Form 497K GOLDMAN SACHS TRUST

December 29, 2020 6:04 AM ESTSummary

Prospectus

December 29, 2020

Goldman Sachs Tactical Tilt Overlay Fund

Institutional: TTIFX Class R6:

TTRFX

Before you invest, you may want to review the Goldman Sachs

Tactical Tilt Overlay Fund (the “Fund”) Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus, reports to shareholders and other information about the Fund online at www.gsamfunds.com/mutualfunds. You can also get this information at no cost by calling 800-621-2550 or by sending an e-mail request to [email protected]. The Fund’s Prospectus and

Statement of Additional Information (“SAI”), both dated December 29, 2020, are incorporated by reference into this Summary Prospectus.

It is our intention that beginning on January 1, 2021, paper

copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary. Instead, the reports will be made

available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports

electronically, you will not be affected by this change and you need not take any action. At any time, you may elect to receive reports and certain communications from the Fund electronically by calling the applicable toll-free number below or by

contacting your financial intermediary.

You may elect to

receive all future shareholder reports in paper free of charge. If you hold shares of the Fund directly with the Fund’s transfer agent, you can inform the transfer agent that you wish to receive paper copies of reports by calling toll-free

800-621-2550 for Institutional and Class R6 shareholders . If you hold shares of the Fund through a financial intermediary, please contact your financial intermediary to make this election. Your election to receive reports in paper will apply to all

Goldman Sachs Funds held in your account if you invest through your financial intermediary or all Goldman Sachs Funds held with the Fund’s transfer agent if you invest directly with the transfer agent.

| Investment Objective |

The Goldman

Sachs Tactical Tilt Overlay Fund (the “Fund”) seeks long-term total return.

| Fees and Expenses of the Fund |

This table describes the fees and expenses that you

may pay if you buy, hold and sell Shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and Example below.

2 Summary

Prospectus — Goldman Sachs Tactical Tilt Overlay Fund

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the

value of your investment)

| Institutional | Class R6 | |

| Management Fees | 0.72% | 0.72% |

| Other Expenses | 0.06% | 0.05% |

| Acquired (Underlying) Fund Fees and Expenses | 0.12% | 0.12% |

| Total Annual Fund Operating Expenses1 | 0.90% | 0.89% |

| Fee Waivers and Expense Limitation2 | (0.08)% | (0.08)% |

| Total Annual Fund Operating Expenses After Fee Waivers and Expense Limitation1 | 0.82% | 0.81% |

| 1 | The “Total Annual Fund Operating Expenses” do not correlate to the ratios of the net and total expenses to average net assets provided in the Financial Highlights, which reflect the operating expenses of the Fund and do not include “Acquired (Underlying) Fund Fees and Expenses.” |

| 2 | The Investment Adviser has agreed to: (i) waive a portion of its management fee payable by the Fund in an amount equal to any management fees it earns as an investment adviser to any of the affiliated funds in which the Fund invests, except those management fees it earns from the Fund’s investments of cash collateral received in connection with securities lending transactions in affiliated funds; (ii) waive a portion of its management fee in an amount equal to the management fee paid to the Investment Adviser by the Subsidiary (as defined below) at an annual rate of 0.42% of the Subsidiary’s average daily net assets; and (iii) reduce or limit “Other Expenses” (excluding acquired (underlying) fund fees and expenses, transfer agency fees and expenses, taxes, dividend and interest expenses on short sales, interest, brokerage fees, expenses of shareholder meetings, litigation and indemnification, and extraordinary expenses) to 0.164% of the Fund’s average daily net assets. The management fee waiver arrangement with respect to the Subsidiary may not be discontinued by the Investment Adviser as long as its contract with the Subsidiary is in place. The management fee waiver arrangement with respect to affiliated fund fees and expense limitation arrangement will remain in effect through at least December 29, 2021, and prior to such date the Investment Adviser may not terminate these arrangements without the approval of the Board of Trustees. |

| Expense Example |

This Example is

intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in

Institutional and Class R6 Shares of the Fund for the time periods indicated and then redeem all of your Institutional and Class R6 Shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that

the Fund’s operating expenses remain the same (except that the Example incorporates any applicable fee waiver and/or expense limitation arrangements for only the first year). Although your actual costs may be higher or lower, based on

these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Institutional Shares | $84 | $279 | $491 | $1,100 |

| Class R6 Shares | $83 | $276 | $485 | $1,089 |

| Portfolio Turnover |

The Fund does

not pay transaction costs when it buys and sells shares of the underlying mutual funds. However, the Fund and the Underlying Funds (as defined below) pay transaction costs when they buy and sell other securities or instruments (i.e., “turn over” their portfolio). A high rate of portfolio turnover may result in increased transaction costs, including brokerage commissions, which must be borne by the Underlying Fund and its

shareholders, including the Fund, and is also likely to result in higher short-term capital gains for taxable shareholders. These costs are not reflected in total annual fund operating expenses or in the expense example above, but are reflected in

the Fund’s performance. The Fund’s portfolio turnover rate for the fiscal year ended August 31, 2020 was 70% of the average value of its portfolio.

| Principal Strategy |

The Fund seeks

to achieve its investment objective through the implementation of investment ideas that are generally derived from short-term or medium-term market views on a variety of asset classes and instruments (“Tactical Tilts”) generated by the

Goldman Sachs Investment Strategy Group (“Investment Strategy Group”). Investment Strategy Group Tactical Tilt recommendations are recommendations to

overweight or underweight exposures to certain asset classes, with

such overweighting and underweighting to be funded from a “funding source” from which assets should be reallocated. The Investment Strategy Group will consider, among other things, the stand-alone risk/reward of each investment idea that

may become a Tactical Tilt recommendation, how it fits with the Investment Strategy Group’s broader global economic and market views, and its merits compared to other ideas. The Investment Adviser determines in its sole discretion how to

implement Tactical Tilt recommendations in the Fund.

Tactical Tilts are generally implemented by investing

in any one or in any combination of the following securities and instruments:

(i) U.S. and foreign equity securities, including

common and preferred stocks; (ii) pooled investment vehicles including, but not limited to, (a) unaffiliated investment companies, exchange-traded funds (“ETFs”) and exchange-traded notes (“ETNs”) and

(b) affiliated investment companies that currently

exist or that may become available for investment in the future for which GSAM or an affiliate now or in the future acts as investment adviser or principal underwriter (the “Underlying Funds”); (iii) fixed income instruments, which

include, among others, debt issued by governments (including the U.S. and foreign governments), their agencies, instrumentalities, sponsored entities, and political subdivisions, notes, commercial paper, certificates of deposit, debt participations

and non-investment grade securities (commonly known as “junk bonds”); (iv) derivatives and (v) commodity investments, primarily through a wholly-owned subsidiary of the Fund organized as a company under the laws of the Cayman Islands

(the “Subsidiary”). The Fund’s investments may be publicly traded or privately issued or negotiated. The Fund may invest without restriction as to issuer capitalization, country, currency, maturity or credit rating. The Fund may

implement short positions for hedging purposes or to seek to enhance absolute return, and may do so by using swaps or futures, or through short sales of any instrument that the Fund may purchase for investment.

