Form 8-K SALESFORCE COM INC For: Oct 04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________________

FORM 8-K

________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

October 4, 2016

Date of Report (Date of earliest event reported)

__________________________________________________________

salesforce.com, inc.

(Exact name of registrant as specified in its charter)

__________________________________________________________

Delaware | 001-32224 | 94-3320693 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (I. R. S. Employer Identification No.) | ||

The Landmark @ One Market, Suite 300

San Francisco, CA 94105

(Address of principal executive offices)

Registrant’s telephone number, including area code: (415) 901-7000

N/A

(Former name or former address, if changed since last report)

________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 8.01 Other Events.

On October 4, 2016, salesforce.com, inc., a Delaware corporation (the “Company”), posted to its website an investor presentation that the Company presented at its Analyst Day event held and audiocast live on its website on that date, including information regarding the Company’s financial performance, market opportunity, competitive position and economic model. A copy of the presentation is included with this Form 8-K for convenience and attached hereto as Exhibit 99.1.

The information in this current report on Form 8-K and the exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit No. | Description | |

99.1 | Salesforce.com, inc. investor presentation dated October 4, 2016 | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: October 4, 2016 | SALESFORCE.COM, INC. | |||||||

By: | /s/ Mark J. Hawkins | |||||||

Name: | Mark J. Hawkins | |||||||

Title: | Executive Vice President and Chief Financial Officer | |||||||

EXHIBIT INDEX

Exhibit No. | Description | |

99.1 | Salesforce.com, inc. investor presentation dated October 4, 2016 | |

Safe Harbor

Safe harbor statement under the Private Securities Litigation Reform Act of 1995:

This presentation contains forward-looking statements about our financial and operational results. The achievement or success of the

matters covered by such forward-looking statements involves risks, uncertainties and assumptions. If any such risks or uncertainties

materialize or if any of the assumptions prove incorrect, our results could differ materially from the results expressed or implied by the

forward-looking statements we make.

The risks and uncertainties referred to above include -- but are not limited to -- risks associated with past and future acquisitions; risks

associated with possible fluctuations in our financial and operating results, such as our rate of growth and anticipated revenue run rate;

foreign currency exchange rates; errors, interruptions or delays in our services or our Web hosting; breaches of our security measures; the

nature of our business model; our ability to continue to release, and gain customer acceptance of, new and improved versions of our

services; successful customer deployment and utilization of our existing and future services; changes in our sales cycle; competition; various

financial aspects of our subscription model; unexpected increases in attrition or decreases in new business; our ability to realize benefits

from strategic partnerships and strategic investments; the emerging markets in which we operate; unique aspects of entering or expanding in

international markets, our ability to hire, retain and motivate employees and manage our growth; changes in our customer base;

technological developments; regulatory developments; litigation related to intellectual property and other matters, and any related claims,

negotiations and settlements; unanticipated changes in our effective tax rate; factors affecting our outstanding convertible notes and

revolving credit facility; fluctuations in the number of our shares outstanding and the price of such shares; collection of receivables; interest

rates; factors affecting our deferred tax assets and ability to value and utilize them; the potential negative impact of indirect tax exposure; the

risks and expenses associated with our real estate and office facilities space; and general developments in the economy, financial markets,

and credit markets.

Further information on these and other factors that could affect the financial results of salesforce.com, inc. is included in the reports on Forms

10-K, 10-Q and 8-K and in other filings we make with the Securities and Exchange Commission, available on the SEC Filings section of the

Investor Information section of our Investor Relations website.

Any unreleased services or features referenced in this or other presentations, press releases or public statements are not currently available

and may not be delivered on time or at all. Customers who purchase our services should make the purchase decisions based upon features

that are currently available. Salesforce.com, inc. assumes no obligation and does not intend to update these forward-looking statements.

`

Agenda

Tuesday, October 4

Mark Hawkins

David Havlek

Alex Dayon

Mike Rosenbaum

Bob Stutz

Stephanie Buscemi

Adam Seligman

John Wookey

Keith Block

Tyler Prince

10:00a

Business

Review &

Q&A

11:30a

Lunch 1:00p

Product

Q&A

2:45p

Go-to-

Market Q&A

Parker Harris

4:15p

Technology

Q&A

St. Regis Foyer

5:00p

Reception

St. Regis Terrace

`

Agenda

Wednesday, October 5

Mark Hawkins

David Havlek

Keith Block

Tyler Prince

10:00a

Business

Review &

Q&A

11:30a

Lunch

2:45p

Go-to-

Market Q&A

Parker Harris

4:15p

Technology

Q&A

St. Regis Foyer

5:00p

Reception

St. Regis Terrace

Wed. 10/5

3:30p

CEO Q&A

Marc Benioff

Alex Dayon

Mike Rosenbaum

Bob Stutz

Stephanie Buscemi

Adam Seligman

John Wookey

1:00p

Product

Q&A

IoT

Scaling to $20B and Beyond

Salesforce Investor Day

October 4, 2016

Competitive

Advantage with

Strong Core

MARK HAWKINS

CFO

`

1All references to operating margin refer to non-GAAP operating margin. Non-GAAP operating margin excludes the effects of stock-based compensation, amortization of purchased intangibles, lease termination resulting from purchase of office

building, and the potential impact of FX and M&A. A complete reconciliation of GAAP to non-GAAP measures can be found in the Appendix and at www.salesforce.com.

Growth/Margin Framework is Our Compass…

Balancing growth with improving profitability

PRIORITY

REV. GROWTH

NON-GAAP

OP. MARGIN

OCF GROWTH

Top Line

> 30%

Flat to Up Slightly

< Revenue Growth

Top & Bottom Line

20%-30%

+100-300 bps

≈ Revenue Growth

Bottom Line

< 20%

+200-400 bps

> Revenue Growth

HIGH GROWTH GROWTH LOW GROWTH

1

Mid-30s

percent

LONG-TERM OP.

MARGIN AT MATURITY

…and We’re on the Right Path

Strong core performance

Note: FY17 estimates represent guidance ranges provided August 31, 2016. Non-GAAP operating margin excludes the effects of stock-based compensation, amortization of purchased intangibles, and lease termination resulting from purchase of office

building. A complete reconciliation of GAAP to non-GAAP measures can be found in the Appendix and atwww.salesforce.com.

