Competition, Spending Cuts Make Illumina (ILMN) One Risky Play - Barron's

Get Alerts ILMN Hot Sheet

Join SI Premium – FREE

Illumina (Nasdaq: ILMN) recently reported stronger-than-expected earnings, approved a $250 million common stock buyback, and snubbed an offer from Roche (OTCBB: RHHBY)...all within a week. But, Barron's believes this one-time "Apple of the genome business" might be starting to look more like a lemon.

Following the diss against Roche, Barron's cautioned about rough waters for Illumina ahead with the decline of public spending as well as rivals producing lower-priced products.

Illumina's quarterly report showed profit of 36 cents per share, which beat views. Declines in revenue were offset by a similar ebb in expenses.

Since hitting a recent high of $55 following Roche's bid, shares are down 15 percent to the mid-$40 range. Shares may have fallen further if not for investors expecting Roche to pounce once again on further dips. Shares traded as low as $26 in the months leading up to the Roche bid as government spending cut expectations and light third-quarter results weighed.

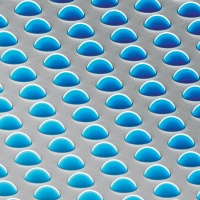

Illumina's benchmark machine -- the HiSeq -- goes for about $500,000, making it only a purchase universities and government's might make. The devices performs a full-body gene sequencing process. Recently, Illumina released the less-expensive MiSeq for $120,000 a pop. It's biggest competition is from Life Technologies (Nasdaq: LIFE), which is offering the Ion Personal Genome Machine at $50,000...less than half the price of Illumina's device.

What's more is that later in 2012, Oxford Nanopore Technologies will begin marketing a USB-sized gene sequencing device. Possibly to impress guests at cocktail parties or as a very elaborate, yet totally literal, pickup line? ("Care if I unzip your 'genes?')

Barron's also alludes to the National Institutes of Health which makes up about 33 percent of Illumina's sales. Should Congress not pass deficit reduction measures, the agency could face severe funding cuts in 2013.

For a stock trading at 29 times earnings, that's a lot.

Factors going for Illumina include its management team, which said the National Institutes of Health cuts are an unlikely scenario, as well as improved consumable sales and growing backlog.

So for a fun speculative play, maybe Illumina is your guy. For the rest of us, we'll stick with Apple, thanks.

Shares of Illumina are flat in early Friday trading.

Following the diss against Roche, Barron's cautioned about rough waters for Illumina ahead with the decline of public spending as well as rivals producing lower-priced products.

Illumina's quarterly report showed profit of 36 cents per share, which beat views. Declines in revenue were offset by a similar ebb in expenses.

Since hitting a recent high of $55 following Roche's bid, shares are down 15 percent to the mid-$40 range. Shares may have fallen further if not for investors expecting Roche to pounce once again on further dips. Shares traded as low as $26 in the months leading up to the Roche bid as government spending cut expectations and light third-quarter results weighed.

Illumina's benchmark machine -- the HiSeq -- goes for about $500,000, making it only a purchase universities and government's might make. The devices performs a full-body gene sequencing process. Recently, Illumina released the less-expensive MiSeq for $120,000 a pop. It's biggest competition is from Life Technologies (Nasdaq: LIFE), which is offering the Ion Personal Genome Machine at $50,000...less than half the price of Illumina's device.

What's more is that later in 2012, Oxford Nanopore Technologies will begin marketing a USB-sized gene sequencing device. Possibly to impress guests at cocktail parties or as a very elaborate, yet totally literal, pickup line? ("Care if I unzip your 'genes?')

Barron's also alludes to the National Institutes of Health which makes up about 33 percent of Illumina's sales. Should Congress not pass deficit reduction measures, the agency could face severe funding cuts in 2013.

For a stock trading at 29 times earnings, that's a lot.

Factors going for Illumina include its management team, which said the National Institutes of Health cuts are an unlikely scenario, as well as improved consumable sales and growing backlog.

So for a fun speculative play, maybe Illumina is your guy. For the rest of us, we'll stick with Apple, thanks.

Shares of Illumina are flat in early Friday trading.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Super Micro Computer (SMCI) Falls 6%

- Procter & Gamble (PG) revenue falls short of expectations, raises full-year earnings guidance

- American International Group (AIG) PT Raised to $89 at Piper Sandler

Create E-mail Alert Related Categories

Insiders' BlogRelated Entities

Barron's, Stock Buyback, EarningsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share