Form 1-A POS Zummo Flight Technologie

1-A POS LIVE 0001734549 XXXXXXXX 024-11347 true false true Zummo Flight Technologies AZ 2014 0001734549 3720 47-1124222 3 0 8311 E. VIA DE VENTURA STE 2082 SCOTTSDALE AZ 85258 5712761067 Nicholas Antaki Other 30634.00 0.00 0.00 0.00 30634.00 0.00 0.00 0.00 -757993.00 30634.00 0.00 0.00 0.00 -121503.00 0.00 0.00 Junaid Qazi, CPA Class A 1300000 0 0 0 0 true true false Tier2 Audited Equity (common or preferred stock) Y N N Y N N 3750000 0 5.0000 0.00 0.00 0.00 0.00 0.00 true false AL AK AZ AR CA CO CT DE DC FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA PR RI SC SD TN TX UT VT VA WA WV WI WY A0 A1 A2 A3 A4 A5 A6 A7 A8 A9 B0 Z4 false Zummo Flight Technologies Corporation Class A Common Shares 122500 0 $122500 Section 4(a)(2) of the federal Securities Act of 1933, Arizona Statute: Section 44-1844(A)(1) of the Arizona Securities Act

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION ("SEC") DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE SEC HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

This is a post-qualification amendment to an offering statement on Form 1-A filed by Zummo Flight Technologies Inc.. The offering statement was originally qualified by the SEC on February 1, 2021. The reason for this post-qualification is to identify the broker-dealer which Zummo Flight Technologies Inc. has engaged, adjusting the expected commissions schedule, and adjusting the expected Use of Proceeds. Also, amendments have been made regarding the legal proceedings of a Director. Audited Financials for FY 2020 have been included along with adjustments to the Management’s Discussion and Analysis section. Furthermore, The Company’s FY 2019 Audited Financials have been re-audited by a new independent auditor and FY 2017/FY 2018 have been removed.

FORM 1-A POS: AMENDMENT #7

Offering Circular

For

Zummo Flight Technologies Corporation

An Arizona Corporation

OFFERING UP TO 3,750,000 CLASS B COMMON SHARES

MINIMUM INVESTMENT AMOUNT OF $500.00

September 23, 2021

SECURITIES OFFERED : Equity in the form of 3,750,000 Class B Common Shares

MAXIMUM OFFERING AMOUNT : $18,750,000.00

MINIMUM OFFERING AMOUNT : $0

MINIMUM INVESTMENT : $500.00

CONTACT INFORMATION :

Zummo Flight Technologies Corporation

8311 E. Via de

Ventura, #2082

Scottsdale, AZ 85258

Phone: 571-276-1067

Zummo Flight Technologies Corporation (“ZFT” or the “Company”) is an Arizona Corporation, originally formed on June 6, 2014 under the name RJ Helicopter Corporation. On August 10, 2017 the Company filed an amendment to the Articles of Incorporation changing the company name from RJ Helicopter Corporation to Zummo Flight Technologies Corporation (see Exhibit EX1A-2A “Amended Articles of Incorporation, Original Articles of Incorporation, Name Change Records).

The Company is offering (the “Offering”) by means of this offering circular (the “Offering Circular”) Company equity in the form of Class B common stock denominated in Class B shares (the “Shares) on a “best efforts” and ongoing basis to investors who meet the Investor Suitability standards as set forth herein. (See “Investor Suitability Standards” below.) The Company will offer Shares through its own website www.zummotechnologies.com (“Platform”) through the efforts of its Directors, Officers, and employees of the Company, and through The Dalmore Group, a FINRA-registered broker-dealer entitled to commissions upon the sale of the Shares. (See the “Terms of the Offering” below.) Persons who purchase Shares will be shareholders of the Company (“Shareholders” or “Investors”). Nonetheless, the Company projects to spend Two Hundred Thousand Dollars ($200,000) in total Offering expenses including legal and accounting expenses, and other miscellaneous expenses, not including state filing fees.

The Company intends to use the proceeds of this Offering (“Proceeds”) to continue research and development operations of the Company.

The minimum investment amount per Investor is Five Hundred Dollars ($500.00) for the Offering (“Minimum Investment Amount”). Although the Company does not intend to list the Shares for trading on any exchange or other trading market, the Company has adopted withdrawal provisions designed to provide Investors with limited liquidity for their investment in the Company. (see “Redemption Provisions” below). The Board reserves the right to list the securities on a trading market in the future.

Sales of the Shares pursuant to the Offering will commence immediately upon qualification of the Offering by the SEC (the “Effective Date”) and will terminate at the discretion of the Board or twelve (12) months following the Effective Date, whichever is earlier. The maximum amount of the Offering shall not exceed Eighteen Million, Seven Hundred Fifty Thousand Dollars ($18,750,000) in any twelve (12) month period (“Maximum Offering Amount”) in accordance with Tier II of Regulation A as set forth under the Securities Act of 1933, as amended.

This Offering Circular conforms to the requirements of the Securities and Exchange Commission Form 1-A.

The Company intends to offer the Shares described herein on a continuous and ongoing basis pursuant to Rule 251(d)(3)(i)(f). Further, the acceptance of Investor subscriptions, may be briefly paused at times to allow the Company to effectively and accurately process and settle subscriptions that have been received. (See “Terms of the Offering” below.) The Company may increase the Maximum Offering Amount at its sole and absolute discretion, subject to qualification by the SEC of a post-qualification amendment.

Prior to this Offering, there has been no public market for the Shares, and none is expected to develop. The Offering price is arbitrary and does not bear any relationship to the value of the assets of the Company. The Company does not currently have plans to list any Shares on any securities market. Investing in the Company through the purchase of Shares involves risks, some of which are set forth below. See the section titled “Risk Factors” to read about the factors an Investor should consider prior to purchasing Shares.

Investors who purchase Shares will become Shareholders of the Company subject to the terms of the Shareholders’ Agreement (the “Shareholders’ Agreement”) and the Bylaws of ZFT (the “Bylaws”) once the Company deposits the Investor’s investment into the Company’s main operating account. (See Exhibits EX1A-2B “Bylaws of Zummo Flight Technologies” and Exhibit EX1A-3 “Shareholders’ Agreement”).

There will be no escrow account since there is no Minimum Offering Amount for this Offering.

The Directors and Officers will receive compensation from the Company as employees. (See “Risk Factors”, “Compensation of Directors and Officers” below.) Investing in the Shares is speculative and involves substantial risks, including risk of complete loss. Prospective Investors should purchase these securities only if they can afford a complete loss of their investment. (See “Risk Factors” below starting on Page 8) There are material income tax risks associated with investing in the Company that prospective Investors should consider.

As of the date of this Offering Circular, the Company has engaged KoreConX Inc. as the Company’s SEC-registered transfer agent and registrar of the Shares. The Shares are available for purchase exclusively through KoreConX Inc. and will be issued in book-entry electronic form only.

The Company will commence sales of the Shares immediately upon qualification of the Offering by the SEC. The Company approximates that sales will commence during Q4 - 2021.

| Price to Public* | Underwriting Discounts and Commissions** | Proceeds to the Company*** | Proceeds to other Persons**** | |

| Amount to be Raised per Interest | $5 | $0 | $4.95 | $.05 |

| Minimum Investment Amount | $500 | $0 | $495 | $5 |

| Minimum Offering Amount | $0 | $0 | $0 | $0 |

| Maximum Offering Amount | $18,750,000 | $0 | $18,562,500 | $187,500 |

*The Offering price to investors was arbitrarily determined by the Board.

** The Company is not using an underwriter for the sale of Shares.

*** Shares will be offered and sold directly by the Company, the Board and the Company’s respective Officers and employees. No commissions for selling Shares will be paid to the Company, the Board or the Company’s respective Officers or employees.

