Marathon Gold Reports Latest Berry Infill Drill Results

Results include 4.16 g/t Au over 11m, 2.51 g/t Au over 13m, 7.64 g/t Au over 4m, 1.24 g/t Au over 24m, 1.99 g/t Au over 11m

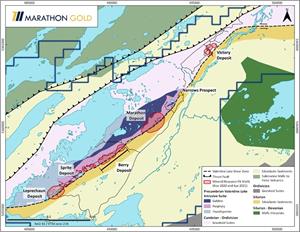

TORONTO, Sept. 28, 2021 (GLOBE NEWSWIRE) -- Marathon Gold Corporation (“Marathon” or the “Company”; TSX: MOZ) is pleased to report the latest drill assay results from the Valentine Gold Project in central Newfoundland (the ‘Project”; Figure 1). These latest results represent fire assay data from fifteen diamond drill holes completed as part of the ongoing in-fill drill campaign at the 1.5 kilometre long Berry Deposit. Highlights include:

- VL-21-1040 intersected 10.86 g/t Au over 2 metres, and 9.33 g/t Au over 2 metres including 12.33 g/t Au over 1 metre, and 7.67 g/t Au over 2 metres including 13.29 g/t Au over 1 metre, and 7.18 g/t Au over 2 metres including 12.92 g/t Au over 1 metre;

- VL-21-1042 intersected 4.16 g/t Au over 11 metres including 20.93 g/t Au over 1 metre and including 19.07 g/t Au over 1 metre;

- VL-21-1052 intersected 2.51 g/t Au over 13 metres including 25.33 g/t Au over 1 metre, and 1.03 g/t Au over 12 metres;

- VL-21-1050 intersected 7.64 g/t Au over 4 metres including 27.59 over 1 metre, and 1.24 g/t Au over 24 metres;

- VL-21-1041 intersected 1.99 g/t Au over 11 metres, and 0.90 g/t Au over 18 metres; and

- VL-21-1047 intersected 1.35 g/t Au over 14 metres;

All quoted intersections comprise uncut gold assays in core lengths. All significant assay intervals are reported in Table 1.

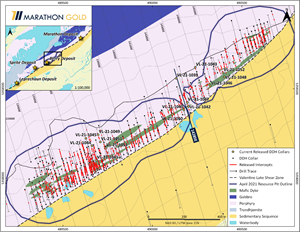

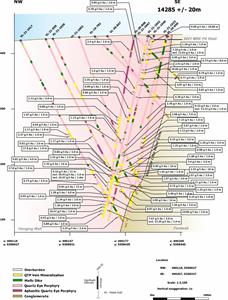

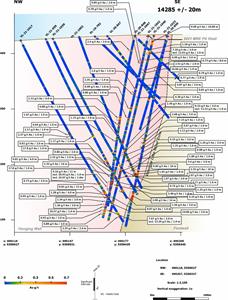

Matt Manson, President and CEO, commented: “These latest drill results represent further in-fill drilling at Berry in two areas where positive results offer us the potential to expand the overall scope of the deposit. These are the hanging-wall area in the western portion of the Berry Deposit and the “saddle area” between the two conceptual pit shells used in the April 2021 Mineral Resource Estimate. The western hanging-wall area continues to reward us with strong intercepts of resource grade material and is bulking-up well, as illustrated in plan view in Figure 2 and in the long-section in Figure 3. The “saddle area” is showing mineralization at greater depths, within the scope of a large single pit shell for the whole deposit, as illustrated in the long-section view and in the cross sections of Figures 4 and 5.” Matt Manson continued: “We currently have four diamond drill rigs operating at Valentine as part of our 2021 exploration program: one rig at the Berry Deposit, two rigs at the Victory Deposit, and one rig at the Sprite Deposit. Of note, drilling at Victory has revealed strong areas of mineralization in previously untested areas adjacent to the Valentine Lake Shear Zone, with visible gold. We expect to be reporting results from our exploration drill programs on a regular basis through to the end of the year.”

