Form 10-K Andersons, Inc. For: Dec 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2021

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to .

Commission file number: 000-20557

(Exact name of the registrant as specified in its charter)

| (State of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||||||||

| (Address of principal executive offices) | (Zip Code) | ||||||||||

(419 ) 893-5050

(Telephone Number)

| Securities registered pursuant to Section 12(b) of the Act: | ||||||||||||||

| Title of each class: | Trading Symbol | Name of each exchange on which registered: | ||||||||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| ý | Accelerated filer | ☐ | |||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | |||||||||

| Emerging growth company | |||||||||||

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ | ||||||||||

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ý

The aggregate market value of the registrant's voting stock which may be voted by persons other than affiliates of the registrant was $939.5 million as of June 30, 2021, computed by reference to the last sales price for such stock on that date as reported on the Nasdaq Global Select Market. The registrant had 33,702,465 common shares outstanding, no par value, at February 11, 2022.

DOCUMENTS INCORPORATED BY REFERENCE

THE ANDERSONS, INC.

Table of Contents

| Page No. | |||||

| PART I. | |||||

| PART II. | |||||

| PART III. | |||||

| PART IV. | |||||

Part I.

Item 1. Business

Company Overview

The Andersons, Inc. (the "Company") is a diversified company rooted in agriculture. Founded in Maumee, Ohio in 1947, the Company is a significant player in the North American agricultural supply chain and conducts its business in the trade, renewables, and plant nutrient sectors.

Segment Descriptions

The Company's operations are classified into three reportable business segments: Trade, Renewables, and Plant Nutrient. Each of these segments is organized based upon the nature of products and services offered and aligns with the management structure. See Note 12 to the Consolidated Financial Statements in Item 8 for information regarding business segments.

Trade

The Trade Group is a diversified business focusing on logistics and merchandising across a wide range of commodities. The group specializes in the movement of physical commodities such as: whole grains, grain products, feed ingredients, domestic fuel products, and other agricultural commodities. The business also operates grain elevators across the U.S. and Canada where income is earned on commodities bought and sold through the elevator, commodities that are purchased and conditioned for resale, and commodities that are held in inventory until a future period, earning space income. Space income consists of appreciation or depreciation in the basis value of commodities held and represents the difference between the cash price of a commodity in one of the Company's facilities and an exchange traded futures price (“basis”); appreciation or depreciation between the future exchange contract months (“spread”); and commodities stored for others upon which storage fees are earned. The Trade Group business also offers a number of unique grain marketing, risk management and origination services to its customers and affiliated ethanol facilities for which it collects fees.

Sales are negotiated by the Company's merchandising staff as commodity prices are not predetermined. The Trade Group has a diversified portfolio of physical commodities that are sold, however, the principal commodities sold by the Company are corn, wheat and soybeans which are consistent with the prior year. Most of the Company's exported commodity sales are made through intermediaries while some commodities are shipped directly to foreign countries, mainly Canada. The Company ships grain from its facilities by rail, truck, or boat. Rail shipments are made primarily to grain processors and feeders with some rail shipments made to exporters on the Gulf of Mexico or east coast. Boat shipments are from the Port of Toledo, the Port of Houston or the Port of Oswego. In addition, commodities are transported via direct ship transactions in which suppliers sell grain to the Company, but delivered directly to domestic and international end users.

The Company's trade operations rely principally on forward purchase contracts with producers, dealers and commercial elevators to ensure an adequate supply of commodities to the Company's facilities throughout the year. The Company makes commodity purchases at prices referenced to regulated commodity exchanges.

The Company competes in the sale of commodities with other public and private grain brokers, elevator operators and farmer owned cooperative elevators. Some of the Company's competitors are also its customers. Competition is based primarily on price, service and reliability. Because the Company often buys in smaller lots, its competition for the purchase of commodities is generally local or regional in scope, although there are some large national and international companies that maintain regional grain purchase and storage facilities. Significant portions of grain bushels purchased and sold are made using forward contracts.

The Group's asset based grain handling business is seasonal in nature in that the largest portion of the principal grains are harvested and delivered from the farm and commercial elevators typically in July for wheat and September through November for corn and soybeans, although a significant portion of the principal grains are bought, sold and handled throughout the year.

The Andersons, Inc. | 2021 Form 10-K | 1

Fixed price purchase and sale commitments as well as commodities held in inventory expose the Company to risks related to adverse changes in market prices. Grain prices are typically comprised of two components, futures prices on regulated commodity exchanges and local basis adjustments. The Company manages the futures price risk by entering into exchange-traded futures and option contracts with regulated commodity exchanges. The contracts are economic hedges of price risk but are not designated or accounted for as hedging instruments. These regulated commodity exchanges maintain futures markets for the grains merchandised by the Company. Futures prices are determined by worldwide supply and demand.

The Company's grain risk management practices are designed to reduce the risk of changing commodity prices. In that regard, such practices also limit potential gains from further changes in market prices. The Company has policies that provide key controls over its risk management practices. These policies include a description of the objectives of the programs and review of daily position limits along with other internal controls. The Company monitors current market conditions and may expand or reduce the purchasing program in response to changes in those conditions. In addition, the Company monitors its counterparties on a regular basis for credit worthiness, defaults and non-delivery.

Purchases of commodities can be made the day the product is delivered to a terminal or via a forward contract made prior to actual delivery. Sales of commodities generally are made by contract for delivery in a future period. When the Company purchases commodities at a fixed price or at a price where a component of the purchase price is fixed via reference to a futures price on a regulated commodity exchange, it also enters into an offsetting sale of a futures contract on the regulated commodity exchange. Similarly, when the Company sells commodities at a fixed price, the sale is offset with the purchase of a futures contract on the regulated commodity exchange. At the close of business each day, inventory and open purchase and sale contracts as well as open futures and option positions are marked-to-market. Gains and losses in the value of the Company's ownership positions due to changing market prices are netted with, and substantially offset in the Statement of Operations by, losses and gains in the value of the Company's futures positions.

When a futures contract is entered into, an initial margin deposit must be sent to the regulated commodity exchange. The amount of the margin deposit is set by the regulated commodity exchange and varies by commodity. If the market price of a futures contract moves in a direction that is adverse to the Company's position, an additional margin deposit, called a maintenance margin, is required by regulated commodity exchanges. Subsequent price changes could require additional maintenance margin deposits or result in the return of maintenance margin deposits by the regulated commodity exchange. Significant increases in market prices, such as those that occur when grain supplies are affected by unfavorable weather conditions and/or when increases in demand occur, can have an effect on the Company's liquidity and, as a result, require it to maintain appropriate short-term lines of credit. The Company may utilize regulated commodity exchange option contracts to limit its exposure to potential required margin deposits in the event of a rapidly rising market.

The Company has a lease and marketing agreement with Cargill, Incorporated ("Cargill") for Cargill's Maumee and Toledo, Ohio grain handling and storage facilities. As part of the agreement, Cargill holds certain marketing rights to grain in the Cargill-owned facilities as well as the adjacent Company-owned facilities in Maumee and Toledo. The marketing agreement contains a profit-sharing provision whereby cumulative earnings generated from the grain facilities are contractually shared. As of December 31, 2021, the lease of the Cargill-owned facilities covers approximately 5%, or 8.8 million bushels, of the Company's total storage capacity.

