Form 10-D Sequoia Mortgage Trust For: Jul 25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-D

ASSET-BACKED ISSUER DISTRIBUTION REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the monthly distribution period from:

June 28, 2022 to July 25, 2022

Commission File Number of issuing entity: 333-185882-03

Central Index Key Number of issuing entity: 0001576709

Sequoia Mortgage Trust 2013-7

(Exact name of issuing entity as specified in its charter)

Commission File Number of depositor: 333-185882-01

Central Index Key Number of depositor: 0001176320

Sequoia Residential Funding, Inc.

(Exact name of depositor as specified in its charter)

Central Index Key Number of sponsor: 0001530239

RWT Holdings, Inc.

(Exact name of sponsor as specified in its charter)

Jeremy P. Strom

(720) 627-8472

(Name and telephone number, including area code, of the person to contact in connection with this filing)

New York

(State or other jurisdiction of incorporation or organization of the issuing entity)

38-3906841

38-3906842

(I.R.S. Employer Identification No.)

| c/o Citibank, N.A. 388 Greenwich Street, 14th Floor New York, New York |

10013 | |

| (Address of principal executive offices of the issuing entity) | (Zip Code) |

(212) 816-5693

(Telephone number, including area code)

| Registered/reporting pursuant to (check one) |

Name of exchange (If Section 12(b)) | |||||||

| Title of class |

Section 12(b) | Section 12(g) | Section 15(d) | |||||

| A-1 |

¨ | ¨ | x | |||||

|

| ||||||||

| A-2 |

¨ | ¨ | x | |||||

|

| ||||||||

| A-IO1 |

¨ | ¨ | x | |||||

|

| ||||||||

| A-IO2 |

¨ | ¨ | x | |||||

|

| ||||||||

| B-1 |

¨ | ¨ | x | |||||

|

| ||||||||

| B-2 |

¨ | ¨ | x | |||||

|

| ||||||||

| B-3 |

¨ | ¨ | x | |||||

|

| ||||||||

| B-4 |

¨ | ¨ | x | |||||

|

| ||||||||

| B-5 |

¨ | ¨ | x | |||||

|

| ||||||||

| LT-R |

¨ | ¨ | x | |||||

|

| ||||||||

| R |

¨ | ¨ | x | |||||

|

| ||||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

PART I – DISTRIBUTION INFORMATION

Item 1. Distribution and Pool Performance Information.

On July 25, 2022, a distribution was made to holders of the certificates issued by Sequoia Mortgage Trust 2013-7.

The distribution report is attached as Exhibit 99.1 to this Form 10-D.

No assets securitized by Sequoia Residential Funding, Inc. (the “Depositor”) and held by Sequoia Mortgage Trust 2013-7 were the subject of a demand to repurchase or replace for breach of the representations and warranties during the monthly distribution period from June 28, 2022 to July 25, 2022.

RWT Holdings, Inc. (the “Securitizer”), an affiliate of the Depositor, is the sponsor and the Securitizer of assets held by Sequoia Mortgage Trust 2013-7. The Securitizer filed its first Form ABS-15G on February 6, 2012, and most recently filed its Form ABS-15G on February 11, 2022. The CIK number of the Securitizer is 0001530239.

PART II – OTHER INFORMATION

Item 10. Exhibits.

(a) The following is a list of documents filed as part of this Report on Form 10-D:

(99.1): Monthly report distributed to holders of the certificates issued by Sequoia Mortgage Trust 2013-7, relating to the July 25, 2022 distribution.

(b) The exhibits required to be filed by the Registrant pursuant to this Form 10-D are listed above and in the Exhibit Index that immediately follows the signature page hereof.

EXHIBIT INDEX

| Exhibit Number |

Description | |

| Exhibit 99.1 | Monthly report distributed to holders of the certificates issued by Sequoia Mortgage Trust 2013-7, relating to the July 25, 2022 distribution. | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| Sequoia Residential Funding, Inc. |

| (Depositor) |

| /s/ Jeremy P. Strom |

| Jeremy P. Strom, President & Senior Officer in Charge of Securitization |

Date: August 8, 2022

| Distribution Date: | 07/25/2022 | Sequoia Mortgage Trust |

| Determination Date: | 07/18/2022 | |

| Mortgage Pass-Through Certificates | ||

| Series 2013-7 |

| CONTACT INFORMATION | |

| Depositor | Sequoia Residential Funding, Inc. |

| Trustee | Wilmington Trust Company |

| Master Servicer | Wells Fargo Bank, N.A. |

| CONTENTS | |

| Distribution Summary | 2 |

| Distribution Summary (Factors) | 3 |

| Interest Distribution | 4 |

| Principal Distribution | 5 |

| Reconciliation Detail | 6 |

| Collateral Summary | 7 |

| Stratification Detail | 8 |

| Delinquency Information | 9 |

| Standard Prepayment and Default Information | 11 |

| Distribution Waterfall Detail | 12 |

| Other Information | 13 |

| Asset Level Detail | 14 |

| Deal Contact: | Karen Schluter | Citibank, N.A. |

| [email protected] | Agency and Trust | |

| Tel: (212) 816-5827 | 388 Greenwich Street | |

| New York, NY 10013 |

| Reports Available at | sf.citidirect.com | Page 1 of 18 | © Copyright | 2022 Citigroup |

| Distribution Date: | 07/25/2022 | Sequoia Mortgage Trust |

| Determination Date: | 07/18/2022 | |

| Mortgage Pass-Through Certificates | ||

| Series 2013-7 | ||

| DISTRIBUTION IN DOLLARS | Distribution Summary | |

| Prior | Pass- | Current | ||||||||||||||||||||||

| Original | Principal | Through | Accrual | Accrual | Interest | Principal | Total | Balance | Realized | Principal | ||||||||||||||

