Form 1-A Teton Advisors, Inc.

1-A LIVE 0001444874 XXXXXXXX Teton Advisors, Inc. DE 1994 0001444874 6282 13-4008049 22 0 189 Mason Street Greenwich CT 06830 914-457-1070 Elizabeth Gonzalez-Sussman Other 21506861.00 0.00 1430021.00 0.00 30768922.00 11012814.00 0.00 11012814.00 19756108.00 30768922.00 16438017.00 13008761.00 358077.00 2341299.00 1.86 1.85 RSM US LLP Class A Common Stock 991395 88165Y200 Pink Open Market Class B Common Stock 329093 88165Y101 Pink Open Market None 0 000000000 None None 0 000000000 None true true Tier2 Audited Equity (common or preferred stock) N N N Y N N 440162 991395 15.5000 6822500.00 0.00 0.00 0.00 6822500.00 RSM US LLP 20000.00 Olshan Frome Wolosky LLP 110000.00 6642500.00 Additional estimated fees of $50,000 include marketing of the offering, EDGAR filing, subscription agent and information agent services. We intend to engage a broker-dealer in certain states which would increase the offering expenses. AL AK AZ AR CA CO CT DE FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY DC PR AZ TX Teton Advisors, Inc. Restricted Class A common stock, par value $0.001 per share, issued pursuant to the Teton Advisors, Inc. Stock Award and Incentive Plan 17500 0 $0.00. Shares issued pursuant to the Teton Advisors, Inc. Stock Award and Incentive Plan Section 4(a)(2) of the Securities Act

An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted prior to the time an offering circular which is not designated as a Preliminary Offering Circular is delivered and the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

PART II — INFORMATION REQUIRED IN OFFERING CIRCULAR

| Preliminary Offering Circular (Subject to Completion) | Dated May 16, 2022 |

Teton Advisors, Inc.

189 Mason Street, Greenwich, CT 06830

(914) 457-1077

tetonadv.com

Subscription Rights to Purchase Up to 440,162 Shares of Class A Common Stock

at a Subscription Price of $15.50 Per Share

We are distributing, free of charge, to the holders of our Class A common stock, par value of $0.001 per share (the “Class A common stock”), and to the holders of our Class B common stock, par value of $0.001 per share (the “Class B common stock”) (collectively, the “Common Shareholders”), transferable subscription rights to purchase up to 440,162 shares of our Class A common stock, at a subscription price of $15.50 per share. Holders of Class A common stock granted pursuant to restricted stock awards will receive transferable subscription rights to purchase Class A common stock on the same terms as the other Common Shareholders, regardless of whether such restricted stock awards are unvested, and shall also be considered “Common Shareholders” for purposes of the rights offering.

The Common Shareholders will receive three (3) subscription rights for each share of Class A common stock and three (3) subscription rights for each share of Class B common stock that they hold of record as of 5:00 p.m., New York, New York time, on [_____], 2022 (the “Record Date”). Nine (9) subscription rights entitles the holder a basic subscription right to purchase one share of our Class A common stock at the subscription price of $15.50 per share. The subscription rights will be transferable until the expiration of the rights offering. We intend to apply to list the subscription rights to purchase Class A common stock on the OTC Pink under the symbol “[_____]”.

Common Shareholders of record on the Record Date (“Record Date Shareholders”) who fully exercise their subscription rights, may also subscribe to purchase additional shares of our Class A common stock at the same subscription price of $15.50 per, subject to the conditions and limitations described later in this offering statement (the “Over-Subscription Privilege”). The Over-Subscription Privilege will only be available to Record Date Shareholders who fully exercise all subscription rights initially issued to them. Rights that are sold will not confer any right to acquire any Class A common stock in any Over-Subscription Privilege offered.

We will not issue fractional shares of Class A common stock. If the number of subscription rights exercised by a rights holder would otherwise permit them to purchase a fraction of a share, the number of shares that such holder may purchase will be rounded down to the nearest whole share. If all of the basic subscription rights are exercised, the total purchase price of the shares offered in the rights offering would be approximately $6,822,500.

The shares in this rights offering will be sold on a best efforts basis. The rights offering is not contingent upon the occurrence of any event or the sale of a minimum number of shares.

Your subscription rights may be exercised at any time during the period starting on [_____], 2022 and ending at 5:00 p.m., New York, New York time, on [_____], 2022 (the “Expiration Date”), unless we extend the rights offering period, in our sole discretion. Under no circumstances will we issue more than the aggregate of 440,162 shares of Class A common stock in the rights offering. We may cancel the rights offering at any time and for any reason. If we terminate the rights offering, all subscription payments received will be returned as soon as practicable thereafter without interest or deduction.

Our Class A common stock is quoted on the OTC Pink under the symbol “TETAA”. The most recent closing price of our Class A common stock on the OTC Pink as of May 13, 2022, was $22.01 per share. Once the rights offering has commenced, the subscription rights to purchase Class A common stock will be transferable until the expiration of the rights offering. We intend to apply to have such subscription rights listed for trading on the OTC Pink under the symbol “[_____]”. We anticipate that the subscription rights will be listed upon commencement of the rights offering. However, we cannot give any assurance that a market for the subscription rights will develop or, if a market does develop, of the prices at which the subscription rights will trade or whether such market will be sustainable throughout the period when the rights are transferable.

[_________], will serve as the Subscription Agent for the rights offering, and [_________] will serve as the Information Agent for the rights offering. The Subscription Agent will hold the funds we receive from subscribers until we complete, abandon or terminate the rights offering. If you want to participate in this rights offering and you are the record holder of your shares, we recommend that you submit your subscription documents to the Subscription Agent well before the deadline. If you want to participate in this rights offering and you hold shares through a broker, dealer, bank or other nominee, you should promptly contact your broker, dealer, bank or other nominee and submit your subscription documents in accordance with the instructions and within the time period provided by your broker, dealer, bank or other nominee. For a detailed discussion, see “The Rights Offering” beginning on page 24.

We intend to use a broker-dealer to serve as accommodating broker-dealer in certain states, including Texas and Arizona, in connection with this rights offering. We have not yet finalized the engagement of any broker-dealer and have therefore not included any sales commissions in our offering expenses. If we retain a broker-dealer, our offering expenses will be significantly higher and our net proceeds will be lower than disclosed in this offering circular.

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

This Offering Circular is following the offering circular format described in Part II of Form 1-A.

The United States Securities and Exchange Commission does not pass upon the merits of or give its approval to any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering circular or other selling literature. These securities are offered pursuant to an exemption from registration with the Commission; however, the commission has not made an independent determination that the securities offered hereunder are exempt from registration.

This investment involves risk. See “Risk Factors” beginning on page 10.

The date of this Preliminary Offering Circular is May 16, 2022.

TABLE OF CONTENTS

i

QUESTIONS AND ANSWERS RELATING TO THE RIGHTS OFFERING

As used through this offering circular, the terms “we,” “us,” “our,” “the Company” and “Teton Advisors, Inc.” refers to Teton Advisors, Inc. and its subsidiaries.

The following are examples of what we anticipate will be common questions about the rights offering. The answers are based on selected information included elsewhere in this offering circular. The following questions and answers do not contain all of the information that may be important to you and may not address all of the questions that you may have about the rights offering. This offering circular contains a more detailed description of the terms and conditions of the rights offering and provides additional information about us and our business, including potential risks related to the rights offering our Class A common stock, and our business. See the section entitled “The Rights Offering” beginning on page 24 below.

What is the rights offering?

We are distributing, at no cost or charge, to the holders of our Class A common stock, and to the holders of our Class B common stock (collectively, the “Common Shareholders”), transferable subscription rights to purchase up to 440,162 shares of our Class A common stock. The purchase price is $15.50 per share. Holders of Class A common stock granted pursuant to restricted stock awards will receive transferable subscription rights to purchase Class A common stock on the same terms as the other Common Shareholders, regardless of whether such restricted stock awards are unvested, and shall also be considered “Common Shareholders” for purposes of the rights offering. The Common Shareholders will receive three (3) subscription rights for each share of Class A common stock and three (3) subscription rights for each share of Class B common stock that they hold of record as of 5:00 p.m., New York, New York time, on [_____], 2022, the record date of the rights offering. If you hold your shares in the name of a broker, bank or other nominee who uses the services of the Depository Trust Company (“DTC”), DTC will issue three (3) subscription rights to the nominee for each share of our Class A common and Class B common stock you beneficially own at the record date. The subscription rights will be evidenced by Subscription Rights Certificates.

