Form 10-D BA Credit Card Trust For: Apr 30

|

UNITED STATES

|

||

|

SECURITIES AND EXCHANGE COMMISSION

|

||

|

Washington, D.C. 20549

|

||

|

FORM 10-D

|

||

|

ASSET-BACKED ISSUER

|

||

|

Distribution Report Pursuant to Section 13 or 15(d) of

|

||

|

the Securities Exchange Act of 1934

|

||

|

For the monthly distribution period from April 1, 2021 to April 30, 2021

|

||

|

Commission File Number of issuing entity:

333-228572

Central Index Key Number of issuing entity:

0001128250

BA CREDIT CARD TRUST *

(Exact name of issuing entity as specified in its charter)

(Issuer of the Notes)

|

Commission File Number of issuing entity:

333-228572-02

Central Index Key Number of issuing entity:

0000936988

BA MASTER CREDIT CARD TRUST II

(Exact name of issuing entity as specified in its charter)

(Issuer of the Collateral Certificate)

|

|

|

Commission File Number of depositor: 333-228572-01

Central Index Key Number of depositor: 0001370238

BA CREDIT CARD FUNDING, LLC

(Exact name of depositor as specified in its charter)

Central Index Key Number of sponsor (if applicable): 0001102113

|

||

|

BANK OF AMERICA, NATIONAL ASSOCIATION

(Exact name of sponsor as specified in its charter)

Keith Landis (980) 683-4915

(Name and telephone number, including area code, of the person to contact in connection with this filing)

|

||

|

Delaware

|

Delaware

|

|

|

(State or other jurisdiction of incorporation or organization of the issuing entity)

|

(State or other jurisdiction of incorporation or organization of the issuing entity)

|

|

|

c/o BA Credit Card Funding, LLC

1020 North French Street

DE5-002-01-05

Wilmington, DE 19884

|

c/o BA Credit Card Funding, LLC

1020 North French Street

DE5-002-01-05

Wilmington, DE 19884

|

|

|

(Address of principal executive offices of issuing entity)

|

(Address of principal executive offices of issuing entity)

|

|

|

(980) 683-4915

|

(980) 683-4915

|

|

|

(Telephone number, including area code)

|

(Telephone number, including area code)

|

|

|

N/A

|

N/A

|

|

|

(I.R.S. Employer Identification No.)

|

(I.R.S. Employer Identification No.)

|

|

|

N/A

|

N/A

|

|

|

(Former name, former address, if changed since last report)

|

(Former name, former address, if changed since last report)

|

|

|

Each class of Notes to which this report on Form 10-D relates is reporting in accordance with Section 15(d) of the Securities Exchange Act of 1934. The title of each class of Notes to which this report on Form 10-D relates is set forth in

Exhibit 99.2 hereto.

|

||

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No __

|

||

|

* In accordance with relevant regulations of the Securities and Exchange Commission, the depositor files annual and other reports with the Commission in respect of the BA Credit Card Trust and the BA Master Credit Card Trust II under the

Central Index Key (CIK) number (0001128250) for the BA Credit Card Trust.

|

||

|

PART I – DISTRIBUTION INFORMATION

|

|

ITEM 1 – Distribution and Pool Performance Information.

|

|

Response to Item 1 is set forth in Exhibits 99.1 and 99.2.

|

|

ITEM 2 – Legal Proceedings.

|

|

The most current information or update to this item, as of the end of the monthly distribution period to which this report relates, was previously reported

by BA Credit Card Trust, Central Index Key (CIK) number 0001128250, SEC File Number 333-228572. See the prospectus dated May 7, 2021 filed on May 11, 2021.

|

|

PART II – OTHER INFORMATION

|

|

ITEM 3 – Sales of Securities and Use of Proceeds.

|

|

The following table provides information about sales of securities by BA Credit Card Trust during the period covered by this report that have not been previously reported. For purpose of this report, sales of securities are treated as

having been previously reported if such sales have been previously reported in another report or registration statement, including a prospectus forming a part of a registration statement filed by BA Credit Card Funding, LLC on behalf of BA

Credit Card Trust.

|

|

Date of Sale

|

Size (millions) / Title

|

Purchasers

|

Exemption from Securities Act

Registration

|

||||

|

NOTHING TO REPORT

|

|||||||

|

Any sale of securities by the BA Credit Card Trust during the period covered by this report that is not included in the preceding table has been previously reported in a prospectus filed by the depositor on behalf of the BA Credit Card

Trust under the Central Index Key (CIK) number (0001128250) for the BA Credit Card Trust on the filing date, and under the Commission file number, indicated below:

|

|||||||

|

Prospectus Filing Date

|

Commission File Number

|

|||

|

05/11/21

|

333-228572

|

|||

|

A class designation of notes determines the relative seniority for receipt of cash flows and funding of uncovered defaults on principal receivables allocated to the related series of notes. The Class B notes are subordinate to the Class A

notes and the Class C notes are subordinate to the Class A and Class B notes. With respect to the tranches in each class of notes, the cash flows and funding of uncovered defaults will be allocated to the tranches on a pro rata basis.

Without noteholder consent, BA Credit Card Trust may issue a new series, class or tranche of notes at any time upon the satisfaction of certain conditions described in the underlying transaction agreements, including confirmation that

(i) the issuer reasonably believes that the new issuance will not adversely affect the amount of funds available to be distributed to the holders of any outstanding notes or the timing of such distributions, and (ii) the new issuance will not

cause a reduction, qualification or withdrawal of the ratings of any outstanding notes.

