Operational Highlights and Financial Results for the Period Ended December 31, 2021

Mesoblast Prepares for Resubmission of Biologics License Application

NEW YORK, Feb. 24, 2022 (GLOBE NEWSWIRE) -- Mesoblast Limited (Nasdaq:MESO; ASX: MSB), global leader in allogeneic cellular medicines for inflammatory diseases, today reported financial results and operational highlights for the period ended December 31, 2021.

Financial Highlights

- Mesoblast completed a refinancing of its senior secured debt facility with a new US$90 million five-year facility provided by funds managed by Oaktree Capital Management, L.P.

- Cash on hand at the end of the quarter was US$94.8 million, with up to an additional US$40 million available to be drawn down from existing financing facilities subject to certain milestones

- Total Operating Activities saw a 40% reduction in net cash usage on the comparative quarter last year, to US$18.2 million in the current quarter

- Regulatory and manufacturing activities related to the planned Biologics License Application (BLA) resubmission for remestemcel-L in steroid-refractory acute graft versus host disease (SR-aGVHD) in children accounted for over half of this cash usage

- Revenues in the quarter were US$2.4 million, primarily from TEMCELL® HS Inj.1 royalties on sales for SR-aGvHD in Japan, which increased 7% on the comparative quarter last year

Operational Highlights

Activities supporting potential resubmission of the Biologics License Application (BLA) for remestemcel-L in the treatment of children with steroid-refractory acute graft versus host disease (SR-aGVHD):

- Appointed Dr. Eric Rose as the Company’s Chief Medical Officer (CMO). Dr. Rose brings to Mesoblast an extensive record of excellence in clinical development and successful interactions at the highest levels with key regulatory, industry and government stakeholders including the United States Food and Drug Administration (FDA), the National Institutes of Health (NIH), and the Biomedical Advanced Research and Development Authority (BARDA)

- Held meeting with the FDA’s Office of Tissues and Advanced Therapies (OTAT) to address potency assay and chemistry, manufacturing, and controls (CMC) items identified in the complete response letter (CRL) for remestemcel-L in the treatment of SR-aGVHD in children

- FDA indicated that the in vitro immunomodulatory activity Mesoblast intends to measure for potency of the product is reasonable and that the relevance of this activity to clinical outcomes should be established

- Mesoblast has now generated substantial new data that it believes establish the relevance of the proposed potency assay measuring remestemcel-L’s in vitro anti-inflammatory and immunomodulatory activity to the in vivo clinical effect of the product in the Phase 3 trial in children with SR-aGVHD, including survival and biomarkers of in vivo activity

- Mesoblast will provide these new data to FDA and address all other outstanding items as required for resubmission of the BLA

- Mesoblast continues to be in a well-established process with FDA’s Center for Biologics Evaluation and Research (CBER), and if the resubmission is accepted, FDA will consider the adequacy of the clinical data in the context of the related CMC issues noted above.

Activities regarding the rexlemestrocel-L Phase 3 programs in chronic low back pain (CLBP) and chronic heart failure (CHF):

- During the period, Mesoblast received feedback from the FDA’s OTAT on the Phase 3 program for CLBP and plans to conduct an additional US Phase 3 trial which may support submissions for potential approval in both the US and EU

- Following review of the completed Phase 3 trial data, OTAT agreed with Mesoblast’s proposal for pain reduction at 12 months as the primary endpoint of the next trial, with functional improvement and reduction in opioid use as secondary endpoints

- Received feedback from FDA’s OTAT confirming that reduction in major adverse cardiovascular events (MACE) of cardiovascular mortality or irreversible morbidity (non-fatal heart attack or stroke) is an acceptable clinically meaningful endpoint for determining the treatment benefit of rexlemestrocel-L for patients with chronic heart failure and low ejection fraction (HFrEF)

- Preparing formal submission to FDA of the detailed analyses of outcomes in high-risk HFrEF patients with diabetes and/or myocardial ischemia to agree on a potential pathway to approval

Board Update

As foreshadowed at the Annual General Meeting in November 2021, the two long standing Australia-based non-executive directors will retire from the Board over a 6-12 month period. As such, Mr Donal O’Dwyer retires from the Board today.

Mesoblast’s Chief Executive, Silviu Itescu said, “I would like to thank Donal for his tenure since 2004 and specifically his vision, dedication, and commitment in supporting Mesoblast’s objectives to bring important and potentially life-saving therapies to market.”

