Form 1-A/A LGH Global Corp

1-A/A LIVE 0001877859 XXXXXXXX 024-11629 true LGH Global Corp. DE 2021 0001335288 8699 86-2140533 0 0 87 N. RAYMOND AVE SUITE 200 PASADENA CA 91103 626-569-9688 Yanden Zheng Other 10813.00 0.00 0.00 0.00 10813.00 0.00 0.00 0.00 10813.00 10813.00 0.00 0.00 0.00 5015.00 0.00 0.00 Gries and Associates, LLC Common Stock 15000000 50203L103 None None 0 00000None None None 0 00000None None true true Tier2 Audited Equity (common or preferred stock) Y N N Y N Y 100000000 0.0000 0.00 0.00 0.00 0.00 0.00 Gries and Associates, LLC 7500.00 Law Office of Mark E. Pena 5000.00 9987500.00 true AL AK AZ AR CA CO CT DE FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY DC PR true

PART II AND III

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 1-A/A

TIER II OFFERING

OFFERING STATEMENT UNDER THE SECURITIES ACT OF 1933 CURRENT REPORT

| LGH Global Corp. |

| (Exact name of registrant as specified in its charter) |

Date: ________________________, 2020

| Delaware | 8699 | 86-2140533 | ||

(State of Other Jurisdiction Of Incorporation) |

(Primary Standard Industry Code) |

(IRS Employer Identification No.) |

| Yandan Zheng |

(213)459-0006 www.Lghglobalcorp.com |

| 87 N. Raymond Ave |

| Suite 200 |

| Pasadena |

California 91103 |

Please send copies of all correspondence to our corporate business address: X

THIS OFFERING STATEMENT SHALL ONLY BE QUALIFIED UPON ORDER OF THE COMMISSION, UNLESS A SUBSEQUENT AMENDMENT IS FILED INDICATING THE INTENTION TO BECOME QUALIFIED BY OPERATION OF THE TERMS OF REGULATION A.

PART I - NOTIFICATION

Part I should be read in conjunction with the attached XML Document for Items 1-6

PART I - END

PRELIMINARY OFFERING CIRCULAR DATED ________________, 2020

An offering statement pursuant to Regulation A relating to these securities has been filed with the U.S. Securities and Exchange Commission, which we refer to as the Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

LGH GLOBAL CORP.

87 N. Raymond Ave – Suite 200

Pasadena, California 91103

(213)459-0006

www.lghglobalcorp.com

Best Efforts Offering of up to 20,000,000 Shares of Common Stock

This is the initial public offering of securities of LGH Global Corp., a Delaware corporation (“we,” “us,” “our,” “our company” or the “Company”). In this offering we are offering 20,000,000 shares of our common stock. The offering is being made on a self-underwritten, “best efforts” basis directly to purchasers or through agents designated from time to time. For additional information regarding the methods of sale, you should refer to the section entitled “Plan of Distribution” in this offering statement. There is no minimum number of shares required to be purchased by each investor. The shares offered by the Company will be sold on our behalf by our Chief Executive Officer, Yandan Zheng. She will not receive any commissions or proceeds for selling the shares on our behalf. There is uncertainty that we will be able to sell any of the 20,000,000 shares being offered by the Company. All the shares being qualified for sale by the Company will be sold at a fixed price of $0.50 per share for the duration of the Offering. There is no minimum amount we are required to raise from the shares being offered by the Company and any funds received will be immediately available to us. There is no guarantee that we will sell any of the securities being offered in this offering. Additionally, there is no guarantee that this Offering will successfully raise enough funds to institute our company’s business plan. Additionally, there is no guarantee that a public market will ever develop, and you may be unable to sell your shares.

This primary offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the Offering Statement or (ii) 365 days from the qualified date of this offering circular, unless extended by our director(s) for an additional 90 days. We may however, at any time and for any reason terminate the offering.

| Price to Public(1) | Underwriting Discount and Commissions(2) | Proceeds to Issuer(3) | Proceeds to Other Persons | |||||

| Per share | $ | .50 | $ | 0.00 | $ | .50 | $ | 0.00 |

| Total Maximum | $ | 10,000,000 | $ | 0.00 | $ | 10,000,000 | $ | 0.00 |

| (1) | We do not intend to use commissioned sales agents or underwriters. |

| (2) | The amounts shown are before deducting offering costs to us, which include legal, accounting, printing, due diligence, marketing, consulting, selling, and other costs incurred in this offering, which we estimate will be $0 in the aggregate. See the section entitled “Plan of Distribution.” |

Currently, our officers and directors own 15,000,000 of our Common Stock and have 100% of the voting power of our outstanding capital stock.

The proceeds from the sale of the securities will be placed directly into the Company’s account; any investor who purchases shares will have no assurance that any monies, beside their own, will be invested in the offering. All proceeds from the sale of the securities are non-refundable, except as may be required by applicable laws. All expenses incurred in this offering are being paid for by the company. There has been no public trading market for the common stock LGH GLOBAL CORP.

The Company qualifies as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, which became law in April 2012 and will be subject to reduced company reporting requirements.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE OFFERING CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

AN OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE COMMISSION. INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF SUCH STATE. THE COMPANY MAY ELECT TO SATISFY ITS OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION OF A SALE TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(D)(2)(I)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO WWW.INVESTOR.GOV.

THESE SECURITIES ARE SPECULATIVE AND INVOLVE A HIGH DEGREE OF RISK. YOU SHOULD PURCHASE SHARES ONLY IF YOU CAN AFFORD THE COMPLETE LOSS OF YOUR INVESTMENT. PLEASE REFER TO ‘RISK FACTORS’ BEGINNING ON PAGE 7.

THE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

You should rely only on the information contained in this offering circular and the information we have referred you to. We have not authorized any person to provide you with any information about this Offering, the Company, or the shares of our Common Stock offered hereby that is different from the information included in this offering circular. If anyone provides you with different information, you should not rely on it.

This offering circular is following the offering circular format described in Part II (a)(1)(i) of Form 1-A.

The date of this offering circular is ________, 2020

The following table of contents has been designed to help you find important information contained in this offering circular. We encourage you to read the entire offering circular.

TABLE OF CONTENTS

You should rely only on the information contained in this offering circular. We have not authorized anyone to provide you with additional information or information different from that contained in this offering circular. We take no responsibility for and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, our common stock only in jurisdictions where offers and sales are permitted. The information contained in this offering circular is accurate only as of the date of this offering circular, regardless of the time of delivery of this offering circular or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

| PAGE | ||

| PART - II OFFERING CIRCULAR | ||

| OFFERING CIRCULAR SUMMARY | 5 | |

| RISK FACTORS | 7 | |

| DILUTION | 13 | |

| SELLING SHAREHOLDERS | 14 | |

| DETERMINATION OF OFFERING PRICE | 14 | |

| PLAN OF DISTRIBUTION | 14 | |

| USE OF PROCEEDS | 17 | |

| DESCRIPTION OF BUSINESS | 18 | |

| DESCRIPTION OF PROPERTY | 25 | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION | 25 | |

| DIRECTORS, EXECUTIVE OFFICERS AND SIGNIFICANT EMPLOYEES | 28 | |

| COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS | 29 | |

| SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS | 29 | |

| INTEREST OF MANAGEMENT AND OTHERS IN CERTAIN TRANSACTIONS | 30 | |

| SECURITIES BEING OFFERED | 30 | |

| WHERE YOU CAN FIND MORE INFORMATION | 31 | |

| FINANCIAL STATEMENTS | F-1 | |

| PART – III | ||

| EXHIBITS TO OFFERING STATEMENT | 22 | |

| SIGNATURES | F-13 |

PART - II

OFFERING CIRCULAR SUMMARY

In this offering circular, ‘‘LGH GLOBAL CORP..,’’ the “Company,’’ ‘‘we,’’, “LGH:”, ‘‘us,’’ and ‘‘our,’’ refer to LGH GLOBAL CORP.., unless the context otherwise requires. Unless otherwise indicated, the term ‘‘fiscal year’’ refers to our fiscal year ending March 31. Unless otherwise indicated, the term ‘‘common stock’’ refers to shares of the Company’s common stock.

