Form 8-K GARTNER INC For: Feb 15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported)

February 15, 2018

GARTNER, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 1-14443 | 04-3099750 | ||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

P.O. Box 10212

56 Top Gallant Road

Stamford, CT 06902-7747

(Address of principal executive offices, including Zip Code)

(203) 316-1111

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter): o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act: o

Item 7.01 Regulation FD Disclosure.

On February 15, 2018, Gartner, Inc. (the “Company”) plans to make investor presentations that include the slides furnished as Exhibit 99.1 to this Current Report on Form 8-K. The slides contained in Exhibit 99.1 are also posted on the Company’s website at www.gartner.com.

In accordance with General Instruction B.2 of Form 8-K, the information in this Item 7.01 and in Exhibit 99.1 of this Current Report on Form 8-K shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 8.01 Other Events.

On February 15, 2018, the Company announced that it will hold its 2018 Annual Meeting of Stockholders at 10:00 a.m. eastern time on May 24, 2018 at the Company’s offices in Stamford, Connecticut.

Item 9.01 Financial Statements and Exhibits.

| (d) | Exhibits |

| Exhibit No. | Description | |

| 99.1 | Gartner, Inc. Investor Presentation dated February 15, 2018 |

SIGNATURE

Pursuant to requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Gartner, Inc. | ||

| Date: February 15, 2018 | By: | /s/ Craig W. Safian |

| Craig W. Safian | ||

| Executive Vice President and Chief Financial Officer |

EXHIBIT INDEX

| Exhibit No. | Description | |

| 99.1 | Gartner, Inc. Investor Presentation dated February 15, 2018. |

Exhibit 99.1

2018

1 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Statements contained in this presentation regarding the growth and prospects of the business, the Company’s projected 2018 financial results, long - term objectives and all other statements in this presentation other than recitation of historical facts are forward looking statements (as defined in the Private Securities L iti gation Reform Act of 1995). Such forward looking statements involve known and unknown risks, uncertainties and other factors; consequently, actual results may differ materially from those expressed o r i mplied thereby. Factors that could cause actual results to differ materially include, but are not limited to, the ability to achieve and effe cti vely manage growth, including the ability to integrate our recent acquisitions, and consummate and integrate future acquisitions; the ability to pay Gartner’s debt obligations, the ability to maintain and expa nd Gartner’s products and services; the ability to expand or retain Gartner’s customer base; the ability to grow or sustain revenue from individual customers; the ability to attract and retain a p rofessional staff of research analysts and consultants upon whom Gartner is dependent; the ability to achieve continued customer renewals and achieve new contract value, backlog and deferred revenue gr owt h in light of competitive pressures; the ability to carry out Gartner’s strategic initiatives and manage associated costs; the ability to successfully compete with existing competitors and potentia l n ew competitors; the ability to enforce and protect our intellectual property rights; additional risks associated with international operations including foreign currency fluctuations; the impact of rest ruc turing and other charges on Gartner’s businesses and operations; general economic conditions; risks associated with the credit worthiness and budget cuts of governments and agencies; the impact of t he Tax Cut and Jobs Act of 2017; and other risks listed from time to time in Gartner’s reports filed with the Securities and Exchange Commission, including Gartner’s most recent Annual Report on Form 10 - K and Quarterly Reports on Form 10 - Q. The Company’s SEC filings can be found on Gartner’s website at investor.gartner.com and on the SEC’s website at www.sec.gov. For ward looking statements included herein speak only as of February 15, 2018 and the Company disclaims any obligation to revise or update such statements to reflect events or circumstances after th is date or to reflect the occurrence of unanticipated events or circumstances. In this presentation, we include “Combined” numbers that, for periods prior to our acquisition of CEB (unless expressly noted ot herwise), reflect numerical addition of the results of Gartner and CEB for each line item and do not include all the adjustments required with respect to the presentation of pro forma financial inform ati on under GAAP and the rules and regulations of the SEC. Accordingly, these “Combined” numbers are non - GAAP, but are provided because Gartner believes they are useful in comparing performance of Gar tner following the CEB acquisition with performance of Gartner and CEB independently prior to Gartner’s acquisition of CEB. These Combined numbers should be read together with the historic al financial statements of Gartner and CEB included in their respective quarterly reports on Form 10 - Q and annual reports on Form 10 - K, and the pro forma financial statements included in Exhibit 99.1 to Gartner’s Current Report on Form 8 - K filed with the SEC on April 6, 2017 and footnote 2 to Gartner’s Current Report on Form 10 - Q for the period ended September 30, 2017. References in this presentation to "Heritage Gartner" operating results and business measurements refer to Gartner excluding CEB . Disclaimer & Explanatory Note

2 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. ▪ Gene Hall, CEO ▪ Peter Sondegaard , EVP, Research & Advisory ▪ Break for lunch ▪ Joe Beck, EVP, Global Technology Sales ▪ Chris Thomas, EVP, Global Business Sales ▪ Craig Safian , EVP & CFO ▪ Q&A – Gene Hall & Craig Safian Gartner Investor Day 2018 Agenda

Strategy for Achieving Sustained Double Digit Growth GENE HALL

4 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Detailed overview of our business Continue creating extraordinary value Long - term, double digit growth in key financial metrics

5 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Gartner Overview $ 4B+ Revenues 15,000 Associates 12,000 Client Enterprises 100 Countries

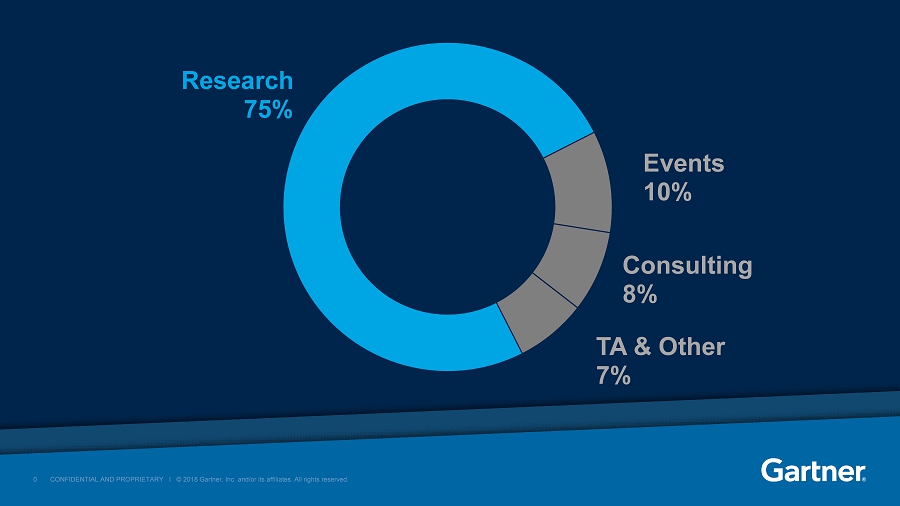

6 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 6 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Gartner Business Segments $4.2 Billion Research 75% Events 10% Consulting 8% TA & Other 7%

7 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 7 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Gartner Business Segments $ 4.2 Billion Research 75% Events 10% Consulting 8% TA & Other 7%

8 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 8 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Gartner Business Segments $4.2 Billion Research 75% Events 10% Consulting 8% TA & Other 7%

9 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 9 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Gartner Business Segments $4.2 Billion Research 75% Events 10% Consulting 8% TA & Other 7%

10 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 10 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Gartner Business Segments $4.2 Billion Research 75% Events 10% Consulting 8% TA & Other 7%

11 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Our Strong Value Proposition for Clients Actionable Insights Products, Pricing and Terms Benchmarks Connect with Peers Professional Development

12 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved.

