Form DEF 14A W&T OFFSHORE INC For: Sep 01

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material under Rule 14a-12 | |

W&T Offshore, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||

| (1) | Amount previously paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Table of Contents

August 4, 2016

Dear Shareholder:

It is my pleasure to invite you to the Special Meeting of Shareholders of W&T Offshore, Inc., a Texas corporation, to be held on Thursday, September 1, 2016 at 8:00 a.m., Central Daylight Time, at the offices of the Company, Nine Greenway Plaza, Suite 300, Houston, Texas 77046. I hope you will be able to attend.

The Special Meeting is being called to request approval by our shareholders of:

| • | an amendment to our Amended and Restated Articles of Incorporation, as amended, in substantially the form attached to the proxy statement (the “Proxy Statement”) as Appendix A, to increase the number of authorized shares of the Company’s common stock, par value $0.00001 per share (“Common Stock”), to 200,000,000 shares (the “Authorized Shares Proposal”); and |

| • | for purposes of the rules of the New York Stock Exchange, the issuance of up to 62,100,000 shares of our Common Stock in connection with the exchange offer described below (the “Exchange Offer Proposal” and, together with the Authorized Shares Proposal, the “Proposals”). |

The Proposals are being submitted to our shareholders in connection with an offer to exchange (the “Exchange Offer”) the Company’s outstanding 8.50% Senior Notes due 2019 (the “Notes”) for up to (assuming 100% participation): (i) 62,100,000 shares of Common Stock of the Company, which will represent 45% of the Company’s total equity upon consummation of the Exchange Offer (the “Shares”), (ii) $202.5 million aggregate principal amount of new second lien exchange notes due May 2020 on terms substantially identical to the Company’s existing 9.00% second lien term loans, except that the interest on the new second lien exchange notes may be paid in kind at the option of the Company at a rate of 10.75% per annum for the 18 months after issuance and is otherwise payable in cash at a rate of 9.00% per annum, and (iii) $180 million aggregate principal amount of new unsecured exchange notes due June 2021 on terms substantially identical to the Notes, except that the interest on the new unsecured notes may be paid in kind at a rate of 10.00% per annum for the first 2 years after issuance and is otherwise payable in cash at a rate of 8.50% per annum. The Exchange Offer is intended to reduce our outstanding indebtedness, preserve liquidity, reduce interest expense and increase our ability to comply with our debt instruments during the current decline in the oil and gas industry. If we are unable to successfully consummate the Exchange Offer and address our near term liquidity needs, we may be unable to satisfy our future debt service obligations, meet other financial obligations and comply with the debt covenants governing our indebtedness, and we may seek relief under the U.S. Bankruptcy Code, which such relief may include: (i) seeking bankruptcy court approval for the sale or sales of some, most or substantially all of our assets and a subsequent liquidation of the remaining assets in the bankruptcy case; (ii) pursuing a plan of reorganization or (iii) seeking another form of bankruptcy relief, all of which involve uncertainties, potential delays and litigation risks. In such an event, holders of the Notes and our Common Stock may receive little or no consideration. The Exchange Offer will be conditioned upon, among other things, the approval of both of the Proposals. The amendment to our Amended and Restated Articles of Incorporation to increase the number of authorized shares of our Common Stock to be approved at this Special Meeting shall only become effective in connection with the Exchange Offer.

Our Board of Directors believes that each of the Authorized Shares Proposal and the Exchange Offer Proposal is in the best interests of the Company and its shareholders and, therefore, recommends that you vote “FOR” each of the Proposals.

The Proxy Statement does not constitute the Exchange Offer, which is being conducted pursuant to a separate offer to exchange.

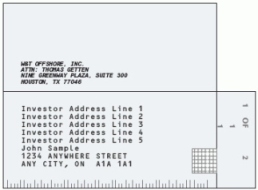

Additional details of the business to be conducted at the Special Meeting are provided in the attached Notice of Special Meeting of Shareholders and Proxy Statement. You received these materials with a proxy card that

Table of Contents

indicates the number of votes that you will be entitled to cast at the Special Meeting according to our records or the records of your broker or other nominee. Our Board of Directors has determined that owners of record of the Company’s Common Stock at the close of business on August 4, 2016 are entitled to notice of, and have the right to vote at, the Special Meeting and any reconvened meeting following any adjournment or postponement of the meeting.

Whether or not you attend the Special Meeting, it is important that your shares be represented and voted at the meeting. Therefore, I urge you to promptly vote using the Internet or telephone voting procedures described on the proxy card or vote and submit your proxy by signing, dating and returning the enclosed proxy card in the enclosed envelope. If you decide to attend the Special Meeting, you will be able to vote in person, even if you have previously submitted your proxy.

On behalf of the Board of Directors and our employees, I would like to express my appreciation for your continued interest in our affairs. I look forward to greeting as many of you as possible at the meeting.

Sincerely,

Tracy W. Krohn

Chairman of the Board and

Chief Executive Officer

Nine Greenway Plaza, Suite 300

Houston, Texas 77046

Phone (713) 626-8525

Table of Contents

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON SEPTEMBER 1, 2016

Notice is hereby given that the Special Meeting of Shareholders of W&T Offshore, Inc., a Texas corporation, will be held at the offices of the Company, Nine Greenway Plaza, Suite 300, Houston, Texas 77046 on September 1, 2016 at 8:00 a.m., Central Daylight Time, for the following purposes:

| 1. | to approve an amendment to our Amended and Restated Articles of Incorporation, as amended, in substantially the form attached to the proxy statement (the “Proxy Statement”) as Appendix A, to increase the number of authorized shares of the Company’s common stock, par value $0.00001 per share (“Common Stock”), to 200,000,000 shares (the “Authorized Shares Proposal”); |

| 2. | to approve, for purposes of the rules of the New York Stock Exchange, the issuance of up to 62,100,000 shares of our Common Stock in connection with the offer to exchange (the “Exchange Offer”) the Company’s outstanding 8.50% Senior Notes due 2019 (the “Notes”) for up to (assuming 100% participation): (i) 62,100,000 shares of Common Stock of the Company, which will represent 45% of the Company’s total equity upon consummation of the Exchange Offer (the “Shares”), (ii) $202.5 million aggregate principal amount of new second lien exchange notes due May 2020 on terms substantially identical to the Company’s existing 9.00% second lien term loans, except that the interest on the new second lien exchange notes may be paid in kind at the option of the Company at a rate of 10.75% per annum for the 18 months after issuance and is otherwise payable in cash at a rate of 9.00% per annum, and (iii) $180 million aggregate principal amount of new unsecured exchange notes due June 2021 on terms substantially identical to the Notes, except that the interest on the new unsecured notes may be paid in kind at a rate of 10.00% per annum for the first 2 years after issuance and is otherwise payable in cash at a rate of 8.50% per annum (the “Exchange Offer Proposal” and, together with the Authorized Shares Proposal, the “Proposals”); and |

| 3. | to transact such other business as may properly come before the meeting and any adjournment or postponement thereof. |

The Company’s Board of Directors recommends that shareholders vote “FOR” each of the Proposals.

Only shareholders of record at the close of business on August 4, 2016 will be entitled to notice of, and to vote at, the Special Meeting, or any adjournment or postponement thereof, notwithstanding the transfer of any shares after such date. For specific voting information, see “General Information” beginning on page 1 of the enclosed Proxy Statement. A list of these shareholders will be open for examination by any shareholder for ten days prior to the date of the Special Meeting at our principal executive offices at Nine Greenway Plaza, Suite 300, Houston, Texas 77046.

