Form 8-K Forestar Group Inc. For: Nov 08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report: November 8, 2016

(Date of earliest event reported)

FORESTAR GROUP INC.

(Exact name of registrant as specified in its charter)

Delaware | Commission File Number | 26-1336998 | ||

(State or other jurisdiction of incorporation or organization) | 001-33662 | (I.R.S. Employer Identification No.) | ||

6300 Bee Cave Road, Building Two, Suite 500

Austin, Texas 78746

(Address of principal executive offices) (zip code)

(512) 433-5200

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

1

Item 2.02. Results of Operations and Financial Condition.

On November 8, 2016, Forestar Group Inc. (the “Company”) issued a press release announcing the Company’s results for the quarter ended September 30, 2016. A copy of the press release is furnished as Exhibit 99.1.

Item 7.01. Regulation FD Disclosure

On November 9, 2016, management of the Company will participate in a conference call discussing the Company’s results for the quarter ended September 30, 2016. Copies of the presentation materials to be used by management are furnished as Exhibit 99.2 of this report.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Exhibit | Description | ||

99.1 | Press release, dated November 8, 2016 | ||

99.2 | Presentation materials to be used by management in a conference call on November 9, 2016, discussing the Company’s results for the quarter ended September 30, 2016. | ||

2

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

FORESTAR GROUP INC. | ||||

Date: | November 9, 2016 | By: | /s/ Charles D. Jehl | |

Name: | Charles D. Jehl | |||

Title: | Chief Financial Officer | |||

3

EXHIBIT INDEX

Exhibit | Description | ||

99.1 | Press release, dated November 8, 2016 | ||

99.2 | Presentation materials to be used by management in a conference call on November 9, 2016, discussing the Company’s results for the quarter ended September 30, 2016. | ||

4

Exhibit 99.1

NEWS

RELEASE

FOR IMMEDIATE RELEASE

CONTACT: Charles D. Jehl

(512) 433-5229

FORESTAR GROUP INC. REPORTS THIRD QUARTER 2016 RESULTS

Forestar significantly transformed in one year through execution of our key initiatives to reduce costs, divest non-core assets, strengthen balance sheet and focus on maximizing shareholder value.

Transformation - Highlights

• | Actions taken to eliminate over $50 million in annualized SG&A, expect full cost savings realization once all non-core assets are sold |

• | Decreased headcount by over 50% compared to 2014 peak |

• | Executed $425 million in non-core asset sales |

• | Reduced outstanding debt by over $320 million - reducing annual interest expense by approximately $23 million going forward |

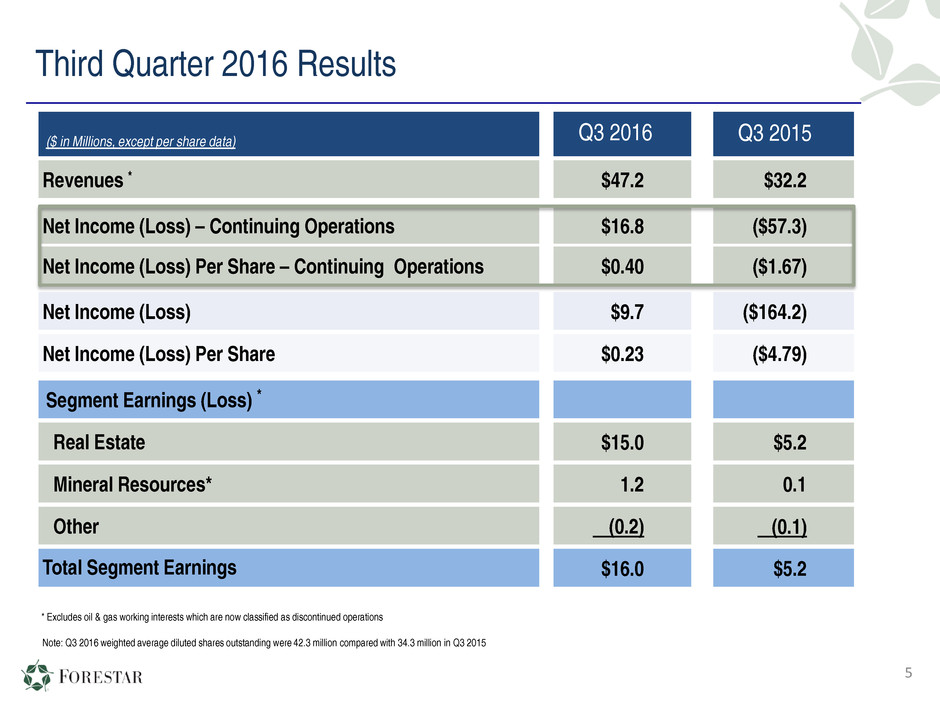

AUSTIN, TEXAS, November 8, 2016—Forestar Group Inc. (NYSE: FOR) (“Forestar” or the “Company”) today reported third quarter 2016 net income of approximately $9.7 million, or $0.23 per share outstanding, compared with third quarter 2015 net loss of approximately ($164.2) million, or ($4.79) per share outstanding. Third quarter 2016 earnings from continuing operations were approximately $16.8 million, or $0.40 per share outstanding, compared with third quarter 2015 net loss from continuing operations of approximately ($57.3) million, or ($1.67) per share outstanding.

Significant progress: Sold Non-Core Assets, Strengthened Balance Sheet, Reduced Costs and Focused on Core Community Development Business

"In one year, we have made significant progress transforming Forestar through the execution of our key initiatives to divest non-core assets, reduce outstanding debt, reduce SG&A costs and focus on maximizing shareholder value. Key highlights include selling $425 million in non-core assets, reducing outstanding debt by over $320 million, and reducing annual interest expense by approximately $23 million going forward. Once non-core asset sales are fully executed, projected annual SG&A costs are expected to decrease by over $50 million compared with 2015 actuals. In addition, we have transformed our capital structure by significantly reducing leverage, which has strengthened our balance sheet and created flexibility," said Phil Weber, Chief Executive Officer of Forestar.