Gold mineralization at the Valentine Gold Project is contained predominantly within shallowly southwest dipping, en-echelon stacked Quartz-Tourmaline-Pyrite-Gold (“QTP-Au”) veins. At the Leprechaun, Marathon and Berry Deposits, these QTP-Au veins form densely stacked and northwest plunging “Main Zone” envelopes within intrusive host rocks on the hanging wall (northwest) side of the Valentine Lake Shear Zone (“VLSZ”; Figure 1). The extent of mineralization appears related to the size and frequency of sheared mafic dykes which extend northeast-southwest within the hanging wall, parallel to the shear zone.

Figure 1: Location Map, Valentine Gold Projecthttps://www.globenewswire.com/NewsRoom/AttachmentNg/4ec5b3ee-9b60-4285-9e45-8fd4c9ca2df0

The results released today are derived from six drillholes located on sections 13700E and 13800E at the western end of the Berry Deposit, and nine drillholes located between sections 14300E and 14540E, close to, or within, the connecting “saddle area” between the two conceptual pit shells utilized in the April 2021 Berry Mineral Resource Estimate (Figure 2).

Three of the fifteen holes were oriented on a southeast azimuth towards the footwall contact with the VLSZ to test for mineralization at progressive distances into the Berry Deposit’s hanging-wall rocks (VL-21-1039, 1043, 1045). Twelve of the fifteen holes were oriented steeply down to the northwest testing for Main Zone type stacked QTP-Au mineralization, either close to the VLSZ (VL-21-1040, 1042, 1046, 1048) or within the hanging-wall (VL-21-1041, 1044, 1047, 1049, 1050, 1051, 1052, 1053).

Thirteen of the fifteen drill holes returned “significant” drill intercepts of greater than 0.7 g/t Au (Table 1), and all but one of the fifteen returned additional intercepts with gold grades above the 0.3 g/t Au cut-off used in the April 2021 Berry Mineral Resource Estimate.

Figure 2: Location of Berry Deposit Exploration Drill Hole Collars VL-21-1039 to VL-21-1053https://www.globenewswire.com/NewsRoom/AttachmentNg/ffc8b3a7-f246-43f2-9be5-d3a077a8d779

Figure 3: Long Section of the Berry Deposit (View NW) Incorporating 84,448 meters of Drilling up to and Including VL-21-1053 and Assays Above 0.3 g/t Au.https://www.globenewswire.com/NewsRoom/AttachmentNg/8a4e0ae5-c34f-4670-a9fe-99d31e17cfbb

Table 1: Significant Assay Intervals from Drill Hole Collars VL-21-1039 to VL-21-1053, Berry Deposit, Valentine Gold Project

| DDH | Section | Az | Dip | From | To | Core Length (m) | True Thickness (m) | Gold g/t | Gold g/t (cut) |