****The Company has engaged The Dalmore Group as independent managing broker-dealer. All Proceeds under this column are commissions equaling one (1%) percent of the proceeds received for the sale of Shares. The Company reserves the right to engage other broker dealers for the sale of the Shares through this Offering.

| Page 1 |

| Page 2 |

The following information is only a brief summary of, and is qualified in its entirety by, the detailed information appearing elsewhere in this Offering. This Offering Circular, together with the exhibits attached including, but not limited to, the Shareholders’ Agreement, a copy of which is attached hereto as Exhibit EX1A-3 should be carefully read in its entirety before any investment decision is made. If there is a conflict between the terms contained in this Offering Circular and the Shareholders’ Agreement, the Shareholders’ Agreement shall prevail, and control and no Investor should rely on any reference herein to the Shareholders’ Agreement without consulting the actual underlying document.

Zummo Flight Technologies Corporation (“ZFT” or the “Company”) was organized under the laws of Arizona. Originally formed on June 6, 2014, under the name RJ Helicopter Corporation, on August 10, 2017, the Company filed an amendment to the Articles of Incorporation changing the Company name from RJ Helicopter Corporation to Zummo Flight Technologies Corporation. The Company has been exclusively conducting research and development activities regarding the Company’s Inventions and has not generated revenue as of the date of this Offering Circular. The Company expects to expand research and development operations with the intention of bringing the Company’s Inventions to market.

The Company intends to conduct research and development regarding the Company’s Inventions, marketing the Inventions to the aircraft industry, eventually integrating the Inventions into military and FAA compliant civilian aircraft. The Company has no affiliates. DLO & Associates (“DLO”) is a related Company and a Class A Shareholder of ZFT owning five thousand (5,000) Class A Shares. Furthermore, DLO’s President is Mr. David Oglesbee who also acts as the Company’s Chief Marketing Officer. The Company was founded and organized by Mr. Robert Zummo. Mr. Zummo is the Chairman of the Board and the CEO, the driving mind behind the Company’s Inventions, and Mrs. Lisa Roulette Zummo is the President of the Company. The Company currently has four (4) utility patents, issued under the United States Patent and Trademark Office (“USPTO”): (1) Recuperated gas turbine system for reaction-jet helicopters (United States Patent No. 9,145,831); (2) Reaction drive helicopter with circulation control (United States Patent No. 9,771,151); (3) Deflection cone in a reaction drive helicopter (United States Patent No. 9,849,975); and (4) Nozzles for a reaction drive blade tip with turning vanes (United States Patent No. 10,377,475). Collectively, the underlying inventions will be referred to herein as “Inventions” and the patents as “Patents”. Figures from the Patents are attached hereto as Exhibits EX1A-15A through EX1A-15D.

| Page 3 |

The Company is raising Offering Proceeds to engage in the following activities: (i) to fund the research and development of the Company’s Inventions; (ii) to progress the research and development of the Company’s Inventions for the purpose of use in rotary-winged aircraft; (iii) to conduct market research on the current market for Company designed rotary-winged aircraft and systems, or “Vertical Lift Systems”, and to tailor the development of the Company’s Inventions to the military and civilian markets; (iv) to modify, adapt, and increase patent protection for the Company’s existing Inventions and to file any additional patents for additional inventions which may arise as a result of the research, development, and testing process; (v) to design an operable military and Federal Aviation Administration compliant aircraft and KIT aircraft; and (vi) to bring the Company’s Inventions and/or aircraft designs to market for military and civilian use.

| COMPANY INFORMATION AND BUSINESS |

Zummo Flight Technologies Corporation is an Arizona corporation with a principal place of business located at 8311 E. Via de Ventura, #2082 Scottsdale, AZ 85258 Phone: 571-276-1067. Through this Offering, the Company is offering equity in the Company in the form of Class B Shares (“Shares”) on a “best efforts” and ongoing basis to qualified investors who meet the Investor Suitability Standards as set forth herein. The Company intends to raise Offering Proceeds to engage in the following activities: (i) to fund the research and development of the Company’s Inventions; (ii) to progress the research and development of the Company’s Inventions for the purpose of use in rotary-winged aircraft; (iii) to conduct market research on the current market for Company designed rotary-winged aircraft and systems, or “Vertical Lift Systems”, and to tailor the development of the Company’s Inventions to the military and civilian markets; (iv) to modify, adapt, and increase patent protection for the Company’s existing Inventions and to file any additional patents for additional inventions which may arise as a result of the research, development, and testing process; (v) to design an operable military and Federal Aviation Administration compliant aircraft and KIT aircraft; and (vi) to bring the Company’s Inventions and/or aircraft designs to market for military and civilian use. |

| Page 4 |

| MANAGEMENT | The Company is organized as a corporation, with all authority to direct the operations of the Company vested in a Board of Directors. The day-to-day management and investment decisions of the Company are vested in the Board and the Officers. As of the date for this Offering Circular, there are three (3) Directors and three (3) Officers (the “Directors” and “Officers”, respectively). |

| THE OFFERING | This Offering is the first capital raise by ZFT offered to the public. During the life of the Company, ZFT has taken on investments from friends and family of the Officers. Of this initial funding, approximately Three Million Dollars ($3,000,000) was directly funded by Mr. Robert Zummo, with the remaining approximately Two Million Dollars ($2,000,000) funded by friends and family of the Officers. The Company is exclusively selling Company equity in the form of Class B Shares through this Offering. The Company will use the Proceeds of this Offering to continue research and development operations and commence other design activities (see “Use of Proceeds” below). |

| SECURITIES BEING OFFERED |

3,750,000 Shares are being offered at a purchase price of Five Dollars ($5) per Share. The Minimum Offering Amount for any Investor is Five Hundred Dollars ($500). Therefore, an Investor must purchase at least one hundred (100) Shares. Upon purchase of Shares, a Shareholder is granted (1) no voting rights; (2) a right to receive dividends or disbursements, when the Board declares such dividends or disbursements; and (3) a voluntary option to engage in further capital calls. For a complete summary of the rights granted to Class B Shareholders, see “Description of the Securities” below. The Shares are non-transferrable except in limited circumstances, and no market is expected to form with respect to the Shares. |

| COMPENSATION OF DIRECTORS AND OFFICERS | The Board or Officers of the Company will not be compensated through commissions for the sale of the Shares through this Offering. The Directors may be reimbursed for expenses related to the execution of their duties (see “Compensation of Directors and Officers” below) |

| Page 5 |

| PRIOR EXPERIENCE OF COMPANY MANAGEMENT |

The Company has three (3) Directors, Mr. Robert Zummo, Mrs. Lisa Roulette, and Ms. Kathy McDaniel. In addition to the aforementioned Directors, the Officers of the Company include Mr. Michael Schifsky (Chief Financial Officer) and Mr. David Oglesbee (Chief Marketing Officer). All of the Directors and Officers have relevant prior experience in the aviation industry, finance industry, and/or the military. For more information please see “Prior Experience of Company Management” below. |

| INVESTOR SUITABILITY STANDARDS |

The Shares will not be sold to any person unless they are a “Qualified Purchaser”. A Qualified Purchaser includes: (1) an “Accredited Investor” as that term is defined in Rule 501(a) of Regulation D promulgated under the Securities Act of 1933 (the “Securities Act”); or (2) all other Investors who meet the investment limitations set forth in Rule 251(d)(2) (C) of Regulation A. Such persons as stated in (2) above must conform with the “Limitations on Investment Amount” as described in the section below. Each person purchasing Shares will be subject to the terms of the Shareholders’ Agreement, a copy of which is attached hereto as EX1A-3 Shareholders’ Agreement. Each person acquiring Shares may be required to represent that he, she, or it is purchasing the for his, her, or its own account for investment purposes and not with a view to resell or distribute the securities. Each prospective purchaser of Shares may be required to furnish such information or certification as the Company may require to determine whether any person or entity purchasing Shares is an Accredited Investor if such is claimed by the Investor. |

| Page 6 |

| LIMITATIONS ON INVESTMENT AMOUNT |

For Qualified Purchasers who are Accredited Investors, there is no limitation as to the amount invested through the purchase of Shares. For non-Accredited Investors, the aggregate purchase price paid to the Company for the purchase of the Shares cannot be more than Ten Percent (10%) of the greater of the purchaser’s: (1) annual income or net worth (excluding the value of the primary residence), if purchaser is a natural person; or (2) revenue or net assets for the purchaser’s most recently completed fiscal year, if purchaser is a non-natural person. Different rules apply to Accredited Investors and non-natural persons. Each Investor should review Rule 251(d)(2)(i)(C) of Regulation A before purchasing the Shares. |

