Form 8-K SCHULMAN A INC For: Sep 14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) September 14, 2016

A. SCHULMAN, INC. | ||||

(Exact name of registrant as specified in its charter)

Delaware | 0-7459 | 34-0514850 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||

3637 Ridgewood Road, Fairlawn, Ohio | 44333 | ||||

(Address of principal executive offices) | (Zip Code) | ||||

(330) 666-3751 | ||||

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 7.01 REGULATION FD DISCLOSURE.

On September 14, 2016, A. Schulman, Inc. will give an investor presentation to certain analysts and institutional investors. A copy of the investor presentation used at the investor event is attached as Exhibit 99.1 hereto and incorporated by reference herein.

Pursuant to General Instruction B.2 of Current Report on Form 8-K, the information in this Item 7.01 and Exhibit 99.1 attached hereto is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section. Furthermore, the information in this Item 7.01 shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits.

Exhibit Number | Description |

99.1 | Investor Presentation (filed herewith). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

A. Schulman, Inc.

By: /s/ Andrean R. Horton

Andrean R. Horton

Executive Vice President & Chief Legal Officer

Date: September 14, 2016

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

KeyBanc Capital Markets’ Basic Materials &

Packaging Conference

September 14, 2016

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

A number of the matters discussed in this document that are not historical or current facts deal with potential future circumstances and developments and August constitute "forward-looking

statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the fact that they do not relate strictly to historic or

current facts and relate to future events and expectations. Forward-looking statements contain such words as "anticipate,” "estimate," "expect," "project," "intend," "plan," "believe," and

other words and terms of similar meaning in connection with any discussion of future operating or financial performance. Forward-looking statements are based on management's current

expectations and include known and unknown risks, uncertainties and other factors, many of which management is unable to predict or control, that August cause actual results,

performance or achievements to differ materially from those expressed or implied in the forward-looking statements. Important factors that could cause actual results to differ materially from

those suggested by these forward-looking statements, and that could adversely affect the Company's future financial performance, include, but are not limited to, the following:

– worldwide and regional economic, business and political conditions, including continuing economic uncertainties in some or all of the Company's major product markets or countries

where the Company has operations;

– the effectiveness of the Company's efforts to improve operating margins through sales growth, price increases, productivity gains, and improved purchasing techniques;

– competitive factors, including intense price competition;

– fluctuations in the value of currencies in areas where the Company operates;

– volatility of prices and availability of the supply of energy and raw materials that are critical to the manufacture of the Company's products, particularly plastic resins derived from oil

and natural gas;

– changes in customer demand and requirements;

– effectiveness of the Company to achieve the level of cost savings, productivity improvements, growth and other benefits anticipated from acquisitions, joint ventures and

restructuring initiatives;

– escalation in the cost of providing employee health care;

– uncertainties and unanticipated developments regarding contingencies, such as pending and future litigation and other claims, including developments that would require increases

in our costs and/or reserves for such contingencies;

– the performance of the global automotive market as well as other markets served;

– further adverse changes in economic or industry conditions, including global supply and demand conditions and prices for products;

– operating problems with our information systems as a result of system security failures such as viruses, cyber-attacks or other causes;

– our current debt position could adversely affect our financial health and prevent us from fulfilling our financial obligations;

– integration of acquisitions, including most recently Citadel, with our existing business, including the risk that the integration will be more costly or more time consuming and complex

or simply less effective than anticipated;

– our ability to achieve the anticipated synergies, cost savings and other benefits from the Citadel acquisition;

– substantial time devoted by management to the integration of the Citadel acquisition; and

– failure of counterparties to perform under the terms and conditions of contractual arrangements, including suppliers, customers, buyers and sellers of a business and other third

parties with which the Company contracts.

