Form 1-A/A Nevada Canyon Gold Corp.

1-A/A LIVE 0001605481 XXXXXXXX 024-11911 true NEVADA CANYON GOLD CORP. NV 2014 0001605481 1040 46-5152859 0 0 316 CALIFORNIA AVENUE SUITE 543 RENO NV 89509 888-909-5548 Deron Colby, Esq. Janus Capita Other 1381725.00 558513.00 0.00 0.00 2592786.00 830409.00 0.00 1871681.00 721105.00 2592786.00 0.00 0.00 0.00 436387.00 0.16 0.09 Dale Matheson Carr-Hilton Labonte, LLP Common Stock 8685093 64130W207 OTC Markets None 0 000000000 None None 0 000000000 None true true Tier2 Audited Equity (common or preferred stock) Option, warrant or other right to acquire another security Security to be acquired upon exercise of option, warrant or other right to acquire security N N N Y N N 12500000 8685093 0.8000 25000000.00 0.00 0.00 0.00 25000000.00 Digital Offering LLC 115000.00 Dale Matheson Carr-Hilton Labonte, LLP 5000.00 Janus Capital Law Group 10000.00 Mergent Inc. 2500.00 166401 9638553.00 Does not include accounting, printing, marketing, travel and other costs, including payments to Equifund, LLC. We will pay Equifund, LLC, a one-time startup fee of $20,000 and $50 per investor for services in hosting the Offering on its platform. true AL AK AZ AR CA CO CT DE FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY Nevada Canyon Gold Corp Common Stock and Convertible Promissory Notes 6005000 6005000 Common shares were issued for total consideration of $601 at $0.0001; convertible notes were issued for a total cash consideration of $1,000,000, and included a discount of $663,867. The 6,005,000 shares of common stock were issued to directors of the issuer at par value for a total consideration of $601. In addition to the regular restrictive legend, the release of the Director Shares is subject to the terms and conditions included in a 3-year lock-up and vesting agreement, dated for reference March 18, 2022, which contemplates that the Director Shares are to be issued in equal annual installments over a 3-year term, during which term the shareholders agreed not to sell, directly or indirectly, or enter into any other transactions involving the Company's common shares. Shares were issued to persons who qualified as "accredited investors" pursuant to the provisions of Rule 506(b) of Regulation D of the Act (for US persons) and under Regulation S of the Act (to non-US person)

| As filed with the Securities and Exchange Commission on August 12, 2022. | Offering Circular No. 1 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-A

Amendment No. 3

REGULATION A OFFERING CIRCULAR

UNDER THE SECURITIES ACT OF 1933

NEVADA CANYON GOLD CORP.

(Exact name of Registrant as specified in its charter)

| Nevada | 1041 | 46-5152859 | ||

(State or jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) | (I.R.S. Employee Identification No.) |

| 316 California Avenue, Suite 543 Reno, NV 89509 | (888) 909-5548 | |

| (Address of principal executive offices) | (Registrant’s telephone number, including area code) |

Jeff Faillers, P.C.

241 Ridge St. Suite 210

Reno, NV 89501

(775) 825 4300

(Name, address and telephone number of agent for service)

Copy to:

Deron Colby, Esq.

Janus Capital Law Group

22 Executive Park, Suite 250

Irvine, CA 92614

(949) 633-8965

AN OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION (THE “SEC” OR THE “COMMISSION”). INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTERATION OR QUALIFICATION UNDER THE LAWS OF SUCH STATE. THE COMPANY MAY ELECT TO SATISFY ITS OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU, WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION OF THE COMPANY’S FINAL SALE TO YOU, A NOTICE THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH A FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

PRELIMINARY OFFERING CIRCULAR DATED August 12, 2022

NEVADA CANYON GOLD CORP.

316 California Avenue, Suite 543

Reno, NV 89509

(888) 909-5548

www.nevadacanyongold.com

OFFERING: UP TO 12,500,000 UNITS EACH OF WHICH IS COMPRISED OF ONE COMMON SHARE (A “COMMON SHARE”), AND ONE COMMON SHARE PURCHASE WARRANT (A “WARRANT”) TO PURCHASE ONE ADDITIONAL COMMON SHARE (A “WARRANT SHARE”) AT AN EXERCISE PRICE OF $1.20 USD PER WARRANT SHARE, SUBJECT TO CERTAIN ADJUSTEMENTS, OVER A 24-MONTH EXERCISE PERIOD FOLLOWING THE DATE OF ISSUANCE OF THE WARRANTS.

PRICE: $0.80 PER UNIT

Title of Each Class of Securities to be qualified | Price to Public | Underwriting discount and commissions (1) | Proceeds to the Company | |||||||||

| Units (12,500,000), each consisting of: | $0.80 per Unit | $ | 0.01 | $ | 0.79 | |||||||

| -One Common Share | ||||||||||||

| -One Warrant | ||||||||||||

| Total Maximum | $ | 100,000 | $ | 9,900,000 | ||||||||

| Common Shares (12,500,000) underlying Warrants | $1.20 Per Warrant | $ | 15,000,000 | |||||||||

| Total Maximum | $ | 25,000,000 | $ | 100,000 | $ | 24,900,000 | ||||||

| (1) | The Company has engaged Digital Offering LLC (“Digital Offering”), a FINRA/SIPC Member, to perform administrative and technology related functions in connection with this Offering, but not for underwriting or placement agent services. As compensation to Digital Offering for its services, the Company has agreed to pay Digital Offering a fee (the “Agent Fee”) equal to 1% of the gross proceeds from any closings of the Offering. In addition, on the closing dates of the Offering, the Company will issue to Digital Offering warrants (the “Agent Warrants”) to purchase 1% of the common shares sold in this Offering. The Agent Warrants will have an exercise price of $1.20 and will expire five years after they are issued. The Agent Warrants will contain customary terms and conditions, including without limitation, provisions for cashless exercise. The Agent Warrants and the shares issuable upon the exercise of the Agent Warrants are being registered by means of the Offering Statement for the Offering. See “Plan of Distribution” for details. | |

| (2) | Does not include other expenses of the Offering. See “Plan of Distribution” for a description of these expenses. |

The Common Shares and Warrants comprising the Units and the underlying Warrant Shares are being offered pursuant to Regulation A of Section 3(b) of the Securities Act for Tier 2 offerings. The Common Shares and Warrants comprising the Units and the underlying Warrant Shares are only issued to purchasers who satisfy the requirements set forth in Regulation A.

The minimum investment required is $1,000 or 1,250 Units. However, the Company has the option in its sole discretion to accept less than the minimum investment.

Each common share of the Unit shall be subject to a six month lock-up period, meaning that a purchaser of Units will not be able to resell the share of common stock for six months from the date of purchase.

The Company has engaged Northern Capital Private Securities Corp (the “Escrow Agent”), to hold funds tendered by investors.

The Offering will terminate at the earlier of: (1) the date at which all Units offered have been sold, (2) one year from the date the SEC qualifies the Offering Statement of which this Offering Circular forms a part, or (3) the date at which the Offering is earlier terminated by us in our sole discretion.

