Form 10-12G/A TCW Star Direct Lending

Table of Contents

As filed with the Securities and Exchange Commission on August 16, 2022

File No. 000-56404

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 to

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

PURSUANT TO SECTION 12(b) OR 12(g)

OF THE SECURITIES EXCHANGE ACT OF 1934

TCW Star Direct Lending LLC

(Exact name of registrant as specified in charter)

| Delaware | 88-1126955 | |

| (State or other jurisdiction of incorporation or registration) |

(I.R.S. Employer Identification No.) | |

| 200 Clarendon Street, 51st Floor Boston, Massachusetts (Address of principal executive offices) |

02116 (Zip Code) | |

| (617) 936-2275 (Registrant’s telephone number, including area code) | ||

with copies to:

| Meredith Jackson, Esq. Executive Vice President and General Counsel The TCW Group, Inc. 865 South Figueroa Street Los Angeles, California 90017 (213) 244-0896 (213) 244-0491 (fax) |

Vadim Avdeychik, Esq. Clifford Cone, Esq. Clifford Chance US LLP 31 West 52nd Street New York, NY 10019 (212) 878-3055 (212) 878-3180 |

Securities to be registered pursuant to Section 12(b) of the Act:

None

Securities to be registered pursuant to Section 12(g) of the Act:

Common Limited Liability Company Units

(Title of class)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Table of Contents

Table of Contents

TCW Star Direct Lending LLC is filing this registration statement on Form 10 (this “Registration Statement”) under the Securities Exchange Act of 1934, as amended (the “1934 Act” or the “Exchange Act”), on a voluntary basis to permit it to file an election to be regulated as a business development company (a “BDC”), under the Investment Company Act of 1940, as amended (the “1940 Act”). In this Registration Statement, each of the “Company,” “we,” “us,” and “our” refers to TCW Star Direct Lending LLC, and the “Adviser” refers to TCW Asset Management Company LLC, unless otherwise specified.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012. As a result, we are eligible to take advantage of certain reduced disclosure and other requirements that are otherwise applicable to public companies including, but not limited to, not being subject to the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002.

Once this Registration Statement has been deemed effective, we will be subject to the requirements of Section 13(a) of the 1934 Act, including the rules and regulations promulgated thereunder, which will require us, among other things, to file annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, and we will be required to comply with all other obligations of the 1934 Act applicable to issuers filing registration statements pursuant to Section 12(g) of the 1934 Act. Upon the effectiveness of this Registration Statement, we will also be subject to the proxy rules in Section 14 of the 1934 Act, and we and our directors, officers and principal unitholders will be subject to the reporting requirements of Sections 13 and 16 of the Exchange Act. The Securities and Exchange Commission (the “SEC” or the “Commission”) maintains an Internet Website (http://www.sec.gov) that contains the reports mentioned in this section.

In connection with the foregoing, we will file an election to be regulated as a BDC under the 1940 Act. Upon filing of such election, we will become subject to the 1940 Act requirements applicable to BDCs.

- 1 -

Table of Contents

This Registration Statement contains forward-looking statements that involve substantial risks and uncertainties. These forward- looking statements are not historical facts, but rather are based on current expectations, estimates and projections about us, our prospective portfolio investments, our industry, our beliefs, and our assumptions. Words such as “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “would,” “should,” “targets,” “projects,” and variations of these words and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties, and other factors, some of which are beyond our control and are difficult to predict, that could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements including, without limitation:

| • | an economic downturn, such as the downturn associated with the COVID-19 pandemic, could impair our portfolio companies’ ability to continue to operate, which could lead to the loss of some or all of our investments in such portfolio companies; |

| • | the impact of the novel strain of coronavirus known as “COVID-19” on the global economy, our industry, our business and our targeted investments; |

| • | an economic downturn, such as the downturn associated with the COVID-19 pandemic, could disproportionately impact the companies which we intend to target for investment, potentially causing us to experience a decrease in investment opportunities and diminished demand for capital from these companies; |

| • | the effect of legal and regulatory changes, including Coronavirus Aid, Relief and Economic Security Act signed into law in December 2020 and the American Rescue Plan Act of 2021, signed into law in March 2021; |

| • | a contraction of available credit could impair our lending and investment activities; |

| • | interest rate volatility could adversely affect our results, particularly since we intend to use leverage as part of our investment strategy; |

| • | interest rate volatility, including volatility associated with the decommissioning of LIBOR, could adversely affect our results, particularly since we intend to use leverage as a part of our investment strategy; |

| • | our future operating results; |

| • | our business prospects and the prospects of our portfolio companies; |

| • | our contractual arrangements and relationships with third parties; |

| • | the ability of our portfolio companies to achieve their objectives; |

| • | competition with other entities and our affiliates for investment opportunities; |

| • | an inability to replicate the historical success of any previously launched fund managed by the TCW Private Credit Group; |

| • | the speculative and illiquid nature of our investments; |

| • | the use of borrowed money to finance a portion of our investments; |

| • | the adequacy of our financing sources and working capital; |

- 2 -

Table of Contents

| • | uncertainty surrounding the financial and political stability of the United States, the United Kingdom, the European Union, Russia, Ukraine and China, including the effect of the current COVID-19 pandemic; |

| • | the loss of key personnel; |

| • | the timing of cash flows, if any, from the operations of our portfolio companies; |

| • | the ability of the Adviser to locate suitable investments for us and to monitor and administer our investments; |

| • | the ability of The TCW Group, Inc. to attract and retain highly talented professionals that can provide services to the Adviser and Administrator; |

| • | our ability to qualify and maintain our qualification as a regulated investment company, or “RIC,” under Subchapter M of the U.S. Internal Revenue Code of 1986, as amended (the “Code”) and as a BDC; |

| • | the effect of legal, tax and regulatory changes; and |

| • | the other risks, uncertainties and other factors we identify under “Item 1A. Risk Factors” and elsewhere in this Registration Statement. |

Although we believe that the assumptions on which these forward-looking statements are based are reasonable, some of those assumptions are based on the work of third parties and any of those assumptions could prove to be inaccurate; as a result, the forward-looking statements based on those assumptions also could prove to be inaccurate. In light of these and other uncertainties, the inclusion of a projection or forward-looking statement in this Registration Statement should not be regarded as a representation by us that our plans and objectives will be achieved. These risks and uncertainties include those described or identified in the section entitled “Item 1A. Risk Factors” and elsewhere in this Registration Statement. You should not place undue reliance on these forward-looking statements, which apply only as of the date of this Registration Statement. We do not undertake any obligation to update or revise any forward-looking statements or any other information contained herein, except as required by applicable law. The safe harbor provisions of Section 21E of the 1934 Act, which preclude civil liability for certain forward-looking statements, do not apply to the forward-looking statements in this Registration Statement because we are an investment company.