13 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 13 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Developing the Gartner Formula ‘01 ‘02 ‘03 ‘04 ‘05 ‘06 ‘07 ‘08 ‘09 Indispensable Insights Exceptional Talent Sales Excellence Enabling Infrastructure Globally Consistent Execution Continuous Improvement & Innovation v1 v1 v1 v1 v1 v1 CAGR - 3% CAGR 10% $764M TECHNOLOGY BUSINESS

14 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. The Gartner Formula For Sustained Long - Term Double Digit Growth

15 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 15 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Gartner Market Opportunity IT $55B

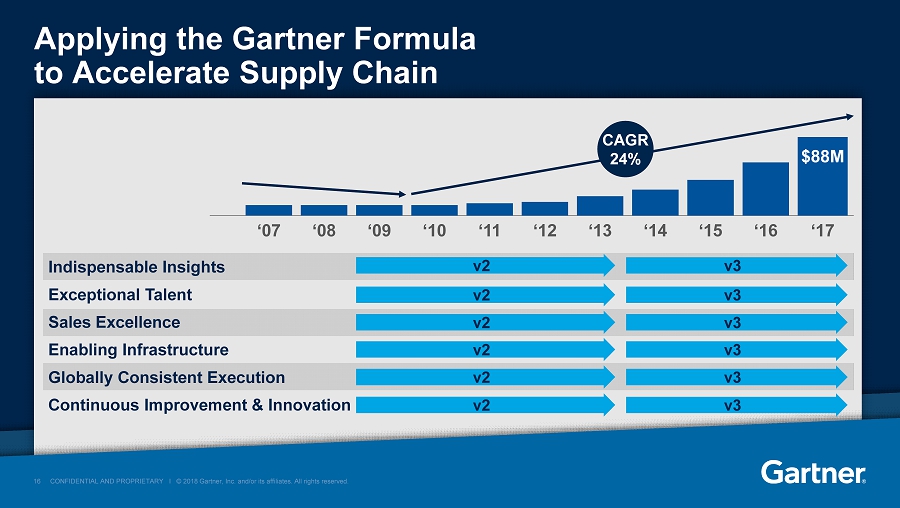

16 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 16 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Applying the Gartner Formula to Accelerate Supply Chain ‘09 ‘10 ‘11 ‘12 ‘13 ‘14 ‘15 ‘16 ‘17 CAGR 24% $88M v2 Indispensable Insights Exceptional Talent Sales Excellence Enabling Infrastructure Globally Consistent Execution Continuous Improvement & Innovation v3 v2 v3 v2 v3 v2 v3 v2 v3 v2 v3 ‘08 ‘07

17 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 17 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Gartner Market Opportunity Supply Chain $23B Total $78B IT $55B

18 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 18 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Applying the Gartner Formula to Grow Marketing ‘13 ‘14 ‘15 ‘16 ‘17 Organic CAGR 76% ‘12 $20M Indispensable Insights Exceptional Talent Sales Excellence Enabling Infrastructure Globally Consistent Execution Continuous Improvement & Innovation v3 v3 v3 v3 v3 v3

19 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 19 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Gartner Market Opportunity M arketing $25B Supply Chain $23B Total $103B IT $55B

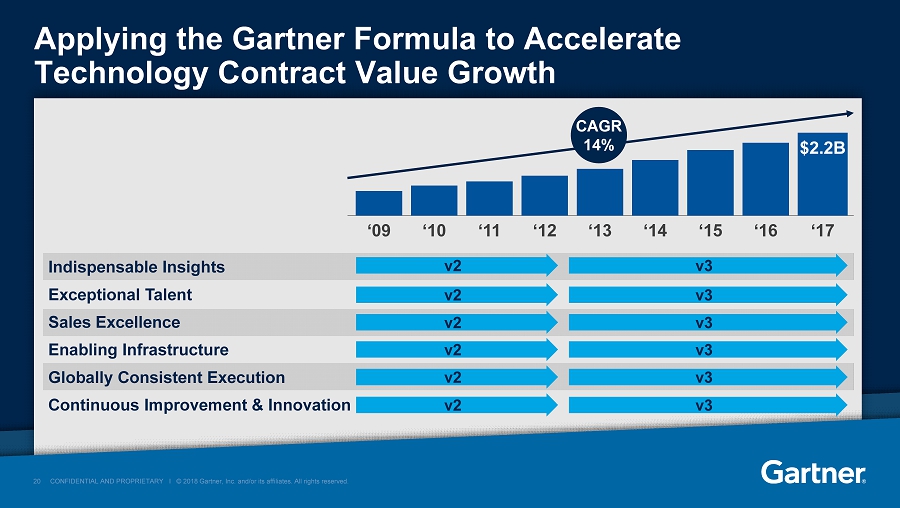

20 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 20 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Applying the Gartner Formula to Accelerate Technology Contract Value Growth ‘09 ‘10 ‘11 ‘12 ‘13 ‘14 ‘15 ‘16 ‘17 CAGR 14% $2.2B v2 Indispensable Insights Exceptional Talent Sales Excellence Enabling Infrastructure Globally Consistent Execution Continuous Improvement & Innovation v3 v2 v3 v2 v3 v2 v3 v2 v3 v2 v3

21 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 21 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. ‘09 ‘10 ‘11 ‘12 ‘13 ‘14 ‘15 ‘16 ‘17 ‘04 ‘05 ‘06 ‘07 ‘08 CV ‘09 ‘10 ‘11 ‘12 ‘13 ‘14 ‘15 ‘16 ‘17 ‘04 ‘05 ‘06 ‘07 ‘08 Free Cash Flow +13% +23% Note: Free cash flow is combined for 2017 Please see appendix for free cash flow definition and reconciliation

22 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Three Megaforces Driving Unprecedented Change MACROECONOMIC & POLITICAL VOLATILITY TECHNOLOGY - DRIVEN INDUSTRY DISRUPTION TECHNOLOGY PERVASIVENESS 101101 011010 010011

23 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Analytics Mobility Enablement AI & Machine Learning Natural Language Processing Technology is Pervasive Across the Enterprise Supply Chain Marketing Sales Information Technology Human Resources Legal Finance Customer Svc. & Support General Manager

24 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Three Megaforces Driving Unprecedented Change MACROECONOMIC & POLITICAL VOLATILITY TECHNOLOGY - DRIVEN INDUSTRY DISRUPTION TECHNOLOGY PERVASIVENESS 101101 011010 010011

25 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. The Scope, Scale and Impact of Technology - Driven Disruption is Enormous *Trademarks depicted are the property of the respective companies.

26 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Three Megaforces Driving Unprecedented Change MACROECONOMIC & POLITICAL VOLATILITY TECHNOLOGY - DRIVEN INDUSTRY DISRUPTION TECHNOLOGY PERVASIVENESS 101101 011010 010011

27 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Technology Expertise Technology + Business Expertise Drives Value Supply Chain Marketing Sales Information Technology Human Resources Legal Finance Customer Svc. & Support General Manager Functional Expertise +

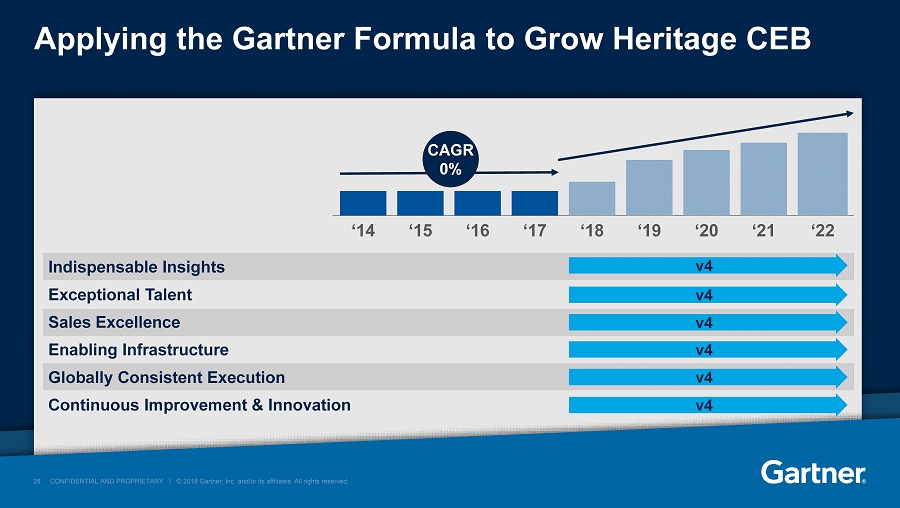

28 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 28 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Applying the Gartner Formula to Grow Heritage CEB ‘14 ‘15 ‘16 ‘17 ‘18 ‘19 ‘20 ‘21 ‘22 CAGR 0 % Indispensable Insights Exceptional Talent Sales Excellence Enabling Infrastructure Globally Consistent Execution Continuous Improvement & Innovation v4 v4 v4 v4 v4 v4

29 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 29 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Technology Large Market Opportunity 55 23 25 14 24 38 19 198 Supply Chain Marketing Human Resources Finance Sales Legal & Other Total Market Opportunity Combined Gartner CV ($ in billions) $2.8B