The Offering is being conducted on a “best efforts” basis without a minimum offering amount, which means that there is no guarantee that any minimum amount will be sold in this Offering and all funds raised in this Offering shall be immediately available to the Company.

INVESTING IN THE UNITS, THE COMMON SHARES AND WARRANTS OF WHICH THE UNITS CONSIST OF AND THE UNDERLYING WARRANT SHARES OF THE COMPANY IS SPECULATIVE AND INVOLVES SUBSTANTIAL RISKS. MOREOVER, EACH COMMON SHARE OF THE UNIT SHALL BE SUBJECT TO A SIX MONTH LOCK-UP PERIOD, MEANING A PURCHASER OF UNITS WILL NOT BE ABLE TO RESELL THE SHARE OF COMMON STOCK FOR SIX MONTHS FROM THE DATE OF PURCHASE. YOU SHOULD PURCHASE THESE SECURITIES ONLY IF YOU CAN AFFORD A COMPLETE LOSS OF YOUR INVESTMENT. SEE “RISK FACTORS” BEGINNING ON PAGE 6 TO LEARN THE MORE SIGNIFICANT RISKS YOU SHOULD CONSIDER IN CONNECTION WITH AN INVESTMENT IN THE SECURITIES.

THE COMMISSION DOES NOT PASS UPON THE MERITS OR GIVE ITS APPROVAL OF ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A OF THE SEC. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO WWW.INVESTOR.GOV.

| 2 |

TABLE OF CONTENTS

In this Offering Circular, the term “NGLD”, “we”, “us”, “our” or “the Company” refers to Nevada Canyon Gold Corp. and its affiliates.

THIS OFFERING CIRCULAR MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,” “BELIEVE,” “ANTICIPATE,” “INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTANTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH A DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

| 3 |

This summary highlights selected information contained elsewhere in this Offering Circular. This summary is not complete and does not contain all the information that you should consider before deciding whether to invest in our Common Stock. You should carefully read the entire Offering Circular, including the risks associated with an investment in the Company discussed in the “Risk Factors” section of this Offering Circular, before making an investment decision. Some of the statements in this Offering Circular are forward-looking statements. See the section entitled “Cautionary Statement Regarding Forward-Looking Statements.”

Company Information

Nevada Canyon Gold Corp., (the “Company”) was originally incorporated on February 27, 2014, in the state of Nevada as Tech Foundry Ventures. On July 8, 2016, the Company changed its name to Nevada Canyon Gold Corp., in order to reflect its current business and strategy. The Company is a US based natural resource company headquartered in Reno, Nevada. The Company has a large, strategic land position and royalties, in multiple projects, within some of Nevada’s highest-grade historical mining districts. All the Company’s projects and royalties (collectively, the “Projects”) are located within the state of Nevada which is rated as one of the best places to explore and mine in the world. The Projects all have excellent year around access, with good infrastructure in proven and active mining districts. Nevada Canyon has a three-fold business model: (1) Exploration project accelerator; (2) mineral royalty acquisitions; and (3) precious-metals streaming.

● An exploration project accelerator means finding under-valued or distressed assets, providing initial investment capital for geological and exploration work, then selling the assets to other mining companies for premium returns without large capital expenditures. In this model, Nevada Canyon retains a royalty, recovers its costs, and avoids the high cost of putting mines into production. This can create short term upside value in these assets at very low risk while retaining a long-term royalty at a very low-cost basis. Nevada Canyon’s geological team discovers, interprets, and builds the geological models, then increases the land package through additional land acquisitions. The mineral resources are increased and upgraded, followed by the sale to larger mining companies.

● Nevada Canyon’s second business model is the acquisition of mineral property royalties (net smelter royalties or “NSR’s”). The Company plans to generate revenue from selling mineral properties to mining companies while retaining a long-term royalty for the life of the mine. This business model also includes the purchase of existing royalties from third parties as well as optioned sales of properties that provide ongoing revenue and eventual royalties. Nevada Canyon will stake and/or assemble drill-ready land packages for mining companies to explore and develop, then sell those claims while retaining a royalty. Nevada Canyon will also option exploration properties to mining or exploration companies for staged payments to the Company while retaining a royalty. Lastly, Nevada Canyon will also acquire royalties related to producing or near-term producing properties with close proximity to producing mines.

● The Company’s third business model is a precious-metals streaming company. A precious-metals streaming company provides up-front capital for mine development in exchange for a percentage of the precious metals output at a below-market cost, in some instances up to an 80% discount to market. Nevada Canyon can then sell what it receives from its partners at market prices and retain the difference as profit.

Nevada Canyon has identified numerous gold and silver streaming opportunities and is not tied to the performance of any one producer. Most importantly, streaming companies are instant beneficiaries of rising physical metal prices. For example, the average cash cost per gold equivalent ounce (“GEO”) is $400 for Nevada based on comparable operating streaming Companies. This offers investors cost predictability, direct leverage to increasing precious metals prices and in a high-quality asset base within Nevada. This portion of our business model offers investors commodity price leverage and exploration upside but with a much lower risk profile than a traditional mining company.

Nevada Canyon management (“Management”) has vast contacts within the mining industry and extensive experience in mineral property acquisitions and divestures with over 30 years-experience operating in Nevada. This enables us the unique ability to assemble valuable land packages near producing mines, which can then be sold to the mine operators while retaining a life-of-mine royalty. Nevada Canyon can generate near-term revenue through mineral property sales and generate long-term revenue through life-of-mine royalties. This strategy allows for the bypass of risk and the expense of exploration programs and/ or large production capital costs while keeping our overhead low.

| 4 |

We believe this multi-level business model is a significant improvement on the typical project generator/joint venture model. It allows the Company to maintain a large portfolio of properties and generate significant deal flow. Shareholder value is highly leveraged to the price of gold. As prices increase, we anticipate seeing growth in the value of our properties, the cash flow from our option portfolio, our equity investments in mid-tier/junior companies, and a higher market valuation on our growing royalty portfolio and the blue sky of our exploration programs. We also hope this revenue generating, low overhead type business model will also allow Nevada Canyon the ability to provide a potential dividend distribution to its shareholders.

Our fiscal year-end date is December 31st.

Our mailing address is 316 California Avenue, Suite 543 Reno, NV 89509. Our telephone number is (888) 909-5548. Our Website is www.nevadacanyongold.com and our email address is [email protected]

We do not incorporate the information on or accessible through our websites into this Offering Circular, and you should not consider any information on, or that can be accessed through, our websites as a part of this Offering Circular.

Trading Market

Our Common Stock trades in the OTC Pinks Open Market under the symbol NGLD.

