Form 10-Q Nuveen Global Cities For: Jun 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

FORM 10-Q

______________

(Mark One)

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the quarterly period ended June 30, 2022

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission File Number 000-56273

___________________________

nuveen

(Exact name of Registrant as specified in its Charter)

___________________________

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

(Address of principal executive offices) | (Zip Code) | |||||||

Registrant’s telephone number, including area code: (212 ) 490-9000

_____________________________

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

None | N/A | N/A | ||||||||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ | ||||||||

☒ | Smaller reporting company | ||||||||||

Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of August 15, 2022, there were 16,066,787 outstanding shares of Class T common stock, 41,762,306 outstanding shares of Class S common stock, 7,808,029 outstanding shares of Class D common stock, 69,522,125 outstanding shares of Class I common stock, and 29,730,608 outstanding shares of Class N common stock.

Table of Contents

| Page | ||||||||

Consolidated Balance Sheets as of June 30, 2022 and December 31, 2021 (unaudited) | ||||||||

Consolidated Statements of Operations for the three and six months ended June 30, 2022 and June 30, 2021 (unaudited) | 2 | |||||||

Consolidated Statements of Comprehensive Income (Loss) for the three and six months ended June 30, 2022 and June 30, 2021 (unaudited) | ||||||||

Consolidated Statements of Changes in Equity for the three and six months ended June 30, 2022 and June 30, 2021 (unaudited) | ||||||||

Consolidated Statements of Cash Flows for the six months ended June 30, 2022 and June 30, 2021 (unaudited) | ||||||||

ITEM 1. FINANCIAL STATEMENTS

Nuveen Global Cities REIT, Inc.

Consolidated Balance Sheets (unaudited)

(in thousands, except share and per share data)

| June 30, 2022 | December 31, 2021 | ||||||||||

| Assets | |||||||||||

| Investments in real estate, net | $ | $ | |||||||||

| Investment in commercial mortgage loans, at fair value | |||||||||||

| Investments in international affiliated funds | |||||||||||

| Investments in real estate-related securities, at fair value | |||||||||||

| Investments in real estate debt, at fair value | |||||||||||

| Cash and cash equivalents | |||||||||||

| Restricted cash | |||||||||||

| Intangible assets, net | |||||||||||

| Other assets | |||||||||||

| Total assets | $ | $ | |||||||||

| Liabilities and Equity | |||||||||||

| Credit facility | $ | $ | |||||||||

| Loan participations, at fair value | |||||||||||

| Mortgages payable, net | |||||||||||

| Note payable, at fair value | |||||||||||

| Subscriptions received in advance | |||||||||||

| Due to affiliates | |||||||||||

| Accounts payable, accrued expenses, and other liabilities | |||||||||||

| Intangible liabilities, net | |||||||||||

| Distributions payable | |||||||||||

| Total liabilities | |||||||||||

| Redeemable non-controlling interest | |||||||||||

| Equity | |||||||||||

| Series A Preferred Stock | |||||||||||

Common stock - Class T shares, $ | |||||||||||

Common stock - Class S shares, $ | |||||||||||

Common stock - Class D shares, $ | |||||||||||

Common stock - Class I shares, $ | |||||||||||

Common stock - Class N shares, $ | |||||||||||

| Additional paid-in capital | |||||||||||

1

| Accumulated deficit and cumulative distributions | ( | ( | |||||||||

| Accumulated other comprehensive loss | ( | ( | |||||||||

| Total stockholder's equity | |||||||||||

| Non-controlling interest attributable to third party joint venture | |||||||||||

| Total equity | |||||||||||

| Total liabilities and equity | $ | $ | |||||||||

| The accompanying notes are an integral part of these consolidated financial statements. | |||||||||||

2

Nuveen Global Cities REIT, Inc.

Consolidated Statements of Operations (Unaudited)

(in thousands, except share and per share data)

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| Revenues | |||||||||||||||||||||||

| Rental revenue | $ | $ | $ | $ | |||||||||||||||||||

| Income from commercial mortgage loans | |||||||||||||||||||||||

| Total revenues | |||||||||||||||||||||||

| Expenses | |||||||||||||||||||||||

| Rental property operating | |||||||||||||||||||||||

| General and administrative | |||||||||||||||||||||||

| Advisory fee due to affiliate | |||||||||||||||||||||||

| Depreciation and amortization | |||||||||||||||||||||||

| Total expenses | |||||||||||||||||||||||

| Other income (expense) | |||||||||||||||||||||||

| Realized and unrealized (loss) income from real estate-related securities | ( | ( | |||||||||||||||||||||

| Realized and unrealized loss from real estate debt | ( | ( | |||||||||||||||||||||

| Income (loss) from equity investments in unconsolidated international affiliated funds | ( | ||||||||||||||||||||||

| Unrealized loss on commercial mortgage loan | ( | ( | |||||||||||||||||||||

| Interest income | |||||||||||||||||||||||

| Interest expense | ( | ( | ( | ( | |||||||||||||||||||

| Total other income (expense) | ( | ( | |||||||||||||||||||||

| Net (loss) income | $ | ( | $ | $ | ( | $ | |||||||||||||||||

| Net loss attributable to non-controlling interest in third party joint venture | ( | ( | |||||||||||||||||||||

| Net income attributable to preferred stock | |||||||||||||||||||||||

| Net (loss) income attributable to common stockholders | $ | ( | $ | $ | ( | $ | |||||||||||||||||

| Net (loss) income per share of common stock - basic and diluted | $ | ( | $ | $ | ( | $ | |||||||||||||||||

| Weighted-average shares of common stock outstanding, basic and diluted | |||||||||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

3

Nuveen Global Cities REIT, Inc.

Consolidated Statements of Comprehensive Income (Loss) (Unaudited)

(in thousands)

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| Net (loss) income | $ | ( | $ | $ | ( | $ | |||||||||||||||||

| Other comprehensive (loss) income: | |||||||||||||||||||||||

| Foreign currency translation adjustment | ( | ( | ( | ||||||||||||||||||||

| Comprehensive (loss) income | ( | ( | |||||||||||||||||||||

| Comprehensive loss attributable to non-controlling interest in third party joint venture | ( | ( | |||||||||||||||||||||

| Comprehensive income attributable to preferred stock | |||||||||||||||||||||||

| Comprehensive (loss) income attributable to common stockholders | $ | ( | $ | $ | ( | $ | |||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

4

Nuveen Global Cities REIT, Inc.

Consolidated Statements of Changes in Equity (unaudited)

(in thousands, except share data)

| Three Months Ended June 30, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Preferred Stock | Par Value | Additional Paid-in Capital | Accumulated Deficit and Cumulative Distributions | Accumulated Other Comprehensive Income (Loss) | Total Stockholders' Equity | Non-Controlling Interest Attributable to Third Party Joint Venture | Total Equity | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common Stock Class T | Common Stock Class S | Common Stock Class D | Common Stock Class I | Common Stock Class N | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at March 31, 2022 | $ | $ | $ | $ | $ | $ | $ | $ | ( | $ | ( | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Issuance of | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Distribution reinvestment | — | (a) | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stock repurchased | — | (a) | ( | ( | ( | — | ( | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of restricted stock grants | — | — | — | — | — | — | ( | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | — | — | — | ( | — | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Distributions on common stock | — | — | — | — | — | — | — | ( | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Distribution on preferred stock | ( | — | — | — | — | — | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustment | — | — | — | — | — | — | — | — | ( | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Allocation to redeemable non-controlling interest | — | — | — | — | — | — | ( | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at June 30, 2022 | $ | $ | $ | $ | $ | $ | $ | $ | ( | $ | ( | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a)Amount is not presented due to rounding; see Note 17.

