Form 6-K Amira Nature Foods Ltd. For: Mar 02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2015

Commission File Number: 001-35681

AMIRA NATURE FOODS LTD

(Exact name of the Registrant as specified in its charter)

29E, A.U. Tower

Jumeirah Lake Towers

Dubai, United Arab Emirates

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-Fo

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):o

CONVENTIONS USED IN THIS REPORT

In this report (this “Report”), unless otherwise stated or unless the context otherwise requires, references to (i) ‘‘we’’, ‘‘us’’, ‘‘our’’, the “Company’’, the“Amira Group”, ‘‘our Company’’ or “ANFI” are to Amira Nature Foods Ltd, a British Virgin Islands business company, including its subsidiaries; (ii)references to “Amira Mauritius” are solely to Amira Nature Foods Ltd, a Mauritius company and ANFI’s wholly owned subsidiary and (iii) “APFPL” or “Amira India” are to Amira Pure Foods Private Limited, and its subsidiaries, including Amira I Grand Foods Inc., Amira Food Pte. Ltd., Amira Foods (Malaysia) SDN. Bhd., Amira C Foods International DMCC, Basmati Rice GmbH, Basmati Rice North America LLC, Amira G Foods Limited and Amira Ten Nigeria Limited.

In this Report, references to “India” are to the Republic of India, references to “BVI” are to the British Virgin Islands, and references to “Mauritius” are to the Republic of Mauritius. References to “$”, “USD” , “dollars” or “U.S. dollars” are to the legal currency of the United States and references to “Rs.”, “Rupees”, “INR” or “Indian Rupees” are to the legal currency of India.

The condensed interim consolidated financial statements for the three and nine months ended December 31, 2014 and 2013 and notes thereto included elsewhere in this Report have been prepared in compliance with International Accounting Standard (IAS) 34, “Interim financial reporting” as issued by International Accounting Standards Board (IASB). These condensed interim consolidated financial statements should be read in conjunction with the Amira Group’s annual consolidated financial statements and related notes included in the Company’s annual report on Form 20-F for the fiscal year ended March 31, 2014 (the “Annual Report”). References to a particular “fiscal year” are to our fiscal year ended March 31 of that year. Our fiscal quarters end on June 30, September 30, and December 31. References to a year other than a “fiscal” are to the calendar year ended December 31.

In this Report, references to our “international sales” are to those sales which are made to international markets outside of India. In this Report, references to increase/ decrease in percent for the financial statement items have been computed based on absolute figures reported. We also refer in various places within this report to earnings before interest, tax, depreciation and amortization (EBITDA), adjusted EBITDA, adjusted profit after tax, adjusted earnings per share, adjusted net working capital and net debt, which are non-IFRS measures and are more fully explained in the section titled “Non-IFRS Financial Measures”. The presentation of this non-IFRS information is not meant to be considered in isolation or as a substitute for our consolidated financial results prepared in accordance with IFRS as issued by the IASB.

FORWARD-LOOKING STATEMENTS

This Report contains statements of a forward-looking nature. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. You can identify these forward-looking statements by words or phrases such as “may,” “will,” “except,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “future” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include, but are not limited to:

| · | our goals and strategies; |

| · | our expansion plans; |

| · | our future business development, results of operations and financial condition; |

| · | our ability to protect our intellectual property rights; |

| · | projected revenue, profits, earnings and other estimated financial information; |

| · | our ability to maintain strong relationships with our customers and suppliers; |

| · | the continued application of the proceeds from our initial public offering (“IPO”); |

| · | governmental policies regarding our industry; and |

| · | the impact of legal proceedings. |

We would like to caution you not to place undue reliance on forward-looking statements and you should read these statements in conjunction with the risk factors disclosed in “Risk Factors” appearing in the Annual Report. Those risks are not exhaustive. We operate in a rapidly evolving environment. New risk factors emerge from time to time, and it is impossible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ from those contained in any forward-looking statement. We do not undertake any obligation to update or revise the forward-looking statements except as required under applicable law.

Results of Operations and Financial Position

Following this page are our condensed interim consolidated financial position as at December 31, 2014 and our financial results for the three and nine months ended December 31, 2014 and 2013, respectively.

| 2 |

INDEX TO CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

| 3 |

Amira Nature Foods Ltd

Condensed Consolidated Statements of Financial Position

| (Amounts in USD) | ||||||||

| As at December 31, 2014 (Unaudited) | As at March 31, 2014 (Audited) | |||||||

| ASSETS | ||||||||

| Non-current | ||||||||

| Property, plant and equipment | $ | 22,037,426 | $ | 23,284,918 | ||||

| Goodwill | 1,549,872 | 1,727,338 | ||||||

| Other intangible assets | 1,898,476 | 2,262,731 | ||||||

| Other long-term financial assets | 592,950 | 485,731 | ||||||

| Total non-current assets | $ | 26,078,724 | $ | 27,760,718 | ||||

| Current | ||||||||

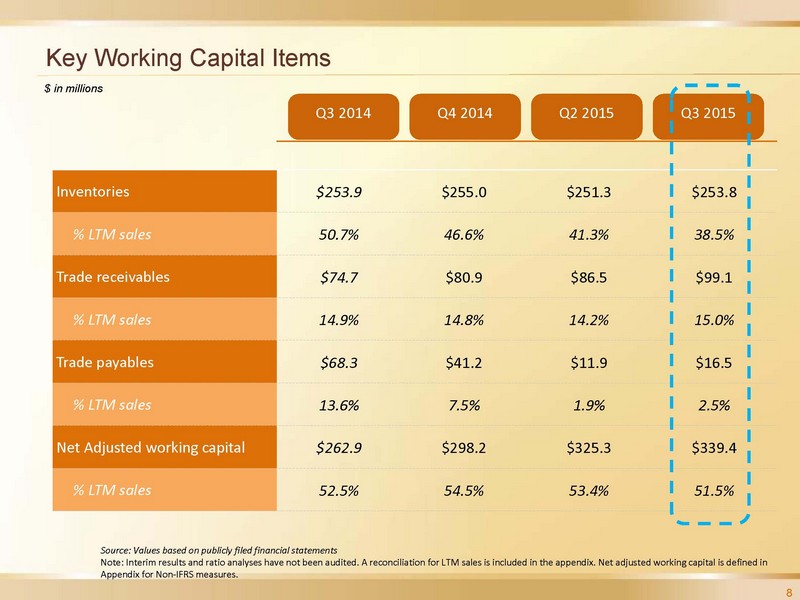

| Inventories (Note 7) | $ | 253,752,955 | $ | 254,952,549 | ||||

| Trade receivables | 99,132,069 | 80,882,986 | ||||||

| Derivative financial assets | 260,034 | 2,352,886 | ||||||

| Other financial assets | 11,541,259 | 9,768,514 | ||||||

| Prepayments (Note 8) | 10,206,040 | 8,361,244 | ||||||

| Other current assets | 1,664,630 | 765,655 | ||||||

| Cash and cash equivalents | 26,960,875 | 37,606,098 | ||||||

| Total current assets | $ | 403,517,862 | $ | 394,689,932 | ||||

| Total assets | $ | 429,596,586 | $ | 422,450,650 | ||||

| EQUITY AND LIABILITIES | ||||||||

| Equity | ||||||||

| Share capital | $ | 9,119 | $ | 9,115 | ||||

| Share premium | 82,896,597 | 82,804,750 | ||||||

| Other reserves | (8,575,285 | ) | (3,312,575 | ) | ||||

| Retained earnings | 100,878,863 | 74,334,687 | ||||||

| Equity attributable to shareholders of the Company | $ | 175,209,294 | $ | 153,835,977 | ||||

| Equity attributable to non-controlling interest | 23,479,458 | 18,005,030 | ||||||

| Total equity | $ | 198,688,752 | $ | 171,841,007 | ||||

| Liabilities | ||||||||

| Non-current liabilities | ||||||||

| Defined benefit obligations | $ | 344,971 | $ | 246,548 | ||||

| Debt | 1,676,780 | 2,739,414 | ||||||

| Deferred tax liabilities | 6,291,114 | 6,666,270 | ||||||

| Total non-current liabilities | $ | 8,312,865 | $ | 9,652,232 | ||||

| Current liabilities | ||||||||

| Trade payables | $ | 16,451,264 | $ | 41,197,158 | ||||

| Debt (Note 9) | 185,432,472 | 182,103,347 | ||||||

| Current tax liabilities (net) | 13,066,707 | 9,644,944 | ||||||

| Derivative financial liabilities | 489,466 | - | ||||||

| Other financial liabilities | 5,814,444 | 6,031,593 | ||||||

| Other current liabilities | 1,340,616 | 1,980,369 | ||||||

| Total current liabilities | $ | 222,594,969 | $ | 240,957,411 | ||||

| Total liabilities | $ | 230,907,834 | $ | 250,609,643 | ||||

| Total equity and liabilities | $ | 429,596,586 | $ | 422,450,650 | ||||

(The accompanying notes are an integral part of these condensed interim consolidated financial statements)

| 4 |

Amira Nature Foods Ltd

Condensed Consolidated Statements of Profit or Loss

(Amounts in USD)