The Offering

| Securities Offered: | A maximum of 12,500,000 units (the “Units”) at an offering price of $0.80 USD per Unit, each Unit being comprised of: |

| ● | One share of the Company’s common stock (a “Common Share”) (1); and | |

| ● | One Common Share purchase warrant (a “Warrant”) to purchase one additional Common Share (a “Warrant Share”) at a price of $1.20 USD per share, subject to customary adjustments, over a 24-month exercise period following the date of the issuance of the Warrant. |

| Securities outstanding before the Offering: | 8,685,093 shares of common stock (2) |

| Securities outstanding after the Offering: | 21,185,093 Common Shares and 12,500,000 Warrants if all Units are sold, or 33,685,093 Common Shares upon the exercise of the Warrants if all Units offered are sold and all Warrants are exercised. |

| (1) | Each common share of the Unit shall be subject to a six month lock-up period, meaning that a purchaser of Units will not be able to resell the share of common stock for six months from the date of purchase. | |

| (2) | Does not reflect the shares of common stock issuable upon the conversion of outstanding convertible notes. Assuming full conversion of the notes, shares of common stock outstanding before and after the Offering would increase by 2,666,667 shares. |

| 5 |

Investing in our Common Stock involves a high degree of risk. Prospective investors should carefully consider the risks described below, together with all of the other information included or referred to in this Offering Circular, before purchasing Units. The risks set out below are not the only risks we face. Additional risks and uncertainties not presently known to us or not presently deemed material by us might also impair our operations and performance. If any of these risks actually occurs, our business, financial condition or results of operations may be materially adversely affected. In such case, the trading price of our Common Stock, could decline and investors in our Common Stock could lose all or part of their investment.

Risks Relating to Our Company and Industry

The following risks relate to our business and the effects upon us assuming we obtain financing in a sufficient amount.

Disruption caused by the Covid-19 Virus

In December 2019, a novel strain of coronavirus was reported to have surfaced in Wuhan, China, which has and is continuing to spread throughout China and other parts of the world, including the United States (“Covid-19”). On January 30, 2020, the World Health Organization declared the outbreak of Covid-19 a “Public Health Emergency of International Concern.” The outbreak of Covid-19 has resulted in a widespread health crisis that has adversely affected economies and financial markets worldwide. To date, the Covid-19 outbreak has not had a material impact on the Company’s business. However, Nevada Canyon’s business and development activities may be materially adversely affected by the continuing disruption caused by the Covid-19 outbreak, including as a result of supply chain delays and disruptions, governmental regulation and prevention measures, labor shortages and breakdowns. If there is an outbreak of Covid-19 cases at the Company’s mineral properties or amongst the Company’s employees or contractors, the Company may be required, or may voluntarily, close, curtail or otherwise limit its exploration and other business activities, which would impact the Company’s business plans and timelines and could have an adverse impact on, among other things, the Company’s relationship with suppliers, employees and contractors. Additionally, Covid-19 has disrupted the capital markets world-wide and commodity prices, including gold prices. Nevada Canyon may be unable to complete a capital raising transaction (including this Offering) if continued concerns relating to Covid-19 cause significant market disruptions, restrict travel, limit the ability to have meetings with potential investors or the market for the Common Stock does not stabilize in a timely manner. At this time, the Company cannot accurately predict the impact that Covid-19 may have on its exploration activities, business operations or financial results. The extent to which Covid-19 impacts the Company’s business will depend on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of Covid-19 and subsequent strains of Covid-19, and the actions to contain Covid-19 or treat its impact, among others. If the disruptions posed by Covid-19 or other matters of global concern continue for an extensive period of time, the Company’s business may be materially adversely affected. See “Risk Factors - Market Price of Securities” below.

We own passive interests in mining properties, and it is difficult if not impossible for us to ensure properties are developed or operated in our best interest

Aside from properties controlled within our exploration project accelerator, we are not and will not be directly involved in the exploration, development and production of minerals from, or the continued operation of, the mineral projects underlying royalties, streams and similar interests that are or may be held by us. The exploration, development and operation of such properties is determined and carried out by third party owners and operators and any revenue that may be derived from our asset portfolio will be based on any production by such owners and operators. Third party owners and operators will generally have the power to determine the manner in which the properties are exploited, including decisions regarding feasibility, exploration and development of such properties or decisions to commence, continue or reduce, or suspend or discontinue production from a property.

The interests of third-party owners and operators and our interests may not always be aligned. As an example, it will usually be in our interest to advance development and production on properties as rapidly as possible, in order to maximize near-term cash flow, while third party owners and operators may take a more cautious approach to development, as they are exposed to risk on the cost of exploration, development and operations. Likewise, it may be in the interest of owners and operators to invest in the development of, and emphasize production from, projects or areas of a project that are not subject to royalties, streams or similar interests that are or may be held by us.

| 6 |

Our inability to control or influence the exploration, development or operations for the properties in which we hold or may hold royalties, streams and similar interests may have a material adverse effect on our business, results of operations and financial condition. In addition, the owners or operators may take action contrary to our policies or objectives; be unable or unwilling to fulfill their obligations under their agreements with us; or experience financial, operational or other difficulties, including insolvency, which could limit the owner or operator’s ability to advance such properties or perform its obligations under arrangements with us.

We may not be entitled to any compensation if the properties in which we hold or may hold royalties, streams and similar interests discontinue exploration, development or operations on a temporary or permanent basis.

The owners or operators of the projects in which we hold interests may, from time to time, announce transactions, including the sale or transfer of the projects or of the operator itself, over which we have little or no control. If such transactions are completed, it may result in a new operator, which may or may not explore, develop or operate the project in a similar manner to the current operator, which may have a material adverse effect on our business, results of operations and financial condition. The effect of any such transaction on us may be difficult or impossible to predict.

None of our royalty and other interests are on currently producing properties and these and any future royalty, streaming or similar interests we acquire, particularly on development stage properties, are subject to the risk that they may never achieve production.

None of the properties underlying our royalty and other interests are in production nor do they have established mineral reserves. These and any future royalty, streaming or similar interests we acquire may not achieve production or produce any revenues. While the discovery of gold deposits may result in substantial rewards, few properties that are explored are ultimately developed into producing mines. Major expenditures may be required to locate and establish mineral reserves, to develop metallurgical processes and to construct mining and processing facilities at a particular site. It is impossible to ensure that exploration or development programs planned by the owners or operators of the properties underlying royalties, streams and similar interests that are or may be held by us will result in profitable commercial mining operations. Whether a mineral deposit will be commercially viable depends on several factors, including cash costs associated with extraction and processing; the particular attributes of the deposit, such as size, grade and proximity to infrastructure; mineral prices, which are highly cyclical; government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use and environmental protection; and political stability. The exact effect of these factors cannot be accurately predicted but the combination of these factors may result in one or more of the properties underlying our current or future interests not receiving an adequate return on invested capital. Accordingly, there can be no assurance the properties underlying our current or future interests will be brought into a state of commercial production.

The failure of any of the properties underlying our interests to achieve production on schedule or at all would have a material adverse effect on our asset carrying values or the other benefits we expect to realize from our royalties and other interests or the acquisition of royalty interests, and potentially our business, results of operations, cash flows and financial condition.

