Form 1-A POS Atlis Motor Vehicles

1-A POS LIVE 0001722969 XXXXXXXX 024-11714 true Atlis Motor Vehicles DE 2016 0001722969 3711 81-4380534 77 0 1828 N HIGLEY RD SUITE 116 MESA AZ 85205 480-674-9027 Annie Pratt Other 3146134.00 0.00 0.00 980028.00 4614229.00 709035.00 0.00 812668.00 3801561.00 4614229.00 0.00 0.00 0.00 -133736082.00 0.00 0.00 Prager Metis CPAs LLP Class A Common Stock 6929576 00000None None Class C Common Stock 0 00000None None Class D Common Stock 25725370 00000None None None 0 00000None None true true Tier2 Audited Equity (common or preferred stock) N N N Y N N 1852345 6929576 27.5000 34000010.00 16355313.36 0.00 0.00 50355323.36 Rialto Markets 1013818.48 Prager Metis 115000.00 WCAZ Law, PLLC 120000.00 Winston & Strawn LLP 175000.00 Rialto Markets 15000.00 000283477 32986191.52 true AL AK AZ AR CA CO CT DE FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY DC PR A0 A1 A2 A3 A4 A5 A6 A7 A8 A9 B0 Z4 AL AK AZ AR CA CO CT DE FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY DC PR A0 A1 A2 A3 A4 A5 A6 A7 A8 A9 B0 Z4 true

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

Post- Qualification Amendment No. 9

FORM 1-A POS

REGULATION A OFFERING CIRCULAR

UNDER THE SECURITIES ACT OF 1933

Atlis Motor Vehicles Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 81-4380534 | |

| (State of Incorporation) | (I.R.S Employer Identification No.) |

1828 N. Higley Rd. Suite 116

Mesa, AZ 85205

(Full mailing address of principal executive offices)

(602) 309-5425

(Issuer’s Telephone number, including area code)

FILE NO. 024-11714

Copies to:

Michael J. Blankenship

James R. Brown

Winston & Strawn, LLP

800 Capitol St., Suite 2400

Houston, TX 77002-2925

Telephone: (713) 651-2600

Explanatory Note

This Post-Qualification Amendment No. 9 of the Offering Circular of Atlis Motor Vehicles Inc., originally qualified on December 16, 2021, and as may be amended and supplemented from time to time (the “Offering Circular”), is being filed to increase the maximum offering amount (the “Maximum Offering”), update the Company’s Risk Factors, and disclose the Company’s intention to register its securities with the U.S Securities and Exchange Commission (“SEC” or “Commission”) and list the securities for trade on The Nasdaq Stock Market LLC (“NASDAQ”) under the symbol “AMV”. In connection with listing the Company’s securities on NASDAQ, each share of Class A Common Stock of Atlis Motor Vehicles, Inc. will be exchanged for two shares of Class A Common Stock of ATLIS, Inc. Please see “Corporate Reorganization” for a description of the Corporate Reorganization we intend to undertake in connection with our NASDAQ listing.

An offering statement pursuant to Regulation A relating to these securities has been filed with Commission. Information contained in this Offering Circular is subject to completion or further amendment/supplement. To the extent not already qualified under Regulation A, these securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. We may elect to satisfy our obligation to deliver a final Offering Circular (the “Final Offering Circular”) by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

NINTH AMENDED OFFERING CIRCULAR AUGUST 8, 2022, SUBJECT TO REVISION

Atlis Motor Vehicles Inc.

A Delaware Corporation

|

Class A Common Stock |

Maximum Price to Public |

Bonus Share Price |

Aggregate Share Price |

Commissions and Bonus Share Value(1) |

Cash Proceeds to the Company(2) |

| Per share of Class A Common Stock | $27.50 | $0 | $27.50 | $0.41 + $2.06 | $26.12 |

| Maximum Offering amount | $34,000,010.00 | $6,000,001.76 | $40,000,011.76(3) | $1,013,818.48 +$6,000,001.76 | $32,986,191.52 |

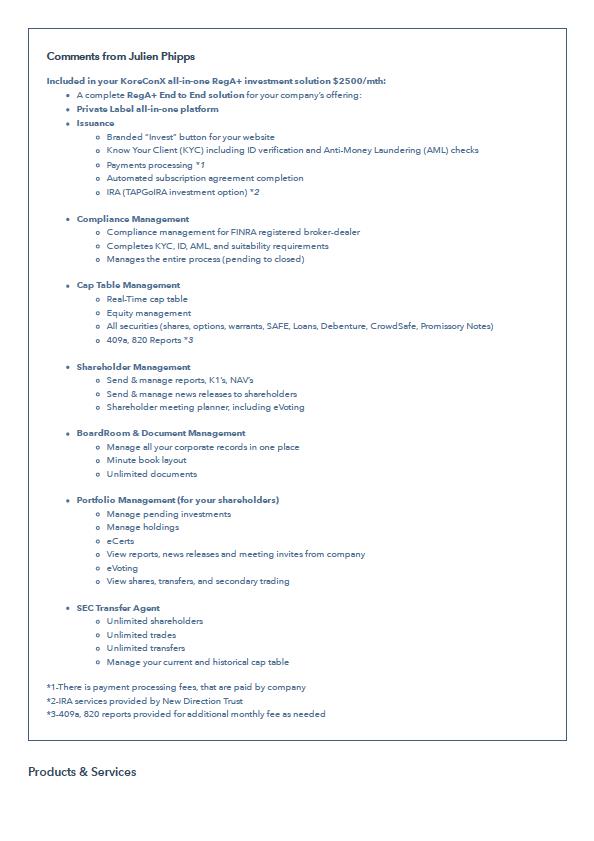

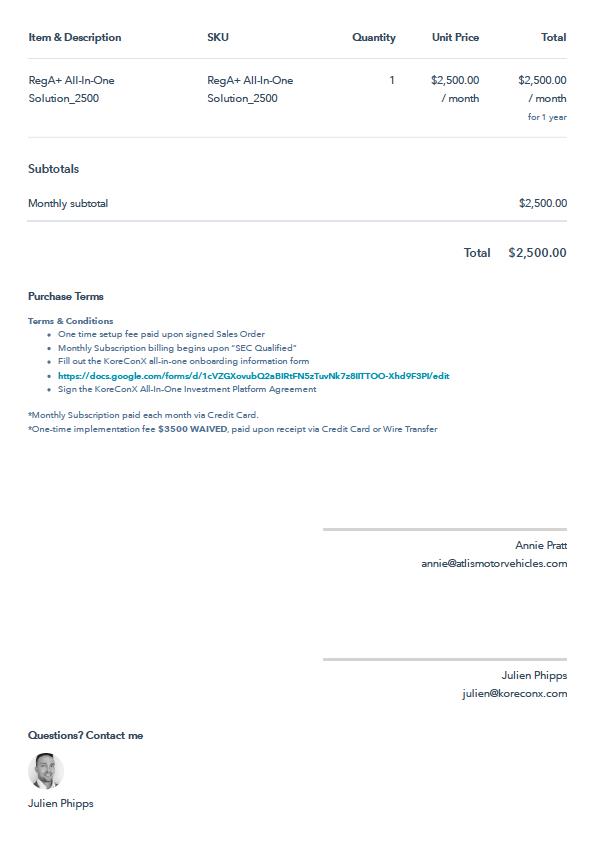

(1) The Company has retained Rialto Markets, LLC (“Rialto Markets”) to act as the broker of record for the Offering (as defined below). Rialto Markets will receive a consulting fee of $5,000, a blue-sky service fee of $5,000 and a commission/fee of 3% of the aggregate amount of gross proceeds from the Offering. In addition to these fees, Rialto Markets may also receive expense reimbursements up to $15,000 for FINRA and blue-sky fees. Additionally, monthly technology fees of $2,500 will be paid to KoreConX for the duration of the Offering.

(2) Based on aggregate share price that assumes maximum bonus shares are issued. Does not include expenses of the Offering, including but not limited to, fees and expenses for marketing and advertising of the Offering, media expenses, fees for administrative, accounting, audit and legal services, fees for EDGAR document conversion and filing, and website posting fees, which are estimated to be as much as $4,000,000.