The Mesoblast Board and management team wish to thank Donal for his invaluable contributions and wish him well in the future.

DETAILED PRODUCT ACTIVITIES FOR THE PERIOD

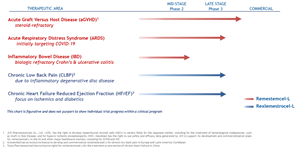

Late-Stage Clinical Pipeline

A graphic accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/a21e2f2b-2122-4564-a693-1b5a8431a9f6

Remestemcel-L

Steroid-refractory acute graft versus host disease (SR-aGVHD) in children:

Mesoblast met with FDA’s OTAT to address the appropriateness of a potency assay related to remestemcel-L’s proposed immunomodulatory mechanism of action as well as the approach to outstanding CMC items identified in the CRL. OTAT indicated that Mesoblast’s approach to address outstanding CMC items is reasonable, that the in vitro immunomodulatory activity of remestemcel-L proposed by Mesoblast as a measure of its potency is a reasonable critical quality attribute (CQA) for the product in the treatment of children with SR-aGVHD, and the relevance of this immunomodulatory activity to clinical outcomes should be established.

The relevance of remestemcel-L’s activity on severe inflammation was most recently shown in results from an investigator-initiated study, published in the peer-reviewed journal Bone Marrow Transplantation2, in children with SR-aGVHD stratified by baseline levels of inflammatory biomarkers. The study compared outcomes in 25 children from Mesoblast’s Phase 3 trial of remestemcel-L in SR-aGVHD with 27 closely matched children from the Mount Sinai Acute GVHD International Consortium (MAGIC)3 who participated in a prospective natural history study and were matched for the Phase 3 trial entry criteria. The objective of the study was to evaluate whether remestemcel-L improved outcomes in children with highest risk of death, namely those with baseline MAGIC Algorithm Probability (MAP) biomarker levels ≥0.29, a level associated with significant GI inflammation and damage, and which is predictive of poor treatment responses and very high mortality in SR-aGVHD.

In children with MAP ≥0.29, treatment with remestemcel-L resulted in 67% Day 28 Overall Response and 64% Day 180 overall survival compared with 10% Day 28 Overall Response and 10% Day 180 survival in the MAGIC cohort (both p=0.01) when treated with various biologics, including ruxolitinib. These results showed that remestemcel-L provided a significant benefit in terms of both response and survival in children with the highest levels of inflammation and at greatest risk of death.

Mesoblast has now generated substantial new data that it believes establish the relevance of the proposed potency assay measuring remestemcel-L’s in vitro anti-inflammatory and immunomodulatory activity to the in vivo clinical effect of the product in the Phase 3 trial in children with SR-aGVHD, including survival and biomarkers of in vivo activity.

Mesoblast will provide these new data to OTAT and address all other outstanding items as required for resubmission of the BLA.

Mesoblast continues to be in a well-established process with FDA’s Center for Biologics Evaluation and Research (CBER), and if the resubmission is accepted, CBER will consider the adequacy of the clinical data in the context of the related CMC issues noted above.

Inflammatory Bowel Disease (IBD) - Ulcerative Colitis & Crohn’s Colitis

The immunomodulatory effects of remestemcel-L on GI inflammation is being further evaluated in a randomized, controlled study of remestemcel-L by direct endoscopic delivery to areas of inflammation in patients with medically refractory ulcerative colitis or Crohn’s colitis. Results from an interim analysis of the first patient cohort showed that a single local delivery of remestemcel-L by colonoscopy resulted in rapid mucosal healing and disease remission in these refractory patients at high risk of progression to surgery. These results were presented at the 17th Congress of European Crohn’s and Colitis Organisation (ECCO) by the trial’s lead investigator Dr. Amy L. Lightner, Associate Professor of Surgery in the Department of Colon and Rectal Surgery at Cleveland Clinic and were published in the Journal of Crohn's and Colitis.4,5

The study at Cleveland Clinic will randomize up to 48 patients with medically refractory ulcerative colitis or Crohn’s colitis in a 2:1 fashion to receive a single intervention with remestemcel-L or placebo. Medically refractory ulcerative colitis and Crohn’s colitis patients are defined as having active disease for at least 6 months and having lost response to at least one monoclonal antibody (anti-TNF or anti-integrin).6,7

