Form 10-K/A Idaho Strategic Resource For: Dec 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Amendment No. 1)

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______ to ______

Commission file number:

(Name of small business issuer in its charter) |

(State or other jurisdiction of incorporation or organization) | (I.R.S. employer identification No.) |

(Address of principal executive offices) (zip code)

(

Registrant’s telephone number, including area code

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

Title of Each Class |

| Trading Symbol(s) |

| Name of Each Exchange on Which Registered |

None |

| N/A |

| N/A |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

Title of Each Class |

| Trading Symbol(s) |

| Name of Each Exchange on Which Registered |

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained herein, and no disclosure will be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “small reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

☒ | Smaller reporting company | ||

|

| Emerging Growth Company |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act Yes

The aggregate market value of all common stock held by non-affiliates of the registrant, based on the average of the bid and ask prices on June 30, 2021 was $

On March 1, 2022 there were

EXPLANATORY NOTE

We are filing this Amendment No. 1 on Form 10-K/A, or this Amendment, to our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, for the purpose of reporting the information required by Items 1300 through 1305 of Regulation S-K for our mining properties under Item 2 of Part I, revising our reporting under Item 7, Part II of Form 10-K, and correcting our name in our auditor’s audit report in Item 8 of Part II. Our Annual Report on Form 10-K, or the Original Filing, was originally filed with the Securities and Exchange Commission, or the SEC, on March 31, 2022. Item 2 of Part I of Form 10-K is reorganized and includes additional disclosures and clarifications related to our properties as prescribed by Items 1300 through 1305 of Regulation S-K. Item 7 of Part II includes further details related to our increase in revenues and gross profits. Item 8 of Part II has been corrected to state our name, Idaho Strategic Resources Inc., rather than our former name, New Jersey Mining Company. And, we have included a Technical Report Summary that is attached as Exhibit 96.1 in Item 15 of Part IV.

Pursuant to the SEC rules, Item 15 of Part IV has also been amended to contain the currently dated certificates from the Company’s principal executive officer and principal financial officer pursuant to Sections 302, 303, and 308 of the Sarbanes-Oxley Act of 2002. The certificates of the Company’s principal executive officer and principal financial officer are attached to this Amendment as Exhibits 31.1, 31.2, 31.3 and 31.4.

Other than with respect to the information contained herein with respect to Item 2 of Part I, Item 7 of Part II, and Item 8 of Part II, below, this Amendment does not change any of the information contained in the Original Filing. Other than as specifically set forth herein, we have not updated or amended the disclosures contained in the Original Filing to reflect events that have occurred since the date thereof. Accordingly, this Amendment should be read in conjunction with our Original Filing. Capitalized terms used but not defined herein shall have the meanings ascribed to them in the Original Filing.

TABLE OF CONTENTS

| 2 |

| Table of Contents |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K and the exhibits attached hereto contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking statements concern the Company’s anticipated results and developments in the Company’s operations in future periods, planned exploration and development of its properties, plans related to its business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. These statements include, but are not limited to, comments regarding:

| · | the establishment and estimates of mineralization; |

| · | the grade of mineralization; |

| · | anticipated expenditures and costs in our operations; |

| · | planned exploration activities and the anticipated outcome of such exploration activities; |

| · | plans and anticipated timing for obtaining permits and licenses for our properties; |

| · | expected future financing and its anticipated outcome; |

| · | anticipated liquidity to meet expected operating costs and capital requirements; |

| · | our ability to obtain joint ventures partners and maintain working relationships with our current joint venture partners; |

| · | our ability to obtain financing to fund our estimated exploration expenditures and capital requirements; and |

| · | factors expected to impact our results of operations. |

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties, and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

| · | risks related to our limited operating history; |

| · | risks related to our history of losses and our expectation of continued losses; |

| · | risks related to our properties being in the exploration or development stage; |

| · | risks related our mineral operations being subject to government regulation; |

| · | risks related to future legislation and administrative changes to mining laws; |

| · | risks related to future legislation regarding climate change; |

| · | risks related to our ability to obtain additional capital or joint venture partners; |

| · | risks related to land reclamation requirements and costs; |

| · | risks related to mineral exploration and development activities being inherently dangerous; |

| · | risks related to our insurance coverage for operating risks; |

| · | risks related to cost increases for our exploration and development projects; |

| · | risks related to a shortage of equipment and supplies adversely affecting our ability to operate; |

| · | risks related to mineral estimates; |

| · | risks related to the fluctuation of prices for precious metals, such as gold and silver; |

| · | risks related to the competitive industry of mineral exploration; |

| · | risks related to our title and rights in our mineral properties and mill; |

| · | risks related to joint venture partners and our contractual obligations therewith; |

| · | risks related to potential conflicts of interest with our management; |

| · | risks related to our dependence on key management; |

| · | risks related to the New Jersey Mill operations, management, and milling capacity; |

| · | risks related to our business model; |

| · | risks related to evolving corporate governance standards for public companies; and |

| · | risks related to our shares of common stock. |

This list is not exhaustive of the factors that may affect our forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further under the sections titled “Description of Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Annual Report. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated, or expected. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events, except as required by law.

We qualify all the forward-looking statements contained in this Annual Report by the foregoing cautionary statements.

| 3 |

| Table of Contents |

GLOSSARY OF SIGNIFICANT MINING TERMS

Ag-Silver.

Au-Gold.

Alluvial-Adjectivally used to identify rocks or minerals deposited over time by moving water.

Argillites-Metamorphic rock containing clay minerals.

Arsenopyrite-An iron-arsenic sulfide. Common constituent of gold mineralization.

Ball Mill-A large rotating cylinder usually filled to about 45% of its total volume with steel grinding balls. The mill rotates and crushed rock is fed into one end and discharged through the other. The rock is pulverized into small particles by the cascading and grinding action of the balls.

Bedrock-Solid rock underlying overburden.

Cu-Copper.

CIL-A standard gold recovery process involving the leaching with cyanide in agitated tanks with activated carbon. CIL means "carbon-in-leach."

Crosscut-A nominally horizontal mine passageway, generally driven at right angles to the strike of a vein.

Dip-Angle made by an inclined surface with the horizontal, measured perpendicular to strike.

Deposit-A mineral deposit is a mineralized body that has been intersected by sufficient closely-spaced drill holes or underground sampling to support sufficient tonnage and average grade(s) of metal(s) to warrant further exploration or development activities.

Drift-A horizontal mine opening driven on the vein. Driving is a term used to describe the excavation of a mine passageway.

Exploration Stage-As defined by the SEC-includes all issuers engaged in the search for mineral deposits (reserves), which are not in the production stage.

Fault-A fracture in the earth’s crust accompanied by a displacement of one side of the fracture with respect to the other and in a direction parallel to the fracture.

Flotation-A physiochemical process for the separation of finely divided solids from one another. Separation of these (dissimilar) discrete solids from each other is affected by the selective attachment of the particle surface to gas bubbles.

GPT-grams per metric tonne.

Galena-A lead sulfide mineral. The most important lead mineral in the Coeur d’Alene Mining District.

Grade-A term used to assign the concentration of metals per unit weight of ore. An example-ounces of gold per ton of ore (opt). One troy ounce per short ton is 34.28 parts per million or 34.28 grams per metric tonne.

Mill-A general term used to denote a mineral processing plant.

Mineralization-The presence of minerals, usually of potential economic significance, in a specific area or geologic formation.

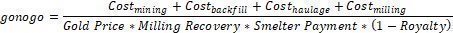

Mineral Reserve-An estimate of tonnage and grade or quality of indicated and measured mineral resources that, in the opinion of the qualified person, can be the basis of an economically viable project. More specifically, it is the economically mineable part of a measured or indicated mineral resource, which includes diluting materials and allowances for losses that may occur when the material is mined or extracted.

