Form 1-A/A Triad Pro Innovators,

1-A/A LIVE 0000852447 XXXXXXXX 024-11506 Triad Pro Innovators, Inc. NV 1994 0000852447 3690 88-0317700 7 0 8275 S. Eastern Ave. Las Vegas NV 89123 714-790-3662 John Dolkart Jr., Esq. Other 26256.00 0.00 4728.00 726541.00 886880.00 206504.00 0.00 926366.00 -39486.00 886880.00 0.00 0.00 0.00 -2174905.00 0.00 0.00 Common Stock $.001 par value 104944050 895817104 OTC Markets Series A Preferred 1000000 None None Debt Securities 0 None Convertible and Other Notes payable. true true false Tier1 Unaudited Equity (common or preferred stock) Option, warrant or other right to acquire another security Security to be acquired upon exercise of option, warrant or other right to acquire security Y N Y Y N N 100000000 104944050 0.0500 20000000.00 0.00 0.00 0.00 20000000.00 0.00 0.00 0.00 0.00 John Dolkart Jr., Esq 1000.00 0.00 Various States 3000.00 19950000.00 true CA CO CT FL IA MA MI NJ NV NY RI TX WA false Triad Pro Innovators, Inc. Common Stock 4167000 0 $100,000 0 Exempt from registration under Regulation S and Section 4(2) of the Securities Act, as Amended, and the Rules promulgated thereunder.

Preliminary Offering Circular dated June 23, 2021

An Offering Statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the Offering Statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the Offering Statement in which such Final Offering Circular was filed may be obtained.

TRIAD PRO

INNOVATORS

Triad Pro Innovators, Inc.

$20,000,000

$ 0.05 per Unit

100,000,000 Units,

Each Unit consisting of 1 Share of Common Stock and 1 Warrant exercisable at $0.15 per Warrant.

100,000,000 S hares of Common Stock to be issued upon Exercise of Warrants

This is the public offering of securities of Triad Pro Innovators, Inc., a Nevada corporation. We are offering 100,000,000 units, each unit consisting of 1 share of common stock and 1 warrant, par value $0.001 ("Units"), at an offering price of $0.05 per Unit (the "Offered Units") by the Company. The total number of shares included in the Units is 1 00,000,000 and the total underlying shares after the exercise of all warrants is 100,000,000 shares . Each Class A Warrant, is exercisable at $0.15 per warrant and will entitle the holder to purchase one share of commo n stock. This Offering will terminate twelve months from the day the Offering is qualified, subject to extension for up to thirty (30) days as defined below or the date on which the maximum offering amount is sold (such earlier date, the "Termination Date"). The minimum purchase requirement per investor is 10,000 Offered Units; however, we can waive the minimum purchase requirement on a case-by-case basis in our sole discretion.

These securities are speculative securities. Investment in the Company’s stock involves significant risk. You should purchase these securities only if you can afford a complete loss of your investment. See the “Risk Factors” section on page 4 of this Offering Circular.

No Escrow

The proceeds of this offering will not be placed into an escrow account. We will offer our Units on a “best efforts” basis. As there is no minimum offering, upon the approval of any subscription to this Offering Circular, the Company shall immediately deposit said proceeds into the bank account of the Company and may dispose of the proceeds in accordance with the Use of Proceeds. The Company will not raise more than $20,000,000 in gross proceeds from this Offering.

Subscriptions are irrevocable and the purchase price is non-refundable as expressly stated in this Offering Circular. The Company, by determination of the Board of Directors, in its sole discretion, may issue the Securities under this Offering for cash, promissory notes, services, and/or other consideration without notice to subscribers. All proceeds received by the Company from subscribers for this Offering will be available for use by the Company upon acceptance of subscriptions for the Securities by the Company.

Sale of these Units will commence within two calendar days of the qualification date and it will be a continuous Offering pursuant to Rule 251(d)(3)(i)(F).

This Offering will be conducted on a “best-efforts” basis, which means our Officers will use their commercially reasonable best efforts in an attempt to offer and sell the Units. Our Officers will not receive any commission or any other remuneration for these sales. In offering the securities on our behalf, the Officers will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities Exchange Act of 1934, as amended.

This Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sales of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful, prior to registration or qualification under the laws of any such state.

Our Common Stock is traded in the OTCMarket Pink Open Market under the stock symbol “TPII.”

Investing in our Common Stock involves a high degree of risk. See "Risk Factors" beginning on page 4 for a discussion of certain risks that you should consider in connection with an investment in our Common Stock.

|

|

| Number of Units or Shares |

|

| Per Unit or Share (1)(2)(3) |

|

| Total Maximum(4) |

| |||

| Public Offering Price– Units |

|

| 100,000,000 |

|

| $ | 0.05 |

|

| $ | 5,000,000.00 |

|

| Proceeds to Company – Units |

|

|

|

|

|

|

|

|

| $ | 5,000,000.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Warrants |

|

|

|

|

| Exercise Price per Warrant |

|

|

|

|

| |

| Public Offering Price – Shares Underlying Warrants |

|

| 100,000,000 |

|

| $ | 0.15 |

|

| $ | 15,000,000.00 |

|

| Proceeds to Company – From the Exercise of Shares Underlying Warrants |

|

|

|

|

|

|

|

|

| $ | 15,000,000.00 |

|

________________

| (1) | We are offering Units on a continuous basis. See “Distribution – Continuous Offering. The number of Units being sold is 100,000,000 Units which consist of one (1) share and one (1) warrant per unit. The total underlying shares of all warrants is 100,000,000 shares. |

| (2) | This is a “best efforts” offering. The proceeds of this offering will not be placed into an escrow account. We will offer the Units on a best efforts basis primarily through an online platform. As there is no minimum offering, upon the approval of any subscription to this Offering Circular, the Company shall immediately deposit said proceeds into the bank account of the Company and may dispose of the proceeds in accordance with the Use of Proceeds. See “How to Subscribe.” |

| (3) | We are offering these securities without an underwriter. |

| (4) | Excludes estimated total offering expenses, including underwriting discount and commissions, will be approximately $50,000 assuming the maximum offering amount is sold. |

Our Board of Directors used its business judgment in setting a value of $0.05 per Unit to the Company as consideration for the stock to be issued under the Offering. The sales price per Unit bears no relationship to our book value or any other measure of our current value or worth.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

| ii |

|

|

| Page |

| |

|

|

| 1 |

| |

|

|

| 2 |

| |

|

|

| 3 |

| |

|

|

| 4 |

| |

|

|

| 16 |

| |

|

|

| 17 |

| |

|

|

| 18 |

| |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

|

| 19 |

|

|

|

| 24 |

| |

|

|

| 33 |

| |

|

|

| 33 |

| |

|

|

| 36 |

| |

|

|

| 38 |

| |

|

|

| 39 |

| |

|

|

| 40 |

| |

|

|

| 43 |

| |

|

|

| 43 |

| |

|

|

| 44 |

| |

|

|

| 44 |

| |

|

| F-1 |

| ||

We are offering to sell, and seeking offers to buy, our securities only in jurisdictions where such offers and sales are permitted. You should rely only on the information contained in this Offering Circular. We have not authorized anyone to provide you with any information other than the information contained in this Offering Circular. The information contained in this Offering Circular is accurate only as of its date, regardless of the time of its delivery or of any sale or delivery of our securities. Neither the delivery of this Offering Circular nor any sale or delivery of our securities shall, under any circumstances, imply that there has been no change in our affairs since the date of this Offering Circular. This Offering Circular will be updated and made available for delivery to the extent required by the federal securities laws.

In this Offering Circular, unless the context indicates otherwise, references to "Triad Pro Innovators, Inc.", “Triad Pro”, “TPII”, "we", the "Company", "our" and "us" refer to the activities of and the assets and liabilities of the business and operations of Triad Pro Innovators, Inc.

| iii |

| Table of Contents |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements under “Summary”, “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, “Our Business” and elsewhere in this Offering Circular constitute forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar matters that are not historical facts. In some cases, you can identify forward-looking statements by terms such as “anticipate”, “believe”, “could”, “estimate”, “expect”, “intend”, “may”, “plan”, “potential”, “should”, “will” and “would” or the negatives of these terms or other comparable terminology.

