Form 8-K OMNICOM GROUP INC. For: Oct 18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 18, 2016

OMNICOM GROUP INC.

(Exact Name of Registrant as Specified in its Charter)

|

New York (State or other jurisdiction |

1-10551 (Commission |

13-1514814 (IRS Employer |

|

437 Madison Avenue, New York, NY (Address of principal executive offices) |

10022 (Zip Code) |

Registrant’s telephone number, including area code: (212) 415-3600

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On October 18, 2016, Omnicom Group Inc. (“Omnicom” or the “Company”) published an earnings release reporting its financial results for the three and nine months ended September 30, 2016. A copy of the earnings release is attached as Exhibit 99.1 hereto and is incorporated by reference herein. Following the publication of the earnings release, Omnicom hosted an earnings call in which its financial results were discussed. The investor presentation materials used for the call are attached as Exhibit 99.2 hereto and are incorporated by reference herein.

On October 18, 2016, Omnicom posted the materials attached as Exhibits 99.1 and 99.2 on its web site (www.omnicomgroup.com).

Certain statements in the exhibits to this Current Report on Form 8-K constitute forward-looking statements, including statements within the meaning of the Private Securities Litigation Reform Act of 1995. In addition, from time to time, the Company or its representatives have made, or may make, forward-looking statements, orally or in writing. These statements may discuss goals, intentions and expectations as to future plans, trends, events, results of operations or financial condition, or otherwise, based on current beliefs of the Company’s management as well as assumptions made by, and information currently available to, the Company’s management. Forward-looking statements may be accompanied by words such as “aim,” “anticipate,” “believe,” “plan,” “could,” “should,” “would,” “estimate,” “expect,” “forecast,” “future,” “guidance,” “intend,” “may,” “will,” “possible,” “potential,” “predict,” “project” or similar words, phrases or expressions. These forward-looking statements are subject to various risks and uncertainties, many of which are outside the Company’s control. Therefore, you should not place undue reliance on such statements. Factors that could cause actual results to differ materially from those in the forward-looking statements include: international, national or local economic conditions that could adversely affect the Company or its clients; losses on media purchases and production costs incurred on behalf of clients; reductions in client spending, a slowdown in client payments and a deterioration in the credit markets; ability to attract new clients and retain existing clients in the manner anticipated; changes in client advertising, marketing and corporate communications requirements; failure to manage potential conflicts of interest between or among clients; unanticipated changes relating to competitive factors in the advertising, marketing and corporate communications industries; ability to hire and retain key personnel; currency exchange rate fluctuations; reliance on information technology systems; changes in legislation or governmental regulations affecting the Company or its clients; risks associated with assumptions the Company makes in connection with its critical accounting estimates and legal proceedings; and the Company’s international operations, which are subject to the risks of currency repatriation restrictions, social or political conditions and regulatory environment. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties that may affect the Company’s business, including those described under “Risk Factors” in Omnicom's Annual Report on Form 10-K for the year ended December 31, 2015 and other documents filed from time to time with the Securities and Exchange Commission. Except as required under applicable law, the Company does not assume any obligation to update these forward-looking statements.

The foregoing information (including the exhibits hereto) is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit |

Description |

| 99.1 | Earnings release dated October 18, 2016. |

| 99.2 |

Investor presentation materials dated October 18, 2016.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Omnicom Group Inc. | |||

| By: | /s/ Andrew L. Castellaneta | ||

| Name: | Andrew L. Castellaneta | ||

| Title: | Senior Vice President, | ||

| Chief Accounting Officer | |||

Date: October 18, 2016

2

EXHIBIT INDEX

|

Exhibit |

Description |

| 99.1 | Earnings release dated October 18, 2016. |

| 99.2 |

Investor presentation materials dated October 18, 2016.

|

3

Exhibit 99.1

FOR IMMEDIATE RELEASE

Omnicom Group Reports Third Quarter and Year-to-Date 2016 Results

NEW YORK, October 18, 2016 - Omnicom Group Inc. (NYSE: OMC) today announced that its diluted net income per common share for the third quarter of 2016 increased nine cents, or 9.3%, to $1.06 per share versus $0.97 per share for the third quarter of 2015.

Omnicom’s worldwide revenue in the third quarter of 2016 increased 2.3% to $3,791.1 million from $3,706.6 million in the third quarter of 2015. The components of the change in revenue included an increase in revenue from organic growth of 3.2%, an increase in revenue from acquisitions, net of dispositions of 0.4% and a decrease in revenue from the negative impact of foreign exchange rates of 1.3% when compared to the third quarter of 2015.

Across our regional markets, organic revenue growth in the third quarter of 2016 was 1.7% in North America, 5.2% in the United Kingdom, 2.0% in the Euro Markets and Other Europe, 8.0% in Asia Pacific, 11.9% in Latin America and 15.6% in the Middle East and Africa when compared to the same quarter of 2015.

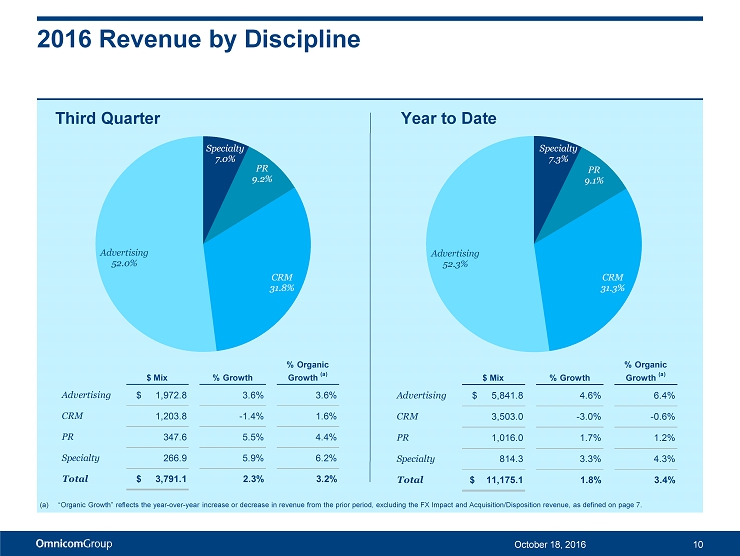

The change in organic revenue in the third quarter of 2016 as compared to the third quarter of 2015 in our four fundamental disciplines was as follows: advertising increased 3.6%, CRM increased 1.6%, public relations increased 4.4% and specialty communications increased 6.2%.