- 3 -

Table of Contents

Investing in our units involves a number of significant risks. You should carefully consider information found in the section entitled “Item 1A. Risk Factors” and elsewhere in this Registration Statement. Some of the risks involved in investing in our units include:

| • | We are a new company and we are subject to all of the business risks and uncertainties associated with any business with a limited operating history, including the risk that we will not achieve our investment objective and that the value of our units could decline substantially. |

| • | We are an “emerging growth company” under the JOBS Act, and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our units less attractive to investors. |

| • | We intend to finance our investments with borrowed money. Our inability to access leverage in a timely fashion may inhibit our ability to make timely investments. |

| • | Regulations governing our operation as a BDC affect our ability to, and the way in which we, raise additional capital. As a BDC, the necessity of raising additional capital exposes us to risks, including the typical risks associated with leverage. |

| • | There is no public market for our units, nor can we give any assurance that one will develop in the future. Furthermore, we currently do not intend to conduct repurchases of the Units. As a result, an investment in the Units may not be suitable for investors who may need the money they invest in a specified time frame. |

| • | You should not expect to be able to sell Units regardless of how we perform. As a result, if you are unable to sell your Units, you will be unable to reduce your exposure on any market downturn that affects our portfolio. |

| • | We generally will not control the business operations of our portfolio companies and, due to the illiquid nature of our holdings in our portfolio companies, we may not be able to dispose of our interests in our portfolio companies. |

| • | The collateral securing a senior loan may be insufficient to protect us against losses or a decline in income in the event of a borrower’s non-payment of interest or principal. |

| • | An investment strategy focused primarily on privately held companies presents certain challenges, including the lack of available information about these companies. Such companies are also generally more vulnerable to economic downturns and may experience substantial variations in operating results. |

| • | There is no public market or active secondary market for many of the investments that we intend to make and hold and as a result, these investments may be deemed illiquid. |

| • | If we make additional offerings of Units in the future, a unitholder may be required to make additional purchases of our Units on one or more dates to be determined by us. |

| • | Our portfolio may be concentrated in a limited number of portfolio companies and industries, which will subject us to a risk of significant loss if any of these companies defaults on its obligations under any of its debt instruments or if there is a downturn in a particular industry. |

| • | We may make investments in highly levered companies. Price declines in the corporate leveraged loan market may adversely affect the fair value of our portfolio, reducing our net asset value through increased net unrealized depreciation and the incurrence of realized losses. |

- 4 -

Table of Contents

| • | We will invest in securities that are rated below investment grade by rating agencies or that would be rated below investment grade if they were rated. Below investment grade securities, which are often referred to as “junk,” have predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. They will also be difficult to value and are illiquid. |

| • | The amount of any distributions we may make on our units is uncertain. We may not be able to pay you distributions, or be able to sustain distributions at any particular level, and our distributions per unit, if any, may not grow over time, and our distributions per share may be reduced. |

| • | If the current period of capital market disruption and instability due to the COVID-19 pandemic continues for an extended period of time, there is a risk that you may not receive distributions or that our distributions may not grow over time and a portion of our distributions may be a return of capital. A return of capital is a return to investors of a portion of their original investment in the Company. A return of capital is treated as a non-dividend distribution for tax purposes and is not subject to current tax. A return of capital reduces a shareholder’s tax cost basis in Company’s Units. Any capital returned to you through distributions will be distributed after payment of fees and expenses. |

| • | To the extent original issue discount (“OID”), and payment-in-kind (“PIK”), interest income constitute a portion of our income, we will be exposed to risks associated with the deferred receipt of the cash representing such income. |

| • | The Adviser and its affiliates, including our officers and some of our directors, may face conflicts of interest caused by compensation arrangements with us and our affiliates, which could result in increased risk-taking by us. |

| • | Our business model depends to a significant extent upon strong referral relationships with private equity sponsors, financial intermediaries, direct lending institutions and other counterparties that are active in our markets. Any inability of the Adviser to maintain or develop these relationships, or the failure of these relationships to generate investment opportunities, could adversely affect our business. |

| • | The Adviser may frequently be required to make investment analyses and decisions on an expedited basis in order to take advantage of investment opportunities, and our Adviser may not have knowledge of all circumstances that could impact an investment by us. |

| • | Our management and incentive fee structure may create incentives for the Adviser that are not fully aligned with the interests of our unitholders and may induce the Adviser to make speculative investments. |

| • | If we do not invest a sufficient portion of our assets in qualifying assets, we could fail to qualify as a BDC or be precluded from investing according to our current business strategy. |

| • | Efforts to comply with the Sarbanes-Oxley Act will involve significant expenditures, and non-compliance with the Sarbanes-Oxley Act would adversely affect us and the value of our units. |

| • | We are highly dependent on information systems, and systems failures could significantly disrupt our business, which may, in turn, negatively affect the value of our units and our ability to pay distributions. |

| • | Investment in us is suitable only for sophisticated investors and requires the financial ability and willingness to accept the high risks and lack of liquidity inherent in such an investment. |

| • | We intend to elect to be regulated as a BDC under the 1940 Act, which imposes numerous restrictions on our activities, including restrictions on leverage and on the nature of our investments. |

- 5 -

Table of Contents

| (a) | General Development of Business |

We were formed on March 7, 2022 as a limited liability company under the laws of the State of Delaware. We expect to conduct a private offering of our common limited liability company units (the “Units”) to investors in reliance on exemptions from the registration requirements of the U.S. Securities Act of 1933, as amended (the “Securities Act”). Any investors in our initial private offering will be required to be “accredited investors” as defined in Regulation D of the Securities Act.

We anticipate commencing our loan origination and investment activities on the date we issue Units to persons not affiliated with the Adviser, which we refer to as the “Initial Closing Date.” We expect the Initial Closing Date to occur in the third quarter of 2022.

We are an externally managed, closed-end, non-diversified management investment company, that intends to file an election to be regulated as a BDC under the 1940 Act. We also intend to elect to be treated for U.S. federal income tax purposes as a RIC under Subchapter M of the Code. As a BDC and a RIC, we are required to comply with certain regulatory requirements. See “Item 1(c). Description of Business—Regulation as a Business Development Company” and “Item 1(c). Description of Business—Certain U.S. Federal Income Tax Consequences.”

We are a direct lending investment company that will seek to generate attractive risk-adjusted returns primarily through direct investments in senior secured loans to middle market companies.

We will be managed by the TCW Private Credit Group (the “Private Credit Group”), a group of investment professionals that will use the same investment strategy employed by the Private Credit Group over the past 20 years.

Although we will be primarily focused on investing in senior secured debt obligations, there may be occasions where our investments may be unsecured. Our highly negotiated private investments may include senior secured loans, unsecured senior loans, subordinated and mezzanine loans, convertible securities, notes and other non-convertible debt securities, equity securities, and equity- linked securities such as options and warrants. We may also consider making an equity investment, in combination with a debt investment. Our investments will mostly be made in portfolio companies formed as corporations, partnerships and other business entities. Our typical investment commitment is expected to be between $25 million and $150 million. We estimate the general maturity and duration for our investments to be approximately five years. We currently expect to focus our investments in portfolio companies in a variety of industries. While we intend to focus on investments in middle market companies, we may invest in larger or smaller companies. See “Item 2. Financial Information—Management’s Discussion and Analysis of Financial Condition and Results of Operations.” We will consider financings for many different purposes, including corporate acquisitions, growth opportunities, liquidity needs, rescue situations, recapitalizations, debtor-in-possession (“DIP”) loans, bridge loans and Chapter 11 exits.

The issuers in which we intend to invest will typically be highly leveraged, and, in most cases, these investments will not be rated by any rating agency. If these investments were rated, we believe that they would likely receive a rating from a nationally recognized statistical rating organization of below investment grade, which is often referred to as “junk.” Exposure to below investment grade securities involves certain risks, and those securities are viewed as speculative with respect to the issuer’s capacity to pay interest and repay principal.