Whether or not you attend the Special Meeting, it is important that your shares be represented and voted at the meeting. Therefore, I urge you to promptly vote and submit your proxy. You may vote by telephone, Internet, mail or in person. To vote by telephone, call (1-800-690-6903) using a touch-tone phone to transmit your voting instructions up until 11:59 p.m. (EDT) the day before the date of the Special Meeting. Please have your proxy card in hand when you call and then follow the instructions. To vote electronically, access www.proxyvote.com over the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m. (EDT) the day before the date of the Special Meeting. Please have your proxy card in hand when you access the website and follow the instructions to obtain your records and to create an electronic voting instruction form. You may vote by mail by signing, dating and returning the enclosed proxy card in the enclosed envelope. If you decide to attend the Special Meeting, you will be able to vote in person, even if you have previously

Table of Contents

submitted your proxy. Your vote is important. We urge you to review the accompanying Proxy Statement carefully and to submit your proxy as soon as possible so that your shares will be represented at the meeting.

| By Order of the Board of Directors, | ||

|

Thomas F. Getten | ||

| Corporate Secretary and General Counsel | ||

Houston, Texas

August 4, 2016

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON SEPTEMBER 1, 2016

This Notice of Special Meeting of Shareholders, Proxy Statement, our Annual Report to Shareholders on Form 10-K for the year ended December 31, 2015 and our Quarterly Report on Form 10-Q for the three months ended March 31, 2016 are available at www.proxyvote.com.

Nine Greenway Plaza, Suite 300

Houston, Texas 77046

Phone (713) 626-8525

Table of Contents

| Page | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 6 | ||||

| 7 | ||||

| PROPOSAL 1 AMENDMENT NO. 2 TO AMENDED AND RESTATED ARTICLES OF INCORPORATION OF W&T OFFSHORE, INC. |

11 | |||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| 20 | ||||

| 20 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

21 | |||

| 22 | ||||

| 23 | ||||

| 23 | ||||

| 23 | ||||

| A-1 | ||||

Table of Contents

W&T OFFSHORE, INC.

Nine Greenway Plaza, Suite 300

Houston, Texas 77046

PROXY STATEMENT

SPECIAL MEETING OF SHAREHOLDERS

This proxy statement (the “Proxy Statement”) is solicited by and on behalf of the Board of Directors (the “Board”) of W&T Offshore, Inc. for use at the Special Meeting of Shareholders (the “Special Meeting”) to be held on September 1, 2016 at the offices of the Company, Nine Greenway Plaza, Suite 300, Houston, Texas 77046, at 8:00 a.m., Central Daylight Time, or at any adjournments or postponements thereof. Unless the context requires otherwise, references in this Proxy Statement to “we,” “us,” “our” and the “Company” refer to W&T Offshore, Inc. The solicitation of proxies by the Board will be conducted primarily electronically and telephonically or by mail for those shareholders who sign, date and return the enclosed proxy card in the enclosed envelope. Officers, directors and employees of the Company may also solicit proxies personally or by telephone, e-mail or other forms of wire or facsimile communication. These officers, directors and employees will not receive any extra compensation for these services. The Company will reimburse brokers, custodians, nominees and fiduciaries for reasonable expenses incurred by them in forwarding proxy materials to beneficial owners of the Company’s common stock, par value $0.00001 per share (the “Common Stock”). The costs of the solicitation will be borne by the Company.

Purposes of the Special Meeting

The significant reductions in crude oil, natural gas liquids (“NGLs”) and natural gas pricing commencing in the second half of 2014 and continuing through the first half of 2016 have adversely impacted the Company’s financial strength and operations and have directly affected our revenues, profitability, cash flows, liquidity, access to capital and future rate of growth. During 2015 and the first half of 2016, we have taken steps to mitigate the effects of these lower prices including: (i) significantly reducing our budgeted capital spending for 2016; (ii) continuing the suspension of our drilling and completion activities at several locations; (iii) continued suspension of the regular quarterly common stock dividend; (iv) selling certain of our interests; (v) reducing our headcount of employees and contractors; and (vi) continuing the implementation of numerous projects to reduce our operating costs. We continue to focus on conserving capital and maintaining liquidity, as wells as to analyze transactions in an effort to further mitigate the effects of lower commodity prices.

In this light, we are calling a Special Meeting of our shareholders to approve the following proposals to effect an exchange offer of our unsecured senior notes: (1) to approve an amendment to our Amended and Restated Articles of Incorporation, as amended, in substantially the form attached hereto as Appendix A, to increase the number of authorized shares of the Company’s Common Stock, to 200,000,000 shares (the “Authorized Shares Proposal”); (2) to approve, for purposes of the rules of the New York Stock Exchange, the issuance of up to 62,100,000 shares of our Common Stock in connection with the offer to exchange (the “Exchange Offer”) the Company’s outstanding 8.50% Senior Notes due 2019 (the “Notes”) for up to (assuming 100% participation):

| • | 62,100,000 shares of Common Stock of the Company, which will represent 45% of the Company’s total equity upon consummation of the Exchange Offer (the “Shares”); |

| • | $202.5 million aggregate principal amount of new second lien exchange notes due May 2020 on terms substantially identical to the Company’s existing 9.00% second lien term loans, except that the interest on the new second lien exchange notes may be paid in kind at the option of the Company at a rate of 10.75% per annum for the 18 months after issuance and is otherwise payable in cash at a rate of 9.00% per annum; and |

1

Table of Contents

| • | $180 million aggregate principal amount of new unsecured exchange notes due June 2021 on terms substantially identical to the Notes, except that the interest on the new unsecured notes may be paid in kind at a rate of 10.00% per annum for the first 2 years after issuance and is otherwise payable in cash at a rate of 8.50% per annum (the “Exchange Offer Proposal” and, together with the Authorized Shares Proposal, the “Proposals”); and |

(3) to transact such other business as may properly come before the meeting and any adjournment or postponement thereof. Although the Board does not anticipate that any other matters will come before the Special Meeting, your executed proxy gives the official proxies the right to vote your shares at their discretion on any other matter properly brought before the Special Meeting.

The consummation of the Exchange Offer is subject to the satisfaction of certain conditions precedent, including, among other things, the valid and effective tender of no less than 95% of the aggregate principal amount of Notes outstanding (the “Minimum Tender Condition”), provided that the Company shall be permitted to waive such Minimum Tender Condition, provided, further that if the Exchange Offer is consummated at a participation threshold below 90%, the new unsecured notes will be secured by third-priority liens on substantially all of the Company’s and its subsidiary guarantors’ assets that secure the Company’s revolving bank credit facility.

The Exchange Offer is intended to reduce our outstanding indebtedness, preserve liquidity, reduce interest expense and increase our ability to comply with our debt instruments during the current decline in the oil and gas industry. If we are unable to successfully consummate the Exchange Offer and address our near term liquidity needs, we may be unable to satisfy our future debt service obligations, meet other financial obligations and comply with the debt covenants governing our indebtedness, and we may seek relief under the U.S. Bankruptcy Code, which such relief may include: (i) seeking bankruptcy court approval for the sale or sales of some, most or substantially all of our assets and a subsequent liquidation of the remaining assets in the bankruptcy case; (ii) pursuing a plan of reorganization or (iii) seeking another form of bankruptcy relief, all of which involve uncertainties, potential delays and litigation risks. In such an event, holders of the Notes and our Common Stock may receive little or no consideration.

| Q. | Why am I receiving these proxy materials? |

| A. | You are receiving this Proxy Statement and a proxy card from the Company because, on August 4, 2016, the record date for the Special Meeting, you owned shares of the Company’s Common Stock. This Proxy Statement describes the matters that will be presented for consideration by the Company’s shareholders at the Special Meeting. It also gives you information concerning the matters to assist you in making an informed decision. As discussed in greater detail above, we are calling a Special Meeting of our shareholders to approve proposals to effect an exchange offer of our unsecured senior notes. |

| Q. | What am I voting on? |

| A. | Holders of our Common Stock are being asked to approve: |

| 1. | A proposal to amend to our Amended and Restated Articles of Incorporation, as amended, in substantially the form attached hereto as Appendix A, to increase the number of authorized shares of the Company’s Common Stock to 200,000,000 shares; and |

| 2. | A proposal to approve, for purposes of the rules of the New York Stock Exchange, the issuance of up to 62,100,000 shares of our Common Stock in connection with the Exchange Offer. |

| Q. | When and where is the Special Meeting? |

| A. | The Special Meeting will be held at the offices of the Company, Nine Greenway Plaza, Suite 300, Houston, Texas 77046 on September 1, 2016 at 8:00 a.m., Central Daylight Time. |

