Land & Buildings Issues Letter Detailing Brookdale Senior Living’s History of Underperformance

Get Alerts BKD Hot Sheet

Join SI Premium – FREE

– Highlights Persistent Operational Failures, Poor Capital Allocation and Balance Sheet Mismanagement at Brookdale –

– Views Brookdale’s Pattern of Missed and Lowered Guidance as Indicative of Company’s Squandered Credibility with Investors –

– Believes a Failure of Oversight and a Track Record of Poor Decision-Making by the Board is Directly Responsible for Brookdale’s Abysmal TSR and Inability to Reverse a Multi-Year Tide of Value Destruction –

– Believes Real Change on the Board is Desperately Needed to Reverse Years of Underperformance and Unlock Value for the Benefit of All Brookdale Shareholders –

– Nominates Two Highly Qualified Executives Jay Flaherty and Jon Litt for Election at Upcoming Annual Meeting –

STAMFORD, Conn.--(BUSINESS WIRE)-- Today Land and Buildings Investment Management LLC (“Land & Buildings”) issued the following open letter to shareholders of Brookdale Senior Living Inc. (NYSE: BKD) (“Brookdale” or the “Company”):

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190730005614/en/

(Graphic: Business Wire)

Dear Fellow Brookdale Shareholders:

For nearly three years, we have sought to work constructively with the Board of Directors (the “Board”) and management of Brookdale to help unlock the opportunities that we believe are available to drive substantial value for all Brookdale shareholders. As a result, we have repeatedly given Brookdale the benefit of the doubt and have been willing to accept incremental change accompanied by repeated promises that a new day for shareholders was just over the horizon.

However, we have reached a point where the facts are simply too overwhelming to ignore: the current Board and management team have abjectly failed to reverse the Company’s track record of alarming operational underperformance and poor shareholder returns. We can no longer stand idly by while shareholder value is destroyed, and the Company continues to window dress the real issues facing Brookdale.

Meaningful change is clearly – and urgently – needed. That is why we have nominated two highly qualified and experienced director candidates, Jay Flaherty and Jonathan Litt, for election to the Board at the Company’s 2019 Annual Meeting of Shareholders (the “Annual Meeting”).

Today, we would like to take the opportunity to highlight Brookdale’s history of stark operational underperformance, squandered credibility and poor capital allocation and balance sheet management – all of which have contributed to the Company’s unacceptable total shareholder return (TSR) underperformance compared to its peers.

Importantly, this sustained underperformance is not an aberration or a trend that can be blamed on external market conditions. It is the result of consistently poor decision-making and a failure of oversight that we believe is symptomatic of a deeply under-qualified and out of touch Board. And we are past the point where it is prudent to trust the patients to adequately perform surgery on themselves.

Substantial Operational Underperformance

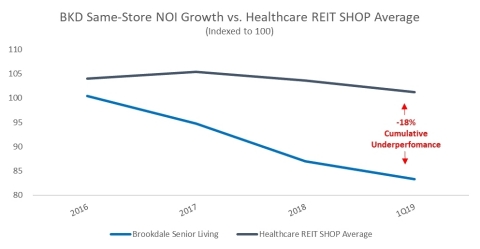

In recent years, the Company has underperformed its Healthcare REIT peers’i senior housing operating portfolios (“SHOP”) on nearly all relevant metrics, including:

- Same-store net operating income (NOI) growth

- Same-store occupancy

- Same-store RevPOR (rate) growth

Brookdale’s operations have significantly trailed the senior housing operating portfolios of its Healthcare REIT peers, leading to same-store NOI growth underperformance of -18% on a compound basis 2016 – 1Q19. Had the Company simply performed in-line with the Healthcare REIT peers, our estimated net asset value for Brookdale would be more than 50% higher. This upside potential is substantial, and we believe further change is needed at the Company to ensure it is recaptured, including new directors that have the experience and expertise necessary to identify and execute upon the right solutions to help reverse this trend of underperformance.

The Company’s historical operational underperformance is clearly displayed by its consistent lower level of same-store senior housing occupancy relative to the Healthcare REIT SHOP portfolios. Quarter-by-quarter, Brookdale has experienced lower occupancy than the Healthcare REIT peer average and has failed to close the gap in any meaningful way. The Company states that a 1% increase in occupancy is $20 million in additional operating margin.