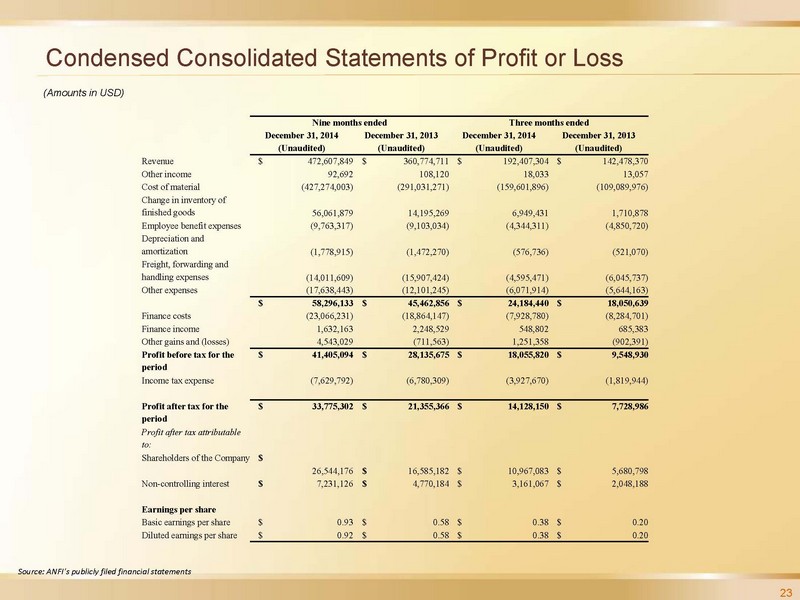

| Nine months ended | Three months ended | |||||||||||||||

| December 31, 2014 (Unaudited) | December 31, 2013 (Unaudited) | December 31, 2014 (Unaudited) | December 31, 2013 (Unaudited) | |||||||||||||

| Revenue | $ | 472,607,849 | $ | 360,774,711 | $ | 192,407,304 | $ | 142,478,370 | ||||||||

| Other income | 92,692 | 108,120 | 18,033 | 13,057 | ||||||||||||

| Cost of material | (427,274,003 | ) | (291,031,271 | ) | (159,601,896 | ) | (109,089,976 | ) | ||||||||

| Change in inventory of finished goods | 56,061,879 | 14,195,269 | 6,949,431 | 1,710,878 | ||||||||||||

| Employee benefit expenses | (9,763,317 | ) | (9,103,034 | ) | (4,344,311 | ) | (4,850,720 | ) | ||||||||

| Depreciation and amortization | (1,778,915 | ) | (1,472,270 | ) | (576,736 | ) | (521,070 | ) | ||||||||

| Freight, forwarding and handling expenses | (14,011,609 | ) | (15,907,424 | ) | (4,595,471 | ) | (6,045,737 | ) | ||||||||

| Other expenses | (17,638,443 | ) | (12,101,245 | ) | (6,071,914 | ) | (5,644,163 | ) | ||||||||

| $ | 58,296,133 | $ | 45,462,856 | $ | 24,184,440 | $ | 18,050,639 | |||||||||

| Finance costs | (23,066,231 | ) | (18,864,147 | ) | (7,928,780 | ) | (8,284,701 | ) | ||||||||

| Finance income | 1,632,163 | 2,248,529 | 548,802 | 685,383 | ||||||||||||

| Other gains and (losses) | 4,543,029 | (711,563 | ) | 1,251,358 | (902,391 | ) | ||||||||||

| Profit before tax for the period | $ | 41,405,094 | $ | 28,135,675 | $ | 18,055,820 | $ | 9,548,930 | ||||||||

| Income tax expense | (7,629,792 | ) | (6,780,309 | ) | (3,927,670 | ) | (1,819,944 | ) | ||||||||

| Profit after tax for the period | $ | 33,775,302 | $ | 21,355,366 | $ | 14,128,150 | $ | 7,728,986 | ||||||||

| Profit after tax attributable to: | ||||||||||||||||

| Shareholders of the Company | $ | 26,544,176 | $ | 16,585,182 | $ | 10,967,083 | $ | 5,680,798 | ||||||||

| Non-controlling interest | $ | 7,231,126 | $ | 4,770,184 | $ | 3,161,067 | $ | 2,048,188 | ||||||||

| Earnings per share | ||||||||||||||||

| Basic earnings per share (Note 6) | $ | 0.93 | $ | 0.58 | $ | 0.38 | $ | 0.20 | ||||||||

| Diluted earnings per share (Note 6) | $ | 0.92 | $ | 0.58 | $ | 0.38 | $ | 0.20 | ||||||||

(The accompanying notes are an integral part of these condensed interim consolidated financial statements)

| 5 |

Amira Nature Foods Ltd

Condensed Consolidated Statements of Comprehensive Income

(Amounts in USD)

| Nine months ended | Three months ended | |||||||||||||||

| December 31, 2014 (Unaudited) | December 31, 2013 (Unaudited) | December 31, 2014 (Unaudited) | December 31, 2013 (Unaudited) | |||||||||||||

| Profit after tax for the period | $ | 33,775,302 | $ | 21,355,366 | $ | 14,128,150 | $ | 7,728,986 | ||||||||

| Other comprehensive income | ||||||||||||||||

| Items that may be reclassified subsequently to profit or loss: | ||||||||||||||||

| Available for sale financial assets: | ||||||||||||||||

| Current period gain/(loss) | 48,434 | (14,536 | ) | 18,304 | 9,258 | |||||||||||

| Reclassification to profit or loss | - | - | - | - | ||||||||||||

| Income tax | (11,622 | ) | 4,941 | (6,222 | ) | (3,147 | ) | |||||||||

| $ | 36,812 | $ | (9,595 | ) | $ | 12,082 | $ | 6,111 | ||||||||

| Cash flow hedging reserve: | ||||||||||||||||

| Current period gain/(loss) | 1,948,914 | (8,090,011 | ) | 281,214 | 2,976,006 | |||||||||||

| Reclassification to profit or loss | (2,872,337 | ) | 3,281,293 | (284,792 | ) | 1,072,748 | ||||||||||

| Income tax | 313,871 | 1,634,483 | 1,216 | (1,376,172 | ) | |||||||||||

| $ | (609,552 | ) | $ | (3,174,235 | ) | $ | (2,362 | ) | $ | 2,672,582 | ||||||

| Currency translation reserve | (8,370,804 | ) | (15,407,013 | ) | (5,036,825 | ) | 2,167,917 | |||||||||

| Other comprehensive income/(loss) for the period, net of tax | $ | (8,943,544 | ) | $ | (18,590,843 | ) | $ | (5,027,105 | ) | $ | 4,846,610 | |||||

| Total comprehensive income for the period | $ | 24,831,758 | $ | 2,764,523 | $ | 9,101,045 | $ | 12,575,596 | ||||||||

| Total comprehensive income for the period attributable to: | ||||||||||||||||

| Shareholders of the Company | $ | 19,357,330 | $ | 1,636,105 | $ | 6,927,407 | $ | 9,575,433 | ||||||||

| Non-controlling interest | $ | 5,474,428 | $ | 1,128,418 | $ | 2,173,638 | $ | 3,000,163 | ||||||||

(The accompanying notes are an integral part of these condensed interim consolidated financial statements)

| 6 |

Amira Nature Foods Ltd

Condensed Consolidated Statements of Changes in Equity

(Amounts in USD)

| Other reserves | ||||||||||||||||||||||||||||||||||||||||||||

| Share capital | Share premium |

Share-based

compensation reserve |

Reserve

for available for sale financial assets |

Currency

translation Reserve |

Cash

flow hedging Reserve |

Restructuring

Reserve |

Retained

earnings |

Equity

attributable to shareholders of the Company |

Equity

attributable to non - controlling interest |

Total equity | ||||||||||||||||||||||||||||||||||

| Balance as at April 1, 2013 (Audited) | $ | 9,111 | $ | 82,683,926 | $ | 183,514 | $ | (21,561 | ) | $ | (5,582,983 | ) | $ | 258,647 | $ | 9,398,927 | $ | 44,375,024 | $ | 131,304,605 | $ | 12,328,130 | $ | 143,632,735 | ||||||||||||||||||||

| Share based compensation | 4 | 120,824 | 2,679,848 | - | - | - | - | - | $ | 2,800,676 | - | $ | 2,800,676 | |||||||||||||||||||||||||||||||

| Profit after tax for the period | - | - | - | - | - | - | - | 16,585,182 | $ | 16,585,182 | 4,770,184 | $ | 21,355,366 | |||||||||||||||||||||||||||||||

| Other comprehensive income /(loss) for the period | - | - | - | (7,717 | ) | (12,388,151 | ) | (2,553,209 | ) | - | - | $ | (14,949,077 | ) | (3,641,766 | ) | $ | (18,590,843 | ) | |||||||||||||||||||||||||

| Total comprehensive income/(loss) for the period | $ | - | $ | - | $ | - | $ | (7,717 | ) | $ | (12,388,151 | ) | $ | (2,553,209 | ) | $ | - | $ | 16,585,182 | $ | 1,636,105 | $ | 1,128,418 | $ | 2,764,523 | |||||||||||||||||||

| Balance as at December 31, 2013 (Unaudited) | $ | 9,115 | $ | 82,804,750 | $ | 2,863,362 | $ | (29,278 | ) | (17,971,134 | ) | $ | (2,294,562 | ) | $ | 9,398,927 | $ | 60,960,206 | $ | 135,741,386 | $ | 13,456,548 | $ | 149,197,934 | ||||||||||||||||||||

| Balance as at April 1, 2014 (Audited) | $ | 9,115 | $ | 82,804,750 | $ | 2,863,362 | $ | (30,127 | ) | $ | (16,018,401 | ) | $ | 473,664 | $ | 9,398,927 | $ | 74,334,687 | $ | 153,835,977 | $ | 18,005,030 | $ | 171,841,007 | ||||||||||||||||||||

| Share based compensation | 8 | 130,033 | 1,924,136 | - | - | - | - | - | $ | 2,054,177 | - | $ | 2,054,177 | |||||||||||||||||||||||||||||||

| Repurchase of shares from ex-director and cancelled | (4 | ) | (38,186 | ) | - | - | - | - | - | - | $ | (38,190 | ) | - | $ | (38,190 | ) | |||||||||||||||||||||||||||

| Profit after tax for the period | - | - | - | - | - | - | - | 26,544,176 | $ | 26,544,176 | 7,231,126 | $ | 33,775,302 | |||||||||||||||||||||||||||||||

| Other comprehensive income /(loss) for the period | - | - | - | 29,581 | (6,726,604 | ) | (489,823 | ) | - | - | $ | (7,186,846 | ) | (1,756,698 | ) | $ | (8,943,544 | ) | ||||||||||||||||||||||||||

| Total comprehensive income/(loss) for the period | $ | - | $ | - | $ | - | $ | 29,581 | $ | (6,726,604 | ) | $ | (489,823 | ) | $ | - | $ | 26,544,176 | $ | 19,357,330 | $ | 5,474,428 | $ | 24,831,758 | ||||||||||||||||||||

| Balance as at December 31, 2014 (Unaudited) | $ | 9,119 | $ | 82,896,597 | $ | 4,787,498 | $ | (546 | ) | $ | (22,745,005 | ) | $ | (16,159 | ) | $ | 9,398,927 | $ | 100,878,863 | $ | 175,209,294 | $ | 23,479,458 | $ | 198,688,752 | |||||||||||||||||||