| VL-21-1039 | 14280E | 164 | -65 | 266 | 267 | 1 | 0.85 | 0.71 | |

| 301 | 302 | 1 | 0.85 | 0.74 | |||||

| VL-21-1040 | 14300E | 345 | -76 | 7.11 | 18 | 10.89 | 9.80 | 0.99 | |

| 25 | 26 | 1 | 0.90 | 1.18 | |||||

| 30 | 32 | 2 | 1.80 | 7.18 | |||||

| Including | 30 | 31 | 1 | 0.90 | 12.92 | ||||

| 43 | 46 | 3 | 2.70 | 4.09 | |||||

| 63 | 65 | 2 | 1.80 | 2.51 | |||||

| 72 | 73 | 1 | 0.90 | 10.66 | |||||

| 102 | 103 | 1 | 0.90 | 0.77 | |||||

| 131 | 133 | 2 | 1.80 | 4.87 | |||||

| 160 | 162 | 2 | 1.80 | 4.20 | |||||

| 213 | 215 | 2 | 1.80 | 9.33 | |||||

| Including | 214 | 215 | 1 | 0.90 | 12.33 | ||||

| 221 | 224 | 3 | 1.80 | 4.33 | |||||

| 248 | 258 | 10 | 9.00 | 0.85 | |||||

| 263 | 266 | 3 | 2.70 | 2.07 | |||||

| 270 | 271 | 1 | 0.90 | 1.25 | |||||

| 277 | 278 | 1 | 0.90 | 3.48 | |||||

| 300 | 301 | 1 | 0.90 | 8.87 | |||||

| 306 | 308 | 2 | 1.80 | 10.86 | |||||

| 324 | 326 | 2 | 1.80 | 7.67 | |||||

| Including | 324 | 325 | 1 | 0.90 | 13.29 | ||||

| VL-21-1041 | 13720E | 345 | -77 | 38 | 40 | 2 | 1.80 | 4.37 | |

| 51 | 52 | 1 | 0.90 | 3.76 | |||||

| 60 | 64 | 4 | 3.60 | 1.37 | |||||

| 80 | 91 | 11 | 9.90 | 1.99 | |||||

| 98 | 100 | 2 | 1.80 | 0.76 | |||||

| 114 | 115 | 1 | 0.90 | 9.60 | |||||

| 124 | 126 | 2 | 1.80 | 2.69 | |||||

| 148 | 150 | 2 | 1.80 | 0.77 | |||||

| 174 | 175 | 1 | 0.90 | 0.77 | |||||

| 204 | 222 | 18 | 16.20 | 0.90 | |||||

| 233 | 235 | 2 | 1.80 | 0.82 | |||||

| 261 | 262 | 1 | 0.90 | 3.95 | |||||

| 267 | 268 | 1 | 0.90 | 0.94 | |||||

| 277 | 282 | 5 | 4.50 | 0.87 | |||||

| 294 | 299 | 5 | 4.50 | 3.74 | |||||

| VL-21-1042 | 14300E | 341 | -77 | 46 | 48 | 2 | 1.80 | 0.85 | |

| 50 | 51 | 1 | 0.90 | 0.78 | |||||

| 104 | 105 | 1 | 0.90 | 1.60 | |||||

| 108 | 109 | 1 | 0.90 | 2.35 | |||||

| 134 | 135 | 1 | 0.90 | 0.99 | |||||

| 151 | 152 | 1 | 0.90 | 0.86 | |||||

| 192 | 199 | 7 | 6.30 | 1.15 | |||||

| 249 | 251 | 2 | 1.80 | 0.86 | |||||

| 257 | 261 | 4 | 3.60 | 0.81 | |||||

| 268 | 279 | 11 | 9.90 | 4.16 | |||||

| Including | 270 | 271 | 1 | 0.90 | 20.93 | ||||

| Including | 278 | 279 | 1 | 0.90 | 19.07 | ||||

| 284 | 288 | 4 | 3.60 | 1.28 | |||||

| 295 | 297 | 2 | 1.80 | 1.34 | |||||

| 313 | 315 | 2 | 1.80 | 1.20 | |||||

| 318 | 319 | 1 | 0.90 | 10.57 | |||||

| 324 | 326 | 2 | 1.80 | 0.93 | |||||

| 330 | 332 | 2 | 1.80 | 0.88 | |||||

| VL-21-1043 | 14400E | 166 | -70 | 28 | 29 | 1 | 0.85 | 2.53 | |

| 132 | 133 | 1 | 0.85 | 2.61 | |||||

| 140 | 141 | 1 | 0.85 | 3.16 | |||||

| 148 | 149 | 1 | 0.85 | 0.70 | |||||

| 288 | 290 | 2 | 1.70 | 1.49 | |||||

| 327 | 330 | 3 | 2.55 | 1.61 | |||||

| VL-21-1044 | 13720E | 345 | -75 | 103 | 107 | 4 | 3.60 | 0.71 | |

| 139 | 140 | 1 | 0.90 | 6.59 | |||||

| 212 | 214 | 2 | 1.80 | 2.07 | |||||

| 220 | 222 | 2 | 1.80 | 0.97 | |||||

| VL-21-1045 | 13700E | 167 | -70 | 170 | 171 | 1 | 0.85 | 1.49 | |

| 217 | 218 | 1 | 0.85 | 0.89 | |||||

| 223 | 228 | 5 | 4.25 | 2.29 | |||||

| 249 | 250 | 1 | 0.85 | 1.75 | |||||

| 259 | 260 | 1 | 0.85 | 1.35 | |||||

| 275 | 276 | 1 | 0.85 | 3.24 | |||||

| 302 | 303 | 1 | 0.85 | 4.89 | |||||

| 328 | 329 | 1 | 0.85 | 3.15 | |||||

| 353 | 355 | 2 | 1.70 | 7.64 | |||||

| VL-21-1046 | 14450E | 338 | -77 | 56 | 57 | 1 | 0.90 | 4.67 | |

| 59 | 60 | 1 | 0.90 | 1.89 | |||||

| 107 | 108 | 1 | 0.90 | 0.73 | |||||

| 118 | 120 | 2 | 1.80 | 1.70 | |||||

| 154 | 156 | 2 | 1.80 | 3.53 | |||||

| 172 | 176 | 4 | 3.60 | 3.21 | |||||

