Form 1-A Masterworks 144, LLC

1-A LIVE 0001925327 XXXXXXXX true Masterworks 144, LLC DE 2022 0001925327 7380 88-1533891 0 0 225 LIBERTY STREET 29TH FLOOR NEW YORK NY 10281 203-518-5172 JOSH GOLDSTEIN Other 100.00 0.00 0.00 0.00 100.00 0.00 0.00 0.00 100.00 100.00 0.00 0.00 0.00 0.00 0.00 0.00 N/A Membership Interests 1000 000000000 NONE Membership Interests 0 000000000 NONE None 0 000000000 NONE true true Tier2 Audited Equity (common or preferred stock) Y Y N Y Y N 31100 0 20.0000 622000.00 0.00 0.00 0.00 622000.00 Independent Brokerage Solutions LLC and Arete Wealth Management, LLC 9642.00 Independent Brokerage Solutions LLC and Arete Wealth Management, LLC 18660.00 N/A 0.00 N/A 0.00 N/A 0.00 N/A 0.00 N/A 13000.00 44856 622000.00 Estimated Net Proceeds Calculation (above) of $622,000 does not include any offering fees as all fees in connection with the offering are to be paid by Masterworks Administrative Services, LLC and affiliates. true AL AK AZ AR CA CO CT DE FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY DC PR A0 A1 A2 A3 A4 A5 A6 A7 A8 A9 B0 Z4 AL AK AZ AR CA CO CT DE FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY DC PR A0 A1 A2 A3 A4 A5 A6 A7 A8 A9 B0 Z4 Masterworks 144, LLC Membership Interests 1000 0 100% of the membership interests in Masterworks 144, LLC were issued to Masterworks Gallery, LLC in return for a capital contribution of $100 The foregoing issuances were pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended, for transactions by an issuer not involving any public offering.

As filed with the Securities and Exchange Commission on August 15, 2022

File No.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-A

REGULATION A OFFERING CIRCULAR

UNDER THE SECURITIES ACT OF 1933

MASTERWORKS 144, LLC

(Exact name of issuer as specified in its charter)

Delaware

(State of other jurisdiction of incorporation or organization)

225 Liberty St. 29th Floor

New York, New York 10281

Phone: (203) 518-5172

(Address, including zip code, and telephone number,

including area code of issuer’s principal executive office)

Joshua B. Goldstein

General Counsel and Secretary

Masterworks 144, LLC

225 Liberty St. 29th Floor

New York, New York 10281

Phone: (203) 518-5172

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

| 7380 | 88-1533891 | |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this preliminary offering circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Securities and Exchange Commission is qualified. This preliminary offering circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a final offering circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the offering circular may be obtained.

MASTERWORKS 144, LLC

Preliminary Offering Circular

August 15, 2022

Subject to Completion

31,100 Class A ordinary shares

Representing Class A Limited Liability Company Interests

$622,000 Maximum Offering Amount

Masterworks 144, LLC is a Delaware limited liability company formed to facilitate an investment in a single work of art by Yayoi Kusama, entitled “xPxuxmxpxkxixnx” (the “Artwork” or the “Painting”) as described in an art purchase agreement, a form of which is attached as Exhibit 6.3 to the offering statement of which this offering circular is an integral part. We believe that, for many investors, our Class A shares represent an effective means to gain economic exposure to the Artwork and, by extension, to the fine art market.

We are offering up to $622,000 of our Class A shares representing Class A limited liability company interests, at an offering price of $20.00 per Class A share in a “Tier 2” offering under Regulation A (the “Offering”). We expect to offer Class A shares in this Offering until we raise the maximum amount being offered. The maximum offering period is 24 months from the date of commencement, but we reserve the right to terminate this Offering for any reason at any time prior to the initial closing. Subscriptions will be accepted on a rolling basis and the initial closing of the Offering and the final closing of the Offering will occur on a date or dates determined by the Company in its discretion. This Offering will commence on the date this Offering is qualified by the SEC. If any of the Class A shares offered remain unsold as of the final closing, such Class A shares shall be issued to Masterworks, in full satisfaction of its advance and the true-up as described in this Offering Circular. There is no minimum number of Class A shares or dollar amount that needs to be sold as a condition of any closing of this Offering. Subscriptions, once received, are irrevocable by investors but can be rejected by us.

This Offering is being conducted on a “best efforts” basis, which means that there is no guarantee that any minimum amount will be sold through our co-managing underwriters, Independent Brokerage Solutions LLC (“IndieBrokers”) and Arete Wealth Management LLC (“Arete”). Each of IndieBrokers and Arete are referred to as an “Underwriter” or collectively as the “Underwriters.” Each of the Underwriters is a Securities and Exchange Commission (“SEC”) registered broker-dealer, and a member of the Financial Industry Regulatory Authority (“FINRA”) and Securities Investors Protection Corporation (“SIPC”). See “Plan of Distribution” in this Offering Circular.

Our affiliate Masterworks.io, LLC owns an online investment platform located at https://www.masterworks.com/ (the “Masterworks Platform”) that allows investors to acquire ownership of an interest in special purpose companies that invest in distinct artworks or a collection of artworks. Once an investor establishes a user profile on the Masterworks Platform, they can browse and screen potential artwork investments, view details of an investment and sign contractual documents online.

We do not currently intend to list the Class A shares for trading on a national securities exchange. We intend to facilitate secondary sales of Class A shares on an alternative trading system operated by Templum Markets LLC, referred to as the “Templum ATS,” commencing on or after the three-month anniversary of the date this Offering is fully subscribed. No assurance can be given that the Templum ATS will provide an effective means of selling your Class A shares or that the price at which any Class A shares are sold through the Templum ATS will be reflective of the fair value of the Class A shares or the Artwork.

No sales of Class A shares will be made prior to the qualification of the Offering Statement by the SEC. All Class A shares will be offered in all jurisdictions at the same price that is set forth in this offering circular.

| Class

A shares Offered by Us | Number

of Class A ordinary shares | Price

to Public | Underwriting Discounts and Commissions (1) | Proceeds,

Before Expenses, to Us (2) | ||||||||||||

| Per Class A share: | 1 | $ | 20.00 | $ | 0.00 | $ | 20.00 | |||||||||

| Total (3) | 31,100 | $ | 622,000 | $ | 0.00 | $ | 622,000 | |||||||||

| (1) | We have engaged the Underwriters in connection with this Offering. The Underwriters may engage other broker-dealers to assist us in finding potential investors. The Underwriters will receive certain fees and commissions and expense reimbursements from Masterworks in respect of its activities, but no commissions, fees or expense reimbursements of the Underwriters shall be paid by the Company or from the proceeds of this Offering. The maximum amount of underwriting compensation payable to the Underwriters in connection with this offering shall not exceed approximately 4.45% of the gross offering proceeds if the maximum offering is sold, excluding any FINRA filing fees. The Underwriters are acting solely on a “best efforts” basis and will not acquire or sell any Class A shares for their own account. The Company intends to distribute the Offering through the Masterworks Platform. See the section entitled “Plan of Distribution” beginning on page 28 of this offering circular for additional information. | |

| (2) | This amount does not include underwriting compensation, including maximum fees and commissions payable to the Underwriters and estimated offering expenses in an aggregate amount of approximately $41,302, all of which will be paid by Masterworks rather than from the net proceeds of the Offering. | |

| (3) | Assumes that the maximum aggregate offering amount of $622,000 is received by us. |

The Class A shares are to be offered on a “best efforts” basis primarily through the Masterworks Platform. The Company is not offering, and does not anticipate selling, Class A shares in any state where the Underwriters are not registered as broker-dealers.

Generally, no sale may be made to you in this Offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov. We retain complete discretion to determine that subscribers are “qualified purchasers” (as defined in Regulation A under the Securities Act) in reliance on the information and representations provided to us regarding their financial situation.

An investment in the Class A shares is subject to certain risks and should be made only by persons or entities able to bear the risk of and to withstand the total loss of their investment. Prospective investors should carefully consider and review the information under the heading “Risk Factors” beginning on page 10.

The SEC does not pass upon the merits of or give its approval to any securities offered or the terms of the Offering, nor does it pass upon the accuracy or completeness of any offering circular or other solicitation materials. These securities are offered pursuant to an exemption from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”); however, the SEC has not made an independent determination that the securities offered are exempt from registration.

We expect that our operations will not cause us to meet the definition of an “investment company” under the Investment Company Act of 1940, as amended (the “1940 Act”), because (1) at all times our sole assets will consist only of cash and a single work of art referred to herein as the “Artwork,” neither of which is deemed to be a “security” for purposes of the 1940 Act, and (2) at all times we will not be engaged primarily in owning, holding, investing or trading in “securities” (as such term is used for purposes of the 1940 Act).