This offering circular, and any supplement to this offering circular include “forward-looking statements”. To the extent that the information presented in this offering circular discusses financial projections, information or expectations about our business plans, results of operations, products or markets, or otherwise makes statements about future events, such statements are forward-looking. Such forward-looking statements can be identified using words such as “intends”, “anticipates”, “believes”, “estimates”, “projects”, “forecasts”, “expects”, “plans” and “proposes”. Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These include, among others, the cautionary statements in the “Risk Factors” section and the “Management’s Discussion and Analysis of Financial Position and Results of Operations” section in this offering circular.

This summary only highlights selected information contained in greater detail elsewhere in this offering circular. This summary may not contain all of the information that you should consider before investing in our common stock. You should carefully read the entire offering circular, including “Risk Factors” beginning on Page 6, and the financial statements, before making an investment decision.

The Company

We were originally incorporated in the State of Delaware on February 18, 2021

Our corporate business address is: 87 N. Raymond Ave, Suite 200, Pasadena, CA 91103. Our phone number is (213)459-0006. Our E-Mail address [email protected]. We maintain a website at www.lghglobalcorp.com Information available on our website is not incorporated by reference in and is not deemed a part of this offering circular.

Our company

Our independent auditor has expressed substantial doubt about our ability to continue as a going concern given our lack of operating history and the fact to date, we have had no revenues. The Company has not generated any revenues since inception and sustained an accumulated net loss of $(5,015) for the period from inception to March 3, 2021. These factors, among others, raise substantial doubt about the ability of the Company to continue as a going concern for a reasonable period.

The Offering

All dollar amounts refer to US dollars unless otherwise indicated.

Through this offering, we intend to qualify 20,000,000 shares for offering to the public. We are offering these shares at a price per share of $0.50. We will receive all proceeds from the sale of the common stock.

| Securities being offered by the Company | 20,000,000 shares of common stock at a price of $0.50 per share. Our offering will terminate upon the earliest of (i) such time as all the common stock has been sold pursuant to the Offering Statement or (ii) 365 days from the qualified date of this offering circular unless extended by our Board of Directors for an additional 90 days. We may however, at any time and for any reason terminate the offering. For more information, please refer to Item 14, page 27 of the Offering. | |

| Offering price per share | We will sell the shares at price per share of $0.50. | |

| Number of shares of common stock outstanding before the offering of common stock | 15,000,000 common shares are currently issued and outstanding. | |

| Number of shares of common stock outstanding after the offering of common stock | 35,000,000 common shares will be issued and outstanding if we sell all the shares we are offering herein. | |

5 |

| The minimum number of shares to be sold in this offering | None. | |

| Best efforts offering: | We are offering shares on a “best efforts” basis through our Chief Executive Officer, Ms. Zhang, who will not receive any discounts or commissions for selling the shares. There is no minimum number of shares that must be sold in order to close this offering. | |

| Market for the common shares | Our common stock is not listed for trading on any exchange or automated quotation system. There can be no assurance that any market for our common stock or any of our other securities will ever develop. | |

| Use of Proceeds | We intend to use the net proceeds to us for working capital. | |

| Termination of the Offering | This offering will terminate upon the earlier to occur of (i) 365 days after this Offering Statement becomes qualified with the Securities and Exchange Commission, or (ii) the date on which all 20,000,000 shares registered hereunder have been sold. We may, at our discretion, extend the offering for an additional 90 days. At any time and for any reason we may also terminate the offering. | |

| Subscriptions: | All subscriptions once accepted by us are irrevocable. | |

| Risk Factors: | See “Risk Factors” and the other information in this offering circular for a discussion of the factors you should consider before deciding to invest in shares of our common stock. | |

| Restrictions on Investment: | Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(c) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov. |

6 |

Item 1: Risk Factors

An investment in our shares involves a high degree of risk and many uncertainties. You should carefully consider the specific factors listed below, together with the cautionary statement that follows this section and the other information included in this Offering Circular, before purchasing our shares in this offering. If one or more of the possibilities described as risks below actually occur, our operating results and financial condition would likely suffer and the trading price, if any, of our shares could fall, causing you to lose some or all of your investment. The following is a description of what we consider the key challenges and material risks to our business and an investment in our securities.

Risks Related to our Business

Our independent auditor has expressed substantial doubt about our ability to continue as a going concern given our lack of operating history and the fact that to date, we have generated no revenues.

The accompanying financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The Company has not generated any revenues since inception and sustained an accumulated net loss of $(5,015) for the period from inception to March 3, 2021. These factors, among others, raise substantial doubt about the ability of the Company to continue as a going concern for a reasonable period. The Company’s continuation as a going concern is dependent upon, among other things, its ability to generate revenues and its ability to obtain capital from third parties. No assurance can be given that the Company will be successful in these efforts. If the Company ceases to continue as a going concern, you will lose your entire investment.

This offering is being conducted by the Company without the benefit of an underwriter, who could have confirmed the accuracy of the disclosures in our prospectus.

We have self-underwritten our offering on a “best efforts” basis, which means: No underwriter has engaged in any due diligence activities to confirm the accuracy of the disclosure in the prospectus or to provide input as to the offering price; the Company will attempt to sell the shares and there can be no assurance that all of the shares offered under the prospectus will be sold or that the proceeds raised from the offering, if any, will be sufficient to cover the costs of the offering; and there is no assurance that we can raise the intended offering amount.

We are not currently profitable and may not become profitable.

We have incurred operating losses since our formation and expect to incur losses in the foreseeable future. We also expect to experience negative cash flow for the foreseeable future as we fund our operating losses and capital expenditures. There is substantial doubt as to our ability to continue as a going concern.

As a result, we will need to generate significant revenues in order to achieve and maintain profitability. We may not be able to generate these revenues or achieve profitability in the future. Our failure to achieve or maintain profitability could negatively impact the value of our business.

We are dependent upon the proceeds of this offering to fund our business. If we do not sell enough shares in this offering to continue operations, this could have a negative effect on the value of the common stock.

We must raise approximately $1,000,000 of the $10,000,000 offered in this offering unless we begin to generate enough revenues to finance operations as a going concern, we may experience liquidity and solvency problems. Such liquidity and solvency problems may force us to cease operations if additional financing is not available.

