Form 8-K FNB CORP/FL/ For: Jul 20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 21, 2016 (July 20, 2016)

F.N.B. CORPORATION

(Exact name of registrant as specified in its charter)

| Florida | ||

| (State or other jurisdiction of incorporation) | ||

| 001-31940 | 25-1255406 | |

| (Commission File Number) | (IRS Employer Identification No.) | |

| One North Shore Center, 12 Federal Street Pittsburgh, Pennsylvania |

15212 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

(800) 555-5455

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 8.01 | Other Events. |

On July 21, 2016, F.N.B. Corporation and Yadkin Financial Corporation issued a joint press release announcing the execution of an Agreement and Plan of Merger, dated as of July 20, 2016. A copy of the joint press release is attached hereto as Exhibit 99.1. In addition, F.N.B. will be providing supplemental information regarding the proposed transaction in connection with a presentation to analysts and investors. The slides to be used in connection with this analyst and investor presentation are attached hereto as Exhibit 99.2.

Cautionary Statement Regarding Forward-Looking Information

This Current Report on Form 8-K contains forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which contain F.N.B.’s expectations or predictions of future financial or business performance or conditions. Forward-looking statements are typically identified by words such as “believe”, “plan”, “expect”, “anticipate”, “intend”, “outlook”, “estimate”, “forecast”, “will”, “should”, “project”, “goal”, and other similar words and expressions. These forward-looking statements involve certain risks and uncertainties. In addition to factors previously disclosed in F.N.B.’s and Yadkin’s reports filed with the SEC and those identified elsewhere in this report, the following factors among others, could cause actual results to differ materially from forward-looking statements or historical performance: failure to obtain all regulatory approvals and meet other closing conditions to the merger, including approval by the shareholders of F.N.B. and Yadkin, respectively, on the expected terms and time schedule; delay in closing the merger; potential risks and challenges attendant to the successful conversions of core data systems; difficulties and delays in integrating the F.N.B. and Yadkin businesses or fully realizing cost savings and other benefits; business disruption following the merger; changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer acceptance of F.N.B. products and services; potential difficulties encountered in expanding into a new and remote geographic market; customer borrowing, repayment, investment and deposit practices; customer disintermediation; the introduction, withdrawal, success and timing of business initiatives; competitive conditions; the inability to realize cost savings or revenues or to implement integration plans and other consequences associated with mergers, acquisitions and divestitures; economic conditions; and the impact, extent and timing of technological changes, capital management activities, and other actions of the Office of the Comptroller of the Currency, the Board of Governors of the Federal Reserve System and legislative and regulatory actions and reforms. F.N.B. and Yadkin do not undertake any obligation to revise these forward-looking statements or to reflect events or circumstances after the date of this report.

Additional Information About the Merger and Where to Find It

Communications in this document do not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed merger, F.N.B. Corporation will file with the SEC a Registration Statement on Form S-4 that includes a Joint Proxy Statement of F.N.B. and Yadkin and a Prospectus of F.N.B., as well as other relevant documents concerning the proposed transaction.

SHAREHOLDERS OF F.N.B. CORPORATION AND YADKIN FINANCIAL CORPORATION ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER.

The Joint Proxy Statement/Prospectus and other relevant materials (when they become available), and any other documents F.N.B. and Yadkin have filed with the SEC, may be obtained free of charge at the SEC’s internet site, http://www.sec.gov. Copies of the documents F.N.B. has filed with the SEC may be obtained, free of charge, by contacting James G. Orie, Chief Legal Officer, F.N.B. Corporation, One F.N.B. Boulevard, Hermitage, PA 16148, telephone: (724) 983-3317; and copies of the documents Yadkin has filed with the SEC may be obtained free of charge at Yadkin’s website at www.yadkinbank.com.