Because we intend to qualify as a RIC under the Code, our portfolio will be subject to diversification and other requirements. See “—Certain U.S. Federal Income Tax Consequences.” In addition to those diversification requirements, we will not invest more than 10% of investors’ aggregate capital commitments to us through the Units (the “Commitments”) in any single portfolio company.

We may borrow money from time to time, but do not intend to exceed a 1:1 debt-to-equity ratio, or such other maximum amount as may be permitted by applicable law. In determining whether to borrow money, we will analyze the maturity, covenant package and rate structure of proposed borrowings as well as the risks of such borrowings compared to our investment outlook. The use of borrowed funds or the proceeds of preferred units issued by the Company (the “Preferred Units”) to make investments would have its own specific set of benefits and risks, and all of the costs of borrowing funds or issuing preferred units would be borne by the holders of the Units (each, a “Unitholder”). See “Item 1A. Risk Factors—Borrowing Money.”

- 6 -

Table of Contents

| (b) | Financial Information about Industry Segments |

Our operations comprise only a single reportable segment. See “Item 2. Financial Information.”

| (c) | Description of Business |

The Adviser

Our investment activities will be managed by the Adviser. Subject to the overall supervision of our board of directors, the Adviser will manage our day-to-day operations and provide investment advisory and management services to us pursuant to the investment management and advisory agreement (the “Advisory Agreement”) by and between the Adviser and us.

The Adviser is a Delaware limited liability company registered with the SEC under the Investment Advisers Act of 1940, as amended (the “Advisers Act”), and has been since 1970. The Adviser is a wholly owned subsidiary of The TCW Group, Inc. (the “TCW Group”) and together with its affiliated companies (collectively, “TCW”) manages or has committed to manage approximately $264 billion of assets as of December 31, 2021. Such assets are managed in various formats, including managed accounts, funds, structured products and other investment vehicles, including TCW Direct Lending LLC, TCW Direct Lending VII LLC, and TCW Direct Lending VIII LLC (together with their five predecessor funds, the “Direct Lending Funds”).

The Adviser is responsible for sourcing investment opportunities, conducting industry research, performing diligence on potential investments, structuring our investments and monitoring our portfolio companies on an ongoing basis.

The Adviser monitors our portfolio companies on an ongoing basis. It monitors the financial trends of each portfolio company to determine if they are meeting their respective business plans and to assess the appropriate course of action for each company. The Adviser has several methods of evaluating and monitoring the performance and fair value of our investments, which may include the following:

| • | assessment of success in adhering to the portfolio company’s business plan and compliance with covenants; |

| • | periodic or regular contact with portfolio company management and, if appropriate, the financial or strategic sponsor, to discuss financial position, requirements and accomplishments; |

| • | comparisons to our portfolio companies in the industry, if any; |

| • | attendance at and participation in board meetings or presentations by portfolio companies; and review of monthly and quarterly financial statements and financial projections of portfolio companies. |

The Private Credit Group

The Private Credit Group joined the TCW Group in December 2012. The Private Credit Group was previously with Regiment Capital Advisors, LP, an independent investment manager based in Boston, Massachusetts. The Private Credit Group is launching the Company as its eighth Direct Lending Fund. The Private Credit Group is led by Richard Miller and currently includes a group of seventeen investment professionals who have substantial investing, corporate finance, and merger and acquisition expertise and also significant experience in leveraged transactions, high yield financings and restructurings.

The Private Credit Group and other investment professionals of the Adviser have extensive experience in the capital markets, including work on deal origination, due diligence, transaction structuring, and portfolio management in the public and private markets across a wide spectrum of securities and industries. The Adviser believes that the experience of its investment professionals, and the Private Credit Group in particular, should position us to achieve attractive risk-adjusted returns.

- 7 -

Table of Contents

The investment approach of the Private Credit Group is primarily to originate and invest in loans to middle market companies and generally focuses on the following:

| • | Investing in adjustable-rate, senior secured investment opportunities; |

| • | Maintaining a principal preservation/absolute return focus; |

| • | Investing capital in a disciplined manner with an eye towards finding opportunities in both positive and negative markets, without attempting to time markets; and |

| • | Evaluating investment opportunities on a risk-adjusted return basis. |

We will employ the investment approach and strategy the Private Credit Group developed and implemented over the past 21 years of investing in the middle markets. The approach will focus on the fundamental objectives of preserving capital and generating attractive risk-adjusted returns.

The Private Credit Group’s Investment Committee

The Private Credit Group’s investment committee (the “Investment Committee”) evaluates and approves all investments by the Adviser. The Investment Committee process is intended to bring the diverse experiences and perspectives of the committee members to the analysis and consideration of every investment. The Investment Committee determines appropriate investment sizing, structure, pricing, and ongoing monitoring requirements for each investment, thus serving to provide investment consistency and adherence to the Adviser’s investment philosophies and policies. In addition to reviewing investments, the Investment Committee meetings serve as a forum to discuss credit views and outlooks. Potential transactions and deal flow are also reviewed on a regular basis. The team’s investment professionals are encouraged to share information and views on credits with the Investment Committee early in their analysis. This process improves the quality of the analysis and enables the investment team members to work more efficiently. Each proposed transaction is presented to the Investment Committee for consideration in a formal written report. Each of our new investments, and the disposition or sale of each existing investment, must be approved by the Investment Committee.

The Adviser will keep our board of directors well informed as to the identity and title of each member of its Investment Committee and provide to the board of directors such other information with respect to such persons and the functioning of the Investment Committee and the Private Credit Group as the board of directors may from time to time request.

The Investment Committee will initially be composed of five members of the Private Credit Group. The members of the Investment Committee are Richard T. Miller, Suzanne Grosso, Ryan Carroll, Mark Gertzof and David Wang. Richard T. Miller, Suzanne Grosso, Mark Gertzof and David Wang, are referred to as “Key Persons” of the Company.

We expect to use the expertise of the members of the Investment Committee/Key Persons (including Mr. Miller, Ms. Grosso, Mr. Carroll, Mr. Gertzof, and Mr. Wang), and the Private Credit Group to assess investment risks and determine appropriate pricing for our investments. In addition, we expect that the relationships developed by the Private Credit Group will enable us to learn about, and compete effectively for, financing opportunities with attractive middle market companies. For additional information concerning the competitive risks we face. See “Item 1A. Risk Factors—Competition for Investment Opportunities.”

Investment Management and Advisory Agreement

Pursuant to the Advisory Agreement, the Adviser will:

| • | determine the composition of our portfolio, the nature and timing of the changes to our portfolio and the manner of implementing such changes; |

| • | identify, evaluate and negotiate the structure of the investments we make (including performing due diligence on our prospective portfolio companies); |

- 8 -

Table of Contents

| • | determine the assets we will originate, purchase, retain or sell; |

| • | close, monitor and administer the investments we make, including the exercise of any rights in our capacity as a lender; and |

| • | provide us such other investment advice, research and related services as we may, from time to time, require. |

The Adviser’s services under the Advisory Agreement are not exclusive, and the Adviser is free to furnish similar or other services to others so long as its services to us are not impaired. Under the Advisory Agreement, the Adviser will receive a management fee and an incentive fee from us as described below.