Our minimal operating history gives no assurances that our future operations will result in profitable revenues, which could result in the suspension or end of our operations.

We have a limited operating history upon which an evaluation of our future success or failure can be made. Our ability to achieve and maintain profitability and positive cash flow is dependent upon the completion of this offering and our ability to generate revenues.

7 |

There is substantial doubt as to our ability to continue as a going concern. We have incurred significant operating losses since our formation and expect to incur significant losses in the foreseeable future. We also expect to experience negative cash flow for the foreseeable future as we fund our operating losses and capital expenditures. As a result, we will need to generate significant revenues in order to achieve and maintain profitability. We may not be able to generate these revenues or achieve profitability in the future. Our failure to achieve or maintain profitability could negatively impact the value of our business and may cause us to go out of business.

We are a new company with a limited operating history, and we face a high risk of business failure that could result in the loss of your investment.

We are a development stage company formed to carry out the activities described in this offering circular and thus have only a limited operating history upon which an evaluation of our business can be made. We have limited business operations.

Accordingly, our future revenue and operating results are difficult to forecast. As of the date of this Offering Circular, we have earned no revenue. Failure to generate revenue in the future will cause us to go out of business, which could result in the complete loss of your investment.

Our officers and directors control our company and may unilaterally make decisions regarding corporate transactions that are contrary to investor interests.

Our officers and directors currently own 100% of our outstanding voting securities. If less than $10 million is raised in this offering, our executive officers and directors will continue to control our company. Our officers and directors have the ability to control the voting power of our outstanding capital stock. Investors may find that his decisions are contrary to their interests. You should not purchase shares unless you are willing to entrust all aspects of management to our officers and directors, or their successors. Management will have the ability to make decisions regarding: (i) changing the business without shareholder notice or consent, (ii) make changes to the articles of incorporation whether to issue additional common and preferred stock, including themselves, (iii) make employment decisions, including compensation arrangements; and (iv) whether to enter into material transactions with related parties.

As a result, our officers and directors will have control of the Company and be able to choose all our directors. Their interests may differ from the ones of other stockholders. Factors that could cause their interests to differ from the other stockholders include the impact of corporate transactions on the timing of business operations and their ability to continue to manage the business given the amount of time they are able to devote to us.

Purchasers of the offered shares may not participate in our management and, therefore, are dependent upon their management abilities. The only assurance that our shareholders, including purchasers of the offered shares, have that our officers and directors will not abuse their discretion in executing our business affairs, as their fiduciary obligation and business integrity. Such discretionary powers include, but are not limited to, decisions regarding all aspects of business operations, corporate transactions, and financing.

Accordingly, no person should purchase the offered shares unless willing to entrust all aspects of management to the officers and directors, or their successors. Potential purchasers of the offered shares must carefully evaluate the personal experience and business performance of our management.

Adverse developments that develop in the global economy restricting the credit markets may materially and negatively impact our business.

Though current global economic conditions appear stable and it has been several years from the last downturn in the world’s major economies which constrained the credit markets, we must be aware that similar events could occur quickly and could heighten a number of material risks to our business, cash flows, and financial condition, as well as our future prospects. Any such current or future issues involving liquidity and capital adequacy affecting lenders could affect our ability to access credit facilities or obtain debt financing and could affect the ability of lenders to meet their funding requirements when we need to borrow. Further, in the uncertain event that a public market for our stock develops, any current or future volatility in the equity markets may make it difficult in the future for us to access the equity markets for additional capital at attractive prices, if at all. Should a credit crisis develop in other countries, for example, which could create concerns over any number of economic indicators, it could increase volatility in global credit and equity markets. If we are unable to obtain credit or access capital markets, our business could be negatively impacted. For example, we may be unable to raise sufficient capital from this offering.

8 |

Our operating results may prove unpredictable, which could negatively affect our profit.

Our operating results are likely to fluctuate significantly in the future due to a variety of factors, many of which we have no control. Factors that may cause our operating results to fluctuate significantly include: our inability to generate enough working capital from operations our inability to secure long-term service contract with the utilities that benefit from the installed technology; the level of commercial acceptance of our technology; fluctuations in the demand for our technology; the amount and timing of operating costs and capital expenditures relating to expansion of our business, operations and infrastructure and general economic conditions. If realized, any of these risks could have a material adverse effect on our business, financial condition, and operating results.

Key management personnel may leave the Company, which could adversely affect the ability of the Company to continue operations.

Because we are entirely dependent on the efforts of our officers and directors, any one of their departure or the loss of other key personnel in the future, could have a material adverse effect on the business. We believe that all commercially reasonable efforts have been made to minimize the risks attendant with the departure by key personnel from service.

However, there is no guarantee that replacement personnel, if any, will help the Company to operate profitably. We do not maintain key-person life insurance on any of our officers and directors.

If our Company is dissolved, it is unlikely that there will be sufficient assets remaining to distribute to our shareholders.

In the event of the dissolution of our company, the proceeds realized from the liquidation of our assets, if any, will be used primarily to pay the claims of our creditors, if any, before there can be any distribution to the shareholders. In that case, the ability of purchasers of the offered shares to recover all or any portion of the purchase price for the offered shares will depend on the amount of funds realized and the claims to be satisfied there from.

If we are unable to manage our future growth, our business could be harmed, and we may not become profitable.

Significant growth may place a significant strain on management, financial, operating and technical resources. Failure to manage growth effectively could have a material adverse effect on the Company’s financial condition or the results of its operations.

Competitors may enter this sector with superior infrastructure and backing, infringing on our customer base, and affecting our business adversely.

We have identified a market opportunity for our services. Competitors may enter this sector with superior service. This would infringe on our customer base, having an adverse effect upon our business and the results of our operations.

Since we anticipate operating expenses will increase prior to earning revenue, we may never achieve profitability.

There is no history upon which to base any assumption as to the likelihood that we will prove successful. We cannot provide investors with any assurance that our products and services will attract potential buyers, generate any operating revenue, or ever achieve profitable operations. If we are unable to address these risks, there is a high probability that our business can fail, which will result in the loss of your entire investment.

We are not subject to Sarbanes-Oxley regulations and lack the financial controls and safeguards required of public companies.

We do not have the internal infrastructure necessary, and are not required, to complete an attestation about our financial controls that would be required under Section 404 of the Sarbanes-Oxley Act of 2002. There can be no assurances that there are no significant deficiencies or material weaknesses in the quality of our financial controls. We expect to incur additional expenses and diversion of management’s time when it becomes necessary to perform the system and process evaluation, testing and remediation required to comply with the management certification and auditor attestation requirements.

9 |

COVID-19 and similar health epidemics and contagious disease outbreaks could significantly disrupt our operations and adversely affect our business, results of operations, cash flows or financial condition.

In December 2019, a novel strain of coronavirus (“COVID-19”) was identified, and on March 11, 2020, the World Health Organization declared COVID-19 as a global pandemic. Numerous state and local jurisdictions have imposed, and others in the future may impose, “shelter-in-place” orders, quarantines, executive orders and similar government orders and restrictions for their residents to control the spread of COVID-19. In particular, the governments in jurisdictions where our employees are located have imposed limitations on gatherings, social distancing measures and restrictions on movement, only allowing essential businesses to remain open. Such restrictions have resulted in temporary store closures, work stoppages, slowdowns and delays, travel restrictions and cancellation of events, among other restrictions, any of which may negatively impact workforces, customers, consumer sentiment and economies in many markets and, along with decreased consumer spending, have led to an economic downturn throughout much of the world.