(The accompanying notes are an integral part of these condensed interim consolidated financial statements)

| 7 |

Amira Nature Foods Ltd

Condensed Consolidated Statements of Cash Flows

(Amounts in USD)

| Nine months ended | ||||||||

| December 31, 2014 (Unaudited) | December 31, 2013 (Unaudited) | |||||||

| (A) CASH FLOW FROM OPERATING ACTIVITIES | ||||||||

| Profit before tax for the period | $ | 41,405,094 | $ | 28,135,675 | ||||

| Adjustments for non-cash items | 4,195,710 | 2,453,905 | ||||||

| Adjustments for non-operating incomes and expenses | 21,433,198 | 16,611,490 | ||||||

| Changes in operating assets and liabilities | (66,896,650 | ) | (37,142,521 | ) | ||||

| $ | 137,352 | $ | 10,058,549 | |||||

| Income taxes paid | (3,063,424 | ) | (2,714,900 | ) | ||||

| Net cash (used in)/ generated from operating activities | $ | (2,926,072 | ) | $ | 7,343,649 | |||

| (B) CASH FLOW FROM INVESTING ACTIVITIES | ||||||||

| Purchase of property, plant and equipment | $ | (1,709,197 | ) | $ | (1,364,502 | ) | ||

| Purchase of intangible assets | (2,498 | ) | (298,763 | ) | ||||

| Proceeds from sale of property, plant and equipment | 1,614 | 5,332 | ||||||

| Proceeds from term deposits | 12,497,806 | 12,883,590 | ||||||

| Investments in term deposits | (13,671,865 | ) | (14,005,325 | ) | ||||

| Purchase of short term investments | (41,300 | ) | (4,145 | ) | ||||

| Proceeds from the sale of short term investments | - | (218,250 | ) | |||||

| Interest income | 625,812 | 1,102,293 | ||||||

| Net cash used in investing activities | $ | (2,299,628 | ) | $ | (1,899,770 | ) | ||

| (C) CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||

| Repurchase of shares from ex-director and cancelled | $ | (38,190 | ) | $ | - | |||

| Net proceeds from short term debt | 14,217,389 | 17,821,423 | ||||||

| Proceeds from long term debt | 18,150 | 41,445 | ||||||

| Repayment of long term debt | (963,487 | ) | (1,394,134 | ) | ||||

| Interest paid | (16,383,217 | ) | (14,502,897 | ) | ||||

| Net cash (used in)/ generated from financing activities | $ | (3,149,355 | ) | $ | 1,965,837 | |||

| (D) Effect of change in exchange rate on cash and cash equivalents | (2,270,168 | ) | (6,907,131 | ) | ||||

| Net increase/ (decrease) in cash and cash equivalents (A+B+C+D) | $ | (10,645,223 | ) | $ | 502,585 | |||

| Cash and cash equivalents at the beginning of the period | 37,606,098 | 33,270,338 | ||||||

| Cash and cash equivalents at the end of the period | $ | 26,960,875 | $ | 33,772,923 | ||||

(The accompanying notes are an integral part of these condensed interim consolidated financial statements)

| 8 |

Amira Nature Foods Ltd

Notes to condensed interim consolidated financial statements

| 1. | Background and nature of operations |

Amira Nature Foods Ltd (‘‘ANFI” or ‘‘the Company’’) and its subsidiaries (hereinafter together referred to as ‘‘Amira’’ or the “Amira Group’’) are engaged primarily in the business of processing and selling packaged Indian specialty rice, primarily basmati rice and other food products. The Amira Group sells these products to buyers including distributors and retail chains in India and Internationally (including Asia Pacific, Europe, Middle East, North Africa and North America). The Amira Group has currently one rice processing plant which is located in Gurgaon, India.

ANFI was incorporated on February 20, 2012 and is domiciled in the British Virgin Islands. The principal office of the Company is located at 29E, A.U. Tower Jumeirah Lake Towers Dubai, United Arab Emirates.

| 2. | Basis of preparation |

These condensed interim consolidated financial statements are prepared in compliance with International Accounting Standard (IAS) 34, “Interim financial reporting” as issued by International Accounting Standards Board (IASB). These condensed interim consolidated financial statements should be read in conjunction with the Amira Group’s annual consolidated financial statements and related notes included in the Company’s annual report on Form 20-F for the fiscal year ended March 31, 2014.

The accounting policies applied are consistent with the policies that were applied for the preparation of the consolidated financial statements for the fiscal year ended March 31, 2014.

| 3. | Fair value hierarchy |

The following table presents fair value hierarchy of assets and liabilities measured at fair value on a recurring basis:

| Fair value measurements at reporting date using | ||||||||||||

| December 31, 2014 (Unaudited) | Total | Level 1 | Level 2 | |||||||||

| Assets | ||||||||||||

| Derivative assets | ||||||||||||

| Forward contracts | $ | 260,034 | $ | - | $ | 260,034 | ||||||

| Available for sale financial assets | ||||||||||||

| Mutual funds in units | 427,872 | 427,872 | - | |||||||||

| Listed securities | 82,730 | 82,730 | - | |||||||||

| Liabilities | ||||||||||||

| Derivative liabilities | ||||||||||||

| Forward contracts | $ | 489,466 | $ | - | $ | 489,466 | ||||||

| Fair value measurements at reporting date using | ||||||||||||

| March 31, 2014 (Audited) | Total | Level 1 | Level 2 | |||||||||

| Assets | ||||||||||||

| Derivative assets | ||||||||||||

| Forward contracts | $ | 2,352,886 | $ | - | $ | 2,352,886 | ||||||

| Available for sale financial assets | ||||||||||||

| Mutual funds in units | 393,763 | 393,763 | - | |||||||||

| Listed securities | $ | 58,672 | $ | 58,672 | $ | - | ||||||

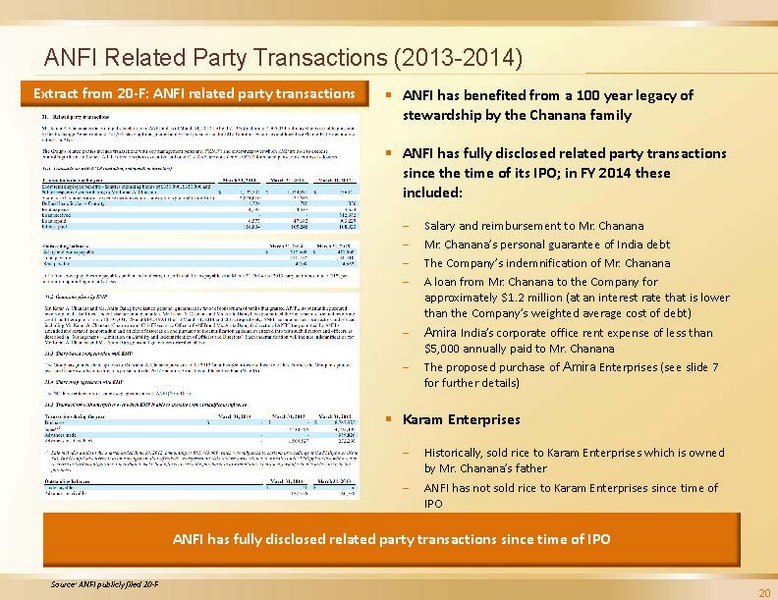

| 4. | Related party transactions |

Mr. Karan A. Chanana is the principal shareholder of ANFI and as of December 31, 2014, he held majority effective interest (including 7,005,434 ordinary shares issuable pursuant to the Exchange Agreement and 721,535 share options granted and vested pursuant to the 2012 Omnibus Securities and Incentive Plan) in ANFI.