Mineral Resource-A concentration or occurrence of material of economic interest in or on the Earth’s crust in such form, grade or quality, and quantity that there are reasonable prospects for economic extraction. A mineral resource is a reasonable estimate of mineralization, taking into account relevant factors such as cut-off grade, likely mining dimensions, location or continuity, that, with the assumed and justifiable technical and economic conditions, is likely to, in whole or in part, become economically extractable. It is not merely an inventory of all mineralization drilled or sampled.

Net Smelter Return (“NSR”)-The Net Smelter Return from a processed ore is the value recouped from the mineral products less the costs associated with smelting, refining, and transport to the smelter. The NSR specifically does not permit the deduction of mining and milling costs.

Ore-A mineral or aggregate of minerals that can be mined and treated at a profit. A large quantity of ore that is surrounded by waste or sub-ore material is called an orebody.

| 4 |

| Table of Contents |

Patented Claim-A mineral claim where the title has been obtained from the U.S. federal government through the patent process of the 1872 Mining Law. The owner of the patented claim is granted title to the surface and mineral rights.

Production Stage-As defined by the SEC-includes all issuers engaged in the exploitation of a mineral deposit (reserve).

Proven Reserve-The economically mineable part of a measured mineral resource and can only result from conversion of a measured mineral resource.

Pyrite-An iron sulfide mineral that usually has no commercial value but is commonly associated with mineral deposits of gold, copper, and other metals.

Quartz-Crystalline silica (SiO2). An important rock-forming and gangue material in veins or other types of mineral deposits.

Quartzites-Metamorphic rock containing significant amounts of quartz.

Raise-An underground opening driven upward, generally on the vein.

Ramp-An underground opening usually driven downward, but not always, to provide access to an orebody for rubber-tired equipment such as loaders and trucks. Typically ramps are inclined at a slope grade of approximately 15%.

Rare Earth Elements (REE)- The rare earth elements (REE) comprise of 15 elements that range in atomic number from 57 (lanthanum) to 71 (lutetium) on the periodic table. Most of the REE’s are not as rare as the group’s name suggests. Although REE’s are relatively abundant in the Earth’s crust, they are rarely concentrated into mineable ore deposits. These elements are in demand because they are essential for a diverse and expanding array of high-technology applications and emerging alternative energy uses.

Royalty or NSR Royalty-A mineral royalty is a percentage of the value extracted from an ore that is paid to an interest holding party, usually a claim owner. The NSR Royalty is calculated based on the value of the processed ore after deducting the costs of smelting, refining, and transport to a smelter. However, the cost of mining and milling is not deducted. Typical NSR Royalty rates in the United States are on the order of 1–5%.

Shoot – A body of ore, usually of elongated form, extending downward or upward in a vein.

Stope-An underground void created by the mining of ore.

Strike-The bearing or azimuth of the line created by the intersection of a horizontal plane with an inclined rock strata, vein or body.

Tellurium-Relatively rare chemical element found with gold and silver that can form minerals known as tellurides.

Tetrahedrite-Sulfosalt mineral containing copper, antimony, and silver.

Vein-A zone or body of mineralized rock lying within boundaries separating it from neighboring wallrock. A mineralized zone having a more or less regular development in length, width and depth to give it a tabular form and commonly inclined at a considerable angle to the horizontal.

Unpatented Claim-A mineral claim staked on United States Public Domain (USPD) that is open for mineral entry. Unpatented lode claims can be no more than 1,500 feet long by 600 feet wide. The claimant owns the mineral rights, but does not own the surface, which is USPD. Any exploration or mining on the claim must first be submitted in a plan of operations (POO) for approval to the appropriate federal land management entity.

Wallrock-Usually barren rock surrounding a vein.

| 5 |

| Table of Contents |

PART I

ITEM 1. DESCRIPTION OF THE BUSINESS

Business

Idaho Strategic Resources, Inc. (“the Company” or “IDR”) is a gold producer with an established base in three historic mining districts in the Western United States. The Company’s primary source of revenue comes from its operating gold mine, the Golden Chest Mine located in the Murray Gold Belt of northern Idaho. The Company is also pursuing a Rare Earth Element (REE) exploration strategy and has acquired REE properties in Idaho.

Idaho Strategic Resources, Inc. (“the Company” or “IDR”) was incorporated under the laws of the State of Idaho on July 18, 1996. The Company’s head office and registered records office is located at 201 N. 3rd St. Coeur d’Alene, ID 83814.

Any Bankruptcy, Receivership or Similar Proceedings

There have been no bankruptcy, receivership, or similar proceedings.

Any Material Reclassification, Merger, Consolidation, or Purchase or Sale of a Significant Amount of Assets Not in the Ordinary Course of Business.

There have been no material reclassifications, mergers, consolidations, purchases, or sales not in the ordinary course of business for the past three years.

BUSINESS OF THE COMPANY

General Description of the Business

Domiciled in Idaho and headquartered in the Panhandle of northern Idaho, Idaho Strategic Resources, Inc. (formerly New Jersey Mining Company (NJMC)) was incorporated in the State of Idaho on July 18, 1996. On December 6, 2021, The Company changed its name to Idaho Strategic Resources, Inc. (IDR) to better reflect its corporate focus, Idaho-based operations and being domiciled in Idaho. Idaho Strategic Resources (IDR) is one of the few resource-based companies (public or private) possessing the combination of officially recognized U.S. domestic rare earth element properties (in Idaho) and Idaho-based gold production located in an established mining community.

Idaho Strategic Resources produces gold at the Golden Chest Mine located in the Murray Gold Belt (MGB) area of the world-class Coeur d’Alene Mining District, north of the prolific Silver Valley. With over 7,000 acres of patented and unpatented land, the Company has the largest private land position in the area following its consolidation of the Murray Gold Belt for the first time in over 100-years.

The Company is an established gold producer, with surface and underground mining operations at its 100-percent owned Golden Chest Mine and conducts milling operations at its majority-owned New Jersey Mill. The Company also has an expanded focus on identifying and exploring Critical Minerals (Rare Earth Minerals). Its business strategy is to grow its asset base and mineral production over time while advancing its Rare Earth Element projects. In addition to gold and gold production, the Company maintains an important strategic presence in the U.S. Critical Minerals sector, specifically focused on the more “at-risk” Rare Earth Elements (REE’s). The Company’s Diamond Creek and Roberts REE properties are included the U.S. national REE inventory as listed in USGS, IGS and DOE publications. Both projects are in central Idaho and participating in the USGS Earth MRI program, with the Diamond Creek Project also participating in the Idaho Department of Commerce’s IGEM program.

The Company holds mineral properties in three historic mining districts of Idaho and Montana. Its portfolio of mineral properties includes:

| · | The Golden Chest Mine, a producing gold mine located in the Murray Gold Belt (MGB) of North Idaho; | |

| · | A significant portfolio of early-stage exploration properties within the MGB, many of which include historic gold mines and known gold mineralization; | |

| · | United States Geologic Survey (USGS) recognized Rare Earth Element potential | |

|

| o | Diamond Creek-one of Idaho’s most prospective REE properties |

|

| o | Roberts Rare Earth-one the highest grade REE properties in the US |

| · | A significant portfolio of early-stage exploration properties in Central Idaho, primarily in the Elk City area, and; | |

| · | The Butte Highlands Mine (50-percent interest), an advanced-stage project which has seen considerable development work, located south of the city of Butte, in Western Montana, however management does not expect this project to be advanced in the near future; | |

In addition to its portfolio of exploration, pre-development, and producing properties, the Company is also the manager and majority-owner of the New Jersey Mill, which currently processes ore from the Golden Chest Mine. The New Jersey Mill can process gold and silver ore through a 360-tonne per day flotation plant.

