Form 10-Q MEI Pharma, Inc. For: Dec 31

ROC

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

(Mark One)

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from |

|

to |

|

|

Commission File Number:

(Exact name of registrant as specified in its charter)

|

|

|

|

||

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

(Address of principal executive offices) (Zip Code)

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

The |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

☒ |

|

Smaller reporting company |

|

||

Emerging growth company |

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes

As of February 8, 2022, the number of shares outstanding of the issuer’s common stock, $0.00000002 par value, was

MEI PHARMA, INC.

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

Page |

|

|

|

|

|

||||

PART I |

|

|

|

3 |

|

|

|

|

|

||||

Item 1: |

|

|

|

3 |

|

|

|

|

|

||||

|

|

Condensed Balance Sheets as of December 31, 2021 and June 30, 2021 |

|

|

3 |

|

|

|

|

||||

|

|

Condensed Statements of Operations for the three and six months ended December 31, 2021 and 2020 |

|

|

4 |

|

|

|

|

||||

|

|

|

|

5 |

|

|

|

|

|

||||

|

|

Condensed Statements of Cash Flows for the six months ended December 31, 2021 and 2020 |

|

|

6 |

|

|

|

|

||||

|

|

|

|

7 |

|

|

|

|

|

||||

Item 2: |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

|

19 |

|

|

|

|

||||

Item 3: |

|

|

|

33 |

|

|

|

|

|

||||

Item 4: |

|

|

|

33 |

|

|

|

|

|

||||

PART II |

|

|

|

34 |

|

|

|

|

|

||||

Item 1: |

|

|

|

34 |

|

|

|

|

|

||||

Item 1A: |

|

|

|

34 |

|

|

|

|

|

||||

Item 2: |

|

|

|

34 |

|

|

|

|

|

||||

Item 3: |

|

|

|

34 |

|

|

|

|

|

||||

Item 4: |

|

|

|

34 |

|

|

|

|

|

||||

Item 5: |

|

|

|

34 |

|

|

|

|

|

||||

Item 6: |

|

|

|

35 |

|

|

|

|

|||||

|

|

36 |

|

|||

2

PART I FINANCIAL INFORMATION

Item 1: Condensed Financial Statements – Unaudited

MEI PHARMA, INC.

CONDENSED BALANCE SHEETS

(In thousands, except per share amounts)

|

|

December 31, |

|

|

June 30, |

|

||

|

|

(unaudited) |

|

|

|

|

||

ASSETS |

|

|

|

|

|

|

||

Current assets: |

|

|

|

|

|

|

||

Cash and cash equivalents |

|

$ |

|

|

$ |

|

||

Short-term investments |

|

|

|

|

|

|

||

Total cash, cash equivalents and short-term investments |

|

|

|

|

|

|

||

Contract assets |

|

|

|

|

|

|

||

Prepaid expenses and other current assets |

|

|

|

|

|

|

||

Total current assets |

|

|

|

|

|

|

||

Operating lease right-of-use asset |

|

|

|

|

|

|

||

Property and equipment, net |

|

|

|

|

|

|

||

Total assets |

|

$ |

|

|

$ |

|

||

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

||

Current liabilities: |

|

|

|

|

|

|

||

Accounts payable |

|

$ |

|

|

$ |

|

||

Accrued liabilities |

|

|

|

|

|

|

||

Deferred revenue |

|

|

|

|

|

|

||

Operating lease liability |

|

|

|

|

|

|

||

Total current liabilities |

|

|

|

|

|

|

||

Deferred revenue, long-term |

|

|

|

|

|

|

||

Operating lease liability, long-term |

|

|

|

|

|

|

||

Warrant liability |

|

|

|

|

|

|

||

Total liabilities |

|

|

|

|

|

|

||

|

|

|

|

|

|

|||

Stockholders’ equity: |

|

|

|

|

|

|

||

Preferred stock, $ |

|

|

|

|

|

|

||

Common stock, $ |

|

|

|

|

|

|

||

Additional paid-in capital |

|

|

|

|

|

|

||

Accumulated deficit |

|

|

( |

) |

|

|

( |

) |

Total stockholders’ equity |

|

|

|

|

|

|

||

Total liabilities and stockholders’ equity |

|

$ |

|

|

$ |

|

||

See accompanying notes to condensed financial statements.

3

MEI PHARMA, INC.

CONDENSED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts)

(Unaudited)

|

|

Three Months Ended |

|

|

Six Months Ended |

|

||||||||||

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

||||

Revenue |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Cost of revenue |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Research and development |

|

|

|

|

|

|

|

|

|

|

|

|

||||

General and administrative |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Loss from operations |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Other income: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Change in fair value of warrant liability |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Interest and dividend income |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Other income |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net loss |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

Net loss: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Basic |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

Diluted |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

Net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Basic |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

Diluted |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

Shares used in computing net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Basic |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Diluted |

|

|

|

|

|

|

|

|

|

|

|

|

||||

See accompanying notes to condensed financial statements.

4

MEI PHARMA, INC.

CONDENSED STATEMENTS OF STOCKHOLDERS’ EQUITY

(In thousands)

(Unaudited)

|

|

Common Shares |

|

|

Additional |

|

|

Accumulated Deficit |

|

|

Total Stockholders’ Equity |

|

||||

Balance at June 30, 2021 |

|

|

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|||

Net loss |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Issuance of common stock for vested restricted stock units |

|

|

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

Share-based compensation expense |

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Balance at September 30, 2021 |

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|||

Net loss |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Issuance of common stock, net of issuance costs of $ |

|

|

|

|

|

|

|

|

— |

|

|

|

|

|||

Exercise of stock options |

|

|

|

|

|

|

|

|

— |

|

|

|

|

|||

Share-based compensation expense |

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Balance at December 31, 2021 |

|

|

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|||

|

|

Common Shares |

|

|

Additional |

|

|

Accumulated Deficit |

|

|

Total Stockholders’ Equity |

|

||||

Balance at June 30, 2020 |

|

|

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|||

Net loss |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Issuance of common stock, net of issuance costs of $ |

|

|

|

|

|

|

|

|

— |

|

|

|

|

|||

Exercise of stock options |

|

|

|

|

|

|

|

|

— |

|

|

|

|

|||

Share-based compensation expense |

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Balance at September 30, 2020 |

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|||

Net loss |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Exercise of stock options |

|

|

|

|

|

|

|

|

— |

|

|

|

|

|||

Share-based compensation expense |

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Balance at December 31, 2020 |

|

|

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|||

See accompanying notes to condensed financial statements.

