Form 8-K Parkway, Inc. For: Dec 12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 12, 2016

PARKWAY, INC.

(Exact Name of Registrant as Specified in its Charter)

Maryland | 001-37819 | 61-1796261 | ||

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||

San Felipe Plaza 5847 San Felipe Street, Suite 2200, | ||||

Houston, Texas | 77057 | |||

(Address of Principal Executive Offices) | (Zip code) | |||

(346) 200-3100

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

As previously disclosed, on October 7, 2016, Cousins Properties Incorporated (“Cousins”) completed the spin-off (the “Spin-Off”) of Parkway, Inc. (the “Company”). Prior to the Spin-Off, Parkway Properties, Inc. (“Legacy Parkway”) was merged with and into a wholly-owned subsidiary of Cousins (the “Merger”), and then the Houston, Texas-based assets of Cousins and Legacy Parkway and their respective subsidiaries and certain other assets were contributed to the Company and Parkway Operating Partnership LP, the Company’s operating partnership (the “Separation”).

Before the Merger and the Separation, Legacy Parkway was party to an employment agreement with (i) James R. Heistand, dated as of July 8, 2013 and amended as of June 15, 2015 and July 7, 2016, (ii) M. Jayson Lipsey, dated as of October 25, 2013 and amended as of June 15, 2015, and (iii) Scott E. Francis, dated as of December 22, 2014 and amended as of June 15, 2015 (together, the “Prior Agreements”). In addition, concurrently with the execution of the merger agreement relating to the Merger, each of Messrs. Heistand, Lipsey, and Francis entered into limited waivers of certain rights under the Prior Agreements, which provided, among other things, that if he is offered continued employment with the Company pursuant to the assignment of his existing employment agreement to the Company or to a new employment agreement with the Company that is no less favorable than his employment agreement with Legacy Parkway, he may not terminate his employment for “good reason” under certain provisions of his Prior Agreement. In connection with the Separation and the Spin-Off, these executives were offered employment with the Company, and the Company assumed the Prior Agreements.

In recognition of the transformational aspects of the Separation and the Spin-Off of the Company’s business, the Compensation Committee (the “Compensation Committee”) of the Company’s Board of Directors (the “Board”) undertook a comprehensive review of the Company’s executive compensation policies. As a result of that review, on December 8, 2016, the Compensation Committee recommended that the Board approve, and on December 10, 2016, the Board acted on the Compensation Committee’s recommendation to approve, the following compensatory arrangements that affect the Company’s named executive officers.

New Employment Agreements

On December 12, 2016, the Company entered into new employment agreements (each an “Employment Agreement,” and collectively, the “Employment Agreements”) with each of Mr. Heistand, Mr. Lipsey, and Mr. Francis (each, an “Executive,” and collectively, the “Executives”) that supersede and replace in their entirety the Prior Agreements. Pursuant to the Employment Agreements, Mr. Heistand will continue his employment as the Company’s President and Chief Executive Officer; Mr. Lipsey will continue his employment as the Company’s Executive Vice President and Chief Operating Officer; and Mr. Francis will continue his employment as the Company’s Executive Vice President, Chief Financial Officer and Chief Accounting Officer.

The term of each Employment Agreement commenced on December 12, 2016 (the “Effective Date”) and ends on December 31, 2019, with automatic one-year renewals unless either the Company or the Executive elects not to renew the term of the Employment Agreement by providing the other party with 90 days’ notice. However, upon the occurrence of a “change in control” (as defined in the Employment Agreements), the term of the Employment Agreement will automatically extend until the later of the second anniversary of such change in control and the date on which the term would otherwise have ended.

Pursuant to the Employment Agreements, Mr. Heistand’s base salary will be $750,000; Mr. Lipsey’s base salary will be $450,000; and Mr. Francis’ base salary will be $400,000. These base salary amounts are the same as the Executives’ previously disclosed 2016 base salaries, except that, in connection with his promotion to Chief Financial Officer in connection with the Separation and the Spin-Off, Mr. Francis’ base salary has been increased from $350,000 to $400,000 to recognize and compensate for his increased duties and responsibilities. Each Executive’s base salary will be annually reviewed by the Compensation Committee and may be increased in the Compensation Committee’s sole discretion.

In addition, each Executive is entitled to participate in the Company’s discretionary annual cash incentive program as may be established or approved by the Board or the Compensation Committee from time to time. Mr.

Heistand’s annual cash incentive target opportunity is 150% of his base salary then in effect; Mr. Lipsey’s annual cash incentive target opportunity is 95% of his base salary then in effect; and Mr. Francis’ annual cash incentive target opportunity is 90% of his base salary then in effect. Mr. Lipsey’s annual cash incentive target opportunity has been increased from 90% to 95%; and Mr. Francis’ annual cash incentive target opportunity has been increased from 60% to 90%. Each Executive’s annual cash incentive target opportunity will be annually reviewed by the Compensation Committee and may be increased in the Compensation Committee’s sole discretion. For the 2016 calendar year, to compensate for each of the Executive’s efforts with respect to the Company’s business both before and after the Spin-Off and to recognize the extraordinary efforts of each Executive in preparing for and consummating the Separation and the Spin-Off, the Company will pay each Executive a transition bonus in lieu of an annual bonus for the 2016 calendar year, in an amount of $1,025,000 for Mr. Heistand, $427,500 for Mr. Lipsey, and $360,000 for Mr. Francis, payable in each case after the close of the 2016 calendar year.

Each Executive is also eligible to receive an annual equity grant under the Parkway, Inc. and Parkway Operating Partnership LP 2016 Omnibus Equity Incentive Plan (as it may be amended from to time to time, or its successor, the “2016 Plan”) in the amount and form as the Board or the Compensation Committee deems appropriate. For the 2017 calendar year, each Executive will receive pursuant to the 2016 Plan, effective as of the Effective Date, both (i) a grant of performance-based restricted stock units, covering 74,027 target units for Mr. Heistand, 32,572 target units for Mr. Lipsey, and 29,611 target units for Mr. Francis and (ii) a grant of time-based restricted stock units, having an aggregate grant date value equal to $375,000 for Mr. Heistand, $165,000 for Mr. Lipsey, and $150,000 for Mr. Francis. The performance-based restricted stock units will vest based upon achievement of certain total shareholder return performance metrics over the three-year performance period commencing on the Effective Date, subject to the Executive’s continued employment. The time-based restricted stock units will vest in equal annual installments over, for Mr. Heistand, three years commencing on the Effective Date, and for Messrs. Lipsey and Francis, four years commencing on the Effective Date, in each case subject to the Executive’s continued employment on each applicable vesting date.