During the last two years, the Company has focused its efforts on expanding underground development and production at the Golden Chest Mine with an aggressive focus on consolidating and increasing its land holding within the Murray Gold Belt. With all debt associated with the start-up of operations behind it, the Company significantly increased its exploration and expansion activities in the Murray Gold Belt. This progress combined with the existing infrastructure and development over the last two years has created a solid foundation for continued growth real estate holdings, and a base of value regardless of market cycles.

| 6 |

| Table of Contents |

Competitive Business Conditions

While there has been a market for gold and precious metals historically, the Company competes on several different fronts within the minerals exploration industry. The Company competes with other junior mining companies for the capital necessary to sustain its exploration and development programs. IDR also competes with other mining companies for exploration properties and mining assets, mostly properties in the western United States. In recent years, the Company has been successful in resuming operations at the New Jersey Mill, consolidating 100% ownership of the Golden Chest Mine, and acquiring a 50% interest in the Butte Highlands Joint Venture. In October 2016 production at the Golden Chest resumed with the Company as the sole owner and operator. While not its core business, the New Jersey Mill has little competition for contract milling within an approximate 175-mile radius.

Generally, the Company is subject to the risks inherent to the mineral industry. A primary risk of mineral exploration is the low probability of finding a major ore deposit. The Company attempts to mitigate this risk by focusing its efforts in areas known to host significant mineral deposits, and also by relying on its experienced management team to drive analysis, evaluation, and acquisition of properties that it feels have a higher-than-average probability of success. In addition to deal essentials, such as cost, terms, timing, and market considerations, the Company’s process of property acquisition involves screening target properties based on geological, economic, engineering, environmental, and metallurgical factors. In all its operations the Company competes for skilled labor within the mining industry.

The risks associated with the Company’s mining and milling operations include other risks typical of the mining industry, such as: operational effectiveness in the processing plant that could result in lower recovery of the economic metals, mechanical failure of equipment that could increase costs or decrease efficacy, ability to hire and retain qualified operators, and risks that the mining operations are unable to economically extract material due to ground or slope failures that increase cost. The Company manages these risks with engineering and geologic analysis, detailed mine planning, a preventive maintenance program, and installing experienced and technically proficient management.

Another significant risk in the mining industry is the price of metals such as gold and silver. If the prices of these metals were to fall substantially, it could lead to a loss of investor interest in the mineral exploration sector, which would make it more difficult to raise the capital necessary for the Company to move exploration and development plans forward.

Customer Dependence and Product Distribution

The Company sold all its flotation gold concentrate to H&H Metals Corporation of New York, NY which accounted for 95% of gold sales in 2021. The remaining gold sales were gold dore’ which was sold to a western U.S. refinery. H&H Metals is also an IDR shareholder. Although not expected, if H&H Metals could not purchase the gold concentrate, it is anticipated another customer could be found readily as the floatation gold concentrate is a high-value concentrate with minor deleterious element content.

The Company ships its gold concentrate overseas to a smelter in Japan and the recent global shipping problems due to Covid-19 have caused an increase of inventory of gold concentrate at the New Jersey Mill. Only one day has been allowed for loading vessels in Seattle making it nearly impossible to ship from Idaho. Management is working to set up a concentrate storage area near the Port of Seattle so that several 20-tonne lots of concentrate could be stored closer to the port and loaded on a vessel in the short time currently allowed for loading.

Effect of Existing or Probable Governmental Regulations on the Business

The mining business is subject to extensive federal, state and local laws and regulations governing development, production, labor standards, occupational health, waste disposal, the use of toxic substances, environmental regulations, mine safety and other matters. The Company is subject to potential risks and liabilities occurring as a result of mineral exploration and production. Insurance against environmental risk (including potential liability for pollution or other hazards as a result of the disposal of waste products occurring from exploration and production) is not generally available to the Company (or to other companies in the minerals industry) at a reasonable price. To the extent that the Company becomes subject to environmental liabilities, the satisfaction of any such liabilities would reduce funds otherwise available to the Company and could have a material adverse effect on the Company. Laws and regulations intended to ensure the protection of the environment are constantly changing and are generally becoming more restrictive.

All operating and exploration plans have been made in consideration of existing governmental regulations. Regulations that most affect operations are related to surface water quality and access to public lands. An approved plan of operations (POO) and a financial bond are usually required before exploration or mining activities can be conducted on public land that is administered by the United States Bureau of Land Management (BLM) or United States Forest Service (USFS).

The New Jersey Mine, Golden Chest Mine, and other nearby properties are part of the expanded Bunker Hill Superfund Site. Current plans for expanded cleanup do not include any IDR projects. There is no known evidence that previous operations at the New Jersey Mine (prior to 1910) caused any groundwater or surface water pollution or discharged any tailings into the South Fork of the Coeur d’Alene River; however, it is possible that such evidence could surface. Should such a liability emerge for the Company, its exposure would likely be to clean up or cover old mine tailings that may have washed downstream from upstream mining operations. There are no mineral processing tailings deposits at the Golden Chest Mine. However, at least two old adits have small water discharges. The Company could conceivably be required to conduct cleanup operations at its own expense, however, the Environmental Protection Agency’s (EPA) Record of Decision for the Bunker Hill Mining and Metallurgical Complex Operating Unit 3 does not include any cleanup activities at the Company’s projects. Recently, the EPA has proposed a new cleanup plan that greatly increases the number of historic mine sites to be reclaimed, however, the plan has not been approved. IDR has not received any notifications that it could be liable for any environmental cleanup.

| 7 |

| Table of Contents |

Costs and Effects of Compliance with Environmental Laws (Federal, State and Local)

No major Federal permits are required for the Golden Chest and New Jersey Mines because the operations are on private land and there are no process discharges to surface waters. However, any exploration program conducted by the Company on unpatented mining claims, usually administered by the BLM or USFS, requires a POO to be submitted. The Company’s exploration programs on public land can be delayed for significant periods of time (one to two years) because of the slow permitting process applied by the USFS. The Company believes that such permitting delays are caused by insufficient manpower, complicated regulations, competing priorities, and sympathy for environmental groups who oppose all mining projects.

The Company is also subject to the rules of the U.S. Department of Labor, Mine Safety and Health Administration (MSHA) for the New Jersey and Golden Chest operations. When an underground mine or mill is operating, MSHA performs a series of regular quarterly inspections to verify compliance with mine safety laws, and can assess financial penalties for violations of MSHA regulations. A typical mine citation order for a violation that is not significant or substantial is about $200.

The New Jersey Mine and Mill have two important State of Idaho permits. The first is an Idaho Cyanidation Permit and the second is a reclamation plan for surface mining operations. The Company has also applied for a permit to expand its tailings storage facility (TSF) with the Idaho Department of Water Resources. Once approved, the Company will have to post a reclamation bond of approximately $110,000. If not approved in a timely manner, the Company would have to dispose of tailings in with a slightly more expensive method such as backhauling tailings to the Golden Chest Mine. An Idaho cyanidation permit was granted October 10, 1995 [No. CN-000027]. Construction of the Concentrate Leach Plant (CLP) at the New Jersey Mill was completed in November of 2007. The Idaho Cyanidation permit requires quarterly surface water and groundwater monitoring during the operation of the CLP. IDR estimates the cost of water-monitoring associated with the CLP to be approximately $6,000 per year. The New Jersey Mill also has an EPA general stormwater permit.

The Idaho Department of Lands (IDL) approved a surface mining reclamation plan for the New Jersey Mine in 1993. The plan calls for grading of steep fill slopes and planting of vegetation on the area disturbed by the open pit mine. IDR pays an annual reclamation fee of $133 to the Idaho Department of Lands for surface disturbance associated with the New Jersey Mine open pit. The Company has estimated its costs to reclaim the New Jersey Mine and Mill site to be $96,600. The Company submitted a reclamation plan to the IDL for its current open pit mining operation at the Golden Chest Mine. The plan was approved, and the Company was required to post a reclamation bond of $103,320. This plan also calls for the grading of steep fill slopes and re-vegetation of disturbed land as well as erosion control measures utilizing best practices. The Golden Chest Mine also has an EPA stormwater permit.