30 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 30 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Maximizing Growth While Minimizing Risk Heritage Gartner $2.2B (+15%) Global Technology Sales Heritage CEB $0.6B (+2%) Tech Global Business Sales Tech $2.1B Supply Chain $0.1B Supply Chain $0.1B Sales & Marketing $ 0.2B Sales & Marketing $0.1B Marketing <$0.1B Tech $0.1B Other $0.1B Finance $0.1B HR $0.2B Other $0.1B Finance $0.1B HR $0.2B Notes: 2017 FX rates / 2017 year - end results Heritage Gartner includes L2 Growth rates for 2017 assume CEB & L2 acquired 12/31/2016

31 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 31 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Maximizing Growth While Minimizing Risk Global Technology Sales Tech Global Business Sales Supply Chain $0.1B Sales & Marketing $ 0.2B Other $0.1B Finance $0.1B HR $0.2B Net growth 12% +13% $2.2B +8% $0.6B Notes: 2017 FX rates / 2017 year - end results Heritage Gartner includes L2 Growth rates for 2017 assume CEB & L2 acquired 12/31/2016

32 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. + Better Together

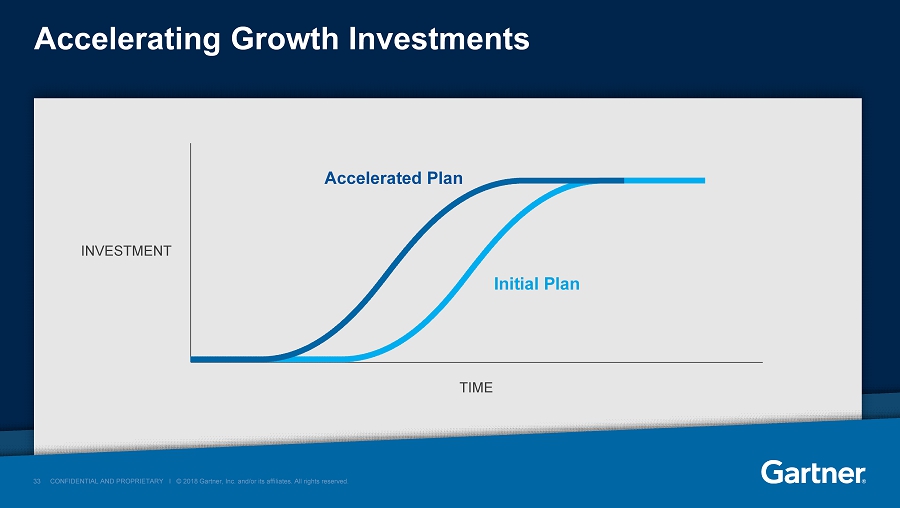

33 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 33 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Accelerating Growth Investments INVESTMENT TIME Initial Plan Accelerated Plan

34 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. In Summary Integration approach to maximize growth while minimizing risk The Gartner Formula drives sustained, double digit growth Gartner + CEB gives us leading capabilities and a large market opportunity Experienced, capable leadership team

35 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved.

Indispensable Insights for Every Function Across the Enterprise PETER SONDERGAARD

37 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Better Together Leverage Everywhere Urgent and Relevant

38 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Gartner Research & Advisory Best practices and talent management insights Analyst - driven, syndicated research and advisory services Combined two exceptional research models

39 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Better Together

40 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Gartner Serves All Major Functions Supply Chain Marketing Sales Information Technology Human Resources Legal Finance Customer Svc. & Support General Manager

41 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Head of HR Learning & Development Leader Recruiting Leader Total Rewards Leader Compensation Global L&D Talent Analytics Recruiting Benefits Regional HR Leader HRIS Talent Mgmt. Leader Diversity & Inclusion HR Shared Services Organizational Development Organizational Effectiveness Human Resources

42 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Analysis & Evaluation Peer & Practitioner Research Quantitative Modeling Research Models Functions & Roles Three Complementary Research Models Supply Chain Marketing Sales Information Technology Human Resources Legal Finance Customer Svc. & Support General Manager Content & Interactions Indispensable Insights, Advice and Tools

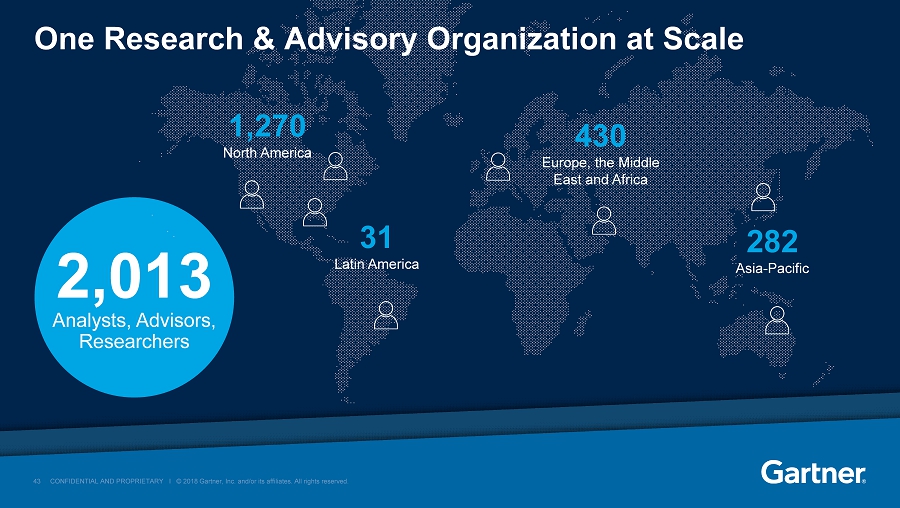

43 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 2,013 Analysts, Advisors, Researchers One Research & Advisory Organization at Scale 1,270 North America 430 Europe, the Middle East and Africa 282 Asia - Pacific 31 Latin America

44 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Better Together HELEN POITEVIN Research Director , Human Capital Management Technologies DION LOVE Principal Executive Advisor , HR

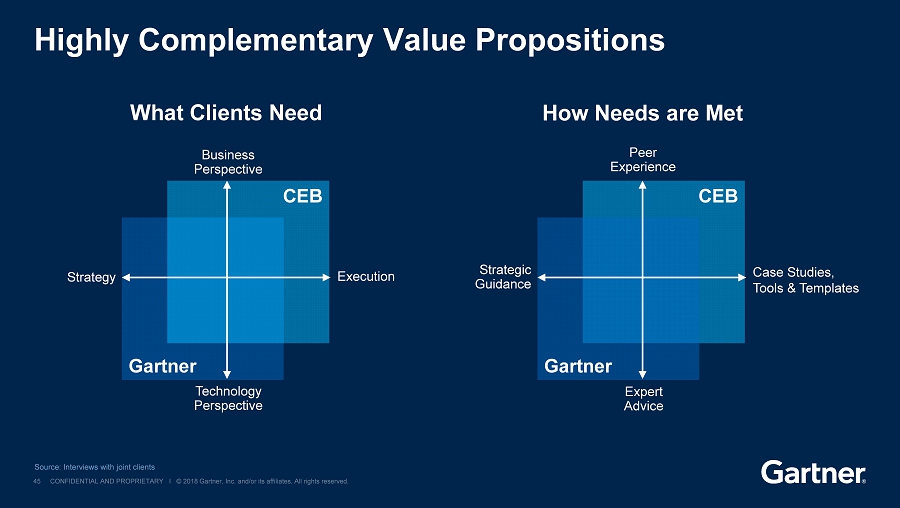

45 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. CEB Strategic Guidance Case Studies, Tools & Templates Peer Experience Expert Advice Gartner How Needs are Met Source: Interviews with joint clients What Clients Need Gartner CEB Strategy Execution Business Perspective Technology Perspective Highly Complementary Value Propositions

46 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Leverage Everywhere

47 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Research & Advisory coverage Supply Chain Marketing Sales Information Technology Human Resources Legal Finance Customer Svc. & Support Global CxO CxO Enterprise Leaders Leaders Professionals General Manager

48 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Gartner Prioritizes and Invests in Covering What is Important to Each Role T T T T T T T T T T T T T T T T T T T T Library of Topics EA & Tech Innovation Applications Infrastructure & Operations Program & Portfolio Mgmt. Data & Analytics Security & Risk Mgmt. Sourcing & Vendor Mgmt. CIO