Nine (9) subscription rights entitles the holder a basic subscription right to purchase one share of our Class A common stock at the subscription price of $15.50 per share. Any unsold shares from the basic subscription right will be available for purchase by Common Shareholders of record as of the close of business on the Record Date (the “Record Date Shareholders”) under the Over-Subscription Privilege, described below. The Over-Subscription Privilege will only be available to Record Date Shareholders who fully exercise all subscription rights initially issued to them. Rights that are sold will not confer any right to acquire any Class A common stock in any Over-Subscription Privilege offered. You may exercise any number of your subscription rights, or you may choose not to exercise any subscription rights.

The Class A common stock to be issued upon exercise of the subscription rights in the rights offering will, like our existing shares of Class A common stock be quoted on the OTC Pink under the symbol “TETAA”. The subscription rights granted to you are transferable until the Expiration Date and, therefore, you may sell, transfer or assign your subscription rights to anyone during the offering period. We intend to apply to have the subscription rights to purchase Class A common stock listed for trading on the OTC Pink under the symbol “[_____]”. We anticipate that the subscription rights will be listed upon commencement of the rights offering. However, we cannot give any assurance that a market for the subscription rights will develop or, if a market does develop, of the prices at which the subscription rights will trade or whether such market will be sustainable throughout the offering period when the rights are transferable.

ii

The subscription rights may be exercised at any time during the [●]-day subscription period, which commences on [_____], 2022, through the expiration date for the rights offering, which is 5:00 p.m., New York, New York time, on [_____], 2022 (the “Expiration Date”), unless the rights offering is extended or earlier terminated by us in our sole discretion; provided, however, that we may not extend the Expiration Date by more than 45 calendar days past the original Expiration Date. The subscription rights will expire if they are not exercised by 5:00 p.m., New York City Time, on the Expiration Date, unless the rights offering is extended or earlier terminated by us in our sole discretion. We will not be required to issue shares to you if the Subscription Agent receives your Subscription Rights Certificate or your subscription payment after that time.

Fractional shares resulting from the exercise of the basic subscription right or the Over-Subscription Privilege, each as described below, will be eliminated by rounding down to the nearest whole share, with the total subscription payment being adjusted accordingly. As a result, we may not issue the full number of shares authorized for issuance in connection with the rights offering. Any excess subscription payments received by us will be returned, without interest or penalty, as soon as practicable.

Why are we conducting the rights offering?

We are conducting the rights offering as a way of raising equity capital in a cost-effective manner that gives all of our shareholders an opportunity to participate. We cannot predict the number of shares that will be sold. We intend to add the proceeds from the sales to our general funds to be used for general corporate purposes. See section entitled “Use of Proceeds” beginning on page 23 below.

How will the shares be offered?

The shares will be offered in the rights offering to our Common Shareholders, including to holders of restricted stock awards. These shareholders have a right to buy shares pursuant to their basic subscription right, and if they are a Record Date Shareholder, also have the ability to subscribe for additional shares through an Over-Subscription Privilege in our discretion. Our marketing for this offering will be accomplished through a combination of telephone calls, mail and personal visits and meetings.

What is the basic subscription right?

The basic subscription right gives our stockholders the opportunity to purchase shares of our Class A common stock at the subscription price of $15.50 per share. For every nine (9) rights that you own, you will have a basic subscription right to buy from us one share of Class A common stock at the subscription price. You may exercise your basic subscription right for some or all of your subscription rights, or you may choose not to exercise any subscription rights. Common Shareholders will receive three (3) subscription rights for each share of Class A common stock and three (3) subscription rights for each share of Class B common stock that they hold of record as of 5:00 p.m., New York, New York time on the record date.

For example, if you owned 300 shares of our Class A common stock or Class A common stock as of 5:00 p.m., New York, New York time on the record date, you would receive 900 subscription rights and would have the right to purchase 100 shares of Class A common stock for $15.50 per share with your basic subscription right. If you owned 300 shares of our Class A common stock and 300 shares of our Class B common stock as of 5:00 p.m., New York, New York time on the record date, you would receive 1,800 subscription rights, and would have the right to purchase 200 shares of Class A common stock for $15.50 per share with your basic subscription right.

iii

How do I sell or transfer my rights?

The subscription rights granted to you are transferable until the Expiration Date and, therefore, you may sell, transfer or assign your subscription rights to anyone during the offering period.

We intend to apply to have the subscription rights to purchase Class A common stock listed for trading on the OTC Pink under the symbol “[_____]”. We anticipate that the subscription rights will be listed upon commencement of the rights offering. However, we cannot give any assurance that a market for the subscription rights will develop or, if a market does develop, of the prices at which the subscription rights will trade or whether such market will be sustainable throughout the offering period when the rights are transferable.

Rights acquired in the secondary market may not participate in the Over-Subscription Privilege. See the section entitled “The Rights Offering—Over-Subscription Privilege.”

What is the Over-Subscription Privilege?

If you are a Record Date Shareholder and you exercise your basic subscription right in full, you, together with other Record Date Shareholders that exercise their basic subscription right in full, will be entitled to subscribe to purchase additional shares subject to certain conditions and limitations. The subscription price per share that applies to the Over-Subscription Privilege is the same subscription price per share that applies to the basic subscription right.

If you wish to exercise your Over-Subscription Privilege, you must exercise your basic subscription right in full and specify the number of additional shares of Class A common stock you wish to purchase, which may be up to the maximum number of shares offered in the rights offering, less the number of shares you may purchase under your basic subscription right.

In order to properly exercise your Over-Subscription Privilege, you must deliver the subscription payment for exercise of your Over-Subscription Privilege before the expiration of the rights offering. Because we will not know the total number of unsubscribed shares before the expiration of the rights offering, if you wish to maximize the number of shares you purchase pursuant to your Over-Subscription Privilege, you will need to deliver payment in an amount equal to the aggregate subscription price for the maximum number of shares of Class A common stock available to you, assuming that no stockholder other than you has purchased any shares of our Class A common stock pursuant to their basic subscription right and Over-Subscription Privilege. Rights acquired in the secondary market may not participate in the Over-Subscription Privilege. See the section entitled “The Rights Offering—Over-Subscription Privilege.”

What are the limitations on the Over-Subscription Privilege?

Record Date Shareholders will be permitted to purchase additional shares pursuant to their Over-Subscription Privilege only if other rights holders do not exercise their basic subscription right in full. We reserve the right to reject in whole or in part any over-subscription request, regardless of the availability of shares to satisfy these requests. Subject to this right, we will honor over-subscription requests in full to the extent sufficient shares are available following the exercise of rights under the basic subscription right. If over-subscription requests exceed the shares that are available to satisfy the requests, then, subject to our right to reject in whole or in part any over-subscription request, the available over-subscription shares will be allocated pro rata among those fully exercising holders who over-subscribe based on the number of subscription rights originally issued to them. Any excess subscription payments will be returned, without interest or penalty.

The Over-Subscription Privilege will only be available to Record Date Shareholders who fully exercise all subscription rights initially issued to them. Rights that are sold will not confer any right to acquire any Class A common stock in any Over-Subscription Privilege offered. Banks, broker-dealers and trust companies that hold shares for the accounts of others are advised to notify those persons that purchase rights in the secondary market that such rights will not participate in any Over-Subscription Privilege offered. See the section entitled “The Rights Offering—Over-Subscription Privilege.”

Am I required to exercise the rights I receive in the rights offering?

No. You may exercise any number of your subscription rights, or you may choose not to exercise any subscription rights. However, if you choose not to fully exercise your basic subscription right and other shareholders fully exercise their basic subscription right, the percentage of our common stock owned by these other shareholders will increase relative to your ownership percentage, and your voting rights, if any, and other rights will likewise be diluted. In addition, if you do not exercise your basic subscription right in full, you will not be entitled to subscribe to purchase additional shares pursuant to the Over-Subscription Privilege and your ownership percentage in our common stock and any related voting and other rights may be further diluted.

How soon must I act to exercise my subscription rights?

The subscription rights may be exercised at any time during the [●]-day subscription period, which commences on [_____], 2022, through the expiration date for the rights offering, which is 5:00 p.m., New York, New York time, on [_____], 2022 (the “Expiration Date”), unless we extend the subscription period in our sole discretion. If you elect to exercise any subscription rights, the Subscription Agent must actually receive all required documents and payments from you at or prior to the expiration date. Although we have the option of extending the subscription period at our sole discretion, we do not currently intend to do so.

