Form 497K GOLDMAN SACHS TRUST

Summary

Prospectus

December 29, 2020, as supplemented on June 22, 2021

Goldman Sachs U.S. Equity ESG Fund

Class A:

GAGVX Class C: GCGVX Institutional: GINGX Investor: GIRGX Class R: GRGVX Class R6: GDEUX

Before

you invest, you may want to review the Goldman Sachs U.S. Equity ESG Fund (the “Fund”) Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus, reports to shareholders and other

information about the Fund online at www.gsamfunds.com/mutualfunds. You can also get this information at no cost by calling 800-621-2550 for Institutional and Class R6 shareholders, 800-526-7384 for

all other shareholders or by sending an e-mail request to [email protected]. The Fund’s Prospectus and Statement of Additional Information (“SAI”), both dated December 29, 2020, as supplemented to date, are

incorporated by reference into this Summary Prospectus.

It is our intention that beginning on January 1, 2021, paper

copies of the Fund’s annual and semi-annual shareholder reports will not be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary. Instead, the reports will be made

available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports

electronically, you will not be affected by this change and you need not take any action. At any time, you may elect to receive reports and certain communications from the Fund electronically by calling the applicable toll-free number below or by

contacting your financial intermediary.

You may elect to

receive all future shareholder reports in paper free of charge. If you hold shares of the Fund directly with the Fund’s transfer agent, you can inform the transfer agent that you wish to receive paper copies of reports by calling toll-free

800-621-2550 for Institutional and Class R6 shareholders or 800-526-7384 for all other shareholders. If you hold shares of the Fund through a financial intermediary, please contact your financial intermediary to make this election. Your election to

receive reports in paper will apply to all Goldman Sachs Funds held in your account if you invest through your financial intermediary or all Goldman Sachs Funds held with the Fund’s transfer agent if you invest directly with the transfer

agent.

Shareholder Fees

(fees paid directly from your

investment)

| Class A | Class C | Institutional | Investor | Class R | Class R6 | |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | 5.50% | None | None | None | None | None |

| Maximum Deferred Sales Charge (Load) (as a percentage of the lower of original purchase price or sale proceeds)1 | None | 1.00% | None | None | None | None |

2 Summary

Prospectus — Goldman Sachs U.S. Equity ESG Fund

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the

value of your investment)

| Class A | Class C | Institutional | Investor | Class R | Class R6 | |

| Management Fees | 0.55% | 0.55% | 0.55% | 0.55% | 0.55% | 0.55% |

| Distribution and/or Service (12b-1) Fees | 0.25% | 0.75% | 0.00% | 0.00% | 0.50% | 0.00% |

| Other Expenses2 | 2.81% | 3.06% | 2.69% | 2.81% | 2.81% | 2.68% |

| Service Fees | 0.00% | 0.25% | 0.00% | 0.00% | 0.00% | 0.00% |

| All Other Expenses | 2.81% | 2.81% | 2.69% | 2.81% | 2.81% | 2.68% |

| Total Annual Fund Operating Expenses | 3.61% | 4.36% | 3.24% | 3.36% | 3.86% | 3.23% |

| Fee Waiver and Expense Limitation3 | (2.59)% | (2.59)% | (2.57)% | (2.59)% | (2.59)% | (2.57)% |

| Total Annual Fund Operating Expenses After Fee Waiver and Expense Limitation | 1.02% | 1.77% | 0.67% | 0.77% | 1.27% | 0.66% |

| 1 | A contingent deferred sales charge (“CDSC”) of 1% is imposed on Class C Shares redeemed within 12 months of purchase. |

| 2 | “Other Expenses” for Class C, Institutional, Investor, and Class R6 Shares of the Fund have been restated to reflect expenses expected to be incurred during the current fiscal year. |

| 3 | The Investment Adviser has agreed to reduce or limit “Other Expenses” (excluding acquired fund fees and expenses, transfer agency fees and expenses, service fees, taxes, interest, brokerage fees, expenses of shareholder meetings, litigation and indemnification, and extraordinary expenses) to 0.084% of the Fund’s average daily net assets. Additionally, Goldman Sachs & Co. LLC (“Goldman Sachs”), the Fund’s transfer agent, has agreed to waive a portion of its transfer agency fee (a component of “Other Expenses”) equal to 0.02% as an annual percentage rate of the average daily net assets attributable to Class A, Class C, Investor, and Class R Shares of the Fund. These arrangements will remain in effect through at least December 29, 2021, and prior to such date, the Investment Adviser and Goldman Sachs may not terminate the arrangements without the approval of the Board of Trustees. |