The Investment Adviser expects that the Fund may

invest in one or more of the following Underlying Funds in order to implement Tactical Tilts: Goldman Sachs Core Fixed Income Fund, Goldman Sachs Dynamic Municipal Income Fund, Goldman Sachs Emerging Markets Debt Fund, Goldman Sachs Energy

Infrastructure Fund, Goldman Sachs Enhanced Income Fund, Goldman Sachs Global Real Estate Securities Fund, Goldman Sachs Government Income Fund, Goldman Sachs High

3 Summary

Prospectus — Goldman Sachs Tactical Tilt Overlay Fund

Quality Floating Rate Fund, Goldman Sachs High Yield Fund, Goldman

Sachs High Yield Floating Rate Fund, Goldman Sachs High Yield Municipal Fund, Goldman Sachs Inflation Protected Securities Fund, Goldman Sachs International Real Estate Securities Fund, Goldman Sachs Investment Grade Credit Fund, Goldman Sachs Local

Emerging Markets Debt Fund, Goldman Sachs MLP Energy Infrastructure Fund, Goldman Sachs Short Duration Income Fund and Goldman Sachs Short Duration Tax-Free Fund as may be determined by the Investment Adviser from time to time without considering or

canvassing the universe of unaffiliated investment companies available.

The Fund may invest in derivatives for both hedging

and non-hedging purposes. Derivative positions may be listed or over the counter (“OTC”) and may or may not be centrally cleared. The Fund’s derivative investments may include but are not limited to

(i) futures contracts, including futures based on

equity or fixed income securities and/or equity or fixed income indices, interest rate futures, currency futures and swap futures; (ii) swaps, including equity, currency, interest rate, total return, excess return, variance and credit default swaps,

and swaps on futures contracts; (iii) options, including long and short positions in call options and put options on indices, individual securities or currencies, swaptions and options on futures contracts; (iv) forward contracts, including forwards

based on equity or fixed income securities and/or equity or fixed income indices, currency forwards, interest rate forwards, swap forwards and non-deliverable forwards; and (v) other instruments, including structured securities and exchange-traded

notes. As a result of the Fund’s use of derivatives, the Fund may also hold significant amounts of U.S. Treasuries or short-term investments, including money market funds, repurchase agreements, cash and time deposits.

Investment in Cayman Subsidiary. The Fund seeks to

gain exposure to the commodities markets by investing in the Subsidiary. The Fund may invest up to 25% of its total assets in the Subsidiary. The Subsidiary primarily obtains its commodity exposure by investing in commodity-linked derivative

instruments, which may include but are not limited to total return swaps and excess return swaps on commodity indexes, sub-indexes and single commodities, as well as commodity (U.S. or foreign) futures, commodity options and commodity-linked notes.

Commodity-linked swaps are derivative instruments whereby the cash flows agreed upon between counterparties are dependent upon the price of the underlying commodity or commodity index over the life of the swap. Commodity futures contracts are

standardized, exchange-traded contracts that provide for the sale or purchase of, or economic exposure to the price of, a commodity or a specified basket of commodities at a future time. An option on commodities gives the purchaser the right (and

the writer of the option the obligation) to assume a position in a commodity or a specified basket of commodities at a specified exercise price within a specified period of time. The value of these commodity-linked derivatives will rise and fall in

response to changes in the underlying commodity or commodity index. Commodity-linked derivatives expose the Subsidiary and the Fund economically to movements in commodity prices. Such instruments may be leveraged so that small changes in the

underlying commodity prices would result in disproportionate changes in the value of the instrument. Neither the Fund nor the Subsidiary invests directly in physical commodities. The Subsidiary may also invest in other instruments, including fixed

income securities, either as investments or to serve as margin or collateral for its swap positions, and foreign currency transactions (including forward contracts).

Exposure to Commodities. The Fund may also gain

exposure to commodities by investing in commodity index-linked structured notes, publicly traded partnerships (“PTPs”) and pooled investment vehicles

(including ETFs, ETNs and affiliated or unaffiliated investment

companies). PTPs are limited partnerships, the interests (or “units”) in which are traded on public exchanges. The Fund may invest in PTPs that are commodity pools.

The investments and positions that the Investment

Adviser determines to use to implement the Tactical Tilt recommendations will constitute the Fund’s only investments, other than its investments in investment-grade fixed income instruments, cash or cash equivalents or other short-term

instruments. At any time, and from time to time, a material portion of the Fund’s assets may be invested in such instruments, and not for the purpose of implementing Tactical Tilts.

The Fund is designed to provide investors with an

efficient means of implementing the Tactical Tilts strategy, which is intended to complement an investor’s broader, diversified investment portfolio. A Tactical Tilt strategy should be an appropriately sized portion of an investor’s

overall investment portfolio. It is important that investors view an allocation to the Fund as a long-term addition to a broader, diversified portfolio and not look to opportunistically time their investments in or redemptions from the Fund.

The Fund’s benchmark index is the ICE® BofAML® U.S. Dollar Three-Month LIBOR Constant

Maturity Index. References in the Prospectus to the Fund’s benchmark are for informational purposes only and are not an indication of how the Fund is managed. The Fund’s risk profile is different from that of its benchmark and, as a

result, the performance of the Fund may not correlate with that of the benchmark.

THE PARTICULAR UNDERLYING FUNDS IN WHICH THE FUND MAY

INVEST, AND THE INVESTMENTS IN EACH UNDERLYING FUND, MAY BE CHANGED FROM TIME TO TIME WITHOUT SHAREHOLDER APPROVAL OR NOTICE.

| Principal Risks of the Fund |

Loss of

money is a risk of investing in the Fund. The investment program of the Fund is speculative, entails substantial risks and includes alternative investment techniques not employed by traditional mutual funds. The Fund should not be relied upon as a

complete investment program. The Fund’s investment techniques (if they do not perform as designed) may increase the volatility of performance and the risk of investment loss, including the loss of the entire amount that is invested, and there

can be no assurance that the investment objective of the Fund will be achieved. Moreover, certain investment techniques which the Fund may employ in its investment program can substantially increase the adverse impact to which the Fund’s

investments may be subject. There is no assurance that the investment processes of the Fund will be successful, that the techniques utilized therein will be implemented successfully or that they are adequate for their intended uses, or that the

discretionary element of the investment processes of the Fund will be exercised in a manner that is successful or that is not adverse to the Fund. These risks may also apply to one or more Underlying Funds. An investment in the Fund is not a bank

deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any government agency. Investors should carefully consider these risks before investing. The Fund's principal risks are presented below in

alphabetical order, and not in the order of importance or potential exposure.