| Class | Balance | Balance | Rate | Day Count | Dates | Distributed | Distributed | Distributed | Change | Loss | Balance | |||||||||||||

| (1 | ) | (2 | ) | (3 | ) | (4 | ) | (5 | ) | (6 | ) | (7 | ) | (8 | ) | (9)= | (7 | +8) | (10 | ) | (11 | ) | (12)= | (3-8+10-11) |

| A-1 | 125,000,000.00 | 16,191,426.17 | 2.500000 | % | 30 / 360 | 06/01 - 06/30 | 33,732.14 | 48,979.83 | 82,711.97 | 0.00 | 0.00 | 16,142,446.34 | ||||||||||||

| A-2 | 298,878,000.00 | 38,714,088.60 | 3.000000 | % | 30 / 360 | 06/01 - 06/30 | 96,785.22 | 117,111.95 | 213,897.17 | 0.00 | 0.00 | 38,596,976.65 | ||||||||||||

| B-1 | 8,165,000.00 | 2,082,179.20 | 3.504009 | % | 30 / 360 | 06/01 - 06/30 | 6,079.98 | 11,015.09 | 17,095.07 | 0.00 | 0.00 | 2,071,164.11 | ||||||||||||

| B-2 | 7,711,000.00 | 1,966,403.41 | 3.504009 | % | 30 / 360 | 06/01 - 06/30 | 5,741.91 | 10,402.62 | 16,144.53 | 0.00 | 0.00 | 1,956,000.79 | ||||||||||||

| B-3 | 6,577,000.00 | 1,677,218.96 | 3.504009 | % | 30 / 360 | 06/01 - 06/30 | 4,897.49 | 8,872.78 | 13,770.27 | 0.00 | 0.00 | 1,668,346.18 | ||||||||||||

| B-4 | 2,494,000.00 | 636,001.82 | 3.504009 | % | 30 / 360 | 06/01 - 06/30 | 1,857.13 | 3,364.56 | 5,221.69 | 0.00 | 0.00 | 632,637.26 | ||||||||||||

| B-5 | 4,763,656.00 | 4,763,656.00 | 3.504009 | % | 30 / 360 | 06/01 - 06/30 | 13,909.91 | 0.00 | 13,909.91 | 0.00 | 0.00 | 4,763,656.00 | ||||||||||||

| LT-R | 0.00 | 0.00 | 0.000000 | % | - | - | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||

| R | 0.00 | 0.00 | 0.000000 | % | - | - | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||

| Totals | 453,588,656.00 | 66,030,974.16 | 163,003.78 | 199,746.83 | 362,750.61 | 0.00 | 0.00 | 65,831,227.33 |

| Notional Classes | ||||||||||||

| A-IO1 | 125,000,000.00 | 16,191,426.17 | 0.500000 | % | 30 / 360 | 06/01 - 06/30 | 6,746.43 | 0.00 | 6,746.43 | 0.00 | 0.00 | 16,142,446.34 |

| A-IO2 | 423,878,000.00 | 54,905,514.78 | 0.504009 | % | 30 / 360 | 06/01 - 06/30 | 23,060.74 | 0.00 | 23,060.74 | 0.00 | 0.00 | 54,739,422.98 |

| Totals | 548,878,000.00 | 71,096,940.95 | 29,807.17 | 0.00 | 29,807.17 | 0.00 | 0.00 | 70,881,869.32 |

| Reports Available at | sf.citidirect.com | Page 2 of 18 | © Copyright | 2022 Citigroup |

| Distribution Date: | 07/25/2022 | Sequoia Mortgage Trust |

| Determination Date: | 07/18/2022 | |

| Mortgage Pass-Through Certificates | ||

| Series 2013-7 | ||

| PER $1,000 OF ORIGINAL BALANCE | Distribution Summary (Factors) | |

| Prior | Current | |||||||||

| Record | Principal | Interest | Principal | Total | Balance | Realized | Principal | |||

| Class | CUSIP(s) | Date | Balance | Distributed | Distributed | Distributed | Change | Loss | Balance | |

| (3/2 x 1000) | (7/2 x 1000) | (8/2 x 1000) | (9/2 x 1000) | (10/2 x 1000) | (11/2 x 1000) | (12/2 x 1000) | ||||

| A-1 | 81745 | CAA1 | 6/30/2022 | 129.531409 | 0.269857 | 0.391839 | 0.661696 | 0.000000 | 0.000000 | 129.139571 |

| A-2 | 81745 | CAB9 | 6/30/2022 | 129.531409 | 0.323829 | 0.391839 | 0.715667 | 0.000000 | 0.000000 | 129.139571 |

| B-1 | 81745 | CAM5 | 6/30/2022 | 255.012762 | 0.744639 | 1.349062 | 2.093701 | 0.000000 | 0.000000 | 253.663700 |

| B-2 | 81745 | CAN3 | 6/30/2022 | 255.012762 | 0.744639 | 1.349062 | 2.093701 | 0.000000 | 0.000000 | 253.663700 |

| B-3 | 81745 | CAG8 | 6/30/2022 | 255.012766 | 0.744639 | 1.349062 | 2.093701 | 0.000000 | 0.000000 | 253.663704 |

| B-4 | 81745 | CAH6 | 6/30/2022 | 255.012759 | 0.744639 | 1.349062 | 2.093701 | 0.000000 | 0.000000 | 253.663697 |

| B-5 | 81745 | CAJ2 | 6/30/2022 | 1,000.000000 | 2.920007 | 0.000000 | 2.920007 | 0.000000 | 0.000000 | 1,000.000000 |

| LT-R | 81745 | CAL7 | 6/30/2022 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| R | 81745 | CAK9 | 6/30/2022 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| A-IO1 | 81745 | CAC7 | 6/30/2022 | 129.531409 | 0.053971 | 0.000000 | 0.053971 | 0.000000 | 0.000000 | 129.139571 |