3 Summary

Prospectus — Goldman Sachs U.S. Equity ESG Fund

4 Summary

Prospectus — Goldman Sachs U.S. Equity ESG Fund

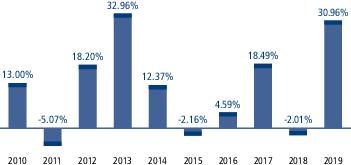

The bar chart (including “Best Quarter”

and “Worst Quarter” information) does not reflect the sales loads applicable to Class A Shares. If the sales loads were reflected, returns would be less. Performance reflects applicable fee waivers and/or expense limitations in effect

during the periods shown.

CALENDAR YEAR (CLASS A)

The total return

illustrated in the table above for the 9-month period ended September 30, 2020 was 7.67%.

| During the periods shown in the chart above: | Returns | Quarter ended |

| Best Quarter Return | 14.96% | March 31, 2012 |

| Worst Quarter Return | -16.97% | September 30, 2011 |

| AVERAGE ANNUAL TOTAL RETURN |

| For the period ended December 31, 2019 | 1 Year | 5 Years | 10 Years |

| Class A Shares (Inception 11/30/2009) | |||

| Returns Before Taxes | 23.75% | 8.01% | 10.78% |

| Returns After Taxes on Distributions | 22.52% | 5.73% | 8.89% |

| Returns After Taxes on Distributions and Sale of Fund Shares | 14.90% | 5.87% | 8.45% |

| Class C Shares (Inception 11/30/2009) | |||

| Returns Before Taxes | 28.66% | 8.42% | 10.57% |

| Institutional Shares (Inception 11/30/2009) | |||

| Returns Before Taxes | 31.46% | 9.65% | 11.85% |

| Investor Shares (Inception 11/30/2009) | |||

| Returns Before Taxes | 31.19% | 9.49% | 11.68% |

| Class R Shares (Inception 11/30/2009) | |||

| Returns | 30.58% | 8.96% | 11.14% |

| Class R6 Shares (Inception 7/31/2015)* | |||

| Returns Before Taxes | 31.35% | 9.66% | 11.86% |

| S&P 500® Index (reflects no deduction for fees or expenses) | 31.49% | 11.69% | 13.55% |

| * | Class R6 Shares commenced operations on July 31, 2015. Prior to that date, the performance of Class R6 Shares shown in the table above is that of Institutional Shares. Performance has not been adjusted to reflect the lower expenses of Class R6 Shares. Class R6 Shares would have had higher returns because: (i) Institutional Shares and Class R6 Shares represent interests in the same portfolio of securities; and (ii) Class R6 Shares have lower expenses. |

The after-tax returns are for Class A Shares only.

The after-tax returns for Class C, Institutional, Investor and Class R6 Shares, and returns for Class R Shares (which are offered exclusively to employee benefit plans), will vary. After-tax returns are calculated using the historical highest

individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. In addition, the after-tax returns shown are

not relevant to investors who hold Fund Shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

5 Summary

Prospectus — Goldman Sachs U.S. Equity ESG Fund

6 Summary

Prospectus — Goldman Sachs U.S. Equity ESG Fund

[This page intentionally left blank]

7 Summary

Prospectus — Goldman Sachs U.S. Equity ESG Fund

[This page intentionally left blank]

8 Summary

Prospectus — Goldman Sachs U.S. Equity ESG Fund

EQG1SUM3-20V2

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Goldman Sachs First Take on Netflix (NFLX): 'We expect the market to have a muted reaction'

- Rubrik IPO: 5 key things to know

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Goldman SachsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share