Form 8-K TYSON FOODS INC For: Nov 21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): November 21, 2016

Tyson Foods, Inc.

(Exact name of Registrant as specified in its charter)

Delaware

(State of incorporation or organization)

001-14704

(Commission File Number)

71-0225165

(IRS Employer Identification No.)

2200 West Don Tyson Parkway, Springdale, AR 72762-6999

(479) 290-4000

(Address, including zip code, and telephone number, including area code, of

Registrant’s principal executive offices)

Not applicable

(Former name, former address and former fiscal year, if applicable)

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01. Regulation FD Disclosure

Attached hereto as Exhibit 99.1 is a presentation of Tyson Foods, Inc. (together with its subsidiaries, the "Company") referenced during the Company's earnings conference call on November 21, 2016.

The information furnished in Item 7.01 and in Exhibit 99.1 shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or incorporated by reference in any of the Company's filings under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01. Financial Statements and Exhibits

(d) | Exhibit |

Exhibit Number | Description |

99.1 | Fourth Quarter Fiscal 2016 Earnings Call Presentation |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

TYSON FOODS, INC. | |||

Date: November 21, 2016 | By: | /s/ Dennis Leatherby | |

Name: | Dennis Leatherby | ||

Title: | Executive Vice President and | ||

Chief Financial Officer | |||

4th Quarter Fiscal 2016 Earnings

Supplemental Information

November 21, 2016

Forward-Looking Statements

Certain information contained in the press release may constitute forward-looking statements, such as statements

relating to expected performance, and including, but not limited to, statements appearing in the “Outlook” section

and statements relating to GAAP EPS guidance and adjusted EPS guidance. These forward-looking statements are

subject to a number of factors and uncertainties which could cause our actual results and experiences to differ

materially from the anticipated results and expectations expressed in such forward-looking statements. We wish to

caution readers not to place undue reliance on any forward-looking statements, which speak only as of the date

made. Among the factors that may cause actual results and experiences to differ from anticipated results and

expectations expressed in such forward-looking statements are the following: (i) the effect of, or changes in,

general economic conditions; (ii) fluctuations in the cost and availability of inputs and raw materials, such as live

cattle, live swine, feed grains (including corn and soybean meal) and energy; (iii) market conditions for finished

products, including competition from other global and domestic food processors, supply and pricing of competing

products and alternative proteins and demand for alternative proteins; (iv) successful rationalization of existing

facilities and operating efficiencies of the facilities; (v) risks associated with our commodity purchasing activities;

(vi) access to foreign markets together with foreign economic conditions, including currency fluctuations,

import/export restrictions and foreign politics; (vii) outbreak of a livestock disease (such as avian influenza (AI) or

bovine spongiform encephalopathy (BSE)), which could have an adverse effect on livestock we own, the availability

of livestock we purchase, consumer perception of certain protein products or our ability to access certain domestic

and foreign markets; (viii) changes in availability and relative costs of labor and contract growers and our ability to

maintain good relationships with employees, labor unions, contract growers and independent producers providing

us livestock; (ix) issues related to food safety, including costs resulting from product recalls, regulatory compliance

and any related claims or litigation; (x) changes in consumer preference and diets and our ability to identify and

react to consumer trends; (xi) significant marketing plan changes by large customers or loss of one or more large

customers; (xii) adverse results from litigation; (xiii) impacts on our operations caused by factors and forces beyond

our control, such as natural disasters, fire, bioterrorism, pandemics or extreme weather; (xiv) risks associated with

leverage, including cost increases due to rising interest rates or changes in debt ratings or outlook; (xv) compliance

with and changes to regulations and laws (both domestic and foreign), including changes in accounting standards,

tax laws, environmental laws, agricultural laws and occupational, health and safety laws; (xvi) our ability to make

effective acquisitions or joint ventures and successfully integrate newly acquired businesses into existing

operations; (xvii) failures, cyber incidents, security breaches or other disruptions of our information technology

systems; (xviii) effectiveness of advertising and marketing programs; and (xix) those factors listed under Item 1A.

“Risk Factors” included in our Annual Report filed on Form 10-K for the period ended October 1, 2016.