| A-IO2 | 81745 | CAD5 | 6/30/2022 | 129.531409 | 0.054404 | 0.000000 | 0.054404 | 0.000000 | 0.000000 | 129.139571 |

| Reports Available at | sf.citidirect.com | Page 3 of 18 | © Copyright | 2022 Citigroup |

| Distribution Date: | 07/25/2022 | Sequoia Mortgage Trust |

| Determination Date: | 07/18/2022 | |

| Mortgage Pass-Through Certificates | ||

| Series 2013-7 | ||

| DISTRIBUTION IN DOLLARS | Interest Distribution Detail | |

| Prior | Pass- | Next Pass- | Interest | Optimal | Prior | Interest on | Non-Recov. | Current | |||||||||||||||||

| Principal | Through | Through | Accrual Day | Accrued | Unpaid | Prior Unpaid | Interest | Interest | Deferred | Interest | Unpaid | ||||||||||||||

| Class | Balance | Rate | Rate | Cnt Fraction | Interest | Interest | Interest | Shortfall | Due | Interest | Distributed | Interest | |||||||||||||

| (1 | ) | (2 | ) | (3 | ) | (4 | ) | (5 | ) | (6 | ) | (7 | ) | (8 | ) | (9 | ) | (10)= | (6)+(7)+(8)-(9) | (11 | ) | (12 | ) | (13)= | (10)-(11)-(12) |

| A-1 | 16,191,426.17 | 2.500000 | % | 2.500000 | % | 30 / 360 | 33,732.14 | 0.00 | 0.00 | 0.00 | 33,732.14 | 0.00 | 33,732.14 | 0.00 | |||||||||||

| A-2 | 38,714,088.60 | 3.000000 | % | 3.000000 | % | 30 / 360 | 96,785.22 | 0.00 | 0.00 | 0.00 | 96,785.22 | 0.00 | 96,785.22 | 0.00 | |||||||||||

| B-1 | 2,082,179.20 | 3.504009 | % | 3.504045 | % | 30 / 360 | 6,079.98 | 0.00 | 0.00 | 0.00 | 6,079.98 | 0.00 | 6,079.98 | 0.00 | |||||||||||

| B-2 | 1,966,403.41 | 3.504009 | % | 3.504045 | % | 30 / 360 | 5,741.91 | 0.00 | 0.00 | 0.00 | 5,741.91 | 0.00 | 5,741.91 | 0.00 | |||||||||||

| B-3 | 1,677,218.96 | 3.504009 | % | 3.504045 | % | 30 / 360 | 4,897.49 | 0.00 | 0.00 | 0.00 | 4,897.49 | 0.00 | 4,897.49 | 0.00 | |||||||||||

| B-4 | 636,001.82 | 3.504009 | % | 3.504045 | % | 30 / 360 | 1,857.13 | 0.00 | 0.00 | 0.00 | 1,857.13 | 0.00 | 1,857.13 | 0.00 | |||||||||||

| B-5 | 4,763,656.00 | 3.504009 | % | 3.504045 | % | 30 / 360 | 13,909.91 | 258.68 | 0.00 | 0.00 | 14,168.59 | 0.00 | 13,909.91 | 258.68 | |||||||||||

| LT-R | 0.00 | 0.000000 | % | - | - | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||

| R | 0.00 | 0.000000 | % | - | - | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||

| Totals | 66,030,974.16 | 163,003.78 | 258.68 | 0.00 | 0.00 | 163,262.46 | 0.00 | 163,003.78 | 258.68 |

| Notional Classes | ||||||||||||||

| A-IO1 | 16,191,426.17 | 0.500000 | % | 0.500000 | % | 30 / 360 | 6,746.43 | 0.00 | 0.00 | 0.00 | 6,746.43 | 0.00 | 6,746.43 | 0.00 |

| A-IO2 | 54,905,514.78 | 0.504009 | % | 0.504045 | % | 30 / 360 | 23,060.74 | 0.00 | 0.00 | 0.00 | 23,060.74 | 0.00 | 23,060.74 | 0.00 |

| Totals | 71,096,940.95 | 29,807.17 | 0.00 | 0.00 | 0.00 | 29,807.17 | 0.00 | 29,807.17 | 0.00 |

| Reports Available at | sf.citidirect.com | Page 4 of 18 | © Copyright | 2022 Citigroup |

| Distribution Date: | 07/25/2022 | Sequoia Mortgage Trust |

| Determination Date: | 07/18/2022 | |

| Mortgage Pass-Through Certificates | ||

| Series 2013-7 | ||

| DISTRIBUTION IN DOLLARS | Principal Distribution Detail | |

| Prior | Scheduled | Unscheduled | Current | Current | Current | Cumulative | Original | Current | Original | Current | ||||||||||||||||||

| Original | Principal | Principal | Principal | Balance | Realized | Principal | Principal | Realized | Class | Class | Credit | Credit | ||||||||||||||||

| Class | Balance | Balance | Distribution | Distribution | Change | Losses | Recoveries | Balance | Losses | (%) | (%) | Support Support | ||||||||||||||||

| (1 | ) | (2 | ) | (3 | ) | (4 | ) | (5 | ) | (6 | ) | (7 | ) | (8 | ) | (9)= | (3)-(4)-(5)+(6)- | (10 | ) | (11 | ) | (12 | ) | (13 | ) | (14 | ) | |

| (7)+ | (8 | ) | ||||||||||||||||||||||||||

| A-1 | 125,000,000.00 | 16,191,426.17 | 45,508.75 | 3,471.08 | 0.00 | 0.00 | 0.00 | 16,142,446.34 | 0.00 | 27.56 | % | 24.52 | % | 6.55 | % | 16.85 | % | |||||||||||