| 174 | 175 | 1 | 0.90 | 11.16 | |||||

| 196 | 197 | 1 | 0.90 | 8.07 | |||||

| 214 | 217 | 3 | 2.70 | 0.97 | |||||

| 223 | 224 | 1 | 0.90 | 1.91 | |||||

| VL-21-1047 | 14270E | 342 | -77 | 26 | 28 | 2 | 1.80 | 2.40 | |

| 149 | 155 | 6 | 5.40 | 1.12 | |||||

| 161 | 162 | 1 | 0.90 | 0.88 | |||||

| 176 | 177 | 1 | 0.90 | 1.47 | |||||

| 192 | 193 | 1 | 0.90 | 6.64 | |||||

| 247 | 248 | 1 | 0.90 | 2.32 | |||||

| 267 | 281 | 14 | 12.60 | 1.35 | |||||

| 295 | 296 | 1 | 0.90 | 0.95 | |||||

| VL-21-1048 | 14540E | 346 | -77 | 110 | 111 | 1 | 0.90 | 7.37 | |

| 273 | 274 | 1 | 0.90 | 5.27 | |||||

| VL-21-1050 | 14200E | 343 | -81 | 17 | 18 | 1 | 0.95 | 1.51 | |

| 27 | 30 | 3 | 2.85 | 1.04 | |||||

| 43 | 44 | 1 | 0.95 | 4.59 | |||||

| 52 | 58 | 6 | 5.70 | 1.76 | |||||

| 71 | 75 | 4 | 3.80 | 2.00 | |||||

| 82 | 83 | 1 | 0.95 | 3.03 | |||||

| 85 | 89 | 4 | 3.80 | 7.64 | |||||

| Including | 86 | 87 | 1 | 0.95 | 27.59 | ||||

| 124 | 125 | 1 | 0.95 | 0.95 | |||||

| 141 | 146 | 5 | 4.75 | 0.72 | |||||

| 160 | 161 | 1 | 0.95 | 3.56 | |||||

| 202 | 203 | 1 | 0.95 | 1.96 | |||||

| 212 | 236 | 24 | 22.80 | 1.24 | |||||

| 261 | 262 | 1 | 0.95 | 0.92 | |||||

| 288 | 289 | 1 | 0.95 | 1.84 | |||||

| 292 | 294 | 2 | 1.90 | 0.76 | |||||

| 310 | 319 | 9 | 8.55 | 1.05 | |||||

| 324 | 325 | 1 | 0.95 | 1.19 | |||||

| 328 | 330 | 2 | 1.90 | 0.90 | |||||

| VL-21-1051 | 13770E | 347 | -77 | 86 | 89 | 3 | 2.85 | 1.14 | |

| 108 | 114 | 6 | 5.70 | 0.83 | |||||

| 134 | 138 | 4 | 3.80 | 0.84 | |||||

| 230 | 231 | 1 | 0.95 | 1.16 | |||||

| VL-21-1052 | 14540E | 346 | -77 | 25 | 26 | 1 | 0.90 | 1.20 | |

| 35 | 38 | 3 | 2.70 | 1.42 | |||||

| 94 | 106 | 12 | 10.80 | 1.03 | |||||

| 111 | 124 | 13 | 11.70 | 2.51 | |||||

| Including | 122 | 123 | 1 | 0.90 | 25.33 | ||||

| 143 | 150 | 7 | 6.30 | 0.91 | |||||

| 172 | 175 | 3 | 2.70 | 0.96 | |||||

| 248 | 249 | 1 | 0.90 | 0.95 | |||||

| 264 | 265 | 1 | 0.90 | 1.75 |

Notes on the Calculation of Assay Intervals

- “Significant” assay intervals are defined as 1m core length or more of mineralization with an average fire assay result of greater than 0.7 g/t Au, representing the bottom cut-off for high-grade mill feed in the Marathon April 2021 Feasibility Study mine plan. Assay intervals with an average fire assay result of between 0.3 g/t Au and 0.7 g/t Au are above the cut-off used in the April 2021 Mineral Resource Estimate for the Berry Deposit but are not considered “significant” for the purposes of this news release.

- Cut gold grades are calculated at 30 g/t Au.

- No significant assays were returned in drill holes VL-21-1049 and VL-21-1053

Figure 4: Cross Section 14285E (View NE) with Significant (>0.7 g/t Au) Intercepts, Berry Deposit, Valentine Gold Project.https://www.globenewswire.com/NewsRoom/AttachmentNg/6abe8c49-0def-4eb0-a2ee-92d9a00aaa2f

Figure 5: Cross Section 14285E (View NE) with all Fire Assay Data, Berry Deposit, Valentine Gold Project.https://www.globenewswire.com/NewsRoom/AttachmentNg/aef95d38-006a-4df8-97d4-db5fe602be5b

Qualified Person

Disclosure of a scientific or technical nature in this news release was prepared under the supervision of Nicholas Capps, P.Geo. (NL), Manager of Exploration for Marathon Gold Corporation. Exploration data quality assurance and control for Marathon is under the supervision of Jessica Borysenko, P.Geo (NL), GIS Manager for Marathon Gold Corporation. Both Mr. Capps and Ms. Borysenko are qualified persons under National Instrument (“NI”) 43-101.