In addition, without noteholder consent and without the consent of any holders of certificates issued by BA Master Credit Card Trust II, BA Credit Card Funding, LLC has the right to designate, from time to time, additional eligible credit

card accounts to BA Master Credit Card Trust II. In connection with any such designation, BA Credit Card Funding, LLC will transfer the related receivables, whether then existing or thereafter created, to BA Master Credit Card Trust II.

|

||||

|

ITEM 10 – Exhibits.

|

||||

|

Monthly Series Certificateholders' Statement.

|

||||

|

Schedule to Monthly Noteholders' Statement.

|

||||

|

SIGNATURES

|

||||

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

||||

|

Dated: May 17, 2021

|

||||

|

BA CREDIT CARD TRUST

(Issuing Entity)

BA MASTER CREDIT CARD TRUST II

(Issuing Entity)

BANK OF AMERICA, NATIONAL ASSOCIATION,

(Servicer)

|

|

|

|

By: /s/ Joseph L. Lombardi |

|

|

Name: Joseph L. Lombardi |

|

|

Title: Director |

|

Exhibit 99.1

|

EXHIBIT C to the Supplement to PSA

|

|

MONTHLY CERTIFICATEHOLDERS' STATEMENT

|

||

|

SERIES 2001-D

|

||

|

BA CREDIT CARD FUNDING, LLC

|

||

|

BA MASTER CREDIT CARD TRUST II

|

||

|

MONTHLY PERIOD ENDING April 30, 2021

|

||

|

The information which is required to be prepared with respect to the Transfer Date of May 14, 2021 and with respect to the performance of the Trust during the related Monthly Period is set forth below.

|

||

|

Data presented in this Monthly Certificateholders’ Statement was produced utilizing BANA’s consolidated payment prioritization methodology. See “Current Consolidated Payment Prioritization Methodology Not Fully Comparable with Previous

Payment Prioritization Methodologies” in the endnotes below.

Terms and abbreviations used in this report and not otherwise defined herein have the meanings set forth in the certain program documents for the BA Master Credit Card Trust II and the BA Credit Card Trust, as certain of such program

documents have been amended, as applicable. Each of these agreements and related amendments, as applicable, has been included as an exhibit to a report on Form 8-K filed by BA Credit Card Funding, LLC, the BA Master Credit Card Trust II and

the BA Credit Card Trust, with the Securities and Exchange Commission ("SEC") under Central Index Key (CIK) Nos. 0001370238, 0000936988 and 0001128250, respectively, on October 1, 2014, July 8, 2015 or December 18, 2015.

|

||

|

A.

|

Information Regarding the Current Monthly Distribution

|

||||

|

1.

|

The amount of the current monthly distribution which constitutes Available Funds

|

$

|

140,707,086.38†

|

||

|

2.

|

The amount of the current monthly distribution which constitutes Available Investor Principal Collections

|

$

|

1,843,811,398.53†

|

||

|

Total

|

$

|

1,984,518,484.91†

|

|||

|

B.

|

Information Regarding the Trust Assets

|

||||

|

1.

|

Collection of Principal Receivables

|

||||

|

(a)

|

The aggregate amount of Collections of Principal Receivables processed during the related Monthly Period and allocated to Series 2001-D

|

$

|

2,404,958,028.36†

|

||

|

2.

|

Collection of Finance Charge Receivables

|

|||||||

|

(a)

|

The aggregate amount of Collections of Finance Charge Receivables (excluding Interchange) processed during the related Monthly Period and allocated to Series 2001-D

|

$

|

101,051,048.06†

|

|||||

|

3.

|

Principal Receivables in the Trust

|

|||||||

|

(a)

|

The aggregate amount of Principal Receivables in the Trust as of the end of the day on the last day of the related Monthly Period

|

$

|

15,448,084,571.12†

|

|||||

|

(b)

|

The amount of Principal Receivables in the Trust represented by the Investor Interest of Series 2001-D as of the end of the day on the last day of the related Monthly Period

|

$

|

9,488,730,000.00

|

|||||

|

(c)

|

The Floating Allocation Investor Interest as of the end of the day on the last day of the related Monthly Period

|

$

|

9,817,800,000.00

|

|||||

|

(d)

|

The Principal Allocation Investor Interest as of the end of the day on the last day of the related Monthly Period

|

$

|

10,067,800,000.00

|

|||||

|

(e)

|

The Floating Investor Percentage with respect to the related Monthly Period

|

|||||||

|

April 1, 2021 through April 30, 2021 60.17%

|

||||||||

|

(f)

|

The Principal Investor Percentage with respect to the Monthly Period

|

|||||||

|

April 1, 2021 through April 30, 2021 61.70%

|

||||||||

|

(g)

|

The Class D Investor Interest as of the beginning of the day on the first day of the related Monthly Period

|

$

|

1,242,800,000.00

|

|||||

|

(h)

|

The Class D Investor Interest as of the end of the day on the last day of the related Monthly Period

|

$

|

1,163,730,000.00

|

|||||

|

(i)

|

The Class D Required Investor Interest as of the end of the day on the last day of the related Monthly Period

|

$

|

1,163,730,000.00

|

|||||

|

(j)

|

The Class D Investor Interest, determined as of the close of business on the Transfer Date relating to the Monthly Period to which this Monthly Certificateholders' Statement relates,

following the application of all payments and deposits to be made on such date |

$

|

1,284,750,000.00

|

|||

|

(k)

|

The Class D Required Investor Interest,

determined as of the close of business on the Transfer Date relating to the Monthly Period to which this Monthly Certificateholders' Statement relates, following the application of all payments and deposits to be made on such date |

$

|

1,284,750,000.00

|

|||

|

4.

|

Shared Principal Collections

|

|||||

|

The aggregate amount of Shared Principal Collections Applied as Available Investor Principal Collections

|

$

|

0.00

|

||||

|

5.

|

The aggregate amount of Available Principal Collections for all series in Group One

|

$

|

1,843,811,398.53†

|

|||

|

6.