Are we requiring a minimum subscription to complete the rights offering?

No.

iv

Are there any limitations on the number of subscription rights I may exercise in the rights offering?

As a Common Shareholder, you may only purchase the number of shares purchasable upon exercise of the number of basic subscription rights distributed to you in the rights offering or that you acquired on the secondary market and, if you are a Record Date Shareholder, up to the number of shares that may be made available pursuant to the Over-Subscription Privilege. Accordingly, the number of shares you may purchase in the rights offering is limited by the number of shares of our Class A common stock and/or shares of our Class B common stock that you held on the record date, or the number of rights you acquired in the secondary market, and by the extent to which other shareholders exercise their subscription rights, including any over-subscription requests, if you are a Record Date Shareholder.

The Over-Subscription Privilege will only be available to Record Date Shareholders who fully exercise all subscription rights initially issued to them. Rights that are sold will not confer any right to acquire any Class A common stock in any Over-Subscription Privilege offered. Thus, if you acquire rights on the secondary market and are not a Record Date Shareholder, you may only purchase the number of shares purchasable upon exercise of the number of basic subscription rights that you acquired.

However, no sale may be made to you in this offering if the aggregate purchase price you would pay exceeds 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

In addition, under applicable federal banking laws, any purchase of shares may also require the prior clearance or approval of, or prior notice to, federal bank regulatory authorities if the purchase will result in any person or entity or group of persons or entities acting in concert owning or controlling shares in excess of 10.0% of our outstanding shares of common stock following the completion of the rights offering.

How do I exercise my subscription rights?

If you are a Common Shareholder and wish to participate in the rights offering, you must properly complete the enclosed Subscription Rights Certificate and deliver it, along with the full subscription price (including any amounts in respect of your over-subscription request, if applicable), to the Subscription Agent before 5:00 p.m., New York, New York time, on [_____], 2022. For instructions on exercising your rights, see the sections in this offering circular under the caption “The Rights Offering—Method of Exercising Subscription Rights” and “—Payment Method.” If you cannot deliver your Subscription Rights Certificate to the Subscription Agent before the Expiration Date, you may use the procedures for guaranteed delivery as described in “The Rights Offering—Guaranteed Delivery Procedures.”

If you are a beneficial owner of shares of our Class A common stock or Class B common stock that are registered in the name of a broker, bank or other nominee, then your broker, bank or other nominee is the “record holder” of the shares you own. The record holder must exercise the subscription rights on your behalf for the shares of our Class A common stock you wish to purchase. If you wish to participate, you should instruct your broker, bank or other nominee to exercise your subscription rights and deliver all subscription documents, Subscription Rights Certificate, notice of guaranteed delivery (if applicable) and payment on your behalf before the expiration of the rights offering. You should complete and return to your broker, bank or other nominee the form entitled “Beneficial Owner Election Form.” You should receive this form from your broker, dealer, bank or other nominee with the other offering materials. We assume no responsibility in respect of the timely administration of your broker, dealer, bank or other nominee to perform its obligations on your behalf.

Banks, broker-dealers and trust companies that hold shares for the accounts of others are advised to notify those persons that purchase rights in the secondary market that such rights will not confer any right to acquire any Class A common stock in any Over-Subscription Privilege offered.

If the rights offering is not completed, will my subscription payment be refunded to me?

Yes. The Subscription Agent will hold all funds it receives in a segregated account until completion of the rights offering. If the rights offering is not completed, all subscription payments received by the Subscription Agent will be returned, without interest, as soon as practicable. If you own shares in “street name,” the Subscription Agent will return payments to the record holder of the shares.

What form of payment must I use to pay the subscription price?

You must timely pay the full subscription price for the full number of shares you wish to acquire under the basic subscription right and any over-subscription request by delivering to the Subscription Agent a certified or cashier’s check, a bank draft drawn on a U.S. bank, a U.S. postal or express money order, or wire transfer of funds.

After I exercise my subscription rights, can I change my mind?

No. All exercises of subscription rights are irrevocable by the shareholders, even if you later learn information about us that you consider unfavorable. You should not exercise your subscription rights unless you are certain that you wish to purchase. However, we may cancel, extend or otherwise amend the rights offering at any time prior to the expiration date.

v

Does exercising my subscription rights involve risk?

Yes. The exercise of your subscription rights involves risks. Exercising your subscription rights involves the purchase of additional shares of our Class A common stock and should be considered as carefully as you would consider other equity investments. Among other things, you should carefully consider the risks described under the heading “Risk Factors” beginning on page 10 of this offering circular.

What fees or charges apply if I exercise my subscription rights?

We are not charging any fees or sales commissions to issue subscription rights to you or to issue shares to you if you exercise your subscription rights. If you exercise your subscription rights through a broker or other record holder of your shares, you are responsible for paying any fees that person may charge.

When will I receive my new shares of Class A common stock?

Shares of Class A common stock purchased in the rights offering will be issued only in book-entry form (i.e., no physical stock certificates will be issued). If you are the holder of record of our common stock (whether you hold share certificates or your shares are maintained in book-entry form by our transfer agent), you will receive a statement of ownership reflecting the shares of Class A common stock purchased in the offering in the Direct Registration System (“DRS”) as soon as practicable after the expiration of the rights offering. If your shares of common stock are registered in “street name,” that is, in the name of a broker, bank or other nominee, your shares of Class A common stock will be issued to the same account, and you may request a statement of ownership from the nominee following the expiration of the rights offering.

Shares purchased pursuant to the Over-Subscription Privilege will be issued in the same manner as soon as practicable after the expiration date of the rights offering and following the completion of any pro-rations as may be necessary in the event the over-subscription requests exceed the number of shares available to satisfy such requests. Thereafter, the shares should be available for delivery to you or your broker as soon as reasonably possible.

May I transfer my subscription rights?

Yes. The subscription rights issued in the rights offering are transferable during the course of the offering period, before the expiration of the rights offering. We intend to apply to have the subscription rights to purchase Class A common stock listed for trading on the OTC Pink under the symbol “[_____]”. We anticipate that the subscription rights will be listed upon commencement of the rights offering. However, we cannot give any assurance that a market for the subscription rights will develop or, if a market does develop, of the prices at which the subscription rights will trade or whether such market will be sustainable throughout the offering period when the rights are transferable. Please see “Risk Factors” for a discussion of some of the risks associated with transferring the subscription rights.

Has our Board of Directors made a recommendation to our shareholders regarding the rights offering?

No. Our Board of Directors is making no recommendations regarding your exercise of subscription rights. You could risk investment loss on new money invested. We cannot assure you that the trading price for our Class A common stock will be above the subscription price at the time of exercise or at the expiration of the rights offering period or that anyone purchasing shares at the subscription price will be able to sell those shares in the future at the same price or a higher price. You are urged to decide whether or not to exercise your subscription rights based on your own assessment of our business and the rights offering. See the section entitled “Risk Factors” beginning on page 10 of this offering circular.

vi

Can the rights offering be cancelled?

Yes. We may cancel the rights offering at any time prior to the expiration date for any reason. If we cancel the rights offering, we will issue a press release notifying rights holders of the cancellation and all subscription payments received by the Subscription Agent will be promptly returned, without interest or penalty.

Can we extend the rights offering?

Yes. We may extend the rights offering and the period for exercising your rights for a period not to exceed 45 calendar days, at our sole discretion. If we elect to extend the expiration of the rights offering, we will issue a press release announcing such extension no later than 9:00 a.m., Eastern time, on the next Business Day after the most recently announced expiration time of the rights offering. We will extend the duration of the rights offering as required by applicable law or regulation and may choose to extend it if we decide to give rights holders more time to exercise their rights in the rights offering. We do not presently intend to extend the rights offering. For purposes of this offering, a “Business Day” shall mean any day on which trading is conducted on the market.

Can we amend the rights offering?

Yes. We also may amend or modify the terms of the rights offering. If we make any fundamental change to the terms of the rights offering set forth in this offering circular, we will offer persons who have exercised their rights the opportunity to cancel their purchases and the Subscription Agent will refund the funds advanced by each such person and recirculate an updated offering circular. In addition, upon such event, we may extend the expiration date of the rights offering to allow rights holders ample time to make new investment decisions and for us to recirculate updated documentation. Promptly following any such occurrence, we will issue a press release announcing any changes with respect to the rights offering and the new expiration date.