Key results of the interim analysis performed in the first 12 enrolled patients were as follows:

- Colonoscopic delivery of remestemcel-L was not associated with any treatment-related adverse events

- All ulcerative colitis patients treated with remestemcel-L had improved clinical and endoscopy scores within two weeks, as defined by the Mayo clinical score and Mayo endoscopic severity (MES) score, and all achieved clinical and endoscopic remission by six weeks

- All ulcerative colitis patients were extremely satisfied or satisfied with remestemcel-L treatment at three months, based on the inflammatory bowel disease patient reported treatment impact (IBD-PRTI), and response was described as excellent or good in all patients

- All Crohn’s colitis patients treated with remestemcel-L showed treatment remissions or responses by three months, as measured by the Simple Endoscopy Score for Crohn’s Disease (SES-CD) (mean score 17 at baseline decreased to 5 at three months)

- Remestemcel-L treatment resulted in reduction of fecal calprotectin, a validated biomarker of disease activity,8 from mean of 231 at baseline to 67 at three months, indicative of remission

- In controls with ulcerative colitis and Crohn’s colitis over three months, endoscopy scores increased, fecal calprotectin levels increased from a mean of 330 to 505, and clinical responses were described as poor or unchanged

Acute Respiratory Distress Syndrome (ARDS) due to COVID-19

High infection rates continue and new variants of COVID-19 are emerging globally. Hospitalizations remain high with significant numbers of patients in ICU and on ventilators. The ongoing mortality rates underline the high unmet clinical need for new therapies in hospitalized patients who are at risk of developing ARDS.

Mesoblast has met with the FDA in regard to potential emergency use authorization (EUA) for remestemcel-L in the treatment of ventilator-dependent patients with moderate or severe ARDS due to COVID-19. The FDA advised Mesoblast that an additional clinical study in COVID ARDS would be required which, if statistically positive, could provide a dataset in conjunction with the recently completed 222 patient clinical study that might be sufficient to support an EUA. Mesoblast intends to move forward with the pivotal trial for EUA, with reference to the aGVHD BLA for product potency assay in place prior to trial commencement.

Rexlemestrocel-L

Chronic Low Back Pain (CLBP) associated with Degenerative Disc Disease (DDD)

There is a significant need for a safe, effective, and durable opioid-sparing treatment in patients with CLBP associated with degenerative disc disease. Mesoblast recently presented 36-month follow-up results from the 404-patient, three-arm, Phase 3 trial in patients with CLBP associated with DDD, which showed durable reduction in back pain lasting at least three years from a single intra-discal injection of rexlemestrocel-L+hyaluronic acid (HA) carrier.

Results presented from this trial showed that:

- Durable reduction in pain through 36 months was greatest in the pre-specified population with CLBP of shorter duration than the study median of 68 months (n=194), suggesting that greatest benefits may be seen when the therapy is administered earlier in the disease process when there is active inflammation and before irreversible fibrosis of the intervertebral disc has occurred

- Pain reduction through 36 months was also seen in the subset of patients using opioids at baseline (n=168) with the rexlemestrocel-L+HA group having substantially greater reduction at all time points compared with saline controls

- Among patients on opioids at baseline, despite instructions to maintain existing therapies throughout the trial, at 36 months 28% who received rexlemestrocel-L + HA were not taking an opioid compared with 8% of saline treated controls (nominal p value 0.0075)

During the period, Mesoblast received feedback from the FDA’s OTAT on the Phase 3 program for CLBP and plans to conduct an additional US Phase 3 trial which may support submissions for potential approval in both the US and EU. Following review of the completed Phase 3 trial data, OTAT agreed with Mesoblast’s proposal for pain reduction at 12 months as the primary endpoint of the next trial, with functional improvement and reduction in opioid use as secondary endpoints.

Chronic Heart Failure

Data from the landmark DREAM-HF randomized, controlled Phase 3 trial of rexlemestrocel-L in 565 patients with chronic heart failure and low ejection fraction (HFrEF) were presented as a late breaking presentation at the AHA annual Scientific Sessions during a featured program titled ‘Building on the Foundations of Treatment: Advances in Heart Failure Therapy.’