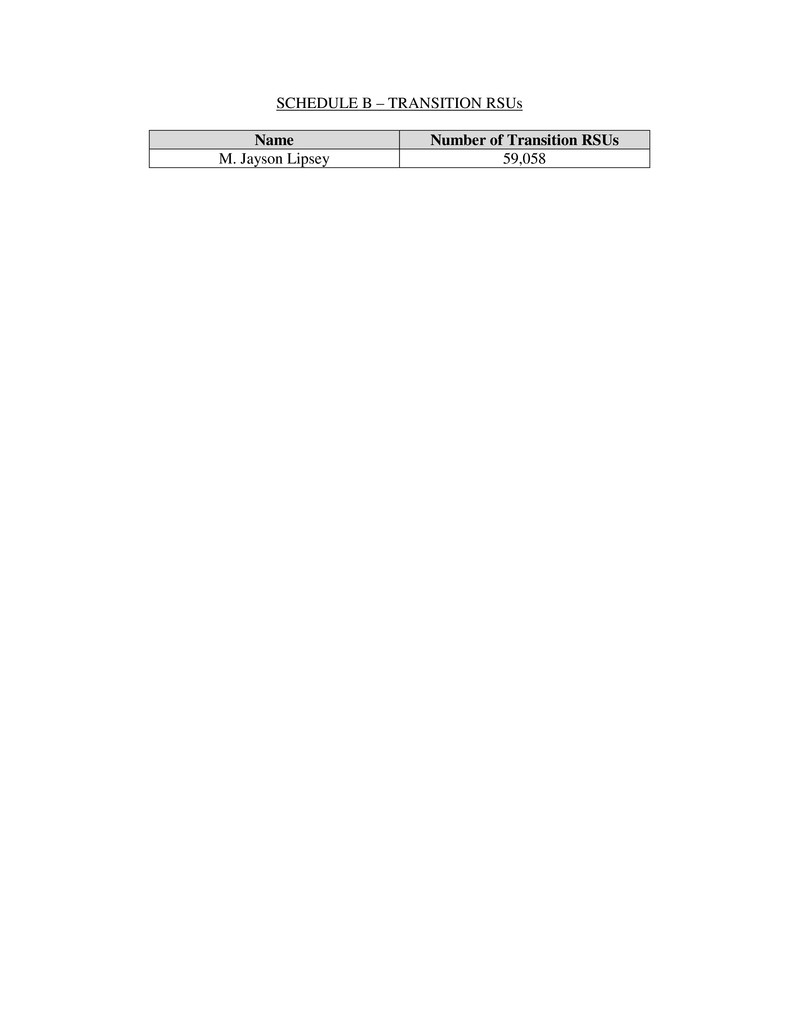

Immediately prior to the Merger and the Spin-Off, each Executive forfeited certain time-based restricted stock units with respect to common stock of Legacy Parkway and certain performance-based LTIP units with respect to Parkway Properties LP in exchange for the same number of unvested time-based restricted stock units with respect to common stock of Legacy Parkway (the “Modified RSUs”). In the Spin-Off, the Company assumed the unvested portion of the Modified RSUs and converted them into time-based restricted stock units with respect to the Company’s common stock (the “Transition RSUs”). The Transition RSUs were originally scheduled to vest one-third on each of the first, second, and third anniversaries of the closing date of the Merger, subject to the Executive’s continued service with the Company on the applicable vesting date. Pursuant to the Employment Agreements, the Transition RSUs will instead vest 50% on January 1, 2017, and the remaining 50% of the Transition RSUs will vest in equal installments on each of the first, second, and third anniversaries of the closing date of the Merger, in each case subject to the Executive’s continued service with the Company on the applicable vesting date.

In addition, each Executive is entitled to participate in all employee benefit plans and programs available generally to other executives of the Company, including reimbursement of reasonable business expenses and vacation days, for Mr. Heistand, no fewer than 25 days per year and, for Messrs. Lipsey and Francis, in accordance with the Company’s policies.

Except in the case of a change in control of the Company (described below), if the Executive is terminated by the Company without “cause” (including the Company’s election not to renew and/or extend the term of the Employment Agreement where the Executive is willing to do so) or resigns for “good reason” (each as defined in the Employment Agreement) (a “Regular Involuntary Termination”), the Executive will be entitled to:

(i) | lump sum payment of any earned but unpaid base salary accrued through the date of termination and any earned but unpaid vacation pay, |

(ii) | to the extent unpaid, lump sum payment of the transition bonus with respect to the 2016 calendar year, |

(iii) | lump sum payment of any earned but unpaid annual bonus for the preceding calendar year, |

(iv) | if the termination is more than six months into the performance year, subject to the Compensation Committee’s certification of achievement for such year, payment of a pro-rated portion of the annual bonus for the year in which the termination occurs, |

(v) | payment of an amount equal to, for Mr. Heistand, the sum of 18 months of his then-current base salary plus 1.5 times the Executive’s then-current annual cash incentive target opportunity and, for Messrs. Lipsey and Francis, 12 months of his then-current base salary, in each case payable in 12 equal monthly installments, |

(vi) | immediate and automatic vesting of all then unvested Transition RSUs, |

(vii) | for other equity or equity-based awards that are subject to time-based vesting, an additional, for Mr. Heistand, 18 months of time-based vesting credit or, for Messrs. Lipsey and Francis, 12 months of time-based vesting credit, and |

(viii) | continued health care coverage for the Executive and his dependents at the Company’s cost for up to, for Mr. Heistand, 18 months and, for Messrs. Lipsey and Francis, 12 months after coverage would otherwise lapse. |

Furthermore, if the Regular Involuntary Termination is prior to the second anniversary of the Effective Date, and subject to Executive’s execution of the Release and Non-Compete Agreement, severance is enhanced with a lump sum payment of an amount equal to, for Mr. Heistand, 2.9 times the sum of (A) his then-current base salary and (B) his then-current annual cash incentive target opportunity or, for Messrs. Lipsey and Francis, the sum of (A) 24 months’ then-current base salary and (B) two times his then-current annual cash incentive target opportunity.

In lieu of the foregoing, if the Executive is terminated by the Company without “cause” (including the Company’s election not to renew and/or extend the term of the Employment Agreement where the Executive is willing to do so) or resigns for “good reason” (each as defined in the Employment Agreement), in each case within the 90 days prior to a “change in control” or two-year period following a “change in control,” or the Company’s delivery of a notice of its intent not to renew the term within the 90 days prior to a “change in control,” or for Mr. Heistand only, if he dies or becomes disabled within the two-year period following a “change in control” (as such term is defined in the Employment Agreement) (such events together, a “CIC Termination”), the Executive will be entitled to:

(i) | lump sum payment of any earned but unpaid base salary accrued through the date of termination and any earned but unpaid vacation pay, |

(ii) | to the extent unpaid, lump sum payment of the transition bonus with respect to the 2016 calendar year, |

(iii) | lump sum payment of any earned but unpaid annual bonus for the preceding calendar year, |

(iv) | if the termination is more than six months into the performance year, subject to the Compensation Committee’s certification of achievement for such year, payment of a pro-rated portion of the annual bonus for the year in which the termination occurs, |

(v) | payment of an amount equal to, for Mr. Heistand, 2.9 times the sum of (A) his then-current base salary and (B) his then-current annual cash incentive target opportunity or, for Messrs. Lipsey and Francis, the sum of (A) 24 months’ then-current base salary and (B) two times his then-current annual cash incentive target opportunity, |

(vi) | immediate and automatic vesting of all then unvested equity or equity-based awards that are subject to time-based vesting, and |

(vii) | continued health care coverage for the Executive and his dependents at the Company’s cost for up to, for Mr. Heistand, 18 months and, for Messrs. Lipsey and Francis, 12 months after coverage would otherwise lapse. |

Payment of the foregoing amounts or benefits in clauses (iv)-(viii) in connection with a Regular Involuntary Termination and clauses (iv)-(v) and (vii) in connection with a CIC Termination are subject to and conditioned upon the Executive’s execution of a general release and waiver in a form reasonably acceptable to the Company and the Executive’s compliance with the restrictive covenants contained in the Employment Agreement (the “Release and Non-Compete Agreement”).

Upon the Executive’s termination of employment due to death or “disability” (as defined in the Employment Agreement) (for Mr. Heistand only, other than within the two-year period following a “change in control”), the Executive (or, in the case of the Executive’s death, the Executive’s estate) will be entitled to:

(i) | lump sum payment of any earned but unpaid base salary accrued through the date of termination and any earned but unpaid vacation pay, |

(ii) | to the extent unpaid, lump sum payment of the transition bonus with respect to the 2016 calendar year, |

(iii) | lump sum payment of any earned but unpaid annual bonus for the preceding calendar year, |

(iv) | if the termination is more than six months into the performance year, subject to the Compensation Committee’s certification of achievement for such year, payment of a pro-rated portion of the annual bonus for the year in which the termination occurs, and |

(v) | immediate and automatic vesting of all then unvested Transition RSUs. |

For Mr. Heistand only, in the event that Mr. Heistand voluntarily terminates his employment with the Company after the three-year initial term of the Employment Agreement or after identifying and hiring if necessary a replacement president and chief executive officer of the Company deemed acceptable to the Board in its reasonable discretion, Mr. Heistand’s outstanding equity or equity-based awards subject to (i) time-based vesting will immediately vest pro rata based on the number of completed months in the vesting period and (ii) performance-based vesting will vest pro rata based on the number of completed whole years of the performance period and on the actual performance achievement level through the entire duration of the applicable performance period.

The Employment Agreements also include certain restrictive covenants. The covenants include (i) confidentiality and non-disparagement restrictions during the term of the Employment Agreement and thereafter, (ii) non-competition restrictions on the Executive during the term of the Employment Agreement and for 12 months thereafter, and (iii) non-solicitation restrictions on the Executive during the term of the Employment Agreement and, for Mr. Heistand, from 18 months thereafter to two years thereafter depending on the type of termination of employment or, for Messrs. Lipsey and Francis, for 12 months thereafter. The Company may also recover incentive and other compensation paid to the Executives, as and to the extent required by applicable law and the Company’s “clawback” policy, as in effect from time to time.