The risks and uncertainties identified above are not the only risks the Company faces. Additional risk factors that could affect the Company's performance are

set forth in the Company's Annual Report on Form 10-K for the fiscal year ended August 31, 2015. In addition, risks and uncertainties not presently known to

the Company or that it believes to be immaterial also may adversely affect the Company. Should any known or unknown risks or uncertainties develop into

actual events, or underlying assumptions prove inaccurate, these developments could have material adverse effects on the Company's business, financial

condition and results of operations.

2

Cautionary Note

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

This presentation includes certain financial information determined by methods other than in accordance with

accounting principles generally accepted in the United States (“GAAP”). These non-GAAP financial measures include

segment gross profit, SG&A expenses excluding certain items, segment operating income, operating income before

certain items, net income excluding certain items, net income per diluted share excluding certain items, adjusted

EBITDA and free cash flow as discussed further in the Reconciliation of GAAP and Non-GAAP Financial Measures

below. These non-GAAP financial measures are considered relevant to aid analysis and understanding of the

Company’s results and business trends. However, non-GAAP measures are not in accordance with, nor are they a

substitute for, GAAP measures, and tables included in this release reconcile each non-GAAP financial measure with

the most directly comparable GAAP financial measure. The most directly comparable GAAP financial measures for

these purposes are gross profit, SG&A expenses, operating income, net income, net income per diluted share and

cash provided from operating activities. The Company's non-GAAP financial measures are not meant to be considered

in isolation or as a substitute for comparable GAAP financial measures, and should be read only in conjunction with

the Company's consolidated financial statements prepared in accordance with GAAP.

While the Company believes that these non-GAAP financial measures provide useful supplemental information to

investors, there are very significant limitations associated with their use. These non-GAAP financial measures are not

prepared in accordance with GAAP, may not be reported by all of the Company’s competitors and may not be directly

comparable to similarly titled measures of the Company’s competitors due to potential differences in the exact method

of calculation. The Company compensates for these limitations by using these non-GAAP financial measures as

supplements to GAAP financial measures and by reviewing the reconciliations of the non-GAAP financial measures to

their most comparable GAAP financial measures.

3

Use of Non-GAAP Financial Measures

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

A. Schulman Business Overview

4

• By transforming pennies-per-pound commodity resins into dollars-per-pound specialty

materials, we help define success for our customers around the world

• We add significant value by enhancing the performance, appearance or ability to process

our customers’ products - providing our customers with critical solutions and differentiation in

their markets

BUSINESS MODEL

Engineered Plastics

Specialty Powders &

Engineered Composites

Masterbatch Solutions

Custom Performance Colors

Polymer Polymer Additives

Fiber & Reinforcements Finished

Compound

SIGNIFICANT TRANSFORMATION SINCE 2008 WITH A FOCUS ON SPECIALTY MATERIALS SOLUTIONS

Resin

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

A. Schulman Overview

5

1928

Founded by

Alex Schulman

in Akron,

Ohio, US

Public company

1972

(Symbol: SHLM)

Global

Presence

since

1950s

11

Acquisitions

since 2010

~$55M

*Free cash

flow

$2.4B

in revenue

in FY15

6

Product

families

57

Manufacturing

sites

~ 1,000,000

Tons current annual

manufacturing

capacity

5,000

Associates

*Free cash flow calculated as TTM May-16 cash flow provided from operations less capital expenditures