The trial’s co-principal investigator Dr Emerson Perin, Medical Director of Texas Heart Institute, and Clinical Professor, Baylor College of Medicine, presented new results from the landmark study showing a significant relationship between presence of systemic inflammation as quantified by high-sensitivity C-reactive protein (hs-CRP) and treatment benefit with rexlemestrocel-L on risk of major adverse cardiovascular events (MACE) of cardiovascular mortality, heart attack or stroke.

In addition, FDA provided guidance that confirmed a reduction in incidence of cardiovascular mortality or irreversible morbidity (non-fatal heart attack or stroke) is a clinically meaningful acceptable endpoint in patients with chronic HFrEF and encouraged Mesoblast to identify the highest-risk group with greatest likelihood of beneficial response to intervention with rexlemestrocel-L in the DREAM-HF Phase 3 trial.

In line with this guidance, Mesoblast performed additional analyses of MACE outcomes in pre-specified high-risk patient groups from the landmark DREAM-HF trial, and the results were presented in December at the 18th Global CardioVascular Clinical Trialists Forum (CVCT) in Washington DC.

The data showed that:

- While a single rexlemestrocel-L dose on top of maximal standard of care therapies reduced the composite 3-point MACE in all 537 patients by 33% (p=0.02) over a mean follow-up of 30 months, a hierarchical analysis across pre-specified high-risk subgroups showed greatest benefit in patients with diabetes and/or myocardial ischemia (hazard ratio 0.63, p=0.019)

- Among control patients with HFrEF (n=276) all of whom were treated with maximal available standard of care therapies, risk of 3-point MACE was 1.9-fold higher in controls with diabetes and/or myocardial ischemia (n=192) than controls with neither diabetes nor myocardial ischemia (n=84), p=0.02. This confirmed the ongoing high-risk of 3-point MACE in control patients with diabetes and/or myocardial ischemia due to micro- and macro-vascular disease despite receiving optimal standard of care therapies

- Compared to control patients, rexlemestrocel-L reduced the incidence of 3-point MACE by 37% overall in NYHA class II or III HFrEF patients with diabetes and/or myocardial ischemia (n=385, p=0.02) and by 54% in those with diabetes and/or myocardial ischemia who had evidence of systemic inflammation, as defined by elevated baseline levels of hs-CRP >2mg/L (n=212, p=0.003).

Diabetes Mellitus is not only a significant risk factor in the onset of heart failure, it also increases the risk of mortality and morbidity in patients who have existing heart failure.,9-11 Type 2 diabetes causes structural heart disease and heart failure through myocardial ischemia involving small and large vessels. Importantly, inflammation which is a critical component of the pathophysiology of the disease is also known to accelerate large vessel atherosclerosis.9

Mesoblast will submit for formal FDA review the new data analyses showing the reduction in mortality and irreversible morbidity by rexlemestrocel-L in HFrEF patients with diabetes and/or myocardial ischemia, to agree on a potential pathway to approval.

FINANCIAL RESULTS FOR THE PERIOD ENDED DECEMBER 31, 2021 (SECOND QUARTER FY2022)

- Total Revenue was US$2.4 million for the second quarter FY2022, primarily from TEMCELL® HS Inj.1 royalties on sales for SR-aGvHD in Japan, which increased 7% on the comparative quarter last year

- In November Mesoblast completed a refinancing of its senior secured debt facility with a new US$90 million five-year facility provided by funds managed by Oaktree Capital Management, L.P.

- Cash on hand at the end of the quarter was US$94.8 million, with up to an additional US$40 million available to be drawn down from existing financing facilities subject to certain milestones.

- Net operating cash usage was US$18.2 million for the second quarter FY2022, a reduction of 40% or US$12.4 million on the comparative quarter.

- Research & Development expenses reduced by US$4.0 million (28%), down to US$10.2 million for the second quarter FY2022 from US$14.2 million for the second quarter FY2021 as clinical trial activities for our COVID-19 ARDS, CLBP and CHF product candidates reduced given clinical trial recruitment and data analysis is now complete.

- Manufacturing expense were US$6.6 million for the second quarter FY2022, compared to US$6.5 million for the second quarter FY2021. During the quarter we continued to build our pre-launch inventory levels of remestemcel-L to support the long-term commercial supply for SR-aGVHD and COVID ARDS.We expect to recognize the US$28.0 million balance of remestemcel-L pre-launch inventory, and the balance of any further production completed at that time, on our balance sheet if we receive FDA approval.