The foregoing summary of the Employment Agreements does not purport to be complete and is qualified in its entirety by reference to the full text of each of the Employment Agreements, which are attached as Exhibits 10.1, 10.2 and 10.3 to this Current Report on Form 8-K, which are incorporated by reference herein.

Form Restricted Stock Unit Award Agreements

To memorialize the time-based restricted stock units and the performance-based restricted stock units granted to the Executives in accordance with the Employment Agreements and to memorialize future restricted stock unit awards to the Executives, which awards shall be in the sole discretion of the Board or the Compensation Committee, the Compensation Committee approved a Form of Time-Based Restricted Stock Unit Agreement and a Form of Performance-Based Restricted Stock Unit Agreement, which are attached as Exhibits 10.4 and 10.5 to this Current Report on Form 8-K, which are incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

Exhibit No. | Description | |

10.1 | Employment Agreement, dated as of December 12, 2016, by and between Parkway, Inc. and James R. Heistand. | |

10.2 | Employment Agreement, dated as of December 12, 2016, by and between Parkway, Inc. and M. Jayson Lipsey. | |

10.3 | Employment Agreement, dated as of December 12, 2016, by and between Parkway, Inc. and Scott E. Francis. | |

10.4 | Form of Time-Based Restricted Stock Unit Agreement under the Parkway, Inc. and Parkway Operating Partnership LP 2016 Omnibus Equity Incentive Plan. | |

10.5 | Form of Performance-Based Restricted Stock Unit Agreement under the Parkway, Inc. and Parkway Operating Partnership LP 2016 Omnibus Equity Incentive Plan. | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: December 13, 2016 | PARKWAY, INC. | |||||||

BY: | /s/ A. Noni Holmes-Kidd | |||||||

A. Noni Holmes-Kidd | ||||||||

Vice President, General Counsel and Secretary | ||||||||

EXHIBIT INDEX

Exhibit No. | Description | |

10.1 | Employment Agreement, dated as of December 12, 2016, by and between Parkway, Inc. and James R. Heistand. | |

10.2 | Employment Agreement, dated as of December 12, 2016, by and between Parkway, Inc. and M. Jayson Lipsey. | |

10.3 | Employment Agreement, dated as of December 12, 2016, by and between Parkway, Inc. and Scott E. Francis. | |

10.4 | Form of Time-Based Restricted Stock Unit Agreement under the Parkway, Inc. and Parkway Operating Partnership LP 2016 Omnibus Equity Incentive Plan. | |

10.5 | Form of Performance-Based Restricted Stock Unit Agreement under the Parkway, Inc. and Parkway Operating Partnership LP 2016 Omnibus Equity Incentive Plan. | |

EXECUTION VERSION

1

EMPLOYMENT AGREEMENT

This AGREEMENT (the “Agreement”) is entered into as of December 12, 2016 (the

“Effective Date”), by and between Parkway, Inc. (the “Company”) and James R. Heistand (the

“Executive”).

WHEREAS, Cousins Properties Incorporated (“Cousins”), Parkway Properties, Inc.

(“Legacy Parkway”), Parkway Properties LP, and Clinic Sub Inc. (“Merger Sub”) entered into

that certain Agreement and Plan of Merger, dated as of April 28, 2016 (the “Merger

Agreement”), pursuant to which Legacy Parkway merged with and into Merger Sub, with

Merger Sub continuing as the surviving company (the “Merger”);

WHEREAS, Cousins, Legacy Parkway, the Company, Parkway Operating Partnership

LP (the “Partnership”), and certain other parties entered into a Separation, Distribution and

Transition Services Agreement, dated as of October 5, 2016 (the “Separation and Distribution

Agreement”), pursuant to which, among other things, (i) the Houston, Texas assets of Legacy

Parkway and Cousins and certain other assets were contributed to the Company and the

Partnership, and (ii) Cousins distributed 100% of the capital stock of the Company to the

stockholders of Cousins (which included legacy stockholders of Legacy Parkway) (the

“Distribution”);

WHEREAS, the Company desires to continue to employ the Executive as President and

Chief Executive Officer of the Company, on the terms and conditions set forth herein;

WHEREAS, except as otherwise provided in this Agreement, the Company and the

Executive desire to replace, in their entirety, any prior agreements or arrangements providing for

severance payments and related benefits or payments or benefits upon a change in control

between the Executive and the Company or any of its affiliates, including without limitation that

Employment Agreement, dated as of July 8, 2013 and as amended June 15, 2015 and July 7,

2016, between Legacy Parkway and the Executive, which agreement was assumed by the

Company in connection with the Distribution as of October 7, 2016 (together, the “Prior

Agreements”); and

WHEREAS, the Executive desires to accept employment on the terms hereinafter set

forth in this Agreement.

NOW, THEREFORE, in consideration of the premises and mutual covenants herein and

for other good and valuable consideration, the parties agree as follows:

1. Effective Date and Term; Termination of Prior Agreements.

(a) The Executive shall be employed by the Company for the period

commencing as of the Effective Date and ending on December 31, 2019, unless earlier

terminated pursuant to the terms hereof (the “Initial Term”), subject to automatic renewal for

additional one (1) year periods unless either party provides the other with ninety (90) days’

notice of such party’s intent not to renew (the Initial Term and any such renewal, the “Term”).

Notwithstanding anything to the contrary in this Section 1(a), upon the occurrence of a Change

EXECUTION VERSION

2

in Control (as defined below), the Term shall automatically extend until the later of (i) the

second (2nd) anniversary of such Change in Control and (ii) the date upon which the Term would

otherwise have ended. As further described in Section 6(b) and Section 6(c), the Company’s

election not to renew this Agreement at the end of the Initial Term or a renewal Term shall

constitute a termination by the Company without Cause, where the Executive is willing to extend

the Term under the Agreement’s existing terms and conditions; provided the Executive ceases

his employment on account of such non-renewal at the end of the then-current Term.

(b) From and after the Effective Date, the Executive’s entitlement to

payments or benefits under all Prior Agreements shall terminate, and the Prior Agreements and

all obligations of the parties thereunder will cease to have any further force and effect, except to

the extent set forth or contemplated herein or in that certain Letter Agreement, dated as of April

28, 2016, by and between Legacy Parkway and the Executive attached hereto as Schedule A

(“Transition Letter Agreement”).

2. Position and Duties.

(a) During the Term, the Executive shall serve as the Company’s President

and Chief Executive Officer and shall serve as a director on the Company’s Board of Directors

(the “Board”). The Executive shall report to the Company’s Board and shall have such duties

and responsibilities as are consistent with the Executive’s position and as may be assigned by the

Board from time to time. During the Term, the Executive shall be subject to, and shall act in

accordance with, all reasonable instructions and directions of the Board and all applicable

policies and rules of the Company.

(b) The Executive shall devote his full working time, energy, and attention to

the performance of his duties and responsibilities hereunder and shall not engage in any other

business, profession, or occupation for compensation or otherwise which would conflict with or

interfere with the rendition of the Executive’s services hereunder; provided that nothing herein

shall (i) preclude the Executive from (A) managing his personal, financial, and legal affairs, and

(B) with the Board’s prior written consent, serving as a director on the board of directors of a

publicly traded company that is not a competitor of the Company, or (ii) prevent the Executive

from engaging in civic and charitable activities, so long as such activities do not interfere with

the performance of his duties and responsibilities to the Company as provided hereunder. For

purposes hereof, United Legacy Bank is not a competitor of the Company, and consent is hereby

granted for the Executive to serve on the board thereof.

3. Compensation.

(a) During the Term, the Company shall pay the Executive a minimum base

salary at the rate of $750,000 per annum (the “Base Salary”), payable in regular installments in

accordance with the Company’s customary payroll practices. The Board or the Board’s

Compensation Committee (the “Committee”) shall annually review the Executive’s Base Salary

and, in its sole discretion, may increase the Executive’s annual Base Salary. References in this

Agreement to Base Salary shall refer to the annual Base Salary as may be increased by the Board

or the Committee from time to time.