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

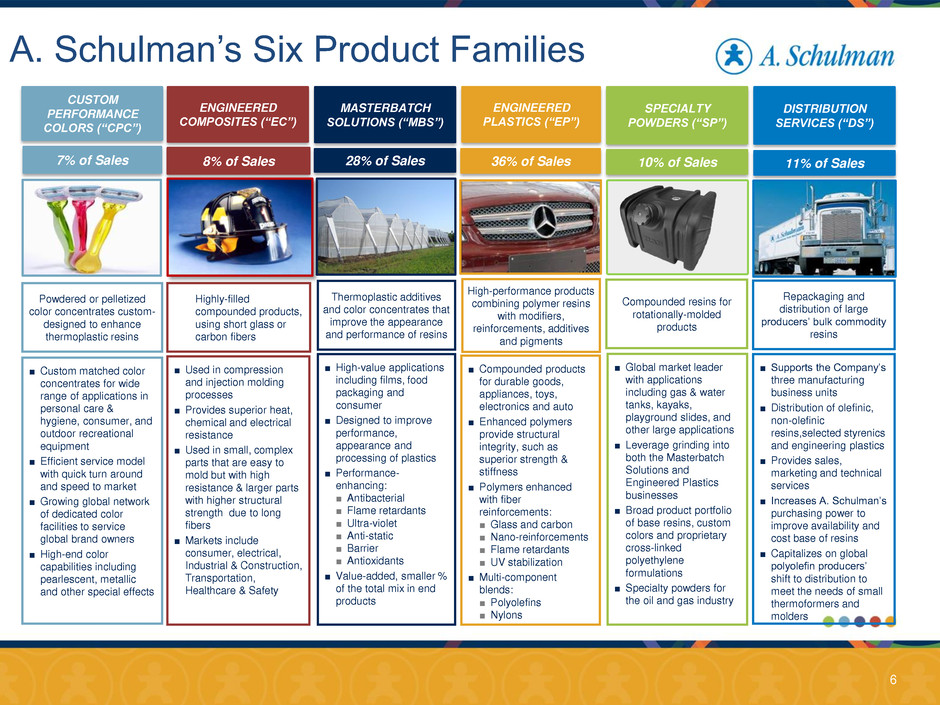

A. Schulman’s Six Product Families

6

7% of Sales 28% of Sales 36% of Sales 10% of Sales 11% of Sales

CUSTOM

PERFORMANCE

COLORS (“CPC”)

MASTERBATCH

SOLUTIONS (“MBS”)

ENGINEERED

PLASTICS (“EP”)

SPECIALTY

POWDERS (“SP”)

DISTRIBUTION

SERVICES (“DS”)

High-performance products

combining polymer resins

with modifiers,

reinforcements, additives

and pigments

■ Custom matched color

concentrates for wide

range of applications in

personal care &

hygiene, consumer, and

outdoor recreational

equipment

■ Efficient service model

with quick turn around

and speed to market

■ Growing global network

of dedicated color

facilities to service

global brand owners

■ High-end color

capabilities including

pearlescent, metallic

and other special effects

Repackaging and

distribution of large

producers’ bulk commodity

resins

Compounded resins for

rotationally-molded

products

Powdered or pelletized

color concentrates custom-

designed to enhance

thermoplastic resins

Thermoplastic additives

and color concentrates that

improve the appearance

and performance of resins

■ High-value applications

including films, food

packaging and

consumer

■ Designed to improve

performance,

appearance and

processing of plastics

■ Performance-

enhancing:

■ Antibacterial

■ Flame retardants

■ Ultra-violet

■ Anti-static

■ Barrier

■ Antioxidants

■ Value-added, smaller %

of the total mix in end

products

■ Compounded products

for durable goods,

appliances, toys,

electronics and auto

■ Enhanced polymers

provide structural

integrity, such as

superior strength &

stiffness

■ Polymers enhanced

with fiber

reinforcements:

■ Glass and carbon

■ Nano-reinforcements

■ Flame retardants

■ UV stabilization

■ Multi-component

blends:

■ Polyolefins

■ Nylons

■ Global market leader

with applications

including gas & water

tanks, kayaks,

playground slides, and

other large applications

■ Leverage grinding into

both the Masterbatch

Solutions and

Engineered Plastics

businesses

■ Broad product portfolio

of base resins, custom

colors and proprietary

cross-linked

polyethylene

formulations

■ Specialty powders for

the oil and gas industry

■ Supports the Company’s

three manufacturing

business units

■ Distribution of olefinic,

non-olefinic

resins,selected styrenics

and engineering plastics

■ Provides sales,

marketing and technical

services

■ Increases A. Schulman’s

purchasing power to

improve availability and

cost base of resins

■ Capitalizes on global

polyolefin producers’

shift to distribution to

meet the needs of small

thermoformers and

molders

ENGINEERED

COMPOSITES (“EC”)