"In addition to executing these initiatives, we have focused on maximizing shareholder value delivered from our core community development business. Builder demand for residential lots in our key communities remains steady. At third quarter-end 2016, we have over 2,080 residential lots under option contract with builders, the highest number of lots under option contract in over five years, " continued Mr. Weber.

Business Segments

Forestar manages its operations through three business segments: real estate, mineral resources and other.

REAL ESTATE

Third Quarter 2016 Highlights (Includes Ventures)

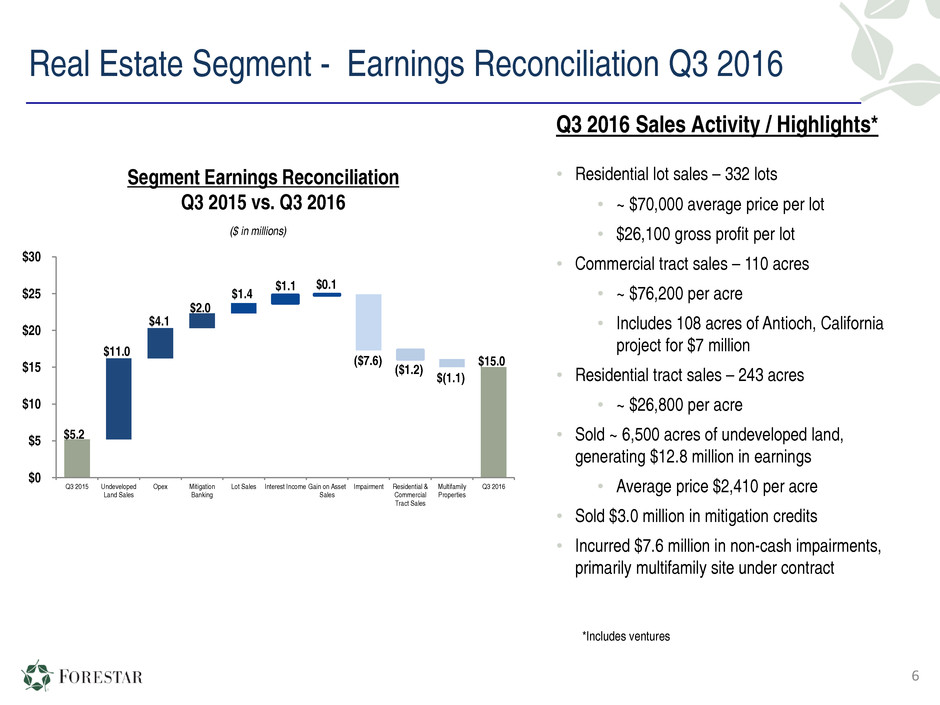

• | Sold 332 developed residential lots for $70,000 per lot |

• | Sold 243 residential tract acres for $26,800 per acre |

• | Sold 110 commercial acres for approximately $76,200 per acre |

◦ | Includes 108 acres - Antioch, CA project for $7 million |

1

• | Sold approximately 6,500 acres of undeveloped land for $2,410 per acre |

• | Incurred $7.6 million in non-cash impairments, primarily related to a multifamily site under contract in Austin |

Segment Financial Results:

($ in millions) | Q3 2016 | Q3 2015 | Q2 2016 | |||

Segment Revenues | $45.3 | $28.0 | $46.4 | |||

Segment Earnings | $15.0 | $5.2 | $73.3 | |||

Real estate segment earnings increased in third quarter 2016 compared with third quarter 2015 principally due to higher undeveloped land sales activity which was offset by non-cash impairment charges of $7.6 million related to one non-core multifamily site and two non-core community development projects. Commercial sale activity in third quarter 2016 is primarily related to sale of 108 acres from our San Joaquin River project in Antioch, California for $7 million which generated approximately $37 million in tax losses to offset tax gains. Residential tract sale activity in third quarter 2016 is related to the bulk sale of 243 acres from a venture project near Austin for $6.5 million which contributed approximately $1.4 million in segment earnings. Second quarter 2016 real estate segment earnings includes gain on sale of non-core assets of $107.7 million, principally due to a $95.3 million gain associated with the sale of the Radisson Hotel & Suites and over $10.3 million in gains associated with the sale of our Eleven multifamily community and sale of our Dillon multifamily site, which were partially offset by non-cash impairment charges of $48.8 million related to five non-core community development projects and one non-core multifamily site.

MINERAL RESOURCES

Segment Financial Results:

($ in millions) | Q3 2016 | Q3 2015 | Q2 2016 | |||

Segment Revenues | $1.4 | $2.5 | $1.3 | |||

Segment Earnings | $1.2 | $0.1 | $0.9 | |||

Mineral Resources segment earnings increased in third quarter 2016 compared with third quarter 2015 principally due to a non-cash impairment charge of $1.8 million related to Louisiana wells in third quarter 2015. In third quarter 2016, royalty revenues declined principally due to lower oil and gas production volumes and prices.

OTHER

Segment Financial Results:

($ in millions) | Q3 2016 | Q3 2015 | Q2 2016 | |||

Segment Revenues | $0.5 | $1.7 | $0.3 | |||

Segment Earnings (Loss) | ($0.2) | ($0.1) | ($0.2) | |||

Third quarter 2016 other segment revenues decreased compared with third quarter 2015 principally due to deferral of timber harvest activity in support of our key initiative to exit our non-core timberland and undeveloped land.

OUTLOOK

Fundamentals Stable in Forestar's Community Development Markets

“Fundamentals are stable in our community development markets supported by low developed lot inventories. Forestar sold 1,105 residential lots in the first nine months of 2016 and we continue to project 2016 residential lot sales volume to be in the range of 1,600 - 1,800 lots,” said Michael Quinley, President - Community Development.

2

Executing Key Initiatives

“Our entire organization has worked extremely hard to execute our key initiatives and produce these significant results in one year. On behalf of the entire board, I would like to personally thank our team for their efforts to move our Company forward. We remain focused on maximizing shareholder value, including evaluating the next best steps for Forestar,” added Jim Rubright, Chairman of the Board.