The following risks include the principal risks that

the Fund is exposed to through its direct investments in securities and other instruments, as well as the principal risks of the Underlying Funds. The Fund is exposed to the same risks as the Underlying Funds in direct proportion to the

4 Summary

Prospectus — Goldman Sachs Tactical Tilt Overlay Fund

allocation of its assets among the Underlying Funds. Each principal

risk listed below is followed by a parenthetical that indicates whether it is a principal risk of the Fund, of one or more Underlying Funds, or both. Changes in the particular Underlying Funds in which the Fund may invest, and changes in the

investments of the Underlying Funds, may cause the Fund to be subject to additional or different risks than the risks listed below.

Asset Allocation Risk (The Fund). The Fund’s allocations to the various asset classes may cause the Fund to underperform other funds with a similar investment

objective.

Call/Prepayment Risk (One or more Underlying Funds). An issuer could exercise its right to pay principal on an obligation held by an Underlying Fund (such as a mortgage-backed

security) earlier than expected. This may happen when there is a decline in interest rates, when credit spreads change, or when an issuer’s credit quality improves. Under these circumstances,an Underlying Fund may be unable to recoup all of

its initial investment and will also suffer from having to reinvest in lower-yielding securities.

Commodity Sector Risk (The Fund). Exposure to the commodities markets may subject the Fund to greater volatility than investments in more traditional securities. The value of

commodity-linked investments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease,

embargoes, tariffs and international economic, political and regulatory developments. The prices of energy, industrial metals, precious metals, agriculture and livestock sector commodities may fluctuate widely due to factors such as changes in

value, supply and demand and governmental regulatory policies. The commodity-linked investments in which the Subsidiary may enter into may involve counterparties in the financial services sector, and events affecting the financial services sector

may cause the Subsidiary’s, and therefore the Fund’s, share value to fluctuate.

Concentration

Risk (The Fund). If the Fund invests a substantial portion of its total assets in issuers within the same country, state, region, currency or economic

sector, an adverse economic, business or political development may affect the value of the Fund’s investments more than if its investments were not so concentrated.

Conflict of Interest Risk (One or more Underlying Funds). Affiliates of the Investment

Adviser may participate in the primary and secondary market for loan obligations. Because of limitations imposed by applicable law, the presence of the Investment Adviser’s affiliates in the loan obligations market may restrict an Underlying

Fund’s ability to acquire some loan obligations or affect the timing or price of such acquisitions. Also, because the Investment Adviser may wish to invest in the publicly traded securities of a borrower, it may not have access to material

non-public information regarding the borrower to which other lenders have access.

Counterparty

Risk (The Fund and one or more Underlying Funds). Many of the protections afforded to cleared transactions, such as the security afforded by

transacting through a clearing house, might not be available in connection with OTC transactions. Therefore, in those instances in which the Fund and/or an Underlying Fund enters into uncleared OTC transactions, the Fund and/or an

Underlying Fund will be subject to the risk that its direct counterparty will not perform its obligations under the transactions and that the Fund and/or an Underlying Fund will sustain losses.

CPIU Measurement Risk (One or more Underlying Funds). The Consumer Price Index for Urban Consumers (“CPIU”) is a measurement of changes in the cost of living, made up

of components

such as housing, food, transportation and energy. There can be no

assurance that the CPIU will accurately measure the real rate of inflation in the prices of goods and services, which may affect the valuation of the Underlying Fund.

Credit/Default

Risk (The Fund and one or more Underlying Funds). An issuer or guarantor of fixed income securities held by the Fund and/or an Underlying

Fund (which may have low credit ratings) may default on its obligation to pay interest and repay principal or default on any other obligation. Additionally, the credit quality of securities may deteriorate rapidly, which may impair the

Fund's and/or an Underlying Fund’s liquidity and cause significant net asset value (“NAV”) deterioration. These risks are more pronounced in connection with the Fund’s and/or an Underlying Fund's investments in

non-investment grade fixed income securities.

Deflation

Risk (One or more Underlying Funds). The Underlying Fund will be subject to the risk that prices throughout

the economy may decline over time, resulting in “deflation.” If this occurs, the principal and income of inflation protected securities held by the Underlying Fund would likely decline in price, which could result in losses for

the Underlying Fund.

Derivatives Risk (The Fund and one or more Underlying Funds). The Fund's and/or an Underlying Fund's use of options, futures,

forwards, swaps, options on swaps, structured securities and other derivative instruments may result in losses. These instruments, which may pose risks in addition to and greater than those associated with investing directly in securities,

currencies or other instruments, may be illiquid or less liquid, volatile, difficult to price and leveraged so that small changes in the value of the underlying instruments may produce disproportionate losses to the Fund and/or an Underlying

Fund. Certain derivatives are also subject to counterparty risk, which is the risk that the other party in the transaction will not fulfill its contractual obligations. The use of derivatives is a highly specialized activity that involves investment

techniques and risks different from those associated with investments in more traditional securities and instruments.

Dividend-Paying Investments Risk (The Fund and one or more Underlying Funds). The Underlying Fund’s investments in dividend-paying securities could cause the Underlying

Fund to underperform other funds. Securities that pay dividends, as a group, can fall out of favor with the market, causing such securities to underperform securities that do not pay dividends. Depending upon market conditions and political and

legislative responses to such conditions, dividend-paying securities that meet the Underlying Fund’s investment criteria may not be widely available and/or may be highly concentrated in only a few market sectors. In addition, issuers that

have paid regular dividends or distributions to shareholders may not continue to do so at the same level or at all in the future. This may limit the ability of the Underlying Fund to produce current income.

Energy Sector Risk (One or more Underlying Funds). The MLP Energy Infrastructure Fund concentrates its investments in the energy sector, and will therefore be susceptible to adverse economic, business, social, political, environmental, regulatory

or other occurrences affecting that sector. The energy sector has historically experienced substantial price volatility. Energy infrastructure master limited partnership (“MLP”) investments, energy infrastructure companies and other

companies operating in the energy sector are subject to specific risks, including, among others: fluctuations in commodity price and/or interest rates; increased government or environment regulation; reduced consumer demand for commodities such as

oil, natural gas or petroleum products; reduced availability of natural gas or other commodities for transporting, processing, storing or delivering; slowdowns in new construction; extreme weather or other natural disasters; and threats

of

5 Summary

Prospectus — Goldman Sachs Tactical Tilt Overlay Fund

attack by terrorists on energy assets. Energy companies can be

significantly affected by the supply of, and demand for, particular energy products (such as oil and natural gas), which may result in overproduction or underproduction. Additionally, changes in the regulatory environment for energy companies may

adversely impact their profitability. Over time, depletion of natural gas reserves and other energy reserves may also affect the profitability of energy companies.