5

| Three Months Ended June 30, 2021 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Par Value | Additional Paid-in Capital | Accumulated Deficit and Cumulative Distributions | Accumulated Other Comprehensive Income | Total Stockholders' Equity | Non-Controlling Interest Attributable to Third Party Joint Venture | Total Equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Preferred Stock | Common Stock Class T | Common Stock Class S | Common Stock Class D | Common Stock Class I | Common Stock Class N | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at March 31, 2021 | $ | $ | $ | $ | $ | $ | $ | $ | ( | $ | $ | $ | — | $ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Issuance of | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Distribution reinvestment | — | (a) | (a) | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stock repurchased | — | (a) | (a) | (a) | ( | — | ( | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of restricted stock grants | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Distributions on common stock | — | — | — | — | — | — | — | ( | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Distribution on preferred stock | ( | — | — | — | — | — | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustment | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at June 30, 2021 | $ | $ | $ | $ | $ | $ | $ | $ | ( | $ | $ | $ | — | $ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a)Amount is not presented due to rounding; see Note 17.

6

| Six Months Ended June 30, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Preferred Stock | Par Value | Additional Paid-in Capital | Accumulated Deficit and Cumulative Distributions | Accumulated Other Comprehensive Loss | Total Stockholders' Equity | Non-Controlling Interest Attributable to Third Party Joint Venture | Total Equity | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common Stock Class T | Common Stock Class S | Common Stock Class D | Common Stock Class I | Common Stock Class N | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at December 31, 2021 | $ | $ | $ | $ | $ | $ | $ | $ | ( | $ | ( | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Issuance of | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Distribution reinvestment | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stock repurchased | — | (a) | ( | ( | ( | — | ( | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of restricted stock grants | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | — | — | — | ( | — | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Distributions on common stock | — | — | — | — | — | — | — | ( | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Distribution on preferred stock | ( | — | — | — | — | — | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustment | — | — | — | — | — | — | — | — | ( | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Allocation to redeemable non-controlling interest | — | — | — | — | — | — | ( | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at June 30, 2022 | $ | $ | $ | $ | $ | $ | $ | $ | ( | $ | ( | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

7

| Six Months Ended June 30, 2021 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Par Value | Additional Paid-in Capital | Accumulated Deficit and Cumulative Distributions | Accumulated Other Comprehensive Income | Total Stockholders' Equity | Non-Controlling Interest Attributable to Third Party Joint Venture | Total Equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Preferred Stock | Common Stock Class T | Common Stock Class S | Common Stock Class D | Common Stock Class I | Common Stock Class N | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at December 31, 2020 | $ | $ | $ | $ | $ | $ | $ | $ | ( | $ | $ | $ | — | $ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Issuance of | — | — | — | — | $ | $ | — | $ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Distribution reinvestment | — | (a) | (a) | — | — | — | $ | $ | — | $ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Preferred stock redemption | ( | — | — | — | — | — | — | — | — | $ | ( | $ | — | $ | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of restricted stock grants | — | — | — | — | — | — | — | — | $ | $ | — | $ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stock repurchased | — | (a) | (a) | (a) | ( | — | ( | — | — | $ | ( | $ | — | $ | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | — | — | — | $ | $ | — | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Distributions on common stock | — | — | — | — | — | — | — | ( | — | $ | ( | $ | — | $ | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Distribution on preferred stock | ( | — | — | — | — | — | — | — | — | $ | ( | $ | — | $ | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustment | — | — | — | — | — | — | — | — | ( | $ | ( | $ | — | $ | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at June 30, 2021 | $ | $ | $ | $ | $ | $ | $ | $ | ( | $ | $ | $ | — | $ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(a)Amount is not presented due to rounding; see Note 17.

8

Nuveen Global Cities REIT, Inc. Consolidated Statements of Cash Flows (Unaudited) (in thousands) | |||||||||||

| Six Months Ended June 30, | |||||||||||

| 2022 | 2021 | ||||||||||

| Cash flows from operating activities: | |||||||||||

| Net (loss) income | $ | ( | $ | ||||||||

| Adjustments to reconcile net (loss) income to net cash provided by operating activities: | |||||||||||

| Depreciation and amortization | |||||||||||

| Unrealized loss (gain) on changes in fair value of real estate-related securities | ( | ||||||||||

| Realized gain on sale of real estate-related securities | ( | ( | |||||||||

| Unrealized loss on changes in fair value of real estate debt | |||||||||||

| Unrealized loss on changes in commercial mortgage loans | |||||||||||

| Realized loss on sale of real estate debt | |||||||||||

| Income from equity investment in unconsolidated international affiliated funds | ( | ( | |||||||||

| Income distribution from equity investment in unconsolidated international affiliated funds | |||||||||||

| Straight line rent adjustment | ( | ( | |||||||||

| Amortization of above and below-market lease intangibles | ( | ( | |||||||||

| Amortization of deferred financing costs | |||||||||||

| Amortization of restricted stock grants | |||||||||||

| Change in assets and liabilities: | |||||||||||

| Decrease in other assets | |||||||||||

| Increase in accounts payable, accrued expenses, and other liabilities | |||||||||||

| Net cash provided by operating activities | |||||||||||

| Cash flows from investing activities: | |||||||||||

| Acquisitions of real estate | ( | ( | |||||||||

| Origination and fundings of commercial mortgage loans | ( | ||||||||||

| Capital improvements to real estate | ( | ( | |||||||||

| Purchase of real estate-related securities | ( | ( | |||||||||

| Proceeds from sale of real estate-related securities | |||||||||||

| Purchases of real estate debt | ( | ||||||||||

| Net cash used in investing activities | ( | ( | |||||||||

| Cash flows from financing activities: | |||||||||||

| Proceeds from issuance of common stock | |||||||||||

| Repurchase of common stock | ( | ( | |||||||||

| Offering costs paid | ( | ( | |||||||||

| Borrowings from credit facility | |||||||||||

| Repayments on credit facility | ( | ( | |||||||||

| Borrowings from mortgages payable | |||||||||||

| Proceeds from note payable | |||||||||||

| Payment of deferred financing costs | ( | ||||||||||

9

Nuveen Global Cities REIT, Inc. Consolidated Statements of Cash Flows (Unaudited) (in thousands) | |||||||||||

| Six Months Ended June 30, | |||||||||||

| 2022 | 2021 | ||||||||||

| Proceeds from sale of loan participations | |||||||||||

| Payment of offering and organization costs due to affiliate | ( | ||||||||||

| Repurchase of preferred stock | ( | ||||||||||

| Distributions to preferred stockholders | ( | ( | |||||||||

| Subscriptions received in advance | |||||||||||

| Distributions | ( | ( | |||||||||

| Net cash provided by financing activities | |||||||||||

| Net increase in cash and cash equivalents and restricted cash during the period | |||||||||||

| Cash and cash equivalents and restricted cash, beginning of period | |||||||||||

| Cash and cash equivalents and restricted cash, end of period | $ | $ | |||||||||

| Reconciliation of cash and cash equivalents and restricted cash to the Consolidated Balance Sheets, end of period: | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash | |||||||||||

| Total cash and cash equivalents and restricted cash | $ | $ | |||||||||

| Supplemental disclosures: | |||||||||||

| Interest paid | $ | $ | |||||||||

| Non-cash investing activities: | |||||||||||

| Assumption of other liabilities in conjunction with acquisitions of investments in real estate | $ | $ | |||||||||

| Accrued capital expenditures | $ | $ | |||||||||

| Non-cash financing activities: | |||||||||||

| Accrued distributions | $ | ( | $ | ||||||||

| Accrued stockholder servicing fees | $ | $ | |||||||||

| Distribution reinvestments | $ | $ | |||||||||

| Accrued offering costs | $ | $ | ( | ||||||||

| Allocation to redeemable non-controlling interest | $ | $ | |||||||||

The accompanying notes are an integral part of these consolidated financial statements.

