Form 8-K Tallgrass Energy Partner For: Feb 07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): February 7, 2018

Tallgrass Energy Partners, LP

(Exact name of registrant as specified in its charter)

Delaware | 001-35917 | 46-1972941 | ||

(State or Other Jurisdiction of Incorporation or Organization) | (Commission File Number) | (I.R.S. Employer Identification No.) | ||

4200 W. 115th Street, Suite 350 Leawood, Kansas | 66211 | |

(Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (913) 928-6060

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01. | Regulation FD Disclosure. |

On February 7, 2018, Tallgrass Energy Partners, LP ("TEP") issued a joint press release with Silver Creek Midstream, LLC announcing that they have signed definitive documents to develop the Iron Horse Pipeline, a joint venture pipeline to transport crude oil from the Powder River Basin to Guernsey, Wyoming. A copy of this press release is furnished with this Form 8-K as Exhibit 99.1 and incorporated into this Item 7.01 by reference.

In addition, on February 7, 2018, TEP issued a press release announcing that its subsidiary BNN Water Solutions, LLC has acquired Buckhorn SWD Solutions, LLC and Buckhorn Energy Services, LLC. A copy of this press release is furnished with this Form 8-K as Exhibit 99.2 and incorporated into this Item 7.01 by reference.

The information in this Item 7.01 of Form 8-K, including the accompanying Exhibits 99.1 and 99.2, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934 (the "Exchange Act"), or otherwise subject to the liability of such section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, regardless of the general incorporation language of such filing, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

EXHIBIT NUMBER | DESCRIPTION | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

TALLGRASS ENERGY PARTNERS, LP | ||||

By: | Tallgrass MLP GP, LLC | |||

its general partner | ||||

Date: | February 7, 2018 | By: | /s/ David G. Dehaemers, Jr. | |

David G. Dehaemers, Jr. | ||||

President and Chief Executive Officer | ||||

Exhibit 99.1

Tallgrass Energy Partners and Silver Creek Midstream Announce Joint Venture to Transport Crude Oil Production in the Powder River Basin to Guernsey, Wyoming