During periods of heightened volatility, energy

products that are burdened with debt may seek bankruptcy relief. Bankruptcy laws may permit the revocation or renegotiation of contracts between energy producers and MLPs/energy infrastructure companies, which could have a dramatic impact on the

ability of MLPs/energy infrastructure companies to pay distributions to its investors, including the MLP Energy Infrastructure Fund, which in turn could impact the ability of the Underlying Fund to pay dividends and dramatically impact the

value of the Underlying Fund’s investments.

Expenses

Risk (The Fund). By investing in pooled investment

vehicles (including investment companies, ETFs and money market funds, partnerships and real estate investment trusts (“REITs”)) indirectly through the Fund, the investor will incur not only a proportionate share of the expenses of the

other pooled investment vehicles, partnerships and REITs held by the Fund (including operating costs and investment management fees), but also the expenses of the Fund.

Foreign and Emerging Countries Risk (The Fund and one or more Underlying Funds). Foreign securities may be subject to risk of loss because of more or less foreign government regulation, less

public information, less stringent investor protections and disclosure standards and less economic, political and social stability in the countries in which the Fund and/or an Underlying Fund invests. The imposition of exchange controls

(including repatriation restrictions), sanctions, confiscations, trade restrictions (including tariffs) and other government restrictions by the United States and other governments, or from problems in share registration, settlement or custody, may

also result in losses. Foreign risk also involves the risk of negative foreign currency exchange rate fluctuations, which may cause the value of securities denominated in such foreign currency (or other instruments through which the Fund and/or

an Underlying Fund has exposure to foreign currencies) to decline in value. Currency exchange rates may fluctuate significantly over short periods of time. These risks may be more pronounced in connection with the Fund and/or an Underlying

Fund’s investments in securities of issuers located in emerging countries.

Geographic

Risk (The Fund and one or more Underlying Funds).

If the Fund and/or an Underlying Fund focuses their investments in issuers located in a particular country or geographic region, the Fund and/or an Underlying Fund may be subjected

to a greater extent than if investments were less focused, to the risks of volatile economic cycles and/or conditions and developments that may be particular to that country or region, such as: adverse securities markets; adverse exchange rates;

adverse social, political, regulatory, economic, business, environmental or other developments; or natural disasters.

Industry Concentration Risk (One or more Underlying Funds). The

Global Real Estate Securities Fund and International Real Estate Securities Fund concentrate their investments in the real estate industry, which has historically experienced substantial price volatility. This concentration subjects the Global Real

Estate Securities and International Real Estate Securities Funds to greater risk of loss as a result of adverse economic, business, political, environmental or other developments than if their investments were diversified across different

industries.

Inflation Protected Securities Risk (One or more Underlying Funds). The value of inflation protected securities generally fluctuates in response to changes in real interest rates, which are in turn

tied to the relationship between nominal interest rates and the rate of inflation. If nominal interest rates increased at a faster rate than inflation, real interest rates might rise, leading to a decrease in the value of inflation protected

securities. The market for inflation protected securities may be less developed or liquid, and more volatile, than certain other securities markets.

Interest Rate

Risk (The Fund and one or more Underlying Funds). When interest rates increase, fixed income securities or instruments held by the Fund and/or an

Underlying Fund will generally decline in value. Long-term fixed income securities or instruments will normally have more price volatility because of this risk than short-term fixed income securities or instruments. The risks associated with

changing interest rates may have unpredictable effects on the markets and the Fund's and/or an Underlying Fund's investments. Fluctuations in interest rates may also affect the liquidity of fixed income securities and instruments held by the

Fund and/or an Underlying Fund.

Investing in the Underlying Funds (The Fund). The Fund’s investment performance is directly related to the investment performance of the Underlying Funds it holds. The ability of the Fund

to meet its investment objective is directly related to the ability of the Underlying Funds to meet their objectives as well as the allocation among those Underlying Funds by the Investment Adviser.

Investments in Affiliated Underlying Funds (The Fund). The Investment Adviser will have the authority to select and substitute Underlying Funds. The Investment Adviser and/or its affiliates are

compensated by the Fund and by certain Underlying Funds for advisory and/or principal underwriting services provided. The Investment Adviser is subject to conflicts of interest in allocating Fund assets among certain Underlying Funds both because

the fees payable to it and/or its affiliates by Underlying Funds differ and because the Investment Adviser and its affiliates are also responsible for managing the Underlying Funds. The portfolio managers may also be subject to conflicts of interest

in allocating Fund assets among the various Underlying Funds because the Fund’s portfolio management team may also manage some of the Underlying Funds. The Trustees and officers of the Goldman Sachs Trust may also have conflicting interests in

fulfilling their fiduciary duties to both the Fund and the Underlying Funds for which GSAM or its affiliates now or in the future serve as investment adviser or principal underwriter. In addition, the Investment Adviser’s authority to allocate

investments among affiliated and unaffiliated investment companies creates conflicts of interest. For example, investing in affiliated investment companies could cause the Fund to incur higher fees and may cause the Investment Adviser and/or its

affiliates to receive greater compensation, increase assets under management or support particular investment strategies or affiliated investment companies. In selecting actively managed Underlying Funds, the Investment Adviser generally

expects to select affiliated investment companies without considering or canvassing the universe of unaffiliated investment companies available even though there may (or may not) be one or more unaffiliated investment companies that may be a more

appropriate addition to the Fund, that investors may regard as a more attractive investment for the Fund, or that may have higher returns. To the extent that an investment in an affiliated investment company is not available, including as the result

of capacity constraints, only then will the Investment Adviser consider unaffiliated investment companies.

Investments in ETFs (The Fund). The Fund may invest

directly in unaffiliated ETFs. The ETFs in which the Fund may invest are subject to the same risks and may invest directly in the same securities as those of the Underlying Funds, as described below under “Investments of the

6 Summary

Prospectus — Goldman Sachs Tactical Tilt Overlay Fund

Underlying Funds.” In addition, the Fund’s investments

in these unaffiliated ETFs will be subject to the restrictions applicable to investments by an investment company in other investment companies, unless relief is otherwise provided under the terms of a Securities and Exchange Commission

(“SEC”) exemptive order or SEC exemptive rule.

Investments of the Underlying Funds (The Fund). Because the Fund invests in the Underlying Funds, the Fund’s shareholders will be affected by the investment policies and practices of

the Underlying Funds in direct proportion to the amount of assets the Fund allocates to those Underlying Funds.