49 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Leveraging Content Everywhere AI Supply Chain Marketing Sales Information Technology Human Resources Legal Finance Customer Svc. & Support General Manager AI AI AI AI AI AI AI AI

50 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. VIDEO

51 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Leveraging Content Everywhere Talent Talent Talent Talent Talent Talent Talent Talent Talent AI AI AI AI AI AI AI AI AI Supply Chain Marketing Sales Information Technology Human Resources Legal Finance Customer Svc. & Support General Manager

52 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Topics That Impact All Functions Driving Digital Business Transformation for Industry Leadership Driving Cost Optimization Across the Enterprise Leading the Next Generation Workforce Supply Chain Marketing Sales Information Technology Human Resources Legal Finance Customer Svc. & Support General Manager

53 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Urgent and Relevant

54 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Technology Trends Impacting All Functions Artificial Intelligence Software Everywhere Internet of Things Cloud to the Edge Blockchain

55 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Nexus of Forces

56 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Key Priorities for HR Leaders Customize HR - Employee Interactions Team - Based Performance Management Digitalize HR Source: Gartner Survey, December 2017

57 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. VIDEO

58 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Key Priorities for Finance Leaders Optimize Costs Grow the Business Recruit and Retain the Best Talent Source: Gartner Survey, December 2017

59 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Key Priorities for Sales Leaders New Customer Acquisition Existing Account Retention and Growth Sales Talent Acquisition and Retention Source: Gartner Survey, December 2017

60 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Our Strong Value Proposition for Clients Actionable Insights Products, Pricing and Terms Benchmarks Connect with Peers Professional Development

61 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Summary Better Together Leverage Everywhere Urgent and Relevant

Global Technology Sales JOE BECK, EVP

63 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. $2.2B in Contract Value 2,700 sales people 100 countries Selling in 1,200 enterprises

64 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. LARGE Opportunity EFFECTIVE Strategy UNRIVALED Capabilities

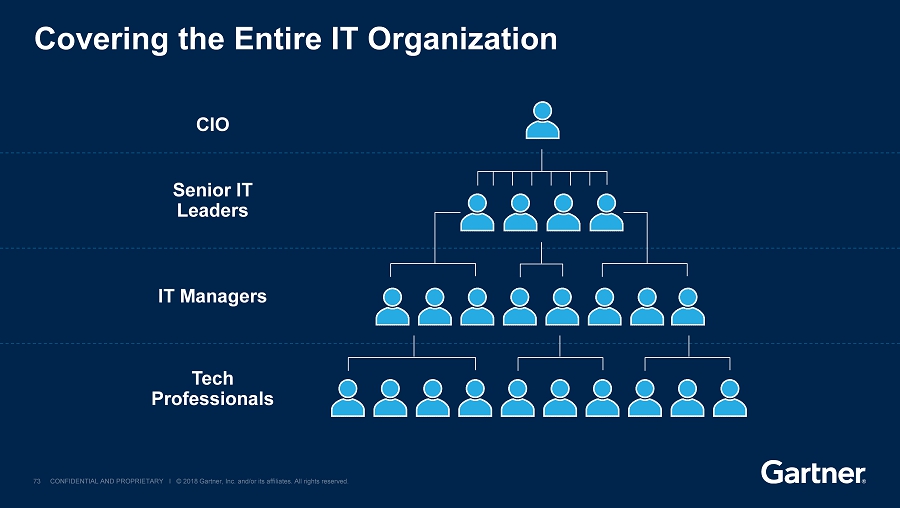

65 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Covering the Entire IT Organization Senior IT Leaders CIO IT Managers Tech Professionals

66 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 66 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Market Opportunity – New Enterprise Opportunity Current Enterprises Covered Enterprises Uncovered Enterprises Total Potential Enterprises 12k 30k 96k 138k

67 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. GTS Sales Excellence LARGE Opportunity EFFECTIVE Strategy UNRIVALED Capabilities

68 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Three Megaforces Driving Unprecedented Change MACROECONOMIC & POLITICAL VOLATILITY TECHNOLOGY - DRIVEN INDUSTRY DISRUPTION TECHNOLOGY PERVASIVENESS 101101 011010 010011

69 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. ▪ Leverage tools ▪ Optimize cost ▪ Return to growth Helping Clients Cut Costs

70 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Helping Clients Fuel Growth

71 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 71 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 71 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved.

72 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 72 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 72 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved.

73 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Covering the Entire IT Organization Senior IT Leaders CIO IT Managers Tech Professionals

74 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Better Together

75 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. VIDEO

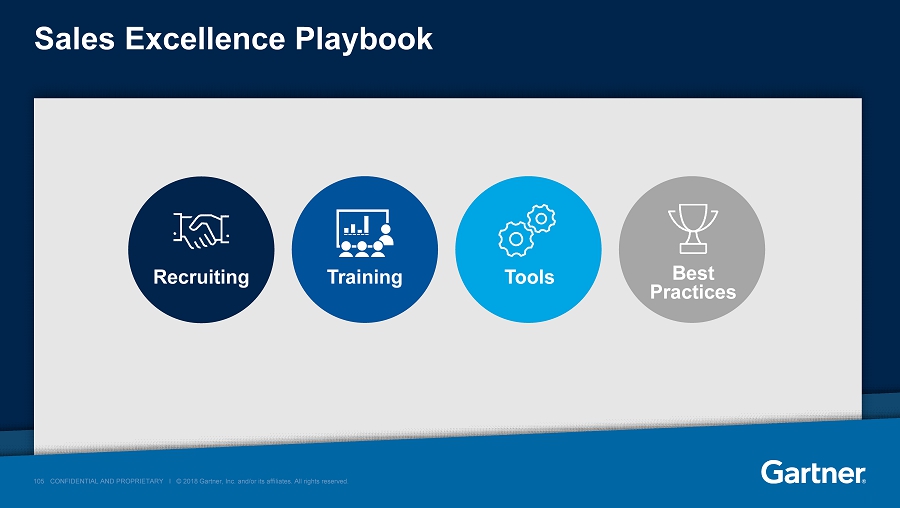

76 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 76 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Sales Excellence Playbook Recruiting Training Tools Best Practices

77 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Strategies to Capture Market Opportunity Globally Diverse Sales Organization Matched to Global Opportunity Agile Territory Planning Capabilities

78 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Gartner Culture ▪ Strategic relationships ▪ Collaboration ▪ Leading tools and best practices ▪ Innovative products Gartner Sales: A Great Place to Work 78 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved.

79 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Gartner Sales: A Great Place to Work 79 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Most Innovative Growth Companies 2015 America’s Best Midsized Employers 2016 & 2017 Best Mgmt. Consulting Firms 2017 Best Place To Work, Employees’ Choice Winner 2013, 2014, 2015 and 2016 Top 50 Companies To Work For 2017 Top 25 Most Socially Engaged Companies

80 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. LARGE Opportunity EFFECTIVE Strategy UNRIVALED Capabilities

81 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved.

Global Business Sales CHRIS THOMAS, EVP

83 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Applying the Gartner Formula Across GBS

84 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Who are we? How have we reset the foundation? How are we applying Sales Excellence to drive accelerated growth?

85 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Supply Chain Marketing Sales Human Resources Legal Finance Customer Svc. & Support General Manager $600M in Contract Value 700 sales people 73% of sales people are based in the U.S.

86 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Better Together +

87 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Resetting the Foundation for Growth Functional Alignment Research Growth Seat - Based Solutions No Discounting Consistent Price Increases Tech Supply Chain Marketing GBS

88 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 88 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Enterprise Seat - Based

89 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Resetting the Foundation for Growth Functional Alignment Research Growth Seat - Based Solutions No Discounting Consistent Price Increases Tech Supply Chain Marketing GBS

90 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. TEAM CAPACITY CAPABILITIES OPPORTUNITY BEST PRACTICES

91 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. TEAM OPPORTUNITY CAPACITY CAPABILITIES BEST PRACTICES

92 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. VIDEO

93 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. TEAM OPPORTUNITY CAPACITY CAPABILITIES BEST PRACTICES

94 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. CAPACITY OPPORTUNITY CAPABILITIES BEST PRACTICES

95 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Add supply chain generic event photo 95 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved.

96 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved.