| A-2 | 298,878,000.00 | 38,714,088.60 | 108,812.53 | 8,299.43 | 0.00 | 0.00 | 0.00 | 38,596,976.65 | 0.00 | 65.89 | % | 58.63 | % | 6.55 | % | 16.85 | % | |||||||||||

| B-1 | 8,165,000.00 | 2,082,179.20 | 10,234.48 | 780.61 | 0.00 | 0.00 | 0.00 | 2,071,164.11 | 0.00 | 1.80 | % | 3.15 | % | 4.75 | % | 13.70 | % | |||||||||||

| B-2 | 7,711,000.00 | 1,966,403.41 | 9,665.41 | 737.21 | 0.00 | 0.00 | 0.00 | 1,956,000.79 | 0.00 | 1.70 | % | 2.97 | % | 3.05 | % | 10.73 | % | |||||||||||

| B-3 | 6,577,000.00 | 1,677,218.96 | 8,243.99 | 628.79 | 0.00 | 0.00 | 0.00 | 1,668,346.18 | 0.00 | 1.45 | % | 2.53 | % | 1.60 | % | 8.20 | % | |||||||||||

| B-4 | 2,494,000.00 | 636,001.82 | 3,126.12 | 238.44 | 0.00 | 0.00 | 0.00 | 632,637.26 | 0.00 | 0.55 | % | 0.96 | % | 1.05 | % | 7.24 | % | |||||||||||

| B-5 | 4,763,656.00 | 4,763,656.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 4,763,656.00 | 0.00 | 1.05 | % | 7.24 | % | 0.00 | % | 0.00 | % | |||||||||||

| Totals | 453,588,656.00 | 66,030,974.16 | 185,591.28 | 14,155.56 | 0.00 | 0.00 | 0.00 | 65,831,227.33 | 0.00 | 100 | % | 100 | % | |||||||||||||||

| Reports Available at | sf.citidirect.com | Page 5 of 18 | © Copyright | 2022 Citigroup |

| Distribution Date: | 07/25/2022 | Sequoia Mortgage Trust |

| Determination Date: | 07/18/2022 | |

| Mortgage Pass-Through Certificates | ||

| Series 2013-7 | ||

| Reconciliation Detail | ||

| SOURCE OF FUNDS | |||

| Interest Funds Available | |||

| Scheduled Interest | 207,667.92 | ||

| Uncompensated PPIS | 0.00 | ||

| Relief Act Shortfall | 0.00 | ||

| Losses in Excess of Principal Balance | 0.00 | ||

| Stop Advance Interest | 0.00 | ||

| Other Interest Reductions | 0.00 | ||

| Total Interest Funds Available: | 207,667.92 | ||

| Principal Funds Available | |||

| Scheduled Principal | 185,591.28 | ||

| Curtailments | 14,155.55 | ||

| Curtailments Adjustments | 0.00 | ||

| Prepayments in Full | 0.00 | ||

| Liquidation Principal | 0.00 | ||

| Repurchased Principal | 0.00 | ||

| Other Principal | 0.00 | ||

| Substitution Principal | 0.00 | ||

| Principal Losses and Forgiveness | 0.00 | ||

| Subsequent Recoveries / (Losses) | 0.00 | ||

| Total Principal Funds Available: | 199,746.83 | ||

| Total Funds Available | 407,414.75 | ||

| ALLOCATION OF FUNDS | ||

| Scheduled Fees | ||

| Master Servicing Fee | 286.13 | |

| Servicing Fee | 13,756.43 | |

| Trustee Fee | 66.05 | |

| Securities Administrator Fee | 748.35 | |

| Total Scheduled Fees: | 14,856.96 | |

| Additional Fees, Expenses, etc. | ||

| Trust Fund Expenses | 0.00 | |

| Other Expenses | 0.00 | |

| Total Additional Fees, Expenses, etc.: | 0.00 | |

| Distributions | ||

| Interest Distribution | 192,810.95 | |

| Principal Distribution | 199,746.84 | |

| Total Distributions: | 392,557.79 | |

| Total Funds Allocated | 407,414.75 | |

| Reports Available at | sf.citidirect.com | Page 6 of 18 | © Copyright | 2022 Citigroup |

| Distribution Date: | 07/25/2022 | Sequoia Mortgage Trust |

| Determination Date: | 07/18/2022 | |

| Mortgage Pass-Through Certificates | ||

| Series 2013-7 | ||

| Collateral Summary | ||

| ASSET CHARACTERISTICS | ||||||||

| Cut-Off | Beginning | Ending | Delta or % of Orig | |||||

| Aggregate Stated Principal Balance | 453,588,656.25 | 66,030,974.43 | 65,831,227.60 | 14.51 | % | |||

| Aggregate Actual Principal Balance | 453,588,656.25 | 66,161,484.70 | 65,965,653.80 | 14.54 | % | |||

| Loan Count | 595 | 111 | 111 | 484 | ||||

| Weighted Average Coupon Rate (WAC) | 3.833510 | % | 3.774009 | % | 3.774045 | % | -0.059465 | % |

| Net Weighted Average Coupon Rate (Net WAC) | 3.563510 | % | 3.504009 | % | 3.504045 | % | -0.059465 | % |

| Weighted Average Remaining Term (WART in months) | 358 | 250 | 249 | 109 | ||||