Renewables

The Renewables Group (formerly the Ethanol Group) produces, purchases and sells ethanol and co-products, offers facility operations, risk management, and ethanol and co-products marketing services to the ethanol plants it invests in and operates. The group was rebranded in 2021 to reflect the strategic shift and focus on serving the broader renewables market, including renewable diesel and our ethanol plants. The group co-owns five ethanol plants located in Indiana, Iowa, Kansas, Michigan and Ohio. The group demonstrates an expertise in ethanol plant management, logistics and commercialization of ethanol and feed products with a focus on leading the industry in margins per bushel. The business also leverages partnerships, which are discussed in further detail below, to expand market knowledge and shared technology across its five plants. The group also operates a merchandising and trade portfolio of ethanol, ethanol co-products and other biofuels such as renewable diesel.

The Andersons, Inc. | 2021 Form 10-K | 2

Through the first nine months of 2019 the Renewables Group held ownership interests in three limited liability companies (“the ethanol LLCs” or “LLCs”), each of which owned an ethanol plant that was operated by the Company's Renewables Group. On October 1, 2019, the Renewables Group entered into an agreement to merge the LLCs and the Company's wholly-owned subsidiary, The Andersons Denison Ethanol LLC into a new legal entity, The Andersons Marathon Holdings LLC ("TAMH"). As a result of the merger, the Company and Marathon Petroleum Corporation ("Marathon") own 50.1% and 49.9% of TAMH equity, respectively. The transaction resulted in the consolidation of TAMH’s results in the Company's financial statements effective October 1, 2019. Prior to October 1, 2019, the results of the Ethanol LLCs were accounted for under the equity method of accounting. The four ethanol plants within TAMH are located in Iowa, Indiana, Michigan, and Ohio. These plants have a combined production capacity of 480 million gallons of ethanol, with a nameplate capacity of 405 million gallons.

The Company also owns 51% of ELEMENT, LLC ("ELEMENT") and ICM, Inc. ("ICM") owns the remaining 49% interest. In 2019, ELEMENT completed the construction of a 70 million-gallon-per-year bio-refinery in Kansas which began limited production in the third quarter of 2019. ICM managed the initial construction of the facility, while the Company operates the facility under a management contract, provides corn origination, ethanol marketing, and risk management services. The Company fully consolidates ELEMENT's results in the Company's financial statements.

Plant Nutrient

The Plant Nutrient Group is a leading manufacturer, distributor and retailer of agricultural and related plant nutrients, corncob-based products, and pelleted lime and gypsum products in the U.S. Corn Belt and Puerto Rico. The group provides warehousing, packaging and manufacturing services to basic nutrient producers and other distributors. The group also manufactures and distributes a variety of industrial products throughout the U.S. and Puerto Rico including nitrogen reagents for air pollution control systems used in coal-fired power plants, and water treatment and dust abatement products.

In its plant nutrient business, the Company competes with regional and local cooperatives, wholesalers and retailers, predominantly publicly owned manufacturers and privately-owned retailers, wholesalers and importers. Some of these competitors are also suppliers. Competition in the nutrient business is based largely on depth of product offering, price, location and service. Sales and warehouse shipments of agricultural nutrients are heaviest in the spring and fall.

As of January 1, 2020, the group reorganized into the three divisions listed below:

Ag Supply Chain - The Ag Supply Chain division provides wholesale nutrients and farm services focused primarily in the Eastern Grain Belt. The wholesale nutrients part of the business stores and distributes dry and liquid agricultural nutrients, and soil amendments. The major nutrient products sold principally contain nitrogen, phosphate, potassium and sulfur which are typically bought and sold as commodities. The farm centers offer a variety of essential crop nutrients, crop protection chemicals and seed products in addition to application and agronomic services to commercial and family farmers. Soil and tissue sampling along with global satellite assisted services provide for pinpointing crop or soil deficiencies and prescriptive agronomic advice is provided to farmers.

Engineered Granules - The Engineered Granules division manufactures and distributes proprietary professional lawn care products that are primarily sold into the golf course and professional turf care markets, serving both U.S. and international customers. These products are sold both directly and through distributors to golf courses and lawn service applicators. The Company also performs contract manufacturing services to sell fertilizer and weed and pest control products to various markets as well as the manufacturing of pelleted lime, gypsum and value add soil amendments. Additionally, corncob-based products are manufactured for a variety of uses including laboratory animal bedding and private-label cat litter, as well as absorbents, blast cleaners, carriers and polishers. The products are distributed throughout the United States, Canada, Europe and Asia. The principal sources for corncobs are seed corn producers.

Specialty Liquids - The Specialty Liquids division manufactures specialty ag liquids, seed starters and zinc as well as a manufacturer of industrial liquids. The business has a diverse portfolio of specialty products which support more sustainable farming practices and command higher margins.

Other

The Company's “Other” activities include corporate income, a small corporate venture fund and the cost for functions that provide support and services to the operating segments. The results include expenses and benefits not allocated to the operating segments.

The Andersons, Inc. | 2021 Form 10-K | 3

Human Capital Resources and Management

As of December 31, 2021, the Company had a total of 2,371 employees across its Trade, Renewables and Plant Nutrient segments and Corporate Services function. This total was comprised of 913 salary, 1,383 hourly and 75 seasonal employees who conducted work at 147 locations across the United States, Canada, United Kingdom, Switzerland, Mexico and Singapore. Ninety five of the Company’s locations included less than 10 employees.

•Recruiting: Talent acquisition efforts target both internal and external candidates. The Company advertises opportunities on large online job boards, state job boards and various targeted diversity job boards, as well as geographically specific media channels. The Company strives to find candidates within its geographic footprint to generate a diverse talent pool. It also engages in campus recruiting efforts for entry level professional talent, internships and professional development programs.

•Focus on Safety: Maintaining a high standard of employee safety is paramount to the Company’s core values. Systems and technology have been implemented to support the Company’s safety initiative, maintain a safe working environment and foster a culture of personal accountability. As a part of our employee onboarding process, employees are required to complete core safety courses. A yearly training calendar is followed to ensure timely completion of annual safety training. The Company advanced its safety program in recent years by identifying and focusing on high-risk work that has the potential of causing serious injury or fatality.

•Employee Engagement: The Company maintains an open-door policy that encourages candid conversations between employees and any level of leadership about job-related concerns without fear of reprisal. It regularly solicits employee feedback through informal pulse surveys and formal engagement surveys. It also communicates with employees on a weekly, monthly and quarterly basis through electronic newsletters, town halls, its intranet site and small group meetings with the Chief Executive Officer.

•Talent Development: The Company offers several resources to help employees expand their business knowledge and leadership skills. It hosts a Foundations of Leadership training course to newly appointed supervisors. It also offers a learning management system which houses numerous online courses, videos, audiobooks and podcasts that are available to all employees on demand. Additionally, several in-person trainings are led by internal staff.

•Health and Wellness: The Company partners with a wellness vendor to offer a comprehensive healthy lifestyles program to employees and their spouses. The program uses rewards and incentives to encourage participants to take the necessary steps to manage their health and wellness. The program was recently expanded to offer a prediabetes program, personal e-coaching with a licensed health professional and financial wellness webinars.

•Compensation and Benefits: The Company offers market competitive employee compensation and benefits programs. Benefits include a health care benefits, dental and vision benefits, disability and life insurance coverages and other a la carte voluntary benefit offerings. Company leave policies include domestic and sexual violence leave, family and medical leave, parental leave and military leave.

•Community Involvement: The Company believes strongly in sharing its time, talent and financial resources to help improve and sustain the quality of life in its communities. It has contributed a portion of its operating income to community organizations every year since its founding in 1947. The Company also encourages employees to share their time and gifts through volunteerism, participation in its annual workplace giving campaign and gift match program.

Government Regulation

Grain sold by the Company must conform to official grade standards imposed under a federal system of grain grading and inspection administered by the United States Department of Agriculture (“USDA”).