The Amira Group's related parties include transactions with key management personnel ("KMP") and enterprises over which KMP are able to exercise control/significant influence. All the directors (both executive and others) of ANFI and Ms. Anita Daing (a director of Amira Pure Foods Private Limited “APFPL”) are considered as KMP for related party transactions disclosures.

| 9 |

| 4.1 | Transactions with KMP |

| Nine months ended | Three months ended | |||||||||||||||

| Transactions during the period | December 31, 2014 (Unaudited) | December 31, 2013 (Unaudited) | December 31, 2014 (Unaudited) | December 31, 2013 (Unaudited) | ||||||||||||

| Short term employee benefits | $ | 1,246,063 | $ | 891,641 | $ | 443,796 | $ | 266,361 | ||||||||

| Share-based compensation: | ||||||||||||||||

| - expense recognized on share options granted | - | 2,679,848 | - | 2,553,276 | ||||||||||||

| - expense recognized on share awards granted | 1,924,136 | 120,829 | 1,736,913 | 92,579 | ||||||||||||

| Defined benefit plan – Gratuity | 1,282 | 1,306 | 421 | 421 | ||||||||||||

| Rent expense | 3,112 | 3,169 | 1,021 | 1,021 | ||||||||||||

| Loan repaid | - | 4,432 | - | - | ||||||||||||

| Interest expense | 95,299 | 88,936 | 31,481 | 28,704 | ||||||||||||

| Outstanding Balances | December 31, 2014 (Unaudited) | March 31, 2014 (Audited) | ||||||

| Salary and bonus payable | $ | 668,134 | $ | 510,600 | ||||

| Loan payable | 1,163,190 | 1,170,492 | ||||||

| Rent payable | 17,945 | 4,208 | ||||||

All of the above payables are short term and carry no collateral. Loan payable as at December 31, 2014 and March 31, 2014 carry an interest rate of 11% per annum, compounded on daily basis.

| 4.2 | Guarantee given by KMP |

Mr. Karan A. Chanana (Chairman and Chief Executive Officer of ANFI) and Ms. Anita Daing (a director of APFPL) have issued personal guarantees in favor of consortium of banks that granted APFPL its outstanding term loans and secured revolving credit facilities. Under these personal guarantees Mr. Karan A. Chanana and Ms. Anita Daing have guaranteed the repayment of term loans and secured revolving credit facilities up to a limit of $223,753,570 and $197,301,128 as at December 31, 2014 and March 31, 2014, respectively. ANFI has indemnified its directors and officers, including Mr. Karan A. Chanana and Ms. Anita Daing as permitted by ANFI’s amended and restated memorandum and articles of association and pursuant to indemnification agreements entered into with such directors and officers. Such indemnification will include indemnification for the personal guarantees provided by Mr. Karan A. Chanana and Ms. Anita Daing as described above.

| 4.3 | Transactions with enterprises over which KMP are able to exercise control/significant influence |

| Nine months ended | Three months ended | |||||||||||||||

| Transactions during the period | December 31, 2014 (Unaudited) | December 31, 2013 (Unaudited) | December 31, 2014 (Unaudited) | December 31, 2013 (Unaudited) | ||||||||||||

| Advance paid in quarter ended September 30, 2014 for purchase of Office premises, which has been adjusted in quarter ended December 31, 2014 | $ | 272,220 | $ | - | $ | - | $ | - | ||||||||

| Purchase of Office premises in quarter ended December 31, 2014 against advance given as mentioned above | 272,220 | - | 272,220 | - | ||||||||||||

| Outstanding balances | December 31, 2014 (Unaudited) | March 31, 2014 (Audited) | ||||||

| Trade payable | $ | 48 | $ | 51 | ||||

| Advances receivable | 142,176 | 152,576 | ||||||

| 10 |

| 5. | Equity |

Shares issued and authorized are summarized as follows:

| Shares issued and fully paid: | No. of Shares |

| Balance as at April 1, 2012 | 19,660,000 |

| Shares issued during the year ended March 31, 2013 | 9,000,000 |

| Shares issued under share-based compensation plan during the year ended March 31, 2013 and 2014 | 14,997 |

| Total Shares issued and fully paid as at March 31, 2014 | 28,674,997 |

| Shares issued under the share-based compensation plan during the nine months ended December 31, 2014 | 8,986 |

| Repurchase of shares issued under the share-based compensation plan and cancelled, from one of the ex-directors | (3,819) |

| Total shares issued and fully paid as at December 31, 2014 (A) | 28,680,164 |

| Shares issuable pursuant to exchange agreement* (B) | 7,005,434 |

| Total (C) = (A) + (B) | 35,685,598 |

|

Shares authorized for share-based compensation (Net of 20,164 shares already issued to directors till December 31, 2014) |

3,942,662 |

|

On October 17, 2014, the Compensation Committee of the Company has approved the grant of 100,000 ordinary equity shares to Mr. Karan A Chanana based on the 2012 Omibus Securities and Incentive Plan. The grant is subject to specified performance targets being achieved for the year ended March 31, 2015. For this share grant, the Company has recorded an expense of $1,612,000 and $1,612,000 during the nine months and three months period ended December 31, 2014.

| |

| *Represents ordinary shares issuable to NCI shareholders in APFPL pursuant to an exchange agreement. |

| 6. | Earnings per Share |

Earnings per share has been calculated using outstanding shares of ANFI which are reflected in the table below.

| Nine months ended | Three months ended | |||||||||||||||

| December 31, 2014 (Unaudited) | December 31, 2013 (Unaudited) | December 31, 2014 (Unaudited) | December 31, 2013 (Unaudited) | |||||||||||||

| Profit attributable to Shareholders of the Company (A) | $ | 26,544,176 | $ | 16,585,182 | $ | 10,967,083 | $ | 5,680,798 | ||||||||

| Weighted average number of shares: | ||||||||||||||||

| - For calculation of basic earnings per share (B) | 28,677,018 | 28,672,134 | 28,679,439 | 28,674,389 | ||||||||||||

| - Dilutive impact of stock options as converted in equivalent number of shares (C) | 239,016 | 138,785 | 225,944 | 231,445 | ||||||||||||

| For diluted earnings per share (D) = (B) + (C) | 28,916,034 | 28,810,919 | # | 28,905,383 | * | 28,905,834 | # | |||||||||

| Basic earnings per share (A) ÷ (B) | $ | 0.93 | $ | 0.58 | $ | 0.38 | $ | 0.20 | ||||||||

| Diluted earnings per share (A) ÷ (D) | $ | 0.92 | $ | 0.58 | $ | 0.38 | $ | 0.20 | ||||||||

The Company has granted an option to NCI shareholders in APFPL to exchange shares in ANFI at a pre- determined share swap ratio. The swap ratio is reflective of fair values of the shares and therefore, the option is not considered as dilutive.

* The dilutive impact of total share options of 721,535 granted to Mr. Karan A. Chanana through the three months ended December 2014, is negligible and hence there is no impact on the presented basic and diluted earnings per share in the table above.

# The effect of 721,535 share options granted to Mr. Karan A. Chanana through the three and nine months ended December 2013 was negligible and hence there is no impact on the presented basic and diluted earnings per share in the table above.

| 11 |

| 7. | Inventories |

Inventories comprise the following:

| December 31, 2014 (Unaudited) | March 31, 2014 (Audited) | |||||||

| Raw materials | $ | 5,547,564 | $ | 62,914,367 | ||||

| Finished goods | 246,623,656 | 190,561,778 | ||||||

| Stores, spares and others | 1,581,735 | 1,476,404 | ||||||

| Total | $ | 253,752,955 | $ | 254,952,549 | ||||

The cost of inventories expensed during the three and nine months ended December 31, 2014 was $152,652,465 (December 31, 2013: $107,379,098) and $371,212,124 (December 31, 2013: $276,836,002), respectively.

No inventory write downs or reversals are recognized for the three and nine months ended December 31, 2014 and 2013.

| 8. | Prepayments |

Prepayments include $9,893,567 as of December 31, 2014 (March 31, 2014: $7,745,972) in respect of advances made to suppliers, for purchase of inventory.

| 9. | Current liabilities – Debt |

| December 31, 2014 (Unaudited) | March 31, 2014 (Audited) | |||||||

| Working capital debt | $ | 182,921,878 | $ | 179,085,080 | ||||

| Loan from Mr. Karan A. Chanana | 1,163,190 | 1,170,492 | ||||||

| $ | 184,085,068 | $ | 180,255,572 | |||||

| Add: Current portion of long term debt | 1,347,404 | 1,847,775 | ||||||

| Total | $ | 185,432,472 | $ | 182,103,347 | ||||

Working capital debt represents credit limits from banks with renewal period not exceeding one year. The Amira Group's property, plant and equipment, trade receivables and inventories with a carrying value of $21,605,820 (March 31, 2014: $23,104,444), $11,530,018 (March 31, 2014: $19,668,385), and $235,267,592 (March 31, 2014: $249,894,991), respectively have been pledged as collateral to secure repayment of these debts. This working capital debt carries floating rates of interest.

Loan from Mr. Karan A. Chanana comprises debt taken from a director of the Company that is payable on demand and carries a fixed rate of interest of 11% per annum, compounded daily.

The annualized weighted average interest rates (including corresponding bank processing charges and fees) for each of the reporting periods for working capital debt and debt from related party are as follows:

| December 31, 2014 (Unaudited) | March 31, 2014 (Audited) | |||||||

| Working capital debt | 12.51 | % | 11.84 | % | ||||

| Debt from a related party | 11.60 | % | 11.60 | % | ||||

| 10. | Capital Commitments |

Capital commitments net of advance amounted to $9.2 million and $6.9 million as of December 31, 2014 and March 31, 2014 respectively.

| 11. | Events after the reporting period |

There have been no material events other than disclosed in the financial statement after reporting date which would require disclosure or adjustments to the condensed interim consolidated financial statements as of and for the three and nine months ended December 31, 2014.

| 12. | Authorization of financial statements |

These condensed interim consolidated financial statements for the three and nine months ended December 31, 2014 and 2013 were approved and authorized for issue by the Board of Directors on March 1, 2015.

| 12 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You should read the following discussion in conjunction with our consolidated financial statements and the related notes included elsewhere in this Report. We urge you to carefully review and consider the various disclosures made by us in this Report and in our other SEC filings, including our Annual Report on Form 20-F for the year ended March 31, 2014. Some of the statements in the following discussion are forward-looking statements. See “Forward-Looking Statements.”

Overview

We are a leading global provider of branded packaged Indian specialty rice and other related rice based products, with sales in over 60 countries. We generate the majority of our revenue through the sale of Basmati rice, a premium long-grain variety of rice grown only in certain regions of the Indian sub-continent, under our flagship Amira brand, as well as under other third party brands. We have developed a complete line of Amira branded products to complement our packaged rice offerings, including snacks, ready-to-heat meals and a growing line of organic product offerings. We also sell other products such as wheat, barley, legumes and other produce. Our fourth generation leadership has built on a rich, century-old legacy and transformed Amira from a local family-run business to a publicly-listed globally focused packaged food company with a leadership position in the high growth Basmati rice sector.