2

($ in Millions) FY16

Dollars ROS%

Operating Income

Chicken 1,305 11.9% -3%

Beef 347 2.4% 755%

Pork 528 10.8% 42%

Prepared Foods 734 10.0% 15%

Other (81) n/a n/a

Total 2,833 7.7% 26%

Adjusted

YOY

Growth *

($ in Millions) FY16 FY15

YOY

Growth

Net Sales* 36,881 40,623 -9%

Adjusted Operating Income* 2,833 2,253 26%

Adjusted Operating Margin* 7.7% 5.5%

Adjusted EPS* $4.39 $3.15 39%

Operating Cash Flow 2,716 2,570 6%

FY16 – Another Record Year!

•Record Operating Income

•Record Operating Margin

•Record Adjusted EPS*

•Record Operating Cash Flow

•Record Pork Segment Operating Margin

•Record Prepared Foods Segment

Operating Margin

*Represents a non-GAAP financial measure. Adjusted sales, adjusted

operating income, adjusted operating margin and adjusted EPS are

explained and reconciled to comparable GAAP measures in the Appendix.

3

*Represents a non-GAAP financial measure. Adjusted EPS is explained and reconciled in the Appendix at “Annual EPS

Reconciliations.”

FY16 Adjusted EPS Growth Up 39% vs. 2015

Projected 5-Year CAGR including midpoint of FY17 guidance = 19%

4

FY12 FY13 FY14 FY15 FY16 FY17 proj.

$3.15*

$2.26*

$2.94*

$4.39*

$4.70 - 4.85

$1.97*

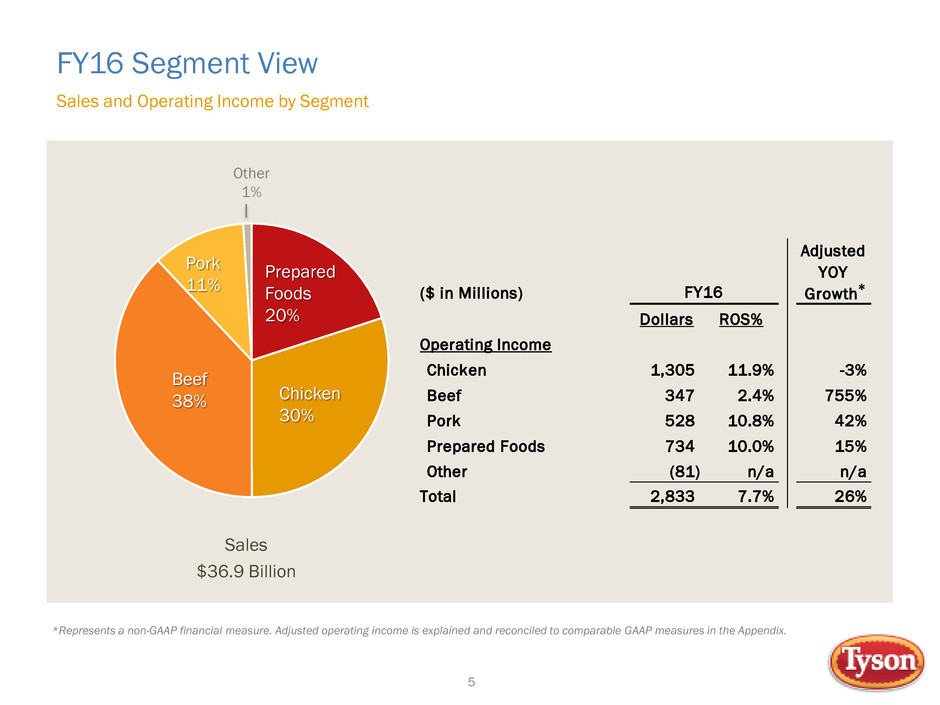

FY16 Segment View

Sales

$36.9 Billion

Chicken

30%

Beef

38%

Prepared

Foods

20%

Pork

11%

Other

1%

5

Sales and Operating Income by Segment

($ in Millions) FY16

Dollars ROS%

Operating Income

Chicken 1,305 11.9% -3%

Beef 347 2.4% 755%

Pork 528 10.8% 42%

Prepared Foods 734 10.0% 15%

Other (81) n/a n/a

Total 2,833 7.7% 26%

Adjusted

YOY

Growth *

*Represents a non-GAAP financial measure. Adjusted operating income is explained and reconciled to comparable GAAP measures in the Appendix.