(3) We previously sold $14,949,987 at a weighted average price of $15.88 per share. This Post-Qualification Amendment No. 9 to the Offering Circular relates to the sale of an additional $25,050,024.70 at a price of $27.50 per share. If we sell all of the shares in this Offering, we expect to sell an aggregate of $40,000,011.76. Please see the summary charts, above and below (under “Previous Shares Sold in this Offering”) for additional information.

Previous Shares Sold in this Offering

Prior to this amendment, the Company offered for sale 818,639 shares at $15.88 per share plus up to 122,796 bonus shares at $0.00 per share of our Class A Common Stock, $0.001 par value per share, at an aggregate share price of $15.88 on a “best efforts” basis.

Class A Common Stock |

Maximum

Price to Public |

Bonus Price |

Aggregate

Share Price |

Commissions

and bonus share value(1) |

Cash

proceeds to the Company(2) |

| Per share of Class A Common Stock | $15.88 | $0 | $15.88 | $0.79 + $2.07 | 13.02 |

| Maximum Offering amount | $12,999,987 | $1,950,000 | $14,949,987 | $743,734 +$1,950,000 | $12,256,253 |

We are offering up to $34,000,010.00 of securities (the “Offering”) of Atlis Motor Vehicles Inc., a Delaware corporation (“Atlis” or the “Company”). We expect to commence the sale of the shares of Class A Common Stock as of the date on which the offering statement (the “Offering Statement”), of which this Offering Circular is a part, is qualified by the SEC.

Prior to this Offering, there has been no public market for our Class A common stock (“Class A Common Stock”). We have applied to list our Class A Common Stock on NASDAQ under the symbol “AMV.” We expect our Class A Common Stock to begin trading on NASDAQ following the completion of our Corporate Reorganization (as defined below). The Company intends to file a registration statement on Form 8-A to register the Class A Common Stock with the Commission and list publicly immediately following the termination of this Offering.

This Offering will terminate on the earlier of (i) October 31, 2022, subject to extension for up to one hundred-eighty (180) days in the sole discretion of the Company; or (ii) the date on which the Maximum Offering is sold; or (iii) when our Board of Directors elects to terminate the Offering (in either case, the “Termination Date”). Upon the receipt of investors’ subscriptions and acceptance of such subscriptions by the Company, we may hold closings. There is no aggregate minimum requirement for the Offering to become effective, therefore, we reserve the right, subject to applicable securities laws, to begin applying “dollar one” of the proceeds from the Offering towards our business strategy, development expenses, offering expenses and other uses as more specifically set forth in this Offering Circular.

| 2 |

Investing in our Class A Common Stock involves a high degree of risk. See “Risk Factors” for a discussion of certain risks that you should consider in connection with an investment in Atlis. This Offering Circular is following the offering circular format of Part I of Form S-1 as described in the general instructions of Part II (a)(I)(ii) of Form 1-A.

THE SEC DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE BEING OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN TEN PERCENT (10%) OF THE GREATER OF YOUR ANNUAL INCOME OR YOUR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(D)(2)(I)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO WWW.INVESTOR.GOV.

THE SECURITIES UNDERLYING THIS OFFERING STATEMENT MAY NOT BE SOLD UNTIL QUALIFIED BY THE SEC. THIS OFFERING CIRCULAR IS NOT AN OFFER TO SELL, NOR SOLICITING AN OFFER TO BUY, ANY SHARES OF OUR CLASS A COMMON STOCK IN ANY STATE OR OTHER JURISDICTION IN WHICH SUCH SALE IS PROHIBITED.

We are an “emerging growth company” as defined in the Jumpstart our Business Startups Act of 2012 and, as such, we have elected to take advantage of certain reduced public company reporting requirements for this Offering Circular and future filings. See “Risk Factors.”

AN OFFERING STATEMENT PURSUANT TO REGULATION A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SEC. INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF ANY SUCH STATE. WE MAY ELECT TO SATISFY OUR OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO (2) BUSINESS DAYS AFTER THE COMPLETION OF OUR SALE TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

Sales of these securities will commence on approximately August 2, 2022.

