Form FWP TETRA TECHNOLOGIES INC Filed by: TETRA TECHNOLOGIES INC

Filed Pursuant to Rule 433

Issuer Free Writing Prospectus

Registration No. 333-210335

December 8, 2016

TETRA Technologies, Inc.

TETRA Technologies, Inc. (the “Company”) has filed a registration statement (including a prospectus) on Form S-3 (File No. 333-210335), which became effective on April 13, 2016, with the Securities and Exchange Commission (the “SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Company has filed with the SEC for more complete information about the Company and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Company will arrange to send you the prospectus if you request it by calling (281) 367-1983.

December

2016 Investor Presentation

1 |

Forward Looking Statements Forward-Looking Statements: This presentation includes certain statements that are or may be deemed to be forward-looking statements. Generally, the use of words such as “may,” “will,” “expect,” “intend,” “estimate,” “projects,” “anticipate,” “believe,” “assume,” “could,” “should,” “plans,” “targets” or similar expressions that convey the uncertainty of future events, activities, expectations or outcomes identify forward-looking statements that we intend to be included within the safe harbor protections provided by the federal securities laws. These forward-looking statements include statements concerning expected results of operational business segments for 2016, anticipated benefits from our acquisitions of assets and businesses, projections concerning our business activities in the Gulf of Mexico, including potential future benefits from increased regulatory oversight of well abandonment and decommissioning activities, estimated earnings, earnings per share, and statements regarding our beliefs, expectations, plans, goals, future events and performance, and other statements that are not purely historical. These forward-looking statements are based on certain assumptions and analyses made in light of our experience and our perception of historical trends, current conditions, expected future developments and other factors we believe are appropriate in the circumstances. Such statements are subject to a number of risks and uncertainties, many of which are beyond our control. Investors are cautioned that any such statements are not guarantees of future performances or results and that actual results or developments may differ materially from those projected in the forward-looking statements. Some of the factors that could affect actual results are described in the section titled “Risk Factors” contained in our Annual Report on Form 10-K for the year ended December 31, 2015, as well as other risks identified from time to time in our reports on Form 10-Q and Form 8-K filed with the Securities and Exchange Commission. Registration Statement: The securities described in this presentation are being offered by TETRA Technologies, Inc. (“TETRA”) pursuant to a shelf registration statement which was filed with the Securities and Exchange Commission on March 23, 2016 and became effective on April 13, 2016. A preliminary prospectus supplement and the accompanying base prospectus describing the terms of the offering have been filed with the Securities and Exchange Commission and form part of the registration statement. Copies of the preliminary prospectus supplement and accompanying base prospectus relating to the offering can be obtained at the SEC's website at http://www.sec.gov or by mail at J.P. Morgan via Broadridge Financial Solutions 1155 Long Island Avenue Edgewood, New York, 11717. This presentation shall not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

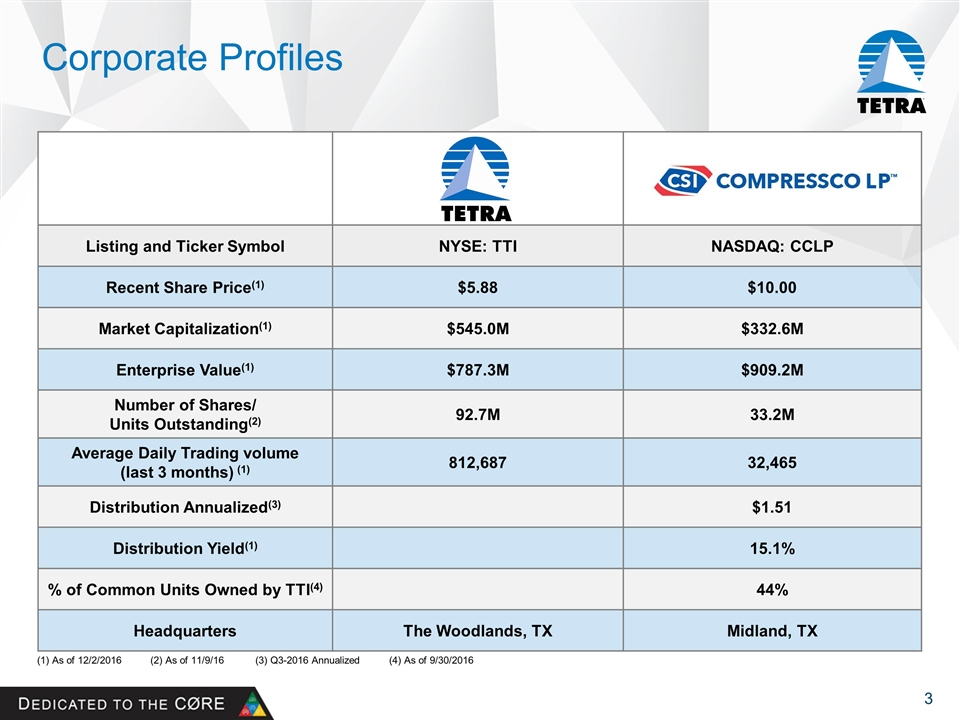

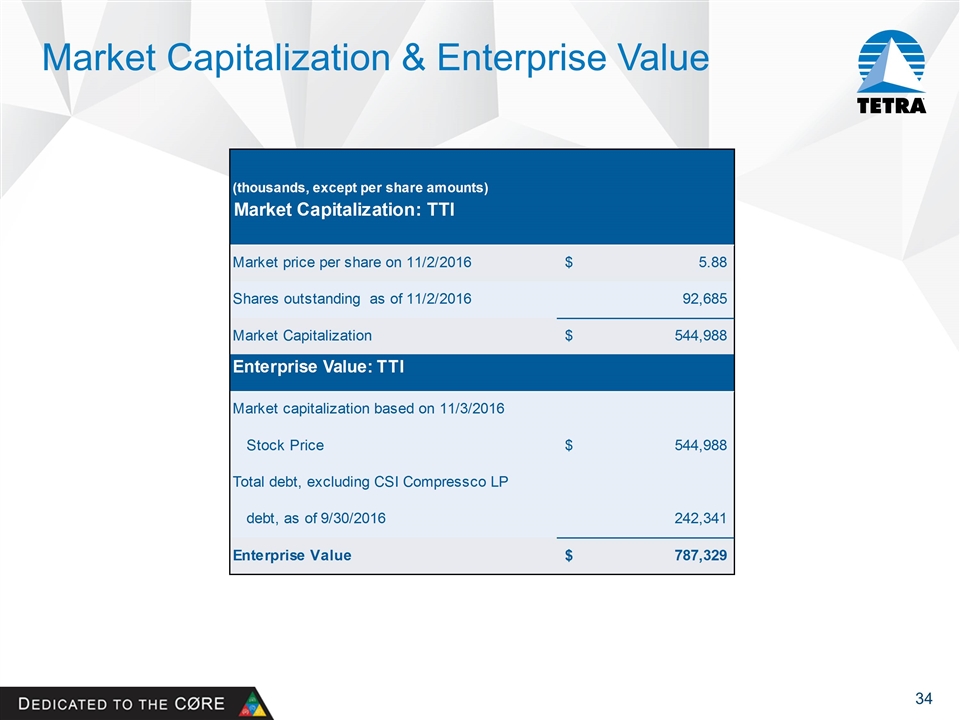

Listing and Ticker Symbol NYSE: TTI NASDAQ: CCLP Recent Share Price(1) $5.88 $10.00 Market Capitalization(1) $545.0M $332.6M Enterprise Value(1) $787.3M $909.2M Number of Shares/ Units Outstanding(2) 92.7M 33.2M Average Daily Trading volume (last 3 months) (1) 812,687 32,465 Distribution Annualized(3) $1.51 Distribution Yield(1) 15.1% % of Common Units Owned by TTI(4) 44% Headquarters The Woodlands, TX Midland, TX Corporate Profiles (1) As of 12/2/2016 (2) As of 11/9/16 (3) Q3-2016 Annualized (4) As of 9/30/2016

Current Events Positive broad oil and gas market trends Continued increases in the US onshore drilling activity and completion of previously uncompleted wells (DUCs)` OPEC announcement on production cut backs BP indication of $9 billion investment for ultra deep water GoM project TETRA seeing positive signs from Increasing US Onshore activity, particularly Water Management Stabilization of Compression fleet utilization rates TETRA anticipating modest $48 - $55 oil price range in 2017 Supports continued improvements in US onshore activity Stable Middle East activity levels Expectations are for a weak 2017 deep water market that is expected to improve in 2018 Near term Significant GoM CS Neptune deep water project deferred by client into Q1-2017 from Q4-2016 Projecting a debt covenant breach due to the shift in timing of the CS Neptune project Equity offering and related debt pay down will achieve covenant compliance; will also result in increased financial flexibility that provides cushion against future market weakness TETRA obtained an interim arbitration award of $7M on a long-standing claim. Additional award legal fees anticipated in Q4-2016, with expected settlement of both in H1-2017