This offering circular is part of an offering statement that we filed with the SEC, using a continuous offering process pursuant to Rule 251(d)(3) of Regulation A, meaning that while the offering of securities is continuous, active sales of securities may happen sporadically over the term of the offering. Further, the acceptance of subscriptions, whether via the Masterworks Platform or otherwise, may be briefly paused at times to allow us to effectively and accurately process and settle subscriptions that have been received. Periodically, we will provide an offering circular supplement that may add, update or change information contained in this offering circular. Any statement that we make in this offering circular will be modified or superseded by any inconsistent statement made by us in a subsequent offering circular supplement. The offering statement we filed with the SEC includes exhibits that provide more detailed descriptions of the matters discussed in this offering circular. You should read this offering circular and the related exhibits filed with the SEC and any offering circular supplement, together with additional information contained in our annual reports, semi-annual reports and other reports and information statements that we will file periodically with the SEC. See the section entitled “Where You Can Find More Information” below for more details.

Our principal office is located at 225 Liberty St., 29th Floor, New York, New York 10281 and our phone number is (203) 518-5172. Our corporate website address is located at www.masterworks.com. Information contained on, or accessible through, the website is not a part of, and is not incorporated by reference into, this offering circular.

This offering circular is following the offering circular format described in Part II of Form 1-A.

| INDEPENDENT BROKERAGE SOLUTIONS LLC | ARETE WEALTH MANAGEMENT, LLC |

The date of this offering circular is ______, 2022.

TABLE OF CONTENTS

Neither we nor the Underwriters have authorized anyone to provide any information other than that contained or incorporated by reference in this offering circular prepared by us or to which we have referred you. Neither we nor the Underwriters take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This offering circular is an offer to sell only the Class A shares offered hereby but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this offering circular is current only as of its date, regardless of the time of delivery of this offering circular or any sale of Class A shares.

For investors outside the United States: We have not done anything that would permit this Offering or possession or distribution of this offering circular in any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourselves about and to observe any restrictions relating to the Offering and the distribution of this offering circular.

| 1 |

Certain data included in this offering circular is derived from information provided by third-parties that we believe to be reliable. The discussions contained in this offering circular relating to the Artwork, the artist, the art market, and the art industry are taken from third-party sources that the Company believes to be reliable and reasonable, and that the factual information is fair and accurate. Certain data is also based on our good faith estimates which are derived from management’s knowledge of the industry and independent sources. Industry publications, surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of included information. We have not independently verified such third-party information, nor have we ascertained the underlying economic assumptions relied upon therein. The statistical data relating to the art market is difficult to obtain, may be incomplete, out-of-date, or inconsistent and you should not place undue reliance on any statistical or general information related to the art market included in this offering circular. The art market data used in this offering circular involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such data. While we are not aware of any material misstatements regarding any market, industry or similar data presented herein, such data was derived from third party sources and reliance on such data involves risks and uncertainties.

We own or have applied for rights to trademarks or trade names that we use in connection with the operation of our business, including our corporate names, logos and website names. In addition, we own or have the rights to copyrights, trade secrets and other proprietary rights that protect our business. We do not own the copyright to the Artwork, as such term is defined below. This offering circular may also contain trademarks, service marks and trade names of other companies, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this offering circular is not intended to, and should not be read to, imply a relationship with or endorsement or sponsorship of us. Solely for convenience, some of the copyrights, trade names and trademarks referred to in this offering circular are listed without their ©, ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our copyrights, trade names and trademarks. All other trademarks are the property of their respective owners.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This offering circular contains certain forward-looking statements that are subject to various risks and uncertainties. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “plan,” “intend,” “expect,” “outlook,” “seek,” “anticipate,” “estimate,” “approximately,” “believe,” “could,” “project,” “predict,” or other similar words or expressions. Forward-looking statements are based on certain assumptions, discuss future expectations, describe future plans and strategies, or state other forward-looking information. Our ability to predict future events, actions, plans or strategies is inherently uncertain. Although we believe that the expectations reflected in our forward-looking statements are based on reasonable assumptions, actual outcomes could differ materially from those set forth or anticipated in our forward-looking statements. Factors that could cause our forward-looking statements to differ from actual outcomes include, but are not limited to, those described under the heading “Risk Factors.” Readers are cautioned not to place undue reliance on any of these forward-looking statements, which reflect our views as of the date of this offering circular. Furthermore, except as required by law, we are under no duty to, and do not intend to, update any of our forward-looking statements after the date of this offering circular, whether as a result of new information, future events or otherwise.

| 2 |

STATE LAW EXEMPTION AND PURCHASE RESTRICTIONS

Our Class A shares are being offered and sold only to “qualified purchasers” (as defined in Regulation A under the Securities Act). As a Tier 2 offering pursuant to Regulation A under the Securities Act, this Offering is exempt from state law “Blue Sky” review, subject to meeting certain state filing requirements and complying with certain anti-fraud provisions, to the extent that our Class A shares offered hereby are offered and sold only to “qualified purchasers” or at a time when our Class A shares are listed on a national securities exchange. “Qualified purchasers” include: (i) “accredited investors” under Rule 501(a) of Regulation D and (ii) all other investors so long as their investment in our Class A shares does not represent more than 10% of the greater of their annual income or net worth (for natural persons), or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural persons). Accordingly, we reserve the right to reject any investor’s subscription in whole or in part for any reason, including if we determine in our sole and absolute discretion that such investor is not a “qualified purchaser” for purposes of Regulation A.

To determine whether a potential investor is an “accredited investor” for purposes of satisfying one of the tests in the “qualified purchaser” definition, the investor must be a natural person who:

| 1. | has a net worth, or joint net worth with the person’s spouse or spousal equivalent, that exceeds $1,000,000 at the time of the purchase, excluding the value of the primary residence of such person; or | |

| 2. | had earned income exceeding $200,000 in each of the two most recent years or joint income with a spouse or spousal equivalent exceeding $300,000 for those years and has a reasonable expectation of reaching the same income level in the current year; or | |

| 3. | is holding in good standing one or more professional certifications or designations or credentials from an accredited educational institution that the SEC has designated as qualifying an individual for accredited investor status; or | |

| 4. | is a “family client,” as defined by the Investment Advisers Act of 1940, of a family office meeting the requirements in Rule 501(a) of Regulation D and whose prospective investment in the issuer is directed by such family office pursuant to Rule 501(a) of Regulation D. |

For purposes of determining whether a potential investor is a “qualified purchaser,” annual income and net worth should be calculated as provided in the “accredited investor” definition under Rule 501 of Regulation D. In particular, net worth in all cases should be calculated excluding the value of an investor’s home, home furnishings and automobiles.

USE OF CERTAIN TERMS AND DEFINITIONS

In this offering circular, unless the context indicates otherwise, the following terms have the following meaning:

| ● | “Class A ordinary share” or “Class A ordinary shares” refers to a Class A ordinary share or Class A ordinary shares, respectively, representing membership interests in the Company. | |

| ● | “Class A preferred share” or “Class A preferred shares” refers to a Class A preferred share or Class A preferred shares, representing membership interests in the Company, which has no voting rights but has a $20.00 per share liquidation preference over Class A shares. | |

| ● | “Class A share” or “Class A shares” refers generically to a Class A ordinary share or Class A preferred share or Class A ordinary shares and Class A preferred shares collectively or any combination thereof, respectively, representing membership interests in the Company. | |

| ● | “Class B share” or “Class B shares” refers to a Class B ordinary share or Class B ordinary shares, respectively, representing profits interests in the Company. | |

| ● | “Class C share” refers to a Class C ordinary share, representing a special class of membership interests in the Company, which has no economic rights or obligations and has no voting rights, but solely represents the right to reconstitute, remove and or replace the Board of Managers of the Company pursuant to the Company’s operating agreement. | |

| ● | “Masterworks” refers to Masterworks.io, LLC, and or its wholly owned subsidiaries, which include Masterworks Investor Services, LLC, which will conduct operations related to investor relations and pay all fees and expenses of the Underwriters and is referred to herein as “Masterworks Investor Services,” Masterworks Administrative Services, LLC, which will provide management services to us and is referred to herein as the “Administrator,” and Masterworks Gallery, LLC, but does not include Masterworks 144, LLC or Masterworks Cayman. | |

| ● | “Masterworks Cayman” refers to a Cayman Islands segregated portfolio company. Following the initial closing of the Offering, title to the Artwork will be held in a segregated portfolio of Masterworks Cayman. The Artwork will be the only asset of the segregated portfolio, and we will be the only shareholder of that segregated portfolio. | |

| ● | “Masterworks Investor” refers to an affiliate of Masterworks that has raised capital from unaffiliated third party investors to invest the proceeds in a diversified collection of artwork and which acquires Class A shares as part of such investment strategy. | |

| ● | “Masterworks Platform” refers to the first online fine art investment platform located at https://www.masterworks.com/. The Masterworks Platform gives eligible investors the ability to: |

| ○ | Browse art investment offerings; | |

| ○ | Transact entirely online, including digital legal documentation, initiate funds transfer, and ownership recordation; and | |

| ○ | Execute trades in shares issued by Masterworks issuers via the Templum ATS; and | |

| ○ | Manage and track investments easily through an online portfolio management tool. |

| ● | “Shares” refers generically to the Class A shares and Class B shares. | |

| ● | “we,” “our,” “ours,” “us,” “Masterworks 144” or the “Company,” refer to Masterworks 144, LLC, a Delaware limited liability company and, as the context requires, the segregated portfolio of Masterworks Cayman that will hold title to the Artwork. |

