Bove: Next Round of Stress Tests Unnecessary, Potentially Harmful (C) (BAC) (JPM)

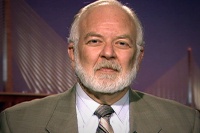

Outspoken bank analyst Richard 'Dick' Bove believes that the next round of stress tests on U.S. banks will not only be unnecessary, but potentially harmful.

Speaking with CNBC late last week, Bove, of Rochdale Securities, said the U.S. banks "are in good shape, the banks are ready and able to assist the economy."

But the annual tests by the Fed, mandated under Dodd-Frank, aim to see how banks will react with 13 percent unemployment, a 21 percent fall in home prices, GDP getting clipped 8 percent, and a 52 percent plunge in the stock market (i.e. - the worst case scenario). The time frame is the third-quarter of 2011 through the fourth-quarter of 2012.

Bove argues that the tests will require banks to "increase capital ratios by shrinking the balance sheet," therefore hampering lending ability, crimping margins, and adding less value for shareholders.

Conversely, CNBC noted that Goldman Sachs (NYSE: GS) ran simulations on banks akin to what the Fed will be doing. Goldman said the banks have about $900 billion of loss absorption capacity from accumulating assets and limiting lending over the last two years.

With banks required to report results by January 9th, investors might focus on some of the largest players in the sector leading up to that point, include: Bank of America (NYSE: BAC), Citigroup (NYSE: C), Wells Fargo (NYSE: WFC), Goldman, JPMorgan (NYSE: JPM), and Morgan Stanley (NYSE: MS).

Speaking with CNBC late last week, Bove, of Rochdale Securities, said the U.S. banks "are in good shape, the banks are ready and able to assist the economy."

But the annual tests by the Fed, mandated under Dodd-Frank, aim to see how banks will react with 13 percent unemployment, a 21 percent fall in home prices, GDP getting clipped 8 percent, and a 52 percent plunge in the stock market (i.e. - the worst case scenario). The time frame is the third-quarter of 2011 through the fourth-quarter of 2012.

Bove argues that the tests will require banks to "increase capital ratios by shrinking the balance sheet," therefore hampering lending ability, crimping margins, and adding less value for shareholders.

Conversely, CNBC noted that Goldman Sachs (NYSE: GS) ran simulations on banks akin to what the Fed will be doing. Goldman said the banks have about $900 billion of loss absorption capacity from accumulating assets and limiting lending over the last two years.

With banks required to report results by January 9th, investors might focus on some of the largest players in the sector leading up to that point, include: Bank of America (NYSE: BAC), Citigroup (NYSE: C), Wells Fargo (NYSE: WFC), Goldman, JPMorgan (NYSE: JPM), and Morgan Stanley (NYSE: MS).

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Wells Fargo Upgrades Neurocrine Bio. (NBIX) to Overweight 'as the Company is Knocking on the Doors of the Large-Cap Club'

- Wells Fargo (WFC) Weighs Debut Risk Transfer as Banks Shore Up Capital - Bloomberg

- Humana (HUM) surges on Q1 beat, reiterated adjusted earnings outlook

Create E-mail Alert Related Categories

Insiders' Blog, Trader TalkRelated Entities

JPMorgan, Citi, Morgan Stanley, Wells FargoSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share Up)

Up)