F.N.B. and Yadkin and certain of their directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Yadkin in connection with the merger. Information concerning such participants’ ownership of Yadkin common stock will be set forth in the Joint Proxy Statement/Prospectus regarding the merger when it becomes available.

| Item 9.01 | Financial Statements and Exhibits. |

| (d) | Exhibits |

| 99.1 | Joint Press Release of F.N.B. Corporation and Yadkin Financial Corporation, dated July 21, 2016 | |

| 99.2 | Investor Presentation, dated July 21, 2016 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| F.N.B. CORPORATION | ||

| By: | /s/ James G. Orie | |

| James G. Orie | ||

| Chief Legal Officer | ||

Date: July 21, 2016

EXHIBIT INDEX

| Exhibit |

Description | |

| 99.1 | Joint Press Release of F.N.B. Corporation and Yadkin Financial Corporation, dated July 21, 2016 | |

| 99.2 | Investor Presentation, dated July 21, 2016 | |

Exhibit 99.1

F.N.B. Corporation to Acquire Yadkin Financial Corporation, Creating Premier Mid-Atlantic and Southeast Regional Bank

Joint Press Release

PITTSBURGH, PA and RALEIGH, NC, July 21, 2016 — F.N.B. Corporation (“FNB”) (NYSE: FNB) and Yadkin Financial Corporation (“Yadkin”) (NYSE: YDKN) today jointly announced the signing of a definitive merger agreement pursuant to which F.N.B. Corporation will acquire Yadkin Financial Corporation, the holding company and parent of Yadkin Bank, in an all-stock transaction valued at approximately $27.35 per share, or $1.4 billion in the aggregate, using the 20-day trailing average closing stock price of FNB as of Wednesday, July 20, 2016. Following the merger of the parent holding companies, Yadkin Bank will merge with and into FNB’s subsidiary, First National Bank of Pennsylvania.

The acquisition of the North Carolina-based bank will provide FNB with approximately $7.5 billion in total assets, $5.3 billion in total deposits, $5.4 billion in total loans and 100 banking offices located in North Carolina and South Carolina. The transaction creates a unique regional banking franchise that extends from the Mid-Atlantic to the Southeast and provides FNB with a presence in several high-growth markets, including Raleigh, Charlotte and the Piedmont Triad which is comprised of Winston-Salem, Greensboro, and High Point.

With the acquisition of Yadkin on a pro-forma basis, FNB will have nearly $30 billion in total assets and more than 400 full-service banking offices. The combined Company will also have approximately $21 billion in deposits and $20 billion in total loans. Under the terms of the merger agreement, which has been approved by the board of directors of each company, shareholders of Yadkin will be entitled to receive 2.16 shares of FNB common stock for each common share of Yadkin*. The exchange ratio is fixed and the transaction is expected to qualify as a tax-free exchange for shareholders of Yadkin. Yadkin shareholders will own approximately 35 percent of FNB post-transaction. The merger is subject to certain closing conditions, including approval by the FNB and Yadkin shareholders and approval by the federal bank regulators.

“We are pleased to welcome Yadkin employees and are excited to bring FNB’s relationship-focused banking model and leading-edge technology to our new customers and prospective clients. Both FNB and Yadkin are high performing banks with a track record of successful growth. The combination with Yadkin transforms FNB’s growth profile and creates a premier regional bank with an expanded footprint across the Mid-Atlantic and Southeast,” said Vincent J. Delie, Jr., President and Chief Executive Officer of F.N.B. Corporation. “With this additional scale, FNB will be better positioned to compete effectively in an environment which requires constant attention to improving operational efficiencies. Our prospects for improved efficiency and revenue growth will serve FNB well as we continue to drive shareholder value creation.”

Scott Custer, President and Chief Executive Officer of Yadkin Financial Corporation, said “Yadkin Financial Corporation is delighted to partner with F.N.B. Corporation, one of the most impressive banking organizations in the United States. FNB’s executive management team has done a tremendous job of delivering value to customers and shareholders while consistently being recognized as one of the best places to work for employees. We believe this partnership will provide the best returns for our shareholders while providing tremendous opportunities for our employees, customers and the communities we serve.”