|

Delinquent Balances

|

|||||

|

(a)The aggregate amount of outstanding balances in the Accounts which were delinquent as of the end of the day on the last day of the related Monthly Period:

|

||||||

|

Aggregate

Account Balance |

Percentage

of Total Receivables |

|||||

|

(i)

|

30 - 59 days:

|

$

|

46,121,009.90

|

0.29%

|

||

|

(ii)

|

60 - 89 days:

|

$

|

37,493,315.59

|

0.24%

|

||

|

(iii)

|

90 - 119 days:

|

$

|

33,494,399.09

|

0.21%

|

||

|

(iv)

|

120 - 149 days

|

$

|

32,595,872.42

|

0.20%

|

||

|

(v)

|

150 - 179 days:

|

$

|

36,834,116.06

|

0.23%

|

||

|

(vi)

|

180 – or more days:

|

$

|

43,848.07

|

0.00%

|

||

|

Total:

|

$

|

186,582,561.13

|

1.17%

|

|||

|

(b) 60+-Day Delinquency Rate

|

0.88%

|

||

|

(c) Three-Month Average 60+-Day Delinquency Rate

|

0.99%

|

||

|

(d) Delinquency Trigger Rate

|

7.50%1

|

||||||||

|

7.

|

Investor Default Amount

|

||||||||

|

(a)

|

The Aggregate Class D Investor Default Amount for the related Monthly Period

|

$

|

24,920,147.35†

|

||||||

|

(b)

|

The Aggregate Investor Default Amount for the related Monthly Period

|

$

|

0.00

|

||||||

|

8.

|

Investor Servicing Fee

|

||||||||

|

(a)

|

The amount of the Investor Servicing Fee payable by the Trust to the Servicer for the related Monthly Period

|

$

|

16,363,000.00

|

||||||

|

(b)

|

The amount of the Net Servicing Fee payable by the Trust to the Servicer for the related Monthly Period

|

$

|

10,226,875.00

|

||||||

|

(c)

|

The amount of the Servicer Interchange payable by the Trust to the Servicer for the related Monthly Period

|

$

|

6,136,125.00

|

||||||

|

9.

|

Portfolio Yield

|

||||||||

|

(a)

|

The Portfolio Yield for the related Monthly Period

|

15.06%†

|

|||||||

|

C.

|

Supplemental Information

|

||||

|

1.

|

Collections of Trust Receivables and Payment Rates

|

||||

|

(a)

|

The aggregate amount of Collections processed during the related Monthly Period (excluding Interchange)

|

$

|

4,065,758,681.88†

|

||

|

(b)

|

The aggregate amount of Principal Collections processed during the related Monthly Period

|

$

|

3,897,810,821.05†

|

||

|

(c)

|

Collections of Discount Option Receivables for the related Monthly Period

|

$

|

0.00†

|

||

|

(d)

|

The aggregate amount of Finance Charge Collections processed during the related Monthly Period (excluding Interchange and Collections of Discount Option Receivables)

|

$

|

167,947,860.83†

|

||

|

(e)

|

Collections as a percentage of prior month Principal Receivables and Finance Charge Receivables

|

|

24.20%†

|

||

|

(f)

|

Collections of Principal Receivables as a percentage of prior month Principal Receivables

|

|

23.89%†

|

||

|

1 The Delinquency Trigger Rate is subject to review and adjustment from time to time in accordance with subsections 14.01(b) and 14.01(c) of the Pooling and Servicing

Agreement.

|

|||||

|

2.

|

Receivables in the Trust

|

||||

|

BA Master Credit Card Trust II

|

|||||

|

(a)

|

The aggregate amount of Receivables in the Trust as of the beginning of the related Monthly Period

|

$

|

16,798,295,204.05

|

||

|

(b)

|

The aggregate amount of Principal Receivables in the Trust as of the beginning of the related Monthly Period

|

$

|

16,317,282,597.48†

|

||

|

(c)

|

Discount Option Receivables as of the beginning of the related Monthly Period

|

$

|

0.00†

|

||

|

(d)

|

The aggregate amount of Finance Charge Receivables in the Trust as of the beginning of the related Monthly Period (excluding Discount Option Receivables)

|

$

|

481,012,606.57†

|

||

|

(e)

|

The aggregate amount of Receivables removed from the Trust during the related Monthly Period

|

$

|

816,569,236.18

|

||

|

(f)

|

The aggregate amount of Principal Receivables removed from the Trust during the related Monthly Period

|

$

|

794,020,662.47

|

||

|

(g)

|

The aggregate amount of Finance Charge Receivables removed from the Trust during the related Monthly Period

|

$

|

22,548,573.71

|

||

|

(h)

|

The aggregate amount of Receivables added to the Trust during the related Monthly Period

|

$

|

0.00

|

||

|

(i)

|

The aggregate amount of Principal Receivables added to the Trust during the related Monthly Period

|

$

|

0.00

|

||

|

(j)

|

The aggregate amount of Finance Charge Receivables added to the Trust during the related Monthly Period

|

$

|

0.00

|

||

|

(k)

|

The aggregate amount of Receivables in the Trust as of the end of the day on the last day of the related Monthly Period

|

$

|

15,909,712,633.13

|

||

|

(l)

|

The aggregate amount of Principal Receivables in the Trust as of the end of the day on the last day of the related Monthly Period

|

$

|

15,448,084,571.12†

|

||

|

(m)

|

Discount Option Receivables as of the end of the day on the last day of the related Monthly Period

|

$

|

0.00†

|

||

|

(n)

|

The aggregate amount of Finance Charge Receivables in the Trust as of the end of the day on the last day of the related Monthly Period (excluding Discount Option Receivables)

|

$

|

461,628,062.01†

|

||||||

|

(o)

|

Discounted Percentage for the related Monthly Period

|

0.00%

|

|||||||

|

Transferor’s Interest

|

|||||||||

|

(p)

|

Aggregate Investor Interest for all outstanding Series of the Trust as of the end of the day on the last day of the related Monthly Period

|

$

|

9,488,730,000.00

|

||||||

|

(q)

|

Transferor Interest as of the beginning of the day on the first day of the related Monthly Period

|

$

|

6,259,482,597.48†

|

||||||

|

(r)

|

Transferor Interest as of the end of the day on the last day of the related Monthly Period

|

$

|

5,959,354,571.12†

|

||||||

|

(s)

|

Transferor Interest (30 day average) as a percentage of Average Principal Receivables, as of the end of the day on the last day of the related Monthly Period

|

|

33.89%

|

||||||

|

Last day of the

related Monthly

Period

|

Last Day of the previous Monthly Period

|

||||||||

|

(t)

|

Seller’s Interest

|

$5,459,354,571.12

|

$5,049,482,597.48

|

||||||

|

(u)

|

Seller’s Interest percentage*

|

54.66%

|

44.81%

|

||||||

|

Series 2001-D

|

|||||||||

|

(v)

|

The amount of Principal Receivables in the Trust represented by the Investor Interest of Series 2001-D as of the end of the day on the last day of the related Monthly Period

|

$

|

9,488,730,000.00

|

||||||

|

(w)

|

Weighted Average Floating Allocation Investor Interest

|

$

|

9,817,800,000.00

|

||||||

|

* The Seller's Interest percentage is calculated by dividing the Seller's Interest by the aggregate outstanding principal amount of BAseries Notes as of such day.