5

MEI PHARMA, INC.

CONDENSED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

|

|

Six Months Ended |

|

|||||

|

|

2021 |

|

|

2020 |

|

||

Cash flows from operating activities: |

|

|

|

|

|

|

||

Net loss |

|

$ |

( |

) |

|

$ |

( |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

||

Change in fair value of warrant liability |

|

|

( |

) |

|

|

( |

) |

Share-based compensation |

|

|

|

|

|

|

||

Depreciation and amortization |

|

|

|

|

|

|

||

Non-cash lease expense |

|

|

|

|

|

|

||

Changes in operating assets and liabilities: |

|

|

|

|

|

|

||

Accounts receivable |

|

|

|

|

|

|

||

Contract assets |

|

|

( |

) |

|

|

( |

) |

Prepaid expenses and other current assets |

|

|

( |

) |

|

|

( |

) |

Accounts payable |

|

|

( |

) |

|

|

|

|

Accrued liabilities |

|

|

|

|

|

|

||

Deferred revenue |

|

|

|

|

|

|

||

Operating lease liability |

|

|

( |

) |

|

|

|

|

Net cash used in operating activities |

|

|

( |

) |

|

|

( |

) |

Cash flows from investing activities: |

|

|

|

|

|

|

||

Purchases of property and equipment |

|

|

( |

) |

|

|

( |

) |

Purchases of short-term investments |

|

|

( |

) |

|

|

( |

) |

Proceeds from maturity of short-term investments |

|

|

|

|

|

|

||

Net cash used in investing activities |

|

|

( |

) |

|

|

( |

) |

Cash flows from financing activities: |

|

|

|

|

|

|

||

Payment of RSU tax withholdings in exchange for common shares surrendered by RSU holders |

|

|

( |

) |

|

|

|

|

Proceeds from exercise of stock options |

|

|

|

|

|

|

||

Proceeds from issuance of common stock, gross |

|

|

|

|

|

|

||

Payment of issuance costs |

|

|

( |

) |

|

|

( |

) |

Net cash provided by financing activities |

|

|

|

|

|

|

||

Net increase (decrease) in cash and cash equivalents |

|

|

|

|

|

( |

) |

|

Cash and cash equivalents at beginning of the period |

|

|

|

|

|

|

||

Cash and cash equivalents at end of the period |

|

$ |

|

|

$ |

|

||

Supplemental disclosures: |

|

|

|

|

|

|

||

Income taxes paid |

|

$ |

|

|

$ |

( |

) |

|

Operating lease right-of-use assets obtained in exchange for operating lease liabilities |

|

$ |

|

|

$ |

|

||

See accompanying notes to condensed financial statements.

6

MEI PHARMA, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

(Unaudited)

Note 1. The Company and Summary of Significant Accounting Policies

The Company

MEI Pharma, Inc. is a late-stage pharmaceutical company committed to the development and commercialization of novel cancer therapies intended to improve outcomes for patients. Our portfolio of drug candidates includes

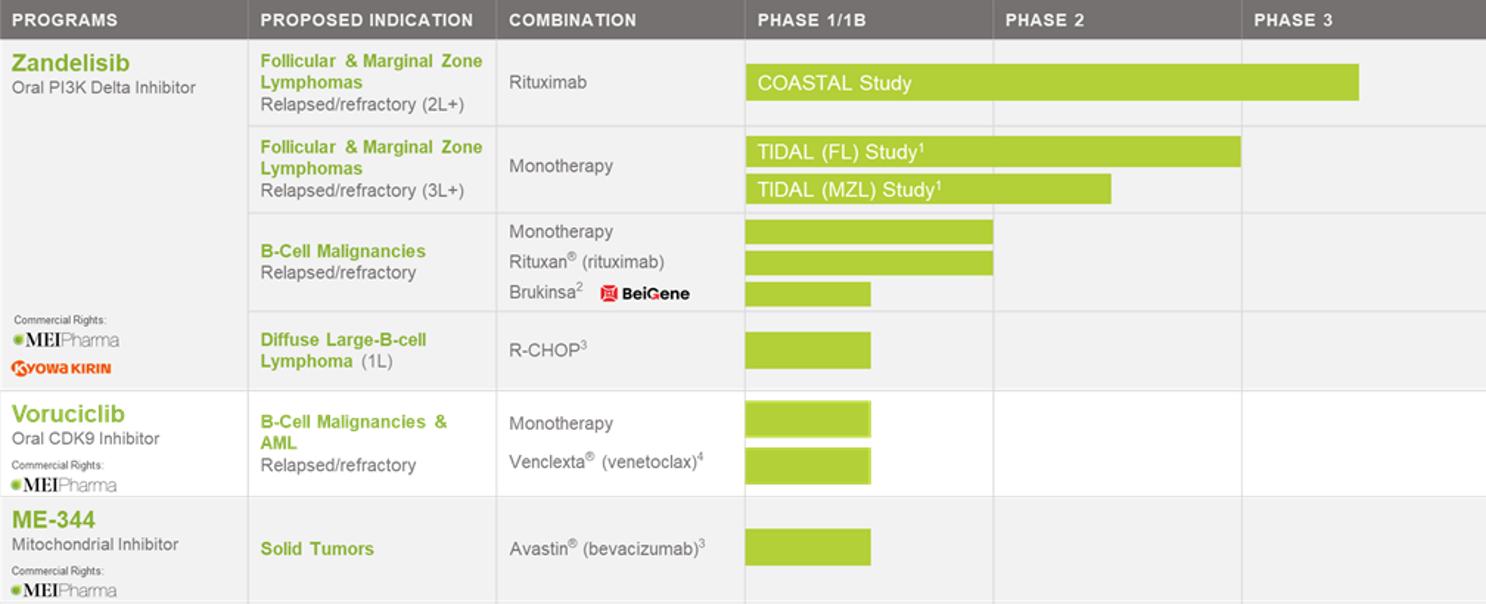

Clinical Development Programs

We build our pipeline by licensing or acquiring promising cancer agents and creating value in programs through development, commercialization and strategic partnerships, as appropriate. Our objective is to leverage the mechanisms and properties of our pipeline drug candidates to optimize the balance between efficacy and tolerability to meet the needs of patients with cancer. Our drug candidate pipeline includes:

The results of pre-clinical studies and completed clinical trials are not necessarily predictive of future results, and our current drug candidates may not have favorable results in later studies or trials. The commercial opportunity will be reduced or eliminated if competitors develop and market products that are more effective, have fewer side effects or are less expensive than our drug candidates. We will need substantial additional funds to progress the clinical trial programs for the drug candidates zandelisib, voruciclib, and ME-344, and to develop new compounds. The actual amount of funds that will be needed are determined by a number of factors, some of which are beyond our control. Negative U.S. and global economic conditions may pose challenges to our business strategy, which relies on funding from the financial markets or collaborators.