When the Company plans an exploration drilling program on public lands, it must submit a POO to either the BLM or USFS. Compilation of the plan can take several days of professional time and a reclamation bond is usually required to start drilling once the plan is approved. Bond costs vary directly with surface disturbance area, but a small, single set-up drilling program usually requires a bond amount of approximately $5,000. If a plan requires road building, the bond amount can increase significantly. Upon completion of site reclamation and approval by the managing agency, the bond is returned to the Company.

The Company complies with local building codes and ordinances as required by law.

Number of Total Employees and Number of Full Time Employees

The Company's total number of full-time employees is 38.

REPORTS TO SECURITY HOLDERS

The Company is not required to deliver an annual report to shareholders, however, it plans to deliver an annual report to shareholders in 2022. The annual report will contain audited financial statements. The Company may also rely on the Internet to deliver annual reports to shareholders.

The SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the Commission and SEC.

The Company maintains a website where recent press releases and other information can be found. A link to the Company’s filings with the SEC is provided on the Company’s website www.idahostrategic.com.

| 8 |

| Table of Contents |

ITEM 2. DESCRIPTION OF PROPERTIES

Note on New SEC Mining Disclosure Rules

Information concerning our mining properties in this Annual Report on Form 10-K/A has been prepared in accordance with the requirements of subpart 1300 of Regulation S-K, which first became applicable to us for the fiscal year ended December 31, 2021. These requirements differ significantly from the previously applicable disclosure requirements of SEC Industry Guide 7. Among other differences, subpart 1300 of Regulation S-K requires us to disclose our mineral resources, in addition to our mineral reserves, as of the end of our most recently completed fiscal year both in the aggregate and for each of our individually material mining properties.

Summary

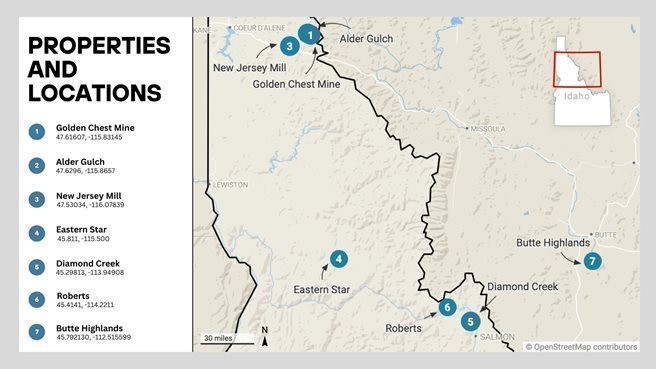

The map below shows the locations of our operations and our exploration Properties.

Figure 1 - Property Location Map

The following table summarizes our aggregate metal quantities produced and sold, which only includes the quantities produced and sold from the Golden Chest Mine (the Company’s only producing mine) for the last three years:

|

|

| Year Ended December 31, |

| ||||||||||

|

|

| 2021 |

|

| 2020 |

|

| 2019 |

| ||||

Gold - |

| Ounces produced |

|

| 4,826 |

|

|

| 3,755 |

|

|

| 5,060 |

|

|

| Payable ounces sold |

|

| 4,826 |

|

|

| 3,755 |

|

|

| 5,060 |

|

The following table summarizes the Company’s total in-situ mineral reserves (the Golden Chest Mine is the Company’s only property with calculated reserves) as of December 31, 2021:

Classification |

| Year |

| Tonnes |

|

| Grade (grams gold per tonne) |

|

| Cut-off (grams gold per tonne) |

|

| Metallurgical Recovery | ||||

Proven reserves |

| 2020 |

|

| 42,500 |

|

|

| 5.17 |

|

|

| 2.0 |

|

| 93% | |

Proven reserves |

| 2021 |

|

| 38,700 |

|

|

| 4.87 |

|

|

| 2.0 |

|

| 93% | |

Total mineral reserves |

|

|

|

| 38,700 |

|

|

| 4.87 |

|

|

| 2.0 |

|

| 93% | |

| 9 |

| Table of Contents |

The Company has not completed a Mineral Resource estimate for the year ending December 31, 2021, but is planning to complete one for the year ending December 31, 2022. In 2012, an historic resource estimate was completed as a part of a Canadian NI 43-101 by a third party and is provided for background only and does not represent a current SK 1300-compliant resource. A summary of the historic 2012 NI 43-101 is provided in Exhibit 96.1, the Technical Report Summary on the Golden Chest Mine, Idaho, prepared by the Qualified Person under Section 1300 of SEC Regulation S-K (QP), Grant Brackebusch who is the Qualified Person.

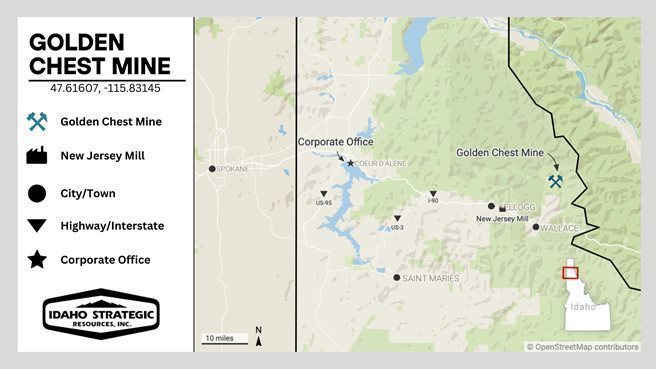

GOLDEN CHEST MINE

Figure 1 - Photo of Golden Chest Mine in February 2020

The Golden Chest Mine is the Company’s only Production Stage mine and is comprised of an underground mine, an open pit mine, and an exploration property located about 1.5 miles east of Murray, Idaho. The Golden Chest Mine includes 26 patented mining claims (319 acres) and 70 unpatented claims (562.5 acres). The mine is permitted with the Idaho Department of Lands and has posted a reclamation bond for an approved reclamation plan. IDR is the operator and owns 100% of the Golden Chest LLC (owner of the Golden Chest Mine). Production from the Golden Chest and an adjacent Area of Interest is subject a 2% NSR payable to Marathon Gold Corporation (Marathon). The mineralization occurs as gold-quartz veins associated with an orogenic deposit type. Ore from the Golden Chest Mine is processed off-site at the New Jersey Mill in Kellogg, Idaho. For more information concerning the Golden Chest Mine, please refer to the information set forth under the caption “Individual Properties-MATERIAL OPERATING PROPERTIES” and under the caption “Golden Chest Mine” in this Item 2.

NEW JERSEY MILL

Property Location

The New Jersey Mill is a fully permitted, 360-tonne per day, flotation mill and concentrate leach plant (“CLP”) located two miles east of Kellogg, Idaho, in the Coeur d’Alene Mining District. The CLP is permitted with Idaho Department of Environmental Quality (IDEQ). The mill is located on the same property as the New Jersey Mine, adjacent to U.S. Interstate Highway 90 and easily accessed year-round by local roads. Three-phase electrical power is supplied to the New Jersey Mill by Avista Utilities.

Property Ownership and Operation

The New Jersey Mill is operated by IDR. In 2011, IDR signed a joint venture (“JV”) agreement with Crescent Silver LLC (Crescent) to increase the capacity of the New Jersey Mill. Crescent funded the mill expansion in return for a 35% interest in JV assets plus the right to process 7,000 tonnes of its ore per month. IDR is the JV manager and retains a 65% interest in JV assets as well as the right to process its own ore at the rate of 3,000 tonnes per month and to allocate unused and excess capacity in its role as manager. The property covered by the JV agreement includes the crushing circuit, grinding circuit, gravity circuit, flotation circuit, CLP, buildings, and surface rights only over the patented mill site claim. Unpatented mill site claims are also part of the JV.

| 10 |

| Table of Contents |

Present Condition of Plant & Equipment

Mill Expansion and Crescent Ore Processing

The mill expansion was completed in 2012, rendering the mill capable of processing 360 tonnes of sulfide ore per day to produce a single flotation concentrate. The expansion cost approximately $3.2 million, all of which was funded by Crescent under terms of the JV (Ex. 10.1). The expansion project included the installation of a new cone crusher, a new fine ore bin, new conveyors, a new 2.4-meter by 4.0-meter ball mill, additional flotation cells, a new paste thickener, associated pumps, and a new building.