The Advisory Agreement will be approved by our board of directors at the initial board meeting. Unless earlier terminated as described below, the Advisory Agreement will remain in effect for a period of two years from its effective date and will remain in effect from year to year thereafter if approved annually by (i) the vote of our board of directors, or by the vote of a majority of our outstanding voting securities, and (ii) the vote of a majority of our directors who are not “interested persons” (as defined in Section 2(a)(19) of the 1940 Act) of the Company, the Adviser or any of their respective affiliates (the “Independent Directors”). The Advisory Agreement will automatically terminate in the event of an assignment by the Adviser. The Advisory Agreement may be terminated by either party, or by a vote of the majority of our outstanding voting units or, if less, such lower percentage as required by the 1940 Act, without penalty upon not less than 60 days’ prior written notice to the applicable party. If the Advisory Agreement is terminated according to this paragraph, we will pay the Adviser a pro-rated portion of the Management Fee and Incentive Fee (each as defined below). See “Item 1A. Risk Factors—Dependence on Key Personnel and Other Management.”

The Adviser will not assume any responsibility to us other than to render the services described in, and on the terms of, the Advisory Agreement and the Administration Agreement, and will not be responsible for any action of our board of directors in declining to follow the advice or recommendations of the Adviser. Under the terms of the Advisory Agreement, the Adviser (and its members, managers, officers, employees, agents, controlling persons and any other person or entity affiliated with it) and any person who otherwise serves at the request of the board of directors on our behalf (in each case, an “Indemnitee”) will not, in the absence of its own willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of such Indemnitee’s respective position, be liable to us or to our investors for (a) any mistake in judgment, (b) any act performed or omission made by it or (c) losses due to the mistake, action, inaction or negligence of our other agents.

We will indemnify each Indemnitee for any loss, damage or expense incurred by such Indemnitee on our behalf or in furtherance of the interests of our investors or otherwise arising out of or in connection with the Company, except for losses (x) arising from such Indemnitee’s own willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of such Indemnitee’s position or losses due to a violation of an applicable law or regulation by the Indemnitee or (y) arising from the Indemnitee defending an actual or threatened claim, action, suit or proceeding against the Indemnitee brought or initiated by the Company, the board of directors of the Company and/or the Adviser (or brought or initiated by the Indemnitee against the Company, the board of directors of the Company and/or the Adviser). If we do not have sufficient available funds to satisfy such an indemnification liability or obligation and each Unitholder has already made aggregate contributions pursuant to drawdowns equal to such Unitholder’s Commitment plus amounts that can be recalled as described below in “Item 9. Market Price of and Dividends on the Registrant s Common Equity and Related Unitholder Matters—Recallable Amounts,” then we may require that each Unitholder return distributions we have previously made to such Unitholder to satisfy its proportionate share of the shortfall; provided, however, that no Unitholder shall be required (i) to return an aggregate amount in excess of the lesser of (a) the aggregate amount of distributions we made to such Unitholder and (b) 25% of such Unitholder’s aggregate Commitment or (ii) to return amounts distributed to such Unitholder more than three years prior to the date such Unitholder is informed of a potential indemnification claim.

U.S. federal and state securities laws may impose liability under certain circumstances on persons who act in good faith. Nothing in the Advisory Agreement will constitute a waiver or limitation of any rights that we may have under any applicable federal or state securities laws.

- 9 -

Table of Contents

Management Fee

We will pay to the Adviser, quarterly in arrears, a management fee (the “Management Fee”) calculated as follows: 0.3125% (i.e., 1.25% per annum) of the average gross assets of the Company on a consolidated basis, with the average determined based on the gross assets of the Company as of the end of the three most recently completed calendar months. “Gross assets” means the amortized cost of our portfolio investments (including portfolio investments purchased with borrowed funds and other forms of leverage, such as preferred units, public and private debt issuances, derivative instruments, repurchase agreements and other similar instruments or arrangements) that have not been sold, distributed to members, or written off for tax purposes (but reduced by any portion of such cost basis that has been written down to reflect a permanent impairment of value of any portfolio investment), and excluding cash and cash equivalents. The Management Fee for any partial month or quarter will be appropriately pro-rated. While the Management Fee will accrue from the Initial Closing Date, the Adviser intends to defer payment of such fee to the extent that such fee is greater than the aggregate amount of interest and fee income earned by the Company.

Incentive Fee

In addition, the Adviser will receive an incentive fee (the “Incentive Fee”) as follows:

| (a) | First, no Incentive Fee will be owed until the Unitholders have collectively received cumulative distributions pursuant to this clause (a) equal to their aggregate capital contributions in respect of all Units; |

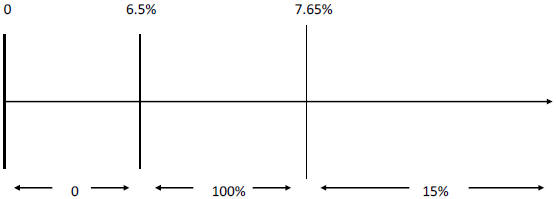

| (b) | Second, no Incentive Fee will be owed until the Unitholders have collectively received cumulative distributions equal to a 6.5% internal rate of return on their aggregate capital contributions in respect of all Units (the “Hurdle”); |

| (c) | Third, the Adviser will be entitled to an Incentive Fee out of 100% of additional amounts otherwise distributable to Unitholders until such time as the Incentive Fee paid to the Adviser is equal to 15% of the sum of (i) the amount by which the Hurdle exceeds the aggregate capital contributions of the Unitholders in respect of all Units and (ii) the amount of Incentive Fee being paid to the Adviser pursuant to this clause (c); and |

| (d) | Thereafter, the Adviser will be entitled to an Incentive Fee equal to 15% of additional amounts otherwise distributable to Unitholders, with the remaining 85% distributed to the Unitholders. |

The Incentive Fee will be calculated on a cumulative basis and the amount of the Incentive Fee payable in connection with any distribution (or deemed distribution) will be determined and, if applicable, paid in accordance with the foregoing formula each time amounts are to be distributed to the Unitholders.

The following is a graphical representation of the incentive fee calculation pursuant to the Advisory Agreement:

- 10 -

Table of Contents

Example Incentive Fee Calculations

Case #1 (5.00% return on contributed capital)

Assume $100.00 of aggregate contributed capital, with the entire amount contributed on January 1.

The Company produces $5.00 of net profit over the year (after payment of all Company expenses including the Management Fee) and liquidates on December 31, designating $105.00 for distribution and Incentive Fee payments.

Step 1: Unitholders receive distributions totalling their $100.00 of aggregate contributed capital. There remains $5.00 designated for distribution and Incentive Fee payments.

Step 2: Unitholders are entitled to 100% of the remaining amount until they have received a 6.5% annual return on their unreturned contributed capital, which in this case totals $6.50. The remaining $5.00 is distributed to the Unitholders in satisfaction of this entitlement, leaving no further amounts designated for distribution and Incentive Fee payments.

In this case the total Incentive Fee received by the Adviser is $0.00, or 0% of the $5.00 of net profit to the Company.

Case #2 (8.75% return on contributed capital)

Assume $100.00 of aggregate contributed capital, with the entire amount contributed on January 1.

The Company produces $8.75 of net profit over the year (after payment of all Company expenses including the Management Fee) and liquidates on December 31, designating $108.75 for distribution and Incentive Fee payments.