The production levels, markets and prices of the grains that the Company merchandises are affected by United States government programs, which include acreage control and price support programs of the USDA. In regard to our investments in ethanol production facilities, the U.S. government has mandated a ten percent blend for motor fuel gasoline sold.

The U.S. Food and Drug Administration (“FDA”) has developed bioterrorism prevention regulations for food facilities, which require that the Company registers its grain operations with the FDA, provide prior notice of any imports of food or other agricultural commodities coming into the United States and maintain records to be made available upon request that identifies the immediate previous sources and immediate subsequent recipients of its grain commodities.

The Andersons, Inc. | 2021 Form 10-K | 4

The Company, like other companies engaged in similar businesses, is subject to a multitude of federal, state and local environmental protection laws and regulations including, but not limited to, laws and regulations relating to air quality, water quality, pesticides and hazardous materials. The provisions of these various regulations could require modifications of certain of the Company's existing facilities and could restrict the expansion of future facilities or significantly increase the cost of their operations. Compliance with environmental laws and regulations did not materially affect the Company's earnings or competitive position in 2021. In each of the countries in which we operate, we are subject to a variety of laws and regulations governing various aspects of our business, including general business regulations as well as those governing the manufacturing, handling, storage, transport, marketing and sale of our products. These include laws and regulations relating to facility licensing and permitting, food and feed safety, the handling and production of regulated substances, nutritional and labeling requirements, global trade compliance and other matters.

Available Information

The Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are filed with the Securities and Exchange Commission (the “SEC”). The Company is subject to the informational requirements of the Exchange Act and files or furnishes reports, proxy statements and other information with the SEC. Such reports and other information filed by the Company with the SEC are available free of charge at https://theandersonsinc.gcs-web.com/financial-information/sec-filings when such reports are available on the SEC’s website. The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at www.sec.gov. The Company periodically provides other information for investors on its corporate website, www.andersonsinc.com, and its investor relations website, https://theandersonsinc.gcs-web.com. This includes press releases and other information about financial performance, information on corporate governance and details related to the Company’s annual meeting of shareholders. The information contained on the websites referenced in this Form 10-K is not incorporated by reference into this filing. Further, the Company’s website references above are intended to be inactive textual references only.

Item 1A. Risk Factors

The Company's operations are subject to risks and uncertainties that could cause actual results to differ materially from those discussed in this Form 10-K and could have a material adverse impact on our financial results. The risks described below are not the only risks facing us. Additional risks and uncertainties not currently known to us or those we currently view to be immaterial may also materially and adversely affect our business, financial condition or results of operations. These risks can be impacted by factors beyond our control. The following risk factors should be read carefully in connection with evaluating our business and the forward-looking statements contained elsewhere in this Form 10-K.

Risks Related to our Business and Industry

The Company’s business, results of operations, financial condition and stock price have been adversely affected and could in the future be materially adversely affected by the COVID-19 pandemic.

The novel strain of coronavirus ("COVID-19") has spread rapidly throughout the world, prompting governments and businesses to take unprecedented measures in response. Such measures have included restrictions on travel and business operations, temporary closures of businesses, quarantine requirements and shelter-in-place orders. The COVID-19 pandemic has significantly curtailed global economic activity and caused significant volatility and disruption in global financial markets.

The COVID-19 pandemic and the measures taken by many countries in response have adversely affected and could in the future materially adversely impact the Company’s business, results of operations, financial condition and stock price. Following the initial outbreak of the virus, the Company experienced disruptions in ethanol demand as a result of the stay at home orders enforced throughout the year limiting travel. The Company has been designated a key infrastructure company by the U.S. Cybersecurity and Infrastructure Security Agency which has resulted in the Company's facilities to remain open under the appropriate government guidelines to protect public health and the health and safety of employees and customers. The Company has at times required substantially all of its administrative employees to work remotely.

The Company is continuing to monitor the situation and has taken actions in accordance with the recommendations and requirements of relevant authorities. The full extent of the impact of the COVID-19 pandemic on the Company’s operational and financial performance remains uncertain and will depend on many factors outside the Company’s control, including, without limitation, the timing, extent, trajectory and duration of the pandemic and the impacts of resurgences or new variants of

The Andersons, Inc. | 2021 Form 10-K | 5

the virus, the development, availability and use of effective treatments and vaccines, the imposition of and compliance with protective public safety measures, and the impact of the pandemic on the global economy. Additional future impacts on the Company may include, but are not limited to, material adverse effects on: demand for the Company’s products and services; the Company’s supply chain and sales and distribution channels; the Company’s ability to execute its strategic plans; and the Company’s profitability and cost structure.

To the extent the COVID-19 pandemic adversely affects the Company’s business, results of operations, financial condition and stock price, it may also have the effect of heightening many of the other risks described in this Part I, Item 1A of this Form 10-K.

Certain of our business segments are affected by the supply and demand of commodities and are sensitive to factors outside of our control. Adverse price movements could negatively affect our profitability and results of operations.

Our Trade, Renewables and Plant Nutrient businesses buy, sell and hold inventories of agricultural input and output commodities, some of which are readily traded on commodity futures exchanges. Unfavorable weather conditions, both local and worldwide, as well as other factors beyond our control, can affect the supply and demand of these commodities and expose us to liquidity pressures to finance hedges in the commodity business in rapidly rising markets. In our Plant Nutrient business, changes in the supply and demand of these commodities can also affect the value of inventories that we hold, as well as the price of raw materials as we are unable to effectively hedge these commodities. Increased costs of inventory and prices of raw material would decrease our profit margins and adversely affect our results of operations.

Corn - The principal raw material used to produce ethanol and co-products is corn. As a result, an increase in the price of corn in the absence of a corresponding increase in petroleum-based fuel prices will typically decrease ethanol margins thus adversely affecting financial results in the Renewables Group. At certain levels, corn prices may make ethanol uneconomical to produce for fuel markets. The price of corn is influenced by weather conditions and other factors affecting crop yields, shifts in acreage allocated to corn versus other major crops and general economic and regulatory factors. These factors include government policies and subsidies with respect to agriculture and international trade, and global and local demand and supply. The significance and relative effect of these factors on the price of corn is difficult to predict. Any event that tends to negatively affect the supply of corn, such as adverse weather or crop disease, could increase corn prices and adversely impact income. In addition, we may also have difficulty, from time to time, in physically sourcing corn on economical terms due to supply shortages. High costs or shortages could require us to suspend ethanol operations until corn is available on economical terms, which would have an adverse effect on operating results.

Commodities - While we attempt to manage the risk associated with agricultural commodity price changes for our commodity inventory positions with derivative instruments, including purchase and sale contracts, we are unable to offset 100% of the price risk of each transaction due to timing, availability of futures and options contracts and third-party credit risk. Furthermore, there is a risk that the derivatives we employ will not be effective in offsetting all of the risks that we are trying to manage. This can happen when the derivative and the underlying value of grain inventories and purchase and sale contracts are not perfectly matched. Our commodity derivatives, for example, do not perfectly correlate with the basis component of our commodity inventory and contracts. Basis is defined as the difference between the local cash price of a commodity and the corresponding exchange-traded futures price. Differences can reflect time periods, locations or product forms. Although the basis component is smaller and generally less volatile than the futures component of our grain market price, basis moves on a large commodity position can significantly impact the profitability of the Trade business.

Our futures, options and over-the-counter contracts are subject to margin calls. If there are large movements in the commodities market, we could be required to post significant levels of margin deposits, which would impact our liquidity. There is no assurance that the efforts we have taken to mitigate the impact of the volatility of the prices of commodities upon which we rely will be successful and any sudden change in the price of these commodities could have an adverse effect on our business and results of operations.