9.6%

5.9% 5.9%

1.1%

-1.2%

-2.3%

-4.6%

-6.3%

-8.0% -8.2%

-9.5%

Core 9

Tyson Core 9 and Total Tyson Leading in CPG Volume Performance

Volume sales % change among top 10 branded food companies > $5B

Source: IRI Total U.S. Multi-Outlet Volume Sales (Edible Foods), 13 weeks ending 10/02/2016

6

4.7%

2.1%

-0.4% -0.4% -0.5% -0.8%

-2.4%

-2.9%

-3.6%

-6.1% -6.1%

Tyson Core 9 and Total Tyson Leading in CPG Dollar Performance

Dollar sales % change among top 10 branded food companies > $5B

Core 9

Source: IRI Total U.S. All Outlet (x Costco) All Edible Food Dollar Sales, 13 weeks ending 9/18/2016

7

Marketplace Trends: Food Service Distribution

88

Tyson value-added chicken growing >2x faster than category

Largest branded player; outpacing private label

Tyson Foods Volume Growth

Value-Added Chicken

+3.9%

Category Volume Growth

Value-Added Chicken

+1.7%

Share Share ∆

Tyson Foods 33.1% 0.7

Private Label 19.8% -0.2

Competitor A 11.1% -2.7

Competitor B 7.1% 0.8

Competitor C 5.3% 0.4

Competitor D 3.2% 0.0

All Other 5.5% 0.3

Source: NPD Supply Track, 52 weeks ending July 2016 (most recent period available)

($ in Millions) FY16

Dollars ROS%

Operating Income

Chicken 1,305 11.9% -3%

Beef 347 2.4% 755%

Pork 528 10.8% 42%

Prepared Foods 734 10.0% 15%

Other (81) n/a n/a

Total 2,833 7.7% 26%

Adjusted

YOY

Growth *

($ in Millions) FY16 FY15

YOY

Growth

Net Sales* 36,881 40,623 -9%

Adjusted Operating Income* 2,833 2,253 26%

Adjusted Operating Margin* 7.7% 5.5%

Adjusted EPS* $4.39 $3.15 39%

Operating Cash Flow 2,716 2,570 6%

FY16 – Another Record Year!

•Record Operating Income

•Record Operating Margin

•Record Adjusted EPS*

•Record Operating Cash Flow

•Record Pork Segment Operating Margin

•Record Prepared Foods Segment

Operating Margin

*Represents a non-GAAP financial measure. Adjusted sales, adjusted

operating income, adjusted operating margin and adjusted EPS are

explained and reconciled to comparable GAAP measures in the Appendix.