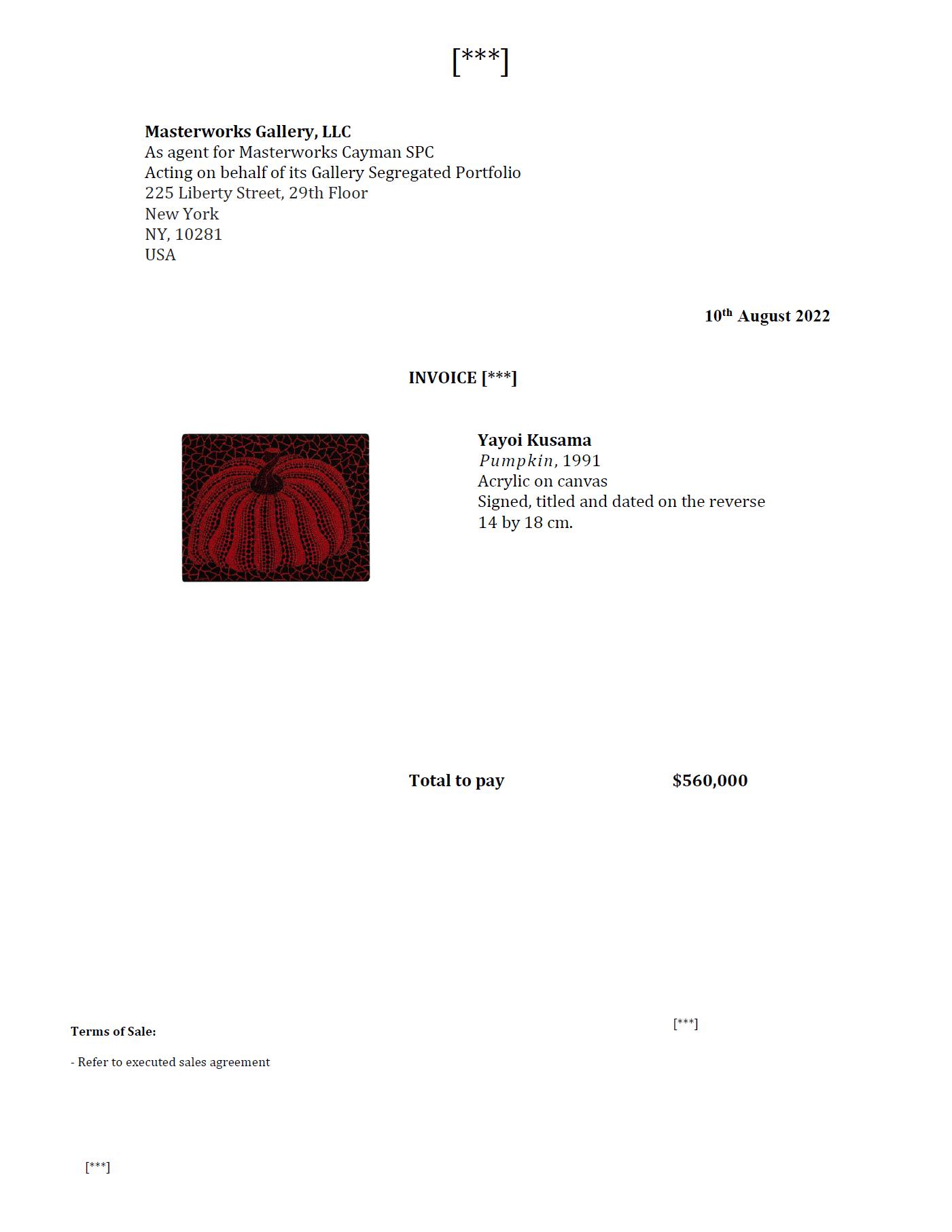

Acting as agent for the Company, Masterworks has agreed to acquire the Artwork at a purchase price of $560,000. Dollar amounts throughout this offering circular have been rounded to the nearest whole dollar and information such as auction sale prices, that were originally denominated in a currency other than the U.S. dollar have been converted into U.S. dollars at the prevailing exchange rate on the applicable date of such sale transaction per publicly available data.

| 3 |

This summary highlights selected information contained elsewhere in this offering circular. This summary does not contain all of the information you should consider before investing in the Class A shares. You should read this entire offering circular carefully, especially the risks of investing in the Class A shares discussed under “Risk Factors,” before making an investment decision.

Overview

We were formed as a Delaware limited liability company on March 2, 2022 to facilitate an investment in the Artwork. Masterworks will manage all maintenance and entity-level administrative services relating to the Artwork and the Company. We will not conduct any business activities except for activities relating to an investment in, maintenance, promotion and the eventual sale of the Artwork. Our strategy will be to display and promote the Artwork so as to enhance its value and broaden its exposure to the art-viewing public.

Acting as agent for the Company, Masterworks has agreed to acquire the Painting, which measures at 6 inches by 7 inches, in a privately negotiated transaction from a private gallery for $560,000 on August 11, 2022. The acquisition of the Artwork by a segregated portfolio of Masterworks Cayman that is wholly-owned by the Company is planned to occur on or before the initial closing of this Offering.

We are offering up to 31,100 Class A shares in this Regulation A+ Offering for aggregate proceeds of up to $622,000.

We do not expect to generate any material amount of revenues or cash flow unless and until the Artwork is sold and no profits will be realized by investors unless they are able to sell their Class A shares or the Artwork is sold. We will be totally reliant on Masterworks for entity-level and asset management services and the payment of all ordinary and routine operating costs, including those relating to our Company and the Artwork.

The Artist

Yayoi Kusama (b. 1929, Japan) is one of the most prolific artists living today. Since the 1950s, Kusama has worked actively in various media, including performance, painting, sculpture and immersive installations. After she arrived in New York in 1957, the artist began to focus on abstraction and soon, her “Infinity Nets” series developed and garnered recognition. Kusama also exhibited frequently alongside Minimalist and Pop artists, including Donald Judd, Andy Warhol and Dan Flavin. Notably, the artist was included in the “1961 Whitney Annual’’ at the Whitney Museum of American Art in New York. Though Kusama exhibited her “Narcissus Garden” (1966) alongside the 33rd Venice Biennale in 1966, it was not until 1993 that she officially returned to represent Japan at the 45th edition of the show. As of August 15, 2022, Kusama continues her studio practice and is represented by several major galleries, including David Zwirner Gallery and Victoria Miro Gallery.

The artist’s works are included in important permanent collections, such as the Museum of Modern Art in New York, the Broad Museum in Los Angeles, the Hirshhorn Museum in Washington, D.C., the Tate Modern in London, as well as the artist’s eponymous museum in Tokyo, among others. Recent major retrospectives of the artist’s works have been held by art institutions all over the world, including a 2017 to 2019 traveling exhibition titled, “Yayoi Kusama: Infinity Mirrors,” which began at the Hirshhorn Museum in Washington D.C. The artist’s body of work is premised on repetition and her recognizable motifs include the “Infinity Nets,” “xPxuxmxpxkxixnxs’’ and immersive installations, such as the “Infinity Mirror Rooms,” which patrons have been known to wait hours to experience. As of August 15, 2022, Kusama’s top auction records are led by “Untitled (Nets)” (1959), which sold on May 18, 2022 for $10,496,000 at Phillips New York, “xPxuxmxpxkxixnx (LPASG)” (2013), which sold on December 1, 2021 at Christie’s Hong Kong for HKD 62,540,000 ($8,026,633) and “Interminable Net #4” (1959), which sold on April 1, 2019 for HKD 62,433,000 ($7,953,215) at Sotheby’s Hong Kong.