You should not place undue reliance on forward looking statements. The cautionary statements set forth in this Offering Circular, including in “Risk Factors” and elsewhere, identify important factors which you should consider in evaluating our forward-looking statements. These factors include, among other things:

The speculative nature of the business;

Our reliance on suppliers and customers;

Our dependence upon external sources for the financing of our operations, particularly given that there are concerns about our ability to continue as a “going concern;”

Our ability to effectively execute our business plan;

Our ability to manage our expansion, growth and operating expenses;

Our ability to finance our businesses;

Our ability to promote our businesses;

Our ability to compete and succeed in highly competitive and evolving businesses;

Our ability to respond and adapt to changes in technology and customer behavior; and

Our ability to protect our intellectual property and to develop, maintain and enhance strong brands.

Although the forward-looking statements in this Offering Circular are based on our beliefs, assumptions and expectations, taking into account all information currently available to us and our perception and interpretation thereof, we cannot guarantee future transactions, results, performance, achievements or outcomes. No assurance can be made to any investor by anyone that the expectations reflected in our forward-looking statements will be attained, or that deviations from them will not be material and adverse. We urge you to read this Offering Circular in its entirety and not place undue reliance on forward-looking statements. We undertake no obligation, other than as may be required by law, to re-issue this Offering Circular or otherwise make public statements revising and/or updating our forward-looking statements if events occur or circumstances change.

| 1 |

| Table of Contents |

This summary highlights selected information contained elsewhere in this Offering Circular. This summary is not complete and does not contain all the information that you should consider before deciding whether to invest in the Units. You should carefully read the entire Offering Circular, including the risks associated with an investment in the company discussed in the “Risk Factors” section of this Offering Circular, before making an investment decision. Some of the statements in this Offering Circular are forward-looking statements. See the section entitled “Cautionary Statement Regarding Forward-Looking Statements.”