Current Ore Processing Operations

In October 2016, the Company resumed operations at the New Jersey Mill, processing ore extracted from open pit and underground at the Golden Chest. In 2021, the New Jersey Mill processed 44,305 tonnes at an average head grade of 3.85 gpt gold with 89% gold recovery. Since restarting operations at the Golden Chest in October 2016, the Company has milled a total of 207,000 tonnes.

The mill recycles process water and utilizes a paste tailings disposal process patented by IDR founder Fred Brackebusch to minimize impacts to the environment. By implementing paste tailings processing methods, IDR can recycle process water and prevent the discharge of process water to surface waters. At full capacity, this method saves more than 50 million gallons of water per year. IDR was recognized as a “Pollution Prevention Champion” by the Idaho Department of Environmental Quality in 2014 for its efforts to reduce pollution at the mill. The Company has submitted a permit for an expansion of its existing tailings storage facility, TSF #1. If the tailings expansion permit approval was delayed beyond mid-2022, the Company would to most likely, back-haul tailings to the Golden Chest mine.

As of December 31, 2021, the Company had a net capital cost of $3,868,692 associated with the New Jersey Mill.

Permit Requirements

The New Jersey Mill has all the required environmental permits to operate currently and into the foreseeable. Some permits may require modification if operating conditions change, but typically these changes can be completed without impeding the milling operation. A summary of the permits held by the Company are found in following table:

Permit Descriptions

Permit Description | Reference |

Idaho Cyanidation Permit for NJ Mill | #CN-0026-001 Idaho Department of Environmental Quality |

Tailings Storage Facility (TSF) NJ Mill | 94-7509 Idaho Department of Water Resources |

Air Quality Exemption (Crushing) for NJ Mill | Idaho Department of Envirnmental Quality |

BUTTE HIGHLANDS PROPERTY

Property Location

The Butte Highlands property is an underground gold Exploration Stage property operated by Highland Mining LLC. In January 2016, IDR purchased a 50% interest in Butte Highlands Joint Venture LLC (“BHJV”) from Timberline Resources Corporation (“Timberline”). BHJV owns the Butte Highlands property, located 15 miles south of Butte, Montana, within a gold-producing region that includes several large gold deposits. The property can be accessed via State Highway 2 and county and USFS roads. Electricity and water are available on the property.

Property Ownership

The Butte Highlands property covers approximately 135 acres and includes 11 patented claims. All the private lands within the Butte Highlands property are patented lode and placer claims. BHJV is responsible for paying Montana state property taxes on all patented lands and for paying annual BLM maintenance fees on any unpatented mining claims.

Butte Highlands Joint Venture

In 2009, Timberline formed a 50/50 joint venture, the BHJV, with Highland Mining LLC (“Highland”) for the purpose of developing and mining the Butte Highlands property, with Highland to operate and fund all mine development costs through to commercial production. In 2012, Montana State Gold Company LLC (“MSGC”) purchased Highland, assuming its project loan and its funding commitment.

IDR purchased Timberline’s 50% “carried to production” interest in BHJV in 2016 for total consideration of $435,000 with Highland funding all development costs and IDR’s 50% share of costs to be paid from proceeds of future mine production. Proceeds are to be split on an 80/20 basis (to Highland and IDR, respectively) until payback is reached, after which proceeds will be split evenly.

| 11 |

| Table of Contents |

Property History

The Butte Highlands gold mine was an historic lode mine that produced an estimated 60,000 ounces of gold from 1937 until the War Production Board forced its closure at the onset of WWII. The property was later explored by Battle Mountain, Placer Dome, ASARCO, and Orvana in the 1980’s and 1990’s which, in total, drilled more than 30,000 meters at Butte Highlands, prior to its acquisition by Timberline in 2007.

In 2009, Timberline formed a 50/50 joint venture with Highland to create BHJV for the purpose of developing and mining the property. In 2009 and 2010, Timberline conducted surface exploration, drilling, and permitting work as Highland began building surface and underground infrastructure.

In 2011, BHJV completed an underground exploration ramp and a 16,000-meter underground core drilling program to support mine modeling, focusing on the upper portion of the “Old Mill Block” which has dimensions of approximately 85 meters along strike, 335 meters down dip, and a mineralized thickness of 2.5 to 4.5 meters.

A NI 43-101 compliant technical report for Butte Highlands was completed in May 2013 by Mine Development Associates of Reno, Nevada. However, the property has no mineral reserves or resources as defined by Regulation S-K Subpart 1300.

The project has experienced significant timeline delays due, in part, to miscalculations of the permitting process and other technical issues. Permitting advanced more effectively from 2013 to 2015 with the following critical milestones successfully achieved:

| · | In July 2013, the Montana Department of Environmental Quality (“DEQ”) issued the final Montana Pollutant Discharge Elimination System (“MPDES”) water discharge permit; |

|

|

|

| · | In January 2015, the Montana DEQ authorized BHJV to construct and operate an underground gold mine by publishing positive Record of Decision (“ROD”) on Final Environmental Impact Statement (“EIS”); |

|

|

|

| · | In October 2015, the U.S. Forest Service (“USFS”) released its Final Decision Notice on haul road with a Finding of No Significant Impacts. |

These milestones represent the final major hurdles to the receipt of necessary permits allowing the project to proceed. Final construction designs and completion of work will be required, along with bond payments, before final authority is granted to proceed with the proposed operation. Once final designs and road construction are complete, the USFS will grant authority to use local USFS roads for material haulage. Upon payment of the reclamation bond, the Hard Rock Operating Permit will be granted by the Montana DEQ.

Present Condition, Work Completed, and Exploration Plans

IDR does not anticipate any progress regarding BHJV (not the mine or operations) this year and is looking forward to one day cooperating with its partner to advance and or consolidate ownership in 2022. The partner maintains management and operation control and all plans are subject to their approval and direction and they have proven to be a less than optimal partner.

Present Condition of Plant & Equipment

Since 2009 Highland has invested nearly $40 million at Butte Highlands building a modern gold mine, including nearly 1.6 kilometers of underground mine development and construction of surface facilities, all of which are located on private lands owned by BHJV. As of December 31, 2021, the Company had a net capital cost of $435,000 associated with the Butte Highlands property.

Geology & Mineralization

Gold mineralization at Butte Highlands is hosted primarily in lower Paleozoic Wolsey Shale with higher-grade mineralization occurring within sediments proximal to diorite sills and dikes. The property is within a favorable geologic domain that has hosted several multi-million-ounce gold deposits. There are currently no mineral resources or reserves as defined by Regulation S-K Subpart 1300.

NEW JERSEY MINE PROPERTY

Property Location

The New Jersey Mine is an underground gold Exploration Stage property operated by IDR and located two miles east of Kellogg, Idaho, in the Coeur d'Alene Mining District. The mine is adjacent to U.S. Interstate Highway 90 and is easily accessed year-round by local roads. The New Jersey Mill is located on the same property. Three-phase electrical power is supplied to the New Jersey Mill by Avista Utilities.

Property Ownership

At the New Jersey Mine and Mill complex, the Company owns 102 acres of private land with surface and mineral rights, 108 acres of private land with mineral rights only, 40 acres of private land with surface rights only, and approximately 130 acres of unpatented mining claims. The unpatented claims are on federal land administered by the BLM. The gold-bearing Coleman vein system, including the underground workings and the Coleman pit, are located on the patented mining claims that are wholly owned by the Company and not part of the New Jersey Mill Joint Venture.

| 12 |

| Table of Contents |

Property History

In the late 1800’s and early 1900’s, New Jersey Mining and Milling (an unrelated company) drove more than 760 meters of development workings on the Coleman Vein and its northwest branch, including drifts, crosscuts, shafts, and raises. The historic development also included a 10-stamp gravity mill that was operated for a short period.