| COMMISSIONS FOR SELLING SHARES |

The Shares will be offered and sold directly by the Company, Officers, and Company employees. No commissions for selling the Shares will be paid to the Company, Officers, or employees. The Company has engaged The Dalmore Group as independent managing broker-dealer receiving commissions equaling one (1%) percent of the proceeds received for the sale of Shares. The Company reserves the right to engage other broker dealers for the sale of the Shares through this Offering. |

| NO LIQUIDITY | There is no public market for the Shares, and none is expected to develop. Additionally, the Shares will be non-transferable, except as may be required by law, and will not be listed for trading on any exchange or automated quotation system. (See “Risk Factors” and “Description of the Securities” below.) The Company will not facilitate or otherwise participate in the secondary transfer of any Shares. Prospective Investors are urged to consult their own legal advisors with respect to secondary trading of the Shares. (See “Risk Factors” below.) |

| COMPANY EXPENSES | Except as otherwise provided herein, the Company shall bear all costs and expenses associated with the Offering, and the operation of the Company, including, but not limited to, the annual tax preparation of the Company's tax returns, any state and federal income tax due, accounting fees, filing fees, independent audit reports, costs associated with insurance, real estate leasing, research and development, protection of Company intellectual property, legal fees, and any other costs incurred by the Company with respect to operations. |

| Page 7 |

The SEC requires ZFT to identify risks that are specific to its business and its financial condition. The Company is still subject to all the same risks that all companies in its business, and all companies in the economy, are exposed to. These include risks relating to economic downturns, political and economic events and technological developments (such as hacking and the ability to prevent hacking). Additionally, early-stage companies are inherently riskier than more developed companies. You should consider general risks as well as specific risks when deciding whether to invest.

INVESTMENT RISKS

The Company is controlled by its Chairman/Board of Directors, and only Class A Shareholders have voting rights.

The Company’s founder, Robert Zummo, currently holds a majority of the Company’s Class A Shares of voting stock, and at the conclusion of this Offering will continue to hold a majority of the Company’s voting stock. Class B Shares do not have any voting rights. As a result, Investors in this offering of Class B Shares will not have the ability to control or influence a vote of the Shareholders.

Investor’s ability to transfer your Shares may be limited.

The Shareholders’ Agreement restricts transfers of any stock of the Company, or any interest therein to any person or entity either by gift or bequest or by mortgage, pledge, or other hypothecation, without prior written consent by Majority Vote of the Board, with the sole exception that each Shareholder may provide for the disposition of his or her Shares in a will or other testamentary device without the Board’s consent.

There is no current market for the Shares.

There is no formal marketplace for the resale of Company Shares and none is expected to arise for the foreseeable future. Investors should assume that they may not be able to liquidate their investment.

The Company may raise additional capital through equity offerings. Therefore, any ownership interest in ZFT may be diluted in the future if the Company does not raise enough funds in this fund-raising effort, ZFT may conduct another offering, and/or seek angel investors, venture capital funds, or funds from an equity partner.

The Company might not sell enough securities through this Offering to meet its operational needs. Even if the Proceeds received equal the Maximum Offering Amount, the Company may need to raise more funds in the future through additional offerings. ZFT may offer additional Shares and/or other classes of equity or debt, or other forms of securities. If equity, or a security convertible into equity, is offered in these future offerings, then Shareholders’ ownership percentages in the Company may be diluted.

| Page 8 |

Class B Shareholders do not elect or vote on the Management and do not have the ability to influence decisions regarding the business.

ZFT’s Bylaws provide that the assets, affairs and business of the Company will be managed under the direction of the Board of Directors. The Board consists of three Directors. Two of those Directors, Mr. Robert Zummo and Mrs. Lisa Roulette Zummo are permanent Directors, not subject to election by the Class A Shareholders. The Class A Shareholders may only vote on one Director seat and have only limited voting rights on matters affecting the Company’s business, and therefore limited ability to influence decisions regarding the business.

Shareholders are limited in their ability to sell their Shares pursuant to the Company’s Shareholders’ Agreement.

Each Shareholder agrees that, he or she will not sell, transfer, assign, or otherwise dispose of (either voluntarily or by operation of contract or law) any Shares of the Company, except in limited circumstances, such as death, permanent disability, removal by the Company, and insolvency, without first offering such Shares for sale to the Company at the same price and on the same terms and conditions as the selling Shareholder proposes to sell, transfer, assign, or otherwise dispose of the Shares pursuant to a bona fide offer received by the selling Shareholder, disclosing the terms and conditions of such bona fide offer and the identity of the offeror. The Company has ninety (90) days within which to accept such offer pursuant to the terms of the Shareholders’ Agreement.

The Offering price of the Company’s Shares was not established on an independent basis; the actual value of your investment may be substantially less than what Investor pays for the securities.

ZFT’s Board of Directors established the Offering price of the Company’s Shares on an arbitrary basis. The selling price of the Shares bears no relationship to the book or asset values or to any other established criteria for valuing Shares. Because the Offering price is not based upon any independent valuation, the Offering price may not be indicative of the proceeds that you would receive upon liquidation. Further, the Offering price may be significantly more than the price at which the Shares would trade if they were to be listed on an exchange or actively traded by broker-dealers.

| Page 9 |

The Company is an early stage company and has not generated any profits since inception.

Since the Company has been exclusively conducting research and development activities regarding the Company’s Inventions that are intended to create a safer and more efficient rotor craft system for use by helicopters, drones, and other flying machines (“Inventions”), and has not generated revenue as of the date of this Offering Circular, the Company may not be able to succeed as a business without additional financing. The Company has incurred losses from operations and has had negative cash flows from operating activities since its inception. Its current operating plan indicates that ZFT will continue to incur losses from operating activities given ongoing expenditures related to the development and implementation of the Inventions. Without sufficient additional funds, the Company’s ability to continue is a going concern for the next twelve months and is dependent upon the Company’s ability to raise the necessary funds from investors to meet financial obligations.

Furthermore, the Company’s anticipated plan of operations anticipates a research and development schedule of several years before the Company anticipates any revenues to be generated or profits to be made (see “Plan of Operations” below).

The Company may never have an operational product.

It is possible that a commercially operational or viable product may never be produced as a result of the Company’s research, development, and design activities regarding the Reaction Jet Drive System (“RJDS”) Technology (or the “Technology”). It is possible that the failure to release any product is the result of a change in business model due to the Board making a determination that the business model needs to be changed, or some other external factor not in the Company’s control. Even though the Board will make an effort to steer the Company towards success, ZFT cannot guarantee that any changes to the business model will be in the best interest of the Company and its Shareholders.

Developing new products and technologies entails significant risks and uncertainties, including if the Patents do not meet the Company’s projected performance goals, or if unforeseen development costs are incurred and ZFT’s cost estimates are understated.

The Company is currently in the research and development stage and has only manufactured prototypes for the Inventions. Delays or cost overruns in the development of the Technology and failure of the Inventions to meet anticipated performance estimates may be caused by, among other things, unanticipated technological hurdles, difficulties in manufacturing, changes to design, and regulatory hurdles. Any of these events could materially and adversely affect the performance success of the Technology and the results of operations.

RJDS Technology and the four-seat kit aircraft utilizing the RJDS Technology (the “KITs”) could fail to achieve the sales projections expected.

The growth projections are based on the assumptions that the Inventions for use in rotary-winged aircraft can be successfully industrialized, manufactured, sold and supported. The Company assumes that the research, development, and design process will be successful in developing strategic partnerships that will financially support the development of a safer and more efficient rotor craft system for use by helicopters, drones, and other aircraft for their application markets. It is possible that the RJDS Technology will fail to gain market acceptance for any number of reasons. If the new products fail to achieve significant sales and acceptance in the marketplace, this could materially and adversely impact the value of your investment.

| Page 10 |

The loss of one or more of ZFT’s key personnel, could harm the Company’s operations.