8% of Sales

Highly-filled

compounded products,

using short glass or

carbon fibers

■ Used in compression

and injection molding

processes

■ Provides superior heat,

chemical and electrical

resistance

■ Used in small, complex

parts that are easy to

mold but with high

resistance & larger parts

with higher structural

strength due to long

fibers

■ Markets include

consumer, electrical,

Industrial & Construction,

Transportation,

Healthcare & Safety

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

Diverse End Markets & Applications

7

Color matching and color trending services

Global technical expertise and extensive

industry know-how

Compliance with regulation and design needs

Expertise in scratch and surface appearance,

paint replacement, lightweight materials, and

look & feel etc.

Flame retardant and UV stability meeting

industry standards w/o hazardous materials

Meet the highest thermal stability

requirements

Flame retardant – various halogen-free

solutions, antimony trioxide free options

Colored & UV resistant

Optimized for a large variety of base polymers

Extensive know-how especially in UV

protection & antimicrobial (patented)

Fully equipped lab for testing and small scale

production

Color matching and color trending services

Key properties: mechanical strength, impact

resistance, UV stability & surface appearance

Transfer of plasma adhesion technology

Mobility

Building &

Construction

Electronics &

Electrical

Agriculture

Sports, Leisure &

Home

Packaging

Personal Care &

Hygiene

% of Revenue

36% Masterbatches

Custom Performance Colors

Distribution products

19% Custom Performance Colors

Engineered Plastics

Engineered Composites

Food packaging

Security / Anti-Theft

Packaging

7% Masterbatches

Custom Performance Colors

Engineered Plastics

Engineered Composites

5% Masterbatches

Customer Performance Colors

Engineered Plastics

Specialty Powders

9% Masterbatches

Custom Performance Colors

Engineered Plastics

Engineered Composites

5% Masterbatches

Customer Performance Colors

Specialty Powders

Engineered Composites

4% Masterbatches

Custom Performance Colors

Engineered Plastics

End Market % of Revenue Key Products Key Applications Key Attributes

Interiors, exteriors and under

the hood applications

Automotive electrical and

electronic parts

EPS and XPS industries

Polyethylene pipe production

and insulation

Window Frames

Green house frames & films

Mulch and silage film

Irrigation systems and tanks

UL, VDE, IEC, DIN, Building

& Construction

Power tools

Small Appliances

Stadium seats

Helmets, coolers

Synthetic grass system for

hockey, tennis, golf etc.

Toothbrushes, razors,

shampoo bottles

Diapers & adult incontinence

(key mega trend for aging

population)

Customer focused approach meeting specific

needs (i.e., customized colors and effects)

Soft touch solutions offering aesthetics and a

good grip

Breathable films

1 Revenue splits based on LTM 2/28/15 net sales

11

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

4Q Update

8

• On 8/11/16 Company lowered its full-year 2016 adjusted net income guidance range to

$1.90 to $1.95 per diluted share

• APAC and LATAM had performed close to internal forecasts

• USCAN experienced share loss from a major Engineered Plastics customer due to a

product shift that A. Schulman did not pursue given formulation and price requirements

• Engineered Composites experienced softer demand in mobility, E&E and B&C markets in

US

• EMEA

• Distribution, Specialty Powders and Masterbatch Solutions suffered from customer

hesitation in an overall downward polyolefin market as well as uncertainty in the

macro environment (i.e. Brexit & Turkey coup)

• In addition, consolidation in France has gone slower than anticipated and resulted in

temporary share loss in SP

• MBS experienced a temporary share loss after competitors lagged behind the

Company's pricing actions related to white Masterbatch product offerings

• Engineered Plastics and CPC on track

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

4Q Update

9

• On 8/18/16 Board of Directors asked Joe Gingo to return as our president and chief

executive officer with a 2-year contract & 1-year renewal option

• On 8/22/16 Gary Miller was appointed Chief Operating Officer and Frank Roederer was

appointed SVP, GM of U.S. and Canada (“USCAN”) in addition to his role as GM of

Engineered Composites (“EC”)

• The Company has partnered with Citi to provide a comprehensive review of the

Company’s 2017 budget, five-year plan, as well as near- and longer-term global market

trends. Purpose of the comprehensive review is to understand lack of performance and

review Company’s market assumptions and outlook.