10

Nuveen Global Cities REIT, Inc.

Notes to consolidated financial statements (Unaudited)

Note 1. Organization and Business Purpose

Nuveen Global Cities REIT, Inc. (the “Company”) was formed on May 1, 2017 as a Maryland corporation and elected to be taxed as a real estate investment trust (“REIT”) for U.S. federal income tax purposes commencing with its taxable year ending December 31, 2018 and intends to operate in a manner that will allow it to continue to qualify as a REIT. The Company’s sponsor is Nuveen, LLC (the “Sponsor”), a wholly owned subsidiary of Teachers Insurance and Annuity Association of America (“TIAA”). The Company is the sole general partner of Nuveen Global Cities REIT OP, LP, a Delaware limited partnership (“Nuveen OP”). Nuveen OP has issued a limited partner interest to Nuveen Global Cities REIT LP, LLC (the “Limited Partner”), a wholly owned subsidiary of the Company. The Company was organized to invest primarily in stabilized income-oriented commercial real estate in the United States and a substantial but lesser portion of the Company's portfolio will include real properties located in Canada, Europe and the Asia-Pacific region. Substantially all of the Company’s business is conducted through Nuveen OP. The Company and Nuveen OP are externally managed by Nuveen Real Estate Global Cities Advisors, LLC (the “Advisor”), an indirect, wholly owned subsidiary of the Sponsor and an investment advisory affiliate of Nuveen Real Estate.

Pursuant to a Registration Statement on Form S-11 (File No. 333-222231), the (“IPO Registration Statement”), the Company registered with the Securities and Exchange Commission (the “SEC”) its initial public offering of up to $5.0 billion in shares of common stock, consisting of up to $4.0 billion in shares in its primary offering and up to $1.0 billion in shares pursuant to its distribution reinvestment plan (the “Initial Public Offering”). The IPO Registration Statement was initially declared effective on January 31, 2018 and terminated on July 2, 2021.

On January 13, 2021, the Company filed a Registration Statement on Form S-11 (File No. 333-252077), (the "Follow-on Registration Statement") to register up to $

Note 2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying unaudited consolidated financial statements include the accounts of the Company and its subsidiaries, and in the opinion of management, include all necessary adjustments, consisting of only normal and recurring items, necessary for a fair statement of the Company’s consolidated financial statements as of June 30, 2022 and for the three and six months ended June 30, 2022 and 2021. Results of operations for the interim periods are not necessarily indicative of results for the entire year. These financial statements have been prepared by the Company in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information and the applicable rules and regulations of the SEC. Accordingly, they do not include all information and footnotes required by GAAP for complete financial statements. Certain footnote disclosures normally included in financial statements prepared in accordance with GAAP have been condensed from this report pursuant to the rules of the SEC. The accompanying unaudited consolidated interim financial statements should be read in conjunction with the audited consolidated financial statements prepared in accordance with GAAP, and the related notes thereto, that are included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021 as filed with the SEC. The year-end balance sheet was derived from those audited financial statements.

Principles of Consolidation

The Company consolidates all entities in which it has a controlling financial interest through majority ownership or voting rights and variable interest entities whereby the Company is the primary beneficiary. In determining whether the Company has a controlling financial interest in a partially owned entity and the requirement to consolidate the accounts of that entity, the Company considers whether the entity is a variable interest entity (“VIE”) and whether it is the primary beneficiary. The Company is the primary beneficiary of a VIE when it has (i) the power to direct the most significant activities impacting the

11

economic performance of the VIE and (ii) the obligation to absorb losses or receive benefits significant to the VIE. Entities that do not qualify as VIEs are generally considered voting interest entities (“VOEs”) and are evaluated for consolidation under the voting interest model. VOEs are consolidated when the Company controls the entity through a majority voting interest or other means. When the requirements for consolidation are not met and the Company has significant influence over the operations of the entity, the investment is accounted for under the equity method of accounting. Equity method investments for which the Company has not elected a fair value option (“FVO”) are initially recorded at cost and subsequently adjusted for the Company’s pro-rata share of net income, contributions and distributions. When the Company elects the FVO, the Company records its share of net asset value of the entity and any related unrealized gains and losses.

The Company holds interest in a joint venture that is considered to be a VIE. The Company consolidated this entity because it has the ability to direct the most significant activities of the joint venture, including unilateral decision making on the disposition of the investment.

For select joint ventures, the non-controlling partner’s share of the assets, liabilities, and operations of each joint venture is included in noncontrolling interests as equity of the Company. The non-controlling partner’s interest is generally computed as the joint venture partner’s ownership percentage. Certain of the joint ventures formed by the Company provide the other partner a profits interest based on certain internal rate of return hurdles being achieved. Any profits interest due to the other partner is reported within redeemable non-controlling interests.

As of June 30, 2022, and December 31, 2021, the total assets and liabilities of the Company’s consolidated VIE were $52.2 million and $30.0 million, and $53.5 million and $29.7 million, respectively. Such amounts are included on the Company’ Consolidated Balance Sheets.

Investments in Real Estate

In accordance with the guidance for business combinations, the Company determines whether the acquisition of a property qualifies as a business combination, which requires that the assets acquired and liabilities assumed constitute a business. If the property acquired is not a business, the Company accounts for the transaction as an asset acquisition. All property acquisitions to date have been accounted for as asset acquisitions.

Whether the acquisition of a property acquired is considered a business combination or asset acquisition, the Company recognizes the identifiable assets acquired, the liabilities assumed, and any non-controlling interest in the acquired entity. In addition, for transactions that will be considered business combinations, the Company will evaluate the existence of goodwill or a gain from a bargain purchase. The Company expenses acquisition-related costs associated with business combinations as they are incurred. The Company capitalizes acquisition-related costs associated with asset acquisitions.

Upon acquisition of a property, the Company assesses the fair value of acquired tangible and intangible assets (including land, buildings, tenant improvements, above-market and below-market leases, acquired in-place leases, other identified intangible assets and assumed liabilities) and allocates the purchase price to the acquired assets and assumed liabilities. The Company assesses and considers fair value based on estimated cash flow projections that utilize discount and/or capitalization rates that it deems appropriate, as well as other available market information. Estimates of future cash flows are based on a number of factors including the historical operating results, known and anticipated trends and market and economic conditions.

The fair value of the tangible assets of an acquired property considers the value of the property as if it were vacant. The Company also considers an allocation of purchase price of other acquired intangibles, including acquired in-place leases that may have a customer relationship intangible value, including but not limited to the nature and extent of the existing relationship with the tenants, the tenants’ credit quality and expectations of lease renewals. Based on its acquisitions to date, the Company’s allocation to customer relationship intangible assets has not been material.

The Company records acquired above-market and below-market leases at their fair values (using a discount rate which reflects the risks associated with the leases acquired) equal to the difference between (1) the contractual amounts to be paid pursuant to

12

each in-place lease and (2) management’s estimate of fair market lease rates for each corresponding in-place lease, measured over a period equal to the remaining term of the lease for above-market leases and the initial term plus the term of any below-market fixed rate renewal options for below-market leases. Other intangible assets acquired include amounts for in-place lease values that are based on the Company’s evaluation of the specific characteristics of each tenant’s lease. Factors to be considered include estimates of carrying costs during hypothetical expected lease-up periods considering current market conditions, and costs to execute similar leases. In estimating carrying costs, the Company includes real estate taxes, insurance and other operating expenses and estimates of lost rentals at market rates during the expected lease-up periods, depending on local market conditions. In estimating costs to execute similar leases, the Company considers leasing commissions, legal and other related expenses.

Intangible assets and intangible liabilities are recorded as separate components on the Company's Consolidated Balance Sheets. The amortization of acquired above-market and below-market leases is recorded as an adjustment to Rental Revenue on the Company’s Consolidated Statements of Operations. The amortization of in-place leases is recorded as an adjustment to Depreciation and Amortization on the Company's Consolidated Statements of Operations.