Liquidity

We have accumulated losses of $

To date, we have obtained cash and funded our operations primarily through equity financings and license agreements. In order to continue the development of our drug candidates, at some point in the future we expect to pursue one or more capital transactions, whether through the sale of equity securities, debt financing, license agreements or entry into strategic partnerships. There can be no assurance that we will be able to continue to raise additional capital in the future.

Basis of Presentation

The accompanying unaudited financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) for interim financial information and in accordance with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, the accompanying financial statements do not include all of the information and notes required by U.S. GAAP for complete financial statements. In the opinion of management, the accompanying financial statements reflect all adjustments (consisting of normal recurring adjustments) that are necessary for a fair statement of the financial position, results of operations and cash flows for the periods presented.

7

The accompanying unaudited financial statements should be read in conjunction with the audited financial statements and notes thereto as of and for the fiscal year ended June 30, 2021, included in our Annual Report on Form 10-K (“2021 Annual Report”) filed with the Securities and Exchange Commission on September 2, 2021. Interim results are not necessarily indicative of results for a full year.

Reclassifications

Certain reclassifications have been made to the prior year financial statements to conform to the current year financial statement presentation of contract assets and cash flows from financing activities. These changes did not impact previously reported net loss, loss per share, stockholders’ equity, total assets or cash flows.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the amounts reported in the financial statements and disclosures made in the accompanying notes to the financial statements. We use estimates that affect the reported amounts (including assets, liabilities, revenues and expenses) and related disclosures. Actual results could materially differ from those estimates.

Revenue Recognition

Accounting Standards Codification ("ASC") Topic 606, Revenue from Contracts with Customers (“Topic 606” or the “new revenue standard”)

We recognize revenue when control of the promised goods or services is transferred to our customers, in an amount that reflects the consideration we expect to be entitled to in exchange for those goods or services. For enforceable contracts with our customers, we first identify the distinct performance obligations – or accounting units – within the contract. Performance obligations are commitments in a contract to transfer a distinct good or service to the customer.

Payments received under commercial arrangements, such as licensing technology rights, may include non-refundable fees at the inception of the arrangements, milestone payments for specific achievements designated in the agreements, and royalties on the sale of products. At the inception of arrangements that include milestone payments, we use judgment to evaluate whether the milestones are probable of being achieved and we estimate the amount to include in the transaction price using the most likely method. If it is probable that a significant revenue reversal will not occur, the estimated amount is included in the transaction price. Milestone payments that are not within our or the licensee’s control, such as regulatory approvals, are not included in the transaction price until those approvals are received. At the end of each reporting period, we re-evaluate the probability of achievement of development milestones and any related constraint and, as necessary, we adjust our estimate of the overall transaction price. Any adjustments are recorded on a cumulative catch-up basis, which would affect revenues and earnings in the period of adjustment.

We develop estimates of the stand-alone selling price for each distinct performance obligation. Variable consideration that relates specifically to our efforts to satisfy specific performance obligations is allocated entirely to those performance obligations. Other components of the transaction price are allocated based on the relative stand-alone selling price, over which management has applied significant judgment. We develop assumptions that require judgment to determine the stand-alone selling price for license-related performance obligations, which may include forecasted revenues, development timelines, reimbursement rates for personnel costs, discount rates and probabilities of technical, regulatory and commercial success. We estimate stand-alone selling price for research and development performance obligations by forecasting the expected costs of satisfying a performance obligation plus an appropriate margin.

In the case of a license that is a distinct performance obligation, we recognize revenue allocated to the license from non-refundable, up-front fees at the point in time when the license is transferred to the licensee and the licensee can use and benefit from the license. For licenses that are bundled with other distinct or combined obligations, we use judgment to assess the nature of the performance obligation to determine whether the performance obligation is satisfied over time or at a point in time and, if over time, the appropriate method of measuring progress for purposes of recognizing revenue. If the performance obligation is satisfied over time, we evaluate the measure of progress each reporting period and, if necessary, adjust the measure of performance and related revenue recognition.

The selection of the method to measure progress towards completion requires judgment and is based on the nature of the products or services to be provided. Revenue is recorded proportionally as costs are incurred. We generally use the cost-to-cost measure of progress because it best depicts the transfer of control to the customer which occurs as we incur costs. Under the cost-to-cost measure of progress, the extent of progress towards completion is measured based on the ratio of costs incurred to date to the total estimated costs at completion of the performance obligation (an “input method” under Topic 606). We use judgment to estimate the total cost expected to complete the research and development performance obligations, which include subcontractors’ costs, labor,

8

materials, other direct costs and an allocation of indirect costs. We evaluate these cost estimates and the progress each reporting period and, as necessary, we adjust the measure of progress and related revenue recognition.

For arrangements that include sales-based or usage-based royalties, we recognize revenue at the later of (i) when the related sales occur or (ii) when the performance obligation to which some or all of the royalty has been allocated has been satisfied or partially satisfied. To date, we have not recognized any sales-based or usage-based royalty revenue from license agreements.

We recognized revenue associated with the following license agreements (in thousands):

|

|

Three Months Ended |

|

|

Six Months Ended |

|

||||||||||

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

||||

KKC License Agreements |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Helsinn License Agreement |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Timing of Revenue Recognition: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Services performed over time |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

The KKC Commercialization Agreement and KKC Japan License Agreement (Note 3) included other distinct performance obligations satisfied over time, and accordingly we recognized $

Based on the characteristics of the Helsinn License Agreement (Note 3), we recognized revenue based on the extent of progress towards completion of the performance obligations. The Helsinn License Agreement was terminated in November 2021.