Company Information

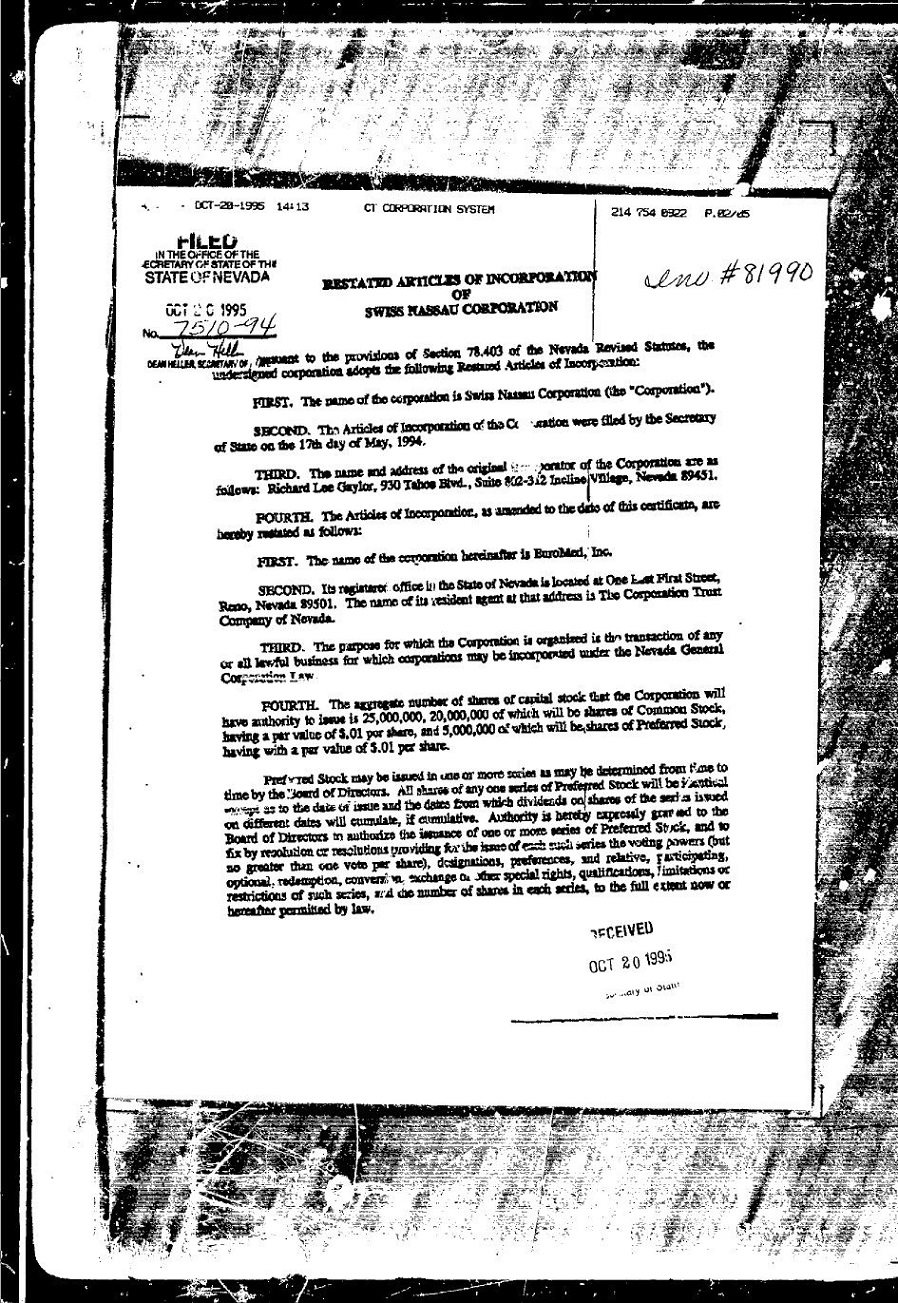

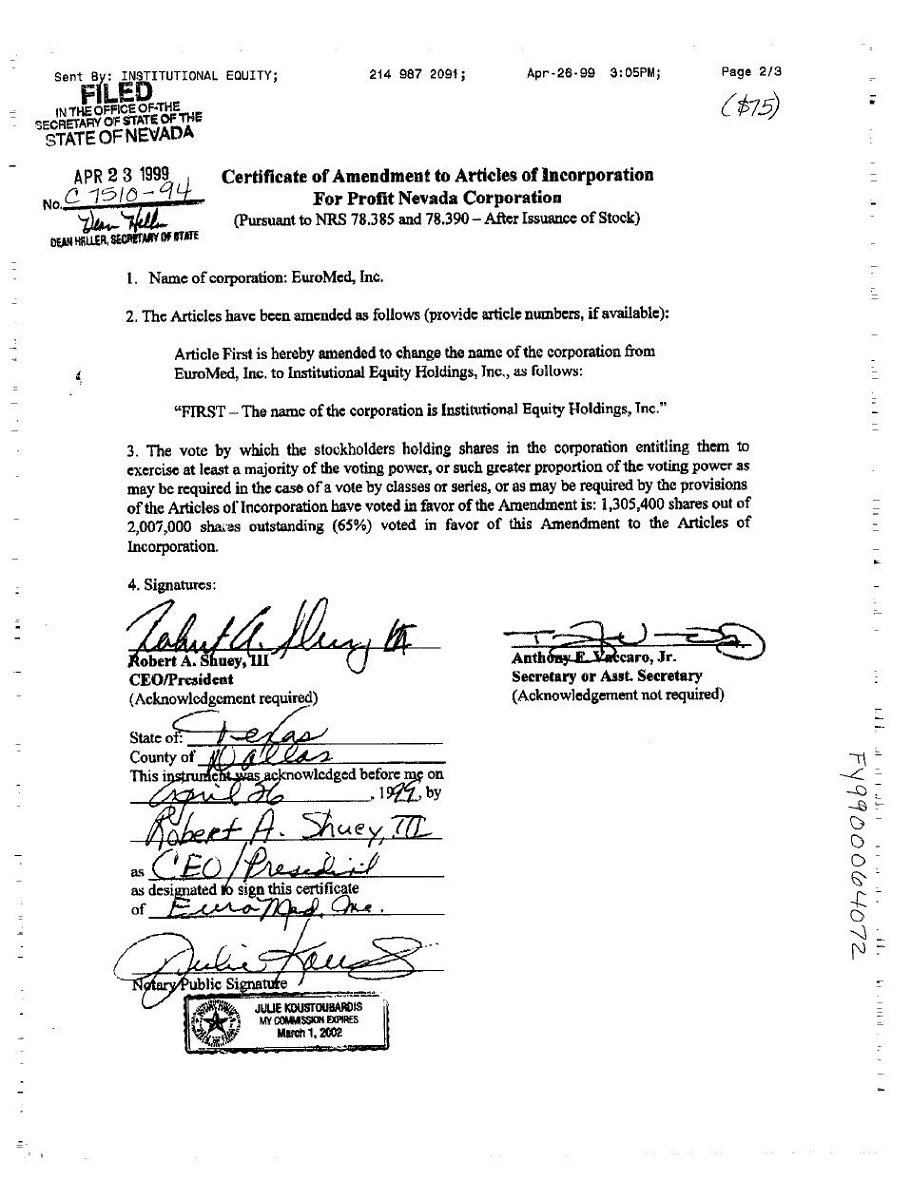

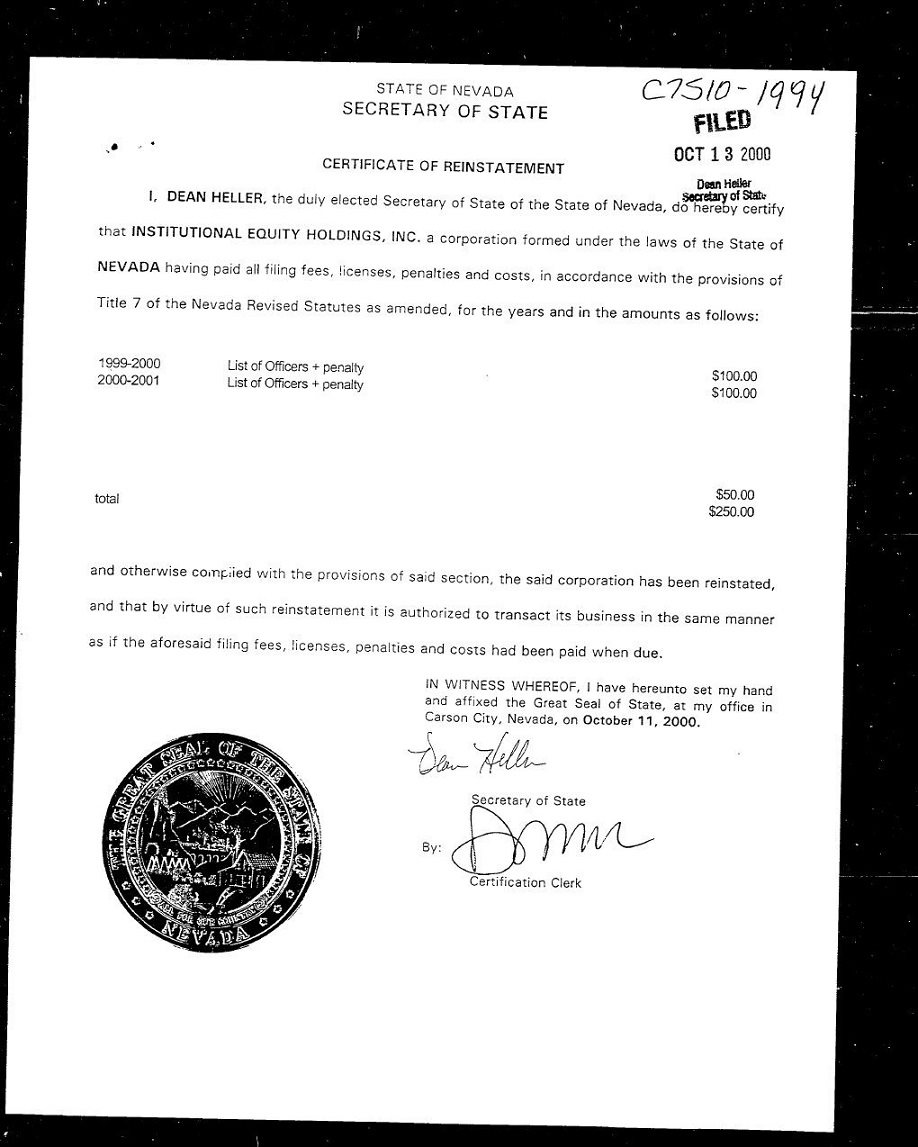

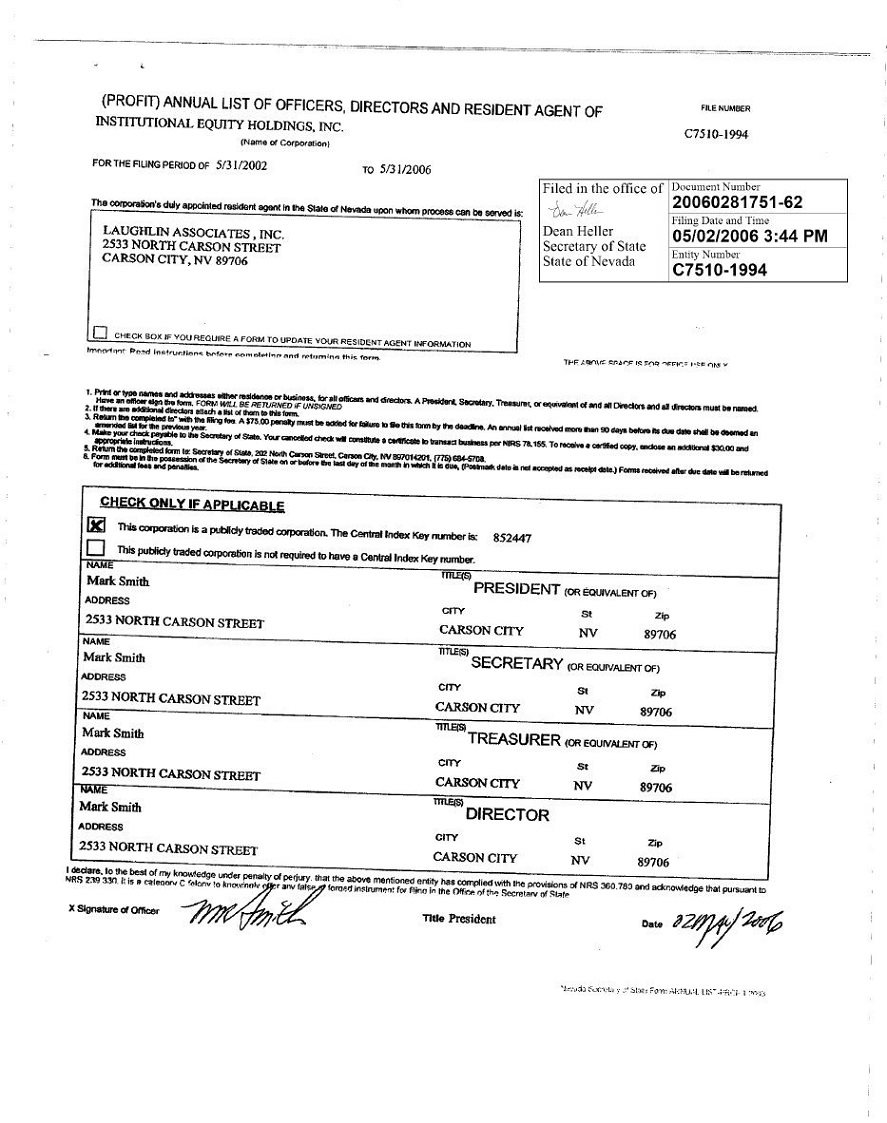

Triad Pro Innovators, Inc. (the Company) was incorporated as Swiss Nassau Corporation on May 17, 1994, in the State of Nevada. After several failed business attempts during the late 1990’s through August 22, 2016, the Company acquired new management, and a certificate of Reinstatement was issued by the State of Nevada. New management obtained control at that time and has entered into a business plan to develop renewable energy storage products. On August 18, 2016, Pal Business Groups, Inc., a company possessing significant energy storage technology, was merged into our Company. On August 20, 2016, the Company acquired Rapid-K Energy Solutions; its proprietary energy storage solutions and its registered trademarks. On October 31, 2016 and on January 2, 2017 the Company acquired two revenue producing co-generation facilities. Our co-generation plants are located in Los Angeles, California and are currently shuttered due to COVID-19. The Company believes that the co-generation plants will not be reactivated at this time. The closing of the co-generation plants does not have a material effect on our current businesses related to our eCell products.