- Management and Administration expenses were stable at US$7.8 million and US$7.9m for the second quarters FY2022 and FY2021 respectively.

- Remeasurement of Contingent Consideration reduced to a loss of US$0.3 million for the second quarter FY2022 whereas a gain of US$1.5 million was recognized in the second quarter FY2021 as a result of revaluing future third party payments.

- Fair value movement of warrants a gain of US$2.2 million in the second quarter FY2022, compared to Nil for the second quarter FY2021.

- Finance Costs for borrowing arrangements with Hercules, NovaQuest and Oaktree were US$5.4 million for the second quarter FY2022, compared to US$1.1 million for the second quarter FY2021. The increase was primarily due to the recognition of a non-cash gain on revaluation of our borrowings in the comparative quarter.

Loss after tax for the second quarter FY2022 was US$25.9 million compared to US$25.7 million for the second quarter FY2021.The net loss attributable to ordinary shareholders was 4.00 US cents per share for the second quarter FY2022, compared with 4.38 US cents per share for the second quarter FY2021.

Conference Call

There will be a webcast today, beginning at 5.00pm EST (Thursday, February 24); 9.00am AEDT (Friday, February 25). It can be accessed via: https://webcast.openbriefing.com/8499/

The archived webcast will be available on the Investor page of the Company’s website: www.mesoblast.com

About Mesoblast

Mesoblast is a world leader in developing allogeneic (off-the-shelf) cellular medicines for the treatment of severe and life-threatening inflammatory conditions. The Company has leveraged its proprietary mesenchymal lineage cell therapy technology platform to establish a broad portfolio of late-stage product candidates which respond to severe inflammation by releasing anti-inflammatory factors that counter and modulate multiple effector arms of the immune system, resulting in significant reduction of the damaging inflammatory process.

Mesoblast has a strong and extensive global intellectual property portfolio with protection extending through to at least 2041 in all major markets. The Company’s proprietary manufacturing processes yield industrial-scale, cryopreserved, off-the-shelf, cellular medicines. These cell therapies, with defined pharmaceutical release criteria, are planned to be readily available to patients worldwide.

Mesoblast is developing product candidates for distinct indications based on its remestemcel-L and rexlemestrocel-L stromal cell technology platforms. Remestemcel-L is being developed for inflammatory diseases in children and adults including steroid refractory acute graft versus host disease and moderate to severe acute respiratory distress syndrome. Rexlemestrocel-L is in development for advanced chronic heart failure and chronic low back pain. Two products have been commercialized in Japan and Europe by Mesoblast’s licensees, and the Company has established commercial partnerships in Europe and China for certain Phase 3 assets.

Mesoblast has locations in Australia, the United States and Singapore and is listed on the Australian Securities Exchange (MSB) and on the Nasdaq (MESO). For more information, please see www.mesoblast.com, LinkedIn: Mesoblast Limited and Twitter: @Mesoblast

References / Footnotes

- TEMCELL® HS Inj. is a registered trademark of JCR Pharmaceuticals Co. Ltd.

- Kasikis S., et al. Mesenchymal stromal cell therapy induces high responses and survival in children with steroid refractory GVHD and poor risk. Bone Marrow Transplantation 2021; https://doi.org/10.1038/s41409-021-01442-3

- Mount Sinai Acute GVHD International Consortium (MAGIC) - a group of ten BMT centers throughout the US and Europe whose purpose is to conduct ground-breaking clinical trials in GVHD, including developing informative biorepositories that assist in developing treatments that can guide GVHD therapy

- Lightner A., et al. A Phase IB/IIA study of remestemcel-L, an allogeneic bone marrow derived mesenchymal stem cell product, for the treatment of medically refractory Crohn’s colitis: A preliminary analysis. Journal of Crohn's and Colitis, Volume 16, Issue Supplement_1, January 2022, Pages i412–i413, https://doi.org/10.1093/ecco-jcc/jjab232.555

- Lightner A., et al. A Phase IB/IIA study of remestemcel-L, an allogeneic bone marrow derived mesenchymal stem cell product, for the treatment of medically refractory ulcerative colitis: An interim analysis. Journal of Crohn's and Colitis, Volume 16, Issue Supplement_1, January 2022, Pages i398–i399, https://doi.org/10.1093/ecco-jcc/jjab232.534

- Abreu MT and Sandborn WJ. Defining Endpoints and Biomarkers in Inflammatory Bowel Disease: Moving the Needle Through Clinical Trial Design. Gastroenterology 2020;159:2013–2018

- Daperno M, et al. Development and validation of a new, simplified endoscopic activity score for Crohn’s disease: the SES-CD. Gastrointest Endosc 2004;60:505–512.

