Form 497K GOLDMAN SACHS TRUST

Summary

Prospectus

February 28, 2021

Goldman Sachs ESG Emerging Markets Equity Fund

Class P: GEPPX

Before you invest, you may want to review the Goldman Sachs

ESG Emerging Markets Equity Fund (the “Fund”) Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus, reports to shareholders and other information about the Fund online at www.gsamfunds.com/content/gsam/us/en/individual/literature-and-forms/literature.html. You can also get this information at no cost by calling 800-621-2550 or by sending an e-mail request to

[email protected]. The Fund’s Prospectus and Statement of Additional Information (“SAI”), both dated February 28, 2021, are incorporated by reference into this Summary Prospectus.

It is our intention that beginning on January 1, 2021, paper

copies of the Fund’s annual and semi-annual shareholder reports will not be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary. Instead, the reports will be made

available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports

electronically, you will not be affected by this change and you need not take any action. At any time, you may elect to receive reports and certain communications from the Fund electronically by calling the applicable toll-free number below or by

contacting your financial intermediary.

You may elect to

receive all future shareholder reports in paper free of charge. If you hold shares of the Fund directly with the Fund’s transfer agent, you can inform the transfer agent that you wish to receive paper copies of reports by calling toll-free

800-621-2550 for Institutional and Class R6 shareholders or 800-526-7384 for all other shareholders. If you hold shares of the Fund through a financial intermediary, please contact your financial intermediary to make this election. Your election to

receive reports in paper will apply to all Goldman Sachs Funds held in your account if you invest through your financial intermediary or all Goldman Sachs Funds held with the Fund’s transfer agent if you invest directly with the transfer

agent.

| Investment Objective |

The Goldman

Sachs ESG Emerging Markets Equity Fund (the “Fund”) seeks long-term capital appreciation.

| Fees and Expenses of the Fund |

This table describes the fees and expenses that you

may pay if you buy, hold and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and Example below.

2 Summary

Prospectus — Goldman Sachs ESG Emerging Markets Equity Fund

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the

value of your investment)

| Class P | |

| Management Fees | 0.98% |

| Other Expenses | 4.85% |

| Total Annual Fund Operating Expenses1 | 5.83% |

| Expense Limitation2 | (4.70)% |

| Total Annual Fund Operating Expenses After Expense Limitation | 1.13% |

| 1 | The “Other Expenses” for Class P Shares have been restated to reflect expenses expected to be incurred during the current fiscal year. |

| 2 | The Investment Adviser has agreed to reduce or limit “Other Expenses” (excluding acquired fund fees and expenses, transfer agency fees and expenses, taxes, interest, brokerage fees, expenses of shareholder meetings, litigation and indemnification, and extraordinary expenses) to 0.124% of the Fund’s average daily net assets through at least February 28, 2022, and prior to such date, the Investment Adviser may not terminate the arrangement without the approval of the Board of Trustees. |

3 Summary

Prospectus — Goldman Sachs ESG Emerging Markets Equity Fund

4 Summary

Prospectus — Goldman Sachs ESG Emerging Markets Equity Fund

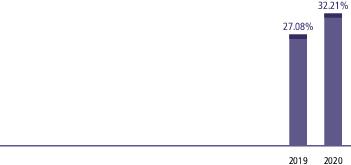

| AVERAGE ANNUAL TOTAL RETURN |

| For the period ended December 31, 2020 | 1 Year | Since

Inception |

| Institutional Shares (Inception 5/31/2018) | ||

| Returns Before Taxes | 32.21% | 14.62% |

| Returns After Taxes on Distributions | 32.25% | 14.62% |

| Returns After Taxes on Distributions and Sale of Fund Shares | 19.27% | 11.55% |

| MSCI Emerging Markets Index (Net, USD, Unhedged) | 18.25% | 8.28% |

| Returns are for a share class that is not presented that would have substantially similar annual returns because the shares are invested in the same portfolio of securities and the annual returns would differ only to the extent that the share classes do not have the same expenses. |

After-tax returns are calculated using the

historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. In addition, the after-tax

returns shown are not relevant to investors who hold Fund Shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

EMESUM4-21P

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- T-Mobile (TMUS) and EQT Announce JV to Acquire Lumos

- Victoria's Secret (VSCO) initiated with sell rating at Goldman Sachs on 'less attractive' risk/reward

- 10 analysts discuss Meta Platforms (META) stock after earnings selloff

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Goldman SachsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share