Our business is largely tied to the disposable income of our subscribers and clients. The global economic and financial uncertainty may result in significant declines to the number of clients using our products. See “— A reduction in discretionary consumer spending could have an adverse impact on our business.”

In response to the COVID-19 outbreak, we will transition many of our future employees to remote working arrangements. It is possible that this could have a negative impact on the execution of our business plans and operations. If a natural disaster, power outage, connectivity issue, or other event occurred that impacted our employees’ ability to work remotely, it may be difficult or, in certain cases, impossible, for us to continue our business for a substantial period of time. The increase in remote working may also result in player privacy, IT security and fraud concerns as well as increase our exposure to potential wage and hour issues.

The degree to which COVID-19 affects our financial results and operations will depend on future developments, which are highly uncertain and cannot be predicted, including, but not limited to, the duration and spread of the outbreak, its severity, the governmental actions and regulations imposed to contain the virus or treat its impact, how quickly and to what extent pre-pandemic economic and operating conditions can resume and overall changes in players’ behavior. To the extent the COVID-19 pandemic could affect our business and financial results, it may also have the effect of heightening other risks described in this “Risk Factors” section.

Risks Related to This Offering

Due to the lack of a current public market for our common stock, investors may have difficulty in selling stock they purchase.

Prior to this offering, no public trading market existed for our securities. There can be no assurance that a public trading market for our common stock will develop or that a public trading market, if developed, will be sustained. Because there is none and may be no public market for our stock, we may not be able to secure future equity financing which would have a material adverse effect on our company

Furthermore, when and if our common stock is eligible for quotation on the OTC Market, there can also be no assurance as to the depth or liquidity of any market for the common stock or the prices at which holders may be able to sell the shares.

As a result, investors could find it more difficult to trade, or to obtain accurate quotations of the market value of, the stock as compared to securities that are traded on the NASDAQ trading market or on an exchange. Moreover, an investor may find it difficult to dispose of any shares purchased hereunder.

Investors may have difficulty in reselling their shares due to the lack of market or state Blue Sky laws.

Our common stock is currently not quoted on any market. No market may ever develop for our common stock, or if developed, may not be sustained in the future. The holders of our shares of common stock and persons who desire to purchase them in any trading market that might develop in the future should be aware that there may be significant state law restrictions upon the ability of investors to resell our shares. Accordingly, even if we are successful in having our securities available for trading on the OTC Market, investors should consider any secondary market for our securities to be a limited one. We intend to seek coverage and publication of information regarding the Company in an accepted publication which permits a “manual exemption.” This manual exemption permits a security to be distributed in a particular state without being registered if the company issuing the security has a listing for that security in a securities manual recognized by the state. However, it is not enough for the security to be listed in a recognized manual. The listing entry must contain (1) the names of issuers, officers, and directors, (2) an issuer’s balance sheet, and (3) a profit and loss statement for either the fiscal year preceding the balance sheet or for the most recent fiscal year of operations. We may not be able to secure a listing containing all of this information. Furthermore, the manual exemption is a non-issuer exemption restricted to secondary trading transactions, making it unavailable for issuers selling newly issued securities. Most of the accepted manuals are those published in Standard and Poor’s, Moody’s Investor Service, Fitch’s Investment Service, and Best’s Insurance Reports, and many states expressly recognize these manuals. A smaller number of states declare that they “recognize securities manuals” but do not specify the recognized manuals. The following states do not have any provisions and therefore do not expressly recognize the manual exemption: Alabama, Georgia, Illinois, Kentucky, Louisiana, Montana, South Dakota, Tennessee, Vermont, and Wisconsin. Accordingly, our shares should be considered totally illiquid, which inhibits investors’ ability to resell their shares.

10 |

Investing in our company is highly speculative and could result in the entire loss of your investment.

Purchasing the offered shares is highly speculative and involves significant risk. The offered shares should not be purchased by any person who cannot afford to lose their entire investment. Our business objectives are also speculative, and it is possible that we would be unable to accomplish them. Our shareholders may be unable to realize a substantial or any return on their purchase of the offered shares and may lose their entire investment. For this reason, each prospective purchaser of the offered shares should read this prospectus and all of its exhibits carefully and consult with their attorney, business and/or investment advisor.

Investing in our company may result in an immediate loss because buyers will pay more for our common stock than what the pro rata portion of the assets are worth.

The offering price and other terms and conditions regarding our shares have been arbitrarily determined and do not bear any relationship to assets, earnings, book value or any other objective criteria of value. No investment banker, appraiser or other independent third party has been consulted concerning the offering price for the shares or the fairness of the offering price used for the shares.

The price of per share as determined herein is substantially higher than the net tangible book value per share of our common stock. Our assets do not substantiate a share price of $0.50. This premium in share price applies to the terms of this offering. The offering price will not change for the duration of the offering even if a market develops in our securities.

We have 100,000,000 authorized shares of common stock, of which 15,000,000 shares are currently issued and outstanding and 35,000,000 shares will be issued and outstanding after this offering terminates (assuming all shares have been sold). Our management could, with the consent of the existing shareholders, issue substantially more shares, causing a large dilution in the equity position of our current shareholders.

We may, in the future, issue additional shares of common stock, which would reduce investors’ percent of ownership and may dilute our share value.

Our articles of incorporation authorize the issuance of 100,000,000 shares of common stock. Upon completion of this offering, we will have approximately 35,000,000 shares of common stock issued and outstanding if all shares offered are sold. Accordingly, we may issue up to an additional 65,000,000 shares of common stock after this offering. The future issuance of common stock may result in substantial dilution in the percentage of our common stock held by our then existing shareholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors and might have an adverse effect on any trading market for our common stock.

As we do not have an escrow or trust account with the subscriptions for investors, if we file for or are forced into bankruptcy protection, investors will lose their entire investment.

Invested funds for this offering will not be placed in an escrow or trust account and if we file for bankruptcy protection or a petition for involuntary bankruptcy is filed by creditors against us, your funds will become part of the bankruptcy estate and administered according to the bankruptcy laws. As such, you will lose your investment and your funds will be used to pay creditors.

11 |

We do not anticipate paying dividends in the foreseeable future, so there will be less ways in which you can make a gain on any investment in us.

We have never paid dividends and do not intend to pay any dividends for the foreseeable future. To the extent that we may require additional funding currently not provided for in our financing plan, our funding sources may prohibit the declaration of dividends. Because we do not intend to pay dividends, any gain on your investment will need to result from an appreciation in the price of our common stock. There will therefore be fewer ways in which you are able to make a gain on your investment.

In the event that our shares are traded, they may trade under $5.00 per share, and thus will be considered a penny stock. Trading penny stocks has many restrictions, and these restrictions could severely affect the price and liquidity of our shares.