The principal business that will be carried on by TPII will be the continued development of its proprietary eCell, for use in a wide variety of applications that benefit from electricity storage and the reduction of costs related to the use of other fossil fuel input. Two of the applications, presently available, are the solar powered SPREE (solar powered renewable electrical energy) golf cart and a portable lighting tower (“PLT”). The Company is also engaging with other businesses to complement the use of the Triad Pro eCell when used with their own equipment. The Company intends to open a flagship showroom in the City of Palm Desert, California, for its battery operated SPREE golf cars and Portable Tower Lights.

Our fiscal year-end date is November 30.

Our TPII mailing address is 8275 S. Eastern Ave, Las Vegas, NV 89123. Our main telephone number is (714) 790-3662. Our website is www.TriadProInc.comand our email address is [email protected].

We do not incorporate the information on or accessible through our websites into this Offering Circular, and you should not consider any information on, or that can be accessed through, our websites a part of this Offering Circular.

Section 15(g) of the Securities Exchange Act of 1934

Our shares are covered by section 15(g) of the Securities Exchange Act of 1934, as amended that imposes additional sales practice requirements on broker/dealers who sell such securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouses). For transactions covered by the Rule, the broker/dealer must make a special suitability determination for the purchase and have received the purchaser’s written agreement to the transaction prior to the sale. Consequently, the Rule may affect the ability of broker/dealers to sell our securities and also may affect your ability to sell your shares in the secondary market.

Section 15(g) also imposes additional sales practice requirements on broker/dealers who sell penny securities. These rules require a one-page summary of certain essential items. The items include the risk of investing in penny stocks in both public offerings and secondary marketing; terms important to in understanding of the function of the penny stock market, such as bid and offer quotes, a dealers spread and broker/dealer compensation; the broker/dealer compensation, the broker/dealers’ duties to its customers, including the disclosures required by any other penny stock disclosure rules; the customers’ rights and remedies in cases of fraud in penny stock transactions; and, the FINRA’s toll free telephone number and the central number of the North American Securities Administrators Association, for information on the disciplinary history of broker/dealers and their associated persons.

Dividends

The Company has not declared or paid a cash dividend to stockholders since it was organized and does not intend to pay dividends in the foreseeable future. The board of directors presently intends to retain any earnings to finance our operations and does not expect to authorize cash dividends in the foreseeable future. Any payment of cash dividends in the future will depend upon the Company’s earnings, capital requirements and other factors.

Trading Market

Our Common Stock trades in the OTCMarket Pink Open Market Sheets under the symbol TPII.

| 2 |

| Table of Contents |

______

| Issuer: |

| Triad Pro Innovators, Inc. | |

|

|

|

| |

| Securities offered: |

| A maximum of 100,000,000 Units, par value $0.001 (“Units”) at an offering price of $0.05 per Unit (the “Offered Units”). The total number of shares included in the Units is 1 00,000,000 and the total underlying shares of all warrants is 1 00,000,000 (See “Distribution.”) | |

|

|

|

| |

| Number of shares of Common Stock outstanding before the offering |

| 104,944,050 issued and outstanding as of June 18, 2021 | |

|

|

|

| |

| Number of shares of Common Stock to be outstanding after the offering |

| 200,944,050 shares, if the maximum amount of Offered Units are sold. The total number of shares of our common stock outstanding assumes that the maximum number of units each containing shares of our common stock and warrants is sold in this offering. | |

|

|

|

| |

| Number of Warrants to be outstanding after the offering |

| A maximum of 100,000,000 Warrants, par value $0.001. | |

|

|

|

| |

| Number of shares of Common Stock to be outstanding if all the warrants are exercised |

| 300,944,050 shares, if the maximum amount of Offered Units are sold and all the Warrants are exercised. The total number of shares of our common stock outstanding assumes that the maximum number of units each containing shares of our common stock and warrants is sold in this offering and that all the warrants are exercised. | |

|

|

|

| |

| Price per Unit: |

| $0.05 per Unit . | |

|

|

|

| |

| Maximum offering amount: |

| 100,000,000 Units at $0.05 per Unit, or $5,000,000 and an additional $15,000,000 from the exercise of Warrants (See “Distribution.”). The Company will not raise more than $20,000,000 in gross proceeds from this offering. | |

|

|

|

| |

| Trading Market: |

| Our Common Stock is trading on the OTC Markets Pink Open Market Sheets division under the symbol “TPII.” | |

|

|

|

| |

| Use of proceeds: |

| If we sell all of the Units being offered, and all the Warrants are exercised, our net proceeds (after our estimated offering expenses) will be $19,950,000.00 . We will use these net proceeds for working capital and other general corporate purposes. | |

|

|

|

| |

| Risk factors: |

| Investing in our Common Stock involves a high degree of risk, including:

Immediate and substantial dilution.

Limited market for our stock.

See “Risk Factors.” | |

| 3 |

| Table of Contents |

______

The following is only a brief summary of the risks involved in investing in our Company. Investment in our Securities involves risks. You should carefully consider the following risk factors in addition to other information contained in this Disclosure Document. The occurrence of any of the following risks might cause you to lose all or part of your investment. Some statements in this Document, including statements in the following risk factors, constitute “Forward-Looking Statements.”

Our business and future operations may be adversely affected by epidemics and pandemics, such as the recent COVID-19 outbreak.

We may face risks related to health epidemics and pandemics or other outbreaks of communicable diseases, which could result in a widespread health crisis that could adversely affect general commercial activity and the economies and financial markets of the country as a whole. For example, the recent outbreak of COVID-19, which began in China, has been declared by the World Health Organization to be a “pandemic,” has spread across the globe, including the United States of America. A health epidemic or pandemic or other outbreak of communicable diseases, such as the current COVID-19 pandemic, poses the risk that we, or potential business partners may be disrupted or prevented from conducting business activities for certain periods of time, the durations of which are uncertain, and may otherwise experience significant impairments of business activities, including due to, among other things, operational shutdowns or suspensions that may be requested or mandated by national or local governmental authorities or self-imposed by us, our customers or other business partners. While it is not possible at this time to estimate the impact that COVID-19 could have on our business, our customers, our potential customers, suppliers or other current or potential business partners, the continued spread of COVID-19, the measures taken by the local and federal government, actions taken to protect employees, and the impact of the pandemic on various business activities could adversely affect our results of operations and financial condition.

The price of our common stock may continue to be volatile.

The trading price of our common stock has been and is likely to remain highly volatile and could be subject to wide fluctuations in response to various factors, some of which are beyond our control or unrelated to our operating performance. In addition to the factors discussed in this “Risk Factors” section and elsewhere, these factors include: the operating performance of similar companies; the overall performance of the equity markets; the announcements by us or our competitors of acquisitions, business plans, or commercial relationships; threatened or actual litigation; changes in laws or regulations relating to our businesses; any major change in our board of directors or management; publication of research reports or news stories about us, our competitors, or our industry or positive or negative recommendations or withdrawal of research coverage by securities analysts; large volumes of sales of our shares of common stock by existing stockholders; and general political and economic conditions.

In addition, the stock market in general, and the market for developmental related companies in particular, has experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of those companies’ securities. This litigation, if instituted against us, could result in very substantial costs; divert our management’s attention and resources; and harm our business, operating results, and financial condition.

There are doubts about our ability to continue as a going concern.