| AVAILABLE PRINCIPAL | |

| Scheduled Principal | 185,591.28 |

| Curtailments | 14,155.55 |

| Curtailments Adjustments | 0.00 |

| Prepayments in Full | 0.00 |

| Liquidation Principal | 0.00 |

| Repurchased Principal | 0.00 |

| Other Principal | 0.00 |

| Substitution Principal | 0.00 |

| Principal Losses and Forgiveness | 0.00 |

| Subsequent Recoveries / (Losses) | 0.00 |

| TOTAL AVAILABLE PRINCIPAL | 199,746.83 |

| Realized Loss Summary | |

| Principal Losses and Forgiveness | 0.00 |

| Losses in Excess of Principal Balance | 0.00 |

| Subsequent (Recoveries) / Losses | 0.00 |

| Cumulative Realized Losses | 0.00 |

| AVAILABLE INTEREST | ||

| Scheduled Interest | 207,667.92 | |

| Less: | Master Servicing Fee | 286.13 |

| Servicing Fee | 13,756.43 | |

| Trustee Fee | 66.05 | |

| Securities Administrator Fee | 748.35 | |

| Uncompensated PPIS | 0.00 | |

| Relief Act Shortfall | 0.00 | |

| Other Expenses | 0.00 | |

| Losses in Excess of Principal Balance | 0.00 | |

| Stop Advance Interest | 0.00 | |

| Other Interest Reductions | 0.00 | |

| TOTAL AVAILABLE INTEREST | 192,810.96 | |

| Reports Available at | sf.citidirect.com | Page 7 of 18 | © Copyright | 2022 Citigroup |

| Distribution Date: | 07/25/2022 | Sequoia Mortgage Trust |

| Determination Date: | 07/18/2022 | |

| Mortgage Pass-Through Certificates | ||

| Series 2013-7 | ||

| Stratification Detail | ||

| Loan Rate | ||||||

| # of | Ending Sched | % of Agg | ||||

| Loan Rate | Loans | Balance | Balance | WAC | WART | |

| 3.00 or Less | 0 | 0.00 | 0.00 | 0.0000 | 0 | |

| 3.01 to 3.25 | 0 | 0.00 | 0.00 | 0.0000 | 0 | |

| 3.26 to 3.50 | 13 | 8,211,735.02 | 12.47 | 3.4676 | 249 | |

| 3.51 to 3.75 | 49 | 29,739,759.18 | 45.18 | 3.7199 | 249 | |

| 3.76 to 4.00 | 47 | 26,804,685.10 | 40.72 | 3.9119 | 249 | |

| 4.01 to 4.25 | 2 | 1,075,048.30 | 1.63 | 4.1766 | 249 | |

| 4.26 to 4.50 | 0 | 0.00 | 0.00 | 0.0000 | 0 | |

| 4.51 to 4.75 | 0 | 0.00 | 0.00 | 0.0000 | 0 | |

| 4.76 to 5.00 | 0 | 0.00 | 0.00 | 0.0000 | 0 | |

| 5.01 to 5.25 | 0 | 0.00 | 0.00 | 0.0000 | 0 | |

| 5.26 to 5.50 | 0 | 0.00 | 0.00 | 0.0000 | 0 | |

| 5.51 to 5.75 | 0 | 0.00 | 0.00 | 0.0000 | 0 | |

| 5.76 to 6.00 | 0 | 0.00 | 0.00 | 0.0000 | 0 | |

| 6.01 or Greater | 0 | 0.00 | 0.00 | 0.0000 | 0 | |

| Totals | 111 | 65,831,227.60 | 100.00 | 3.7740 | 249 | |

| Ending Scheduled Balance | |||||

| Ending Sched | # of | Ending Sched | % of Agg | ||

| Balance | Loans | Balance | Balance | WAC | WART |

| 1 to 150,000 | 1 | 138,154.22 | 0.21 | 3.7500 | 249 |

| 150,001 to 300,000 | 1 | 287,536.11 | 0.44 | 4.0000 | 249 |

| 300,001 to 450,000 | 21 | 8,334,764.30 | 12.66 | 3.7971 | 249 |

| 450,001 to 600,000 | 44 | 23,429,715.91 | 35.59 | 3.7609 | 249 |

| 600,001 to 750,000 | 21 | 13,877,555.17 | 21.08 | 3.8051 | 249 |

| 750,001 to 900,000 | 17 | 13,514,358.04 | 20.53 | 3.7581 | 249 |

| 900,001 to 1,050,000 | 3 | 2,830,280.28 | 4.30 | 3.7500 | 249 |

| 1,050,001 to 1,200,000 | 3 | 3,418,863.57 | 5.19 | 3.7470 | 249 |

| Totals | 111 | 65,831,227.60 | 100.00 | 3.7740 | 249 |

| Reports Available at | sf.citidirect.com | Page 8 of 18 | © Copyright | 2022 Citigroup |

| Distribution Date: | 07/25/2022 | Sequoia Mortgage Trust |

| Determination Date: | 07/18/2022 | |

| Mortgage Pass-Through Certificates | ||

| Series 2013-7 | ||

| Delinquency Information | ||

| DELINQUENT | BANKRUPTCY | FORECLOSURE | REO | TOTAL | ||||||||||||||||||||

| Days | Balance | Count | Days | Balance | Count | Days | Balance | Count | Days | Balance | Count | Days | Balance | Count | ||||||||||

| < 30 | 0.00 | 0 | < 30 | 0.00 | 0 | < 30 | 0.00 | 0 | < 30 | 0.00 | 0 | |||||||||||||

| 0.000000 | % | 0.0 | % | 0.000000 | % | 0.0 | % | 0.000000 | % | 0.0 | % | 0.000000 | % | 0.0 | % | |||||||||

| 30-59 | 0.00 | 0 | 30-59 | 0.00 | 0 | 30-59 | 0.00 | 0 | 30-59 | 0.00 | 0 | 30-59 | 0.00 | 0 | ||||||||||