FNB and Yadkin expect to complete the transaction and integration in the first quarter of 2017 after satisfaction of customary closing conditions, including regulatory approvals and the approval of the FNB and Yadkin shareholders.

RBC Capital Markets, LLC served as exclusive financial advisor and Reed Smith LLP served as legal counsel to FNB. Sandler O’Neill & Partners LP acted as exclusive financial advisor and Skadden, Arps, Slate, Meagher & Flom LLP served as legal counsel to Yadkin.

An investor presentation will be available through the “About Us” section of FNB’s website at www.fnbcorporation.com by clicking on the “Investor Relations & Shareholder Services” tab or on the SEC’s website at www.sec.gov.

| * | Non-voting common stock shareholders will elect to receive FNB shares at the exchange ratio or cash equal to exchange ratio multiplied by FNB’s 20-day trailing average closing price ending on and including the fifth such trading day prior to the closing date. Yadkin had 200K non-voting common shares (0.4% of shares outstanding). |

CONFERENCE CALL

F.N.B. Corporation will host a conference call to discuss the transaction on Thursday, July 21, 2016, at 2:00 p.m. Eastern Time. Participating callers may access the call by dialing (844) 802- 2440 or (412) 317-5133 for international callers. Participants should ask to be joined into the F.N.B. Corporation call. The Webcast and presentation materials may be accessed through the “About Us - Investor Relations & Shareholder Services” section of the Corporation’s website at www.fnbcorporation.com.

A replay of the call will be available shortly after the completion of the call on the day of the call until midnight Eastern Time on Thursday, July 28, 2016. The replay can be accessed by dialing (877) 344-7529 or (412) 317-0088 for international callers; the conference replay access code is 10088077. Following the call, a transcript of the call and the related presentation materials will be posted to the “Shareholder and Investor Relations” section of F.N.B. Corporation’s website at www.fnbcorporation.com.

ADDITIONAL INFORMATION ABOUT THE MERGER AND WHERE TO FIND IT

F.N.B. Corporation and Yadkin Financial Corporation will file a joint proxy statement/prospectus and other relevant documents with the SEC in connection with the merger.

THE RESPECTIVE SHAREHOLDERS OF F.N.B. CORPORATION AND YADKIN FINANCIAL CORPORATION ARE ADVISED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

The proxy statements/prospectuses and other relevant materials (when they become available), and any other documents F.N.B. Corporation and Yadkin Financial Corporation have filed with the SEC, may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents F.N.B. Corporation has filed with the SEC by contacting James Orie, Chief Legal Officer, F.N.B. Corporation, One North Shore Center, Pittsburgh, PA 15212, telephone: (724) 983-3317; and may obtain free copies of the documents Yadkin Financial Corporation has filed with the SEC by contacting Terry Earley, CFO, Yadkin Financial Corporation, 3600 Glenwood Avenue, Raleigh, NC 27612, telephone: (919) 659-9015.

F.N.B. Corporation and Yadkin Financial Corporation and certain of their directors and executive officers may be deemed to be participants in the solicitation of proxies from shareholders of F.N.B. Corporation and Yadkin Financial Corporation in connection with the proposed merger. Information concerning such participants’ ownership of F.N.B. Corporation and Yadkin Financial Corporation common shares will be set forth in the joint proxy statements/prospectuses relating to the merger when they become available. This communication does not constitute an offer of any securities for sale.