Present Condition, Work Completed, and Exploration Plans

Since 2001, IDR has drilled 14 holes totaling 1,765 meters to explore the Coleman Vein and associated zones. Drilling confirmed vein system continuity and resulted in the discovery of the broad, low grade (averaging about 0.70 gpt gold) Grenfel zone. The Company’s best intercept of the Coleman vein assayed 2.76 gpt gold over 12.5 meters, which included 6.80 gpt gold over 2.5 meters.

In 2008, the Company performed underground exploration on the Coleman Vein at the 740 level, including 84 meters of drifting, with 20 meters along the vein before it was displaced by a fault.

In 2010, a raise was driven upward on the 740 level to explore a narrow high-grade vein that crosscut the main Coleman Vein. This raise was driven 12 meters vertically, leading to the extraction of 367 tonnes that assayed 2.68 gpt gold in processing at the New Jersey Mill.

IDR has not conducted material work at the New Jersey Mine since 2010 and has no plans for exploration in 2022.

While the Company has conducted significant drilling, underground development, and even limited gold production from the New Jersey Mine, the property has no mineral reserves or resources as defined by Regulation S-K Subpart 1300.

As of December 31, 2021, the Company had a capitalized development plus investment cost of $248,289 associated with the mine.

Permits for the New Jersey Mill are set forth in under the caption “New Jersey Mill” in this Item 2.

Geology & Mineralization

The New Jersey Mine area is underlain by argillites and quartzites of the Proterozoic-age Prichard Formation, which commonly hosts gold mineralization regionally. The property occurs adjacent to and north of the major Osburn Fault, an important geological structure of the Coeur d’Alene Mining District. The Prichard Formation is divided into nine units of alternating argillites, siltites, and quartzites; the units exposed in the New Jersey Mine area appear to belong to the lower members. Gold mineralization is associated with sulfide-bearing quartz veins that cut the bedding in Prichard argillite and quartzite. Associated sulfides are pyrite, arsenopyrite, chalcopyrite, low-silver tennantite, galena, and sphalerite.

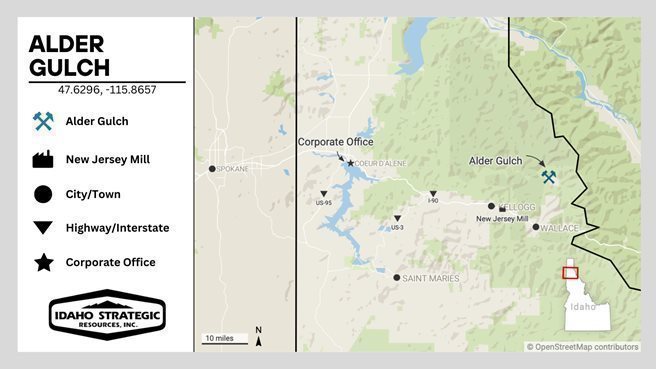

ALDER GULCH PROPERTY

The Alder Gulch property is a gold Exploration Stage property operated by IDR and located just north of the town of Murray in Shoshone County, Idaho. The property is comprised of 880 acres of patented mining claims having both surface and mineral rights. IDR owns 100% of Alder Gulch, subject to convertible promissory notes secured by 512 acres of the property. The property’s mineralization styles include vein systems and alluvial deposits. The Company has not obtained permits for this property and there are no processing plants or other available facilities located on the property. For more information concerning the Alder Gulch property, please refer to the information set forth under the caption “Individual Properties – MATERIAL OPERATING PROPERTIES” and under the caption “Alder Gulch Property” in this Item 2.

BUCKSKIN PROPERTY

Property Location

The Buckskin property is a gold Exploration Stage property operated by IDR and located 1.5 kilometers north of the town of Murray in Shoshone County, Idaho. The property can be accessed via dirt roads from paved Forest Highway 9.

Property Ownership

The Buckskin property is comprised of 12 patented mining claims covering 218 acres and 73 unpatented mining claims covering approximately 1,367 acres. The 218 acres of patented mining claims were acquired through an exploration and mining lease. The Buckskin Lease term runs for 7.5 years and includes annual payments of $12,000 and a 2-percent NSR on future production from the property. If the property is placed into production, the lease will continue as long as production is underway and also includes a right of first refusal for IDR to purchase the property, and the lease payments are treated as an advance payment on the royalty. The unpatented lode claims adjacent to the core group of claims are wholly owned by the Company and not subject to a royalty. These claims require an annual claim fee payment to the BLM.

Property History

The Buckskin property was mined intermittently for both gold and base metals in the early 20th century with most of the mining completed in the 1930’s. The property contains numerous old workings, most of which are inaccessible. A mill was located on the property, but historic production is unknown.

| 13 |

| Table of Contents |

Present Condition, Work Completed, and Exploration Plans

In 2019, the Company conducted exploration efforts in the Buckskin area with trenching mapping/sampling, road building, reopening historic underground workings, and underground mapping/sampling. The Company conducted additional field work in 2020 and 2021 such as mapping, trenching, and ground based magnetic surveys. Core drilling is planned for 2022. The Company has a capitalized investment cost of $332,728 associated with this property.

Geology & Mineralization

The bedrock geology at the Buckskin property is largely quartzites of the Burke Formation and argillite-siltite of the Prichard Formation. A major structural feature is the Murray Peak Fault, a northerly trending, high-angle reverse fault. Historical prospects and adits are developed along northerly trending shear zones that are likely related to the Murray Peak Fault, that contain silica flooded rock. Gold mineralization is found in quartz veins and is associated with sulfide minerals including pyrite, chalcopyrite, and galena. Anomalous tungsten was also detected in assays.

Permits and Facilities

There are no permits associated with this property, and there are no processing plants or other available facilities located on the property.

BUTTE GULCH PROPERTY

Property Location

The Butte Gulch property is a gold Exploration Stage property operated by IDR and located 3 kilometers east of the town of Murray in Shoshone County, Idaho. The property lies immediately adjacent to the east side of Golden Chest Mine. It is accessed by paved Forest Highway 9, then on secondary dirt roads.

Property Ownership

The Butte Gulch property is comprised of 60 acres of both patented surface and mineral rights, 117 acres of patented mineral rights, and 602 acres of unpatented claims. The patented surface and mineral rights were purchased from a third party in mid-2018 and any lode production from the patented claims is subject to a 2% NSR. The patented claims where the Company only owns the lode mineral rights can be placer mined by the current owner. IDR holds a first right of refusal for the purchase of the surface rights not already owned by the Company. The unpatented lode claims are wholly owned by the Company and not subject to a royalty.

Property History

Butte Gulch has been placer mined by several different operations over the last century; however, there are no gold production records from these historic placer mining efforts. There is evidence of historic lode prospecting in the form of surface pits and exploration adits on the property, but the Company is not aware of any modern exploration occurring on the property.

Present Condition, Work Completed, and Exploration Plans

The property is an Exploration Stage property adjacent to the Golden Chest Mine. The property vendor has retained the placer mining rights in the bottom of the drainage on the patented claims and conducted placer mining activity last year. IDR has no affiliation or connection with the placer mining operation. Two historic adits have been reopened for mapping and sampling. Additionally, areas have been rock sampled where current placer operations have uncovered altered bedrock. More geologic fieldwork is planned for the upcoming 2022 season to explore for gold mineralization. The Company has a capitalized investment cost of $274,440 combined between this property and the Potosi property.

Geology & Mineralization

Outcrops in the Butte Gulch area are dominantly argillite, siltite, and quartzite units that belong to the Prichard Formation. The hinge line of a major regional scale fold called the Trout Creek Anticline traverses the property. Both northwest and northeast trending quartz veins containing pyrite, galena and chalcopyrite have been identified with anomalous silver mineralization.

Permits and Facilities

There are no permits associated with this property, and there are no processing plants or other available facilities located on the property.