The terms of the rights offering cannot be modified or amended after the expiration date of the rights offering. Although we do not presently intend to do so, we may choose to amend or modify the terms of the rights offering for any reason, including, without limitation, in order to increase participation in the rights offering. Such amendments or modifications may include a change in the purchase price, although we do not currently anticipate any such change.

What are the U.S. federal income tax consequences of exercising my subscription rights?

The receipt and exercise of your subscription rights will generally not be taxable under U.S. federal income tax laws, unless the rights offering is part of a “disproportionate distribution” within the meaning of applicable tax law, in which case you may recognize taxable income upon the receipt of the subscription rights. We believe that the rights offering will not be part of a disproportionate distribution. You should, however, seek specific tax advice from your personal tax advisor in light of your personal tax situation and as to the applicability of any other tax laws. See the section below entitled “United States Federal Income Taxation.”

How can I get further information about the rights offering?

This offering circular describes the rights offering in detail. If you have other questions or need assistance, please contact the Information Agent, [______], by email at [_______] or by telephone at (xxx) [xxx]-[xxxx]. Banks and brokerage firms also may contact the Information Agent at (xxx) [xxx]-[xxxx].

vii

As used through this offering circular, the terms “we,” “us,” “our,” “the Company” and “Teton” refers to Teton Advisors, Inc. and its subsidiaries.

This summary highlights selected information from this offering circular and may not contain all the information that you should consider before investing in the securities we are offering. To understand the offered securities properly, you should read the entire document carefully, including the risk factors and our consolidated financial statements and the related notes.

Business Description

Teton Advisors, Inc. (“Teton”), a company incorporated under the laws of Delaware, is a holding company that, through its subsidiaries, provides investment advisory services to open-end funds and separate account clients. We generally manage assets on a fully discretionary basis and invest primarily in U.S. securities. Our revenues are based primarily on the Company’s level of assets under management (“AUM”) and fees associated with our various investment products. We conduct our investment advisory business principally through two subsidiaries, which are registered investment advisors: Keeley-Teton Advisors, LLC and Teton Advisors, LLC.

Teton was formed in Texas as Teton Advisers LLC in December 1994. On March 2, 1998, Teton Advisers LLC was renamed Gabelli Advisors LLC and, on the same date, merged into Gabelli Advisers, Inc., a Delaware corporation. On January 25, 2008, Gabelli Advisers, Inc. was renamed Teton Advisors, Inc. On March 20, 2009, Teton was spun-off from GAMCO Investors, Inc. (NYSE: GBL) (“GAMCO”), which had a 42% ownership stake in the Company.

On February 28, 2017, Teton acquired the assets of Keeley Asset Management Corp. (“KAMCO”) in a newly formed, wholly-owned subsidiary, Keeley-Teton Advisors, LLC (“Keeley-Teton”). The acquisition expanded Teton’s product suite to eleven mutual funds under the TETON Westwood and KEELEY Funds Brands (collectively referred to herein as the “Funds”), along with various separately managed account strategies. On December 30, 2021, Teton transferred the investment management agreement with the TETON Westwood SmallCap Equity Fund and the portfolio team that managed the fund to Keeley-Teton. Keeley-Teton is a registered investment advisor and serves as the investment manager for the KEELEY Funds with AUM of $561.5 million at December 31, 2021. It is also the investment manager of one TETON Westwood Fund named TETON Westwood SmallCap Equity Fund with AUM of $57.3 million at December 31, 2021. In addition to the Funds, Keeley-Teton acts as investment adviser to various separately managed and wrap product accounts. The total assets under management of these accounts were $513.6 million at December 31, 2021. The KEELEY Funds consist of the following three Funds:

| ● | KEELEY Small Cap Dividend Fund | |

| ● | KEELEY Small-Mid Cap Fund | |

| ● | KEELEY Mid Cap Dividend Value Fund |

On December 31, 2021, Teton transferred its advisory business, operations and personnel to a newly formed, wholly-owned subsidiary, Teton Advisors, LLC (“Teton LLC”). Teton LLC is a registered investment advisor and serves as the investment manager for four TETON Westwood Funds with AUM of $868.6 million at December 31, 2021. The four TETON Westwood Funds are:

| ● | TETON Westwood Mighty MitesSM Fund | |

| ● | TETON Westwood Equity Fund | |

| ● | TETON Westwood Balanced Fund | |

| ● | TETON Convertible Securities Fund |

Teton LLC has retained Gabelli Funds, LLC, a subsidiary of GAMCO Investors, Inc. (“GAMCO”), to act as sub-advisor for the TETON Westwood Mighty Mites Fund and the TETON Convertible Securities Fund. Teton LLC has also retained Westwood Management Corporation, a subsidiary of Westwood Holdings Group, Inc. (NYSE: WHG) to act as sub-advisor for the TETON Westwood Balanced Fund and the TETON Westwood Equity Fund. The TETON Westwood SmallCap Equity Fund and all of the KEELEY Funds are advised by Keeley-Teton.

1

Teton LLC and Keeley-Teton’s combined total assets under management were $2.0 billion at December 31, 2021.

G.distributors, LLC (“G.distributors”), an affiliate of Teton and a subsidiary of GAMCO, distributes both the TETON Westwood and KEELEY Funds pursuant to distribution agreements with each Fund.

Teton’s principal executive office is located at 189 Mason Street, Greenwich, Connecticut 06830, and our telephone number is (914) 457-1077. Our website is www.tetonadv.com. Our website and the information included therein are not part of this offering circular.

Business Strategy

Our business strategy targets global growth of the franchise through continued leveraging of our asset management capabilities, including our brand name and long-term investment performance records, through organic and strategic growth initiatives.

Open-End Funds. Teton provides advisory services to the Funds, consisting of eight open-end funds, four of which are managed on a day-to-day basis by Keeley-Teton, two of which are sub-advised by Gabelli Funds, LLC, and two of which are sub-advised by Westwood Management Corporation. AUM in open-end Funds was approximately $1.5 billion at December 31, 2021, an increase of 7.1% from $1.4 billion of AUM at December 31, 2020.

We market our open-end funds primarily through third party distribution programs, including no transaction fee (“NTF”) programs, and have developed additional share classes for many of our funds for distribution through additional third-party distribution channels.

At December 31, 2021, third party distribution programs accounted for approximately 89% of all assets in TETON Westwood open-end funds, and all of the assets in KEELEY Funds. At December 31, 2021, approximately 11% of TETON Westwood Fund’s AUM and 0% of KEELEY Fund’s AUM in open-end funds were sourced through G.distributors direct sales relationships.

Separate, Private Client and Wrap Accounts. Beginning in 2009, we have provided investment management services to separate account clients. In connection with our acquisition of KAMCO’s assets in 2017, we expanded our investment advisory service offerings to include private client and wrap accounts. At December 31, 2021, we had $513.6 million of AUM in these product offerings, an increase of $95.3 million from $418.3 million at December 31, 2020. In general, our separate, private client and wrap accounts will be managed to meet the specific needs and objectives of each client. The investment advisory agreements for our separate, private client and wrap account clients are subject to termination by the client without penalty on 30 days’ notice.

Shareholders of the open-end TETON Westwood Funds and KEELEY Funds can exchange shares among the same class of shares of the other open-end TETON Westwood Funds, as well as the Gabelli/GAMCO open-end funds, as economic and market conditions and investor needs change, at no additional cost. However, certain open-end Funds impose a 2% redemption fee on shares redeemed seven days or less after a purchase. We may periodically introduce new funds designed to complement and expand our investment product offerings, respond to competitive developments in the financial marketplace and meet the changing needs of investors.