- Pathirana GW, et al. Faecal Calprotectin. Clin Biochem Rev. 2018 Aug; 39(3): 77–90.

- Dunlay SM., et al. Circulation. 2019;140:e294–e324

- Wang CCL et al. Circulation 2019; 139: 1741-1743.

- McGuire DK et al. JAMA Cardiol. 2021; 6:148-158.

Forward-Looking Statements

This press release includes forward-looking statements that relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to differ materially from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. We make such forward-looking statements pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. Forward-looking statements should not be read as a guarantee of future performance or results, and actual results may differ from the results anticipated in these forward-looking statements, and the differences may be material and adverse. Forward-looking statements include, but are not limited to, statements about: the initiation, timing, progress and results of Mesoblast’s preclinical and clinical studies, and Mesoblast’s research and development programs; Mesoblast’s ability to advance product candidates into, enroll and successfully complete, clinical studies, including multi-national clinical trials; Mesoblast’s ability to advance its manufacturing capabilities; the timing or likelihood of regulatory filings and approvals (including BLA resubmission), manufacturing activities and product marketing activities, if any; the commercialization of Mesoblast’s product candidates, if approved; regulatory or public perceptions and market acceptance surrounding the use of stem-cell based therapies; the potential for Mesoblast’s product candidates, if any are approved, to be withdrawn from the market due to patient adverse events or deaths; the potential benefits of strategic collaboration agreements and Mesoblast’s ability to enter into and maintain established strategic collaborations; Mesoblast’s ability to establish and maintain intellectual property on its product candidates and Mesoblast’s ability to successfully defend these in cases of alleged infringement; the scope of protection Mesoblast is able to establish and maintain for intellectual property rights covering its product candidates and technology; estimates of Mesoblast’s expenses, future revenues, capital requirements and its needs for additional financing; Mesoblast’s financial performance; developments relating to Mesoblast’s competitors and industry; and the pricing and reimbursement of Mesoblast’s product candidates, if approved. You should read this press release together with our risk factors, in our most recently filed reports with the SEC or on our website. Uncertainties and risks that may cause Mesoblast’s actual results, performance or achievements to be materially different from those which may be expressed or implied by such statements, and accordingly, you should not place undue reliance on these forward-looking statements. We do not undertake any obligations to publicly update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise.

Release authorized by the Chief Executive.

For more information, please contact:

| Corporate Communications / Investors | Media |

| Paul Hughes | Sumit Media |

| T: +61 3 9639 6036 | Grant Titmus |

| E: [email protected] | T: +61 419 388 161 |

| E: [email protected] | |

| Rubenstein | |

| Nadine Woloshin | |

| T: +1 917-699-9456 | |

| E: [email protected] |

Consolidated Income Statement

| Three Months EndedDecember 31, | Six Months EndedDecember 31, | |||||||||||||||

| (in U.S. dollars, in thousands, except per share amount) | 2021 | 2020 | 2021 | 2020 | ||||||||||||

| Revenue | 2,383 | 2,241 | 5,977 | 3,546 | ||||||||||||

| Research & development | (10,198 | ) | (14,238 | ) | (19,526 | ) | (33,516 | ) | ||||||||

| Manufacturing commercialization | (6,590 | ) | (6,450 | ) | (14,127 | ) | (18,374 | ) | ||||||||

| Management and administration | (7,814 | ) | (7,867 | ) | (13,692 | ) | (15,546 | ) | ||||||||

| Fair value remeasurement of contingent consideration | (351 | ) | 1,462 | (71 | ) | 16,569 | ||||||||||

| Fair value remeasurement of warrant liability | 2,152 | — | 2,152 | — | ||||||||||||

| Other operating income and expenses | (227 | ) | 296 | (405 | ) | 395 | ||||||||||

| Finance costs | (5,380 | ) | (1,062 | ) | (9,040 | ) | (3,966 | ) | ||||||||

| Loss before income tax | (26,025 | ) | (25,618 | ) | (48,732 | ) | (50,892 | ) | ||||||||