We have limited or no access to data or the operations underlying our existing or future royalty and other interests

We are not, and will not be, the owner or operator of any such properties underlying our existing or future royalties, streams and similar interests and have no input in the exploration, development or operation of such properties. Consequently, we have limited or no access to related exploration, development or operational data or to the properties themselves. This could affect our ability to assess the value of such interest. This could also result in delays in cash flow from that anticipated by us, based on the stage of development of the properties underlying our existing or future royalties and similar interests. Our entitlement to payments in relation to such interests may be calculated by the royalty payors in a manner different from our projections and we may not have rights of audit with respect to such interests. In addition, some royalties, streams or similar interests may be subject to confidentiality arrangements that govern the disclosure of information with regard to such interests and, as a result, we may not be in a position to publicly disclose related non-public information. The limited access to data and disclosure regarding the exploration, development and production of minerals from, or the continued operation of, the properties in which we have an interest may restrict our ability to assess value, which may have a material adverse effect on our business, results of operations and financial condition. We attempt to mitigate this risk by building relationships with various owners, operators and counterparties, in order to encourage information sharing which we believe increases transparency.

| 7 |

We are subject to many of the risks faced by the owners and operators of our existing or future royalty and other interests

To the extent that they relate to the exploration, development and production of minerals from, or the continued operation of, the properties in which we hold or may hold royalties, streams or similar interests, we will be subject to the risk factors applicable to the owners and operators of such mines or projects.

Mineral exploration, development and production generally involves a high degree of risk. Such operations are subject to all of the hazards and risks normally encountered in the exploration, development and production of metals, including weather related events, unusual and unexpected geology formations, seismic activity, environmental hazards and the discharge of toxic chemicals, explosions and other conditions involved in the drilling, blasting and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to property, injury or loss of life, environmental damage, work stoppages, delays in exploration, development and production, increased production costs and possible legal liability. Any of these hazards and risks and other acts of God could shut down such activities temporarily or permanently. Mineral exploration, development and production is subject to hazards such as equipment failure or failure of retaining dams around tailings disposal areas, which may result in environmental pollution and consequent liability for the owners or operators thereof. The exploration for, and development, mining and processing of, mineral deposits involve significant risks that even a combination of careful evaluation, experience and knowledge may not eliminate.

We may fund future acquisitions or other material transactions with equity or debt financings which could increase our debt service, further leverage our assets and/or result in dilution to existing shareholders

In the ordinary course of business, we engage in a continual review of opportunities to acquire royalties, streams or similar interests, to establish new royalties, streams or similar interests on operating mines, to create new royalties, streams or similar interests through financing mine development or exploration, or to acquire companies that hold royalty interests. We currently, and generally at any time, have acquisition opportunities in various stages of active review, including, for example, our engagement of consultants and advisors to analyze particular opportunities, analysis of technical, financial, legal and other confidential information, submission of indications of interest and term sheets, participation in preliminary discussions and negotiations and involvement as a bidder in competitive processes. We may consider obtaining debt commitments for acquisition financing. In the event that we choose to raise debt capital to finance any acquisition, our leverage may be increased. We also could issue common shares to fund acquisitions. Issuances of common shares could dilute existing shareholders and may reduce some or all of our per share financial measures.

Any such acquisition could be material to us. All transactions include risks associated with our ability to negotiate acceptable terms with counterparties. In addition, any such acquisition or other transaction may have other transaction-specific risks associated with it, including risks related to the completion of the transaction, the project, its operators, or the jurisdictions in which the project is located, and other risks discussed in this Offering Circular. There can be no assurance that any acquisitions completed will ultimately benefit us.

The volatility in gold and other commodity prices may have an adverse impact on the value of our royalty interests

The value of our royalty interests and the potential future development of the projects underlying our interests are directly related to the market price of gold and other commodity prices. Market prices may fluctuate widely and are affected by numerous factors beyond our control or that of any mining company, including metal supply, industrial and jewelry fabrication, investment demand, central banking economic policy, expectations with respect to the rate of inflation, the relative strength of the dollar and other currencies, interest rates, gold purchases, sales and loans by central banks, forward sales by metal producers, global or regional political, trade, economic or banking conditions, and a number of other factors.

Volatility in gold prices is demonstrated by its annual high and low prices over the past decade as reported by the London Bullion Market Association:

| Gold | ||||||||

| ($/ounce) | ||||||||

| Calendar Year | High | Low | ||||||

| 2012 - 2013 | $ | 1,792 | $ | 1,192 | ||||

| 2014 - 2015 | $ | 1,385 | $ | 1,049 | ||||

| 2016 - 2017 | $ | 1,366 | $ | 1,077 | ||||

| 2018 - 2019 | $ | 1,355 | $ | 1,178 | ||||

| 2019 - 2020 | $ | 1,536 | $ | 1,287 | ||||

| 2020 - 2021 | $ | 2,067 | $ | 1,472 | ||||

| 8 |

Declines in market prices could cause an operator to cease or slowdown exploration and development activities, reduce, suspend or terminate production from an operating project or construction work at a development project which would negatively impact our ability to obtain revenues from our interests in the future. A price decline may result in a material and adverse effect on our business, results of operations and financial condition.

Our future growth is to a large extent dependent on our acquisition strategy and our ability to identify and negotiate the purchase of additional assets

As part of our business strategy, we will seek to purchase or otherwise acquire gold and other precious metal royalties, streams or similar interests from third party natural resource companies and others. In pursuit of such opportunities, we may fail to select appropriate acquisition targets or negotiate acceptable arrangements, including arrangements to finance acquisitions. There can be no assurance that we will be able to identify and complete any acquisition, transaction or business arrangement that we pursue on favorable terms or at all, or that any acquisition, transaction or business arrangement completed will ultimately benefit us.

If we are unable to continually identify and acquire additional assets on terms that are favorable to us, our business, results of operations and financial condition may be materially adversely affected.

Our operating results and ability to generate revenue could be adversely impacted if we experience challenges with our existing assets, including our royalty interests

Problems concerning the existence, validity, enforceability, terms or geographic extent of our royalty interests could adversely affect our business and revenues, and our interests may similarly be materially and adversely impacted by change of control, bankruptcy or the insolvency of operators.

Defects in or disputes relating to the royalty interests we hold or acquire may prevent us from realizing the anticipated benefits from these interests and could have a material adverse effect on our business, results of operations, cash flows and financial condition. Material changes could also occur that may adversely affect management’s estimate of the carrying value of our royalty interests and could result in impairment charges. While we seek to confirm the existence, validity, enforceability, terms and geographic extent of the royalty interests we acquire, there can be no assurance that disputes or other problems concerning these and other matters or other problems will not arise. Confirming these matters is complex and is subject to the application of the laws of each jurisdiction to the particular circumstances of each parcel of mining property and to the agreement reflecting the royalty interest. Similarly, in many jurisdictions, royalty interests are contractual in nature, rather than interests in land, and therefore may be subject to risks resulting from change of control, bankruptcy or insolvency of operators, and our royalty interests could be materially restricted or set aside through judicial or administrative proceedings. We often do not have the protection of security interests that could help us recover all or part of our investment in a royalty interest in the event of an operator’s bankruptcy or insolvency.

Operators may interpret our existing or future royalty or other interests in a manner adverse to us or otherwise may not abide by their contractual obligations, and we could be forced to take legal action to enforce our contractual rights.