2

Assets Under Management

The following table sets forth total AUM by product type as of the year ended shown:

Assets Under Management

By Product Type

(in millions)

| % Inc. (Dec.) | ||||||||||||||||||||||||

| 2021 | 2020 | 2019 | 2018 | 2017 | 2021 / 2020 | |||||||||||||||||||

| Equities | $ | 2,001 | $ | 1,829 | $ | 2,326 | $ | 2,428 | $ | 3,371 | 9.4 | % | ||||||||||||

| Fixed Income | - | - | 5 | 7 | 8 | 0.0 | % | |||||||||||||||||

| Total Assets Under Management | $ | 2,001 | $ | 1,829 | $ | 2,331 | $ | 2,435 | $ | 3,379 | 9.4 | % | ||||||||||||

Distribution, Marketing and Shareholder Servicing

In an effort to increase AUM, the marketing team at Teton is focused on major mutual fund industry distribution channels, which include the direct, advisory, supermarket, retirement and institutional channels. In the direct channel, investors carry out transactions directly with mutual fund companies. In all other mutual fund channels, individuals use intermediaries to purchase funds on their behalf. The advisory channel consists of financial intermediaries which provide ongoing investment advice and monitoring. These include full-service brokerage firms, banks, insurance companies and financial planners. Advisors are compensated through sales loads or fees. Through a service agreement with GAMCO, Teton utilizes the G.distributors wholesaler and internal marketing force to gather assets in these channels. Teton is similarly targeting the defined contribution retirement and institutional channels, which consists of corporations, endowments and foundations. Teton believes it is capable of serving all of these channels because its mutual funds have multiple share classes.

Teton is pursuing non-mutual fund opportunities mainly in the small, small-mid (SMID) and mid cap equity asset classes. The marketing effort is focused on sub-advisory and traditional separate accounts, as well as private client and wrap accounts. The target market consists of insurance companies, commercial banks, institutions and charitable organizations that rely on consultant due diligence and recommendations. Teton seeks to build strategic relationships with institutions and wealth management providers with whom the Teton management team has developed long-term relationships.

G.distributors, a subsidiary of GAMCO, distributes the Funds pursuant to distribution agreements with each Fund. Under the distribution agreements, G.distributors offers and sells the Funds’ shares on a continuous basis and pays most of the costs of marketing and selling the shares, including printing and mailing prospectuses and sales literature, advertising and maintaining sales and customer service personnel and sales and services fulfillment systems, and payments to the sponsors of third-party distribution and financial intermediaries programs for the Funds, and G.distributors sales personnel. G.distributors receives fees for such services pursuant to distribution plans adopted under provisions of Rule 12b-1 of the Investment Company Act of 1940, as amended.

Under the distribution agreements, certain share classes of the Funds are subject to 12b-1 distribution plans (the “12b-1 Plans”). Pursuant to the 12b-1 Plans, the Class AAA shares of the TETON Westwood Funds and the Class A shares of the KEELEY Funds pay 0.25% per year on the average daily net assets of the fund, the Class A shares of the TETON Westwood Funds pay 0.35% or 0.50% per year on the average daily net assets of the fund, and the Class C and Class T shares of the TETON Westwood Funds pay 1.00% per year on the average daily net assets of the fund. The payments are made to G.distributors and other third-party broker-dealers.

3

G.distributors’ distribution agreements with the Funds may continue in effect from year to year only if specifically approved at least annually by (i) the Funds’ Board of Trustees (“Board of Trustees”) or (ii) the Funds’ shareholders and, in either case, the vote of a majority of the trustees who are not parties to the agreement or “interested persons” of any such party, within the meaning of the Investment Company Act. Each Fund may terminate its distribution agreement, or any agreement thereunder, at any time upon 60 days’ written notice by (i) a vote of the majority of the trustees cast in person at a meeting called for the purpose of voting on such termination or (ii) a vote at a meeting of shareholders of the lesser of either 67% of the voting shares represented in person or by proxy or 50% of the outstanding voting shares of such Fund. Each distribution agreement automatically terminates in the event of its assignment, as defined in the Investment Company Act. G.distributors may terminate a distribution agreement without penalty upon 60 days’ written notice.

Keeley-Teton serves as the shareholder servicing agent of the KEELEY Funds pursuant to a shareholder servicing plan and agreement. Under the shareholder servicing agreement, Keeley-Teton is responsible for providing non-distribution, shareholder support services to certain shareholders of the KEELEY Funds. Pursuant to the shareholder service plan, all share classes of the KEELEY Funds pay Keeley-Teton 0.05% per year on the average daily net assets of each Fund. The payments are made to Keeley-Teton by the KEELEY Funds, and Keeley-Teton in turn remits such payments to various third-party intermediaries. The shareholder servicing plan and agreement may continue in effect from year to year only if specifically approved at least annually by the Funds’ Board of Trustees, the vote of a majority of the trustees who are not parties to the agreement or “interested persons” of any such party, within the meaning of the Investment Company Act. Each Fund may terminate its shareholder servicing plan and agreement, or any agreement thereunder, at any time by a vote of the majority of the trustees cast in person at a meeting called for the purpose of voting on such termination.

Investment Management Agreements

Teton provides investment advisory and management services pursuant to investment management agreements with the Funds. The investment management agreements with the Funds generally provide that Teton is responsible for the overall investment and administrative services, subject to the oversight of the Board of Trustees and in accordance with each Fund’s fundamental investment objectives and policies. The administrative services include, without limitation, supervision of the calculation of net asset value, preparation of financial reports for shareholders of the Funds, internal accounting, tax accounting and reporting, regulatory filings and other services. Most of these administrative services are provided through contracts or sub-contracts with unaffiliated third parties.

The Funds’ investment management agreements may continue in effect from year to year only if specifically approved at least annually by (i) the Funds’ Board of Trustees or (ii) the Fund’s shareholders and, in either case, the vote of a majority of the trustees who are not parties to the agreement or “interested persons” of any such party, within the meaning of the Investment Company Act. Each Fund may terminate its investment management agreement at any time upon 60 days’ written notice by (i) a vote of the majority of the Board of Trustees cast in person at a meeting called for the purpose of voting on such termination or (ii) a vote at a meeting of shareholders of the lesser of either 67% of the voting shares represented in person or by proxy or 50% of the outstanding voting shares of such fund. Each investment management agreement automatically terminates in the event of its assignment, as defined in the Investment Company Act. Teton may terminate an investment management agreement with the TETON Westwood Funds without penalty on 60 days’ written notice.

Pursuant to the terms of these investment management agreements, neither Teton nor its officers, directors, employees, agents or controlling persons (“Teton Persons”) are liable to the Funds for any act or omission or for any loss sustained by the Funds in connection with the matters to which the advisory agreement relates. However, Teton Persons are liable to the Funds under these agreements with respect to a loss resulting from willful misfeasance, bad faith or gross negligence in the performance of its duties, or by reason of its reckless disregard of its obligation and duties under the agreement. The investment management agreements also set forth certain indemnification rights for Teton, its employees, officers, directors and agents.

4

Sub-advisory Agreements

Teton pays Westwood Management Corporation a sub-advisory fee of 35% of net revenues for the TETON Westwood Balanced and TETON Westwood Equity Funds. “Net revenues” are defined as management fees less twenty basis points for mutual fund administration expenses (which are paid to GAMCO). For 2021, 2020 and 2019, the sub-advisory fees paid to Westwood Management Corporation by Teton amounted to $256,978, $242,102 and $269,010, respectively. This agreement may be terminated by Westwood Management Corporation on 60 days’ prior written notice and may be terminated by the Funds or Teton on 60 days’ prior written notice, provided that termination by the Funds must be approved by a majority of the Board of Trustees or the holders of a “majority of the voting securities” of the Funds.

Teton pays Gabelli Funds, LLC an annual rate of 0.32% of the average net assets of the TETON Westwood Mighty Mites and TETON Westwood Convertible Securities Funds. For 2021, 2020 and 2019, the sub-advisory fees paid to Gabelli Funds, LLC by Teton amounted to $2,523,875, $2,312,961 and $3,494,412, respectively. This agreement may be terminated by Gabelli Funds, LLC on 60 days’ prior written notice and may be terminated by the Funds or Teton on 60 days’ prior written notice, provided that termination by the Funds must be approved by a majority of the Board of Trustees or the holders of a “majority of the voting securities” of the Funds.