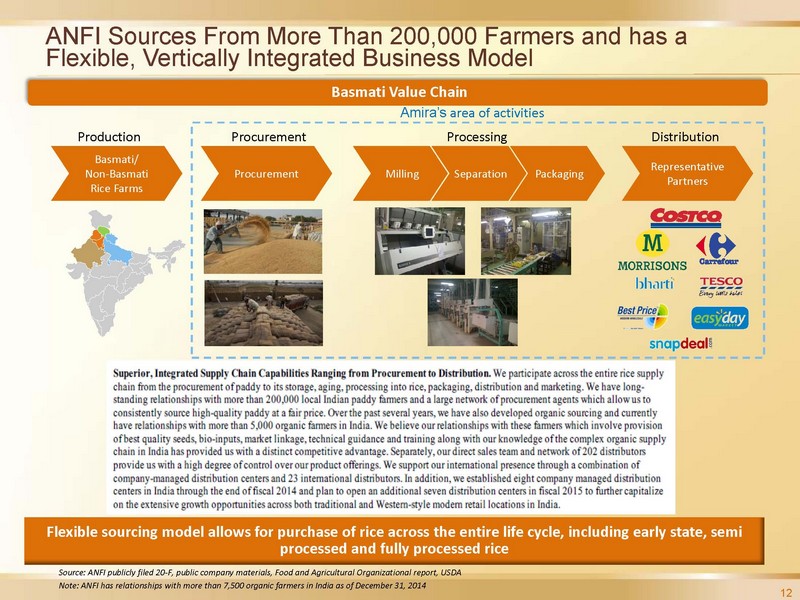

We sell our products globally in both developed and emerging markets through a broad distribution network. Our Amira branded products are currently sold in more than 40 countries by global retailers such as Asda, Reliance Retail Limited, Big Bazaar, Carrefour, Costco, Easyday, Jetro Restaurant Depot, Lulu’s, Metro Cash & Carry, Morrisons, Panda, Smart & Final, Spar, Spencer’s and Tesco. In emerging markets, our products are sold by global retailers and regional supermarkets (“the modern trade”), as well as a network of small, privately-owned independent stores, which are also known as general trade or traditional retail. We had established nine company-managed distribution centers in India till December 31, 2014. We target having company-managed distribution centers in six additional major cities in India by the end of the fiscal 2015, which we expect will result in greater market penetration and higher margins. We maintain a strong distribution platform into the restaurant channel and have a longstanding network of third party branded partners who sell our products in 40 countries throughout the rest of the world.

We have successfully expanded the Amira brand into more than 40 countries and are investing resources to further establish our brand as a premium, high quality packaged Basmati brand. We have tailored our strategy to local market requirements and continuously focus on strengthening our brand and developing new value-added products. Since 2010, Amira has been recognized each year by the World Economic Forum as a Global Growth Company, an invitation-only community consisting of approximately 300 of the world’s fastest-growing corporations, including companies such as illycaffé SpA and Intralinks. In 2011 and 2013, Planman Marcom recognized the Amira brand as one of only six food Power Brands in our Indian market, based on a survey of Indian consumers, along with such other brands as United Breweries, Britannia, Dabur, Godrej and Tata. In 2013, Amira was voted as one of “Asia’s Most Promising Brand” by the WCRC group. Additionally, Inc. India, a leading Indian business magazine, has recognized Amira as one of India’s fastest growing mid-sized companies in every year since 2010. The Amira brand remains the foundation of our expansion strategy and it continues to gain traction with customers as a trusted standard of premium quality. In 2013, Bharti Retail named Amira its Indian Best Partner in the “Staples” category. The Amira brand has also been recognized as “The Admired Brand of India” for the year 2014-15 by VWP World Brands.

We are vertically integrated and participate across the rice supply chain beginning with the procurement of paddy (or unprocessed rice) to its storage, aging, processing into rice, packaging, distribution and marketing. We have multigenerational relationships with more than 200,000 local Indian paddy farmers and a large network of procurement agents which allow us to consistently source high-quality paddy. Over the past several years, we have implemented an organic sourcing initiative and currently have relationships with more than 7,500 farmers practicing organic farming in India. We operate a state-of-the-art, fully-automated and integrated processing and milling facility that is strategically located in the vicinity of the key Basmati rice paddy producing regions of northern India. The facility spans a covered area of approximately 310,000 square feet, with a processing capacity of approximately 24 metric tons of paddy per hour. We had previously secured 48.2 acres of land in Karnal Haryana, India and have begun construction of our new processing facility which we expect to increase our production capacity to more than 60 metric tons per hour. Additionally, we have relationships with several independent rice millers throughout India which supplement our production capacity to fully meet our growing product needs. We believe our flexible, vertically integrated model provides us with significant advantages in ensuring stability of supply and maintaining quality control throughout the processing cycle.

The global rice market represented approximately $275 billion in value, according to statistics from the Horizon Research based on benchmark rice export prices for the international rice trade. The Indian rice industry was valued at approximately $50 billion in wholesale prices in fiscal 2013, within which the Indian Basmati rice segment is large and growing and was valued at approximately $4.2 billion, according to the CRISIL Research Report on the Indian Rice Industry. The Basmati rice segment has benefited from increased consumption trends both within India and internationally. According to CRISIL research, volume sales in India increased at a 15% CAGR between 2008 and 2013 while international volume sales increased at a 24% CAGR during the same time period. International sales of Indian Basmati rice have also benefited from favorable pricing trends and value sales have grown at a 30% CAGR between 2008 and 2013. We believe that global demand for Basmati and other specialty rice will continue to outpace the growth of the overall rice industry.

| 13 |

As of December 31, 2014 and 2013, we had 474 and 455 full time employees, respectively. As of December 31, 2014, we had 75 employees working in our finance, accounting & legal department, 255 working in sales, marketing & distribution, 45 working in HR, IT & administration, and 99 working in operations and processing facility. We support our sales force using a marketing strategy including extensive media advertising in both Indian and international markets. We use television, radio and print advertisements to reach our end users in order to promote the Amira brand name.

Corporate Structure

For information regarding Corporate Structure, see Item 4. INFORMATION ON THE COMPANY – “Corporate Structure” contained in the Company’s annual report on Form 20-F for the year ended March 31, 2014. There is no significant change in the corporate structure after March 31, 2014.

Results of Operations

Our results of operations for the three and nine months ended December 31, 2014 and 2013, respectively, were as follows:

| Nine months ended | Three months ended | |||||||||||||||

| December 31, 2014 (Unaudited) | December 31, 2013 (Unaudited) | December 31, 2014 (Unaudited) | December 31, 2013 (Unaudited) | |||||||||||||

| Revenue | $ | 472,607,849 | $ | 360,774,711 | $ | 192,407,304 | $ | 142,478,370 | ||||||||

| Other income | 92,692 | 108,120 | 18,033 | 13,057 | ||||||||||||

| Cost of material | (427,274,003 | ) | (291,031,271 | ) | (159,601,896 | ) | (109,089,976 | ) | ||||||||

| Change in inventory of finished goods | 56,061,879 | 14,195,269 | 6,949,431 | 1,710,878 | ||||||||||||

| Employee benefit expenses | (9,763,317 | ) | (9,103,034 | ) | (4,344,311 | ) | (4,850,720 | ) | ||||||||

| Depreciation and amortization | (1,778,915 | ) | (1,472,270 | ) | (576,736 | ) | (521,070 | ) | ||||||||

| Freight, forwarding and handling expenses | (14,011,609 | ) | (15,907,424 | ) | (4,595,471 | ) | (6,045,737 | ) | ||||||||

| Other expenses | (17,638,443 | ) | (12,101,245 | ) | (6,071,914 | ) | (5,644,163 | ) | ||||||||

| $ | 58,296,133 | $ | 45,462,856 | $ | 24,184,440 | $ | 18,050,639 | |||||||||

| Finance costs | (23,066,231 | ) | (18,864,147 | ) | (7,928,780 | ) | (8,284,701 | ) | ||||||||

| Finance income | 1,632,163 | 2,248,529 | 548,802 | 685,383 | ||||||||||||

| Other gains and (losses) | 4,543,029 | (711,563 | ) | 1,251,358 | (902,391 | ) | ||||||||||

| Profit before tax for the period | $ | 41,405,094 | $ | 28,135,675 | $ | 18,055,820 | $ | 9,548,930 | ||||||||

| Income tax expense | (7,629,792 | ) | (6,780,309 | ) | (3,927,670 | ) | (1,819,944 | ) | ||||||||

| Profit after tax for the period | $ | 33,775,302 | $ | 21,355,366 | $ | 14,128,150 | $ | 7,728,986 | ||||||||

| Profit after tax attributable to: | ||||||||||||||||

| Shareholders of the Company | $ | 26,544,176 | $ | 16,585,182 | $ | 10,967,083 | $ | 5,680,798 | ||||||||

| Non-controlling interest | $ | 7,231,126 | $ | 4,770,184 | $ | 3,161,067 | $ | 2,048,188 | ||||||||

| Earnings per share(1) | ||||||||||||||||

| Basic earnings per share | $ | 0.93 | $ | 0.58 | $ | 0.38 | $ | 0.20 | ||||||||

| Diluted earnings per share | $ | 0.92 | $ | 0.58 | $ | 0.38 | $ | 0.20 | ||||||||

| (1) | Basic earnings per share is calculated by dividing our profit after tax as reduced by the amount of a non-controlling interest reflecting the remaining 19.6% of Amira India that is not owned by us, by the number of our weighted average outstanding ordinary shares, during the applicable period. Diluted earnings per share is calculated by dividing our profit after tax as reduced by the amount of a non-controlling interest reflecting the remaining 19.6% of Amira India that is not owned by us, by the number of our weighted average outstanding ordinary shares adjusted by the dilutive impact of equivalent stock options granted. For three months ended December 31, 2014, the dilutive impact of total share options of 721,535 granted to Mr. Karan A. Chanana through December 31, 2014, is negligible and hence there is no impact on the presented basic and diluted earnings per share in the table above. For three and nine months ended December 31, 2013, the dilutive impact of total share options of 721,535 granted to Mr. Karan A. Chanana through December 31, 2013, was negligible and hence there is no impact on the presented basic and diluted earnings per share in the table above. |