The cost of buildings and improvements includes the purchase price of the Company’s properties and any acquisition-related adjustments, along with any subsequent improvements to such properties. The Company’s Investments in Real Estate are stated at cost and are generally depreciated on a straight-line basis over the estimated useful lives of the assets as follows:

| Description | Depreciable Life | |||||||

| Building | ||||||||

| Building, land and site improvements | ||||||||

| Furniture, fixtures and equipment | ||||||||

| Lease intangibles | Over lease term | |||||||

Significant improvements to properties are capitalized. When assets are sold or retired, their costs and related accumulated depreciation or amortization are removed from the accounts with the resulting gains or losses reflected in net income or loss for the period.

Repairs and maintenance are expensed to operations as incurred and are included in Rental Property Operating on the Company’s Consolidated Statements of Operations.

The Company’s management reviews its real estate properties for impairment each quarter or when there is an event or change in circumstances that indicates an impaired value. If the carrying amount of the real estate investment is no longer recoverable and exceeds the fair value of such investment, an impairment loss is recognized. The impairment loss is recognized based on the excess of the carrying amount of the asset over its fair value, or fair value, less cost to sell if classified as held for sale. If the Company’s strategy changes or market conditions otherwise dictate an earlier sale date, an impairment loss may be recognized and such loss could be material to the Company’s results. If the Company determines that an impairment has occurred, the affected assets are reduced to their fair value or fair value, less cost to sell if classified as held for sale. During the periods presented, no such impairment occurred.

Investments in Real Estate-Related Securities

The Company reports its investment in real estate-related securities at fair value and any changes in fair value are recorded in the current period earnings. Dividend income is recorded when declared and the resulting dividend income, along with gains and losses are recorded as a component of Realized and Unrealized Income (Loss) from Real Estate-Related Securities on the Company’s Consolidated Statements of Operations.

Investments in Real Estate Debt

The Company’s investments in real estate debt consists of commercial mortgage-backed securities (“CMBS”). The Company classifies the securities as trading securities and records such investments at fair value. As such, the resulting unrealized gains

13

and losses of such securities are recorded as a component of Realized and Unrealized Loss from Real Estate Debt on the Company’s Consolidated Statements of Operations.

Interest income from the Company’s investments in CMBS is recognized over the life of each investment and is recorded on the accrual basis on the Company’s Consolidated Statements of Operations.

Investments in International Affiliated Funds

The Company reports its investment in European Cities Partnership SCSp (“ECF”) and Asia Pacific Cities Fund (“APCF”), investment funds managed by an affiliate of TIAA (collectively, the “International Affiliated Funds”), under the equity method of accounting as it has significant influence over these investments. The equity method income (loss) from the investments in the International Affiliated Funds represents the Company’s allocable share of each fund’s net income or loss, which includes income and expense, realized gains and losses, and unrealized appreciation or depreciation as determined from the financial statements of ECF and APCF (which carry investments at fair value in accordance with the applicable GAAP) and is reported as Income (Loss) from Equity Investment in Unconsolidated International Affiliated Funds on the Company’s Consolidated Statements of Operations.

All contributions to or distributions from the investment in the International Affiliated Funds are accrued when notice is received and recorded as a receivable from or payable to the International Affiliated Funds on the Company's Consolidated Balance Sheets.

Investment in Commercial Mortgage Loans

The Company has originated multiple commercial mortgage loans and elected the fair value option for each. In accordance with the adoption of the fair value option allowed under ASC 825, Financial Instruments, and at the election of the Company, the commercial mortgage loans were stated at fair value and were initially valued at the face amount of the loan funding. Subsequently, the commercial mortgage loans were valued at least quarterly by an independent third-party valuation firm with additional oversight being performed by the Advisor’s internal valuation department. The value was based on market factors, such as market interest rates and spreads for comparable loans, the performance of the underlying collateral (such as the loan-to-value ratio and the cash flow of the underlying collateral), and the credit quality of the borrower.

The income from the commercial mortgage loans represents interest income and origination fee income, which is reported as Income from Commercial Mortgage Loans on the Company’s Consolidated Statements of Operations. Unrealized gains and losses are recorded as a component of Unrealized Loss on Commercial Mortgage Loan on the Company’s Consolidated Statements of Operations.

In the event of a partial or whole sale of the commercial mortgage loan that qualifies for sale accounting under GAAP, the Company derecognizes the corresponding asset and fees paid as part of the partial or whole sale are recognized on the Company’s Consolidated Statements of Operations.

Senior Loan Participations

In certain instances, the Company finances loans through the non-recourse syndication of a senior loan interest to a third party. Depending on the particular structure of the syndication, the senior loan interest may remain on the Company's Consolidated Balance Sheets or, in other cases, the sale will be recognized and the senior loan interest will no longer be included in consolidated financial statements. When these sales do not qualify for sale accounting under GAAP, the Company reflects the transaction by recording a loan participations liability at fair value on the Consolidated Balance Sheets, however this gross presentation does not impact Stockholders’ Equity or Net Income. When the sales are recognized, the Consolidated Balance Sheets only includes the remaining subordinate loan and not the non-consolidated senior interest sold.

Note Payable

The Company finances the acquisition of certain mortgage loans through the use of "note-on-note" transactions in which the Company pledges mortgage loans as collateral to secure a loan which is equal in value to a specified percentage of the estimated fair value of the pledged collateral. These "note-on-note" transactions are recorded in Note Payable on the Consolidated Balance Sheets and are carried at fair value through the adoption of the fair value option allowed under ASC 825.

14

Deferred Charges

The Company's deferred charges include financing and leasing costs. Financing costs include legal, structuring, and other loan costs incurred by the Company for its financing arrangements. Deferred financing costs related to the Credit Facility (as defined herein) are recorded as a component of Other Assets on the Company’s Consolidated Balance Sheets and are being amortized on a straight-line basis over the term of the Credit Facility, which approximates the effective interest method. Unamortized costs are charged to interest expense upon early repayment or significant modification of the Credit Facility and fully amortized deferred financing costs are removed from the books upon the maturity of the Credit Facility. Deferred financing costs related to the Company’s mortgages payable are recorded as an offset to the related liability and amortized on a straight-line basis over the term of the financing instrument, which approximates the effective interest method. Deferred leasing costs incurred in connection with new leases, which consist primarily of brokerage and legal fees, are recorded as a component of Investments in Real Estate, Net on the Company’s Consolidated Balance Sheets and amortized over the life of the related lease.

Fair Value Measurement

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. Accounting guidance also establishes a fair value hierarchy that requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. The standard describes three levels of inputs that may be used to measure fair value:

Level 1—quoted prices are available in active markets for identical investments as of the measurement date. The Company does not adjust the quoted price for these investments.

Level 2—quoted prices are available in markets that are not active or model inputs are based on inputs that are either directly or indirectly observable as of the measurement date.

Level 3—pricing inputs are unobservable and include instances where there is minimal, if any, market activity for the investment. These inputs require significant judgment or estimation by management or third parties when determining fair value and generally represent anything that does not meet the criteria of Levels 1 and 2. Due to the inherent uncertainty of these estimates, these values may differ materially from the values that would have been used had a ready market for these investments existed.

Investments in real estate-related securities are recorded at fair value based on the closing price of the common stock as reported by the applicable national securities exchange and were classified as Level 1.

The Company’s investments in real estate debt are reported at fair value. As of June 30, 2022, the Company’s investments in real estate debt consisted of CMBS, which are securities backed by one or more mortgage loans secured by real estate assets. The Company generally determines the fair value of its investments in real estate debt by utilizing third-party pricing service providers whenever available and has classified as Level 2.