Operating income in the third quarter of 2016 increased $24.8 million, or 5.8%, to $453.1 million from $428.3 million in the third quarter of 2015. Our operating margin for the third quarter of 2016 increased to 12.0% versus 11.6% for the third quarter of 2015.

For the third quarter of 2016, earnings before interest, taxes and amortization of intangibles (“EBITA”) increased $27.4 million, or 6.0%, to $482.1 million from $454.7 million in the third quarter of 2015. Our EBITA margin (defined as EBITA divided by revenue) increased to 12.7% for the third quarter of 2016 versus 12.3% in the third quarter of 2015.

437 Madison Avenue, New York, NY 10022 (212) 415-3600 Fax (212) 415-3530

Omnicom Group Inc.

For the third quarter of 2016, our income tax rate was 32.7% compared to 32.8% for the same period in 2015.

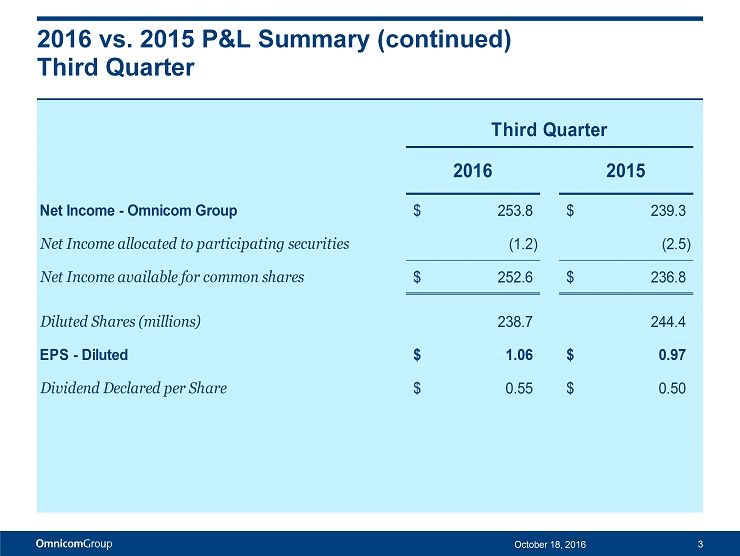

Net income for the third quarter of 2016 increased $14.5 million, or 6.1%, to $253.8 million from $239.3 million in the third quarter of 2015.

Year-to-date

Diluted net income per common share for the nine months ended September 30, 2016 increased 25 cents, or 8.2%, to $3.31 per share compared to $3.06 per share for the nine months ended September 30, 2015.

Worldwide revenue for the nine months ended September 30, 2016 increased 1.8% to $11,175.1 million from $10,981.1 million in the same period of 2015. The components of the change in revenue included an increase in revenue from organic growth of 3.4%, an increase in revenue from acquisitions, net of dispositions of 0.3% and a decrease in revenue from the negative impact of foreign exchange rates of 1.9% when compared to the same period of 2015.

Across our regional markets for the nine months ended September 30, 2016, organic revenue growth was 3.1% in North America, 3.6% in the United Kingdom, 3.1% in the Euro Markets and Other Europe, 5.9% in Asia Pacific, 1.4% in Latin America and 5.1% in the Middle East and Africa when compared to the same period of 2015.

The change in organic revenue for the nine months ended September 30, 2016 compared to the same period in 2015 in our four fundamental disciplines was as follows: advertising increased 6.4%, public relations increased 1.2% and specialty communications increased 4.3%, while CRM decreased 0.6%.

Operating income for the nine months ended September 30, 2016 increased $62.4 million, or 4.6%, to $1,407.0 million compared to $1,344.6 million for the same period in 2015. Our operating margin for the nine months ended September 30, 2016 increased to 12.6% versus 12.2% for the same period in 2015.

Page 2

Omnicom Group Inc.

Omnicom’s EBITA for the nine months ended September 30, 2016 increased 4.7%, or $67.3 million, to $1,492.7 million from $1,425.4 million for the same period in 2015. Our EBITA margin for the nine months ended September 30, 2016 increased to 13.4% versus 13.0% for the same period in 2015.

For the nine months ended September 30, 2016, our income tax rate was 32.6% compared to 32.8% for the same period in 2015.

Net income for the nine months ended September 30, 2016 increased $36.0 million, or 4.7%, to $798.3 million from $762.3 million versus the same period in 2015.

Non-GAAP Financial Measures

We used certain non-GAAP financial measures in describing our performance above. We use EBITA (defined as earnings before interest, taxes and amortization of intangibles) and EBITA margin (defined as EBITA divided by revenue) as additional operating performance measures, which excludes the non-cash amortization expense of intangible assets (primarily consisting of amortization arising from acquisitions), because we believe it is a useful measure for investors to evaluate the performance of our businesses. The financial tables at the end of this document reconcile EBITA to the GAAP financial measure of net income for the periods presented.

Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information presented in compliance with U.S. GAAP. Non-GAAP financial measures reported by us may not be comparable to similarly titled amounts reported by other companies.

Omnicom Group Inc. (NYSE: OMC) (www.omnicomgroup.com) is a leading global marketing and corporate communications company. Omnicom’s branded networks and numerous specialty firms provide advertising, strategic media planning and buying, digital and interactive marketing, direct and promotional marketing, public relations and other specialty communications services to over 5,000 clients in more than 100 countries. Follow us on Twitter for the latest news.