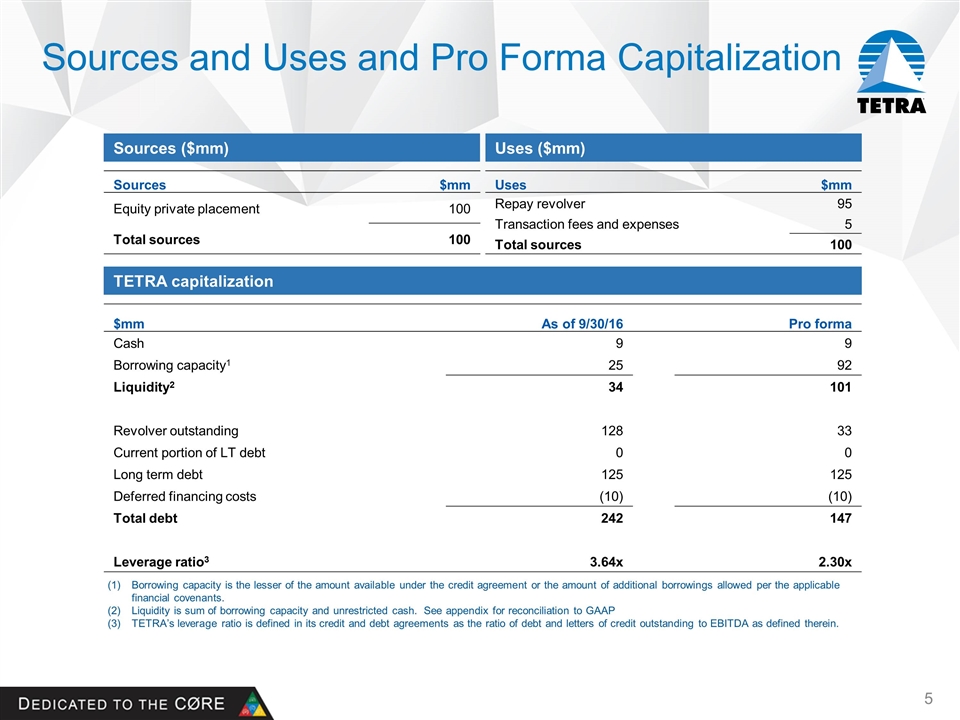

Sources and Uses and Pro Forma Capitalization Sources ($mm) Sources $mm Equity private placement 100 Total sources 100 Uses ($mm) Uses $mm Repay revolver 95 Transaction fees and expenses 5 Total sources 100 TETRA capitalization $mm As of 9/30/16 Pro forma Cash 9 9 Borrowing capacity1 25 92 Liquidity2 34 101 Revolver outstanding 128 33 Current portion of LT debt 0 0 Long term debt 125 125 Deferred financing costs (10) (10) Total debt 242 147 Leverage ratio3 3.64x 2.30x Borrowing capacity is the lesser of the amount available under the credit agreement or the amount of additional borrowings allowed per the applicable financial covenants. Liquidity is sum of borrowing capacity and unrestricted cash. See appendix for reconciliation to GAAP TETRA’s leverage ratio is defined in its credit and debt agreements as the ratio of debt and letters of credit outstanding to EBITDA as defined therein.

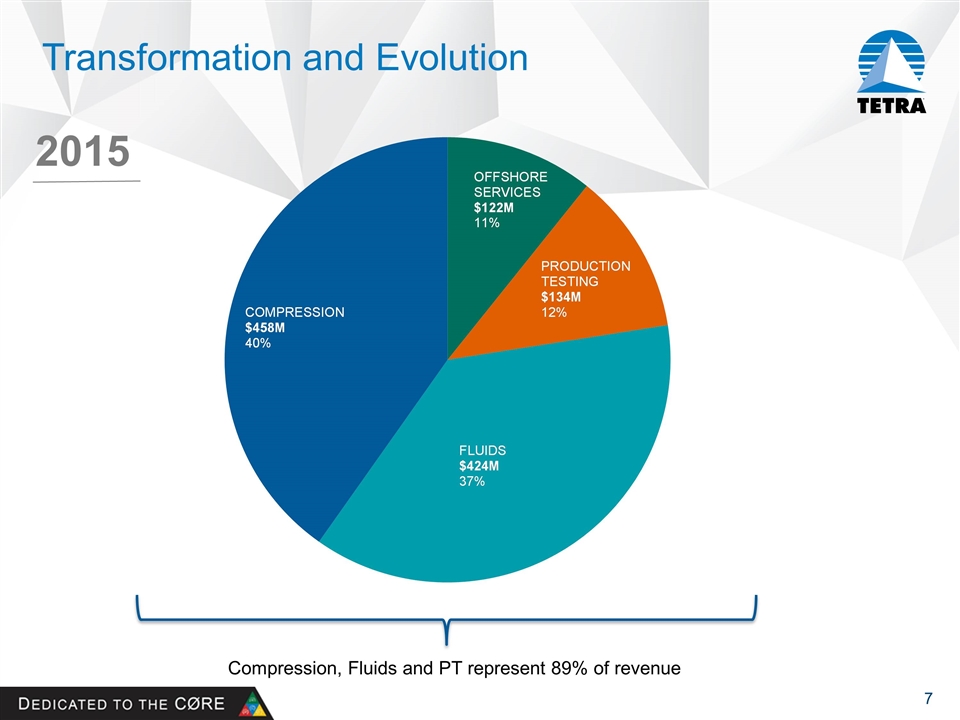

Business Segments $134M Revenue(1) Production Testing The largest North America production testing company Fluids Services Only vertically integrated completion fluids based company for the oil & gas market CSI Compressco Full service compression: well head, gathering, midstream, processing and transportation Offshore Services A leading provider of decommissioning and well abandonment services in Gulf of Mexico $424M Revenue(1) $458M Revenue(1) $122M Revenue(1) 2015 Revenue.

Transformation and Evolution 2015 Compression, Fluids and PT represent 89% of revenue

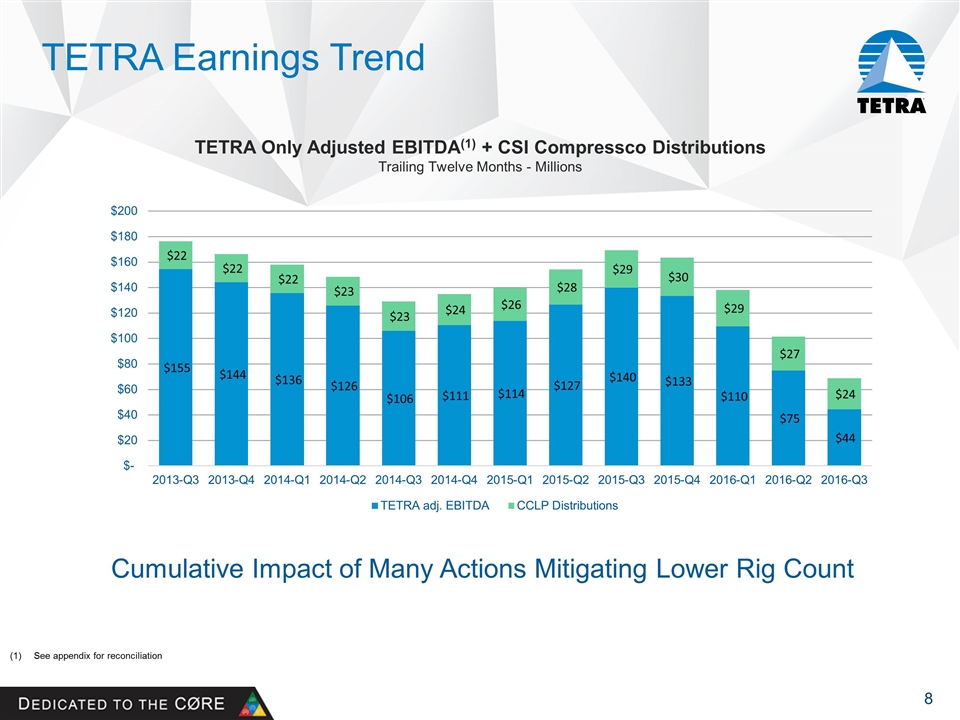

TETRA Earnings Trend TETRA Only Adjusted EBITDA(1) + CSI Compressco Distributions Trailing Twelve Months - Millions See appendix for reconciliation Cumulative Impact of Many Actions Mitigating Lower Rig Count

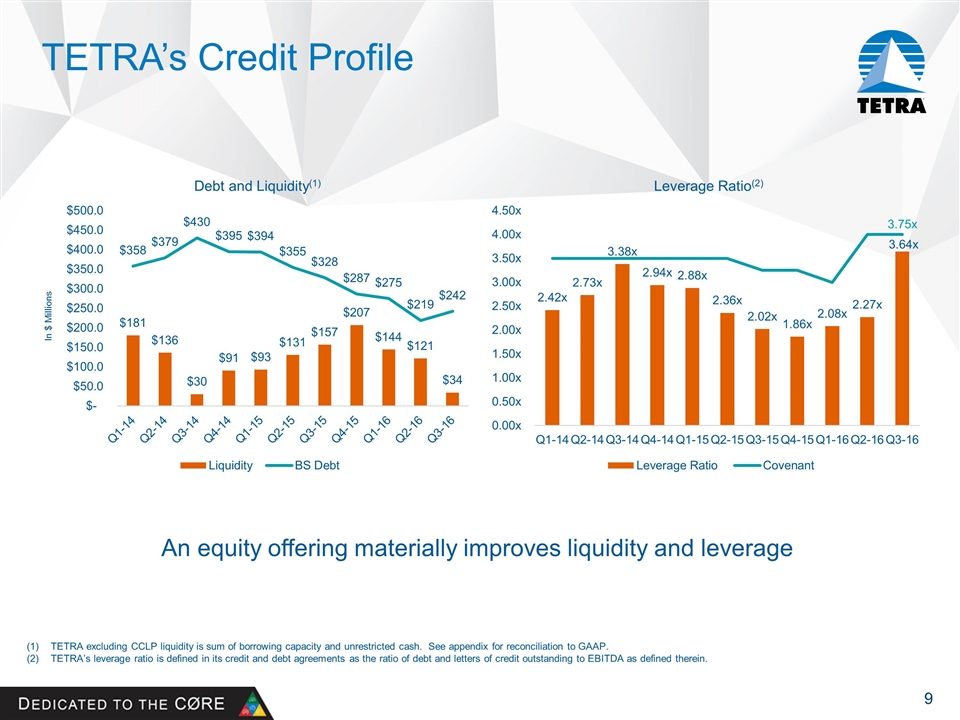

TETRA’s Credit Profile TETRA excluding CCLP liquidity is sum of borrowing capacity and unrestricted cash. See appendix for reconciliation to GAAP. TETRA’s leverage ratio is defined in its credit and debt agreements as the ratio of debt and letters of credit outstanding to EBITDA as defined therein. An equity offering materially improves liquidity and leverage 3.75x