The Painting

| ● | The Painting is a striking, small-scale example of Kusama’s iconic “xPxuxmxpxkxixnx” series, which features one, central, red and black spotted pumpkin against a black and red net background. | |

| ● | The pumpkin first appeared as a motif in 1946, when she exhibited “Kabocha” (xPxuxmxpxkxixnx) in a traveling exposition in Japan. | |

| ● | Kusama’s “xPxuxmxpxkxixnx” paintings have become some of the most commercially desirable examples within her body of work. As of August 15, 2022, pumpkin paintings represent four of the artist’s top eight record prices achieved at auction. | |

| ● | On March 2, 2022, “xPxuxmxpxkxixnx (TOWSSO)” (2006) set the record for xPxuxmxpxkxixnxs smaller than 12 by 12 inches, when it sold for $1,110,538 (£831,600) at Christie’s, London. | |

| ● | The motif, color, size and execution of the Painting make it a particularly commercial and desirable work by the artist. |

Highlights

| ● | Attractive historical price appreciation for similar works to the Painting: 23.3% CAGR implied from selected sales occurring from May 15, 1998 to May 28, 2022.(1) | |

| ● | Moderate auction track-record with 30 years of transaction history and a high level of auction volume based on $178.2 million in total sales over the previous year ending on December 31, 2021.(2) |

Notes:

| 1. | Implied annualized price appreciation based on 29 sales of works by Yayoi Kusama, including one past sale of the Painting, that are similar to the Painting and based on publicly available auction records. | |

| 2. | Based on publicly available auction records as tracked by third-party data sources. |

The Art Market

The Art Market

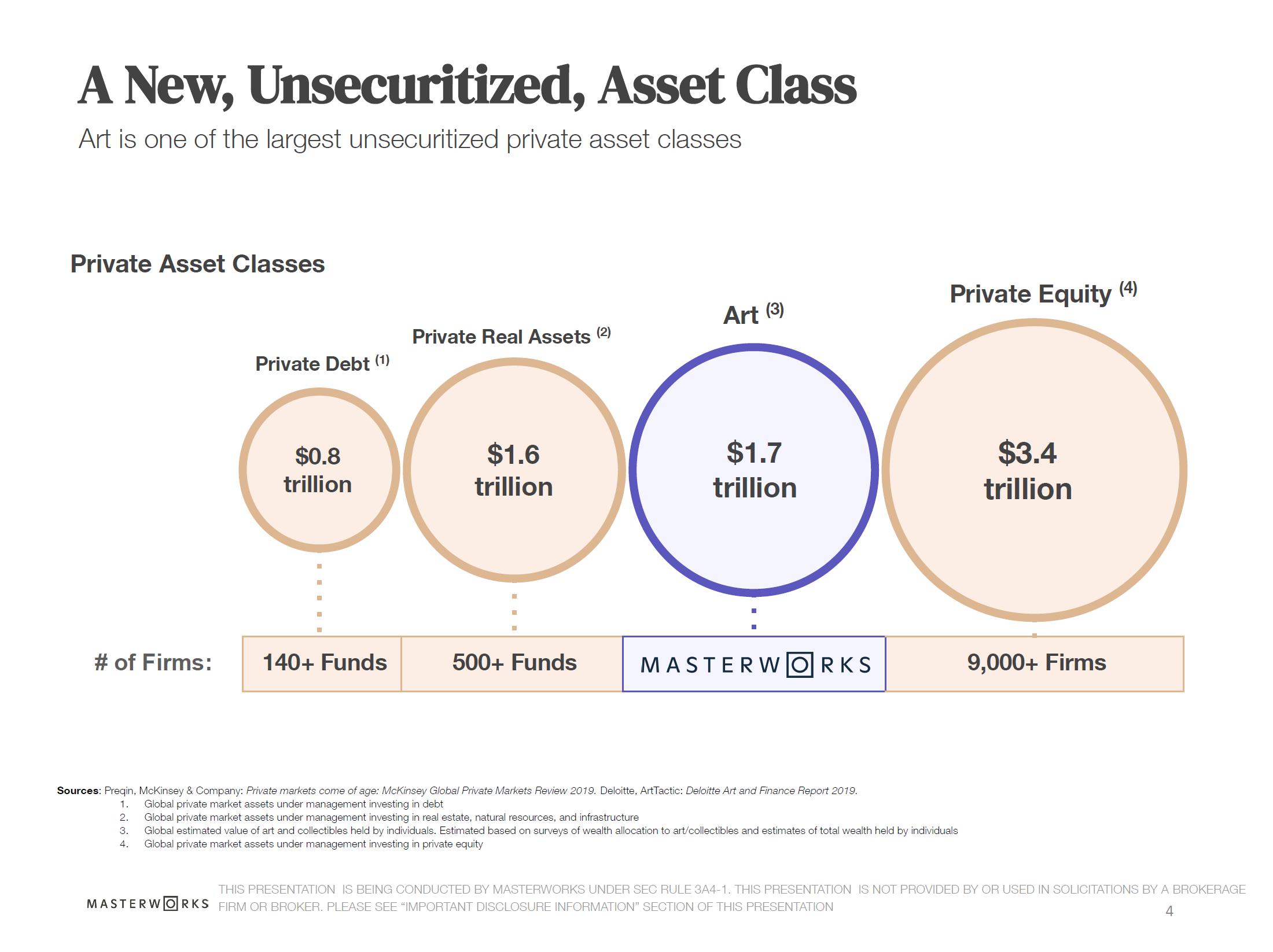

The global art market is comprised of a network of auction houses, dealers, galleries, advisors, agents, individual collectors, museums, public institutions, and various experts and service providers engaged in the purchase and sale of unique and collectible works of art. We estimate that the total value of artwork held by private collectors is approximately $1.7 trillion, based on data included in the Deloitte Art and Finance Report 2019. Over the past decade, total annual art sales have ranged from $50.1 billion to $68.2 billion and have grown at 20% from 2006 through 2021.

| 4 |

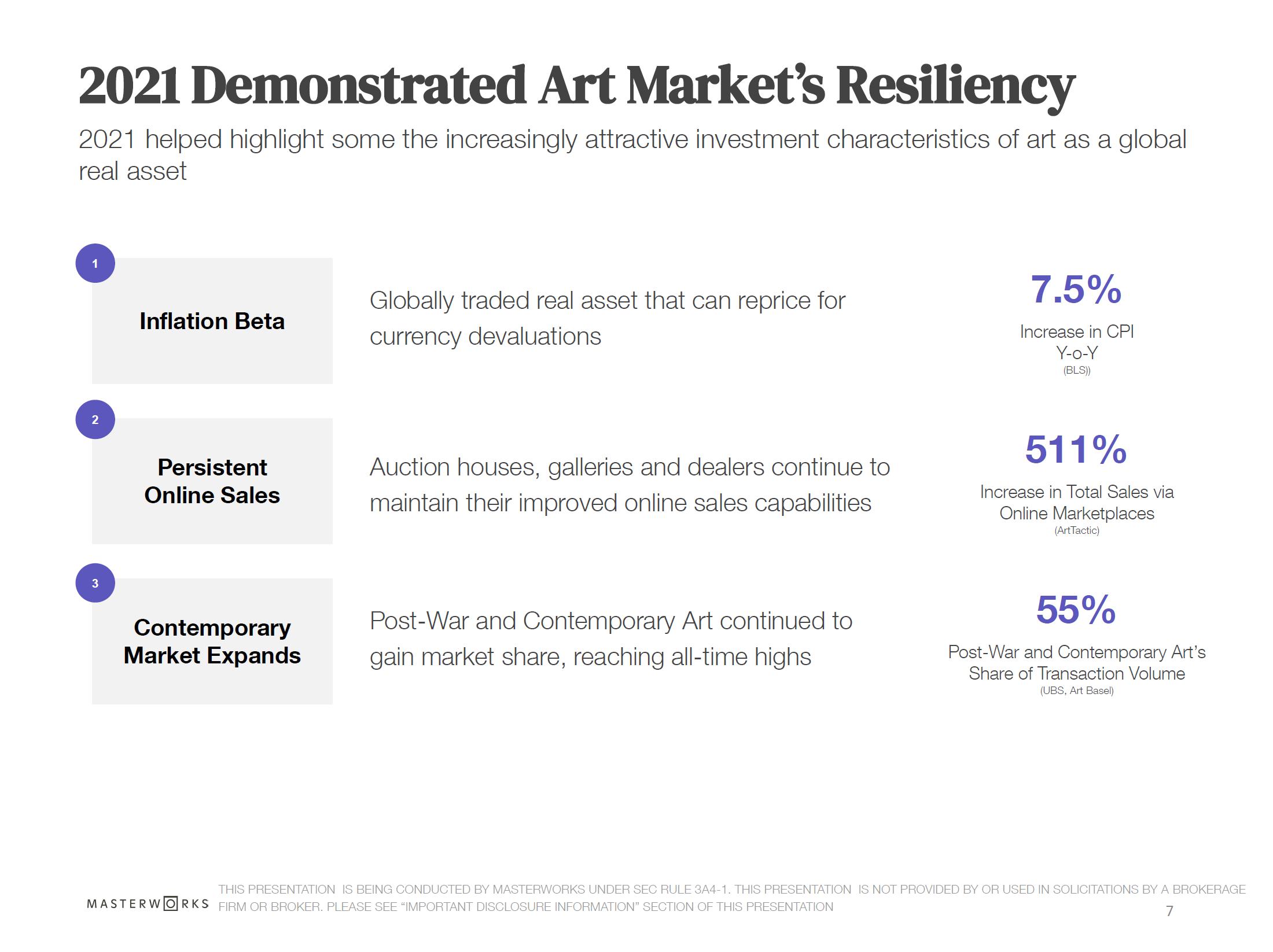

In 2021, the art market experienced a significant recovery in terms of total sales, which had been suppressed in 2020 as a result of COVID-19. A major shift that occurred as a result of COVID was a shift to online sales in the art market, as participants could only transact digitally. And while the traditional schedule of in-person art fairs and public auctions has largely resumed, online sales still made up 20% of transactions in the art market - twice what it accounted for in 2019.