The Company’s investment in commercial mortgage loans consists of floating rate senior and mezzanine loans the Company originated and has classified as Level 3. The commercial mortgage loans are carried at fair value based on significant unobservable inputs.

The Company's loan participations and note payable are carried at fair value based on significant observable inputs and have been classified as Level 3.

The carrying amounts of financial instruments such as other assets, accounts payable, accrued expenses and other liabilities approximate their fair values due to the short-term maturities and market rates of interest of these instruments.

15

The following table details the Company’s assets and liabilities measured at fair value on a recurring basis ($ in thousands):

| June 30, 2022 | December 31, 2021 | |||||||||||||||||||||||||||||||||||||||||||||||||

| Level I | Level 2 | Level 3 | Total | Level I | Level 2 | Level 3 | Total | |||||||||||||||||||||||||||||||||||||||||||

| Assets: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Investments in real estate-related securities | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||

| Investments in real estate debt | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||

| Investments in commercial mortgage loans | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||

| Total | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||

| Liabilities: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Loan participations | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||

| Note payable | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||

| Total | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||

The following table details the Company’s assets and liabilities measured at fair value on a recurring basis using Level 3 inputs ($ in thousands):

| Investments in Commercial Mortgage Loans | Loan Participations | Note Payable | ||||||||||||

| Balance as of December 31, 2021 | $ | $ | $ | |||||||||||

| Loan Originations | — | — | ||||||||||||

| Loan Participations Sold | — | — | ||||||||||||

| Additional Fundings | — | |||||||||||||

| Net Unrealized (Loss) Gain | ( | (a) | — | |||||||||||

| Financing Proceeds | — | — | ||||||||||||

| Balance as of June 30, 2022 | $ | $ | $ | |||||||||||

The following table shows the quantitative information about unobservable inputs related to the Level 3 fair value measurements comprising the investments in commercial mortgage loans, loan participations and note payable as of June 30, 2022.

| Type | Asset Class | Valuation Technique | Unobservable Inputs | Weighted Average | ||||||||||||||||||||||

| Commercial Mortgage Loans | Various | Cash Equivalency Method | Discount Rate | LIBOR(1) + | ||||||||||||||||||||||

SOFR (2) + | ||||||||||||||||||||||||||

| Loan Participations | Various | Cash Equivalency Method | Discount Rate | LIBOR(1) + | ||||||||||||||||||||||

SOFR (2) + | ||||||||||||||||||||||||||

| Note Payable | Various | Cash Equivalency Method | Discount Rate | SOFR (2) + | ||||||||||||||||||||||

(1) LIBOR as of June 30, 2022 was 1.2 %.

(2) SOFR as of June 30, 2022 was1.3 %.

(2) SOFR as of June 30, 2022 was

16

As of June 30, 2022, the carrying value of the Company's Credit Facility approximated fair value. The fair value of the Company's mortgages payable was $98.7 million and $106.3 million as of June 30, 2022 and December 31, 2021, respectively. Fair value of the Company's indebtedness is estimated by modeling the cash flows required by the Company's debt agreements and discounting them back to present value using the appropriate discount rate. Additionally, the Company considers current market rates and conditions by evaluating similar borrowing agreements with comparable loan-to-value ratios and credit profiles. The inputs used in determining the fair value of the Company's indebtedness are considered Level 3 .

Revenue Recognition

The Company’s sources of revenue and the related revenue recognition policies are as follows:

Rental revenue — consists primarily of base rent arising from tenant operating leases at the Company’s office, industrial, self-storage, multifamily, retail, healthcare and single-family housing properties. Rental revenue is recognized on a straight-line basis over the life of the lease, including any rent steps or abatement provisions. The Company begins to recognize revenue when a tenant takes possession of the leased space. The Company includes its tenant reimbursement income in rental revenue that consists of amounts due from tenants for costs related to common area maintenance, real estate taxes and other recoverable costs as defined in lease agreements.

Income from Commercial Mortgage Loan — consists of income from interest earned and recognized as operating income based upon the principal amount outstanding and the contracted interest rate along with origination fees. The accrual of interest income on mortgage loans is discontinued when in management’s opinion, the borrower may be unable to meet payments as they become due (“nonaccrual mortgage loans”), unless the loan is well-secured and is in the process of collection. Interest income on nonaccrual mortgage loans is subsequently recognized only to the extent cash payments are received until the loans are returned to accrual status. As of June 30, 2022, the Company did not have any mortgage loans on nonaccrual status.

Leases

The Company derives revenue pursuant to lease agreements. At the inception of a contract, the Company assesses whether a contract is, or contains, a lease. A contract is, or contains, a lease if the contract conveys the right to control the use of an identified asset for a period of time in exchange for consideration. At the lease inception, the Company determines whether each lease is a sales-type, direct financing or operating lease. Such classification is based on whether:

•The lessee gains control of the underlying asset and the lessor therefore relinquishes control to the lessee under certain criteria (sales-type or direct-financing); or

•All other leases that do not meet the criteria as sales-type or direct financing leases (operating).

The Company's leases are classified as operating leases in accordance with relevant accounting guidelines, and the related revenue is recognized on a straight-line basis. Upon the termination or vacation of a tenant lease, the associated straight-line rent receivable is written off.

Cash and Cash Equivalents

Cash and cash equivalents represent cash held in banks, cash on hand and liquid investments with original maturities of three months or less at the time of purchase. The Company may have bank balances in excess of federally insured amounts; however, the Company deposits its cash with high credit-quality institutions to minimize credit risk.

Income Taxes

The Company elected to be taxed as a REIT under Sections 856 through 860 of the Internal Revenue Code (“Code”) commencing with its taxable year ending December 31, 2018 and intends to operate in a manner that will allow it to continue to qualify as a REIT. In qualifying for taxation as a REIT, the Company generally is not subject to federal corporate income tax to

17

the extent it distributes annually at least 90% of its taxable income (determined without regard to the dividends-paid deduction and excluding any net capital gains) to its shareholders. A REIT is subject to U.S. federal income tax on undistributed REIT taxable income and net capital gains, and may be subject to 21% corporate income tax and a 4% excise tax. REITs are subject to a number of other organizational and operational requirements. Even in qualifying for taxation as a REIT, the Company may be subject to certain state and local taxes on its income and property, and federal income and excise taxes on its undistributed income. The Company may elect to treat certain of its corporate subsidiaries as taxable REIT subsidiaries (“TRSs”). In general, a TRS may perform additional services for the Company’s tenants and generally may engage in any real estate or non-real estate-related business other than management or operation of a lodging facility or a health care facility. A domestic TRS is subject to US corporate federal income tax. The Cayman Islands TRSs are not subject to US corporate federal income tax or Cayman Islands taxes. As of June 30, 2022, the Company had four active TRSs: the Company uses two Cayman Islands TRSs to hold its investments in the International Affiliated Funds, uses one domestic TRS to hold the senior portions of the commercial mortgage loans, and one domestic TRS for self-storage, nonrental-related business.

The Company accrues liabilities when it believes that it is more likely than not that it will not realize the benefits of tax positions that it has taken in its tax returns or for the amount of any tax benefit that exceeds the cumulative probability threshold in accordance with ASC 740-10, Uncertain Tax Positions.

Tax legislation commonly referred to as the Tax Cuts & Jobs Act (the “TCJA”) was enacted on December 22, 2017. Among other things, the TCJA reduced the U.S. federal corporate income tax rate from 35% to 21% and created new taxes on certain foreign-sourced earnings. Federal legislation intended to ameliorate the economic impact of the COVID-19 pandemic, the Coronavirus Aid, Relief and Economic Security Act (the "CARES Act"), was enacted on March 27, 2020, which, among other things, made technical corrections to, or modifies on a temporary basis, certain of the provisions of the TCJA.