The Company will host a conference call on November 9, 2016 at 10:00 am ET to discuss results of third quarter 2016. The meeting may be accessed through webcast or by conference call. The webcast may be accessed through Forestar’s Internet site at www.forestargroup.com. To access the conference call, listeners calling from North America should dial 1-844-634-1445 at least 15 minutes prior to the start of the meeting. Those wishing to access the call from outside North America should dial 1-615-247-0254. The passcode is Forestar. Replays of the call will be available for two weeks following the completion of the live call and can be accessed at 1-855-859-2056 in North America and at 1-404-537-3406 outside North America. The passcode for the replay is 97993686.

About Forestar Group

Forestar is a residential and mixed-use real estate development company. At third quarter-end 2016, we own directly or through ventures interests in 55 residential and mixed-use projects comprised of approximately 7,000 acres of real estate located in 11 states and 15 markets. The company also owns approximately 590,000 net acres of oil and gas fee minerals located in Texas, Louisiana, Georgia and Alabama. The company has water interests in 1.5 million acres which include a 45 percent nonparticipating royalty interest in groundwater produced or withdrawn for commercial purposes or sold from 1.4 million acres in Texas, Louisiana, Georgia and Alabama, and 20,000 acres of groundwater leases in central Texas. The company's non-core assets include about 75,000 acres of timberland and undeveloped land, and commercial and income producing properties which consist of three multifamily projects and two multifamily sites. Forestar operates in three business segments: real estate, mineral resources and other. Forestar’s address on the World Wide Web is www.forestargroup.com.

Forward Looking Statements

This release contains “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements are typically identified by words or phrases such as “will,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “target,” “forecast,” and other words and terms of similar meaning. These statements reflect management’s current views with respect to future events and are subject to risk and uncertainties. We note that a variety of factors and uncertainties could cause our actual results to differ significantly from the results discussed in the forward-looking statements, including but not limited to: general economic, market, or business conditions; market demand for our non-core assets; changes in commodity prices; opportunities (or lack thereof) that may be presented to us and that we may pursue; fluctuations in costs and expenses including development costs; demand for new housing, including impacts from mortgage credit rates or availability; lengthy and uncertain entitlement processes; cyclicality of our businesses; accuracy of accounting assumptions; competitive actions by other companies; changes in laws or regulations; and other factors, many of which are beyond our control. Except as required by law, we expressly disclaim any obligation to publicly revise any forward-looking statements contained in this news release to reflect the occurrence of events after the date of this news release.

3

FORESTAR GROUP INC.

(UNAUDITED)

Business Segments

Third Quarter | First Nine Months | ||||||||||||||

2016 | 2015 | 2016 | 2015 | ||||||||||||

(In thousands) | |||||||||||||||

Revenues: | |||||||||||||||

Real estate | $ | 45,297 | $ | 27,957 | $ | 127,776 | $ | 100,196 | |||||||

Mineral resources | 1,423 | 2,502 | 3,842 | 7,616 | |||||||||||

Other | 487 | 1,726 | 1,199 | 5,372 | |||||||||||

Total revenues | $ | 47,207 | $ | 32,185 | $ | 132,817 | $ | 113,184 | |||||||

Segment earnings (loss): | |||||||||||||||

Real estate | $ | 15,017 | $ | 5,154 | $ | 108,531 | $ | 29,747 | |||||||

Mineral resources | 1,182 | 77 | 2,668 | 3,215 | |||||||||||

Other | (196 | ) | (77 | ) | (974 | ) | (511 | ) | |||||||

Total segment earnings | 16,003 | 5,154 | 110,225 | 32,451 | |||||||||||

Items not allocated to segments: | |||||||||||||||

General and administrative expense | (4,505 | ) | (8,343 | ) | (13,992 | ) | (19,540 | ) | |||||||

Share-based and long-term incentive compensation expense | (1,024 | ) | (2,245 | ) | (2,980 | ) | (5,726 | ) | |||||||

Interest expense | (3,369 | ) | (8,315 | ) | (17,926 | ) | (25,851 | ) | |||||||

Loss on extinguishment of debt, net | — | — | (35,864 | ) | — | ||||||||||

Other corporate non-operating income | 58 | 38 | 283 | 133 | |||||||||||

Income (loss) from continuing operations before taxes | 7,163 | (13,711 | ) | 39,746 | (18,533 | ) | |||||||||

Income tax (expense) benefit | 9,666 | (43,568 | ) | (7,415 | ) | (41,699 | ) | ||||||||

Net income (loss) from continuing operations attributable to Forestar Group Inc. | 16,829 | (57,279 | ) | 32,331 | (60,232 | ) | |||||||||

Loss from discontinued operations, net of taxes | (7,164 | ) | (106,937 | ) | (17,428 | ) | (146,649 | ) | |||||||

Net income (loss) attributable to Forestar Group Inc. | 9,665 | (164,216 | ) | 14,903 | (206,881 | ) | |||||||||

Net income (loss) per diluted share: | |||||||||||||||

Continuing operations | $ | 0.40 | $ | (1.67 | ) | $ | 0.76 | $ | (1.76 | ) | |||||

Discontinued operations | (0.17 | ) | (3.12 | ) | (0.41 | ) | (4.28 | ) | |||||||

Net income (loss) per diluted share | $ | 0.23 | $ | (4.79 | ) | $ | 0.35 | $ | (6.04 | ) | |||||