Natural gas - We rely on third parties for our supply of natural gas, which is consumed in the drying of wet grain, manufacturing of certain lawn products, pelleted lime and gypsum, and manufacturing of ethanol. The prices for and availability of natural gas are subject to market conditions. These market conditions often are affected by factors beyond our control such as higher prices resulting from colder than average weather and overall economic conditions. Significant disruptions in the supply of natural gas could impair the operations of the ethanol facilities. Furthermore, increases in natural gas prices or changes in our natural gas costs relative to natural gas costs paid by competitors may adversely affect future results of operations and financial position.

The Andersons, Inc. | 2021 Form 10-K | 6

Gasoline and oil - We market ethanol as a fuel additive to reduce vehicle emissions from gasoline, as an octane enhancer to improve the octane rating of gasoline with which it is blended and as a substitute for petroleum-based gasoline. As a result, ethanol prices will be influenced by the supply and demand for gasoline and oil and our future results of operations and financial position may be adversely affected if gasoline and oil demand or price changes.

Potash, phosphate and nitrogen - Raw materials used by the Plant Nutrient business include potash, phosphate and nitrogen, for which prices can be volatile and are driven by global and local supply and demand factors. Significant increases in the price of these commodities may result in lower customer demand and higher than optimal inventory levels. In contrast, reductions in the price of these commodities may create lower of cost or net realizable value adjustments to inventories.

Some of our business segments operate in highly regulated industries. Changes in government regulations or trade association policies could adversely affect our results of operations.

Many of our business segments are subject to government regulation and regulation by certain private sector associations, compliance with which can impose significant costs on our business. Other regulations are applicable generally to all our businesses and corporate functions, including, without limitation, those promulgated under the Internal Revenue Code, the Affordable Care Act, the Employee Retirement Income Security Act and other employment and health care related laws, federal and state securities laws, and the US Patriot Act. Failure to comply with such regulations can result in additional costs, fines or criminal action.

A significant part of our operations is regulated by environmental laws and regulations, including those governing the labeling, use, storage, discharge and disposal of hazardous materials. Because we use and handle hazardous substances in our businesses, changes in environmental requirements or an unanticipated significant adverse environmental event could have an adverse effect on our business. We cannot assure that we have been, or will at all times be, in compliance with all environmental requirements, or that we will not incur costs or liabilities in connection with these requirements. Private parties, including current and former employees, could bring personal injury or other claims against us due to the presence of, or exposure to, hazardous substances used, stored or disposed of by us, or contained in our products. We are also exposed to residual risk because some of the facilities and land which we have acquired may have environmental liabilities arising from their prior use. In addition, changes to environmental regulations may require us to modify our existing plant and processing facilities which could significantly increase the cost of those operations.

Trade and Renewables - In our Trade and Renewables businesses, agricultural production and trade flows can be affected by government programs and legislation. Production levels, markets and prices of the commodities we merchandise can be affected by U.S. government programs, which include acreage controls and price support programs administered by the USDA and required levels of ethanol in gasoline through the Renewable Fuel Standards as administered by the Environmental Protection Agency ("EPA"). Other examples of government policies that can have an impact on our business include tariffs, taxes, duties, subsidies, import and export restrictions, outright embargoes and price controls on agricultural commodities. Because a portion of our commodity sales are to exporters, the imposition of export restrictions and other foreign countries' regulations could limit our sales opportunities and create additional credit risk associated with export brokers if shipments are rejected at their destination.

International trade disputes can adversely affect agricultural commodity trade flows by limiting or disrupting trade between countries or regions. Trade disputes can lead to the implementing of tariffs on commodities in which we merchandise or otherwise use in our operations. This can lead to significant volatility in commodity prices, disruptions in historical trade flows and shifts in planting patterns in the Company's geographic footprint, which would present challenges and uncertainties for our business. The imposition of new tariffs or uncertainty around future tariff levels can cause significant fluctuations in the futures and basis levels of agricultural commodities, impacting our earnings. We cannot predict the effects that future trade policy or the terms of any negotiated trade agreements and their impact on our business.

Plant Nutrient - Our Plant Nutrient business manufactures certain agricultural nutrients and uses potentially hazardous materials. All products containing pesticides, fungicides and herbicides must be registered with the EPA and state regulatory bodies before they can be sold. The inability to obtain or the cancellation of such registrations could have an adverse impact on our business. In the past, regulations governing the use and registration of these materials have required us to adjust the raw material content of our products and make formulation changes. Future regulatory changes may have similar consequences. Regulatory agencies, such as the EPA, may at any time reassess the safety of our products based on new scientific knowledge or other factors. If it were determined that any of our products were no longer considered to be safe, it could result in the amendment or withdrawal of existing approvals, which, in turn, could result in a loss of revenue, cause our inventory to become obsolete or give rise to potential lawsuits against us. Consequently, changes in existing and future government or trade association polices may restrict our ability to do business and cause our financial results to suffer.

The Andersons, Inc. | 2021 Form 10-K | 7

We are required to carry significant amounts of inventory across all of our businesses. If a substantial portion of our inventory becomes damaged or obsolete, its value would decrease, and our profit margins would suffer.

We are exposed to the risk of a decrease in the value of our inventories due to a variety of circumstances in all of our businesses. For example, within our Trade and Renewables businesses, there is the risk that the quality of our inventory could deteriorate due to damage, moisture, insects, disease or foreign material. If the quality of our inventory were to deteriorate below an acceptable level, the value of our inventory could decrease significantly. In our Plant Nutrient business, planted acreage, and consequently the volume of fertilizer and crop protection products applied, is partially dependent upon government programs and the producer's perception of demand. Technological advances in agriculture, such as genetically engineered seeds that resist disease and insects, or that meet certain nutritional requirements, could also affect the demand for our crop nutrients and crop protection products. Either of these factors could render some of our inventory obsolete or reduce its value.

Our indebtedness could negatively affect our financial condition, decrease our liquidity and impair our ability to operate the business.

If cash on hand is insufficient to pay our obligations or margin calls as they come due at a time when we are unable to draw on our credit facility, it could have an adverse effect on our ability to conduct our business. Our ability to make payments on and to refinance our indebtedness will depend on our ability to generate cash in the future. Our ability to generate cash is dependent on various factors. These factors include general economic, financial, competitive, legislative, regulatory and other factors that are beyond our control. Certain of our long-term borrowings include provisions that require minimum levels of working capital and equity and impose limitations on additional debt. Our ability to satisfy these provisions can be affected by events beyond our control, such as the demand for and the fluctuating price of commodities. Noncompliance with these provisions could result in default and acceleration of long-term debt payments.

Further, the Financial Conduct Authority, the authority that regulates the London Interbank Offered Rate ("LIBOR"), announced it intends to stop compelling banks to submit rates for the calculation of LIBOR beginning in 2022 and ceasing all such rates by mid-2023. The Alternative Reference Rates Committee ("ARRC") has proposed that the Secured Overnight Financing Rate ("SOFR") is the rate that represents best practice as the alternative to USD-LIBOR for use in debt instruments, derivatives and other financial contracts that are currently indexed to USD-LIBOR. ARRC has proposed a paced market transition plan to SOFR from USD-LIBOR, and organizations are currently working on industry wide and company specific transition plans as they relate to derivatives, debt and cash markets exposed to USD-LIBOR. Although an alternative to LIBOR has been contemplated in the Company’s bank credit agreement, it is unclear as to the new method of calculating LIBOR that may evolve, and this new method could adversely affect the Company’s interest rates on its indebtedness.