| 3 |

TABLE OF CONTENTS

| CORPORATE INFORMATION | 5 |

| CORPORATE REORGANIZATION | 5 |

| REGULATION A+ | 6 |

| CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS | 7 |

| OFFERING SUMMARY | 8 |

| RISK FACTORS | 11 |

| DILUTION | 36 |

| CAPITALIZATION | 37 |

| PLAN OF DISTRIBUTION | 38 |

| USE OF PROCEEDS | 40 |

| MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 41 |

| OUR BUSINESS | 42 |

| PROPERTY | 46 |

| LEGAL PROCEEDINGS | 46 |

| MANAGEMENT’S DISCUSSION & ANALYSIS OF FINANCIAL CONDITION & RESULTS OF OPERATIONS | 47 |

| MANAGEMENT | 54 |

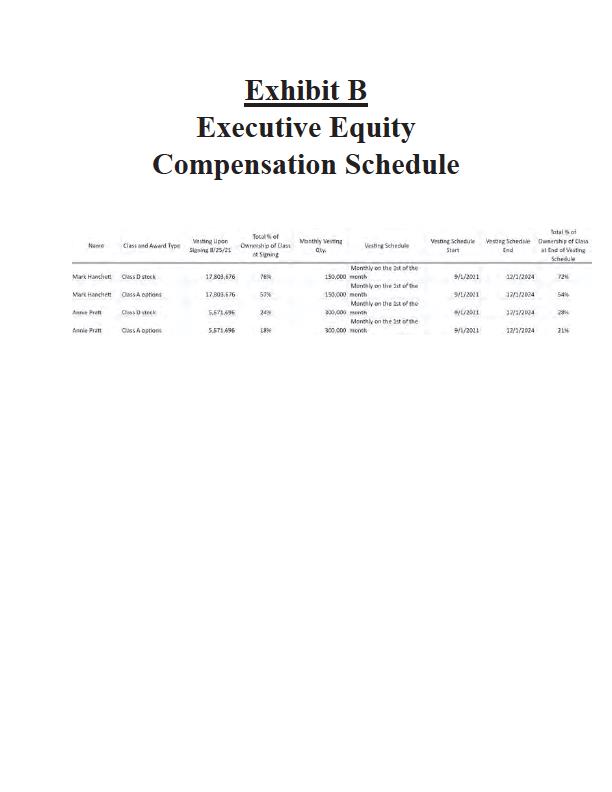

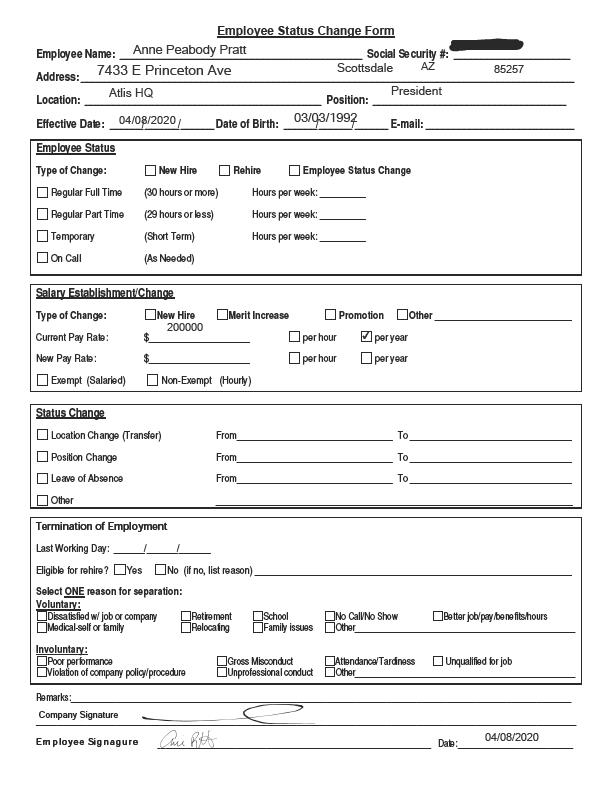

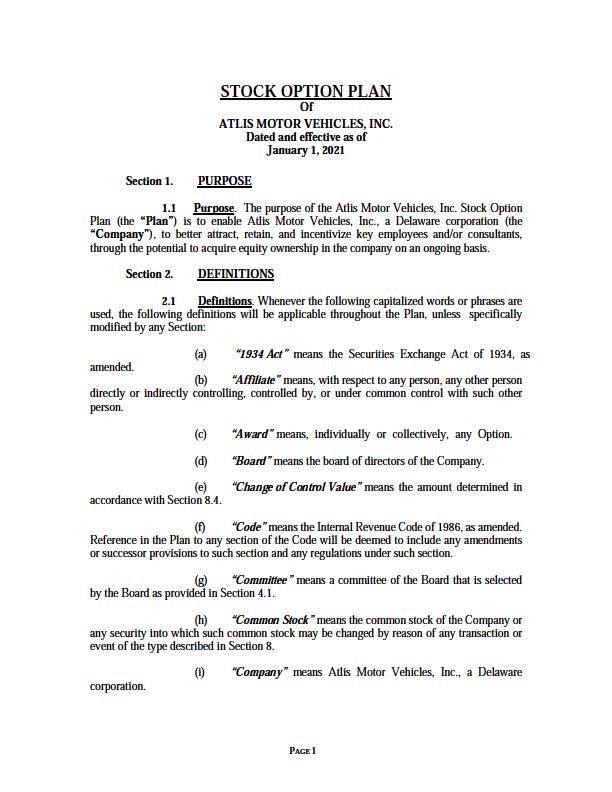

| EXECUTIVE COMPENSATION | 59 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 59 |

| INTEREST OF MANAGEMENT AND OTHERS IN CERTAIN TRANSACTIONS | 60 |

| DESCRIPTION OF SECURITIES | 61 |

| ADDITIONAL INFORMATION ABOUT THE OFFERING | 66 |

| OFFERING PERIOD AND EXPIRATION DATE | 67 |

| EXPERTS | 68 |

| FINANCIAL STATEMENTS | 69 |

| PART III - EXHIBIT INDEX | 100 |

| 4 |

We are offering to sell, and seeking offers to buy, our securities only in jurisdictions where such offers and sales are permitted. You should rely only on the information contained in this Offering Circular. We have not authorized anyone to provide you with any information other than the information contained in this Offering Circular. The information contained in this Offering Circular is accurate only as of its date, regardless of the time of its delivery or of any sale or delivery of our securities. Neither the delivery of this Offering Circular nor any sale or delivery of our securities shall, under any circumstances, imply that there has not been a change in our affairs since the date of this Offering Circular. This Offering Circular will be updated and made available for delivery to the extent required by the federal securities laws.

Unless otherwise indicated, data contained in this Offering Circular concerning the business of the Company are based on information from various public sources. Although we believe that these data are generally reliable, such information is inherently imprecise, and our estimates and expectations based on these data involve a number of assumptions and limitations. We have not independently verified the accuracy or completeness of this information. Some data is also based on good faith estimates. As a result, you are cautioned not to give undue weight to such data, estimates or expectations.

In this Offering Circular, unless the context indicates otherwise, references to “Atlis Motor Vehicles,” “Atlis,” “we,” the “Company,” “our,” and “us” refer to the activities of and the assets and liabilities of the business and operations of Atlis Motor Vehicles Inc., a Delaware corporation prior to our Corporate Reorganization and to ATLIS, Inc. after our Corporate Reorganization.

CORPORATE INFORMATION

Atlis Motor Vehicles Inc. was incorporated under the laws of the State of Delaware on November 9, 2016. Our Chief Executive Officer, President and Secretary has not been in bankruptcy, receivership or any similar proceeding. Our principal executive offices are located at 1828 North Higley Road, Mesa, AZ 85205. Our website address is www.atlismotorvehicles.com. Information on our website is not part of this Offering Circular.

Emerging Growth Company Status

We are an “emerging growth company” within the meaning of the federal securities laws. For as long as we are an emerging growth company, we will not be required to comply with certain requirements that are applicable to other public companies that are not “emerging growth companies,” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”) and the reduced disclosure obligations regarding executive compensation in our periodic reports. In addition, Section 107 of the Jumpstart Our Business Startups Act (the “JOBS Act”) provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”), for complying with new or revised accounting standards. We have elected to adopt certain of the reduced disclosure requirements available to emerging growth companies. For a description of the qualifications and other requirements applicable to emerging growth companies and certain elections that we have made due to our status as an emerging growth company, see “Risk Factors—Related to this Offering and Our Class A Common Stock.”

CORPORATE REORGANIZATION

We were incorporated under the laws of the State of Delaware on November 9, 2016. We have applied to list our Class A Common Stock on The Nasdaq Stock Market LLC under the symbol “AMV.” We expect our Class A Common Stock to begin trading on NASDAQ when the following conditions are met: (i) the Offering is completed; and (ii) we have filed a post-qualification amendment of the Offering Circular and a registration statement on Form 8-A (the “Form 8-A”) under the Securities Exchange Act of 1934 (the “Exchange Act”), and such post-qualification amendment is qualified by the SEC and the Form 8-A has become effective. Under the rules under Regulation A, the Form 8-A will not become effective until the SEC qualifies the post-qualification amendment. We intend to file the post qualification amendment and request its qualification immediately after receipt of approval to list our Class A Common Stock on NASDAQ.

In connection with the listing of our Class A Common Stock on NASDAQ, the following transactions (our “Corporate Reorganization”) will occur:

| · | Atlis Motor Vehicles. will form a new wholly owned subsidiary, ATLIS, Inc. (“ATLIS”); |

| · | ATLIS will form a new wholly owned subsidiary, Atlis MergeCo, Inc. (“Atlis MergeCo”); and |

| · | Atlis Motor Vehicles will merge with and into Atlis MergeCo with Atlis Motor Vehicles surviving as a wholly owned subsidiary of ATLIS (the "Merger"). In connection with the Merger, (i) each share of Class A Common Stock of Atlis will be exchanged for two shares of Class A Common Stock of ATLIS and (ii) each share of Class D Common Stock of Atlis will be exchanged for two shares of Class B Common Stock of ATLIS.. |

Following the Corporate Reorganization, ATLIS will be a holding company whose only material asset will consist of an ownership interest in Atlis Motor Vehicles. ATLIS will conduct our business and own all of the outstanding equity interest in the subsidiaries through which we operate our business. ATLIS will be the sole owner of Atlis Motor Vehicles and will be responsible for all operational, management, and administrative decisions relating to ATLIS’sbusiness and will consolidate financial results of Atlis and its subsidiaries.

| 5 |

REGULATION A+

We are offering our Class A Common Stock pursuant to recently adopted rules by the SEC mandated under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. These offering rules are often referred to as “Regulation A+.” We are relying upon “Tier 2” of Regulation A+, which allows us to offer up to $75 million in a 12-month period.

In accordance with the requirements of Tier 2 of Regulation A+, we will be required to publicly file annual, semiannual, and current event reports with the SEC after the qualification of the Offering Statement of which this Offering Circular forms a part. Having conducted a Regulation A+ offering in 2020, Atlis’s annual, and current event reports have been filed with the SEC and are available for public viewing at www.sec.gov.

| 6 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Some of the information included in this Offering Circular constitutes forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar matters that are not historical facts. In some cases, you can identify forward-looking statements by terms such as “anticipate”, “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “should,” “will” and “would” or the negatives of these terms or other comparable terminology.

You should not place undue reliance on forward looking statements. The cautionary statements set forth in this Offering Circular, including in “Risk Factors” and elsewhere, identify important factors which you should consider in evaluating our forward-looking statements. These factors include, among other things:

| · | Our ability to effectively execute our business plan, including without limitation our ability to fully develop our battery technology, XP Platform, XT pickup truck, subscription model, mass production, and respond to the highly competitive and rapidly evolving marketplace and regulatory environment in which we intend to operate; |

| · | Our ability to manage our research, development, expansion, growth and operating expenses; |

| · | Our ability to evaluate and measure our business, prospects and performance metrics, and our ability to differentiate our business model and products; |

| · | Our ability to compete, directly and indirectly, and succeed in the highly competitive and evolving electric vehicle industry; |

| · | Our ability to respond and adapt to changes in technology and customer behavior; and |

| · | Our ability to protect our intellectual property and to develop, maintain and enhance a strong brand. |

Although the forward-looking statements in this Offering Circular are based on our beliefs, assumptions and expectations, taking into account all information currently available to us, we cannot guarantee future transactions, results, performance, achievements or outcomes. No assurance can be made to any investor by anyone that the expectations reflected in our forward-looking statements will be attained, or that deviations from them will not be material and adverse. Any forward-looking statement speaks only as of the date of this Offering Circular, and, we undertake no obligation, other than as may be required by law, to re-issue this Offering Circular or otherwise make public statements updating our forward-looking statements.