| 14 |

Comparison of the nine months ended December 31, 2014 and 2013

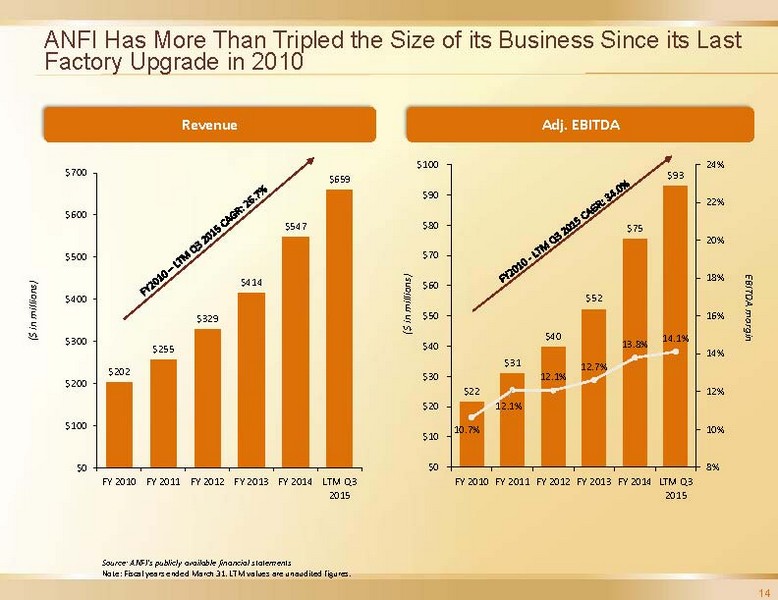

For the nine months ended December 31, 2014, we had revenues of $472.6 million, adjusted EBITDA of $66.5 million, and adjusted profit after tax of $35.7 million. Our revenue increased by $111.8 million or 31.0% for the nine months ended December 31, 2014 to $472.6 million from $360.8 million for the prior year’s nine month period. Our adjusted EBITDA increased by $17.5 million or 35.7% to $66.5 million for the nine months ended December 31, 2014 from $49.0 million for the prior year’s nine month period. Our adjusted profit after tax increased by $11.5 million or 47.8% to $35.7 million for the nine months ended December 31, 2014 from $24.2 million for the prior year’s nine month period. For the reconciliation of above mentioned non-IFRS measures with IFRS measures, please refer section “Non-IFRS Financial Measures”.

Revenue

Revenue increased by $111.8 million, or 31.0%, to 472.6 million in the nine months ended December 31, 2014 from $360.8 million in the nine months ended December 31, 2013. The revenue increase was primarily due to increased sales volume, price and product mix of rice in India and internationally.

During the nine months ended December 31, 2014, sales of our Amira branded and third party branded products increased by $134.3 million or 42.0% to $454.0 million from $319.7 million in the prior year’s nine month period. Our total sales consists of Amira branded, third party branded and institutional sales. Our Amira branded and third party branded sales contributed to 96.1% of our total sales for the period, up from 88.6% in the prior year’s nine month period. During the nine months ended December 31, 2014 our institutional sales were $18.6 million or 3.9% of our total sales for the period. During the nine months ended December 31, 2013, our institutional sales were $41.1 million or 11.4% of our total sales for the period.

During the nine months ended December 31, 2014, our revenue from international sales increased by $65.8 million or 31.4% to $274.9 million from $209.1 million in the prior year’s nine month period, while our revenue from sales in India increased by $46.0 million or 30.4% to $197.7 million from $151.6 million in the prior year’s nine month period. Revenue growth in India was negatively impacted by the depreciation of the Indian rupee against the U.S. dollar during the nine months ended December 31, 2014 as compared to December 31, 2013. Our sales in India grew by approximately 32.5% during the nine months ended December 31, 2014 as compared to December 31, 2013, when measured in Indian rupees. During the nine months ended December 31, 2014, our revenue from international sales contributed 58.2% of total sales, while revenue from sales in India contributed 41.8% of total sales. During the nine month period ended December 31, 2013, our revenue from international sales contributed 58.0% of total sales, while revenue from sales in India contributed 42.0% of total sales.

Other income

Other income was $92,692 in the nine months ended December 31, 2014 compared to $108,120 in the nine months ended December 31, 2013.

Cost of material, including change in inventory of finished goods

Cost of material including change in inventory of finished goods increased by $94.4 million, or 34.1%, to $371.2 million in the nine months ended December 31, 2014 from $276.8 million in the nine months ended December 31, 2013, primarily reflecting the growth in our revenue. Since we age rice, the higher cost of raw material in the procurement season of FY14 has been impacting our Cost of material including change in inventory of finished goods this year. Accordingly, as a percentage of revenue, cost of material including change in inventory of finished goods increased to 78.5% in the nine months ended December 31, 2014 as compared to 76.7% in the nine months ended December 31, 2013. Our cost of material including change in inventory of finished goods as a percentage of revenue, was negatively impacted due to exchange fluctuation on revenue which has been partially offset by a foreign exchange gain/ (loss) based on our hedging policy. Accordingly, our cost of material including change in finished goods as a percentage of revenue plus foreign exchange gain/ (loss) (due to hedging of foreign exchange risk) increased marginally to 78.1% as compared to 77.4% in the corresponding period in the prior year.

Employee benefit expenses

Employee benefit expenses increased by $0.7 million, or 7.3%, to $9.8 million in the nine months ended December 31, 2014 from $9.1 million in the nine months ended December 31, 2013. The non-cash charge for share awards during nine months ended December 31, 2014 is $1.9 million as compared to non-cash charge for share awards and options of $2.8 million for same period last year, showing a decrease of $0.9 million which is more than offset by increase in the number of employees across function to support business growth resulting into net increase of $0.7 million in employee benefit expenses. Accordingly, as a percentage of revenue, employee benefit expenses were 2.1% and 2.5% in the nine months ended December 31, 2014 and 2013, respectively.

| 15 |

Depreciation and amortization

Depreciation and amortization expense increased to $1.8 million in the nine months ended December 31, 2014 as compared to $1.5 million in the nine months ended December 31, 2013. As a percentage of revenue, depreciation and amortization costs remained same as of 0.4% as in the nine months ended December 31, 2014 and 2013.

Freight, forwarding and handling expenses

Freight, forwarding and handling expenses decreased by $1.9 million, or 11.9 % to $14.0 million in the nine months ended December 31, 2014 from $15.9 million in the nine months ended December 31, 2013, primarily due to more shipments involving free on board (FOB) terms during the nine months ended December 31, 2014, as compared to last year same period when we had higher incident of sales involving payment of shipping, insurance and freight costs. As a percentage of revenue, freight, forwarding and handling expenses were 3.0% and 4.4% in the nine months ended December 31, 2014 and 2013, respectively.

Other expenses

Other expenses increased by $5.5 million, or 45.8% to $17.6 million in the nine months ended December 31, 2014 from $12.1 million in the nine months ended December 31, 2013. As a percentage of revenue, other expenses were 3.7% in the nine months ended December 31, 2014 as compared to 3.4% in the nine months ended December 31, 2013. The increase was primarily due to an increase in legal & professional, advertising & business promotion expenses and travel & conveyance which are in line with our business growth.

Finance costs

Finance costs were $23.1 million in the nine months ended December 31, 2014, as compared to $18.9 million in the nine months ended December 31, 2013. Finance costs increased by $4.2 million as a result of an increase in our debt, which was $187.1 million at the end of December 31, 2014 compared to $160.3 million at the end of December 31, 2013. The increase in debt during the period is consistent with the working capital requirements of our publicly stated growth forecasts.

Finance income

Finance income has marginally decreased to $1.6 million in the nine months ended December 31, 2014 compared to $2.2 million in the nine months ended December 31, 2013.

Other gains and (losses)

Other gains and (losses) increased by $5.2 million, to a gain of $4.5 million in the nine months ended December 31, 2014 from a loss of $0.7 million in the nine months ended December 31, 2013. This is primarily due to foreign exchange gain for hedging revenue.

Profit before tax

Profit before tax increased by $13.3 million, or 47.2% to $41.4 million in the nine months ended December 31, 2014 from $28.1 million in the nine months ended December 31, 2013. This increase was primarily due to an increase in revenue from both our Indian and international markets. Our key strategy of focusing on emerging growth markets supported this growth in profits. Profit before tax as a percentage of revenue was 8.8% and 7.8%% in the nine months ended December 31, 2014 and nine months ended December 31, 2013, respectively.

Income tax expense

Corporate tax expense was $7.6 million and our effective tax rate was 18.4% in the nine months ended December 31, 2014. This compares favorably to our nine months ended December 31, 2013 corporate tax expense of $6.8 million and effective tax rate of 24.1%. The reduction in effective tax rate was primarily due to relatively higher contribution of revenue and corresponding profit from lower tax jurisdictions in nine months ended December 2014.

Profit after tax

Profit after tax increased by $12.4 million, or 58.2%, to $33.8 million in the nine months ended December 31, 2014 from $21.4 million in the nine months ended December 31, 2013, primarily due to increase in our revenue. Profit after tax as a percentage of revenue was 7.1% and 5.9% in the nine months ended December 31, 2014 and nine months ended December 31, 2013, respectively.