The revival of in person auctions and growth in online sales resulted in $65.1 billion transaction volume, a 30% Y-o-Y increase and the second highest total amount in the last 7 years. Auction volume was up 105% in the first half of 2021 and 71% for the year. May and June of 2021 specifically combined for $3.7 billion, up from $2.0 billion in 2020, when the impacts of COVID-19 on the art market were especially prevalent. This growth in transaction volume was driven by both a higher number of lots sold, as well as higher average prices. Galleries, auction houses and dealers facilitated transactions through traditional in-person events, online sales and a hybrid of the two.

While global auction sales by Christie’s, Sotheby’s and Phillips totaled $125.6 billion in 2021, a 7% Y-o-Y, the Impressionist, Modern, Post-War and Contemporary segments of the auction market comprised nearly 70% of public auction sales for the period. In 2021, the Post-War and Contemporary segment of the art market also continued to gain market share, accounting for 55% of the value of public auction sales, up from 53% in 2019. Based on The Art Market Report 2022, published jointly by Art Basel and UBS, global art sales totaled $65.1 billion in 2021. Global art sales were up 29% in 2021 as compared to 2020, the largest year-over-year increase since 2010, when, largely as a result of the financial crises, sales had fallen by 36% in 2009.

In general, the global art market is influenced by the overall strength and stability of the global economy, geopolitical conditions, capital markets and world events, all of which may affect the willingness of potential buyers and sellers to purchase and sell art. While the global art market is large, its exact size is unknown and statistical data is inconsistent. Much of the uncertainty stems from differing estimates of the size of the private dealer and gallery market, which is based on survey data, but disparities also exist in reported auction sales.

Observations on the Historical Progression of Art Prices

The following are general observations based on a repeat-sales index of historical art market prices computed based on a value weighted-basis and focused on the Post-War & Contemporary Art category, as developed by Masterworks:

| ● | The Post-War & Contemporary Art category showed price appreciation at an estimated annualized rate of 13.8% from the year ended December 31, 1995 to December 31, 2021, versus 10.2% for the S&P 500 Index (includes dividends reinvested) for the same period. | |

| ● | Correlation factor of (0.08) between Post-War & Contemporary Art and the S&P 500 Index based on annual price performance from the year ended December 31, 1995 to December 31, 2021. | |

| ● | Resilience of art market transaction volume through periods of financial stress (e.g., 2001-2, 2008-9, 2020). | |

| ● | We believe these above characteristics present the investment case for art as a possible risk diversifier. |

Management Services

Pursuant to a management services agreement between us, Masterworks Cayman and Masterworks, to be entered into prior to the initial closing of the Offering, the Administrator will fund our ongoing operating costs and expenses and manage all management services relating to our business and the Artwork. In exchange for these services and as reimbursement for ordinary and necessary management costs and expenses, we will issue Class A preferred shares to the Administrator at a rate of 1.5% of the total Class A shares outstanding or for which subscriptions have been received, after giving effect to such issuance, per annum, commencing on the date of the final closing or the date of an earlier closing if, as of such earlier closing date, the Offering is fully subscribed and at least 95% of the subscription proceeds have been received by the Company. These Class A preferred shares will be subject to vesting provisions set forth in the management services agreement. There is no overall limit to the number of shares that may be issued to pay these fees. Any extraordinary or non-routine costs, payments and expenses, if any, relating to our Company or the Artwork will be paid for by the Administrator, but will be reimbursed by us upon the sale of the Artwork. Masterworks may determine to sell the Artwork without engaging a third-party intermediary, in which event, the Administrator would charge the buyer of the Artwork a reasonable fee not to exceed the lowest published buyer’s premium charged by Sotheby’s, Christie’s or Phillips in effect at such time.

Acquisition of the Artwork

Acting as agent for the Company, Masterworks has agreed to acquire the Painting, which measures at 6 inches by 7 inches, in a privately negotiated transaction from a private gallery for $560,000 on August 11, 2022. The acquisition of the Artwork by a segregated portfolio of Masterworks Cayman that is wholly-owned by the Company is planned to occur on or before the initial closing of this Offering. We intend to use a portion of the proceeds from the initial closing of this Offering to contribute to a segregated portfolio of Masterworks Cayman to acquire the Artwork, and if and to the extent such proceeds are less than the purchase price, Masterworks will advance such segregated portfolio of Masterworks Cayman any additional funds required to consummate the acquisition. The remaining net proceeds of the Offering, together with any unsold Class A shares, if any, will be contributed to the segregated portfolio of Masterworks Cayman that will acquire the Artwork and will be used to repay the Masterworks advance and pay Masterworks the true-up. No interest will accrue on the Masterworks advance. Following the initial closing, title to the Artwork will be held in such segregated portfolio of Masterworks Cayman. The Artwork will be the only asset of the segregated portfolio, and we will be the only shareholder of that segregated portfolio.

Sale of the Artwork or the Class A shares

We, in our sole and absolute discretion, will be able to execute a sale of the Artwork at any time and in any manner and, after distribution of the proceeds of such sale, we intend to liquidate our Company. The Company will own the Artwork for an indefinite period and may sell the Artwork at any time following the final closing of the Offering. There is no guaranty that any such means for holders of Class A shares to sell those shares or any sale of the Artwork will be successful, or if successful, that the net proceeds realized by shareholders from such transaction will be reflective of the estimated fair market value of the shares at such time.

| 5 |

Organizational Structure

The following diagram reflects the planned organizational structure and the material relationships between us and Masterworks that will exist following the Offering:

*All entities are Delaware limited liability companies, except Masterworks Cayman, SPC, which is a Cayman Islands segregated portfolio company.

| (1) | “Masterworks.io” refers to our affiliate Masterworks.io, LLC, which owns the Masterworks Platform at www.masterworks.com which will facilitate online investment in connection with this Offering and facilitates similar offerings for other companies. Scott W. Lynn, the founder and Chief Executive Officer of Masterworks, has effective control over Masterworks. |

| (2) | “Masterworks Investor Services” refers to Masterworks Investor Services, LLC, which conducts investor relations services and pays all fees and expenses of the Underwriters. Masterworks Investor Services is not a registered investment advisor under the Investment Advisors Act of 1940, a registered broker-dealer under the Exchange Act, or licensed under any state securities laws. Masterworks Investor Services acts as an agent of Masterworks Administrative Services, LLC and all services performed by Masterworks Investor Services are covered by the management services agreement (See Note 4). Masterworks Investor Services receives no compensation or reimbursement from the Company or investors.

|

| (3) | Masterworks Administrative Services, LLC or the “Administrator” will operate the Masterworks Platform and will perform management services for us and Masterworks Cayman pursuant to the management services agreement. |

| (4) | “Masterworks Gallery” refers to Masterworks Gallery, LLC, which, indirectly (through a segregated portfolio of Masterworks Cayman), owns 100% of our membership interests prior to giving effect to the Offering. We intend to use a portion of the proceeds from the initial closing of this Offering to contribute to a segregated portfolio of Masterworks Cayman to acquire the Painting, and if and to the extent such proceeds are less than the purchase price, Masterworks Gallery will advance to the segregated portfolio of Masterworks Cayman that will acquire the Painting any additional funds required to consummate the acquisition. The remaining net proceeds of the Offering, together with any unsold Class A shares, if any, will be contributed to the segregated portfolio of Masterworks Cayman that will acquire the Painting and will be used as repayment of the advance and payment of the true up. |

| (5) | The Company intends to hold title to the Artwork in a segregated portfolio of a Cayman Islands segregated portfolio company (“Masterworks Cayman”). The Artwork will be the only asset of the segregated portfolio, and we will be the only shareholder of that segregated portfolio. A segregated portfolio company registered under the Cayman Islands Companies Law is a single legal entity which may establish internal segregated portfolios. Each portfolio’s assets and liabilities are legally separated from the assets and liabilities of the Masterworks Cayman ordinary account and are also separate from assets and liabilities attributed to Masterworks Cayman’s other segregated portfolios. This means that a creditor of Masterworks Cayman will only be entitled to recover against assets attributed and credited to the specific segregated portfolio to which the contract is also attributed. The segregated portfolio of Masterworks Cayman holding title to the Artwork does not intend to enter into any contracts or incur any liabilities, except as may be necessary in connection with a sale of the Artwork. |