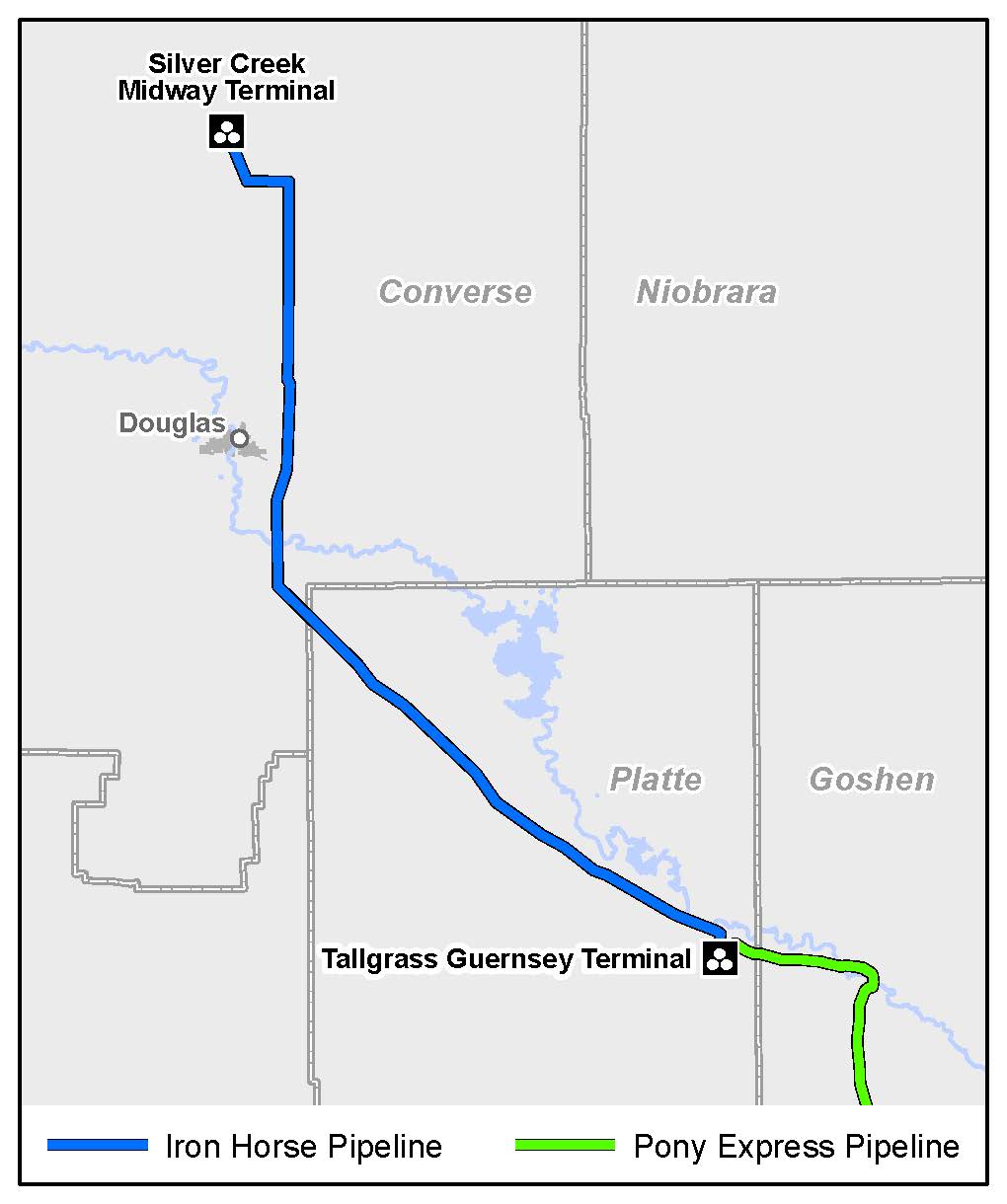

The above map depicts the planned Iron Horse Pipeline and associated Silver Creek and Tallgrass infrastructure. Note: The Silver Creek Midway Terminal, Iron Horse Pipeline, and Tallgrass Guernsey Terminal are under construction. (Graphic: Business Wire)

LEAWOOD, Kan.--(BUSINESS WIRE)-- Tallgrass Energy Partners, LP (NYSE: TEP) (“Tallgrass”) and Silver Creek Midstream, LLC (“Silver Creek”) announced today that they have signed definitive documents to develop the Iron Horse Pipeline (“Iron Horse”), a joint venture pipeline to transport crude oil from the growing Powder River Basin (“PRB”) to Guernsey, Wyo. Iron Horse will connect Silver Creek’s developing gathering system to the Tallgrass Guernsey Terminal, which is currently under construction, and then to Tallgrass's Pony Express crude pipeline system (“Pony Express”), and other pipelines at Guernsey. Iron Horse and Pony Express intend to create a joint tariff to offer producers and marketers a single rate and direct access to the multiple refineries on Pony Express and to the Cushing, Okla. crude oil hub, from the PRB production zone.

In addition to forming the joint venture, Tallgrass has agreed and signed definitive documents to sell its 50-mile PRB crude oil gathering system to Silver Creek (formerly owned by Outrigger Energy). Tallgrass and Silver Creek expect to close the formation of the joint venture and the sale of Tallgrass Crude Gathering, LLC later this month.

The transaction gives Silver Creek an immediate presence in the PRB and provides a strategic footprint as it constructs additional gathering to cover the core of the PRB. The acquired gathering system alongside the newly constructed Silver Creek gathering system will deliver into the Silver Creek Midway Terminal, which will deliver barrels to Iron Horse. As a result of the acquisition and announced projects, Silver Creek will be positioned as the preeminent crude oil gathering company in the PRB.

As part of the joint venture, Tallgrass has agreed to contribute approximately 40 miles of pipe from Labonte, Wyo. to Guernsey, Wyo. This pipe is currently owned by Tallgrass Interstate Gas Transmission, LLC, and is undergoing abandonment from gas service. Tallgrass will be a 75 percent owner and will operate the approximately 80-mile, 16” pipeline, which consists of 40 miles of new build and the 40 miles of gas-to-oil conversion pipe. Silver Creek will own the remaining 25 percent. Iron Horse is anticipated to be in-service Q1 2019 with an expected initial capacity of about 100,000 barrels per day with significant available expansion capacity. After conversations with both producers and marketers in the PRB, the parties anticipate a significant amount of the Iron Horse’s initial capacity will be contracted prior to the pipeline being placed into service, and depending on commitments obtained, capacity could be expanded above the 100,000 barrels per day currently planned.