In the event that our shares trade below $5.00 per share, our stock would be known as a “penny stock”, which is subject to various regulations involving disclosures to be given to you prior to the purchase of any penny stock. The U.S. Securities and Exchange Commission (the “SEC”) has adopted regulations which generally define a “penny stock” to be any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. Depending on market fluctuations, our common stock could be considered to be a “penny stock”. A penny stock is subject to rules that impose additional sales practice requirements on broker/dealers who sell these securities to persons other than established customers and accredited investors. For transactions covered by these rules, the broker/dealer must make a special suitability determination for the purchase of these securities. In addition, he must receive the purchaser’s written consent to the transaction prior to the purchase. He must also provide certain written disclosures to the purchaser. Consequently, the “penny stock” rules may restrict the ability of broker/dealers to sell our securities and may negatively affect the ability of holders of shares of our common stock to resell them. These disclosures require you to acknowledge that you understand the risks associated with buying penny stocks and that you can absorb the loss of your entire investment. Penny stocks are low priced securities that do not have a very high trading volume. Consequently, the price of the stock is often volatile, and you may not be able to buy or sell the stock when you want to.

Governing Law and Legal Venue

The legal venue shall be construed in accordance with, and governed by, the laws of the Court of Chancery of the State of Delaware for any claim as to which the Court of Chancery has jurisdiction. Unless any claim as to which the Court of Chancery determines there is an indispensable party not subject to the jurisdiction of the Court of Chancery (and the indispensable party does not consent to the personal jurisdiction of the Court of Chancery within ten days following such determination), which is vested in the exclusive jurisdiction of a court or forum other than the Court of Chancery, or for which the Court of Chancery does not have subject matter jurisdiction. This provision does not, nor is intended to, apply to claims under the Federal securities laws. This exclusive legal forum provision could add significant cost, discourage claims, and limits the ability of investors to bring a claim in a more favorable legal forum or jurisdiction. This provision does not apply to purchasers in secondary transactions. This exclusive forum provision is included in both this Offering and in the Subscription Agreement but is not in our Articles of By-Laws at this time.

Financial Industry Regulatory Authority (“FINRA”) sales practice requirements may also limit your ability to buy and sell our common stock, which could depress the price of our shares.

FINRA rules require broker-dealers to have reasonable grounds for believing that an investment is suitable for a customer before recommending that investment to the customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status and investment objectives, among other things. Under interpretations of these rules, FINRA believes that there is a high probability such speculative low-priced securities will not be suitable for at least some customers. Thus, FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our shares, have an adverse effect on the market for our shares, and thereby depress our share price.

12 |

Status as Not a Shell Company

The Company it is not a “shell company” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, The Company is a “start-up” company which the Commission explicitly differentiates in Footnote 172 to SEC Release No. 33-8869 from “shell” companies covered under Rule 144(i)(1)(i) (the “Rule”). In adopting the definition of a shell company in SEC Release No. 33-8587 (the “Release”), the Commission stated that it intentionally did not define the term “nominal” and it did not set a quantitative threshold of what constitutes a shell company. Indeed, under the Rule, the threshold for what is considered “nominal” is, to a large degree, subjective and based upon facts and circumstances of each individual case.

The Company is actively engaged in the implementation and deployment of its business plan. These activities include:

The Company’s operations are more than just “nominal.” As the Commission points out in its Release, there are no established quantitative thresholds to determine whether a company’s operations are in-fact “nominal”. Instead, the determination is to be made on a case-by-case basis, with significant regards to a subjective analysis aimed at preventing serious problems from allowing scheming promoters and affiliates to evade the definition of a “shell” company (as well as the intent of the Rule). As described in Footnote 32 to the Release, the Commission expounds its rationale for declining to quantitatively define the term “nominal” regarding a shell company.

It is reasonably commonplace that development stage or “start-up” companies have limited assets and resources, as well as having a going concern explanatory paragraph in the report of its independent registered public accounting firm. The Company is considering all possible avenues to develop its business model. The Company believes that by being a company this should increase its image and credibility in the marketplace and provide possible sources of funding for its business.

The Company’s management has been working at implementing the Company’s core business strategy, including, but not limited to, and business development in anticipation of its progressing operations and the development of its business model. The Company’s operations are more than “nominal” and that it does not fall within the class of companies for which the Commission was aiming to prevent as referenced in Release Footnote 32.

| Item 2: | Dilution |

The price of the current offering is fixed a $0.50 per share. This price is significantly higher than the price paid by the Company’s officers and directors and early investors which was $0.0021.

An early-stage company typically sells its shares (or grants options over its shares) to its founders and early employees at a very low cash cost because they are, in effect, putting their “sweat equity” into the company. When the company seeks cash from outside investors, the new investors typically pay a much larger sum for their shares than the founders or earlier investors, which means that the cash value of the new investors stake is diluted because each share of the same type is worth the same amount, and the new investor has paid more for the shares than earlier investors did for theirs.

We intend to sell 20,000,000 shares of our Common Stock. We were initially capitalized by the sale of our Common Stock. The following table sets forth the number of shares of Common Stock purchased from us, the total consideration paid and the price per share. The table assumes all 20,000,000 shares of Common Stock will be sold.

| Shares Issued | Total Consideration | Price | ||||||||

| Number | Percent | Amount | Percent | Per Share | ||||||

| Existing Shareholders | 15,000,000 | 42.9% | $ | 10,813 | 0.11% | $ | 0.0021 | |||

| Purchasers of Shares | 20,000,000 | 57.1% | $ | 10,000,000 | 99.89% | $ | 0.5000 | |||

| Total | 35,000,000 | 100.0% | $ | 10,010,813 | 100.00% | $ | .286 | |||

The following table sets forth the difference between the offering price of the shares of our Common Stock being offered by us (If all 20 million shares are sold and the full $20 million is raised), the net tangible book value per share, and the net tangible book value per share after giving effect to the offering by us, assuming that 25%, 50%, 75% and 100% of the offered shares are sold. Net tangible book value per share represents the amount of total tangible assets less total liabilities divided by the number of shares outstanding as of May 31, 2021. Totals may vary due to rounding.

13 |

| 25% of offered shares are sold | 50% of offered shares are sold | 75% of offered shares are sold | 100% of offered shares are sold | |||||||||||||

| Offering Price | $ | 0.50 | $ | 0.50 | $ | 0.50 | $ | 0.50 | ||||||||

| Net tangible book value at May 31, 2021 | $ | 0.00072 | $ | 0.00072 | $ | 0.000721 | $ | 0.00072 | ||||||||

| Net tangible book value after giving effect to the offering | $ | 0.13 | $ | 0.200 | $ | 0.250 | $ | 0.286 | ||||||||

| Increase in net tangible book value per share attributable to cash payments made by new investors | $ | 0.125 | $ | 0.200 | $ | 0.250 | $ | 0.285 | ||||||||

| Per Share Dilution to New Investors | $ | 0.37 | $ | 0.30 | $ | 0.25 | $ | 0.21 | ||||||||

| Percent Dilution to New Investors | 74.89 | % | 59.91 | % | 49.93 | % | 42.80 | % | ||||||||

| Item 3: | SELLING SHAREHOLDERS |

None

| Item 4: | DETERMINATION OF OFFERING PRICE |

The offering price of the common stock is not fixed and has been arbitrarily determined and bears no relationship to any objective criterion of value. The price does not bear any relationship to our assets, book value, historical earnings, or net worth. No valuation or appraisal has been prepared for our business. We cannot assure you that a public market for our securities will develop or if developed, it will continue or that the securities will ever trade at a price higher than the offering price.