EXECUTION VERSION

3

(b) In addition to the Base Salary, during the Term, the Executive shall be

eligible to participate in the Company’s discretionary annual incentive plan (the “AIP”) as may

be established and approved by the Board or the Committee from time to time, and pursuant to

the AIP, the Executive may earn an annual bonus (the “Annual Bonus”) for each calendar year

during the Term, with a target Annual Bonus opportunity of one hundred fifty (150%) of Base

Salary (the “Target Bonus”); provided, that the Board or the Committee shall annually review

the Executive’s Target Bonus and, in its sole discretion, may increase the Executive’s Target

Bonus, and references in this Agreement to Target Bonus shall refer to the Target Bonus as may

be increased by the Board or the Committee from time to time.

(1) The Annual Bonus actually paid, if any, for any calendar year shall

be determined by the Board or the Committee based upon the achievement of

annual performance objectives established by the Committee, and communicated

to the Executive, from time to time. The Annual Bonus shall be paid no later than

two and one-half (2.5) months following the end of the calendar year to which

such Annual Bonus relates, subject to the Executive’s continued employment with

the Company on the applicable payment date, except as otherwise provided

in Sections 6(a), 6(b), and 6(c).

(2) The Company agrees to pay to the Executive an Annual Bonus for

calendar year 2016 in the amount of $1,025,000 (the “Transition Bonus”). The

Transition Bonus shall be paid no later than February 15, 2017, subject to the

Executive’s continued employment with the Company on the applicable payment

date, except as otherwise provided in Sections 6(a), 6(b), and 6(c). The Transition

Bonus shall be in satisfaction of any Annual Bonus payable to the Executive by

Legacy Parkway, Cousins, or the Company under any Prior Agreements for the

2016 calendar year or fiscal year.

(c) During the Term, pursuant and subject to the terms of the Parkway, Inc.

and Parkway Operating Partnership LP 2016 Omnibus Equity Incentive Plan (as it may be

amended from time to time, or its successor, the “Plan”) and subject to Board or Committee

approval, the Executive shall be eligible to receive an annual grant of restricted stock units

(“RSUs”), which may be time-based and/or performance-based, and/or such other awards as the

Board or the Committee deems appropriate. In addition:

(1) Transition RSUs. Following the consummation of the Distribution

but not later than the Effective Date, the Executive shall receive (or shall have

received) the grant of time-based restricted stock units (“RSUs”) set forth on

Schedule B attached hereto (the “Transition RSUs”). Fifty percent (50%) of the

Transition RSUs shall vest on January 1, 2017, and the remaining fifty percent

(50%) shall vest ratable on each of the first, second and third anniversaries of the

Merger, subject to the Executive’s continued employment on each applicable

vesting date.

(2) Equity Grants. The Executive shall be eligible to receive an annual

grant in each calendar year commencing with 2017. However, the grant for

calendar year 2017 shall be made as of the Effective Date, based on a twelve (12)-

EXECUTION VERSION

4

month period beginning on the Effective Date (an "Agreement Year"). For such

grant, the Executive shall receive (i) a grant of performance-based RSUs,

covering 74,027 common share units, that vest based on achievement of certain

performance metrics over a three (3)-Agreement Year performance period, and

(ii) a grant of time-based RSUs, having an aggregate value equal to $375,000, that

vest in three equal annual installments over a three (3)-Agreement Year period,

and each such grant subject to the Executive’s continued employment on each

applicable vesting date. For purposes of the grant of time-based RSUs for the

Agreement Year, the number of common share units covered by the time-based

RSUs shall be determined by dividing the aggregate value of such award by the

fifteen (15)-day trailing average closing price of the Company’s common stock as

of the date of grant. For the avoidance of doubt, for any calendar year following

the 2017 calendar year, the Executive shall be eligible to receive an annual grant

in an amount and in the form as the Board or the Committee deems appropriate,

such grant to be made on or about the time the Committee convenes to evaluate

achievement for annual bonus determinations for the prior year and to have a

vesting start date commencing January 1 of the applicable calendar year.

(3) Qualified Retirement and CIC Termination. In the event of a CIC

Termination (as defined below), each of the Executive’s outstanding equity or

equity-based awards that is subject to time-based vesting shall immediately vest

and be paid in full upon the date of such CIC Termination. In the event of a

Qualified Retirement, the Executive’s outstanding equity or equity-based awards

subject to (i) time-based vesting shall immediately vest pro-rata, based on the

number of completed months in the vesting period prior to the Qualified

Retirement and (ii) performance-based vesting shall vest pro-rata, based on the

Executive’s number of completed whole years of the performance period and on

the actual performance achievement level through the entire duration of the

applicable performance period. For purposes hereof, a “Qualified Retirement”

shall occur when the Executive voluntarily terminates his employment with the

Company (i) after the Initial Term, or (ii) after identifying and hiring if necessary

a replacement to the Executive’s position with the Company deemed acceptable

to the Board in its reasonable discretion.

(4) Code Section 409A. Notwithstanding the foregoing, to the extent

accelerated payment is not permitted under Section 409A of the Internal Revenue

Code of 1986, as amended (the “Code”) without the imposition of a penalty, the

awards shall immediately vest in full, but be paid on the original payment

schedule set forth in such award.

4. Employee Benefits; Expense Reimbursement. During the Term:

(a) The Executive shall be entitled to participate in all employee benefit plans

and programs available generally to other executives of the Company.

EXECUTION VERSION

5

(b) The Executive shall be entitled to no fewer than twenty-five (25) days per

full year of vacation, subject to the terms and conditions of the Company’s policies as may be in

effect from time to time during the Term.

(c) The Company shall reimburse the Executive for all reasonable business

and entertainment expenses incurred by the Executive in furthering the goals of the Company,

subject to the Executive’s provision of documentation as the Board or the Committee may

reasonably request.

5. Termination of Employment.

(a) The Term and the Executive’s employment hereunder may be terminated

under the following circumstances.

(1) Death. The Term and the Executive’s employment hereunder shall

terminate upon the Executive’s death.

(2) Disability. The Term and the Executive’s employment hereunder

shall terminate in the event of the Executive’s Disability. For purposes of this

Agreement, “Disability” shall mean: as a result of the Executive’s incapacity due

to physical or mental illness or injury, the Executive (i) is eligible to receive a

benefit under the Company’s long-term disability plan applicable to the

Executive, or (ii) if no such long-term disability plan is applicable to the

Executive, the Executive is unable to perform his duties hereunder for a period of

ninety (90) consecutive days or a period of ninety (90) days in any one hundred

eighty (180)-day period, even with any reasonable accommodation required by

law.

(3) Cause. The Company may immediately terminate the Term and

the Executive’s employment hereunder for Cause. For purposes of this

Agreement, “Cause” shall mean: (i) the continued refusal by the Executive to

perform the material responsibilities and duties under this Agreement, (ii) the

engaging by the Executive in willful or reckless conduct, if such conduct is done

or omitted to be done by the Executive not in good faith, and is materially

injurious to the Company monetarily or otherwise, (iii) the Executive’s conviction

of, or pleading of guilty or nolo contendere to, a felony, (iv) the commission or

omission of any act by the Executive that is materially detrimental to the best

interests of the Company and that constitutes common law fraud or a violation of

applicable law, or (v) the Executive’s breach of any material provision of this

Agreement (including any Restrictive Covenants). Notwithstanding the

foregoing, the Term and the Executive’s employment shall not be deemed to have

been terminated for Cause unless the Company shall have given the Executive (A)

written notice setting forth the reasons for the Company’s intention to terminate

the Executive’s employment for Cause, and (B) a reasonable opportunity, not to

exceed thirty (30) days, to cure such failure, to the extent reasonably susceptible

to cure.

EXECUTION VERSION

6

(4) Good Reason. The Executive may terminate the Term and his

employment hereunder for Good Reason. For purposes of this Agreement, “Good

Reason” shall mean, (i) the Company’s failure to pay material compensation

when due and payable; (ii) a material diminution in the Executive’s position,

duties or responsibilities, including without limitation, the Executive’s no longer

holding the position and title of President and Chief Executive Officer or the

Executive’s being removed from or not being elected to the Board of the

Company; (iii) the Company’s material breach of any other material provision of

this Agreement; (iv) requiring the Executive to relocate his or her residence to a

location outside of Orlando, Florida; or (v) following a Change in Control, if at

any time during the two (2)-year period following such Change in Control

Executive is not given a compensation and benefits package, including in

particular annual equity or equity-based grants, that is at least as favorable as the

package Executive receives from the Company prior to the Change in Control.