The Company is an early stage enterprise and has commenced principal operations. The Company had $166,603 in revenues and has incurred losses from operations of $1,441,477 for the year ended November 30, 2020. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

There can be no assurance that sufficient funds required during the next year or thereafter will be generated from operations or that funds will be available from external sources, such as debt or equity financings or other potential sources. The lack of additional capital resulting from the inability to generate cash flow from operations, or to raise capital from external sources would force the Company to substantially curtail or cease operations and would, therefore, have a material adverse effect on its business. Furthermore, there can be no assurance that any such required funds, if available, will be available on attractive terms or that they will not have a significant dilutive effect on the Company’s existing stockholders.

| 4 |

| Table of Contents |

The Company intends to overcome the circumstances that impact its ability to remain a going concern through a combination of the growth of revenues, with interim cash flow deficiencies being addressed through additional equity and debt financing. The Company anticipates raising additional funds through public or private financing, strategic relationships or other arrangements in the near future to support its business operations; however, the Company may not have commitments from third parties for a sufficient amount of additional capital. The Company cannot be certain that any such financing will be available on acceptable terms, or at all, and its failure to raise capital when needed could limit its ability to continue its operations. The Company’s ability to obtain additional funding will determine its ability to continue as a going concern. Failure to secure additional financing in a timely manner and on favorable terms would have a material adverse effect on the Company’s financial performance, results of operations and stock price and require it to curtail or cease operations, sell off its assets, seek protection from its creditors through bankruptcy proceedings, or otherwise. Furthermore, additional equity financing may be dilutive to the holders of the Company’s common stock, and debt financing, if available, may involve restrictive covenants, and strategic relationships, if necessary, to raise additional funds, and may require that the Company relinquish valuable rights. Please see Financial Statements – Note 3. Going Concern for further information.

There is no minimum capitalization required in this offering.

We cannot assure that all or a significant number of the units consisting of common stock and warrants will be sold in this offering. Investors’ subscription funds will be used by us as soon as they are received, and no refunds will be given if an inadequate amount of money is raised from this offering to enable us to conduct our business. Management has no obligation to purchase units. If we raise less than the entire amount that we are seeking in the offering, then we may not have sufficient capital to meet our operating requirements. We cannot assure that we could obtain additional financing or capital from any source, or that such financing or capital would be available to us on terms acceptable to us. Under such circumstances, investors in our company could lose their investment in us. Furthermore, investors who subscribe for units in the earlier stages of the offering will assume a greater risk than investors who subscribe for units later in the offering as subscriptions approach the maximum amount.

We determined the price of the Units arbitrarily.

The offering price of the units each containing 1 share of common stock and 1 warrant has been determined by management, and bears no relationship to our assets, book value, potential earnings, net worth or any other recognized criteria of value. We cannot assure that price of the units is the fair market value of the units or that investors will earn any profit on them.

Risks Relating to Our Financial Condition

Our financials are not independently audited, which could result in errors and/or omissions in our financial statements if proper standards are not applied.

Although the Company is confident with its accounting firm, we are not required to have our financials audited by a certified Public Company Accounting Oversight Board (“PCAOB”). As such, our accountants do not have a third party reviewing the accounting. Our accountants may also not be up to date with all publications and releases put out by the PCAOB regarding accounting standards and treatments. This could mean that our unaudited financials may not properly reflect up to date standards and treatments resulting misstated financials statements.

| 5 |

| Table of Contents |

Our management has limited experience operating a public company and are subject to the risks commonly encountered by early-stage companies.

Although management of Triad Pro Innovators, Inc. has experience in operating small companies, current management has not previously had much experience managing expansion while being a public company. Many investors may treat us as an early-stage company. Because we have a limited operating history, our operating prospects should be considered in light of the risks and uncertainties frequently encountered by early-stage companies in rapidly evolving markets. These risks include:

-risks that we may not have sufficient capital to achieve our growth strategy;

-risks that we may not develop our products and service offerings in a manner that enables us to be profitable and meet our customers’ requirements;

-risks that our growth strategy may not be successful; and

-risks that fluctuations in our operating results will be significant relative to our revenues.

These risks are described in more detail below. Our future growth will depend substantially on our ability to address these and the other risks described in this section. If we do not successfully address these risks, our business could be significantly harmed.

We have limited operational history in an emerging industry, making it difficult to accurately predict and forecast business operations.

As we have limited operations in our business and have only recently begun to generate revenue, it is extremely difficult to make accurate predictions and forecasts on our finances. This is compounded by the fact that we operate in the electric vehicle and battery industries, which are highly competitive and rapidly evolving. There is no guarantee that our products or services will remain attractive to potential and current users as these industries undergo rapid change, or that potential customers will utilize our services.

As a growing company, we have yet to achieve a profit and may not achieve a profit in the near future, if at all.

We have not yet produced a net profit and may not in the near future, if at all. While we expect our revenue to grow, we have not achieved profitability and cannot be certain that we will be able to sustain our current growth rate or realize sufficient revenue to achieve profitability. Further, many of our competitors have a significantly larger user base and revenue stream but have yet to achieve profitability. Our ability to continue as a going concern may be dependent upon raising capital from financing transactions, increasing revenue throughout the year and keeping operating expenses below our revenue levels in order to achieve positive cash flows, none of which can be assured.

We will require additional capital to support business growth, and this capital might not be available on acceptable terms, if at all.

We intend to continue to make investments to support our business growth and may require additional funds to respond to business challenges, including the need to update our website, add to our inventory, and improve our operating infrastructure or acquire complementary businesses and technologies. Accordingly, we will need to engage in continued equity or debt financings to secure additional funds. If we raise additional funds through future issuances of equity or convertible debt securities, our existing stockholders could suffer significant dilution, and any new equity securities we issue could have rights, preferences and privileges superior to those of our common stock. Any debt financing, we secure in the future could involve restrictive covenants relating to our capital raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital and to pursue business opportunities. We may not be able to obtain additional financing on terms favorable to us, if at all. If we are unable to obtain adequate financing or financing on terms satisfactory to us when we require it, our ability to continue to support our business growth and to respond to business challenges could be impaired, and our business may be harmed.

| 6 |

| Table of Contents |

We are highly dependent on the services of our key executives, the loss of whom could materially harm our business and our strategic direction. If we lose key management or significant personnel, cannot recruit qualified employees, directors, officers, or other personnel or experience increases in our compensation costs, our business may materially suffer.

We are highly dependent on our management, specifically Murray Goldenberg. If we lose key management or employees, our business may suffer. Furthermore, our future success will also depend in part on the continued service of our management personnel and our ability to identify, hire, and retain additional key personnel. We do not carry “key-man” life insurance on the lives of any of our executives, employees or advisors. We experience intense competition for qualified personnel and may be unable to attract and retain the personnel necessary for the development of our business. Because of this competition, our compensation costs may increase significantly.

We operate in a highly competitive environment, and if we are unable to compete with our competitors, our business, financial condition, results of operations, cash flows and prospects could be materially adversely affected.

We operate in a highly competitive environment. Our competition includes all other companies that are in the business of selling small electric vehicles (golf-carts), rechargeable batteries, portable light towers, and untethered energy sources (generators) or other related items. A highly competitive environment could materially adversely affect our business, financial condition, results of operations, cash flows and prospects.

We may not be able to compete successfully with other established companies offering the same or similar products and, as a result, we may not achieve our projected revenue and user targets.

If we are unable to compete successfully with other businesses in our existing markets, we may not achieve our projected revenue and/or customer targets. We compete with both start-up and established companies. Compared to our business, some of our competitors may have greater financial and other resources, have been in business longer, have greater name recognition and be better established in our markets.

Our lack of adequate D&O insurance may also make it difficult for us to retain and attract talented and skilled directors and officers.

In the future we may be subject to additional litigation, including potential class action and stockholder derivative actions. Risks associated with legal liability are difficult to assess and quantify, and their existence and magnitude can remain unknown for significant periods of time. To date, we have not obtained directors and officers liability (“D&O”) insurance. Without adequate D&O insurance, the amounts we would pay to indemnify our officers and directors should they be subject to legal action based on their service to the Company could have a material adverse effect on our financial condition, results of operations and liquidity. Furthermore, our lack of adequate D&O insurance may make it difficult for us to retain and attract talented and skilled directors and officers, which could adversely affect our business .