The combined systems of Silver Creek and Tallgrass intend to leverage each company’s asset footprint, providing producers in the PRB gathering and transportation services from wellhead to final sale point. “Silver Creek is extremely excited to work with Tallgrass in the PRB. Their current presence in the basin and long-haul crude transport capabilities bring a competitive advantage to Silver Creek as we work to fully build out our gathering system. Collectively, we will be able to provide optimal midstream service solutions for producers in the Powder River Basin,” said J. Patrick Barley, Founder and Chief Executive Officer of Silver Creek.

“Silver Creek brings a best-in-class oil gathering management team to the PRB,” said Matt Sheehy, Tallgrass’s Chief Commercial Officer. “Their extensive customer relationships and focus on customer service make them an ideal partner for Tallgrass. Iron Horse Pipeline will quickly become an important path to bring Wyoming production into Guernsey and onto Pony Express.”

Tallgrass anticipates that it will invest approximately $150 million into this initiative, including its proportionate share of the cost to construct the Iron Horse Pipeline and the new Tallgrass Guernsey Terminal, but excluding the proceeds from the sale of its PRB gathering system.

About Tallgrass Energy

Tallgrass Energy is a family of companies that includes publicly traded partnerships Tallgrass Energy Partners, LP (NYSE: TEP) and Tallgrass Energy GP, LP (NYSE: TEGP), and privately held Tallgrass

Development, LP. Operating across 11 states, Tallgrass is a growth-oriented midstream energy

operator with transportation, storage, terminal, water, gathering and processing assets that serve some of the nation’s most prolific crude oil and natural gas basins.

To learn more, please visit our website at www.tallgrassenergy.com.

About Silver Creek Midstream, LLC

Headquartered in Irving, Texas, Silver Creek Midstream is a private midstream company focused on providing crude oil gathering, transportation and storage services in Texas and Wyoming. Silver Creek Midstream is backed by an initial $150 million funding commitment from Tailwater Capital, LLC and Silver Creek management.

To learn more, please visit our website at: www.scmidstream.com.

About Tailwater Capital, LLC

Dallas-based Tailwater Capital is a highly specialized, growth-oriented energy private equity firm with a well-established track record, having executed more than 65 energy transactions in the upstream and midstream sectors representing over $16.6 billion in transaction value. Tailwater currently manages over $2.3 billion in committed capital, over $800 million of which is available for new investments. Tailwater is focused on acquiring and growing midstream assets as well as participating in non-operated upstream opportunities in select basins. For more information, please visit: www.tailwatercapital.com.

Cautionary Note Concerning Forward-Looking Statements

Disclosures in this press release contain forward-looking statements. All statements, other than statements of historical facts, included in this press release that address activities, events or developments that management expects, believes or anticipates will or may occur in the future are forward-looking statements. Without limiting the generality of the foregoing, forward-looking statements contained in this press release specifically include the closing of the joint venture and sale transactions between Tallgrass and Silver Creek, whether the Iron Horse Pipeline, the Tallgrass Guernsey Terminal and the Sliver Creek Midway Terminal will be constructed on time, on budget, or at all and, if constructed, the capacity of the Iron Horse Pipeline and if the joint tariff will offer producers a single rate from the PRB to final market, whether Silver Creek will be positioned as the preeminent crude oil gathering company in the PRB, whether a significant amount of the Iron Horse Pipeline’s initial capacity will be contracted prior to the pipeline being placed into service, whether the combined systems of Silver Creek and Tallgrass will be able to leverage each company's asset footprint to provide producers in the PRB gathering and transportation services from wellhead to final sale point, and the total amount invested by Tallgrass on this initiative. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of Tallgrass and Silver Creek, which may cause actual results to differ materially from those implied or expressed by the forward-looking statements, and other important factors that could cause actual results to differ materially from those projected, including those set forth in reports filed by Tallgrass with the Securities and Exchange Commission. Any forward-looking statement applies only as of the date on which such statement is made and Tallgrass and Silver Creek do not intend to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law.