Recent Developments

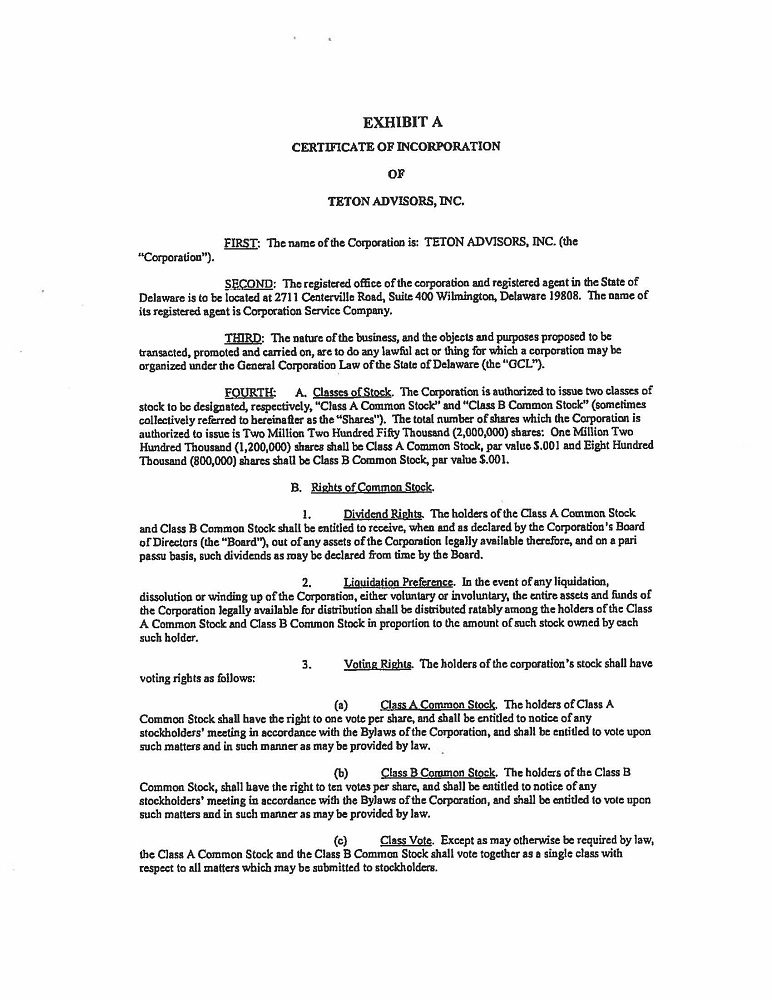

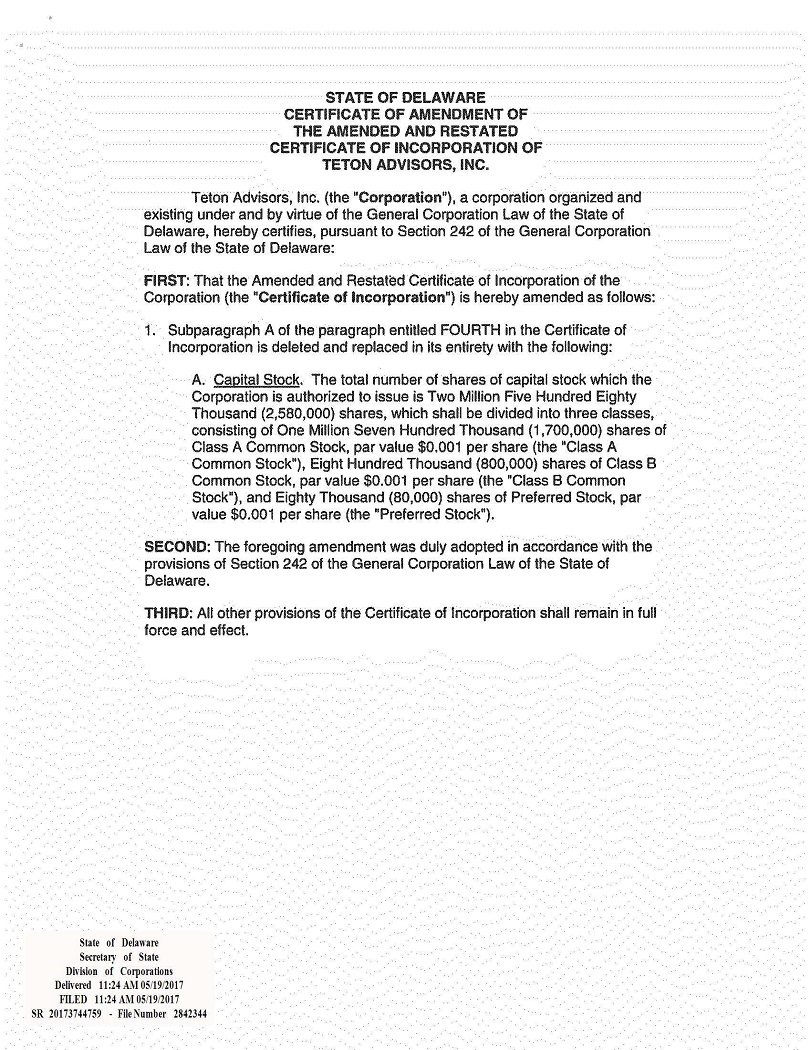

At our 2022 Annual Meeting of Shareholders (the “Annual Meeting”), to be held on Tuesday, May 24, 2022, we intend to, among other things, submit the following proposals for approval by our shareholders: (i) a proposal to amend the Company’s Amended and Restated Certificate of Incorporation to increase the total number of authorized shares from 2,580,000 to 7,500,000, whereby the authorized Class A common stock is increased from 1,700,000 to 5,150,000, the authorized Class B common stock is increased from 800,000 to 2,000,000, and the authorized preferred stock is increased from 80,000 to 350,000 (the “Authorized Shares Increase Proposal”); and (ii) a proposal to approve the Company’s Amended and Restated Stock Award and Incentive Plan, which amends our existing Stock Award and Incentive Plan to (i) increase the number of shares of Class A common stock currently reserved for the granting of stock awards under the plan from 100,000 to 200,000 and (ii) add a provision whereby the number of shares of Class A common stock available for issuance under the plan is subject to an increase on the first trading day of January of each calendar year during the term of the plan, beginning with calendar year 2023, by an amount up to 5% of the combined number of shares of Class A common stock and Class B common stock outstanding as of the last trading day of the prior calendar year, as determined by the Board in its discretion prior to the date of the increase (the “Amended and Restated Stock Award and Incentive Plan Proposal”).

5

The following summary describes the principal terms of the rights offering, but is not intended to be complete. See the section of this offering circular below entitled “The Rights Offering” for a more detailed description of the terms and conditions of the rights offering.

| Securities Offered | We are distributing, at no cost or charge, to the holders of our Class A common stock and to the holders of our Class B common stock (collectively, the “Common Shareholders”), transferable subscription rights to purchase up to 440,162 shares of our Class A common stock, at a subscription price of $15.50 per share. Holders of Class A common stock granted pursuant to restricted stock awards will receive transferable subscription rights to purchase Class A common stock on the same terms as the other Common Shareholders, regardless of whether such restricted stock awards are unvested, and shall also be considered “Common Shareholders” for purposes of the rights offering. The Common Shareholders will receive three (3) subscription rights for each share of Class A common stock and three (3) subscription rights for each share of Class B common stock that they hold of record as of 5:00 p.m., New York, New York time, on [_____], 2022 (the “Record Date”). |

| Basic Subscription Right | For every nine (9) rights that you own, you will have a basic subscription right to buy from us one share of Class A common stock at the subscription price. You may exercise your basic subscription right for some or all of your subscription rights, or you may choose not to exercise any subscription rights. |

| Over-Subscription Privilege | If you are a Common Shareholder as of 5:00 p.m., New York, New York time on the Record Date (a “Record Date Shareholder”) and you fully exercise all subscription rights initially issued to you, then you may be entitled to buy shares of Class A common stock, referred to as “over-subscription shares,” that are not purchased by other rights holders in the offering (the “Over-Subscription Privilege”). The Over-Subscription Privilege will only be available to Record Date Shareholders who fully exercise all subscription rights initially issued to them. Rights that are sold will not confer any right to acquire any Class A common stock in any Over-Subscription Privilege offered.

The subscription price for shares purchased pursuant to the Over-Subscription Privilege will be the same as the subscription price for the basic subscription right. If enough over-subscription shares are available, all such requests will be honored in full. We reserve the right to reject in whole or in part any or all over-subscription requests. Subject to this right, we will honor over-subscription requests in full to the extent sufficient shares are available following the exercise of rights under the basic subscription right. If over-subscription requests exceed the shares that are available to satisfy the requests, then, subject to our right to reject in whole or in part any over-subscription request, the available over-subscription shares will be allocated pro rata among those fully exercising holders who over-subscribe based on the number of subscription rights originally issued to them.