Brookdale’s lower levels of occupancy have not been compensated for with stronger rate growth (revenue per occupied room). The Company has materially underperformed the Healthcare REIT peers. The Company states that a 1% increase in rate above expense inflation is $25 million in additional operating margin. The upside opportunity is once again extraordinary given the ~1% annualized underperformance since 2016.

We believe it is critical that new independent directors are in place to more effectively oversee management and help implement strategies for realizing these opportunities before it is too late.

A Lack of Credibility: Consistently Missing and Lowering

Brookdale has a long history of issuing guidance below investor expectations and then failing to meet the Company’s own forecasts. This trend has continued in 2018 and 2019. For example:

- 2015 Cash from Facility Operations (CFFO) per share, a now abandoned metric, came in over 10% below the midpoint of initial guidance.

- 2016 Adjusted EBITDA came in over 6% below the midpoint of initial guidance.

- 2017 Adjusted EBITDA came in about 4% below the midpoint of initial guidance.

- 2018 Adjusted EBITDA came in about 4% below the midpoint of initial guidance.

- 2019 Adjusted EBITDA guidance was issued 18% below consensus expectations.

In fact, Brookdale has seen consensus EBITDA estimatesii decline by an average of 35% annually from 2016 – 2019.

This pattern needs to be reversed, and we believe better Board oversight is required to rebuild lost credibility and instill much needed accountability.

Poor Capital Allocation and Balance Sheet Management

Brookdale is the largest operator in the US senior housing sector, with more than double the units under management of its closest peers. Unfortunately, numerous acquisitions over the past decades have led to scale, but not value creation. In fact, Brookdale’s share price today is less than half of its $19 IPO in August 2005.

This poor capital allocation acumen was highlighted by Brookdale’s 2014 acquisition of Emeritus, its closest competitor, near the peak of the last senior housing upcycle. Though the Emeritus merger, Brookdale bulked up, added leverage and promised a host of synergies and revenue opportunities that never materialized as integration issues plagued the Company. Additionally, the transaction saddled shareholders with a whole new portfolio of leased assets that have negatively impacted cash flow and have been a significant impediment to various strategic options.

The day the Emeritus merger closed the share price was $34.65 per share. Today, Brookdale trades below $8 per share.

The Company’s misguided dual commitment to growth and reticence to shrink has allowed Brookdale to operate at elevated leverage levels for far too long. Brookdale has and continues to operate with a higher percentage of debt than the Healthcare REIT peers, and the Company has articulated no clear plan to lower leverage in the near-term, which is at 7.0x vs. 5.5x for its Healthcare REIT peersiii.

The small amount of proceeds from asset sales in recent months are being reinvested into the Company instead of being used to pay down debt or being sent down back to shareholders. Brookdale has not paid a dividend to shareholders since 2008 while its Healthcare REIT peers have paid meaningful dividends, consistently increasing them, and today yield nearly 5% on an annualized basis.

Abysmal Total Shareholder Returns

We believe Brookdale’s operational failures, poor capital allocation and balance sheet mismanagement have led to its persistent share price underperformance.

Brookdale’s total shareholder returns have consistently underperformed relative to Proxy Peersiv, Healthcare REIT peers, and the broad marketv over the trailing 10-year, 5-year, 3-year, and 1-year time periodsvi. Given the operational underperformance of the Company, this is not surprising.

| Total Shareholder Returns |

Trailing

|

Trailing

|

Trailing

|

Trailing

|

| Brookdale Senior Living | -16% |

-77% |

-51% |

-18% |

| BKD Underperformance vs. Proxy Peer Average | -486% |

-150% |

-93% |

-22% |

| BKD Underperformance vs. Healthcare REIT Average | -314% |

-129% |

-72% |

-53% |

| BKD Underperformance vs. S&P 500 | -327% |

-144% |

-102% |

-30% |

In 2019, Brookdale’s stock plumbed new lows, trading below $6 per share for the first time since the financial crisis. While the Company will claim they are on the right track and in the midst of a turnaround, shareholders are yet to be convinced and these persistent failures give us little hope that things will be different this time around. A departure from the status quo and new solutions are clearly required to drive performance and execute upon the opportunities available to maximize value for the benefit of all Brookdale shareholders.

