Form DEF 14A ORACLE CORP For: Nov 16

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement | |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x |

Definitive Proxy Statement | |

| ¨ |

Definitive Additional Materials | |

| ¨ |

Soliciting Material Pursuant to Section 240.14a-12 | |

Oracle Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x |

No fee required. | |||

| ¨ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) |

Title of each class of securities to which transaction applies:

| |||

| (2) |

Aggregate number of securities to which transaction applies:

| |||

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) |

Proposed maximum aggregate value of transaction:

| |||

| (5) |

Total fee paid:

| |||

| ¨ |

Fee paid previously with preliminary materials. | |||

| ¨ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) |

Amount Previously Paid:

| |||

| (2) |

Form, Schedule or Registration Statement No.:

| |||

| (3) |

Filing Party:

| |||

| (4) |

Date Filed:

| |||

Table of Contents

500 Oracle Parkway

Redwood City, California 94065

September 23, 2016

To our Stockholders:

You are cordially invited to attend the 2016 Annual Meeting of Stockholders of Oracle Corporation. Our Annual Meeting will be held on Wednesday, November 16, 2016, at 10:00 a.m., Pacific Time, in the Oracle Conference Center, located at 350 Oracle Parkway, Redwood City, California.

We describe in detail the actions we expect to take at the Annual Meeting in the attached Notice of 2016 Annual Meeting of Stockholders and proxy statement. We have also made available a copy of our Annual Report on Form 10-K for fiscal 2016. We encourage you to read the Form 10-K, which includes information on our operations, products and services, as well as our audited financial statements.

This year, we will again be using the “Notice and Access” method of providing proxy materials to stockholders via the Internet. We believe that this process provides stockholders with a convenient and quick way to access the proxy materials and vote, while allowing us to conserve natural resources and reduce the costs of printing and distributing the proxy materials. We will mail to most of our stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement and the Form 10-K and vote electronically via the Internet. This notice will also contain instructions on how to receive a paper copy of the proxy materials. All stockholders who do not receive a notice will receive a paper copy of the proxy materials by mail or an electronic copy of the proxy materials by email. See “Questions and Answers about the Annual Meeting” beginning on page 63 for more information.

Please use this opportunity to take part in our corporate affairs by voting your shares on the business to come before this meeting. Whether or not you plan to attend the meeting, please vote electronically via the Internet or by telephone, or, if you requested paper copies of the proxy materials, please complete, sign, date and return the accompanying proxy card or voting instruction card in the enclosed postage-paid envelope. See “How Do I Vote?” on page 5 of the proxy statement for more details. Voting electronically, by telephone or by returning your proxy card does NOT deprive you of your right to attend the meeting and to vote your shares in person for the matters acted upon at the meeting. If you cannot attend the meeting in person, we invite you to watch the meeting via webcast by going to www.oracle.com/investor.

Sincerely,

Lawrence J. Ellison

Chairman and Chief Technology Officer

Table of Contents

500 Oracle Parkway

Redwood City, California 94065

NOTICE OF 2016 ANNUAL MEETING OF STOCKHOLDERS

| TIME AND DATE |

10:00 a.m., Pacific Time, on Wednesday, November 16, 2016 | |||

| PLACE |

Oracle Conference Center 350 Oracle Parkway Redwood City, CA 94065 | |||

| LIVE WEBCAST |

Available on our website at www.oracle.com/investor, starting at 10:00 a.m., Pacific Time, on Wednesday, November 16, 2016 | |||

| ITEMS OF BUSINESS |

(1) |

To elect thirteen director nominees to serve on the Board of Directors until our 2017 Annual Meeting of Stockholders. | ||

| (2) |

To hold an advisory vote to approve the compensation of our named executive officers. | |||

| (3) |

To ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for fiscal 2017. | |||

| (4) |

To consider and act on a stockholder proposal, if properly presented at the Annual Meeting. | |||

| (5) |

To transact such other business as may properly come before the Annual Meeting and any adjournment or postponement thereof. | |||

| RECORD DATE |

September 19, 2016 | |||

| PROXY VOTING |

It is important that your shares be represented and voted at the Annual Meeting. You can vote your shares electronically via the Internet, by telephone or by completing and returning the proxy card or voting instruction card if you requested paper proxy materials. Voting instructions are provided in the Notice of Internet Availability of Proxy Materials, or, if you requested printed materials, the instructions are printed on your proxy card and included in the accompanying proxy statement. You can revoke a proxy at any time prior to its exercise at the Annual Meeting by following the instructions in the proxy statement. | |||

| MEETING ADMISSION |

You are entitled to attend the Annual Meeting only if you are a stockholder as of the close of business on September 19, 2016, the record date, or hold a valid proxy for the meeting. In order to be admitted to the Annual Meeting, you must present proof of ownership of Oracle common stock on the record date. This can be a brokerage statement or letter from a bank or broker indicating ownership on September 19, 2016, the Notice of Internet Availability of Proxy Materials, a proxy card, or legal proxy or voting instruction card provided by your broker, bank or nominee. Any holder of a proxy from a stockholder must present the proxy card, properly executed, and a copy of the proof of ownership. Stockholders and proxy holders must also present a form of photo identification such as a driver’s license. We will be unable to admit anyone who does not present identification or refuses to comply with our security procedures. | |||

|

| ||||

| Dorian Daley Executive Vice President, General Counsel and Secretary September 23, 2016 | ||||

Table of Contents

| 1 | ||||

| 5 | ||||

| 6 | ||||

| 6 | ||||

| 12 | ||||

| 12 | ||||

| 15 | ||||

| 19 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| Stock Ownership Guidelines for Directors and Senior Officers |

21 | |||

| Share Pledging and Our Prohibition on Speculative Transactions |

21 | |||

| 22 | ||||

| 22 | ||||

| 23 | ||||

| 24 | ||||

| 24 | ||||

| 24 | ||||

| 24 | ||||

| Security Ownership of Certain Beneficial Owners and Management |

26 | |||

| 28 | ||||

| 28 | ||||

| Report of the Compensation Committee of the Board of Directors |

43 | |||

| 44 | ||||

| 46 | ||||

| 47 | ||||

| 48 | ||||

| 48 | ||||

| 49 | ||||

| 50 | ||||

| 51 | ||||

| 53 | ||||

| 53 | ||||

| 54 | ||||

| 54 | ||||

| Proposal No. 2: Advisory Vote to Approve the Compensation of our Named Executive Officers |

55 | |||

| Proposal No. 3: Ratification of Selection of Independent Registered Public Accounting Firm |

57 | |||

| Report of the Finance and Audit Committee of the Board of Directors |

59 | |||

| 60 | ||||

| Proposal No. 4: Stockholder Proposal Regarding Lobbying Report |

60 | |||

| 62 | ||||

| 63 | ||||

| 68 | ||||

| 68 |

2016 Annual Meeting of

Stockholders

Table of Contents

This summary highlights information contained elsewhere in this Proxy Statement. For more complete information about these topics, please review our Annual Report on Form 10-K for fiscal 2016 and the entire Proxy Statement. Fiscal 2016 began on June 1, 2015 and ended on May 31, 2016. Fiscal 2017 began on June 1, 2016 and ends on May 31, 2017.

The Notice of Internet Availability of Proxy Materials, this Proxy Statement and the accompanying proxy card or voting instruction card, including an Internet link to our Annual Report on Form 10-K for fiscal 2016, were first made available to stockholders on or about September 23, 2016.

2016 Annual Meeting of Stockholders

| Date and Time Wednesday, November 16, 2016 10:00 a.m., Pacific Time

Place Oracle Conference Center 350 Oracle Parkway Redwood City, CA 94065

Record Date September 19, 2016 |

Live Webcast Available on our website at www.oracle.com/investor, starting at 10:00 a.m., Pacific Time, on Wednesday, November 16, 2016

Attendance You are entitled to attend the Annual Meeting only if you are a stockholder as of the close of business on September 19, 2016, the record date, or hold a valid proxy for the meeting. If you plan to attend the Annual Meeting, you will need to provide photo identification, such as a driver’s license, and proof of ownership of Oracle common stock as of September 19, 2016 in order to be admitted. We will be unable to admit anyone who does not present identification or refuses to comply with our security procedures. |

Voting Roadmap

| Agenda Item |

Board Recommendation |

Page | ||

| • Election of thirteen directors

|

For Each Nominee

|

54

| ||

| • Advisory vote to approve the compensation of our named executive officers (“NEOs”)

|

For

|

55

| ||

| • Ratification of selection of Ernst & Young LLP as our independent registered public accounting firm for fiscal 2017

|

For

|

57

| ||

| • Stockholder proposal

|

Against

|

60

| ||

Corporate Governance Highlights

|

|

Stockholder proxy access right adopted in June 2016 | |

|

|

Majority of independent directors (9 out of 13) and 100% independent Board committees | |

|

|

Ongoing Board refreshment, with new independent directors added in fiscal 2016 and fiscal 2015 | |

|

|

Active stockholder outreach and engagement program | |

|

|

Annual director elections | |

|

|

Director majority voting policy | |

|

|

Separate Chairman and Chief Executive Officers | |

|

|

Single class of voting stock and no supermajority voting provisions | |

|

|

Annual Board and committee performance evaluations | |

|

|

Director and executive officer stock ownership guidelines | |

|

|

Anti-hedging policy applicable to all employees and directors | |

|

|

Stockholders representing at least 20% of the outstanding votes have the right to call a special meeting | |

|

|

Stockholder right to act by written consent |

2016 Annual

Meeting of Stockholders

1

1

Table of Contents

Director Nominees

In Proposal No. 1, we are asking you to vote “FOR” each of the thirteen director nominees listed below. Each director attended at least 75% of all Board meetings and applicable committee meetings during fiscal 2016.

| Nominee | Age | Director Since |

Independent | Current Committees | ||||

| Jeffrey S. Berg Chairman of Northside Services, LLC; Former Chairman and Chief Executive Officer (“CEO”), International Creative Management, Inc. |

69 | 1997 |

|

• Independence (Chair) • Governance | ||||

| H. Raymond Bingham Executive Chairman, Cypress Semiconductor Corporation; Advisory Director, Riverwood Capital Management; Former CEO, Cadence Design Systems, Inc. |

70 | 2002 |

|

• Compensation (Chair) • Finance and Audit (Vice Chair) • Independence | ||||

| Michael J. Boskin Tully M. Friedman Professor of Economics and Hoover Institution Senior Fellow, Stanford University |

70 | 1994 |

|

• Finance and Audit (Chair) • Governance | ||||

| Safra A. Catz CEO, Oracle Corporation |

54 | 2001 | ||||||

| Bruce R. Chizen* Senior Adviser to Permira Advisers LLP; Venture Partner, Voyager Capital; Former CEO, Adobe Systems Incorporated |

61 | 2008 |

|

• Governance (Chair) • Finance and Audit | ||||

| George H. Conrades Chairman and former CEO, Akamai Technologies, Inc.; Venture Partner, Longfellow Venture Fund |

77 | 2008 |

|

• Compensation • Independence | ||||

| Lawrence J. Ellison Chairman, Chief Technology Officer (“CTO”) and Founder, Oracle Corporation |

72 | 1977 | ||||||

| Hector Garcia-Molina Leonard Bosack and Sandra Lerner Professor, Departments of Computer Science and Electrical Engineering, Stanford University |

62 | 2001 |

|

• Independence | ||||

| Jeffrey O. Henley Vice Chairman of the Board, Oracle Corporation |

71 | 1995 | ||||||

| Mark V. Hurd CEO, Oracle Corporation |

59 | 2010 | ||||||

| Renée J. James Operating Executive, The Carlyle Group; Former President, Intel Corporation |

52 | 2015 |

|

• Compensation | ||||

| Leon E. Panetta Co-founder and Chairman, Panetta Institute for Public Policy; Former U.S. Secretary of Defense; Former Director of the Central Intelligence Agency |

78 | 2015 |

|

• Governance | ||||

| Naomi O. Seligman Senior Partner, Ostriker von Simson, Inc. |

78 | 2005 |

|

• Compensation (Vice Chair) |

* Current lead independent director. See “Corporate Governance—Board Leadership Structure” on page 22 for more information.

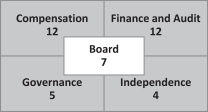

Active and Engaged Board

We have an active and engaged Board that is committed to fulfilling its fiduciary duty to act in good faith in the best interests of our company and all of our stockholders. The number of Board and committee meetings held in fiscal 2016 is set forth below.

2

2016 Annual Meeting of Stockholders

2016 Annual Meeting of Stockholders

Table of Contents

Stockholder Outreach and Board Responsiveness

We maintain an active stockholder engagement program to solicit our stockholders’ views on corporate governance, executive compensation and other issues.

| • | In fiscal 2016, members of our Board (including both independent and executive directors) conducted in-person or telephonic meetings with stockholders representing approximately 24% of Oracle’s outstanding unaffiliated shares. |

| • | Since the beginning of fiscal 2017, independent directors, including members of the Compensation and Governance Committees, have held in-person meetings with eight of our large institutional stockholders, representing approximately 18% of Oracle’s outstanding unaffiliated shares, and offered to meet with stockholders representing an additional 4% of Oracle’s outstanding unaffiliated shares. (Percentages calculated based on data available as of June 30, 2016.) |

Below is a summary of recent feedback we have received from our stockholders and our Board’s response to this feedback:

| What We Heard | Our Board’s Response | |||||||

| Implement stockholder proxy access right |

è | Adoption of Proxy Access. In June 2016, our Board adopted proxy access amendments to our Bylaws permitting a stockholder (or a group of up to 20 stockholders) continuously owning at least 3% of Oracle’s outstanding shares of common stock for at least three years to nominate and include in Oracle’s proxy materials for an annual meeting, director nominees constituting up to the greater of two individuals or 20% of the Board. See page 20 for details. |

||||||

| Concerns regarding compensation practices for independent directors |

è | Reductions in Director Compensation. In April 2016, our Board approved significant changes to our non-employee director compensation levels, which contributed to an average reduction of 24% in the total value of our non-employee directors’ compensation in fiscal 2016 compared to fiscal 2015. See page 15 for details. |

||||||

| Focus on Board refreshment to balance out long-tenured directors |

è | Two New Independent Directors. Our Board elected two new independent directors, Renée J. James and Secretary Leon E. Panetta, in fiscal 2016 and fiscal 2015, respectively, to further its goal of ensuring that the Board consists of a mix of newer directors with fresh perspectives and longer-tenured, experienced directors with a deep understanding of Oracle’s challenges and strategy. See page 24 for details. |

||||||

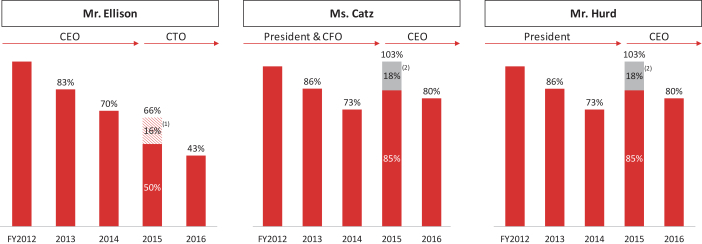

| Concerns regarding the compensation of our top three NEOs |

è | Year-over-Year Decreases in Compensation. The aggregate reported compensation of our Chairman and CTO decreased 57% from fiscal 2012 through fiscal 2016 (with compensation decreasing every year during that period). The aggregate reported compensation of our CEOs decreased 23% from fiscal 2015 through fiscal 2016 and decreased 20% from fiscal 2012 through fiscal 2016. See page 30 for details. |

||||||

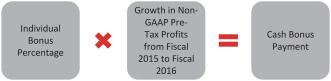

| è | Introduction of Performance Stock Units. Since fiscal 2015, approximately half of our NEOs’ equity compensation opportunities have been delivered in the form of performance stock units (“PSUs”) that may be earned only upon the attainment of multiple pre-established, specified and quantifiable performance criteria. See page 33 for details. |

|||||||

| è | Reduction in Term of Stock Options. Stock options granted to our Chairman and CTO and CEOs in fiscal 2016 will expire after five years instead of ten years, while maintaining a four-year vesting schedule, to align the term of these awards with Oracle’s goal of accelerating growth in cloud-based revenue over a five-year period. The reduction in term also reduced the grant date fair values of the awards. See page 28 for details. |

|||||||

| Outcome of our 2015 say-on-pay vote |

è | Rotation of Compensation Committee Members and Compensation Consultant Principal Partner; Continued Stockholder Engagement. At our 2015 annual meeting of stockholders, our say-on-pay proposal received the support of 48% of the votes cast. In fiscal 2016, our Board changed the composition of the Compensation Committee, and the Compensation Committee rotated the principal partner from its independent compensation consultant in order to gain a fresh perspective on compensation matters. Ray Bingham is now Chair, Naomi Seligman is Vice Chair and Renée James (our newest director) joined the committee. The Compensation Committee continues to engage in substantive discussions with our stockholders regarding executive compensation matters and continues to evaluate and refine the design of our executive compensation program. See page 42 for details.

|

||||||

In our fiscal 2017 meetings with stockholders, we received positive feedback on our director compensation changes, our adoption of proxy access, our recent additions of two independent Board members and our continued stockholder engagement.

2016 Annual

Meeting of Stockholders

3

3

Table of Contents

Executive Compensation Highlights

Compensation Governance Best Practices

What We Do

What We Do |

What We Don’t Do

What We Don’t Do | |||||||

|

|

97% of executive compensation is “at-risk” |

|

No employment agreements with NEOs providing for severance or termination payments or benefits | |||||

|

|

Focus on maintaining low dilution rates from equity awards |

|

No change-in-control agreements with NEOs | |||||

|

|

Clawback policy for executive officers |

|

No hedging of Oracle stock permitted | |||||

|

|

Ongoing Board engagement with stockholders regarding executive and director compensation |

|

No discretionary bonuses paid to NEOs when performance-based bonuses result in zero ($0) payment | |||||

|

|

Independent compensation consultant and independent compensation committee |

|

No minimum guaranteed vesting amounts for PSUs (vesting amounts can range from 0% to 150% or 0% to 110% of target based on performance) | |||||

|

|

“Double trigger” change-in-control provision in equity plan |

|

No tax “gross-ups” for NEOs | |||||

|

|

Regular Board and committee oversight of share pledging by Mr. Ellison

|

|

No repricing of “underwater” stock options |

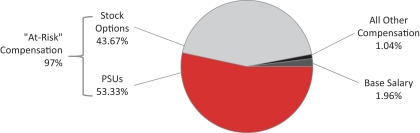

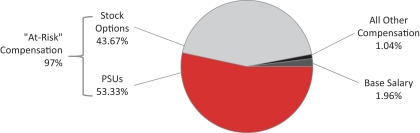

Emphasis on Variable, “At-Risk” Compensation

In fiscal 2016, an average of 97% of our NEOs’ total compensation (as reported in the Summary Compensation Table on page 44) was “at-risk,” as shown in the chart below. Annual performance-based cash bonuses were zero ($0) in fiscal 2016 for all of our NEOs and therefore do not appear in the chart.

Fiscal 2016 NEO Compensation Mix

4

2016 Annual Meeting of Stockholders

2016 Annual Meeting of Stockholders

Table of Contents

PROXY STATEMENT

We are providing these proxy materials in connection with Oracle Corporation’s 2016 Annual Meeting of Stockholders (the “Annual Meeting”). The Notice of Internet Availability of Proxy Materials (the “Notice”), this proxy statement and the accompanying proxy card or voting instruction card, including an Internet link to our most recently filed Annual Report on Form 10-K, were first made available to stockholders on or about September 23, 2016. This proxy statement contains important information for you to consider when deciding how to vote on the matters brought before the Annual Meeting. Please read it carefully.

Your vote is important. You may vote on the Internet, by telephone, by mail or by attending the Annual Meeting and voting by ballot, all as described below. The Internet and telephone voting procedures are designed to authenticate stockholders by use of a control number and to allow you to confirm that your instructions have been properly recorded. If you vote by telephone or on the Internet, you do not need to return your proxy card or voting instruction card. Telephone and Internet voting facilities are available now and will be available 24 hours a day until 11:59 p.m., Eastern Time, on November 15, 2016.

Vote on the Internet

If you are a stockholder of record, you may submit your proxy by going to www.voteproxy.com and following the instructions provided in the Notice. If you requested printed proxy materials, you may follow the instructions provided with your proxy materials and on your proxy card. If your shares are held with a broker, you will need to go to the website provided on your Notice or voting instruction card. Have your Notice, proxy card or voting instruction card in hand when you access the voting website. On the Internet voting site, you can confirm that your instructions have been properly recorded. If you vote on the Internet, you can also request electronic delivery of future proxy materials.

Vote by Telephone

If you are a stockholder of record, you can also vote by telephone by dialing 1-800-PROXIES (1-800-776-9437). If your shares are held with a broker, you can vote by telephone by dialing the number specified on your voting instruction card. Easy-to-follow voice prompts will allow you to vote your shares and confirm that your instructions have been properly recorded. Have your proxy card or voting instruction card in hand when you call.

Vote by Mail

If you have requested printed proxy materials, you may choose to vote by mail, by marking your proxy card or voting instruction card, dating and signing it, and returning it in the postage-paid envelope provided. If the envelope is missing and you are a stockholder of record, please mail your completed proxy card to American Stock Transfer & Trust Company, LLC, 6201 15th Avenue, Brooklyn, New York 11219. If the envelope is missing and your shares are held with a broker, please mail your completed voting instruction card to the address specified therein. Please allow sufficient time for mailing if you decide to vote by mail.

Please note that if you received a Notice, you cannot vote by marking the Notice and returning it. The Notice provides instructions on how to vote by Internet and how to request paper copies of the proxy materials.

Voting at the Annual Meeting

The method or timing of your vote will not limit your right to vote at the Annual Meeting if you attend the Annual Meeting and vote in person. However, if your shares are held in the name of a bank, broker or other nominee, you must obtain a legal proxy, executed in your favor, from the holder of record to be able to vote at the Annual Meeting. You should allow yourself enough time prior to the Annual Meeting to obtain this proxy from the holder of record.

The shares voted electronically, telephonically, or represented by the proxy cards received, properly marked, dated, signed and not revoked, will be voted at the Annual Meeting.

2016 Annual Meeting of

Stockholders

5

5

Table of Contents

Our Board of Directors (our “Board”) consists of thirteen directors, twelve of whom stood for election at our last annual meeting of stockholders. The Board unanimously elected Renée J. James as a director effective as of December 16, 2015, and Ms. James will stand for election as a director at the Annual Meeting along with our other twelve directors. We refer to these directors as the “incumbent directors” in this proxy statement.

Director Qualifications

Our Corporate Governance Guidelines (described in detail in “Corporate Governance—Corporate Governance Guidelines” on page 19) contain Board membership qualifications that apply to Board nominees recommended by the Nomination and Governance Committee (the “Governance Committee”). The Governance Committee strives for a mix of skills, experience and perspectives that will help create an outstanding, dynamic and effective Board to represent the interests of the stockholders. In selecting nominees, the Governance Committee assesses the independence, character and acumen of candidates and endeavors to collectively establish areas of core competency of the Board, including, among others, industry knowledge and experience; management, accounting and finance expertise; and demonstrated business judgment, leadership and strategic vision. The Governance Committee values diversity of backgrounds, experience, perspectives and leadership in different fields when identifying nominees.

The Governance Committee also takes director tenure into consideration when making director nomination decisions and believes that it is desirable to maintain a mix of longer-tenured, experienced directors and newer directors with fresh perspectives. When recommending Ms. James for election to the Board, the Governance Committee reviewed the Board’s composition with a specific view to refreshment. The Governance Committee and the Board also believe that longer-tenured, experienced directors are a significant strength of the Board, given the large size of our company, the breadth of our product offerings and the international scope of our organization. See “Corporate Governance—Director Tenure and Board Refreshment” on page 24 for more information.

Below we identify the key experiences, qualifications and skills our director nominees bring to the Board and that the Board considers important in light of Oracle’s businesses and industry.

| • | Industry Knowledge and Experience. We seek to have directors with experience as executives, directors or other leadership positions in the particular technology industries in which we compete because our success depends on developing and investing in innovative products and technologies. This experience is critical to the Board’s ability to understand our products and business, assess our competitive position within the technology industry and the strengths and weaknesses of our competitors, maintain awareness of technology trends and innovations, and evaluate potential acquisitions and our acquisition strategy. |

| • | Management, Accounting and Finance Expertise. We believe that an understanding of management practices, finance and financial reporting processes is important for our directors. We value management experience in our directors as it provides a practical understanding of organizations, processes, strategies, risk management and the methods to drive change and growth that permit the Board to, among other things, identify and recommend improvements to our business operations, sales and marketing approaches and product strategy. We also seek to have at least one director who qualifies as an audit committee financial expert, and we expect all of our directors to be financially knowledgeable. |

| • | Business Judgment, Leadership and Strategic Vision. We believe that directors with experience in significant leadership positions are commonly required to provide excellent business judgment, demonstrate leadership skills and develop strategic vision. We seek directors with these characteristics as they bring special insights to Board deliberations and processes. |

The Board evaluates its own composition in the context of the diverse experiences and perspectives that the directors bring to the boardroom as a collective. Their backgrounds provide the Board with vital insights in areas such as:

| Finance and Accounting |

Technology Industry |

Risk Management and Cybersecurity |

Mergers and Acquisitions | |||

| Operation of Global Organizations |

Computer Science |

Governmental Affairs |

Strategic Transformation | |||

| International Tax and Monetary Policy

|

Intellectual Property

|

Executive Leadership and Talent Development

|

Customer Perspective

|

6

2016 Annual Meeting of Stockholders

2016 Annual Meeting of Stockholders

Table of Contents

The experiences, qualifications and skills of each director that the Board considered in his or her nomination are included below the directors’ individual biographies on the following pages. The Board concluded that each nominee should serve as a director based on the specific experience and attributes listed below and the direct personal knowledge of each nominee’s previous service on the Board, including the insight and collegiality each nominee brings to the Board’s functions and deliberations. The age of each director is provided as of September 19, 2016, the record date for the Annual Meeting.

| Jeffrey S. Berg |

| |||

| Director since 1997 Age: 69 |

|

Board Committees Independence (Chair), Governance |

| |

Mr. Berg has been an agent in the entertainment industry for over 35 years. Mr. Berg has served as Chairman of Northside Services, LLC, a media and entertainment advisory firm, since May 2015. Mr. Berg was Chairman of Resolution, a talent and literary agency he founded, from January 2013 until April 2015. Between 1985 and May 2012, he was the Chairman and CEO of International Creative Management, Inc. (“ICM”), a talent agency for the entertainment industry. He has served as Co-Chair of California’s Council on Information Technology and was President of the Executive Board of the College of Letters and Sciences at the University of California at Berkeley. He is currently on the Board of Trustees of the Anderson School of Management at the University of California at Los Angeles.

As the former CEO of ICM, Mr. Berg brings to the Board over 25 years of leadership experience running one of the world’s preeminent full service talent agencies in the entertainment industry. Mr. Berg’s prior experience as CEO and as a representative of some of the world’s most well-known celebrities offers the Board a unique perspective with respect to managing a global brand in rapidly-changing industries and in management, compensation and operational matters.

| H. Raymond Bingham |

| |||

| Director since 2002 Age: 70 |

|

Board Committees Compensation (Chair), Finance and Audit (Vice Chair), Independence |

| |

Mr. Bingham has served as Executive Chairman of Cypress Semiconductor Corporation, a semiconductor design and manufacturing company, since August 2016, and as an advisory director at Riverwood Capital Management, a private equity firm that invests in high-growth technology companies, since January 2016. From 2010 to 2015, Mr. Bingham was an advisory director at the leading global private equity firm General Atlantic LLC, serving as a managing director from 2006 to 2009. From 1993 to 2005, Mr. Bingham served in various capacities at Cadence Design Systems, Inc., a supplier of electronic design automation software and services, including as Executive Vice President and Chief Financial Officer (“CFO”), President and CEO, director and, most recently, as Executive Chairman of the Board of Directors. Mr. Bingham was formerly a director of DHI Group, Inc. (formerly known as Dice Holdings, Inc.) until April 2015, Spansion, Inc. until March 2015, Fusion-io, Inc. until June 2014 and STMicroelectronics N.V. until June 2013. Mr. Bingham currently serves as a director of Cypress Semiconductor Corporation, Flextronics International Ltd. and TriNet Group, Inc.

As the former CEO of Cadence, Mr. Bingham brings to the Board first-hand experience in successfully leading and managing a large, complex global organization in the technology industry. In particular, Mr. Bingham’s experience in leading Cadence’s global expansion into India, China and Russia and the extension of Cadence’s technology leadership through a series of strategic acquisitions, internal research and development and venture investments provides the Board with a perspective readily applicable to challenges faced by Oracle. In addition, Mr. Bingham’s roles at Riverwood Capital Management and General Atlantic have required him to be very familiar with companies driven by information technology or intellectual property. The Board also benefits from Mr. Bingham’s financial expertise and significant audit and financial reporting knowledge, including his experience as the former CFO of Cadence. Mr. Bingham’s service as a director of large, complex global organizations, as well as smaller private companies, provides the Board with important perspectives in its evaluation of Oracle’s practices and processes.

2016 Annual Meeting of

Stockholders

7

7

Table of Contents

| Michael J. Boskin |

| |||

| Director since 1994 Age: 70 |

|

Board Committees Finance and Audit (Chair), Governance |

| |

Dr. Boskin is the Tully M. Friedman Professor of Economics and Hoover Institution Senior Fellow at Stanford University, where he has been on the faculty since 1971. He is CEO and President of Boskin & Co., Inc., a consulting firm. He was Chairman of the President’s Council of Economic Advisers from February 1989 until January 1993. Dr. Boskin also currently serves as a director of Exxon Mobil Corporation.

Dr. Boskin is recognized internationally for his research on world economic growth, tax and budget theory and policy, U.S. saving and consumption patterns and the implications of changing technology and demography on capital, labor, and product markets. He brings to the Board significant economic and financial expertise and provides the Board with a unique perspective on a number of challenges faced by Oracle due to its global operations, including, for example, questions regarding international tax and monetary policy, treasury functions, currency exposure and general economic and labor trends and risks. In addition, Dr. Boskin’s experience as CEO of his consultancy firm and as a director of another large, complex global organization provides the Board with important perspectives in its evaluation of Oracle’s practices and processes.

| Safra A. Catz | ||

| Director since 2001 Age: 54 |

Chief Executive Officer | |

Ms. Catz has been our CEO since September 2014. She served as our President from January 2004 to September 2014 and as our CFO most recently from April 2011 until September 2014. Ms. Catz was previously our CFO from November 2005 until September 2008 and our Interim CFO from April 2005 until July 2005. Prior to being named President, she held various other positions with us since joining Oracle in 1999. Ms. Catz also previously served as a director of HSBC Holdings plc.

In her current role at Oracle, Ms. Catz is primarily responsible for all operations at Oracle other than product development, sales and marketing, consulting, support and Oracle’s industry-specific global business units. Ms. Catz also leads the execution of our acquisition strategy and integration of acquired companies and products. Our Board benefits from Ms. Catz’s many years with Oracle and her unique expertise regarding Oracle’s strategic vision, management and operations. Prior to joining Oracle, Ms. Catz developed deep technology industry experience as a managing director with the investment banking firm Donaldson, Lufkin & Jenrette from 1986 to 1999 covering the technology industry. With this experience, Ms. Catz brings valuable insight regarding the technology industry generally, and in particular in the execution of our acquisition strategy. In addition, Ms. Catz’s prior service as a director of another large, complex global organization provides the Board with important perspectives in its evaluation of Oracle’s practices and processes.

8

2016 Annual Meeting of Stockholders

2016 Annual Meeting of Stockholders

Table of Contents

| Bruce R. Chizen | ||

| Director since 2008 Age: 61 |

Board Committees Governance (Chair), Finance and Audit | |

Mr. Chizen is currently an independent consultant and has served as Senior Adviser to Permira Advisers LLP since July 2008 and as a Venture Partner at Voyager Capital since August 2009. Mr. Chizen served as a strategic adviser to Adobe Systems Incorporated, a provider of design, imaging and publishing software for print, Internet and dynamic media production, from November 2007 through November 2008. From December 2000 to November 2007, Mr. Chizen served as CEO of Adobe and as its President from April 2000 to January 2005. He also served as Adobe’s acting CFO from November 2006 to February 2007. From August 1998 to April 2000 he was Adobe’s Executive Vice President, Products and Marketing. Mr. Chizen joined Adobe Systems in August 1994 and held various positions in its Consumer Products Division and Graphics Products Division. He served as a director of Adobe from December 2000 to April 2008. Mr. Chizen also currently serves as a director of Synopsys, Inc.

As the former CEO of Adobe, Mr. Chizen brings to the Board first-hand experience in successfully leading and managing a large, complex global organization in the technology industry. In particular, Mr. Chizen’s experience in heading the extension of Adobe’s product leadership provides the Board with a perspective applicable to challenges faced by Oracle. In addition, Mr. Chizen’s current roles at Permira and Voyager require him to be very familiar with companies driven by information technology or intellectual property, which provides the Board with valuable insights in its deliberations regarding Oracle’s acquisition and product strategies. The Board also benefits from Mr. Chizen’s financial expertise and significant audit and financial reporting knowledge, including his experience as the former acting CFO of Adobe. Mr. Chizen’s service as a director of a large, complex global organization, as well as smaller private companies, provides the Board with important perspectives in its evaluation of Oracle’s practices and processes.

| George H. Conrades | ||

| Director since 2008 Age: 77 |

Board Committees Compensation, Independence | |

Mr. Conrades has served as Chairman of Akamai Technologies, Inc., a service provider for accelerating and improving the delivery of content and applications over the Internet, since May 2005. He currently serves as a Managing Partner at Longfellow Venture Partners, a private venture fund advising and investing in early stage healthcare and technology companies. He also served as a Venture Partner at Polaris Venture Partners, an early stage investment company, from August 1998 to 2012 and is currently Partner Emeritus. Mr. Conrades was Chairman and CEO of Akamai Technologies from April 1999 to May 2005. He previously served as a director of Ironwood Pharmaceuticals, Inc. and Harley-Davidson, Inc.

As the former CEO of Akamai, Mr. Conrades brings to the Board first-hand experience in successfully leading and managing a large, complex global organization in the technology industry. Mr. Conrades’ experience provides the Board with a perspective applicable to challenges faced by Oracle. In addition, Mr. Conrades’ current role at Longfellow Venture Partners requires him to be very familiar with growth companies, including those driven by information technology or intellectual property, which provides the Board with valuable insights in its deliberations regarding Oracle’s acquisition and product strategies. Mr. Conrades’ service as a director of a large, complex global organization, as well as smaller private companies, provides the Board with important perspectives in its evaluation of Oracle’s practices and processes.

2016 Annual Meeting of

Stockholders

9

9

Table of Contents

| Lawrence J. Ellison | ||

| Director since 1977 Age: 72 |

Chairman, Chief Technology Officer and Founder | |

Mr. Ellison has been our Chairman of the Board and CTO since September 2014. Mr. Ellison served as our CEO from June 1977, when he founded Oracle, until September 2014. He previously served as our Chairman of the Board from May 1995 to January 2004.

Mr. Ellison is Oracle’s founder and served as our CEO since we commenced operations in June 1977 through September 2014. He is widely regarded as a technology visionary and one of the world’s most successful business executives. Mr. Ellison’s familiarity with and knowledge of our technologies and product offerings are unmatched. He continues to lead and oversee our product engineering, technology development and strategy. For almost 40 years he has successfully steered Oracle in new strategic directions in order to adapt to and stay ahead of our competition and changing industry trends. Mr. Ellison is our largest stockholder, owning approximately 28% of the outstanding shares of our common stock, directly aligning his interests with those of all of our stockholders.

| Hector Garcia-Molina | ||

| Director since 2001 Age: 62 |

Board Committees Independence | |

Mr. Garcia-Molina has been the Leonard Bosack and Sandra Lerner Professor in the Departments of Computer Science and Electrical Engineering at Stanford University since October 1995 and served as Chairman of the Department of Computer Science from January 2001 to December 2004. He has been a professor at Stanford University since January 1992. From August 1994 until December 1997, he was the Director of the Computer Systems Laboratory at Stanford University.

Widely regarded as an expert in computer science, Mr. Garcia-Molina brings to the Board significant technical expertise in the fields of computer science, generally, and database technology, specifically. He is the author of numerous books, journal articles, papers and reports documenting his research on a variety of technology subjects, including distributed computing systems, digital libraries and database systems. Mr. Garcia-Molina is a Fellow of the Association for Computing Machinery and the American Academy of Arts and Sciences and from 1997 to 2001 was a member of the President’s Information Technology Advisory Committee. He also serves as a Venture Advisor for Onset Ventures and is a member of technical advisory boards of numerous private companies. In these roles, and as a former director of other public companies, Mr. Garcia-Molina has helped oversee the strategy and operations of other technology companies and brings a valuable technical and industry-specific perspective to the Board’s consideration of Oracle’s product strategy, competitive positioning and technology trends.

| Jeffrey O. Henley | ||

| Director since 1995 Age: 71 |

Vice Chairman | |

Mr. Henley has served as our Vice Chairman of the Board since September 2014. Mr. Henley previously served as our Chairman of the Board from January 2004 to September 2014. He served as our Executive Vice President and CFO from March 1991 to July 2004.

Our Board benefits from Mr. Henley’s many years with Oracle and his significant expertise and knowledge regarding our strategic vision, management and operations. Mr. Henley meets regularly with significant Oracle customers and is instrumental in closing major commercial transactions worldwide. This role allows Mr. Henley to remain close to our customers and the technology industry generally. Mr. Henley also brings to the Board significant financial and accounting expertise from his service as our former CFO and in other finance positions prior to joining Oracle.

10

2016 Annual Meeting of Stockholders

2016 Annual Meeting of Stockholders

Table of Contents

| Mark V. Hurd | ||

| Director since 2010 Age: 59 |

Chief Executive Officer | |

Mr. Hurd has been our CEO since September 2014. He served as our President from September 2010 to September 2014. Prior to joining us, he served as Chairman of the Board of Directors of Hewlett-Packard Company from September 2006 to August 2010 and as CEO, President and a member of the Board of Directors of Hewlett-Packard Company from April 2005 to August 2010. From 2007 to 2010, Mr. Hurd served as a member of the Board of Directors of Newscorp, Inc. and served on the Governance Committee of Newscorp.

In his current role at Oracle, Mr. Hurd is responsible for sales and marketing, consulting, support and Oracle’s industry-specific global business units. Our Board benefits from Mr. Hurd’s insight as he guides Oracle’s sales and marketing efforts, manages our support and consulting organizations and acts as a primary contact for our customers. As the former CEO of Hewlett-Packard Company and NCR Corporation, Mr. Hurd brings to the Board first-hand experience in successfully leading and managing large, complex global sales, support and consulting organizations in the technology industry. In addition, Mr. Hurd’s prior experience as Chairman of Hewlett-Packard Company’s board and as a director of another large, public company provides the Board with important perspectives in its evaluation of Oracle’s practices and processes.

| Renée J. James | ||

| Director since 2015 Age: 52 |

Board Committees Compensation | |

Ms. James has served as an Operating Executive for The Carlyle Group, a global alternative asset manager, since February 2016. In January 2016, Ms. James concluded a 28-year career with Intel Corporation, where she most recently served as President. In her tenure at Intel, she oversaw the company’s strategic expansion into providing proprietary and open source software and services for applications in enterprise, security and cloud-based computing. Ms. James is Vice Chair of the National Security Telecommunications Advisory Committee to the President of the United States. She also serves as a director of Citigroup Inc., Sabre Corporation and Vodafone Group Plc, and she previously served as a director of VMware, Inc.

As a seasoned technology executive, Ms. James brings to the Board extensive, international experience managing large, complex global operations in the technology industry. In her distinguished career at Intel, Ms. James held a variety of positions in research and development leadership in both software and hardware and the management of global manufacturing. Our Board benefits from the leadership, industry and technical expertise Ms. James acquired in the positions she held at Intel and through her service on the boards of public and private companies in the technology and financial services industries. In addition, Ms. James brings to the Board expansive knowledge of cybersecurity gained through the positions she has held at Intel and as the Vice Chair of the National Security Telecommunications Advisory Committee to the President of the United States.

| Leon E. Panetta | ||

| Director since 2015 Age: 78 |

Board Committees Governance | |

Secretary Panetta served as U.S. Secretary of Defense from 2011 to 2013 and as Director of the Central Intelligence Agency from 2009 to 2011. Prior to that time, Secretary Panetta was a member of the United States House of Representatives from 1977 to 1993, served as Director of the Office of Management and Budget from 1993 to 1994 and served as President Bill Clinton’s Chief of Staff from 1994 to 1997. He is the co-founder and Chairman of the Panetta Institute for Public Policy and currently serves as moderator of the Leon Panetta Lecture Series, a program he created. Secretary Panetta previously served as Distinguished Scholar to Chancellor Charles B. Reed of the California State University System and professor of public policy at Santa Clara University.

With a distinguished record of public service at the highest levels of government, Secretary Panetta brings to the Board robust, first-hand knowledge of government affairs and public policy issues. Secretary Panetta’s 16 years of experience in the U.S. House of Representatives and service in the administrations of two U.S. Presidents allow him to advise the Board on a wide range of issues related to Oracle’s interactions with governmental entities. In addition, Secretary Panetta’s service as a leader of large and complex government institutions, including the U.S. Department of Defense, the Central Intelligence Agency and the Office of Management and Budget, provides the Board with important perspectives on Oracle’s operational practices and processes, as well as risk management and oversight.

2016 Annual Meeting of

Stockholders

11

11

Table of Contents

| Naomi O. Seligman | ||

| Director since 2005 Age: 78 |

Board Committees Compensation (Vice Chair) | |

Ms. Seligman is a senior partner at Ostriker von Simson, Inc., a technology research firm which chairs the CIO Strategy Exchange. Since 1999, this forum has brought together senior executives in four vital quadrants of the IT sector. From 1977 until June 1999, Ms. Seligman served as a co-founder and senior partner of the Research Board, Inc., a private sector institution sponsored by 100 chief information officers from major global corporations. She also currently serves as a director of Akamai Technologies, Inc. Ms. Seligman previously served as a director of iGate Corporation and The Dun & Bradstreet Corporation.

As a senior partner at Ostriker von Simson, Inc. and co-partner of the CIO Strategy Exchange, and in her prior role as a co-founder and senior partner of the Research Board, Ms. Seligman is recognized as a thought leader in the technology industry. Ms. Seligman also serves as an independent advisor to some of the largest multinational corporations where she helps oversee global strategy and operations, which provides our Board with important perspectives in its evaluation of Oracle’s practices and processes. The Board also benefits from Ms. Seligman’s unique experience and customer-focused perspective and the valuable insights gained from the senior-level relationships she maintains throughout the technology industry.

Recommendations of Director Candidates

The Governance Committee will consider all properly submitted candidates recommended by stockholders for Board membership. Our Corporate Governance Guidelines (available on our website at www.oracle.com/goto/corpgov) set forth the Governance Committee’s policy regarding the consideration of all properly submitted candidates recommended by stockholders as well as candidates recommended by current Board members and others.

Any stockholder wishing to recommend a candidate for consideration for nomination by the Governance Committee must provide a written notice to Dorian Daley, Executive Vice President, General Counsel and Secretary at 500 Oracle Parkway, Mailstop 5op7, Redwood City, California 94065, or by email ([email protected]) with a confirmation copy sent by mail. The written notice must include the candidate’s name, biographical data and qualifications and a written consent from the candidate agreeing to be named as a nominee and to serve as a director if nominated and elected. By following these procedures, a stockholder will ensure consideration of a submitted candidate by the Governance Committee. However, there is no guarantee that the candidate will be nominated.

Potential candidates for directors are generally suggested to the Governance Committee by current Board members and stockholders and are evaluated at meetings of the Governance Committee. In evaluating such candidates, every effort is made to complement and strengthen skills within the existing Board. The Governance Committee seeks Board approval of the final candidates recommended by the Governance Committee. The same identifying and evaluating procedures apply to all candidates for director, whether submitted by stockholders or otherwise.

Information regarding procedures for the stockholder submission of director nominations to be considered at our next annual meeting of stockholders may be found in “Corporate Governance—Proxy Access and Director Nominations” on page 20 and “Stockholder Proposals for the 2017 Annual Meeting” on page 62.

Our business, property and affairs are managed under the direction of our Board. Members of our Board are kept informed of our business through discussions with our Chairman, Vice Chairman, CEOs, Corporate Secretary and other officers and employees, by reviewing materials provided to them, by visiting our offices and by participating in meetings of the Board and its committees.

12

2016 Annual Meeting of Stockholders

2016 Annual Meeting of Stockholders

Table of Contents

Each committee reviews its charter at least annually, or more frequently as legislative and regulatory developments and business circumstances warrant. Each of the committees may make additional recommendations to our Board for revision of its charter to reflect evolving best practices. The charters for the F&A, Governance, Compensation and Independence Committees are posted on our website at www.oracle.com/goto/corpgov.

Committee Membership

The table below identifies committee membership as of September 19, 2016, the record date of the Annual Meeting.

| Director | Finance and Audit | Compensation | Governance | Independence | ||||

| Jeffrey S. Berg |

|

Chair

Chair | ||||||

| H. Raymond Bingham |

Vice Chair

Vice Chair |

Chair

Chair |

*

* | |||||

| Michael J. Boskin |

Chair

Chair |

*

* |

||||||

| Safra A. Catz |

||||||||

| Bruce R. Chizen |

|

Chair

Chair |

||||||

| George H. Conrades |

|

| ||||||

| Lawrence J. Ellison |

||||||||

| Hector Garcia-Molina |

| |||||||

| Jeffrey O. Henley |

||||||||

| Mark V. Hurd |

||||||||

| Renée J. James |

|

|||||||

| Leon E. Panetta |

|

|||||||

| Naomi O. Seligman |

Vice Chair

Vice Chair |

| * | One-year transitional committee term ending concurrently with the Annual Meeting. |

The Board has determined that all directors who served during fiscal 2016 on the Compensation, F&A, Governance and Independence Committees were independent under the applicable New York Stock Exchange (“NYSE”) listing standards. The Board has also determined that all directors who served during fiscal 2016 on the Compensation and F&A Committees satisfied the applicable NYSE and U.S. Securities and Exchange Commission (“SEC”) heightened independence standards for members of compensation and audit committees. See “Corporate Governance—Board of Directors and Director Independence” on page 23 for more information.

The Finance and Audit Committee

The F&A Committee oversees our accounting and financial reporting processes and the audit and integrity of our financial statements, assists the Board in fulfilling its oversight responsibilities regarding audit, finance, accounting, tax and legal compliance, and evaluates merger and acquisition transactions and investment transactions proposed by management. In particular, the F&A Committee is responsible for overseeing the engagement, independence, compensation, retention and services of our independent registered public accounting firm. The F&A Committee’s primary responsibilities and duties are to:

| • | act as an independent and objective party to monitor our financial reporting process and internal control over financial reporting; |

| • | review and appraise the audit efforts of our independent registered public accounting firm; |

| • | oversee our internal audit department; |

| • | evaluate our quarterly financial performance at earnings review meetings; |

| • | oversee management’s establishment and enforcement of financial policies and business practices; |

| • | oversee our compliance with laws and regulations and Oracle’s Code of Ethics and Business Conduct; |

| • | provide an open avenue of communication between the Board and the independent registered public accounting firm, General Counsel, financial and senior management, Chief Compliance & Ethics Officer and the internal audit department; |

2016 Annual Meeting of

Stockholders

13

13

Table of Contents

| • | review and, if within its delegated range of authority, approve merger and acquisition and financial transactions proposed by our management; and |

| • | produce the Report of the Finance and Audit Committee of the Board, included elsewhere in this proxy statement, as required by SEC rules. |

The F&A Committee held executive sessions with our independent registered public accounting firm on four occasions in fiscal 2016. The Board has determined that H. Raymond Bingham qualifies as an “audit committee financial expert” as defined by the SEC rules.

The Compensation Committee

The primary functions of the Compensation Committee are to:

| • | review and set all compensation arrangements, including, as applicable, base salaries, bonuses and equity awards, of our CEOs and other executive officers, as well as our directors; |

| • | lead the Board in its evaluation of the performance of our CEOs; |

| • | review and discuss the Compensation Discussion and Analysis (“CD&A”) portion of our proxy statement with management and determine whether to recommend to the Board that the CD&A be included in our proxy statement; |

| • | produce the Compensation Committee Report, included elsewhere in this proxy statement, as required by SEC rules; |

| • | review, approve and administer our stock plans, and approve certain equity awards; |

| • | assess the risks associated with our compensation practices, policies and programs applicable to employees to determine whether the risks arising from such practices, policies and programs are appropriate or reasonably likely to have a material adverse effect on Oracle; and |

| • | oversee our 401(k) Plan Committee and have responsibility for amendments to the Oracle Corporation 401(k) Savings and Investment Plan (the “401(k) Plan”). |

The Compensation Committee helps us to attract and retain talented executive personnel in a competitive market. In determining any component of executive or director compensation, the Compensation Committee considers the aggregate amounts and mix of all components in its decisions. Our legal department, human resources department and Corporate Secretary support the Compensation Committee in its work. For additional details regarding the Compensation Committee’s role in determining executive compensation, including its engagement of an independent compensation consultant, refer to “Executive Compensation—Compensation Discussion and Analysis” beginning on page 28. See “Executive Compensation—Compensation Discussion and Analysis—Other Compensation Policies—Equity Awards and Grant Administration” on page 43 for a discussion of the Compensation Committee’s role as the administrator of our stock plans and for a discussion of our policies and practices regarding the grant of our equity awards.

Risk Assessment of Compensation Policies and Practices

The Compensation Committee, in consultation with management and Compensia, Inc. (“Compensia”), the committee’s independent compensation consultant, over the course of several committee meetings has assessed the compensation policies and practices applicable to our executive officers and other employees and concluded that they do not create risks that are reasonably likely to have a material adverse effect on Oracle.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee has ever been an officer or employee of Oracle or of any of our subsidiaries or affiliates. During the last fiscal year, none of our executive officers served on the board of directors or on the compensation committee of any other entity, any officers of which served either on our Board or on our Compensation Committee.

The Nomination and Governance Committee

The Governance Committee has responsibility for monitoring corporate governance matters, including periodically reviewing the composition and performance of the Board and its committees (including reviewing the performance of individual directors) and overseeing our Corporate Governance Guidelines. The Governance Committee also considers and recommends qualified candidates for election as directors of Oracle.

14

2016 Annual Meeting of Stockholders

2016 Annual Meeting of Stockholders

Table of Contents

The Committee on Independence Issues

The Independence Committee is charged with reviewing and approving individual transactions, or a series of related transactions, involving amounts in excess of $120,000 between us (or any of our subsidiaries) and any of our affiliates, such as an executive officer, director or owner of 5% or more of our common stock. The Independence Committee’s efforts are intended to ensure that each proposed related person transaction is on terms that, when taken as a whole, are fair to us. If any member of the Independence Committee would derive a direct or indirect benefit from a proposed transaction, he or she is excused from the review and approval process with regard to that transaction. The role of the Independence Committee also encompasses the monitoring of related person relationships as well as reviewing proposed transactions and other matters for potential conflicts of interest and possible corporate opportunities in accordance with our Supplemental Conflict of Interest Policy for Senior Officers. The Independence Committee also evaluates the independence of each non-management director as defined by NYSE listing standards. See “Corporate Governance—Board of Directors and Director Independence” on page 23 for more information.

Our directors play a critical role in guiding our strategic direction and overseeing the management of Oracle. Ongoing developments in corporate governance and financial reporting have resulted in an increased demand for highly qualified and productive public company directors. Further, Oracle’s active acquisition program, our expansion into new lines of business and rapid changes in the technology industry demand substantial time commitments from our directors.

These considerable time commitments and the many responsibilities and risks of being a director of a public company of Oracle’s size, complexity and profile require that we provide adequate incentives for our directors’ continued performance by paying compensation commensurate with our directors’ significant workload. Our non-employee directors are compensated based upon their respective levels of Board participation and responsibilities, including service on Board committees. Several of our directors serve on more than one committee. Our non-employee directors display a high level of commitment and flexibility in their service to Oracle. In addition to engaging with our senior management, our directors also personally attend important customer-related events such as Oracle OpenWorld and Oracle President Council forums and meet with our stockholders throughout the year to better understand their perspectives. Annual cash retainers and formula equity award grants to our non-employee directors are intended to correlate to the responsibilities and time commitments of each such director.

Our employee directors, Mr. Ellison, Ms. Catz, Mr. Hurd and Mr. Henley, receive no separate compensation for serving as directors of Oracle.

Reductions in Director Compensation in Fiscal 2016

While we believe our non-employee directors have been properly compensated in prior years, certain of our stockholders and their advisors expressed concern last year regarding our director compensation practices. We value stockholder feedback, and we do not want our director compensation to create even the appearance of an independence issue. Consequently, and in direct response to this stockholder feedback, our Board approved significant reductions to our non-employee director compensation structure effective as of April 29, 2016, including:

| • | Eliminating the F&A Committee Vice Chair cash retainer and equity award grant; |

| • | Reducing the amount of equity granted in the annual equity award grant for Board service by 25%; |

| • | Reducing the amount of equity granted in the initial equity award grant for new directors by 25%; |

| • | Reducing the amount of equity granted annually for committee chair service by 25%; and |

| • | Delivering all equity awards in the form of restricted stock units (“RSUs”) that vest on the first anniversary of the date of grant. |

2016 Annual Meeting of

Stockholders

15

15

Table of Contents

These changes contributed to an average reduction of 24% in the total value of our non-employee directors’ compensation in fiscal 2016 compared to fiscal 2015.

| Director | Fiscal 2016 Total Compensation ($) |

Fiscal 2015 Total Compensation ($) |

% Reduction | |||||||||

| Jeffrey S. Berg |

512,398 | 561,131 |

9%

9% |

|||||||||

| H. Raymond Bingham |

890,902 | 1,243,639 |

28%

28% |

|||||||||

| Michael J. Boskin |

724,092 | 1,081,763 |

33%

33% |

|||||||||

| Bruce R. Chizen |

716,061 | 1,084,763 |

34%

34% |

|||||||||

| George H. Conrades |

468,645 | 585,131 |

20%

20% |

|||||||||

| Hector Garcia-Molina |

425,645 | 534,131 |

20%

20% |

|||||||||

| Renée J. James |

548,005 | n/a | n/a | |||||||||

| Leon E. Panetta |

424,681 | 591,840 |

28%

28% |

|||||||||

| Naomi O. Seligman |

440,645 | 558,131 |

21%

21% |

|||||||||

|

|

|

|||||||||||

| Average Reduction in Director Total Compensation |

24%

24% |

|||||||||||

Cash Retainer and Meeting Fees for Directors

During fiscal 2016, each of our non-employee directors received (1) an annual cash retainer of $52,500 for serving as a director of Oracle (prorated for directors who did not serve on the Board for the full year) and (2) each of the applicable retainers and fees set forth below for serving as a chair or as a member of one or more of the committees of the Board (with retainers prorated for directors who served as chairs or committee members for less than a full year). As noted above, the F&A Committee Vice Chair annual retainer of $25,000 was eliminated effective as of April 29, 2016, and the F&A Committee Vice Chair fiscal 2016 retainer was prorated accordingly.

| Annual Committee Member Retainers | ||||

| F&A and Compensation Committees |

$ 25,000 | |||

| Governance and Independence Committees |

$ 15,000 | |||

| Additional Annual Retainers for Committee Chairs | ||||

| F&A and Compensation Committees |

$ 25,000 | |||

| Governance and Independence Committees |

$ 15,000 | |||

| Fee per Board Meeting | ||||

| Regular Meeting |

$ 3,000 | |||

| Special Meeting |

$ 2,000 | |||

| Fee per Committee Meeting | ||||

| F&A Committee (other than earnings review meetings) |

$ 3,000 | |||

| F&A Committee (earnings review meetings) |

$ 2,000 | |||

| Compensation Committee (other than equity award meetings, where no meeting fee is paid) |

$ 3,000 | |||

| Governance and Independence Committees |

$ 2,000 | |||

In addition, in fiscal 2016 and fiscal 2017, Mr. Conrades, Ms. James and Secretary Panetta served on a Special Committee of the Board (the “Special Committee”) which evaluated, assessed and approved the acquisition of NetSuite Inc. on behalf of the Board. See “Transactions with Related Persons—Proposed Acquisition of NetSuite Inc.” on page 52 for details. Each Special Committee member received a per meeting fee of $2,000. Each Special Committee member will also receive a one-time fee of $15,000 for Special Committee service which will be distributed upon the conclusion of the committee’s activities. No equity compensation was provided for Special Committee service.

16

2016 Annual Meeting of Stockholders

2016 Annual Meeting of Stockholders

Table of Contents

Equity Compensation for Directors

Non-employee directors also participate in our Amended and Restated 1993 Directors’ Stock Plan (the “Directors’ Stock Plan”), which sets forth stockholder-approved limits on annual equity awards for Board and committee chair service. As described above, the Board approved significant reductions to our non-employee director compensation for fiscal 2016, including reductions in equity compensation. Below is a summary of the stockholder-approved limits on annual equity awards set forth in the Directors’ Stock Plan and the number of RSUs actually granted to directors on May 31, 2016.

| Position |

Stockholder-Approved Equity Limits (#) |

Equity Actually Granted on May 31, 2016 (#) |

% Reduction from Approved Limits |

|||||||

| Board Annual Grant |

45,000 options (or 11,250 RSUs) |

8,438 RSUs |

25

25 |

% | ||||||

| F&A Committee Chair |

45,000 options (or 11,250 RSUs) |

8,438 RSUs |

25

25 |

% | ||||||

| F&A Committee Vice Chair |

30,000 options (or 7,500 RSUs) |

— | (1) |

100

100 |

% | |||||

| Compensation Committee Chair |

45,000 options (or 11,250 RSUs) |

8,438 RSUs |

25

25 |

% | ||||||

| Governance Committee Chair |

15,000 options (or 3,750 RSUs) |

2,813 RSUs |

25

25 |

% | ||||||

| Independence Committee Chair |

15,000 options (or 3,750 RSUs) |

2,813 RSUs |

25

25 |

% | ||||||

| (1) | As noted above, the annual equity award for service as F&A Committee Vice Chair was eliminated as of April 29, 2016. Therefore, no director received an equity award for service as F&A Committee Vice Chair on May 31, 2016. |

The Directors’ Stock Plan provides that non-employee directors may receive grants of stock options or RSUs of an equivalent value, as determined on any reasonable basis by the Board, in lieu of all or some of the stock option limits set forth in the plan. The Board determined that a ratio of four stock options to one RSU should be used, consistent with its approach for equity awards granted to Oracle employees. As noted above, effective as of April 29, 2016, the Board determined that all non-employee director equity awards will be delivered in the form of RSUs that vest on the first anniversary of the date of grant.

Initial Equity Grant for New Directors

The Directors’ Stock Plan also provides for an initial equity grant of not more than 45,000 stock options (or 11,250 RSUs) for new non-employee directors, prorated based upon the number of full calendar months remaining in the fiscal year. Any new director appointed subsequent to April 29, 2016 will receive an initial grant of 8,438 RSUs (constituting a 25% reduction from the stockholder-approved limit in the Directors’ Stock Plan), prorated based upon the number of full calendar months remaining in the fiscal year.

Ms. James, who was appointed prior to the director compensation changes effective April 29, 2016, received an initial grant on December 16, 2015 consisting of a combination of stock options to purchase 9,375 shares of our common stock and 2,343 RSUs, in each case vesting 25% per year over four years on each anniversary of the date of grant. Ms. James’ award was prorated based upon the number of full calendar months remaining in the fiscal year.

Fiscal 2016 Director Compensation Table

The following table provides summary information regarding the compensation we paid to our non-employee directors in fiscal 2016.

| Name |

Fees Earned or Paid in Cash ($) |

Stock Awards (1)(2) ($) |

Option Awards (1)(2) ($) |

Total ($) | ||||||||||||

| Jeffrey S. Berg |

122,536 | 389,862 | — | 512,398 | ||||||||||||

| H. Raymond Bingham |

204,040 | 686,862 | — | 890,902 | ||||||||||||

| Michael J. Boskin |

176,464 | 547,628 | — | 724,092 | ||||||||||||

| Bruce R. Chizen |

187,005 | 529,056 | — | 716,061 | ||||||||||||

| George H. Conrades |

134,500 | 334,145 | — | 468,645 | ||||||||||||

| Hector Garcia-Molina |

91,500 | 334,145 | — | 425,645 | ||||||||||||

| Renée J. James (3) |

51,847 | 421,867 | 74,291 | 548,005 | ||||||||||||

| Leon E. Panetta |

90,536 | 334,145 | — | 424,681 | ||||||||||||

| Naomi O. Seligman |

106,500 | 334,145 | — | 440,645 | ||||||||||||

| (1) | The amounts in the “Stock Awards” and “Option Awards” columns represent the aggregate grant date fair values of RSUs and stock options, respectively, computed in accordance with Financial Accounting Standards Board’s (“FASB”) Accounting Standards Codification (“ASC”) Topic 718, Compensation-Stock Compensation (“FASB ASC 718”). The non-employee directors have not presently realized a financial benefit from these awards because none of the RSUs granted in fiscal 2016 |

2016 Annual Meeting of

Stockholders

17

17

Table of Contents

| have vested and none of the stock options granted in fiscal 2016 are currently exercisable. For information on the valuation assumptions used in our stock-based compensation computations, see Note 14 to our consolidated financial statements in our Annual Report on Form 10-K for fiscal 2016. |

| (2) | The following table provides additional information concerning the stock awards (in the form of RSUs) and stock options held by our non-employee directors as of the last day of fiscal 2016. |

| Name |

Total Unvested RSUs Fiscal 2016 Year End (#) |

RSUs Granted During Fiscal 2016 (a) (#) |

Total Option Awards Outstanding at Fiscal 2016 Year End (#) |

Option Awards Granted During Fiscal 2016 (b) (#) |

||||||||||||

| Jeffrey S. Berg |

14,064 | 9,845 | 480,000 | — | ||||||||||||

| H. Raymond Bingham |

27,189 | 17,345 | 537,500 | — | ||||||||||||

| Michael J. Boskin |

22,267 | 13,829 | 675,000 | — | ||||||||||||

| Bruce R. Chizen |

21,798 | 13,360 | 431,250 | — | ||||||||||||

| George H. Conrades |

12,657 | 8,438 | 168,750 | — | ||||||||||||

| Hector Garcia-Molina |

12,657 | 8,438 | 360,000 | — | ||||||||||||

| Renée J. James |

10,781 | 10,781 | 9,375 | 9,375 | ||||||||||||

| Leon E. Panetta |

12,657 | 8,438 | 37,500 | — | ||||||||||||

| Naomi O. Seligman |

12,657 | 8,438 | 362,500 | — | ||||||||||||

| (a) | The RSUs reported in this column were granted on May 31, 2016 and vest on the first anniversary of the date of grant, except as follows: with respect to Ms. James, 2,343 RSUs were granted on December 16, 2015 and vest 25% per year over four years on each anniversary of the date of grant. |

| (b) | The stock options reported in this column were granted on December 16, 2015, with a per share exercise price of $38.91, the closing market price of Oracle common stock on the date of grant. The stock options vest 25% per year over four years on each anniversary of the date of grant. |