2

Table of Contents

| Q. | Who is entitled to vote? |

| A. | Only holders of record of our Common Stock at the close of business on August 4, 2016, will be entitled to notice of and vote at the Special Meeting. |

| Q. | Who is soliciting my vote pursuant to this Proxy Statement? |

| A. | Our Board is soliciting your vote at the Special Meeting. In addition, certain of our officers and employees may solicit, or be deemed to be soliciting, your vote. We will bear the expense of preparing, printing and mailing this Proxy Statement and the proxies our Board, officers and employees solicit. Proxies will be solicited by mail, telephone, personal contact, and electronic means. We have retained Georgeson LLC to act as a proxy solicitor in conjunction with the Special Meeting. We have agreed to pay Georgeson LLC $7,500, plus reasonable disbursements for proxy solicitation services and costs and expenses incidental to the solicitation of proxies. |

We will also request brokerage firms, banks, nominees, custodians and fiduciaries to forward proxy materials to the beneficial owners of shares of our Common Stock as of the record date and will reimburse them for the cost of forwarding the proxy materials in accordance with customary practice. Your cooperation in promptly completing and returning the enclosed proxy card will help to avoid additional expense.

| Q. | How many shares are eligible to be voted? |

| A. | As of the record date of August 4, 2016, we had 76,634,957 shares of Common Stock outstanding. Each outstanding share of our Common Stock will entitle its holder to one vote on each matter to be voted on at the Special Meeting. For information regarding security ownership by the beneficial owners of more than 5% of our common stock and by our directors and management, see “Security Ownership of Certain Beneficial Owners and Management.” |

| Q. | How do I vote my shares? |

| A. | You may vote your shares either in person or by proxy. To vote by proxy, you may vote via telephone by using the toll-free number listed on the proxy card, via Internet at the website for Internet voting listed on the proxy card, or you may mark, date, sign and mail the enclosed proxy card in the enclosed envelope. Giving a proxy will not affect the right to vote your shares if you attend the Special Meeting and want to vote in person – by voting in person you automatically revoke the proxy. If you vote the shares in person, you must present proof that you own the shares as of the record date through brokers’ statements or similar proof and identification. You also may revoke the proxy at any time before the meeting by giving the Corporate Secretary written notice of the revocation or by submitting a later dated proxy. If you return the signed proxy card but do not mark your voting preference, the individuals named as proxies will vote the shares in accordance with the recommendations of the Board as set forth below. |

| Q. | What are my voting choices? |

| A. | You may vote “FOR” or “AGAINST” or you may “ABSTAIN” from voting on any proposal to be voted on at the Special Meeting. Your shares will be voted as you specifically instruct. If you sign your proxy or voting instruction card without giving specific instructions, your shares will be voted in accordance with the recommendations of our Board and in the discretion of the proxy holders on any other matters that properly come before the meeting. |

| Q. | What are the recommendations of the Board? |

| A. | 1. The Board unanimously recommends that you vote “FOR” the approval of the Authorized Shares Proposal. |

| 2. | The Board unanimously recommends that you vote “FOR” the approval of the Exchange Offer Proposal. |

3

Table of Contents

| Q. | Can I change or revoke my vote? |

| A. | Yes. Even if you submitted a proxy by telephone or via the Internet or if you signed the proxy card accompanying this Proxy Statement, you retain the power to revoke your proxy and to change your vote. You can revoke your proxy any time before it is exercised by giving written notice to the Corporate Secretary specifying such revocation. You may also revoke your proxy by a later-dated proxy by telephone or via the Internet or by timely delivery of a valid, later-dated proxy by mail or by voting by ballot at the Special Meeting. Your attendance at the Special Meeting in itself will not automatically revoke a previously submitted proxy. However, if you hold your shares through a broker, bank or nominee and have instructed your broker, bank or nominee how to vote your shares, you must follow directions received from the broker, bank or nominee in order to change your vote or to vote at the Special Meeting. |

| Q. | What vote is required to hold the Special Meeting? |

There must be a quorum for the Special Meeting to be held. A quorum is the presence at the Special Meeting, in person or by proxy, of the holders of a majority of the shares of Common Stock issued and outstanding and entitled to vote at the Special Meeting on the record date. The presence of the holders of at least a majority of the outstanding shares of Common Stock is required to establish a quorum for the Special Meeting. Proxies that are voted “FOR,” “AGAINST” or “ABSTAIN” with respect to a matter are treated as being present at the Special Meeting for purposes of establishing a quorum and also treated as shares “represented and voting” at the Special Meeting with respect to such matter. All votes will be tabulated by the inspector of elections appointed for the Special Meeting who will separately tabulate, for each Proposal, affirmative and negative votes, and abstentions.

Any abstentions and broker non-votes (if any) will be counted in determining whether a quorum is present at the Special Meeting.

As of the close of business on August 4, 2016, there were 76,634,957 shares of our Common Stock issued and outstanding and entitled to vote at the Special Meeting. Each holder of our Common Stock is entitled to one vote for each share of Common Stock held as of the close of business on the record date.

| Q. | What is a broker non-vote? |

| A. | Brokers are permitted to vote on discretionary items if they have not received instructions from the beneficial owners, but they are not permitted to vote (a “broker non-vote”) on non-discretionary items absent instructions from the beneficial owner. With respect to the Special Meeting, brokers are prohibited from exercising discretionary authority with respect to the approval of both the Authorized Shares Proposal and the Exchange Offer Proposal. Therefore, if you hold your shares in “street name,” you must instruct your broker how to vote for each of the Proposals in order for your shares to be voted at the Special Meeting. |

| Q. | How many votes are needed to approve each of the proposals? |

| A. | The approval of the Authorized Shares Proposal requires the affirmative vote of the holders of at least two-thirds of the outstanding shares of Common Stock entitled to vote on this proposal. Abstentions will have the same effect as a vote against the Authorized Shares Proposal. |

The approval of the Exchange Offer Proposal requires the affirmative vote of a majority of the outstanding shares of Common Stock entitled to vote on this proposal. Abstentions will have the same effect as a vote against the proposal. As of July 15, 2016, Mr. Tracy W. Krohn, our Chairman of the Board and Chief Executive Officer, controlled approximately 52.26% of the voting power entitled to vote at the Special Meeting. Mr. Krohn has the requisite voting power to constitute a quorum at the Special Meeting and to ensure the approval of the Exchange Offer Proposal. Mr. Krohn intends to vote all of his shares of Common Stock in favor of the Proposals.

4

Table of Contents

| Q. | What do I need to do now? |

| A. | We urge you to read this Proxy Statement carefully and to consider how approving each proposal affects you. Then mail your completed, dated and signed proxy card in the enclosed return envelope as soon as possible so that your shares can be voted at the Special Meeting. Holders of record may also vote by telephone or via the Internet by following the instructions on the proxy card, or they may vote in person at the Special Meeting. |

| Q. | What happens if I do not respond or if I respond and fail to indicate my voting preference or if I abstain from voting? |

| A. | If you fail to sign, date and return your proxy card or fail to vote by telephone or via the Internet as provided on your proxy card, your shares will not be counted towards establishing a quorum for the Special Meeting, which requires holders representing a majority of the outstanding shares of our Common Stock to be present in person or by proxy. As of July 15, 2016, Mr. Krohn, our Chairman of the Board and Chief Executive Officer, controlled approximately 52.26% of the voting power entitled to vote at the Special Meeting and has the requisite voting power to constitute a quorum at the Special Meeting. |

If you respond and do not indicate your voting preference, we will count your proxy as a vote in favor of the approval of each of the Proposals. Abstentions will have the same effect as a vote against each of the Proposals.