The Executive shall not have Good Reason to terminate the Term and his

employment hereunder unless the Company shall have been given (A) a Notice of

Termination setting forth the reasons for the Executive asserting Good Reason,

and (B) a reasonable opportunity, not to exceed thirty (30) days, to cure such

failure.

(5) Any Other Reason. Either party may terminate the Term and the

Executive’s employment hereunder at any time for any reason other than those set

forth above; provided that the terminating party shall provide the other party with

Notice of Termination (as defined below in Section 5(b)).

(b) Notice of Termination. Any termination of the Executive’s employment

by the Company or by the Executive during the Term shall be communicated by providing the

other party at least sixty (60) days’ advance written notice of such termination (the “Notice of

Termination”) in accordance with Section 13(a); provided that no Notice of Termination shall be

required in the event of a termination on account of the death of the Executive and that the notice

of termination required under Section 5(a)(3) on account of the Executive’s termination by the

Company for Cause shall not require any amount of advance notification (except that with

respect to the determination of Cause, the Company shall have given the Executive prior notice

and the opportunity to cure as set forth in Section 5(a)(3) above).

6. Termination Payments.

(a) Death or Disability. In the event that the Executive’s employment

hereunder terminates as a result of the Executive’s death or Disability

other than within the two (2)-year period following a Change in Control,

all then unvested Transition RSUs shall immediately and automatically

vest, and the Company shall pay to the Executive (or, if applicable, to the

Executive’s estate), within thirty (30) days following the date of

termination of employment, (i) any earned but unpaid Base Salary accrued

through the date of termination and any earned but unpaid vacation pay

(collectively, the “Accrued Amounts”), (ii) any unpaid Transition Bonus,

and (iii) any earned but unpaid Annual Bonus for the calendar year

EXECUTION VERSION

7

preceding the date the Executive’s employment hereunder terminates and,

provided the Executive’s date of employment termination is more than six

months into the performance year and subject to the Committee’s

certification of achievement of the performance goals for such year after

the year is concluded, a pro-rated portion of any Annual Bonus for the

calendar year in which termination occurs (in each case without regard to

whether the Executive is employed on the date such Annual Bonus is

paid).

(b) Without Cause or For Good Reason. In the event that the Company

terminates the Executive’s employment hereunder without Cause (which shall include the

Company’s election not to renew and/or extend the Agreement, where the Executive is willing to

extend the Term, as provided in Section 1, on the Agreement’s existing terms and where the

Executive serves out the current Term, it being understood that Sections 5 and 6 shall continue to

apply in accordance with their terms and it being understood that following the end of the then-

current Term, the Executive’s employment shall have terminated), or the Executive terminates

his employment hereunder for Good Reason, in each case other than a CIC Termination, the

Executive shall be entitled to (i) the Accrued Amounts and any unpaid Transition Bonus, and, if

such termination is prior to the second anniversary of the Effective Date, the CIC Cash (as

defined in Section 6(c) below), each payable within thirty (30) days following the date of

termination of employment; (ii) any earned but unpaid Annual Bonus for the calendar year

preceding the date the Executive’s employment hereunder terminates and, provided the

Executive’s date of employment termination is more than six (6) months into the performance

year and subject to the Committee’s certification of achievement of the performance goals for

such year after the year is concluded, a pro-rated portion of any Annual Bonus for the calendar

year in which termination occurs, in each case payable on the date such amount would otherwise

have been paid (without regard to whether the Executive is employed on the date such Annual

Bonus is paid); (iii) an amount equal to the sum of (A) eighteen (18) months of the Executive’s

Base Salary and (B) one and one half (1.5) times the Executive’s then current Target Bonus,

payable in twelve (12) equal monthly installments in accordance with the Company’s customary

payroll practices starting one month after termination; (iv) immediate and automatic vesting of

all then unvested Transition RSUs and an additional eighteen (18) months’ time-based vesting

credit on any other outstanding equity or equity-based awards that are subject to time-based

vesting; and (v) continued health care coverage for himself and any of his eligible dependents at

the Company’s cost, for up to eighteen (18) months after coverage would otherwise lapse on

account of termination under the Company’s group health plans pursuant to the continuation of

coverage provisions contained in Sections 601 through 608 of the Employee Retirement Income

Security Act of 1974, as amended (the “Health Continuation Benefit”); provided, that any

payment that would otherwise have been made but that is conditioned upon the execution and

effectiveness of the Release (as defined below) shall not be made or provided until the fortieth

(40th) day following the date of such termination of employment. The payments and benefits

provided under this Section 6(b), other than the Accrued Amounts, Transition Bonus, and the

earned but unpaid Annual Bonus payment for the preceding calendar year, are subject to and

conditioned upon (x) the Executive’s execution of a valid general release and waiver (in a form

reasonably acceptable to the Company) within thirty (30) days following the date of termination,

waiving all claims the Executive may have against the Company, its successors, assigns,

affiliates, executives, officers, and directors relating to the Executive’s employment with the

EXECUTION VERSION

8

Company and the termination thereof (the “Release”), and such waiver becoming effective, and

(y) the Executive’s compliance with any restrictive covenants to which he may be subject

pursuant to Sections 7, 8, and 9 hereof (the “Restrictive Covenants”), provided that to the extent

the Executive inadvertently breaches any of the Restrictive Covenants set forth in Sections 7 and

9(a) hereof and such breach is reasonably susceptible to cure, the Executive shall be given a

reasonable opportunity, not to exceed ten (10) days, to cure such breach (the conditions in (x)

and (y), the “Conditions”). The Executive shall not be entitled to any other compensation or

benefits not expressly provided for in this Section 6(b), regardless of the time that would

otherwise remain in the Term had the Term not been terminated hereunder.

(c) CIC Termination. In lieu of the payments and benefits described

in Sections 6(a) and 6(b) above, and in addition to any accelerated vesting pursuant to Section

3(c)(3), in the event the Executive’s employment is terminated either by the Company without

Cause (which shall include the Company’s election not to renew and/or extend the Agreement,

where the Executive is willing to extend the Term, as provided in Section 1, on the Agreement’s

existing terms and where the Executive serves out the current Term, it being understood that

Sections 5 and 6 shall continue to apply in accordance with their terms and it being understood

that following the end of the then-current Term, the Executive’s employment shall have

terminated), by the Executive for Good Reason, or as a result of the Executive’s death or

Disability, in each such case within the two (2)-year period following a Change in Control, or if

there is a Termination in Anticipation of a Change in Control (any such termination, a “CIC

Termination”), the Executive shall be entitled to (i) the Accrued Amounts and any unpaid

Transition Bonus, each payable within thirty (30) days following the date of termination of

employment; (ii) any earned but unpaid Annual Bonus for the calendar year preceding the date

the Executive’s employment hereunder terminates, payable within thirty (30) days following the

date of termination of employment and, provided the Executive’s date of employment

termination is more than six (6) months into the performance year and subject to the

Committee’s certification of achievement of the performance goals for such year after the year is

concluded, a pro-rated portion of any Annual Bonus for the calendar year in which termination

occurs, payable on the date such amount would otherwise have been paid (without regard to

whether the Executive is employed on the date such Annual Bonus is paid); (iii) the Health

Continuation Benefit; and (iv) an amount equal to two and nine-tenths (2.9) times the sum of the

Executive’s Base Salary and then-current Target Bonus (“CIC Cash”). The payments and

benefits provided under this Section 6(c), other than the Accrued Amounts, Transition Bonus,

and the earned but unpaid Annual Bonus payment for the preceding calendar year, are subject to

and conditioned upon the Executive’s compliance with the Conditions. The payment described

in clause (iv) above shall be paid in lump sum within thirty (30) days following the date of

termination of employment, unless the Change in Control does not qualify as a 409A Change in

Control or such form is otherwise prohibited by Section 409A of the Code, in which case such

payment shall be payable in equal installments over a period of twelve (12) months, in

accordance with the Company’s customary payroll practices. For purposes of this Agreement:

(1) “Change in Control” shall have the meaning ascribed to such term

in the Plan and shall be inclusive of a 409A Change in Control; provided, for the

avoidance of doubt, a Change in Control shall exclude the Merger and the

Distribution.