| 0.000000 | % | 0.0 | % | 0.000000 | % | 0.0 | % | 0.000000 | % | 0.0 | % | 0.000000 | % | 0.0 | % | 0.000000 | % | 0.0 | % | |||||

| 60-89 | 0.00 | 0 | 60-89 | 0.00 | 0 | 60-89 | 0.00 | 0 | 60-89 | 0.00 | 0 | 60-89 | 0.00 | 0 | ||||||||||

| 0.000000 | % | 0.0 | % | 0.000000 | % | 0.0 | % | 0.000000 | % | 0.0 | % | 0.000000 | % | 0.0 | % | 0.000000 | % | 0.0 | % | |||||

| 90-119 | 0.00 | 0 | 90-119 | 0.00 | 0 | 90-119 | 0.00 | 0 | 90-119 | 0.00 | 0 | 90-119 | 0.00 | 0 | ||||||||||

| 0.000000 | % | 0.0 | % | 0.000000 | % | 0.0 | % | 0.000000 | % | 0.0 | % | 0.000000 | % | 0.0 | % | 0.000000 | % | 0.0 | % | |||||

| 120-149 | 0.00 | 0 | 120-149 | 0.00 | 0 | 120-149 | 0.00 | 0 | 120-149 | 0.00 | 0 | 120-149 | 0.00 | 0 | ||||||||||

| 0.000000 | % | 0.0 | % | 0.000000 | % | 0.0 | % | 0.000000 | % | 0.0 | % | 0.000000 | % | 0.0 | % | 0.000000 | % | 0.0 | % | |||||

| 150-179 | 0.00 | 0 | 150-179 | 0.00 | 0 | 150-179 | 0.00 | 0 | 150-179 | 0.00 | 0 | 150-179 | 0.00 | 0 | ||||||||||

| 0.000000 | % | 0.0 | % | 0.000000 | % | 0.0 | % | 0.000000 | % | 0.0 | % | 0.000000 | % | 0.0 | % | 0.000000 | % | 0.0 | % | |||||

| 180+ | 0.00 | 0 | 180+ | 0.00 | 0 | 180+ | 0.00 | 0 | 180+ | 0.00 | 0 | 180+ | 0.00 | 0 | ||||||||||

| 0.000000 | % | 0.0 | % | 0.000000 | % | 0.0 | % | 0.000000 | % | 0.0 | % | 0.000000 | % | 0.0 | % | 0.000000 | % | 0.0 | % | |||||

| Total | 0.00 | 0 | Total | 0.00 | 0 | Total | 0.00 | 0 | Total | 0.00 | 0 | Total | 0.00 | 0 | ||||||||||

| 0.000000 | % | 0.0 | % | 0.000000 | % | 0.0 | % | 0.000000 | % | 0.0 | % | 0.000000 | % | 0.0 | % | 0.000000 | % | 0.0 | % |

| Principal and Interest Advances | N/A |

| Reports Available at | sf.citidirect.com | Page 9 of 18 | © Copyright | 2022 Citigroup |

| Distribution Date: | 07/25/2022 | Sequoia Mortgage Trust |

| Determination Date: | 07/18/2022 | |

| Mortgage Pass-Through Certificates | ||

| Series 2013-7 | ||

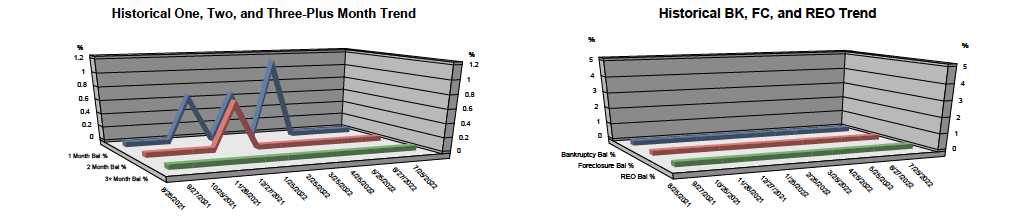

| Historical Delinquency Information | ||

| Distribution | 1 Month | 2 Month | 3 | + Month | Bankruptcy | Foreclosure | REO | Total | ||||||||||||||||||||

| Date | Balance | Cnt | Balance | Cnt | Balance | Cnt | Balance | Cnt | Balance | Cnt | Balance | Cnt | Balance | Cnt | ||||||||||||||

| 07/2022 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||

| 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | |

| 06/2022 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||

| 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | |

| 05/2022 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||

| 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | |

| 04/2022 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||

| 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | |

| 03/2022 | 781,663 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 781,663 | 1 | ||||||||||||||

| 1.106 | % | 0.8 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 1.106 | % | 0.8 | % | |

| 02/2022 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||

| 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | |

| 01/2022 | 492,417 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 492,417 | 1 | ||||||||||||||

| 0.655 | % | 0.8 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.655 | % | 0.8 | % | |

| 12/2021 | 0 | 0 | 500,011 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 500,011 | 1 | ||||||||||||||

| 0.000 | % | 0.0 | % | 0.659 | % | 0.8 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.659 | % | 0.8 | % | |

| 11/2021 | 501,270 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 501,270 | 1 | ||||||||||||||

| 0.654 | % | 0.8 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.654 | % | 0.8 | % | |

| 10/2021 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||

| 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | |

| 09/2021 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||

| 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | |

| 08/2021 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||

| 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % | 0.000 | % | 0.0 | % |

| Reports Available at | sf.citidirect.com | Page 10 of 18 | © Copyright | 2022 Citigroup |