Contract Balances

Contract liabilities are included in “Deferred revenue” and “Deferred revenue long-term”.

|

|

Six Months Ended |

|

|||||

|

|

2021 |

|

|

2020 |

|

||

Accounts Receivable |

|

|

|

|

|

|

||

Accounts Receivable, beginning of period |

|

$ |

|

|

$ |

|

||

Amounts billed |

|

|

|

|

|

|

||

Payments received |

|

|

( |

) |

|

|

( |

) |

Accounts Receivable, end of period |

|

$ |

|

|

$ |

|

||

Contract assets |

|

|

|

|

|

|

||

Contract assets, beginning of period |

|

$ |

|

|

$ |

|

||

Billable amounts |

|

|

|

|

|

|

||

Amounts billed |

|

|

( |

) |

|

|

( |

) |

Contract assets, end of period |

|

$ |

|

|

$ |

|

||

Contract liabilities |

|

|

|

|

|

|

||

Contract liabilities, beginning of period |

|

$ |

|

|

$ |

|

||

Net change |

|

|

|

|

|

|

||

Contract liabilities, end of period |

|

$ |

|

|

$ |

|

||

The timing of revenue recognition, invoicing and cash collections results in billed accounts receivable and unbilled receivables (contract assets) and deferred revenue (contract liabilities). We invoice our customers in accordance with agreed-upon contractual terms, typically at periodic intervals or upon achievement of contractual milestones. Invoicing may occur subsequent to revenue recognition, resulting in contract assets. We may receive advance payments from our customers before revenue is recognized, resulting in contract liabilities. The contract assets and liabilities reported on the Condensed Balance Sheet relate to the KKC Commercialization Agreement.

9

As of December 31, 2021, we had $

As of December 31, 2021, we had $

Our contract liabilities accounted for under Topic 606 relate to the amount of initial upfront consideration that was allocated to the research and development performance obligations as well as additional cost reimbursements in excess of revenue recognized. Contract liabilities are expected to be recognized over the duration of the performance obligations based on the costs incurred relative to total expected costs. Our contract liabilities may fluctuate due to changes in the total estimated cost of the performance obligations and our expected reimbursement of those costs. For the six months ended December 31, 2021, we recognized revenue of $

For the six months ended December 31, 2020, we recognized revenue of $

Revenues from Collaborators

We earn revenue in connection with collaboration agreements, which are described in Note 3, License Agreements.

At contract inception, we assess whether the collaboration arrangements are within the scope of ASC Topic 808, Collaborative Arrangements (“Topic 808”), to determine whether such arrangements involve joint operating activities performed by parties that are both active participants in the activities and exposed to significant risks and rewards dependent on the commercial success of such activities. This assessment is performed based on the responsibilities of all parties in the arrangement. For collaboration arrangements within the scope of Topic 808 that contain multiple units of account, we first determine which units of account within the arrangement are within the scope of Topic 808 and which elements are within the scope of Topic 606. For units of account within collaboration arrangements that are accounted for pursuant to Topic 808, an appropriate recognition method is determined and applied consistently, by analogy to authoritative accounting literature. For elements of collaboration arrangements that are accounted for pursuant to Topic 606, we recognize revenue as discussed above. Consideration received that does not meet the requirements to satisfy Topic 606 revenue recognition criteria is recorded as deferred revenue in the accompanying consolidated balance sheets, classified as either short-term or long-term deferred revenue based on our best estimate of when such amounts will be recognized.

Research and Development Costs

Research and development costs are expensed as incurred and include costs paid to third-party contractors to perform research, conduct clinical trials and develop and manufacture drug materials. Clinical trial costs, including costs associated with third-party contractors, are a significant component of research and development expenses. We expense research and development costs based on work performed. In determining the amount to expense, management relies on estimates of total costs based on contract components completed, the enrollment of subjects, the completion of trials, and other events. Costs incurred related to the purchase or licensing of in-process research and development for early-stage products or products that are not commercially viable and ready for use, or have no alternative future use, are charged to expense in the period incurred.

Share-based Compensation

Share-based compensation expense for employees and directors is recognized in the Condensed Statement of Operations based on estimated amounts, including the grant date fair value and the expected service period. For stock options, we estimate the grant date fair value using a Black-Scholes valuation model, which requires the use of multiple subjective inputs including estimated future volatility, expected forfeitures and the expected term of the awards. We estimate the expected future volatility based on the stock’s historical price volatility. The stock’s future volatility may differ from the estimated volatility at the grant date. For restricted stock unit (“RSU”) equity awards, we estimate the grant date fair value using our closing stock price on the date of grant. We recognize the effect of forfeitures in compensation expense when the forfeitures occur. The estimated forfeiture rates may differ from actual forfeiture rates which would affect the amount of expense recognized during the period. We recognize the value of the awards over the awards’ requisite service or performance periods. The requisite service period is generally the time over which our share-based awards vest.

10

Income Taxes

Our income tax expense consists of current and deferred income tax expense or benefit. Current income tax expense or benefit is the amount of income taxes expected to be payable or refundable for the current year. A deferred income tax asset or liability is recognized for the future tax consequences attributable to tax credits and loss carryforwards and to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. As of December 31, 2021, we have established a valuation allowance to fully reserve our net deferred tax assets. Tax rate changes are reflected in income during the period such changes are enacted. Changes in our ownership may limit the amount of net operating loss carryforwards that can be utilized in the future to offset taxable income.

There have been

Leases

We account for our leases under FASB ASC Topic 842, Leases (“ASC 842”). Leases which are identified within the scope of ASC 842 and which have a term greater than one year are recognized on our Condensed Balance Sheet as ROU assets and lease liabilities. Operating lease liabilities and their corresponding ROU assets are recorded based on the present value of lease payments over the expected remaining lease term. The lease term includes any renewal options and termination options that we are reasonably certain to exercise. Certain adjustments to the right-of-use asset may be required for items such as initial direct costs paid or incentives received. The present value of lease payments is determined by using the interest rate implicit in the lease, if that rate is readily determinable; otherwise, we use our incremental borrowing rate. The incremental borrowing rate is determined based on the rate of interest that we would pay to borrow on a collateralized basis an amount equal to the lease payments for a similar term and in a similar economic environment. The interest rate implicit in lease contracts to calculate the present value is typically not readily determinable. As such, significant management judgment is required to estimate the incremental borrowing rate.

Rent expense for operating leases is recognized on a straight-line basis over the lease term based on the total lease payments. We have elected the practical expedient to not separate lease and non-lease components for our real estate leases. Our non-lease components are primarily related to property maintenance, which varies based on future outcomes, and thus is recognized in rent expense when incurred.