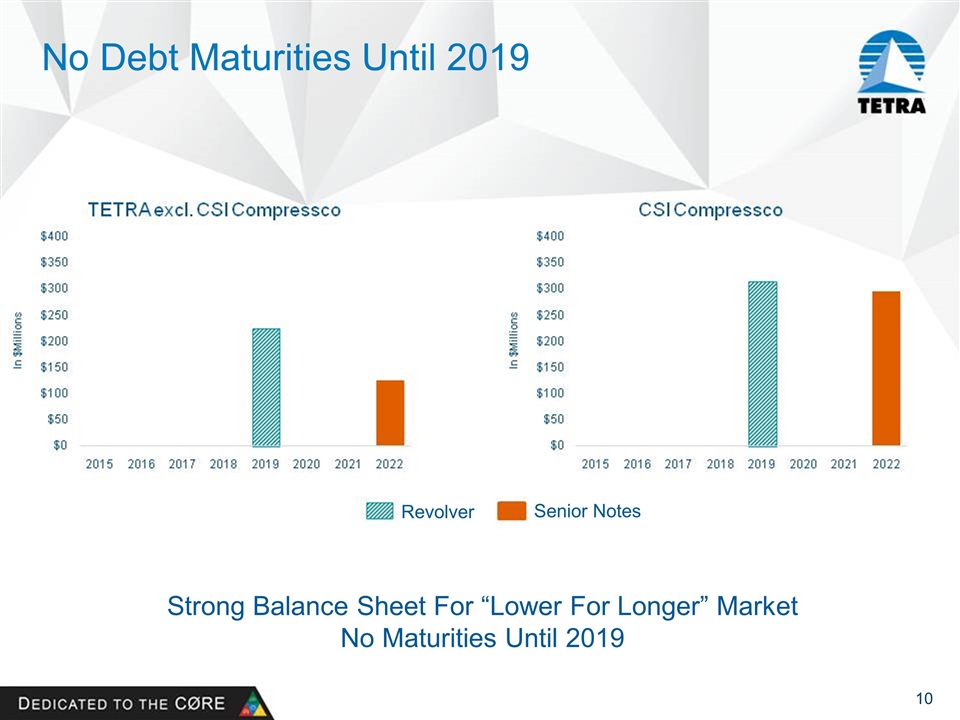

No Debt Maturities Until 2019 Revolver Senior Notes Strong Balance Sheet For “Lower For Longer” Market No Maturities Until 2019

Fluids

Fluids Chemicals/Completion Fluids Only vertically integrated service provider globally Seamless supply channel from manufacturing plants to clear brine fluid (CBF) blending facilities Significant infrastructure Strong global competitor Introducing new technology, products and services Advantaged cost position in non-oil and gas markets proximate to manufacturing plants Water Management Treatment, transfer, automation and monitoring capabilities Unique cost effective solutions for frac water management Proprietary technology with an exclusive supplier agreement Rapid deployment for shorter turnaround time between jobs Deployed in most of the key U.S. shale basins

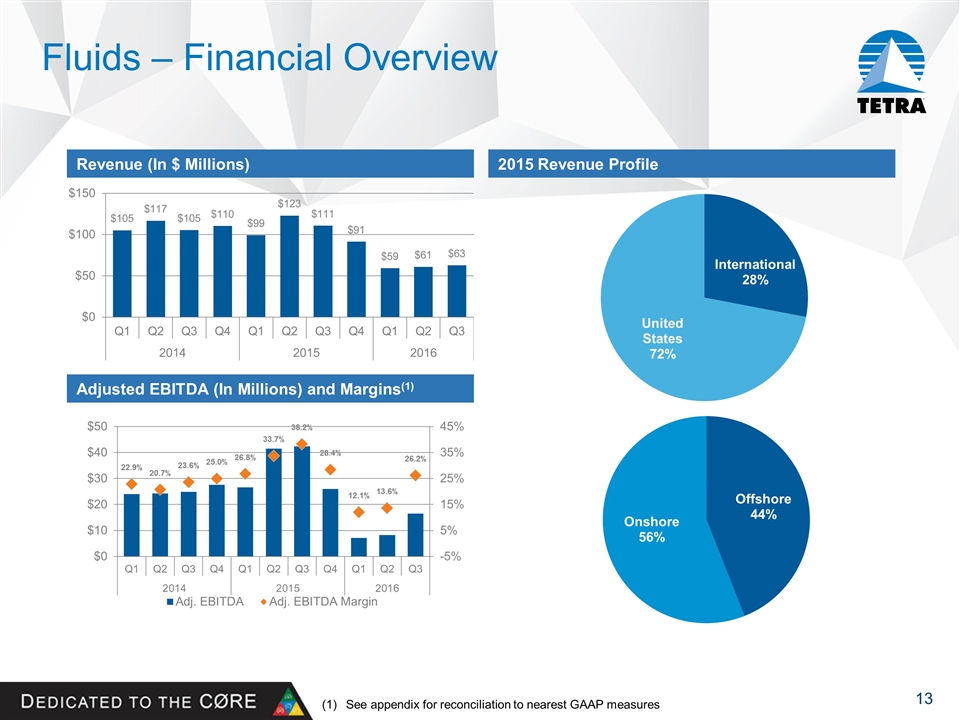

Fluids – Financial Overview Revenue (In $ Millions) Adjusted EBITDA (In Millions) and Margins(1) 2015 Revenue Profile See appendix for reconciliation to nearest GAAP measures

CSI Compressco LP

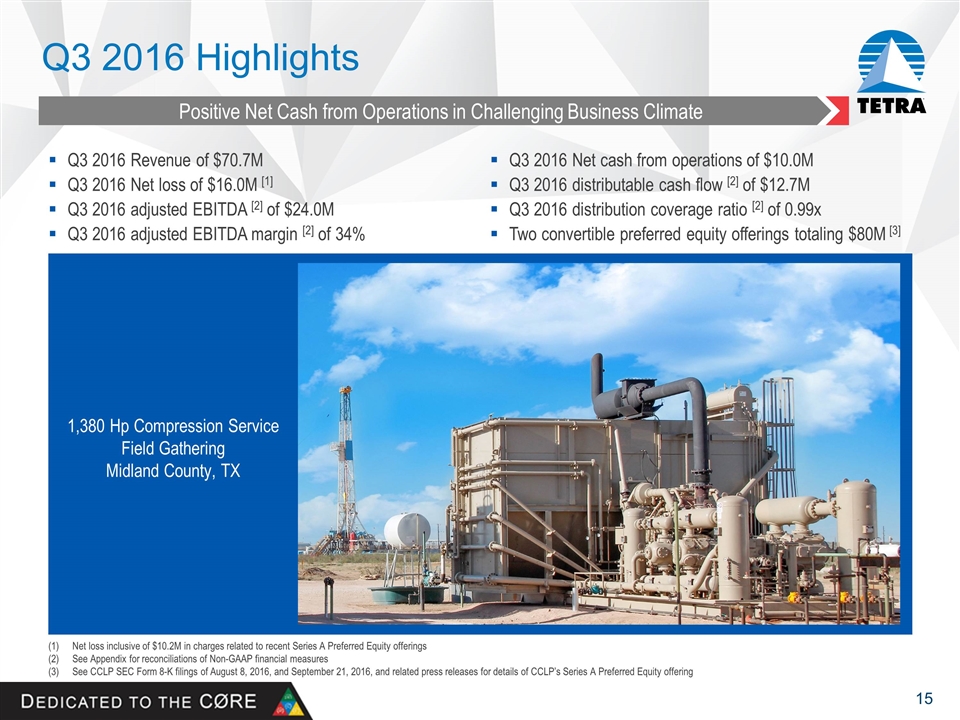

Q3 2016 Highlights Positive Net Cash from Operations in Challenging Business Climate Q3 2016 Revenue of $70.7M Q3 2016 Net loss of $16.0M [1] Q3 2016 adjusted EBITDA [2] of $24.0M Q3 2016 adjusted EBITDA margin [2] of 34% 1,380 Hp Compression Service Field Gathering Midland County, TX Net loss inclusive of $10.2M in charges related to recent Series A Preferred Equity offerings See Appendix for reconciliations of Non-GAAP financial measures See CCLP SEC Form 8-K filings of August 8, 2016, and September 21, 2016, and related press releases for details of CCLP’s Series A Preferred Equity offering Q3 2016 Net cash from operations of $10.0M Q3 2016 distributable cash flow [2] of $12.7M Q3 2016 distribution coverage ratio [2] of 0.99x Two convertible preferred equity offerings totaling $80M [3]