Weighted average common shares outstanding (in millions): | |||||||||||||||

Basic | 34.1 | 34.3 | 34.2 | 34.2 | |||||||||||

Diluted (a) | 42.3 | 34.3 | 42.3 | 34.2 | |||||||||||

Third Quarter | Year-End | |||||||

Supplemental Financial Information: | 2016 | 2015 | ||||||

(In thousands) | ||||||||

Cash and cash equivalents | $ | 122,130 | $ | 96,442 | ||||

Senior secured notes, net | 5,195 | 224,647 | ||||||

Convertible senior notes, net of discount | 103,637 | 104,719 | ||||||

Tangible equity unit notes, net | 2,219 | 8,666 | ||||||

Other debt, net (b) | 1,297 | 43,483 | ||||||

Total debt (c) | $ | 112,348 | $ | 381,515 | ||||

Net cash (debt) | $ | 9,782 | $ | (285,073 | ) | |||

_____________________

(a) | Weighted average diluted shares outstanding for third quarter and first nine months 2015 excludes 7.9 million shares associated with tangible equity units issued during fourth quarter 2013. The actual number of shares to be issued in December 2016 will be between 6.5 million - 7.9 million shares based on the market value of our stock. |

(b) | Other debt for third quarter-end 2016 and year-end 2015 excludes unconsolidated venture debt of $126.1 million and $134.7 million and outstanding letters of credit of approximately $13.7 million and $15.9 million. Other debt at year-end 2015 consists principally of $39.3 million in senior secured loans for Radisson Hotel & Suites and Eleven multifamily property. In second |

4

quarter 2016, we sold Radisson Hotel & Suites and Eleven for $130.0 million and $60.2 million. The proceeds were used to pay off the related senior secured loans of $39.3 million.

(c) | At third quarter-end 2016 and year-end 2015, $1,768,000 and $8,267,000 of unamortized deferred financing fees are deducted from our outstanding debt. |

5

FORESTAR GROUP INC.

REAL ESTATE SEGMENT

PERFORMANCE METRICS

Third Quarter | First Nine Months | ||||||||||||||

2016 | 2015 | 2016 | 2015 | ||||||||||||

REAL ESTATE | |||||||||||||||

Owned, Consolidated & Equity Method Ventures: | |||||||||||||||

Residential Lots Sold | 332 | 301 | 1,105 | 1,109 | |||||||||||

Revenue per Lot Sold | $ | 69,970 | $ | 76,623 | $ | 68,573 | $ | 75,019 | |||||||

Commercial Acres Sold | 110 | 2 | 120 | 56 | |||||||||||

Revenue per Commercial Acre Sold | $ | 76,187 | $ | 28,037 | $ | 99,800 | $ | 216,997 | |||||||

Undeveloped Acres Sold | 6,501 | 4,616 | 13,898 | 6,595 | |||||||||||

Revenue per Acre Sold | $ | 2,410 | $ | 2,190 | $ | 2,460 | $ | 2,411 | |||||||

Owned & Consolidated Ventures: | |||||||||||||||

Residential Lots Sold | 272 | 186 | 975 | 699 | |||||||||||

Revenue per Lot Sold | $ | 69,131 | $ | 76,232 | $ | 67,301 | $ | 73,287 | |||||||

Commercial Acres Sold | 108 | 2 | 116 | 27 | |||||||||||

Revenue per Commercial Acre Sold | $ | 64,923 | $ | 28,037 | $ | 83,347 | $ | 109,802 | |||||||

Undeveloped Acres Sold | 6,501 | 744 | 13,898 | 2,378 | |||||||||||

Revenue per Acre Sold | $ | 2,410 | $ | 2,900 | $ | 2,460 | $ | 2,911 | |||||||

Ventures Accounted For Using the Equity Method: | |||||||||||||||

Residential Lots Sold | 60 | 115 | 130 | 410 | |||||||||||

Revenue per Lot Sold | $ | 73,773 | $ | 77,256 | $ | 78,108 | $ | 77,973 | |||||||

Commercial Acres Sold | 2 | — | 4 | 29 | |||||||||||

Revenue per Commercial Acre Sold | $ | 750,902 | $ | — | $ | 527,152 | $ | 311,995 | |||||||

Undeveloped Acres Sold | — | 3,872 | — | 4,217 | |||||||||||

Revenue per Acre Sold | $ | — | $ | 2,053 | $ | — | $ | 2,129 | |||||||

THIRD QUARTER 2016

RESIDENTIAL REAL ESTATE PIPELINE

Real Estate | Entitled Acres | Developed & Under Development Acres | Total Acres (a) | |||||

Residential | ||||||||

Owned | 4,030 | 691 | ||||||

Ventures | 739 | 182 | 5,642 | |||||

Commercial | ||||||||

Owned | 440 | 217 | ||||||

Ventures | 191 | 94 | 942 | |||||

Total Acres | 5,400 | 1,184 | 6,584 | |||||

_____________________

(a) | Excludes acres associated with commercial and income producing properties. |

6

FORESTAR GROUP INC.

PROJECTS IN ENTITLEMENT

A summary of our real estate projects in the entitlement process (a) at third quarter-end 2016 follows:

Project | County | Market | Project Acres (b) | |||

California | ||||||

Hidden Creek Estates | Los Angeles | Los Angeles | 700 | |||

Terrace at Hidden Hills | Los Angeles | Los Angeles | 30 | |||

Texas | ||||||

Lake Houston | Harris/Liberty | Houston | 3,700 | |||

Total | 4,430 | |||||

_____________________

(a) | A project is deemed to be in the entitlement process when customary steps necessary for the preparation of an application for governmental land-use approvals, like conducting pre-application meetings or similar discussions with governmental officials, have commenced, or an application has been filed. Projects listed may have significant steps remaining, and there is no assurance that entitlements ultimately will be received. |

(b) | Project acres are approximate and the actual number of acres entitled may vary. |

TIMBERLAND AND UNDEVELOPED LAND

A summary of our non-core timberland and undeveloped land at third quarter-end 2016 follows:

Acres | |||

Timberland | |||

Alabama | 1,900 | ||

Georgia | 44,300 | ||

Texas | 4,400 | ||

Higher and Better Use Timberland | |||

Georgia | 18,900 | ||

Entitled Undeveloped Land | |||

Georgia | 5,100 | ||

Total | 74,600 | ||

7

FORESTAR GROUP INC.