Large Shareholder Transactions Risk (The Fund and one or more Underlying Funds). The Fund and/or an Underlying Fund may experience adverse effects when certain large shareholders purchase or

redeem large amounts of shares of the Fund and/or an Underlying Fund. Such large shareholder redemptions, which may occur rapidly or unexpectedly, may cause the Fund and/or an Underlying Fund to sell portfolio securities at times when it

would not otherwise do so, which may negatively impact the NAV and liquidity of the Fund and/or an Underlying Fund. Similarly, large Fund and/or Underlying Fund share purchases may adversely affect the

performance of the Fund and/or an Underlying Fund to the extent that the Fund and/or an Underlying Fund is delayed in investing new cash or otherwise maintains a larger cash position than it ordinarily would. These transactions may also

accelerate the realization of taxable income to shareholders if such sales of investments resulted in gains, and may also increase transaction costs. In addition, a large redemption could result in the current expenses of the Fund and/or an

Underlying Fund being allocated over a smaller asset base, leading to an increase in the expense ratio of the Fund and/or an Underlying Fund.

Leverage

Risk (The Fund). Borrowing and the use of derivatives may result in leverage and may make the Fund more volatile. The use of leverage may cause the

Fund to liquidate portfolio positions to satisfy its obligations or to meet asset segregation requirements when it may not be advantageous to do so. The use of leverage by the Fund can substantially increase the adverse impact to which the Fund's

investment portfolio may be subject.

Liquidity

Risk (The Fund and one or more Underlying Funds). The Fund and/or an Underlying Fund may make investments that are illiquid or that may become

less liquid in response to market developments or adverse investor perceptions. Illiquid investments may be more difficult to value. Liquidity risk may also refer to the risk that the Fund and/or an Underlying Fund will not be able to pay redemption

proceeds within the allowable time period because of unusual market conditions, an unusually high volume of redemption requests, or other reasons. To meet redemption requests, the Fund and/or an Underlying Fund may be forced to sell securities at an

unfavorable time and/or under unfavorable conditions. Liquidity risk may be the result of, among other things, the reduced number and capacity of traditional market participants to make a market in fixed income securities or the lack of an active

market. The potential for liquidity risk may be magnified by a rising interest rate environment or other circumstances where investor redemptions from fixed income funds may be higher than normal, potentially causing increased supply in the market

due to selling activity. These risks may be more pronounced in connection with the Fund’s or an Underlying Fund’s investments in securities of issuers located in emerging market countries. Redemptions by large shareholders may have

a negative impact on the Fund’s and an Underlying Fund’s liquidity.

Loan-Related Investments Risk (The Fund and one or more Underlying Funds). In addition to risks generally associated with debt investments

(e.g., interest rate risk and default risk), loan-related investments such as

loan participations and assignments are subject to other risks.

Although a loan obligation may be fully collateralized at the time of acquisition, the collateral may decline in value, be or become relatively illiquid or less liquid, or lose all or substantially all of its value subsequent to investment. Many

loan investments are subject to legal or contractual restrictions on resale and certain loan investments may be or become relatively illiquid or less liquid and more difficult to value, particularly in the event of a downgrade of the loan or the

borrower. There is less readily available, reliable information about most loan investments than is the case for many other types of securities. Substantial increases in interest rates may cause an increase in loan obligation defaults. With respect

to loan participations, the Fund and/or an Underlying Fund do not always have direct recourse against a borrower if the borrower fails to pay scheduled principal and/or interest; may be subject to greater delays, expenses and risks than if the

Fund and/or an Underlying Fund had purchased a direct obligation of the borrower; and may be regarded as the creditor of the agent lender or counterparty (rather than the borrower), subjecting the Fund and/or an Underlying Fund to the

creditworthiness of that lender as well. Investors in loans, such as the Fund and/or an Underlying Fund may not be entitled to rely on the anti-fraud protections of the federal securities laws, although they may be entitled to certain

contractual remedies.

The market for loan

obligations may be subject to irregular trading activity, wide bid/ask spreads and extended trade settlement periods. Because transactions in many loans are subject to extended trade settlement periods, the Fund and/or an Underlying Fund may

not receive the proceeds from the sale of a loan for a period after the sale. As a result, sale proceeds related to the sale of loans may not be available to make additional investments or to meet the Fund's and/or Underlying Fund's redemption

obligations for a period after the sale of the loans, and, as a result, the Fund and/or an Underlying Fund may have to sell other investments or engage in borrowing transactions, such as borrowing from its credit facility, if necessary to

raise cash to meet its obligations. During periods of heightened redemption activity or distressed market conditions, the Fund and/or Underlying Fund may seek to obtain expedited trade settlement, which will generally incur additional costs

(although expedited trade settlement will not always be available).

Senior loans hold the most senior position in the

capital structure of a business entity, and are typically secured with specific collateral, but are nevertheless usually rated below investment grade. Because second lien loans are subordinated or unsecured and thus lower in priority of payment to

senior loans, they are subject to the additional risk that the cash flow of the borrower and property securing the loan or debt, if any, may be insufficient to meet scheduled payments after giving effect to the senior secured obligations of the

borrower. Second lien loans generally have greater price volatility than senior loans and may be less liquid. Generally, loans have the benefit of restrictive covenants that limit the ability of the borrower to further encumber its assets or impose

other obligations. To the extent a loan does not have certain covenants (or has less restrictive covenants), an investment in the loan will be particularly sensitive to the risks associated with loan investments.

Management

Risk (The Fund). A strategy used by the Investment Adviser may fail to produce the intended results.

Market Risk (The

Fund and one or more Underlying Funds). The value of the securities in which the Fund and/or an Underlying Fund invests may go up or down in response to the prospects of

individual companies, particular sectors or governments and/or general economic conditions throughout the world due to increasingly interconnected global economies and financial markets. Events such as war, acts of

7 Summary

Prospectus — Goldman Sachs Tactical Tilt Overlay Fund

terrorism, social unrest, natural disasters, the spread of

infectious illness or other public health threats could also significantly impact the Fund and/or an Underlying Fund and its investments.

Master Limited Partnership Risk (One or more Underlying Funds). Investments in securities of an MLP involve risks that differ from investments in common stock, including risks related to

limited control and limited rights to vote on matters affecting the MLP. Certain MLP securities may trade in lower volumes due to their smaller capitalizations, and may be subject to more abrupt or erratic price movements and lower market liquidity.

MLPs are generally considered interest-rate sensitive investments. During periods of interest rate volatility, these investments may not provide attractive returns.

Mid-Cap and Small-Cap Risk (One or more Underlying Funds). Investments in mid-capitalization and small-capitalization companies involve greater risks than those associated with

larger, more established companies. These securities may be subject to more abrupt or erratic price movements and may lack sufficient market liquidity, and these issuers often face greater business risks.

Mortgage-Backed and Other Asset-Backed Securities Risk (One or more Underlying Funds). Mortgage-related and other asset-backed securities are subject to certain additional risks, including “extension

risk” (i.e., in periods of rising interest rates, issuers may pay principal later than expected) and “prepayment risk” (i.e., in periods of declining interest rates, issuers may pay principal more quickly than expected, causing

the Underlying Fund to reinvest proceeds at lower prevailing interest rates). Mortgage-backed securities offered by non-governmental issuers are subject to other risks as well, including failures of private insurers to meet their obligations

and unexpectedly high rates of default on the mortgages backing the securities. Other asset-backed securities are subject to risks similar to those associated with mortgage-backed securities, as well as risks associated with the nature and servicing

of the assets backing the securities. Asset-backed securities may not have the benefit of a security interest in collateral comparable to that of mortgage assets, resulting in additional credit risk.