About F.N.B. Corporation

F.N.B. Corporation (NYSE: FNB), headquartered in Pittsburgh, Pennsylvania, is a diversified financial services company operating in six states and three major metropolitan areas. It holds a top retail deposit market share in Pittsburgh, PA, Baltimore, MD, and Cleveland, OH. The Company has total assets of $21.2 billion and more than 300 banking offices throughout Pennsylvania, Maryland, Ohio and West Virginia. F.N.B. provides a full range of commercial banking, consumer banking and wealth management solutions through its subsidiary network which is led by its largest affiliate, First National Bank of Pennsylvania, founded in 1864. Commercial banking solutions include corporate banking, small business banking, investment real estate financing, international banking, business credit, capital markets and lease financing. The consumer banking segment provides a full line of consumer banking products and services, including deposit products, mortgage lending, consumer lending and a complete suite of mobile and online banking services. F.N.B.’s wealth management services include asset management, private banking and insurance. The Company also operates Regency Finance Company, which has more than 70 consumer finance offices in Pennsylvania, Ohio, Kentucky and Tennessee. The common stock of F.N.B. Corporation trades on the New York Stock Exchange under the symbol “FNB” and is included in Standard & Poor’s MidCap 400 Index with the Global Industry Classification Standard (GICS) Regional Banks Sub-Industry Index. Customers, shareholders and investors can learn more about this regional financial institution by visiting the F.N.B. Corporation web site at www.fnbcorporation.com.

About Yadkin Financial Corporation

Yadkin Financial Corporation is the holding company for Yadkin Bank, a full-service state- chartered community bank providing services in 100 branches across North Carolina and upstate South Carolina. Serving approximately 130,000 customers, Yadkin has assets of $7.5 billion. Yadkin Bank’s primary business is providing banking, mortgage, investment and insurance services to residents and businesses across the Carolinas. Yadkin Bank provides mortgage- lending services through its mortgage division, Yadkin Mortgage, headquartered in Winston-Salem, NC. Yadkin Bank’s SBA Lending (Government Guaranteed Lending) is headquartered in Charlotte, NC. Yadkin Financial Corporation’s website is www.yadkinbank.com. Yadkin Financial Corporation’s common stock is traded on the NYSE under the symbol YDKN.

Forward-Looking Statements

This joint press release of F.N.B. Corporation and Yadkin Financial Corporation contains “forward- looking statements” within the meaning of the Private Securities Litigation Reform Act, relating to present or future trends or factors affecting the banking industry and, specifically, the financial operations, markets and products of F.N.B. Corporation and Yadkin Financial Corporation.

Forward-looking statements are typically identified by words such as “believe”, “plan”, “expect”, “anticipate”, “intend”, “outlook”, “estimate”, “forecast”, “will”, “should”, “project”, “goal”, and other similar words and expressions. These forward-looking statements involve certain risks and uncertainties. In addition to factors previously disclosed in F.N.B. Corporation and Yadkin Financial Corporation, Inc. reports filed with the SEC and those identified elsewhere in this press release, the following factors among others, could cause actual results to differ materially from forward- looking statements or historical performance: ability to obtain regulatory approvals in a timely manner and without significant expense or other burdens; meet other closing conditions to the Merger, including approval by F.N.B. Corporation and Yadkin Financial Corporation shareholders

and the approval by the federal bank regulators, on the expected terms and schedule; delay in closing the Merger; difficulties and delays in integrating the F.N.B. Corporation and Yadkin Financial Corporation businesses or fully realizing cost savings and other benefits; business disruption following the Merger; changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; the challenges associated with entrance into a new remote geographic market; changes in interest rates and capital markets; inflation; customer acceptance of F.N.B. Corporation products and services; customer borrowing, repayment, investment and deposit practices; customer disintermediation; the introduction, withdrawal, success and timing of business initiatives; competitive conditions; the inability to realize anticipated cost savings or revenues or to implement integration plans and other consequences associated with mergers, acquisitions and divestitures; economic conditions; and the impact, extent and timing of technological changes, capital management activities, and the actions and policies of the Federal Reserve Board and the Office of the Comptroller of the Currency and legislative and regulatory actions and reforms. F.N.B. Corporation and Yadkin Financial Corporation undertake no obligation to revise these forward-looking statements or to reflect events or circumstances after the date of this press release.