Management has evaluated the effects of TCJA, as modified by the CARES Act, and concluded that the TCJA will not materially impact its consolidated financial statements. The Company also estimates that the taxes on foreign-sourced earnings imposed under the TCJA are not likely to apply to its foreign investments.

Organization and Offering Expenses

The Advisor advanced organization and offering expenses on behalf of the Company (including legal, accounting, and other expenses attributable to the organization, but excluding upfront selling commissions, dealer manager fees and stockholder servicing fees) through the fourth full fiscal quarter after the Company’s acquisition of its first property. The Company agreed to reimburse the Advisor for all such advanced expenses it incurred in 60 equal monthly installments commencing on the earlier of the date the Company’s NAV reaches $1.0 billion or January 31, 2023. The Company's NAV reached $1.0 billion in October 2021 and as of June 30, 2022, had reimbursed the Advisor $0.6 million for such costs.

The Advisor and its affiliates have incurred organization and offering expenses on the Company’s behalf for the Initial Public Offering of $4.6 million, consisting of offering costs of $3.5 million and organization costs of $1.1 million, of which $4.0 million and $4.6 million remain outstanding as of June 30, 2022 and December 31, 2021, respectively. These organization and offering costs are recorded as Due to Affiliates on the Company’s Consolidated Balance Sheets.

Foreign Currency

The financial position and results of operations of ECF is measured using the local currency (Euro) as the functional currency and are translated into U.S. dollars for purposes of recording the related activity under the equity method of accounting. Net income (loss), which includes the Company’s allocable share of ECF's income and expense, realized gains and losses and unrealized appreciation or depreciation, has been translated at average exchange rates prevailing during the period. Assets and liabilities have been translated at the rates of exchange on the balance sheet date. The resulting translation gain and loss adjustments are recorded directly as a separate component of accumulated other comprehensive income (loss), unless there is a sale or complete liquidation of the underlying foreign investments. Foreign currency translation adjustments resulted in other comprehensive losses of approximately $(4.5 ) million and $(6.4 ) million for the three and six months ended June 30, 2022, respectively. Foreign currency translation adjustments resulted in other comprehensive gains (losses) of approximately $0.3 million and $(0.9 ) million for the three and six months ended June 30, 2021, respectively.

The financial position and results of operations of APCF is measured in U.S. dollars for purposes of recording the related activity under the equity method of accounting. There is no direct foreign currency exposure to the Company for its investment in APCF.

18

Earnings per Share

Basic net income/(loss) per share of common stock is determined by dividing net income/(loss) attributable to common stockholders by the weighted average number of common shares outstanding during the period. All classes of common stock are allocated net income/(loss) at the same rate per share. The Company does not have any dilutive securities outstanding that would cause basic earnings per share and diluted earnings per share to differ.

Recent Accounting Pronouncements

In July 2021, the Financial Accounting Standards Board ("FASB") issued ASU 2021-05—Leases (Topic 842): Lessors—Certain Leases with Variable Lease Payments (“ASU 2021-05”). The amendments in ASU 2021-05 amend the lease classification requirements for lessors to align them with practice under Topic 840. Lessors should classify and account for a lease with variable lease payments that do not depend on a reference index or a rate as an operating lease if certain criteria are met. When a lease is classified as operating, the lessor does not recognize a net investment in the lease, does not derecognize the underlying asset, and, therefore, does not recognize a selling profit or loss. The amendments are effective for fiscal years beginning after December 15, 2021, for all entities, and interim periods within those fiscal years for public business entities. Management has adopted the guidance and it did not have a material impact to the financial statements.

In April 2020, the FASB staff released guidance focused on treatment of concessions related to the effects of COVID-19 on the application of lease modification guidance in Accounting Standards Codification (ASC) 842, “Leases.” The guidance provides a practical expedient to forgo the associated reassessments required by ASC 842 when changes to a lease result in similar or lower future consideration. There were no material exposures to rent concessions or lease defaults for tenants impacted by the COVID-19 pandemic as of June 30, 2022.

In March 2020, the FASB issued ASU 2020-04, Facilitation of the Effects of Reference Rate Reform on Financial Reporting (“ASU 2020-04”). The guidance provides optional expedients and exceptions for applying generally accepted accounting principles to contract modifications and hedging relationships, subject to meeting certain criteria, that reference London Interbank Offered Rate (“LIBOR”) or another reference rate expected to be discontinued. The expedients and exceptions are effective for the period from March 12, 2020 to December 31, 2022. Management is assessing the impact and currently does not expect the guidance to materially impact the Company.

Note 3. Investments in Real Estate

| June 30, 2022 | December 31, 2021 | ||||||||||

| Building and building improvements | $ | $ | |||||||||

| Land and land improvements | |||||||||||

| Furniture, fixtures and equipment | |||||||||||

| Total | |||||||||||

| Accumulated depreciation | ( | ( | |||||||||

| Investments in real estate, net | $ | $ | |||||||||

For the three and six months ended June 30, 2022, depreciation expense was $9.1 million and $16.7 million, respectively. For the three and six months ended June 30, 2021, depreciation expense was $4.2 million and $8.0 million, respectively.

During the six months ended June 30, 2022, the Company acquired an interest in three industrial, two self-storage, and 65 single-family rental real estate investments.

19

The following table provides details of the properties acquired during the six months ended June 30, 2022 ($ in thousands):

| Property Name | Ownership Interest | Number of Properties | Location | Sector | Acquisition Date | Acquisition Price(1) | ||||||||||||||||||||||||||||||||

| Tampa Lakeland Industrial | Tampa, FL | Industrial | January, 2022 | |||||||||||||||||||||||||||||||||||

| 610 Loop - Houston Industrial | Houston, TX | Industrial | March, 2022 | |||||||||||||||||||||||||||||||||||

| Palm Bay Storage | Palm Bay, FL | Self-Storage | June, 2022 | |||||||||||||||||||||||||||||||||||

| Imperial Sugarland Storage | Sugarland, TX | Self-Storage | June, 2022 | |||||||||||||||||||||||||||||||||||

| UP Minneapolis Industrial | Minnesota | Industrial | June, 2022 | |||||||||||||||||||||||||||||||||||

| Single-Family Rentals | Various | Single-Family Housing | Various | |||||||||||||||||||||||||||||||||||

| $ | ||||||||||||||||||||||||||||||||||||||

(1) Acquisition price is inclusive of acquisition costs and other acquisition related adjustments. Acquisition price does not include any net liabilities assumed.

The following table summarizes the purchase price allocation for the properties acquired during the six months ended June 30, 2022 ($ in thousands):

| Tampa Lakeland Industrial | 610 Loop - Houston Industrial | Palm Bay Storage | Imperial Sugarland Storage | UP Minneapolis Industrial | Single-Family Rentals | ||||||||||||||||||||||||||||||

| Building and building improvements | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||

| Land and land improvements | |||||||||||||||||||||||||||||||||||

| In-place lease intangibles | |||||||||||||||||||||||||||||||||||

| Furniture, fixtures and equipment | |||||||||||||||||||||||||||||||||||

| Leasing Commissions | |||||||||||||||||||||||||||||||||||

| Other intangibles | ( | ( | |||||||||||||||||||||||||||||||||

| Total purchase price | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||

Note 4. Investments in Real Estate-Related Securities

As of June 30, 2022 and December 31, 2021, the Company’s investments in real estate-related securities consisted of shares of common stock of publicly-listed REITs. As described in Note 2, the Company records its investments in real estate-related securities at fair value on its Consolidated Balance Sheets.