Municipal Securities Risk (One or more Underlying Funds). Municipal securities are subject to credit/default risk, interest rate risk and certain additional risks. The Underlying Fund may

be more sensitive to adverse economic, business or political developments if it invests a substantial portion of its assets in the bonds of similar projects (such as those relating to education, health care, housing, transportation, and utilities),

industrial development bonds, or in particular types of municipal securities (such as general obligation bonds, private activity bonds and moral obligation bonds). While interest earned on municipal securities is generally not subject to federal

tax, any interest earned on taxable municipal securities is fully taxable at the federal level and may be subject to tax at the state level.

Non-Diversification Risk (One or more Underlying Funds). Certain Underlying Funds are non-diversified, meaning that they are permitted to invest a larger percentage of their assets

in fewer issuers than diversified mutual funds. Thus, those Underlying Funds may be more susceptible to adverse developments affecting any single issuer held in their portfolios, and may be more susceptible to greater losses because of these

developments.

Non-Hedging Foreign Currency

Trading Risk (The Fund and one or more Underlying Funds). The Fund and one or more Underlying Funds may engage in forward foreign currency

transactions for hedging and non-hedging purposes. The Investment Adviser may purchase or sell foreign currencies through the use of forward contracts based on the Investment Adviser's judgment regarding the direction of the market for a particular

foreign currency or currencies. In pursuing this strategy, the Investment Adviser seeks to profit from anticipated movements in

currency rates by establishing “long” and/or

“short” positions in forward contracts on various foreign currencies. Foreign exchange rates can be extremely volatile and a variance in the degree of volatility of the market or in the direction of the market from the Investment

Adviser's expectations may produce significant losses to the Fund and/or an Underlying Fund. Some of these transactions may also be subject to interest rate risk.

Non-Investment Grade Fixed Income Securities Risk (The Fund and one or more Underlying Funds). Non-investment grade fixed income securities and unrated securities of comparable credit quality (commonly

known as “junk bonds”) are considered speculative and are subject to the increased risk of an issuer’s inability to meet principal and interest payment obligations. These securities may be subject to greater price volatility due to

such factors as specific issuer developments, interest rate sensitivity, negative perceptions of the junk bond markets generally and less liquidity.

Private Investment in Public Equities

(“PIPE”) Risk (One or more Underlying Funds). The MLP Energy Infrastructure Fund may make PIPE transactions. PIPE transactions typically involve the purchase of securities directly from a publicly traded company or its affiliates in a private

placement transaction, typically at a discount to the market price of the company’s common stock. In a PIPE transaction, the MLP Energy Infrastructure Fund may bear the price risk from the time of pricing until the time of closing. Equity

issued in this manner is often subject to transfer restrictions and is therefore less liquid than equity issued through a registered public offering. The MLP Energy Infrastructure Fund may be subject to lock-up agreements that prohibit transfers for

a fixed period of time. In addition, because the sale of the securities in a PIPE transaction is not registered under the Securities Act of 1933, as amended (the “Securities Act”), the securities are “restricted” and cannot

be immediately resold into the public markets. The MLP Energy Infrastructure Fund may enter into a registration rights agreement with the issuer pursuant to which the issuer commits to file a resale registration statement allowing the Fund to

publicly resell its securities. However, the ability of the MLP Energy Infrastructure Fund to freely transfer the shares is conditioned upon, among other things, the SEC’s preparedness to declare the resale registration statement effective and

the issuer’s right to suspend the Fund’s use of the resale registration statement if the issuer is pursuing a transaction or some other material non-public event is occurring. Accordingly, PIPE securities may be subject to risks

associated with illiquid investments.

Real

Estate Industry Risk (One or more Underlying Funds). Risks associated with investments in the real estate industry include, among others: possible

declines in the value of real estate; risks related to general and local economic conditions; possible lack of availability of mortgage financing, variations in rental income, neighborhood values or the appeal of property to tenants; interest rates;

overbuilding; extended vacancies of properties; increases in competition, property taxes and operating expenses; and changes in zoning laws. The real estate industry is particularly sensitive to economic downturns. The values of securities of

companies in the real estate industry may go through cycles of relative underperformance and out-performance in comparison to equity securities markets in general.

REIT Risk (One

or more Underlying Funds). Risks associated with investments in the real estate industry (such as REITs) include, among others: possible declines in

the value of real estate; risks related to general and local economic conditions; possible lack of availability of mortgage financing, variations in rental income, neighborhood values or the appeal of property to tenants; interest rates;

overbuilding; extended vacancies of properties; increases in competition, property taxes and operating expenses; and changes in zoning laws. REITs whose underlying properties are concentrated in a particular industry or

8 Summary

Prospectus — Goldman Sachs Tactical Tilt Overlay Fund

geographic region are subject to risks affecting such industries and

regions. The securities of REITs involve greater risks than those associated with larger, more established companies and may be subject to more abrupt or erratic price movements because of interest rate changes, economic conditions and other

factors. Securities of such issuers may lack sufficient market liquidity to enable the Underlying Fund to effect sales at an advantageous time or without a substantial drop in price.

Reverse Repurchase Agreements Risk (One or more Underlying Funds). Reverse repurchase

agreements are a form of secured borrowing and subject an Underlying Fund to the risks associated with leverage, including exposure to potential gains and losses in excess of the amount invested. Reverse repurchase agreements involve the risk that

the investment return earned by an Underlying Fund (from the investment of the proceeds) will be less than the interest expense of the transaction, that the market value of the securities sold by an Underlying Fund will decline below the price an

Underlying Fund is obligated to pay to repurchase the securities, and that the other party may fail to return the securities in a timely manner or at all.

Short Position

Risk (The Fund and one or more Underlying Funds). The Fund and/or an Underlying Fund may enter into a short position through a futures contract,

an option or swap agreement or through short sales of any instrument that the Fund and/or an Underlying Fund may purchase for investment. Taking short positions involves leverage of the Fund’s and/or an Underlying Fund’s assets

and presents various risks. If the value of the underlying instrument or market in which the Fund and/or an Underlying Fund has taken a short position increases, then the Fund and/or an Underlying Fund will incur a loss equal to the

increase in value from the time that the short position was entered into plus any related interest payments or other fees. Taking short positions involves the risk that losses may be disproportionate, may exceed the amount invested and may be

unlimited. To the extent that the Fund and/or an Underlying Fund uses the proceeds it receives from a short position to take additional long positions, the risks associated with the short position, including leverage risks, may be heightened,

because doing so increases the exposure of the Fund and/or an Underlying Fund to the markets and therefore could magnify changes to the Fund’s and/or an Underlying Fund’s NAV.