EXECUTION VERSION

9

(2) “409A Change in Control” shall mean a change in the ownership

or effective control of the Company, or a change in the ownership of a substantial

portion of the assets of the Company, within the meaning of Section

409A(a)(2)(A)(v) of the Code and U.S. Treasury Regulation Section 1.409A-

3(i)(5); provided, for the avoidance of doubt, a 409A Change in Control shall

exclude the Merger and the Distribution.

(3) “Termination in Anticipation of a Change in Control” shall mean

termination of the Executive’s employment by the Company without Cause or by

the Executive for Good Reason, in either the case within the ninety (90) day

period prior to the consummation of a Change in Control.

(d) Any Other Reason. In the event the Executive’s employment is

terminated for any reason other than those described in Sections 6(a)-(c) above, the Company

shall pay to the Executive the Accrued Amounts within thirty (30) days following the date of

termination of employment.

(e) No Additional Obligations. Except as otherwise provided in this Section

6, and except for any vested benefits under any tax qualified pension plans of the Company, and

continuation of health insurance benefits on the terms and to the extent required by Section

4980B of the Code and Section 601 of the Employee Retirement Income Security Act of 1974,

as amended (which provisions are commonly known as COBRA), the Company shall have no

additional obligations under this Agreement, and the Executive shall not be entitled to any

additional compensation or benefits (including vesting) hereunder.

7. Confidentiality.

(a) The Executive hereby agrees that, during the Term and thereafter, he will

hold in strict confidence any Confidential Information related to the Company and its affiliates.

For purposes of this Agreement, the term “Confidential Information” shall mean all proprietary

information of the Company and its affiliates, which is not generally known to the public,

including without limitation any inventions, processes, methods of distribution, customer lists or

customers’ or trade secrets, and including any information which would not have been generally

known to the public but for disclosure by the Executive in breach of his obligations

hereunder; provided, that Confidential Information shall not include any information required by

law to be disclosed, but only if the Executive gave prompt written notice to the Company of such

requirement, discloses no more information than is so required, and cooperates with any attempts

by the Company to obtain a protective order or similar treatment.

(b) The Executive hereby agrees that, upon the termination of his

employment, he shall not take, without the prior written consent of the Company, any property of

the Company, including without limitation any drawing, blueprint, specification or other

document (in whatever form) of the Company or its affiliates which is of a confidential nature

relating to the Company or its affiliates, or, without limitation, relating to its or their methods of

distribution, or any description of any formulas or secret processes and will return any such

property or information (in whatever form) then in his possession.

EXECUTION VERSION

10

8. Non-Disparagement. The Executive hereby agrees, during the Term and

thereafter, not to defame or disparage the Company, its affiliates and their respective officers,

directors, members or employees, and the Company hereby agrees, during the Term and

thereafter, to prevent the then-current members of the Board from defaming or disparaging the

Executive; provided, that in addition to any other remedies a party may have, in the event the

other party fails to comply with the obligations set forth in this Section 8, any obligations the

first party may have under this Section 8 shall cease immediately. The Executive hereby agrees

to cooperate with the Company in refuting any defamatory or disparaging remarks by any third

party made in respect of the Company, its affiliates, or their directors, members, officers, or

employees. The Company hereby agrees to cooperate with the Executive in refuting any

defamatory or disparaging remarks made by any third party in respect of the Executive.

9. Non-Competition and Non-Solicitation.

(a) The Executive and the Company agree that the Company would likely

suffer significant harm from the Executive’s competing with the Company during the Term and

for some period of time thereafter. Accordingly, the Executive agrees that he will not, during the

Term and for a period of twelve (12) months following the termination of the Term and his

employment, directly or indirectly, become employed by, engage in business with, serve as an

agent or consultant to, become a partner, member, principal, stockholder or other owner (other

than a holder of less than one percent (1%) of the outstanding voting shares of any publicly held

company) of, any Competitor, or otherwise perform services relating to, the business or any

product, service or process of the Company or its affiliates at the time of the termination for any

Competitor (whether or not for compensation), including without limitation, office ownership,

office leasing and office management activities (the “Business”). For purposes of this

Agreement, the term “Competitor” shall mean any individual, partnership, corporation, limited

liability company, unincorporated organization, trust or joint venture, or a governmental agency

or political subdivision thereof that is engaged in, or otherwise competes or has a reasonable

potential for competing with the Company, anywhere in which the Company engages in the

Business.

(b) The Executive agrees that he shall not, directly or indirectly, during the

Term and for a period thereafter of (i) eighteen (18) months in the event of any termination other

than a CIC Termination, or (ii) two (2) years in the event of a CIC Termination, solicit or hire or

attempt to solicit or hire, as applicable, (A) any customer or supplier of the Company or its

affiliates in connection with a Competitor or to terminate or alter in a manner adverse to the

Company or its affiliates such customer’s or supplier’s relationship with the Company or its

affiliates, or (B) any employee, consultant or individual who was an employee or consultant

within the six (6) month period immediately prior thereto to terminate or otherwise alter his or

her relationship with the Company or any of its affiliates.

10. Injunctive Relief. It is impossible to measure in money the damages that will

accrue to the Company in the event that the Executive breaches any of the Restrictive Covenants.

In the event that the Executive breaches any such Restrictive Covenant, the Company shall be

entitled to an injunction restraining the Executive from violating such Restrictive Covenant

(without posting any bond). If the Company shall institute any action or proceeding to enforce

any such Restrictive Covenant, the Executive hereby waives the claim or defense that the

EXECUTION VERSION

11

Company has an adequate remedy at law and agrees not to assert in any such action or

proceeding the claim or defense that the Company has an adequate remedy at law. The

foregoing shall not prejudice the Company’s right to require the Executive to account for and

pay over to the Company, and the Executive hereby agrees to account for and pay over, the

compensation, profits, monies, accruals or other benefits derived or received by the Executive as

a result of any transaction constituting a breach of any of the Restrictive Covenants.

11. 280G.

(a) Notwithstanding any other provision of this Agreement or any other plan,

arrangement, or agreement to the contrary, if any of the payments or benefits provided or to be

provided by the Company or its affiliates to the Executive or for the Executive’s benefit pursuant

to the terms of this Agreement or otherwise (“Covered Payments”) constitute parachute

payments within the meaning of Section 280G of the Code (such payments, the “Parachute

Payments”) and would, but for this Section 11, be subject to the excise tax imposed under

Section 4999 of the Code (or any successor provision thereto) or any similar tax imposed by state

or local law or any interest or penalties with respect to such taxes (collectively, the “Excise

Tax”), or not be deductible under Section 280G of the Code, then such Covered Payments shall

be payable either (i) in full or (ii) reduced to the minimum extent necessary to ensure that no

portion of the Covered Payments is subject to the Excise Tax, whichever of the foregoing (i) or

(ii) results in the Executive’s receipt on an after-tax basis of the greatest amount of benefits after

taking into account the applicable federal, state, local and foreign income, employment and

excise taxes (including the Excise Tax).

(b) The Covered Payments shall be reduced in a manner that maximizes the

Executive’s economic position. In applying this principle, the reduction shall be made in a

manner consistent with the requirements of Section 409A of the Code, to the extent applicable,

and where two or more economically equivalent amounts are subject to reduction but payable at

different times, such amounts payable at the later time shall be reduced first but not below zero.

(c) Any determination required under this Section 11 shall be made in writing

by the Company or by an accounting firm selected and paid for by the Company. The Executive

shall provide the Company with such information and documents as the Company may

reasonably request in order to make a determination under this Section 11.

12. Clawback. The Company may recover incentive and other compensation paid to

the Executive, as and to the extent required by applicable law and the Company’s clawback

policy as may be in effect from time to time.

13. Miscellaneous.

(a) Any notice or other communication required or permitted under this

Agreement shall be effective only if it is in writing and shall be deemed to be given when

delivered personally or four (4) days after it is mailed by registered or certified mail, postage

prepaid, return receipt requested or one day after it is sent by a reputable overnight courier

service and, in each case, addressed as follows (or if it is sent through any other method agreed

upon by the parties):

EXECUTION VERSION

12

If to the Company, to:

Parkway, Inc.

390 North Orange Avenue

Suite 2400

Orlando, FL 32801

Attention: Compensation Committee Chairman

With a copy to:

Hogan Lovells US LLP

555 Thirteenth Street NW

Washington, D.C. 20004

Attention: Matt Thomson

If to the Executive:

_____________

or to such other address as any party hereto may designate by notice to the others.