[This space intentionally left blank]

| 7 |

OFFERING SUMMARY

This summary highlights information contained elsewhere in this Offering Circular, but might not contain all of the information that is important to you. This summary is not complete and does not contain all the information that you should consider before deciding whether to invest in our Class A Common Stock. As such, before investing in our Class A Common Stock, you should read the entire Offering Circular carefully, including the “Risk Factors” section and our historical financial statements and the notes thereto attached as part of this Offering Circular. Some of the statements in this Offering Circular are forward-looking statements. See the section entitled “Cautionary Statement Regarding Forward-Looking Statements.”

The Company

Overview

Atlis Motor Vehicles Inc. is a vertically integrated electric vehicle company committed to electrifying work vehicles. The Company is working toward production of the Atlis XT pickup truck, a 100% electric work truck, and Atlis XP Platform, the skateboard chassis that can be used to power various other models of work vehicles such as last mile delivery vehicles, garbage trucks, cement trucks, vans, RVs, box trucks, and more. At the core of Atlis’s hardware platform is a proprietary battery technology capable of charging a full-size pickup truck in less than 15 minutes and a modular system architecture capable of scaling to meet the specific vehicle or equipment application needs.

Services and Products

The work industry is composed of use cases like agriculture, mining, construction, and utilities. These industries are seeking to transition from Internal Combustion Engine “ICE” vehicles to electric, and they need capable vehicles at a competitive cost. When making the switch to electric, individuals and businesses consider numerous factors, including vehicle capability, charging solutions, service & maintenance costs, insurance, and total cost. The Atlis vertically integrated EV technology ecosystem addresses many of these concerns with its array of products, services, and unique business model.

Atlis Products:

| · | Atlis Energy: a superior battery technology solution that enables unparalleled fast charging and superior inclement weather and output performance. |

| · | Atlis XP: a scalable technology solution with a connected cloud, mobile, service, and charging ecosystem that will provide unprecedented workflows and customer experiences moving forward. |

| · | Atlis XT pickup truck: our flagship product, a 100% electric full-sized electric work truck. |

Atlis Services:

| · | Atlis charging: Atlis Advanced Charging Stations, a 1.5MW charging station, that is as simple to operate as filling up your gas vehicle today. |

| · | Maintenance, Insurance, and Service: part of our vehicle-as-a-service business model, the subscription covers all maintenance, insurance, and service costs. |

| 8 |

The Offering

| Securities Offered: | 1,852,345 shares consisting of 941,435 shares issued at a weighted average share price of $15.88, and 910,910 shares issued at a weighted average share price of $27.50. |

| Class A Common Stock Outstanding: | 6,929,576 shares |

| Prior to the Offering |

36,809,149 shares issued

30,454,784 options issued |

| After the Offering and Corporate Reorganization | 76,527,045 shares issued 60,909,568 options issued. Please see “Corporate Reorganization” for a description of the corporate reorganization we intend to undertake in connection with listing our shares of Class A Common Stock on NASDAQ. |

| (Assuming the sale of all shares offered) | |

| Use of Proceeds: | If we sell all of the shares of common stock (the " Shares") being offered, our net proceeds (after our estimated commissions, if any, but excluding our estimated Offering expenses) will be approximately $32,300,000. We will use these net proceeds for our product research and development, expenses associated with the marketing and advertising of the Offering, working capital and general corporate purposes, and such other purposes described in the “Use of Proceeds” section of this Offering Circular. |

| Risk Factors: | Investing in our Class A Common Stock involves a high degree of risk. See “Risk Factors.” |

| No Market: | There is no market for our Class A Common Stock and there can be no assurance that a market will develop. |

| Proposed NASDAQ Listing: | We have applied to list our Class A Common Stock on The Nasdaq Stock Market LLC under the symbol “AMV.” Our Class A Common Stock will not commence trading on NASDAQ until all of the following conditions are met: (i) the Offering is completed and (ii) we have filed a post-qualification amendment to the Offering Statement and a registration statement on Form 8-A under the Securities Exchange Act of 1934, as amended, and such post-qualification amendment is qualified by the Commission and the Form 8-A has become effective. Pursuant to applicable rules under Regulation A, the Form 8-A will not become effective until the Commission qualifies the post-qualification amendment. We intend to file the post-qualification amendment and request its qualification immediately prior to the closing of the Offering in order that the Form 8-A may become effective as soon as practicable. Even if we meet the minimum requirements for listing on NASDAQ, we may wait before closing the Offering and commencing the trading of our Class A Common Stock on NASDAQ in order to raise additional proceeds. As a result, you may experience a delay between the subscription for your purchase of shares of Class A Common Stock and the commencement of trading of the Class A Common Stock on NASDAQ. |

| 9 |

Risk Factors

Our business and our ability to execute our business strategy are subject to a number of risks as more fully described in the section titled “Risk Factors.” These risks include, among others:

| · | Atlis is a fledgling company without having developed any products in the past. |

| · | Uncertainty exists as to whether Atlis will be able to raise sufficient funds to continue developing the XP platform and XT pickup truck. |

| · | Future capital raises may dilute current stockholders’ ownership interests. |

| · | Atlis will experience losses for the foreseeable future. |

| · | Our intense capital requirements could be costly. |

| · | Development timelines are at risk of delays outside of Atlis’s control. |

| · | Competition will be stiff. |

| · | Supply chain bottlenecks may be out of our control. |

| · | Natural resources and battery raw materials may experience periods of scarcity. |

| · | Raw material prices can fluctuate based on volatility within the market. |

| · | Scaling up manufacturing will be a challenge and fraught with potential pitfalls. |

| · | Product recall could cripple growth. |

| · | Product liability could result in costly litigation. |

| · | We may face regulatory challenges. |

| · | We may not be able to successfully manage growth. |

| · | Our growth rate may not meet our expectations. |

| · | Our management team does not have experience running a public company. |

| · | We may not be successful in developing an effective direct sales force. |

| · | Raising capital may be costly. |

| · | Atlis stock is not marketable and initial investors should be aware that the investment is speculative. |

| · | Lack of diversification could cause you to lose all or some of your investment if initial products fail. |

| · | Our executive officers and executive staff will retain most of Atlis’s voting rights. |

| 10 |

RISK FACTORS

An investment in our Class A Common Stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this Offering Circular, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our shares of Class A Common Stock could decline and you may lose all or part of your investment. See “Cautionary Note Regarding Forward Looking Statements” above for a discussion of forward-looking statements and the significance of such statements in the context of this Offering Circular.

RISKS RELATED TO OUR COMPANY

Atlis is an early-stage company that has never turned a profit and there are no assurances that the Company will ever be profitable.

Atlis is a relatively new company that was incorporated on November 9, 2016. If you are investing in this company, it’s because you think Atlis’s business model is a good idea, and Atlis will be able to successfully grow their 3 business units and become profitable. We have yet to fully develop or sell any electric vehicles. We are launching our Energy business and have yet to start mass manufacturing of battery cells and pack solutions. As of right now, we are aiming to develop an electric truck that has no commercial contemporaries. In the meantime, other companies could develop successful alternatives. We have never turned a profit and there is no assurance that we will ever be profitable.

We also have no history in the automotive industry. Although Atlis has taken significant steps in building brand awareness, Atlis is a new company and currently has no experience developing or selling motor vehicles. As such, it is possible that Atlis’s lack of history in the industry may impact our brand, business, financial goals, operation performance, and products.

We should be considered a “Development Stage Company,” and our operations will be subject to all the risks inherent in the establishment of a new business enterprise, including, but not limited to, hurdles or barriers to the implementation of our business plans. Further, because there is no history of operations there is also no operating history from which to evaluate our executive management’s ability to manage our business and operations and achieve our goals or the likely performance of the Company. Prospective investors should also consider the fact that our management team has not previously developed or managed similar companies. No assurances can be given that we will be able to achieve or sustain profitability.