9

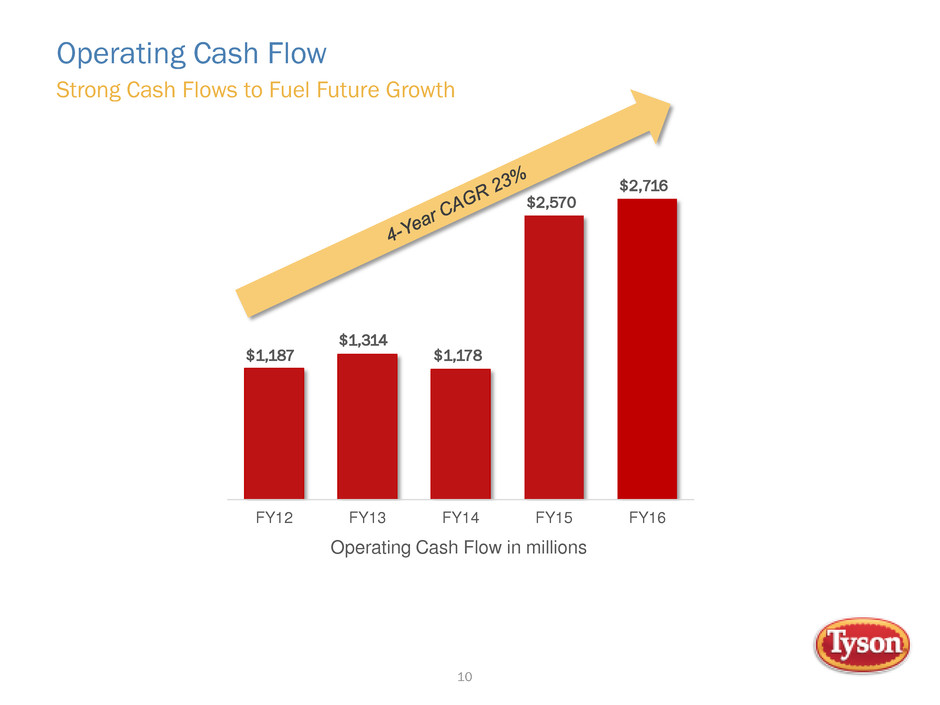

Operating Cash Flow

Operating Cash Flow in millions

FY12 FY13 FY14 FY15 FY16

$1,187

$1,314

$2,716

$2,570

$1,178

Strong Cash Flows to Fuel Future Growth

10

Net Debt/Adjusted EBITDA*

FY12*** FY13*** FY14** FY15* FY16***

$442*.7X

.8X

3.0X

2.0X

1.7X

Positioned for growth through rapid deleveraging

*Represents a non-GAAP financial measure. Net debt/adjusted EBITDA is explained and reconciled to a comparable GAAP

measure in the Appendix.

** FY14 Net Debt/EBITDA was calculated on a pro forma basis due to the acquisition of Hillshire Brands in August 2014. See

Appendix for reconciliation to GAAP measure.

*** FY12, FY13 and FY16 represent net debt to EBITDA

11

FY17 Outlook

12

• EPS $4.70–$4.85, 7-10% adjusted EPS growth over FY16

• Expect similar revenue to FY16 as we grow volume across each segment

• Net interest expense of ~$225 million

• Effective tax rate of ~35%

• CapEx of ~$1 billion

• Average diluted shares of ~376 million*

• 50% increase in Class A Dividends

• from $0.15 to $0.225 per share quarterly

• from $0.60 to $0.90 per share annually

• Expect to increase dividends by at least $0.10 per share annually

*Prior to adjustments for additional share repurchases subsequent to 11/21/16 and based on average share price Q1’17 to date