|

|||||||||

|

3.

|

Trust Yields

|

||||||||

|

Series 2001-D

|

|||||||||

|

(a)

|

Collections of Finance Charge Receivables (other than Interchange, Recoveries and Collections of Discount Option Receivables but including Interest Funding Account, Principal Account, and Finance Charge Account Investment Proceeds)

allocated to Series 2001-D for the related Monthly Period

|

$

|

96,059,803.69†

|

||||||

|

(b)

|

Collections of Discount Option Receivables allocated to Series 2001-D

|

$

|

0.00†

|

||||||

|

(c)

|

Interchange allocated to Series 2001-D

|

$

|

45,788,722.44†

|

||||||

|

(d)

|

Recoveries allocated to Series 2001-D

|

$

|

6,286,403.26†

|

||||||

|

(e)

|

Total Collections of Finance Charge Receivables, Discount Option Receivables, Interchange and Recoveries (collectively, “Cash Yield”) allocated to Series 2001-D for the related Monthly Period

|

$

|

148,134,929.39†

|

||||||

|

(f)

|

Aggregate Class D Investor Default Amount allocated to Series 2001-D for the related Monthly Period

|

$

|

24,920,147.35†

|

||||||

|

(g)

|

Aggregate Investor Default Amount allocated to Series 2001-D for the related Monthly Period

|

$

|

0.00

|

||||||

|

(h)

|

Cash Yield net of the Aggregate Class D Investor Default Amount and Aggregate Investor Default Amount (collectively, “Portfolio Yield”) for Series 2001-D, each for the related Monthly Period

|

$

|

123,214,782.04†

|

||||||

|

(i)

|

Total Cash Yield for the related Monthly Period as a percentage of Series 2001-D Weighted Average Floating Allocation Investor Interest

|

18.11%†

|

|||||||

|

(j)

|

Total Cash Yield excluding Recoveries, each for the related Monthly Period, as a percentage of Series 2001-D Weighted Average Floating Allocation Investor Interest

|

17.34%†

|

|||||||

|

(k)

|

Aggregate Class D Investor Default Amount for the related Monthly Period as a percentage of Series 2001-D Weighted Average Floating Allocation Investor Interest

|

3.05%†

|

|||||||

|

(l)

|

Aggregate Class D Investor Default Amount net of Recoveries, each for the related Monthly Period, as a percentage of Series 2001-D Weighted Average Floating Allocation Investor Interest

|

2.28%†

|

|||||||

|

(m)

|

The Portfolio Yield for the related Monthly Period as a percentage of Series 2001-D Weighted Average Floating Allocation Investor Interest

|

15.06%†

|

|||||||

|

(n)

|

Base Rate for the related Monthly Period

|

2.64%†

|

|||||||

|

(o)

|

Excess Available Funds Percentage for the related Monthly Period

|

12.42%†

|

|||||||

|

(p)

|

Three Month Average Excess Available Funds Percentage for the related Monthly Period

|

12.16%†

|

|||||||

The following table sets forth the delinquency experience for cardholder payments on the credit card accounts comprising the Master Trust II Portfolio for each of the dates shown. The receivables outstanding on the

accounts consist of all amounts due from cardholders as posted to the accounts as of the date shown. We cannot provide any assurance that the delinquency experience for the receivables in the future will be similar to the historical experience set

forth below.

Delinquency Experience

(Dollars in Thousands)

(Dollars in Thousands)

|

At April 30, 2021

|

At March 31, 2021

|

|||

|

Receivables

|

Percentage of Total

Receivables

|

Receivables

|

Percentage of Total

Receivables

|

|

|

Receivables

Outstanding |

$15,909,713

|

$16,798,295

|

||

|

Receivables Delinquent:

|

||||

|

30-59 Days

|

$ 46,122

|

0.29%

|

$ 56,006

|

0.34%

|

|

60-89 Days

|

37,493

|

0.24%

|

43,249

|

0.26%

|

|

90-119 Days

|

33,494

|

0.21%

|

39,228

|

0.23%

|

|

120-149 Days

|

32,596

|

0.20%

|

40,675

|

0.24%

|

|

150-179 Days

|

36,834

|

0.23%

|

40,277

|

0.24%

|

|

180 or More Days

|

44

|

0.00%

|

0

|

0.00%

|

|

Total

|

$186,583

|

1.17%

|

$219,435

|

1.31%

|

|

At February 28, 2021

|

At January 31, 2021

|

|||

|

Receivables

|

Percentage of Total

Receivables

|

Receivables

|

Percentage of Total

Receivables

|

|

|

Receivables

Outstanding |

$17,945,058

|

$19,357,856

|

||

|

Receivables Delinquent:

|

||||

|

30-59 Days

|

$ 68,319

|

0.37%

|

$73,872

|

0.38%

|

|

60-89 Days

|

49,873

|

0.28%

|

60,871

|

0.31%

|

|

90-119 Days

|

50,502

|

0.28%

|

52,817

|

0.27%

|

|

120-149 Days

|

44,062

|

0.25%

|

61,014

|

0.32%

|

|

150-179 Days

|

57,111

|

0.32%

|

52,381

|

0.27%

|

|

180 or More Days

|

0

|

0.00%

|

0

|

0.00%

|

|

Total

|

$269,867

|

1.50%

|

$300,955

|

1.55%

|

The following table sets forth the principal charge-off experience for cardholder payments on the credit card accounts comprising the Master Trust II Portfolio for each of the periods shown. Charge-offs consist of

write-offs of principal receivables. If accrued finance charge receivables that have been written off were included in total charge-offs, total charge-offs would be higher as an absolute number and as a percentage of the average of principal

receivables outstanding during the periods indicated. Average principal receivables outstanding is the average of the daily principal receivables balance during the periods indicated. We cannot provide any assurance that the charge-off experience for

the receivables in the future will be similar to the historical experience set forth below.