REAL ESTATE PROJECTS

A summary of activity within our projects in the development process, which includes entitled, developed and under development real estate projects, at third quarter-end 2016 follows:

Residential Lots/Units | Commercial Acres | ||||||||||||||||

Project | County | Interest Owned (a) | Lots/Units Sold Since Inception | Lots/Units Remaining | Acres Sold Since Inception | Acres Remaining | |||||||||||

Texas | |||||||||||||||||

Austin | |||||||||||||||||

Arrowhead Ranch | Hays | 100 | % | 2 | 382 | — | 19 | ||||||||||

The Colony | Bastrop | 100 | % | 475 | 1,448 | 22 | 5 | ||||||||||

Double Horn Creek | Burnet | 100 | % | 167 | — | — | — | ||||||||||

Hunter's Crossing | Bastrop | 100 | % | 510 | — | 54 | 51 | ||||||||||

La Conterra | Williamson | 100 | % | 202 | — | 3 | — | ||||||||||

Westside at Buttercup Creek | Williamson | 100 | % | 1,497 | — | 66 | — | ||||||||||

2,853 | 1,830 | 145 | 75 | ||||||||||||||

Corpus Christi | |||||||||||||||||

Caracol | Calhoun | 75 | % | 16 | 58 | — | 14 | ||||||||||

Padre Island (b) | Nueces | 50 | % | — | — | — | 15 | ||||||||||

Tortuga Dunes | Nueces | 75 | % | — | 134 | — | 4 | ||||||||||

16 | 192 | — | 33 | ||||||||||||||

Dallas-Ft. Worth | |||||||||||||||||

Bar C Ranch | Tarrant | 100 | % | 448 | 673 | — | — | ||||||||||

Keller | Tarrant | 100 | % | — | — | 1 | — | ||||||||||

Lakes of Prosper | Collin | 100 | % | 165 | 122 | 4 | — | ||||||||||

Lantana | Denton | 100 | % | 3,617 | 484 | 44 | — | ||||||||||

Maxwell Creek | Collin | 100 | % | 982 | 19 | 10 | — | ||||||||||

Parkside | Collin | 100 | % | 60 | 140 | — | — | ||||||||||

The Preserve at Pecan Creek | Denton | 100 | % | 619 | 163 | — | 7 | ||||||||||

River's Edge | Denton | 100 | % | — | 202 | — | — | ||||||||||

Stoney Creek | Dallas | 100 | % | 292 | 404 | — | — | ||||||||||

Summer Creek Ranch | Tarrant | 100 | % | 983 | 246 | 35 | 44 | ||||||||||

Timber Creek | Collin | 88 | % | 61 | 540 | — | — | ||||||||||

Village Park | Collin | 100 | % | 567 | — | 3 | 2 | ||||||||||

7,794 | 2,993 | 97 | 53 | ||||||||||||||

Houston | |||||||||||||||||

Barrington Kingwood | Harris | 100 | % | 176 | 4 | — | — | ||||||||||

City Park | Harris | 75 | % | 1,468 | — | 58 | 104 | ||||||||||

Harper's Preserve (b) | Montgomery | 50 | % | 522 | 1,160 | 30 | 49 | ||||||||||

Imperial Forest | Harris | 100 | % | 74 | 354 | — | — | ||||||||||

Long Meadow Farms (b) | Fort Bend | 38 | % | 1,611 | 186 | 194 | 99 | ||||||||||

Southern Trails (b) | Brazoria | 80 | % | 942 | 53 | 1 | — | ||||||||||

Spring Lakes | Harris | 100 | % | 348 | — | 25 | 4 | ||||||||||

Summer Lakes | Fort Bend | 100 | % | 744 | 323 | 56 | — | ||||||||||

Summer Park | Fort Bend | 100 | % | 119 | 80 | 34 | 62 | ||||||||||

Willow Creek Farms II | Waller / Fort Bend | 90 | % | 154 | 111 | — | — | ||||||||||

6,158 | 2,271 | 398 | 318 | ||||||||||||||

8

Residential Lots/Units | Commercial Acres | ||||||||||||||||

Project | County | Interest Owned (a) | Lots/Units Sold Since Inception | Lots/Units Remaining | Acres Sold Since Inception | Acres Remaining | |||||||||||