| Item 5: | PLAN OF DISTRIBUTION |

Our common stock offered through this offering is being made by the Company through a direct offering. Our Common Stock may be sold or distributed from time to time by the Company utilizing general solicitation through the internet, social media, and any other means of widespread communication. The sale of our common stock offered by us through this offering may be effected by one or more of the following methods: internet, social media, and any other means of widespread communication including but not limited to crowdfunding sites, ordinary brokers’ transactions;· transactions involving cross or block trades; through brokers, dealers, or underwriters who may act solely as agents; in other ways not involving market makers or established business markets, including direct sales to purchasers or sales effected through agents;· in privately negotiated transactions; or· any combination of the foregoing. Brokers, dealers, underwriters, or agents participating in the distribution of the shares as agents may receive compensation in the form of commissions, discounts, or concessions from the Company and/or purchasers of the common stock for whom the broker-dealers may act as agent. The Company has 15,000,000 shares of common stock issued and outstanding as of the date of this offering circular. The Company is registering an additional 20,000,000 shares of its common stock for sale at $0.50 per share.

14 |

Our offering will terminate upon the earliest of (i) such time as all the common stock has been sold pursuant to the Offering Statement or (ii) 365 days from the qualified date of this offering circular unless extended by our Board of Directors for an additional 90 days. We may however, at any time and for any reason terminate the offering.

There is no arrangement to address the possible effect of the offering on the price of the stock.

In connection with the Company’s selling efforts in the offering, our officers and directors will not register as a broker-dealer pursuant to Section XXX of the Exchange Act, but rather will rely upon the “safe harbor” provisions of SEC Rule 3a4-1, promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Generally speaking, Rule 3a4-1 provides an exemption from the broker-dealer registration requirements of the Exchange Act for persons associated with an issuer that participate in an offering of the issuer’s securities. Yandan Zheng is not subject to any statutory disqualification, as that term is defined in Section 3(a)(39) of the Exchange Act. Yandan Zheng will not be compensated in connection with his participation in the offering by the payment of commissions or other remuneration based either directly or indirectly on transactions in our securities. Yandan Zheng will not participate in selling an offering of securities for any issuer more than once every 12 months other than in reliance on Exchange Act Rule 3a4-1(a)(4)(i) or (iii).

In the following states we cannot offer or sell our shares of common stock unless we register as an issuer dealer: Alabama, Arizona, Florida, Nebraska, Delaware, New Jersey, New York, North Dakota, Texas, and Washington. If we wish to offer and sell our shares of common stock in these states, we will hire an SEC registered broker-dealer to serve as our placement agent. We may, however, decide to comply with a particular state’s issuer dealer registration requirements, in New York, for example, if we deem it appropriate.

The Company will receive all proceeds from the sale of the 20,000,000 shares being offered on behalf of the company itself. The Company’s shares may be sold to purchasers from time to time directly by and subject to the discretion of the Company. The shares of common stock sold by the Company may be occasionally sold in one or more transactions; all shares sold under this offering circular will be sold at a fixed price of $0.50 per share.

The Company will pay all expenses incidental to the registration of the shares (including registration pursuant to the securities laws of certain states), which we expect to be no more than $50,000.

Procedures for Subscribing

If you decide to subscribe for any shares in this offering, you must

| · | Execute and deliver a subscription agreement; and |

| · | Deliver a check or certified funds to us for acceptance or rejection. |

All checks for subscriptions must be made payable to “LGH GLOBAL CORP.”. The Company will deliver stock certificates attributable to shares of common stock purchased directly to the purchasers within ninety (90) days of the close of the offering.

Right to Reject Subscriptions

We have the right to accept or reject subscriptions in whole or in part, for any reason or for no reason. All monies from rejected subscriptions will be returned immediately by us to the subscriber, without interest or deductions. Subscriptions for securities will be accepted or rejected with letter by mail within 48 hours after we receive them.

15 |

Shareholders Voting Rights vs. Common Rights

Preferred Shareholders have inordinate voting rights as compared to Common Shareholders.

At present there are no preferred shareholders. In the Company Articles Preferred Shareholders are granted five (5) votes for each share and may be converted into five (5) common shares. Although no decision has been made when or whether to issue any preferred shares, preferred shares are authorized for the use by the Board to potentially issue to any significant investors (individuals or organizations) willing to invest who are interested in our platform and to give those investors preferential treatment in the event of the liquidation of the company and to potentially be used to reward management for successful implementation of our business plan. The Management and Board of Directors may also elect to use Preferred Shares to maintain control of the Company and its Operations.

Investment Limitations

As set forth in Title IV of the JOBS Act, there are limits on how many shares an investor may purchase if the offering does not result in a listing on a national securities exchange. The following would apply unless we are able to obtain a listing on a national securities exchange.

Generally, in the case of trading on the over-the-counter markets, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)c of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov .

| (viii) | Because this is a Tier 2, Regulation A offering, most investors in the case of trading on the over-the-counter markets must comply with the 10% limitation on investment in the offering. The only investor in this offering exempt from this limitation is an “accredited investor” as defined under Rule 501 of Regulation D under the Securities Act. If you meet one of the following tests you should qualify as an accredited investor) You are a natural person who has had individual income in excess of $200,000 in each of the two most recent years, or joint income with your spouse in excess of $300,000 in each of these years and have a reasonable expectation of reaching the same income level in the current year. |

(i) You are a natural person who has had individual income in excess of $200,000 in each of the two most recent years, or joint income with your spouse in excess of $300,000 in each of these years and have a reasonable expectation of reaching the same income level in the current year.”

(ii) You are a natural person and your individual net worth, or joint net worth with your spouse, exceeds $1,000,000 at the time you purchase shares of our common stock in the offering.

(iii) You are an executive officer or general partner of the issuer or a manager or executive officer of the general partner of the issuer.

(iv) You are an organization described in Section 501(c)(3) of the Internal Revenue Code of 1986, as amended, or the Code, a corporation, a Massachusetts or similar business trust or a partnership, not formed for the specific purpose of acquiring the shares in this offering, with total assets in excess of $5,000,000.

(v) You are a bank or a savings and loan association or other institution as defined in the Securities Act, a broker or dealer registered pursuant to Section 15 of the Exchange Act, an insurance company as defined by the Securities Act, an investment company registered under the Investment Company Act of 1940, or a business development company as defined in that act, any Small Business Investment Company licensed by the Small Business Investment Act of 1958 or a private business development company as defined in the Investment Advisers Act of 1940;

(vi) You are an entity (including an Individual Retirement Account trust) in which each equity owner is an accredited investor.

(vii) You are a trust with total assets in excess of $5,000,000, your purchase of shares of our common stock in the offering is directed by a person who either alone or with his purchaser representative(s) (as defined in Regulation D promulgated under the Securities Act) has such knowledge and experience in financial and business matters that he is capable of evaluating the merits and risks of the prospective investment, and you were not formed for the specific purpose of investing in the shares in this offering; or

(viii) You are a plan established and maintained by a state, its political subdivisions, or any agency or instrumentality of a state or its political subdivisions, for the benefit of its employees, if such plan has assets in excess of $5,000,000.