Notwithstanding the above, the Board of Directors has the right in its absolute discretion to eliminate the Over-Subscription Privilege with respect to over-subscription shares if it considers it to be in the best interest of the Company to do so. The Board of Directors may make that determination at any time, without prior notice to Record Date Shareholders or others, up to and including the fifth day following the Expiration Date (as defined below). See the section below entitled “The Rights Offering—Over-Subscription Privilege.” |

| Subscription Price | The subscription price per share shall be equal to $15.50. To be effective, any payment related to the exercise of a subscription right or the Over-Subscription Privilege must clear prior to the expiration of the rights offering period. |

| Record Date | The record date will be [____], 2022. |

| Commencement Date | The subscription period for the rights offering begins on [____], 2022. |

| Expiration Date | The subscription rights will expire at 5:00 p.m., New York, New York time, on [_____], 2022, which expiration date is subject to extension for a period not to exceed 45 calendar days, at our sole discretion (the “Expiration Date”). |

| Procedure for Exercising Subscription Rights | The subscription rights may be exercised at any time during the subscription period, which commences on [____], 2022.

If you are a record holder of shares of Class A common stock and/or Class B common stock, to exercise your subscription rights, you must properly complete the enclosed Subscription Rights Certificate and deliver it, along with the full subscription price (including any amounts in respect of an over-subscription request) and Notice of Guaranteed Delivery (if applicable), to the Subscription Agent before 5:00 p.m., New York, New York time, on [_____], 2022, unless the expiration date is extended. If you use the mail, we recommend that you use insured, registered mail, return receipt requested. |

6

| If you are a beneficial owner of shares of Class A common stock and/or Class B common stock that are registered in the name of a broker, dealer, bank, or other nominee, you will not receive a Subscription Rights Certificate. Instead, you should instruct your broker, bank or other nominee to exercise your subscription rights and deliver all subscription documents, Subscription Rights Certificate, Notice of Guaranteed Delivery (if applicable) and payment on your behalf before the expiration of the rights offering. If you are not contacted by your nominee, you should promptly contact your nominee in order to subscribe for shares in the rights offering and follow the instructions provided by your nominee. | |

| Delivery of Shares of Class A Common Stock | Shares of Class A common stock purchased in the rights offering will be issued only in book-entry form (i.e., no physical stock certificates will be issued). If you are the holder of record of our common stock (whether you hold share certificates or your shares are maintained in book-entry form by our transfer agent), you will receive a statement of ownership reflecting the shares of Class A common stock purchased in the offering in the Direct Registration System (“DRS”) as soon as practicable after the expiration of the rights offering. If your shares of common stock are registered in “street name,” that is, in the name of a broker, bank or other nominee, your shares of Class A common stock will be issued to the same account, and you may request a statement of ownership from the nominee following the expiration of the rights offering. |

| Net Proceeds of Offering | The net proceeds to us will depend on the number of subscription rights that are exercised, including over-subscription requests. If we issue all shares available for the exercise of basic subscription rights in the rights offering, the net proceeds to us, after deducting estimated offering expenses, will be approximately $6,642,500. We estimate that the expenses of the rights offering will be approximately $180,000. We intend to use the net proceeds for general corporate purposes. See the section below entitled “Use of Proceeds.” |

| No Revocation of Exercise by Shareholders | All exercises of subscription rights are irrevocable, even if you later learn information about us that you consider unfavorable. You should not exercise your subscription rights unless you are certain that you wish to purchase the shares of Class A common stock offered pursuant to the rights offering. |

| Conditions to the Rights Offering | The completion of the rights offering is subject to the conditions described in the section below entitled “The Rights Offering—Conditions and Cancellation.” |

| Amendment; Cancellation | We may amend the terms of the rights offering or extend the rights offering period. We also reserve the right to cancel the rights offering at any time prior to the expiration date for any reason. |

| No Board Recommendation | Our Board of Directors is making no recommendations regarding your exercise of the subscription rights. You are urged to make your own decision whether or not to exercise your subscription rights based on your own assessment of our business and the rights offering. See the section below entitled “Risk Factors.” |

| Trading of Common Stock | Our Class A common stock is quoted on the OTC Markets OTC Pink tier under the symbol “TETAA”. |

| Transferability of Subscription Rights | The subscription rights issued in the rights offering are transferable during the course of the offering period, before the expiration of the rights offering. We intend to apply to have the subscription rights to purchase Class A common stock listed for trading on the OTC Pink under the symbol “[_____]”. Rights that are purchased on the OTC Pink do not confer any right to acquire any Class A common stock in any Over-Subscription Privilege offered. See the section entitled “The Rights Offering—Transferability of Subscription Rights.” |

7

| Certain Material U.S. Federal Income Tax Considerations | The receipt and exercise of your subscription rights will generally not be taxable under U.S. federal income tax laws, unless the rights offering is part of a “disproportionate distribution” within the meaning of applicable tax law, in which case you may recognize taxable income upon the receipt of the subscription rights. We believe that the rights offering will not be part of a disproportionate distribution. However, you should seek specific tax advice from your personal tax advisor in light of your personal tax situation and as to the applicability and effect of any other tax laws. See the section entitled “United States Federal Income Taxation” on page 55 below. |

| Subscription Agent | Our subscription agent is [_________]. |

| Information Agent | Our information agent is [_________]. |

| Shares of Common Stock Outstanding Before the Rights Offering | As of May 13, 2022, there were 991,395 shares of our Class A common stock outstanding and 329,093 shares of our Class B common stock outstanding. (1) |

| Shares of Common Stock Outstanding After Completion of the Rights Offering | We will issue up to 440,162 shares of Class A common stock in the rights offering, depending on the number of subscription rights that are exercised. Based on the number of shares of common stock outstanding as of May 13, 2022, if we issue all 440,162 shares of Class A common stock available for the exercise of basic subscription rights in the rights offering, we would have 1,431,557 shares of Class A common stock and 329,093 shares of Class B common stock outstanding following the completion of the rights offering. (1) |

| Questions | If you have any questions about the rights offering, including questions about subscription procedures and requests for additional copies of this offering circular or other documents, please contact the Information Agent, [______], by email at [_______] or by telephone at ([xxx]) [xxx]-[xxxx]. Banks and brokerage firms also may contact [_____] at ([xxx]) [xxx]-[xxxx]. |

| Risk Factors | An investment in our common stock involves certain risks. You should carefully consider the risks described under “Risk Factors” beginning on page 10 of this offering circular, as well as other information included in this offering circular, including our financial statements and notes thereto, before making an investment decision. |

| (1) | The number of shares of Class A common stock immediately before and immediately after this offering excludes 138,000 shares of Class A common stock reserved for issuance under our Amended and Restated Stock Award and Incentive Plan. |

8

Set forth below is selected consolidated financial data of the Company for the years and at the dates indicated. The information at December 31, 2021 and 2020 and for the years ended December 31, 2021, 2020 and 2019 is derived in part from our audited consolidated financial statements and notes thereto beginning at page F-1 of this offering circular. The selected consolidated financial data below should be read in conjunction with our consolidated financial statements and the accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The historical results are not necessarily indicative of results that may be expected for any future period.

| For the Years Ended December 31, | ||||||||||||||||||||

| 2021 | 2020 | 2019 | 2018 | 2017 | ||||||||||||||||

| Income Statement Data | ||||||||||||||||||||

| Revenues: | ||||||||||||||||||||

| Investment advisory fees, net | $ | 16,404,470 | $ | 13,704,762 | $ | 20,637,324 | $ | 27,949,496 | $ | 28,510,064 | (b) | |||||||||

| Distribution fees | 30,105 | 51,929 | 103,722 | 207,393 | 216,119 | |||||||||||||||

| Other income, net | 3,442 | 50,422 | 135,145 | 96,677 | 74,157 | |||||||||||||||

| Total revenues | 16,438,017 | 13,807,113 | 20,876,191 | 28,253,566 | 28,800,340 | |||||||||||||||

| Expenses: | ||||||||||||||||||||

| Compensation | 5,501,495 | 4,575,357 | 5,654,516 | 6,915,935 | 8,571,309 | |||||||||||||||

| Marketing and administrative fees | 1,436,309 | 1,324,788 | 1,750,220 | 2,065,704 | 1,936,662 | |||||||||||||||

| Distribution expenses | 1,704,012 | 1,718,386 | 2,153,478 | 2,610,734 | 2,200,728 | (b) | ||||||||||||||