Donnie Smith

Chief Executive Officer

Tom Hayes

President

Dennis Leatherby

Executive Vice President &

Chief Financial Officer

13

Q & A

Appendix

4th Quarter Fiscal 2016

Non-GAAP Reconciliations

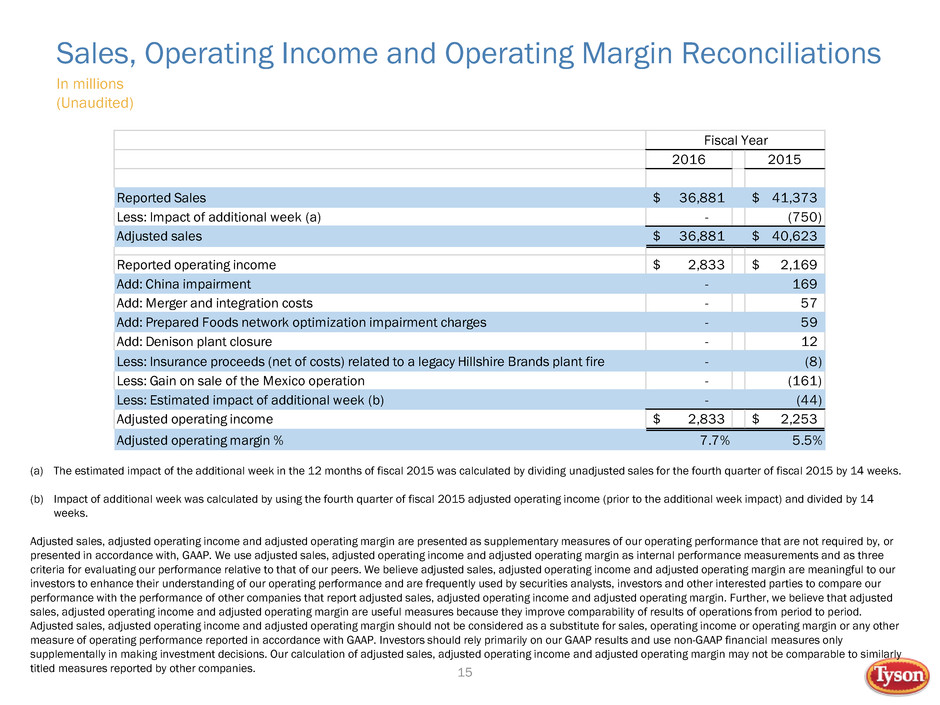

Sales, Operating Income and Operating Margin Reconciliations

15

In millions

(Unaudited)

(a) The estimated impact of the additional week in the 12 months of fiscal 2015 was calculated by dividing unadjusted sales for the fourth quarter of fiscal 2015 by 14 weeks.

(b) Impact of additional week was calculated by using the fourth quarter of fiscal 2015 adjusted operating income (prior to the additional week impact) and divided by 14

weeks.

Adjusted sales, adjusted operating income and adjusted operating margin are presented as supplementary measures of our operating performance that are not required by, or

presented in accordance with, GAAP. We use adjusted sales, adjusted operating income and adjusted operating margin as internal performance measurements and as three

criteria for evaluating our performance relative to that of our peers. We believe adjusted sales, adjusted operating income and adjusted operating margin are meaningful to our

investors to enhance their understanding of our operating performance and are frequently used by securities analysts, investors and other interested parties to compare our

performance with the performance of other companies that report adjusted sales, adjusted operating income and adjusted operating margin. Further, we believe that adjusted

sales, adjusted operating income and adjusted operating margin are useful measures because they improve comparability of results of operations from period to period.

Adjusted sales, adjusted operating income and adjusted operating margin should not be considered as a substitute for sales, operating income or operating margin or any other

measure of operating performance reported in accordance with GAAP. Investors should rely primarily on our GAAP results and use non-GAAP financial measures only

supplementally in making investment decisions. Our calculation of adjusted sales, adjusted operating income and adjusted operating margin may not be comparable to similarly

titled measures reported by other companies.

2016 2015

Reported Sales 36,881$ 41,373$

Less: Impact of additional week (a) - (750)

Adjusted sales 36,881$ 40,623$

Reported operating income 2,833$ 2,169$

Add: China impairment - 169

Add: Merger and integration costs - 57

Add: Prepared Foods network optimization impairment charges - 59

Add: Denison plant closure - 12

Less: Insurance proceeds (net of costs) related to a legacy Hillshire Brands plant fire - (8)

Less: Gain on sale of the Mexico operation - (161)

Less: Estimated impact of additional week (b) - (44)

Adjusted operating income 2,833$ 2,253$

Adjusted operating margin % 7.7% 5.5%

Fiscal Year

Fiscal 2016 (a) Fiscal 2015 (a) Fiscal 2014 (a) Fiscal 2013 (a) Fiscal 2012 (a)

Net income 1,772$ 1,224$ 856$ 778$ 576$

Less: Interest income (6) (9) (7) (7) (12)

Add: Interest expense 249 293 132 145 356

Add: Income tax expense 826 697 396 411 351

Add: Depreciation 617 609 494 474 443

Add: Amortization (b) 80 92 26 17 17

EBITDA 3,538$ 2,906$ 1,897$ 1,818$ 1,731$

Adjustments to EBITDA:

Add: China impairment -$ 169$ -$ -$ -$

Add: Merger and integration costs - 57 - - -

Add: Prepared Foods network optimization charges - 59 - - -

Add: Denison plant closure - 12 - - -

Add: Brazil impairment - - 42 - -

Add: Hillshire Brands purchase price accounting adjustments - - 19 - -

Add: Hillshire Brands acquisition, integration and costs associated with our Prepared Foods

improvement plan - - 197 - -

Add: Costs (insurance proceeds, net of costs) related to a legacy Hillshire Brands plant fire - (8) 12 - -

