’s ataxia patients. In the patients who reported SAEs while receiving omaveloxolone, none led to discontinuation.

MOXIe Extension Trial

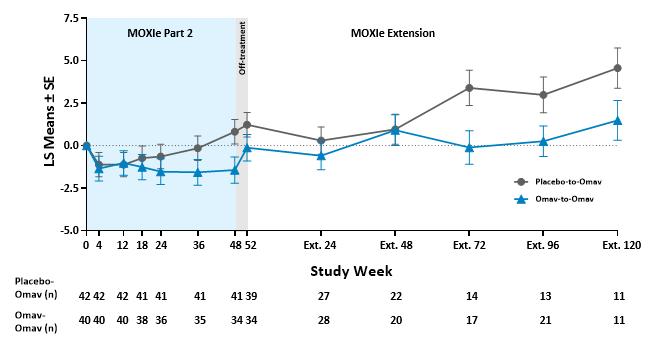

The open-label MOXIe Extension trial is ongoing and enrolled a total of 149 patients (57 patients from MOXIe Part 1 and 92 patients from MOXIe Part 2). A total of 73 out of 75 (97%) patients without severe pes cavus who completed MOXIe Part 2 were enrolled in the MOXIe Extension, including 39 patients previously randomized to placebo (the placebo-to-omaveloxolone group) and 34 patients previously randomized to omaveloxolone (the omaveloxolone-to-omaveloxolone group). Due to the COVID-19 pandemic, not all patients had mFARS assessments performed at each time point. The ongoing safety review of the MOXIe Extension trial has not identified any new safety signals, including cardiovascular safety.

Delayed-Start Analysis Results from August 2021 Data Cut-Off (Used in Clinical Modules of NDA submission)

The intent of the post-hoc Delayed-Start Analysis is to evaluate whether omaveloxolone has a persistent effect on Friedreich’s ataxia disease course. Conceptually, this analysis evaluates whether the treatment effect that was

20

observed in the placebo-controlled MOXIe Part 2 trial is maintained in the MOXIe Extension trial when all patients are receiving omaveloxolone. If the treatment effect is maintained between those originally randomized to placebo (the placebo-to-omaveloxolone group) versus those originally randomized to omaveloxolone (the omaveloxolone-to-omaveloxolone group), then it demonstrates evidence of a persistent effect on the course of the disease. If the treatment effect is not maintained, and the patients originally randomized to placebo are able to achieve the same absolute response and “catch up” to the patients initially randomized to omaveloxolone, the results are consistent with a symptomatic treatment that does not affect the underlying course of the disease.

Two timepoints were compared in the analysis. The first timepoint was at Week 48, the final week of treatment in the placebo-controlled MOXIe Part 2 trial. The second timepoint was at Week 72 of the open-label MOXIe Extension in which all patients received omaveloxolone. A non-inferiority test was used to evaluate if the difference in mFARS between groups observed at the first timepoint was maintained or non-inferior at the second timepoint. The analysis methods, including the specified non-inferiority margin, were based on literature (Liu-Seifert, 2015a, 2015b). When comparing treatment groups using this methodology, maintaining a negative difference between treatment groups in mFARS is evidence of a persistent treatment effect.

The Delayed-Start Analysis used in clinical modules in our initial NDA rolling submission for omaveloxolone was based on data from an August 2021 data cut-off. In this analysis 58 of 73 patients from MOXIe Part 2 without severe pes cavus who enrolled into MOXIe Extension had at least 72 weeks of exposure in MOXIe Extension, and 28 of these patients had at least 120 weeks of exposure in the MOXIe Extension.

Results of this analysis demonstrated that the between-group difference in mFARS observed at the end of the placebo-controlled MOXIe Part 2 period (least squares mean difference = -2.25 ± 1.07) was preserved at MOXIe Extension Week 72 in the delayed-start period (LS mean difference = -3.51 ± 1.45). Consistent with a persistent treatment effect on disease, the upper limit of the 90% confidence interval (CI) for the difference estimate was less than zero (-0.615), meeting the threshold for demonstrating significant evidence of non-inferiority.