The following table summarizes the Investments in Real Estate-Related Securities as of June 30, 2022 ($ in thousands):

| Investments in Real Estate-Related Securities | ||||||||

| Balance as of December 31, 2021 | $ | |||||||

| Additions | ||||||||

| Disposals | ( | |||||||

| Unrealized losses | ( | |||||||

| Realized gains | ||||||||

| Balance as of June 30, 2022 | $ | |||||||

20

The following table summarizes the components of Realized and Unrealized Income (Loss) from Real Estate-Related Securities during the three and six months ended June 30, 2022 and 2021 ($ in thousands):

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| Unrealized (losses) gains | $ | ( | $ | $ | ( | $ | |||||||||||||||||

| Realized gains | |||||||||||||||||||||||

| Dividend income | |||||||||||||||||||||||

| Total | $ | ( | $ | $ | ( | $ | |||||||||||||||||

Note 5. Investments in Real Estate Debt

The following tables detail the Company's Investments in Real Estate Debt ($ in thousands):

| June 30, 2022 | |||||||||||||||||||||||||||||

| Type of Security/Loan | Weighted Average Coupon | Weighted Average Maturity Date (1, 2) | Face Amount | Cost Basis | Fair Value | ||||||||||||||||||||||||

| CMBS - Fixed | % | $ | $ | $ | |||||||||||||||||||||||||

| CMBS - Floating | % | ||||||||||||||||||||||||||||

| Total | % | $ | $ | $ | |||||||||||||||||||||||||

| December 31, 2021 | |||||||||||||||||||||||||||||

| Type of Security/Loan | Weighted Average Coupon | Weighted Average Maturity Date (1, 2) | Face Amount | Cost Basis | Fair Value | ||||||||||||||||||||||||

| CMBS - Fixed | % | $ | $ | $ | |||||||||||||||||||||||||

| CMBS - Floating | % | ||||||||||||||||||||||||||||

| Total | % | $ | $ | $ | |||||||||||||||||||||||||

(1) Weighted by face amount

(2) Stated legal maturity; expected maturity is earlier and not the same

(2) Stated legal maturity; expected maturity is earlier and not the same

21

The following table details the collateral type of the properties securing the Company's investments in real estate debt ($ in thousands):

| June 30, 2022 | December 31, 2021 | ||||||||||||||||||||||||||||||||||

| Collateral | Cost Basis | Fair Value | Percentage based on Fair Value | Cost Basis | Fair Value | Percentage based on Fair Value | |||||||||||||||||||||||||||||

| Office | $ | $ | % | $ | $ | % | |||||||||||||||||||||||||||||

| Industrial | % | % | |||||||||||||||||||||||||||||||||

| Retail | % | % | |||||||||||||||||||||||||||||||||

| NNN | % | % | |||||||||||||||||||||||||||||||||

| Life Science | % | % | |||||||||||||||||||||||||||||||||

| Multifamily | % | % | |||||||||||||||||||||||||||||||||

| Hotel | % | % | |||||||||||||||||||||||||||||||||

| Self-Storage | % | % | |||||||||||||||||||||||||||||||||

| Cold-Storage | % | % | |||||||||||||||||||||||||||||||||

| Manu Housing | % | % | |||||||||||||||||||||||||||||||||

| Diversified | % | % | |||||||||||||||||||||||||||||||||

| Total | $ | $ | % | $ | $ | % | |||||||||||||||||||||||||||||

The following table details the credit rating of the Company's investments in real estate debt ($ in thousands):

| June 30, 2022 | December 31, 2021 | ||||||||||||||||||||||||||||||||||

Credit Rating (1) | Cost Basis | Fair Value | Percentage based on Fair Value | Cost Basis | Fair Value | Percentage based on Fair Value | |||||||||||||||||||||||||||||

| AAA | $ | $ | % | $ | $ | % | |||||||||||||||||||||||||||||

| AA | % | % | |||||||||||||||||||||||||||||||||

| A | % | % | |||||||||||||||||||||||||||||||||

| BBB | % | % | |||||||||||||||||||||||||||||||||

| BB | % | % | |||||||||||||||||||||||||||||||||

| B | % | % | |||||||||||||||||||||||||||||||||

| Total | $ | $ | % | $ | $ | % | |||||||||||||||||||||||||||||

(1) Composite rating at the time of purchase.

| Investments in Real Estate Debt | ||||||||

| Balance as of December 31, 2021 | $ | |||||||

| Additions | ||||||||

| Unrealized losses | ( | |||||||

| Realized losses | ( | |||||||

| Balance as of June 30, 2022 | $ | |||||||

Note 6. Investment in International Affiliated Funds

Investment in ECF:

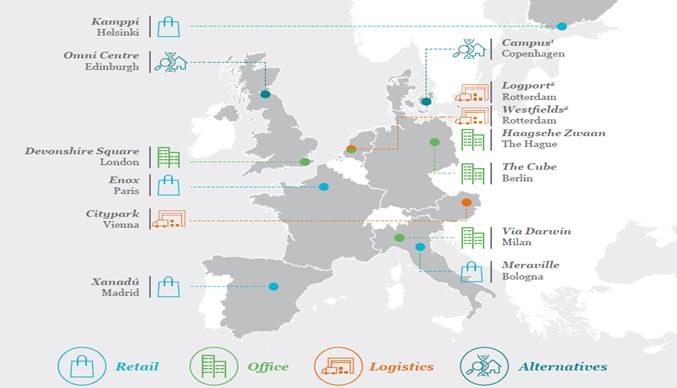

ECF was formed in March 2016 as an open-end, Euro-denominated fund that seeks to build a diversified portfolio of high quality and stabilized commercial real estate with good fundamentals (i.e., core real estate) located in or around certain investment cities in Europe selected for their resilience, potential for long-term structural performance and ability to deliver an attractive and stable distribution yield.

22

The Company originally committed to invest approximately $28.4 million (€25.0 million) into ECF and subsequently increased its commitment by $51.0 million (€45.0 million). As of June 30, 2022, the Company had fully satisfied both commitments.

As described in Note 2, the Company records its investment in ECF using the equity method on its Consolidated Balance Sheets. While the Company has strategies to manage the foreign exchange risk associated with its investment made in Euros, there can be no assurance that these strategies will be successful or that foreign exchange fluctuations will not negatively impact the Company’s financial performance and results of operations in a material manner.

| Investment in ECF | ||||||||

| Balance as of December 31, 2021 | $ | |||||||

| Income distribution | ( | |||||||

| Income from equity investment in unconsolidated international affiliated fund | ||||||||

| Foreign currency translation adjustment | ( | |||||||

| Balance as of June 30, 2022 | $ | |||||||

Income from equity investments in Unconsolidated International Affiliated Funds from ECF was $2.9 million and $3.8 million, for the three and six months ended June 30, 2022, respectively. Income from equity investments in Unconsolidated International Affiliated Funds from ECF was $0.4 million and $0.3 million for the three and six months ended June 30, 2021, respectively.

Investment in APCF:

APCF was launched in November 2018 as an open-end, U.S. dollar denominated fund that seeks durable income and capital appreciation from a balanced and diversified portfolio of real estate investments in a defined list of investment cities in the Asia-Pacific region.

The Company committed to invest $10.0 million into APCF and subsequently, twice increased its commitment by $20.0 million, bringing its total commitment to $50.0 million. As of June 30, 2022, the Company has fully funded its total commitment. As described in Note 2, the Company records its investment in APCF using the equity method on its Consolidated Balance Sheets.

| Investment in APCF | ||||||||

| Balance as of December 31, 2021 | $ | |||||||

| Income distribution | ( | |||||||

| Income from equity investment in unconsolidated international affiliated fund | ||||||||

| Balance as of June 30, 2022 | $ | |||||||

Note 7. Investment in Commercial Mortgage Loans

On November 9, 2021 the Company originated a floating rate senior mortgage and mezzanine loan to finance the acquisition of an office property in Farmington, Massachusetts, amounting to $63.0 million and has committed to fund an additional $30.4 million for future renovations of the property. On November 16, 2021 the Company originated a second floating rate senior mortgage and mezzanine loan in the amount of $76.9 million to finance the acquisition of a multifamily property in Seattle, Washington, with additional commitments to fund $11.1 million for future renovations.