Less: Gain on sale of the Mexico operation - (161) - - -

Less: Gain on sale of equity securities - (21) - - -

Total Adjusted EBITDA 3,538$ 3,013$ 2,167$ 1,818$ 1,731$

Pro forma Adjustments to EBITDA:

Add: Hillshire Brands adjusted EBITDA (prior to acquisition) (c) n/a n/a 422 n/a n/a

Total Pro forma Adjusted EBITDA n/a n/a 2,589$ n/a n/a

Total gross debt (d) 6,279$ 6,690$ 8,128$ 2,398$ 2,418$

Less: Cash and cash equivalents (349) (688) (438) (1,145) (1,071)

Less: Short-term investments (4) (2) (1) (1) (3)

Total net debt 5,926$ 6,000$ 7,689$ 1,252$ 1,344$

Ratio Calculations:

Gross debt/EBITDA 1.8x 2.3x 4.3x 1.3x 1.4x

Net debt/EBITDA 1.7x 2.1x 4.1x 0.7x 0.8x

Gross debt/Adjusted EBITDA 1.8x 2.2x 3.8x 1.3x 1.4x

Net debt/Adjusted EBITDA 1.7x 2.0x 3.5x 0.7x 0.8x

Gross debt/Pro forma Adjusted EBITDA n/a n/a 3.1x n/a n/a

Net debt/Pro forma Adjusted EBITDA n/a n/a 3.0x n/a n/a

16

Net Debt/EBITDA Reconciliations

In millions

(Unaudited)

Net Debt/EBITDA Reconciliations – continued

17

(a) EBITDA and Adjusted EBITDA for fiscal 2015 were based on a 53-week year while fiscal 2016, 2014, 2013 and 2012 are based on a 52-week

year.

(b) (b) Excludes the amortization of debt discount expense of $8 million, $10 million, $10 million, $28 million and $39 million for fiscal 2016, 2015,

2014, 2013 and 2012, respectively, as it is included in Interest expense.

(c) Represents Hillshire Brands adjusted EBITDA, prior to our acquisition, for the eleven months ended August 28, 2014. This amount is added to our

Adjusted EBITDA for the fiscal year ended September 27, 2014, in order for Net debt to Adjusted EBITDA to include a full twelve months of

Hillshire Brands results on a pro forma basis for each of the periods presented. The pro forma adjusted EBITDA was derived from Hillshire Brand’s

historical financial statements for the periods ended March 29, 2014 and June 28, 2014 as filed with the Securities and Exchange Commission,

as well as amounts for the two months ended August 28, 2014, prior to the closing of the acquisition. These amounts were adjusted to remove

the impact of deal costs related to Pinnacle Foods, Inc. and Tyson Foods, Inc. transactions, Storm Lake fire, and severance costs. We believe this

pro forma presentation is useful and helps management, investors, and rating agencies enhance their understanding of our financial performance

and to better highlight future financial trends on a comparable basis with Hillshire Brands results included for the periods presented given the

significance of the acquisition to our overall results.

(d) In the fourth quarter of fiscal 2016, we adopted new accounting guidance, retrospectively, requiring classification of debt issuance costs as a

reduction of the carrying value of the debt. In doing so, $29 million, $35 million, $50 million, $10 million and $14 million of deferred issuance

costs have been reclassified from Other Assets to Long-Term Debt in our Consolidated Balance Sheets for fiscal 2016, 2015, 2014, 2013 and

2012 respectively.

EBITDA is defined as net income before interest, income taxes, depreciation and amortization. Net debt to EBITDA (and to Adjusted EBITDA)

represents the ratio of our debt, net of cash and short-term investments, to EBITDA (and to Adjusted EBITDA). EBITDA, Adjusted EBITDA, net debt to

EBITDA and net debt to Adjusted EBITDA are presented as supplemental financial measurements in the evaluation of our business. Adjusted EBITDA is

a tool intended to assist our management and investors in comparing our performance on consistent basis for purposes of business decision-making

by removing the impact of certain items that management believes do not directly reflect our core operations on an ongoing basis.