Note 2. Fair Value Measurements

Fair value is defined as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. Valuation techniques used to measure fair value must maximize the use of observable inputs and minimize the use of unobservable inputs. The fair value hierarchy based on three levels of inputs, of which the first two are considered observable and the last unobservable, that may be used to measure fair value is as follows:

We measure the following financial instruments at fair value on a recurring basis. The fair values of these financial instruments were as follows (in thousands):

|

|

December 31, 2021 |

|

|

June 30, 2021 |

|

||||||||||||||||||

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

||||||

Warrant liability |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

||

Total |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

|

||

The carrying amounts of financial instruments such as cash equivalents, short-term investments and accounts payable approximate the related fair values due to the short-term maturities of these instruments. We invest our excess cash in financial

11

instruments which are readily convertible into cash, such as money market funds and U.S. government securities. Cash equivalents, where applicable, and short-term investments are classified as Level 1 as defined by the fair value hierarchy.

In May 2018, we issued warrants in connection with our private placement of shares of common stock. Pursuant to the terms of the warrants, we could be required to settle the warrants in cash in the event of an acquisition of the Company and, as a result, the warrants are required to be measured at fair value and reported as a liability in the Condensed Balance Sheet. We recorded the fair value of the warrants upon issuance using the Black-Scholes valuation model and are required to revalue the warrants at each reporting date with any changes in fair value recorded on our Condensed Statement of Operations. The valuation of the warrants is considered under Level 3 of the fair value hierarchy due to the need to use assumptions in the valuation that are both significant to the fair value measurement and unobservable. Inputs used to determine estimated fair value of the warrant liabilities include the estimated fair value of the underlying stock at the valuation date, the estimated term of the warrants, risk-free interest rates, expected dividends and the expected volatility of the underlying stock. The significant unobservable inputs used in the fair value measurement of the warrant liabilities were the volatility rate and the estimated term of the warrants. Generally, increases (decreases) in the fair value of the underlying stock and estimated term would result in a directionally similar impact to the fair value measurement. The change in the fair value of the Level 3 warrant liability is reflected in the Condensed Statement of Operations for the three and six months ended December 31, 2021 and 2020, respectively.

To calculate the fair value of the warrant liability, the following assumptions were used:

|

|

December 31, |

|

|

June 30, |

|

||

Risk-free interest rate |

|

|

% |

|

|

% |

||

Expected life (years) |

|

|

|

|

|

|

||

Expected volatility |

|

|

% |

|

|

% |

||

Dividend yield |

|

|

% |

|

|

% |

||

Black-Scholes Fair Value |

|

$ |

|

|

$ |

|

||

The following table sets forth a summary of changes in the estimated fair value of our Level 3 warrant liability for the six months ended December 31, 2021 and 2020 (in thousands):

|

|

Fair Value of Warrants Using Significant Unobservable Inputs (Level 3) |

|

|||||

|

|

2021 |

|

|

2020 |

|

||

Balance at July 1, |

|

$ |

|

|

$ |

|

||

Change in estimated fair value of liability classified warrants |

|

|

( |

) |

|

|

( |

) |

Balance at December 31, |

|

$ |

|

|

$ |

|

||

Note 3. License Agreements

KKC License, Development and Commercialization Agreement

In April 2020, we entered into the License, Development and Commercialization Agreement (the “KKC Commercialization Agreement”) with Kyowa Kirin Company (“KKC”). Under the agreement, we granted to KKC a co-exclusive, sublicensable, payment-bearing license under certain patents and know-how controlled by us to develop and commercialize zandelisib and any pharmaceutical product containing zandelisib for all human indications in the U.S. (the "U.S. License"), and an exclusive (subject to certain retained rights to perform obligations under the KKC Commercialization Agreement), sublicensable, payment-bearing, license under certain patents and know-how controlled by us to develop and commercialize zandelisib and any pharmaceutical product containing zandelisib for all human indications in countries outside of the United States (the “Ex-U.S.”) (the “Ex-U.S. License”). KKC granted to us a co-exclusive, sublicensable, license under certain patents and know-how controlled by KKC to develop and commercialize zandelisib for all human indications in the U.S., and a co-exclusive, sublicensable, royalty-free, fully paid license under certain patents and know-how controlled by KKC to perform our obligations in the Ex-U.S. under the KKC Commercialization Agreement. KKC paid us an initial payment of $

KKC will be responsible for the development and commercialization of zandelisib in the Ex-U.S. and, subject to certain exceptions, will be solely responsible for all costs related thereto. We will co-develop and co-promote zandelisib with KKC in the U.S., with the Company recording all revenue from U.S. sales. We will share U.S. profits and costs (including development costs) on

12

a 50-50 basis with KKC. We will also provide to KKC certain drug supplies necessary for the development and commercialization of zandelisib in the Ex-U.S., with the understanding that KKC will assume responsibility for manufacturing for the Ex-U.S. as soon as practicable.

We assessed the KKC Commercialization Agreement in accordance with Topic 808 and Topic 606 and determined that our obligations comprise the U.S. License, the Ex-U.S. License, and development services (the “Development Services”). We determined that the KKC Commercialization Agreement is a collaborative arrangement in accordance with Topic 808 that contains multiple units of account, as we and KKC are both active participants in the development and commercialization activities and are exposed to significant risks and rewards that are dependent on commercial success of the activities of the arrangement. The U.S. License is a unit of account under the scope of Topic 808 and is not a deliverable under Topic 606, while the Ex-U.S. License and Development Services performance obligations are under the scope of Topic 606.

We determined, at the time of our initial assessment, that the total transaction price of $

We allocated the transaction price to each unit of account. Variable consideration that relates specifically to our efforts to satisfy specific performance obligations are allocated entirely to those performance obligations. Other components of the transaction price are allocated based on the relative stand-alone selling price, over which management has applied significant judgment. We developed the estimated stand-alone selling price for the licenses using the risk-adjusted net present values of estimated cash flows, and the estimated stand-alone selling price of the development services performance obligations by estimating costs to be incurred, and an appropriate margin, using an income approach.