| Q. | What will happen if the Proposals are not approved? |

| A. | If either of the Proposals is not approved, we will be unable to consummate the proposed Exchange Offer on the terms currently contemplated, and we may consider alternative transactions in effort to reduce our outstanding indebtedness, preserve liquidity, reduce interest expense and increase our ability to comply with our debt instruments during the current decline in the oil and gas industry. |

| Q. | Can I vote on other matters? |

| A. | We do not expect any other matter to come before the meeting. If any other matter is presented at the Special Meeting, the signed proxy gives the individuals named as proxies authority to vote the shares on such matters at their discretion. |

| Q. | Can I obtain an electronic copy of the proxy materials? |

| A. | Yes, this Proxy Statement, the accompanying Notice of Special Meeting of Shareholders and the proxy card are available on the Internet at www.proxyvote.com. |

| Q. | What happens if the Special Meeting is adjourned or postponed? |

| A. | Although it is not expected, the Special Meeting may be adjourned or postponed for the purpose of soliciting additional proxies. Any adjournment or postponement may be made without notice, other than by an announcement made at the Special Meeting, by approval of the holders of a majority of the outstanding shares of our Common Stock present in person or represented by proxy at the Special Meeting, whether or not a quorum exists. Any signed proxies received by the Company will be voted in favor of an adjournment or postponement in these circumstances. Any adjournment or postponement of the Special Meeting for the purpose of soliciting additional proxies will allow Company shareholders who have already sent in their proxies to revoke them at any time prior to their use. |

| Q. | Who can help answer my other questions? |

| A. | If you have more questions about the proposals or voting, you should contact Georgeson LLC who is assisting us with the proxy solicitation by calling toll free at 1-800-868-1390. If your shares are held in an account at a broker, dealer, commercial bank, trust company or other nominee, you should also call such broker or other nominee for additional information. |

5

Table of Contents

Upon written request, we will provide any shareholder, without charge, a copy of our Annual Report on Form 10-K for the year ended December 31, 2015 (the “Form 10-K”) and a copy of our quarterly report on Form 10-Q for the three months ended March 31, 2016 (the “Form 10-Q”), but without exhibits. Shareholders should direct requests to W&T Offshore, Inc., Attn: General Counsel, Nine Greenway Plaza, Suite 300, Houston, Texas 77046. The Form 10-K and Form 10-Q and the exhibits filed with each report are available on our website at www.wtoffshore.com in the “SEC Filings” subsection of the “Investor Relations” section. These materials do not constitute a part of the proxy solicitation materials.

6

Table of Contents

We are an independent oil and natural gas producer with operations offshore in the Gulf of Mexico. We have grown through acquisitions, exploration and development and currently hold working interests in approximately 54 offshore fields in federal and state waters (50 producing and four fields capable of producing). We currently have under lease approximately 850,000 gross acres, with approximately 500,000 gross acres on the shelf and approximately 350,000 gross acres in the deepwater. Our operating results are strongly influenced by the price of the commodities that we produce and sell. The price of those commodities is affected by both domestic and international factors. Beginning in the second half of 2014 and continuing through the first quarter of 2016, crude oil prices have fallen dramatically from a peak of over $100 per barrel for WTI in June 2014. In addition, prices of NGLs and natural gas have fallen significantly from 2014 levels.

Due to this decline of commodity prices, we expect our future revenues, earnings, liquidity and ability to invest in future reserve growth to continue to be negatively impacted under our existing capital structure. Potential negative impacts of such price weakness include:

| • | our ability to meet our financial covenants in future periods; |

| • | recognizing additional ceiling test write-downs of the carrying value of our oil and gas properties; |

| • | reductions in our proved reserves and the estimated value thereof; |

| • | reductions in our borrowing base under our revolving bank credit facility; |

| • | our ability to fund capital expenditures needed to replace produced reserves, which must be replaced on a long-term basis to provide cash to fund liquidity needs described above. |

The significant reductions in crude oil and natural gas pricing commencing in the second half of 2014 have adversely impacted our financial strength and have resulted in our inability to meet the relevant financial strength and reliability criteria set forth by the BOEM’s supplemental bonding requirements. In February and March 2016, we received several orders from the BOEM demanding that we provide additional supplemental bonding on certain Federal offshore oil and gas leases, rights of way and rights of use and easement that we own or operate. We continue to have discussions with the BOEM regarding these matters and hope to reach a mutual agreement on the financial assurance requirements, but can provide no assurances we will be able to do so. The issuance of any additional surety bonds to satisfy the BOEM orders or any future BOEM orders may require the posting of cash collateral, which may be significant, and the creation of escrow accounts.

As a result of the potential for the events described above, we engaged legal and financial advisors in February 2016 to assist the Board and our management team to evaluate the various alternatives available to us. In May 2016, our advisors initiated discussions with certain holders of the Notes regarding possible deleveraging transactions. These discussions were primarily with the largest holder of the Notes, who owns over fifty percent of both the outstanding principal amount of the Notes and outstanding principal amount of the Existing Term Loans. These discussions resulted in the terms of the proposed Exchange Offer and the new 1.5 Lien Term Loan (as defined below), which are intended to restructure our balance sheet and improve our liquidity. As of July 25, 2016, we had entered into the Support Agreement (as defined below) with holders of approximately 63.1% of the outstanding principal amount of the Notes, pursuant to which they have agreed to participate in the Exchange Offer subject to the terms and conditions of such agreement. Please see “Proposal 2 – Approval, For Purposes of the Rules of the New York Stock Exchange, the Issuance of up to 62,100,000 Shares of the Company’s Common Stock in Connection with the Proposed Exchange Offer of the Company’s Outstanding 8.50% Senior Notes due 2019 – The Exchange Offer.”

The Board has considered the Exchange Offer as well as various alternatives, including not engaging in any transaction.

7

Table of Contents

Effects of the Exchange Offer on Our Capital Structure and Capital Stock.

The following table sets forth our capitalization and cash and cash equivalents as of March 31, 2016 on:

| • | a historical basis; and |

| • | as adjusted to give effect to the repayment of $76.0 million and $64.0 million under our revolving bank credit facility in May 2016 and June 2016, respectively, the issuance of $75.0 million aggregate principal amount of 1.5 Lien Term Loan, the consummation of the Exchange Offer, assuming the exchange of $855.0 million aggregate principal amount of Notes in exchange for (i) 58,995,000 Shares, (ii) $192.4 million aggregate principal amount of New Second Lien Notes and (iii) $171.0 million aggregate principal amount of New Unsecured Notes. |

| As of March 31, 2016 | ||||||||

| Historical | As Adjusted(4) | |||||||

| (In thousands) | ||||||||

| Cash and cash equivalents(1) |

$ | 370,623 | $ | 288,323 | ||||

|

|

|

|

|

|||||

| Long-term debt: |

||||||||

| Revolving bank credit facility |

$ | 288,000 | $ | 148,000 | ||||

| 1.5 Lien Term Loan |

— | 75,000 | ||||||

| Existing Term Loans |

300,000 | 300,000 | ||||||

| New Second Lien Notes |

— | 192,375 | ||||||

| Notes |

900,000 | 45,000 | ||||||

| New Unsecured Notes |

— | 171,000 | ||||||

|

|

|

|

|

|||||

| Total long-term debt |

1,488,000 | 931,375 | ||||||

|

|

|

|

|

|||||

| Shareholders’ equity (deficit): |

||||||||

| Common stock, $0.00001 par value; 200,000,000 shares authorized(2); 76,506,489 shares outstanding on a historical basis and 135,501,489 shares outstanding, as adjusted for the Exchange Offer |