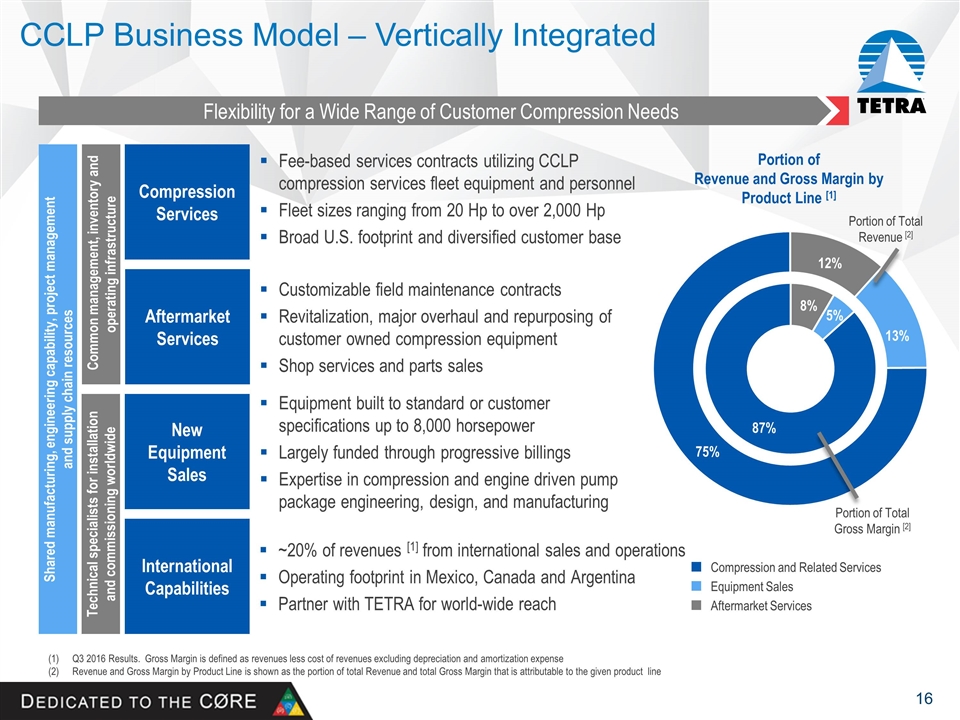

CCLP Business Model – Vertically Integrated Q3 2016 Results. Gross Margin is defined as revenues less cost of revenues excluding depreciation and amortization expense Revenue and Gross Margin by Product Line is shown as the portion of total Revenue and total Gross Margin that is attributable to the given product line Compression Services Aftermarket Services New Equipment Sales International Capabilities Fee-based services contracts utilizing CCLP compression services fleet equipment and personnel Fleet sizes ranging from 20 Hp to over 2,000 Hp Broad U.S. footprint and diversified customer base ~20% of revenues [1] from international sales and operations Operating footprint in Mexico, Canada and Argentina Partner with TETRA for world-wide reach Common management, inventory and operating infrastructure Customizable field maintenance contracts Revitalization, major overhaul and repurposing of customer owned compression equipment Shop services and parts sales Equipment built to standard or customer specifications up to 8,000 horsepower Largely funded through progressive billings Expertise in compression and engine driven pump package engineering, design, and manufacturing Shared manufacturing, engineering capability, project management and supply chain resources Portion of Revenue and Gross Margin by Product Line [1] Flexibility for a Wide Range of Customer Compression Needs Portion of Total Revenue [2] Portion of Total Gross Margin [2] Compression and Related Services Technical specialists for installation and commissioning worldwide Equipment Sales Aftermarket Services

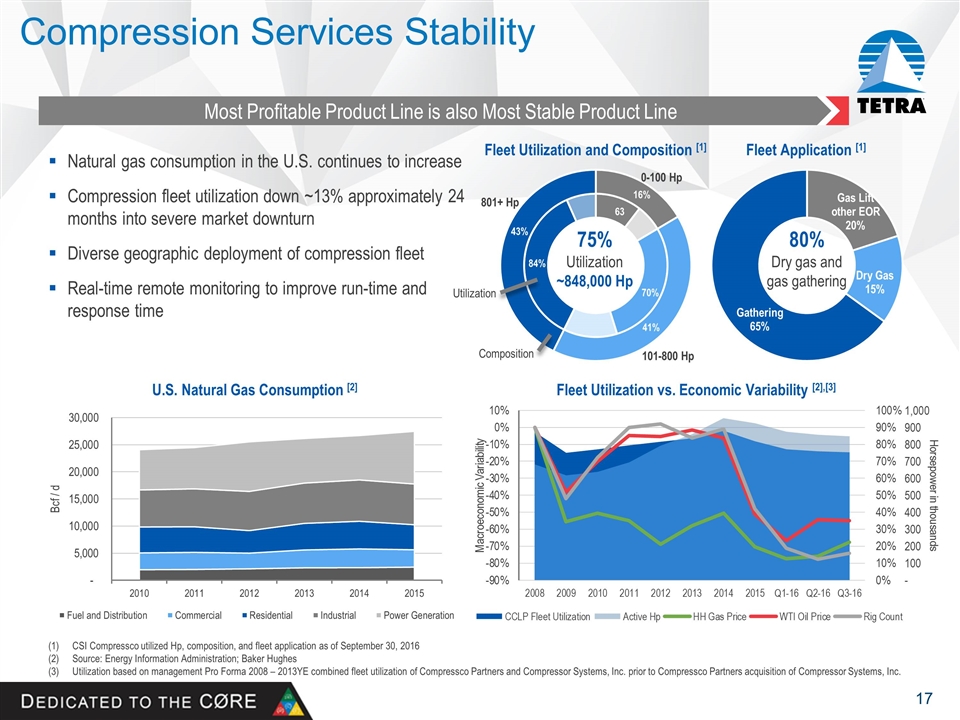

Compression Services Stability Most Profitable Product Line is also Most Stable Product Line Natural gas consumption in the U.S. continues to increase Compression fleet utilization down ~13% approximately 24 months into severe market downturn Diverse geographic deployment of compression fleet Real-time remote monitoring to improve run-time and response time U.S. Natural Gas Consumption [2] Fleet Utilization vs. Economic Variability [2],[3] CSI Compressco utilized Hp, composition, and fleet application as of September 30, 2016 Source: Energy Information Administration; Baker Hughes Utilization based on management Pro Forma 2008 – 2013YE combined fleet utilization of Compressco Partners and Compressor Systems, Inc. prior to Compressco Partners acquisition of Compressor Systems, Inc. 75% Utilization ~848,000 Hp Fleet Utilization and Composition [1] Fleet Application [1] 80% Dry gas and gas gathering 63 70% 84% 0-100 Hp 101-800 Hp 801+ Hp 16% 41% 43% Utilization Composition

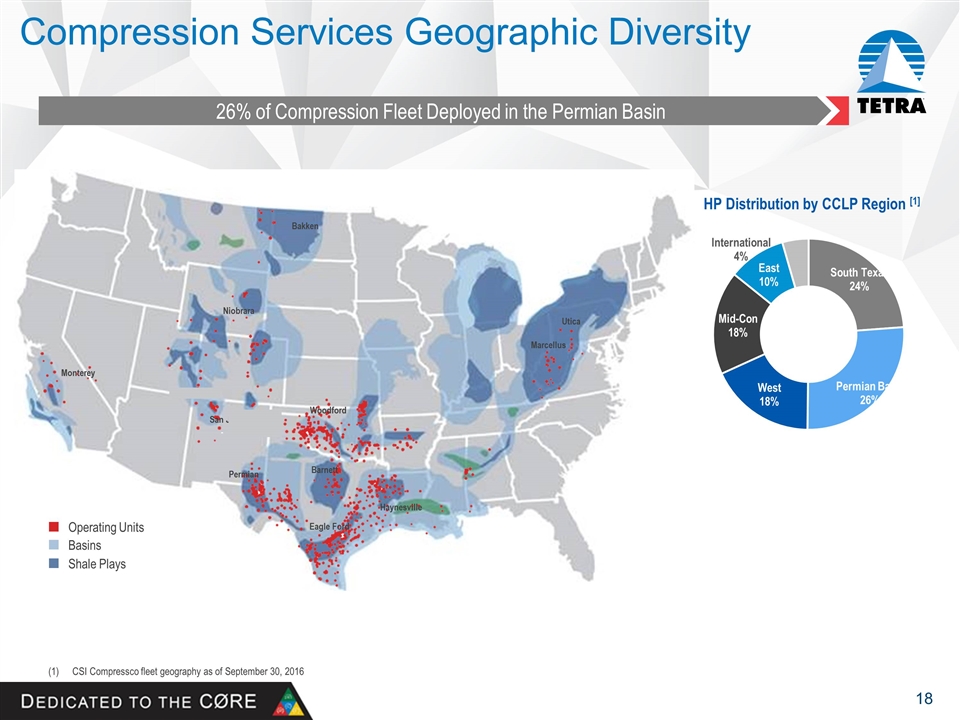

Compression Services Geographic Diversity 26% of Compression Fleet Deployed in the Permian Basin Eagle Ford Marcellus Utica Permian Barnett Haynesville Bakken Niobrara Monterey San Juan Woodford CSI Compressco fleet geography as of September 30, 2016 HP Distribution by CCLP Region [1] Operating Units Basins Shale Plays Gas Jack® unit on Well Head Service