Principal Charge-Off Experience

(Dollars in Thousands, except as noted)*

(Dollars in Thousands, except as noted)*

|

Month Ended

|

Month Ended

|

|

|

April 30, 2021

|

March 31, 2021

|

|

|

Average Principal Receivables Outstanding

|

$ 15,940,314

|

$16,997,133

|

|

Total Charge-Offs

|

$41,418

|

$55,882

|

|

Total Charge-Offs as a percentage of Average Principal Receivables Outstanding

|

3.12%

|

3.95%

|

|

Recoveries

|

$10,448

|

$11,099

|

|

Recoveries as a percentage of Average Principal Receivables Outstanding

|

0.79%

|

0.78%

|

|

Net Charge-Offs

|

$30,969

|

$44,783

|

|

Net Charge-Offs as a percentage of Average Principal Receivables Outstanding

|

2.33%

|

3.17%

|

|

Average Net Loss of Accounts with a Loss*

|

$ 4,983.02

|

$ 5,682.40

|

|

Month Ended

|

Month Ended

|

|

|

February 28, 2021

|

January 31, 2021

|

|

|

Average Principal Receivables Outstanding

|

$18,035,812

|

$19,959,610

|

|

Total Charge-Offs

|

$49,350

|

$40,275

|

|

Total Charge-Offs as a percentage of Average Principal Receivables Outstanding

|

3.28%

|

2.42%

|

|

Recoveries

|

$ 9,225

|

$10,121

|

|

Recoveries as a percentage of Average Principal Receivables Outstanding

|

0.61%

|

0.61% |

|

Net Charge-Offs

|

$40,125

|

$30,154

|

|

Net Charge-Offs as a percentage of Average Principal Receivables Outstanding

|

2.67%

|

1.81%

|

|

Average Net Loss of Accounts with a Loss*

|

$ 6,043.78

|

$ 4,972.65

|

| * |

All dollar amounts in this table are expressed as dollars in thousands, except for Average Net Loss of Accounts with a Loss, which is expressed as actual dollars.

|

Total charge-offs are total principal charge-offs before recoveries and do not include any charge-offs of finance charge receivables or the amount of any reductions in average daily principal receivables outstanding due

to fraud, returned goods, customer disputes or other miscellaneous adjustments.

Net charge-offs are total charge-offs less recoveries on receivables in Defaulted Accounts, determined as described below. Each month, BANA allocates amounts recovered (net of expenses) from the U.S. credit card portfolio to the Master Trust II

Portfolio by dividing the total principal charge-offs for the Master Trust II Portfolio for the related calendar month by the total

principal charge-offs for the U.S. credit card portfolio for the same calendar month. Under the master trust II agreement, recoveries allocated to the Master Trust II Portfolio and transferred to Funding under the receivables purchase agreement are treated as collections of finance charge receivables.

principal charge-offs for the U.S. credit card portfolio for the same calendar month. Under the master trust II agreement, recoveries allocated to the Master Trust II Portfolio and transferred to Funding under the receivables purchase agreement are treated as collections of finance charge receivables.

|

4.

|

Repurchase Demand Activity (Rule 15Ga-1)

|

No Activity to Report

Most Recent Form ABS – 15G

Filed by: BA Credit Card Funding, LLC

CIK#: 0001370238

Filing Date: January 20, 2021

5. Impact of COVID-19 Pandemic and Related Cardholder Relief on

the Master Trust II Portfolio

The coronavirus disease (COVID-19) pandemic has resulted in authorities implementing numerous measures attempting to contain the spread

and impact of COVID-19, such as travel bans and restrictions, quarantines, shelter-in-place orders and other limitations on business activity. Additionally, there has been a decline in global economic activity, reduced U.S. and global economic

output and a deterioration in macroeconomic conditions in the U.S. and globally. This has resulted in, among other things, higher rates of unemployment and underemployment, and negatively impacted consumer spending and payment patterns. Although

some restrictive measures have been eased in certain areas, many of the restrictive measures remain in place or have been reinstated, and in some cases additional restrictive measures are being or may need to be implemented. U.S. and global

economies are likely to be negatively impacted for an extended period of time as there remains significant uncertainty about the timing and strength of an economic recovery.

In response to the pandemic, beginning in March 2020, BANA implemented a client assistance program for its cardholders experiencing hardship from impacts of COVID-19, which includes payment deferrals for those

cardholders. Under this program, interest continues to accrue and is added to the principal balance each month and, if not otherwise brought current, the delinquency status for the related accounts is reported using the payment status of each account

at the time payment deferral was granted. While the vast majority of these deferrals expired in 2020, reflecting a decline in customer requests for assistance, BANA continues to evaluate, and may need to further modify, its policies and programs to

continue helping its card customers through the COVID-19 pandemic but any future actions will depend on future developments, which are highly uncertain and difficult to predict. As of April 30, 2021, the portion of the Master Trust II Portfolio

subject to payment deferrals under this program was de minimis.

Endnotes to Monthly Certificateholders’ Statement.

† Current Consolidated Payment Prioritization Methodology Not Fully Comparable with Previous Payment Prioritization Methodologies

Prior to February 5, 2015, BANA utilized two payment prioritization methodologies when servicing credit card accounts -- the daily trust payment methodology and the cardholder cycle payment methodology. For more detailed information regarding these two payment prioritization methodologies, see "Endnotes to Monthly Certificateholders' Statement" in the Monthly Certificateholders' Statement relating to the Monthly Period ending February 28, 2015, included as Exhibit 99.1 to the Form 10-D filed by BA Credit Card Trust with the Securities Exchange Commission on March 16, 2015.