| Advanced commissions | 18,296 | 47,398 | 89,022 | 190,712 | 197,419 | |||||||||||||||

| Sub-advisory fees | 2,780,853 | 2,555,063 | 3,763,422 | 4,770,393 | 3,734,300 | |||||||||||||||

| Other operating expenses | 1,567,796 | 1,652,141 | 1,972,286 | 2,669,632 | 2,213,927 | |||||||||||||||

| Total operating expenses | 13,008,761 | 11,873,133 | 15,382,944 | 19,223,110 | 18,854,345 | |||||||||||||||

| Income before interest, taxes, depreciation, amortization and impairment | 3,429,256 | 1,933,980 | 5,493,247 | 9,030,456 | 9,945,995 | |||||||||||||||

| Interest expense | - | - | 426,822 | 1,579,904 | 854,817 | |||||||||||||||

| Depreciation and amortization expense | 358,077 | 792,350 | 851,266 | 855,363 | 706,036 | |||||||||||||||

| Impairment of intangible assets | - | 5,550,000 | 8,220,000 | 1,755,839 | 202,000 | |||||||||||||||

| Income (loss) before income taxes | 3,071,179 | (4,408,370 | ) | (4,004,841 | ) | 4,839,350 | 8,183,142 | |||||||||||||

| Income tax provision (benefit) | 729,180 | (854,557 | ) | (1,402,514 | ) | 1,216,695 | 3,314,454 | |||||||||||||

| Net income (loss) | $ | 2,341,999 | $ | (3,553,813 | ) | $ | (2,602,327 | ) | $ | 3,622,655 | $ | 4,868,688 | ||||||||

| Net income (loss) per share: | ||||||||||||||||||||

| Basic | $ | 1.86 | $ | (2.82 | ) | $ | (2.06 | ) | $ | 1.81 | $ | 2.83 | ||||||||

| Fully diluted | $ | 1.85 | $ | (2.82 | ) | $ | (2.06 | ) | $ | 1.76 | $ | 2.63 | ||||||||

| Weighted average shares outstanding: | ||||||||||||||||||||

| Basic | 1,260,988 | 1,261,293 | 1,262,491 | 1,232,961 | 1,157,272 | |||||||||||||||

| Fully diluted | 1,268,828 | 1,261,293 | 1,262,491 | 1,270,021 | 1,244,306 | |||||||||||||||

| Actual shares outstanding at December 31st (a) | 1,320,487 | 1,302,988 | 1,304,788 | 1,263,387 | 1,176,883 | |||||||||||||||

| Dividends declared | $ | - | $ | 0.05 | $ | 0.20 | $ | 0.20 | $ | 0.20 | ||||||||||

| (a) | Includes 59,500, 42,000, 42,500, zero and 11,500 of unvested RSAs for the five years ended December 2021, 2020, 2019, 2018 and 2017, respectively. |

| (b) | Amounts were restated to reflect adoption of the new revenue recognition standard. Please see footnote A in the audited financial statements. |

| December 31, | ||||||||||||||||||||

| 2021 | 2020 | 2019 | 2018 | 2017 | ||||||||||||||||

| Balance Sheet Data | ||||||||||||||||||||

| Total assets | $ | 30,768,922 | $ | 20,074,244 | $ | 24,188,792 | $ | 27,716,607 | $ | 31,921,960 | ||||||||||

| Total liabilities and redeemable preferred stock | 11,012,814 | 3,166,153 | 4,163,333 | 4,907,863 | 11,004,769 | |||||||||||||||

| Total stockholders’ equity | 19,756,108 | 16,908,091 | 20,025,459 | 22,808,744 | 20,917,191 | |||||||||||||||

9

An investment in the securities offered hereby involves certain risks. You should carefully read the following risk factors about our business and this offering, together with the other information in this offering circular, before making a decision to purchase any shares. If any of the following risks actually occurs, our business, assets, liquidity, operating results, prospects and financial condition could be seriously harmed. This could cause the trading price of our securities to decline, resulting in a loss of all or part of your investment.

Risk is inherent in all investing. Therefore, before investing in the Class A common stock you should consider the risks associated with such an investment carefully. The following summarizes some of the matters that you should consider before investing in the Fund through the rights offering.

Risks Related to the Rights Offering

Your interest in us may be diluted as a result of the rights offering.

Up to 440,162 shares of our Class A common stock are issuable in the rights offering, with any remaining shares available to satisfy over-subscription requests. If you do not choose to fully exercise your basic subscription right, your percentage ownership interest in us will decrease. In addition, if you do not exercise your Over-Subscription Privilege and other shareholders exercise their Over-Subscription Privilege, the percentage of our common stock owned by all other shareholders will increase.

Further, if you purchase shares in the rights offering and the subscription price is less than the fair value of our shares, then you would experience an immediate dilution of the aggregate fair value of the shares you purchase in the rights offering.

What if I am a shareholder of record and do not exercise my rights?

If you do not exercise all of your subscription rights, you may own a smaller proportional interest in the Company when the rights offering is over. In addition, you will experience an immediate dilution of the aggregate value per share of your Class A or Class B common stock if you do not participate in the rights offering, which may be partially offset (in whole or in part) by the accretive nature of the rights offering. As with any security, the price of Class A common stock fluctuates with market conditions and other factors.

No prior market exists for the subscription rights, and if you acquire subscription rights in the open market, you may suffer a complete loss of your investment.

The subscription rights will be transferable during the course of the offering period, before the expiration of the rights offering. We intend to apply to have the subscription rights to purchase Class A common stock listed for trading on the OTC Pink under the symbol “[_____]”. We anticipate that the subscription rights will be listed upon commencement of the rights offering. However, the subscription rights are a new issue of securities with no prior trading market, and we cannot provide you any assurances as to the liquidity of the trading market for the subscription rights or the market value of the subscription rights. If you wish to sell your subscription rights but such subscription rights cannot be sold, or if you provide the Subscription Agent with instructions to exercise the subscription rights and your instructions are not timely received by the Subscription Agent or if you do not provide any instructions to exercise your subscription rights, the subscription rights will expire and will be void and no longer exercisable.

Moreover, if you acquire subscription rights in the open market or otherwise and the rights offering, is not consummated, the purchase price for the acquisition of such subscription rights will not be refunded to you. Accordingly, you may suffer a complete loss of your investment if you acquire subscription rights.

In addition, any rights acquired in the secondary market may not participate in the Over-Subscription Privilege.

The subscription rights subscriptions are stock will be subject to more volatility and more limited liquidity than subscription rights traded on national exchanges.

We intend to apply to have the subscription rights to purchase Class A common stock listed for trading on the OTC Pink under the symbol “[_____]”. If the subscription rights begin trading on the OTC Pink, there will likely be low trading volumes in the subscription rights. As a result, there is a lower likelihood of one’s orders for subscription rights being executed, and current prices may differ significantly from the price one was quoted at the time of one’s order entry.

Electronic processing of orders is not available for securities traded in the OTC Pink and high order volume and communication risks may prevent or delay the execution of one’s trading orders. This lack of automated order processing may affect the timeliness of order execution reporting and the availability of firm quotes for the subscription rights. Heavy market volume may lead to a delay in the processing of security orders for the subscription rights, due to the manual nature of these markets. Consequently, you may not be able to sell subscription rights at optimum trading prices.

10

The Over-Subscription Privilege will only be available to Record Date Shareholders who fully exercise all subscription rights initially issued to them. Rights that are sold will not confer any right to acquire any Class A common stock in any Over-Subscription Privilege offered.

Only holders of rights that are Record Date Shareholders will be able to participate in the Over-Subscription Privilege. If you acquire rights on the secondary market and are not a Record Date Shareholder, you may not participate in the Over-Subscription Privilege and you may only purchase the number of shares purchasable upon exercise of the number of basic subscription rights that you acquired.

Banks, broker-dealers and trust companies that hold shares for the accounts of others are advised to notify those persons that purchase rights in the secondary market that such rights will not participate in any Over-Subscription Privilege.

The subscription price determined for the rights offering is not necessarily an indication of the fair value of our common stock.

Our Board of Directors determined the terms of the rights offering, including the subscription price, in its sole discretion. In determining the subscription price, the Board of Directors considered a number of factors, including:

| ● | the size and timing of the rights offering and the price at which our shareholders might be willing to participate in a rights offering offered on a pro rata basis to all shareholders with an Over-Subscription Privilege; |