The Company currently depends on the continued services and performance of key members of its management team. The loss of key personnel from disability, death, or attrition could disrupt operations and have an adverse effect on the operational success of the business.

Costs may grow more quickly than the Company’s revenues, harming the business and profitability.

Delivering ZFT’s products is costly because of the upfront research and development expenses required ot bring a functional, safe, and marketable Reaction Jet Drive System to market. Furthermore, the technical and specialized nature of the Company’s designs may result in a higher demand for more specialized and skilled, and therefore more expensive, employees. The Company expects operational expenses to continue to increase in the future as the RJDS Technology expands and there is a need to hire additional employees. Projected expenses and/or the time-to-market may be greater than anticipated and any capital investments intended to make the business more efficient may not be successful. In addition, the Company may need to increase marketing, sales, and other operating expenses in order to grow and expand its operations and to remain competitive. Increases in costs may adversely affect the Company’s business and profitability.

The Company relies on third parties to provide services essential to the success of the business. Unavailability of contract engineers and technicians to support development efforts could cause disruptions in the business.

The Company relies on third parties to provide a variety of essential business functions, including testing, design, engineering, manufacturing, systems integration specialists, marketing, proposal drafting, distribution, and other partners. Quality and timeliness of parts manufacturers is critical to ZFT’s ability to build prototypes for development and internal testing.

The Company intends to use the manufacturing licensees, systems integrators, OEMs, and distributors for the manufacturing and distribution of the Company’s products. Discussions with some of those industry players are currently in the early stages. It is possible that some of these third parties will fail to perform their services or will perform them in an unacceptable manner. It is possible that the Company will experience delays, defects, errors, or other problems with their work that will materially impact operations and the Company may have little or no recourse to recover damages for these losses. A disruption in these third parties’ operations could materially and adversely affect the business. As a result, any investment could be adversely impacted by the Company’s reliance on third parties and their performance.

Commercialization risk if the KITs project is not competitive, or if ZFT fails to meet market entry objectives, or if Government bids are rejected.

ZFT will be developing and designing the RJDS Technology with the expectation such Technology will be a safer and more efficient alternative for use in rotary-winged aircraft. Additionally, ZFT will use the Proceeds of this Offering to design the KITs for direct sale to the worldwide civil aviation market. (see “Narrative of the Business”) ZFT has no intention to conduct all necessary processes for execution of this strategy internally. Therefore the current business model relies on strategic partners to 1) assist in development and design of the Technology by either funding a portion of development and design, or investing in-kind resources to assist in the development; 2) to distribute the KITs to market; (3) to conduct market research and to draft bid proposals to private and public persons; or (4) manufacturing of any prototype parts. If the strategic partners do not take on this capital-intensive initiative, the Company may require significant additional financing to bring the RJDS Technology to market.

The Company depends on large industrial partners.

The Company’s strategy is based on providing technology and manufacturing licenses to established service companies that can design, manufacture, distribute, or otherwise integrate RJDS Technology into existing systems or easily adapted systems. The Company may not be able to consummate such strategic partnering agreements with supply chain and go-to-market partners, which could seriously limit or delay the projected revenue growth and profitability.

The Company’s business, including costs and supply chain, is subject to risks associated with sourcing and manufacturing.

In the event of a significant disruption in the supply of the raw materials used in the manufacture of the products, ZFT and our strategic partners might not be able to locate alternative suppliers of materials of comparable quality at an acceptable price. ;

| Page 11 |

RISKS RELATED TO INTELLECTUAL PROPERTY AND GOVERNMENT REGULATION ;

ZFT has existing Patents that the Company might not be able to protect.

The Company's most valuable asset is its intellectual property. ZFT holds four (4) United States utility patents. It is possible that competitors may attempt to misappropriate or violate intellectual property rights owned by the Company. The Company intends to protect its intellectual property portfolio from such violations, within the constraints of available resources. It is important to note that unforeseeable costs associated with such practices may consume a significant portion of capital, which could negatively affect ZFT’s research and development efforts and business, in general. However, the Company has anticipated the possible need to protect its Patents from infringement and therefore has allocated Proceeds from this Offering to account for this potential event. (see section titled “Use of Proceeds” below)

The ability to sell the products is subject to United States and international government regulations, which are subject to change at any time.

The Company’s products will be subject to regulation by the Federal Aviation Administration (the “FAA”) and equivalent agencies in other countries. For aviation there will be performance, reliability, and safety certification requirements that the products must meet in order to be used by systems integrators and operators for those applications. Generally speaking, the KITs are not required to be FAA certified, however they are still subject to FAA regulation.

The ability to sell products for specific applications is or may become dependent on favorable government regulation, such as regulations enforced by agencies like and including the State Department, the Department of Commerce and other relevant government laws and regulations, especially concerning exports of certain product which may have military applications, subject to International Traffic in Arms Regulation (“ITAR”) and scrutiny by the Department of State. The laws and regulations concerning the selling and use of RJDS Technology may be subject to change. At such point the Company may no longer be able to or want to sell RJDS Technology into selected markets and an investment in the Company may be negatively affected.

| Page 12 |

RISKS RELATED TO EMPLOYEE BENEFIT PLANS AND INDIVIDUAL RETIREMENT ACCOUNTS

In some cases, if you fail to meet the fiduciary and other standards under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), the Code or common law as a result of an investment in the Company’s Shares, you could be subject to liability for losses as well as civil penalties.

There are special considerations that apply to investing in the Company’s Shares on behalf of pension, profit sharing or 401(k) plans, health or welfare plans, individual retirement accounts or Keogh plans. If you are investing the assets of any of the entities identified in the prior sentence in the Company’s Shares, you should satisfy yourself that:

- Your investment is consistent with your fiduciary obligations under applicable law, including common law, ERISA and the Code;

- Your investment is made in accordance with the documents and instruments governing the trust, plan or IRA, including a plan’s investment policy;

- Your investment satisfies the prudence and diversification requirements of Sections 404(a)(1)(B) ;and 404(a)(1)(C) ;of ERISA, if applicable, and other applicable provisions of ERISA and the Code;

- Your investment will not impair the liquidity of the trust, plan or IRA;

- Your investment will not produce “unrelated business taxable income” for the plan or IRA;

- You will be able to value the assets of the plan annually in accordance with ERISA requirements and applicable provisions of the applicable trust, plan or IRA document and

- Your investment will not constitute a prohibited transaction under Section 406 of ERISA or Section 4975 of the Code.

Failure to satisfy the fiduciary standards of conduct and other applicable requirements of ERISA, the Code, or other applicable statutory or common law may result in the imposition of civil penalties and can subject the fiduciary to liability for any resulting losses as well as equitable remedies. In addition, if an investment in the Company’s Shares constitutes a prohibited transaction under the Code, the “disqualified person” that engaged in the transaction may be subject to the imposition of excise taxes with respect to the amount invested.

| Page 13 |

FORWARD LOOKING STATEMENTS

Investors should not rely on forward-looking statements because they are inherently uncertain. Investors should not rely on forward-looking statements in this Offering Circular. This Offering Circular contains forward-looking statements that involve risks and uncertainties. The use of words such as “anticipated”, “projected”, “forecasted”, “estimated”, “prospective”, “believes”, “expects,” “plans”, “future”, “intends”, “should”, “can”, “could”, “might”, “potential,” “continue”, “may”, “will”, and similar expressions identifying these forward-looking statements. Investors should not place undue reliance on these forward-looking statements, which may apply only as of the date of this Offering Circular.

There have not been transfers or sales of the Company’s Shares within the past year to Directors, Officers, or affiliated persons.

TERMS OF THE OFFERING

This Offering will be made to Investors through general solicitation, direct solicitation, and marketing efforts. In addition to direct sales of the securities by the Directors, Officers, and employees of the Company, the Company has chosen to also sell the Shares through the services of one independent broker-dealer is a member of the Financial Industry Regulatory Authority.

At the time of this Offering Circular, the Company has engaged The Dalmore Group (“Dalmore” or “Managing Broker Dealer”) as independent managing broker-dealers to help in the sale of the Shares. The Company reserves the right to engage additional FINRA member broker-dealers at any point from the date of this Offering Circular to the termination of the Offering (assuming the offering is qualified by the SEC).