We face increasing competition and pricing pressure from other companies in our industries. If we are unable to compete effectively with these companies, our sales and profit margins would decrease, and our earnings and cash flows would be adversely affected.

The markets for our products in each of our business segments are highly competitive. While we have substantial operations in certain of the regions where we operate, some of our competitors are significantly larger, compete in wider markets, have greater purchasing power, and have considerably larger financial resources. We also may enter into new markets where our brand is not recognized and in which we do not have an established customer base. Competitive pressures in all of our businesses could affect the price of, and customer demand for, our products, thereby negatively impacting our profit margins and resulting in a loss of market share.

Our Trade and Renewables businesses use derivative contracts to reduce volatility in the commodity markets. Non-performance by the counter-parties to those contracts could adversely affect our future results of operations and financial position.

A significant amount of purchases and sales within the Trade and Renewables segment are made through forward contracting, much of which includes a natural back-to-back hedging relationship.. In addition, the Company uses exchange traded and, to a lesser degree, over-the-counter contracts to further reduce volatility in changing commodity prices. A significant adverse change in commodity prices could cause a counter-party of one or more of our derivative contracts to not perform on its obligation.

The Andersons, Inc. | 2021 Form 10-K | 8

Adverse weather conditions, including as a result of climate change, may adversely affect the availability, quality and price of agricultural commodities and agricultural commodity products, as well as our operations and operating results.

Adverse weather conditions have historically caused volatility in the agricultural commodity industry and consequently in our operating results by causing crop failures or significantly reduced harvests, which may affect the supply and pricing of the agricultural commodities that we sell and use in our business, reduce demand for our fertilizer products and negatively affect the creditworthiness of agricultural producers who do business with us. A significant portion of the Company's assets are exposed to conditions in the Eastern Grain Belt. In this region, adverse weather during the fertilizer application, planting, and harvest seasons can have negative impacts on our Trade, Renewables and Plant Nutrient businesses. Higher basis levels or adverse crop conditions in the Eastern Grain Belt can increase the input costs or lower the market value of our products relative to other market participants that do not have the same geographic concentration.

Additionally, the potential physical impacts of climate change are uncertain and may vary by region. These potential effects could include changes in rainfall patterns, water shortages, changing sea levels, changing storm patterns and intensities, and changing temperature levels that could adversely impact our costs and business operations, the location, costs and competitiveness of agricultural commodity production and related storage and processing facilities and the supply and demand for agricultural commodities. These effects could be material to our results of operations, liquidity or capital resources.

General Risk Factors

We rely on a limited number of suppliers for certain of our raw materials and other products and the loss of one or several of these suppliers could increase our costs and have a material adverse effect on any one of our business segments.

We rely on a limited number of suppliers for certain of our raw materials and other products. If we were unable to obtain these raw materials and products from our current vendors, or if there were significant increases in our supplier's prices, it could significantly increase our costs and reduce our profit margins.

We are subject to global and regional economic downturns and related risks.

The level of demand for our products is affected by global and regional demographic and macroeconomic conditions, including population growth rates and changes in standards of living. A significant downturn in global economic growth, or recessionary conditions in major geographic regions, may lead to reduced demand for agricultural commodities and food products, which could adversely affect our business and results of operations. The pace of economic improvement is uncertain especially given the current global pandemic caused by COVID-19 and there can be no assurance that economic and/or political conditions will not continue to affect market and consumer confidence or deteriorate further in the near term.

The Company may not be able to effectively integrate businesses it acquires.

We continuously look for opportunities to enhance our existing businesses through strategic acquisitions. The process of integrating an acquired business into our existing business and operations may result in unforeseen operating difficulties and expenditures as well as require a significant amount of management resources. There is also the risk that our due diligence efforts may not uncover significant business flaws or hidden liabilities. In addition, we may not realize the anticipated benefits of an acquisition and they may not generate the anticipated financial results. Additional risks may include the inability to effectively integrate the operations, products, technologies and personnel of the acquired companies. The inability to maintain uniform standards, controls, procedures and policies would also negatively impact operations.

If our goodwill or amortizable intangible assets become impaired, then we could be required to record a significant charge to earnings.

GAAP requires us to test for goodwill impairment at least annually. In addition, we review our tangible and intangible assets for impairment when events or changes in circumstances indicate the carrying value may not be recoverable. Factors that may be considered a change in circumstances indicating that the carrying value of our goodwill or amortizable intangible assets may not be recoverable include prolonged declines in stock price, market capitalization or cash flows, and slower growth rates in our industry. Depending on the results of our review, we could be required to record a significant charge to earnings in our Consolidated Financial Statements during the period in which any impairment of our goodwill or amortizable intangible assets were determined, negatively impacting our results of operations.

The Andersons, Inc. | 2021 Form 10-K | 9

Our business involves considerable safety risks. Significant unexpected costs and liabilities would have an adverse effect on our profitability and overall financial position.

Due to the nature of some of the businesses in which we operate, we are exposed to significant operational hazards such as grain dust explosions, fires, malfunction of equipment, abnormal pressures, blowouts, pipeline and tank ruptures, chemical spills or run-off, transportation accidents and natural disasters. Some of these operational hazards may cause personal injury or loss of life, severe damage to or destruction of property and equipment or environmental damage and may result in suspension of operations and the imposition of civil or criminal penalties. If grain dust were to explode at one of our elevators, if an ethanol plant were to explode or catch fire, or if one of our pieces of equipment were to fail or malfunction due to an accident or improper maintenance, it could put our employees and others at serious risk.

The Company's information technology systems may impose limitations or failures, or may face external threats, which may affect the Company's ability to conduct its business.

The Company's information technology systems, some of which are dependent on services provided by third parties, provide critical data connectivity, information and services for internal and external users. These interactions include, but are not limited to, ordering and managing materials from suppliers, converting raw materials to finished products, inventory management, shipping products to customers, processing transactions, summarizing and reporting results of operations, complying with regulatory, legal or tax requirements, human resources and other processes necessary to manage the business. The Company has put in place business continuity plans for its critical systems. However, if the Company's information technology systems are damaged, or cease to function properly due to any number of causes, such as catastrophic events or power outages, and the Company's business continuity plans do not allow it to effectively recover on a timely basis, the Company may suffer interruptions in the ability to manage its operations, which may adversely impact the Company's operating results. Our security measures may also be breached due to employee error, malfeasance, or otherwise. In addition, although the systems continue to be refreshed periodically, portions of the infrastructure are outdated and may not be adequate to support new business processes, accounting for new transactions, or implementation of new accounting standards if requirements are complex or materially different than what is currently in place.

Additionally, outside parties may attempt to destroy critical information, or fraudulently induce employees, third-party service providers, or users to disclose sensitive information to gain access to our data or our users' data. As a response, the Company requires user names and passwords to access its information technology systems. The Company also uses encryption and authentication technologies designed to secure the transmission and storage of data and prevent access to Company and user data or accounts. The Company also conducts tests and assessments using independent third parties on a regular basis. As with all companies, these security measures are subject to third-party security breaches, employee error, malfeasance, faulty password management, or other irregularities. We cannot assure our ability to prevent, repel or mitigate the effects of such an attack by outside parties. The Company also relies on third parties to maintain and process certain information which could be subject to breach or unauthorized access to Company or employee information. Any such breach or unauthorized access could result in an inability to perform critical functions, significant legal and financial exposure, damage to our reputation, and a loss of confidence in the security of our services that could potentially have an adverse effect on our business.

Unauthorized disclosure of sensitive or confidential customer information could harm the Company's business and standing with our customers.