(b) Except as expressly provided herein, this Agreement shall constitute the

entire agreement among the parties hereto with respect to the Executive’s employment

hereunder, and supersedes and is in full substitution for any and all prior understandings or

agreements with respect to the Executive’s employment or termination thereof (including,

without limitation, the Prior Agreements).

(c) This Agreement may be amended only by an instrument in writing signed

by the parties hereto, and any provision hereof may be waived only by an instrument in writing

signed by the party or parties against whom or which enforcement of such waiver is sought. The

failure of any party hereto at any time to require the performance by any other party hereto of

any provision hereof shall in no way affect the full right to require such performance at any time

thereafter, nor shall the waiver by any party hereto of a breach of any provision hereof be taken

or held to be a waiver of any succeeding breach of such provision or a waiver of the provision

itself or a waiver of any other provision of this Agreement.

(d) The parties hereto acknowledge and agree that each party has reviewed

and negotiated the terms and provisions of this Agreement and has had the opportunity to

contribute to its revision. Accordingly, the rule of construction to the effect that ambiguities are

resolved against the drafting party shall not be employed in the interpretation of this Agreement.

Rather, the terms of this Agreement shall be construed fairly as to both parties hereto and not in

favor or against either party.

(e) The parties hereto hereby represent that they each have the authority to

enter into this Agreement, and the Executive hereby represents to the Company that the

execution of, and performance of any of his duties under, this Agreement shall not constitute a

EXECUTION VERSION

13

breach of or otherwise violate any other agreement to which the Executive is a party. The

Executive hereby further represents to the Company that he will not utilize or disclose any

confidential information obtained by the Executive in connection with any former employment

with respect to his duties and responsibilities hereunder.

(f) This Agreement is binding on and is for the benefit of the parties hereto

and their respective successors, assigns, heirs, executors, administrators and other legal

representatives. Neither this Agreement nor any right or obligation hereunder may be assigned

by the Executive. The Company shall require any successor (whether direct or indirect, by

purchase, merger, consolidation or otherwise) to all or substantially all of the business and/or

assets of the Company to assume this Agreement in the same manner and to the same extent that

the Company would have been required to perform it if no such succession had taken place. As

used in the Agreement, the “Company” shall mean both the Company as defined in the first

paragraph of the Agreement and any such successor that assumes this Agreement, by operation

of law or otherwise.

(g) Any provision of this Agreement (or portion thereof) which is deemed

invalid, illegal, or unenforceable in any jurisdiction shall, as to that jurisdiction and subject to

this Section, be ineffective to the extent of such invalidity, illegality or unenforceability, without

affecting in any way the remaining provisions thereof in such jurisdiction or rendering that or

any other provisions of this Agreement invalid, illegal, or unenforceable in any other jurisdiction.

If any covenant should be deemed invalid, illegal or unenforceable because its scope is

considered excessive, such covenant shall be modified so that the scope of the covenant is

reduced only to the minimum extent necessary to render the modified covenant valid, legal and

enforceable. No waiver of any provision or violation of this Agreement by the Company shall be

implied by the Company’s forbearance or failure to take action.

(h) The Company may withhold from any amounts payable to the Executive

hereunder all federal, state, city, or other taxes that the Company may reasonably determine are

required to be withheld pursuant to any applicable law or regulation (it being understood, that the

Executive shall be responsible for payment of all taxes in respect of the payments and benefits

provided herein).

(i) This Agreement shall be governed by and construed in accordance with

the laws of the State of New York without reference to its principles of conflicts of law.

(j) This Agreement may be executed in several counterparts, each of which

shall be deemed an original, but all of which shall constitute one and the same instrument. A

facsimile of a signature shall be deemed to be and have the effect of an original signature.

(k) The headings in this Agreement are inserted for convenience of reference

only and shall not be a part of or control or affect the meaning of any provision hereof.

(l) The intent of the parties is that payments and benefits under the

Agreement comply with Section 409A of the Code and the regulations and guidance

promulgated thereunder (except to the extent exempt as short-term deferrals or otherwise) and,

accordingly, to the maximum extent permitted, the Agreement shall be interpreted to be in

EXECUTION VERSION

14

compliance therewith. A termination of employment shall not be deemed to have occurred for

purposes of any provision of this Agreement providing for the payment of any amounts or

benefits subject to Section 409A of the Code upon or following a termination of employment

unless such termination is also a “separation from service” within the meaning of Section 409A

of the Code and, for purposes of any such provision of this Agreement, references to a

“termination,” “termination of employment,” “termination of the Term” or like terms shall mean

“separation from service.” The determination of whether and when a separation from service has

occurred shall be made in a manner consistent with, and based on the presumptions set forth in,

US Treasury Regulation Section 1.409A-1(h) or any successor provision thereto. It is intended

that each installment, if any, of the payments and benefits provided hereunder shall be treated as

a separate “payment” for purposes of Section 409A of the Code. Neither the Company nor the

Executive shall have the right to accelerate or defer the delivery of any such payments or benefits

except to the extent specifically permitted or required by Section 409A of the Code; and if, as of

the date of the “separation from service,” the Executive is a “specified employee” (within the

meaning of that term under Section 409A(a)(2)(B) of the Code, or any successor provision

thereto), then with regard to any payment or the provision of any benefit that is subject to this

section (whether under this Agreement, or pursuant to any other agreement with, or plan,

program, or payroll practice of, the Company) and is due upon or as a result of the Executive’s

separation from service, such payment or benefit shall not be made or provided, to the extent

making or providing such payment or benefit would result in additional taxes or interest under

Section 409A of the Code, until the date which is the earlier of (A) the expiration of the six (6)-

month period measured from the date of such “separation from service,” and (B) the date of the

Executive’s death (the “Delay Period”) and this Agreement and each such agreement, plan,

program, or payroll practice shall hereby be deemed amended accordingly. Upon the expiration

of the Delay Period, all payments and benefits delayed pursuant to this Section (whether they

would have otherwise been payable in a single sum or in installments in the absence of such

delay) shall be paid or reimbursed to the Executive in a lump sum, and any remaining payments

and benefits due under this Agreement shall be paid or provided in accordance with the normal

payment dates specified for them herein. All reimbursements and in-kind benefits provided

under this Agreement or otherwise to the Executive shall be made or provided in accordance

with the requirements of Section 409A of the Code to the extent that such reimbursements or in-

kind benefits are subject to Section 409A of the Code. All expenses or other reimbursements

paid pursuant herewith and therewith that are taxable income to the Executive shall in no event

be paid later than the end of the calendar year next following the calendar year in which the

Executive incurs such expense or pays such related tax. With regard to any provision herein that

provides for reimbursement of costs and expenses or in-kind benefits, except as permitted by

Section 409A of the Code, the right to reimbursement or in-kind benefits shall not be subject to

liquidation or exchange for another benefit, and the amount of expenses eligible for

reimbursement, or in-kind benefits provided, during any taxable year shall not affect the

expenses eligible for reimbursement, or in-kind benefits to be provided, in any other taxable

year; provided that, the foregoing clause shall not be violated with regard to expenses reimbursed

under any arrangement covered by Section 105(b) of the Code solely because such expenses are

subject to a limit related to the period the arrangement is in effect and such payments shall be

made on or before the last day of the Executive’s taxable year following the taxable year in

which the expense occurred.

[Signature Page Follows]

EXECUTION VERSION

15

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first

written above.

EXECUTIVE

PARKWAY, INC.

By:

Name: A. Noni Holmes-Kidd

Title: Vice President and General Counsel

/s/ James R. Heistand

/s/ A. Noni Holmes-Kidd

EXECUTION VERSION

16

SCHEDULE A – TRANSITION LETTER AGREEMENT

[See Attached.]

April 28, 2016

Mr. James R. Heistand

Parkway Properties, Inc.

Bank of America Center

390 North Orange Avenue, Suite 2400

Orlando, Florida 32801

Dear James,

This letter agreement (this “Letter Agreement ”) memorializes our discussions regarding the terms and conditions of your

employment from and following the consummation of the transactions (collectively, the “Transactions ”) contemplated by the

Agreement and Plan of Merger among Parkway Properties, Inc., Parkway Properties LP, Cousins Properties Incorporated and Clinic

Sub Inc., dated as of the date hereof (the “Merger Agreement ”). For purposes of this Letter Agreement, terms that are capitalized but

not defined herein shall have the meanings set forth in the Merger Agreement.