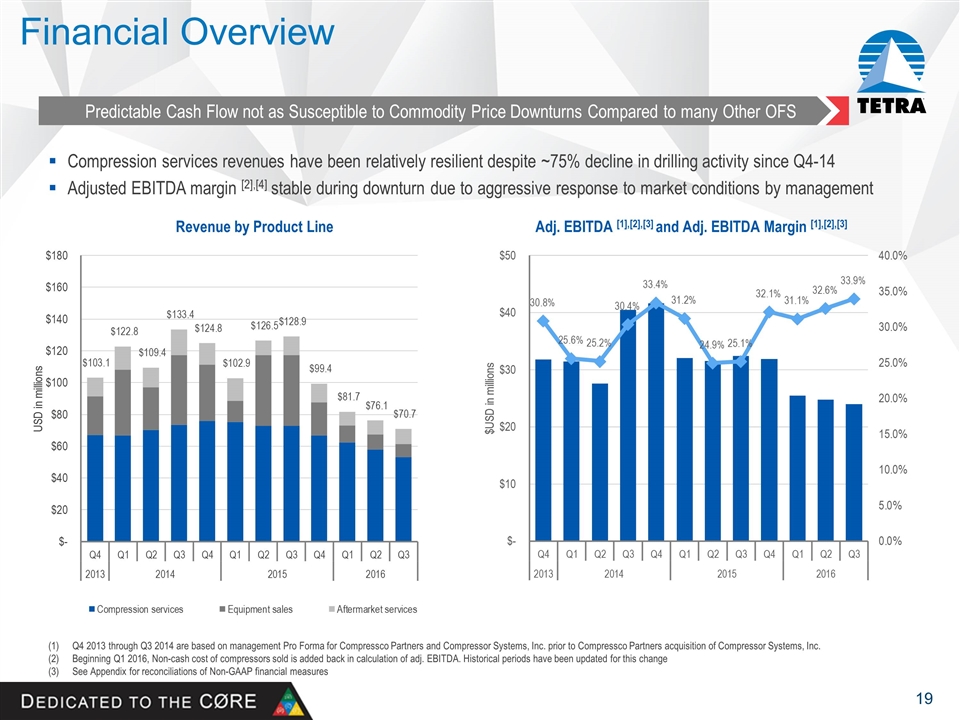

Financial Overview Predictable Cash Flow not as Susceptible to Commodity Price Downturns Compared to many Other OFS Revenue by Product Line Adj. EBITDA [1],[2],[3] and Adj. EBITDA Margin [1],[2],[3] Compression services revenues have been relatively resilient despite ~75% decline in drilling activity since Q4-14 Adjusted EBITDA margin [2],[4] stable during downturn due to aggressive response to market conditions by management Q4 2013 through Q3 2014 are based on management Pro Forma for Compressco Partners and Compressor Systems, Inc. prior to Compressco Partners acquisition of Compressor Systems, Inc. Beginning Q1 2016, Non-cash cost of compressors sold is added back in calculation of adj. EBITDA. Historical periods have been updated for this change See Appendix for reconciliations of Non-GAAP financial measures

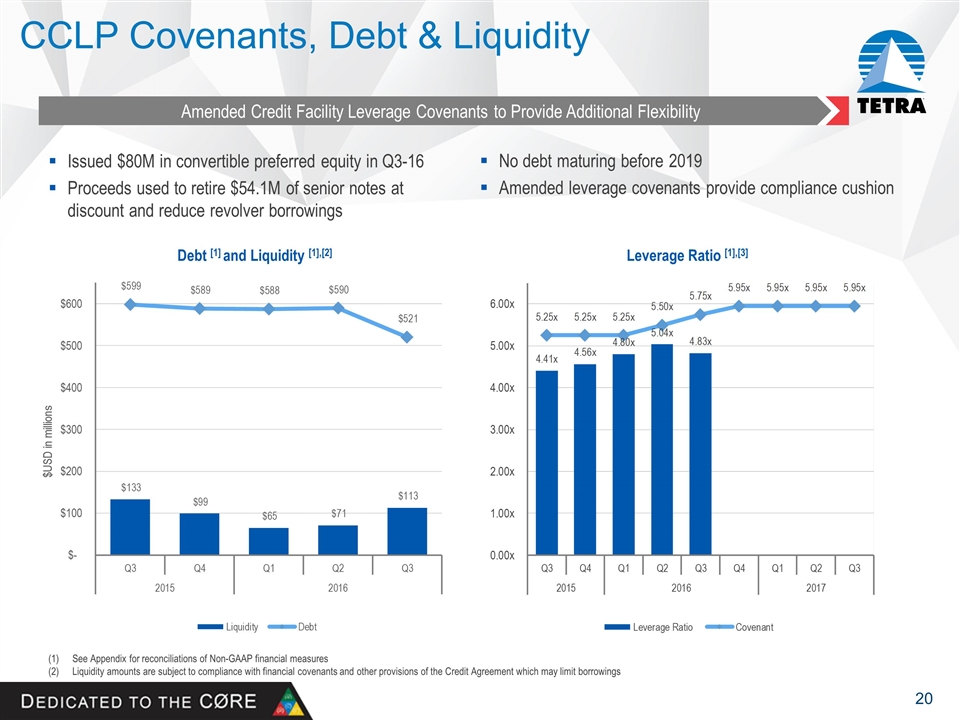

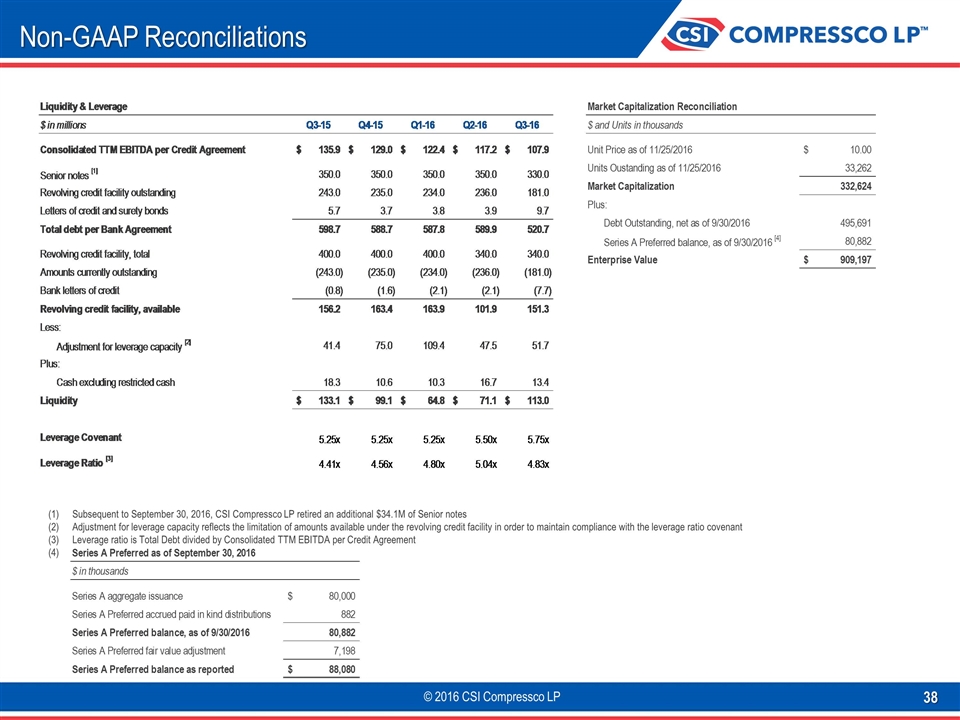

Amended Credit Facility Leverage Covenants to Provide Additional Flexibility CCLP Covenants, Debt & Liquidity Issued $80M in convertible preferred equity in Q3-16 Proceeds used to retire $54.1M of senior notes at discount and reduce revolver borrowings Debt [1] and Liquidity [1],[2] Leverage Ratio [1],[3] See Appendix for reconciliations of Non-GAAP financial measures Liquidity amounts are subject to compliance with financial covenants and other provisions of the Credit Agreement which may limit borrowings No debt maturing before 2019 Amended leverage covenants provide compliance cushion

Production Testing

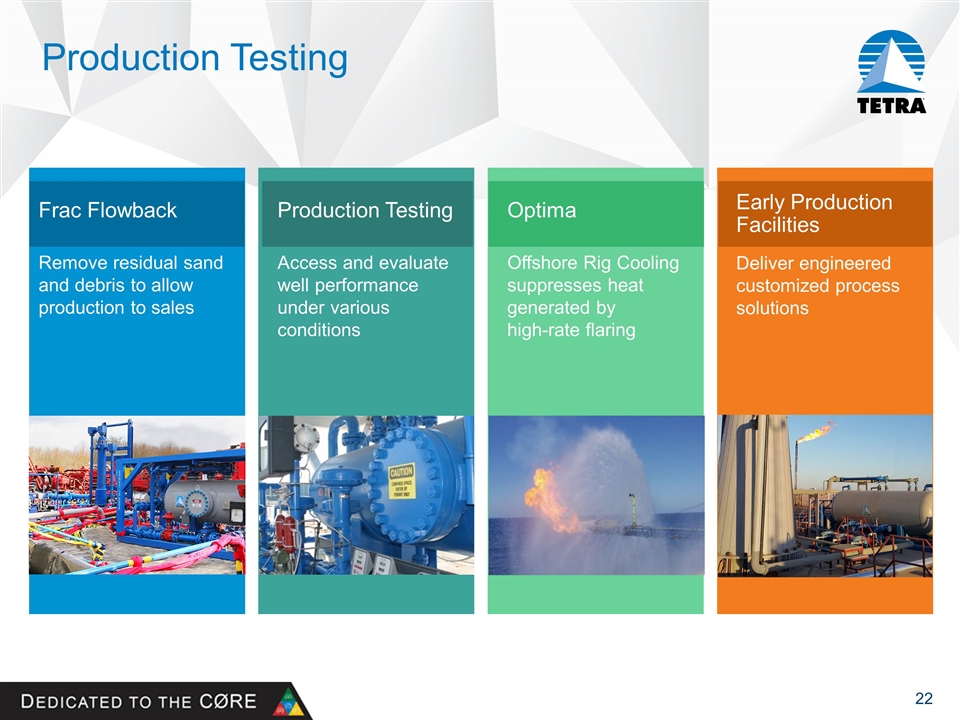

Production Testing Frac Flowback Remove residual sand and debris to allow production to sales Optima Offshore Rig Cooling suppresses heat generated by high-rate flaring Early Production Facilities Deliver engineered customized process solutions Production Testing Access and evaluate well performance under various conditions