• The Board takes – and will always take – seriously its fiduciary duties to deliver

meaningful shareholder value and this action is in line with that goal.

• Company aims to improve performance, not to find a buyer of the Company.

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

• Reported sales up 16%; legacy

sales down 3%

• Significant YOY margin

improvement; 12 consecutive qtrs.

of YOY gains in adjusted gross

margins

• Positive product mix shift between

specialty and commodity

businesses

• Profit improvement from Citadel

integration and past restructuring:

• Adj. gross profit1 up 120 bps

• Adj. operating income1 up 110 bps

10

(1) Reflects Non-GAAP results. Refer to the Appendix for a reconciliation between GAAP and Non-GAAP results.

Financial Highlights – 3Q16

3Q16 FINANCIAL HIGHLIGHTS ($mm, $/sh)

3Q16 3Q15 Change %

REVENUE $650.4 $560.9 16%

GAAP EPS $0.53/sh ($.34)/sh nm

ADJ EPS1 $0.79/sh $0.72/sh 10%

ADJ GROSS PROFIT1 $113.3 $90.9 25%

ADJ OP INCOME1 $45.8 $32.8 40%

ADJ EBITDA1 $66.9 $45.2 48%

3Q16 Revenue Bridge ($mm)

3Q15 FX Acqn Vol/Price 3Q16

561

650

(6)

(17)

112

700

500

100

300

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

Key 3Q16 Takeaways

• Consolidated gross profit and operating income increased by 20.6% and 35.8%,

respectively, versus the prior year period

• Adjusted gross margin1 in 3Q increased to 17.4% vs 16.2% in the prior year period;

adjusted operating margin1 increased to 7% vs 5.9% in the prior year period

• Debt reduction by $40 million during quarter driven by $51* million free cash flow

• Lucent matter addressed operationally; lawsuit filed against former owners

• Citadel synergies raised to $30 million by end of fiscal 2017

• Focus will remain on accelerating value-added portfolio (smart sales) and operational

(smart) savings

11

*Reflects free cash flow calculated as cash flow provided from operations less capital expenditures

(1) Reflects Non-GAAP results. Refer to the Appendix for a reconciliation between GAAP and Non-GAAP results.

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

• Lucent matter addressed operationally

• Lawsuit filed against former sellers

• Company estimates roughly $20mm - $25mm in lost sales in FY16

• No product recalls to date

• Two Lucent plants closed in August and third plant by end of December

12

Lucent Resolution Process

Three months

ended

Nine months

ended

May 31, 2016

(in millions)

Inventory rework, remediation action, investigative costs $ 0.7 $ 5.0

Recurring additional costs to produce to customer specs 1.1 3.8

Total Lucent remediation costs 1.8 8.8

Litigation-related costs 1.2 1.2

Total Lucent Matter costs $ 3.0 $ 10.0

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

• Cost synergies closing in on $20mm

goal; YTD is $12mm

• Increase hard synergy goal to $30mm

in FY17

• Expect sales synergies in FY17

• Refocus resources as Lucent

distraction abates

13

Citadel Integration

CITADEL COST SYNERGY PROGRESS ($mm)

YTD 2016

FORECAST

FY2016

GOAL

FY 2017

Sourcing $4 $6 $11

Operations 0 3 9

SG&A /

Other

8 10 10

TOTAL $12 $19 $30

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

14

• 3Q16 debt reduction was $40mm

• Driven by $51mm of free cash flow*

generation

• Working capital improvement mostly

attributed to effective inventory

management efforts and favorable

seasonality impact

Balance Sheet / Cash Flow

$144 Million Gross Debt Reduction Since June 1 Citadel Purchase

*Reflects free cash flow calculated as cash flow provided from operations less capital expenditures

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

Debt Structure*

* In USD unless noted and millions

** Libor floor at 0.75% 21

Debt Tranches Pricing

As of

8/31/15

11/30/15 2/29/16 5/31/16

Prelim.