Quality Assurance-Quality Control (“QA/QC”)

QA/QC protocols followed at the Valentine Gold Project include the insertion of blanks and standards at regular intervals in each sample batch. Drill core is cut in half with one half retained at site, the other half tagged and sent to Eastern Analytical Limited in Springdale, NL. All reported core samples are analyzed for Au by fire assay (30g) with AA finish. All samples above 0.30 g/t Au in economically interesting intervals are further assayed using metallic screen to mitigate the presence of coarse gold. Significant mineralized intervals are reported in Table 1 as core lengths and estimated true thickness (70 - 95% of core length), and reported with and without a top-cut of 30 g/t Au applied.

For more information, please contact:

| Matt MansonPresident & CEOTel: 416 987-0711[email protected] | Hannes PortmannCFO & Business DevelopmentTel: 416 855-8200[email protected] | Amanda MalloughSenior Associate, Investor RelationsTel: 416 855-8202[email protected] |

To find out more information on Marathon Gold Corporation and the Valentine Gold Project, please visit www.marathon-gold.com.

Cautionary Statement Regarding Forward-Looking Information

Certain information contained in this news release, constitutes forward-looking information within the meaning of Canadian securities laws (“forward-looking statements”). All statements in this news release, other than statements of historical fact, which address events, results, outcomes or developments that Marathon expects to occur are forward-looking statements. Forward-looking statements include statements that are predictive in nature, depend upon or refer to future events or conditions, or include words such as “expects”, “anticipates”, “plans”, “believes”, “estimates”, “considers”, “intends”, “targets”, or negative versions thereof and other similar expressions, or future or conditional verbs such as “may”, “will”, “should”, “would” and “could”. We provide forward-looking statements for the purpose of conveying information about our current expectations and plans relating to the future, and readers are cautioned that such statements may not be appropriate for other purposes. More particularly and without restriction, this news release contains forward-looking statements and information about the FS and the results therefrom (including IRR, NPV5%, Capex, FCF, AISC and other financial metrics), the realization of mineral reserve and mineral resource estimates, the future financial or operating performance of the Company and the Project, capital and operating costs, the ability of the Company to obtain all government approvals, permits and third-party consents in connection with the Company’s exploration, development and operating activities, the potential impact of COVID-19 on the Company, the Company’s ability to successfully advance the Project and anticipated benefits thereof, economic analyses for the Valentine Gold Project, processing and recovery estimates and strategies, future exploration and mine plans, objectives and expectations and corporate planning of Marathon, future environmental impact statements and the timetable for completion and content thereof and statements as to management's expectations with respect to, among other things, the matters and activities contemplated in this news release.