Page 3

Omnicom Group Inc.

For a live webcast or a replay of our third quarter earnings conference call, go to http://investor.omnicomgroup.com/investor-relations/news-events-and-filings.

| Contacts | |

| Investor Relations: | Media: |

| Shub Mukherjee, 212-415-3011 | Joanne Trout, 212-415-3669 |

| [email protected] | [email protected] |

Page 4

Omnicom Group Inc.

Consolidated Statements of Income

Three Months Ended September 30

(Unaudited)

(Dollars in Millions, Except Per Share Data)

| 2016 | 2015 | |||

| Revenue | $ 3,791.1 | $ 3,706.6 | ||

| Operating Expenses: | ||||

| Salary and service costs | 2,855.3 | 2,799.8 | ||

| Occupancy and other costs | 305.5 | 303.0 | ||

| Costs of services | 3,160.8 | 3,102.8 | ||

| Selling, general and administrative expenses | 104.1 | 103.7 | ||

| Depreciation and amortization | 73.1 | 71.8 | ||

| Total operating expenses | 3,338.0 | 3,278.3 | ||

| Operating Income | 453.1 | 428.3 | ||

| Add back: Amortization of intangibles | 29.0 | 26.4 | ||

| EBITA (a) | 482.1 | 454.7 | ||

| Amortization of intangibles | 29.0 | 26.4 | ||

| Operating Income | 453.1 | 428.3 | ||

| Net Interest Expense | 42.0 | 35.9 | ||

| Income before income taxes | 411.1 | 392.4 | ||

| Income tax expense | 134.3 | 128.9 | ||

| Income from equity method investments | 1.4 | 3.2 | ||

| Net income | 278.2 | 266.7 | ||

| Less: Net income allocated to noncontrolling interests | 24.4 | 27.4 | ||

| Net income - Omnicom Group Inc. | 253.8 | 239.3 | ||

| Less: Net income allocated to participating securities | 1.2 | 2.5 | ||

| Net income available for common shares | $ 252.6 | $ 236.8 | ||

| Net income per common share - Omnicom Group Inc. | ||||

| Basic | $ 1.06 | $ 0.97 | ||

| Diluted | $ 1.06 | $ 0.97 | ||

| Weighted average shares (in millions) | ||||

| Basic | 237.4 | 243.2 | ||

| Diluted | 238.7 | 244.4 | ||

| Dividend declared per common share | $ 0.55 | $ 0.50 | ||

| (a) | EBITA (defined as earnings before interest, taxes and amortization of intangibles) is a non-GAAP financial measure. We use EBITA as an additional operating performance measure, which excludes the non-cash amortization expense of intangible assets (primarily consisting of amortization arising from acquisitions), because we believe it is a useful measure for investors to evaluate the performance of our businesses. The above table reconciles EBITA to the GAAP financial measures for the periods presented. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information presented in compliance with U.S. GAAP. Non-GAAP financial measures reported by us may not be comparable to similarly titled amounts reported by other companies. |

Page 5

Omnicom Group Inc.

Consolidated Statements of Income

Nine Months Ended September 30

(Unaudited)

(Dollars in Millions, Except Per Share Data)

| 2016 | 2015 | |||

| Revenue | $ 11,175.1 | $ 10,981.1 | ||

| Operating expenses: | ||||

| Salary and service costs | 8,304.5 | 8,159.8 | ||

| Occupancy and other costs | 920.2 | 942.0 | ||

| Cost of services | 9,224.7 | 9,101.8 | ||

| Selling, general and administrative costs | 323.1 | 316.0 | ||

| Depreciation and amortization | 220.3 | 218.7 | ||

| Total operating expenses | 9,768.1 | 9,636.5 | ||

| Operating Income | 1,407.0 | 1,344.6 | ||

| Add back: Amortization of intangibles | 85.7 | 80.8 | ||

| EBITA (a) | 1,492.7 | 1,425.4 | ||

| Amortization of intangibles | 85.7 | 80.8 | ||

| Operating Income | 1,407.0 | 1,344.6 | ||

| Net Interest Expense | 127.0 | 104.7 | ||

| Income before income taxes | 1,280.0 | 1,239.9 | ||

| Income tax expense | 417.7 | 406.9 | ||

| Income from equity method investments | 4.0 | 6.2 | ||

| Net income | 866.3 | 839.2 | ||

| Less: Net income allocated to noncontrolling interests | 68.0 | 76.9 | ||

| Net income - Omnicom Group Inc. | 798.3 | 762.3 | ||

| Less: Net income allocated to participating securities | 4.8 | 9.0 | ||

| Net income available for common shares | $ 793.5 | $ 753.3 | ||

| Net income per common share - Omnicom Group Inc. | ||||

| Basic | $ 3.33 | $ 3.08 | ||

| Diluted | $ 3.31 | $ 3.06 | ||

| Weighted average shares (in millions) | ||||

| Basic | 238.4 | 244.7 | ||

| Diluted | 239.6 | 245.8 | ||

| Dividend declared per common share | $ 1.60 | $ 1.50 |

| (a) | EBITA (defined as earnings before interest, taxes and amortization of intangibles) is a non-GAAP financial measure. We use EBITA as an additional operating performance measure, which excludes the non-cash amortization expense of intangible assets (primarily consisting of amortization arising from acquisitions), because we believe it is a useful measure for investors to evaluate the performance of our businesses. The above table reconciles EBITA to the GAAP financial measures for the periods presented. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information presented in compliance with U.S. GAAP. Non-GAAP financial measures reported by us may not be comparable to similarly titled amounts reported by other companies. |