8/31/16

Total Debt

Reduction

Since

8/31/15

Revolver - $300 L+225 bps $0 $0 $18 $12 $17 +17

Term Loan A L+225 bps $198 $195 $192 $190 $188 -10

USD Term Loan B L+325** $349 $348 $347 $346 $345 -4

EUR Term Loan B L+325** €125 €104 €74 €45

€15

$140 $110 $80 $50 $16 -124

High Yield Bond 6.875% $375 $375 $375 $375 $375

Misc. (foreign credit lines,

leases, etc.) varies $4 $8 $12 $13 $14 +10

Total Debt $1,066 $1,036 $1,024 $986 $955 -111

Cash 97 96 47 49 43

Total Net Debt $969 $940 $977 $937 $912 -57

Adjusted Net Leverage 4.08x 3.87x 4.22x 3.96x 3.93x

TOTAL DEBT REDUCED BY $111MM IN FISCAL YEAR 2016. COMPANY HAS

EFFECTIVELY UTILIZED THE IN HOUSE BANK TO MANAGE ITS CASH POSITION

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

Use of Cash

• Reinvest in the business

o New operations in Turkey & China

o Capacity expansions in APAC and LATAM

o Restructuring to support specialty demand

• Dividend payments

o Support common dividend currently yielding approximately 3%

• Debt repayments

o Intense focus on de-leveraging balance sheet to 2.5x net leverage

target

• Opportunistic acquisitions

• Share buy backs

16

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

Path to Growth

17

SMART SAVINGS

SMART SALES

CITADEL

INTEGRATION

ACCELERATED

GROWTH

•FY17 cost synergy raised to $30mm

•FY17 sales synergies

•Drive composite capabilities into EMEA

• Investment in key markets (e.g. China)

•Enhanced global R&D/New products

•Enhanced focus on USCAN

•Realignment of Marketing & IT functions/

implement enhanced CRM

•Plant consolidations

•Productivity initiatives

(Manufacturing for Success)