Royalty interests are generally subject to uncertainties and complexities arising from the application of contract and property laws in the jurisdictions where the mining projects are located. Operators and other parties to the agreements governing our existing or future royalty or other interests may interpret our interests in a manner adverse to us or otherwise may not abide by their contractual obligations, and we could be forced to take legal action to enforce our contractual rights. We may or may not be successful in enforcing our contractual rights, and our revenues relating to any challenged royalty interests may be delayed, curtailed or eliminated during the pendency of any such dispute or in the event our position is not upheld, which could have a material adverse effect on our business, results of operations, cash flows and financial condition. Disputes could arise challenging, among other things, methods for calculating the royalty interest, various rights of the operator or third parties in or to the royalty interest or the underlying property, the obligations of a current or former operator to make payments on royalty interests, and various defects or ambiguities in the agreement governing a royalty interest.

| 9 |

We depend on the services of our Chief Executive Officer, management and other key employees and the loss of any key employee coupled with an inability to replace the key employee could harm our operating results

We believe that our success depends on the continued service of our key executive management personnel. We are entirely dependent on the efforts of Jeffrey Cocks, our president, CEO, CFO, and director, and our new directors, Mr. Day and Mr. List. The loss of services of key members of management or other key employees could disrupt the conduct of our business and jeopardize our ability to maintain our competitive position in the industry. From time to time, we may also need to identify and retain additional skilled management and specialized technical personnel to efficiently operate our business. The number of persons skilled in the acquisition, exploration and development of royalty interests is limited and there is competition for such persons. Recruiting and retaining qualified executive management and other key employees is critical to our success and there can be no assurance of such success. If we are not successful in attracting and retaining qualified personnel, our ability to execute our business model and growth strategy could be affected, which could have a material adverse effect on our business, results of operations, cash flows and financial condition.

Certain of our directors and officers also serve as directors and officers of other companies in the mining sector, which may cause them to have conflicts of interest

Certain of our directors and officers also serve as directors and officers of, or have significant shareholdings in, other companies involved in natural resources investment, exploration, development and production and, to the extent that such other companies may engage in transactions or participate in the same ventures in which we participate, or in transactions or ventures in which we may seek to participate, they may have a conflict of interest in negotiating and concluding terms with respect to such participation. In cases where our directors and officers have an interest in other companies, such other companies may also compete with us for the acquisition of royalties, streams or similar interests. Such potential conflicts of interests of our directors and officers may have a material adverse effect on our business, results of operations and financial condition.

Our limited operating history makes our business prospects extremely speculative

Nevada Canyon is an exploration company and has no history of operations, mining or refining mineral products. As such, we are subject to many risks common to such enterprises, including under-capitalization, cash shortages, limitations with respect to personnel, financial and other resources and lack of revenues. There is no assurance that we will be successful in achieving a return on an investment for investors in the Common Shares and Nevada Canyon’s likelihood of success must be considered in light of its early stage of operations.

There can be no assurance that our properties or any property we may obtain in the future will be successfully placed into production, produce minerals in commercial quantities or otherwise generate operating earnings. Advancing projects from the exploration stage into development and commercial production requires significant capital and time and will be subject to the successful completion of further technical studies, permitting requirements and the construction of mines, processing plants, roads and related works and infrastructure. We will continue to incur losses until mining-related operations successfully reach commercial production levels and generate sufficient revenue to fund continuing operations.

We will likely need additional capital in order to finance our business plans and there is no guarantee we will have access to that capital on favorable terms, or at all

Part of our business plan is to focus on exploring for minerals and we intend to use our working capital to carry out such exploration. Other than the proceeds from the Offering, we have no source of financing, including, but not limited to, operating cash flow and no assurance that acceptable additional funding will be available to it for the further exploration and development of our projects. We have incurred net losses in the past and likely will incur losses in the future and will continue to incur losses until and unless we can derive sufficient revenues from our mineral projects. These conditions, including other factors described herein, create a material uncertainty regarding our ability to continue as a going concern.

It is likely that the development and exploration of our assets will require substantial additional financing. Further exploration and development of or assets and/or other properties acquired by us may be dependent upon our ability to obtain acceptable financing through equity or debt, and there can be no assurance that we will be able to obtain adequate financing in the future or that the terms of such financing will be acceptable. Failure to obtain such additional financing could result in the delay or indefinite postponement of further exploration and development of our projects and we may become unable to carry out our business objectives.

| 10 |

We currently rely on only a limited number of properties and our inability to increase and diversify our assets could harm our operating results

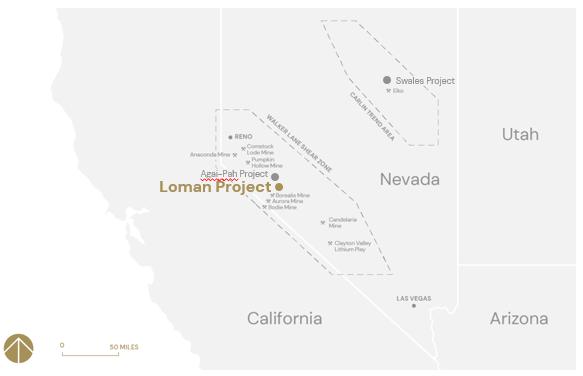

Our material property interests consist of the Loman Property, the Swales Property and the Agai Pah Silver Property all of which are located in Nevada and the Belshazzar Property which is located in Idaho. As a result, unless we acquire additional property interests and diversify our asset base, any adverse developments affecting these properties would have a material adverse effect upon us and would materially and adversely affect the potential mineral resource production, profitability, financial performance and results of our operations. While we may seek to acquire additional mineral properties in accordance with our business objectives, there can be no assurance that we will be able to identify suitable additional mineral properties or, if we do identify suitable properties, that we will have sufficient financial resources to acquire such properties or that such properties will be available on terms acceptable to us or at all and that we will be able to successfully develop such properties and bring such properties into commercial production.

The properties in which we hold interests are all in the early stages of exploration and development and, as such, they may never produce sufficient income to be profitable to us

We are a junior exploration company focused primarily on the acquisition, exploration and development of mineral properties located in Nevada. Our properties have no established mineral reserves due to the early stage of exploration at this time. Any reference to potential quantities and/or grade is conceptual in nature, as there has been insufficient exploration to define any mineral resource and it is uncertain if further exploration will result in the determination of any mineral resource. Quantities and/or grade described in this Offering Circular should not be interpreted as assurances of a potential resource or reserve, or of potential future mine life or of the profitability of future operations.

The exploration and development of mineral deposits involves a high degree of financial risk over a significant period of time. Few properties that are explored are ultimately developed into producing mines and there is no assurance that any of our projects can be mined profitably. Substantial expenditures are required to establish mineral resources and reserves through drilling, to develop metallurgical processes to extract the metal from the ore and in the case of new properties, to develop the mining and processing facilities and infrastructure at any site chosen for mining. It is impossible to ensure that our current exploration and development programs will result in profitable commercial mining operations. Our profitability will be, in part, directly related to the cost and success of its exploration and development programs, which may be affected by a number of factors. Substantial expenditures are required to establish mineral resources and reserves that are sufficient to support commercial mining operations and to construct, complete and install mining and processing facilities on those properties that are actually developed.