97 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. VIDEO

98 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. CAPACITY CAPABILITIES BEST PRACTICES OPPORTUNITY

99 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. CAPACITY CAPABILITIES BEST PRACTICES OPPORTUNITY

100 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Human Resources Supply Chain Marketing Legal Finance Customer Svc. & Support General Manager 12,000 $90,000 $1Billion+ Sales

101 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Human Resources Supply Chain Marketing Legal Finance Customer Svc. & Support General Manager Sales

102 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. CAPABILITIES CAPACITY BEST PRACTICES OPPORTUNITY

103 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Three Complimentary Research Models Analysis & Evaluation Peer & Practitioner Research Quantitative Modeling Research Models Functions & Roles Supply Chain Marketing Sales Human Resources Legal Finance Customer Svc. & Support General Manager Content & Interactions Indispensable Insights, Advice and Tools

104 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. CAPACITY CAPABILITIES OPPORTUNITY BEST PRACTICES

105 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 105 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Sales Excellence Playbook Recruiting Training Tools Best Practices

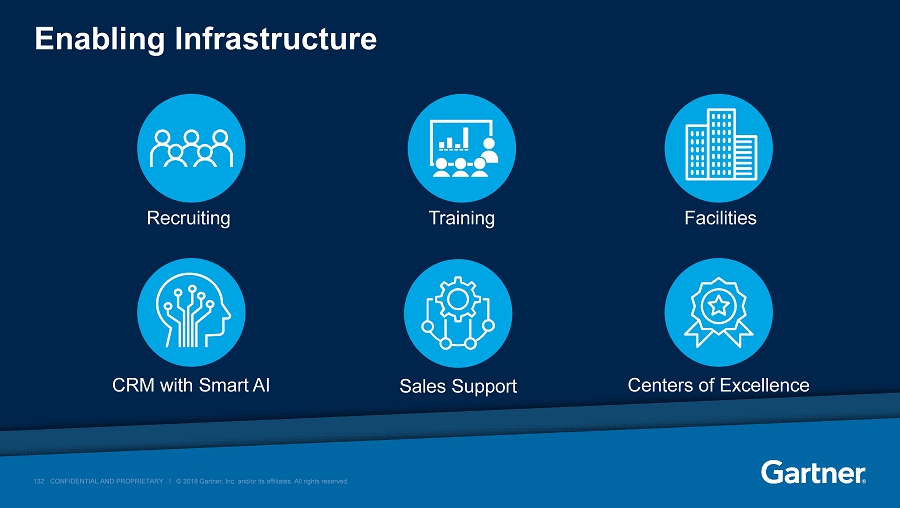

106 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Leveraging Gartner’s Enabling Infrastructure

107 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. TEAM CAPACITY CAPABILITIES Sustained Long - Term Double Digit Growth OPPORTUNITY BEST PRACTICES

The Gartner Business Model CRAIG SAFIAN

109 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. The Gartner Formula Large Market Opportunity Attractive Gartner Business Model Invest to Drive Growth and Value

110 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. The Gartner Formula Large Market Opportunity Attractive Gartner Business Model Invest to Drive Growth and Value

111 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 111 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. In Depth Look at Our Market Opportunity 138,000 Enterprises Tech Addressable Market $55B C - Level Directs Leaders Front Line $$$$ $$$ $$ $ × =

112 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 112 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Market Opportunity: New Enterprise Opportunity Current Enterprises Covered Enterprises Uncovered Enterprises Total Potential Enterprises 12k 30k 96k 138k

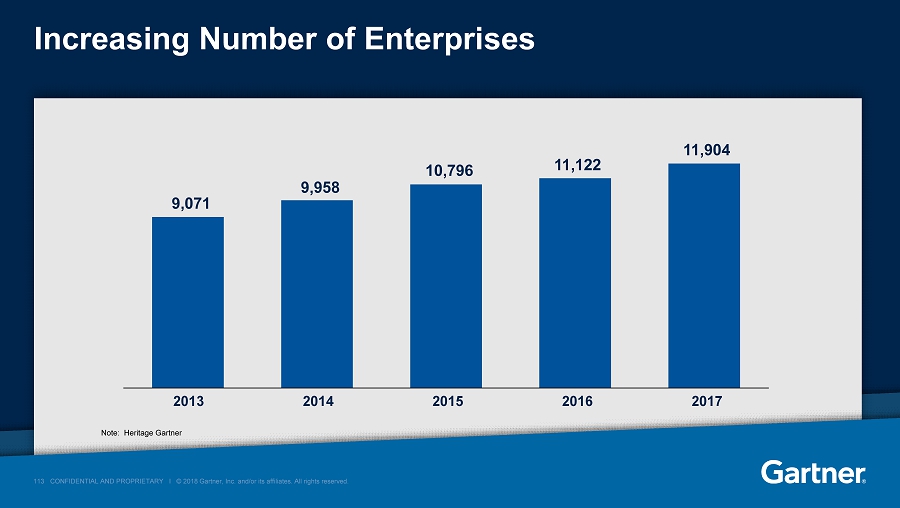

113 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 113 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Increasing Number of Enterprises 9,071 9,958 10,796 11,122 11,904 2013 2015 2017 2016 2014 Note: Heritage Gartner

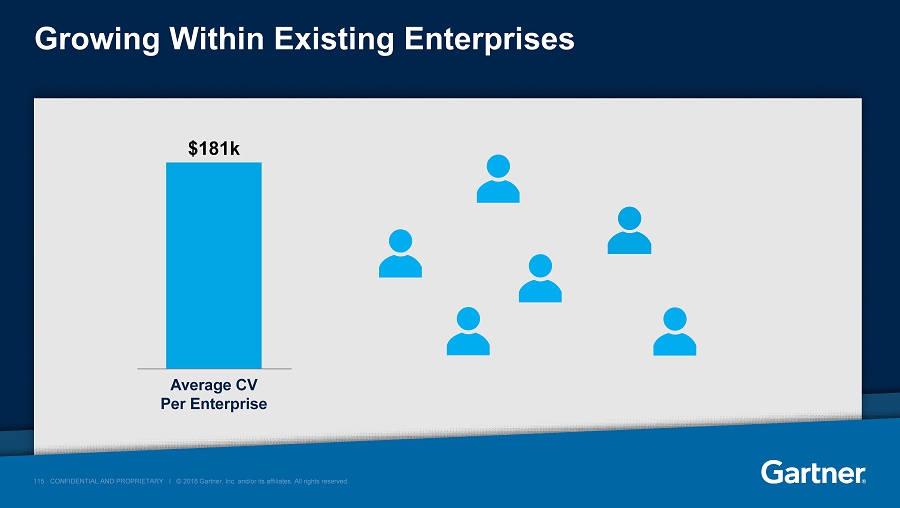

114 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 114 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Increasing Average CV per Enterprise $142k $148k $155k $169k $181k Note: Heritage Gartner, Tech only 2013 2015 2017 2016 2014

115 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 115 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Growing Within Existing Enterprises $181k Average CV Per Enterprise

116 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 116 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Growing Within Existing Enterprises $181k Average CV Per Enterprise

117 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 117 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Technology Large Market Opportunity 55 23 25 14 24 38 19 198 Supply Chain Marketing Human Resources Finance Sales Legal & Other Total Market Opportunity Combined Gartner CV ($ in billions) 2.8B Source: Internal Gartner estimates

118 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Human Resources Supply Chain Marketing Legal Finance Customer Svc. & Support General Manager 12,000 $90,000 $1Billion+ Sales

119 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. The Gartner Formula Large Market Opportunity Attractive Gartner Business Model Invest to Drive Growth and Value

120 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Events 10% Consultin g 8% TA & Other [PERCENT AGE] Research 75%

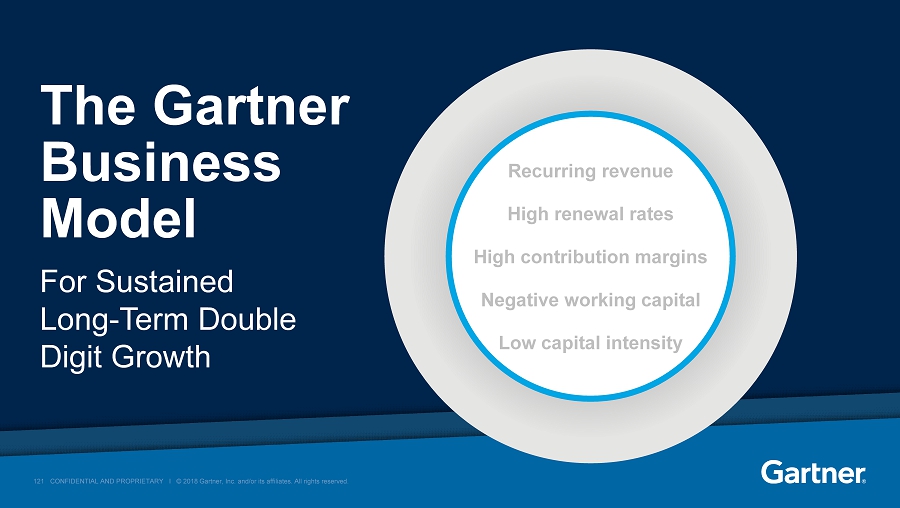

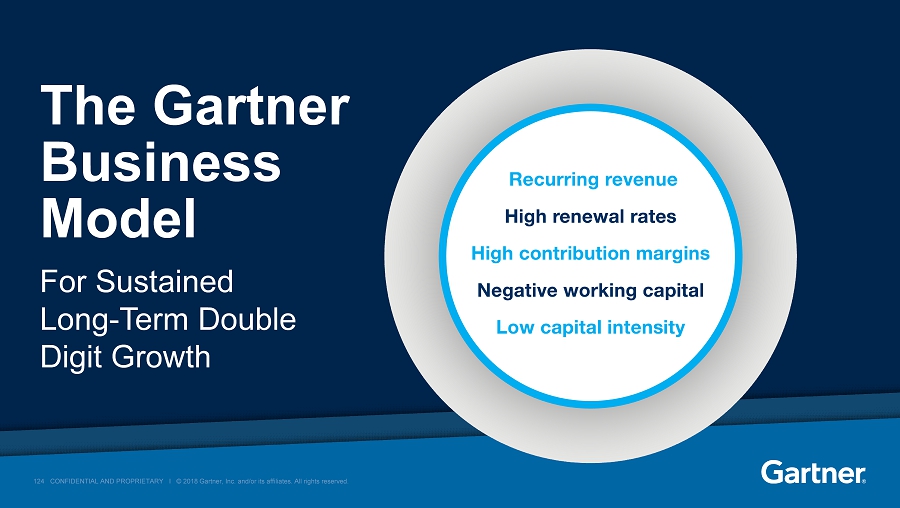

121 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Recurring revenue High renewal rates High contribution margins Negative working capital Low capital intensity The Gartner Business Model For Sustained Long - Term Double Digit Growth

122 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 122 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Projected Double Digit Growth in 2018 12% 11% 11% FCF Growth EBITDA Growth Revenue Growth Notes: Growth based on mid - point of 2018 guidance Revenue growth based on combined adjusted revenue EBITDA growth based on combined adjusted EBITDA FCF based on combined free cash flow, adjusted for Q4 billing timing Please see appendix for non - GAAP reconciliation

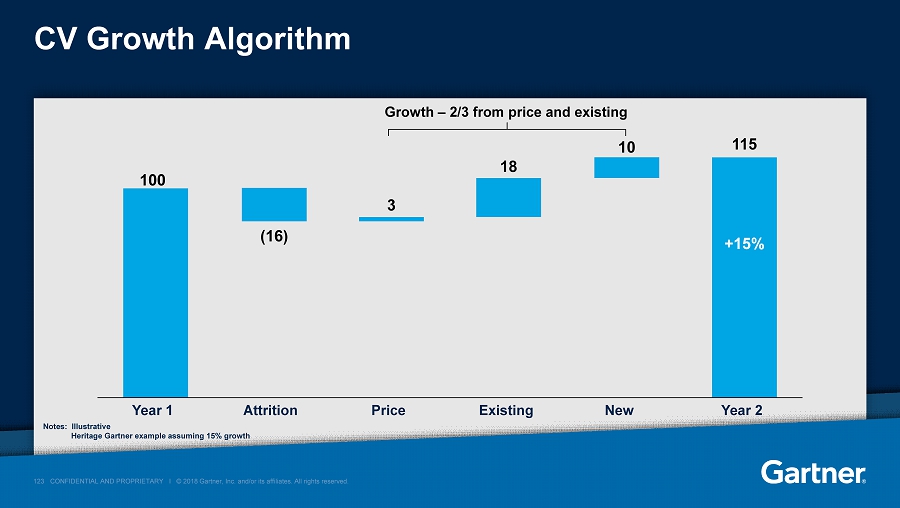

123 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 123 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Year 2 115 New 10 Existing 18 Price 3 Attrition (16) CV Growth Algorithm Notes: Illustrative Heritage Gartner example assuming 15% growth Growth – 2/3 from price and existing Year 1 100 +15%

124 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. The Gartner Business Model For Sustained Long - Term Double Digit Growth

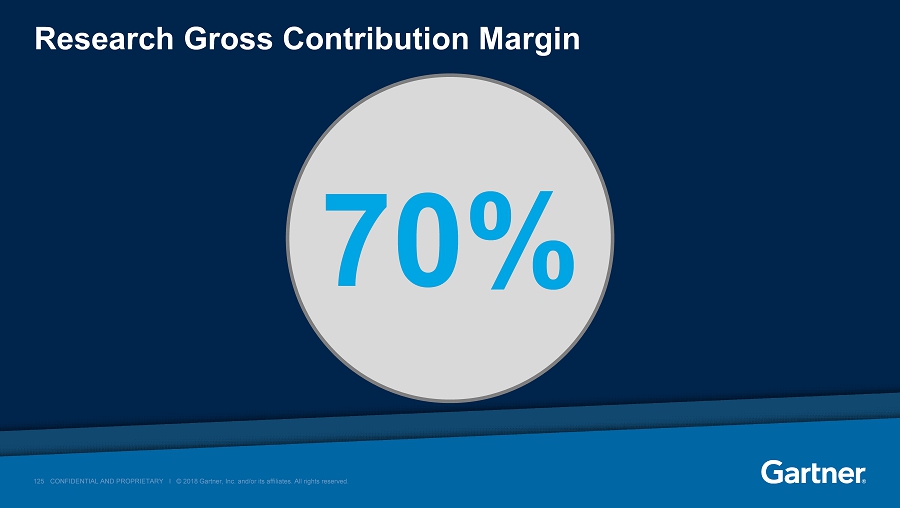

125 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Research Gross Contribution Margin 70%

126 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Total Gross Contribution Margin 63%

127 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. SG&A Selling G&A

128 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. EBITDA Free Cash Flow

129 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. The Gartner Formula Large Market Opportunity Attractive Gartner Business Model Invest to Drive Growth and Value

130 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. New Hire Investment Hire Recruiters and Trainers, Procure Office Space Recruit and Hire Sales Train Sales Deploy in Territory 1 st Sale Decide to Grow

131 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Sales Productivity Gains Year 1 Year 2 Year 3 Year 4 Year 5 Cost CV New Hire Full Productivity Note: Illustrative example

132 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Enabling Infrastructure Recruiting Training Facilities Sales Support Centers of Excellence CRM with Smart AI

133 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 133 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. $2.0B $2.2B $0.6B $0.6B Global Technology and Global Business Sales: 2017 CV +12% $2.8B Y/E 2017 $2.5B GBS GTS Y/E 2016 +13% +8% Note: See appendix for details by quarter

134 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Growth Objectives Growth Rate Research GTS 12 – 16% GBS 12 – 16% Events 5 – 10% Consulting 3 – 8% Revenue 10 – 14% Adjusted EBITDA 10 – 14% Free Cash Flow 10 – 14% Note: Please see appendix for non - GAAP definitions

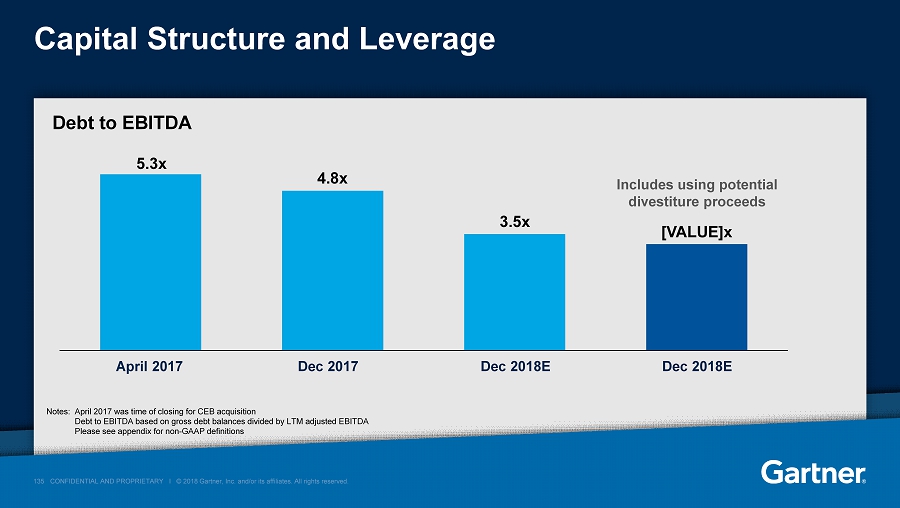

135 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 135 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Capital Structure and Leverage April 2017 Dec 2017 Dec 2018E Notes: April 2017 was time of closing for CEB acquisition Debt to EBITDA based on gross debt balances divided by LTM adjusted EBITDA Please see appendix for non - GAAP definitions 4.8x 3.5x [VALUE] x 5.3x Dec 2018E Includes using potential divestiture proceeds Debt to EBITDA

136 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Strategic Acquisitions Share Repurchases Capital Allocation Strategy

137 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. The Gartner Formula The Gartner Business Model For Sustained Long - Term Double Digit Growth

138 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved.

139 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 139 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Global Technology Sales and Global Business Sales Contract Value @ 2018 rates ($M) Q4 15 Q1 16 Q2 16 Q3 16 Q4 16 Q1 17 Q2 17 Q3 17 Q4 17 GTS 1,769 1,791 1,811 1,868 1,973 2,004 2,045 2,104 2,238 GBS 530 543 559 569 557 574 587 592 602

140 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 140 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Heritage Gartner: Contract Value* ($M) *At 2018 FX rates Does not include CEB or L2

141 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 141 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Heritage Gartner: Client Enterprises

142 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 142 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Heritage Gartner: Sales Quota Bearing Headcount * Includes L2

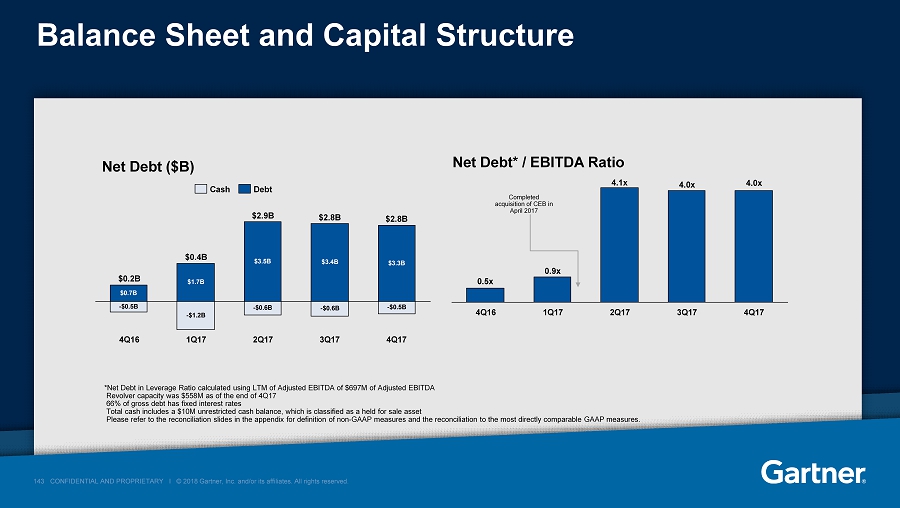

143 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 143 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Balance Sheet and Capital Structure Net Debt* / EBITDA Ratio *Net Debt in Leverage Ratio calculated using LTM of Adjusted EBITDA of $697M of Adjusted EBITDA Revolver capacity was $558M as of the end of 4Q17 66 % of gross debt has fixed interest rates Total cash includes a $10M unrestricted cash balance, which is classified as a held for sale asset Please refer to the reconciliation slides in the appendix for definition of non - GAAP measures and the reconciliation to the most directly comparable GAAP measures. -$1.2B -$0.6B -$0.6B -$0.5B $0.7B $1.7B $3.5B $3.4B $3.3B -$0.5B 4Q17 $2.8B 3Q17 $2.8B 2Q17 $2.9B $0.4B 1Q17 4Q16 $0.2B Cash Debt Net Debt ($B) 1Q17 4Q16 2Q17 4Q17 3Q17 Completed acquisition of CEB in April 2017 0.5x 0.9x 4.1x 4.0x 4.0x

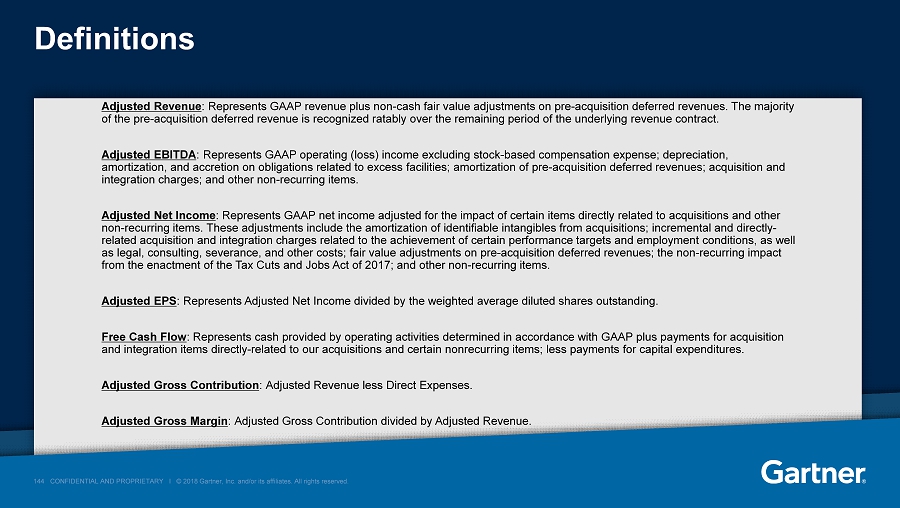

144 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 144 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Definitions Adjusted Revenue : Represents GAAP revenue plus non - cash fair value adjustments on pre - acquisition deferred revenues. The majority of the pre - acquisition deferred revenue is recognized ratably over the remaining period of the underlying revenue contract. Adjusted EBITDA : Represents GAAP operating (loss) income excluding stock - based compensation expense; depreciation, amortization, and accretion on obligations related to excess facilities; amortization of pre - acquisition deferred revenues; acqu isition and integration charges; and other non - recurring items. Adjusted Net Income : Represents GAAP net income adjusted for the impact of certain items directly related to acquisitions and other non - recurring items. These adjustments include the amortization of identifiable intangibles from acquisitions; incremental and d irectly - related acquisition and integration charges related to the achievement of certain performance targets and employment conditio ns, as well as legal, consulting, severance, and other costs; fair value adjustments on pre - acquisition deferred revenues; the non - recurring impact from the enactment of the Tax Cuts and Jobs Act of 2017; and other non - recurring items. Adjusted EPS : Represents Adjusted Net Income divided by the weighted average diluted shares outstanding. Free Cash Flow : Represents cash provided by operating activities determined in accordance with GAAP plus payments for acquisition and integration items directly - related to our acquisitions and certain nonrecurring items; less payments for capital expenditure s. Adjusted Gross Contribution : Adjusted Revenue less Direct Expenses. Adjusted Gross Margin : Adjusted Gross Contribution divided by Adjusted Revenue.

145 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 145 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 2018 Guidance In $ millions, except per share amounts 2018 Guidance Range Research adjusted revenue 3,100 - 3,150 Consulting adjusted revenue 340 - 355 Events adjusted revenue 380 - 400 Talent Assessment & Other adjusted revenue 285 - 305 Total Adjusted Revenue 4,105 - 4,210 Adjusted EBITDA 750 - 800 Adjusted Diluted Earnings Per Share $3.71 - $4.11 Fully Diluted Number of Shares 93 Operating Cash Flow 460 - 510 Acquisition and Integration Payments 126 Capital Expenditures (135) - (145) Free Cash Flow 451 - 491 Please refer to the reconciliation slides in the appendix for definition of non - GAAP measures and the reconciliation to the most directly comparable GAAP measures.

146 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 146 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Additional 2018 Guidance Items In $ millions, except per share amounts 2018 Guidance Range Stock - based compensation 73 - 74 Depreciation 80 - 81 Amortization of intangible assets 190 Interest Expense (net) 129 Effective tax rate (GAAP) 27 - 28% Effective tax rate (adjusted) 26% Please refer to the reconciliation slides in the appendix for definition of non - GAAP measures and the reconciliation to the most directly comparable GAAP measures.

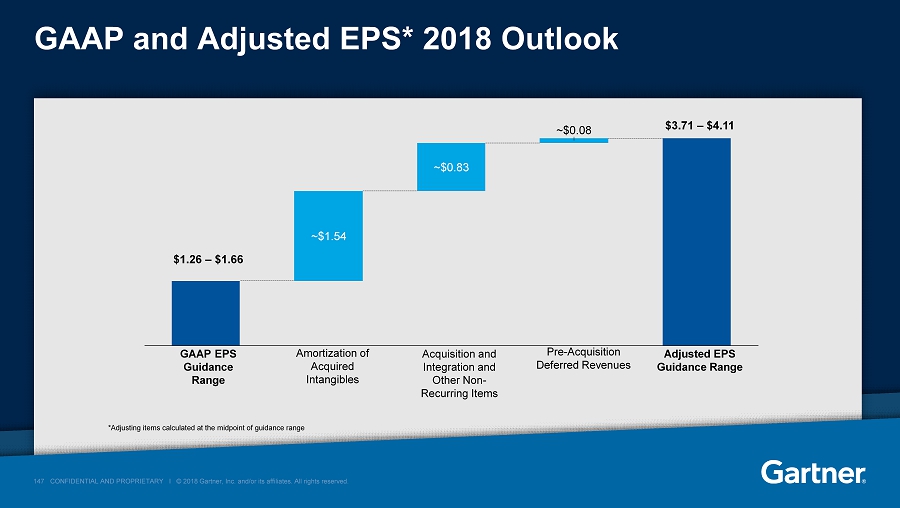

147 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 147 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. GAAP and Adjusted EPS* 2018 Outlook $1.26 – $1.66 *Adjusting items calculated at the midpoint of guidance range Amortization of Acquired Intangibles GAAP EPS Guidance Range Acquisition and Integration and Other Non - Recurring Items Pre - Acquisition Deferred Revenues Adjusted EPS Guidance Range ~$ 0.83 ~$ 0.08 ~$ 1.54 $3.71 – $4.11

148 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 148 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Adjusted Revenue Reconciliation: 2018 Guidance In $ millions 2018 GAAP Revenue Guidance Deferred Revenue Fair Value Adjustment 2018 Adjusted Revenue Research revenue 3,095 - 3,145 5 - 5 3,100 - 3,150 Consulting revenue 340 - 355 - 340 - 355 Events revenue 380 - 400 - 380 - 400 Talent Assessment & Other 280 - 300 5 - 5 285 - 305 Total Revenue 4,095 - 4,200 10 - 10 4,105 - 4,210

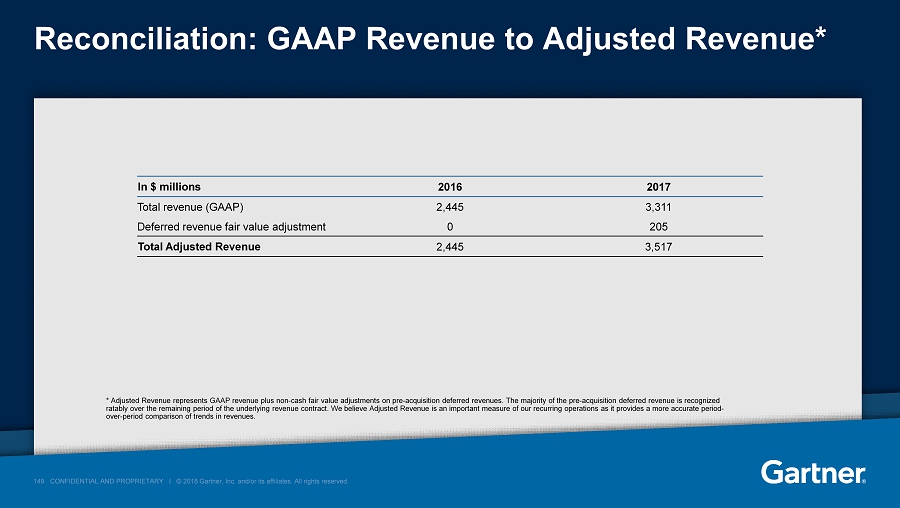

149 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 149 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Reconciliation: GAAP Revenue to Adjusted Revenue* In $ millions 2016 2017 Total revenue (GAAP) 2,445 3,311 Deferred revenue fair value adjustment 0 205 Total Adjusted Revenue 2,445 3,517 * Adjusted Revenue represents GAAP revenue plus non - cash fair value adjustments on pre - acquisition deferred revenues. The majority of the pre - acquisition deferred revenue is recognized ratably over the remaining period of the underlying revenue contract. We believe Adjusted Revenue is an important measure of our recurring operations as it provides a more accurate period - over - period comparison of trends in revenues.

150 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 150 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Reconciliation: Operating Income to Adjusted EBITDA ( a) In $ millions 2016 2017 Net (loss) income 194 3 Interest expense, net 25 125 Other (income) expense, net (8) (3) Tax provision 95 (131) Operating (loss) income 305 (6) Adjustments: Stock - based compensation expense (b) 47 61 Depreciation, accretion, and amortization (c) 62 241 Amortization of pre - acquistion deferred revenues (d) 0 205 Acquisition and integration charges and other nonrecurring items (e) 43 160 Adjusted EBITDA 457 661 a) Adjusted EBITDA is based on GAAP operating income adjusted for certain normalizing adjustments b) Consists of charges for stock - based compensation awards c) Includes depreciation expense, accretion on excess facilities accruals, and amortization of intangibles d) Consists of the amortization of non - cash fair value adjustments on pre - acquisition deferred revenues. The majority of the pre - ac quisition deferred revenue is recognized ratably over the remaining period of the underlying revenue contract. e) Consists of incremental and directly - related charges related to acquisitions and other non - recurring items

151 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 151 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Reconciliation: Operating Income to Adjusted Net Income (a) In $ millions, except per share amounts 2016 2017 GAAP net (loss) income 194 3 Acquisition and other adjustments: Amortization of acquired intangibles (b) 24 176 Amortization of pre - acquistion deferred revenues (c) 0 205 Acquisition and integration charges and other nonrecurring items (d) 43 174 Impact of Tax Cuts and Jobs Act of 2017 (e) (60) Tax impact of adjustments (f) (13) (202) Adjusted net income 248 298 GAAP Diluted Shares 84 90 Adjusted Earnings per Share 2.96 3.31 a) Adjusted net income represents GAAP net (loss) income adjusted for the impact of certain items directly related to acquisitions and o the r non - recurring items b) Consists of non - cash amortizaton charges from acquired intangibles c) Consists of the amortization of non - cash fair value adjustments on pre - acquisition deferred revenues. The majority of the pre - acquisitio n deferred revenue is recognized ratably over the remaining period of the underlying revenue contract d) Consists of incremental and directly - related charges related to acquisitions and other non - recurring items e) Consists of the provisional, non - recurring net income tax benefit from the reduction of certain deferred tax liabilities and the repatriation tax on foreign earnings resulting from the Tax Cuts and Jobs Act of 2017 f) The effective tax rate was 00% for the twelve months ended December 31, 2017 19% and twelve months ended December 31, 2016

152 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. 152 CONFIDENTIAL AND PROPRIETARY I © 2018 Gartner, Inc. and/or its affiliates. All rights reserved. Reconciliation: GAAP Cash Provided by Operating Activities to Free Cash Flow (a) In $ millions 2016 2017 Cash provided by operating activities 366 255 Adjustments: Cash paid for acquisition and integration 31 121 Cash paid for capital expenditures (50) (111) Free Cash Flow 347 265 a) Free cash flow is based on cash provided by operating activities determined in accordance with GAAP plus cash acquisition and in tegration payments less additions to capital expenditures

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Deutsche Bank Starts Gartner (IT) at Hold, 'Under-penetrated addressable market with high FCF conversion'

- ROSEN, A LEADING LAW FIRM, Encourages Waldencast plc Investors to Inquire About Securities Class Action Investigation – WALD, WALDW

- SNOW Shareholders – Lead Plaintiff Deadline Set for April 29, 2024 – Contact Robbins LLP for More Information

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share