An investment in the Class A shares includes a number of risks and uncertainties which are described in the “Risk Factors” section of this offering circular, including the following:

| ● | Risks Related to Our Business Model. Our business model is relatively new and untested and we do not plan to generate any material amount of revenues. Our strategy is to own the Artwork for an extended period of time and sell it at a profit, but no assurance can be given that we will be able to sell the Artwork at a profit or the timing of any such sale. |

| ● | Risks Associated with an Investment in a Company owning Fine Art. Artwork can be highly illiquid and investors must be prepared to hold their investment for an extended period of time. The Artwork may decline in value or may not appreciate sufficiently to exceed management fees and expenses. There are a variety of other risks to art investing, including, without limitation, the risk of claims that the artwork is not authentic, physical damage and market risks for any particular artist or work. |

| ● | Risks Relating to Our Relationship with Masterworks. Since we have minimal liquid assets, we are totally reliant on Masterworks to administer our business. If Masterworks were to cease operations for any reason it would be difficult for us to find a replacement administrator and we would likely be required to sell the Artwork and dissolve the Company. In addition, since Masterworks owns Class B shares, which represent “profits interests” and earns fees in the form of Class A preferred shares and incurs maintenance expenses relating to the administration of our business, Masterworks may have economic interests that diverge from your interests. After the one-year anniversary of the qualification of the Offering Statement for this Offering, Masterworks may offer to sell any Class A shares beneficially owned by Masterworks or any entity administered by Masterworks and any such secondary offering may make it more difficult for you to sell your Class A shares and could adversely affect the price at which you can sell your Class A shares on the Templum ATS. Also, a Masterworks affiliate may invest in this Offering and may acquire the Class C share, which gives it the right to remove and replace our board of managers. |

| ● | Risks Related to Ownership of the Class A shares and the Offering. Investors in this Offering will have limited voting rights and Masterworks and its affiliates will have significant discretion to operate the business and sell the Artwork. In addition, Class A shares held by Masterworks and certain electing shareholders are non-voting, but will become voting shares upon sale, which makes it difficult to predict or determine the aggregate voting power represented by your shares at any given point in time. In addition, although we intend to facilitate secondary sales of Class A shares on the Templum ATS, the Templum ATS will have significant limitations and the Class A shares may be illiquid. |

Company Information

We are a manager-managed limited liability company, managed by the Board of Managers. Our principal office is located at 225 Liberty Street, 29th Floor, New York, New York 10281 and our phone number is (203) 518-5172. Our corporate website address is the website address of Masterworks.io at www.masterworks.com. Information contained on, or accessible through, the website is not a part of, and is not incorporated by reference into, this offering circular.

| 6 |

| Class A shares Offered | Up to 31,100 Class A shares, on a “best efforts” basis for up to $622,000 of gross proceeds. Purchasers of the Class A shares will become members of the Company. | |

| Offering Price per Class A share by the Company | $20.00 per Class A share. | |

| Number of Shares Outstanding Before the Offering | As of the date of this filing, 100% of the membership interests of Masterworks 144, LLC are held by Masterworks in the form of 1,000 Class B shares. | |

| Amended and Restated Operating Agreement | Our amended and restated operating agreement, referred to herein as the “operating agreement,” created four classes of membership interests of the Company in the form of Class A ordinary shares, Class A preferred shares, Class B shares, as well as a Class C share. By participating in this Offering, investors will become party to the operating agreement. | |

| Number of Shares Outstanding After the Offering | 31,100 Class A shares.

1,000 Class B shares (100% held by Masterworks) that will entitle Masterworks to a 20% profits interest upon a sale of the Artwork and will be convertible into Class A shares based on a formula that will result in the issuance of a number of Class A shares to Masterworks equal to the quotient of (a) 20% of the aggregate increase in value of our issued and outstanding Class A and Class B shares, divided by (b) the value of the Class A shares at the time of conversion. For a detailed description of the Class B share conversion formula and an example of how it operates, see “Description of Shares.”

0 Class A preferred shares, which will be issued over time as Masterworks earns management fees.

One Class C share that has no economic rights or obligations and has no voting rights, but has the right to remove and or replace all or any members of the Board of Managers and reconstitute the Board without “cause” for any reason. The Class C share will only be issued to, or subsequently transferred to, a Masterworks Investor. | |

| Minimum and Maximum Investment Amount | The maximum investment amount per investor is $100,000 (5,000 Class A shares) and the minimum investment amount per investor is $15,000 (750 Class A shares), however, we can waive the maximum or minimum purchase restriction on a case-by-case basis in our sole discretion. Subscriptions, once received, are irrevocable by the investors but can be rejected by us prior to acceptance. Further, pursuant to the terms of the Company’s Operating Agreement, an investor, other than an affiliate of Masterworks, generally cannot own, or be deemed to beneficially own, as “beneficial ownership” is determined pursuant to Section 13(d) and 13(g) of the Securities Act, more than 19.99% of the total number of Class A shares outstanding, provided that we may waive such limit on a case-by-case basis in our sole discretion. | |

| Subscribing Online | Our affiliate Masterworks.io owns the Masterworks Platform and Masterworks Administrative Services, LLC operates the Masterworks Platform located at https://www.masterworks.com/ that enables investors to become equity holders in companies that own artworks. Through the Masterworks Platform, investors can browse and screen potential artwork investments, view details of an investment and sign contractual documents online. After the qualification by the SEC of the offering statement of which this offering circular is a part, the Offering will be conducted through the Masterworks Platform, whereby investors will receive, review, execute and deliver subscription agreements electronically. For additional information, see “Plan of Distribution – Subscription Procedures.” | |

| Underwriters | Independent Brokerage Solutions LLC (“IndieBrokers”), a New York limited liability company and Arete Wealth Management, LLC, a Delaware limited liability company (“Arete”) are each broker-dealers that are registered with the SEC and in each state where the offering will be made and each is an Underwriter of this Offering on a “best efforts” basis. Each Underwriter is a member of FINRA and SIPC. |

| 7 |

| Payment for Class A shares | After the qualification by the SEC of the offering statement of which this offering circular is a part, investors can make payment of the purchase price in the form of ACH debit transfer or wire transfer into a segregated non-interest bearing account held by us with Goldman Sachs Bank USA or a similar institution until the applicable closing date. We may also permit payment to be made by credit cards. Investors contemplating using their credit card to invest are urged to carefully review “Risk Factors – Risks of investing using a credit card.” On each closing date, the funds in the account will be released to us and the associated Class A shares will be issued to the investors in this Offering and the obligations to Masterworks in respect of the advance and the true-up will be reduced by such amount. If there is no closing of this Offering, the funds deposited in the segregated account will be returned to subscribers by mail via a check in U.S. dollars, without interest. Credit card subscription shall not exceed the lesser of $30,000 or the amount permitted by applicable law, per subscriber, per transaction. | |

| Investment Amount Restrictions | Generally, no sale may be made to you in this Offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, you are encouraged to review Rule 251(d)(2)(i)(c) of Regulation A. For general information on investing, you are encouraged to refer to www.investor.gov. | |

| Worldwide | Class A shares will be offered worldwide, provided that we may elect not to sell shares in particular jurisdictions for regulatory or other reasons. No sales of Class A shares will be made anywhere in the world prior to the qualification of the offering circular by the SEC in the United States and FINRA’s issuance of a No Objections Letter. All Class A shares will be offered everywhere in the world at the same U.S. dollar price that is set forth in this offering circular. | |

| Masterworks Investor | Masterworks intends to sponsor affiliated entities that invest in a portfolio of artwork, which may include an investment in our Class A shares, which is referred to herein as a “Masterworks Investor”. Any such investment by a Masterworks Investor in our Class A shares in connection with this Offering, would be made for cash consideration at the same price and upon the same terms as offered to other investors in this Offering, although the Masterworks Investor would also be issued a Class C share upon its investment in our Class A shares (unless a Class C share is already issued to a Masterworks Investor), which would entitle it to remove and or replace all or any members of the Board of Managers and reconstitute the Board for any reason. | |

| Voting Rights | The Class A shares have no voting rights other than to vote, as a single class, to remove and replace the Administrator and to remove a member of the Board of Managers for “cause” only. Holders of Class A shares also have the right to and approve certain acts as described in our operating agreement, including the right to vote on certain amendments to the operating agreement and the management services agreement. The Class A preferred shares have no voting rights. The Class C share, which will only be issued or transferred to a Masterworks Investor, if any, will have the right to remove and or replace all or any members of the Board of Managers and reconstitute the Board without “cause” for any reason. Any member that beneficially owns 5% or more of the Class A shares (excluding shares beneficially owned by Masterworks) may irrevocably limit or eliminate its voting rights pursuant to our operating agreement. | |

| Risk Factors | Investing in the Class A shares involves risks. See the section entitled “Risk Factors” for a discussion of factors you should carefully consider before deciding to invest in the Class A shares. | |