We determined that control of the U.S. License and Ex-U.S. License were transferred to KKC during the year ended June 30, 2020, and recognized revenue of $

Helsinn License Agreement

In August 2016, we entered into an exclusive worldwide license, development, manufacturing and commercialization agreement with Helsinn Healthcare SA, a Swiss pharmaceutical corporation (“Helsinn”) for pracinostat in acute myeloid leukemia (“AML”), myelodysplastic syndrome (“MDS”) and other potential indications (the “Helsinn License Agreement”). The Helsinn License Agreement was terminated in November 2021.

Presage License Agreement

In September 2017, we entered into a license agreement with Presage Biosciences, Inc. (“Presage”). Under the terms of such license agreement (the “Presage License Agreement”), Presage granted to us exclusive worldwide rights to develop, manufacture and commercialize voruciclib, a clinical-stage, oral and selective CDK inhibitor, and related compounds. In exchange, we paid $

13

Note 4. BeiGene Collaboration

In October 2018, we entered into a clinical collaboration with BeiGene, Ltd. (“BeiGene”) to evaluate the safety and efficacy of zandelisib in combination with BeiGene’s zanubrutinib (marketed as Brukinsa®), an inhibitor of Bruton’s tyrosine kinase, for the treatment of patients with B-cell malignancies. Under the terms of the clinical collaboration agreement, we amended our ongoing Phase 1b trial to include evaluation of zandelisib in combination with zanubrutinib in patients with B-cell malignancies. Study costs are being shared equally by the parties, and we agreed to supply zandelisib and BeiGene agreed to supply zanubrutinib. We record the costs reimbursed by BeiGene as a reduction of our research and development expenses. We retained full commercial rights for zandelisib and BeiGene retained full commercial rights for zanubrutinib.

Note 5. Net Loss Per Share

Basic and diluted net loss per share are computed using the weighted-average number of shares of common stock outstanding during the period, less any shares subject to repurchase or forfeiture. There were

The following table presents the calculation of net loss used to calculate basic loss and diluted loss per share (in thousands):

|

|

Three Months Ended |

|

|

Six Months Ended |

|

||||||||||

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

||||

Net loss – basic |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

Change in fair value of warrant liability |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Net loss – diluted |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

Share used in calculating net loss per share was determined as follows (in thousands):

|

|

Three Months Ended |

|

|

Six Months Ended |

|

||||||||||

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

||||

Weighted average shares used in calculating basic net loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Effect of potentially dilutive common shares from equity awards and liability-classified warrants |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Weighted average shares used in calculating diluted net loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Our potentially dilutive shares, which include outstanding stock options, restricted stock units, and warrants, are considered to be common stock equivalents and are only included in the calculation of diluted net loss per share when their effect is dilutive.

The following table presents weighted-average potentially dilutive shares that have been excluded from the calculation of net loss per share because of their anti-dilutive effect (in thousands):

|

|

Three Months Ended |

|

|

Six Months Ended |

|

||||||||||

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

||||

Stock options |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Restricted stock units |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total anti-dilutive shares |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Note 6. Commitments and Contingencies

We have contracted with various consultants and third parties to assist us in pre-clinical research and development and clinical trials work for our leading drug compounds. The contracts are terminable at any time, but obligate us to reimburse the providers for any time or costs incurred through the date of termination. We also have employment agreements with certain of our current employees that provide for severance payments and accelerated vesting for share-based awards if their employment is terminated under specified circumstances.

14

Presage License Agreement

As discussed in Note 3, we are party to a license agreement with Presage under which we may be required to make future payments upon the achievement of certain development, regulatory and commercial milestones, as well as potential future royalties based upon net sales. As of December 31, 2021, we had

COVID-19

As a result of the ongoing and rapidly evolving COVID-19 pandemic, various public health orders and guidance measures have been implemented across much of the United States, and across the globe, including in the locations of our office, clinical trial sites, key vendors and partners. Despite the relaxation of many governmental orders earlier this year, COVID-19 still impacts the normal conduct of business. While we continue to enroll and dose patients in our clinical trials, our clinical development program timelines may continue to be subject to potential negative impacts from the ongoing pandemic in the U.S. and globally.

We may experience enrollment delays and suspensions, patient withdrawals, postponement of planned clinical or preclinical studies, redirection of site resources from studies, and study deviations or noncompliance. We may also need to maintain or implement study modifications, suspensions, or terminations, the introduction of additional remote study procedures and modified informed consent procedures, study site changes, direct delivery of investigational products to patient homes or alternative sites, which may require state licensing, and changes or delays in site monitoring. The foregoing may require that we consult with relevant review and ethics committees, Institutional Review Boards ("IRBs"), and the FDA. The foregoing may also impact the integrity of our study data. The COVID-19 outbreak may further increase the need for clinical trial patient monitoring and regulatory reporting of adverse effects, and may delay regulatory authority meetings, inspections, or the regulatory review of marketing or investigational applications or submissions.

Not only might the continuing COVID-19 pandemic impact the conduct of our clinical trials, but it may also impact our ability to procure the necessary supply of our investigational drug products, as well as any ancillary supplies necessary for the conduct of our studies. Third party manufacturers may also need to implement measures and changes, or deviate from typical manufacturing requirements that may otherwise adversely impact our product candidates.

Government stimulus programs enacted in response to the COVID-19 pandemic have not had a material impact on our financial condition, results of operations, or liquidity.

Note 7. Leases

We are party to a lease agreement for approximately

The total operating lease costs were as follows (in thousands):

|

|

Three Months Ended |

|

|

Six Months Ended |

|

||||||||||

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

||||

Operating lease cost |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Supplemental cash flow information related to our operating leases were as follows (in thousands):

|

|

Three Months Ended |

|

|

Six Months Ended |

|

||||||||||

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

||||

Cash paid for amounts included in the measurement of lease liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Operating cash flows from operating leases |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Right-of-use assets obtained in exchange for operating lease obligations: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

15

The following is a schedule of the future minimum rental payments for our operating lease, reconciled to the lease liability as of December 31, 2021 (in thousands):

|

|

December 31, |

|

|

Remainder of fiscal year ending June 30, 2022 |

|

$ |

|

|

Years ending June 30, |

|

|

|

|

2023 |

|

|

|

|

2024 |

|

|

|

|

2025 |

|

|

|

|

2026 |

|

|

|

|

2027 |

|

|

|

|

Thereafter |

|

|

|

|

Total lease payments |

|

|

|

|

Less: Present value discount |

|

|

( |

) |

Total operating lease liability |

|

$ |

|

|

Balance Sheet Classification – Operating Lease |

|

|

|

|

Operating lease liability |

|

$ |

|

|

Operating lease liability, long-term |

|

|

|

|

Total operating lease liability |

|

$ |

|

|

Other Balance Sheet Information – Operating Lease |

|

|

|

|

Weighted average remaining lease term (in years) |

|

|

|

|

Weighted average discount rate |

|

|

% |

|

Note 8. Short-Term Investments

As of December 31, 2021, and June 30, 2021, our short-term investments consisted of $