| Distribution Date: | 07/25/2022 | Sequoia Mortgage Trust |

| Determination Date: | 07/18/2022 | |

| Mortgage Pass-Through Certificates | ||

| Series 2013-7 | ||

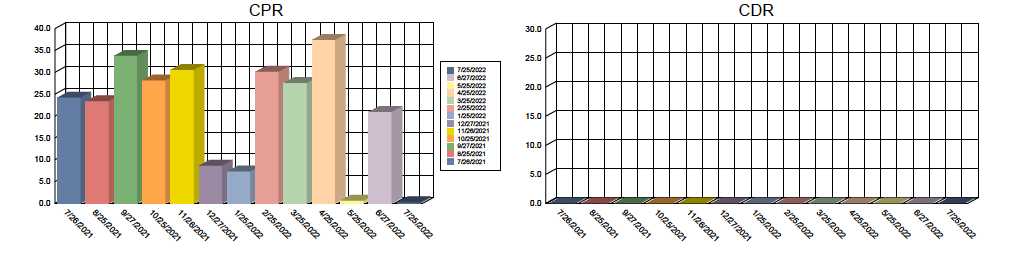

| Standard Prepayment and Default Information | ||

| Wtd. Avg. | Current | ||||||||||||||||

| Payment | Age | Collateral | Scheduled | Unscheduled | Liquidation | ||||||||||||

| Date | (Months) | Balance | Principal | Principal | Principal | SMM | CPR | PSA | MDR | CDR | SDA | ||||||

| 25-Jul-2022 | 111.08 | 65,831,227.60 | 185,591.28 | 14,155.55 | 0.00 | 0.021 | % | 0.258 | % | 4 | % | 0.000 | % | 0.000 | % | 0 | % |

| 27-Jun-2022 | 110.06 | 66,030,974.43 | 190,952.18 | 1,304,682.72 | 0.00 | 1.938 | % | 20.926 | % | 349 | % | 0.000 | % | 0.000 | % | 0 | % |

| 25-May-2022 | 109.06 | 67,526,609.33 | 190,242.17 | 35,610.95 | 0.00 | 0.053 | % | 0.631 | % | 11 | % | 0.000 | % | 0.000 | % | 0 | % |

| 25-Apr-2022 | 108.06 | 67,752,462.45 | 196,913.26 | 2,698,979.53 | 0.00 | 3.831 | % | 37.422 | % | 624 | % | 0.000 | % | 0.000 | % | 0 | % |

| 25-Mar-2022 | 107.06 | 70,648,355.24 | 201,274.37 | 1,925,804.05 | 0.00 | 2.654 | % | 27.583 | % | 460 | % | 0.000 | % | 0.000 | % | 0 | % |

| 25-Feb-2022 | 106.06 | 72,775,433.66 | 210,147.35 | 2,207,332.38 | 0.00 | 2.944 | % | 30.132 | % | 502 | % | 0.000 | % | 0.000 | % | 0 | % |

| 25-Jan-2022 | 105.06 | 75,192,913.39 | 210,877.03 | 476,171.44 | 0.00 | 0.629 | % | 7.295 | % | 122 | % | 0.000 | % | 0.000 | % | 0 | % |

| 27-Dec-2021 | 104.06 | 75,879,961.86 | 211,555.86 | 575,127.71 | 0.00 | 0.752 | % | 8.663 | % | 144 | % | 0.000 | % | 0.000 | % | 0 | % |

| 26-Nov-2021 | 103.05 | 76,666,645.43 | 219,296.27 | 2,365,253.68 | 0.00 | 2.993 | % | 30.554 | % | 509 | % | 0.000 | % | 0.000 | % | 0 | % |

| 25-Oct-2021 | 102.07 | 79,251,195.38 | 224,076.51 | 2,214,489.20 | 0.00 | 2.718 | % | 28.159 | % | 469 | % | 0.000 | % | 0.000 | % | 0 | % |

| 27-Sep-2021 | 101.07 | 81,689,761.09 | 233,164.48 | 2,854,890.29 | 0.00 | 3.377 | % | 33.782 | % | 563 | % | 0.000 | % | 0.000 | % | 0 | % |

| SMM (Single Month Mortality) = (Beginning Balance - Ending Balance - Scheduled Principal) / (Beginning Balance - Scheduled Principal) | MDR (Monthly Default Rate) = Beginning Balance of Liquidated Asset / Total Beginning Balance | ||||||||||||||||

| CPR (Constant Prepayment Rate) = 1 - ((1-SMM)^12) | CDR (Conditional Default Rate) = 1 - ((1-MDR)^12) | ||||||||||||||||

| PSA (Public Securities Association) = CPR / (min(.2% * Age, 6%)) | SDA (Standard Default Assumption) = CDR / (min(.2% * Age, 6%)) | ||||||||||||||||

| Reports Available at | sf.citidirect.com | Page 11 of 18 | © Copyright | 2022 Citigroup |

| Distribution Date: | 07/25/2022 | Sequoia Mortgage Trust |

| Determination Date: | 07/18/2022 | |

| Mortgage Pass-Through Certificates | ||

| Series 2013-7 | ||

| Waterfall Detail | ||

| Remaining | |||

| DISTRIBUTIONS | Amount | Available | |

| Distributed | Funds | ||

| Available Distribution Amount | 392,557.79 | ||

| Senior Certificates, the Interest Distribution Amount and unpaid Interest Shortfalls | (160,324.53 | ) | 232,233.26 |

| Senior Certificates, the Senior Principal Distribution Amount | (166,091.79 | ) | 66,141.47 |

| Class B-1 Certificates, the Interest Distribution Amount and unpaid Interest Shortfalls | (6,079.98 | ) | 60,061.49 |

| Class B-1 Certificates, the Subordinate Principal Distribution Amount | (11,015.09 | ) | 49,046.40 |

| Class B-2 Certificates, the Interest Distribution Amount and unpaid Interest Shortfalls | (5,741.91 | ) | 43,304.49 |

