Form 497K GOLDMAN SACHS TRUST

Summary

Prospectus

April 30, 2021

Goldman Sachs Global Infrastructure Fund

Class

A: GGIAX Class C: GGICX Institutional: GGIDX Investor: GGINX Class R: GGIEX Class R6: GGIJX

Before you invest, you

may want to review the Goldman Sachs Global Infrastructure Fund (the “Fund”) Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus, reports to shareholders and other

information about the Fund online at http://www.gsamfunds.com/mutualfunds. You can also get this information at no cost by calling 800-621-2550 for Institutional and Class R6 shareholders, 800-526-7384

for all other shareholders or by sending an e-mail request to [email protected]. The Fund’s Prospectus and Statement of Additional Information (“SAI”), both dated April 30, 2021, are incorporated by reference into

this Summary Prospectus.

Shareholder Fees

(fees paid directly from your

investment)

| Class A | Class C | Institutional | Investor | Class R | Class R6 | |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | 5.50% | None | None | None | None | None |

| Maximum Deferred Sales Charge (Load) (as a percentage of the lower of original purchase price or sale proceeds)1 | None | 1.00% | None | None | None | None |

2 Summary

Prospectus — Goldman Sachs Global Infrastructure Fund

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the

value of your investment)

| Class A | Class C | Institutional | Investor | Class R | Class R6 | |

| Management Fees | 0.90% | 0.90% | 0.90% | 0.90% | 0.90% | 0.90% |

| Distribution and/or Service (12b-1) Fees | 0.25% | 0.75% | None | None | 0.50% | None |

| Other Expenses2 | 0.41% | 0.66% | 0.29% | 0.41% | 0.41% | 0.28% |

| Service Fees | None | 0.25% | None | None | None | None |

| All Other Expenses | 0.41% | 0.41% | 0.29% | 0.41% | 0.41% | 0.28% |

| Total Annual Fund Operating Expenses | 1.56% | 2.31% | 1.19% | 1.31% | 1.81% | 1.18% |

| Fee Waiver and Expense Limitation3 | (0.21)% | (0.21)% | (0.20)% | (0.21)% | (0.21)% | (0.20)% |

| Total Annual Fund Operating Expenses After Fee Waiver and Expense Limitation | 1.35% | 2.10% | 0.99% | 1.10% | 1.60% | 0.98% |

| 1 | A contingent deferred sales charge (“CDSC”) of 1% is imposed on Class C Shares redeemed within 12 months of purchase. |

| 2 | The “Other Expenses” for Class A, Class C, Investor and Class R Shares have been restated to reflect expenses expected to be incurred during the current fiscal year. |

| 3 | The Investment Adviser has agreed to reduce or limit “Other Expenses” (excluding acquired fund fees and expenses, transfer agency fees and expenses, service fees, taxes, interest, brokerage fees, expenses of shareholder meetings, litigation and indemnification, and extraordinary expenses) to 0.054% of the Fund’s average daily net assets. Additionally, Goldman Sachs & Co. LLC (“Goldman Sachs”), the Fund’s transfer agent, has agreed to waive a portion of its transfer agency fee (a component of “Other Expenses”) equal to 0.01% as an annual percentage rate of the average daily net assets attributable to Class A, Class C, Investor, and Class R Shares of the Fund. These arrangements will remain in effect through at least April 30, 2022, and prior to such date, the Investment Adviser may not terminate these arrangements without the approval of the Board of Trustees. The Fund’s “Total Annual Fund Operating Expenses After Fee Waiver and Expense Limitation” have been restated to reflect the fee waiver and expense limitation currently in effect. |

3 Summary

Prospectus — Goldman Sachs Global Infrastructure Fund

4 Summary

Prospectus — Goldman Sachs Global Infrastructure Fund

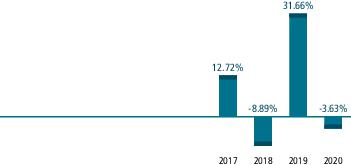

| AVERAGE ANNUAL TOTAL RETURN |

| For the period ended December 31, 2020 | 1 Year | Since

Inception |

| Class A Shares (Inception 6/27/2016) | ||

| Returns Before Taxes | -9.27% | 4.52% |

| Returns After Taxes on Distributions | -9.55% | 2.83% |

| Returns After Taxes on Distributions and Sale of Fund Shares | -5.30% | 2.49% |

| Class C Shares (Inception 6/27/2016) | ||

| Returns Before Taxes | -5.73% | 5.04% |

| Institutional Shares (Inception 6/27/2016) | ||

| Returns Before Taxes | -3.63% | 6.24% |

| Investor Shares (Inception 6/27/2016) | ||

| Returns Before Taxes | -3.80% | 6.09% |

| Class R Shares (Inception 6/27/2016) | ||

| Returns | -4.24% | 5.58% |

| Class R6 Shares (Inception 6/27/2016) | ||

| Returns Before Taxes | -3.64% | 6.24% |

| Dow Jones Brookfield Global Infrastructure Index (Net, USD, Unhedged; reflects no deduction for fees or expenses) | -6.96% | 6.09% |

The after-tax

returns are for Class A Shares only. The after-tax returns for Class C, Institutional, Investor and Class R6 Shares, and returns for Class R Shares (which are offered exclusively to employee benefit plans), will vary. After-tax returns are

calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. In

addition, the after-tax returns shown are not relevant to investors who hold Fund Shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

5 Summary

Prospectus — Goldman Sachs Global Infrastructure Fund

6 Summary

Prospectus — Goldman Sachs Global Infrastructure Fund

[This page intentionally left blank]

7 Summary

Prospectus — Goldman Sachs Global Infrastructure Fund

[This page intentionally left blank]

8 Summary

Prospectus — Goldman Sachs Global Infrastructure Fund

RESSUM4-21

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Meta Platforms Inc. (META) PT Lowered to $500 at Goldman Sachs, 'Management Track Record of Execution Leaves Us Long-Term Constructive'

- Analysis-BHP's proposed bid for Anglo American is a big bet on copper

- Stabilization Notice

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Goldman SachsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share