The Directors, Officers, and employees of the Company will not receive any commission or any other remuneration for these sales. In offering the Shares on behalf of the Company, the Directors, Officers, and employees of the Company will rely on the safe harbor from broker-dealer registration set forth in Rule 3a4-1 under the Securities Exchange Act of 1934, as amended.

The Company believes that the Directors, Officers, and employees of the Company are Associated persons of the Company not deemed to be brokers under Exchange Act Rule 3a4-1 because: (1) no Director, Officer, or employee is subject to a statutory disqualification, as that term is defined in section 3(a)(39) of the Exchange Act at the time of their participation; (2) no Director, Officer, or employee will be compensated in connection with his participation by the payment of commissions or by other remuneration based either directly or indirectly on transactions in connection with the sale of securities through this Offering; (3) no Director, Officer, or employee is an associated person of a broker or dealer; (4) all Directors, Officers, or employees primarily performs substantial duties for the Company other than the sale or promotion of securities; (5) no Director, Officer, or employee has been a broker or dealer within the preceding twelve months of the date of this Offering Circular; (6) no Director, Officer, or employee participates in selling an offering for securities more than twelve months from the date of this Offering Circular.

The Company will use Dalmore as its managing broker dealer for the sale of the Shares. Dalmore will charge Company a 1% percent commission fee for its services on all aggregate sales of the Shares. This does not include flat fees charged by Dalmore

Notwithstanding the foregoing, the amount and nature of commissions payable to broker-dealers is expected to vary if the Company engages broker dealers in addition to Dalmore. The Investor who is admitted to the Company through a broker-dealer(s) will not be responsible for commissions payable to the broker-dealer(s).

The Minimum Investment Amount is Four Hundred Dollars ($500.00) and the Maximum Offering Amount is Eighteen Million Seven Hundred Fifty Thousand Dollars ($18,750,000), subject to an increase of the Maximum Offering Amount through a qualification by the SEC of a post-qualification amendment.

As of the date of this Offering Circular, the Company has engaged KoreConX Inc. as the Company’s SEC-registered transfer agent and registrar of the Shares. The Shares are available for purchase exclusively through KoreConX Inc. and will be issued in book-entry electronic form only.

| Page 14 |

There are no selling security holders in this Offering.

The Company intends to raise Offering Proceeds to engage in the following activities: (i) to fund the research and development of the Company’s Inventions; (ii) to progress the research and development of the Company’s Inventions for the purpose of use in rotary-winged aircraft; (iii) to conduct market research on the current market for Company designed rotary-winged aircraft and systems, or “Vertical Lift Systems”, and to tailor the development of the Company’s Inventions to the military and civilian markets; (iv) to modify, adapt, and increase patent protection for the Company’s existing Inventions and to file any additional patents for additional inventions which may arise as a result of the research, development, and testing process; (v) to design an operable military and Federal Aviation Administration compliant aircraft and KIT aircraft; and (vi) to bring the Company’s Inventions and/or aircraft designs to market for military and civilian use. The Gross Proceeds less any Offering expenses (the “Net Proceeds” or “Net Deployable Proceeds”) from this Offering will not be used to compensate or otherwise make payments to Directors, Officers, or employees of the Company, unless and to the extent it is as otherwise stated below.

| Maximum Offering Amount | Percentage of Proceeds (approximations) | |

| Gross Offering Proceeds | $18,750,000 | 100% |

| Estimated Commissions [1] | $187,500 | 1% |

| Initial Offering Expenses [2] | $200,000 | 1% |

| Net Deployable Proceeds [3] | $18,362,500 | 98% |

[1] Shares will be offered and sold directly by the Company, the Directors, the Officers, and employees. No commissions for selling Shares will be paid to the Company, the Directors, the Officers, or employees. The Company will use Dalmore as its managing broker dealer for the sale of the Shares. Dalmore will charge Company a 1% percent commission fee for its services on all aggregate sales of the Shares. This does not include flat fees charged by Dalmore.

[2] The initial expenses associated with this Offering, including legal and accounting expenses, will be paid by the Company using the Proceeds. Notwithstanding the foregoing, the Company intends to reimburse the Board, any Director, or any Officer (whoever the payor is) for any organization and Offering costs and expenses incurred on behalf of the Company, which are approximately Two Hundred Thousand Dollars ($200,000).

[3] Net Deployable Proceeds to the Company only reflect an approximation of the deduction of organization and offering expenses that may be reimbursed. Any expenses associated with the Shares, and/or other investments of the Company shall be paid by the Company in accordance with the terms set forth herein and in the Shareholders’ Agreement.

| Page 15 |

Use of Proceeds

After estimated total Offering expenses, the Company expects to have Net Proceeds to equal to $18,550,000. The following is an approximation of how the Company expects to deploy the Proceeds from this Offering:

| Purpose of Use | Anticipated Amount of Proceeds |

| (1) RJDS Technology Evaluation and Testing | $2,000,000 |

| (2) New Patents/Claims Prosecution | $812,500 |

| (3) Preliminary Design Process | $5,000,000 |

| (4) Market Research, Proposal Preparation | $1,000,000 |

| (5) Design, Develop and flight test a four-seat heli/the KITs | $5,000,000 |

| (6) General corporate and business expenses | $3,850,000 |

| (7) Design and Manufacture of Models for Heli Drones | $700,000 |

| Total | $18,362,500 |

| Page 16 |

(1) Approximately Two Million Dollars ($2,000,000) will be deployed to research and development activities regarding the Company’s existing Inventions and Patents that are integrated into the RJDS Technology design as it exists as of the date of this Offering Circular.

The existing Inventions and Patents will be reviewed to identify key technology drivers for further testing and development. The Company has already negotiated a strategic partnership with Embry-Riddle Aeronautical University (see “Strategic Partnerships” below) (hereinafter “Embry”). Estimation of the costs required for Stage 1 research, development, and design is derived by the Company’s key personnel’s collective experience in aerospace design, specifically in the vertical lift business. This includes taking design concepts to full-scale manufacturing and flight testing. (See section titled, “Directors, Officers, Significant Expert Consultants” below).

(2) Approximately Eight Hundred Twelve Thousand Five Hundred ($812,500) will be reserved and deployed for new patent or claim prosecution and/or defense against infringement by competing technologies or companies.

The Company anticipates that increasing research and development activities for the Company’s current Patents will lead to the discovery of additional patentable inventions and/or patentable claims. The Company anticipates that the filing and prosecution process for any of these additional patents and/or claims to cost approximately Eight Hundred Twelve Thousand Five Hundred ($812,500). Furthermore, the Company has allocated this part of the Net Proceeds for the defense of the Company’s Patents against any infringing inventions from competitors.

(3) Approximately Five Million Dollars ($5,000,000) is reserved for Preliminary Design of the Inventions for Functional Use in Aircraft

The Company anticipates approximately Five Million Dollars ($5,000,000) of the Net Proceeds to be used for the preliminary design process.

“Preliminary Design” refers to the process whereby the Company takes the collected test data and findings as applied to the conceptual designs to begin designing a functional prototype of integral parts to the RJDS Technology. Because the Inventions are so interconnected and dependent on each other, the Preliminary Design process will necessarily involve the integration of the RJDS Technology into a functional aircraft.