| Income tax benefit/(expense) | 80 | (74 | ) | 142 | 656 | |||||||||||

| Loss attributable to the owners of Mesoblast Limited | (25,945 | ) | (25,692 | ) | (48,590 | ) | (50,236 | ) | ||||||||

| Losses per share from continuing operations attributable to the ordinary equity holders of the Group: | Cents | Cents | Cents | Cents | ||||||||||||

| Basic - losses per share | (4.00 | ) | (4.38 | ) | (7.50 | ) | (8.60 | ) | ||||||||

| Diluted - losses per share | (4.00 | ) | (4.38 | ) | (7.50 | ) | (8.60 | ) | ||||||||

Consolidated Statement of Comprehensive Income

| Three Months EndedDecember 31, | Six Months EndedDecember 31, | |||||||||||||||

| (in U.S. dollars, in thousands) | 2021 | 2020 | 2021 | 2020 | ||||||||||||

| Loss for the period | (25,945 | ) | (25,692 | ) | (48,590 | ) | (50,236 | ) | ||||||||

| Other comprehensive (loss)/income | ||||||||||||||||

| Items that may be reclassified to profit and loss | ||||||||||||||||

| Exchange differences on translation of foreign operations | 166 | 904 | (183 | ) | 1,312 | |||||||||||

| Items that will not be reclassified to profit and loss | ||||||||||||||||

| Financial assets at fair value through other comprehensive income | 112 | (53 | ) | 266 | 28 | |||||||||||

| Other comprehensive (loss)/income for the period, net of tax | 278 | 851 | 83 | 1,340 | ||||||||||||

| Total comprehensive losses attributable to the owners of Mesoblast Limited | (25,667 | ) | (24,841 | ) | (48,507 | ) | (48,896 | ) | ||||||||

Consolidated Balance Sheet

| As ofDecember 31, | As ofJune 30, | |||||||

| (in U.S. dollars, in thousands) | 2021 | 2021 | ||||||

| Assets | ||||||||

| Current Assets | ||||||||

| Cash & cash equivalents | 94,849 | 136,881 | ||||||

| Trade & other receivables | 6,048 | 4,842 | ||||||

| Prepayments | 7,900 | 6,504 | ||||||

| Total Current Assets | 108,797 | 148,227 | ||||||

| Non-Current Assets | ||||||||

| Property, plant and equipment | 2,470 | 3,021 | ||||||

| Right-of-use assets | 9,033 | 9,119 | ||||||

| Financial assets at fair value through other comprehensive income | 2,347 | 2,080 | ||||||

| Other non-current assets | 1,956 | 1,724 | ||||||

| Intangible assets | 579,836 | 580,546 | ||||||

| Total Non-Current Assets | 595,642 | 596,490 | ||||||

| Total Assets | 704,439 | 744,717 | ||||||

| Liabilities | ||||||||

| Current Liabilities | ||||||||

| Trade and other payables | 20,919 | 19,598 | ||||||

| Provisions | 22,288 | 18,710 | ||||||

| Borrowings | 5,203 | 53,200 | ||||||

| Lease liabilities | 3,489 | 2,765 | ||||||

| Warrant liability | 6,055 | — | ||||||

| Total Current Liabilities | 57,954 | 94,273 | ||||||

| Non-Current Liabilities | ||||||||

| Deferred tax liability | — | — | ||||||

| Provisions | 13,992 | 17,017 | ||||||

| Borrowings | 86,542 | 41,045 | ||||||

| Lease liabilities | 7,942 | 8,485 | ||||||

| Deferred consideration | 2,500 | 2,500 | ||||||

| Total Non-Current Liabilities | 110,976 | 69,047 | ||||||

| Total Liabilities | 168,930 | 163,320 | ||||||

| Net Assets | 535,509 | 581,397 | ||||||

| Equity | ||||||||

| Issued Capital | 1,163,586 | 1,163,153 | ||||||

| Reserves | 68,082 | 65,813 | ||||||

| (Accumulated losses)/retained earnings | (696,159 | ) | (647,569 | ) | ||||

| Total Equity | 535,509 | 581,397 | ||||||

Consolidated Statement of Cash Flows

| Six Months EndedDecember 31, | ||||||||

| (in U.S. dollars, in thousands) | 2021 | 2020 | ||||||

| Cash flows from operating activities | ||||||||

| Commercialization revenue received | 5,531 | 1,972 | ||||||

| Government grants and tax incentives received | 24 | 17 | ||||||

| Payments to suppliers and employees (inclusive of goods and services tax) | (41,977 | ) | (59,357 | ) | ||||