1 | 1 | ||||||

| Additional paid-in capital(3) |

426,035 | 555,234 | ||||||

| Retained earnings (deficit) |

(1,116,333 | ) | (925,333 | ) | ||||

| Treasury stock, at cost; 2,869,173 shares |

(24,167 | ) | (24,167 | ) | ||||

|

|

|

|

|

|||||

| Total shareholders’ equity (deficit) |

(714,464 | ) | (394,265 | ) | ||||

|

|

|

|

|

|||||

| Total capitalization |

$ | 773,536 | $ | 537,110 | ||||

|

|

|

|

|

|||||

| (1) | Reflects the repayments under our revolving bank credit facility, issuance of the 1.5 Lien Term Loans and payment of estimated transaction costs associated with the Exchange Offer and Consent Solicitation. |

| (2) | After giving effect to, and assuming the approval by our shareholders of, the Authorized Shares Proposal and the Exchange Offer Proposal at the Special Meeting. |

| (3) | Adjustments were determined using the Company’s share price at March 31, 2016. |

| (4) | Reflects the impact of the Exchange Offer with new debt amounts stated at face value and the estimated gain expected to be recorded and excludes any consideration to the tax expense impact, if any, from recording such gain. The gain computation assumes exercising the payment-in-kind option to the extent possible for both the New Second Lien Notes and the New Unsecured Notes. The table excludes adjustments to carrying amounts from the anticipated accounting for the Exchange Offer as a troubled debt restructuring under GAAP. |

8

Table of Contents

The following table depicts the pro forma impact of the Exchange Offer on the ownership of our Common Stock (in thousands) as of March 31, 2016:

| Pro Forma for the Exchange Offer Assuming Minimum Conditions Met |

||||||||||||||||

| No. of Shares |

Percentage of Common |

No. of Shares |

Percentage of Common |

|||||||||||||

| Existing Common Shareholders |

35,131,938 | 45.92 | % | 35,131,938 | 25.93 | % | ||||||||||

| Holders of the Notes |

— | — | 58,995,000 | 43.54 | % | |||||||||||

| Officers and Directors of the Company |

41,374,551 | 54.08 | % | 41,374,551 | 30.53 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

76,506,489 | 100.00 | % | 135,501,489 | 100.00 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The Board has considered the effects the Exchange Offer would likely have on our capital structure and the holders of our Common Stock, including:

| • | the significant reduction in debt versus substantial dilution to our outstanding Common Stock expected to result from the Exchange Offer; and |

| • | our increased ability to address our near-term liquidity needs, including the material reduction of cash interest expense on our debt obligations and the increased liquidity from new capital. |

Alternatives to the Exchange Offer. The Board considered possible alternatives to the Exchange Offer and the consequences of such alternatives, including seeking relief under the U.S. Bankruptcy Code, in which case we expect that the holders of the Notes and Common Stock would likely receive little or no consideration for their securities.

Consequences if We are Unable to Consummate the Exchange Offer: The Board considered the likely impact on the Company if we are unable to consummate the Exchange Offer or fail to obtain the approval of either of the Proposals, including:

| • | we are unlikely to be able to address our near-term and longer-term liquidity needs; and |

| • | we may be required to seek relief under the U.S. Bankruptcy Code, in which case we expect that the holders of the Notes and Common Stock would likely receive little or no consideration for their securities. |

View of Management. The Board considered the effects that the Exchange Offer is expected to have on us, and management’s view is that the substantial debt reduction contemplated by the Exchange Offer is critical to our continuing viability. If we are unable to successfully consummate the Exchange Offer and address our near-term liquidity needs, we may be unable to satisfy our future debt service obligations, meet other financial obligations and comply with the debt covenants governing our indebtedness, and we may seek relief under the U.S. Bankruptcy Code, which such relief may include: (i) seeking bankruptcy court approval for the sale or sales of some, most or substantially all of our assets and a subsequent liquidation of the remaining assets in the bankruptcy case; (ii) pursuing a plan of reorganization; or (iii) seeking another form of bankruptcy relief, all of which involve uncertainties, potential delays and litigation risks. In such an event, holders of the Notes and our Common Stock may receive little or no consideration.

Consequences if We Complete the Proposed Exchange Offer. The Board considered management’s view that, under the capital structure resulting from the proposed Exchange Offer, we will be able to continue investing in exploration and development in order to maintain production and would have greater flexibility to operate until commodity prices normalize and to take advantage of any future recovery in oil and natural gas prices.

9

Table of Contents

Having considered all of the above factors, the Board determined that the Exchange Offer is in the best interests of the holders of our Common Stock in their capacity as such and are critical to our continuing viability. The foregoing discussion of the information and factors considered by the Board is not intended to be exhaustive and may not include all of the information and factors considered by the Board. The Board, in making its determination regarding the Exchange Offer, did not find it useful to and did not quantify or assign any relative or specific weights to the various factors that it considered. Rather, the Board views its determination and recommendation as being based on an overall analysis and on the totality of the information presented to and factors considered by it. In addition, in considering the factors described above, individual members of the Board may have given differing weights to different factors, and may have viewed some factors relatively more positively or negatively than others. The Board’s determination that the Exchange Offer is in the best interests of the holders of our Common Stock was the result of extensive negotiations between management and a significant holder of Notes and their respective legal and financial advisors, the results of which were regularly communicated to the Board.

Recommendation of the Board of Directors

The Board determined that the Exchange Offer is in our and our shareholders best interests. Accordingly, the Board determined to (1) approve the Exchange Offer, including the Proposals, (2) submit the Proposals to our shareholders and (3) recommend that our shareholders adopt the Proposals.

10

Table of Contents

AMENDMENT NO. 2 TO AMENDED AND RESTATED ARTICLES OF INCORPORATION OF

W&T OFFSHORE, INC.

The Board has approved and is recommending to the shareholders for approval at the Special Meeting, an amendment to ARTICLE IV of the Company’s Amended and Restated Articles of Incorporation, as amended, which sets forth the terms of the Company’s authorized capital stock. ARTICLE IV currently authorizes 118,330,000 shares of Common Stock, par value $0.00001 per share, as well as 20,000,000 shares of preferred stock, par value $0.00001 per share. The proposed amendment would increase the authorized shares of Common Stock to 200,000,000 shares. The authorized shares of preferred stock would remain at 20,000,000. If adopted by the shareholders, this amendment would become effective upon filing of an appropriate certificate of amendment with the Secretary of State of the State of Texas. The proposed amendment to ARTICLE IV of the Amended and Restated Articles of Incorporation would replace the first paragraph of such article with the following:

“The aggregate number of shares of capital stock which the corporation shall have authority to issue is 220,000,000 shares, of which two hundred million (200,000,000) shares shall be designated as Common Stock, par value $0.00001 per share, and twenty million (20,000,000) shares shall be designated as Preferred Stock, par value $0.00001 per share.”

The additional shares of Common Stock authorized by the proposed amendment would become a part of the existing class of the Company’s Common Stock and, if and when issued, would have the same rights and privileges as the shares of Common Stock currently authorized and outstanding. The proposed amendment will not affect the par value of the Common Stock, which will remain at $0.0001 per share. The Shares would not (and the shares of Common Stock presently outstanding do not) entitle the holders thereof to preemptive rights to purchase Common Stock or other securities or to cumulative voting rights. In addition, under Texas law, our shareholders are not entitled to dissenters’ or appraisal rights in connection with the proposed increase in the number of shares of Common Stock authorized for issuance. The amendment to our Amended and Restated Articles of Incorporation to increase the number of authorized shares of our Common Stock to be approved at this Special Meeting shall only become effective in connection with the Exchange Offer.

As of the record date, 76,634,957 shares of Common Stock were issued and outstanding with an additional 41,695,043 shares of Common Stock available for issuance for future purposes or held as treasury stock. As a result, the Board deems it advisable to increase our authorized Common Stock.

Purpose and Effect of Approving Amendment No. 2 to the Company’s Amended and Restated Articles of Incorporation

The purpose of amending the Company’s Amended and Restated Articles of Incorporation to increase the authorized share capital of the Company is to provide the Company with sufficient common share capacity to issue shares of Common Stock in connection with the Exchange Offer. The availability of significant authorized but unissued shares of Common Stock in the Company will provide the Company flexibility to issue additional common equity and create dilution without further approval of the Company’s shareholders. The Board believes that this additional flexibility is warranted.