King & Spalding served as exclusive legal advisor on the transaction to Silver Creek Midstream.

Contacts

Tallgrass Energy:

Investor and Financial Inquiries

Nate Lien, 913-928-6012

or

Media and Trade Inquiries

Phyllis Hammond, 303-763-3568

or

Silver Creek:

or

Tailwater Capital:

Stephen Lipscomb, 214-269-1183

Exhibit 99.2

Tallgrass Energy Partners Announces Acquisition

Expanding Water Infrastructure Footprint into the Bakken

LEAWOOD, Kan.--(BUSINESS WIRE)-- Tallgrass Energy Partners, LP (NYSE: TEP), through its subsidiary BNN Water Solutions, LLC (“BNN”), today announced the acquisition of water infrastructure assets that establishes Tallgrass’s footprint in the Bakken, delivers new business for BNN and provides Tallgrass a platform from which to build additional midstream business in the Bakken.

BNN acquired Buckhorn SWD Solutions, LLC and Buckhorn Energy Services, LLC (“Buckhorn”), which collectively own 10 salt water disposal wells and approximately 39 miles of produced water gathering infrastructure for a cash purchase price of approximately $95 million. The system currently services approximately 133,000 dedicated acres for multiple Bakken producers, including XTO Energy, Inc. Tallgrass anticipates that BNN will spend an additional approximately $45 million in 2018 to further expand the system to accommodate increased dedicated water volumes resulting from expected new drilling and completions. Once the additional infrastructure is completed, Tallgrass expects the total investment will approximate a five times cash flow multiple.

With this acquisition, BNN now owns and operates over 230 miles of water supply and gathering pipelines in addition to other water supply, storage, recycle, and disposal assets; making them one of the largest independent operators of water infrastructure in the industry.

“The acquisition of this Bakken water infrastructure expands BNN’s footprint into another premier oil and gas producing region of the country, while establishing and expanding important customer relationships for BNN and Tallgrass,” said BNN Vice President and General Manager Jeff Nelson. “In addition, this acquisition provides Tallgrass with an opportunity to grow its midstream service offerings in the Bakken.”

About Tallgrass Energy

Tallgrass Energy is a family of companies that includes publicly traded partnerships Tallgrass Energy Partners, LP (NYSE: TEP) and Tallgrass Energy GP, LP (NYSE: TEGP), and privately held Tallgrass Development, LP. Operating across 11 states, Tallgrass is a growth-oriented midstream energy operator with transportation, storage, terminal, water, gathering and processing assets that serve some of the nation’s most prolific crude oil and natural gas basins.

To learn more, please visit our website at www.tallgrassenergy.com.

Cautionary Note Concerning Forward-Looking Statements

Disclosures in this press release contain forward-looking statements. All statements, other than statements of historical facts, included in this press release that address activities, events or developments that management expects, believes or anticipates will or may occur in the future are forward-looking statements. Without limiting the generality of the foregoing, forward-looking statements contained in this press release specifically include whether the additional capital expenditures to further expand BNN's operations in the Bakken will be made on time, on budget, or at all, and if such expenditures are made, whether increased water volumes will result from new drilling and completions (and whether those completions themselves will occur), and whether the transaction and follow-on capital expenditures will result in an approximately five times acquisition multiple. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of TEP, which may cause actual results to differ materially from those implied or expressed by the forward-looking statements, and other important factors that could cause actual results to differ materially from those projected, including those set forth in reports filed by TEP with the Securities and Exchange Commission. Any forward-looking statement applies only as of the date on which such statement is made and TEP does not intend to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law.

Contacts

Tallgrass Energy

Investor and Financial Inquiries

Nate Lien, 913-928-6012

or

Media and Trade Inquiries

Phyllis Hammond, 303-763-3568

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Teleperformance joins tech industry leaders, Thorn and All Tech is Human to support strong child safety commitments for generative AI

- International Contrast Ultrasound Society (ICUS) and Northwest Imaging Forums announce partnership to advance IV training for sonographers

- Transaction in Own Shares

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share