Step 1: Unitholders receive distributions totalling their $100.00 of aggregate contributed capital. There remains $8.75 designated for distribution and Incentive Fee payments.

Step 2: Unitholders are entitled to 100% of the remaining amount until they have received a 6.5% annual return on their unreturned contributed capital, which in this case totals $6.50. $6.50 is distributed to the Unitholders in satisfaction of this entitlement. There remains $2.25 designated for distribution and Incentive Fee payments.

Step 3: The Adviser is entitled to 100% of the remaining amount until it has received 15% of total distributions and Incentive Fee payments in excess of contributed capital, which in this case totals approximately $1.15. Such amount is paid to the Adviser as an Incentive Fee, in satisfaction of this entitlement. There remains approximately $1.10 designated for distribution and Incentive Fee payments.

Step 4: Unitholders are entitled to 85% of the remaining amount and the Adviser is entitled to 15% of the remaining amount. Therefore, the Unitholders receive approximately $0.935 in additional distributions while the Adviser receives approximately $0.165 in additional Incentive Fee payments.

In this case the total Incentive Fee received by the Adviser is $1.315, or 15.00% of the $8.75 of net profit to the Company.

- 11 -

Table of Contents

Case #3 (12.00% return on contributed capital)

Assume $100 of aggregate contributed capital, with the entire amount contributed on January 1.

The Company produces $12.00 of net profit over the year (after payment of all Company expenses including the Management Fee) and liquidates on December 31, designating $112.00 for distribution and Incentive Fee payments.

Step 1: Unitholders receive distributions totalling their $100.00 of aggregate contributed capital. There remains $12.00 designated for distribution and Incentive Fee payments.

Step 2: Unitholders are entitled to 100% of the remaining amount until they have received a 6.5% annual return on their unreturned contributed capital, which in this case totals $6.50. $6.50 is distributed to the Unitholders in satisfaction of this entitlement. There remains $5.50 designated for distribution and Incentive Fee payments.

Step 3: The Adviser is entitled to 100% of the remaining amount until it has received 15% of total distributions and Incentive Fee payments in excess of contributed capital, which in this case totals approximately $1.15. Such amount is paid to the Adviser as an Incentive Fee in satisfaction of this entitlement. There remains approximately $4.35 designated for distribution and Incentive Fee payments.

Step 4: Unitholders are entitled to 85% of the remaining amount and the Adviser is entitled to 15% of the remaining amount. Therefore, the Unitholders receive approximately $3.70 in additional distributions while the Adviser receives approximately $0.65 in additional Incentive Fee payments.

In this case the total Incentive Fee received by the Adviser is $1.80, or 15.00% of the $12.00 of net profit to the Company.

If the Advisory Agreement terminates early for any reason other than (i) the Adviser voluntarily terminating the agreement or (ii) our terminating the agreement for cause (as set out in the Advisory Agreement), we will be required to pay the Adviser a final incentive fee payment (the “Final Incentive Fee Payment”). The Final Incentive Fee Payment will be calculated as of the date the Advisory Agreement is so terminated and will equal the amount of Incentive Fee that would be payable to the Adviser if (A) all our investments were liquidated for their current value (but without taking into account any unrealized appreciation of any portfolio investment), and any unamortized deferred portfolio investment-related fees were deemed accelerated, (B) the proceeds from such liquidation were used to pay all our outstanding liabilities, and (C) the remainder were distributed to Unitholders and paid as Incentive Fee in accordance with the “waterfall” (i.e., clauses (a) through (d)) described above for determining the amount of the Incentive Fee. We will make the Final Incentive Fee Payment in cash on or immediately following the date the Advisory Agreement is so terminated.

In addition, on each fiscal year-end from and after December 31, 2024 (each, a “Interim Incentive Fee Date”) the Adviser shall be entitled to an interim incentive fee payment (each, and “Interim Incentive Fee Payment”), which shall be treated as an advance against future Incentive Fee Payments, in an amount equal to the Incentive Fee payment that would be made to the Adviser if all of the assets of the Company were fully realized for cash as of such Interim Incentive Fee Date in an amount equal to the fair market value of such assets, and the resulting proceeds, after payment or provision for expenses, liabilities and contingencies, were distributed to the common unitholders and the Adviser in accordance with the incentive fee calculation. The Adviser may, in its discretion, defer any such Interim Incentive Fee, and allocate it for future distribution pending expiration of the lookback period described below under Adviser Return Obligation.

Adviser Return Obligation

On each Interim Incentive Fee Date and after we have made our final distribution of assets in connection with our dissolution (“Final Incentive Fee Date”), if the Adviser has received aggregate payments of Final Incentive Fee, or with respect to the Interim Incentive Fee only, an amount equal to or greater than $1,000,000, in excess of the amount the Adviser was entitled to receive as described under “Incentive Fee” above, then the Adviser will return to us (“Adviser Return Event”), on or before 90 days after such Interim Incentive Fee Date or Final Incentive Fee Date,

- 12 -

Table of Contents

as the case may be, an amount equal to such excess (the “Adviser Return Obligation”). Notwithstanding the preceding sentence, in no event shall the Adviser Return Obligation exceed an amount greater than the aggregate amount of Incentive Fee payments previously received by (or allocated to) the Adviser by us with respect to the two Interim Incentive Fee Dates immediately preceding such Adviser Return Event, reduced by the excess (if any) of (a) the aggregate federal, state and local income tax liability the Adviser incurred in connection with the payment of such Incentive Fees (assuming the highest marginal applicable federal and New York City and State income tax rates applied to such payments), over (b) an amount equal to the U.S. federal and state tax benefits available to the Adviser by virtue of the payment made by the Adviser pursuant to its Adviser Return Obligation (assuming that, to the extent such payments are deductible by the Adviser, the benefit of such deductions will be computed using the then highest marginal applicable federal and New York City and State income tax rates), as reasonably determined by the Adviser.

Administration Agreement

We entered into an administration agreement (the “Administration Agreement”) with TCW Asset Management Company LLC (the “Administrator”) under which the Administrator will furnish us with office facilities and equipment, and clerical, bookkeeping and record keeping services. Pursuant to the Administration Agreement, the Administrator will oversee the maintenance of our financial records and otherwise assist with our compliance with BDC and RIC rules, monitor the payment of our expenses, oversee the performance of administrative and professional services rendered to us by others, be responsible for the financial and other records that we are required to maintain, prepare and disseminate reports to our Unitholders and reports and other materials to be filed with the SEC or other regulators, assist us in determining and publishing (as necessary or appropriate) our net asset value, oversee the preparation and filing of our tax returns, generally oversee the payment of our expenses and provide such other services as the Administrator, subject to review of our board of directors, shall from time to time determine to be necessary or useful to perform its obligations under the Administration Agreement. The Administrator may perform these services directly, may delegate some or all of them through the retention of a sub-administrator and may remove or replace any sub-administrator.

Payments under the Administration Agreement will be equal to an amount that reimburses the Administrator for the costs and expenses incurred by the Administrator in performing its obligations and providing personnel and facilities under the Administration Agreement. The amounts paid pursuant to the Administration Agreement are subject to the cap on offering and organizational expenses (as described below). The Administrator agrees that it would not charge total fees under the Administration Agreement that would exceed its reasonable estimate of what a qualified third party would charge to perform substantially similar services. The costs and expenses paid by the Company and the applicable caps on certain costs and expenses are described below under “Expenses” below.