The Way Forward

Now is the time to instill accountability and implement real change at Brookdale in order to reverse the Company’s historical underperformance. It seems quite clear to us that the Company’s current path does not adequately address the range of strategic and operational opportunities available to the Company.

Land & Buildings’ two director candidates, Jay Flaherty and Jon Litt, for election to the Board at the Annual Meeting, have the deep healthcare, real estate and finance experience necessary to help properly evaluate the best ways to maximize value for all Brookdale shareholders, in our view. We look forward to communicating with our fellow Brookdale shareholders in the coming weeks and months as we work to enhance value at the Company.

Sincerely,

Jonathan Litt

Founder & Chief Investment Officer

Land & Buildings

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Land & Buildings Investment Management, LLC together with the other participants named herein (collectively, "Land & Buildings"), intends to file a preliminary proxy statement and accompanying proxy card with the Securities and Exchange Commission ("SEC") to be used to solicit votes for the election of its slate of highly-qualified director nominees at the 2019 annual meeting of stockholders of Brookdale Senior Living, Inc., a Delaware corporation (“BKD” or the “Company”).

LAND & BUILDINGS STRONGLY ADVISES ALL STOCKHOLDERS OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC'S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS' PROXY SOLICITOR.

The participants in the proxy solicitation are anticipated to be Land & Buildings Capital Growth Fund, LP, a Delaware limited partnership (“L&B Capital” ), L & B Real Estate Opportunity Fund, LP, a Delaware limited partnership (“L&B Opportunity”), Land & Buildings GP LP, a Delaware limited partnership (“L&B GP”), Land & Buildings Investment Management, LLC, a Delaware limited liability company (“L&B Management”), Jonathan Litt and James F. Flaherty III.

As of the date hereof, L&B Capital directly owns 1,306,967 shares of Common Stock, $0.01 par value, of the Company (the "Shares”). As of the date hereof, L&B Opportunity directly owns 1,464,337 Shares. As of the date hereof, 3,599,903 Shares were held in certain accounts managed by L&B Management (the “Managed Accounts”). L&B GP, as the general partner of each of L&B Capital and L&B Opportunity, may be deemed the beneficial owner of the (i) 1,306,967 Shares owned by L&B Capital and (ii) 1,464,337 Shares owned by L&B Opportunity. L&B Management, as the investment manager of each of L&B Capital and L&B Opportunity, and as the investment advisor of the Managed Accounts, may be deemed the beneficial owner of the (i) 1,306,967 Shares owned by L&B Capital, (ii) 1,464,337 Shares owned by L&B Opportunity, and (iii) 3,599,903 Shares held in the Managed Accounts. Mr. Litt, as the managing principal of L&B Management, may be deemed the beneficial owner of the (i) 1,306,967 Shares owned by L&B Capital, (ii) 1,464,337 Shares owned by L&B Opportunity, and (iii) 3,599,903 Shares held in the Managed Accounts. As of the date hereof, Mr. Flaherty does not own any Shares.

_______________________

i As defined as HCP, VTR and WELL, the 3 healthcare REITs with large senior housing operating portfolios

ii Source: Bloomberg; Consensus EBITDA estimates captures entire timeframe Bloomberg has consistent data

iii Based on first quarter 2019 disclosures; HCP is Net Debt / Adjusted EBITDA, VTR is Net Debt / Adjusted Pro Forma EBITDA, WELL is Net Debt / Adjusted EBITDA, and BKD is Adjusted Net Debt / Adjusted EBITDAR

iv As defined in the Company’s proxy statement filed August 21, 2018

v As defined as the S&P 500

vi As measured through July 3, 2019, the last trading day before the Company’s public disclosure of Land & Buildings’ director nomination

View source version on businesswire.com: https://www.businesswire.com/news/home/20190730005614/en/

Media:

Sloane & Company

Dan Zacchei / Joe Germani, 212-486-9500

[email protected]

[email protected]

Source: Land and Buildings Investment Management LLC

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Bio-Path Holdings (BPTH) Announces 375K Share Offering at $3.225/sh

- Benitec Biopharma (BNTC) Announces $40M Placement at $4.80/sh

- Kartoon Studios (TOON) Prices 7M Share Offering at $1/sh

Create E-mail Alert Related Categories

Business Wire, Press ReleasesRelated Entities

Dividend, Definitive Agreement, IPOSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share Up)

Up)