Effective February 5, 2015, BANA implemented a system initiative that consolidated the methodologies into a single payment prioritization methodology. As a result, performance and related metrics reported in these indicated items for the Master Trust II portfolio for the period to which this Monthly Certificateholders' Statement relates were produced by utilizing only BANA's consolidated payment prioritization methodology. Therefore, the performance and related metrics reported in these indicated items are not fully comparable to the same performance and related metrics reported for the Master Trust II Portfolio for periods ending (i) on or prior to February 4, 2015, which were produced using the daily trust payment methodology and (ii) between February 5, 2015 and February 28, 2015, which were produced using a combination of the daily trust payment methodology (for the period from February 1, 2015 through February 4, 2015) and the consolidated payment prioritization methodology (for the period from February 5, 2015 through February 28, 2015).

Prior to February 5, 2015, BANA utilized two payment prioritization methodologies when servicing credit card accounts -- the daily trust payment methodology and the cardholder cycle payment methodology. For more detailed information regarding these two payment prioritization methodologies, see "Endnotes to Monthly Certificateholders' Statement" in the Monthly Certificateholders' Statement relating to the Monthly Period ending February 28, 2015, included as Exhibit 99.1 to the Form 10-D filed by BA Credit Card Trust with the Securities Exchange Commission on March 16, 2015.

Effective February 5, 2015, BANA implemented a system initiative that consolidated the methodologies into a single payment prioritization methodology. As a result, performance and related metrics reported in these indicated items for the Master Trust II portfolio for the period to which this Monthly Certificateholders' Statement relates were produced by utilizing only BANA's consolidated payment prioritization methodology. Therefore, the performance and related metrics reported in these indicated items are not fully comparable to the same performance and related metrics reported for the Master Trust II Portfolio for periods ending (i) on or prior to February 4, 2015, which were produced using the daily trust payment methodology and (ii) between February 5, 2015 and February 28, 2015, which were produced using a combination of the daily trust payment methodology (for the period from February 1, 2015 through February 4, 2015) and the consolidated payment prioritization methodology (for the period from February 5, 2015 through February 28, 2015).

|

IN WITNESS WHEREOF, the undersigned has duly executed this certificate this 10th day of May, 2021.

|

|

|

BANK OF AMERICA, NATIONAL ASSOCIATION, Servicer |

|

|

By: /s/Joseph L. Lombardi |

|

|

Name: Joseph L. Lombardi |

|

|

Title: Director |

|

Exhibit 99.2

|

Exhibit C to Indenture Supplement to Indenture

|

SCHEDULE TO MONTHLY NOTEHOLDERS' STATEMENT

BAseries

BA CREDIT CARD TRUST

____________________________________________

MONTHLY PERIOD ENDING April 30, 2021

____________________________________________

Reference is made to the Fifth Amended and Restated Series 2001-D Supplement (the "Series 2001-D Supplement"), dated

as of December 17, 2015, among BA Credit Card Funding, LLC as Transferor, Bank of America, National Association (“BANA”), as Servicer, and The Bank of New York Mellon, as Trustee, the Fourth Amended and Restated Indenture (the “Indenture”), dated as

of December 17, 2015, and the Third Amended and Restated BAseries Indenture Supplement (the "Indenture Supplement"), dated as of December 17, 2015, each between BA Credit Card Trust, as Issuer, and The Bank of New York Mellon, as Indenture Trustee.

Terms used herein and not defined herein have the meanings ascribed to them in the Fifth Amended and Restated 2001-D Supplement, the Fourth Amended and Restated Indenture and the Third Amended and Restated BAseries Indenture Supplement, as

applicable.

The following computations are prepared with respect to the Transfer Date of May 14, 2021 and with respect to the performance of the Trust during the related Monthly Period.

Data presented in this Schedule to Monthly Noteholders’ Statement was produced utilizing BANA’s consolidated payment

prioritization methodology. See “Current Consolidated Payment Prioritization Methodology Not Fully Comparable with

Previous Payment Prioritization Methodologies” in the endnotes below.

Terms and abbreviations used in this report and not otherwise defined herein have the meanings set forth in the

certain program documents for the BA Master Credit Card Trust II and the BA Credit Card Trust, as certain of such program documents have been amended, as applicable. Each of these agreements and related amendments, as applicable, has been included

as an exhibit to a report on Form 8-K filed by BA Credit Card Funding, LLC, the BA Master Credit Card Trust II and the BA Credit Card Trust, with the Securities and Exchange Commission ("SEC") under File Nos. 0001370238, 0000936988 and 0001128250,

respectively, on October 1, 2014, July 8, 2015 or December 18, 2015.

|

A.

|

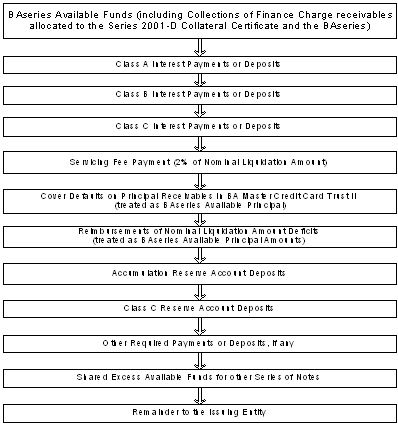

In accordance with Section 3.01 of the Third Amended and Restated BAseries Indenture Supplement dated as of December 17, 2015, between BA Credit

Card Trust and The Bank of New York Mellon, BAseries Available Funds shall be applied in the priority described in the chart below. This chart is only an overview of the application and priority of payments of BAseries Available Funds. For

a more detailed description, please see the Third Amended and Restated BAseries Indenture Supplement as included in Exhibit 4.5 to Registrant's Form 8-K filed with SEC on December 18, 2015.