Our limited operating history makes it difficult for us to evaluate our future business prospects.

We are a company with an extremely limited operating history and have not generated material revenue from sales of our vehicles or other products and services to date. As we continue to transition from research and development activities to production and sales, it is difficult, if not impossible, to forecast our future results, and we have limited insight into trends that may emerge and affect our business. The estimated costs and timelines that we have developed to reach full scale commercial production are subject to inherent risks and uncertainties involved in the transition from a start-up company focused on research and development activities to the large-scale manufacture and sale of vehicles. There can be no assurance that our estimates related to the costs and timing necessary to complete the design and engineering of our products, will prove accurate. These are complex processes that may be subject to delays, cost overruns and other unforeseen issues. In addition, we have engaged in limited marketing activities to date, so even if we are able to bring our other commercial products to market, on time and on budget, there can be no assurance that customers will embrace our products in significant numbers at the prices we establish. Market and geopolitical conditions, many of which are outside of our control and subject to change, including general economic conditions, the availability and terms of financing, the impacts and ongoing uncertainties created by the COVID-19 pandemic, the conflict in the Ukraine, fuel and energy prices, regulatory requirements and incentives, competition, and the pace and extent of vehicle electrification generally, will impact demand for our products, and ultimately our success.

Our ability to develop and manufacture vehicles of sufficient quality and appeal to customers on schedule and on a large scale is unproven.

Our business depends in large part on our ability to develop, manufacture, market, and sell our vehicles. Our production ramp may take longer than originally expected due to a number of reasons. The cascading impacts of the COVID-19 pandemic, and more recently the conflict in the Ukraine, have impacted our business and operations from facility construction to equipment installation to vehicle component supply.

| 11 |

We have not launched a production-intent consumer vehicle and do not anticipate making our first deliveries for the next few years. In conjunction with the launch of future products we may need to manufacture our vehicles in increasingly higher volumes than our present production capabilities. We have no experience as an organization in high volume manufacturing of electric vehicles ("EV"). The continued development of and the ability to manufacture our vehicles at scale and fleet vehicles, such as the Electric Delivery Vehicle, and other commercial products are and will be subject to risks, including with respect to:

| · | our ability to secure necessary funding; |

| · | our ability to negotiate and execute definitive agreements, and maintain arrangements on reasonable terms, with our various suppliers for hardware, software, or services necessary to engineer or manufacture parts or components of our vehicles; |

| · | securing necessary components, services, or licenses on acceptable terms and in a timely manner; |

| · | delays by us in delivering final component designs to our suppliers; |

| · | our ability to accurately manufacture vehicles within specified design tolerances; |

| · | quality controls, including within our manufacturing operations, that prove to be ineffective or inefficient; |

| · | defects in design and/or manufacture that cause our vehicles not to perform as expected or that require repair, field actions, including product recalls, and design changes; |

| · | delays, disruptions or increased costs in our supply chain, including raw material supplies; |

| · | other delays, backlog in manufacturing and research and development of new models, and cost overruns; |

| · | obtaining required regulatory approvals and certifications; |

| · | compliance with environmental, safety, and similar regulations; and |

| · | our ability to attract, recruit, hire, retain, and train skilled employees. |

Our ability to develop, manufacture, and obtain required regulatory approvals for vehicles of sufficient quality and appeal to customers on schedule and on a large scale is unproven. Our vehicles may not meet customer expectations and may not be commercially viable.

Historically, automobile customers have expected car manufacturers to periodically introduce new and improved vehicle models. In order to meet these expectations, we may be required to introduce new vehicle models and enhanced versions of existing models. To date, we have limited experience, as a company, designing, testing, manufacturing, marketing, and selling our vehicles and therefore cannot assure you that we will be able to meet customer expectations.

Any of the foregoing could have a material adverse effect on our business, prospects, financial condition, results of operations, and cash flows.

Uncertainty exists as to whether our business will have sufficient funds over the next 12 months, thereby making an investment in Atlis speculative.

We require additional financing to complete development and marketing of our AMV battery technology, XP Platform, and XT pickup truck until the products are in production and sufficient revenue can be generated for us to be self-sustaining. Our management projects that in order to effectively bring the products to market, that it will require significant funding over the next 12 months to cover costs involved in completing the prototype, getting the battery assembly line up and running, and beginning to develop a supply chain. In the event that we are unable to generate sufficient revenues, and before all of the funds now held by us and obtained by us through this Offering are expended, an investment made in Atlis may become worthless.

If we cannot continue to raise further rounds of funding, we cannot succeed. Atlis will require additional rounds of funding to complete development and begin shipments of the Atlis XT pickup truck. If Atlis is unable to secure funding, we will be unable to succeed in our goal of developing the world’s best electric pickup truck. Atlis will require additional capital infusion to sustain operations. We predict that we will need to raise an additional $418 million dollars to finalize the prototype, obtain regulatory approvals, scale production, and continue lean production and sales for the following 4 years to our point of predicted profitability. If we are unable to raise adequate financing, we will be unable to sustain operations for a prolonged period of time.

| 12 |

We expect to significantly increase our spending to advance the development of our products and services and launch and commercialize the products for commercial sale. We will require additional capital for the further development and commercialization of our products, as well as to fund our other operating expenses and capital expenditures. We cannot be certain that additional funding will be available on acceptable terms, or at all. If we are unable to raise additional capital in sufficient amounts or on terms acceptable to us, we may have to significantly delay, scale back or discontinue the development or commercialization of one or more of our products and services. We may also seek collaborators for the products at an earlier stage than otherwise would be desirable or on terms that are less favorable than might otherwise be available. Any of these events could significantly harm our business, financial condition and prospects.

The expected gross offering proceeds may never be realized. While we believe that such proceeds will capitalize and sustain us to allow for the continued development and implementation of our business plan, if only a fraction of this Offering is sold, or if certain assumptions contained in the business plans prove to be incorrect, we may have inadequate funds to fully develop our business. Although we believe that the proceeds from this Offering will be sufficient to help sustain our development process and business operations, there is no guarantee that we will raise all the funds needed to adequately fund our business plan.

We rely on proprietary technology currently in development by Atlis to meet product performance requirements.

Atlis is developing proprietary technologies which are needed to meet targeted product performance requirements. The development of this technology may be impacted by unforeseen supplier, material, and technical risks which may delay product launches or change product performance expectations.

We need to raise additional capital to meet our future business requirements and such capital raising may be costly or difficult to obtain and could dilute current stockholders’ ownership interest.

We are seeking to raise $34,000,005.09 at a public price of $27.50 per share in this Offering on a "best-efforts" basis to implement our plan and meet our capital needs for the next 6 months of operations. Estimated commissions and Offering related expenses of $1,700,000, the total net proceeds to us, assuming a price per share of $27.50, would be $32,300,005.09. Additionally, we may sell equity shares in a private placement pursuant to Regulation D. We will use the proceeds from these offerings to prepare for production. See the section entitled “Use of Proceeds” for a description of the manner in which we plan to use proceeds from this Offering.

We have relied upon cash from financing activities and in the future, we expect to rely on the proceeds from this Offering, future debt and/or equity financings, and we hope to rely on revenues generated from operations to fund all of the cash requirements of our activities. However, there can be no assurance that we will be able to generate any significant cash from our operating activities in the future. Future financing may not be available on a timely basis, in sufficient amounts or on terms acceptable to us, if at all. Any debt financing or other financing of securities senior to the Class A Common Stock will likely include financial and other covenants that will restrict our flexibility.

Any failure to comply with these covenants would have a material adverse effect on our business, prospects, financial condition and results of operations because we could lose our existing sources of funding and impair our ability to secure new sources of funding. However, there can be no assurance that the Company will be able to generate any investor interest in its securities. If we do not obtain additional financing, our prototype will never be completed, in which case you would likely lose the entirety of your investment in us.