Sovereign Default Risk (The Fund and one or more Underlying Funds). An issuer of non-U.S. sovereign debt held by the Fund and/or an Underlying Fund, or the governmental

authorities that control the repayment of the debt, may be unable or unwilling to repay the principal or interest when due. This may result from political or social factors, the general economic environment of a country, levels of foreign debt or

foreign currency exchange rates.

State/Territory Specific Risk (One or more Underlying Funds). Certain Underlying Fund's investments in municipal obligations of issuers located in a particular state or U.S. territory

may be adversely affected by political, economic and regulatory developments within that state or U.S. territory. Such developments may affect the financial condition of a state’s or territory’s political subdivisions, agencies,

instrumentalities and public authorities and heighten the risks associated with investing in bonds issued by such parties, which could, in turn, adversely affect the Underlying Fund’s income, NAV, liquidity, and/or ability to preserve or

realize capital appreciation.

Stock

Risk (The Fund and one or more Underlying Funds). Stock prices have historically risen and fallen in periodic cycles. U.S. and foreign stock

markets have experienced periods of substantial price volatility in the past and may do so again in the future.

Strategy

Risk (One or more Underlying Funds). The MLP Energy Infrastructure Fund’s strategy of investing primarily in MLPs, resulting in its being taxed as a corporation, or a “C” corporation, rather than as a regulated investment

company for U.S. federal income tax purposes, is a relatively new investment strategy for funds. This strategy involves complicated accounting, tax and valuation issues. Volatility in the NAV may be experienced because of the use of estimates at

various times during a given year that may result in unexpected and potentially significant consequences for the MLP Energy Infrastructure Fund and its shareholders.

Subsidiary Risk (The

Fund). The Subsidiary is not registered under the Investment Company Act and is not subject to all the investor protections of the Investment Company Act. Changes in the laws of the United

States and/or the Cayman Islands could result in the inability of the Fund and/or the Subsidiary to operate as described in the Prospectus and the Statement of Additional Information (“SAI”) and could adversely affect the

Fund.

Swaps Risk (The Fund). In a standard “swap” transaction, two parties agree to exchange the returns, differentials in rates of return or some other amount

earned or realized on the “notional amount” of predetermined investments or instruments, which may be adjusted for an interest factor. Swaps can involve greater risks than direct investment in securities, because swaps may be leveraged

and subject to counterparty risk (e.g., the risk of a counterparty’s defaulting on the obligation or bankruptcy), credit risk and pricing risk (i.e., swaps may be difficult to value). Swaps may also be considered illiquid. It may not be

possible for the Fund to liquidate a swap position at an advantageous time or price, which may result in significant losses.

Tax Risk (The

Fund). The Fund will seek to gain exposure to the commodity markets primarily through investments in the Subsidiary. Historically, the Internal Revenue Service (“IRS”) issued

private letter rulings in which the IRS specifically concluded that income and gains from investments in commodity index-linked structured notes (the “Notes Rulings”) or a wholly-owned foreign subsidiary that invests in commodity-linked

instruments are “qualifying income” for purposes of compliance with Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). However, the Fund has not received such a private letter ruling, and is not able

to rely on private letter rulings issued to other taxpayers. The IRS issued a revenue procedure, which states that the IRS will not in the future issue private letter rulings that would require a determination of whether an asset (such as a

commodity index-linked note) is a “security” under the Investment Company Act. In connection with issuing such revenue procedure, the IRS has revoked the Note Rulings on a prospective basis. In light of the revocation of the Note

Rulings, the Fund intends to limit its investments in commodity index-linked structured notes.

The IRS recently issued final regulations that would

generally treat the Fund’s income inclusion with respect to a subsidiary as qualifying income either if (A) there is a distribution out of the earnings and profits of a subsidiary that are attributable to such income inclusion (the

“Subpart F Distribution Rule”) or (B) such inclusion is derived with respect to the Fund’s business of investing in stock, securities, or currencies.

In reliance on an opinion of counsel, the Fund may

gain exposure to the commodity markets through investments in the Subsidiary.

The tax treatment of the Fund’s investments in

the Subsidiary could affect whether income derived from such investment is “qualifying income” under Subchapter M of Code, or otherwise affect the character, timing and/or amount of the Fund’s taxable income or any gains and

distributions made by the Fund. If the IRS were to successfully assert that the Fund’s income from such investments was not “qualifying

9 Summary

Prospectus — Goldman Sachs Tactical Tilt Overlay Fund

income,” the Fund may fail to qualify as a regulated

investment company (RIC) under Subchapter M of the Code if over 10% of its gross income was derived from these investments. If the Fund failed to qualify as a RIC, it would be subject to federal and state income tax on all of its taxable income at

regular corporate tax rates with no deduction for any distributions paid to shareholders, which would significantly adversely affect the returns to, and could cause substantial losses for, Fund shareholders.

Tax Risk (One or

more Underlying Funds). Any proposed or actual changes in income tax rates or the tax-exempt status of interest income from fixed income securities issued by or on behalf of states,

territories and possessions of the United States (including the District of Columbia) and the political subdivisions, agencies and instrumentalities thereof (“Municipal Securities”) can significantly affect the demand for and supply,

liquidity and marketability of Municipal Securities. Such changes may affect certain Underlying Funds’ net asset values and ability to acquire and dispose of Municipal Securities at desirable yield and price levels.

Tax Consequences Risk (One or more Underlying Funds). An Underlying Fund will be subject to the risk that adjustments for inflation to the principal amount of an inflation indexed

bond may give rise to original issue discount, which will be includable in the Underlying Fund’s gross income.

Treasury Inflation Protected Securities Risk (One or more Underlying Funds). The value of inflation protected securities issued by the U.S. Treasury (“TIPS”) generally fluctuates in response to

inflationary concerns. As inflationary expectations increase, TIPS will become more attractive, because they protect future interest payments against inflation. Conversely, as inflationary concerns decrease, TIPS will become less attractive and less

valuable.

U.S. Government Securities

Risk (The Fund and one or more Underlying Funds). The U.S. government may not provide financial support to U.S. government agencies, instrumentalities

or sponsored enterprises if it is not obligated to do so by law. U.S. Government Securities issued by those agencies, instrumentalities and sponsored enterprises, including those issued by the Federal National Mortgage Association

(“Fannie Mae”), Federal Home Loan Mortgage Corporation (“Freddie Mac”) and Federal Home Loan Banks, are neither issued nor guaranteed by the U.S. Treasury and, therefore, are not backed by the full faith and credit of the

United States. The maximum potential liability of the issuers of some U.S. Government Securities held by the Fund may greatly exceed their current resources, including any legal right to support from the U.S. Treasury. It is possible that issuers of

U.S. Government Securities will not have the funds to meet their payment obligations in the future.