GIANT LEDGE PROPERTY

Property Location

The Giant Ledge property is a gold and base metal Exploration Stage property operated by IDR and located six kilometers east of the town of Murray in Shoshone County, Idaho. The property is situated in Granite Gulch and is accessed by paved Forest Highway 9 and secondary dirt roads.

Property Ownership

The Company’s land position consists of 57 unpatented lode claims covering an area of 1,119 acres. The claim group includes 3 separate claim blocks: Giant Ledge, Porphyry and Bear. The unpatented lode claims are wholly owned by the Company and not subject to a royalty. These claims require an annual claim fee payment to the BLM.

| 14 |

| Table of Contents |

Property History

The Giant Ledge property consists of several historical prospected areas with lead, copper, and gold mineralization in and along the contact of the igneous intrusive. The Giant Ledge Mine was active in the 1920’s when a 122-meter-deep shaft was sunk and about 450 meters of drift development was completed. A flotation mill was erected, and a minor amount of undisclosed production was achieved. Bunker Hill Mining Company also examined and mapped the mine workings in the 1950’s. Sunshine Mining Company conducted exploration at the Giant Ledge in the mid-1980’s and drilled two core holes. In 2008, the Company obtained core from Sunshine’s drilling program, and it was re-logged and assayed. The best of the mineralization showed 4.6 meters of 0.908 gpt gold and 0.24% combined copper and lead. An extensive soil sampling program was completed in conjunction with a VLF and magnetometer survey.

Present Condition, Work Completed, and Exploration Plans

The property is an Exploration Stage prospect east of the Golden Chest Mine. Although no significant work was performed at Giant Ledge during the 2009-2021 period, the Company is preparing to resume exploration efforts in 2022.

Geology & Mineralization

The primary structural feature on the Giant Ledge property is the French Gulch fault. The fault contact extends through the property, separating monzonitic intrusive rocks on the west, from Prichard Formation’s argillite and quartzites on the east. Structurally controlled mineralization is found in both, the contact between argillite-quartzite sediments and in the monzonite. Seams and disseminations of auriferous pyrite, galena and chalcopyrite are found up to 10 meters into the footwall and hanging wall.

Permits and Facilities

There are no permits associated with this property, and there are no processing plants or other available facilities located on the property.

POTOSI PROPERTY

Property Location

The Potosi property is a gold Exploration Stage property operated by IDR and located 4.4 kilometers southwest of the town of Murray in Shoshone County, Idaho. The property is accessed by the paved Beaver Creek county road and other secondary dirt roads.

Property Ownership

IDR acquired fee simple title to of 3 patented lode claims as part of the 2018 Butte Gulch land acquisition. The 3 patented claims cover a 71-acre area.

Property History

Potosi has been placer mined in several different operations over the last century however, there is no gold production records from these historic placer mining efforts. There is evidence of historic lode prospecting in the form of surface pits and exploration adits on the property, but the Company is not aware of any modern lode exploration occurring on the property.

Present Condition, Work Completed, and Exploration Plans

Minor reclamation work, road improvements and timber harvesting was conducted in 2019, In 2020, the Company completed the remaining reclamation of surface disturbance caused by a previous operator. There are no exploration plans for 2022. The Company has a capitalized investment cost of $274,440 combined between this property and the Butte Gulch property.

Geology & Mineralization

Host rocks at the property are siltites and argillites of the Prichard Formation. Geologic mapping suggests fault structures associated with the Crown Point Shear Zone may cross the property.

Permits and Facilities

There are no permits associated with this property, and there are no processing plants or other available facilities located on the property.

McKINLEY-MONARCH PROPERTY

Property Location

The McKinley-Monarch property is an early-stage, gold Exploration Stage property operated by IDR and encompasses several historic prospects in central Idaho and extends, from the town of Riggins northward for nearly five miles. The property is accessed via public and private dirt roads off US Highway 95.

Property Ownership

In 2013, IDR acquired the McKinley-Monarch property through its acquisition of Idaho Champion Resources (“ICR”). The Company also holds 28 unpatented claims, totaling 560 acres, adjacent the 4 patented claims of the McKinley Mine (not owned by the Company). These claims require an annual claim fee payment to the BLM.

| 15 |

| Table of Contents |

Property History

The Monarch-McKinley property is located in the Simpson Mining District which was first prospected in 1891. The nearby McKinley Mine, intermittently active until World War II, was the largest lode gold mine in a mining district better known for its placer gold production. Approximately 3000 feet south-southwest of the McKinley Mine, is an area with substantial historic prospecting but lacking significant development, is the Monarch area. The southern bounds of the property, shows several historic underground developments but no records of production have been located. This area was formerly referred to as the “Big Easy Mine” but is now called the Fiddle Creek Prospect.

Present Condition, Work Completed, and Exploration Plans

Surface mapping and sampling by IDR identified an area with significant gold mineralization in outcrop: the Monarch Zone, about one kilometer S-SW of the McKinley Mine. At the Monarch Zone, several samples returned high-grade gold with values up to 26 gpt. There are no exploration plans for 2022. The Company has a capitalized investment cost of $200,000 associated with this property.

Geology and Mineralization

The Monarch-McKinley property is located within the rocks of the Riggins and Seven Devils Groups of the Blue Mountains Island-Arc Complex. The rocks are part of a sequence of accreted terranes sutured to the North American continent during late Mesozoic time. They are comprised of volcanic and volcano-clastic sediments metamorphosed to greenschist facies rocks. The complex structural environment of the collision boundary supplies ample pathways for mineralizing fluids, typical of orogenic systems. Rock alteration consists of carbonization and silicification. Gold mineralization is associated with auriferous pyrite and quartz-carbonate veining.

Permits and Facilities

There are no permits associated with this property, and there are no processing plants or other available facilities located on the property.

EASTERN STAR PROPERTY

Property Location

The Eastern Star property is an early-stage gold Exploration Stage property operated by IDR and located about four miles west of Elk City in central Idaho. It consists of 11 patented lode mining claims (220 acres) acquired by IDR in 2014 and an additional 45 unpatented lode claims (413 acres) located in 2018. The property is accessible via improved dirt roads from Idaho State Highway 14.

Property Ownership

IDR acquired fee simple title to the 11 patented claims (220 acres) from Premium Exploration Inc. (“Premium”) for $250,817 in 2014. The Company also holds the 45 unpatented lode claims (413 acres) surrounding the core group of patented claims. All of the Eastern Star claims are wholly owned by the Company and not subject to a royalty. The unpatented claims require an annual claim fee payment to the BLM.

Property History

The Elk City Mining District is an historic gold mining region dating back to the 1860s that once supported more than 20 underground mines, including the Eastern Star.

In recent years, prior operator Premium collected grab samples from three separate locations, representing nearly one-half mile of mineralized trend. Of 25 grab samples, nine returned gold values greater than 16.9 gpt. Premium then drilled three core holes at Eastern Star, targeting a bulk mineable gold deposit.

Present Condition, Work Completed, and Exploration Plans

In 2014, The Company completed mapping, sampling, and trenching programs. Company geologists identified several quartz veins that had been exploited by historic prospect pits and small shafts. Surface grab samples from these veins confirmed the widespread presence of high-grade gold within mineralized quartz vein material.

Channel samples across the vein zones intercepted notable gold mineralization including 10.4 m of contiguous samples reporting 2.25 gpt gold and 6.4 meters of 7.97 gpt gold, which includes 4.3 meters of 11.34 gpt gold. Select grab samples from trenched material returned values of up to 35.9 gpt gold. The Company has a capitalized investment cost of $250,817 associated with this property.

Although no significant work was performed at Eastern Star during the 2015-2021 period, the Company is preparing to resume exploration efforts in 2022. The Company’s exploration objective at Eastern Star is to evaluate the potential of these high-grade gold-bearing quartz veins for potential development and production.