|

Priority of Payments

BAseries Available Funds

| B. |

Targeted deposits to Interest Funding sub-Accounts:

|

|

Targeted Deposit to Interest Funding sub-Account for applicable

Monthly Period

|

Actual Deposit to Interest Funding sub-Account for applicable Monthly Period

|

Shortfall from earlier Monthly Periods

|

Interest Funding sub-account Balance prior to

Withdrawals

|

Interest Funding sub-Account Earnings

|

|||||||||

|

Class A:

|

|||||||||||||

|

Class A (2018-03)

|

$3,229,166.67

|

$3,229,166.67

|

$0.00

|

$3,229,166.67

|

$0.00

|

||||||||

|

Class A (2019-01)

|

$1,812,500.00

|

$1,812,500.00

|

$0.00

|

$1,812,500.00

|

$0.00

|

||||||||

|

Class A (2020-01)

|

$283,333.33

|

$283,333.33

|

$0.00

|

$283,333.33

|

$0.00

|

||||||||

|

Class A Total:

|

$5,325,000.00

|

$5,325,000.00

|

$0.00

|

$5,325,000.00

|

$0.00

|

||||||||

|

Class B:

|

|||||||||||||

|

Class B (2010-01)

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

||||||||

|

Class B Total:

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

||||||||

|

Class C:

|

|||||||||||||

|

Class C (2010-01)

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

||||||||

|

Class C Total:

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

||||||||

|

Total:

|

$5,325,000.00

|

$5,325,000.00

|

$0.00

|

$5,325,000.00

|

$0.00

|

||||||||

|

C.

|

Interest to be paid on the corresponding Payment Date:

|

|

CUSIP Number

|

Interest Payment Date

|

Interest Rate

|

Amount of interest to be paid on corresponding Interest Payment Date

|

|||||

|

Class A:

|

||||||||

|

Class A (2018-03)

|

05522RDA3

|

May 17, 2021

|

3.1000000%

|

$3,229,166.67

|

||||

|

Class A (2019-01)

|

05522RDB1

|

May 17, 2021

|

1.7400000%

|

$1,812,500.00

|

||||

|

Class A (2020-01)

|

05522RDC9

|

May 17, 2021

|

0.3400000%

|

$283,333.33

|

||||

|

Class A Total:

|

$5,325,000.00

|

|||||||

|

Total:

|

$5,325,000.00

|

|||||||

.

| D. |

Targeted deposits to Class C Reserve sub-Accounts:

|

|

Targeted Deposit to Class C Reserve sub-Account for applicable Monthly Period

|

Actual Deposit to Class C Reserve sub-Account for applicable Monthly Period

|

Class C Reserve sub-Account Balance on Transfer Date prior to withdrawals

|

Class C Reserve sub-Account Earnings

|

Amount of interest to be paid on corresponding Interest Payment Date

|

|||||||||

|

NOTHING TO REPORT

|

|||||||||||||

|

E.

|

Withdrawals to be made from the Class C Reserve

sub-Accounts on the corresponding Transfer Date:

|

|

Targeted Deposit to Withdrawals for Interest

|

Actual Deposit to Withdrawals for Principal

|

Class C Reserve Class C Reserve sub-Account Balance on Transfer Date after withdrawals

|

|||||

|

NOTHING TO REPORT

|

|||||||

|

F.

|

Targeted deposits to Principal Funding sub-Accounts:

|

|

Targeted Deposit to Principal Funding sub-Account for applicable Monthly Period

|

Actual Deposit to Principal Funding sub-Account for applicable Monthly Period

|

Shortfall from earlier Monthly Periods

|

Principal Funding sub-Account Balance on Transfer Date

|

Principal Funding sub-Account Earnings

|

||||||||||||||

|

Class A:

|

||||||||||||||||||

|

Class A (2018-03)

|

$250,000,000.00

|

$250,000,000.00

|

$0.00

|

$750,000,000.00

|

$3,219.50

|

|||||||||||||

|

Class A Total:

|

$250,000,000.00

|

$250,000,000.00

|

$0.00

|

$750,000,000.00

|

$3,219.50

|

|||||||||||||

|

Total:

|

$250,000,000.00

|

$250,000,000.00

|

$0.00

|

$750,000,000.00

|

$3,219.50

|

|||||||||||||

|

G.

|

Principal to be paid on the corresponding Principal Payment Date:

|

|

CUSIP Number

|

Principal Payment Date

|

Amount of principal to be paid on corresponding Principal Payment Date

|

|||

|

NOTHING TO REPORT

|

|||||

| H. |

Stated Principal Amount, Outstanding Dollar Principal Amount and Nominal Liquidation Amount for the related Monthly Period:

|

|

Initial Dollar Principal Amount

|

Outstanding Principal

Amount

|

Adjusted Outstanding Principal Amount

|

Nominal Liquidation Amount

|

||||||||||

|

Class A:

|

|||||||||||||

|

Class A (2018-03)

|

$1,250,000,000.00

|

$1,250,000,000.00

|

$500,000,000.00

|

$500,000,000.00

|

|||||||||

|

Class A (2019-01)

|

$1,250,000,000.00

|

$1,250,000,000.00

|

$1,250,000,000.00

|

$1,250,000,000.00

|

|||||||||

|

Class A (2020-01)

|

$1,000,000,000.00

|

$1,000,000,000.00

|

$1,000,000,000.00

|

$1,000,000,000.00

|

|||||||||

|

Class A Total:

|

$3,500,000,000.00

|

$3,500,000,000.00

|

$2,750,000,000.00

|

$2,750,000,000.00

|

|||||||||

|

Class B:

|

|||||||||||||

|

Class B (2010-01)

|

$3,350,000,000.00

|

$3,350,000,000.00

|

$3,350,000,000.00

|

$3,350,000,000.00

|

|||||||||

|

Class B Total:

|

$3,350,000,000.00

|

$3,350,000,000.00

|

$3,350,000,000.00

|

$3,350,000,000.00

|

|||||||||

|

Class C:

|

|||||||||||||

|

Class C (2010-01)

|

$1,975,000,000.00

|

$1,975,000,000.00

|

$1,975,000,000.00

|

$1,975,000,000.00

|

|||||||||

|

Class C Total:

|

$1,975,000,000.00

|

$1,975,000,000.00

|

$1,975,000,000.00

|

$1,975,000,000.00

|

|||||||||

|

Total:

|

$8,825,000,000.00

|

$8,825,000,000.00

|

$8,075,000,000.00

|

$8,075,000,000.00

|

|||||||||

|

I.