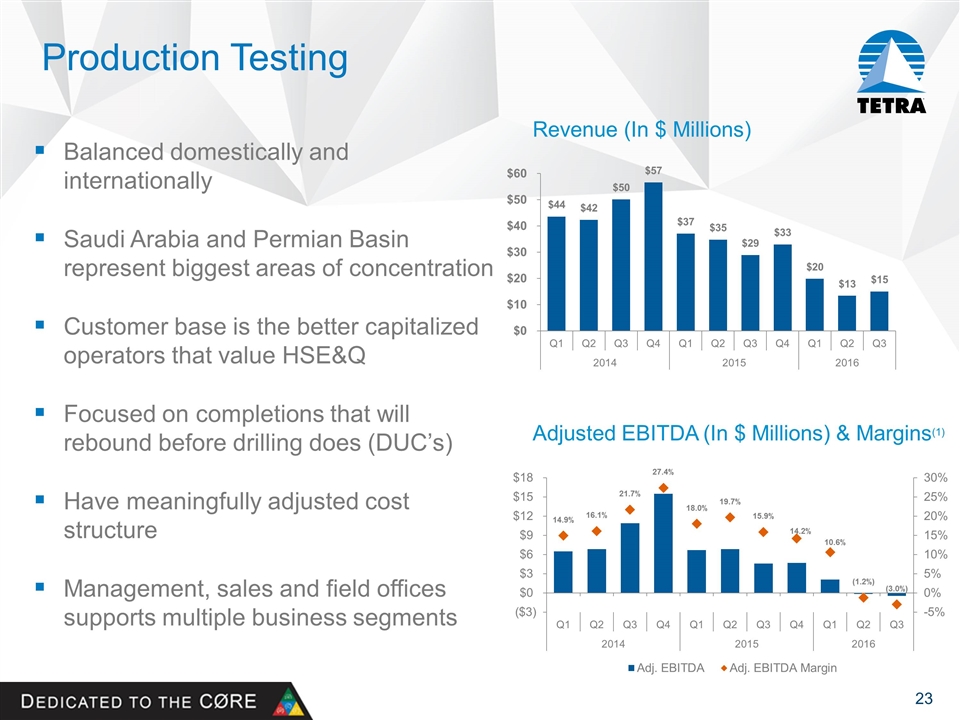

Production Testing Revenue (In $ Millions) Adjusted EBITDA (In $ Millions) & Margins(1) Balanced domestically and internationally Saudi Arabia and Permian Basin represent biggest areas of concentration Customer base is the better capitalized operators that value HSE&Q Focused on completions that will rebound before drilling does (DUC’s) Have meaningfully adjusted cost structure Management, sales and field offices supports multiple business segments

Offshore Services

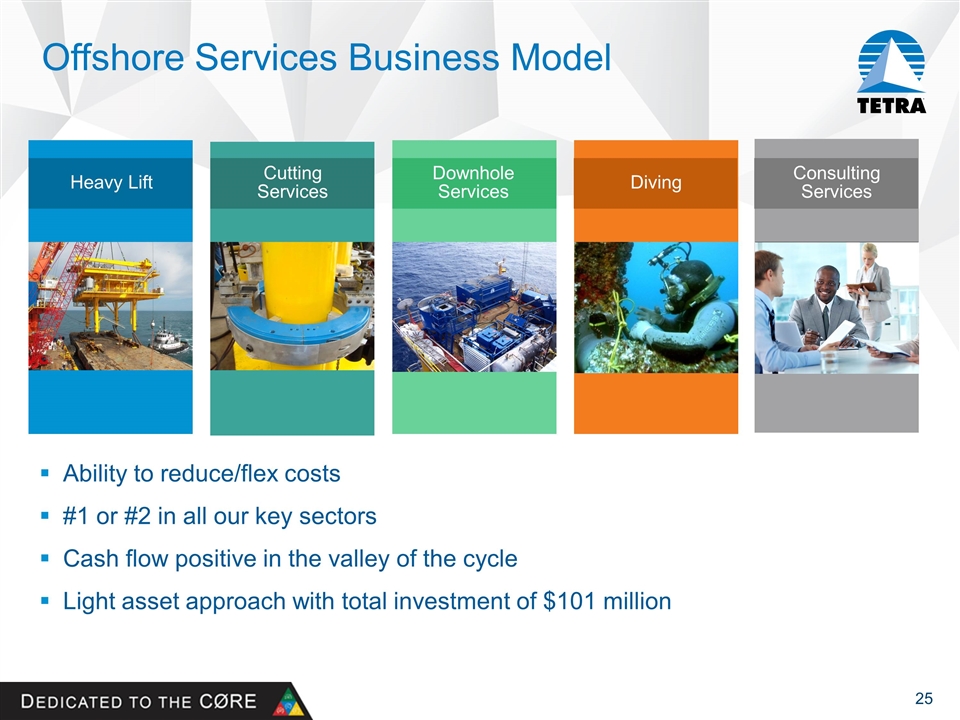

Offshore Services Business Model Heavy Lift Downhole Services Diving Cutting Services Consulting Services Ability to reduce/flex costs #1 or #2 in all our key sectors Cash flow positive in the valley of the cycle Light asset approach with total investment of $101 million

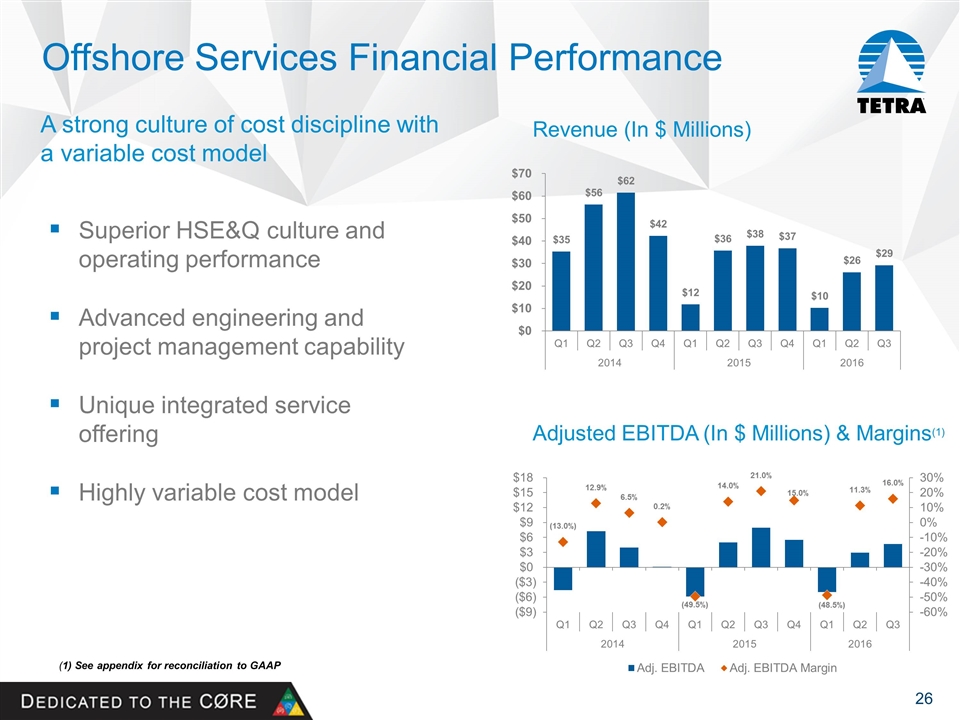

Offshore Services Financial Performance A strong culture of cost discipline with a variable cost model (1) See appendix for reconciliation to GAAP Revenue (In $ Millions) Adjusted EBITDA (In $ Millions) & Margins(1) Superior HSE&Q culture and operating performance Advanced engineering and project management capability Unique integrated service offering Highly variable cost model