We believe the presentation of these financial measures helps management and investors to assess our operating performance from period to period,

including our ability to generate earnings sufficient to service our debt, and enhances understanding of our financial performance and highlights

operational trends. These measures are widely used by investors and rating agencies in the valuation, comparison, rating and investment

recommendations of companies; however, the measurements of EBITDA (and Adjusted EBITDA) and net debt to EBITDA (and to Adjusted EBITDA) may

not be comparable to those of other companies, which limits their usefulness as comparative measures. EBITDA (and Adjusted EBITDA) and net debt

to EBITDA (and to Adjusted EBITDA) are not measures required by or calculated in accordance with generally accepted accounting principles (GAAP)

and should not be considered as substitutes for net income or any other measure of financial performance reported in accordance with GAAP or as a

measure of operating cash flow or liquidity. EBITDA (and Adjusted EBITDA) is a useful tool for assessing, but is not a reliable indicator of, our ability to

generate cash to service our debt obligations because certain of the items added to net income to determine EBITDA (and Adjusted EBITDA) involve

outlays of cash. As a result, actual cash available to service our debt obligations will be different from EBITDA (and Adjusted EBITDA). Investors should

rely primarily on our GAAP results and use non-GAAP financial measures only supplementally in making investment decisions.

Segment Operating Income Reconciliations

18

In millions

(Unaudited)

(a) Impact of additional week was calculated by using the fourth quarter of fiscal 2015 adjusted operating income (prior to the additional week impact) and divided by 14 weeks.

Adjusted segment operating income is presented as a supplementary measure of our operating performance that is not required by, or presented in accordance with, GAAP. We

use adjusted segment operating income as an internal performance measurement and as one criteria for evaluating our performance relative to that of our peers. We believe

adjusted segment operating income is meaningful to our investors to enhance their understanding of our operating performance and is frequently used by securities analysts,

investors and other interested parties to compare our performance with the performance of other companies that report adjusted segment operating income. Further, we believe

that adjusted segment operating income is a useful measure because it improves comparability of results of operations from period to period. Adjusted segment operating income

should not be considered as a substitute for segment operating income or any other measure of operating performance reported in accordance with GAAP. Investors should rely

primarily on our GAAP results and use non-GAAP financial measures only supplementally in making investment decisions. Our calculation of adjusted segment operating income

may not be comparable to similarly titled measures reported by other companies.

Chicken Beef Pork

Prepared

Foods Other Total

Reported operating income (loss) 1,366$ (66)$ 380$ 588$ (99)$ 2,169$

Add: China impairment - - - - 169 169

Add: Merger and integration costs - - - 10 47 57

Add: Prepared Foods network optimization charges - - - 59 - 59

Add: Denison plant closure - 12 - - - 12

Less: Insurance proceeds (net of costs) related to a legacy Hillshire

Brands plant fire - - - (8) - (8)

Less: Gain on sale of the Mexico operation - - - - (161) (161)

Adjusted operating income prior to adjustment for additional week 1,366 (54) 380 649 (44) 2,297

Less: Estimated impact of additional week (a) (26) 1 (7) (13) 1 (44)

Adjusted operating income (loss) 1,340$ (53)$ 373$ 636$ (43)$ 2,253$

Adjusted Segment Operating Income (Loss)

(for 12 months ended October 3, 2015)

EPS Reconciliations

19

In millions, except per share data

(Unaudited)

(a) Impact of additional week was calculated by using the fourth quarter of fiscal 2015 adjusted operating income (prior to the additional week impact) and divided by 14 weeks.

Operating

Income EPS

Operating

Income EPS

Operating

Income EPS

Operating

Income EPS

Operating

Income EPS

Reported from Continuing Operations 2,833$ 4.53$ 2,169$ 2.95$ 1,430$ 2.37$ 1,375$ 2.31$ 1,286$ 1.68$

Less:

Recognition of previously unrecognized tax benefit - (0.14) - (0.06) - (0.15) - - - -

Insurance proceeds (net of costs) related to a legacy Hillshire Brands

plant fire

- - (8) (0.02) - - - - - -

Gain on sale of equity securities - - - (0.03) - - - - - -

Gain on sale of Mexico operations - - (161) (0.24) - - - - - -

Impact of additional week (a) - - (44) (0.06) - - - - - -

Gain from currency translation adjustment - - - - - - - (0.05) - -

Gain on sale of interest in an equity method investment - - - - - - - - - -

Reversal of reserves for foreign uncertain tax positions - - - - - - - - - -

Add:

China Impairment - - 169 0.41 - - - - - -

Merger and integration costs - - 57 0.09 - - - - - -

Prepared Foods network optimization charges - - 59 0.09 - - - - - -

Denison plant closure - - 12 0.02 - - - - - -

Loss related to early extinguishment of debt - - - - - - - - - 0.29

Brazil impairment/Mexico undistributed earnings tax - - - - 42 0.16 - - - -

Hillshire Brands acquisition, integration and costs associated with

our Prepared Foods improvement plan

- - - - 137 0.37 - - - -

Hillshire Brands post-closing results, purchase price accounting and

costs related to a legacy Hillshire Brands plant fire

- - - - 40 0.07 - - - -

Hillshire Brands acquisition financing incremental interest costs and

share dilution

- - - - - 0.12 - - - -

Adjusting from Continuing Operations 2,833$ 4.39$ 2,253$ 3.15$ 1,649$ 2.94$ 1,375$ 2.26$ 1,286$ 1.97$

12 Months Ended

October 1, 2016 October 3, 2015 September 27, 2014 September 28, 2013 September 29, 2012

EPS Reconciliations – continued

20

In millions, except per share data

(Unaudited)

Operating

Income EPS

Operating

Income EPS

Operating

Income EPS

Operating

Income EPS

Operating

Income EPS

Reported from Continuing Operations 1,289$ 1.98$ 1,574$ 2.09$ (215)$ (1.47)$ 331$ 0.24$ 613$ 0.75$

Less:

Gain from currency translation adjustment - - (38) (0.06) - - - - - -

Gain on sale of an investment - - - - - - - (0.03) - -

Gain on sales of assets - - - - - - - - (19) (0.03)

Gain on sale of interest in an equity method investment - (0.03) - - - - - - - -

Reversal of reserves for foreign uncertain tax positions - (0.05) - - - - - - - -

Add:

Charges related to flood damage - - - - - - 7 0.01 - -

Charges related to plant closings - - - - 15 0.02 13 0.02 - -

Cumulative effect of change in accounting principles - - - - - - - - - -

Impairment of goodwill - - 29 0.07 560 1.50 - - - -

Impairment of equity method investment - - - 0.03 - - - - - -

Loss related to note repurchases - - - 0.09 - - - - - -

Impairment of assets - - - - - - 23 0.04 5 0.01

Impairment of intangible assets - - - - - - 10 0.02 7 0.01

Severance and restructuring charges - - - - - - 23 0.04 - -

Adjusted from Continuing Operations 1,289$ 1.90$ 1,565$ 2.22$ 360$ 0.05$ 407$ 0.34$ 606$ 0.74$

12 Months Ended

October 1, 2011 October 2, 2010 October 3, 2009 September 27, 2008 September 29, 2007

Adjusted operating income and adjusted net income from continuing operations per share attributable to Tyson (adjusted EPS) are presented as supplementary measures of

our financial performance that is not required by, or presented in accordance with, GAAP. We use adjusted operating income and adjusted EPS as internal performance

measurements and as two criteria for evaluating our performance relative to that of our peers. We believe adjusted operating income and adjusted EPS are meaningful to our

investors to enhance their understanding of our financial performance and is frequently used by securities analysts, investors and other interested parties to compare our

performance with the performance of other companies that report adjusted operating income and adjusted EPS. Further, we believe that adjusted operating income and

adjusted EPS are useful measures because they improve comparability of results of operations from period to period. Adjusted operating income and adjusted EPS should not

be considered as a substitute for operating income or net income per share attributable to Tyson or any other measure of financial performance reported in accordance with

GAAP. Investors should rely primarily on our GAAP results and use non-GAAP financial measures only supplementally in making investment decisions. Our calculation of

adjusted operating income and adjusted EPS may not be comparable to similarly titled measures reported by other companies.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Tyson (TSN) PT Raised to $54 at Goldman Sachs

- Jaxon Announces Resignation of CFO

- Rocket Lab Successfully Deploys Satellites ~500km Apart to Separate Orbits For KAIST and NASA

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share