No assurance can be given that any particular level of recovery of minerals will be realized or that any potential quantities and/or grade will ever qualify as a mineral resource or reserve, or that any such mineral resource or reserve will ever qualify as a commercially mineable (or viable) deposit which can be legally and economically exploited.

Where expenditures on a property have not led to the discovery of mineral resources or reserves, incurred expenditures will generally not be recoverable.

LAND TITLE AND ROYALTY RISKS

There are many uncertainties, including, but not limited to, title matters; as a result, any defects in title could cause us to lose certain rights in the properties we own

There are uncertainties as to title matters in the mining industry. Any defects in title could cause us to lose rights in our mineral properties and jeopardize our business operations. Our mineral property interests currently consist of unpatented mining claims located on lands administered by the United States’ Department of Interior’s Bureau of Land Management (the “BLM”), Nevada State Office to which we only have possessory title. Because title to unpatented mining claims is subject to inherent uncertainties, it is difficult to determine conclusively the ownership of such claims. These uncertainties relate to such things as sufficiency of mineral discovery, proper location and posting and marking of boundaries, proper and timely payment of annual BLM claim maintenance fees, the existence and terms of royalties, and possible conflicts with other claims not determinable from descriptions of record.

| 11 |

The present status of our unpatented mining claims located on public lands allows us the right to mine and remove valuable minerals, such as precious and base metals, from the claims conditioned upon applicable environmental reviews and permitting programs. We are also allowed to use the surface of the land solely for purposes related to mining and processing the mineral-bearing ores. However, legal ownership of the land remains with the United States. We remain at risk that the mining claims may be forfeited either to the United States or to rival private claimants due to failure to comply with statutory requirements. Prior to 1993, a mining claim locator who was able to prove the discovery of valuable, locatable minerals on a mining claim, and to meet all other applicable federal and state requirements and procedures pertaining to the location and maintenance of federal unpatented mining claims, had the right to prosecute a patent application to secure fee title to the mining claim from the federal government. The right to pursue a patent, however, has been subject to a moratorium since October 1993, through federal legislation restricting the BLM from accepting any new mineral patent applications. If we do not obtain fee title to our unpatented mining claims, there can be no assurance that we will be able to obtain compensation in connection with the forfeiture of such claims.

Pending federal legislation may materially curtail or in some cases eliminate certain rights we have in our assets

In recent years, members of the United States Congress have repeatedly introduced bills which would supplant or alter the provisions of the General Mining Act of 1872, a United States federal law that authorizes and governs prospecting and mining for economic minerals, such as gold, platinum, and silver, on federal public lands. Such bills have proposed, among other things, to either eliminate the right to a mineral patent, impose a federal royalty on production from unpatented mining claims, render certain federal lands unavailable for the location of unpatented mining claims, afford greater public involvement in the mine permitting process, provide for citizen suits, and impose new and stringent environmental operating standards and mined land reclamation requirements in addition to those already in effect. Such proposed legislation could change the cost of holding unpatented mining claims and could significantly impact our ability to develop mineralized material on unpatented mining claims. Currently, all of our mining claims are on unpatented claims. Although we cannot predict what legislative changes might occur, the enactment of these proposed bills could adversely affect the potential for development of our mining claims, the economics of any mines that we bring into operation on federal unpatented mining claims, and as a result, adversely affect our financial performance.

Challenges to our mineral property interests may have adverse effects on assets including, but not limited to, a reduction in our interest, diverting valuable resources and management time, and a requirement that we compensate other persons

There may be challenges to title to the mineral properties in which we hold a material interest. If there are title defects with respect to any properties, we might be required to compensate other persons or to reduce our interest in the affected property. Furthermore, in any such case, the investigation and resolution of these issues would divert our management’s time from ongoing exploration and development programs. Title insurance generally is not available for mining claims in the U.S. and our ability to ensure that we have obtained secure claim to individual mineral properties may be limited. We may be subject to prior unregistered liens, agreements, transfers or claims, including native land claims and title may be affected by, among other things, undetected defects. In addition, we may be unable to operate the properties as permitted or to enforce our rights with respect to our properties. The failure to comply with all applicable laws and regulations, including a failure to pay taxes or annual BLM claim maintenance fees may invalidate title to portions of our properties. We may incur significant costs related to defending the title to our properties. A successful claim contesting title to a property may cause us to compensate other persons, or to reduce our interest in the affected property or to lose our rights to explore and, if warranted, develop that property. This could result in us not being compensated for our prior expenditures relating to the property. Also, in any such case, the investigation and resolution of title issues would divert management’s time from ongoing exploration and, if warranted, development programs.

We could face expensive and time consuming challenges related to defects in title

The ownership and validity or title of unpatented mining claims and concessions can at times be uncertain and may be contested. We also may not have, or may not be able to obtain, all necessary surface rights to develop a property. We have taken reasonable measures, in accordance with industry standards for properties at the same stage of exploration as that of our properties, to ensure proper title to our properties. However, there is no guarantee that title to any of our properties will not be challenged or impugned.

| 12 |

Interpretations of royalty agreements and unfulfilled contractual obligations of certain third parties that we rely on could force us to take legal action that would be expensive and time consuming

Royalty interests in our properties, and any other royalty interests in respect of our properties which may come into existence, may be subject to uncertainties and complexities arising from the application of contract and property laws in the jurisdictions where the mining projects are located. Operators and other parties to the agreements governing the royalty interests in Nevada, or other royalty interests, may interpret their interests in a manner adverse to us, and we could be forced to take legal action to enforce our rights. Challenges to the terms of the royalty interests in Nevada or the existence of other royalties could have a material adverse effect on our business, results of operations, cash flows and financial condition. Disputes could arise with respect to, among other things:

| ● | The existence or geographic extent of the royalty interests; | |

| ● | The methods for calculating royalties; | |

| ● | Third party claims to the same royalty interest or to the property on which a royalty interest exists, or the existence of additional royalties on the same property; | |

| ● | Various rights of the operator or third parties in or to a royalty interest; | |

| ● | Production and other thresholds and caps applicable to payments of royalty interests; | |

| ● | The obligation of an operator to make payments on royalty interests; | |

| ● | Various defects or ambiguities in the agreement governing a royalty interest; and | |

| ● | Disputes over the interpretation of buy-back rights. |

Breaches of contracts with third parties could result in expensive litigation

Parties to contracts do not always honor contractual terms and contracts themselves may be subject to interpretation or technical defects. Accordingly, there may be instances where we would be forced to take legal action to enforce our contractual rights. Such litigation may be time consuming and costly and there is no guarantee of success. Any pending proceedings or actions or any decisions determined adversely to us may have a material and adverse effect on our results of operations, financial condition.

Our exploration operations are highly regulated and our inability to comply with certain regulations would have a material adverse effect on our operations.