Page 6

Exhibit 99.2

Third Quarter 2016 Results October 18, 2016 Investor Presentation

2016 vs. 2015 P&L Summary Third Quarter 1 (a) Additional information regarding our operating expenses can be found on page 24. (b) EBITA is a non - GAAP financial performance measure . Please see page 25 for the definition of this measure and page 22 for the reconciliation of non - GAAP financial measures, which reconciles the EBITA figures presented above to net income for the periods presented above . 2016 2015 Revenue 3,791.1$ 3,706.6$ Operating Expenses (a) 3,338.0 3,278.3 Operating Income 453.1 428.3 Margin % 12.0% 11.6% Addback: Amortization of Intangibles 29.0 26.4 EBITA (b) 482.1$ 454.7$ Margin % 12.7% 12.3% Third Quarter October 18, 2016

2016 vs. 2015 P&L Summary (continued) Third Quarter 2 2016 2015 Operating Income 453.1$ 428.3$ Net Interest Expense 42.0 35.9 Income Taxes 134.3 128.9 Tax Rate % 32.7% 32.8% Income from Equity Method Investments 1.4 3.2 Noncontrolling Interests 24.4 27.4 Net Income - Omnicom Group 253.8$ 239.3$ Third Quarter October 18, 2016

2016 vs. 2015 P&L Summary (continued) Third Quarter 3 2016 2015 Net Income - Omnicom Group 253.8$ 239.3$ Net Income allocated to participating securities (1.2) (2.5) Net Income available for common shares 252.6$ 236.8$ Diluted Shares (millions) 238.7 244.4 EPS - Diluted 1.06$ 0.97$ Dividend Declared per Share 0.55$ 0.50$ Third Quarter October 18, 2016

2016 vs. 2015 P&L Summary Year to Date 4 2016 2015 Revenue 11,175.1$ 10,981.1$ Operating Expenses (a) 9,768.1 9,636.5 Operating Income 1,407.0 1,344.6 Margin % 12.6% 12.2% Addback: Amortization of Intangibles 85.7 80.8 EBITA (b) 1,492.7$ 1,425.4$ Margin % 13.4% 13.0% Year to Date October 18, 2016 (a) Additional information regarding our operating expenses can be found on page 24. (b) EBITA is a non - GAAP financial performance measure . Please see page 25 for the definition of this measure and page 22 for the reconciliation of non - GAAP financial measures, which reconciles the EBITA figures presented above to net income for the periods presented above .

2016 vs. 2015 P&L Summary (continued) Year to Date 5 2016 2015 Operating Income 1,407.0$ 1,344.6$ Net Interest Expense 127.0 104.7 Income Taxes 417.7 406.9 Tax Rate % 32.6% 32.8% Income from Equity Method Investments 4.0 6.2 Noncontrolling Interests 68.0 76.9 Net Income - Omnicom Group 798.3$ 762.3$ Year to Date October 18, 2016

2016 vs. 2015 P&L Summary (continued) Year to Date 6 2016 2015 Net Income - Omnicom Group 798.3$ 762.3$ Net Income allocated to participating securities (4.8) (9.0) Net Income available for common shares 793.5$ 753.3$ Diluted Shares (millions) 239.6 245.8 EPS - Diluted 3.31$ 3.06$ Dividend Declared per Share 1.60$ 1.50$ Year to Date October 18, 2016

2016 Total Revenue Change 7 October 18, 2016 $ % ∆ % ∆ Prior Period Revenue $ 3,706.6 $ 10,981.1 Foreign Exchange (FX) Impact (a) (49.9) -1.3% (209.1) -1.9% Acquisition/Disposition Revenue (b) 15.3 0.4% 24.3 0.3% Organic Revenue (c) 119.1 3.2% 378.8 3.4% Current Period Revenue $ 3,791.1 2.3% $ 11,175.1 1.8% Third Quarter Year to Date $ (a) The FX Impact is calculated by translating the current period’s local currency revenue using the prior period average exchange rates to derive current period constant currency revenue. The FX impact is the difference between the current period revenue in U.S. Dollars and the current period constant currency revenue. (b) Acquisition/Disposition revenue is calculated by aggregating the prior period revenue of the acquired businesses, less the prior period revenue of any business that was disposed of in the current period . (c) Organic revenue is calculated by subtracting both the Acquisition/Disposition revenue and the FX impact from total revenue growth.

2016 Revenue by Region October 18, 2016 8 Third Quarter North America 59.4% UK 9.2% Euro Markets & Other Europe 15.6 % Asia Pacific 11.0% Latin America 3.0% Africa MidEast 1.8% Year to Date North America 60.0% UK 9.4% Euro Markets & Other Europe 15.9 % Asia Pacific 10.5% Latin America 2.5% Africa MidEast 1.7%

2016 Revenue by Region 9 Third Quarter Year to Date October 18, 2016 $ Mix % Growth % Organic Growth (a) North America 2,253.9$ 1.4% 1.7% UK 347.9 -10.4% 5.2% Euro & Other Europe 590.7 2.0% 2.0% Asia Pacific 418.9 8.3% 8.0% Latin America 112.5 60.0% 11.9% Africa Mid East 67.2 11.3% 15.6% Total 3,791.1$ 2.3% 3.2% $ Mix % Growth % Organic Growth (a) North America 6,706.9$ 2.1% 3.1% UK 1,048.6 -5.3% 3.6% Euro & Other Europe 1,773.4 1.9% 3.1% Asia Pacific 1,173.5 3.1% 5.9% Latin America 286.6 21.1% 1.4% Africa Mid East 186.1 -1.2% 5.1% Total 11,175.1$ 1.8% 3.4% (a) “Organic Growth” reflects the year - over - year increase or decrease in revenue from the prior period, excluding the FX Impact and Acquisition/Disposition revenue, as defined on page 7.