$4,071M

$5,374M

$6,667M

$8,275M-

$8,325M

8.9%

10.7%

12.4%

13.1%

FY14 FY15 FY16 FY17E

Revenue Non-GAAP Operating Margin

$884M

$1,181M

$1,672M

$2,000M+

FY14 FY15 FY16 FY17E

Operating Cash Flow

REVENUE

FY14 – FY17E

OCF

FY14 – FY17E

20%-

21%

Y/Y

EST.

Positioned for $20 Billion and Beyond

Fourth largest enterprise software company

Note: Salesforce consensus based on FY17 and FY18 analyst estimates per FactSet. All other consensus estimates represent annualized CY2016 and CY2017 per FactSet.

Welcome to

Base Camp

MT. REVENUE

Rank Company

FY17

Consensus

FY18

Consensus

YoY

Growth Rate

1 Microsoft $93.3 B $97.2 B 4%

2 Oracle $37.5 B $38.2 B 2%

3 SAP $24.3 B $25.8 B 6%

4 Salesforce $8.3 B $10.1 B 22%

5 VMware $7.0 B $7.3 B 4%

$7B $8B $9B $10B $11B

$12B $13B

$15B $17B

$19B

$26B

$28B

$30B

$32B

$34B $7B

$8B

$10B

$12B

$14B

$14B

$15B

$17B

$18B

$19B

$5B

$6B

$6B

$7B

$8B

$70B

$78B

$86B

$95B

$105B

2016 2017 2018 2019 2020

Total Market 11%

19%

CAGR % CY16-20

15%

8%

8%

13%

12%

Current Products Support $20 Billion Objective

Massive and growing TAM

Calculations performed by Salesforce and charts/graphics created by Salesforce based on Gartner research. Source: Gartner Forecast Enterprise Software Markets, Worldwide, 2013-2020, 3Q16 Update; Sales Cloud market defined as Sales; Service

Cloud market defined as Customer Service and Support; Marketing Cloud market defined as Marketing; Commerce Cloud market defined as Digital Commerce Platforms; Analytics Cloud market defined as Modern BI Platforms, Traditional BI

Platforms, Analytic Applications and Performance Management, and Advanced Analytics Platforms; App & Other market defined as Application Platform Software, Other AD, Application Platform as a Service (aPaaS), Business Process Management

Suites, Data Integration Tools, Identity Governance and Administration, Mobile App Development Platforms, Testing, Web Access Management (WAM), Application Services Governance, Collaboration/Social Software Suites, and Portal and Digital

Engagement Technologies. Annual totals and CAGRs are based on actual numbers and not on rounded numbers shown above.

COMMERCE

ANALYTICS

MARKETING

APP & OTHER

SERVICE

SALES

Consistent Share Gain

Extending our #1 CRM market share position

Source: Industry analysts, market research and Salesforce estimates. CRM market includes sales, customer service and support, and marketing software.

5.7%

4.3%

12.6%

7.8%

14.3%

10.2% 10.6%

19.7%

FY11 FY12 FY13 FY14 FY15 FY16

`

Competitive Advantage

Product Strength and

Innovation

Large, Loyal

Installed Base

World-Class Team

and Culture

Cloud

Mobile

Social

IoT

AI

17 Years of Unmatched Customer Innovation

Leader in capitalizing on key technology shifts

Multi-tenant

Cloud

Thunder

IoT Cloud

AppExchange

2005

Force.com

2007

Chatter

2009

Salesforce1

2013

Lightning

Platform

2014

Salesforce IQ

2015 1999

Wave

Analytics Cloud

Cloud

Socia

l

Mobile

IoT

AI

2016

Salesforce

Einstein

Undisputed CRM Product Leader

Community

Cloud

App

Cloud

Service

Cloud

Sales

Cloud

Marketing

Cloud

CommerceC

loud

Industry-Leading Products

Sources: Industry analyst reports.

Innovator of

the Decade

MT. PRODUCT

Strategy Focused on the Front Office

Everything we do is about the customer

Assisted

Service

Smart

Apps

Connected

Products

Intelligent

Communities

Actionable

Analytics

Guided

Sales

Unified

Commerce

Predictive

Marketing

M&A Strategy is Two-Fold

Augments existing clouds or accelerates new product initiatives

Minhash

Sales

Service

Marketing

Community

Analytics

Platform & Apps

Commerce

Einstei

n

Lightning

force.com

Heroku

AppExchange

Thunder

Sale

s

Service Marketing Community Analytics Apps Commerce IoT

Predictive

Analytics

Machine &

Deep Learning

Natural

Language

Processing &

Generation Platform

Applications

Email, Calendar

& Social Data

CRM Data

IoT Events

Quip

The World’s Smartest CRM Platform

`

Rank Company Annual Revenue

Run Rate1

Growth Rate

YoY

1 Sales Cloud $3,020 M 13%

2 Service Cloud $2,302 M 29%

3 App Cloud & Other $1,414 M 43%

4 Workday $1,225 M 37%

5 ServiceNow $1,163 M 45%

6 Marketing Cloud $810 M 28%

7 NetSuite $721 M 28%

8 Ultimate Software $634 M 27%

9 Veeva $421 M 40%

10 Medidata Solutions $387 M 15%

by revenue as of Q2 2016

1

…and Salesforce powers

5 of the

top 10

pure-play public cloud companies…

Our clouds represent

4 o

1Figures represent annualized subscription and support revenue run rate for the most recently completed quarterly filings as of Q2 CY2016. All amounts in millions. Source: FactSet.

We Own The Top Three Pure-Play Clouds

Multiple drivers of customer and shareholder value

`

`

1Represents percentage of new business in which partners were involved during H117.

2Represents the increase in certified consultants during FY16

Unparalleled Cloud Ecosystem

Partners accelerate our value and opportunity

49%

Partner involvement

in new business

+30%

Number of certified

consultants 4M

Appexchange

installations

1

2

`

Competitive Advantage

Cloud

Mobile

Social

IoT

AI

World-Class Team

and Culture

Large, Loyal

Installed Base

Product Strength and

Innovation

1M Completed

Badges

Trailhead Creates Customer Advocacy

Trailhead makes it fun and easy to learn Salesforce

TRAILS

32

`

Note: Chart of dollar attrition as a percentage of revenue when compared to the year-ago period for Sales Cloud, Service Cloud and the Force.com Platform. Numbers represent the second quarter for each respective year. $500 million run-rate savings

is calculated by applying the difference in attrition rate from Q211 to Q217 by FY16 annual revenue.

Customer Loyalty Drives Declining Attrition

Attrition rate is down 45% since FY11

0%

10%

20%

Q211 Q212 Q213 Q214 Q215 Q216 Q217

run-rate savings

~$500M

dollar attrition

<9%

Installed Base is an Important Growth Asset

150K+ customers and growing

Note: Ratios are based on annual revenue contribution for the four fiscal quarters ending Q217.

40%

60%

70%

30%

ADD-ONS &

UPGRADES

NEW PRODUCTS

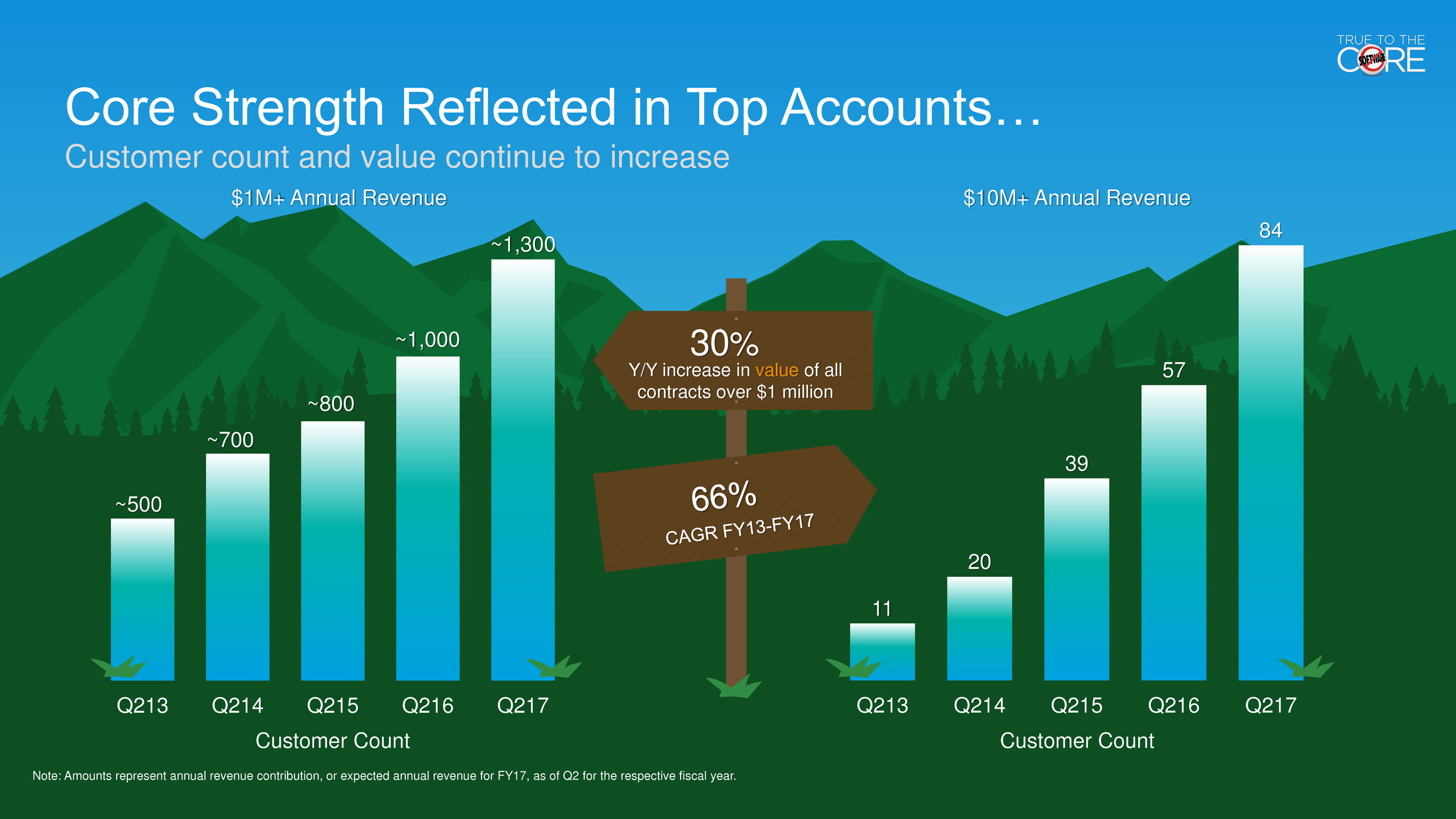

Core Strength Reflected in Top Accounts…

Customer count and value continue to increase

11

20

39

57

84

Q213 Q214 Q215 Q216 Q217

Note: Amounts represent annual revenue contribution, or expected annual revenue for FY17, as of Q2 for the respective fiscal year.

Customer Count

~500

~700

~800

~1,000

~1,300

Q213 Q214 Q215 Q216 Q217

Customer Count

$1M+ Annual Revenue $10M+ Annual Revenue

Y/Y increase in value of all

contracts over $1 million

30%

…and is Matched by Strength in SMB

Revenue from SMB customers has grown >30% annually

Note: Amounts represent annual revenue contribution, or expected annual revenue for FY17, as of Q2 for the respective fiscal year. Q217 SMB annual revenue contribution more than three times larger than Q213 SMB annual revenue contribution.

SMB is defined as customers with up to 3,500 employees.

8%

11%

15%

19%

22%

92%

89%

85%

81%

78%

Q213

Q214

Q215

Q216

Q217

Proportion of Revenue from Customers

Paying >$1M annually

Proportion of Revenue from Customers

Paying <$1M annually

SMB Annual Revenue Contribution

3X

`

`

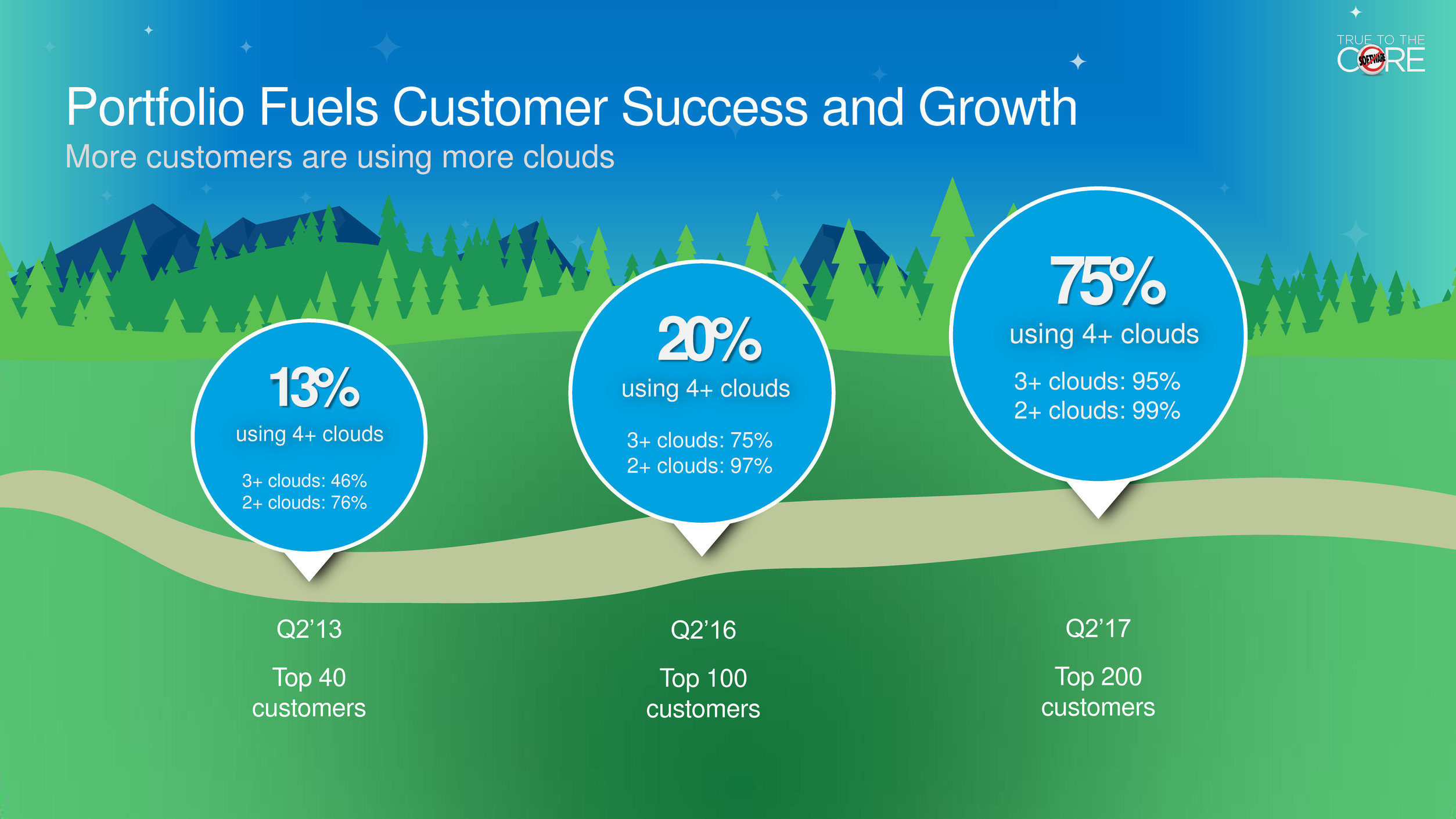

Portfolio Fuels Customer Success and Growth

More customers are using more clouds

Q2’13

Top 40

customers

13%

using 4+ clouds

Q2’16

Top 100

customers

20%

using 4+ clouds

Q2’17

Top 200

customers

75%

using 4+ clouds

3+ clouds: 46%

2+ clouds: 76%

3+ clouds: 75%

2+ clouds: 97%

3+ clouds: 95%

2+ clouds: 99%

`

Competitive Advantage

Product Strength and

Innovation

World-Class Team

and Culture

Large, Loyal

Installed Base

Cloud

Mobile

Social

IoT

AI

`

Salesforce Core Values

Our culture is a competitive advantage

Salesforce has its customers in its DNA.

The laser focus on customer value is

unrelenting. I love it.

SAIDEEP RAJ

MANAGING DIRECTOR, ACCENTURE

“

”

“ We wouldn’t be able to serve this many

communities if it weren’t for Salesforce.

JAY BANFIELD

EXECUTIVE DIRECTOR, YEAR UP BAY AREA

”

It’s an awesome product that helps you do

awesome things.

GITA BOROVSKY

DIRECTOR OF CRM,AMERICAN RED CROSS

“

”

This place oozes energy and passion

… that energy makes this place different.

TAYLOR HILFICKER

BUSINESS MANGER, BRAND, SALESFORCE

“

”

Unique Investments in Our Culture…

Creates customer and employee advocacy

Equality for All Women’s Leadership Environment

Women

in tech

Equa

l

pay

Net-Zero

by 2020

98% more

carbon efficient

Tony Prophet as new

Chief Equality Officer

$3M

salary

adjustment

for equal pay

1% Time 1% Equity 1% Product

4K

6K

9K

13K

15K

18K

23K

Q211 Q212 Q213 Q214 Q215 Q216 Q217

…Make us a Destination Employer…

San Francisco’s largest technology employer

Full-Time Headcount

… and a Magnet for Proven and Visionary Leaders

Neelie Kroes

Former VP of the European Commission,

Board Member

Bob Stutz

CEO, Marketing Cloud &

Chief Analytics Office

Tony Prophet

Chief Equality Officer

Bret Taylor

CEO, Quip

Richard Socher

Chief Scientist

Scaling to $20B and Beyond

$100B

TAM

Large, Loyal

Installed Base

Customer

Focused Culture

Track Record

of Innovation

Industry Leading

Products

Benefits of Scale

with Strong

Economics

DAVID HAVLEK

EVP, Finance

Benefits of Scale

P&L

Balance Sheet

& Cash Flow

Long-term

Economics

`

1All references to operating margin refer to non-GAAP operating margin. Non-GAAP operating margin excludes the effects of stock-based compensation, amortization of purchased intangibles, lease termination resulting from purchase of office

building, and the potential impact of FX and M&A. A complete reconciliation of GAAP to non-GAAP measures can be found in the Appendix and at www.salesforce.com.

Growth/Margin Framework is Our Compass

Balancing growth with improving profitability

PRIORITY

REV. GROWTH

NON-GAAP

OP. MARGIN

OCF GROWTH

Top Line

> 30%

Flat to Up Slightly

< Revenue Growth

Top & Bottom Line

20%-30%

+100-300 bps

≈ Revenue Growth

Bottom Line

< 20%

+200-400 bps

> Revenue Growth

HIGH GROWTH GROWTH LOW GROWTH

1

Mid-30s

percent

LONG-TERM OP.

MARGIN AT MATURITY

`

Note: FY17 estimate represents revenue guidance range provided August 31, 2016. *The FY17 constant currency growth rate represents the constant currency growth rate for the first half of fiscal 2017. Non-GAAP revenue constant currency growth

rates as compared to the comparable prior period. We present constant currency information for revenue to provide a framework for assessing how our underlying business performed excluding the effects of foreign currency rate fluctuations. To

present constant currency revenue, current and comparative prior period results for entities reporting in currencies other than United States dollars are converted into United States dollars at the weighted average exchange rate for the quarter being

compared to for growth rate calculations presented, rather than the actual exchange rates in effect during that period.

Sustained Growth at Scale

Forms the foundation for $20 billion objective

$1,657M

$2,267M

$3,050M

$4,071M

$5,374M

$6,667M

$8,275M-

$8,325M

28%

35%

37%

34% 33%

27% 27%*

FY11 FY12 FY13 FY14 FY15 FY16 FY17E

Annual Revenue C/C Growth Rate

(1H FY17)

Scale Benefits Margin Improvement

Absorbing M&A and investing in growth

Note: Non-GAAP operating margin excludes the effects of stock-based compensation, amortization of purchased intangibles, and lease termination resulting from purchase of office building. A complete reconciliation of GAAP to non-GAAP measures

can be found in the Appendix and atwww.salesforce.com.

5%

10%

15%

0

2,000

4,000

FY12 FY13 FY14 FY15 FY16 1H FY17

Organic Hiring Acquired Headcount NG Operating Margin

bluetail

Minhash

Net H

e

a

d

c

o

u

n

t

Add

iti

o

n

s

No

n

-GA

A

P

Ope

rat

in

g

Ma

rg

in

`

Scale Helps Navigate Through Variability

Managing through FX volatility

USD / JPY EUR / USD GBP / USD

International Growth Outpacing Americas

Increasing investment in datacenters and headcount

Note: Revenue growth rates represent constant currency revenue growth. Non-GAAP revenue constant currency growth rates as compared to the comparable prior period. We present constant currency information for revenue to provide a framework

for assessing how our underlying business performed excluding the effects of foreign currency rate fluctuations. To present constant currency revenue, current and comparative prior period results for entities reporting in currencies other than United

States dollars are converted into United States dollars at the weighted average exchange rate for the quarter being compared to for growth rate calculations presented, rather than the actual exchange rates in effect during that period.

21%

3 year

headcount CAGR

30%

3 year

headcount CAGR

27%

3 year

headcount CAGR

24%

Q217 revenue

growth

32%

Q217 revenue

growth

29%

Q217 revenue

growth

Americas

1999+

EMEA

2014 2015 2015

APAC

2011

Foreign Currency Landscape

4 Regional Hubs

USD

CAD

GBP

EUR

AUD

JPY

USD

3 Functional Currencies

Multiple Billing Currencies

USD

FX Impacts to Growth and Margin

Example of a European contract

TRANSLATIONAL

FX

TRANSLATIONAL

FX

TRANSACTIONAL FX Billing

Currency

Functional

Currency

Consolidated

Currency

DR and Revenue Expenses

Benefits of Scale

P&L

Balance Sheet

& Cash Flow

Long-term

Economics

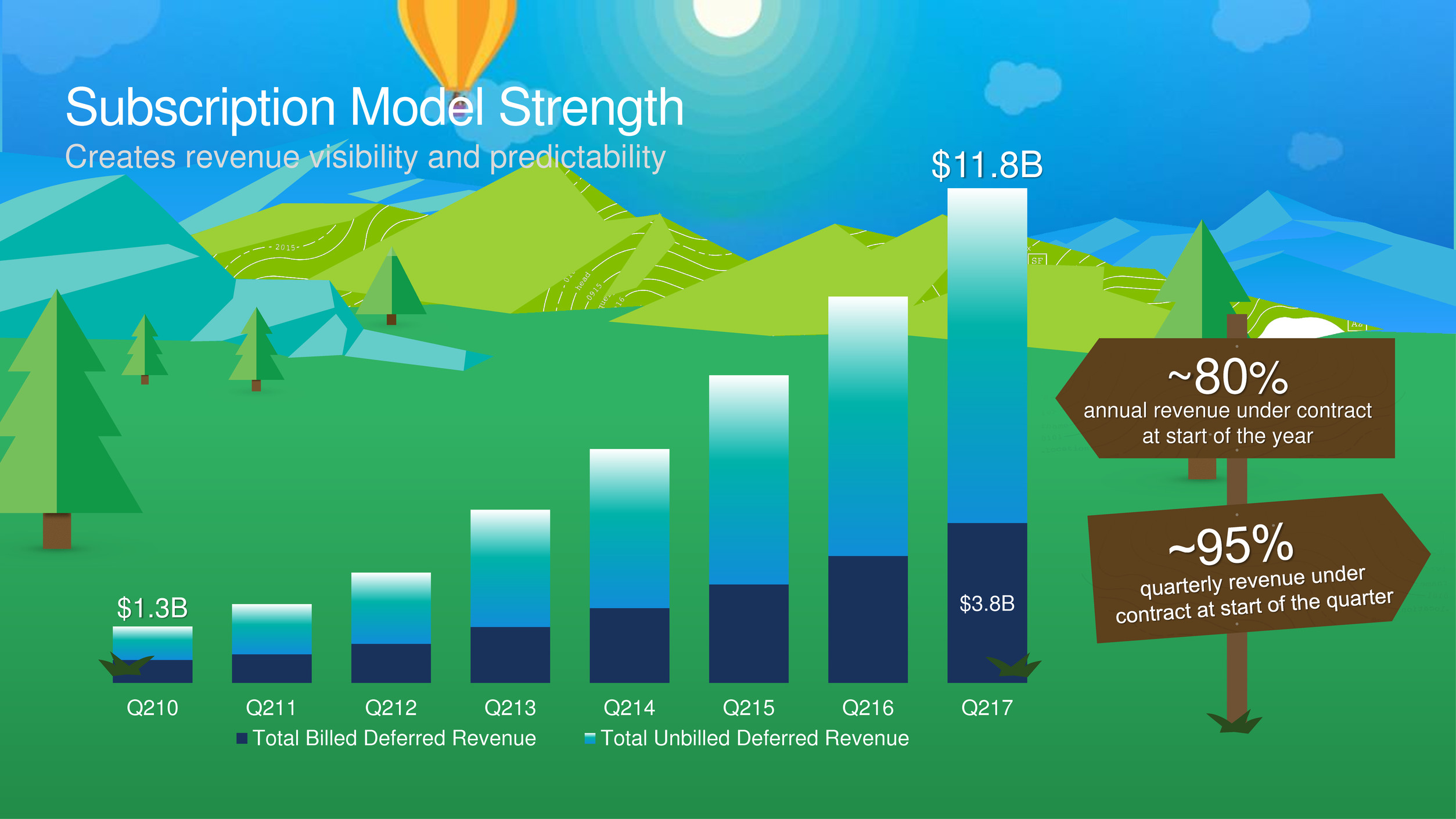

Subscription Model Strength

Creates revenue visibility and predictability

$3.8B $1.3B

$11.8B

Q210 Q211 Q212 Q213 Q214 Q215 Q216 Q217

Total Billed Deferred Revenue Total Unbilled Deferred Revenue

annual revenue under contract

at start of the year

~80%

Multiple Factors Impact Deferred Revenue

Creates growing invoicing seasonality as we scale

Co-terming

(Seasonality)

Compounding

(Seasonality)

Amortization

(Consistent)

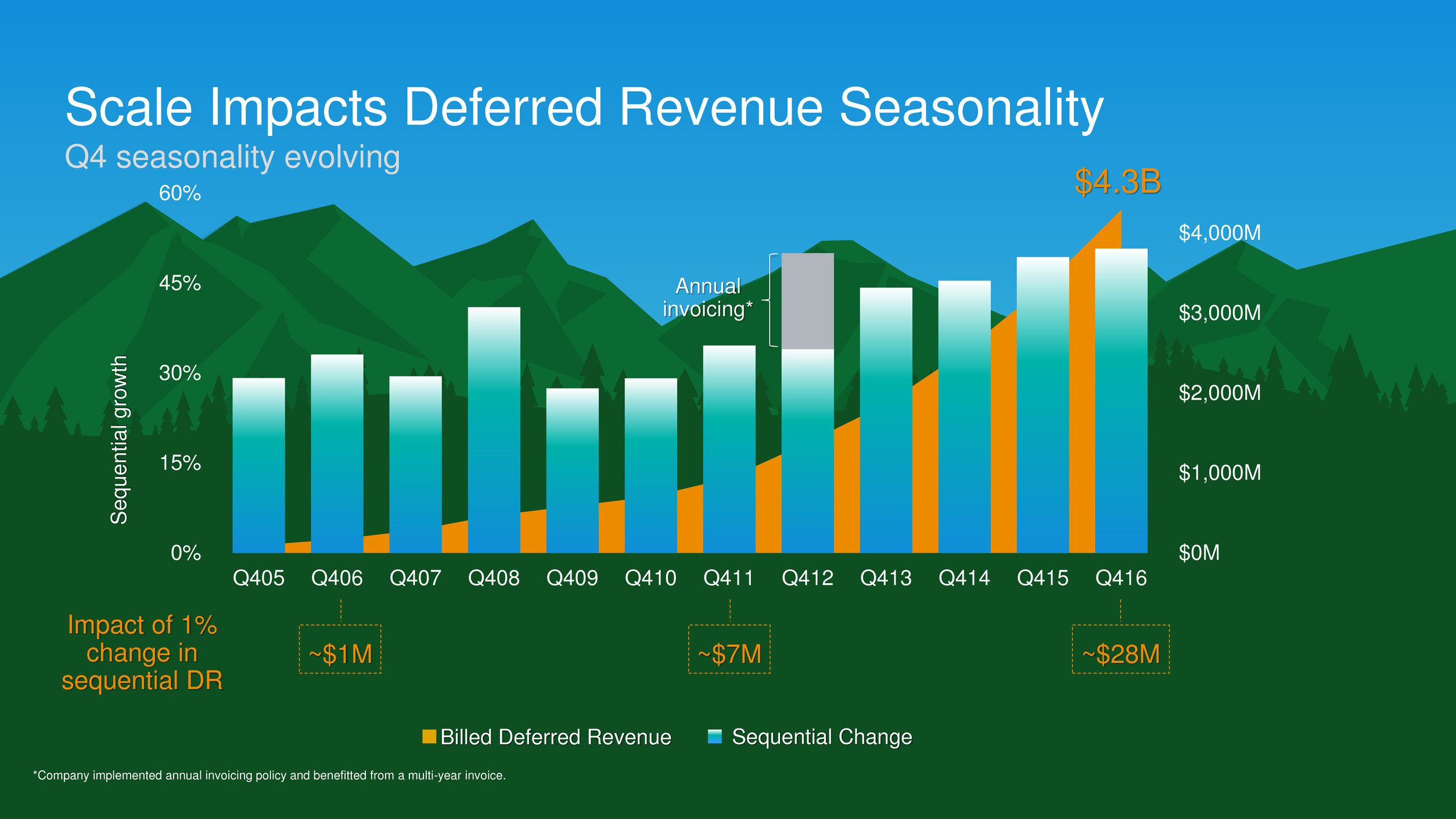

Scale Impacts Deferred Revenue Seasonality

Q1 seasonality evolving

-10%

-5%

0%

5%

10%

15%

20%

Q105 Q106 Q107 Q108 Q109 Q110 Q111 Q112 Q113 Q114 Q115 Q116 Q117

Seq

u

e

n

ti

a

l

g

rowt

h

Scale Impacts Deferred Revenue Seasonality

Q2 seasonality evolving

-10%

-5%

0%

5%

10%

15%

20%

Q205 Q206 Q207 Q208 Q209 Q210 Q211 Q212 Q213 Q214 Q215 Q216 Q217

Seq

u

e

n

ti

a

l

g

rowt

h

Scale Impacts Deferred Revenue Seasonality

Q3 seasonality evolving

1Q3’17 deferred revenue guidance as of August 31st, 2016.

-10%

-5%

0%

5%

10%

15%

20%

Q305 Q306 Q307 Q308 Q309 Q310 Q311 Q312 Q313 Q314 Q315 Q316 Q317

Seq

u

e

n

ti

a

l

g

rowt

h

Guide1

Scale Impacts Deferred Revenue Seasonality

Q4 seasonality evolving

$0M

$1,000M

$2,000M

$3,000M

$4,000M

0%

15%

30%

45%

60%

Q405 Q406 Q407 Q408 Q409 Q410 Q411 Q412 Q413 Q414 Q415 Q416

Seq

u

e

n

ti

a

l

g

rowt

h

$4.3B

Annual

invoicing*

Impact of 1%

change in

sequential DR

~$1M ~$7M ~$28M

Sequential Change Billed Deferred Revenue

*Company implemented annual invoicing policy and benefitted from a multi-year invoice.

`

Deferred Revenue Seasonality Continues to Deepen

Result of invoice compounding and amortization of larger and larger base

-20%

-10%

0%

10%

20%

30%

40%

50%

60%

Q1 Q2 Q3 Q4 Q1

FY06

FY11

FY15

FY16

Seq

u

e

n

ti

a

l

g

rowt

h

`

Q405 Q406 Q407 Q408 Q409 Q410 Q411 Q412 Q413 Q414 Q415 Q416

Operating Cash Flow Indexed Sequential Growth

Note: chart represents indexed sequential growth since Q105.

Cash Flow Seasonality Also Evolving

Result of collections compounding and quarterly cash expenses on larger base

In

d

e

x

e

d

Se

q

u

e

nt

ia

l

Growt

h

Benefits of Scale

P&L

Balance Sheet

& Cash Flow

Long-term

Economics

Prof. Havlek

Office hours: M-W-F, 8:00am- 10:00 Am

Lifetime Unit Economics 301

Subscription economics applied to the business lifecycle

2014: Lifetime Unit Economics

Lifetime Revenue (LTR):

Cumulative value of $1 annuity over expected life

(Value = $1 / attrition)

Cost to Book (CTB):

Cost to acquire $1 annuity

Cost to Serve (CTS):

Cost to serve $1 annuity over expected life

Attrition:

Defines expected life of $1 of annuity

Unit Lifetime Value Drivers

2015: Lifetime Unit Economics

Lifecycle Stage Impacts Growth and Margin

At maturity, companies approach their life-time margin potential

G

r

o

w

t

h

Start-Up Growth Mature

Choice enables top- and

Bottom-line Growth

time

High

Low

T

0

G

r

o

w

t

h

r

a

t

e

Example: Acme Cloud Company

time

High

Low

T

0

Revenue

New business

G

r

o

w

t

h

r

a

t

e

Example: Acme Cloud Company

T

1

time

Velocity = b

r

/R

r

where b

r

= new business rate and R

r

= Revenue rate

High

Low

T

0

Revenue

G

r

o

w

t

h

r

a

t

e

Example: Acme Cloud Company

T

1

time

T

1

Velocity = b

r

/R

r

where b

r

= new business rate and R

r

= Revenue rate

New business

Low

T

0

Example: Acme Cloud Company

T

1

G

r

o

w

t

h

r

a

t

e

time

High

Revenue

If CTB is flat, S&M

expense grows at the same

rate as new business

T

1

New business

High

Low

T

0

Example: Acme Cloud Company

S&M Expense (CTB FLAT)

time

G

r

o

w

t

h

r

a

t

e

Revenue

T

1 T

1

High

Low

T

0

Example: Acme Cloud Company

T

1

CTB Margin Pressure

time

G

r

o

w

t

h

r

a

t

e

S&M Expense (CTB FLAT)

Revenue

T

1

High

Low

T

0

Example: Acme Cloud Company

T

1

CTB Margin leverage

time

G

r

o

w

t

h

r

a

t

e

S&M Expense (CTB FLAT)

Revenue

T

1

High

Low

T

0

Example: Acme Cloud Company

CTB margin leverage

G

r

o

w

t

h

r

a

t

e

time

CTS creates

incremental leverage

S&M Expense (CTB FLAT)

Revenue

T

1 T

1

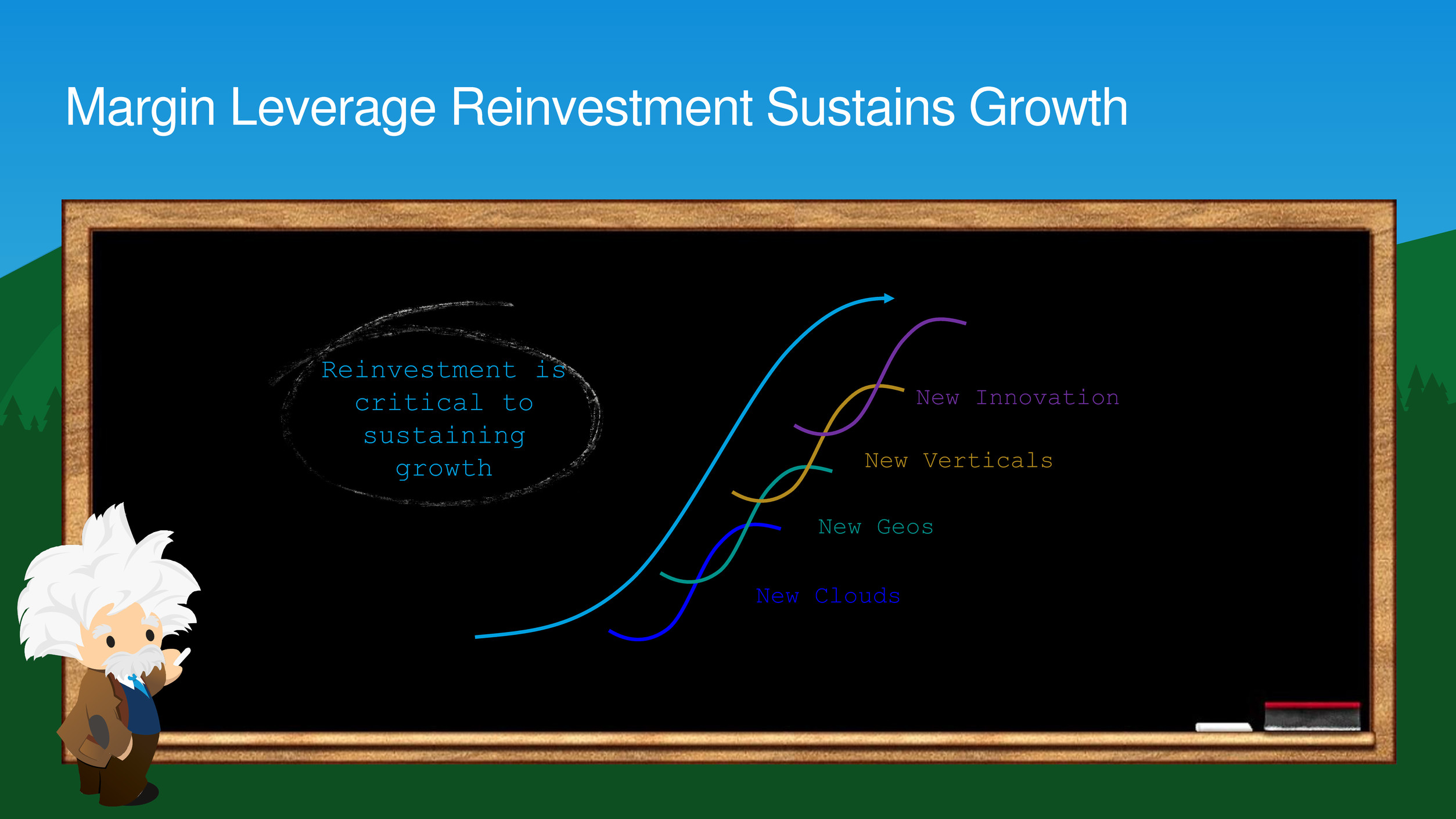

Margin Leverage Reinvestment Sustains Growth

time

New Clouds

New Geos

New Verticals

New Innovation

Reinvestment is

critical to

sustaining

growth

Scale Benefits Near- and Long-Term Performance

Fueling top and bottom line performance

time

PRIORITY

REV. GROWTH

NON-GAAP

OP. MARGIN

OCF

GROWTH

Top Line

30 0/0

Flat to Up

Revenue Growth

Bottom Line

20 0/0

+200-400 bps

Revenue Growth

HIGH GROWTH LOW GROWTH Growth

Top &

Bottom Line

20 0/0 – 30

0/0

+100-300 bps

≈ Revenue Growth

Mid-30s

Long-term op.

margin at

maturity

thank y u

Appendi

x

GAAP to Non GAAP Reconciliation

(in 000's)

Non-GAAP income from operations 1H FY17 FY16 FY15 FY14 FY13 FY12

GAAP income (loss) from operations 84,537$ 114,923$ (145,633)$ (286,074)$ (110,710)$ (35,085)$

Plus:

Amortization of purchased intangibles 86,296 158,070 154,973 146,535 88,171 67,319

Stock-based expenses 371,229 593,628 564,765 503,280 379,350 229,258

Less:

Operating lease termination resulting from purchase

of 50 Fremont 0 (36,617) 0 0 0 0

Non-GAAP income from operations 542,062$ 830,004$ 574,105$ 363,741$ 356,811$ 261,492$

As Margin %

Total revenues 3,953,221$ 6 ,667,216$ 5 ,373,586$ 4 ,071,003$ 3 ,050,195$ 2 ,266,539$

Non-GAAP operating margin 13.7% 12.4% 10.7% 8.9% 11.7% 11.5%

`

Finance

Q&A

Mark Hawkins

CFO

David Havlek

EVP, Finance

`

Salesforce Analyst Day will return at 1:30 p.m. PT

`

Product

Q&A

Alex Dayon

President, Products

Mike Rosenbaum

Sales Cloud & Service

Cloud

Bob Stutz

Marketing Cloud

Stephanie Buscemi

Analytics Cloud

Adam Seligman

Platform Cloud

John Wookey

Vertical Clouds

`

Go-to-

Market

Q&A

Keith Block

Vice Chairman, President, COO

Tyler Prince

EVP, WW

Alliances

`

Technolog

y Q&A

Parker Harris

Co-Founder and CTO

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- BMO Capital Reiterates Outperform Rating on salesforce.com (CRM)

- ROSEN, A TRUSTED AND LEADING LAW FIRM, Encourages Zoetis Inc. Investors to Inquire About Securities Class Action Investigation – ZTS

- Inverness Graham Strengthens its Value Creation Group with the Addition of Two Seasoned Operating Executives

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share