16 |

Blue Sky Law Considerations

The holders of our shares of common stock and persons who desire to purchase them in any trading market that might develop in the future should be aware that there may be significant state law restrictions upon the ability of investors to resell our shares. Accordingly, even if we are successful in having the shares available for trading on the OTC Market, investors should consider any secondary market for our securities to be a limited one. There is no guarantee that our stock will ever be quoted on the OTC Market. We intend to seek coverage and publication of information regarding our company in an accepted publication, which permits a “manual exemption”. This manual exemption permits a security to be distributed in a particular state without being registered if the company issuing the security has a listing for that security in a securities manual recognized by the state. However, it is not enough for the security to be listed in a recognized manual. The listing entry must contain (1) the names of issuers, officers, and directors, (2) an issuer’s balance sheet, and (3) a profit and loss statement for either the fiscal year preceding the balance sheet or for the most recent fiscal year of operations. We may not be able to secure a listing containing all of this information. Furthermore, the manual exemption is a non-issuer exemption restricted to secondary trading transactions, making it unavailable for issuers selling newly issued securities. Most of the accepted manuals are those published in Standard and Poor’s, Moody’s Investor Service, Fitch’s Investment Service, and Best’s Insurance Reports, and many states expressly recognize these manuals. A smaller number of states declare that they “recognize securities manuals” but do not specify the recognized manuals. The following states do not have any provisions and therefore do not expressly recognize the manual exemption: Alabama, Georgia, Illinois, Kentucky, Louisiana, Montana, South Dakota, Tennessee, Vermont, and Wisconsin.

We currently do not intend to and may not be able to qualify securities for resale in other states, which require shares to be qualified before they can be resold by our shareholders.

Item 6: USE OF PROCEEDS

Our offering is being made on a self-underwritten basis: no minimum number of shares must be sold in order for the offering to proceed. The offering price per share is $0.50. The following table sets forth the uses of proceeds assuming the sale of 100%, 75%, 50%, and 25% of the securities offered for sale by the Company. There is no assurance that we will raise the full $10,000,000 as anticipated.

If 20,000,000 shares (100%) are sold:

Next 12 months

| Planned Actions | Estimated Cost to Complete |

| Salary for current or future employees | $ 750,000 |

| Development costs | 2,250,000 |

| Development costs for future projects | 3,000,000 |

| Marketing and distribution costs of service(s) | 2,500,000 |

| General operating capital | 1,500,000 |

| TOTAL | $10,000,000 |

If 15,000,000 shares (75%) are sold:

Next 12 months

| Planned Actions | Estimated Cost to Complete |

| Salary for current or future employees | $562,500 |

| Development costs associated with identified projects | 1,687,500 |

| Development costs for future projects | 2,250,000 |

| Marketing and distribution costs of service(s) | 1,875,000 |

| General operating capital | 1,125,000 |

| TOTAL | $ 7,500,000 |

17 |

If 10,000,000 shares (50%) are sold:

Next 12 months

| Planned Actions | Estimated Cost to Complete |

| Salary for current or future employees | $375,000 |

| Development costs associated with identified projects | 1,125,000 |

| Development costs for future projects | 1,500.000 |

| Marketing and distribution costs of service(s) | 1,250,000 |

| General operating capital | 750,000 |

| TOTAL | $ 5,000,000 |

If 5,000,000 shares (25%) are sold:

Next 12 months

| Planned Actions | Estimated Cost to Complete |

| Salary for current or future employees | $ 187,500 |

| Development costs associated with identified projects | 562,500 |

| Development costs for future projects | 750,000 |

| Marketing and distribution costs of service(s) | 625,000 |

| General operating capital | 375,000 |

| TOTAL | $ 2,500,000 |

The above figures represent only estimated costs for the next 12 months.

Notes: 1. Development cost related “Future projects” include the same as those listed in Note 1 with the additional expense of travel to potential consumers and educational providers as well as additional educational related developments.

2. “Marketing and distribution costs” includes, but is not limited to, preparation of printed materials, digital marketing, webinars, travel to meet with potential investors/consumers, etc. Initially the print and digital marketing work will be outsourced, but the Company may elect to hire a full-time marketing director.

3. “Identified Projects” include, but is not limited to, the following: establishing logistics centers with third parties, payment processing arrangements, inventory control and management systems.

Item 7: Description of Business

Our Company

We were originally incorporated in the State of Delaware on March 8, 2021

18 |

Our corporate business address is: 87 N. Raymond Ave, Suite 200, Pasadena CA 91103. Our telephone number is (213) 459-0006. Our E-Mail address is [email protected]

The address of our web site is www.lghglobalcorp.com The information at our web site is for general information and marketing purposes and is not part of this report for purposes of liability for disclosures under the federal securities laws.

About the Company

Product/Service

LGH Global Corp. provides global on-line Bed and Breakfast (BnB) lodging services platform foro consumers to purchase integrated travelling packages and join the membership program. Different from existing on-line BnB platform, LGH plans to offer and host 2,000~5,000 owner whole-house, condo and apartment units in popular travelling cities, especially in North America, Europe, and Asia (Japan and Taiwan). In addition, we plan to develop unique membership program. Members could join the program and enjoy the incentive and reward.

Our integrated services include on-line booking system, payment security, membership program, different types of lodging services, car rental, airport pick-up, local cuisine, local activities, and etc., to improve traveling experience, local assistance, and service efficiency. Meanwhile, reduce administrative costs and risk of short-term rental services. As a result, LGH can build up its own BnB eco-system to ensure service quality and increase customer turnover rate.

Customers/Members

The target customers of LGH Global Corp. are millennial generation who was born in 1980s, 1990s and early 2000s. According to the market research in recently years, over 70% of booking guests worldwide were millennials (36% of guests are between age 25-34, 23% are between ages 35-44, and 15% are between 18-24). They chose BnB solution mainly because;

| 1. | 95% wanted ease and security of payment; |

| 2. | 85% said location were more convenient, and; |

| 3. | 75% wanted to live like a local. |

19 |

Future of the Company

Global on-line booking BnB and lodging service is a fast-paced, evolving and growing industry. In response to this climate, LGH will encourage young generation travelers become LGH members via special discount, and PR events. Besides, there are additional benefits of new member referral for our existing members. Therefore, increase turnover rate and membership loyalty. Most of all, LGH will be prepared for stock listing on OTC market and develop integrated services under its brand name.

20 |

Mission Statement

To provide advanced global on-line booking BnB lodging services to consumers and develop membership that will help the companies prosper and grow.

Principal Members

Representatives of LGH Global Corp. (DELAWARE, US)

Legal Structure

LGH Global Corp. is a Corporation, incorporated in DELAWARE, United States.

Market Research

Industry

Since 2008, Airbnb has created an incredible marketplace. It made tourism industry more available to new generations. Staying in a BnB was cheaper than staying in a hotel and allows to have a local experience. In essence, online BnB service added a lot of value to the traditional tourism industry.

