Form 8-K TerraForm Power, Inc. For: Aug 18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 18, 2016

____________________________________________________________

TerraForm Power, Inc.

(Exact name of registrant as specified in its charter)

______________________________________________________________

Delaware | 001-36542 | 46-4780940 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I. R. S. Employer Identification No.) |

7550 Wisconsin Avenue, 9th Floor, Bethesda, Maryland 20814

(Address of principal executive offices, including zip code)

(240) 762-7700

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |

Item 7.01. Regulation FD Disclosure.

As previously disclosed, TerraForm Power Operating, LLC (“Operating LLC”), a subsidiary of TerraForm Power, Inc. (the “Company”), commenced a consent solicitation (the “Consent Solicitation”) on June 24, 2016 to holders (collectively, the “Holders”) of its 5.875% Senior Notes due 2023 (the “2023 Notes”) and its 6.125% Senior Notes due 2025 (the “2025 Notes,” and together with the 2023 Notes, the “Notes”).

The Company and its advisors have been engaged in confidential discussions regarding potential revisions to the Consent Solicitation with a steering committee (the “Steering Committee”) of Holders representing approximately 40% of the outstanding principal amount of the 2023 Notes and 25% of the outstanding principal amount of the 2025 Notes and with the Steering Committee’s legal advisor. The members of the Steering Committee have informed us that they are part of a wider committee of Holders beneficially owning in aggregate a majority in outstanding principal amount of each series of Notes. In connection with these discussions and pursuant to certain confidentiality agreements, the Company agreed to publicly disclose the latest draft of any proposal regarding potential revisions to the Consent Solicitation, which such draft is furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K (the “Proposal”).

The members of the Steering Committee have communicated to us their intent to vote for a revised consent solicitation that reflects the Proposal, subject to agreement on definitive documentation, and their intent to recommend the Proposal to the wider committee of Holders. Upon indications of support from an appropriate number of the remaining Holders, Operating LLC plans to amend and restate the Consent Solicitation to reflect the Proposal.

In accordance with General Instruction B.2 of Form 8-K, the information contained in this Form 8-K is deemed to be “furnished” and shall not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall such information and Exhibit be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

Cautionary Note Regarding Forward-Looking Statements.

This Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. These statements involve estimates, expectations, projections, goals, assumptions, known and unknown risks, and uncertainties and typically include words or variations of words such as “expect,” “anticipate,” “believe,” “intend,” “plan,” “seek,” “estimate,” “predict,” “project,” “goal,” “guidance,” “outlook,” “objective,” “forecast,” “target,” “potential,” “continue,” “would,” “will,” “should,” “could,” or “may” or other comparable terms and phrases. All statements that address operating performance, events, or developments that the Company or Operating LLC expect or anticipate will occur in the future are forward-looking statements. These include statements that address the plans of the Company or Operating LLC. Forward-looking statements provide the Company’s current expectations or predictions of future conditions, events, or results and speak only as of the date they are made. Although the Company believes its respective expectations and assumptions are reasonable, it can give no assurance that these expectations and assumptions will prove to have been correct and actual results may vary materially.

By their nature, forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. Factors that might cause such differences include, but are not limited to, developments with respect to the Company’s delayed filings of its Form 10-K for the fiscal year ended December 31, 2015 and delayed Form 10-Q filings with

respect to the first and second quarters of 2016; our relationship with SunEdison, Inc. (“SunEdison”), including SunEdison’s bankruptcy filings and our reliance on SunEdison to perform under material intercompany agreements and to provide management and accounting services, project level operation and maintenance and asset management services, to maintain critical information technology and accounting systems and to provide our employees; our ability to integrate the projects we acquire from third parties or otherwise realize the anticipated benefits from such acquisitions; actions of third parties, including but not limited to the failure of SunEdison, to fulfill its obligations and the actions of the Holders; price fluctuations, termination provisions and buyout provisions in offtake agreements; delays or unexpected costs during the completion of projects under construction; our ability to successfully identify, evaluate, and consummate acquisitions from SunEdison or third parties or changes in expected terms and timing of any acquisitions; regulatory requirements and incentives for production of renewable power; operating and financial restrictions under agreements governing indebtedness; the condition of the debt and equity capital markets and our ability to borrow additional funds and access capital markets; the impact of foreign exchange rate fluctuations; our ability to compete against traditional and renewable energy companies; hazards customary to the power production industry and power generation operations, such as unusual weather conditions and outages or other curtailment of our power plants; departure of some or all of SunEdison’s employees that are dedicated to the Company; pending and future litigation; and our ability to operate our business efficiently, to operate and maintain our information technology, technical, accounting and generation monitoring systems, to manage and complete governmental filings on a timely basis, and to manage our capital expenditures. Many of these factors are beyond the Company’s control.

The Company disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions, factors, or expectations, new information, data, or methods, future events, or other changes, except as required by law. The foregoing list of factors that might cause results to differ materially from those contemplated in the forward-looking statements should be considered in connection with information regarding risks and uncertainties which are described in the Company’s Form 10-K for the fiscal year ended December 31, 2014, and Forms 10-Q with respect to the second and third quarters of 2015, as well as additional factors it may describe from time to time in other filings with the Securities and Exchange Commission or incorporated herein. You should understand that it is not possible to predict or identify all such factors and, consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties.

Item 9.01 Financial Statement and Exhibits.