Appendix

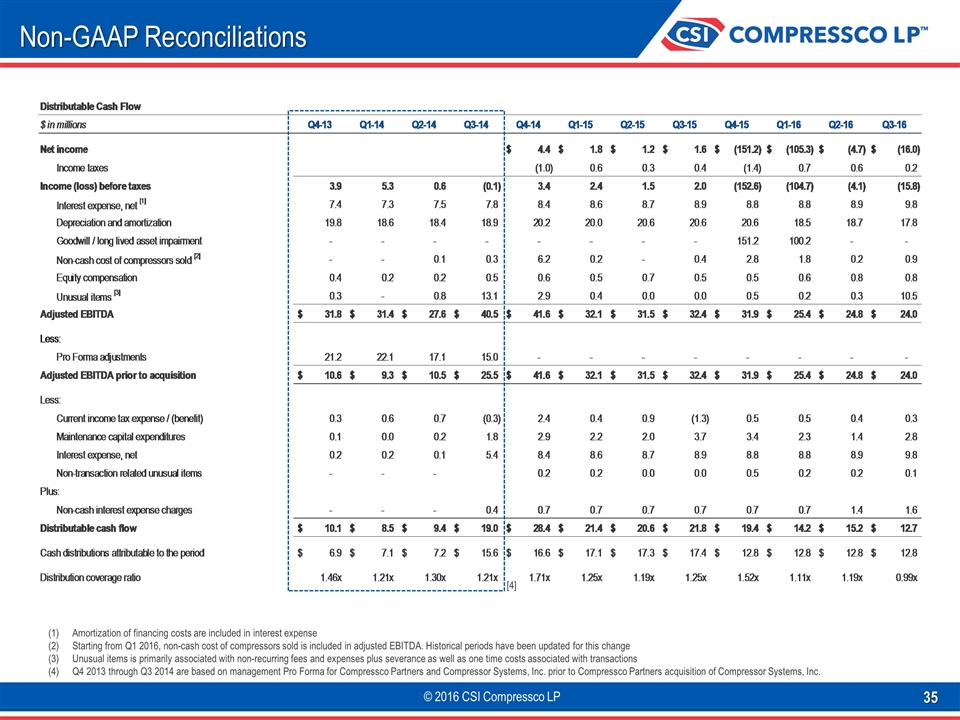

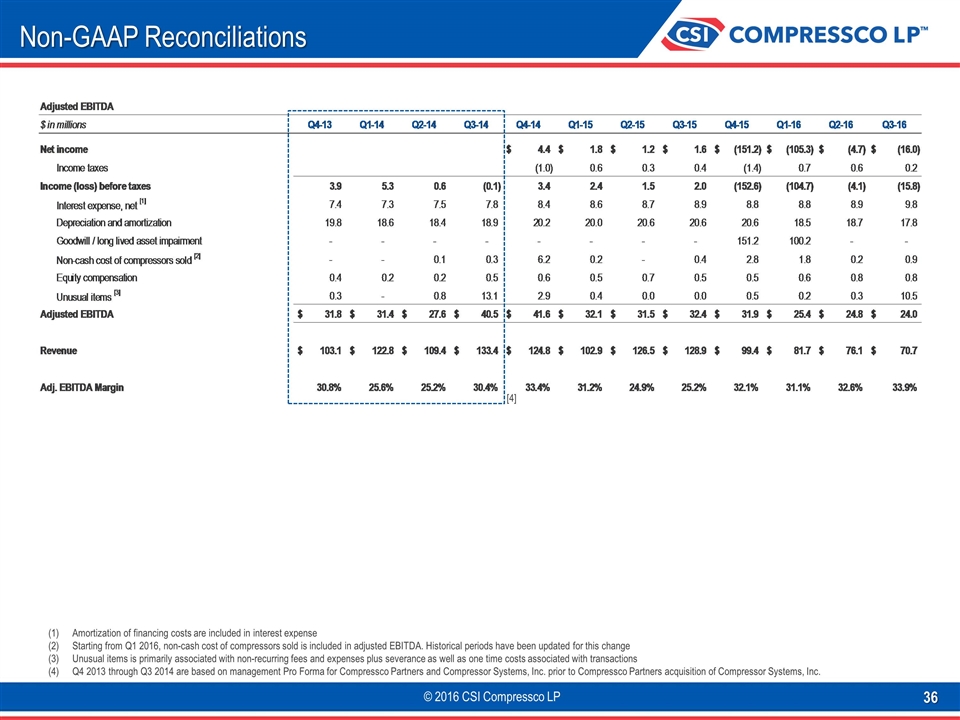

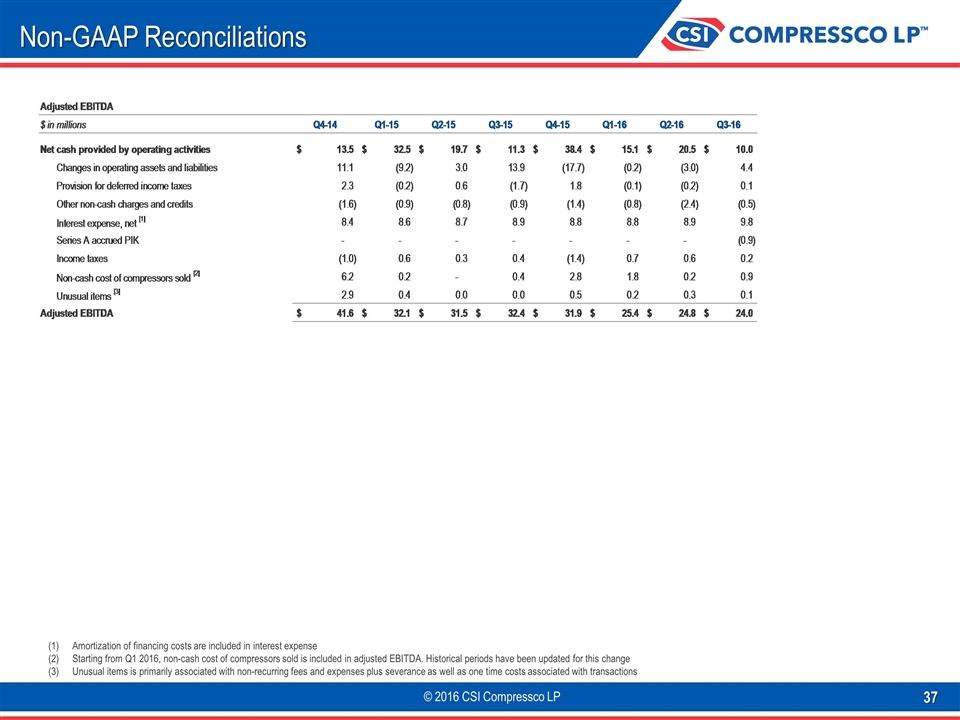

Non-GAAP Financial Measures This presentation includes non-GAAP financial measures, Adjusted EBITDA, Adjusted EBITDA margin, enterprise value, distributable cash flow, adjusted free cash flow, liquidity, distribution coverage ratio and debt to Adjusted EBITDA. Adjusted EBITDA is used as a supplemental financial measure by the management to: evaluate the financial performance of assets without regard to financing methods, capital structure or historical cost basis; measure operating performance and return on capital as compared to competitors; and determine the ability to incur and service debt and fund capital expenditures. assess ability to generate available cash sufficient to make distributions to the CSI Compressco’s unit holders and general partner; Adjusted EBITDA is defined as sum of EBITDA, non-cash equity compensation expense, and amortization of financing costs, less unusual items. Adjusted EBITDA margin is defined as Adjusted EBITDA divided by revenue. Enterprise value is defined as market capitalization plus the sum of long-term and short-term debt on the consolidated balance sheet, less cash, excluding restricted cash on the consolidated balance sheet. Management uses enterprise value as a measure of the market value of the company if it were free of debt. CSI Compressco (CCLP) distributable cash flow is used as a supplemental financial measure by management as it provides important information relating to the relationship between CCLP’s financial operating performance and its cash distribution capability. Additionally, distributable cash flow is used in setting forward expectations. CCLP’s distributable cash flow is defined as EBITDA less current income tax expense, maintenance capital expenditures, and interest expense, plus the non-cash cost of compressors sold and equity compensation expense. The CCLP distribution coverage ratio is defied as the ratio of distributable cash flow to the quarterly distribution payable on all outstanding common and subordinated units and the general partner interest. CCLP Distribution coverage ratio provides important information relating to the relationship between financial operating performance and cash distribution capability. Debt to Adjusted EBITDA is defined as balance of debt at the end of the period divided by last twelve months of Adjusted EBITDA. Liquidity is defined as the availability under the Credit Agreement (consisting of maximum credit commitment, less balance outstanding) plus the sum of unrestricted cash on the consolidated balance sheet. Management views liquidity as a measure of the Company’s ability to fund investing and financing activities. TETRA only adjusted free cash flow is a non-GAAP measure that the Company defines as cash from TETRA's operations, excluding cash settlements of Maritech AROs, less capital expenditures net of sales proceeds, and including cash distributions to TETRA from CSI Compressco LP. These non-GAAP financial measures should not be considered an alternative to net income, operating income, cash flows from operating activities or any other measure of financial performance presented in accordance with GAAP. These non-GAAP financial measures may not be comparable to EBITDA, distributable cash flow or other similarly titled measures of other entities, as other entities may not calculate these non-GAAP financial measures in the same manner. Management compensates for the limitation of these non-GAAP financial measures as an analytical tool by reviewing the comparable GAAP measures, understanding the differences between the measures and incorporating this knowledge into management's decision making process. Furthermore, these non-GAAP measures should not be viewed as indicative of the actual amount of cash that is available for distributions or planned distribution for a given period, nor should they be equated to available cash as defined in the Partnership's partnership agreement.

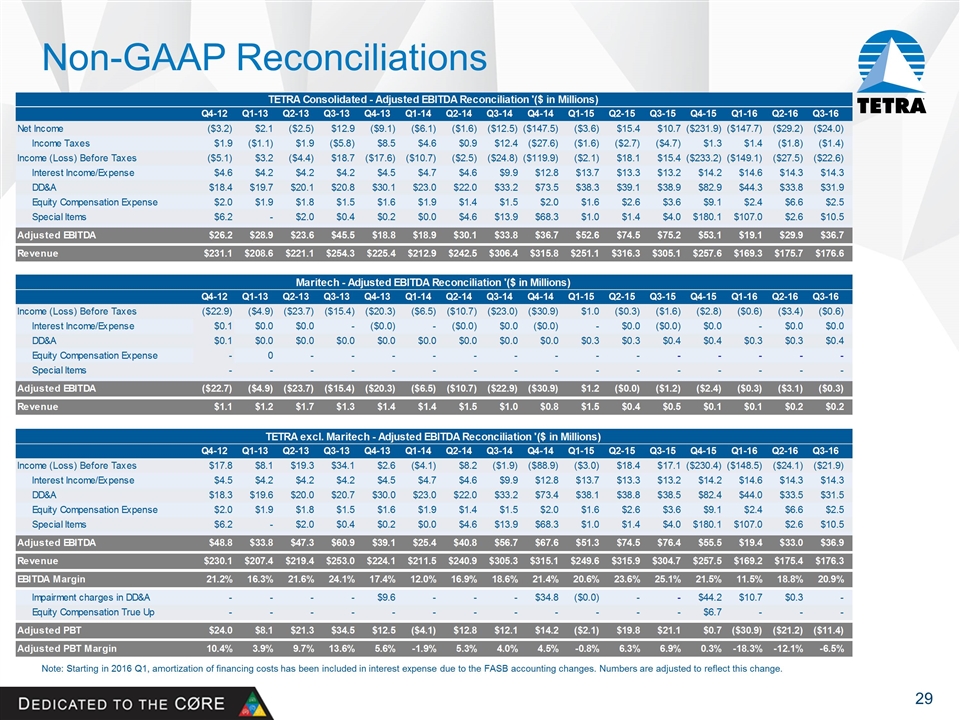

Non-GAAP Reconciliations Note: Starting in 2016 Q1, amortization of financing costs has been included in interest expense due to the FASB accounting changes. Numbers are adjusted to reflect this change.

