Majority of Working Americans are Optimistic About Their Financial Future, Even While Lacking Savings

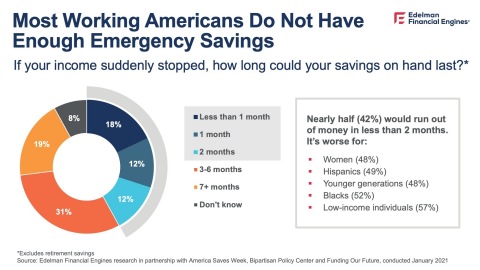

SANTA CLARA, Calif.--(BUSINESS WIRE)-- New polling released today finds more than half (58%) of working Americans believe their financial situation will be better in the future. Younger (69%), Black (75%) and Hispanic (69%) workers are the most optimistic, despite the fact that half (49%, 52% and 49%, respectively) report having two months or less of spending in savings on hand.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210223005969/en/

Source: Edelman Financial Engines research in partnership with America Saves Week, Bipartisan Policy Center and Funding Our Future, Conducted January 2021

This new research, conducted by Edelman Financial Engines, the nation’s top independent financial planning and investment management firm1, in partnership with Funding Our Future, the Bipartisan Policy Center and America Saves, revealed a surprising level of optimism among many working Americans that is disconnected from their present state of financial insecurity.

“It’s encouraging that people are optimistic, but if 2020 has shown us anything, it is that we must be prepared for sudden job loss and unexpected medical expenses,” said Ric Edelman, founder of Edelman Financial Engines. “More Americans need to increase their emergency savings to fulfill their optimism.”

Those with lower incomes are particularly vulnerable. Nearly half (43%) of those with household incomes less than $50,000 report having no money set aside for an emergency. Similarly, when households in this range were asked how they would cover a $400 unexpected expense, only 41% say they would pay it in cash or pay it off on their next credit card statement; the rest would resort to borrowing, debt, or raiding their retirement savings, and 1 in 5 (19%) say they would be entirely unable to come up with the money. In contrast, nearly a third (29%) of households earning more than $100,000 could pay their bills for 12 months or more, even if they lost their jobs.

“The K-shaped economic recovery is allowing many Americans to thrive while others are hurting more than ever,” said Kara Watkins, campaign manager at Funding Our Future. “Millions of those who are struggling are also less likely to have access to a financial advisor to help them.”

In 2020, 1 in 8 workers (13%) say they took out a payday loan, while 1 in 5 (21%) of those with access to a workplace retirement account report having borrowed or withdrawn money. More than 1 in 3 (35%) Millennials say they sought financial help from family or friends in 2020.

“We advocate for workers to have at least $500 set aside in an emergency fund to protect them from a financial setback,” said George Barany, Director of America Saves. “While this can seem daunting for those just getting started, initiatives such as our ‘Split to Save’ program encourage people to automatically set aside a portion of each paycheck toward a savings goal, including an emergency fund.”

In addition to automated savings programs such as Split to Save, innovative companies are providing comprehensive financial wellness programs as an employee benefit to help address critical areas of need that extend beyond saving for retirement.

The research can be viewed here.

Methodology

This poll was conducted between January 22-January 25, 2021, among a national sample of 1,599 adults employed currently or in January 2020 in the United States. The interviews were conducted online among a national audience and results from the full survey have a margin of error of plus or minus 2 percentage points.

About Edelman Financial Engines

Since 1986, Edelman Financial Engines has been committed to always acting in the best interest of our clients. Today, we are America's top independent financial planning and investment advisor1 with 150+ offices across the country and entrusted by more than 1.3 million clients to manage more than $260 billion in assets.2 Our unique approach to serving clients combines our advanced methodology and proprietary technology with the attention of a dedicated personal financial planner. Every client's situation and goals are unique, and the powerful fusion of high-tech and high-touch allows Edelman Financial Engines to deliver the personal plan and financial confidence that everyone deserves.

About Funding Our Future

The first group of its kind, the Funding Our Future initiative is a bipartisan and cross-sector coalition of over 40 organizations working towards retirement security for all Americans. Funding Our Future was launched in 2018 by the Bipartisan Policy Center and Edelman Financial Engines, and today has representation from the academic and nonprofit, trade association, and corporate sectors, showcasing the broad base of support this issue has and requires across the country. Our initiative lifts up partner research and reports, co-hosts events, and educates the public and policymakers about these critical issues. For more information, visit www.fundingourfuture.us.

About The Bipartisan Policy Center

The Bipartisan Policy Center is a Washington, DC-based think tank that actively fosters bipartisanship by combining the best ideas from both parties to promote health, security, and opportunity for all Americans. Our policy solutions are the product of informed deliberations by former elected and appointed officials, business and labor leaders, and academics and advocates who represent both sides of the political spectrum. BPC prioritizes one thing above all else: getting things done. Visit BPC online at bipartisanpolicy.org.

About America Saves

America Saves is a campaign managed by the nonprofit Consumer Federation of America that uses the principles of behavioral economics and social marketing to motivate, encourage, and support low- to moderate-income households to save money, reduce debt, and build wealth. America Saves encourages individuals and families to take the America Saves pledge and organizations to promote savings year-round and during America Saves Week. Learn more at americasaves.org and americasavesweek.org.

1 The 2020 America’s Best RIA Firms Independent Advisory Firm Ranking issued by Barron’s is qualitative and quantitative, including assets managed, technology spending, staff diversity, succession planning, the size and experience of teams, and the regulatory records of the advisors and firms. Firms elect to participate but do not pay to be included in the ranking. Investor experience and returns are not considered.

2 Data as of 12/31/2021.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210223005969/en/

Elise Lapham

Edelman Financial Engines

[email protected]

Source: Edelman Financial Engines

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Formlabs Launches Form 4, The Fastest, Most Reliable 3D Printer for Prototyping through Production

- Serve Robotics Inc. Announces Pricing of $40 Million Public Offering and Uplisting to the Nasdaq Capital Market Under New Ticker "SERV"

- NILIT Announces Strategic Expansions, Including a Joint Venture with Shenma in China

Create E-mail Alert Related Categories

Business Wire, Press ReleasesRelated Entities

Barron'sSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share