Our exploration operations are subject to government legislation, policies and controls relating to prospecting, development, production, environmental protection, including plant and animal species, and more specifically including the greater sage-grouse, mining taxes and labor standards. In order for us to carry out our activities, various licenses and permits must be obtained and kept current. There is no guarantee that the Company’s licenses and permits will be granted, or that once granted will be maintained and extended. In addition, the terms and conditions of such licenses or permits could be changed and there can be no assurances that any application to renew any existing licenses will be approved. There can be no assurance that all permits that we require will be obtainable on reasonable terms, or at all. Delays or a failure to obtain such permits, or a failure to comply with the terms of any such permits that we have obtained, could have a material adverse impact on us We may be required to contribute to the cost of providing the required infrastructure to facilitate the development of our properties and will also have to obtain and comply with permits and licenses that may contain specific conditions concerning operating procedures, water use, waste disposal, spills, environmental studies, abandonment and restoration plans and financial assurances. There can be no assurance that we will be able to comply with any such conditions and non-compliance with such conditions may result in the loss of certain of our permits and licenses on properties, which may have a material adverse effect on us. Future taxation of mining operators, and the timing thereof, cannot be predicted with certainty so planning must be undertaken using present conditions and best estimates of any potential future changes. There is no certainty that such planning will be effective to mitigate adverse consequences of future taxation on us.

| 13 |

The volatility of the global financial markets may have a negative effect on our ability to raise money which could harm our operating results.

Recent global financial conditions have been characterized by increased volatility and access to public financing, particularly for junior mineral exploration companies, has been negatively impacted. These conditions, which include potential disruptions due to a U.S. Government shutdown, may affect our ability to obtain equity or debt financing in the future on terms favorable to us or at all.

Market events and conditions, including the disruptions in the international credit markets and other financial systems, in China, Japan and Europe, along with political instability in the Middle East and Russia and falling currency prices expressed in United States dollars have resulted in commodity prices remaining volatile. These conditions have also caused a loss of confidence in global credit markets, excluding the United States, resulting in the collapse of, and government intervention in, major banks, financial institutions and insurers and creating a climate of greater volatility, tighter regulations, less liquidity, widening credit spreads, less price transparency, increased credit losses and tighter credit conditions. Notwithstanding various actions by governments, concerns about the general condition of the capital markets, financial instruments, banks and investment banks, insurers and other financial institutions caused the broader credit markets to be volatile and interest rates to remain at historical lows. These events are illustrative of the effect that events beyond the Company’s control may have on commodity prices. Access to public financing has been negatively impacted by sovereign debt concerns in Europe and emerging markets, as well as concerns over global growth rates and conditions. If such conditions continue, our operations could be negatively impacted.

Global financial conditions could suddenly and rapidly destabilize in response to future events, as government authorities may have limited resources to respond to future crises. Future crises may be precipitated by any number of causes, including natural disasters, pandemics (including the COVID-19 pandemic), geopolitical instability, changes to energy prices or sovereign defaults.

Any sudden or rapid destabilization of global economic conditions could negatively impact our ability to obtain equity or debt financing or make other suitable financing arrangements. Increased levels of volatility and market turmoil can adversely impact our operations and the value and the price of the Common Stock of the Company could be adversely affected.

Changes in the market price of gold, silver and other metals, which in the past has fluctuated widely, will affect the profitability of our operations and financial condition.

Our profitability and long-term viability depend, in large part, upon the market price of gold, copper, silver and other metals and minerals which may be produced from our mineral claims, and from which we may derive revenues under any agreement we may enter into with a company that conducts mining operations on our claims. The market price of gold and other metals is volatile and is impacted by numerous factors beyond our control, including:

| ● | sales by central banks and other holders, speculators and producers of gold and other metals in response to any of the below factors. | |

| ● | the relative strength of the U.S. dollar and certain other currencies; | |

| ● | interest rates; | |

| ● | global or regional political, financial, or economic conditions; | |

| ● | supply and demand for jewelry and industrial products containing metals; and | |

| ● | expectations with respect to the rate of inflation; |

A material decrease in the market price of gold and other metals could affect the commercial viability of our mineral claims and any of our future anticipated development and production assumptions if any. Lower gold prices could also adversely affect our ability to finance future development of our mining claims, all of which would have a material adverse effect on our financial condition and results of operations. There can be no assurance that the market price of gold and other metals will remain at current levels or that such prices will improve.

| 14 |

Many of our assumptions regarding our operating results are based on mineral resource estimates by third parties; if those estimates are materially inaccurate for any reason, our actual operating results could also be materially effected.

Mineral resource estimates will be based upon geological data supplied by our personnel, confirmed and calculated by independent qualified persons (geologists and engineers). These estimates are inherently subject to uncertainty and are based on geological interpretations and inferences drawn from drilling results and sampling analyses and may require revision based on further exploration or development work. The estimation of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. As a result of the foregoing, there may be material differences between actual and estimated mineral reserves, which may impact the viability of our projects and have a material impact on us.

The grade of mineralization which may ultimately be mined may differ from the indicated by drilling results and such differences could be material. The quantity and resulting valuation of mineral reserves and mineral resources may also vary depending on, among other things, mineral prices (which may render mineral reserves and mineral resources uneconomic), cut-off grades applied and estimates of future operating costs (which may be inaccurate). Production can be affected by such factors as permitting regulations and requirements, weather, environmental factors, unforeseen technical difficulties, unusual or unexpected geological formations and work interruptions. Any material change in quantity of mineral resources, mineral reserves, grade, or stripping ratio may also affect the economic viability of any project undertaken by us. In addition, there can be no assurance that mineral recoveries in small scale, and/or pilot laboratory tests will be duplicated in a larger scale test under on-site conditions or during production. To the extent that we are unable to mine and produce as expected and estimated, our business may be materially and adversely affected.

There is no certainty that any of the mineral resources identified on any of our properties will be realized, that any mineral resources will ever be upgraded to mineral reserves, that any anticipated level of recovery of minerals will in fact be realized, or that an identified mineral reserve or mineral resource will ever qualify as a commercially mineable (or viable) deposit which can be legally and economically exploited. Until a deposit is actually mined and processed, the quantity of mineral resources and mineral reserves and grades must be considered as estimates only, and investors are cautioned that we may ultimately never realize production on any of its properties.

We may not be able to obtain adequate insurance coverage, or coverage at all, in order to insure us against the risks of our operations; any uninsured or underinsured losses could have a negative impact on our operating results.

Our business is subject to a number of risks and hazards generally, including adverse environmental conditions, industrial accidents, labor disputes, unusual or unexpected geological conditions, ground or slope failures, cave-ins, changes in the regulatory environment, natural phenomena such as inclement weather conditions, floods and earthquakes. Such occurrences could result in damage to mineral properties or production facilities, personal injury or death, environmental damage to our properties or the properties of others, delays in the ability to undertake exploration, monetary losses and possible legal liability.

We do not currently have insurance and currently do not have any plans to obtain insurance. Insurance against certain risks, including those related to environmental matters or other hazards resulting from exploration, is generally not available to us or to other companies within the mining industry. In addition, we do not carry business interruption insurance relating to our mineral claims. Accordingly, delays in returning to any future exploration could produce severe near-term impact on our business. Any losses from these events may result in significant costs that could have a material adverse effect on our financial performance, financial position and results of operations.