Note 9. Stockholders’ Equity

Equity Transactions

Underwritten Registered Offering

In December 2021, we completed an underwritten registered offering of

Shelf Registration Statement

We have a shelf registration statement that permits us to sell, from time to time, up to $

At-The-Market Equity Offering

On November 10, 2020, we entered into an At-The-Market Equity Offering Sales Agreement (the “2020 ATM Sales Agreement”), pursuant to which we may sell an aggregate of up to $

During the six months ended December 31, 2020, we sold

Warrants

As of December 31, 2021, we have outstanding warrants to purchase

16

required to settle the warrants in cash in the event of an acquisition of the Company and, as a result, the warrants are required to be measured at fair value and reported as a liability in the Condensed Balance Sheet. Therefore, we are required to account for the warrants as liabilities and record them at fair value. The warrants were revalued as of December 31, 2021 and June 30, 2021 at $

Note 10. Share-based Compensation

We use equity-based compensation programs to provide long-term performance incentives for our employees. These incentives consist primarily of stock options and RSUs. In December 2008, we adopted the MEI Pharma, Inc. 2008 Stock Omnibus Equity Compensation Plan (“Omnibus Plan”), as amended and restated from time-to-time, under which

In May 2021, we adopted the 2021 Inducement Plan ("Inducement Plan"), under which

Total share-based compensation expense for all stock awards consists of the following (in thousands):

|

|

Three Months Ended |

|

|

Six Months Ended |

|

||||||||||

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

||||

Research and development |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

General and administrative |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total share-based compensation |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Stock Options

Stock option activity for the six months ended December 31, 2021 was as follows:

|

|

Number of |

|

|

Weighted- |

|

|

Weighted-Average |

|

|

Aggregate |

|

||||

Outstanding at June 30, 2021 |

|

|

|

|

$ |

|

|

|

|

|

|

|

||||

Granted |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Exercised |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|||

Forfeited / Cancelled |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|||

Outstanding at December 31, 2021 |

|

|

|

|

|

|

|

|

|

|

$ |

|

||||

Vested and exercisable at December 31, 2021 |

|

|

|

|

|

|

|

|

|

|

$ |

|

||||

The fair value of each stock option granted during the six months ended December 31, 2021 is estimated on the grant date under the fair value method using a Black-Scholes valuation model. Stock options granted to employees during the six months ended December 31, 2021 vest

17

The following weighted-average assumptions were used to determine the fair value of options granted during the period:

|

|

Six Months Ended |

|

|||||

|

|

2021 |

|

|

2020 |

|

||

Risk-free interest rate |

|

|

% |

|

|

% |

||

Expected life (years) |

|

|

|

|

|

|

||

Expected volatility |

|

|

% |

|

|

% |

||

Dividend yield |

|

|

% |

|

|

% |

||

Weighted-average grant date fair value |

|

$ |

|

|

$ |

|

||

As of December 31, 2021, there was $

Restricted Stock Units

RSU activity for the six months ended December 31, 2021 was as follows:

|

|

Number of |

|

|

Weighted-Average |

|

||

Non-vested at June 30, 2021 |

|

|

|

|

$ |

|

||

Vested |

|

|

( |

) |

|

$ |

|

|

Forfeited / Cancelled |

|

|

( |

) |

|

$ |

|

|

Non-vested at December 31, 2021 |

|

|

|

|

$ |

|

||

Each RSU represents the contingent right to receive

18

Item 2: Management’s Discussion and Analysis of Financial Condition and Results of Operations

This Quarterly Report on Form 10-Q includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical facts contained in this Quarterly Report, including statements regarding the future financial position, business strategy and plans and objectives of management for future operations, are forward-looking statements. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “expect,” and similar expressions, as they relate to us, are intended to identify forward-looking statements. We have based these forward-looking statements largely on current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including, without limitation, those described in “Risk Factors” in our 2021 Annual Report on Form 10-K, as filed with the Securities and Exchange Commission on September 2, 2021. Set forth below is a summary of the principal risks we face:

19

20

These risks are not exhaustive. Other sections of this report and our other filings with the SEC include additional factors which could adversely impact our business and financial performance. Moreover, we operate in a very competitive and rapidly changing environment. There is substantial uncertainty regarding the impact of the COVID-19 on our business, industry, global economic conditions and government policy. New risk factors emerge from time to time and it is not possible for us to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. We cannot assure you that the events and circumstances reflected in the forward-looking statements will be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Past performance may not be an indicator of future results. The following discussion is qualified in its entirety by, and should be read in conjunction with, the more detailed information set forth in the financial statements and the notes thereto appearing elsewhere in this Quarterly Report on Form 10-Q and the audited financial statements and notes thereto included in our 2021 Annual Report, as filed with the SEC. Operating results are not necessarily indicative of results that may occur in future periods.

Overview and Recent Developments

We are a late-stage pharmaceutical company committed to the development and commercialization of novel cancer therapies intended to improve outcomes for patients. Our portfolio of drug candidates has three clinical-stage assets, including zandelisib, currently in multiple ongoing clinical studies intended to support marketing applications with the U.S. Food and Drug Administration (“FDA”) and other regulatory authorities globally. Our common stock is listed on the Nasdaq Capital Market under the symbol “MEIP.”

Our approach to building our pipeline is to license or acquire promising cancer agents and build value in programs through development, commercialization and strategic partnerships, as appropriate.

As a result of the ongoing and rapidly evolving COVID-19 pandemic, various public health orders and guidance measures have been implemented across much of the United States, and across the globe, including in the locations of our office, clinical trial sites, key vendors and partners. The COVID-19 virus may continue to mutate into different strains, which could be more contagious or severe or for which current vaccines and treatments are not effective or available.