If the Exchange Offer is completely successful, the aggregate number of shares issued and outstanding would exceed the number of shares of Common Stock currently authorized under our Amended and Restated Articles of Incorporation. Having additional shares available for issuance after completion of the Exchange Offer would give the Company greater flexibility and allow shares of Common Stock to be issued without the expense and delay of another shareholders’ meeting. The additional shares of Common Stock would be available for issuance without further action by the shareholders unless such action is required by applicable law or the rules of any stock exchange on which the Common Stock may be listed. The Exchange Offer is expressly conditioned upon the passage of this proposal.

11

Table of Contents

We have not proposed the increase in the authorized number of shares of Common Stock with the intention of using the additional shares for anti-takeover purposes, although we could theoretically use the additional shares to make more difficult or to discourage an attempt to acquire control of the Company. We are not aware of any pending or threatened efforts to acquire control of the Company. In addition, the amendment to our Amended and Restated Articles of Incorporation to increase the number of authorized shares of our Common Stock to be approved at this Special Meeting shall only become effective in connection with the Exchange Offer.

The text of the proposed amendment to the Company’s Amended and Restated Articles of Incorporation to increase the authorized shares of Common Stock to 200,000,000 shares is included as Appendix A to this Proxy Statement (the “Amendment No. 2”).

Approval of the adoption of the proposed Amendment No. 2 to increase the authorized shares of Common Stock to 200,000,000 shares requires the affirmative vote of the holders of at least two-thirds of the outstanding shares of Common Stock entitled to vote on this proposal. Abstentions will have the same effect as a vote against the proposal.

As of July 15, 2016, Mr. Tracy W. Krohn, our Chairman of the Board and Chief Executive Officer, controlled approximately 52.26% of the voting power entitled to vote at the Special Meeting and intends to vote all of his shares of Common Stock in favor of the Authorized Shares Proposal.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS YOU VOTE “FOR” APPROVAL OF AMENDMENT NO. 2 TO THE COMPANY’S AMENDED AND RESTATED ARTICLES OF INCORPORATION TO INCREASE THE AUTHORIZED SHARES OF COMMON STOCK TO 200,000,000 SHARES.

12

Table of Contents

APPROVAL, FOR PURPOSES OF THE RULES OF THE NEW YORK STOCK EXCHANGE, THE ISSUANCE OF UP TO 62,100,000 SHARES OF THE COMPANY’S COMMON STOCK IN CONNECTION WITH THE PROPOSED EXCHANGE OFFER OF THE COMPANY’S OUTSTANDING 8.50% SENIOR NOTES DUE 2019

We are proposing the issuance of up to 62,100,000 shares of our Common Stock, which would be in excess of 20% of our outstanding Common Stock, in connection with the proposed Exchange Offer upon the terms and conditions more fully described below. The exact number of shares of Common Stock to be issued in the Exchange Offer will depend on the aggregate principal amount of Notes tendered in the Exchange Offer. No further shareholder authorization for this issuance will be solicited.

Our Common Stock is listed on the New York Stock Exchange (“NYSE”) and, as a result, we are subject to the rules and regulations of the NYSE. Although we do not know the exact number of shares of Common Stock to be issued in the Exchange Offer, it is likely that the consummation of the Exchange Offer will result in the issuance of more than 20% of our currently outstanding Common Stock. As a result, shareholder approval of the issuance is required by Rule 312.03(c) of the NYSE Listed Company Manual. Rule 312.03(c) of the NYSE Listed Company Manual requires an issuer to obtain shareholder approval prior to the issuance of common stock, or of securities convertible into or exercisable for common stock, in any transaction or series of related transactions, if (i) the common stock has, or will have upon issuance, voting power equal to or in excess of 20% of the voting power outstanding before the issuance of such stock or of securities convertible into or exercisable for common stock or (ii) the number of shares of common stock to be issued is, or will be upon issuance, equal to or in excess of 20% of the number of shares of common stock outstanding before the issuance of common stock or of securities convertible into or exercisable for common stock.

Our Board believes that authorizing the issuance of the Shares in connection with the Exchange Offer is in the best interests of our shareholders because consummation of the Exchange Offer is intended to reduce our outstanding indebtedness, preserve liquidity, reduce interest expense and increase our ability to comply with our debt instruments during the current decline in the oil and gas industry.

Authorizing the issuance of the Shares will not ensure that we will be able to complete the Exchange Offer or that if we make such an offer, it will be accepted by holders of the Notes. Approval will, however, allow us to undertake such a transaction. Approval of the proposed amendment and the issuance of the Shares will not affect the rights of the holders of currently outstanding shares of Common Stock, except for effects incidental to increasing the number of shares of our Common Stock outstanding, such as dilution of any earnings per share and voting rights.

If our shareholders vote to approve the issuance of the Shares, we plan to conduct the Exchange Offer on the terms and conditions set forth below. In addition, we intend to file with the NYSE an application to list the Shares issued in connection with the Exchange Offer. The Shares issued would dilute the percentage ownership of the holders of Common Stock currently outstanding, and their resale could have an adverse effect on the trading price of our Common Stock. There are no impediments to the immediate resale of the newly issued Shares, which may have a further adverse effect on the trading price of our Common Stock.

Under Texas law, our shareholders are not entitled to dissenters’ or appraisal rights with respect to the proposed issuance of the Shares in connection with the proposed Exchange Offer.

For your reference and in compliance with Item 12 of Schedule 14A we are including in this section the description and effects of the Exchange Offer.

13

Table of Contents

Support Agreement

We entered into a support agreement, which became effective on July 25, 2016 (the “Support Agreement”), with certain holders of our outstanding Notes issued under the Indenture, dated as of June 10, 2011 (the “Indenture”), by and among us, our subsidiary guarantors and Wilmington Trust, National Association (as successor trustee to Wells Fargo Bank, National Association) (the “Trustee”), in connection with the Exchange Offer for up to 100% of the Notes in exchange for (assuming 100% participation) (i) 62,100,000 shares of the Company’s Common Stock, which will represent approximately 45% of the Company’s total equity upon consummation of the Exchange Offer, (ii) $202.5 million aggregate principal amount of new second lien exchange notes due May 2020 on terms substantially identical to our existing 9.00% second lien term loans (the “Existing Term Loans”), except that the interest on the new second lien exchange notes may be paid in kind at our option at a rate of 10.75% per annum for the 18 months after issuance and is otherwise payable in cash at a rate of 9.00% per annum (the “New Second Lien Notes”) and (iii) $180 million aggregate principal amount of new unsecured exchange notes due June 2021 (the “New Unsecured Notes”) on terms substantially identical to the Notes, except that the interest on the New Unsecured Notes may be paid in kind at a rate of 10.00% per annum for the first 2 years after issuance and is otherwise payable in cash at a rate of 8.50% per annum.

The consummation of the Exchange Offer is subject to the satisfaction of certain conditions precedent, including, among other things, the Minimum Tender Condition of no less than 95% of the aggregate principal amount of Notes outstanding, provided that we are permitted to waive the Minimum Tender Condition, provided, further that if the Exchange Offer is consummated at a participation threshold below 90%, the New Unsecured Notes will be secured by third-priority liens on substantially all of our and our Guarantors’ (as defined below) assets that secure our revolving bank credit facility.

In addition, we and certain holders of the Notes entered into commitment papers whereby such holders agreed to provide up to $75,000,000 in additional capital through borrowings under a secured term loan facility to be entered into on or around the same date as the consummation of the Exchange Offer (such term loan financing, the “1.5 Lien Term Loan”).

Concurrent with the Exchange Offer, we are soliciting consents (“Consents”) for certain proposed amendments (the “Consent Solicitation”), which we refer to herein as the “Amendments” to the terms of the Indenture. The Amendments, if adopted and effected, will amend the definition of “Credit Facilities” under the Indenture to permit the issuance of the New Second Lien Notes. The act of tendering Notes by a holder pursuant to the Exchange Offer will constitute a Consent to the Amendments. Holders of at least a majority of the outstanding principal amount of the Notes must Consent (the “Requisite Consents”) to the Amendments in order for the Amendments to become effective. As of July 25, 2016, we had entered into the Support Agreement with holders of approximately 63.1% of the outstanding principal amount of the Notes, pursuant to which they have agreed to participate in the Exchange Offer. Such holders’ participation in the Exchange Offer constitutes Consent for purposes of the Amendments.