| Interest received | 4 | 16 | ||||||

| Income taxes paid | — | (6 | ) | |||||

| Net cash (outflows) in operating activities | (36,418 | ) | (57,358 | ) | ||||

| Cash flows from investing activities | ||||||||

| Investment in fixed assets | (103 | ) | (488 | ) | ||||

| Payments for intellectual property | (26 | ) | — | |||||

| Net cash (outflows) in investing activities | (129 | ) | (488 | ) | ||||

| Cash flows from financing activities | ||||||||

| Proceeds from borrowings | 51,919 | — | ||||||

| Repayment of borrowings | (55,458 | ) | — | |||||

| Payment of transaction costs from borrowings | (5,453 | ) | — | |||||

| Interest and other costs of finance paid | (2,951 | ) | (2,771 | ) | ||||

| Proceeds from issue of shares | 209 | 9,565 | ||||||

| Proceeds from issue of warrants | 8,081 | — | ||||||

| Payments for share issue costs | (216 | ) | (905 | ) | ||||

| Payments for lease liabilities | (1,214 | ) | (1,480 | ) | ||||

| Net cash inflows/(outflows) by financing activities | (5,083 | ) | 4,409 | |||||

| Net decrease in cash and cash equivalents | (41,630 | ) | (53,437 | ) | ||||

| Cash and cash equivalents at beginning of period | 136,881 | 129,328 | ||||||

| FX gain/(losses) on the translation of foreign bank accounts | (402 | ) | 1,637 | |||||

| Cash and cash equivalents at end of period | 94,849 | 77,528 | ||||||

| Three Months EndedDecember 31, | ||||||||

| (in U.S. dollars, in thousands) | 2021 | 2020 | ||||||

| Cash flows from operating activities | ||||||||

| Commercialization revenue received | 3,536 | 1,290 | ||||||

| Government grants and tax incentives received | — | — | ||||||

| Payments to suppliers and employees (inclusive of goods and services tax) | (21,755 | ) | (31,873 | ) | ||||

| Interest received | — | 3 | ||||||

| Income taxes paid | — | — | ||||||

| Net cash (outflows) in operating activities | (18,219 | ) | (30,580 | ) | ||||

| Cash flows from investing activities | ||||||||

| Investment in fixed assets | (4 | ) | (407 | ) | ||||

| Payments for intellectual property | (26 | ) | — | |||||

| Net cash (outflows) in investing activities | (30 | ) | (407 | ) | ||||

| Cash flows from financing activities | ||||||||

| Proceeds from borrowings | 51,919 | — | ||||||

| Repayment of borrowings | (55,458 | ) | — | |||||

| Payment of transaction costs from borrowings | (5,353 | ) | — | |||||

| Interest and other costs of finance paid | (1,544 | ) | (1,382 | ) | ||||

| Proceeds from issue of shares | 62 | 1,431 | ||||||

| Proceeds from issue of warrants | 8,081 | — | ||||||

| Payments for share issue costs | (112 | ) | (8 | ) | ||||

| Payments for lease liabilities | (528 | ) | (785 | ) | ||||

| Net cash inflows/(outflows) by financing activities | (2,933 | ) | (744 | ) | ||||

| Net decrease in cash and cash equivalents | (21,182 | ) | (31,731 | ) | ||||

| Cash and cash equivalents at beginning of period (October 1) | 115,956 | 108,123 | ||||||

| FX gain/(losses) on the translation of foreign bank accounts | 75 | 1,136 | ||||||

| Cash and cash equivalents at end of period | 94,849 | 77,528 | ||||||

Source: Mesoblast Limited

Source: Mesoblast Limited

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Scorpius Holdings (SCPX) Receives Nasdaq Filing Delinquency Notification

- SPI Energy (SPI) Receives Nasdaq Non-compliance Notice

- PENN Entertainment (PENN) Names Aaron LaBerge Chief Technology Officer

Create E-mail Alert Related Categories

Globe Newswire, Press ReleasesRelated Entities

Twitter, Earnings, FDASign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share