Forward-looking statements involve known and unknown risks, uncertainties and assumptions and accordingly, actual results and future events could differ materially from those expressed or implied in such statements. You are hence cautioned not to place undue reliance on forward-looking statements. In respect of the forward-looking statements concerning the interpretation of exploration results and the impact on the Project’s mineral resource estimate, the Company has provided such statements in reliance on certain assumptions it believes are reasonable at this time, including assumptions as to the continuity of mineralization between drill holes. A mineral resource that is classified as “inferred” or “indicated” has a great amount of uncertainty as to its existence and economic and legal feasibility. It cannot be assumed that any or part of an “indicated mineral resource” or “inferred mineral resource” will ever be upgraded to a higher category of mineral resource. Investors are cautioned not to assume that all or any part of mineral deposits in these categories will ever be converted into proven and probable mineral reserves.

By its nature, this information is subject to inherent risks and uncertainties that may be general or specific and which give rise to the possibility that expectations, forecasts, predictions, projections or conclusions will not prove to be accurate, that assumptions may not be correct and that objectives, strategic goals and priorities will not be achieved. Factors that could cause future results or events to differ materially from current expectations expressed or implied by the forward-looking statements include risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits and conclusions of economic evaluations; uncertainty as to estimation of mineral resources; inaccurate geological and metallurgical assumptions (including with respect to the size, grade and recoverability of mineral resources); the potential for delays or changes in plans in exploration or development projects or capital expenditures, or the completion of feasibility studies due to changes in logistical, technical or other factors; the possibility that future exploration, development, construction or mining results will not be consistent with the Company’s expectations; risks related to the ability of the current exploration program to identify and expand mineral resources; risks relating to possible variations in grade, planned mining dilution and ore loss, or recovery rates and changes in project parameters as plans continue to be refined; operational mining and development risks, including risks related to accidents, equipment breakdowns, labour disputes (including work stoppages and strikes) or other unanticipated difficulties with or interruptions in exploration and development; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; risks related to commodity and power prices, foreign exchange rate fluctuations and changes in interest rates; the uncertainty of profitability based upon the cyclical nature of the mining industry; risks related to failure to obtain adequate financing on a timely basis and on acceptable terms or delays in obtaining governmental or other stakeholder approvals or in the completion of development or construction activities; risks related to environmental regulation and liability, government regulation and permitting; risks relating to the Company’s ability to attract and retain skilled staff; risks relating to the timing of the receipt of regulatory and governmental approvals for continued operations and future development projects; political and regulatory risks associated with mining and exploration; risks relating to the potential impacts of the COVID-19 pandemic on the Company and the mining industry; changes in general economic conditions or conditions in the financial markets; and other risks described in Marathon’s documents filed with Canadian securities regulatory authorities, including the Annual Information Form for the year ended December 31, 2020.

You can find further information with respect to these and other risks in Marathon’s Amended and Restated Annual Information Form for the year ended December 31, 2020 and other filings made with Canadian securities regulatory authorities available at www.sedar.com. Other than as specifically required by law, Marathon undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made, or to reflect the occurrence of unanticipated events, whether as a result of new information, future events or results otherwise.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Kona Coin Airdrop Ending Shortly - Claim Your Tokens Today

- Hannover Messe 2024: Shanghai Electric Debuts Advanced Industrial Solutions with Its Integrated Energy Equipment Solution

- Interim Report for the period 1 January – 31 March 2024

Create E-mail Alert Related Categories

Globe Newswire, Press ReleasesSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share