San Antonio | |||||||||||||||||

Cibolo Canyons | Bexar | 100 | % | 1,104 | 721 | 97 | 58 | ||||||||||

Oak Creek Estates | Comal | 100 | % | 313 | 240 | 13 | — | ||||||||||

Olympia Hills | Bexar | 100 | % | 743 | 11 | 10 | — | ||||||||||

Stonewall Estates (b) | Bexar | 50 | % | 377 | 9 | — | — | ||||||||||

2,537 | 981 | 120 | 58 | ||||||||||||||

Total Texas | 19,358 | 8,267 | 760 | 537 | |||||||||||||

Colorado | |||||||||||||||||

Denver | |||||||||||||||||

Buffalo Highlands | Weld | 100 | % | — | 164 | — | — | ||||||||||

Cielo | Douglas | 100 | % | — | 343 | — | — | ||||||||||

Johnstown Farms | Weld | 100 | % | 281 | 335 | 2 | — | ||||||||||

Pinery West | Douglas | 100 | % | 86 | — | 20 | 106 | ||||||||||

Stonebraker | Weld | 100 | % | — | 603 | — | — | ||||||||||

367 | 1,445 | 22 | 106 | ||||||||||||||

Georgia | |||||||||||||||||

Atlanta | |||||||||||||||||

Harris Place | Paulding | 100 | % | 22 | 5 | — | — | ||||||||||

Montebello (b) | Forsyth | 90 | % | — | 224 | — | — | ||||||||||

Seven Hills | Paulding | 100 | % | 889 | 189 | 26 | 113 | ||||||||||

West Oaks | Cobb | 100 | % | 6 | 50 | — | — | ||||||||||

917 | 468 | 26 | 113 | ||||||||||||||

North & South Carolina | |||||||||||||||||

Charlotte | |||||||||||||||||

Ansley Park | Lancaster | 100 | % | — | 307 | — | — | ||||||||||

Habersham | York | 100 | % | 76 | 111 | — | 6 | ||||||||||

Walden | Mecklenburg | 100 | % | — | 384 | — | — | ||||||||||

76 | 802 | — | 6 | ||||||||||||||

Raleigh | |||||||||||||||||

Beaver Creek (b) | Wake | 90 | % | 24 | 169 | — | — | ||||||||||

24 | 169 | — | — | ||||||||||||||

100 | 971 | — | 6 | ||||||||||||||

Tennessee | |||||||||||||||||

Nashville | |||||||||||||||||

Beckwith Crossing | Wilson | 100 | % | 24 | 75 | — | — | ||||||||||

Morgan Farms | Williamson | 100 | % | 125 | 48 | — | — | ||||||||||

Scales Farmstead | Williamson | 100 | % | — | 197 | — | — | ||||||||||

Weatherford Estates | Williamson | 100 | % | 8 | 9 | — | — | ||||||||||

157 | 329 | — | — | ||||||||||||||

Wisconsin | |||||||||||||||||

Madison | |||||||||||||||||

Juniper Ridge/Hawks Woods (b) (d) | Dane | 90 | % | 8 | 206 | — | — | ||||||||||

Meadow Crossing II (b) (c) | Dane | 90 | % | 3 | 169 | — | — | ||||||||||

11 | 375 | — | — | ||||||||||||||

9

Residential Lots/Units | Commercial Acres | ||||||||||||||||

Project | County | Interest Owned (a) | Lots/Units Sold Since Inception | Lots/Units Remaining | Acres Sold Since Inception | Acres Remaining | |||||||||||

Arizona, California, Missouri, Utah | |||||||||||||||||

Tucson | |||||||||||||||||

Boulder Pass (b) (c) | Pima | 50 | % | 3 | 85 | — | — | ||||||||||

Dove Mountain | Pima | 100 | % | — | 98 | — | — | ||||||||||

Oakland | |||||||||||||||||

San Joaquin River | Contra Costa/Sacramento | 100 | % | — | — | 108 | 180 | ||||||||||

Kansas City | |||||||||||||||||

Somerbrook | Clay | 100 | % | 173 | 222 | — | — | ||||||||||

Salt Lake City | |||||||||||||||||

Suncrest (b) (c) | Salt Lake | 90 | % | — | 171 | — | — | ||||||||||

176 | 576 | 108 | 180 | ||||||||||||||

Total | 21,086 | 12,431 | 916 | 942 | |||||||||||||

____________________

(a) | Interest owned reflects our total interest in the project, whether owned directly or indirectly, which may be different than our economic interest in the project. |

(b) | Projects in ventures that we account for using equity method |

(c) | Venture project that develops and sells homes. |

(d) | Venture project that develops and sells lots and homes. |

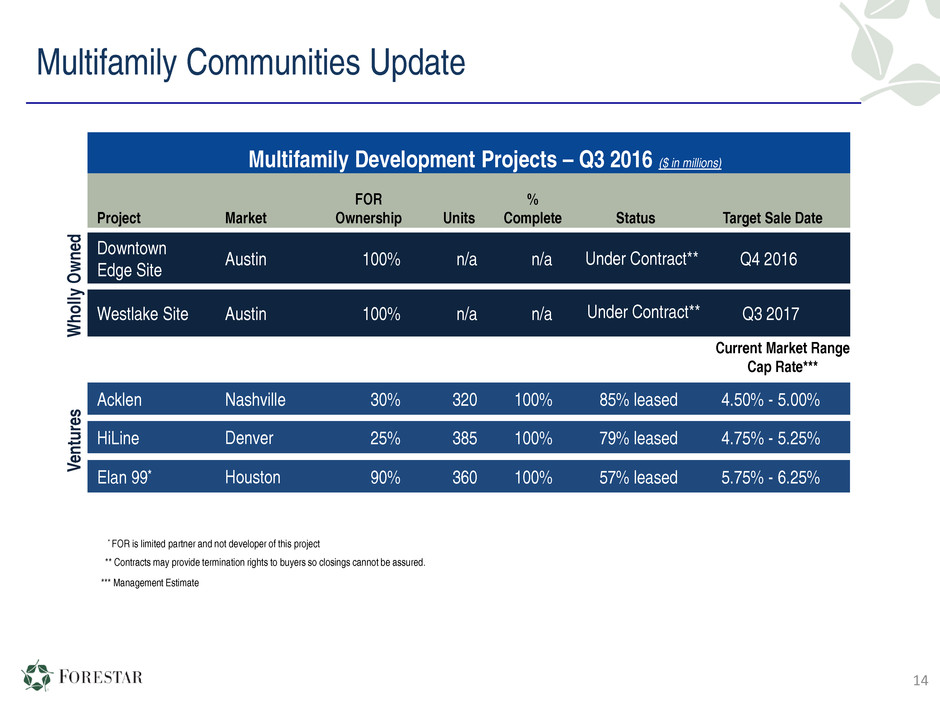

A summary of our non-core multifamily properties, excluding two multifamily sites classified as held for sale, at third quarter-end 2016 follows:

Project | Market | Interest Owned (a) | Type | Acres | Description | |||||||

Elan 99 | Houston | 90 | % | Multifamily | 17 | 360-unit luxury apartment | ||||||

Acklen | Nashville | 30 | % | Multifamily | 4 | 320-unit luxury apartment | ||||||

HiLine | Denver | 25 | % | Multifamily | 18 | 385-unit luxury apartment | ||||||

_____________________

(a) | Interest owned reflects our total interest in the project, whether owned directly or indirectly, which may be different than our economic interest in the project. |

10

Information on Execution of

Key Initiatives and

Third Quarter 2016

Financial Results

November 9, 2016

Exhibit 99.2

Notice to Investors

This presentation contains “forward-looking statements” within the meaning of the federal securities laws.