It will be necessary for the Company to purchase third-party parts to ensure the conceptual design is sufficient as applied. To do so, the Company will require the purchase of a power-plant system (an engine) and a recuperator. A recuperator heats the compressed air before combustion thereby reducing the amount of fuel need to heat the exhaust stream and spin the power turbine. (See “Description of the Business” below)

(4) Market Research, Proposal Preparation for DOD and DARPA One Million Dollars ($1,000,000)

Approximately One Million Dollars ($1,000,000) of the Net Proceeds are anticipated to be used to perform marketing activities, market research, and proposal preparation. The market research will focus the Company’s activities and design decisions to match the goals and objectives of potential customers, both military and civilian. Specifically, the Company intends to use existing contacts with Original Equipment Manufacturers (“OEMs”), the Department of Defense, and DARPA to determine the interest in the market for the RJDS Technology. The Company then intends to draft and submit several design and development proposals for DARPA and the

Department of Defense, both manned and un-manned applications of the Inventions for the military and/or civilian markets. (See “Description of the Business” below.)

| Page 17 |

(5) Design, Develop and flight test a four-seat helicopter/the KITs Five Million Dollars ($5,000,000)

Approximately Five Million Dollars ($5,000,000) of the Proceeds are anticipated to be used to design and develop a functional and reliable four-seat helicopter/the KITs. The goal is to integrate all testing results, design decisions, and market research into functional deliverable parts ready for sale in the civilian marketplace as a four-seat helicopter/the KITs aircraft. The Company will only internally manufacture enough parts using the Proceeds to ensure that prototype helicopters and the KITs are functional and safe for sale. The Proceeds will not be used to expand manufacturing capabilities to meet demand. The Company intends to use third party manufacturers to meet production demand. (See “Description of the Business” below.)

(6) General Corporate and Business Expenses Three Million Eight Hundred and Fifty Thousand Dollars ($3,850,000)

The Company intends to keep Three Million Eight Hundred and Fifty Thousand Dollars ($3,850,000) as cash reserves for administration and operations of the Company. These Proceeds will also be used cover any underestimates in the use of the Proceeds as described above. The Company will pay employee, Director, and Officer salaries from this allocation and may use these Proceeds to pay for any third-party service fees.

(7) Design and Manufacture of UAV Models Seven Hundred Thousand Dollars ($700,000)

Part of the marketing efforts for the Company in bringing and exposing the RJDS Technology to the applicable markets includes the use of scale or actual-size models for the unmanned aerial vehicle designs (“UAVs” or “Drones”). These models will be used to provide proof of the operational potential to potential customers of RJDS Technology and RJDS-integrated aircraft. The Company anticipates approximately Seven Hundred Thousand Dollars ($700,000) of the Net Proceeds will be used to design, develop, and manufacture these UAVs.

The foregoing represents the Company’s best estimate of the allocation of the Proceeds of this Offering based on planned Use of Proceeds for the Company’s operations and current objectives. The Company will not raise funds from other sources in order to achieve its investments, except the possible use of leverage from third party, trusted lenders. Notwithstanding the foregoing, the Company may borrow money from financiers, other lenders, or banks to fund its investments, who are not identified at this moment, as the Company does not have any agreements with any financers, lender, nor banks from which to borrow money.

A substantial portion of the Proceeds from the Offering have not been allocated for a particular purpose or purposes other than as is described above. The Company anticipates approximately Ninety-Eight Percent (98%) of the Offering Proceeds will be used to the intended uses as described above and in the Plan of Operations.

| Page 18 |

This Offering is being made on a “best efforts” basis. If the Maximum Offering Amount is not reached within twelve (12) months of the start of the Offering, the intended use of Proceeds will not change. In the case where the maximum loan amount is not reached, the Proceeds will not be able to conduct as many of the anticipated activities; however, the Proceeds will be used in the following manners:

| Percentage of Proceeds | 100% | 75% | 50% | 25% |

| Gross Proceeds | $18,750,000 | $14,062,500 | $9,375,000 | $4,687,500 |

| Offering Expenses | $200,000 | $200,000 | $200,000 | $200,000 |

| Commissions | $187,500 | $140,625 | $93,750 | $46,875 |

| Net Deployable Proceeds | $18,362,500 | $13,721,875 | $9,081,250 | $4,440,625 |

| RJDS Technology Evaluation and Testing | $2,000,000 | $2,000,000 | $2,000,000 | $1,000,000 |

| New Patents/Claims Prosecution | $812,500 | $859,375 | $406,250 | $453,125 |

| Preliminary Design Process | $5,000,000 | $2,000,000 | $1,000,000 | $1,000,000 |

| Market Research, Proposal Preparation | $1,000,000 | $1,000,000 | $500,000 | $500,000 |

| Design, Develop and flight test a 4 seat KIT Heli | $5,000,000 | $3,312,500 | $3,000,000 | $500,000 |

| General corporate and business expenses | $3,850,000 | $3,850,000 | $1,475,000 | $987,500 |

| Design and Manufacture of Models for Heli Drones | $700,000 | $700,000 | $700,000 | $0 |

| Total Net Proceeds | $18,362,500 | $13,721,875 | $9,081,250 | $4,440,625 |

The Company hereby reserves the right to change the anticipated or intended Use of Proceeds of this Offering as described in this Section and as described elsewhere within this Offering Circular.

| Page 19 |

SUMMARY

Zummo Flight Technologies Corporation. is a research and development company specializing in performance and safety of rotary-wing aircraft (“RWA”) which includes helicopters and Drones. The Company invented and patented the Reaction Jet Drive System which eliminates the need for a tail-rotor, transmission and other moving parts typically found in a conventional RWA. ZFT anticipates that the final design of the RJDS Technology (as integrated into an aircraft) will have significant advantages over traditional helicopters. The Company currently holds four (4) utility patents with the United States Patent and Trademark Office (USPTO) covering the Inventions integral to the RJDS Technology. ; The Company is looking to use the Proceeds from this Offering to further develop the RJDS Technology and to prove its safety, efficiency and effectiveness, as well as to market the Inventions to potential buyers.

The Company intends to use the Proceeds to engage in the following activities: (i) to fund the research and development of the Company’s Inventions; (ii) to progress the research and development of the Company’s Inventions for the purpose of use in rotary-winged aircraft; (iii) to conduct market research on the current market for Company designed rotary-winged aircraft and systems, or “Vertical Lift Systems”, and to tailor the development of the Company’s Inventions to the military and civilian markets; (iv) to modify, adapt, and increase patent protection for the Company’s existing Inventions and to file any additional patents for additional inventions which may arise as a result of the research, development, and testing process; (v) to design an operable military and Federal Aviation Administration compliant aircraft and KIT aircraft; and (vi) to bring the Company’s Inventions and/or aircraft designs to market for military and civilian use.

History of the Business

ZFT was organized under the laws of Arizona. Originally formed on June 6, 2014 under the name RJ Helicopter Corporation, on August 10, 2017 the Company filed an amendment to the Articles of Incorporation changing the Company name from to Zummo Flight Technologies Corporation (see Exhibit EX1A-2A). Since inception, the Company has been exclusively conducting research and development activities regarding the Company’s Patents and has not generated revenue as of the date of this Offering Circular.

The Company intends to further develop the Inventions through various testing stages in order to market the Inventions to the aircraft industry, eventually integrating the inventions into military and FAA compliant civilian aircraft. The Company has no affiliates. The Company was founded and organized by Mr. Robert Zummo. Mr. Zummo is the Chairman of the Board, and the driving mind behind the Company’s mission to dramatically improve safety and efficiency of rotor-wing flight.

Prior to the incorporation of the Company, Mr. Robert Zummo was developing the ideas and core designs fundamental to RJDS. Since its creation, Mr. Zummo has directed the Company’s efforts to the development of the Inventions to prove the functionality of the concepts. To date, the Company has designed, developed, and extensively tested three experimental RJDS-integrated aircraft prototypes: one for ground testing only, and two for flight tests, which were approved by

the FAA via airworthiness certificates. None of the test aircraft are currently in operation due to FAA flight-hour restrictions on experimental aircraft. All ground and flight-tests conclusively showed that a RJDS-integrated aircraft is both viable and may potentially provide many significant advantages over conventional helicopters.

The Company intends to use the Proceeds of this Offering to further develop a Reaction Jet Drive System (and the underlying Inventions) as well as RJDS-integrated aircraft, in order to provide a functional and safe alternative rotary-wing aircraft that is also highly marketable.

| Page 20 |

Reaction Jet Drive System Synopsis

A Reaction Jet Drive System uses high-pressure air ducted through the rotor system to the main rotor blades. Also known as a pressure-jet, reaction jet drive has successfully been used in the past to provide rotor power for helicopters. In the RJDS, the compressed air passes through the length of each rotor blade to the tip of the blade. At the tip, the air is turned to exit the main rotor blade, acting as a jet and spinning the rotor blades. By using ducted air to spin the rotor system, the main rotor transmission and main rotor drive shaft become redundant and are not used. This process can conserve as much as 400 to 500 pounds of weight on a rotary Drone or helicopter significantly reducing the cost of maintenance and down-time.