The protection of our customer, employee and Company data is critical to us. The Company relies on commercially available systems, software, tools and monitoring to provide security for processing, transmission and storage of confidential customer information, such as payment card and personal information. The Company also conducts annual tests and assessments using independent third parties. Despite the security measures the Company has in place, its facilities and systems, and those of its third-party service providers, may be vulnerable to security breaches, acts of vandalism, computer viruses, misplaced or lost data, programming or human errors, or other similar events. Any security breach involving the misappropriation, loss or other unauthorized disclosure of confidential information, whether by the Company or its vendors, could damage our reputation, expose us to risk of litigation and liability, disrupt our operations and harm our business.

The Andersons, Inc. | 2021 Form 10-K | 10

A change in tax laws or regulations of any federal, state or international jurisdiction in which we operate could increase our tax burden and otherwise adversely affect our financial position, results of operations, cash flows and liquidity.

We continue to assess the impact of various U.S. federal, state, local and international legislative proposals that could result in a material increase to our U.S. federal, state, local and/or international taxes. We cannot predict what impact, if any, changes in federal policy, including tax policies, will have on our industry or whether any specific legislation will be enacted or the terms of any such legislation. However, if such proposals were to be enacted, or if modifications were to be made to certain existing regulations, the consequences could have a material adverse impact on us, including increasing our tax burden, increasing our cost of tax compliance or otherwise adversely affecting our financial position, results of operations, cash flows and liquidity. Changes in applicable U.S. or foreign tax laws and regulations, or their interpretation and application, including the possibility of retroactive effect, could affect our tax expense and profitability. Such impact may also be affected positively or negatively by subsequent potential judicial interpretation or related regulation or legislation which cannot be predicted with certainty.

We are subject to various legal and regulatory proceedings, including litigation in the ordinary course of business, and uninsured judgments or a rise in insurance premiums may adversely impact our business, financial condition and results of operations.

In the ordinary course of business, we are subject to various legal and regulatory proceedings, which may include but are not limited to those involving antitrust, tax, environmental, intellectual property, data privacy and other matters, including general commercial litigation. Any claims raised in legal and regulatory proceedings, whether with or without merit, could be time consuming and expensive to defend and could divert management’s attention and resources. Additionally, the outcome of legal and regulatory proceedings may differ from our expectations because the outcomes of these proceedings are often difficult to predict reliably. Various factors and developments can lead to changes in our estimates of liabilities and related insurance receivables, where applicable, or may require us to make additional estimates, including new or modified estimates that may be appropriate due to a judicial ruling or judgment, a settlement, regulatory developments or changes in applicable law. A future adverse ruling, settlement or unfavorable development could result in charges that could have a material adverse effect on our results of operations in any particular period.

In accordance with customary practice, we maintain insurance against some, but not all, of these potential claims. In the future, we may not be able to maintain insurance at commercially acceptable premium levels. In addition, the levels of insurance we maintain may not be adequate to fully cover any and all losses or liabilities. If any significant judgment or claim is not fully insured or indemnified against, it could have a material adverse impact on our business, financial condition and results of operations.

Item 1B. Unresolved Staff Comments

The Company has no unresolved staff comments.

The Andersons, Inc. | 2021 Form 10-K | 11

Item 2. Properties

The Company's principal agriculture and other properties are described below. The Company believes that its properties are adequate for its business, well maintained and utilized, suitable for their intended uses and adequately insured.

| Trade | Renewables | Plant Nutrient | ||||||||||||||||||||||||

| (in thousands) | Grain Storage | Nameplate Capacity | Dry Fertilizer Storage | Liquid Fertilizer Storage | ||||||||||||||||||||||

| Location | (bushels) | (gallons) | (tons) | (tons) | ||||||||||||||||||||||

| Canada | 22,238 | — | — | — | ||||||||||||||||||||||

| Idaho | 16,655 | — | — | — | ||||||||||||||||||||||

| Indiana | 21,690 | 110,000 | 132 | 134 | ||||||||||||||||||||||

| Iowa | — | 55,000 | — | 66 | ||||||||||||||||||||||

| Kansas | — | 70,000 | — | — | ||||||||||||||||||||||

| Louisiana | 24,948 | — | — | — | ||||||||||||||||||||||

| Michigan | 27,814 | 130,000 | 67 | 46 | ||||||||||||||||||||||

| Nebraska | 18,414 | — | — | 45 | ||||||||||||||||||||||

| Ohio | 42,151 | 110,000 | 168 | 73 | ||||||||||||||||||||||

| Wisconsin | — | — | 27 | 78 | ||||||||||||||||||||||

| Other | 11,556 | — | 56 | 69 | ||||||||||||||||||||||

| 185,466 | 475,000 | 450 | 511 | |||||||||||||||||||||||

The Trade facilities are mostly concrete and steel tanks, with some flat storage buildings. The Company also owns grain inspection buildings and dryers, maintenance buildings and truck scales and dumps. Approximately 82% of the total storage capacity noted above, which includes temporary pile storage, is owned, while the remaining capacity is leased from third parties.

The Plant Nutrient properties consist mainly of fertilizer warehouse and formulation and packaging facilities for dry and liquid fertilizers. The Company owns substantially all of the facilities noted above.

Item 3. Legal Proceedings

The Company is currently subject to various claims and suits arising in the ordinary course of business, which include environmental issues, employment claims, contractual disputes, and defensive counterclaims. The Company accrues liabilities in which litigation losses are deemed probable and estimable. The Company believes it is unlikely that the results of its current legal proceedings, even if unfavorable, will result in material liabilities beyond what it currently has accrued. There can be no assurance, however, that any claims or suits arising in the future, whether taken individually or in the aggregate, will not have a material adverse effect on our financial condition or results of operations.

The Andersons, Inc. | 2021 Form 10-K | 12

Item 4. Mine Safety

We are committed to protecting the occupational health and well-being of each of our employees. Safety is one of our core values, and we strive to ensure that safe production is the first priority for all employees. Our internal objective is to achieve zero injuries and incidents across the Company by focusing on proactively identifying needed prevention activities, establishing standards and evaluating performance to mitigate any potential loss to people, equipment, production and the environment. We have implemented intensive employee training that is geared toward maintaining a high level of awareness and knowledge of safety and health issues in the work environment through the development and coordination of requisite information, skills and attitudes. We believe that through these policies, we have developed an effective safety management system.

Under the Dodd-Frank Act, each operator of a coal or other mine is required to include certain mine safety results within its periodic reports filed with the SEC. As required by the reporting requirements included in §1503(a) of the Dodd-Frank Act and Item 104 of Regulation S-K, the required mine safety results regarding certain mining safety and health matters for each of our mine locations that are covered under the scope of the Dodd-Frank Act are included in Exhibit 95.1 of Item 15. Exhibits and Financial Statement Schedules.

The Andersons, Inc. | 2021 Form 10-K | 13

Part II.

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

The Common Shares of The Andersons, Inc. trade on the Nasdaq Global Select Market under the symbol “ANDE”.

Shareholders

At February 11, 2022, there were 952 shareholders of record and approximately 19,068 shareholders for whom security firms acted as nominees.