As you know, the Merger Agreement contemplates that, immediately following the consummation of the Merger and the

Reorganization, Clinic will distribute, on a pro rata basis to the stockholders of Clinic, all of the shares of HoustonCo (the “ Houston

Distribution ”), and that you will be offered the role of Chief Executive Officer of HoustonCo in connection with the Houston

Distribution.

You agree that, if you are offered the role of Chief Executive Officer of HoustonCo in connection with the Houston

Distribution pursuant either to the assignment of your Employment Agreement (defined below) as in effect as of the date hereof (and

as modified hereby) to HoustonCo or to terms of a written employment agreement the terms of which are at least as favorable to you as

your Employment Agreement (defined below) as in effect as of the date hereof, you shall not have a basis for asserting, and shall be

deemed to have waived, any entitlement to terminate your employment under clauses (ii), (iii) or (iv) of the second sentence, as well as

the final sentence, of Section 5(a)(4) of the Employment Agreement by and between Pharmacy and you, dated as of July 8, 2013 and

amended as of June 15, 2015 (the “Employment Agreement ”), as a result of the consummation of the Transactions or any changes to

the terms and conditions (including, without limitation, the location) of your employment that result from the Transactions. Without

limiting the generality of the foregoing, you agree that Pharmacy or Clinic, as applicable, and its Affiliates may assign all of their

obligations under the Employment Agreement and/or this Letter Agreement to HoustonCo and its Affiliates. For purposes of

determining whether the terms of a new employment agreement are at least as favorable as the terms of your Employment Agreement,

any provision providing for “singletrigger” vesting of equity upon a change in control may be replaced with “doubletrigger vesting”

requiring both the occurrence of a change in control and your involuntary termination without cause or resignation for good reason,

and the following provisions may be disregarded: (a) any special onetime equity award, and (b) the provision in the final sentence of

section 5(a)(4) of your Employment Agreement.

You acknowledge and agree that the waiver contemplated by the preceding paragraph is material to Clinic’s and Pharmacy’s

willingness to consummate the Transactions and that good and valuable consideration will be provided, directly or indirectly, to you in

connection with the Transactions, including without limitation: (a) the accelerated vesting of certain Pharmacy Equity Awards and

Pharmacy Partnership LTIP Units upon the consummation of the Transactions, (b) exchange of unvested Pharmacy Partnership LTIP

Units, if any, into timevesting Pharmacy Equity Awards immediately prior to the consummation of the Transactions, which shall

partially vest upon the consummation of the Transactions and shall partially be assumed, (c) assumption of those Pharmacy Equity

Awards that are stock options, and (d) your continued employment with HoustonCo and its Affiliates following the consummation of

the Transactions as the Chief Executive Officer under the terms of the Employment Agreement (subject to the waiver described above)

or, if applicable, a new employment agreement satisfying the conditions described in paragraph three of this Letter Agreement.

Furthermore, in connection with consummation of the Transactions, you acknowledge and agree to the following:

1. That any annual incentive award payable to you for calendar year 2016 shall, notwithstanding any contrary provision of your

Employment Agreement, be subject to the sole discretion of Clinic and its Affiliates (which for this purpose, includes

HoustonCo, whether before or after the Houston Distribution),

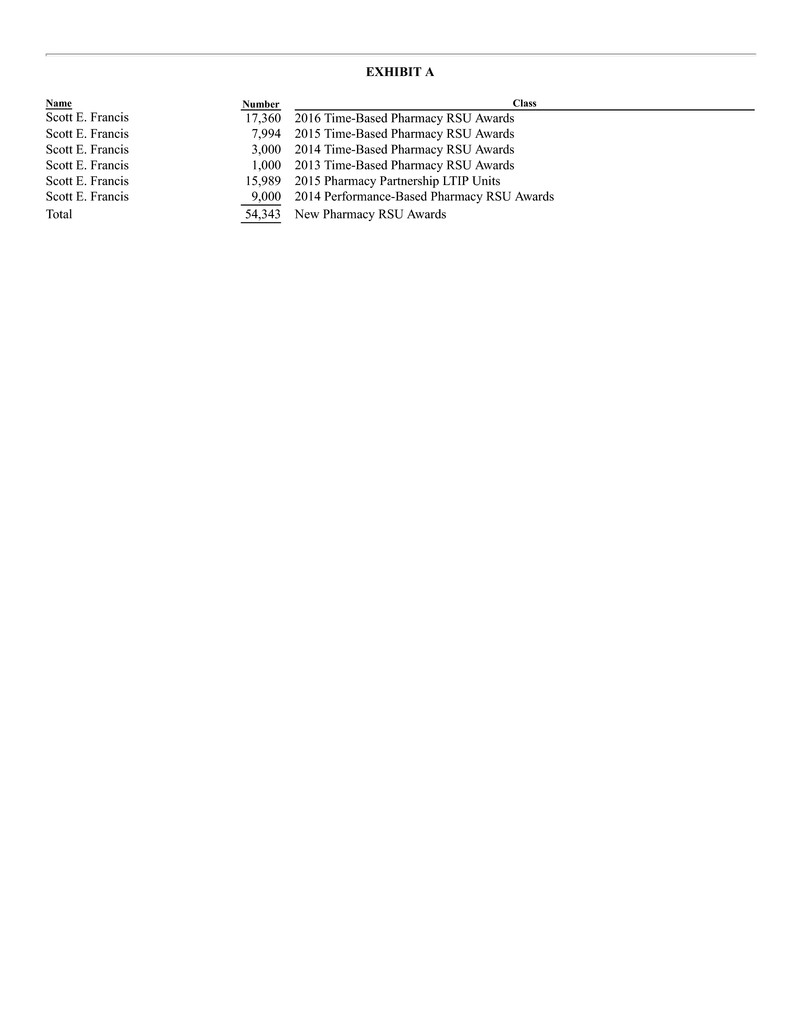

2. That the Pharmacy Equity Awards and Pharmacy Partnership LTIP Units listed on Exhibit A may be converted into an equal

number of Pharmacy RSU Awards immediately prior to consummation of the Transactions, generally subject to the terms

and conditions of your current timebased Pharmacy RSU Awards, but vesting in four equal tranches, with twentyfive

percent (25%) becoming vested on the date of consummation of the Transactions, and twentyfive percent (25%) each

becoming vested on the first, second, and third anniversaries of the date of consummation of the Transactions; and

3. That in connection with the Transactions, unless Clinic waives this requirement in writing, you will not offer, pledge, sell,

contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or

warrant to purchase, lend or otherwise transfer or dispose of, directly or indirectly, any HoustonCo common shares you hold

by reason of a Pharmacy Equity Award or a Pharmacy Partnership LTIP Unit that becomes fully vested as a result of the

Transactions, or enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic

consequences of ownership of such common shares, whether any such transaction is to be settled by delivery of HoustonCo

common shares or other HoustonCo securities, in cash or otherwise, for sixty (60) days after consummation of the

Transactions. You further agree to execute such agreements and instruments as may be reasonably requested by Clinic or

HoustonCo to give further effect to this undertaking.

2

This Letter Agreement, together with the Employment Agreement, constitute the entire agreement between the parties

hereto with respect to the subject matter hereof. No provision of this Letter Agreement may be modified, waived or discharged unless

such waiver, modification or discharge is agreed to in a writing signed by you, Clinic, and Pharmacy. This Letter Agreement shall be

governed, construed, and interpreted under the laws of the State of New York without reference to its principles of conflicts of laws.

If the Effective Time does not occur, this Letter Agreement shall be null and void ab initio.

From and following the Effective Time, your employment shall continue to be at will and may be terminated by either you

or HoustonCo or its Affiliates at any time, without prior notice and for any or no reason.

We believe that you and HoustonCo will have a promising future. Please acknowledge your agreement to the terms of this

Letter Agreement by your signature below.

Cousins Properties Incorporated

By: /s/ Pamela F. Roper

Name: Pamela F. Roper

Title:

Senior Vice President, General Counsel and

Corporate Secretary

3

Parkway Properties, Inc.

By: /s/ David R. O’Reilly

Name: David R. O’Reilly

Title:

Executive Vice President and Chief

Financial Officer

By: /s/ Jeremy R. Dorsett

Name: Jeremy R. Dorsett

Title:

Executive Vice President, General