In conducting our operations, we are required to comply with certain health and safety rules which can be expensive and time consuming.

Our operations are subject to various health and safety laws and regulations that impose various duties on the Company in respect of its operations, relating to, among other things, worker safety and the surrounding communities. These laws and regulations also grant the relevant authorities broad powers to, among other things, close unsafe operations and order corrective action relating to health and safety matters. The costs associated with the compliance with such health and safety laws and regulations may be substantial and any amendments to such laws and regulations, or more stringent implementation thereof, could cause additional expenditure or impose restrictions on, or suspensions of, our operations. We expect to make significant expenditures to comply with the extensive laws and regulations governing the protection of the environment, waste disposal, worker safety, mine development and protection of endangered and other special status species, and, to the extent reasonably practicable, to create social and economic benefit in the surrounding communities near our mineral properties, but there can be no guarantee that these expenditures will ensure our compliance with applicable laws and regulations and any non-compliance may have a material and adverse effect on us.

| 15 |

The costs of compliance with environmental laws and obtaining and maintaining environmental permits and governmental approvals required for construction and/or operation, which currently are significant, may increase in the future and could materially and adversely affect our business, financial condition, future results, and cash flow; any non-compliance with such laws or regulations may result in the imposition of liabilities which could materially and adversely affect our business, financial condition, future results, and cash flow.

All phases of our operations are subject to environmental regulation in the jurisdictions in which we operate, certain of which are set forth below. Environmental legislation is evolving in a manner which may result in stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. These laws address emissions into the air, discharges into water, management of waste, management of hazardous substances, protection of natural resources, antiquities and endangered species and reclamation of lands disturbed by mining operations. The costs associated with compliance with such laws and regulations are substantial. Compliance with environmental laws and regulations and future changes in these laws and regulations may require significant capital outlays and may cause material changes or delays in our operations and future activities. It is possible that future laws, regulations, or more restrictive interpretations of current laws and regulations by governmental authorities could have a significant adverse impact on our properties or some portion of our business, causing us to re-evaluate those activities at that time.

U.S. Federal Laws: CERCLA, and comparable state statutes, impose strict, joint and several liabilities on current and former owners and operators of sites and on persons who disposed of or arranged for the disposal of hazardous substances found at such sites. It is not uncommon for the government to file claims requiring cleanup actions, for reimbursement for government-incurred cleanup costs, or for natural resource damages, or for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by hazardous substances released into the environment. RCRA, and comparable state statutes, govern the disposal of solid waste and hazardous waste and authorize the imposition of substantial fines and penalties for noncompliance, as well as requirements for corrective actions. CERCLA, RCRA and comparable state statutes can impose liability for clean-up of sites and disposal of substances found on exploration, mining and processing sites long after activities on such sites have been completed.

CAA, as amended restricts the emission of air pollutants from many sources, including mining and processing activities. Our mining operations may produce air emissions, including fugitive dust and other air pollutants from stationary equipment, storage facilities and the use of mobile sources such as trucks and heavy construction equipment, which are subject to review, monitoring and/or control requirements under the CAA and state air quality laws. New facilities may be required to obtain permits before work can begin, and existing facilities may be required to incur capital costs in order to remain in compliance. In addition, permitting rules may impose limitations on our production levels or result in additional capital expenditures in order to comply with the rules.

NEPA requires federal agencies to integrate environmental considerations into their decision-making processes by evaluating the environmental impacts of their proposed actions, including issuances of permits to mining facilities, and assessing alternatives to those actions. If a proposed action could significantly affect the environment, the agency must prepare a detailed statement known as an EIS. The United States Environmental Protection Agency (“EPA”), other federal agencies, and any interested third parties will review and comment on the scoping of the Environmental Impact Statement (“EIS”) and the adequacy of and findings set forth in the draft and final EIS. This process can cause delays in the issuance of required permits or result in changes to a project to mitigate its potential environmental impacts, which can in turn impact the economic feasibility of a proposed project.

CWA, and comparable state statutes, impose restrictions and controls on the discharge of pollutants into waters of the United States. The discharge of pollutants into regulated waters is prohibited, except in accordance with the terms of a permit issued by the EPA or an analogous state agency. The CWA regulates storm water from mining facilities and requires a storm water discharge permit for certain activities. Such a permit requires the regulated facility to monitor and sample storm water run-off from its operations. The CWA and regulations implemented thereunder also prohibit discharges of dredged and fill materials in wetlands and other waters of the United States unless authorized by an appropriately issued permit. The CWA and comparable state statutes provide for civil, criminal and administrative penalties for unauthorized discharges of pollutants and impose liability on parties responsible for those discharges for the costs of cleaning up any environmental damage caused by the release and for natural resource damages resulting from the release.

| 16 |

SDWA and the Underground Injection Control (“UIC”) program promulgated thereunder, regulate the drilling and operation of subsurface injection wells. The EPA directly administers the UIC program in some states and in others the responsibility for the program has been delegated to the state. The program requires that a permit be obtained before drilling a disposal or injection well. Violation of these regulations and/or contamination of groundwater by mining related activities may result in fines, penalties, and remediation costs, among other sanctions and liabilities under the SDWA and state laws. In addition, third party claims may be filed by landowners and other parties claiming damages for alternative water supplies, property damages, and bodily injury.

Nevada Laws: At the state level, mining operations in Nevada are also regulated by the Nevada Department of Conservation and Natural Resources, Division of Environmental Protection. Nevada state law requires mine operators to hold Nevada Water Pollution Control Permits, which dictate operating controls and closure and post-closure requirements directed at protecting surface and ground water.

Other Nevada regulations govern operating and design standards for the construction and operation of any source of air contamination and landfill operations. Any changes to these laws and regulations could have an adverse impact on our financial performance and results of operations by, for example, requiring changes to operating constraints, technical criteria, fees or surety requirements.

Our industry is highly competitive and we will be at a competitive disadvantage for assets and financial resources relative to larger, better funded companies in the same space.

The mining industry is highly competitive in all of its phases, both domestically and internationally. Our ability to acquire properties and develop mineral resources and reserves in the future will depend not only on our ability to develop our present properties, but also on our ability to select and acquire suitable producing properties or prospects for mineral exploration, of which there is a limited supply. We may be at a competitive disadvantage in acquiring additional mining properties because we must compete with other individuals and companies, many of which have greater financial resources, operational experience and technical capabilities than us. We may also encounter competition from other mining companies in our efforts to hire experienced mining professionals. Competition could adversely affect our ability to attract necessary funding or acquire suitable producing properties or prospects for mineral exploration in the future. Competition for services and equipment could result in delays if such services or equipment cannot be obtained in a timely manner due to inadequate availability and could also cause scheduling difficulties and cost increases due to the need to coordinate the availability of services or equipment. Any of the foregoing effects of competition could materially increase project development, exploration or construction costs, result in project delays and generally and adversely affect us and our business and prospects.

The Offering Price of our Common Stock in this Offering was determined based on several factors that could materially change or fluctuate resulting in volatility and unpredictability.