On March 24, 2022 and June 27, 2022, the Company sold two senior loans to unaffiliated parties and retained the subordinate mortgages, receiving proceeds of $47.4 million and $57.9 million, respectively, which are net of disposition fees. The sales did not qualify for sale accounting under GAAP and as such, the loans were not de-recognized.

23

On March 28, 2022 we originated a floating rate senior mortgage and mezzanine loan to finance the acquisition and reposition of five multi-family properties located in Tucson, AZ, amounting to $92.4 million and have committed to fund an additional $9.3 million for future renovations of the property. The advance rate was 70.9 % LTV with an in-place debt yield of 5.25 %. The secondary market execution is anticipated to be note-on-note.

For the three months and six months ended June 30, 2022, the Company recognized interest income and loan origination fee income from its investment in its commercial mortgage loans of $1.9 3.9

For the three and six months ended June 30, 2022, the Company had unrealized losses on commercial mortgage loans of $(2.2 ) million for each period. For the three and six months ended June 30, 2021, we did not have a commercial mortgage loan investment.

The following is a reconciliation of the beginning and ending balances for the Company’s investment in commercial mortgage loans for the six months ended June 30, 2022 ($ in thousands):

| Investment in Commercial Mortgage Loans | |||||

| Balance as of December 31, 2021 | $ | ||||

| Loan originations | |||||

| Additional fundings | |||||

Net unrealized loss (a) | ( | ||||

| Balance as of June 30, 2022 | $ | ||||

24

Note 8. Intangibles

June 30, 2022 | December 31, 2021 | ||||||||||

| Intangible assets: | |||||||||||

| In-place lease intangibles | $ | $ | |||||||||

| Above-market lease intangibles | |||||||||||

| Leasing commissions | |||||||||||

| Other intangibles | |||||||||||

| Total intangible assets | |||||||||||

| Accumulated amortization: | |||||||||||

| In-place lease intangibles | ( | ( | |||||||||

| Above-market lease intangibles | ( | ( | |||||||||

| Leasing commissions | ( | ( | |||||||||

| Other intangibles | ( | ( | |||||||||

| Total accumulated amortization | ( | ( | |||||||||

| Intangible assets, net | $ | $ | |||||||||

| Intangible liabilities: | |||||||||||

| Below-market lease intangibles | $ | ( | $ | ( | |||||||

| Accumulated amortization | |||||||||||

| Intangible liabilities, net | $ | ( | $ | ( | |||||||

Amortization expense relating to intangible assets was $5.0 million and $9.7 million for the three and six months ended June 30, 2022, respecitvely. Amortization expense relating to intangible assets was $2.6 million and $4.2 million, respectively, for the three and six months ended June 30, 2021. Income from the amortization of intangible liabilities was $0.9 million and $1.7 million for the three and six months ended June 30, 2022, respectively. Income from the amortization of intangible liabilities was $0.3 million and $0.5 million, respectively, for the three and six months ended June 30, 2021.

| In-Place Lease Intangibles | Above-Market Lease Intangibles | Leasing Commissions | Other Intangibles | Below-Market Lease Intangibles | |||||||||||||||||||||||||

| 2022 (remaining) | $ | $ | $ | $ | $ | ( | |||||||||||||||||||||||

| 2023 | ( | ||||||||||||||||||||||||||||

| 2024 | ( | ||||||||||||||||||||||||||||

| 2025 | ( | ||||||||||||||||||||||||||||

| 2026 | ( | ||||||||||||||||||||||||||||

| Thereafter | ( | ||||||||||||||||||||||||||||

| $ | $ | $ | $ | $ | ( | ||||||||||||||||||||||||

As of June 30, 2022, the weighted-average amortization periods for the acquired in-place lease intangibles, above-market lease intangibles, leasing commissions, other intangibles and below-market lease intangibles of the properties acquired were 6 , 6 , 7 , 9 , and 12 years, respectively.

Note 9. Credit Facility

25

Nuveen OP’s option, at either an adjusted base rate or an adjusted 30-day LIBOR rate, in each case, plus an applicable margin. The applicable margin ranges from 1.30 % to 1.90 % for borrowings at the adjusted LIBOR rate, in each case, based on the total leverage ratio of Nuveen OP and its subsidiaries. Interest under the Credit Facility is determined based on a one-month U.S. dollar-denominated LIBOR, which was 0.1 % and 1.8 % as of December 31, 2020 and 2019, respectively. Loans under the Credit Facility will mature three years from October 24, 2018, with an option to extend twice for an additional year pursuant to the terms of the Credit Agreement. On December 17, 2018 and June 11, 2019, the Company amended the Credit Agreement to increase the Credit Facility to $150.0 million and $210.0 million in aggregate commitments, respectively, with all other terms remaining the same.

On September 30, 2021, Wells Fargo Bank, N.A., the Company and Nuveen OP amended the Credit Agreement to increase the Credit Facility to $335.0 million in aggregate commitments, comprised of a $235.0 million revolving facility, and a senior delayed draw term loan facility in the aggregate amount of up to $100.0 million (the “DDTL Facility”). Loans under the DDTL Facility may be borrowed in up to three advances, each in a minimum amount of $30.0 million. The Credit Facility will terminate, and all amounts outstanding thereunder will be due and payable in full, on September 30, 2024 (the “Revolving Termination Date”), with two additional one-year extension options held by Nuveen OP, including the payment of an extension fee of 0.125 % of the aggregate commitment. The DDTL Facility will mature, and all amounts outstanding thereunder will be due and payable in full, on September 30, 2026. Loans outstanding under the Credit Facility bear interest, at Nuveen OP’s option, at either an adjusted base rate or an adjusted LIBOR rate, in each case, plus an applicable margin. The applicable margin ranges from 0.30 % to 0.90 % for Credit Facility borrowings for base rate loans, in each case, based on the total leverage ratio of the Nuveen OP and its subsidiaries. The applicable margin ranges from 1.30 % to 1.90 % for Credit Facility borrowings at the adjusted LIBOR rate, in each case, based on the total leverage ratio of the Nuveen OP and its subsidiaries. Loans outstanding under the DDTL Facility bear interest, at the Nuveen OP’s option, at either an adjusted base rate or an adjusted LIBOR rate, in each case, plus an applicable margin. The applicable margin ranges from 0.25 % to 0.85 % for DDTL Facility borrowings for base rate loans, in each case, based on the total leverage ratio of the Nuveen OP and its subsidiaries. The applicable margin ranges from 1.25 % to 1.85 % for DDTL Facility borrowings at the adjusted LIBOR rate, in each case, based on the total leverage ratio of the Nuveen OP and its subsidiaries. There is an unused fee of 0.15 % if the usage is greater than or equal to 50 % of the aggregate commitments and 0.25 % of the usage is less than 50 % of the aggregate commitments. There is a ticking fee on the DDTL Facility equal to 0.15 % of the undisbursed portion of the DDTL Facility. An upfront fee of 40 basis points was payable at closing.

In July 2017, the Financial Conduct Authority (the authority that regulates LIBOR) announced it intends to stop compelling banks to submit rates for the calculation of LIBOR after 2021. The Alternative Reference Rates Committee has proposed that the Secured Overnight Financing Rate (“SOFR”) is the rate that represents best practice as the alternative to USD-LIBOR for use in derivatives and other financial contracts that are currently indexed to USD-LIBOR. The consequence of these developments cannot be entirely predicted but could include an increase in the cost of our variable rate indebtedness.

The following is a summary of the Credit Facility ($ in thousands):

| Principal Balance Outstanding | |||||||||||||||||||||||||||||

| Indebtedness | Interest Rate | Maturity Date | Maximum Facility Size | June 30, 2022 | December 31, 2021 | ||||||||||||||||||||||||