The Administration Agreement provides that neither the Administrator, nor any director, officer, agent or employee of the Administrator, shall be liable or responsible to us or any of our Unitholders for any error of judgment, mistake of law or any loss arising out of any investment, or for any other act or omission in the performance by such person or persons of their respective duties, except for liability resulting from willful misfeasance, bad faith, gross negligence, or reckless disregard of their respective duties. We will also indemnify the Administrator and its members, managers, officers, employees, agents, controlling persons and any other person or entity affiliated with it.

Expenses

We, and indirectly our Unitholders, will bear all costs, expenses and liabilities, other than Adviser Operating Expenses (which shall be borne by the Adviser), in connection with our organization, operations, administration and transactions (“Company Expenses”). Company Expenses shall include, without limitation: (a) organizational expenses and expenses associated with the issuance of the Units; (b) expenses of calculating our net asset value (including the cost and expenses of any independent valuation firm); (c) fees payable to third parties, including agents, consultants, attorneys or other advisors, relating to, or associated with, evaluating and making investments; (d) expenses incurred by the Adviser or the Administrator payable to third parties, including agents, consultants, attorneys or other advisors, relating to or associated with monitoring our financial and legal affairs, providing administrative services, monitoring or administering our investments and performing due diligence reviews of prospective investments and the corresponding portfolio companies; (e) costs associated with our reporting and compliance obligations under the 1940 Act, the 1934 Act and other applicable federal or state securities laws; (f) fees and expenses incurred in connection with debt incurred to finance our investments or operations, and payment of interest and repayment of principal on such debt; (g) expenses related to sales and purchases of Units and other

- 13 -

Table of Contents

securities; (h) Management Fees and Incentive Fees; (i) administrator fees and expenses payable under the Administration Agreement including payments based upon our allocable portion of the Administrator’s overhead in performing its obligations, including the allocable portion of the cost of our chief compliance officer, chief legal officer and chief financial officer and their respective staff; (j) transfer agent, sub-administrator and custodial fees; (k) expenses relating to the issue, repurchase and transfer of Units to the extent not borne by the relevant transferring Unitholders and/or assignees; (l) federal and state registration fees; (m) federal, state and local taxes and other governmental charges assessed against us; (n) independent directors’ fees and expenses and the costs associated with convening a meeting of our board of directors or any committee thereof; (o) fees and expenses and the costs associated with convening a meeting of the Unitholders or holders of any Preferred Units, as well as the compensation of an investor relations professional responsible for the coordination and administration of the foregoing; (p) costs of any reports, proxy statements or other notices to Unitholders, including printing and mailing costs; (q) costs and expenses related to the preparation of our financial statements and tax returns; (r) our allocable portion of the fidelity bond, directors and officers/errors and omissions liability insurance, and any other insurance premiums; (s) direct costs and expenses of administration, including printing, mailing, long distance telephone, and copying; (t) independent auditors and outside legal costs, including legal costs associated with any requests for exemptive relief, “no-action” positions or other guidance sought from a regulator, pertaining to us; (u) compensation of other third party professionals to the extent they are devoted to preparing our financial statements or tax returns or providing similar “back office” financial services to us; (v) Adviser costs and expenses (excluding travel) in connection with identifying and investigating investment opportunities for us, monitoring our investments and disposing of any such investments; (w) portfolio risk management costs; (x) commissions or brokerage fees or similar charges incurred in connection with the purchase or sale of securities (including merger fees); (y) costs and expenses attributable to normal and extraordinary investment banking, commercial banking, accounting, auditing, appraisal, valuation, administrative agent activities, custodial and registration services provided to us, including in each case services with respect to the proposed purchase or sale of securities by us that are not reimbursed by the issuer of such securities or others (whether or not such purchase or sale is consummated); (z) costs of amending, restating or modifying our operating agreement (the “LLC Agreement”) or Advisory Agreement or related documents of us or related entities; (aa) fees, costs, and expenses incurred in connection with the termination, liquidation or dissolution of the Company or related entities; and (bb) all other properly and reasonably chargeable expenses incurred by the Company or the Administrator in connection with administering our business.

However, we will not bear more than (a) an amount equal to 10 basis points of our aggregate Commitments for organizational expenses and offering expenses in connection with the offering of Units.

“Adviser Operating Expenses” means overhead and operating and administrative expenses incurred by or on behalf of the Adviser or any of its affiliates, including us, in connection with maintaining and operating the Adviser’s office, including salaries and other compensation (including compensation due to its officers), rent, routine office equipment expense and liability and insurance premiums (other than (i) those incurred in maintaining fidelity bonds and Indemnitee insurance policies and (ii) the allocable portion of the Administrator’s overhead in performing its obligations), in furtherance of providing supervisory investment management services for us. For the avoidance of doubt, Adviser Operating Expenses include any expenses incurred by the Adviser or its affiliates in connection with the Adviser’s registration as an investment adviser under the Investment Advisers Act of 1940, as amended (“Advisers Act”), or with its compliance as a registered investment adviser thereunder.

All Adviser Operating Expenses and all our expenses that we will not bear, as set forth above, will be borne by the Adviser or its affiliates.

Transfer Agent

U.S. Bancorp Fund Services, LLC serves as our transfer agent and disbursing agent.

Employees

We do not currently have any employees and do not expect to have any employees. Services necessary for our business will be provided through the Administration Agreement and the Advisory Agreement. Each of our executive officers described under “Item 5. Directors and Executive Officers.”

- 14 -

Table of Contents

Competition

We will compete for investments with a number of business development companies and other investment funds (including private equity funds and venture capital funds), special purpose acquisition company sponsors, investment banks that underwrite initial public offerings, hedge funds that invest in private investments in public equities, traditional financial services companies such as commercial banks, and other sources of financing. Many of these entities have greater financial and managerial resources than we do. Furthermore, many of our competitors are not subject to the regulatory restrictions that the 1940 Act and the Code will impose on us as a BDC and a RIC.

Derivatives

We do not expect derivatives to be a significant component of our investment strategy. We retain the flexibility, however, to utilize hedging techniques, such as interest rate swaps, to mitigate potential interest rate risk on our indebtedness. Such interest rate swaps would principally be used to protect us against higher costs on our indebtedness resulting from increases in both short-term and long-term interest rates.

We also may use various hedging and other risk management strategies to seek to manage additional risks, including changes in currency exchange rates and market interest rates. Such hedging strategies would be utilized to seek to protect the value of our portfolio investments, for example, against foreign currency fluctuations vis-à-vis the U.S. Dollar or possible adverse changes in the market value of securities held in our portfolio.

Emerging Growth Company

We are an emerging growth company as defined in the Jumpstart Our Business Startups Act and we are eligible to take advantage of certain specified reduced disclosure and other requirements that are otherwise generally applicable to public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002. Although we have not made a determination whether to take advantage of any or all of these exemptions, we expect to remain an emerging growth company for up to five years following the completion of any initial public offering by us or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1.07 billion, (ii) December 31 of the fiscal year that we become a “large accelerated filer” as defined in Rule 12b-2 under the 1934 Act which would occur if the market value of our Units that is held by non-affiliates exceeds $700.0 million as of the last business day of our most recently completed second fiscal quarter and we have been publicly reporting for at least 12 calendar months or (iii) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the preceding three-year period. In addition, we may take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards.