2016 Revenue by Discipline October 18, 2016 10 Third Quarter Specialty 7.0% PR 9.2% CRM 31.8% Advertising 52.0% Specialty 7.3% PR 9.1% CRM 31.3% Advertising 52.3% $ Mix % Growth % Organic Growth (a) Advertising $ 1,972.8 3.6% 3.6% CRM 1,203.8 -1.4% 1.6% PR 347.6 5.5% 4.4% Specialty 266.9 5.9% 6.2% Total $ 3,791.1 2.3% 3.2% $ Mix % Growth % Organic Growth (a) Advertising $ 5,841.8 4.6% 6.4% CRM 3,503.0 -3.0% -0.6% PR 1,016.0 1.7% 1.2% Specialty 814.3 3.3% 4.3% Total $ 11,175.1 1.8% 3.4% (a) “Organic Growth” reflects the year - over - year increase or decrease in revenue from the prior period, excluding the FX Impact and Acquisition/Disposition revenue, as defined on page 7. Year to Date

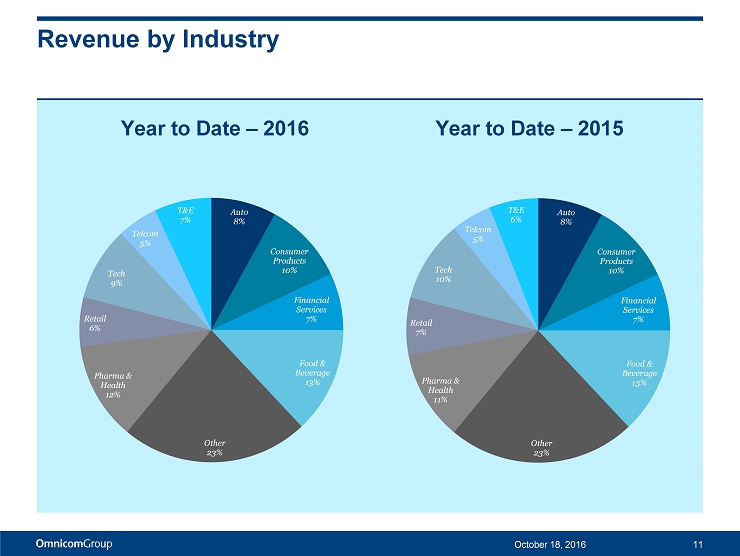

Revenue by Industry October 18, 2016 11 Auto 8% Consumer Products 10% Financial Services 7% Food & Beverage 13% Other 23% Pharma & Health 12% Retail 6% Tech 9% Telcom 5% T&E 7% Year to Date – 2016 Year to Date – 2015 Auto 8% Consumer Products 10% Financial Services 7% Food & Beverage 13% Other 23% Pharma & Health 11% Retail 7% Tech 10% Telcom 5% T&E 6%

Cash Flow Performance 12 October 18, 2016 2016 2015 Net Income 866.3$ 839.2$ Depreciation and Amortization Expense 220.3 218.7 Share-Based Compensation Expense 69.8 75.4 Other Items to Reconcile to Net Cash Provided by Operating Activities, net (55.7) 4.6 Free Cash Flow (a) 1,100.7$ 1,137.9$ Nine Months Ended September 30 Additional information regarding our cash flows can be found in our condensed cash flow statement on page 21. (a) The Free Cash Flow amounts presented above are non - GAAP liquidity measures. See page 25 for the definition of this measure and page 23 for the reconciliation of the non - GAAP financial measures, which reconciles Free Cash Flow to the Net Cash Provided by Operating Activities for the periods presented above.

Cash Flow Performance 13 October 18, 2016 2016 2015 Free Cash Flow (a) 1,100.7$ 1,137.9$ Primary Uses of Cash: Dividends 374.2 373.9 Dividends paid to Noncontrolling Interest Shareholders 71.1 86.7 Capital Expenditures 100.5 145.6 Acquisition of Businesses and Affiliates, Acquisition of Additional Noncontrolling Interests and Contingent Purchase Price Payments 438.3 86.4 Stock Repurchases, net of Proceeds from Stock Plans and Excess Tax Benefit from Stock Plans 422.5 473.7 Primary Uses of Cash (a) 1,406.6 1,166.3 Net Free Cash Flow (a) (305.9)$ (28.4)$ Nine Months Ended September 30 Additional information regarding our cash flows can be found in our condensed cash flow statement on page 21. (a) The Free Cash Flow, Primary Uses of Cash and Net Free Cash Flow amounts presented above are non - GAAP liquidity measures. See page 25 for the definition of these measures and page 23 for the reconciliation of non - GAAP financial measures, which reconciles Free Cash Flow to the Net Cash Provided by Operating Activities and Net Free Cash Flow to the Net Decrease in Cash and Cash Equivalents for the periods presented above.

Current Credit Picture 14 October 18, 2016 (a) EBITDA is a non - GAAP performance measure. See page 25 for the definition of this measure and page 22 for the reconciliation of non - GAAP financial measures. (b) Net Debt is a non - GAAP liquidity measure. See page 25 for the definition of this measure, which is reconciled in the table above . (c) See pages 18 and 19 for additional information on our Senior Notes. 2016 2015 EBITDA (a) $ 2,275.1 $ 2,219.8 Gross Interest Expense 204.7 175.8 EBITDA / Gross Interest Expense 11.1 x 12.6 x Total Debt / EBITDA 2.2 x 2.1 x Net Debt (b) / EBITDA 1.3 x 1.4 x Debt Bank Loans (Due Less Than 1 Year) $ 25 $ 10 CP & Borrowings Issued Under Revolver - - Senior Notes (c) 4,900 4,500 Other Debt 107 88 Total Debt $ 5,032 $ 4,598 Cash and Short Term Investments 1,969 1,430 Net Debt (b) $ 3,063 $ 3,168 Twelve Months Ended September 30

Historical Returns 15 October 18, 2016 Return on Invested Capital (ROIC) (a) : Twelve Months Ended September 30, 2016 19.4% Twelve Months Ended September 30, 2015 18.1% Return on Equity (b) : 15 Twelve Months Ended September 30, 2016 47.1% Twelve Months Ended September 30, 2015 39.6% (a) Return on Invested Capital is After Tax Reported Operating Income (a non - GAAP performance measure – see page 25 for the definiti on of this measure and page 23 for the reconciliation of non - GAAP financial measures) divided by the average of Invested Capital at the beginning and the end of the period (book value of all long - term liabilities and short - term interest bearing debt plus shareholders’ equity less cash, cash equivalents and short term investments). (b) Return on Equity is Reported Net Income for the given period divided by the average of shareholders’ equity at the beginning and end of the period.