We expect to incur substantial expenses to meet our reporting obligations as a public company. In addition, failure to maintain adequate financial and management processes and controls could lead to errors in our financial reporting and could harm our ability to manage our expenses.

We estimate that it will cost approximately $50,000 annually to maintain the proper management and financial controls for our filings required as a public company. In addition, if we do not maintain adequate financial and management personnel, processes and controls, we may not be able to accurately report our financial performance on a timely basis, which could cause a decline in our stock price and adversely affect our ability to raise capital.

| 7 |

| Table of Contents |

Risks Relating to our Common Stock and Offering

The Common Stock is thinly traded, so you may be unable to sell at or near ask prices or at all if you need to sell your shares to raise money or otherwise desire to liquidate your shares.

The Common Stock has historically been sporadically traded on the OTC Pink Sheets, meaning that the number of persons interested in purchasing our shares at, or near ask prices at any given time, may be relatively small or non-existent. This situation is attributable to a number of factors, including the fact that we are a small company which is relatively unknown to stock analysts, stock brokers, institutional investors and others in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons, they tend to be risk-averse and would be reluctant to follow an unproven company such as ours or purchase or recommend the purchase of our shares until such time as we became more seasoned and viable. As a consequence, there may be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer, which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader or more active public trading market for our common shares will develop or be sustained, or that current trading levels will be sustained.

The market price for the common stock is particularly volatile given our status as a relatively unknown company with a small and thinly traded public float, limited operating history, and relatively small revenues, which could lead to wide fluctuations in our share price. The price at which you purchase our shares may not be indicative of the price that will prevail in the trading market. You may be unable to sell your common shares at or above your purchase price, which may result in substantial losses to you.

The market for our shares of common stock is characterized by significant price volatility when compared to seasoned issuers, and we expect that our share price will continue to be more volatile than a seasoned issuer for the indefinite future. The volatility in our share price is attributable to a number of factors. First, as noted above, our shares are sporadically traded. Because of this lack of liquidity, the trading of relatively small quantities of shares may disproportionately influence the price of those shares in either direction. The price for our shares could, for example, decline precipitously in the event that a large number of our shares is sold on the market without commensurate demand, as compared to a seasoned issuer which could better absorb those sales without adverse impact on its share price. Secondly, we are a speculative investment due to, among other matters, our limited operating history and small revenue or lack of profit to date, and the uncertainty of future market acceptance for our potential products. As a consequence of this enhanced risk, more risk-averse investors may, under the fear of losing all or most of their investment in the event of negative news or lack of progress, be more inclined to sell their shares on the market more quickly and at greater discounts than would be the case with the securities of a seasoned issuer. The following factors may add to the volatility in the price of our shares: actual or anticipated variations in our quarterly or annual operating results; acceptance of our solar charged golf-carts, batteries, portable light towers, government regulations, announcements of significant acquisitions, strategic partnerships or joint ventures; our capital commitments and additions or departures of our key personnel. Many of these factors are beyond our control and may decrease the market price of our shares regardless of our operating performance. We cannot make any predictions or projections as to what the prevailing market price for our shares will be at any time, including as to whether our shares will sustain their current market prices, or as to what effect the sale of shares or the availability of shares for sale at any time will have on the prevailing market price.

Shareholders should be aware that, according to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include (1) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (2) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (3) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (4) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and (5) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses. Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities. The possible occurrence of these patterns or practices could increase the volatility of our share price.

The market price of our common stock may be volatile and adversely affected by several factors.

The market price of our common stock could fluctuate significantly in response to various factors and events, including, but not limited to:

-our ability to integrate operations, technology, products and services;

-our ability to execute our business plan;

-operating results below expectations;

-our issuance of additional securities, including debt or equity or a combination thereof;

| 8 |

| Table of Contents |

-announcements of technological innovations or new products by us or our competitors;

-loss of any strategic relationship;

-industry developments, including, without limitation, changes in competition or practices;

-economic and other external factors;

-period-to-period fluctuations in our financial results; and

-whether an active trading market in our common stock develops and is maintained.

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock. Issuers using the Alternative Reporting standard for filing financial reports with OTC Markets are often subject to large volatility unrelated to the fundamentals of the company.

We do not expect to pay dividends in the foreseeable future; any return on investment may be limited to the value of our common stock.

We do not currently anticipate paying cash dividends in the foreseeable future. The payment of dividends on our common stock will depend on earnings, financial condition and other business and economic factors affecting it at such time as the board of directors may consider relevant. Our current intention is to apply net earnings, if any, in the foreseeable future to increasing our capital base and development and marketing efforts. There can be no assurance that the Company will ever have sufficient earnings to declare and pay dividends to the holders of our common stock, and in any event, a decision to declare and pay dividends is at the sole discretion of our board of directors. If we do not pay dividends, our common stock may be less valuable because a return on your investment will only occur if its stock price appreciates.

Our issuance of additional shares of Common Stock, or options or warrants to purchase those shares, would dilute your proportionate ownership and voting rights.

We are entitled under our articles of incorporation to issue up to 1,000,000,000 shares of common stock. We have issued and outstanding, as of June 18, 2021, 104,944,050 shares of common stock. In addition, we are entitled under our Articles of Incorporation to issue “blank check” preferred stock. Our board may generally issue shares of common stock, preferred stock, options, or warrants to purchase those shares, without further approval by our shareholders based upon such factors as our board of directors may deem relevant at that time. It is likely that we will be required to issue a large amount of additional securities to raise capital to further our development. It is also likely that we will issue a large amount of additional securities to directors, officers, employees and consultants as compensatory grants in connection with their services, both in the form of stand-alone grants or under our stock plans. We cannot give you any assurance that we will not issue additional shares of common stock, or options or warrants to purchase those shares, under circumstances we may deem appropriate at the time.

The elimination of monetary liability against our directors, officers and employees under our Articles of Incorporation and the existence of indemnification rights to our directors, officers and employees may result in substantial expenditures by our company and may discourage lawsuits against our directors, officers and employees.

Our Articles of Incorporation contains provisions that eliminate the liability of our directors for monetary damages to our company and shareholders. Our bylaws also require us to indemnify our officers and directors. We may also have contractual indemnification obligations under our agreements with our directors, officers and employees. The foregoing indemnification obligations could result in our company incurring substantial expenditures to cover the cost of settlement or damage awards against directors, officers and employees that we may be unable to recoup. These provisions and resulting costs may also discourage our company from bringing a lawsuit against directors, officers and employees for breaches of their fiduciary duties, and may similarly discourage the filing of derivative litigation by our shareholders against our directors, officers and employees even though such actions, if successful, might otherwise benefit our company and shareholders.

| 9 |

| Table of Contents |

We may become involved in securities class action litigation that could divert management’s attention and harm our business.

The stock market in general, and the shares of early stage companies in particular, have experienced extreme price and volume fluctuations. These fluctuations have often been unrelated or disproportionate to the operating performance of the companies involved. If these fluctuations occur in the future, the market price of our shares could fall regardless of our operating performance. In the past, following periods of volatility in the market price of a particular company’s securities, securities class action litigation has often been brought against that company. If the market price or volume of our shares suffers extreme fluctuations, then we may become involved in this type of litigation, which would be expensive and divert management’s attention and resources from managing our business.

As a public company, we may also from time to time make forward-looking statements about future operating results and provide some financial guidance to the public markets. Our management has limited experience as a management team in a public company and as a result, projections may not be made timely or set at expected performance levels and could materially affect the price of our shares. Any failure to meet published forward-looking statements that adversely affect the stock price could result in losses to investors, stockholder lawsuits or other litigation, sanctions or restrictions issued by the SEC.

Our common stock is currently deemed a “penny stock,” which makes it more difficult for our investors to sell their shares.

The SEC has adopted Rule 15g-9 which establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require that a broker or dealer approve a person’s account for transactions in penny stocks, and the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience objectives of the person and make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight form sets forth the basis on which the broker or dealer made the suitability determination, and that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock if and when such shares are eligible for sale and may cause a decline in the market value of its stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading, and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities, and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stock.