Delayed-Start Analysis Primary Endpoint (Non-Inferiority Test)1

|

Placebo-Controlled Week 48 (Δ1) |

Delayed-Start Week Ex. 72 (Δ2) |

|

||

Difference (LS Mean ± SE) |

-2.25 ± 1.07 p=0.037 |

-3.51 ± 1.45 p=0.016 |

|

||

Estimate = Δ2 – 0.5 × Δ1 |

-2.39 ± 1.38 |

|

|

||

Upper Limit of 1-sided 90% CI for Estimate |

-0.615 |

|

|

||

1Non-Inferiority test performed using a MMRM analysis with a Toeplitz covariance structure. |

|

||||

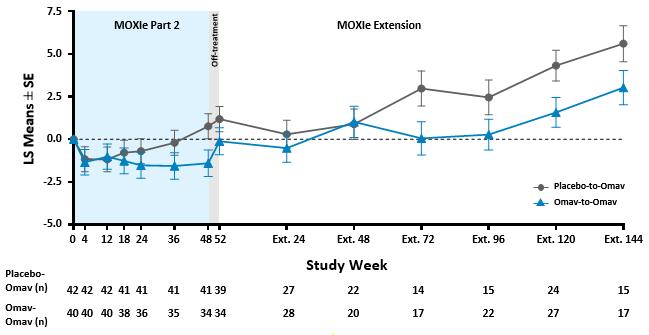

The graphical representation of changes from baseline in mFARS for omaveloxolone and placebo groups shows the separation at the end of the placebo-controlled period is maintained in the open-label period at Extension Week 72 and beyond.

21

Change from Baseline in mFARS (Patients without Severe Pes Cavus)

Many of the visits at Week 48 and Week 72 of the MOXIe Extension were scheduled during the initial peak of COVID-19 cases during Spring to Fall 2020. The mFARS assessment must be conducted in the clinic, and many in-clinic visits did not occur due to COVID-19 related travel restrictions and site closures during this period. Apart from the data at MOXIe Extension Week 48, parallel trajectories were seen in LS Mean mFARS change from baseline between the placebo-to-omaveloxolone group and the omaveloxolone-to-omaveloxolone group in the MOXIe Extension.

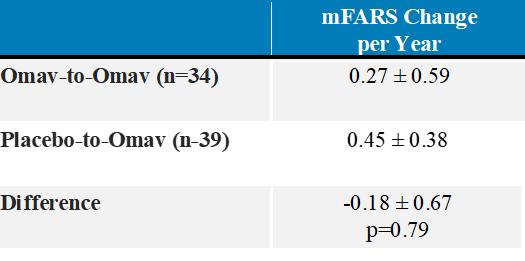

A longitudinal analysis was also performed to calculate annualized slopes incorporating all available data from the MOXIe Extension, which showed similar mean slopes in mFARS for the placebo-to-omaveloxolone group (0.45 ± 0.38 points per year) when compared to the omaveloxolone-to-omaveloxolone group (0.27 ± 0.59 points per year) with no significant difference between slopes (difference = -0.18 ± 0.67; p=0.79).

MOXIe Extension Annualized mFARS Change per Year (± SE)

Results from the Delayed-Start Analysis indicate a persistent omaveloxolone treatment effect on the disease course of Friedreich’s ataxia. Patients who received omaveloxolone during the double-blind MOXIe Part 2 had a benefit that could not be recovered by patients initially randomized to placebo who began omaveloxolone one year later in the MOXIe Extension. Notably, patients previously randomized to omaveloxolone in MOXIe Part 2 continued to show mean mFARS values that were similar to their original baseline after over three years of treatment.

Regulatory Guidance and Regulatory Interactions in the U.S.

Regulatory Guidance in the U.S. We are relying on section 115 of the Food and Drug Administration Modernization Act (FDAMA 115) and the December 2019 draft guidance thereunder from FDA on “Substantial Evidence of Effectiveness” as the basis for seeking approval of omaveloxolone in the U.S. The guidance provides that, if a sponsor has not conducted two adequate well-controlled studies, there are two alternative pathways to demonstrate substantial evidence of efficacy for drug approval; either:

22

Confirmatory evidence could include, for example, adequate and well-controlled clinical investigations in a related disease area, certain types of real world evidence such as extensive data on outcomes that provide further support for the lack of effect seen in the control group in the randomized trial, compelling mechanistic evidence in the setting of well-understood disease pathophysiology (e.g., pharmacodynamic data or compelling data from nonclinical testing), or well-documented natural history of the disease.