(d) Exhibits

Exhibit No. | Description |

99.1* | Company Proposal to Steering Committee |

* Document furnished herewith

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

TERRAFORM POWER, INC. | ||

Date: August 18, 2016 | By: | /s/ Rebecca Cranna |

Name: | Rebecca Cranna | |

Title: | Executive Vice President and Chief Financial Officer | |

Exhibit Index

Exhibit No. | Description |

99.1* | Company Proposal to Steering Committee |

* Document furnished herewith

1

TerraForm Power Consent Solicitation Proposal

Company Proposal (8/17/16)

Fee

Change of

Control

Record Date

Other

Interest Rate

�ƒ50bps upfront payment for 90-day extension

�ƒNo withholding tax applicable to fee

�ƒChange of control threshold remains 50%; ratings downgrade requirement eliminated

�ƒIf third party acquires between 35-50%, then company may offer to repurchase the bonds at 101

– If company does not commence such an offer within 3 months of 35-50% acquisition, then interest rate

increases by 100bps

�ƒ50bps permanent increase

– Call premiums adjusted accordingly per the attached schedule

�ƒSpecial interest rate payable during the 90-day extension period equal to then-current rate plus 300bps

(regardless of whether reporting covenants have then been complied with by the Company or the Company

has then publicly announced a board approved M&A transaction with an offer to repurchase bonds at 101 or

greater)

– No impact to call premiums

�ƒLegal costs reimbursed pursuant to Amended and Restated Reimbursement Agreement, dated August 10,

2016, between Dechert LLP and the Company

�ƒCompliance with reporting covenants is tolled if the Company publicly announces a board-approved binding

M&A transaction with an offer to repurchase bonds at 101 or greater; provided that such tolling shall cease in

the event that such M&A transaction has not been consummated within 6 months of such announcement. If

the M&A transaction has been consummated within 6 months of such announcement, (a) historical

compliance with reporting covenant will be waived and (b) the Company will be required to comply with the

reporting covenants on a going-forward basis, beginning for quarterly reports with the first full quarter that is

at least three months after consummation of such M&A transaction and for annual reports with the first full

fiscal year after consummation of such M&A transaction

�ƒRecord date moved to the date that is three business days prior to commencement of consent solicitation

Exhibit 99.1

2

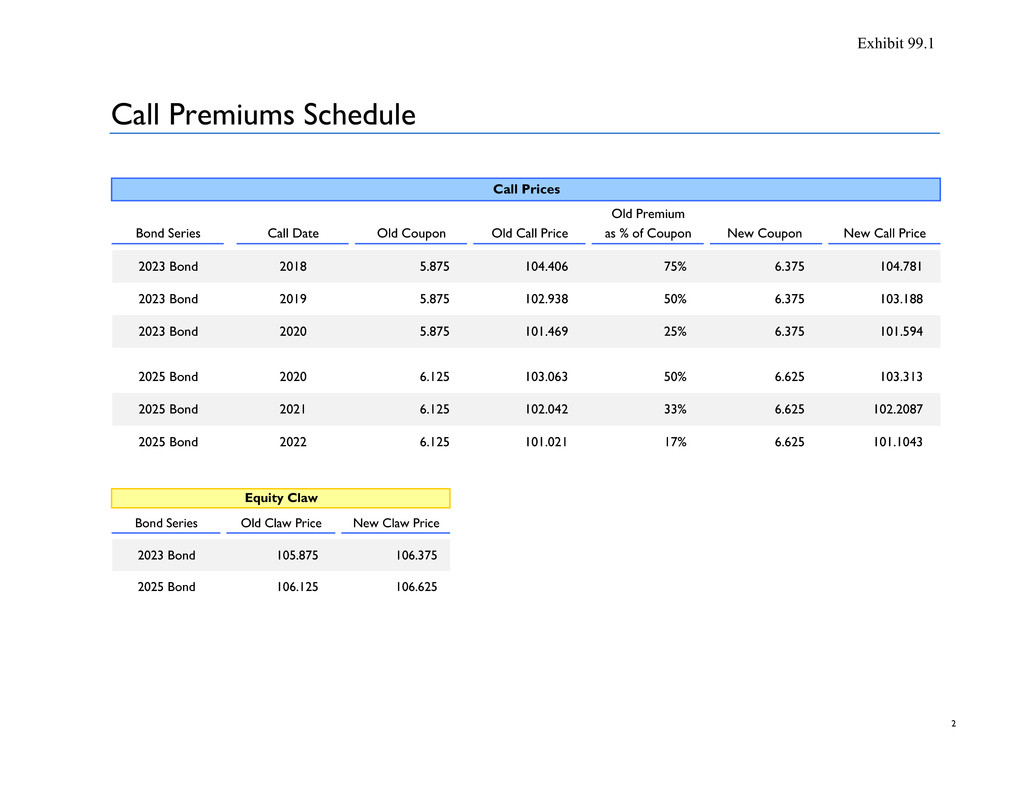

Call Premiums Schedule

Call Prices

Old Premium

Bond Series Call Date Old Coupon Old Call Price as % of Coupon New Coupon New Call Price

2023 Bond 2018 5.875 104.406 75% 6.375 104.781

2023 Bond 2019 5.875 102.938 50% 6.375 103.188

2023 Bond 2020 5.875 101.469 25% 6.375 101.594

2025 Bond 2020 6.125 103.063 50% 6.625 103.313

2025 Bond 2021 6.125 102.042 33% 6.625 102.2087

2025 Bond 2022 6.125 101.021 17% 6.625 101.1043

Equity Claw

Bond Series Old Claw Price New Claw Price

2023 Bond 105.875 106.375

2025 Bond 106.125 106.625

�(�[�K�L�E�L�W��

�

��

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Cove Capital Investments Provides Investors a Closer Look at Its Pharmacy Net Lease 65 DST in Downtown Encinitas, CA Through Aerial Drone Photography

- Himalaya Wellness Launches PartySmart Electrolytes

- Form 8.3 - Centaur Media Plc

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share