As an issuer of a “penny stock,” the protection provided by the federal securities laws relating to forward-looking statements does not apply to us.

Although federal securities laws provide a safe harbor for forward-looking statements made by a public company that files reports under the federal securities laws, this safe harbor is not available to issuers of penny stocks. As a result, we will not have the benefit of this safe harbor protection in the event of any legal action based upon a claim that the material provided by us contained a material misstatement of fact or was misleading in any material respect because of our failure to include any statements necessary to make the statements not misleading. Such an action could hurt our financial condition.

| 10 |

| Table of Contents |

As an issuer not required to make reports to the Securities and Exchange Commission under Section 13 or 15(d) of the Securities Exchange Act of 1934, holders of restricted shares may not be able to sell shares into the open market as Rule 144 exemptions may not apply.

Under Rule 144 of the Securities Act of 1933, holders of restricted shares may avail themselves of certain exemptions from registration if the holder and the issuer meet certain requirements. As a company that is not required to file reports under Section 13 or 15(d) of the Securities Exchange Act, referred to as a non-reporting company, we may not, in the future, meet the requirements for an issuer under 144 that would allow a holder to qualify for Rule 144 exemptions. In such an event, holders of restricted stock would have to utilize another exemption from registration or rely on a registration statement to be filed by the Company registering the restricted stock. Although the Company currently plans to file either a form 10 or S-1 with the Commission upon the conclusion of the Regulation A offering, there can be no guarantee that the Company will be able to fulfill one of these registration statements, which could have an adverse effect on our shareholders.

We are classified as an “emerging growth company” as well as a “smaller reporting company” and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies and smaller reporting companies will make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

Section 107 of the JOBS Act provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably opted out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the JOBS Act.

We could remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $1.07 billion as of the last business day of our most recently completed second fiscal quarter, and (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period.

Notwithstanding the above, we are also currently a “smaller reporting company.” Specifically, similar to “emerging growth companies,” “smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; and have certain other decreased disclosure obligations in their SEC filings. Decreased disclosures in our SEC filings due to our status as an “emerging growth company” or “smaller reporting company” may make it harder for investors to analyze our results of operations and financial prospects.

| 11 |

| Table of Contents |

Because directors and officers currently and for the foreseeable future will continue to control Triad Pro Innovators, Inc., it is not likely that you will be able to elect directors or have any say in the policies of Triad Pro Innovators, Inc.

Our shareholders are not entitled to cumulative voting rights. Consequently, the election of directors and all other matters requiring shareholder approval will be decided by majority vote. The directors, officers and affiliates of Triad Pro Innovators, Inc. beneficially own a majority of our outstanding common stock voting rights, through the holding of the Series A Preferred Shares. Due to such significant ownership position held by our insiders, new investors may not be able to affect a change in our business or management, and therefore, shareholders would have no recourse as a result of decisions made by management.

In addition, sales of significant amounts of shares held by our directors, officers or affiliates, or the prospect of these sales, could adversely affect the market price of our common stock. Management’s stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our stockholders from realizing a premium over our stock price.

Risks Relating to Our Company and Industry

The following risks relate to our businesses and the effects upon us assuming we obtain financing in a sufficient amount.

Our business plan is speculative.

Our planned businesses are speculative and subject to numerous risks and uncertainties. The burden of government regulation on technology, batteries, vehicles and related industry participants, including manufacturers, distributors, retailers, suppliers and consumers, is uncertain and difficult to quantify. There is no assurance that we will ever earn enough revenue to make a net profit.

We have limited existing brand identity and customer loyalty; if we fail to market our brand to promote our service offerings, our business could suffer.

We believe that establishing and maintaining brand identity and brand loyalty is critical to attracting customers once we have a commercially scalable product. In order to attract customers to our Triad Pro Innovators products we may be forced to spend substantial funds to create and maintain brand recognition among consumers. We believe that the cost of our sales campaigns could increase substantially in the future. If our branding efforts are not successful, our ability to earn revenues and sustain our operations will be harmed.

In the event we are not successful in reaching our revenue targets, additional funds may be required.

We may not be able to proceed with our business plan for the development and marketing of our core services. Should this occur, we may be forced to suspend or cease operations. Management intends to raise additional funds by way of a public or private offering. While we believe in the viability of our strategy to increase revenues and in our ability to raise additional funds, there can be no assurances to that effect. Our ability to continue as a going concern is dependent upon our ability to further implement our business plan, raise additional money, and generate sufficient revenues.

While we are attempting to generate sufficient revenues, our cash position may not be enough to support our daily operations.

Management intends to raise additional funds by way of a public offering or additional private offerings, by the exercise of outstanding warrants, or by alternative methods. While we believe in the viability of our strategy to increase revenues and in our ability to raise additional funds, there can be no assurances to that effect. Our ability to continue as a going concern is dependent upon our ability to further implement our business plan, raise additional money, and generate sufficient revenues.

| 12 |

| Table of Contents |

We have to keep up with rapid technological change to continue offering our clients competitive and attractive products or we may lose clients and be unable to compete.

Our future success will depend on our ability to continue delivering our current and potential clients competitive electric battery products, such as electric vehicles, electric generators and portable light towers. In order to do so, we will need to adapt to rapidly changing technologies, to adapt our services to evolving industry standards and to improve the performance of our products. Our failure to adapt to such changes would likely lead to a loss of clients or a substantial reduction in the revenues versus competitors who have more rapidly adopted improved technology. Any loss of clients or reduction of revenues would adversely impact our Company. In addition, the widespread adoption of new battery technologies or other technological changes could require substantial expenditures by us to modify or adapt our services or infrastructure. If we are unable to pass all or part of these costs on to our clients, our margins and, therefore, profitability will be reduced.

Our ability to adapt to industry changes in technology, or market circumstances, may drastically change the business environment in which we operate.

If we are unable to recognize these changes in good time, are late in adjusting our business model, or if circumstances arise such as pricing actions by competitors, then this could have a material adverse effect on our growth ambitions, financial condition and operating results.

We rely on the attraction and retention of talented employees.

Attracting and retaining talented employees in sales and marketing, research and development, finance and general management, as well as of specialized technical personnel, is critical to our success and could also result in business interruptions. There can be no assurance that we will be successful in attracting and retaining all the highly qualified employees and key personnel needed in the future.

We may from time to time be subject to warranty and product liability claims with regard to product performance and effects.

We could incur product liability losses as a result of repair and replacement costs in response to customer complaints or in connection with the resolution of contemplated legal proceedings relating to such claims. Successful claims for damages may be made that are in excess of our insurance coverage. Our insurance could become more expensive and there is no assurance that insurance will still be available on acceptable terms. In addition to potential losses arising from claims and related legal proceedings, product liability claims could affect our reputation and relationships with key customers. As a result, product liability claims could materially impact our financial condition and operating results.

In order to develop additional revenues and further our current products, we have plans to invest in product(s) that are synergistic with our current products.

Investing in these products’ adaptive technologies, such as other battery powered equipment or business models may or may not be successful. They may not be timely nor cost-effective, and there is no assurance the desired results will be achieved. We may need to increase our inventory levels, increase our accounts receivables, and be exposed to bad debt and obsolete inventory, and this would negatively impact our operations and balance sheet.

We may not be able to successfully compete against companies with substantially greater resources.

The industries in which we operate in general are subject to intense and increasing competition. Some of our competitors may have greater capital resources, facilities, and diversity of product lines, which may enable them to compete more effectively in this market. Our competitors may devote their resources to developing and marketing products that will directly compete with our product lines. Due to this competition, there is no assurance that we will not encounter difficulties in obtaining revenues and market share or in the positioning of our products. There are no assurances that competition in our respective industries will not lead to reduced prices for our products. If we are unable to successfully compete with existing companies and new entrants to the market this will have a negative impact on our business and financial condition.

| 13 |

| Table of Contents |

Certain of the Company’s products are dependent on consumer discretionary spending.

Certain of our battery powered products as well as the technology platforms may be susceptible to unfavorable changes in economic conditions. Decreases in consumer discretionary spending could negatively affect the Company’s business and result in a decline in sales and financial performance.