Net Cash Returned to Shareholders through Dividends and Share Repurchases 16 October 18, 2016 0.6 0.7 1.0 1.2 1.6 2.0 2.4 2.9 3.3 2.6 2.6 3.8 4.5 5.4 5.9 7.0 7.7 8.1 $0.9 $1.8 $2.8 $3.6 $4.5 $5.4 $6.4 $7.4 $8.5 $9.6 $10.4 111% 92% 106% 106% 110% 107% 110% 110% 110% $- $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 YTD 2016 Cumulative Cost of Net Shares Repurchased - Payments for repurchases of common stock less proceeds from stock plans. Cumulative Dividends Paid Cumulative Net Income - Omnicom Group Inc. % of Cumulative Net Income Returned to Shareholders - Cumulative Dividends Paid plus Cumulative Cost of Net Shares Repurchased divided by Cumulative Net Income. 120% 142% From 2006 through September 30, 2016, Omnicom distributed 110% of Net Income to shareholders through Dividends and Share Repurchases . $ In Billions

Supplemental Financial Information October 18, 2016 17

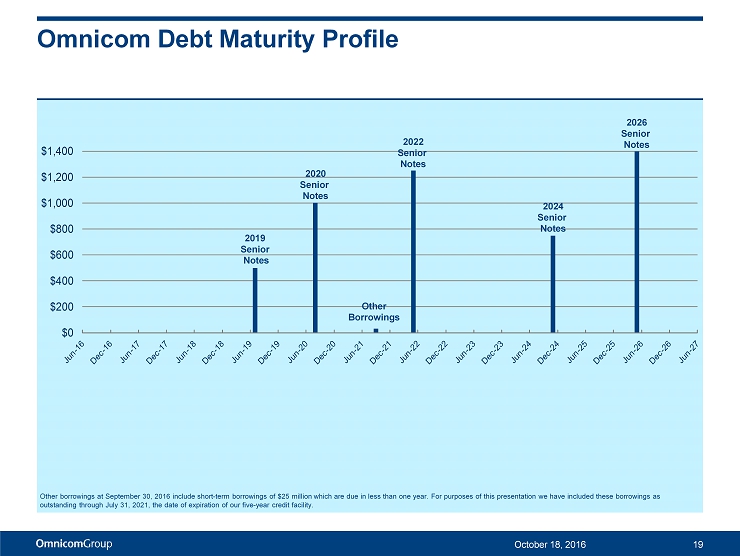

Omnicom Debt Structure Bank Loans $25 2026 Senior Notes $1,400 2024 Senior Notes $ 750 2022 Senior Notes $ 1,250 2020 Senior Notes $1,000 2019 Senior Notes $ 500 18 October 18, 2016 The above chart sets forth Omnicom’s debt outstanding at September 30, 2016. The amounts reflected above for the 2019, 2020, 2022, 2024 and 2026 Senior Notes represent the principal amount of these notes at maturity on July 15, 2019, August 15, 2020, May 1, 2022, November 1, 2024 and April 15, 2026, respectively.

Omnicom Debt Maturity Profile 19 October 18, 2016 Other borrowings at September 30, 2016 include short - term borrowings of $25 million which are due in less than one year. For purposes of this presentation we have included these borrowings as outstanding through July 31, 2021, the date of expiration of our five - year credit facility. $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 Other Borrowings 2019 Senior Notes 2020 Senior Notes 2022 Senior Notes 2024 Senior Notes 2026 Senior Notes

2016 Acquisition Related Expenditures 20 October 18, 2016 (a) Includes acquisitions of a majority interest in agencies resulting in their consolidation, including additional interest in e xis ting affiliate agencies resulting in majority ownership. (b) Includes the acquisition of additional equity interests in already consolidated subsidiary agencies which are recorded to Equ ity – Noncontrolling Interest. (c) Includes additional consideration paid for acquisitions completed in prior periods. (d) Total Acquisition Expenditures figure is net of cash acquired. Year to Date Acquisition of Businesses and Affiliates (a) 268.5$ Acquisition of Additional Noncontrolling Interests (b) 59.8 Contingent Purchase Price Payments (c) 93.6 Total Acquisition Expenditures (d) 421.9$

Condensed Cash Flow 21 October 18, 2016 2016 2015 Net Income 866.3$ 839.2$ Share-Based Compensation Expense 69.8 75.4 Depreciation and Amortization 220.3 218.7 Other Items to Reconcile to Net Cash Provided by Operating Activities, net (55.7) 4.6 Changes in Operating Capital (784.1) (697.1) Net Cash Provided by Operating Activities 316.6 440.8 Capital Expenditures (100.5) (145.6) (284.9) (23.1) Net Cash Used in Investing Activities (385.4) (168.7) Dividends (374.2) (373.9) Dividends paid to Noncontrolling Interest Shareholders (71.1) (86.7) Proceeds from Short-term & Long-term Debt, net 388.4 3.6 Stock Repurchases, net of Proceeds from Stock Plans and Excess Tax Benefit from Stock Plans (422.5) (473.7) Acquisition of Additional Noncontrolling Interests (59.8) (7.7) Contingent Purchase Price Payments (93.6) (55.6) Other Financing Activities, net (24.7) (28.0) Net Cash Used in Financing Activities (657.5) (1,022.0) Effect of exchange rate changes on cash and cash equivalents 57.7 (210.7) Net Decrease in Cash and Cash Equivalents (668.6)$ (960.6)$ Nine Months Ended September 30 Acquisition of Businesses and Affiliates and (Purchases of)/Proceeds from Sales of Investments, net