The New Second Lien Notes will be jointly and severally, fully and unconditionally guaranteed on a senior secured basis by certain of our wholly owned subsidiaries, including the subsidiaries that guarantee (collectively, such guarantor subsidiaries are referred to as, the “Guarantors”) our revolving bank credit facility (the “revolving bank credit facility”), and will be secured (subject in each case to certain exceptions and permitted liens) by a second-priority lien on the same collateral that secures our revolving bank credit facility, our new 1.5 Lien Term Loan) and our Existing Term Loans, consisting of substantially all of our oil and natural gas properties, such assets are referred to herein as the “collateral.” Pursuant to the terms of an intercreditor agreement (the “Intercreditor Agreement”) between the administrative agent under our revolving bank credit facility, as priority lien agent, the collateral trustee for the Existing Term Loans, the collateral agent for the 1.5 Lien Term Loan and the collateral trustee for the New Second Lien Notes, the New Second Lien Notes will be effectively junior to the revolving bank credit facility and 1.5 Lien Term Loan and each of the guarantees thereof, to the extent of the

14

Table of Contents

value of the collateral. The liens securing the New Second Lien Notes will rank equally with the liens securing the Existing Term Loans as provided in the collateral trust agreement and the Intercreditor Agreement. The guarantees of the New Second Lien Notes will be structurally senior to any indebtedness of any future non-guarantor subsidiaries. The New Second Lien Notes will also rank effectively senior to any remaining Notes and the New Unsecured Notes to the extent of the value of the collateral and senior to all of our subordinated indebtedness.

The New Unsecured Notes will be jointly and severally, fully and unconditionally guaranteed on a senior unsecured basis by the Guarantors, and be effectively junior to the revolving bank credit facility, 1.5 Lien Term Loan, Existing Term Loans and New Second Lien Notes and each of the guarantees thereof, to the extent of the value of the collateral. The New Unsecured Notes will rank pari passu to the Notes and senior to all of our subordinated indebtedness. The guarantees of the New Unsecured Notes will be structurally senior to any indebtedness of any future non-guarantor subsidiaries.

Summary Terms of the Exchange Offer

Holders Eligible to Participate in the Exchange Offer. The Company is conducting the Exchange Offer in accordance with the applicable requirements of the Securities Act of 1933, as amended (the “Securities Act”) and the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the rules and regulations of the SEC thereunder. The Exchange Offer is being made only to Eligible Holders. By exchanging Notes in the Exchange Offer, Eligible Holders will be making a series of representations and warranties to us. An Eligible Holder is either a qualified institutional buyer as defined in Rule 144A, or a person that is not a “U.S. person” within the meaning of Regulation S. Only holders of Notes who have properly completed and returned an eligibility certification, which is available in the form approved by us from the information agent, are authorized to participate in the Exchange Offer.

Total Exchange Consideration; Early Tender Premium. For each $1,000 principal amount of Notes validly tendered on or before August 8, 2016 (the “Early Participation Date”) and not validly withdrawn, Eligible Holders will be eligible to receive (i) 69 Shares, (ii) $200 in principal amount of New Second Lien Notes and (iii) $200 in principal amount of New Unsecured Notes (the “Exchange Consideration”) plus an early tender premium equal to $25 in principal amount of New Second Lien Notes for each $1,000 principal amount of Notes validly tendered and not validly withdrawn (the “Early Tender Premium” and, together with the Exchange Consideration, the “Total Exchange Consideration”). Eligible Holders who validly tender their Notes after the Early Participation Date but before September 1, 2016, or such later date as shall be determined by us (the “Expiration Date”), will not be eligible to receive the Early Tender Premium.

Accrued and Unpaid Interest. In addition to the Total Exchange Consideration or Exchange Consideration, as the case may be, with respect to Notes accepted pursuant to the Exchange Offer, each Eligible Holder will receive accrued and unpaid interest on its accepted Notes from June 15, 2016 (the last interest payment date) to, but not including, the settlement date.

Consent Solicitation. Holders who tender Notes pursuant to the Exchange Offer are required to deliver a Consent, which will constitute a consent to the Amendments to the Indenture. By tendering their Notes, Eligible Holders will be deemed to have delivered Consents to the Amendments with respect to such Notes being tendered.

Requisite Consents; Supplemental Indenture. In order to approve the Amendments with respect to the Notes, Consents must be delivered and not revoked in respect of at least a majority of the outstanding principal amount of Notes. Promptly following the Expiration Date, if the requisite Consents are delivered with respect to the Notes, we, the guarantors under the Notes and the trustee for the Notes will enter into a supplemental indenture to give effect to the Amendments. The Amendments will not become operative until the consummation of the Exchange Offer. The calculation of the requisite Consents for the Notes does not include any Notes held by us or

15

Table of Contents

our affiliates. In the event that we do not consummate the Exchange Offer for any reason, the indenture governing the Notes will remain in effect in its current form. The consummation of the Exchange Offer is conditioned upon the receipt of the requisite Consents to approve the applicable Amendments and the execution and delivery of the supplemental indenture giving effect to such Amendments. We may not consummate the Exchange Offer or execute the supplemental indenture without receiving the requisite Consents pursuant to the Consent Solicitations.

Withdrawal of Tenders and Consents. Tenders of Notes and related Consents in the Exchange Offer and Consent Solicitation may be validly withdrawn at any time on or prior to the Withdrawal Deadline except in certain limited circumstances as set forth herein. The Withdrawal Deadline will be 5:00 p.m., New York City time, on August 8, 2016, unless extended or earlier terminated. Tenders and Consents submitted in the Exchange Offer and Consent Solicitation after the Withdrawal Deadline will be irrevocable except in the limited circumstances where additional withdrawal rights are required by law.

Conditions to the Exchange Offer. Our obligation to accept Notes in the Exchange Offer is subject to, among other things, (a) the valid tender, without withdrawal, of a minimum of 95%, or $855.0 million, of the outstanding aggregate principal amount of Notes by Eligible Holders as of the Expiration Date, (b) the Requisite Consents having been received, without withdrawal, prior to the Expiration Date, (c) the approval by our shareholders of both the Authorized Shares Proposal and the Exchange Offer Proposal at the Special Meeting, (d) the amendment to our revolving bank credit facility to permit the consummation of the Exchange Offer and the (e) the consummation of the 1.5 Lien Term Loan. Subject to applicable law, we expressly reserve the right, in consultation with holders who collectively represent at least 66.67% of the aggregate principal amount of Notes held by all parties to the Support Agreement (the “Required Holders”), to amend the Exchange Offer in any respect and to terminate the Exchange Offer if the conditions to the Exchange Offer are not satisfied. If the Exchange Offer is terminated at any time, the Notes tendered pursuant to the Exchange Offer will be promptly returned to the tendering Eligible Holders. We may waive, at any time prior to the Expiration Date, the Minimum Tender Condition in consultation with the Required Holders and certain other conditions. If we waive the Minimum Tender Condition, we will not be obligated to extend the Withdrawal Deadline. Accordingly, the aggregate principal amount of Notes accepted for exchange pursuant to the Exchange Offer may be significantly less than the aggregate principal amount set forth by the Minimum Tender Condition.

Minimum Tender Condition. The Minimum Tender Condition will be no less than 95% of principal amount of the outstanding Notes. We may waive, at any time prior to the Expiration Date, the Minimum Tender Condition. To the extent less than 90% in principal amount of the outstanding Notes are validly tendered and accepted for exchange, the New Unsecured Notes will be secured by third-priority liens on substantially all of our and our Guarantors’ assets that secure our revolving bank credit facility.