| Use of Proceeds | We expect to receive gross proceeds from this Offering of up to $622,000. Masterworks will pay all expenses of the Offering, including fees and expenses associated with qualification of the Offering under Regulation A and all fees and expenses of the Underwriters. Therefore, the gross proceeds from this Offering will equal the net proceeds from this Offering. We intend to use a portion of the proceeds from the initial closing of this Offering to contribute to a segregated portfolio of Masterworks Cayman to acquire the Artwork, and if and to the extent such proceeds are less than the purchase price, Masterworks will advance to the segregated portfolio of Masterworks Cayman that will acquire the Artwork any additional funds required to consummate the acquisition. The remaining net proceeds of the Offering, together with any unsold Class A shares, if any, will be contributed to the segregated portfolio of Masterworks Cayman that will acquire the Artwork and will be used to repay the Masterworks advance and pay Masterworks the true-up. |

| 8 |

| Closings | The Company may close the entire Offering at one time or may have multiple closings. Throughout this Offering Circular, we have assumed multiple closings and refer to the “initial closing” as the first such closing and the “final closing” as the last such closing. The Artwork will be acquired by the Company on or prior to the initial closing of this Offering. Subscriptions will be accepted on a rolling basis. If any of the Class A shares offered remain unsold as of the final closing, such Class A shares shall be issued to Masterworks in full satisfaction of its advance and the true-up as described in this Offering Circular. The maximum Offering period is 24 months from the date of commencement. | |

| Termination of the Offering | We reserve the right to terminate this Offering for any reason at any time prior to the initial closing. | |

| Transfer Restrictions | The Class A shares may only be transferred by operation of law or with the consent of the Company: |

| ● | To an immediate family member or an affiliate of the owner of the Class A shares, | |

| ● | To a trust or other entity for estate or tax planning purposes, | |

| ● | As a charitable gift, | |

| ● | On a trading platform approved by Masterworks, such as the Templum ATS, or | |

| ● | In a transaction otherwise approved by Masterworks. |

Transfer Agent and Registrar |

The transfer agent and registrar for our Class A shares is Equity Stock Transfer, LLC. The transfer agent’s address is 237 West 37th Street, Suite 602, New York, New York 10018. The transfer agent’s telephone number is 212-575-5757. | |

| Distributions | None, unless and until there is a sale of the Artwork, at which point we plan to pay a liquidating distribution. There can be no assurance as to the timing of a liquidating distribution or that we will pay a liquidating distribution at all. |

DETERMINATION OF OFFERING PRICE

The Offering size equals the sum of (a) the estimated purchase price that Masterworks anticipates paying for the Artwork, $560,000, plus (b) approximately 11% of such amount (approximately 10% of the maximum aggregate offering amount), or $62,000 as an upfront payment, or “true-up” payable to Masterworks. The initial price per Class A share was randomly determined by Masterworks and is calculated by dividing (1) the Offering size by (2) 31,100, which is the maximum number of Class A shares that will be sold in this Offering (or issued to Masterworks if any remain unsold).

Masterworks Gallery owns 1,000 Class B shares, representing a 20% “profits interest” in the Company and will own Class A shares if and to the extent the Offering is not fully subscribed, since any unsold Class A shares will be contributed to the segregated portfolio of Masterworks Cayman that will acquire the Artwork and will be used to repay the Masterworks advance and pay Masterworks the true-up. Masterworks determined the amount of the true-up by considering the services provided by it and costs incurred by it which are not otherwise reimbursed by the Company or Class A shareholders, including: (i) sourcing services, such as identification of the seller, research, analysis, evaluation, inspection, appraisal, due diligence and transaction negotiation and execution services to acquire the Artwork; (ii) commitments of Masterworks capital to finance the acquisition of the Artwork, and (iii) other administrative services and costs. The true-up is the only expense incurred by the Company and the only expense directly or indirectly incurred by investors in this Offering associated with sourcing and financing the Artwork and no other expense is directly or indirectly paid by the Company or investors in connection with the organization of the Company, the securitization of the Artwork or in connection with this Offering, including the marketing and underwriting of this Offering. Prior to this Offering, no public market exists for the Class A shares, and there can be no assurance that a public market will ever exist for the Class A shares. The Company believes that based on the arms-length ultimate purchase price of the Artwork, historical appreciation rates of similar artworks by the same artist and other factors, the per share offering price will constitute a reasonable estimate of the fair value of the Class A shares as of the date of this Offering Circular.

| 9 |

We have not declared or paid dividends on the Class A shares since our formation and do not anticipate paying dividends in the foreseeable future on any shares, unless and until the Artwork is sold, at which point we will pay any expenses for which we are responsible and make a liquidating distribution to our shareholders in accordance with our operating agreement. There can be no assurance as to the timing of a liquidating distribution or that we will pay a liquidating distribution at all. There are no contractual restrictions on our ability to declare or pay dividends and if any are to be paid in the future, such decision will be at the discretion of our Board of Managers and will depend on our then current financial condition and other factors deemed relevant by the Board of Managers.

The purchase of the Class A shares offered hereby involves a high degree of risk. Each prospective investor should consult his, her or its own counsel, accountant and other advisors as to legal, tax, business, financial, and related aspects of an investment in the securities offered hereby. Prospective investors should carefully consider the following specific risk factors, in addition to the other information set forth in this offering circular, before purchasing the securities offered hereby.

Risks Related to our Business Model

The Company is a new company and our business model is untested.

The Company is a new company that was formed on March 2, 2022 and had no operating history. We cannot make any assurance that our business model can be successful. Since inception, the scope of our operations has been limited to our formation. Our operations will be dedicated to acquiring and maintaining the Artwork and facilitating the ultimate sale of the Artwork. We do not expect to generate any material amount of revenues or cash flow until the Artwork is sold and no profits will be realized by our investors unless the Artwork is sold for more than we acquire it for and there are sufficient funds after all applicable costs and expenses in order to effectuate a distribution to holders of our Class A shares. Few companies other than Masterworks entities have issued securities that represent indirect ownership in an artwork with the sole goal of realizing appreciation on the value of that artwork. It is difficult to predict whether this business model will succeed or if there will ever be any profits realized from an investment in the Class A shares.

We do not expect to generate any material amount of revenues and rely on the Administrator to fund our operations.

We do not expect to generate any material amount of revenues or cash flow unless and until the Artwork is sold. No profits can be realized by our investors unless the Artwork is sold for more than we acquire it and there are sufficient funds to effectuate a distribution after paying the applicable costs, fees and expenses, or the investors sell their Class A shares. Accordingly, we will be completely reliant on Masterworks to fund our operations.

We are extremely undiversified since our strategy is to achieve capital appreciation from a single work of art.

Our Company was formed to facilitate an investment in, maintain and potentially sell the Artwork. We will not invest in any other artwork or assets or conduct any other operations that could generate income. Such lack of diversification creates a concentration risk that may make an investment in the Class A shares riskier than an investment in a diversified pool of assets or business with more varied operations. Aggregate returns realized by investors are expected to correlate to the change in value of the Artwork, which may not correlate to changes in the overall art market or any segment of the art market.

| 10 |

The Artwork may be sold at a loss or at a price that results in a distribution that is below the purchase price of the Class A shares, or no distribution at all.

Any sale of the Artwork could be effected at an inopportune time, at a loss and or at a price that would result in a distribution of cash that is less than the price paid by investors to purchase our Class A shares. We intend to hold the Artwork for an extended period of time and may choose to sell the Artwork opportunistically if market conditions are favorable, which we believe is necessary to achieve optimal returns. Although the value of the Artwork may decline in the future, we have no current intention nor economic incentive to sell the Artwork at a loss. In the future, we may elect to do so if we determine that such a transaction would be necessary to satisfy our fiduciary obligations to our shareholders. Lastly, circumstances may arise that may compel us to sell the Artwork at an inopportune time and potentially at a loss, such as if we face litigation, regulatory challenges or if Masterworks ceases to exist. Investors should be prepared to hold their Class A shares for an indefinite period of time, as there can be no assurance that the Class A shares can ever be resold or that the Artwork can ever be sold or that any sale would occur at a price that would result in a distribution of more than $20.00 per Class A share.

The timing and potential price of a sale of the Artwork are impossible to predict, so investors need to be prepared to own the Class A shares for an uncertain or even indefinite period of time.

We intend to hold the Artwork for an indefinite period, although the Artwork will be perpetually available for sale following the Offering and we will evaluate any reasonable third party offers to acquire the Artwork. In addition, the occurrence of certain events may compel us to sell the Artwork. Accordingly, a risk of investing in the Class A shares is the unpredictability of the timing of a sale of the Artwork and the unpredictability of funds being available for cash distribution and investors should be prepared for both the possibility they will not receive a cash distribution for many years, if ever, and the contrary possibility that they may receive a cash distribution at any time following the completion of the Offering. An investment in the Class A shares is unsuitable for investors that are not prepared to hold their Class A shares for an indefinite period of time, as there can be no assurance that the Class A shares can ever be resold or that the Artwork can be sold within any specific timeframe, or at all.

Our business model involves certain costs, some of which are to be paid for in the issuance of equity which will have a dilutive effect on the holders of our Class A shares and has priority upon a liquidating event.