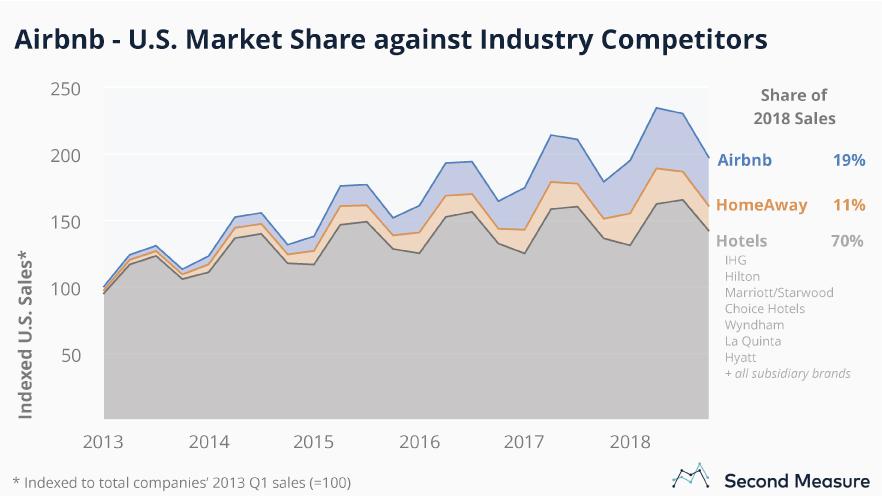

In 2018, BnB market share of total lodging sales exceeded 30% in the U.S. market. On-line booking BnB services has let the vertical grow exponentially in recent years.

The short-term rental industry has become more urban and attracted new guests. They are different from traditional vacation rental guests, who have higher expectations and are pressuring property managers to become more professional. While the market continues to consolidate, it will still remain hyper-local. After all, that’s where all the know-how, assets, relationships, and service providers are.

Detailed Description of Customers

Millennial travel trends are demands by the younger generation of travelers currently affecting the type of hospitality service now and in years to come. They comprise 40% leisure travelers and many of them book a vacation online. The lodging industry will need to attract and approach millennials as the description below;

| 1. | Connect and Reach Out: respond to the unique needs. |

| 2. | Trust their friends’ recommendations for travel and lodging. |

| 3. | They want to fully experience new culture and local cuisine. |

| 4. | I-Digital has provided the means to record their adventure. |

| 5. | Spend more money per day while traveling. |

| 6. | Amenities are critical and they are willing to pay extra for them if they add the experience. |

| 7. | Always-connected generation, but down time is very important as well. |

21 |

Company Advantage

Instead of matching the house hosts and travelers for service charge, LGH will own the properties as the host and provide integrated services via well-trained property manager and local support team. As a result, LGH could ensure service quality and consistency to travelers in different countries.

In addition, LGH plans to procure 2,000 diversified units at first stage and target at 5,000 within following years. Millennials consumers could book a manor farm for culture experience, or a convenience spot to live as a local from LGH platform with secured payment system.

Our advantages are as strong as our unique member and reward system. We v will take the following steps to support our BnB services:

· First on-line BnB platform integrated membership program.

· Develop support team and strategic partners in North America, Europe and Asia to provide quality service and respond promptly.

· User-friendly online booking platform that provides multimedia content, required information, local recommendation, social media sharing, booking system, secured payment system, customer service, … and etc.

Regulations

LGH GLOBAL CORP INC. must meet all Federal and state regulations concerning e-commerce and the natural health supplement business.

Product/Services

Services Included:

· On-line BnB Portal services

· New Product Procurement and Restoration

· Value Added Services, Amenities, and Local Activities

· Membership Program

· Service Quality Assurance

Pricing Structure

LGH will offer the service according to the house value (around 4~5% annual return), prices of our competitors and membership program.

Product Lifecycle

All services are ready to be offered, pending approval of contracts.

Intellectual Property Rights

LGH Global is a trademarked name under LGH Global Corp. in the state of Delaware, and we have filed for protection of our proprietary processes and other intellectual property, such as our logo. We have also registered our domain name and parked relevant social media accounts for future use.

22 |

Research and Development

The company is planning to conduct the following research and development:

· Work with subcontractor to develop LGH logo and corporate identification system (CIS) that fit in brand positioning.

· Build up strong partnership with local support subcontractors for the integrated services, especially in US, Europe, Japan and Taiwan.

· Setup LGH social media official account to create sales funnel that provide critical information including product and services, culture experience and special offering, then lead consumers to visit LGH official platform to book unit.

· Develop membership program to increase referral and turnover rate that carve its niche in the marketplace.

· New Products Procurement and Launch.

· Prepare for OTC stock listing.

Marketing & Sales

Growth Strategy

To grow the company, LGH will do the following:

· Build up a creative and user-friendly LGH Global BnB portal and App. Meanwhile, setup official fan page on different social media and other BnB platform.

· Using existing BnB and social media platform to build up sales funnel that provide engaging contents including brand, services, product information and special offering, then lead consumers to LGH official portal or download the App.

· Improve Search Engine Optimization (SEO) according to Google Analysis.

· Attractive and irresistible offering for new membership joining and referral program.

· As the business grows, advertise in publications, hold PR events and special activities, and exhibition, to reach targeted customers.

Communicating With the Customers

LGH will communicate with its customers by:

· Using social media such as Twitter, YouTube, Facebook, and LinkedIn

· Providing contact information on LGH official portal website and other BnB platform. Hold seminar and other off-line events for new members.

| · | Spread out the brand images, product and services with engaging multi-media content production. |

How To Sell

In early stage, LGH might count on other BnB and social media platform to increase brand awareness. In addition to on-line promotion, LGH will pay more attention on differentiated marketing strategies, e.g. membership referral program, on-line/off-line integrated events, extra bonus, and etc., in order to have more consumers become LGH members.

Reports to Security Holders

After the completion of this Tier II, Regulation A offering, we intend to become subject to the information and periodic reporting requirements of the Exchange Act. If we become subject to the reporting requirements of the Exchange Act, we will file periodic reports, proxy statements and other information with the Commission. Such periodic reports, proxy statements and other information will be available for inspection and copying at the public reference room and on the Commission’s website at: http://www.sec.gov/cgi-bin/browse-edgar?company=vortex+brands&owner=exclude&action=getcompany . Until we become or never become subject to the reporting requirements of the Exchange Act, we will furnish the following reports, statements, and tax information to each stockholder:

1. Reporting Requirements under Tier II of Regulation A. Following this Tier II, Regulation A offering, we will be required to comply with certain ongoing disclosure requirements under Rule 257 of Regulation A. We will be required to file: an annual report with the SEC on Form 1-K; a semi-annual report with the SEC on Form 1-SA; current reports with the SEC on Form 1-U; and a notice under cover of Form 1-Z. The necessity to file current reports will be triggered by certain corporate events, similar to the ongoing reporting obligation faced by issuers under the Exchange Act, however the requirement to file a Form 1-U is expected to be triggered by significantly fewer corporate events than that of the Form 8-K. Such reports and other information will be available for inspection and copying at the public reference room and on the Commission’s, website referred to above. Parts I & II of Form 1-Z will be filed by us if and when we decide to and are no longer obligated to file and provide annual reports pursuant to the requirements of Regulation A. The Company may in the future file a Form 8-A and elect to come under the Exchange Act and it’s reporting requirements, but there is no assurance the Company will elect to do so.

23 |