Our business is dependent upon suppliers.

We plan on entering into supply agreements with manufacturers. Nevertheless, we remain dependent upon a limited number of suppliers for our products. Although we do not anticipate difficulty in obtaining adequate inventory at competitive prices, we can offer no assurance that such difficulties will not arise, especially if our demand for more products increases. The extent to which supply disruption will affect us remains uncertain. Our inability to obtain sufficient quantities of products at competitive prices would have a material adverse effect on our business, financial condition and results of operations.

We cannot assure that we will earn a profit or that our products will be accepted by consumers.

Our business is speculative and dependent upon acceptance of our products by consumers. Our operating performance will be heavily dependent on whether or not we are able to earn a profit on the sale of our products. We cannot assure that we will be successful or earn enough revenue to make a profit, or that investors will not lose their entire investment.

Inventories maintained by the Company, the manufacturers and its customers may fluctuate from time to time.

The Company relies in part on its dealer and customer relationships and predictions of the manufacturer and customer inventory levels in projecting future demand levels and financial results. These inventory levels may fluctuate, and may differ from the Company’s predictions, resulting in the Company’s projections of future results being different than expected. These changes may be influenced by changing relationships with the dealers and customers, economic conditions and customer preference for particular products. There can be no assurance that the Company’s manufacturers and customers will maintain levels of inventory in accordance with the Company’s predictions or past history, or that the timing of customers’ inventory build or liquidation will be in accordance with the Company’s predictions or past history.

We face an inherent risk of exposure to product liability claims in the event that the products we manufacture or sell allegedly cause personal injury.

We face an inherent risk of exposure to product liability claims in the event that the products we sell allegedly cause personal injury. Although we have not experienced any significant losses due to product liability claims, we may experience such losses in the future. While our suppliers maintain insurance against product liability claims but cannot be certain that such coverage will be adequate to cover any liabilities that we may incur, or that such insurance will continue to be available on acceptable terms. A successful claim brought against us in excess of available insurance coverage, or any claim that results in significant adverse publicity, could have a material adverse effect upon our business.

We may be unable to keep pace with changes in the industries that we serve and advancements in technology as our business and market strategy evolves.

As changes in the industries we serve occur or macroeconomic conditions fluctuate we may need to adjust our business strategies or find it necessary to restructure our operations or businesses, which could lead to changes in our cost structure, the need to write down the value of assets, or impact our profitability. We will also make investments in existing or new businesses, including investments in technology and expansion of our business plans. These investments may have short-term returns that are negative or less than expected and the ultimate business prospects of the business may be uncertain.

As our business and market strategy evolves, we also will need to respond to technological advances and emerging industry standards in a cost-effective and timely manner in order to remain competitive, better and more interactive products and web accessibility standards. The need to respond to technological changes may require us to make substantial, unanticipated expenditures. There can be no assurance that we will be able to respond successfully to technological change.

| 14 |

| Table of Contents |

Risks Relating to the Internet

We are dependent on our telephone, Internet and management information systems for the sales and distribution of our products.

Our success depends, in part, on our ability to provide prompt, accurate and complete service to our customers on a competitive basis and our ability to purchase and promote products, manage inventory, ship products, manage sales and marketing activities and maintain efficient operations through our telephone and management information system. A significant disruption in our telephone, Internet or management information systems could harm our relations with our customers and the ability to manage our operations. We can offer no assurance that our back-up systems will be sufficient to prevent an interruption in our operations in the event of disruption in our management information systems, and an extended disruption in the management information systems could adversely affect our business, financial condition and results of operations.

Statements Regarding Forward-looking Statements

______

This Disclosure Statement contains various “forward-looking statements.” You can identify forward-looking statements by the use of forward-looking terminology such as “believes,” “expects,” “may,” “will,” “would,” “could,” “should,” “seeks,” “approximately,” “intends,” “plans,” “projects,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases. You can also identify forward-looking statements by discussions of strategy, plans or intentions. These statements may be impacted by a number of risks and uncertainties.

The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance taking into account all information currently available to us. These beliefs, assumptions and expectations are subject to risks and uncertainties and can change as a result of many possible events or factors, not all of which are known to us. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. You should carefully consider these risks before you make an investment decision with respect to our Securities. For a further discussion of these and other factors that could impact our future results, performance or transactions, see the section entitled “Risk Factors.”

| 15 |

| Table of Contents |

If we sell all of the Units being offered, and all the warrants are exercised our net proceeds (after our estimated offering expenses of $50,000) will be $19,950,000 . We will use these net proceeds for the following:

| Units Offered (% Sold) |

| Units Sold and Warrants Exercised (100%) |

|

| Units Sold and Warrants Exercised (75%) |

|

| Units Sold and Warrants Exercised (50%) |

|

| Units Sold and Warrants Exercised (25%) |

| ||||

| Gross Offering Proceeds |

| $ | 20,000,000 |

|

| $ | 15,000,000 |

|

| $ | 10,000,000 |

|

| $ | 5,000,000 |

|

| Approximate Offering Expenses (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Misc. Expenses |

|

| 15,000 |

|

|

| 15,000 |

|

|

| 15,000 |

|

|

| 15,000 |

|

| Legal and Accounting |

|

| 35,000 |

|

|

| 35,000 |

|

|

| 35,000 |

|

|

| 35,000 |

|

| Total Offering Expenses |

|

| 50,000 |

|

|

| 50,000 |

|

|

| 50,000 |

|

|

| 50,000 |

|

| Total Net Offering Proceeds |

|

| 19,950,000 |

|

|

| 14,950,000 |

|

|

| 9,950,000 |

|

|

| 4,950,000 |

|

| Principal Uses of Net Proceeds (2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Employee/Officers & Directors / Engineers / Independent Contractor Compensation |

|

| 1,908,000 |

|

|

| 1,533,000 |

|

|

| 1,158,000 |

|

|

| 638,000 |

|

| Marketing for Spree and “plt” including sales salaries |

|

| 216,000 |

|

|

| 216,000 |

|

|

| 186,000 |

|

|

| 106,000 |

|

| New and Updating Facilities |

|

| 1,750,000 |

|

|

| 1,187,500 |

|

|

| 1,115,000 |

|

|

| 187,500 |

|

| Legal & Accounting |

|

| 50,000 |

|

|

| 50,000 |

|

|

| 50,000 |

|

|

| 25,000 |

|

| Research and Development |

|

| 2,796,000 |

|

|

| 3,108,500 |

|

|

| 1,206,000 |

|

|

| 762,500 |

|

| Inventory –batteries, golf cars, lights |

|

| 12,500,000 |

|

|

| 8,297,500 |

|

|

| 5,879,000 |

|

|

| 2,996,000 |

|

| Transfer Agent fees |

|

| 7,500 |

|

|

| 7,500 |

|

|

| 6,000 |

|

|

| 6,000 |

|

| General and Administrative Expenses |

|

| 500,000 |

|

|

| 500,000 |

|

|

| 300,000 |

|

|

| 179,000 |

|

| Corporate Debt Reduction |

|

| 60,000 |

|

|

| 50,000 |

|

|

| 50,000 |

|

|

| 50,000 |

|

| Total Principal Uses of Net Proceeds |

|

| 19,787,500 |

|

|

| 14,950,000 |

|

|

| 9,950,000 |

|

|

| 4,950,000 |

|

| Amount Unallocated |

|

| 162,500 |

|

|

| 0 |

|

|

| 0 |

|

|

| 0 |

|

________________

|

| (1) | Offering expenses have been rounded to $50,000. |

|

| (2) | Any line item amounts not expended completely shall be held in reserve as working capital and subject to reallocation to other line item expenditures as required for ongoing operations. |

The precise amounts that we will devote to each of the foregoing items, and the timing of expenditures, will vary depending on numerous factors.

As indicated in the table above, if we sell only 75%, or 50%, or 25% of the shares offered for sale in this offering, we would expect to use the resulting net proceeds for the same purposes as we would use the net proceeds from a sale of 100% of the shares, and in approximately the same proportions, until such time as such use of proceeds would leave us without working capital reserve. At that point we would expect to modify our use of proceeds by limiting our expansion.