•Supply chain efficiencies

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

18

Appendix

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

19

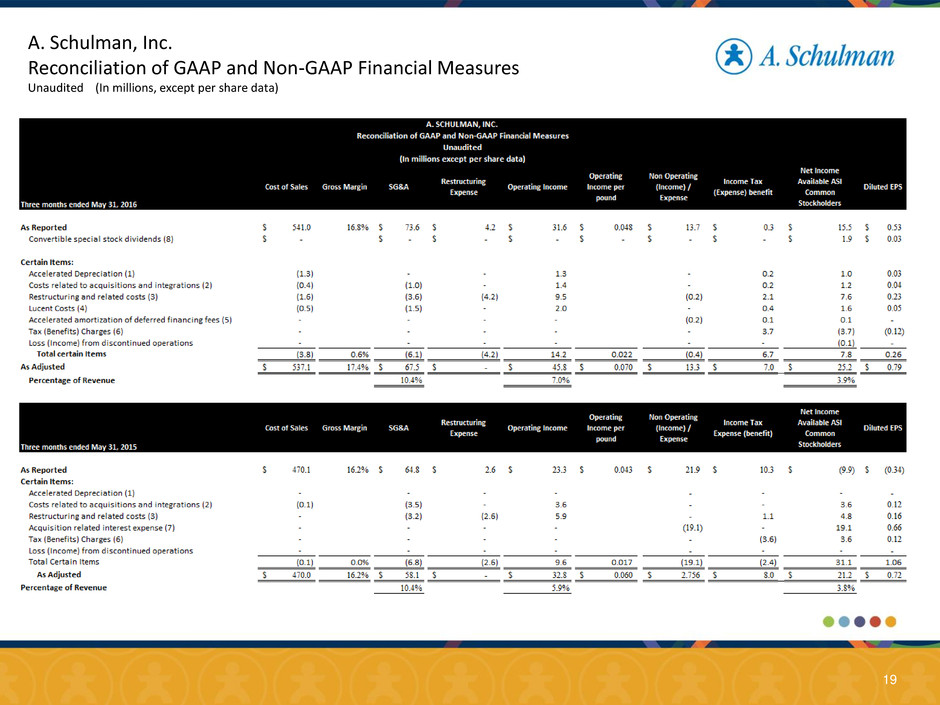

A. Schulman, Inc.

Reconciliation of GAAP and Non-GAAP Financial Measures

Unaudited (In millions, except per share data)

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

20

Explanation of Adjustments

1) Accelerated depreciation is related to restructuring plans in the Company's USCAN and EMEA segments.

Refer to Note 14 in the Company's Quarterly Report on Form 10-Q for further discussion.

2) Costs related to acquisitions and integrations primarily include third party professional, legal, IT and other expenses

associated with successful and unsuccessful full or partial acquisition and divestiture/dissolution transactions, as well

as certain employee-related expenses such as travel, bonuses and post-acquisition severance separate from a formal

restructuring plan.

3) Restructuring and related costs include items such as employee severance charges, lease termination charges,

curtailment gains/losses, other employee termination costs, and professional fees related to the reorganization of the

Company’s legal entity structure and facility operations.

4) Lucent costs primarily represent legal and investigation costs related to resolving the Lucent matter, product

manufacturing costs for reworking existing Lucent inventory, obsolete Lucent inventory reserve costs, and dedicated

internal personnel costs that would have otherwise been focused on normal operations.

5) Write off of deferred financing costs related to the €79.0 million prepayment of the Euro Term Loan B.

6) Tax (benefits) charges represent the Company's quarterly non-GAAP tax based on the overall estimated annual non-

GAAP effective tax rates.

7) Primarily relates to $18.8 million in bridge financing fees.

8) Convertible special stock dividends have been added back as the 2.4 million shares of convertible special stock were

considered dilutive to the third quarter of fiscal 2016.

0

38

84

229

162

38

0

119

193

157

194

75

117

167

192

83

94

125

192

77

55

127

127

127

89

89

89

21

Explanation of Adjustments

1) Other includes Foreign currency transaction (gains) losses, Other (income) expense, net, and Gain on early extinguishment of debt.

2) For details on Non-GAAP adjustments, refer to "Reconciliation of GAAP and Non-GAAP Financial Measures", items (2) - (8) and Loss (income) from discontinued operations. Amounts are included in

Non Operating (Income) Expense, Income Tax Expense (Benefit) and Net Income Available to ASI Common Stockholders. Accelerated depreciation on the "Reconciliation of GAAP and Non-GAAP

Financial Measures" has been excluded as it is already included in Depreciation and Amortization above. The three months ended May 31, 2015 also include additional amortization expense which is in

SG&A in the "Reconciliation of GAAP and Non-GAAP Financial Measures". This expense has been added back to adjusted EBITDA.

A. Schulman, Inc.

Reconciliation of GAAP and Non-GAAP Financial Measures

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Adams Diversified Equity Fund Declares Distribution and Announces First Quarter Performance

- UNITE HERE Local 11: Workers at Aimbridge-Operated SaMo Hotel Submit Letter to City Attorney, Calling for Investigation Into Hotels’ Compliance With Panic Button Law Following Allegations of Sexual

- UPDATE: LifeWallet Announces a Comprehensive Settlement with a Group of Affiliated Property & Casualty Insurers

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share