At this time, we have not secured or identified any additional financing. We do not have any firm commitments or other identified sources of additional capital from third parties or from our officer and director or from other stockholders. There can be no assurance that additional capital will be available to us, or that, if available, it will be on terms satisfactory to us. Any additional financing will involve dilution to our existing stockholders. If we do not obtain additional capital on terms satisfactory to us, or at all, it may cause us to delay, curtail, scale back or forgo some or all of our product development and/or business operations, which could have a material adverse effect on our business and financial results. In such a scenario, investors would be at risk of losing all or a part of any investment in our Company.

We have losses which we expect to continue into the future. There is no assurance our future operations will result in a profit. If we cannot generate sufficient revenues to operate profitably or we are unable to raise enough additional funds for operations, the stockholders will experience a decrease in value and we may have to cease operations.

We are a development-stage technology company that began operating and commenced research and development activities in 2016. As a recently formed "Development-Stage Company", we are subject to all of the risks and uncertainties of a new business, including the risk that we may never develop, complete development or market any of our products or services and we may never generate product or services related revenues. Accordingly, we have only a limited history upon which an evaluation of our prospects and future performance can be made. We only have one product currently under development, which will require further development, significant marketing efforts and substantial investment before it and any successors could provide us with any revenue. As a result, if we do not successfully develop, market and commercialize our XT pickup truck on the XP platform, we will be unable to generate any revenue for many years, if at all. If we are unable to generate revenue, we will not become profitable, and we may be unable to continue our operations. Furthermore, our proposed operations are subject to all business risks associated with new enterprises. The likelihood of our success must be considered in light of the problems, expenses, difficulties, complications, and delays frequently encountered in connection with the expansion of a business, operation in a competitive industry, and the continued development of advertising, promotions and a corresponding customer base. There can be no assurances that we will operate profitably.

| 13 |

We expect to incur operating losses in future periods due to the high cost associated with developing an electric vehicle from the ground up. We cannot be sure that we will be successful in generating revenues in the near future and in the event we are unable to generate sufficient revenues or raise additional funds we will analyze all avenues of business opportunities. Management may consider a merger, acquisition, joint venture, strategic alliance, a roll-up, or other business combination to increase business and potentially increase the liquidity of the Company. Such a business combination may ultimately fail, decreasing the liquidity of the Company and stockholder value or cause us to cease operations, and investors would be at risk to lose all or part of their investment in us.

Competition may crowd the market.

We face significant barriers in the development of a competitive EV in a crowded market space. Atlis faces significant technical, resource, and financial barriers in development of a battery electric vehicle intended to compete in a crowded pickup truck space. Incumbents, also known as legacy manufacturers, have substantially deeper pockets, larger pools of resources, and more significant manufacturing experience. Atlis will need to contract with development partners who may have existing relationships with incumbent manufacturers, these relationships may pose a significant risk in our ability to successfully develop this program. The Atlis product is differentiated from all currently announced electric trucks in that it will be a full-size, heavy-duty truck with capabilities that match or exceed internal combustion trucks of the same size. However, we have a lot of work to do before we reach production. There is a chance that other competitors may release similar full-sized electric trucks before we exit the research and development phase. If several competitors release full-sized electric trucks before Atlis, it will be exceedingly difficult to penetrate the market.

There are several potential competitors who are better positioned than we are to take the market at an earlier time than Atlis. We will compete with larger, established automotive manufacturers who currently have products on the markets and/or various respective product development programs. They have much better financial means and marketing/sales and human resources than us. They may succeed in developing and marketing competing equivalent products earlier than us, or superior products than those developed by us. There can be no assurance that competitors will not render our technology or products obsolete or that the plug-in electric pickup truck developed by us will be preferred to any existing or newly developed technologies. It should further be assumed that that competition will intensify. Atlis’s success depends on our ability to continuously raise funding, keep cost under control, and properly execute in our delivery of the Atlis XT pickup truck, Atlis XP truck platform, and Advanced Charging Station.

In order to be competitive, we must have the ability to respond promptly and efficiently to the ever-changing marketplace. We must establish our name as a reliable and constant source for professional conversion and transmission services. Any significant increase in competitors or competitors with better, more efficient services could make it more difficult for us to gain market share or establish and generate revenues. We may not be able to compete effectively on these or other factors.

We are dependent on our existing suppliers, a significant number of which are single or limited source suppliers, and are also dependent on our ability to source suppliers, for our critical components, and to complete the building out of our supply chain, while effectively managing the risks due to such relationships.

Our success will be dependent upon our ability to enter into supplier agreements and maintain our relationships with existing suppliers who are critical and necessary to the output and production of our vehicles. The supply agreements we have, and may enter into with suppliers in the future, may have provisions where such agreements can be terminated in various circumstances, including potentially without cause. In the ordinary course of our business, we currently have, and may in the future have, legal disputes with our suppliers, including litigation to enforce such supply agreements, which would adversely affect our ability to source components from such suppliers. If our suppliers become unable or unwilling to provide, or experience delays in providing, components, or if the supply agreements we have in place are terminated, or if any such litigation to enforce our supply agreements is not resolved in our favor, it may be difficult to find replacement components. Additionally, our products contain thousands of parts that we purchase from hundreds of mostly single- or limited-source suppliers, for which no immediate or readily available alternative supplier exists. Due to scarce natural resources or other component availability constraints, we may not receive the full allocation of parts we have requested from a particular supplier due to supplier allocation decisions which are outside our control. While we believe that we would be able to establish alternate supply relationships and can obtain or engineer replacement components for our single source components, we may be unable to do so in the short term (or at all) at prices or quality levels that are acceptable to us. Further, any such alternative suppliers may be located a long distance from our manufacturing facilities, which may lead to increased costs or delays. In addition, as we evaluate opportunities and take steps to insource certain components and parts, supply arrangements with current or future suppliers (with respect to other components and parts offered by such suppliers) may be available on less favorable terms or not at all. Changes in business or macroeconomic conditions, governmental regulations, and other factors beyond our control or that we do not presently anticipate could affect our ability to receive components from our suppliers. The unavailability of any component or supplier has resulted, and could in the future result in production delays, idle manufacturing facilities, product design changes, and loss of access to important technology and tools for producing and supporting our products and services.

| 14 |

In addition, if our suppliers experience substantial financial difficulties, cease operations, or otherwise face business disruptions, we would be required to take measures to ensure components and materials remain available. Any disruption could affect our ability to deliver vehicles and could increase our costs and negatively affect our liquidity and financial performance.

Also, if a supplied vehicle component becomes the subject of a field action, including a product recall, we would be required to find an alternative component, which could increase our costs and cause vehicle production delays. Additionally, we may become subject to costly litigation surrounding the component.

If we do not enter into long-term supply agreements with guaranteed pricing for our parts or components, or if those long-term supply agreements are not honored by our suppliers, we may be exposed to fluctuations in prices of components, materials, and equipment. Agreements for the purchase of battery cells contain or are likely to contain pricing provisions that are subject to adjustments based on changes in market prices of key commodities. Substantial increases in the prices for such components, materials, and equipment would increase our operating costs and could reduce our margins if we cannot recoup the increased costs. Increasing the announced or expected prices of our vehicles in response to increased costs has previously been viewed negatively by our potential customers, and any future attempts to increase prices could have similar results, which could adversely affect our business, prospects, financial condition, results of operations, and cash flows.

The automotive market is highly competitive, and we may not be successful in competing in this industry.

Both the automobile industry generally, and the EV segment in particular, are highly competitive, and we will be competing for sales with both EV manufacturers and traditional automotive companies, including those who have announced consumer and commercial vehicles that may be directly competitive to ours. Many of our current and potential competitors may have significantly greater financial, technical, manufacturing, marketing, or other resources than we do and may be able to devote greater resources to the design, development, manufacturing, distribution, promotion, sale, and support of their products than we may devote to our products. We expect competition for EVs to intensify due to increased demand and a regulatory push for alternative fuel vehicles, continuing globalization, and consolidation in the worldwide automotive industry, as well as the recent significant increase in oil and gasoline prices. In addition, as fleet operators begin transitioning to EVs on a mass scale, we expect that more competitors will enter the commercial fleet EV market. Further, as a result of new entrants in the commercial fleet EV market, we may experience increased competition for components and other parts of our vehicles, which may have limited or single-source supply.