Forward-looking statements are typically identified by words or phrases such as “will,” “anticipate,”

“estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “target,” “forecast,” and other words and terms of

similar meaning. These statements reflect management’s current views with respect to future events and

are subject to risk and uncertainties. We note that a variety of factors and uncertainties could cause our

actual results to differ significantly from the results discussed in the forward-looking statements, including

but not limited to: general economic, market, or business conditions; changes in commodity prices;

opportunities (or lack thereof) that may be presented to us and that we may pursue; fluctuations in costs

and expenses including development costs; demand for new housing, including impacts from mortgage

credit rates or availability; lengthy and uncertain entitlement processes; cyclicality of our businesses;

accuracy of accounting assumptions; competitive actions by other companies; changes in laws or

regulations; and other factors, many of which are beyond our control. Except as required by law, we

expressly disclaim any obligation to publicly revise any forward-looking statements contained in this

presentation to reflect the occurrence of events after the date of this presentation.

2

Key Initiatives

Reducing Costs Across the Entire

Organization*

• Actions taken to eliminate over $50MM in annualized SG&A

• Decreased headcount by over 50% compared to 2014 peak

• Implemented zero based budgeting

Reviewing Entire Portfolio of

Assets

• Executed $425MM in non-core asset sales

• Radisson Hotel - $130MM

• 5 multifamily assets - $157MM

• Oil and gas working interests - $81MM

• Undeveloped land sales - $50MM

• 108 commercial acres – Antioch, CA project - $7MM

• Completed multiple NAV scenarios for every asset

Reviewing Capital Structure

• Reduced outstanding debt by over $320MM

• Annual interest expense will be reduced by approximately

$23MM going forward

Providing Additional Information

• Reclassified approximately 24,000 acres in Georgia

associated with 12 entitled and 8 entitlement in process

projects to monetize near term as HBU timberland

The Year of Transformation

3

Significant Progress Since 9/30/15

*Expect full cost savings realization once all non-core assets are sold.

Overview of Assets

CORE

Minerals and Water

590,000 net fee mineral

acres principally in Texas,

Louisiana, Georgia and

Alabama

45% non-participating

royalty interest in

groundwater rights on 1.4

million surface acres

Groundwater leases on

20,000 surface acres in

Central Texas – Under

Contract*

Multifamily

Downtown Edge site in

Austin – Under Contract*

Westlake site in Austin –

Under Contract*

Acklen venture in Nashville

completed - 80% occupied /

85% leased

HiLine venture in Littleton

completed – 74% occupied /

78% leased

Elan 99 venture in Houston

completed – 46% occupied /

56% leased

Timberland and

Undeveloped Land

70,000 acres, primarily in

Georgia

4,000 acres, primarily in

Texas

Community

Development

55 entitled, developed or

under development projects

in 11 states and 15 markets

– 7,000 acres

Three communities in

entitlement (CA and TX) –

4,430 total acres

NON-CORE

4

* Contracts may provide termination rights to buyers so closings cannot be assured.

Third Quarter 2016 Results

5

($ in Millions, except per share data)

Revenues * $47.2 $32.2

Net Income (Loss) – Continuing Operations $16.8 ($57.3)

Net Income (Loss) Per Share – Continuing Operations $0.40 ($1.67)

Net Income (Loss) $9.7 ($164.2)

Net Income (Loss) Per Share $0.23 ($4.79)

Segment Earnings (Loss) *

Real Estate $15.0 $5.2

Mineral Resources* 1.2 0.1

Other (0.2) (0.1)

Total Segment Earnings $16.0 $5.2

Note: Q3 2016 weighted average diluted shares outstanding were 42.3 million compared with 34.3 million in Q3 2015

* Excludes oil & gas working interests which are now classified as discontinued operations

Q3 2016 Q3 2015

Real Estate Segment - Earnings Reconciliation Q3 2016

$1.4

$1.1

$5.2

$11.0

$4.1

$2.0

$0.1

($7.6)

($1.2)

$(1.1)

$15.0

$0

$5

$10

$15

$20

$25

$30

Q3 2015 Undeveloped

Land Sales

Opex Mitigation

Banking

Lot Sales Interest Income Gain on Asset

Sales

Impairment Residential &

Commercial

Tract Sales

Multifamily

Properties

Q3 2016

Segment Earnings Reconciliation

Q3 2015 vs. Q3 2016

($ in millions)

Q3 2016 Sales Activity / Highlights*

• Residential lot sales – 332 lots

• ~ $70,000 average price per lot

• $26,100 gross profit per lot

• Commercial tract sales – 110 acres

• ~ $76,200 per acre

• Includes 108 acres of Antioch, California

project for $7 million

• Residential tract sales – 243 acres

• ~ $26,800 per acre

• Sold ~ 6,500 acres of undeveloped land,

generating $12.8 million in earnings

• Average price $2,410 per acre

• Sold $3.0 million in mitigation credits

• Incurred $7.6 million in non-cash impairments,

primarily multifamily site under contract

6

*Includes ventures

Lot Sales and Lots Under Contract

7

0

500

1,000

1,500

2,000

2,500

Q

11

2

Q

21

2

Q

31

2

Q

41

2

Q

11

3

Q

21

3

Q

31

3

Q

41

3

Q

11

4

Q

21

4

Q

31

4

Q

41

4

Q

11

5

Q

21

5

Q

31

5

Q

41

5

Q

11

6

Q

21

6

Q

31

6

Re

sid

en

tia

l L

ot

s

Developed Lots Lots Under Development

> 2,080 Lots Under Option Contract

Continue to target 2016 residential lot sales of 1,600 – 1,800 lots

Includes ventures

$0

$5,000

$10,000

$15,000

$20,000

$25,000

$30,000

$35,000

0

500

1,000

1,500

2,000

2,500

3,000

3,500

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016E

Bulk Lot Sales Lot Sales

Average Lot Margin Average Lot Margin Excl. Bulk Sales

Annual Lot Sales and Average Lot Margin

• Highest number of lots under option contract

in over 5 years

• Represents over 70% of our total developed

lots and lots under development

8

For questions, please contact:

Charles D. Jehl

Chief Financial Officer

Forestar Group Inc.