|

Class A Usage of Class B and Class C Subordinated

Amounts:

|

|

Class A Usage of Class B Subordinated Amount for this Monthly Period

|

Class A Usage of Class C Subordinated Amount for this Monthly Period

|

Cumulative Class A Usage of Class B Subordinated Amount

|

Cumulative Class A Usage of Class C Subordinated Amount

|

||||||

|

NOTHING TO REPORT

|

|||||||||

|

J.

|

Class B Usage of Class C Subordinated Amounts:

|

|

Class B Usage of Class C Subordinated Amount for this Monthly Period

|

Cumulative Class B Usage of Class C Subordinated Amount

|

|||

|

NOTHING TO REPORT

|

||||

|

K.

|

Nominal Liquidation Amount for Tranches of Notes Outstanding:

|

|

Beginning Nominal Liquidation Amount

|

Increases from accretions on Principal for Discount

Notes

|

Increases from amounts withdrawn from the Principal Funding sub-Account in respect of Prefunding

Excess Amount

|

Reimbursements from

Available

Funds

|

Reductions due to reallocations of Available Principal

Amounts

|

Reductions due to Investor Charge-Offs

|

Reductions due to amounts on deposit in the Principal Funding sub-Account

|

Ending Nominal Liquidation Amount

|

|

|

Class A:

|

||||||||

|

Class A (2018-03)

|

$750,000,000.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$250,000,000.00

|

$500,000,000.00

|

|

Class A (2019-01)

|

$1,250,000,000.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$1,250,000,000.00

|

|

Class A (2020-01)

|

$1,000,000,000.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$1,000,000,000.00

|

|

Class A Total:

|

$3,000,000,000.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$250,000,000.00

|

$2,750,000,000.00

|

|

Class B:

|

||||||||

|

Class B (2010-01)

|

$3,350,000,000.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$3,350,000,000.00

|

|

Class B Total:

|

$3,350,000,000.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$3,350,000,000.00

|

|

Class C:

|

||||||||

|

Class C (2010-01)

|

$1,975,000,000.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$1,975,000,000.00

|

|

Class C Total:

|

$1,975,000,000.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$1,975,000,000.00

|

|

Total:

|

$8,325,000,000.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$250,000,000.00

|

$8,075,000,000.00

|

|

L.

|

Excess Available Funds and 3 Month Excess Available Funds:

|

|

Excess Available Funds

|

$126,446,929.39†

|

|

Is 3 Month Excess Available Funds < 0 ? (Yes/No)

|

No

|

|

M.

|

Other Performance Triggers

|

|

Has a Class C Reserve sub-Account funding trigger occurred? (Yes/No)

|

No

|

N. Repurchase Demand Activity (Rule 15Ga-1)

No Activity to Report

Most Recent Form ABS – 15G

Filed by: BA Credit Card Funding, LLC

CIK#: 0001370238

Filing Date: January 20, 2021

Endnotes to Schedule to Monthly

Noteholders’ Statement.

† Current Consolidated Payment Prioritization Methodology Not Fully Comparable with Previous Payment Prioritization

Methodologies

Prior to February 5, 2015, BANA utilized two payment prioritization methodologies when servicing credit card accounts -- the daily trust payment methodology

and the cardholder cycle payment methodology. For more detailed information regarding these two payment prioritization methodologies, see "Endnotes to Monthly Certificateholders' Statement" in the Monthly Certificateholders' Statement relating to

the Monthly Period ending February 28, 2015, included as Exhibit 99.1 to the Form 10-D filed by BA Credit Card Trust with the Securities Exchange Commission on March 16, 2015.

Effective February 5, 2015, BANA implemented a system initiative that consolidated the methodologies into a single payment prioritization methodology. As a result, performance and related metrics reported in these indicated items for the Master Trust II portfolio for the period to which this Schedule to Monthly Noteholders' Statement relates were produced by utilizing only BANA's consolidated payment prioritization methodology. Therefore, the performance and related metrics reported in these indicated items are not fully comparable to the same performance and related metrics reported for the Master Trust II Portfolio for periods ending (i) on or prior to February 4, 2015, which were produced using the daily trust payment methodology and (ii) between February 5, 2015 and February 28, 2015, which were produced using a combination of the daily trust payment methodology (for the period from February 1, 2015 through February 4, 2015) and the consolidated payment prioritization methodology (for the period from February 5, 2015 through February 28, 2015).

Effective February 5, 2015, BANA implemented a system initiative that consolidated the methodologies into a single payment prioritization methodology. As a result, performance and related metrics reported in these indicated items for the Master Trust II portfolio for the period to which this Schedule to Monthly Noteholders' Statement relates were produced by utilizing only BANA's consolidated payment prioritization methodology. Therefore, the performance and related metrics reported in these indicated items are not fully comparable to the same performance and related metrics reported for the Master Trust II Portfolio for periods ending (i) on or prior to February 4, 2015, which were produced using the daily trust payment methodology and (ii) between February 5, 2015 and February 28, 2015, which were produced using a combination of the daily trust payment methodology (for the period from February 1, 2015 through February 4, 2015) and the consolidated payment prioritization methodology (for the period from February 5, 2015 through February 28, 2015).

IN WITNESS WHEREOF, the undersigned has duly executed and delivered this Monthly Noteholders' Statement this 10 th day of May, 2021.

|

BANK OF AMERICA, NATIONAL ASSOCIATION,

|

|

|

Servicer

|

|

|

By: /S/Joseph L. Lombardi

|

|

|

Name: Joseph L. Lombardi

|

|

|

Title: Director

|

|

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Nurse Well-Being the Focus of Engage, Powered By ENA-Golisano Children's Hospital Partnership

- Cousins Maine Lobster Celebrates 12th Year Anniversary & 65th Unit Opening with Expansion into Northern Illinois!

- White Paper: Mastering the Art of Timekeeping

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share