Termination; Extension; Amendment. We, in our sole discretion, may extend the Early Participation Date and the Expiration Date with respect to the Exchange Offer and Consent Solicitation, subject to applicable law. We expressly reserve the right, in our sole discretion and with respect to the Exchange Offer and Consent Solicitation, to: (i) delay accepting any Notes, extend the Exchange Offer and Consent Solicitation or terminate the Exchange Offer and Consent Solicitation and not accept any Notes; (ii) extend the Early Participation Date without extending the Withdrawal Deadline; and (iii) amend, modify or waive in part or whole, at any time, or from time to time, the terms of the Exchange Offer and Consent Solicitation in any respect, including waiver of any conditions to consummation of the Exchange Offer.

New Second Lien Notes

Generally. In connection with the Exchange Offer, we intend to issue the New Second Lien Notes, which will accrue interest at a rate of 9.00% per annum payable in cash; provided, however, that for the first 18 months

16

Table of Contents

after issuance of the New Second Lien Notes, we may elect to pay interest in kind at the rate of 10.75% per annum. On the May 15, 2018 interest payment date, we will be permitted to make part of the interest payment in kind and part of the interest payment in cash, provided that the maximum payment in kind on such interest payment date shall be equal to interest accrued at a rate of 10.75% from the November 15, 2017 interest payment date up to, but not including, the date that is 18 months after issuance of the New Second Lien Notes. Interest on the New Second Lien Notes will be payable on May 15 and November 15 of each year, beginning on November 15, 2016. The New Second Lien Notes will mature on May 15, 2020. The New Second Lien Notes will be guaranteed by our existing material subsidiaries and our future restricted subsidiaries that guarantee indebtedness under our revolving bank credit facility.

Collateral. The New Second Lien Notes will be secured by second-priority liens on substantially all of our and our subsidiary guarantors’ assets that secure our revolving bank credit facility and on a pari passu basis with the liens securing the Existing Term Loans pursuant to the terms of the Collateral Trust Agreement; provided, however that pursuant to the terms of the Intercreditor Agreement, the security interest in those assets that secure the New Second Lien Notes and the related guarantees will be contractually subordinated to liens thereon that secure our revolving bank credit facility, the 1.5 Lien Term Loan and certain other permitted obligations. Consequently, the New Second Lien Notes and the guarantees will be effectively subordinated to the revolving bank credit facility, the 1.5 Lien Term Loan and such other indebtedness to the extent of the value of such assets and effectively pari passu with the Existing Term Loans.

Optional Redemption. On or after May 15, 2017, we will have the right to redeem all or some of the New Second Lien Notes at the redemption prices below, if redeemed during the 12-month period beginning on May 15 of the following years:

| 2017 |

104.50 | % | ||

| 2018 |

102.25 | % | ||

| 2019 and thereafter |

100.00 | % |

Prior to May 15, 2017, we may redeem all or any portion of the New Second Lien Notes at a redemption price equal to 100% of the aggregate principal amount of the New Second Lien Notes to be redeemed, plus a make-whole premium and accrued and unpaid interest. In addition, prior to May 15, 2017, we may, at our option, on one or more occasions, redeem up to 35% of the aggregate original principal amount of the New Second Lien Notes using cash in an amount not greater than the net cash proceeds from certain equity offerings, at a redemption price equal to 109.00% of the aggregate principal amount of the New Second Lien Notes plus accrued and unpaid interest.

Special Mandatory Offer to Repurchase. We will be required to offer to repurchase all outstanding New Second Lien Notes if a “triggering event” occurs, at a price of 100% of the principal amount of the New Second Lien Notes prepaid plus accrued and unpaid interest to the date of repurchase. For this purpose, a “triggering event” will be deemed to occur on the 30th day prior to the stated maturity date of the Notes, if on such date the aggregate outstanding principal amount of all such New Second Lien Notes that have not been redeemed, discharged, defeased or repurchased under specified arrangements, exceeds $50.0 million.

Change of Control. If we experience a change of control, we will be required to offer to repurchase the New Second Lien Notes at the repurchase price of 101% of the principal amount of repurchased New Second Lien Notes.

Asset Sales. If we sell certain assets, we have 360 days (as may be extended up to 540 days) after receipt of such proceeds to repay certain debt, invest in certain additional oil and gas assets and/or make capital expenditures in our oil and gas business. If we fail to timely do so with aggregate proceeds exceeding $20.0 million, we will be required to offer to repurchase the New Second Lien Notes with such excess proceeds at the repurchase price of 100% of the principal amount of repurchased New Second Lien Notes.

17

Table of Contents

Certain Covenants. The indenture governing the New Second Lien Notes will contain covenants that are substantially identical to the covenants under the Existing Term Loans, including, among other things, covenants that limit our ability and the ability of our restricted subsidiaries to:

| • | make loans and investments; |

| • | incur additional indebtedness or issue preferred stock; |

| • | create certain liens; |

| • | sell assets; |

| • | enter into agreements that restrict dividends or other payments from our subsidiaries to us; |

| • | consolidate, merge or transfer all or substantially all of the assets of our company; |

| • | engage in transactions with our affiliates; |

| • | pay dividends or make other distributions on capital stock or subordinated indebtedness; and |

| • | create unrestricted subsidiaries. |

These covenants are subject to important exceptions and qualifications that are substantially identical to the exceptions and qualifications under the Existing Term Loans. In addition, most of the covenants will terminate if both Standard & Poor’s Ratings Services and Moody’s Investors Service, Inc. assign the New Second Lien Notes an investment grade rating and no default exists with respect to the New Second Lien Notes.

New Unsecured Notes

Generally. In connection with the Exchange Offer, we intend to issue the New Unsecured Notes, which will accrue interest at a rate of 8.50% per annum payable in cash; provided, however, that for the first 24 months after issuance of the New Unsecured Notes, we may elect to pay interest in kind at the rate of 10.00% per annum. On the December 31, 2018 interest payment date, we will be permitted to make part of the interest payment in kind and part of the interest payment in cash, provided that the maximum payment in kind paid on the such interest payment date shall be equal to interest accrued at a rate of 10.00% from the June 30, 2018 interest payment date up to, but not including, the date that is 24 months after issuance of the New Unsecured Notes. Interest on the New Unsecured Notes will be payable on June 15 and December 15 of each year, beginning on December 15, 2016.

Collateral. The New Unsecured Notes will mature on June 15, 2021; provided that if the Notes are not refinanced in whole prior to February 28, 2019, with indebtedness maturing after June 15, 2021, the maturity date shall be February 28, 2019. The New Unsecured Notes will be guaranteed by our existing material subsidiaries and our future restricted subsidiaries that guarantee indebtedness under our revolving bank credit facility. In the event that we waive the Minimum Tender Condition such that less than 90% in principal amount of the outstanding Notes are validly tendered and accepted for exchange, the New Unsecured Notes will be secured by third-priority liens on substantially all of our and our Guarantors’ assets that secure our revolving bank credit facility; provided, however that pursuant to the terms of the Intercreditor Agreement, the security interest in the assets that secure the New Unsecured Notes and the guarantees thereof will be contractually subordinated to liens thereon that secure our revolving bank credit facility, the 1.5 Lien Term Loan, the Existing Term Loans, the New Second Lien Notes and certain other permitted obligations.

Optional Redemption. On or after June 15, 2018, we will have the right to redeem all or some of the New Unsecured Notes at the redemption prices below, if redeemed during the 12-month period beginning on June 15 of the following years:

| 2018 |

104.250 | % | ||

| 2019 |

102.125 | % | ||

| 2020 and thereafter |

100.000 | % |

18

Table of Contents

Prior to June 15, 2018, we may redeem all or any portion of the New Unsecured Notes at a redemption price equal to 100% of the aggregate principal amount of the New Unsecured Notes to be redeemed, plus a make-whole premium and accrued and unpaid interest. In addition, prior to June 15, 2018, we may, at our option, on one or more occasions, redeem up to 35% of the aggregate original principal amount of the New Unsecured Notes using cash in an amount not greater than the net cash proceeds from certain equity offerings, at a redemption price equal to 108.500% of the aggregate principal amount of the New Unsecured Notes plus accrued and unpaid interest.