Geology & Mineralization

The Eastern Star property is underlain by extensively weathered, high grade metamorphic rocks such as biotite gneiss and schist, intruded by felsic dikes and sills emanating from the Idaho Batholith. Two types of gold mineralization are present at the Eastern Star property. The first is the large, low-grade, bulk tonnage mineralization associated with the northerly trending Orogrande Shear Zone, and the second is the easterly trending high-grade gold quartz veins.

| 16 |

| Table of Contents |

Permits and Facilities

There are no permits associated with this property, and there are no processing plants or other available facilities located on the property.

DIAMOND CREEK RARE EARTH PROPERTY

Property Location

The Diamond Creek REE property is a rare earth elements (REE) Exploration Stage property operated by IDR and covers approximately 1,040 acres and is comprised of 52 unpatented mining claims. It is located in the Eureka Mining district, approximately 13 kilometers (8 miles) north-northwest of the town Salmon, Idaho. The property is accessed by a dirt road known as the Diamond Creek Road.

Property Ownership

The unpatented lode claims are wholly owned by the Company and there are no underlying royalties. The unpatented claims require an annual claim fee payment to the BLM.

Property History

The area was historically prospected for gold until 1949 when its unique geologic setting was recognized by the United States Geologic Survey (USGS) and the Idaho Geological Survey. In the early 1950’s the U.S. government sponsored country-wide exploration for raw materials related to nuclear power. This campaign resulted in the discovery of thorium in areas of Lemhi County, including the REE occurrence in the Diamond Creek area. Several other companies have undertaken minor rare earths exploration programs on the property including one stage of limited core drilling.

Present Condition, Work Completed, and Exploration Plans

The Company staked the claims that make up the property in early 2020. Some surface exploration activities including mapping and sampling were completed in 2021. Additionally, the Company submitted a Plan of Operations (POO) to the USFS for a core drilling program. The POO is currently under review by the USFS.

Geology & Mineralization

The REE mineralization at Diamond Creek is found in quartz veins over a large area approximately 3.2 km long and 0.8 km wide. There are at least eight known veins, and they range in width from 0.15 to 7.6 m in thickness. Vein widths appear best developed in the metasediments and can be traced on the surface for distances ranging from 33.5 to 780 m.

Samples taken by the USGS show total REE oxide contents ranging from 0.59 to 5.51 percent. Work by the USGS in 1979 reported three samples cut across one of the larger veins were assayed for gold and contained 0.5, 2.4 and 11.9 grams per tonne. Down-dip extensions of these mineralized veins have never been sufficiently tested. Historical reports indicate two short core holes have been completed with some significant REE mineralization noted.

Permits and Facilities

There are no permits associated with this property, and there are no processing plants or other available facilities located on the property.

ROBERTS RARE EARTH PROPERTY

Property Location

The Roberts Rare Earth Element property is an early-stage REE Exploration Stage property operated by IDR and comprised of 63 unpatented mining claims covering an area of approximately 1,051 acres. This property is located within the Mineral Hill Mining District, approximately 48 kilometers (30 miles) northwest of Salmon, Idaho. Access to the property is via National Forest Road 036 (Indian Creek Road).

Property Ownership

The unpatented lode claims are wholly owned by the Company and there are no underlying royalties. The unpatented claims require an annual claim fee payment to the BLM.

Property History

The Mineral Hill district was historically prospected for gold and copper in the early 1900’s. Rare earth element (REE) mineralization was discovered later in the early 1950’s. Studies conducted by A. T. Abbott (1954) and A. L. Anderson (1958) from the Idaho Geological Survey, and E. P. Kaiser (1956) with the USGS, pioneered recognition of these REE occurrences. Abbott reported cutting a 2.5-foot sample across the Roberts Lode which returned 21.5-percent combined rare earth oxides and thoria.

Present Condition, Work Completed, and Exploration Plans

The Company staked the claims that make up the property in early 2020 and added to the position with additional claims in 2021. Surface exploration activities including mapping and sampling were completed in 2021. Sampling by Company geologists returned assays of combined rare earths elements in excess of 12%. The company’s samples show REEs like, neodymium, praseodymium, and samarium elements in abundance. Similarly, as with IDR’s Diamond Creek property, REE’s are not the only valuable commodities but gold and niobium may also be in profitable concentration as by-products. Recent samples collected from the Roberts’ property, show assays with gold values up to 8.8 grams per ton and niobium as high as 0.50 %. Exploration plans include geologic mapping, sampling, and geophysical surveys.

| 17 |

| Table of Contents |

Geology & Mineralization

The REE mineralization at the Roberts property is associated with a unique group of igneous rocks known as carbonatites. Carbonatites are carbonate rocks sourced from magmatic origins, with primary carbonate compositions exceeding 50%. The Roberts property contains two of the eight known carbonatite occurrences within the Mineral Hill District. The first carbonatite can be found in a northwest-trending seam which measures approximately 400 meters (1,300 feet) long and 90 meters (300 feet) wide; the second occurrence occurs as a small carbonatite plug, measuring about 200 meters in diameter.

Permits and Facilities

There are no permits associated with this property, and there are no processing plants or other available facilities located on the property.

Individual Properties – MATERIAL OPERATING PROPERTIES

GOLDEN CHEST MINE

Property and Location

The Golden Chest Mine is a gold Production Stage property comprised of an underground mine, an open pit mine, and an exploration property located about 1.5 miles east of Murray, Idaho, and 115 km east of the city of Coeur d’Alene, Idaho at Latitude 47o37’14” North and Longitude 115o49’43” West. The Golden Chest Mine includes 26 patented mining claims (319 acres) and 70 unpatented claims (1,390 acres). The mine is permitted with the Idaho Department of Lands and has posted a reclamation bond for an approved reclamation plan. Surface water monitoring is completed as a condition of the permit. The mine is along Forest Highway 9 and is accessible by several improved dirt roads from the paved highway. A three-phase power line was installed at the property in 2014 with power supplied by Avista Utilities.

Property Ownership

IDR owns 100% of the Golden Chest LLC (owner of the Golden Chest Mine). The core of the Golden Chest Mine is a contiguous group of 26 patented claims where all modern mining has taken place to date. The Company owns the rights to both the surface and subsurface mineral on all patented claims directly and through its 100% held subsidiary Golden Chest LLC (GCLLC), excluding the Joe Dandy Claim where IDR owns only the subsurface mineral rights. As these patented claims are considered private lots, legal access is allowed. Property taxes on patented claims are assessed by Shoshone County each year and IDR has paid the taxes in full.

IDR currently maintains 70 unpatented mining claims covering 562.5 ha (1,390 acres). The claims have been filed with the United States Bureau of Land Management (BLM) agency and at the Shoshone County Courthouse. Annual maintenance fees are paid to the BLM by September 1, and the Golden Chest unpatented claim fees have been paid and are in good standing.

| 18 |

| Table of Contents |

Production from the Golden Chest and an adjacent Area of Interest is subject a 2% NSR payable to Marathon Gold Corporation (Marathon).

Property History

The Golden Chest Mine was developed in the late 1800’s through the early 1900’s as part of the first gold production from the Coeur d’Alene Mining District. Historical accounts vary, but the district is believed to have produced approximately 300,000 ounces of gold from placer sources. It is estimated that the historic hard rock mining at the Golden Chest (prior to IDR’s ownership) produced approximately 65,000 ounces of gold, primarily from shallow, underground, high-grade veins. The Golden Chest Mine is considered to be the largest historic lode producer of gold in northern Idaho.

Modern exploration of the Golden Chest area began in the late 1970’s with several companies, including Cominco-American and Golden Chest Inc. (“GCI”), targeting gold and massive sulfides. Drill tests by GCI included a 200-foot hole from surface that intersected a 60-foot zone containing multiple low-grade gold-bearing quartz veins.

Newmont Exploration Ltd. followed GCI’s discovery by evaluating the veins for bulk mineable potential in the late-1980’s. Newmont drilled 35 shallow reverse-circulation and five core holes. In 2010 and 2011, a joint venture between IDR and Marathon Gold drilled 18,300 meters of core and published a resource report in accordance with Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101).