Conventional Helicopter vs. ZFT RJDS

In a conventional helicopter, the main rotor is driven by an engine through a rotor transmission; whereas in a reaction-drive system, the main rotor is driven by pumping highly-pressurized air through hollow blades until the air exits the tip of the blade. The differential air pressure from the tip of the blades causes the rotor to spin. This design eliminates the need for a rotor transmission in a RJDS. Eliminating the conventional transmission solves multiple problems, including cost and downtime associated with maintaining complex systems, in addition to removing a significant amount of weight from the aircraft. Furthermore, elimination of the transmission allows the system to become significantly lighter, allowing for more cargo (freight or passengers) compared to a conventional helicopter.

ZFT intends to utilize all its Patents which will significantly increase fuel efficiency, range, and payload of RJDS-integrated aircraft. Given the early test results from prototype testing, the Company anticipates that RJDS-integrated aircraft may achieve twice the range of conventional helicopters upon full development of the Technology.

The Company will the refine the design RJDS Technology to address major safety issues caused by torque in conventional helicopters. In conventional helicopters, the main rotor is driven by an engine through a transmission into the main rotor causing the main rotor to rotate. The power transfer system through the transmission creates rotational torque on the fuselage. To counteract this rotational torque, a tail rotor is required to act as an anti-torque device. The rotational torque, coupled with an anti-torque device, compromises a pilot’s ability to maintain consistent directional control. Throughout their history, tail rotors have proven to be extremely dangerous and difficult to control, even by the most experienced of helicopter pilots.

| Page 21 |

Competing Technology

Several inventions have been created and tested to which attempt to solve safety issues concerning the tail rotor as well as providing the anti-torque function. The most notable of these is the NOTAR (short for “no-tail rotor”) system was developed as an alternative anti-torque device. The NOTAR system utilizes a fan mounted in close proximity to the transmission and is also driven by the transmission. As a result, the continued utilization of a transmission in NOTAR does not alleviate the need for an anti-torque device. RJDS-integrated aircraft do not require a transmission, therefore there is no requirement for an anti-torque device.

The NOTAR fan blows high-pressure air down a slotted tail boom. The slot along the length of the tail boom releases highly-pressurized air, causing a pressure differential, in order to create a lifting surface out of the tail boom itself. This method provides some degree of anti-torque; however, most of the directional anti-torque control in NOTAR is provided by the rotating thrust nozzle at the end of the tail boom. In order for a NOTAR system to function properly, a pilot must control the direction the nozzle points by pushing on directional anti-torque pedals. This does not alleviate the degree of pilot demand required and still requires the pilot to manage directional control in an already complex system.

NOTAR has never achieved widespread acceptance in the market due to the complexity of the system and the relatively few advantages it provides over a traditional tail rotor.

In contrast to NOTAR and a traditional tail rotor, RJDS drives the main rotor by pumping highly-pressurized air through hollow blades, and finally out through the blade ends. This process causes main rotor rotation, but does not result in torque on the helicopter fuselage due to the removal of the transmission. This removes the necessity for an anti-torque device such as a tail-rotor. Directional control in hover and forward flight in RJDS is achieved when the turbine exhaust passes over the rudder, controlled easily by the pilot’s foot pedals, allowing the reaction jet to maintain directional control without a tail rotor.

| Page 22 |

Brief Description of the Patented Inventions

The Company currently owns four (4) utility patents, issued under the United States Patent and Trademark Office (“USPTO”):

Patent 1: Recuperated gas turbine system for reaction-jet helicopters (United States Patent No. 9,145,831)

This invention is a reaction-jet helicopter with a recuperator encompassing all of the other Inventions. Hot gas exiting the recuperator is directed to the helicopter's hollow-body rotor blades to increase the energy of the air exiting the jets and thus increase thrust and improve fuel efficiency. Hot gas exiting the recuperator may also be directed to the gas turbine of the helicopter's engine, further increasing fuel efficiency. A splitter valve on the exit side of the recuperator may be employed to direct exiting gas to the turbine or rotor blades or both. The recuperator includes a heat exchanger, preferably an all-prime surface heat exchanger. The recuperator system may be combined with a circulation control system on the hollow-body rotor blades to further increase fuel efficiency

Abstract: Hot gas exiting the recuperator is directed to the helicopter's hollow-body rotor blades to increase the energy of the air exiting the jets and thus increase thrust and improve fuel efficiency. Hot gas exiting the recuperator may also be directed to the gas turbine of the helicopter's engine, further increasing fuel efficiency. A splitter valve on the exit side of the recuperator may be employed to direct exiting gas for one or more desired uses. The recuperator includes a heat exchanger, preferably an all-prime surface heat exchanger. The recuperator system may be combined with a circulation control system on the hollow-body rotor blades to further increase fuel efficiency.

For drawings please see Exhibit EX1A-15A.

| Page 23 |

Patent 2: Reaction drive helicopter with circulation control (United States Patent No. 9,771,151)

In the field of aeronautics, circulation control is an approach used to modify an airfoil's aerodynamic forces using a specially-shaped trailing edge, rather than moving surfaces such as flaps. The main purpose of circulation control is to increase the lifting force of the airfoil when large lifting forces at low speeds are required, like during takeoff and landing. Circulation control airfoils take advantage of the Coanda effect, which increases lift through the interaction of an air jet flowing through a slot in the trailing edge of the airfoil and a free air stream moving over the airfoil's upper surface as the airfoil moves through the air. A jet of air flows out of the slot and

follows the curvature of a highly-curved lower surface of the airfoil. The jet of air from the slot entrains the free air stream moving over the airfoil to create a laminar flow around the curvature, creating lift. Briefly, to achieve the desired objects and advantages of the instant invention, provided is a rotor blade for a reaction drive type helicopter. The rotor blade includes a proximal end couplable to a rotor hub, a distal end terminating in a blade tip, and a trailing edge extending from the proximal end to the distal end.

Abstract: The rotor blade includes a main duct extending from a proximal end, couplable to and for fluid communication with a rotor hub, to a distal end for ducting a first air/gas stream from the rotor hub to the distal end. A nozzle is attached to an outlet of the main duct at the distal end for receiving the first air/gas stream from the main duct and releasing the first air/gas stream to propel the rotor blade. A circulation control is carried at a trailing edge of the blade. A trailing edge duct is carried intermediate the trailing edge and the main duct and is in fluid communication with the main duct by a partition with a plurality of orifices formed therein to bleed air from the main duct and generate a second air/gas stream therein with a pressure less than the pressure of the first air/gas stream. The trailing edge duct supplies the second air/gas stream to the circulation control.

For drawings please see Exhibit EX1A-15B

Patent 3: Deflection cone in a reaction drive helicopter (United States Patent No. 9,849,975)

Abstract: A rotor hub for a reaction drive type helicopter includes a cylindrical sidewall having a top and an open bottom which defines an interior volume. A top plate closes the top of the cylindrical sidewall, and at least two pipe sections extend outwardly from the cylindrical sidewall. Each pipe section extends through the sidewall in communication with the interior volume. A horizontal vane is carried in an inlet of the pipe section and extends horizontally across the inlet. A three-dimensional body extends downwardly from a central axis of the top plate into the interior volume.

For drawings please see Exhibit EX1A-15C

Patent 4: Nozzles for a reaction drive blade tip with turning vanes (United States Patent No. 10,377,475)

The objective of this invention is to reduce the energy losses incurred by the air/gasses being transmitted through the blade to the nozzle at the blade tip. Another objective of the present invention is to produce a jet that is a tangent to the described rotor tip circle. Briefly, to achieve the desired objectives and advantages of the instant invention, a nozzle is provided for use with a rotor blade for a reaction drive type helicopter.

Abstract: A nozzle for use with a rotor blade for a reaction drive type helicopter includes a first wall, a second wall opposing the first wall, and sidewalls extending between the first wall and the second wall enclosing a cavity having an upstream end and a downstream end. The nozzle includes an inlet section for receiving a gas-flow at the upstream end. The distance between the first wall and the second wall reduces to a throat downstream of the inlet section, an expansion section extending from the throat, downstream thereof.