There are various services required to administer our business and maintain the Artwork. Pursuant to a management services agreement among us, Masterworks Cayman and the Administrator to be entered into prior to the initial closing of the Offering, the Administrator will manage all entity-level and asset management services relating to our business and the maintenance of the Artwork. The Administrator will pay all ordinary and necessary costs and expenses associated with the administration of our business and maintenance of the Artwork. Because we do not expect to maintain cash reserves or generate any cash flow, we will be completely reliant on the Administrator to fund our operations. In exchange for these services and incurring these costs and expenses, the Administrator will receive equity interests in us in the form of Class A preferred shares. These equity issuances to Masterworks will, subject to vesting provisions set forth in the management services agreement, effectively result in dilution of 1.5% per annum to Class A shareholders in their indirect ownership of the Artwork. Such dilutive issuances, which will commence following the final closing of the Offering, will have a dilutive effect on the holders of our Class A shares and will effectively reduce the tangible book value per Class A share over time. In addition, we remain responsible to reimburse the Administrator for third-party costs associated with extraordinary or non-routine services. Accordingly, while ordinary costs and expenses are fixed pursuant to the management services agreement, investors may suffer losses or a reduction of returns associated with extraordinary or non-routine costs and expenses. In addition, the holders of Class A preferred shares have a $20.00 per share liquidation preference over the holders of Class A ordinary shares. In the event of a liquidation of the Company, the Administrator (or an affiliate of the Administrator that holds the Class A preferred shares) would receive liquidation proceeds, if any, prior to the holders of Class A ordinary shares.

In the event we are able to sell the Artwork, your potential investment returns will be lower than the actual appreciation in value of the Artwork due to applicable commissions, fees and expenses.

In the event the Artwork is sold, your distribution of cash proceeds will be reduced by commissions, fees and expenses incurred as a result of administering, marketing and selling the Artwork, as well as dilution from Class A share issuances to the Administrator pursuant to the management services agreement. Transaction costs incurred as part of the sale of the Artwork will differ depending on whether we choose or are able to sell the Artwork privately or through a public auction. In a public auction, the principal transaction costs are a seller’s commission and buyer’s premium (a form of selling commission, based on a graduated scale set by each auction house), both of which reduce the net proceeds received by a seller from what a buyer ultimately pays. The final reported sales price includes the hammer price (i.e. the price at which the auctioneer declared the winning bid), and the buyer’s premium. The buyer may also separately incur additional sales or VAT taxes, fees or royalties. A seller typically receives the hammer price less the seller’s commission, if any. The economic terms negotiated between the seller and the auction house can vary widely depending on a number of factors, including the value and importance of the specific work, whether the work is sold as an individual piece or part of a larger collection, anticipated demand levels, and other factors. In addition, the proceeds receivable by a seller are less favorable if the work is subject to a pre-auction guaranty. If we sell the Artwork in private transactions, there may be sales commissions payable to third parties who arrange for the sale transaction or, if no seller’s agent is engaged in connection with such sale, Masterworks may charge a sales commission in connection with such sale. While we believe we may be able to substantially reduce the transaction costs of selling the Artwork, they will not be entirely eliminated.

| 11 |

In addition, Masterworks will be entitled to its 20% profits interest in respect of its ownership of Class B shares, plus Class A preferred shares issued by us pursuant to the management services agreement. Accordingly, your investment returns upon a sale of the Artwork, if such a sale can occur and if such sale can generate sufficient funds for a distribution after accounting for applicable fees and expenses, may be significantly lower than the actual rate of appreciation of the Artwork.

Risks Associated with an Investment in the Artwork

There is no assurance of appreciation of the Artwork or sufficient cash distributions resulting from the ultimate sale of the Artwork.

There is no assurance that the Artwork will appreciate, maintain its present value, or be sold at a profit. The marketability and value of the Artwork will depend upon many factors beyond our control. There can be no assurance that there will be a ready market for the Artwork, since investment in artwork is generally illiquid, nor is there any assurance that sufficient cash will be generated from the sale of the Artwork to compensate investors for their investment. Even if the Artwork does appreciate in value, the rate of appreciation may be insufficient to cover our management costs and expenses.

The value of the Artwork is subjective.

The value of the Artwork is inherently subjective given its unique character. The acquisition of the Artwork by a segregated portfolio of Masterworks Cayman that is wholly-owned by the Company is planned to occur on or before the initial closing of this Offering. The future realizable value of a fine artwork may differ widely from its estimated or appraised value for a variety of reasons, many of which are unpredictable and impossible to discern. In addition, the net realizable value to a seller at auction is often significantly lower than the published sale price because the net proceeds are typically reduced by all or a portion of the buyer’s premium and there may also be a sales commission.

For non-cash generating assets, such as fine art, valuation is heavily reliant on an analysis of sales history of similar artwork. Experts often differ on which historical sales are comparable and the degree of comparability. The attempt to discern value from historical sales data is extremely challenging for a variety of reasons, including, without limitation:

| ● | Qualitative Factors. Differences in perceived quality or condition between the subject work and the so-called “comparable” sale. Perceived differences in the physical quality and condition of the respective works require subjective judgements as to the valuation impact attributable to such differences. |

| 12 |

| ● | Lack of Reliable Data. Data from non-auction sales, comprising a majority of all sales, is largely unavailable and historical sales data may be inaccurate. Also, data may be stale or unavailable to the public because comparable works may remain off market for extended periods of time, often for generations. Even for public auctions, sale prices may be incorrectly reported due to credits for guarantees entered into with buyers (though under current rules in certain jurisdictions, these are required to be deducted from the reported sale price), or other credits provided to potential buyers. | |

| ● | Idiosyncratic Factors. Idiosyncratic motivations of a buyer or seller may significantly affect the sale price. These motivations may relate to an emotional attachment to the work, ego, financial, estate or tax planning objectives, the desire to enhance or complete a specific collection objective, perceptions of supply and scarcity and other factors. | |

| ● | Timing Differences. Historical transactions must be viewed in light of market conditions at the time compared to current conditions. Overall market conditions are difficult to track in recent periods and extremely difficult to discern for historical periods. Harder still, is the ability to track the relative popularity of specific works, artists and genres over historical periods. | |

| ● | Market Depth. Sale prices only reflect the price a single buyer was willing to pay for a work, so it is very difficult to determine the depth of demand, as defined by the number of potential buyers that are ready, willing and able to purchase an artwork at or below a given price level. | |

| ● | Entanglements. It is not uncommon in the art market for buyer, sellers and intermediaries to enter into private contractual arrangements that may affect the selling price in a specific transaction. It is often impossible to know of the existence or terms of any such contractual arrangements. |

Accordingly, due to the inherent subjectivity involved in estimating the realizable value of the Artwork, any appraisal or estimate of realizable value may prove, with the benefit of hindsight, to be different than the amount ultimately realized upon sale and such differences can be, and often are, material.

Since the valuation of high-end artwork relies in large part on an analysis of historical auction sales, it is more difficult to accurately determine fair value of artwork by artists that have fewer auction sales.

Certain artists such as Andy Warhol and Pablo Picasso have a relatively large global collector base and a well-established track record of auction sales over a lengthy period. These artists were also extremely prolific during their careers, so their artwork is frequently bought and sold at auction. This relatively large volume of data makes estimates of historical pricing trends and fair value ranges for artwork produced by these artists more reliable. By contrast, valuation of works by other artists who have a smaller collector base and or a shorter track record of auction sales is comparatively more difficult and such assessments are generally prone to wider margins of error. When assessing the historical auction performance of artwork by a particular artist, investors are urged to consider the volume of public auction data available. As a general matter, historical pricing trends and fair value estimates are more likely to be more accurate for artists with higher volumes of prior auction sales than pricing trends and estimates for artists that have fewer historical auction sales. Accordingly, there is a higher risk that we may overpay for, or misprice, artwork by artists with fewer auction sales than those with higher volumes of prior auction sales.

Our appraisal of the fair value of the Artwork may not be reflective of the value of the Class A shares or the realizable value of the Artwork.

We, together with Masterworks, will estimate the fair value of the Artwork for purposes of preparing our annual and semi-annual financial statements in accordance with generally accepted accounting principles in the United States. For the reasons set forth elsewhere in this “Risk Factors” section, any such valuation is inherently subjective and may not represent the actual realizable value of the Artwork. In addition, because an investment in the Company represents not just the physical Artwork, but also our administrative, cost, tax and governance structure, coupled with the fact that the timing of a sale of the Artwork is unknown, the value of the Class A shares may be significantly different than the proportionate indirect ownership of the Artwork that they represent. In addition, our Board of Managers will consider a variety of factors in making any determination to sell the Artwork and the appraised value of the Artwork may not be indicative of the price at which our Board of Managers would determine to sell the Artwork.

An investment in the Artwork is subject to various risks, any of which could materially impair the value of the Artwork and the market value of our Class A shares.

Investing in the Artwork is subject to the following risks: