Form 8-K EYEGATE PHARMACEUTICALS For: Sep 12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): September 12, 2017

EYEGATE PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

| 001-36672 | 98-0443284 | |

| (Commission File Number) | (IRS Employer Identification No.) | |

| 271 Waverley Oaks Road Suite 108 Waltham, MA |

02452 | |

| (Address of principal executive offices) | (Zip Code) |

(781) 788-9043

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. x

| Item 7.01 | Regulation FD Disclosure. |

EyeGate Pharmaceuticals, Inc. (the “Company”) hereby furnishes the updated investor presentation attached as Exhibit 99.1 to this Current Report on Form 8-K, which the Company may use in presentations to investors from time to time, including at the 19th Annual Rodman & Renshaw Global Investment Conference, being held September 10-12, 2017 at The Lotte New York Palace Hotel in New York, New York, at which Stephen From, President and Chief Executive Officer of the Company, will be presenting on September 12, 2017 at 10:00 a.m.

The information furnished pursuant to Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent that the Company specifically incorporates it by reference.

The information furnished in this report, including Exhibit 99.1, shall not be deemed to constitute an admission that such information or exhibit is required to be furnished pursuant to Regulation FD or that such information or exhibit contains material information that is not otherwise publicly available. In addition, the Company does not assume any obligation to update such information or exhibit in the future.

| Item 9.01. | Financial Statements and Exhibits. |

| (d) | Exhibits. |

The Company hereby furnishes the following exhibit:

| 99.1 | Presentation of the Company, dated as of September 12, 2017. |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| EYEGATE PHARMACEUTICALS, INC. | ||

| By: | /s/ Stephen From | |

| Stephen From | ||

| President and Chief Executive Officer | ||

| Date: September 12, 2017 | ||

3

Exhibit Index

| 99.1 | Presentation of the Company, dated as of September 12, 2017. |

4

Exhibit 99.1

Providing innovative products that enhance drug efficacy and patient compliance to improve vision CORPORATE PRESENTATION EyeGate Pharmaceuticals, Inc. 271 Waverley Oaks Road, Suite 108 Waltham, MA 02452 www.eyegatepharma.com

Forward Looking Statements Some of the matters discussed in this presentation contain forward - looking statements that involve significant risks and uncerta inties, including statements relating to the prospects for the Company’s lead product EGP - 437, for the timing and outcome of the Company’s clinical trials, t he potential approval to market EGP - 437, and the Company’s capital needs. Actual events could differ materially from those projected in this presentation and t he Company cautions investors not to rely on the forward - looking statements contained in, or made in connection with, the presentation. Among other things, the Company’s clinical trials may be delayed or may eventually be unsuccessful. The Company may consume mor e cash than it currently anticipates and faster than projected. Competitive products may reduce or eliminate the commercial opportunities of the Comp any ’s product candidates. If the U.S. Food and Drug Administration or foreign regulatory agencies determine that the Company’s product candidates do not meet saf ety or efficacy endpoints in clinical evaluations, they will not receive regulatory approval and the Company will not be able to market them. Operating ex pen se and cash flow projections involve a high degree of uncertainty, including variances in future spending rate due to changes in corporate priorities, the ti ming and outcomes of clinical trials, regulatory and developments and the impact on expenditures and available capital from licensing and strategic collaboration o ppo rtunities. If the Company is unable to raise additional capital when required or on acceptable terms, it may have to significantly alter, delay, scale bac k o r discontinue operations. Additional risks and uncertainties relating to the Company and its business can be found in the “Risk Factors” section of the Co mpany’s Annual Report on Form 10 - K filed with the SEC on February 23, 2017. The Company undertakes no duty or obligation to update any forward - looking statements contained in this presentation as a result of new information, future events or changes in the Company’s expectations, except as required by ap pli cable law. The Company uses its website ( www.EyeGatePharma.com ), Facebook page ( https://www.facebook.com/ EyeGatePharma/ ), corporate Twitter account ( https://twitter.com/EyeGatePharma ), and LinkedIn page ( https://www.linkedin.com/company/135892/ ) as channels of distribution of information about the Company and its product candidates. Such information may be deemed material information, and the Company may use these channe ls to comply with its disclosure obligations under Regulation FD. Therefore, investors should monitor the Company’s website and its social media ac cou nts in addition to following its press releases, SEC filings, public conference calls, and webcasts. The social media channels that the Company intends to us e a s a means of disclosing the information described above may be updated from time to time as listed on the Company’s investor relations website. 2

3 Company Highlights Near Term Commercial Ophthalmic Company ▪ De novo FDA 510(k) and CE Mark filings for OBG expected by Mid - Year 2018 ▪ OBG commercial launch anticipated for Mid - Year 2019 ▪ Targeting initially ~160,000 - 240,000 PRK procedures in U.S. annually ▪ NDA filing expected Q3 2018 for EGP - 437 ▪ Product partnered with Valeant (Bausch & Lomb) Multiple Upcoming Catalysts ▪ OBG: PRK Pilot 2 trial top - line data expected by Year - End 2017 / Q1 2018 ▪ OBG: PRK Pivotal trial top - line data expected Q2 2018 ▪ EGP - 437 Cataract Surgery Phase 2b top - line data expected by year - end 2017 ▪ EGP - 437 Anterior Uveitis Phase 3 trial initiation top - line data expected Q2 2018 Robust pipeline with positive clinical data in hand for all candidates ▪ Most recently announced positive results from OBG: PRK Pilot trial January 2017 ▪ Clinical utility of hyaluronic acid (HA) well understood, further de - risking OBG product line Attractive competitive profile ▪ OBG is first and only eye drop in the U.S. targeting acceleration of re - epithelization claim Validating relationship with Bausch & Lomb (Valeant) for EGP - 437 ▪ Worldwide rights retained for OBG product line

Two platforms in the clinic with an expected FDA filing as early as Mid - Year 2018 4 Clinical Pipeline Ocular Bandage Gel (OBG) Eye Drop: Crosslinked Hyaluronic Acid (CMHA - S) Iontophoresis Delivery System: Delivering EGP - 437: Corticosteroid Indication(s) Stage Upcoming Milestone(s) Large Corneal Epithelial Defects (PRK) Pilot trial completed, Positive data announced ▪ YE 2017 or early Q1 2018 : Pilot 2 top - line data ▪ Q2 2018: Pivotal top - line data ▪ Mid - Year 2018: D e novo FDA 510(k) and CE Mark filing Indication(s) Stage Upcoming Milestone(s) Cataract Surgery Phase 2b, Positive Phase 1b/2a data announced ▪ YE 2017: Phase 2b top - line data ▪ Q2 2018: Phase 3 initiation ▪ Q1 2019: sNDA filing Anterior Uveitis Phase 3 ▪ Q2 2018: Phase 3 top - line data ▪ Q3 2018 : NDA filing

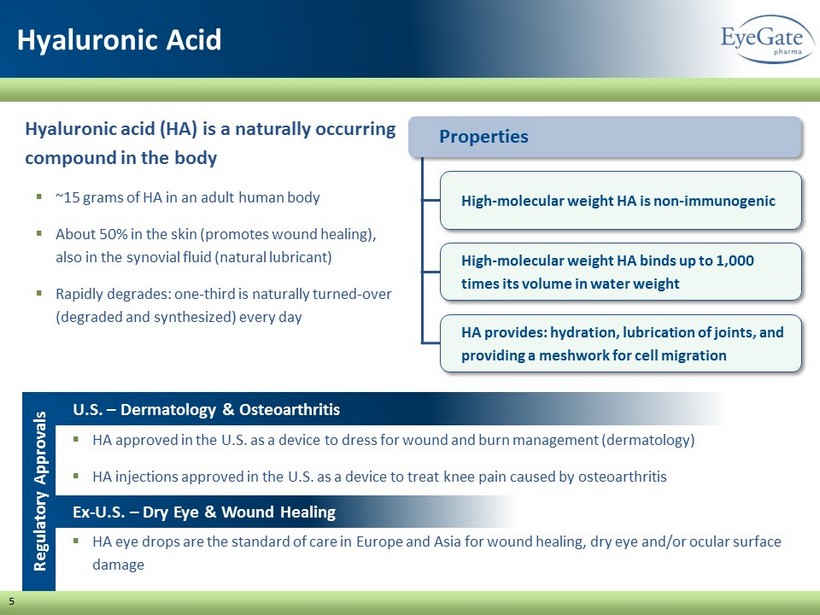

5 Hyaluronic Acid Hyaluronic acid (HA) is a naturally occurring compound in the body ▪ ~15 grams of HA in an adult human body ▪ About 50% in the skin (promotes wound healing), also in the synovial fluid (natural lubricant) ▪ Rapidly degrades: one - third is naturally turned - over (degraded and synthesized) every day ▪ HA approved in the U.S. as a device to dress for wound and burn management (dermatology) ▪ HA injections approved in the U.S. as a device to treat knee pain caused by osteoarthritis Properties High - molecular weight HA is non - immunogenic High - molecular weight HA binds up to 1,000 times its volume in water weight HA provides: hydration, lubrication of joints, and providing a meshwork for cell migration Regulatory Approvals ▪ HA eye drops are the standard of care in Europe and Asia for wound healing, dry eye and/or ocular surface damage U.S. – Dermatology & Osteoarthritis Ex - U.S. – Dry Eye & Wound Healing

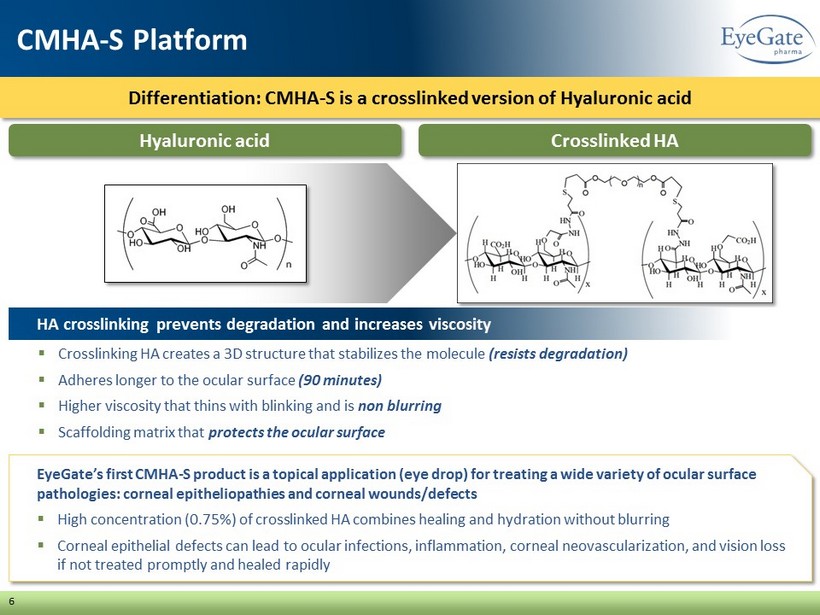

Differentiation: CMHA - S is a crosslinked version of Hyaluronic acid 6 CMHA - S Platform ▪ Crosslinking HA creates a 3D structure that stabilizes the molecule (resists degradation) ▪ Adheres longer to the ocular surface (90 minutes) ▪ Higher viscosity that thins with blinking and is non blurring ▪ Scaffolding matrix that protects the ocular surface HA crosslinking prevents degradation and increases viscosity Crosslinked HA Hyaluronic acid EyeGate’s first CMHA - S product is a topical application (eye drop) for treating a wide variety of ocular surface pathologies: corneal epitheliopathies and corneal wounds/defects ▪ High concentration (0.75%) of crosslinked HA combines healing and hydration without blurring ▪ Corneal epithelial defects can lead to ocular infections, inflammation, corneal neovascularization, and vision loss if not treated promptly and healed rapidly

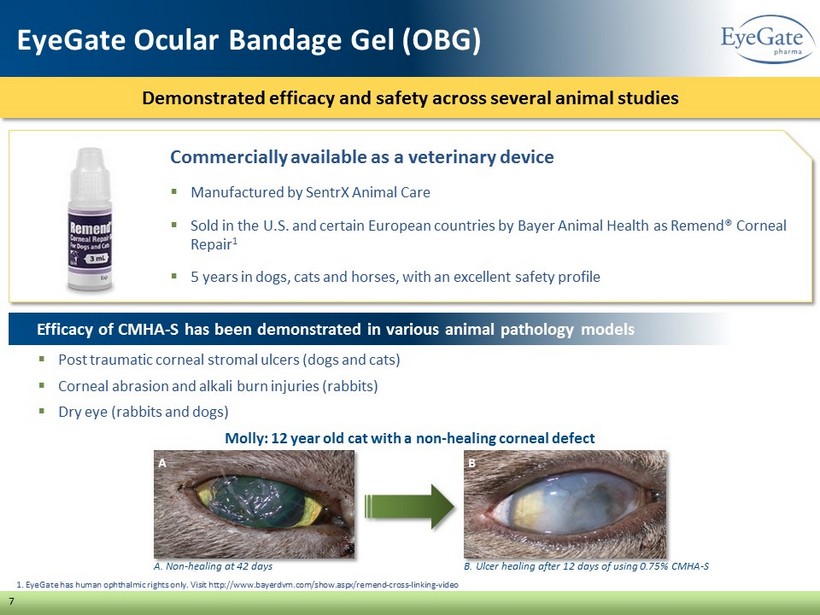

Commercially available as a veterinary device ▪ Manufactured by SentrX Animal Care ▪ Sold in the U.S. and certain European countries by Bayer Animal Health as Remend ® Corneal Repair 1 ▪ 5 years in dogs, cats and horses, with an excellent safety profile 1. EyeGate has human ophthalmic rights only. Visit http://www.bayerdvm.com/show.aspx/remend - cross - linking - video Demonstrated efficacy and safety across several animal studies 7 EyeGate Ocular Bandage Gel (OBG) A. Non - healing at 42 days Efficacy of CMHA - S has been demonstrated in various animal pathology models ▪ Post traumatic corneal stromal ulcers (dogs and cats) ▪ Corneal abrasion and alkali burn injuries (rabbits) ▪ Dry eye (rabbits and dogs) B A Molly: 12 year old cat with a non - healing corneal defect B. Ulcer healing after 12 days of using 0.75% CMHA - S

CMHA - S treated cornea exhibited “more normal” epithelial and stromal organization 8 Healing Corneal Abrasions and Alkali Burns Efficacy Study: Rabbits 1 1. Guanghui Yang, Ladan Espandar , Nick Mamalis and Glenn D. Prestwich, Veterinary Ophthalmology 2010 Histology of alkali burn healing A. Control at Day 12 central wound with unhealed corneal epithelium B. CMHA - S treated central epithelium and corneal stroma showing a better organization than control A. Fluorescein staining of corneal epithelial abrasions B. Quantitative analysis at 24 hours; 49% vs 83% complete P < 0.01 ▪ Abrasion: Wound closure complete by 48 hours with CMHA - S ▪ Burns: Complete re - epithelization at Day 12 for CMHA - S but not for control CMHA - S treated central corneal epithelium exhibited a faster wound closure

x PRK is an efficacious alternative for patients seeking surgical correction of refractive errors who are poor LASIK candidates x PRK surgery provides several advantages as indication to evaluate OBG’s ability ▪ Larger epithelial defects : All eyes randomized at time zero with same size defect ▪ Homogenous population : All eyes healthy (i.e. normal stem cell function) and will heal at ~same rate x 39 subjects randomized to one of three groups: both eyes received the same treatment ▪ Group 1 : EyeGate Ocular Bandage Gel QID for 2 weeks after surgery ▪ Group 2 : EyeGate Ocular Bandage Gel QID for 2 weeks after surgery in combination with a Bandage Contact Lens (BCL) ▪ Group 3 : BCL and preservative - free artificial tears Announced positive data evaluating ability of EyeGate OBG to accelerate corneal surface re - epithelialization following bilateral photorefractive keratectomy (PRK) 9 EyeGate Ocular Bandage Gel (OBG) First - in - human Clinical Trial Completed

x Excellent safety and tolerability ▪ No adverse events in OBG arm ▪ No corneal haze out to Day 28 x ~30% more patients healed by Day 3 with OBG alone than standard - of - care (BCL+AT) x Additionally, wound size was as much as ~36% smaller as early as Day 1 (24 hours post surgery) with OBG alone 10 EyeGate Ocular Bandage Gel (OBG) Data from First - in - human Clinical Trial 1. BCL = bandage contact lens and AT = artificial tears # Subjects per arm # % Horizontal Vertical Horizontal Vertical Arm 1: OBG 12 10 83.3% 4.1 4.5 0.10 0.20 Arm 2: OBG + BCL 14 9 64.3% 6.3 6.50 0.30 0.30 Arm 3: BCL + AT 1 13 7 53.8% 6.4 6.20 0.60 0.60 Total Subjects Enrolled 39 OBG: % better than BCL 54.8% 35.9% 27.4% 83.3% 66.7% Closed Wound: Day 3 Day 1 Day 3 Surface Area (mm 2 )

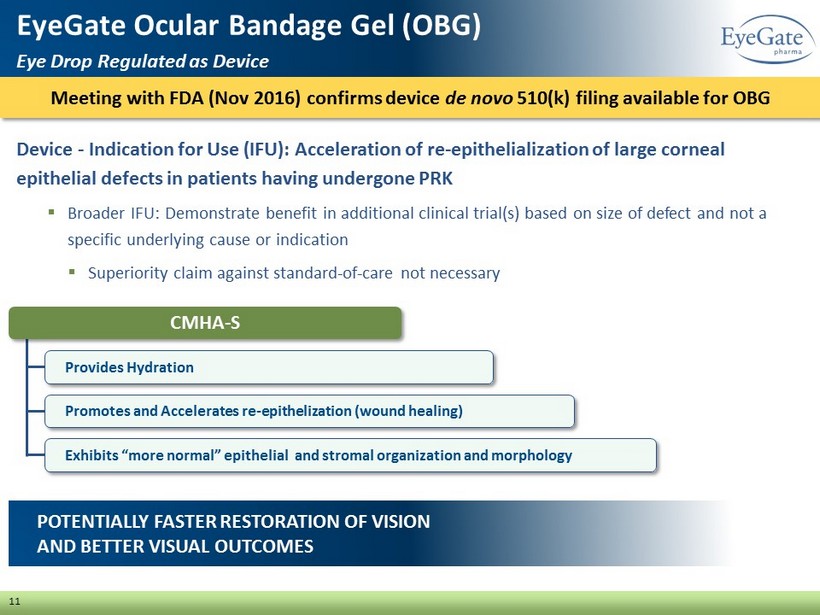

Device - Indication for Use (IFU): Acceleration of re - epithelialization of large corneal epithelial defects in patients having undergone PRK ▪ Broader IFU: Demonstrate benefit in additional clinical trial(s) based on size of defect and not a specific underlying cause or indication ▪ Superiority claim against standard - of - care not necessary Meeting with FDA (Nov 2016) confirms device de novo 510(k) filing available for OBG 11 EyeGate Ocular Bandage Gel (OBG) Eye Drop Regulated as Device POTENTIALLY FASTER RESTORATION OF VISION AND BETTER VISUAL OUTCOMES Provides Hydration Promotes and Accelerates re - epithelization (wound healing) Exhibits “more normal” epithelial and stromal organization and morphology CMHA - S

▪ Corneal foreign bodies ▪ Abrasions / contusions ▪ Chemical burns ▪ Difficult to heal alkali burns (PCED) 12 EyeGate Ocular Bandage Gel (OBG) Market Opportunity EyeGate has exclusive worldwide commercial rights to CMHA - S for use in human ocular space ▪ De novo FDA 510(k) filing targeted for Mid - Year 2018, potentially commercializing Mid - Year 2019 ▪ Estimate 160,000 - 240,000 PRK procedures 1 in the U.S. annually ▪ Expanded commercial use including SPK/dry eye anticipated for Year - End 2019 ▪ European CE Mark targeted for H1 2018, potentially commercializing late 2018 ▪ Refractive surgeries (PRK) ▪ Vitrectomies (Diabetics) ▪ Collagen crosslinking ▪ Pre - cataract surgery ▪ Pterygium ▪ Neurotrophic keratitis (Herpes, Diabetes) ▪ Autoimmune disease ( Sjogren’s ) ▪ GvHD ▪ Contact lens wear ▪ Ocular irritants ▪ Lid malposition (ectropion/entropion) ▪ Dry Eye ▪ Cranial Neuropathies Corneal Epitheliopathies and Corneal Defects/Wounds: U.S. Numbers Ocular / Systemic Disorders: >50.0 million (~1.4 million prescriptions) Epithelial injury (exposure): ~16.0 million (~1.8 million prescriptions) Ocular trauma: ~1.8 million (~0.9 million prescriptions) Surgery : >4.0 million (~0.8 million prescriptions) 1. Source: American Academy of Ophthalmology (https://www.aao.org/newsroom/eye - health - statistics)

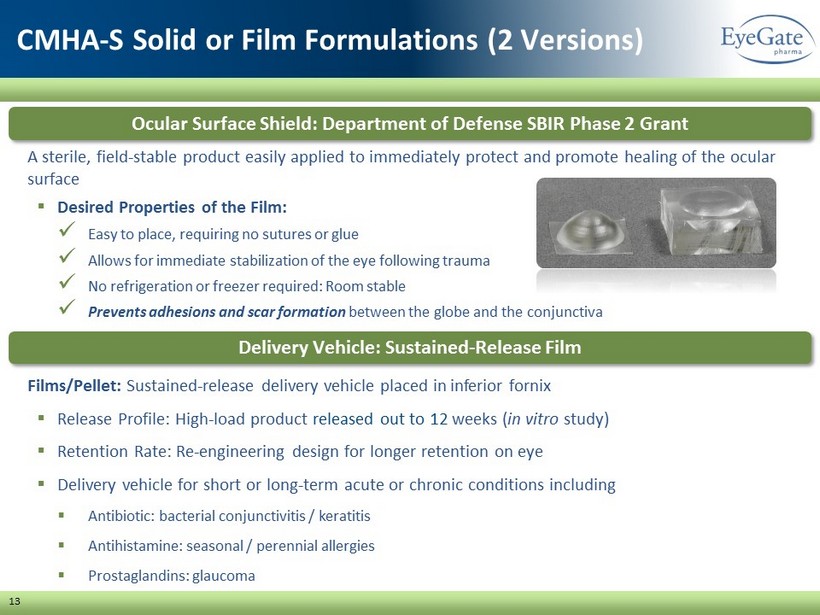

13 CMHA - S Solid or Film Formulations (2 Versions) A sterile, field - stable product easily applied to immediately protect and promote healing of the ocular surface ▪ Desired Properties of the Film: x Easy to place, requiring no sutures or glue x Allows for immediate stabilization of the eye following trauma x No refrigeration or freezer required: Room stable x Prevents adhesions and scar formation between the globe and the conjunctiva Films/Pellet: Sustained - release delivery vehicle placed in inferior fornix ▪ Release Profile: High - load product released out to 12 weeks ( in vitro study) ▪ Retention Rate: Re - engineering design for longer retention on eye ▪ Delivery vehicle for short or long - term acute or chronic conditions including ▪ Antibiotic: bacterial conjunctivitis / keratitis ▪ Antihistamine: seasonal / perennial allergies ▪ Prostaglandins: glaucoma Ocular Surface Shield: Department of Defense SBIR Phase 2 Grant Delivery Vehicle: Sustained - Release Film

x Small electrical current (constant); current has same charge as active substance (drug) x Electrode creates repulsive electromotive forces (like charges repel) x Drug migrates toward return electrode, mobility a function of molecular weight and charge x Drug dose controlled by 2 variables: Current (mA) x application time (minutes) x Easy to use: ophthalmologist or optometrist in <5 minutes x More than 2,400 treatments performed in office setting EyeGate Applicator A non - invasive method of propelling charged active compounds into ocular tissues 14 Iontophoresis Delivery Platform

▪ Etiology assault based (cataract surgery) vs primarily auto - immune (uveitis) ▪ Inflammation of uveal tissue including iris and/or ciliary body ▪ Inflammation severity determined by number of white blood cells in the anterior chamber of the eye (slit - lamp used) ▪ Primary end - point is proportion of subjects with zero cells in EGP - 437 arm vs control arm 1. Market Scope, 2015 Comprehensive Report on The Global IOL Market, June 2015 Two indications licensed by Valeant: cataract surgery and anterior uveitis 15 EGP - 437: A Potent Anti - inflammatory Agent (corticosteroid - dexamethasone phosphate) Cataract surgery incidence: ~4 million 1 annually in U.S. Uveitis incidence: ~26.6 to 102 per 100,000 annually in U.S. Non - compliance leads to sight - threatening complications

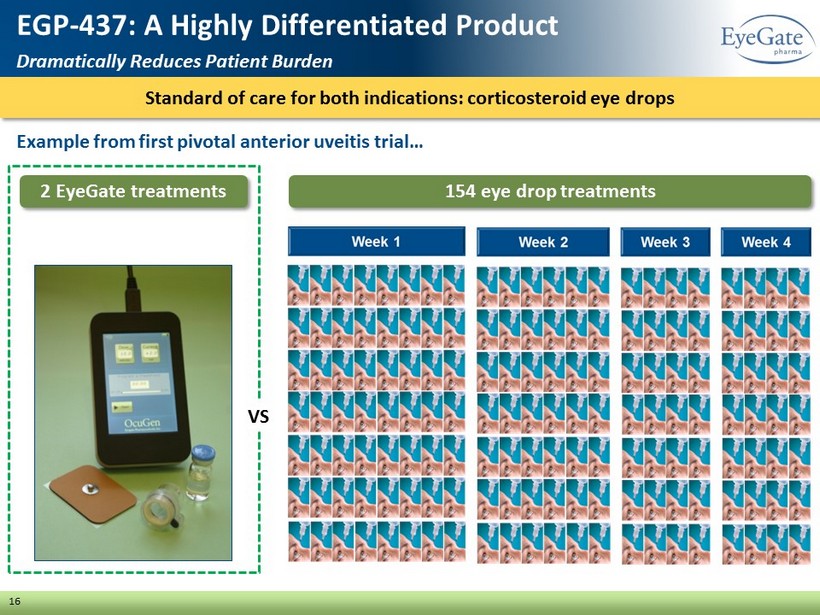

Standard of care for both indications: corticosteroid eye drops 16 EGP - 437: A Highly Differentiated Product Dramatically Reduces Patient Burden Example from first pivotal anterior uveitis trial… 2 EyeGate treatments 154 eye drop treatments VS

EGP - 437 demonstrated safe and effective in reducing inflammation and preventing pain as early as Day 1 with two different iontophoretic doses 17 Cataract Surgery ▪ 80 subjects who underwent unilateral cataract extraction with a monofocal intraocular lens ▪ 7 cohorts whereby EGP - 437 was delivered in iontophoretic doses of 4.0 mA - min, 4.5 mA - min, 9.0 mA - min and 14.0 mA - min, 1 placebo cohort at 14.0 mA - min ▪ Different dosing regimens: 2 or 3 doses, Day 0, Day 1, Day 4 and potential for additional treatment on Day 7 ▪ Primary outcomes: 1. Proportion of subjects with anterior chamber cell (ACC) count of zero 2. Proportion with pain score of zero Trial Design 1 2

EGP - 437 demonstrated safe and effective in reducing inflammation and preventing pain 18 Cataract Surgery Positive results announced Cohorts receiving the 4.5 mA - min and the 14 mA - min doses of iontophoretic EGP - 437 generated the most encouraging results x Cell count (ACC) of zero in 20 - 30% of patients at day 7 and 70 - 80% of patients at Day 28 x Percentage of patients in 4.5 and 14 mA - min doses with zero pain on day 1 was 70% and 90% respectively 1. Durezol data from CDER Application Number 22 - 212: Medical Review for Durezol , studies ST - 601A - 002a and 002b. Durezol data shown is based on combined data from both studies. QID dose, ITT, LOCF. EGP - 437 data from 14mA - min dosed on Days 0, 1, and 4 (some subjects received additional dose at Day 7) and is ITT, LO CF. Phase 2b trial ongoing with top - line data targeted for year - end 2017

19 Anterior Uveitis Initial Phase 3 Non - Inferiority Trial ▪ Two 3 minute treatments of iontophoretically delivered EGP - 437 (Day 0 and Day 7) vs corticosteroid eye drops taken up to 8 times per day for 28 days ▪ Primary end point: Percentage of subjects with ACC count of zero at Day 14 ▪ Safety: Review of side effects, steroid induced increase in intraocular pressure 193 Subjects randomized 2 arms - 1:1 ▪ 2 EGP - 437 iontophoresis treatments + placebo eye drops (N = 96) ▪ 2 placebo iontophoresis treatments + Pred Acet eye drops (N = 97) Day 0 Visit 1 Day 7 Visit 2 Day 14 Visit 3 Day 28 Visit 4 Day 56 Visit 5 154 Pred Acet eye drop installations follow - up period 154 Placebo eye drop installations follow - up period 1 st Treatment Iontophoresis w/ EGP - 437 or w/Placebo 2 nd Treatment Trial Design Week 1 Week 2 Week 3 + 4 Week 5 Week 6 Week 7 Week 8 Primary endpoint proportion of patients w/ ACC count = 0

EGP - 437 demonstrated safe and effective in reducing inflammation vs positive control 20 Anterior Uveitis Results 1. ITT = Intent to Treat 2. Primary End Point (PEP): Total cell clearing (ACC) at Day 14 x Successfully demonstrated similar response to standard of care (corticosteroid eye drops - prednisolone acetate 1%) x Lower incidence of increased intraocular pressure (IOP) with EGP - 437 treatment Confirmatory Phase 3 trial ongoing: Top - line data expected Q2 2018

▪ Exclusive licenses to manufacture, sell, distribute and commercialize throughout the world for use in the fields of cataract surgery and uveitis ▪ Total upfront and milestone payments of $135 million ▪ Includes development and commercial milestones ▪ Royalties based on net sales: high single digits with upward adjustment based on minimum sales for cataract surgery indication ▪ EyeGate responsible for completion of the clinical development and FDA filing for both indications ▪ Valeant responsible for development outside U.S. ▪ Valeant has right of last refusal for product outside of licensed fields ▪ For EGP - 437 delivered with Iontophoretic EG II Delivery System 21 Licensing Agreement EG® II Delivery System + EGP - 437

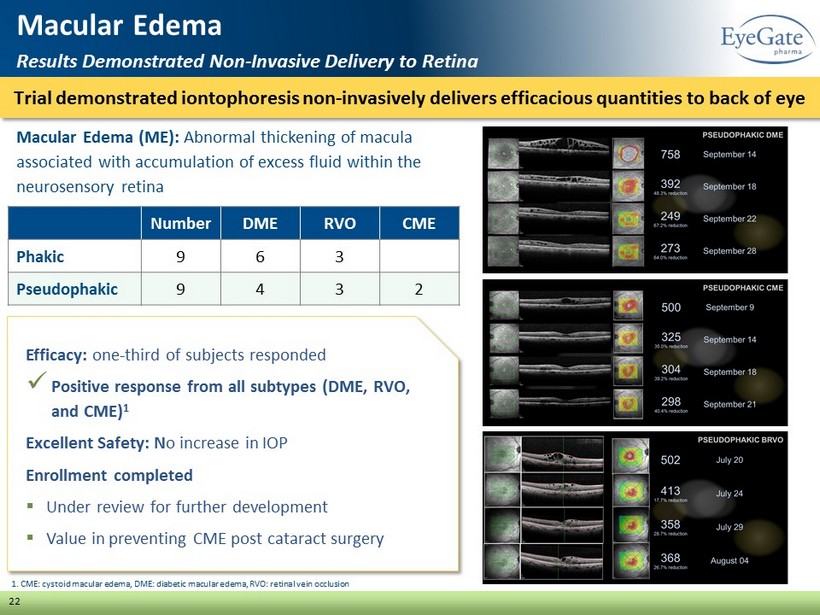

Macular Edema (ME): Abnormal thickening of macula associated with accumulation of excess fluid within the neurosensory retina Trial demonstrated iontophoresis non - invasively delivers efficacious quantities to back of eye 22 Macular Edema Results Demonstrated Non - Invasive Delivery to Retina Number DME RVO CME Phakic 9 6 3 Pseudophakic 9 4 3 2 Efficacy: one - third of subjects responded x Positive response from all subtypes (DME, RVO, and CME) 1 Excellent Safety: N o increase in IOP Enrollment completed ▪ Under review for further development ▪ Value in preventing CME post cataract surgery 1. CME: cystoid macular edema, DME: diabetic macular edema, RVO: retinal vein occlusion

23 Evolution of a Platform At Home Version ▪ Objective: Drug loaded contact lens with iontophoresis electronics ▪ Two layer lens ▪ Layer 1: Sits on surface of eye – loaded with drug ▪ Layer 2: Sits on top of Layer 1 – incorporates iontophoresis electronics Visual Center Conductive Haptic Conducting Polymer

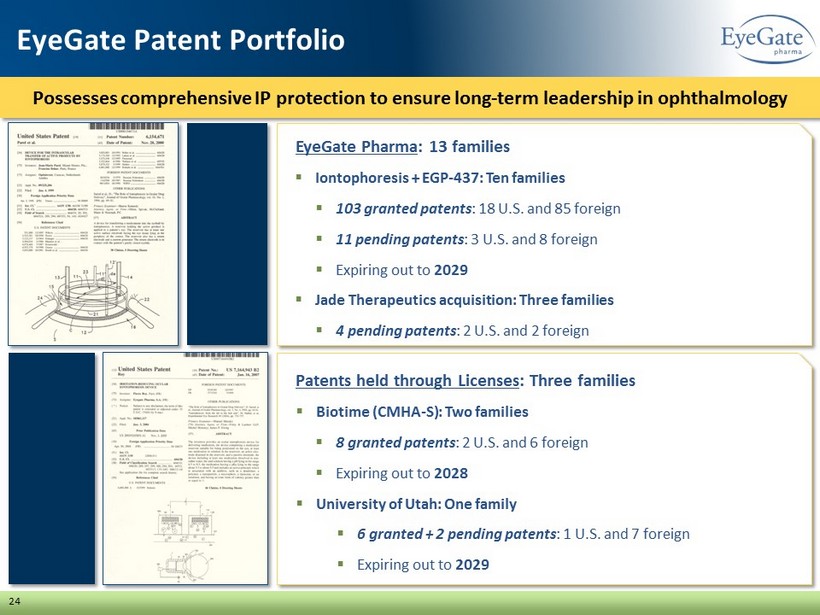

Possesses comprehensive IP protection to ensure long - term leadership in ophthalmology EyeGate Patent Portfolio 24 EyeGate Pharma : 13 families ▪ Iontophoresis + EGP - 437: Ten families ▪ 103 granted patents : 18 U.S. and 85 foreign ▪ 11 pending patents : 3 U.S. and 8 foreign ▪ Expiring out to 2029 ▪ Jade Therapeutics acquisition: Three families ▪ 4 pending patents : 2 U.S. and 2 foreign Patents held through Licenses : Three families ▪ Biotime (CMHA - S): Two families ▪ 8 granted patents : 2 U.S. and 6 foreign ▪ Expiring out to 2028 ▪ University of Utah: One family ▪ 6 granted + 2 pending patents : 1 U.S. and 7 foreign ▪ Expiring out to 2029

Clinical Catalysts Key Inflection Points Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 OBG: PRK Trials EGP - 437: Cataract Surgery Trials EGP - 437: Anterior Uveitis Trial EGP - 437: Anterior Uveitis Trial Pilot 2 Trial IDE Amendment Submitted De novo FDA 510(k) & CE Mark Phase 2b Trial Pivotal Trial Phase 3 Trial Top - line Data Phase 3 Trial 25 Top - line Data Top - line Data NDA Filing IDE Comments EoP2 Meeting Top - line Data PRK: IDE comments received from FDA, majority requesting microbiology and chemistry validation work related to manufacturing be completed prior to starting next trial. Expect to have completed l ate Q3 early Q4 2017

26 Management and Board of Directors Stephen From, President and CEO ▪ Former CEO at Centelion SAS (Aventis subsidiary) ▪ Qualified Chartered Accountant at PwC Barbara Wirostko , MD, Chief Medical Officer ▪ Former founder and CSO at Jade Therapeutics ▪ Former Senior Medical Director at Pfizer ▪ M.D. and residency at Columbia University Management Sarah Romano, Interim CFO ▪ Extensive experience with financial reporting for public companies and as an auditor at PwC ▪ Certified Public Accountant ▪ Masters of Accounting from Boston College Paul Chaney, Chairman ▪ President, CEO at PanOptica ▪ Former EVP and President at Eyetech Pharmaceuticals ▪ Led Eyetech’s IPO in 2004 through OSI Pharma acquisition Morton Goldberg, MD ▪ Joseph E. Green Professor of Ophthalmology at Wilmer Eye Institute, Johns Hopkins University School of Medicine ▪ Former Professor and Chairman of Department of Ophthalmology at University of Illinois College of Medicine Praveen Tyle , PhD ▪ EVP of Research & Development at Lexicon Pharmaceuticals ▪ Former CEO and Director of Osmotica Pharmaceuticals ▪ Former EVP and CSO at United States Pharmacopeia Thomas Balland ▪ Managing Director at IPSA ▪ Former board member at CMC Biologics, Immutep , SpineVision and SpineGuard Board of Directors Bernard Malfroy - Camine , PhD ▪ President, CEO of ViThera Pharmaceuticals ▪ Director, Business Development US Ops at Voisin Consulting ▪ Founder of MindSet Rx Thomas Hancock ▪ Principal of Nexus Medical Partners ▪ Senior Analyst and MD at US Bancorp Piper Jaffray ▪ Numerous positions at Genentech

Clinical - stage Specialty Pharma Ophthalmology Company 27 Summary Ocular Bandage Gel for PRK: ▪ First and only eye drop in the U.S. targeting acceleration of re - epithelization claim ▪ OBG: PRK Pilot 2 trial top - line data expected by YE 2017 / early Q1 2018 ▪ OBG: PRK Pivotal trial top - line data expected Q2 2018 ▪ De Novo 510(k) and CE Mark filing targeted for Mid 2018 ▪ Commercial launch Mid 2019 targeting ~160,000 - 240,000 PRK procedures in U.S. annually EGP - 437 for Anterior Uveitis: ▪ Successfully demonstrated similar response to standard of care with lower incidence of increased IOP ▪ Partnered with Valeant ▪ Phase 3 top - line data expected Q2 2018 ▪ NDA filing expected Q3 2018 EGP - 437 for Cataract Surgery: ▪ Demonstrated ability to control post operative pain and inflammation without the need for drop therapy ▪ Partnered with Valeant ▪ Phase 2b top - line data expected by YE 2017 ▪ Phase 3 initiation expected by Q2 2018 ▪ NDA filing expected by H1 2019

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- AHF Withdraws Bid to Purchase Skid Row Housing Trust Buildings

- OpenGate Capital Completes Sale of SMAC

- Masonite Shareholders Approve Transaction with Owens Corning

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share