Comparison of the three months ended December 31, 2014 and 2013

For the quarter ended December 31, 2014, we had revenue of $192.4 million, adjusted EBITDA of $27.7 million, and adjusted profit after tax of $15.9 million. Our revenue increased by $49.9 million or 35.0% to $192.4 million in the quarter ended December 31, 2014 from $142.5 million in the prior year’s period. Our adjusted EBITDA increased by $7.4 million or 36.6% to $27.7 million in the quarter ended December 31, 2014 from $20.3 million in the prior year’s period. Our adjusted profit after tax increased by $5.5 million or 52.9% to $15.9 million from $10.4 million in the prior year’s three month period. For the reconciliation of above mentioned non-IFRS measures with IFRS measures, please refer section “Non-IFRS Financial Measures”.

| 16 |

Revenue

Revenue increased by $49.9 million, or 35.0%, to $192.4 million in the three months ended December 31, 2014 from $142.5 million in the three months ended December 31, 2013. The revenue increase was primarily due to increased sales volume and product mix of rice in India and internationally.

During the three months ended December 31, 2014, sales of our Amira branded and third party branded products increased by $39.9 million or 29.2% to $176.4 million from $136.5 million in the prior year’s three month period. Our Amira branded and third party branded sales contributed to 91.7% of our total sales for the period, down from 95.8% in the prior year’s three month period. During the three months ended December 31, 2014 our institutional sales were $16.0 million or 8.3% of our total sales for the period. During the three months ended December 31, 2013, our institutional sales were $5.9 million or 4.2% of our total sales for the period.

During the three months ended December 31, 2014, our revenue from international sales increased by $29.6 million or 38.9% to $105.8 million from $76.2 million in the prior year’s three month period, while our revenue from sales in India increased by $20.3 million or 30.7% to $86.6 million from $66.3 million in the prior year’s three month period. During the three months ended December 31, 2014, our revenue from international sales contributed 55.0% of total sales, while revenue from sales in India contributed 45.0% of total sales. During the three month period ended December 31, 2013, our revenue from international sales contributed 53.5% of total sales, while revenue from sales in India contributed 46.5% of total sales.

Other income

Other income was $18,033 in the three months ended December 31, 2014 compared to $13,057 in the three months ended December 31, 2013.

Cost of material, including change in inventory of finished goods

Cost of material including change in inventory of finished goods increased by $45.3 million, or 42.2%, to $152.7 million in the three months ended December 31, 2014 from $107.4 million in the three months ended December 31, 2013, primarily reflecting the growth in our revenue. Since we age rice, the higher cost of raw material in the procurement season of FY14 has been impacting our Cost of material including change in inventory of finished goods this year. Accordingly, as a percentage of revenue, cost of material including change in inventory of finished goods increased to 79.3% in the three months ended December 31, 2014 as compared to 75.4% in the three months ended December 31, 2013. Our cost of material including change in inventory of finished goods as a percentage of revenue, was negatively impacted due to exchange fluctuation on revenue which has been partially offset by a foreign exchange gain/ (loss) based on our hedging policy. Accordingly, our cost of material including change in finished goods as a percentage of Revenue plus foreign exchange gain/ (loss) (due to hedging of foreign exchange risk) increased to 79.2% as compared to 75.9% in the corresponding period in the prior year.

Employee benefit expenses

Employee benefit expenses decreased by $0.6 million, or 10.4%, to $4.3 million in the three months ended December 31, 2014 from $4.9 million in the three months ended December 31, 2013. The non-cash charge for share awards during the three months ended December 31, 2014 was $1.7 million as compared to non-cash charge for share awards and options of $2.6 million for same period last year, showing a decrease of $0.9 million. Accordingly, as a percentage of revenue, employee benefit expenses were 2.3% and 3.4% in each of the three months ended December 31, 2014 and 2013, respectively.

Depreciation and amortization

Depreciation and amortization expense increased to $0.6 million in the three months ended December 31, 2014 as compared to $0.5 million in the three months ended December 31, 2013. As a percentage of revenue, depreciation and amortization costs were 0.3% and 0.4% in the three months ended December 31, 2014 and 2013, respectively.

Freight, forwarding and handling expenses

Freight, forwarding and handling expenses decreased by $1.4 million to $4.6 million in the three months ended December 31, 2014 from $6.0 million in the three months ended December 31, 2013, primarily due to more shipments involving free on board (FOB) terms during the nine months ended December 31, 2014, as compared to last year same period when we had higher incident of sales involving payment of shipping, insurance and freight costs. during the three months ended December 31, 2014. As a percentage of revenue, freight, forwarding and handling expenses were 2.4% and 4.2% in the three months ended December 31, 2014 and 2013, respectively.

| 17 |

Other expenses

Other expenses increased by $0.5 million, or 7.6% to 6.1 million in the three months ended December 31, 2014 from $5.6 million in the three months ended December 31, 2013. As a percentage of revenue, other expenses were 3.2% in the three months ended December 31, 2014 as compared to 4.0% in the three months ended December 31, 2013. The increase was primarily due to an increase in legal & professional, advertising & business promotion expenses and travel & conveyance which are in line with our business growth.

Finance costs

Finance costs were $7.9 million in the three months ended December 31, 2014, as compared to $8.3 million in the three months ended December 31, 2013. Finance costs decreased by $0.4 million during the three months ended December 31, 2014 as a result of having new working capital limits in Dubai at a lower rate of interest as compared to India.

Finance income

Finance income has marginally decreased to $0.5 million in the three months ended December 31, 2014 compared to $0.7 million in the three months ended December 31, 2013.

Other gains and (losses)

Other gains and (losses) increased by $2.2 million, to a gain of $1.3 million in the three months ended December 31, 2014 from a loss of $0.9 million in the three months ended December 31, 2013.

Profit before tax

Profit before tax increased by $8.6 million, or 89.1% to $18.1 million in the three months ended December 31, 2014 from $9.5 million in the three months ended December 31, 2013. This increase was primarily due to an increase in revenue from both our Indian and international markets. Our key strategy of focusing on emerging growth markets supported this growth in profits. Profit before tax as a percentage of revenue was 9.4% and 6.7% in the three months ended December 31, 2014 and three months ended December 31, 2013, respectively.

Income tax expense

Corporate tax expense was $3.9 million and our effective tax rate was 21.8% in the three months ended December 31, 2014 compared to corporate tax expense of $1.8 million and effective tax rate of 19.1% in the corresponding period in the prior year. The increase in effective tax rate was primarily due to relatively higher contribution of profit from higher tax jurisdictions in three months ended December 2014.

Profit after tax

Profit after tax increased by $6.4 million, or 82.8%, to $14.1 million in the three months ended December 31, 2014 from $7.7 million in the three months ended December 31, 2013, primarily due to increase in our revenue. Profit after tax as a percentage of revenue was 7.3% and 5.4% in the three months ended December 31, 2014 and three months ended December 31, 2013, respectively.

Liquidity and Capital Resources

As of December 31, 2014, we had debt and liabilities in the following amounts:

| · | secured revolving credit facilities, aggregating $145.4 million; |

| · | other facilities, aggregating $37.4 million; |

| · | related party debt, aggregating $1.2 million; |

| 18 |

| · | term loan facilities (including current portion of long term debt amounting to $1.3 million), aggregating $2.9 million; |

| · | vehicle loans (including current portion of vehicle loan amounting to $0.1 million), aggregating $0.2 million; and |

| · | trade payables, aggregating $16.5 million. |

Debt incurred under our secured revolving credit facilities bears interest at variable rates of interest, determined by reference to the relevant benchmark rate. Most of our debt is denominated in Rupees.

As of December 31, 2014, the Amira Group had the following undrawn financing facilities which remained available for drawdown under existing financing arrangements:

| December 31, 2014 (Unaudited) | ||||

| Working capital - fund based | $ | 3,009,835 | ||

| Letter of credit and bank guarantee - non fund based | 18,605,165 | |||

| Total | $ | 21,615,000 | ||

The annualized weighted average interest rates (including corresponding bank processing charges and fees for bank-related facilities) for each of the reporting periods were as follows:

| Interest | Nine months ended December 31, 2014 (Unaudited) | Year ended March 31, 2014 (Audited) | ||||||||

| Working capital debt: | ||||||||||

| Secured revolving credit facilities | Floating Rates of Interest | 13.1 | % | 11.7 | % | |||||

| Other facilities | Floating Rates of Interest | 11.0 | % | 12.2 | % | |||||

| Others: | ||||||||||

| Related party debt | Fixed Rate of Interest | 11.6 | % | 11.6 | % | |||||

| Term loans | Floating Rate of Interest | 12.5 | % | 12.5 | % | |||||

| Vehicle loan | Fixed Rate of Interest | 10.6 | % | 9.2 | % | |||||

| Trade payables* | Fixed Rate of Interest | 21.0 | % | 21.0 | % | |||||

* The Amira Group has paid interest to certain suppliers for the payments made beyond the normal credit period as required under “Association of aartiyas (agents)”.

Our outstanding secured revolving credit facilities and term loans have been secured by, among other things, certain current and fixed assets of Amira India, including property, plant and equipment, and supported by personal guarantees issued by Mr. Karan A. Chanana (our Chairman and Chief Executive Officer) and Ms. Anita Daing (a director of Amira India). Mr. Chanana and Ms. Daing have issued personal guarantees in favor of Canara Bank, the lead bank of a consortium of 12 banks that granted Amira India its outstanding secured revolving credit facilities. Under these personal guarantees, Mr. Chanana and Ms. Daing have guaranteed the repayment of the secured revolving credit facilities, up to a sum of $220.9 million, along with any applicable interest and other charges due to the consortium. In the event that Amira India defaults in its payment obligations, Canara Bank has the right to demand such payment from Mr. Chanana and/or Ms. Daing, who are obligated under the terms of the personal guarantees to make such payment.

Additionally, personal guarantees containing similar terms have been issued by Mr. Chanana and Ms. Daing in favor of Bank of Baroda and ICICI Bank for amounts not exceeding $0.4 million and $2.5 million, respectively, guaranteeing repayment of the term loan facilities availed by Amira India from these banks.

ANFI has indemnified its directors and officers, including Mr. Karan A. Chanana, in accordance with its amended and restated memorandum and articles of association and indemnification agreements entered into with such directors and officers. Such indemnification includes indemnification for Mr. Chanana’s and Ms. Daing’s personal guarantees described above.