Factors affecting competition include product performance and quality, technological innovation, customer experience, brand differentiation, product design, pricing and total cost of ownership, and manufacturing scale and efficiency. Increased competition may lead to lower vehicle unit sales and increased inventory, which may result in downward price pressure and adversely affect our business, prospects, financial condition, results of operations, and cash flows.

We rely on complex machinery for our operations, and production involves a significant degree of risk and uncertainty in terms of operational performance, safety, security, and costs.

We rely heavily on complex machinery for our operations and our production involves a significant degree of uncertainty and risk in terms of operational performance, safety, security, and costs. Our manufacturing plant consists of large-scale machinery combining many components, including complex software to operate such machinery and to coordinate operating activities across the manufacturing plant. The manufacturing plant components are likely to suffer unexpected malfunctions from time to time, especially as we ramp up production on new products, and will depend on repairs, spare parts, and IT solutions to resume operations, which may not be available when needed. Unexpected malfunctions of the manufacturing plant components may significantly affect operational efficiency.

| 15 |

Operational performance and costs can be difficult to predict and are often influenced by factors outside of our control, such as, but not limited to, scarcity of natural resources, environmental hazards and remediation, costs associated with decommissioning of machines, labor disputes and strikes, difficulty or delays in obtaining governmental permits, damages or defects in electronic systems including the software used to control or operate them, industrial accidents, pandemics, fire, seismic activity, and natural disasters.

Should operational risks materialize, it may result in the personal injury to or death of workers, the loss of production equipment, damage to manufacturing facilities, products, supplies, tools and materials, monetary losses, delays and unanticipated fluctuations in production, environmental damage, administrative fines, increased insurance costs, and potential legal liabilities, all which could have a material adverse effect on our business, prospects, financial condition, results of operations, and cash flows. Although we generally carry insurance to cover such operational risks, we cannot be certain that our insurance coverage will be sufficient to cover potential costs and liabilities arising therefrom. A loss that is uninsured or exceeds policy limits may require us to pay substantial amounts, which could adversely affect our business, prospects, financial condition, results of operations, and cash flows.

Our vehicles rely on software and hardware that is highly technical, and if these systems contain errors, bugs, vulnerabilities, or design defects, or if we are unsuccessful in addressing or mitigating technical limitations in our systems, our business could be adversely affected.

Our vehicles rely on software and hardware that is highly technical and complex and will require modification and updates over the life of the vehicles. In addition, our vehicles depend on the ability of such software and hardware to store, retrieve, process and manage immense amounts of data. Our software and hardware may contain errors, bugs, vulnerabilities or design defects, and our systems are subject to certain technical limitations that may compromise our ability to meet our objectives. Some errors, bugs, vulnerabilities, or design defects inherently may be difficult to detect and may only be discovered after the code has been released for external or internal use. Although we will attempt to remedy any issues we observe in our vehicles effectively and rapidly, such efforts may not be timely, may hamper production or may not be to the satisfaction of our customers.

Additionally, if we deploy updates to the software (whether to address issues, deliver new features or make desired modifications) and our over-the-air update procedures fail to properly update the software or otherwise have unintended consequences to the software, the software within our customers’ vehicles will be subject to vulnerabilities or unintended consequences resulting from such failure of the over-the-air update until properly addressed.

If we are unable to prevent or effectively remedy errors, bugs, vulnerabilities or defects in our software and hardware, or fail to deploy updates to our software properly, we would suffer damage to our reputation, loss of customers, loss of revenue or liability for damages, any of which could adversely affect our business, prospects, financial condition, results of operations, and cash flows.

There are complex software and technology systems that need to be developed by us and in coordination with vendors and suppliers to reach mass production for our vehicles, and there can be no assurance such systems will be successfully developed or integrated.

Our vehicles and operations will use a substantial amount of complex third-party and in-house software and hardware. The development and integration of such advanced technologies are inherently complex, and we will need to coordinate with our vendors and suppliers to reach mass production for our vehicles. Defects and errors may be revealed over time and our control over the performance of third-party services and systems may be limited. Thus, our potential inability to develop and integrate the necessary software and technology systems may harm our competitive position.

We rely on third-party suppliers to develop a number of emerging technologies for use in our products. Certain of these technologies are not today, and may not ever be, commercially viable. There can be no assurances that our suppliers will be able to meet the technological requirements, production timing, and volume requirements to support our business plan. Furthermore, if we experience delays by our third-party suppliers, we could experience delays in delivering on our timelines. In addition, the technology may not comply with the cost, performance useful life, and warranty characteristics we anticipate in our business plan. As a result, our business plan could be significantly impacted and we may incur significant liabilities under warranty claims which could materially and adversely affect our business, prospects, financial condition, results of operations, and cash flows.

| 16 |

Global microprocessor shortage.

As a vehicle manufacturer, we will be subject to the same vagaries as the rest of the automotive industry. Since 2020, the industry has experienced a global microprocessor shortage. This has caused production bottlenecks for almost every automobile manufacturer. We are not immune to such market forces. Given our weaker relative bargaining power, there is a real risk that we will experience significant difficulties in obtaining supplies of microchips. If this occurs, we may experience significant production delays and will not meet our production goals. Lack of production will have a direct impact on sales and would likely cause us to miss our quarterly and annual earnings estimates.

Scaling up manufacturing will be a challenge.

EV technology is changing rapidly. There is significant development and investment into electric vehicle technology being made today. Such rapidly changing technology conditions may adversely affect Atlis’s ability to continuously remain a market leader, provide superior product performance, and an outstanding customer experience. If we are unable to control the cost of development, cost of manufacturing, and cost of operations, Atlis may be substantially affected. If we are unable to maintain substantially lower cost of manufacturing, developing, design, distributing, and maintaining our vehicles, we may incur significant cost increases which can be material substantial to the operation of our business. We have made and will continue to make substantial investments into the development of Atlis, such investments may have unforeseen costs that we have been unable to accurately predict, which may significantly impact our ability to execute our business as planned. Atlis will face significant costs in development and purchasing of materials required to build the XT pickup truck, XP truck platform, and Advanced Charging Station through external partnerships. These purchases are subject to conditions outside the control of Atlis and as such, these conditions may substantially affect our business, product, brand, operational, and financial goals.

Atlis will continuously and diligently work towards obtaining multiple sources of materials and components to mitigate risk in our supply chain. However, it is possible that specific components or solutions required to manufacture an electric vehicle may be subject to intellectual property, material availability, or expertise owned solely by a single supplier. A condition such as a single source supplier may hinder our ability to secure the cost, schedule, and long term viability of Atlis XT pickup truck, XP truck platform, or Advanced Charging Station. We may be inherently subjected to conditions which permit only a single source supplier for specific components necessary to develop and manufacture the Atlis XT pickup truck, XP truck platform, and Advanced Charging Station, magnifying this risk.

Unforeseen factors may adjust timelines.

Any valuation of Atlis at this stage is pure speculation. Atlis’s business success, timeline, and milestones are estimations. Atlis’s production projections, sales volume, and cost models are only estimates. Atlis produced these valuations based on existing business models of successful and unsuccessful efforts of other companies within the technology and automotive industries. All such projections and timeline estimations may change as Atlis continues in development of a plug-in electric vehicle, charging station and manufacturing facilities.

We are currently in the development phase of the Atlis XT pickup truck and have not yet started manufacturing and sales. Cost overruns, scheduling delays, and failure to meet product performance goals may be caused by, but not limited to, unidentified technical hurdles, delays in material shipments, and regulatory hurdles. We may experience delays in design and manufacturing of the Atlis XT pickup truck We may experience significant delays in bringing the Atlis XT pickup truck to market due to design considerations, technical challenges, material availability, manufacturing complications, and regulatory considerations. Such delays could materially damage our brand, business, financial goals, operation results, and product.

Natural resource scarcity may cause delays.

Our projections are based on an ability to secure requisite levels of natural resources to produce the number of battery cells and battery packs necessary to meet our production goals. Two of the main natural resources in battery chemistry are lithium and cobalt. Given that these are scarce resources, there is a chance that we are unable to secure enough to meet our battery production goals. If this happens, we will not meet our overall production or profitability estimates. To mitigate this risk, we will explore opportunities to purchase futures to hedge against natural resource cost inflation and/or scarcity.

| 17 |

Additionally, global political and economic tensions could contribute to natural resource scarcity. For example, Russia is a major exporter of natural resources. With the imposition of economic sanctions and import restrictions, there will be a loss of supply in global markets. Restricted supply is likely to result in upward price pressures. The automotive industry is subject to similar natural resource unpredictability in other countries. As such, our pricing and profitability models may need to be adjusted in reaction to these outside pressures.