Non-GAAP Reconciliations Note: Starting in 2016 Q1, amortization of financing costs has been included in interest expense due to the FASB accounting changes. Numbers are adjusted to reflect this change.

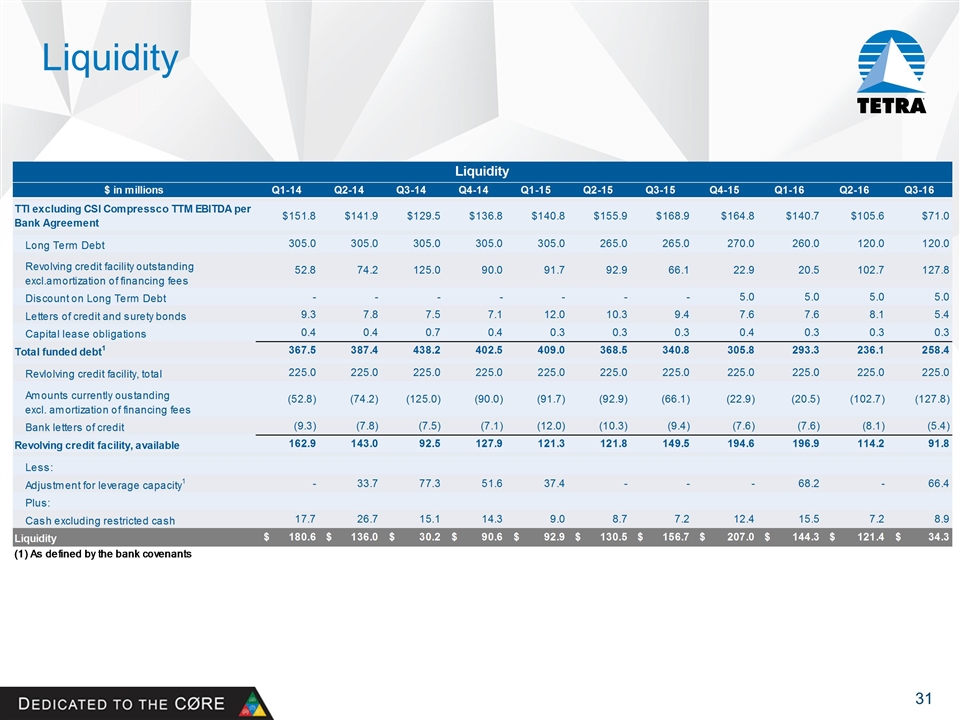

Liquidity

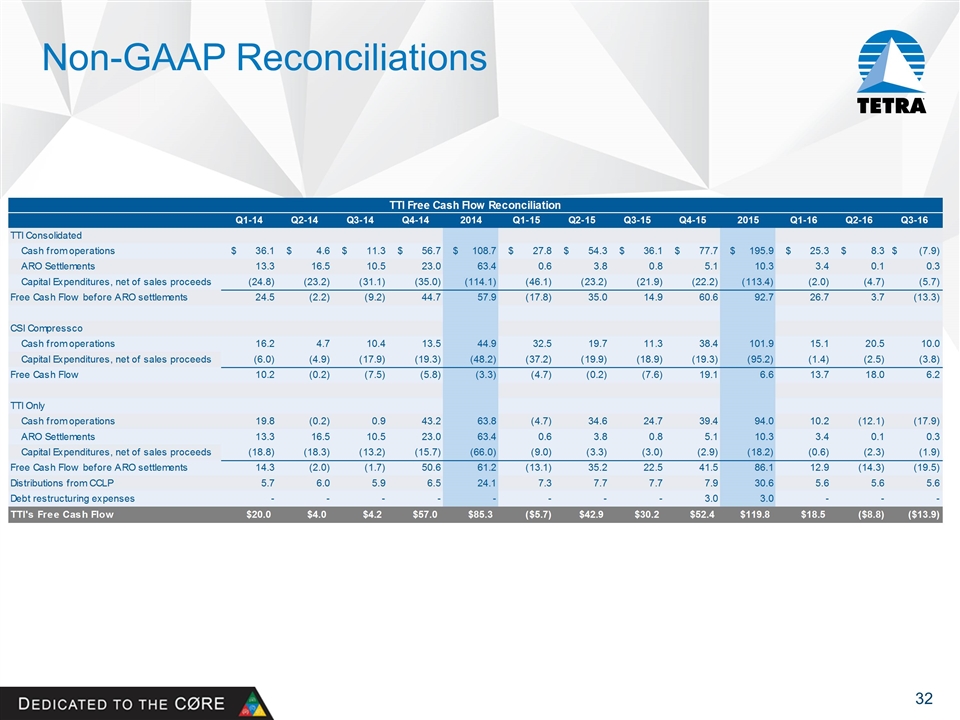

Non-GAAP Reconciliations

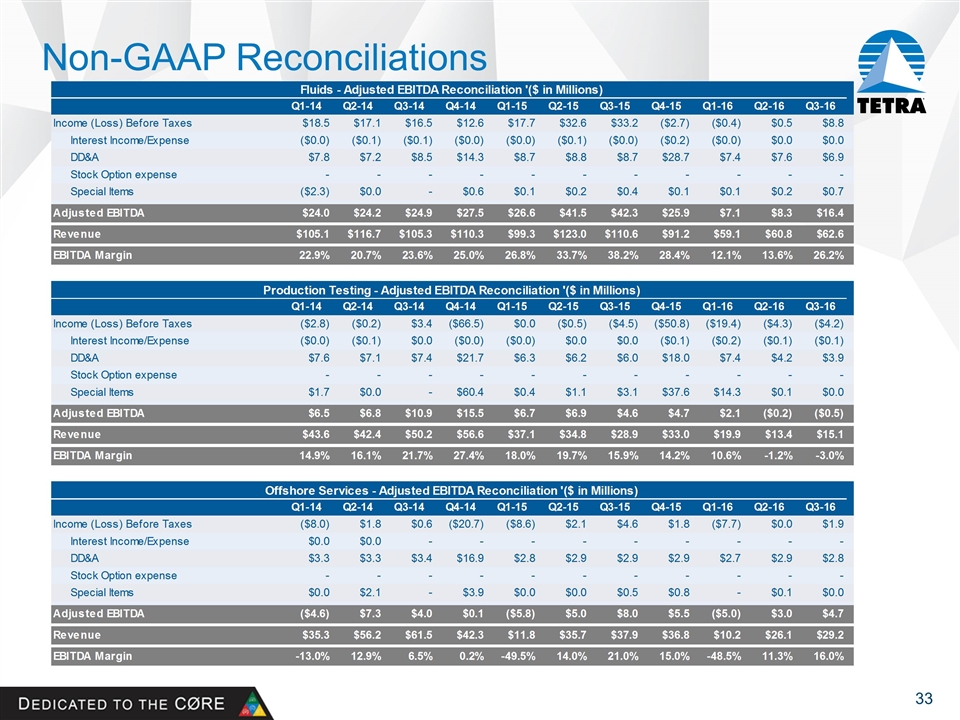

Non-GAAP Reconciliations

Market Capitalization & Enterprise Value

Non-GAAP Reconciliations Amortization of financing costs are included in interest expense Starting from Q1 2016, non-cash cost of compressors sold is included in adjusted EBITDA. Historical periods have been updated for this change Unusual items is primarily associated with non-recurring fees and expenses plus severance as well as one time costs associated with transactions Q4 2013 through Q3 2014 are based on management Pro Forma for Compressco Partners and Compressor Systems, Inc. prior to Compressco Partners acquisition of Compressor Systems, Inc. [4] © 2016 CSI Compressco LP

Non-GAAP Reconciliations Amortization of financing costs are included in interest expense Starting from Q1 2016, non-cash cost of compressors sold is included in adjusted EBITDA. Historical periods have been updated for this change Unusual items is primarily associated with non-recurring fees and expenses plus severance as well as one time costs associated with transactions Q4 2013 through Q3 2014 are based on management Pro Forma for Compressco Partners and Compressor Systems, Inc. prior to Compressco Partners acquisition of Compressor Systems, Inc. [4]

Non-GAAP Reconciliations Amortization of financing costs are included in interest expense Starting from Q1 2016, non-cash cost of compressors sold is included in adjusted EBITDA. Historical periods have been updated for this change Unusual items is primarily associated with non-recurring fees and expenses plus severance as well as one time costs associated with transactions

Non-GAAP Reconciliations Subsequent to September 30, 2016, CSI Compressco LP retired an additional $34.1M of Senior notes Adjustment for leverage capacity reflects the limitation of amounts available under the revolving credit facility in order to maintain compliance with the leverage ratio covenant Leverage ratio is Total Debt divided by Consolidated TTM EBITDA per Credit Agreement

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- TETRA TECHNOLOGIES, INC. ANNOUNCES FIRST QUARTER EARNINGS RELEASE CONFERENCE CALL AND WEBCAST

- Peralta Community College District Seeks More Outstanding Leaders

- FangDD Files 2023 Annual Report on Form 20-F

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share