Under the terms of some of Amira India’s current secured revolving credit facilities (representing less than 10% of our total debt outstanding as of December 31, 2014), we need the consent of lenders under our current secured revolving credit facilities to declare dividends for any year (i) except out of profits relating to that year after meeting all the financial commitments to the bank(s) and making all other due and necessary provisions and (ii) provided that no default had occurred in any repayment obligations during the year. Additionally, such financing arrangements contain limitations on Amira India’s ability to:

| · | incur additional indebtedness, |

| 19 |

| · | effect a change in Amira India’s capital structure, |

| · | formulate any merger or other similar reorganization such as a scheme of amalgamation, |

| · | implement a scheme of expansion, diversification, modernization, |

| · | make investments by way of shares/debentures or lend or advance funds to or place deposits with any other company, except in the normal course of business, |

| · | create any charge, lien or encumbrance over its assets or any part thereof in favor of any financial institution, bank, company or persons, and |

| · | make certain changes in management or ownership. |

In the nine months ended December 31, 2014 and 2013, we spent $1.7 million and $1.4 million, respectively, on capital expenditures.

Historically, our cash requirements have mainly been for working capital as well as capital expenditures. As of December 31, 2014, our primary sources of liquidity, aside from our secured revolving credit facilities, were $ 27.0 million of cash and cash equivalents and $0.5 million of short term investments, deposits which are available on demand.

We believe that our current cash and cash equivalents, cash flow from operations, debt incurred under our secured revolving credit facilities and other short and long-term loans will be sufficient to meet our anticipated regular working capital requirements and our needs for capital expenditures for at least the next 12 months. We may, however, require additional cash resources to fund the development of our new processing facility or to respond to changing business conditions or other future developments, including any new investments or acquisitions we may decide to pursue.

Since we are currently a holding company, we do not generate cash from operations in order to fund our expenses. Restrictions on the ability of our subsidiaries to pay us cash dividends may make it impracticable for us to use such dividends as a means of funding the expenses of ANFI. However, in the event that ANFI requires additional cash resources, we may conduct certain international operations or transactions through ANFI using transfer pricing principles that involve Amira India or its trading affiliates, or seek third-party sources of financing in the form of debt or equity.

The following table sets forth the summary of our cash flows for the periods indicated:

| Nine months ended | ||||||||

| December 31, 2014 (Unaudited) | December 31, 2013 (Unaudited) | |||||||

| Net cash (used in)/ generated from operating activities | $ | (2.9 | ) | $ | 7.3 | |||

| Net cash used in investing activities | (2.3 | ) | (1.9 | ) | ||||

| Net cash (used in)/ generated from in financing activities | (3.1 | ) | 2.0 | |||||

| Effect of change in exchange rate on cash and cash equivalents | (2.3 | ) | (6.9 | ) | ||||

| Net increase/ (decrease) in cash and cash equivalents | $ | (10.6 | ) | $ | 0.5 | |||

| Cash and cash equivalents at the beginning of the period | 37.6 | 33.3 | ||||||

| Cash and cash equivalents at the end of the period | $ | 27.0 | $ | 33.8 | ||||

Net cash generated from/ (used in) operating activities

In nine months ended December 31, 2014, net cash used in operating activities was $2.9 million in comparison to cash generated of $7.3 million in the nine months ended December 31, 2013, primarily due to significant decrease in payables and increase in receivables largely being offset by increase in profit after tax before non-operating expenses and non-cash items.

Generally, factors that affect our earnings include, among others, sales price and volume, costs and productivity, which similarly also affect our cash flows from or (used in) operations. While management of working capital, including timing of collections and payments, affects operating results only indirectly, its impact on working capital and cash flows provided by operating activities can be significant.

Net cash generated from/ (used in) investing activities

In nine months ended December 31, 2014, net cash used in investing activities was $2.3 million in comparison to cash used of $1.9 million in the nine months ended December 31, 2013.

| 20 |

Net cash used in financing activities

In the nine months ended December 31, 2014, we incurred $14.2 million of additional short term debt and repaid $0.9 million of long term debt along with interest of $16.4 million on total debt which resulted in net outflow of $3.1 million.

Inflation

Our results of operations and financial condition have historically not been significantly affected by inflation because we were able to pass most, if not all, increases in raw materials prices on to our customers through price increases on our products.

Off-Balance Sheet Arrangements

As of December 31, 2014, we had no off-balance sheet arrangements, other than items disclosed under Note 4.2 “Guarantees given by KMP” to the unaudited condensed interim consolidated financial statements and undrawn financial facilities as disclosed under “Liquidity Risk Analysis” section.

Critical Accounting Policies and Estimates

For information regarding Critical Accounting Policies and Estimates, see Item 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS – “Critical Accounting Policies and Estimates” contained in the Company’s annual report on Form 20-F for the year ended March 31, 2014. There have been no material changes since March 31, 2014 to the critical accounting policies and estimates.

New standards/amendments relevant for the Amira Group adopted from April 1, 2014 and new standards/amendments issued but not yet effective relevant for the Amira Group

There is no material impact due to adoption of new standards/amendments relevant for the Amira Group from April 1, 2014. The accounting pronouncements which were not effective as of December 31, 2014 and have not been applied in preparing these condensed interim consolidated financial statements.

Non-IFRS Financial Measures

In evaluating our business, we consider and use the non-IFRS measures EBITDA, adjusted EBITDA, adjusted profit after tax, adjusted earnings per share, adjusted net working capital and net debt as supplemental measures to review and assess our operating performance. The presentation of these non-IFRS financial measures is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with IFRS. We define: (1) EBITDA as profit after tax plus finance costs (net of finance income), income tax expense and depreciation and amortization; (2) adjusted EBITDA, as EBITDA plus non-cash expense for share-based compensation for the three and nine months ended December 31, 2014 and 2013, respectively (3) adjusted profit after tax, as profit after tax plus non-cash expense for share-based compensation for three and nine months ended December 31, 2014 and 2013, respectively; (4) adjusted earnings per share as the quotient of: (a) adjusted profit after tax and (b) the sum of our weighted average number of shares (including dilutive impact of share options granted) for the applicable period and the ordinary shares subject to the exchange agreement between us and the non-controlling shareholders of Amira India; (5) adjusted net working capital as total current assets minus: (a) total current liabilities (b) cash and cash equivalents and plus current debt; and (6) net debt as total current and non-current debt minus cash and cash equivalents.

We use both EBITDA and adjusted EBITDA as measures of operating performance to assist in comparing performance from period to period on a consistent basis, as a measure for planning and forecasting overall expectations, for evaluating actual results against such expectations and as a performance evaluation metric, including as part of assessing and administering our executive and employee incentive compensation programs. We believe that the use of both EBITDA and adjusted EBITDA as non-IFRS measures facilitates investors’ assessment of our operating performance from period to period and from company to company by backing out potential differences caused by variations in items such as capital structure (affecting relative finance or interest expenses), non-recurring IPO-related expenses, the book amortization of intangibles (affecting relative amortization expenses), the age and book value of property and equipment (affecting relative depreciation expenses) and other non-cash expenses. We also present these non-IFRS measures because we believe they are frequently used by securities analysts, investors and other interested parties as measures of the financial performance of companies in our industry.

These non-IFRS financial measures are not defined under IFRS and are not presented in accordance with IFRS. These non-IFRS financial measures have limitations as analytical tool, and when assessing our operating performance, investors should not consider it in isolation, or as a substitute for profit/ (loss) or other consolidated statements of operations data prepared in accordance with IFRS. Some of these limitations include, but are not limited to:

| · | it does not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments; |

| · | it does not reflect changes in, or cash requirements for, our working capital needs; |

| · | it does not reflect the finance or interest expenses, or the cash requirements necessary to service interest or principal payments, on our debt; |

| 21 |

| · | it does not reflect income taxes or the cash requirements for any tax payments; |

| · | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized often will have to be replaced in the future, and adjusted net profit, EBITDA and Adjusted EBITDA do not reflect any cash requirements for such replacements; |

| · | other companies may calculate EBITDA, Adjusted EBITDA and other non-IFRS measures differently than we do, limiting the usefulness of this non-IFRS measure as a comparative measure. |

We compensate for these limitations by relying primarily on our IFRS results and using non-IFRS measures only as a supplemental information.

We present adjusted EBITDA, adjusted profit after tax, adjusted earnings per share, adjusted net working capital and net debt because we believe these measures provide additional metrics to evaluate our operations and, when considered with both our IFRS results and the reconciliation to profit after tax, basic and diluted earnings per share, working capital and total current and non-current debt, respectively, provide a more complete understanding of our business than could be obtained absent this disclosure. We also believe that these non-IFRS financial measures are useful to investors in assessing the operating performance of our business after reflecting the adjustments described above.

In the following tables we have provided reconciliation of the non-IFRS measures to the most directly comparable IFRS measure:

- Reconciliation of profit after tax to EBITDA and adjusted EBITDA:

| Nine months ended | Three months ended | |||||||||||||||

| December 31, 2014 | December 31, 2013 | December 31, 2014 | December 31, 2013 | |||||||||||||

| Profit after tax (PAT) | $ | 33,775,302 | $ | 21,355,366 | $ | 14,128,150 | $ | 7,728,986 | ||||||||

| Add: Income tax expense | 7,629,792 | 6,780,309 | 3,927,670 | 1,819,944 | ||||||||||||

| Add: Finance costs (net of finance income) | 21,434,068 | 16,615,618 | 7,379,978 | 7,599,318 | ||||||||||||

| Add: Depreciation and amortization | 1,778,915 | 1,472,270 | 576,736 | 521,070 | ||||||||||||

| EBITDA | $ | 64,618,077 | $ | 46,223,563 | $ | 26,012,534 | $ | 17,669,318 | ||||||||