| Class B-2 Certificates, the Subordinate Principal Distribution Amount | (10,402.62 | ) | 32,901.87 |

| Class B-3 Certificates, the Interest Distribution Amount and unpaid Interest Shortfalls | (4,897.49 | ) | 28,004.38 |

| Class B-3 Certificates, the Subordinate Principal Distribution Amount | (8,872.78 | ) | 19,131.60 |

| Class B-4 Certificates, the Interest Distribution Amount and unpaid Interest Shortfalls | (1,857.13 | ) | 17,274.47 |

| Class B-4 Certificates, the Subordinate Principal Distribution Amount | (3,364.56 | ) | 13,909.91 |

| Class B-5 Certificates, the Interest Distribution Amount and unpaid Interest Shortfalls | (13,909.91 | ) | 0.00 |

| Class B-5 Certificates, the Subordinate Principal Distribution Amount | 0.00 | 0.00 | |

| Class LT-R and R Certificates, any remaining amounts | 0.00 | 0.00 | |

| Reports Available at | sf.citidirect.com | Page 12 of 18 | © Copyright | 2022 Citigroup |

| Distribution Date: | 07/25/2022 | Sequoia Mortgage Trust |

| Determination Date: | 07/18/2022 | |

| Mortgage Pass-Through Certificates | ||

| Series 2013-7 | ||

| Other Information | ||

| Principal Percentages | ||

| Senior Percentage | 83.151150 | % |

| Subordinate Percentage | 16.848850 | % |

| Senior Prepayment Percentage | 83.151150 | % |

| Subordinate Prepayment Percentage | 16.848850 | % |

| Other Information | ||

| Step-Down Test satisfied? | Yes | |

| Reports Available at | sf.citidirect.com | Page 13 of 18 | © Copyright | 2022 Citigroup |

| Distribution Date: | 07/25/2022 | Sequoia Mortgage Trust |

| Determination Date: | 07/18/2022 | |

| Mortgage Pass-Through Certificates | ||

| Series 2013-7 | ||

| Voluntary Prepayments, Repurchases, and Substitutions | ||

| Scheduled | |||||||||||

| Original | Principal | Principal | Prepayment | Prepayment | Current | ||||||

| Principal Pay | Principal | Balance at | Pay Down | Penalties | Penalties | Note | Original | Original | |||

| Loan Number | Down Date | Payoff Type | Balance | Payoff | Amount | Collected | Waived | Rate | LTV | Term | State |

| No Prepayments to Report. | |||||||||||

| Reports Available at | sf.citidirect.com | Page 14 of 18 | © Copyright | 2022 Citigroup |

| Distribution Date: | 07/25/2022 | Sequoia Mortgage Trust |

| Determination Date: | 07/18/2022 | |

| Mortgage Pass-Through Certificates | ||

| Series 2013-7 | ||

| Liquidation / Loss Detail | ||

| Most Recent | Cutoff | Prior Unpaid | Prior Scheduled | Current | Subsequent | |||||

| Most Recent | Next Due | Principal | Principal | Principal | Realized Loss | Loss / (Recovery) | Total Realized | Loss | ||

| Loan Number | Loss Type | Loan Status | Date | Balance | Balance | Balance | Amount | Amount | Loss Amount | Severity |

| No Loans With Losses to Report. | ||||||||||

| Reports Available at | sf.citidirect.com | Page 15 of 18 | © Copyright | 2022 Citigroup |

| Distribution Date: | 07/25/2022 | Sequoia Mortgage Trust |

| Determination Date: | 07/18/2022 | |

| Mortgage Pass-Through Certificates | ||

| Series 2013-7 | ||

| REO Detail | ||

| Current | |||||||

| REO | Original | Unpaid Principal | Scheduled | REO | |||

| Group | Acquisition | Principal | Balance at | Principal | Book | ||

| Loan Number | No. | State | Date | Balance | Acquisition | Balance | Value |

| No REOs to Report. | |||||||

| Reports Available at | sf.citidirect.com | Page 16 of 18 | © Copyright | 2022 Citigroup |

| Distribution Date: | 07/25/2022 | Sequoia Mortgage Trust |

| Determination Date: | 07/18/2022 | |

| Mortgage Pass-Through Certificates | ||

| Series 2013-7 | ||

| Material Modifications, Extensions, and Waivers Loan Detail: Part 1 | ||

| Effective | Current | Current | |||||||||

| Mod. | Scheduled | Actual | Delinquency | Capitalized | Deferred | Deferred | Forgiven | Forgiven | |||

| Date | Loan Number | P&I | Balance | Balance | Balance | Status | Amount | Principal | Interest | Principal | Interest |

| No Modified Loans to Report. | |||||||||||

| Reports Available at | sf.citidirect.com | Page 17 of 18 | © Copyright | 2022 Citigroup |

| Distribution Date: | 07/25/2022 | Sequoia Mortgage Trust |

| Determination Date: | 07/18/2022 | |

| Mortgage Pass-Through Certificates | ||

| Series 2013-7 | ||

| Material Modifications, Extensions, and Waivers Loan Detail: Part 2 | ||

| Interest | Period | Life | Initial Reset | Next | Int Reset | IO | Balloon | Maturity | |||

| Loan Number | Loan Type | Rate | Margin | Cap | Cap | Date | Reset Date | Period | Period | Payment | Date |

| No Modified Loans to Report. | |||||||||||

| Reports Available at | sf.citidirect.com | Page 18 of 18 | © Copyright | 2022 Citigroup |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- East West Bancorp Reports Net Income for First Quarter of 2024 of $285 Million and Diluted Earnings Per Share of $2.03

- Enphase Energy Reports Financial Results for the First Quarter of 2024

- Kemper Announces First Quarter Preliminary Results and Schedule for Earnings Release

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share