Dividends

The Company has declared and paid consecutive quarterly dividends since its first year of trading in 1996. Dividends paid from January 2020 to January 2022 are as follows:

| Payment Date | Amount | |||||||

| 1/23/2020 | $0.175 | |||||||

| 4/22/2020 | $0.175 | |||||||

| 7/22/2020 | $0.175 | |||||||

| 10/22/2020 | $0.175 | |||||||

| 1/20/2021 | $0.175 | |||||||

| 4/21/2021 | $0.175 | |||||||

| 7/22/2021 | $0.175 | |||||||

| 10/22/2021 | $0.175 | |||||||

| 1/21/2022 | $0.180 | |||||||

While the Company's objective is to pay a quarterly cash dividend, dividends are subject to Board of Director approval.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

| Period | Total Number of Shares Purchased | Average Price Paid Per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | Approximate Dollar Value of Shares that May Yet Be Purchased Under the Plans or Programs (1) | ||||||||||||||||||||||

October 2021 | — | $ | — | — | $ | — | ||||||||||||||||||||

November 2021 | 698 | 35.04 | — | — | ||||||||||||||||||||||

December 2021 | — | — | — | — | ||||||||||||||||||||||

| Total | 698 | $ | 35.04 | — | $ | 100,000,000 | ||||||||||||||||||||

(1) As of August 20, 2021, the Company was authorized to purchase up to $100 million of the Company's common stock (the "Repurchase Plan") on or before August 20, 2024. As of December 31, 2021, none of the $100 million available to repurchase shares had been utilized. The Repurchase Plan does not obligate the Company to acquire any specific number of shares. Under the Repurchase Plan, shares may be repurchased in privately negotiated and/or open market transactions, including under plans complying with Rule 10b5-1 under the Exchange Act.

The Andersons, Inc. | 2021 Form 10-K | 14

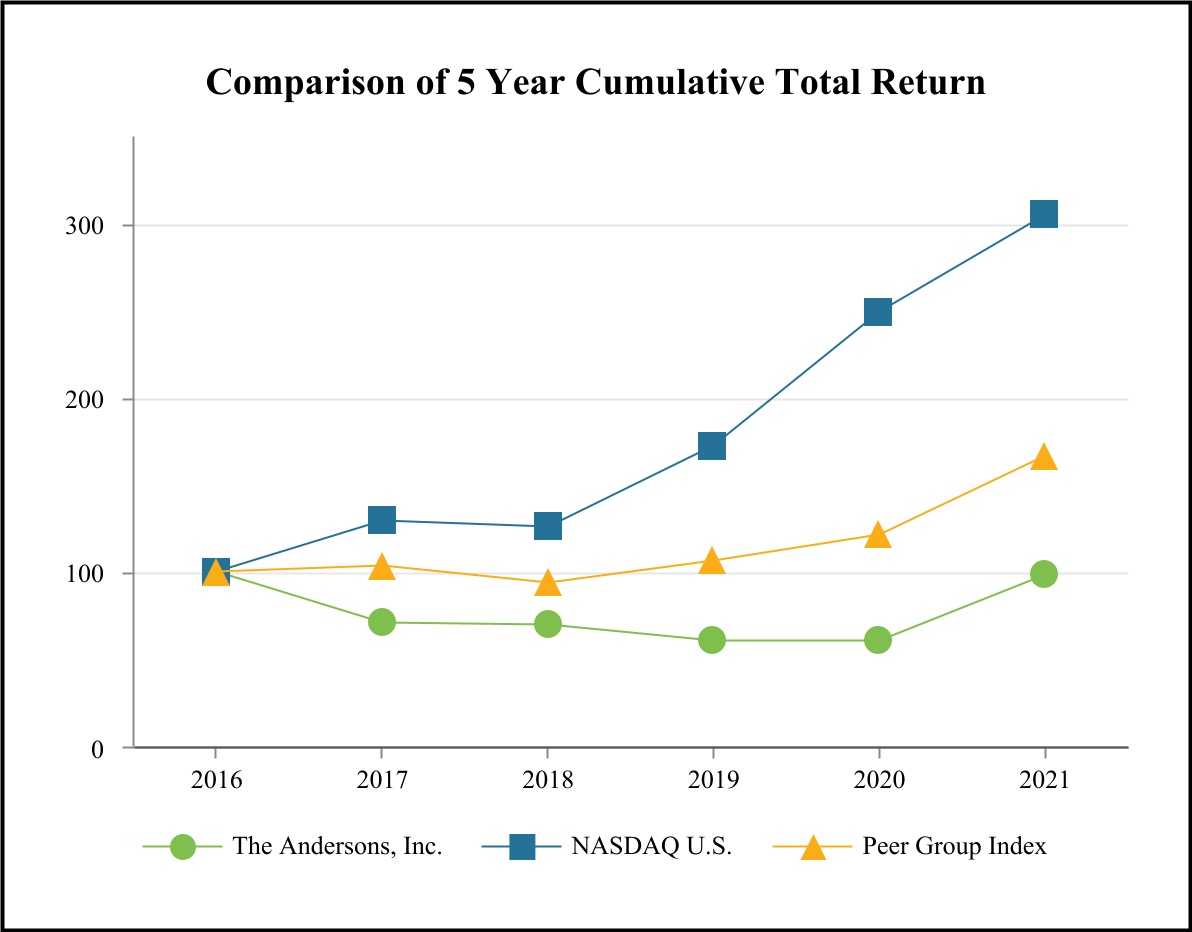

Performance Graph

The graph below compares the total shareholder return on the Company's Common Shares to the cumulative total return for the Nasdaq U.S. Index and a Peer Group Index. The indices reflect the year-end market value of an investment in the stock of each company in the index, including additional shares assumed to have been acquired with cash dividends, if any. The Peer Group Index, weighted for market capitalization, includes the following companies:

| Archer-Daniels-Midland Co. | Nutrien Ltd. | ||||

| GATX Corp. | The Greenbrier Companies, Inc. | ||||

| Green Plains, Inc. | The Scott's Miracle-Gro Company | ||||

| Ingredion Incorporated | |||||

The graph assumes a $100 investment in The Andersons, Inc. Common Shares on December 31, 2016 and also assumes investments of $100 in each of the Nasdaq U.S. and Peer Group indices, respectively, on December 31 of the first year of the graph. The value of these investments as of the following calendar year-ends is shown in the table below the graph.

| Base Period | Cumulative Returns | |||||||||||||||||||||||||||||||||||||

December 31, 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |||||||||||||||||||||||||||||||||

| The Andersons, Inc. | $ | 100.00 | $ | 71.03 | $ | 69.52 | $ | 60.34 | $ | 60.79 | $ | 98.20 | ||||||||||||||||||||||||||

| NASDAQ U.S. | 100.00 | 129.64 | 125.96 | 172.18 | 249.51 | 304.85 | ||||||||||||||||||||||||||||||||

| Peer Group Index | 100.00 | 103.71 | 93.75 | 106.39 | 121.41 | 166.65 | ||||||||||||||||||||||||||||||||

The Andersons, Inc. | 2021 Form 10-K | 15

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

Forward Looking Statements

The following “Management's Discussion and Analysis of Financial Condition and Results of Operations” contains forward-looking statements which relate to future events or future financial performance and involve known and unknown risks, uncertainties and other factors that may cause actual results, levels of activity, performance or achievements to be materially different from those expressed or implied by these forward-looking statements. Without limitation, these risks include economic, weather and regulatory conditions, competition, the COVID-19 pandemic and those listed under Item 1.A, "Risk Factors." The reader is urged to carefully consider these risks and factors. In some cases, the reader can identify forward-looking statements by terminology such as “may”, “anticipates”, “believes”, “estimates”, “predicts”, or the negative of these terms or other comparable terminology. These statements are only predictions. Actual events or results may differ materially. These forward-looking statements relate only to events as of the date on which the statements are made and the Company undertakes no obligation, other than any imposed by law, to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

Executive Overview

Our operations are organized, managed and classified into three reportable business segments: Trade, Renewables, and Plant Nutrient. Each of these segments is generally based on the nature of products and services offered and aligns with the management structure.