The Private Offering

In connection with its subscription for Units, each of our investors will make a Commitment to us and will receive one Unit for every one hundred dollars of such investor’s accepted Commitment (for example, an investor making a Commitment of $200 million would be issued two million Units). Each Unit will be issued for a purchase price of $0.01 per Unit (the “Original Issuance Price”) and will obligate the Unitholder to make additional future capital contributions of $99.99. The amount that remains to be drawn down with respect to a Unit is referred to as that Unit’s “Undrawn Commitment.” The minimum Commitment by an investor will be $10 million (i.e., 100,000 Units), although Commitments of lesser amounts may be accepted at our discretion.

Each investor will be required to enter into a subscription agreement in connection with its Commitment (a “Subscription Agreement”). The Subscription Agreement sets forth, among other things, the terms and conditions upon which the investors will purchase Units, the circumstances under which we may draw down capital from investors, certain covenants that all investors must agree to, and the remedies available to us in the event that an investor defaults on its obligation to make capital contributions. If an investor fails to fund its capital contribution, interest will accrue at the default rate (as defined herein) on the outstanding unpaid balance of such capital contribution, from and including the date such capital contribution was due until the earlier of the date of payment of such capital contribution by such investor. The “Default Rate” with respect to any period shall be the lesser of (a) a variable rate equal to the prime rate in effect, from time to time, during such period plus 6% or (b) the highest interest rate for such period permitted by applicable law. We may waive the requirement to pay interest, in whole or in part.

- 15 -

Table of Contents

In addition, the Subscription Agreement includes an Investor Suitability Questionnaire designed to ensure that all investors are “qualified purchasers” as defined in the 1940 Act, and also are either (i) “accredited investors,” as defined in Rule 501 of Regulation D under the Securities Act, or (ii) in the case of Units sold outside the United States, persons that are not “U.S. persons” in accordance with Regulation S under the Securities Act.

While we expect each Subscription Agreement to reflect the terms and conditions summarized in the preceding paragraph, we reserve the right to enter into Subscription Agreements that contain terms and conditions not found in the Subscription Agreements entered into with other investors, subject to applicable law. No Unitholder will be granted, in its Subscription Agreement, the right to invest in Units on more favorable economic terms and conditions than other Unitholders.

Initial Closing and Subsequent Closings

The first date on which we will accept Subscription Agreements and issue Units to persons not affiliated with the Adviser is referred to as the “Initial Closing Date.”

After the Initial Closing Date, we expect to hold a limited number of additional closings (“Subsequent Closings”) at which we will issue Units (each a “Subsequent Closing Date”). In advance of each Subsequent Closing Date, and as close to it as practicable, the Company will allocate its estimated profits and losses through that date, and distribute to Unitholders any undistributed estimated profits in cash to the extent there is available cash and through a deemed capital call and corresponding deemed distribution to the extent there is not sufficient available cash (on each occasion, a “Pre-Closing Distribution”).

Each investor participating in a Subsequent Closing (a “Later-Closing Investor”) will be issued Units in exchange for the Original Issuance Price and will be required to contribute to us in respect of each Unit newly issued to such investor:

| (i) | an amount equal to the amount of any additional capital contributions we had previously drawn down with respect to a Unit issued on the Initial Closing Date (a “True-Up Contribution”); |

| (ii) | an amount equal to any increase in the net asset value (as reflected in our books and records after giving effect to the applicable Pre-Closing Distribution) of a Unit issued on the Initial Closing Date through the closing date for the newly issued Unit, excluding any increase in net asset value attributable to additional capital contributions made by the applicable Unitholder or decrease attributable to distributions of True-Up Contributions as described in the paragraph below (an “NAV Balancing Contribution”); and |

| (iii) | an amount equal to a rate of 2.0% per annum on the True-Up Contribution for such newly issued Unit, calculated for the period from the Initial Closing Date to the closing date for such newly issued Unit as an administrative fee to compensate us for expenses and activities related to the Later-Closing Investor (a “Late-Closer Contribution”). |

True-Up Contributions may be retained by us and used for any purpose of the Company. If at any time we determine that because of the True-Up Contributions we have excess cash on hand, we may distribute that excess cash among all the Unitholders pro rata based on the number of Units held by each. Any distribution of True-Up Contributions will be treated as a return of previously made capital contributions in respect of the Units and, consequently, will correspondingly increase the Undrawn Commitment of the Units.

NAV Balancing Contributions will not reduce the Undrawn Commitment of the associated Units and will not be treated as capital contributions for purposes of calculating the Incentive Fee. NAV Balancing Contributions received by us will not be treated as amounts distributed to Unitholders for purposes of calculating the Incentive Fee.

Late-Closer Contributions will not reduce the Undrawn Commitment of the associated Units and will not be treated as capital contributions for purposes of calculating the Incentive Fee. Any distribution of Late-Closer Contributions will not be treated as an amount distributed to the Unitholders for purposes of calculating the Incentive Fee.

- 16 -

Table of Contents

Pre-Closing Distributions and NAV Balancing Contributions will be determined by us in good faith on the basis of best commercial efforts and likely will be approximate amounts.

Commitment Period

The “Commitment Period” of the Company will begin on the Initial Closing Date and end four years from the later of (a) the Initial Closing Date and (b) the date on which the Company first completes an investment; unless terminated pursuant to a Key Person Event, as described below, the Commitment Period shall be automatically extended for successive one-year periods beginning one year prior to each scheduled expiration of the Commitment Period (so that, immediately following any such extension, the Commitment Period will expire two years from that date). Supermajority in interest of all Unitholders may terminate the Commitment Period at any time upon 90 days written notice to the Company. After the expiration of the Commitment Period, Unitholders will be released from any further obligation with respect to their Undrawn Commitments, except as described under “Item 11. Description of Registrant’s Securities to be Registered—Delaware Law and Certain Limited Liability Company Agreement Provisions—Capital Call Mechanics.“A “Key Person Event” will occur if, during the Commitment Period, (i) Mr. Miller and one or more Ms. Grosso, Mr. Gertzof and Mr. Wang (each of such four Persons, a “Key Person” and collectively, the “Key Persons”) fail to devote substantially all (i.e. more than 85%) of his or her business time to the investment activities of the Company, the prior funds, any successor funds and any fund(s) managed by the Adviser or an affiliate of the Adviser that are managed within the Private Credit Group (together, the “Related Entities”); or (ii) Ms. Grosso, Mr. Gertzof and Mr. Wang all fail to devote substantially all of his or her business time to the investment activities of the Company and the Related Entities, in each case other than as a result of a temporary disability; provided that if a replacement has been approved as described in the paragraphs below, such replacement shall be specifically designated to take the place of one of the above-named individuals and the definition “Key Person Event” will be amended to take into account such successor.

Upon the occurrence of a Key Person Event, and in the event that the Adviser fails to replace the above-referenced individuals in the manner contemplated by the last sentence of this paragraph, the Commitment Period shall be automatically terminated upon such Key Person Event. The Commitment Period will be re-instated upon the vote or written consent of 66 2/3% in interest of the Unitholders. The Adviser is permitted at any time to replace any person designated above with a senior professional (including a Key Person) selected by the Adviser, provided that such replacement has been approved by a majority of the Unitholders (in which case, the approved substitute will be a Key Person in lieu of the person replaced). The determination of whether a Key Person Event has occurred will be made by the Company in accordance with the criteria set out above. The Company shall provide written notice to Unitholders of such Key Person Event within 30 days of the date of such Key Person Departure.

