Are These The Best SPAC Stocks To Buy Right Now?

2020 was undoubtedly a banner year for SPAC stocks in the stock market. With so many SPAC stocks skyrocketing, many investors have been looking for the best SPAC stocks to buy in the stock market today. After all, many companies want to take a shorter and less expensive pathway to go public. Not to mention, less hassle. But recently, the meme culture has hit Wall Street and investors are also on the lookout for meme stocks. So, what's a meme stock you ask? In short, a stock that is popular with millennial-aged retail traders. Besides, it trades more on hype than its underlying fundamentals.

The thing is, many SPAC stocks could also be considered as meme stocks. Perhaps you are also interested in investing in a company that went public through this route. If you would like to know more about this financial vehicle, read on.

What Is A SPAC & Why Should You Consider Them?

A special purpose acquisition company (SPAC) is a company with no commercial operations. It is structured strictly to raise funds through an initial public offering (IPO). Some also refer to them as blank check companies. With the capital raised, a SPAC then identifies a private company to merge with. This essentially provides a faster way for a private company to go public, without the traditional, more lengthy IPO process. The truth is, SPACs have been around for a few decades now. A possible reason they are getting popular again this year could be to do with the electric vehicle (EV) revolution we are experiencing in the stock market today.

If you have only gotten to know SPACs recently, chances are the ones that you know are in EV-related businesses. For instance, Li-Cycle Corp, a recycler of lithium-ion batteries, is nearing a deal to go public through a merger with Peridot Acquisition Corp (NYSE: PDAC). But as SPAC goes mainstream, companies from other sectors are also interested in going public through SPACs. Over the weekend, reports said chemical-technology company Origin Materials is in talks to go public via Artius Acquisition Inc. (NASDAQ: AACQ).

Nevertheless, investors should take note that not all SPACs are created equal. There's a chance you could burn your investment because they often come with more uncertainty and risk. Not everyone can stomach the big swings. However, there will still be companies that could bring once-in-a-lifetime opportunities. With that in mind, let's take a closer look at SPAC stocks making waves in the stock market today.

Top SPAC Stocks To Watch Right Now

- Tortoise Acquisition II Corp (NYSE: SNPR)

- Foley Trasimene Acquisition II Corp (NYSE: BFT)

- Churchill Capital Corp IV (NYSE: CCIV)

- Gores Holdings VI Inc (NASDAQ: GHVI)

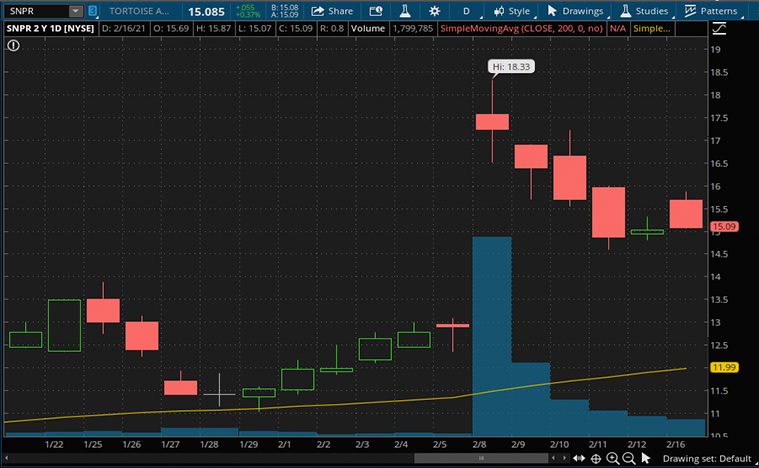

Tortoise Acquisition II Corp.

First up, Tortoise Acquisition II Corp. saw its stock price soared nearly as much as 47% upon the announcement of a merger deal with Volta Industries. For those who may be unfamiliar, Volta Industries develops, manufactures, and installs a network of EV charging stations. From the deal, Volta will receive $600 million. The amount includes a $300 million investment from BlackRock, Fidelity Management & Research, and Neuberger Berman Funds. The company will utilize its proceeds to accelerate the buildout of the company's charging network.

"Volta's unique business model is poised to capture the vast consumer spending shifts that will accompany our society's shift from carbon to electric," said Scott Mercer, Founder, and CEO of Volta. However, since the merger announcement, SNPR stock has been on a downward trend. If you are a potential investor, would buying at dips be an attractive option to you?

Read More

- Should Investors Buy These Top Software Stocks Now? 4 To Watch

- BHP Group (BHP) Vs Rio Tinto (RIO): Which Energy Stock Is A Better Buy?