FDA may consider a number of factors when determining whether reliance on a single adequate and well-controlled clinical investigation plus confirmatory evidence is appropriate. These factors may include the persuasiveness of the single trial; the robustness of the confirmatory evidence; the seriousness of the disease, particularly where there is an unmet medical need; the size of the patient population; and whether it is ethical and practicable to conduct more than one adequate and well-controlled clinical investigation.

Regulatory Interactions Prior to NDA Acceptance. Following the announcement of the positive data from the MOXIe Part 2 study in October 2019, we met with the FDA in a Type C meeting in which the FDA provided us with guidance that it did not have any concerns with the reliability of the mFARS primary endpoint results in the MOXIe Part 2 study. Nevertheless, the FDA was not convinced that the MOXIe Part 2 results could support a single study approval without additional evidence that lends persuasiveness to the results. We believe their communication to us reflects their interpretation of the p-value, which while statistically significant, may not have met their threshold for a single study approval. This level of significance is challenging to generate in rare disease settings, such as Friedreich’s ataxia, since limited numbers of patients are available to enroll in clinical trials and they progress at a relatively slow rate over decades.

The FDA acknowledged the unmet need of patients with Friedreich’s ataxia, reiterated its commitment to facilitate the development of omaveloxolone within the constraints of the regulatory standards, and emphasized its willingness to consider all available options to meet the regulatory standards. In order to support a regulatory pathway of a single adequate and well-controlled clinical study plus confirmatory evidence for approval, we engaged with the FDA to determine what additional evidence they would consider to support an NDA submission and approval. The FDA subsequently requested a Delayed-Start Analysis.

During the first quarter of 2021, we submitted results from the Delayed-Start Analysis from a February 2021 data cut-off to the FDA as additional supporting evidence of effectiveness, and in May 2021 we received a communication from the FDA suggesting that, after a preliminary review of briefing materials for the Type C meeting, including the Delayed-Start Analysis, a pre-NDA meeting would be the most appropriate format for a discussion of the development program for omaveloxolone in Friedreich’s ataxia.

In the third quarter of 2021, we completed our pre-NDA meeting with the FDA. The purpose of the pre-NDA meeting was to discuss the content of Reata’s planned NDA submission including the nonclinical data and CMC packages, data standard plan, and the overall content plan. In the meeting, we stated that we believed that the MOXIe data, along with the Delayed-Start Analysis, would provide sufficient clinical data to support a full approval. The FDA stated that the proposed primary and supportive efficacy data appear reasonable, though the Delayed-Start Analysis was viewed as exploratory. The FDA noted that the ability of the data to support full approval, and the adequacy of the data and the determination of which data may be supportive of efficacy, would be a matter of review.

In November 2021, the FDA granted omaveloxolone Fast Track Designation for the treatment of Friedreich’s ataxia, providing eligibility for FDA programs such as Priority Review and rolling submission of the NDA, if relevant criteria are met. The FDA granted our request for a rolling submission, and, in March 2022, we completed submission of the NDA. In May 2022, the FDA accepted our NDA for filing and granted Priority Review Designation. The FDA advised us that it is planning to hold an advisory committee meeting to discuss the application. The PDUFA date is scheduled for November 30, 2022.

Recent Mid-Cycle Meeting Interactions. We recently completed a mid-cycle communication meeting with the FDA. The purpose of the mid-cycle communication meeting is for the FDA to provide the sponsor with an update of the status of the NDA review, including any issues identified. As is customary with the review of all NDAs, the FDA may identify other issues, and it may request additional information as it continues to review the NDA.

While we have not received formal minutes from the FDA, in the preliminary agenda for, and during, the mid-cycle communication meeting, the FDA stated that it has not identified any new significant issues but it continues to

23

have concerns regarding the strength of the efficacy evidence. The FDA noted specific points of discussion for the meeting including:

With respect to a potential label, the FDA requested additional justification or literature to support the relevance of proposed biomarkers (ferritin, gamma-glutamyl transferase (GGT), alanine aminotransferase (ALT), and aspartate aminotransferase (AST)) to Nrf2 activation and how that would correlate with treatment benefit in Friedreich’s ataxia patients.

The FDA did not identify any significant clinical safety issues. The FDA stated that the safety review is ongoing, and they are continuing to evaluate the cardiac safety of omaveloxolone in patients with Friedreich’s ataxia. They have not identified any other major safety concerns at this stage of their review.