Regulation as a Business Development Company

We will be regulated as a BDC under the 1940 Act. The 1940 Act contains prohibitions and restrictions relating to transactions between BDCs and their affiliates (including any investment advisers or sub-advisers), principal underwriters and affiliates of those affiliates or underwriters. In addition, a BDC must be organized for the purpose of investing in or lending primarily to private companies organized in the United States and making significant managerial assistance available to them.

As with other companies regulated by the 1940 Act, a BDC must adhere to certain substantive regulatory requirements. A majority of our board of directors must be persons who are not “interested persons,” as that term is defined in the 1940 Act. Additionally, we are required to provide and maintain a bond issued by a reputable fidelity insurance company to protect us against larceny and embezzlement. Furthermore, as a BDC, we are prohibited from protecting any director or officer against any liability to us or our Unitholders arising from willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of any such person’s office. As a BDC, we are currently also required to meet a minimum coverage ratio of the value of total assets to total senior securities, which include all of our borrowings and any Preferred Units.

As a BDC, we may not change the nature of our business so as to cease to be, or withdraw our election as, a BDC unless authorized by vote of a majority of our outstanding voting securities, as required by the 1940 Act. A majority of the outstanding voting securities of a company is defined under the 1940 Act as the lesser of: (a) 67% or more of such company’s voting securities present at a meeting if more than 50% of the outstanding voting securities of such company are present or represented by proxy, or (b) more than 50% of the outstanding voting securities of such company.

- 17 -

Table of Contents

We do not intend to acquire securities issued by any investment company that exceed the limits imposed by the 1940 Act. Under these limits, we generally cannot acquire more than 3% of the voting stock of any investment company, invest more than 5% of the value of our total assets in the securities of one investment company, or invest more than 10% of the value of our total assets in the securities of investment companies in the aggregate. We may, however, rely on recently adopted Rule 12d1-4 under the 1940 Act and invest in excess of the limits described above. However, to the extent we rely on Rule 12d1-4, we will be subject to certain conditions and requirements under Rule 12d1-4. The portion of our portfolio invested in securities issued by investment companies ordinarily will subject the Unitholders to additional expenses.

We have no intention to, and are generally not able to, issue and sell our Units at a price below net asset value per Unit. We may, however, issue and sell our Units at a price below the then-current net asset value of our Units if our board of directors determines that such sale is in our best interests and the best interests of the Unitholders, and the Unitholders have approved our policy and practice of making such sales within the preceding 12 months. In any such case, the price at which our securities are to be issued and sold may not be less than a price that, in the determination of our board of directors, closely approximates the market value of such securities. In addition, we may generally issue new Units at a price below net asset value in rights offerings to existing Unitholders, in payment of distributions and in certain other limited circumstances.

We may also be prohibited under the 1940 Act from knowingly participating in certain transactions with our affiliates without the prior approval of the members of our board of directors who are not interested persons and, in some cases, prior approval by the SEC through an exemptive order (other than in certain limited situations pursuant to current regulatory guidance). The Adviser has obtained exemptive relief from the SEC that, subject to certain conditions and limitations, permits us and other funds advised by the Adviser or certain affiliates of the Adviser (referred to herein as “potential co-investment funds”) to engage in certain co-investment transactions. Under the exemptive relief, in the case where the interest in a particular investment opportunity exceeds the size of the opportunity, then the investment opportunity will be allocated among us and such potential co-investment funds based on capital available for investment, which generally will be determined based on the amount of cash on hand, existing commitments and reserves, if any, the targeted leverage level, targeted asset mix and other investment policies and restrictions set from time to time by the board or other governing body of the relevant fund or imposed by applicable laws, rules, regulations or interpretations. In situations where we cannot co-invest with other investment funds managed by the Adviser or an affiliate of the Adviser due to the restrictions contained in the 1940 Act that are not addressed by the exemptive relief or SEC guidance, the investment policies and procedures of the Adviser generally require that such opportunities be offered to us and such other investment funds on an alternating basis. There can be no assurance that we will be able to participate in all investment opportunities that are suitable for us.

We will be subject to periodic examination by the SEC for compliance with the 1940 Act.

Qualifying Assets

Under the 1940 Act, a BDC may not acquire any assets other than assets of the type listed in section 55(a) of the 1940 Act, which are referred to as qualifying assets, unless, at the time the acquisition is made, qualifying assets represent at least 70% of the company’s total assets. The principal categories of qualifying assets relevant to our business are the following:

| • | Securities purchased in transactions not involving any public offering from the issuer of such securities, which issuer (subject to certain limited exceptions) is an eligible portfolio company, or from any person who is, or has been during the preceding 13 months, an affiliated person of an eligible portfolio company, or from any other person, subject to such rules as may be prescribed by the SEC. An eligible portfolio company is defined in the 1940 Act as any issuer which: |

| • | is organized under the laws of, and has its principal place of business in, the United States; |

- 18 -

Table of Contents

| • | is not an investment company (other than a small business investment company wholly owned by us) or a company that would be an investment company but for certain exclusions under the 1940 Act; and |

| • | satisfies either of the following: |

| • | has a market capitalization of less than $250 million or does not have any class of securities listed on a national securities exchange; or |

| • | is controlled by a BDC or a group of companies including a BDC, the BDC actually exercises a controlling influence over the management or policies of the eligible portfolio company, and, as a result thereof, the BDC has an affiliated person who is a director of the eligible portfolio company. |

| • | Securities of any eligible portfolio company that we control. |

| • | Securities purchased in a private transaction from a U.S. issuer that is not an investment company or from an affiliated person of the issuer, or in transactions incident thereto, if the issuer is in bankruptcy and subject to reorganization or if the issuer, immediately prior to the purchase of its securities, was unable to meet its obligations as they came due without material assistance other than conventional lending or financing arrangements. |

| • | Securities of an eligible portfolio company purchased from any person in a private transaction if there is no ready market for such securities and we already own 60% of the outstanding equity of the eligible portfolio company. |

| • | Securities received in exchange for or distributed in connection with securities described above, or pursuant to the exercise of warrants or rights relating to such securities. |

| • | Cash, cash equivalents, U.S. government securities or high-quality debt securities maturing in one year or less from the time of investment. |

Managerial Assistance to Portfolio Companies

A BDC must be operated for the purpose of making investments in the types of securities described under “Qualifying Assets” above. However, in order to count portfolio securities as qualifying assets for the purpose of the 70% test, the BDC must either control the issuer of the securities or must offer to make available to the issuer of the securities significant managerial assistance; except that, where the BDC purchases such securities in conjunction with one or more other persons acting together, the BDC will satisfy this test if one of the other persons in the group may make available such managerial assistance. Making available managerial assistance means, among other things, any arrangement whereby the BDC, through its directors, officers or employees, offers to provide, and, if accepted, does in fact provide, significant guidance and counsel concerning the management, operations or business objectives and policies of a portfolio company.

Temporary Investments

Pending investment in other types of “qualifying assets,” as described above, our investments may consist of cash, cash equivalents, U.S. government securities or high-quality debt securities maturing in one year or less from the time of investment, which is referred to herein, collectively, as temporary investments, such that at least 70% of our assets are qualifying assets.

Senior Securities