Collectively, the underlying inventions will be referred to herein as “Inventions” and the patents as “Patents”.

For drawings please see Exhibit EX1A-15D

| Page 24 |

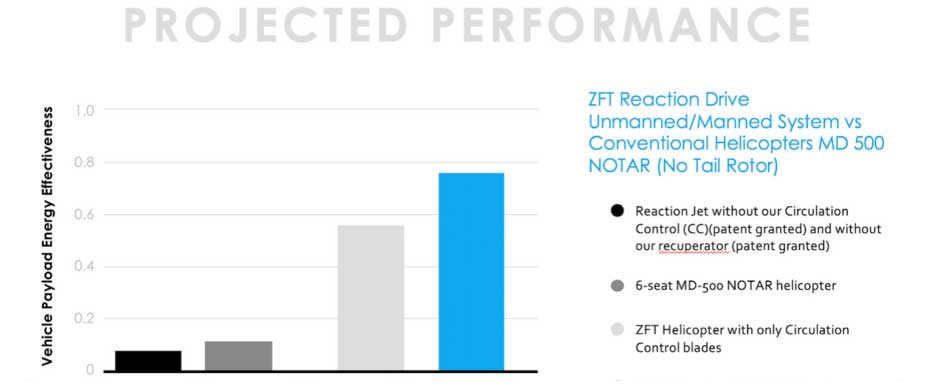

RJDS Technology vs. Conventional Helicopters

RJDS Technology has several advantages to conventional tail-rotor helicopters. Preliminary testing of the prototypes indicates that RJDS Technology may allow for RJDS-integrated rotary-winged aircraft to compete with turbo-prop fixed wing aircraft in both maximum range and speed, with an increased load capacity. A helicopter utilizing RJDS Technology has the following advantages:

1. Reduced demands on the pilot: The elimination of transmission-caused rotational torque and related operational instabilities reduces the necessary degree of pilot skill and attention for effective and safe operation. Additionally, high inertia rotor in ZFT’s RJDS Technology allows for easier, safer descents from altitude.

2. Elimination of drive train failure: Absence of the entire mechanical drive train including transmissions, gear boxes, drive shafts, clutch and disengage systems, eliminates all the risks deriving from accidents caused by failure of any of these components.

3. Elimination of tail rotor accidents: ZFT’s RJDS Technology requires no tail rotor, eliminating the risk of tail rotor dangers and accidents.

4. Increased Stability: Without the need for a transmission, the Company’s testing has shown a marked increase in gyroscopic stability in RJDS-integrated aircraft. There is also a significant degree of vibration reduction in RJDS-integrated aircraft.

5. Mechanical Simplicity: is significantly increased for aircraft integrated with ZFT’s RJDS Technology because there is no need for a transmission, drive train, or tail rotor. This results in an aircraft with approximately half the parts of a conventional helicopter.

6. Ease of Maintenance/Lower Costs: A conventional helicopter has many critical parts to maintain, repair, overhaul, or replace, requiring a high degree of expertise by ground personnel. RJDS Technology is inherently simpler, with fewer parts to maintain, repair, overhaul and replace. The Company anticipates a reduction in maintenance hours for RJDS-integrated aircraft, resulting in a significant decrease in costs of labor and parts.

7. Ease of Operation: By simplifying the mechanics of rotary-wing aircraft, the ease of operation for a pilot during flight is increased with aircraft integrated with RJDS Technology. Because less pilot skill is required for safe operation, the Company anticipates that pilot-error will be reduced. The Company compares the ease of operating an aircraft integrated with the Technology to a six-speed manual shift automobile. In turn, The Company anticipates the Technology may open new markets through the widening of the potential customer base, especially in the civilian aircraft market. The Company expects that the RJDS Technology could be so disruptive to the rotor-craft industry that it will create a substantial new market. Company studies indicate that 10% of the population currently has the skill level to fly a conventional helicopter. However, with the simplicity of RJDS Technology, the Company anticipates that 70% of the population currently has the skill levels to fly aircraft integrated with RJDS Technology.

| Page 25 |

8. Mechanical Safety: The Company’s Technology is anticipated to be safer due to the very nature of the simplified mechanics and operational physics. An aircraft integrated with the Technology has inherently safer auto-rotational descent upon an engine failure. It is estimated that ZFT’s RJDS Technology will have substantially less of a landing danger zone due to its inherent auto-rotation capability compared to conventional helicopters.

9. Noise Reduction: Aircraft integrated with the Technology have a significantly reduced noise signature because of the manner of propelling the rotor blades, both within the fuselage and outside the aircraft. Furthermore, there is no “rotor-slapping” effect during powered flight.

Marketing and Distribution for Company Products

Market for the Reaction Jet Drive Technology

The principal target markets for the RJDS Technology are Government Agency/Military/Aerospace Industry and Commercial. Government Agency/Military/Aerospace Industry target markets and potential missions include transport, reconnaissance, maritime surveillance and combat. Commercial markets include transport, medical services, search & rescue, offshore sector (including oil & gas) and corporate/leisure.

One significant anticipated Use of the Proceeds is derived, essentially, from marketing and distribution activities (see Section “Use of Proceeds” above). Specifically, the company will be using a portion of the Proceeds to (1) conduct market research; and (2) draft and submit proposals to governmental agencies and aerospace OEMs.

Government Agency/Military/Aerospace Industry

The Company will develop the RJDS Technology for use in both manned and un-manned aircraft.

Governments and military from around the world are calling for immediate solutions to the safety concerns with conventional helicopter technology. The aerospace industry is in a race to innovate based on increased demand for safety, simplicity and cost reduction.

Since traditional helicopter technology is rooted in highly complex systems that must work simultaneously in a cooperative and delicate manner, many OEM’s are searching for solutions that address traditional safety concerns, simplified technology, and lower costs for helicopters. The current OEM economic model is largely based on this technical complexity, with ongoing maintenance and replacement parts being critical to the OEM’s financial success. Through ZFT’s RJDS Technology, the Company hopes to address all of the military’s and OEM’s requisites for greater simplicity by providing a simpler rotary-wing alternative.

| Page 26 |

With manned applications, the Company anticipates the RJDS Technology may be applied in combat mission aircraft, convertible to other operational missions, deriving from the advantages an aircraft with RJDS Technology has over conventional helicopters. (see Section “RJDS Technology vs. Conventional Helicopters” above).

The Company’s management team has extensive contacts within relevant government agencies and aerospace industry OEMs. Discussions with persons within various United States federal government agencies have shown a high interest level in the Technology.

The Company intends to leverage these contacts and relationships to generate interest and potential customers within these potential buyer organizations.

Civil/Commercial Aviation

After conducting extensive market research, The Company intends to design a four-seat FAA compliant helicopter with the Technology for use in various applications including transport, medical services search & rescue, offshore transport (including oil & gas) and corporate/leisure transport. The design will be marketed to OEM’s and smaller manufacturers who are interested in licensing the RJDS Technology for manufacture.

The Company also intends to develop a four-seat kit aircraft utilizing the RJDS Technology minus circulation controls. Company sales of the KITs has a large potential upside due to the systems inherent simplicity which makes it affordable and easy to assemble and operate for a licensed private pilot or enthusiast.

The Company does not intend to manufacture or distribute the KITs. Instead the Company anticipates and plans to strategically partner with an aeronautical manufacturer. Though ZFT already had preliminary discussions with one such manufacturer, no agreements have been made as of the date of this Offering Circular. The Company intends to contract with such an aeronautical manufacturer in order to license the KITs design (as distinguished from any such manufacturing license for the four-seat helicopter design).

Company management is deeply rooted in and has many contacts within the aviation industry, including manufacturers and distributors in the United States, Canada), the United Kingdom, Brazil, Denmark, Germany, Italy, South Africa, and Australia. The Company will leverage these contacts to promote and market manufacturing licenses and the KITs. The Directors, Officers, and other associated persons are currently members and educators with at least 14 national and international trade groups and associations.

License or Sale of the Company’s Assets