The agricultural commodity-based business is one in which changes in selling prices generally move in relationship to changes in purchase prices. Therefore, increases or decreases in prices of the commodities that the business deals in will have a relatively equal impact on sales and cost of sales and a much less significant impact on gross profit. As a result, changes in sales between periods may not necessarily be indicative of the overall performance of the business and more focus should be placed on changes in gross profit.

Recent Developments

The global emergence of COVID-19 continues to have a significant impact on the global economy. Government-mandated stay-at-home orders and other public health mandates and recommendations, as well as behavioral changes in response to the pandemic, have created labor shortages as labor force participation has remained below pre-pandemic levels. Additionally, supply constraints, low inventory levels and inflationary pressures from the pandemic have affected the industries in which the Company operates. The Company is continuing to actively manage its response to the COVID-19 pandemic, however, the future impacts of the ongoing pandemic on the Company’s business remain uncertain at this time.

The Company is a critical infrastructure industry as defined by The United States Department of Homeland Security, Cybersecurity and Infrastructure Agency. As COVID-19 continues to spread and certain regions experience accelerated spread or resurgences, the Company is currently conducting business as usual to the greatest extent possible in the current circumstances. The Company is taking a variety of measures to ensure the availability of its services throughout our network, promote the safety and security of our employees, and support the communities in which we operate. Certain modifications the Company has made in response to the COVID-19 pandemic include: implementing working at home protocols for all non-essential support staff; restricting employee business travel; strengthening clean workplace practices; reinforcing socially responsible sick leave recommendations; limiting visitor and third-party access to Company facilities; launching internal COVID-19 resources for employees; creating a pandemic response team comprised of employees and members of senior management; encouraging telephonic and video conference-based meetings along with other hygiene and social distancing practices recommended by health authorities including Health Canada, the U.S. Centers for Disease Control and Prevention, and the World Health Organization; and maintaining employment benefit coverage of employees through the pandemic. The Company is responding to this crisis through measures designed to protect our workforce and prevent disruptions to the Company's operations within the North American agricultural supply chain.

The Andersons, Inc. | 2021 Form 10-K | 16

The Company will continue to actively monitor the situation and may take further actions that could materially alter our business operations as may be required or recommended by federal, provincial, state or local authorities, or that management determines are in the best interests of our employees, customers, shareholders, partners, suppliers and other stakeholders.

Additional information concerning the impact COVID-19 may have to our future business and results of operations is provided in Part I, Item 1A. Risk Factors.

Trade

The Trade Group's performance reflects a substantial increase over the prior year as the Group was able to capitalize on commodity price volatility and market dislocations brought on by a demand-driven agricultural rally. During the course of the year, this demand driven rally created an inversion in the futures market for the majority of the agricultural commodities handled by the Group's asset business, resulting in strong elevation margins. Our recent growth from the Swiss trading and Southwest US feed merchandising businesses also contributed to the improved year-over-year results. Additionally, the food and specialty ingredients business netted higher results as the industry continues to recover from the COVID-19 impacts.

Total grain storage capacity, including temporary pile storage, was approximately 185.5 million bushels as of December 31, 2021 and 202.1 million bushels as of December 31, 2020. Commodity inventories on hand at December 31, 2021 were 187.0 million bushels, of which 3.0 million bushels were stored for others. This compares to 142.8 million bushels on hand at December 31, 2020, of which 3.0 million bushels were stored for others.

Looking forward, the Group is well-positioned to capture value and growth across the diverse portfolio of commodities in which it operates with expected ongoing strong fundamentals.

Renewables

The Renewables Group results attributable to the Company were significantly improved compared to the prior year with the largest increase from strong co-product margins as a result of increased high-protein and corn oil values. Further, the Group benefited as spot ethanol crush margins recovered due to gasoline demand returning to pre-pandemic levels coupled with overall low industry stocks. As we move into 2022, the Renewables Group anticipates strong trading opportunities due to robust co-product margins including high corn oil values from strong renewable diesel demand. While high corn prices may place pressure on crush margins, they also improve co-products sales as we are able to sell products such as DDGs and corn oil at higher values.

Volumes shipped for the years ended December 31, 2021 and December 31, 2020 were as follows:

| Twelve months ended December 31, | |||||||||||

| (in thousands) | 2021 | 2020 | |||||||||

| Ethanol (gallons shipped) | 726,512 | 592,738 | |||||||||

| E-85 (gallons shipped) | 41,572 | 27,321 | |||||||||

| Corn Oil (pounds shipped) | 286,082 | 117,563 | |||||||||

| DDG (tons shipped) | 2,040 | 1,850 | |||||||||

Plant Nutrient

The Plant Nutrient Group's results increased year-over-year due to well-positioned inventory and high fertilizer prices. Fertilizer prices have increased year-over-year due to tight global supplies and increased demand from improved grain prices and strong farmer income. The benefit from higher prices were partially offset by higher input costs and a tight labor market, specifically in the manufactured products business. Further, the Group continues to benefit from cost reduction initiatives and effective working capital management.

Total storage capacity at our ag supply chain and engineered granules locations was approximately 450 thousand tons for dry nutrients and approximately 511 thousand tons for liquid nutrients at December 31, 2021, which is similar to the prior year.

Looking forward, the Group expects continued opportunities in 2022 with high commodity prices, higher farmer income and well-positioned inventory.

The Andersons, Inc. | 2021 Form 10-K | 17

Tons of product sold for the years ended December 31, 2021 and December 31, 2020 were as follows:

| Twelve months ended December 31, | |||||||||||

| (in thousands) | 2021 | 2020 | |||||||||

| Ag Supply Chain | 1,621 | 1,585 | |||||||||

| Specialty Liquids | 410 | 351 | |||||||||

| Engineered Granules | 453 | 416 | |||||||||

| Total tons | 2,484 | 2,352 | |||||||||

In the table above, Ag Supply Chain represents facilities principally engaged in the wholesale distribution and retail sale and application of primary agricultural nutrients such as bulk nitrogen, phosphorus, and potassium. Specialty Liquid locations produce and sell a variety of low-salt liquid starter fertilizers, micronutrients for agricultural use, and specialty products for use in various industrial processes. Engineered Granules facilities primarily manufacture granulated dry products for use in specialty turf and agricultural applications.

Other

The Company's “Other” activities include corporate income and expense and cost for functions that provide support and services to the operating segments. The results include expenses and benefits not allocated to the operating segments and other elimination and consolidation adjustments.

Results for Fiscal 2020 compared to Fiscal 2019

For comparisons of the Company's consolidated and segment results of operations and consolidated cash flows for the fiscal years ended December 31, 2020 to December 31, 2019, refer to Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations of the Annual Report on Form 10-K for the fiscal year ended December 31, 2020, filed with the SEC on February 25, 2021.

The Andersons, Inc. | 2021 Form 10-K | 18

Operating Results

The following discussion focuses on the operating results as shown in the Consolidated Statements of Operations with a separate discussion by segment. Additional segment information is included in Note 12 to the Company's Consolidated Financial Statements in Item 8.

Year ended December 31, 2021 | |||||||||||||||||||||||||||||

| (in thousands) | Trade | Renewables | Plant Nutrient | Other | Total | ||||||||||||||||||||||||

| Sales and merchandising revenues | $ | 9,304,357 | $ | 2,440,798 | $ | 866,895 | $ | — | $ | 12,612,050 | |||||||||||||||||||

| Cost of sales and merchandising revenues | 8,968,675 | 2,324,172 | 726,506 | — | 12,019,353 | ||||||||||||||||||||||||