While we continue to enroll and dose patients in our clinical trials, certain of our clinical trials evaluating zandelisib and voruciclib have been delayed due to COVID-19, and our clinical development program timelines may continue to be subject to potential negative impacts from the ongoing pandemic in the U.S. and globally. The extent to which the ongoing pandemic continues to impact our business, including our preclinical studies, chemistry, manufacturing and controls (“CMC”) studies, manufacturing, and clinical trials, will depend on future developments, which are highly uncertain and cannot be predicted with confidence including the fluctuating geographic distribution of the disease, the duration of the pandemic, the development, effectiveness and timing of distribution of treatments and vaccines for COVID-19, travel restrictions and social distancing in the United States and other countries, business closures or business disruptions and the effectiveness of actions taken in the United States and other countries to contain and treat the disease and to minimize its economic impact, including vaccination rates and effectiveness. See the section entitled "Results of Operations - Contractual Obligations - COVID-19."

Clinical Development Programs

We build our pipeline by licensing or acquiring promising cancer agents and creating value in programs through development, commercialization and strategic partnerships, as appropriate. Our objective is to leverage the mechanisms and properties of our pipeline drug candidates to optimize the balance between efficacy and tolerability to meet the needs of patients with cancer. Our drug candidate pipeline includes:

21

Zandelisib (f/k/a ME-401): PI3Kδ Inhibitor in Multiple Trials Intended to Support Marketing Approvals in Relapsed or Refractory Follicular and Marginal Zone Lymphomas

Zandelisib is an oral, once-daily, selective PI3Kδ inhibitor in clinical development for the treatment of B-cell malignancies. In March 2020, the FDA granted zandelisib Fast Track designation for the treatment of adult patients with relapsed or refractory (“r/r”) follicular lymphoma (“FL”) who have received at least two prior systemic therapies. In November 2021 the FDA granted orphan-drug designation to zandelisib for the treatment of follicular lymphoma. In April 2020, we entered into a global license, development and commercialization agreement to further develop and commercialize zandelisib with Kyowa Kirin Co., Ltd. (“KKC”). MEI and KKC will co-develop and co-promote zandelisib in the U.S., with MEI recording all revenue from U.S. sales. KKC has exclusive commercialization rights outside of the U.S.

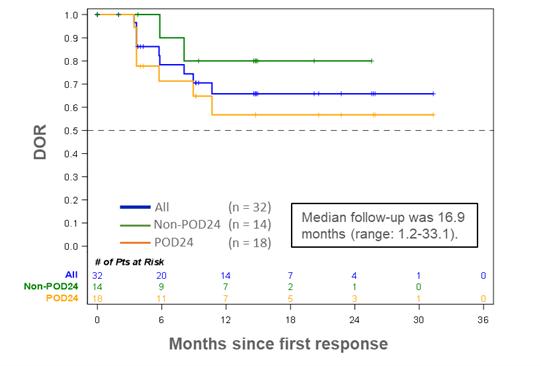

We are conducting multiple ongoing studies evaluating zandelisib. Our studies include TIDAL, a Phase 2 study evaluating zandelisib as a monotherapy in patients with r/r FL and marginal zone lymphoma (“MZL”) patients who have received at least two prior lines of treatment. Enrollment in the FL cohort of the study is complete. Enrollment of the MZL cohort remains ongoing. In November 2021 TIDAL data was reported for the cohort of patients with FL, including an overall response rate of 70.3% in the primary efficacy population as determined by Independent Review Committee assessment in the primary efficacy population of 91 patients; the complete response rate was 35.2%. It was also reported that zandelisib was generally well tolerated in the TIDAL study; with 9.4 months (range: 0.8-24) median duration of follow-up in the total study population of 121 patients with FL, interim data demonstrated a discontinuation rate due to any drug related adverse event of 9.9%. Patients enrolled in the study continue to be followed for safety as well as duration of response. Subject to final results, data from TIDAL are intended to support submissions for accelerated approval marketing applications with the FDA in r/r FL and MZL patients receiving at least two prior lines of treatment.

Also ongoing is COASTAL, a Phase 3 study evaluating zandelisib in combination with rituximab in patients with r/r FL and MZL who have received at least one prior line of treatment. COASTAL is intended to support full marketing applications in the U.S. and globally in r/r FL and MZL patients receiving at least one prior line of treatment. COASTAL is also intended (subject to FDA agreement) to act as the required confirmatory study for the potential U.S. accelerated approvals of zandelisib based on the TIDAL study.

We are also conducting a multi-arm, open-label, Phase 1b dose finding and expansion trial evaluating zandelisib as a monotherapy and in combination with other therapies in patients with relapsed or refractory B-cell malignancies. Other initiated studies include Phase 1 and Phase 2 studies being conducted by KKC evaluating zandelisib as a monotherapy in patients in Japan with indolent B-cell malignancies pursuant to our agreement with KKC.

22

Zandelisib: Potentially Highly Differentiated Pharmaceutical Properties within a Clinically Validated Class of Treatments

While PI3Kδ inhibitors as a group are a clinically validated class for the treatment of B-cell malignancies, the FDA approved orally administered products, idelalisib (marketed as Zydelig®), duvelisib (marketed as COPIKTRA®), umbralisib (marketed as UKONIQ™), and the intravenously administered PI3Kδ/α inhibitor copanlisib (marketed as ALIQOPA®), are challenged by dose-limiting toxicities, modest efficacy and/or inconvenience of administration route. We believe this provides an opportunity for the development of a next-generation candidate with pharmaceutical properties that may better maximize the therapeutic potential of PI3Kδ inhibition by limiting toxicities and improving upon modest efficacy, which together hinder clinical utility.

The molecular structure and pharmacodynamic characteristics of zandelisib are distinct from the FDA approved PI3Kδ inhibitors. Clinical and preclinical data demonstrate that zandelisib’s distinct characteristics include prolonged target binding, preferential cellular accumulation, high volume of distribution throughout the body tissues, and an approximately 28-hour half-life suitable for once daily oral administration. The properties of zandelisib support the evaluation of an innovative dosing regimen, known as Intermittent Dosing Therapy (“IDT”). The IDT consists of daily dosing only in the first seven days of each 28-day dosing cycle. The unique zandelisib IDT is hypothesized to allow for the recovery of regulatory T cells, which in turn may lead to fewer and/or less severe immune-related adverse events. This may provide long-term disease control through maintenance therapy, without the need for dose reductions or premature discontinuations. Clinical evaluation of the IDT to date has demonstrated the potential to maintain clinical benefit while minimizing immune-related toxicities common to other PI3Kδ agents, either as a monotherapy or in combination with other therapies.

KKC License, Development and Commercialization Agreement