6300 Bee Cave Road

Building Two, Suite 500

Austin, TX 78746

512-433-5229

[email protected]

9

Appendix

Real Estate Segment KPI’s

Q3

2016

Q3

2015

YTD Q3

2016

YTD Q3

2015

Residential Lot Sales

Lots Sold 332 301 1,105 1,109

Average Price / Lot $69,970 $76,623 $68,573 $75,019

Gross Profit / Lot $26,100 $30,593 $24,921 $34,193

Commercial Tract Sales

Acres Sold 110 2 120 56

Average Price / Acre $76,187 $28,037 $99,800 $216,997

Undeveloped Land Sales

Acres Sold 6,501 4,616 13,898 6,595

Average Price / Acre $2,410 $2,190 $2,460 $2,411

Segment Revenues ($ in Millions) $45.3 $28.0 $127.8 $100.2

Segment Earnings ($ in Millions) $15.0 $5.2 $108.5 $29.7

10

Includes ventures

Stable Market Demand in Key Markets

*Source: Bureau of Labor Statistics

September 2016 vs. September 2015

Austin 2.8%

Dallas / Fort Worth 3.8%

Houston 0.5%

San Antonio 2.2%

Atlanta 3.0%

Charlotte 2.0%

Nashville 2.8%

U.S. Average 1.7%

Job Growth vs. National Average*

Job growth in our key markets

holding well above U.S. average

(excluding Houston)

Finished Vacant Home Inventories Below Equilibrium**

**Source: Metrostudy

• Equilibrium: Balanced supply and demand for

Finished Vacant housing for an MSA as measured

by months of supply.

• For Texas markets, equilibrium is 2.0 to 2.5

months of supply.

• Finished Vacant months of supply for 3Q 16 in

Forestar Texas markets dropped slightly below

equilibrium. 11

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

0

5,000

10,000

15,000

20,000

25,000

30,000

Finished Vacant Housing Inventory Months of Supply

3Q Forestar Texas Markets

Mineral Resources Segment KPI’s

Q3 2016 Q3 2015

Minerals

Oil Produced (Barrels) * 20,400 30,100

Average Price / Barrel $43.23 $46.16

Natural Gas Produced (MMCF) ** 205.5 242.5

Average Price / MCF ** $1.95 $2.45

Total BOE 54,700 70,500

Average Price / BOE $23.47 $28.13

Segment Revenues ($ in millions) $1.4 $2.5

Segment Income ($ in millions) $1.2 $0.1

* Includes Natural Gas Liquids

** Includes our share of venture production: 36 MMcf in Q3 2016, 47 MMcf in Q3 2015

12

Note: Excludes oil and gas working interest assets now classified as discontinued operations

Non-Core Community Development Projects Update

13

• Sales could

trigger up to

approximately

$110 million in

tax losses to

offset tax gains

from other

non-core asset

sales

• Reduces

annual carry

costs by $2.6

million, once

sold

Community Location Status* Interest

Owned**

Developed

Lots

Undeveloped

Lots

Commercial

Acres

Remaining

San Joaquin

River

Antioch Sold

108 acres

100% --- --- 180

The Colony Austin Under

Contract

100% 91 1,357 5

Caracol TX Coast Under

Contract

75% 49 9 14

Tortuga

Dunes

TX Coast Under

Contract

75% 95 39 4

Somerbrook Kansas

City

Under

Contract

100% 12 210 ---

Buffalo

Highlands

Denver Marketing 100% --- 164 ---

Stonebraker Denver Marketing 100% --- 603 ---

247 2,382 203

** Interest owned reflects our total interest in the project, whether owned directly or indirectly, which may be different than our economic interest in the project.

* Contracts may provide termination rights to buyers so closings cannot be assured.

Multifamily Communities Update

Multifamily Development Projects – Q3 2016 ($ in millions)

Project Market

FOR

Ownership Units

%

Complete Status Target Sale Date

W

ho

lly

O

w

ne

d Downtown

Edge Site Austin 100% n/a n/a Q4 2016

Westlake Site Austin 100% n/a n/a Q3 2017

Current Market Range

Cap Rate***

Ve

nt

ur

es

Acklen Nashville 30% 320 100% 85% leased 4.50% - 5.00%

HiLine Denver 25% 385 100% 79% leased 4.75% - 5.25%

Elan 99* Houston 90% 360 100% 57% leased 5.75% - 6.25%

* FOR is limited partner and not developer of this project

14

Under Contract**

Under Contract**

** Contracts may provide termination rights to buyers so closings cannot be assured.

*** Management Estimate

0

10

20

30

40

50

60

70

80

90

100

2015 2016E 2017E Target

Annual SG&A Costs

Corporate G&A Segment Operating Costs Project Level Expenses

Cost Reductions

SG&A costs in 2016 and target are estimates and actual results may vary depending on the timing of completion of non-core asset sales.

$87 million

$

in

M

illi

on

s

$60 million

Other Corporate Costs

21%

Corporate Employee

Costs

25%

Project Level

Expenses

22%

Other Segment

Operating Costs

12%

Segment Employee

Costs

20%

$7 MM

$8 MM

$7 MM$7 MM

$4 MM

Actions Taken to Eliminate Over $50 million in Annual SG&A Costs

$33 million

15

Target SG&A Cost - $33 million

$38 million

16

For questions, please contact:

Charles D. Jehl

Chief Financial Officer

Forestar Group Inc.

6300 Bee Cave Road

Building Two, Suite 500

Austin, TX 78746

512-433-5229

[email protected]

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Forestar Group (FOR) Tops Q2 EPS by 16c

- Synaptics Astra™ SL-Series Wins Best in Show at Embedded World

- AACOM Releases Historic Statement After “Food As Medicine” Special Session

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share