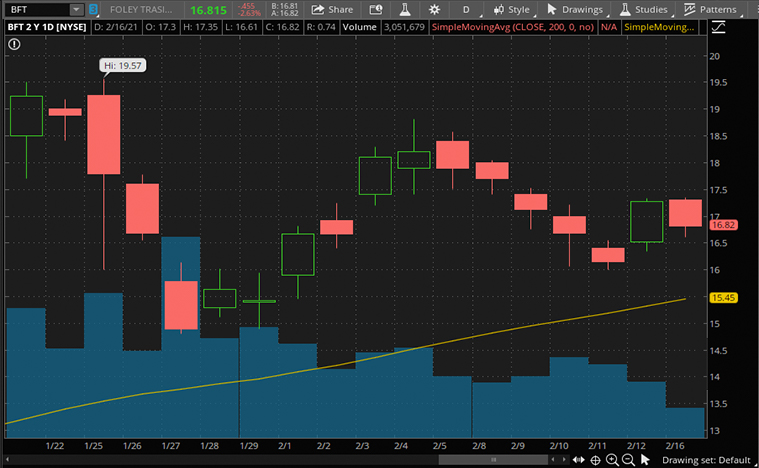

Foley Trasimene Acquisition II Corp

Next up, Foley Trasimene Acquisition II is another trending SPAC stock in the market. For those unfamiliar, the company is not like other SPACs in the market. That is because its target, Paysafe is an extremely attractive acquisition target. You could argue that the most intriguing business is its involvement in the U.S. gaming market with payment solutions Skrill and Neteller (formerly known as Moneybookers) through the acquisition of Paysafe Group. The company is the exclusive debit and credit card processor for DraftKings Inc.'s (NASDAQ: DKNG) UK business.

Paysafe is a payments provider operating across geographies. The company provides both digital wallets and prepaid payment methods. Besides, it offers e-commerce solutions to merchants, simplifying the recording of online and offline payments. With the company's broad moat in the cashless payment and online gambling segments, is BFT stock the best bet among a list of top SPAC stocks to buy?

[Read More] Looking For Which Stocks To Buy Now? 4 Consumer Stocks To Watch

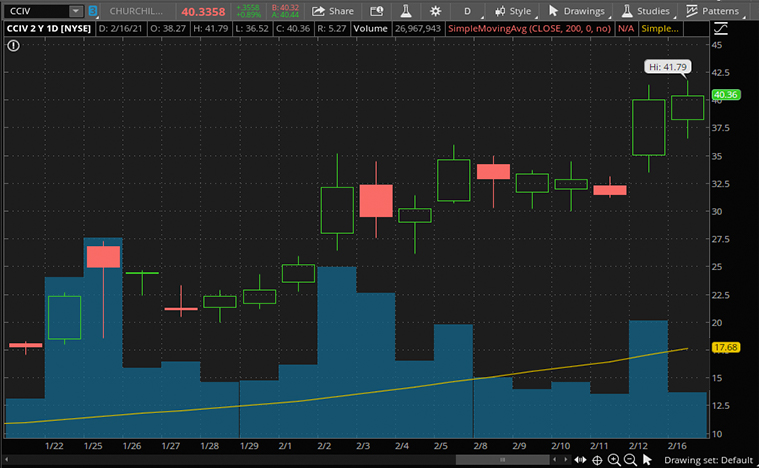

Churchill Capital Corp IV

CCIV stock is one SPAC stock that has surged in popularity among retail investors. That's simply because of a possible merger with Lucid Motors. For the uninitiated, Lucid Motors is an EV company with a premium focus. According to Bloomberg, such a deal could give a valuation of $15 billion for the EV maker. It is also worth mentioning that Lucid has strong backing from the Saudi Arabian sovereign wealth fund. If anything, it is not very common for EV start-ups to be funded by deep-pocketed sovereign funds.

Now, as there are rumors going on about Lucid merging with CCIV stock, it may be wise to keep the stock on your radar. Of course, buying any stock on rumors is particularly risky. But if it turns out to be true, investors would be getting a payday. The question is, are you willing to stomach the volatility?

[Read More] Pacific Biosciences (PACB) Stock: Is This Biotech Stock The Next Illumina?

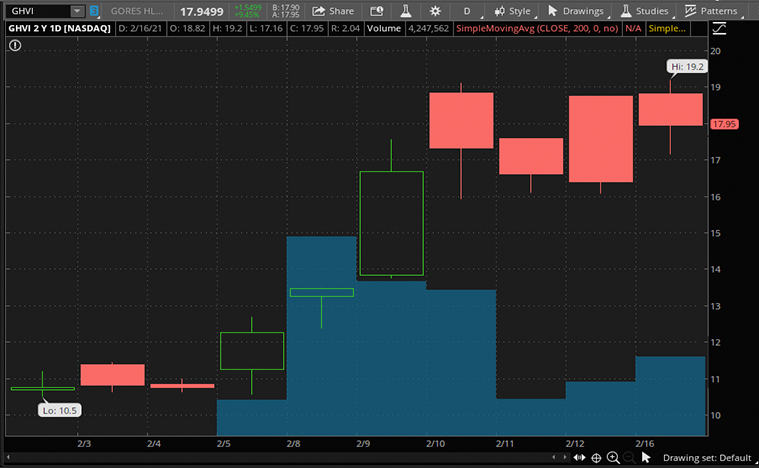

Gores Holdings VI Inc.

The recent announcement of Matterport merging with Gores Holdings VI has made many investors very excited. The digitization of the real estate market could be revolutionary. Matterport has built incredibly powerful technology for the real estate market, and its spatial data business is only beginning to dip its toes into a vast market. That said, if Matterport could make its use cases more widespread, there's massive value to be unlocked.

In the investor presentation, Matterport is forecasting $747 million in revenue and a 73% gross margin in 2025. These represent sizable jumps from an estimated $86 million in revenue for 2020 and a 56% gross margin. Of course, many may be wondering if the company can achieve such targets. Even if you don't believe that Matterport can hit those numbers, there is no denying that the company has huge potential in a massive market. It seems to me that GHVI might be a stock to buy and hold for the decade to come. What do you think?

COMTEX_381669702/2689/2021-02-24T16:10:11

Is there a problem with this press release? Contact the source provider Comtex at [email protected].

Tweet

Tweet Share

Share