Reconciliation of Non - GAAP Financial Measures 22 October 18, 2016 The above reconciles EBITDA and EBITA to the GAAP financial measures for the periods presented. EBITDA and EBITA are non - GAAP performance measures within the meaning of applicable Securities and Exchange Commission (“SEC”) rules and regulations. Our credit facility defines EBITDA as earnings before deducting interest expense, income taxes, depreciation and amortization. Our credit facili ty uses EBITDA to measure our compliance with covenants, such as interest coverage and leverage ratios, as presented on page 14 of this presentation. 2016 2015 2016 2015 2016 2015 Revenue $ 3,791.1 $ 3,706.6 $ 11,175.1 $ 10,981.1 $ 15,328.4 $ 15,176.2 Operating Expenses, excluding Depreciation and Amortization 3,264.9 3,206.5 9,547.8 9,417.8 13,053.3 12,956.4 EBITDA 526.2 500.1 1,627.3 1,563.3 2,275.1 2,219.8 Depreciation 44.1 45.4 134.6 137.9 178.5 185.0 EBITA 482.1 454.7 1,492.7 1,425.4 2,096.6 2,034.8 Amortization of Intangibles 29.0 26.4 85.7 80.8 114.2 110.8 Operating Income 453.1 428.3 1,407.0 1,344.6 1,982.4 1,924.0 Net Interest Expense 42.0 35.9 127.0 104.7 163.6 134.7 Income Before Tax 411.1 392.4 1,280.0 1,239.9 1,818.8 1,789.3 Taxes 134.3 128.9 417.7 406.9 594.4 589.1 Income from Equity Method Investments 1.4 3.2 4.0 6.2 6.2 12.0 Net Income 278.2 266.7 866.3 839.2 1,230.6 1,212.2 Less: Net Income Attributed to Noncontrolling Interests 24.4 27.4 68.0 76.9 100.7 120.4 Net Income - Omnicom Group $ 253.8 $ 239.3 $ 798.3 $ 762.3 $ 1,129.9 $ 1,091.8 3 Months Ended September 30 12 Months Ended September 309 Months Ended September 30

Reconciliation of Non - GAAP Financial Measures October 18, 2016 23 2016 2015 Free Cash Flow 1,100.7$ 1,137.9$ Items excluded from Free Cash Flow: Changes in Operating Capital (784.1) (697.1) Net Cash Provided by Operating Actvities 316.6$ 440.8$ Nine Months Ended September 30 2016 2015 Reported Operating Income 1,982.4$ 1,924.0$ Effective Tax Rate for the applicable period 32.7% 32.9% Income Taxes on Reported Operating Income 648.2 633.0 After Tax Reported Operating Income 1,334.2$ 1,291.0$ Twelve Months Ended September 30 2016 2015 Net Free Cash Flow (305.9)$ (28.4)$ Cash Flow items excluded from Net Free Cash Flow: Changes in Operating Capital (784.1) (697.1) Proceeds from Short-term & Long-term Debt, net 388.4 3.6 Other Financing Activities, net (24.7) (28.0) Effect of exchange rate changes on cash and cash equivalents 57.7 (210.7) Net Decrease in Cash and Cash Equivalents (668.6)$ (960.6)$ Nine Months Ended September 30

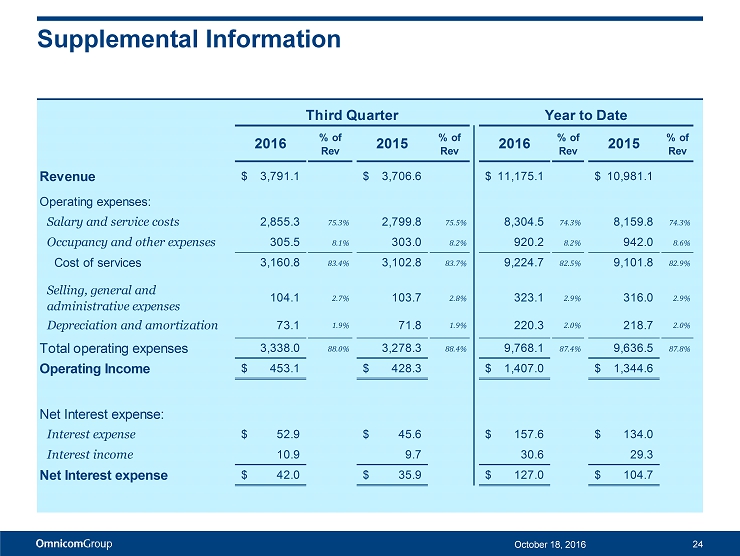

Supplemental Information 24 October 18, 2016 2016 % of Rev 2015 % of Rev 2016 % of Rev 2015 % of Rev Revenue 3,791.1$ 3,706.6$ 11,175.1$ 10,981.1$ Operating expenses: Salary and service costs 2,855.3 75.3% 2,799.8 75.5% 8,304.5 74.3% 8,159.8 74.3% Occupancy and other expenses 305.5 8.1% 303.0 8.2% 920.2 8.2% 942.0 8.6% Cost of services 3,160.8 83.4% 3,102.8 83.7% 9,224.7 82.5% 9,101.8 82.9% Selling, general and administrative expenses 104.1 2.7% 103.7 2.8% 323.1 2.9% 316.0 2.9% Depreciation and amortization 73.1 1.9% 71.8 1.9% 220.3 2.0% 218.7 2.0% Total operating expenses 3,338.0 88.0% 3,278.3 88.4% 9,768.1 87.4% 9,636.5 87.8% Operating Income 453.1$ 428.3$ 1,407.0$ 1,344.6$ Net Interest expense: Interest expense 52.9$ 45.6$ 157.6$ 134.0$ Interest income 10.9 9.7 30.6 29.3 Net Interest expense 42.0$ 35.9$ 127.0$ 104.7$ Third Quarter Year to Date