Company growth depends on avoiding battery production bottlenecks.

Our Company’s success is highly dependent upon our ability to produce battery cells and packs at high levels of volume and low cost. If the Company is unable to produce enough battery cells and packs, for any reason, it would result in the Company missing its overall production and profitability estimates. To avoid the risk of catastrophic battery bottlenecks, the Company intends to explore options for outsourcing some of the battery production to diversify its battery sourcing.

If there is inadequate access to charging stations, our business will be materially and adversely affected.

Demand for our vehicles will depend in part upon the availability of a charging infrastructure. We market our ability to provide our customers with comprehensive charging solutions, including our networks of charging stations, as well as the installation of home chargers for users where practicable, and provide other solutions including charging through publicly accessible charging infrastructure. We have very limited experience in the actual provision of our charging solutions to customers and providing these services is subject to challenges. While the prevalence of charging stations generally has been increasing, charging station locations are significantly less widespread than gas stations. Some potential customers may choose not to purchase our vehicles because of the lack of a more widespread charging infrastructure. Further, to provide our customers with access to sufficient charging infrastructure, we will rely on the availability of, and successful integration of our vehicles with, third-party charging networks. Any failure of third-party charging networks to meet customer expectations or needs, including quality of experience, could impact the demand for EVs, including ours. For example, where charging bays exist, the number of vehicles could oversaturate the available charging bays, leading to increased wait times and dissatisfaction for customers. In addition, given our limited experience in providing charging solutions, there could be unanticipated challenges, which may hinder our ability to provide our solutions or make the provision of our solutions costlier than anticipated. To the extent we are unable to meet user expectations or experience difficulties in providing our charging solutions, our reputation and business, prospects, financial condition, results of operations, and cash flows could be materially and adversely affected.

Our vehicles will make use of lithium-ion battery cells, which, if not appropriately managed and controlled, have been observed to catch fire or vent smoke and flame.

The battery packs within our vehicles will make use of lithium-ion cells. If not properly managed or subject to environmental stresses, lithium-ion cells can rapidly release the energy they contain by venting smoke and flames in a manner that can ignite nearby materials as well as other lithium-ion cells. While the battery pack is designed to contain any single cell’s release of energy without spreading to neighboring cells, a field or testing failure of battery packs in our vehicles could occur, which could result in bodily injury or death and could subject us to lawsuits, field actions (including product recalls), or redesign efforts, all of which would be time consuming and expensive and could harm our brand image. We have already experienced minor thermal events in connection with battery cell testing failures. As the scale and intensity of testing increase, the likelihood of additional thermal events will also increase. Also, negative public perceptions regarding the suitability of lithium-ion cells for automotive applications, the social and environmental impacts of mineral mining or procurement associated with the constituents of lithium-ion cells, or any future incident involving lithium-ion cells, such as a vehicle or other fire, could materially and adversely affect our reputation and business, prospects, financial condition, results of operations, and cash flows.

We have minimal experience servicing and repairing our vehicles. If we or our partners are unable to adequately service our vehicles, our business, prospects, financial condition, results of operations, and cash flows could be materially and adversely affected.

We have minimal experience servicing and repairing our vehicles. Servicing EVs is different than servicing vehicles with internal combustion engines and requires specialized skills, including high voltage training and servicing techniques. Although we are planning to internalize most aspects of vehicle service over time, initially we plan to partner with third parties to enable nationwide coverage for roadside and off-road assistance and collision repair needs. There can be no assurance that we will be able to enter into an acceptable arrangement with any such third-party providers. Although such servicing partners may have experience in servicing other vehicles, they will initially have limited experience in servicing our vehicles. There can be no assurance that our service arrangements will adequately address the service requirements of our customers to their satisfaction, or that we and our servicing partners will have sufficient resources, experience, or inventory to meet these service requirements in a timely manner as the volume of EVs we deliver increases.

| 18 |

In addition, a number of states currently impose limitations on the ability of manufacturers to directly service vehicles. The application of these state laws to our operations would hinder or impede our ability to provide services for our vehicles from a location in every state. As a result, if we are unable to roll out and establish a widespread service network that complies with applicable laws, customer satisfaction could be adversely affected, which in turn could materially and adversely affect our reputation and thus our business, prospects, financial condition, results of operations, and cash flows.

As we continue to grow, additional pressure may be placed on our customer support team or partners, and we may be unable to respond quickly enough to accommodate short-term increases in customer demand for technical support. Customer behavior and usage may result in higher than expected maintenance and repair costs, which may negatively affect our business, prospects, financial condition, results of operations, and cash flows. We also could be unable to modify the future scope and delivery of our technical support to compete with changes in the technical support provided by our competitors. Increased customer demand for support, without corresponding revenue, could increase costs and negatively affect our results of operations. If we are unable to successfully address the service requirements of our customers or establish a market perception that we do not maintain high-quality support, we may be subject to claims from our customers, including loss of revenue or damages, and our business, prospects, financial condition, results of operations, and cash flows could be materially and adversely affected.

The automotive industry and its technology are rapidly evolving and may be subject to unforeseen changes which could adversely affect the demand for our vehicles or increase our operating costs.

We may be unable to keep up with changes in EV technology or alternatives to electricity as a fuel source and, as a result, our competitiveness may suffer. Developments in alternative technologies, such as advanced diesel, hydrogen, ethanol, fuel cells, or compressed natural gas, or improvements in the fuel economy of the ICE or the cost of gasoline, may materially and adversely affect our business and prospects in ways we do not currently anticipate. Existing and other battery cell technologies, fuels or sources of energy may emerge as customers’ preferred alternative to our vehicles. Any failure by us to develop new or enhanced technologies or processes, or to react to changes in existing technologies, could materially delay our development and introduction of new and enhanced alternative fuel and EVs, which could result in the loss of competitiveness of our vehicles, decreased revenue, and a loss of market share to competitors. Our research and development efforts may not be sufficient to adapt to changes in alternative fuel and electric vehicle technology. As technologies change, we plan to upgrade or adapt our vehicles with the latest technology. However, we are a relatively late entrant to the EV space. Our vehicles may not compete effectively with alternative systems if we are not able to source and integrate the latest technology into our vehicles. Additionally, the introduction and integration of new technologies into our vehicles may increase our costs and capital expenditures required for the production and manufacture of our vehicles and, if we are unable to cost efficiently implement such technologies or adjust our manufacturing operations, our business, prospects, financial condition, results of operations, and cash flows would be materially and adversely affected.

A product recall could cripple growth.

If the Atlis’s XT pickup truck, XP truck platform, or Advanced Charging Station are unable to meet performance and quality criteria, we may be required to perform product recalls to address said concerns. A product recall can have substantial cost related to performing such corrective actions. Although Atlis will perform significant internal testing and qualifications, as well as external qualifications through approved third party vendors against industry standards and regulatory requirements, there will be unperceived conditions which may negatively impact the customer or Company expected performance and safety of our vehicles. As such, Atlis may perform a corrective action such as a recall of products, mandatory repairs of defective components, or litigation settlements which can materially affect our financial goals, operation results, brand, business, and products. If we are unable to provide significant charging stations, our business success may be substantially affected.

A significant portion of our success is our ability to deploy the appropriate number of charging stations, in strategic locations relative to our customers and customer behaviors. If Atlis is unable to deploy charging stations to specified locations, this may negatively affect our brand, business, financial goals, operational results, and product success in the market. As such, to meet said availability requirements, Atlis will require significant capital investments to rapidly deploy said Advanced Charging Stations, as well as development of relationships with third party members who can assist in deployment of said charging stations. If we are unable to address service requirements, we may negatively affect our customer experience. As such, Atlis will require service capabilities to be established in locations within close proximity to our XT pickup truck and XP truck platform owners. Atlis’s ability to engage with third party operating service stations, as well as our ability to establish company operated locations, will be critical to the success of developing a positive customer experience.

| 19 |

Product liability.