Samsung's Galaxy S4 Could Account for 2.5% of Semi Sales this Year - Analyst

Samsung Galaxy S4

Get Alerts BRCM Hot Sheet

Price: $54.67 --0%

Rating Summary:

15 Buy, 29 Hold, 1 Sell

Rating Trend: = Flat

Today's Overall Ratings:

Up: 11 | Down: 13 | New: 19

Rating Summary:

15 Buy, 29 Hold, 1 Sell

Rating Trend: = Flat

Today's Overall Ratings:

Up: 11 | Down: 13 | New: 19

Join SI Premium – FREE

Samsung unveiled its highly anticipated flagship smartphone Galaxy S4 in New York City on Thursday evening. The news has wide-spread implications for the semiconductor sector as an estimated 70 million Galaxy S4 units could sell in 2013. The device could account for roughly $7.5 billion, or 2.5%, in total semiconductor sales in 2013, according to RBC Capital's Doug Freedman.

From a components standpoint, the upgrades for the Galaxy S4 are: 1) .ac WiFi (prior .n); 2) 2GB DDR3 LP mobile DRAM (prior DDR2 at 1.0-1.5GB); and 3) 13MPx back-side image sensor (prior 8MPx). Also, sensing and RF content could be higher to manage increasing functionality (infrared, hover, gesture) and 4G complexities (PA, filters, switches and tuning) in select regions.

By RBC's early estimates, the Bill of Material (BOM) for the Galaxy S4 could be 5-10% higher versus predecessor Galaxy S3 with the largest difference stemming from higher mobile DRAM and sensors. "In our view, the average BOM for the S4 should be near $108/per smartphone, with components differing by region."

Freedman weighed in on what the Galaxy S4 could mean for semiconductor sector. The company's exposed, according to the analyst, are likely Broadcom (NASDAQ: BRCM) (incremental NFC and .ac content adding an incremental $0.50 to content), Maxim (NASDAQ: MXIM) (power management SoC at ~$3 plus IR gesture sensor), Avago (NASDAQ: AVGO) (RF components) and SanDisk (NASDAQ: SNDK) & Micron (NYSE: MU) indirectly through higher internal consumption of Samsung NAND. Also, Cypress Semiconductor (NYSE: CY).

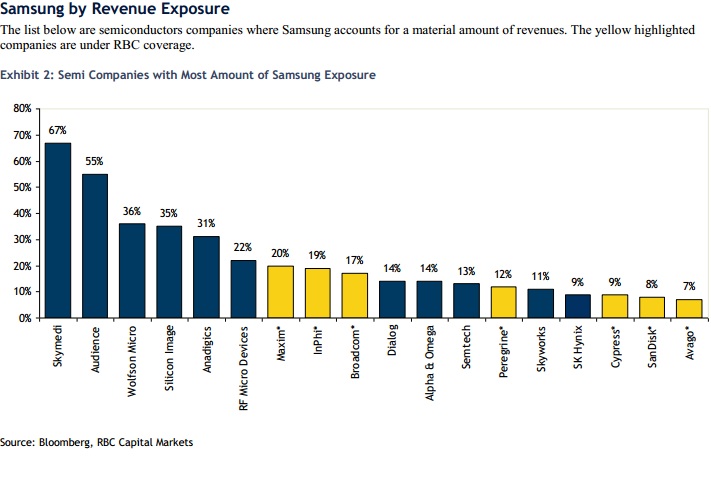

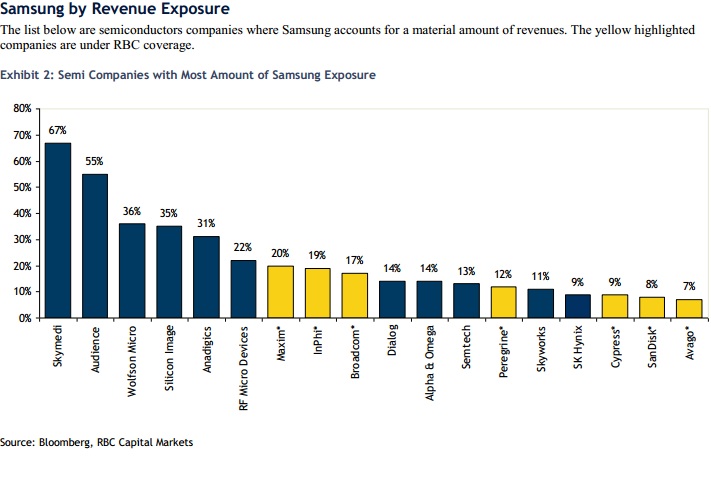

Other U.S.-traded companies will significant exposure to Samsung, but not covered by RBC Capital are:

Audience, Inc. (NASDAQ: ADNC), Silicon Image, Inc. (NASDAQ: SIMG), Anadigics, Inc. (NASDAQ: ANAD), RF Micro Devices Inc. (NASDAQ: RFMD), Semtech Corporation (NASDAQ: SMTC), Skyworks Solutions Inc. (NASDAQ: SWKS)

Below is a chart prepared by RBC on the level of exposure to Samsung:

From a components standpoint, the upgrades for the Galaxy S4 are: 1) .ac WiFi (prior .n); 2) 2GB DDR3 LP mobile DRAM (prior DDR2 at 1.0-1.5GB); and 3) 13MPx back-side image sensor (prior 8MPx). Also, sensing and RF content could be higher to manage increasing functionality (infrared, hover, gesture) and 4G complexities (PA, filters, switches and tuning) in select regions.

By RBC's early estimates, the Bill of Material (BOM) for the Galaxy S4 could be 5-10% higher versus predecessor Galaxy S3 with the largest difference stemming from higher mobile DRAM and sensors. "In our view, the average BOM for the S4 should be near $108/per smartphone, with components differing by region."

Freedman weighed in on what the Galaxy S4 could mean for semiconductor sector. The company's exposed, according to the analyst, are likely Broadcom (NASDAQ: BRCM) (incremental NFC and .ac content adding an incremental $0.50 to content), Maxim (NASDAQ: MXIM) (power management SoC at ~$3 plus IR gesture sensor), Avago (NASDAQ: AVGO) (RF components) and SanDisk (NASDAQ: SNDK) & Micron (NYSE: MU) indirectly through higher internal consumption of Samsung NAND. Also, Cypress Semiconductor (NYSE: CY).

Other U.S.-traded companies will significant exposure to Samsung, but not covered by RBC Capital are:

Audience, Inc. (NASDAQ: ADNC), Silicon Image, Inc. (NASDAQ: SIMG), Anadigics, Inc. (NASDAQ: ANAD), RF Micro Devices Inc. (NASDAQ: RFMD), Semtech Corporation (NASDAQ: SMTC), Skyworks Solutions Inc. (NASDAQ: SWKS)

Below is a chart prepared by RBC on the level of exposure to Samsung:

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Intra-Cellular Therapies (ITCI) Prices Public Offering of Common Stock

- Montrose Environmental (MEG) Announces Pricing of Public Offering of Shares

- Duolingo (DUOL) to Join S&P MidCap 400; Cable One (CABO) to Join S&P SmallCap 600

Create E-mail Alert Related Categories

Analyst Comments, Insiders' Blog, Trader TalkRelated Entities

RBC Capital, S3Sign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share