Further Information on Investment Objectives,

Strategies and Risks of the Underlying Funds. A concise description of the investment objectives, practices and risks of each of the Underlying Funds that are currently expected to be used for investment by the Fund

as of the date of the Prospectus is provided beginning on page 18 of the Prospectus.

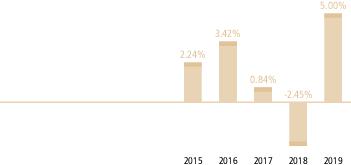

| Performance |

The bar chart and table

below provide an indication of the risks of investing in the Fund by showing: (a) changes in the performance of the Fund’s Institutional Shares from year to year; and (b) how the average annual total returns of the Fund’s Institutional

and Class R6 Shares compare to those of a broad-based securities market index. The Fund’s past performance, before and after taxes, is not necessarily an indication

of how the Fund will perform in the future. Updated performance

information is available at no cost at www.gsamfunds.com/performance or by calling the appropriate phone number on the back cover of the Prospectus.

Performance reflects applicable fee waivers and/or

expense limitations in effect during the periods shown.

CALENDAR YEAR (INSTITUTIONAL)

The total return

illustrated in the table above for the 9-month period ended September 30, 2020 was 1.01%.

| During the periods shown in the chart above: | Returns | Quarter ended |

| Best Quarter Return | 5.75% | March 31, 2015 |

| Worst Quarter Return | -4.75% | September 30, 2015 |

| AVERAGE ANNUAL TOTAL RETURN |

| For the period ended December 31, 2019 | 1 Year | 5 Years | Since

Inception |

| Institutional Shares (Inception 7/31/2014) | |||

| Returns Before Taxes | 5.00% | 1.78% | 1.68% |

| Returns After Taxes on Distributions | 4.54% | 1.05% | 0.92% |

| Returns After Taxes on Distributions and Sale of Fund Shares | 2.96% | 1.03% | 0.95% |

| Class R6 Shares (Inception 12/29/2017)* | |||

| Returns Before Taxes | 4.88% | 1.75% | 1.66% |

| ICE ® BofAML® U.S. Dollar Three-Month LIBOR Constant Maturity Index (reflects no deduction for fees or expenses) | 2.59% | 1.33% | 1.25% |

| * | Class R6 Shares commenced operations on December 29, 2017. Prior to that date, the performance of Class R6 Shares shown in the table above is that of Institutional Shares, including since inception performance as of Institutional Shares’ inception date. Performance has not been adjusted to reflect the lower expenses of Class R6 Shares. Class R6 Shares would have had higher returns because: (i) Institutional Shares and Class R6 Shares represent interests in the same portfolio of securities; and (ii) Class R6 Shares have lower expenses. |

The after–tax returns are for Institutional

Shares only. The after–tax returns for Class R6 Shares will vary. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual

after-tax returns depend on an investor’s tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Fund Shares through tax-deferred arrangements such as 401(k) plans or

individual retirement accounts.

| Portfolio Management |

Goldman Sachs

Asset Management, L.P. is the investment adviser for the Fund (the “Investment Adviser” or “GSAM”).

10 Summary

Prospectus — Goldman Sachs Tactical Tilt Overlay Fund

Portfolio Managers: Sergey

Kraytman, Managing Director—Global Portfolio Solutions, has managed the Fund since 2014; David Hale, CFA, Vice President—Global Portfolio Solutions, has managed the Fund since 2015; and Siwen Wu, Vice President— Global Portfolio

Solutions, has managed the Fund since 2019.

| Buying and Selling Fund Shares |

The Fund does not impose minimum purchase

requirements for initial or subsequent investments in Institutional or Class R6 Shares.

You may purchase and redeem (sell) shares of the Fund

on any business day through certain intermediaries that have a relationship with Goldman Sachs & Co. LLC (“Goldman Sachs”), including banks, trust companies, brokers, registered investment advisers and other financial institutions

authorized to accept, on behalf of the Fund, purchase and exchange orders and redemption requests placed by or on behalf of their customers (“Intermediaries”). Institutional Shares of the Fund are offered exclusively to (i) clients of

Goldman Sachs Private Wealth Management (“GS PWM”), (ii) portfolio managers that, at the time of purchase, are members of the Global Portfolio Solutions (“GPS”) Team, (iii) members of the Investment Strategy Group

(“ISG”) Tactical Asset Allocation Team, and (iv) certain institutional clients of the Investment

Adviser. Class R6 Shares of the Fund are offered exclusively to (i)

portfolio managers that, at the time of purchase, are members of the GPS Team, (ii) members of the ISG Tactical Asset Allocation Team, and (iii) certain institutional clients of the Investment Adviser.

| Tax Information |

The

Fund’s distributions are taxable, and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account. Investments made through

tax-deferred arrangements may become taxable upon withdrawal from such arrangements.

| Payments

to Broker-Dealers and Other Financial Intermediaries |

If you purchase the Fund through an Intermediary,

the Fund and/or its related companies may pay the Intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the Intermediary and your salesperson to recommend the Fund over another

investment. Ask your salesperson or visit your Intermediary’s website for more information.

11 Summary

Prospectus — Goldman Sachs Tactical Tilt Overlay Fund

[This page intentionally left blank]

12 Summary

Prospectus — Goldman Sachs Tactical Tilt Overlay Fund

TACTSUM-20

FREE Breaking News Alerts from StreetInsider.com!

StreetInsider.com Top Tickers, 4/23/2024

- Futures inch higher in run-up to corporate earnings

- JPMorgan is worried about further S&P 500 sell-off potential

- Oil rises on robust EU data as Mideast tensions linger

- China acquired top-end Nvidia AI chips despite recent US ban- Reuters

- SAP Q1 results fall short of Wall Street estimates as transformation kicks off

- Fisker (FSR) Appoints Michael Healy as Chief Restructuring Officer

- Kroger (KR), Albertsons and C&S Wholesale Grocers Announce an Updated and Expanded Divestiture Plan

- Costar Group (CSGP) to Acquire Matterport (MTTR) for $5.50/sh Cash and Stock

- Jaguar Health (JAGX) Files $75M Mixed Shelf

- Apple (AAPL) PT Lowered to $210 at Morgan Stanley, 'We'd buy post-earnings weakness'

- After-hours movers: Cadence Design Systems, Cleveland-Cliffs, Riot Platforms, and more

- Midday movers: Tesla, Li Auto and CNH Industrial fall; Salesforce rises

- Midday movers: Netflix, Super Micro fall; Paramount Global gains

- After-hours movers: Netflix, Intuitive Surgical, Nordstrom, KB Home

- Midday movers: Tesla, Blackstone, Las Vegas Sands fall; DR Horton rises

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Goldman and BofA face renewed calls to split CEO, chairman's roles

- Inflation relief has likely been delayed not destroyed - GS

- SL Green Realty (SLG) PT Lowered to $38 at Goldman Sachs

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Goldman SachsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share