The preceding materials have been prepared for use in the October 18, 2016 conference call on Omnicom’s results of operations fo r the period ended September 30, 2016. The call will be archived on the Internet at http://investor.omnicomgroup.com/investor - relations/news - events - and - filings / . Forward - Looking Statements Certain statements in this presentation constitute forward - looking statements, including statements within the meaning of the Pr ivate Securities Litigation Reform Act of 1995. In addition, from time to time, the Company or its representatives have made, or may make, forward - looking statements, orally or in writing. These stateme nts may discuss goals, intentions and expectations as to future plans, trends, events, results of operations or financial condition, or otherwise, based on current beliefs of the Company’s managem ent as well as assumptions made by, and information currently available to, the Company’s management. Forward - looking statements may be accompanied by words such as “aim,” “anticipate,” “believe,” “plan,” “could,” “should,” “would,” “estimate,” “expect,” “forecast,” “future,” “guidance,” “intend,” “may,” “will,” “possible,” “potential,” “predict,” “project” or similar words, phrases or expressions. The se forward - looking statements are subject to various risks and uncertainties, many of which are outside the Company’s control. Therefore, you should not place undue reliance on such statements. Factors that c oul d cause actual results to differ materially from those in the forward - looking statements include: international, national or local economic conditions that could adversely affect the Company or i ts clients; losses on media purchases and production costs incurred on behalf of clients; reductions in client spending, a slowdown in client payments and a deterioration in the credit markets; ability t o a ttract new clients and retain existing clients in the manner anticipated; changes in client advertising, marketing and corporate communications requirements; failure to manage potential conflicts of interest be tween or among clients; unanticipated changes relating to competitive factors in the advertising, marketing and corporate communications industries; ability to hire and retain key personnel; curr enc y exchange rate fluctuations; reliance on information technology systems; changes in legislation or governmental regulations affecting the Company or its clients; risks associated with assumptions th e C ompany makes in connection with its critical accounting estimates and legal proceedings; and the Company’s international operations, which are subject to the risks of currency repatriation restri cti ons, social or political conditions and regulatory environment. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties tha t may affect the Company’s business, including those described in the “Risk Factors” in Omnicom’s Annual Report on Form 10 - K for the year ended December 31, 2015. Except as required under applicable law, the Company does not assume any obligation to update these forward - looking statements. Non - GAAP Financial Measures We present financial measures determined in accordance with generally accepted accounting principles in the United States (“G AAP ”) and adjustments to the GAAP presentation (“Non - GAAP”), which we believe are meaningful for understanding our performance. Non - GAAP financial measures should not be considered in isolation f rom, or as a substitute for, financial information presented in compliance with GAAP. Non - GAAP financial measures as reported by us may not be comparable to similarly titled amounts reported b y other companies. We provide a reconciliation of non - GAAP measures to the comparable GAAP measures on pages 22 and 23. The Non - GAAP measures used in this presentation include the following: Free Cash Flow, defined as net income plus depreciation, amortization, share based compensation expense plus/(less) other it ems to reconcile to net cash provided by operating activities. We believe Free Cash Flow is a useful measure of liquidity to evaluate our ability to generate excess cash from our operations. Primary Uses of Cash, defined as dividends to common shareholders, dividends paid to non - controlling interest shareholders, capital expe nditures, cash paid on acquisitions, payments for additional interest in controlled subsidiaries and stock repurchases, net of the proceeds and excess tax benefit from our stock plans, a nd excludes changes in operating capital and other investing and financing activities, including commercial paper issuances and redemptions used to fund working capital changes . We believe this liquidity measure is useful in identifying the significant uses of our cash. Net Free Cash Flow, defined as Free Cash Flow less the Primary Uses of Cash. Net Free Cash Flow is one of the metrics used by us to assess our sources and uses of cash and was derived from our consolidated statements of cash flows. We believe that this liquidity measure is meaningful for understanding our primary sources and primary uses of that cash flow. EBITDA, defined as operating income before interest, taxes, depreciation and amortization. We believe EBITDA is meaningful operating performance measure because the financial covenants in our credit facilities are based on EBITDA. EBITA, defined as operating income before interest, taxes and amortization. We use EBITA as an additional operating performan ce measure, which excludes the non - cash amortization expense of intangible assets (primarily consisting of amortization arising from acquisitions), because we believe it is a useful measure for investors to evaluate the performance of our businesses. Net Debt, defined as total debt less cash, cash equivalents and short - term investments. We believe net debt, together with the c omparable GAAP measures, reflects one of the liquidity metrics used by us to assess our cash management. After Tax Reported Operating Income, defined as reported operating income less income taxes calculated using the effective ta x r ate for the applicable period. Management uses after tax operating income as a measure of after tax operating performance as it excludes the after tax effects of financing and investing activi tie s on results of operations. Other Information All dollar amounts are in millions except for per share amounts and figures shown on pages 3 and 6 and the net cash returned to shareholders figures on page 16. The information contained in this document has not been audited, although some data has been derived from Omnicom’s historical financial statements, including its audited financial statements. In addition, industry, operational and other non - financial data contained in this document have been derived from sources that we believe to be reliable, but we have n ot independently verified such information, and we do not, nor does any other person, assume responsibility for the accuracy or completeness of that information. Certain amounts in prior periods ha ve been reclassified to conform to our current presentation. The inclusion of information in this presentation does not mean that such information is material or that disclosure of such inf ormation is required. Disclosure October 18, 2016 25

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Wells Fargo Upgrades Omnicom Group (OMC) to Overweight

- Early Warning News Release

- Notice of 2024 First Quarter Results Conference Call and Webcast for Investors and Analysts and Annual Meeting of Shareholders

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share