# # #

Manager/Institutional Investor Contact:

Matthew Lazzaro, 724-983-4254, 412-216-2510 (cell)

Media Contact:

Jennifer Reel, 724-983-4856, 724-699-6389 (cell)

F.N.B. Corporation Announces Agreement to Acquire Yadkin Financial Corporation July 21, 2016 Exhibit 99.2

Cautionary Statement Regarding Forward-Looking Information and Non-GAAP Financial Information This presentation contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act, relating to present or future trends or factors affecting the banking industry and, specifically, the financial operations, markets and products of F.N.B. Corporation (“FNB”) and Yadkin Financial Corporation (“Yadkin”). Forward-looking statements are typically identified by words such as “believe”, “plan”, “expect”, “anticipate”, “intend”, “outlook”, “estimate”, “forecast”, “will”, “should”, “project”, “goal”, and other similar words and expressions. These forward-looking statements involve certain risks and uncertainties. In addition to factors previously disclosed in FNB and Yadkin reports filed with the SEC and those identified elsewhere in this filing, the following factors among others, could cause actual results to differ materially from forward-looking statements or historical performance: ability to obtain regulatory approvals in a timely manner and without significant expense or other burdens; meet other closing conditions to the Merger, including applicable regulatory approvals and the approval by FNB and Yadkin shareholders, on the expected terms and schedule; delay in closing the Merger; difficulties and delays in integrating the FNB and Yadkin businesses or fully realizing anticipated cost savings and revenues; business disruption following the Merger; the challenges attendant to entering a new remote geographic market, changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer acceptance of FNB products and services by Yadkin customers; customer borrowing, repayment, investment and deposit practices; customer disintermediation; the introduction, withdrawal, success and timing of business initiatives; competitive conditions or to effectively implement integration and data conversion plans and other consequences associated with mergers, acquisitions and divestitures; economic conditions; and the impact, extent and timing of technological changes, capital management activities, and other actions and policies of the Federal Reserve Board and the Office of the Comptroller of the Currency and legislative and regulatory actions and reforms. FNB and Yadkin undertake no obligation to revise their respective forward-looking statements or to reflect events or circumstances after the date of this presentation. To supplement its consolidated financial statements presented in accordance with Generally Accepted Accounting Principles (GAAP), the FNB and Yadkin have respectively provided additional measures of operating results, net income and earnings per share (EPS) adjusted to exclude certain costs, expenses, and gains and losses. FNB and Yadkin believe that these non-GAAP financial measures are appropriate to enhance the understanding of its past performance as well as prospects for its future performance. In the event of such a disclosure or release, the Securities and Exchange Commission’s Regulation G requires: (i) the presentation of the most directly comparable financial measure calculated and presented in accordance with GAAP and (ii) a reconciliation of the differences between the non-GAAP financial measure presented and the most directly comparable financial measure calculated and presented in accordance with GAAP. The Appendix to this presentation contains non-GAAP financial measures used by the FNB and Yadkin to provide information useful to investors in understanding each Company’s respective operating performance and trends, and facilitate comparisons with the performance of each of FNB’s and Yadkin’s respective peers. While each of FNB and Yadkin believe that these non-GAAP financial measures are useful in evaluating each company, the information should be considered supplemental in nature and not as a substitute for or superior to the relevant financial information prepared in accordance with GAAP. The non-GAAP financial measures used by each of FNB and Yadkin may differ from the non-GAAP financial measures other financial institutions use to measure their results of operations. This information should be reviewed in conjunction with each of FNB’s and Yadkin’s financial results disclosed on July 21, 2016 and in its periodic filings with the Securities and Exchange Commission. ADDITIONAL INFORMATION ABOUT THE MERGER This communication is being made in respect of the proposed transaction involving Yadkin and FNB. This material is not a solicitation of any vote or approval of Yadkin’s or FNB's shareholders and is not a substitute for the joint proxy statement/prospectus or any other documents which Yadkin and FNB may send to their respective shareholders in connection with the proposed merger. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities. F.N.B. Corporation and Yadkin Financial Corporation will file a joint proxy statement/prospectus and other relevant documents with the SEC in connection with the merger. THE RESPECTIVE SHAREHOLDERS OF AND F.N.B. CORPORATION AND YADKIN FINANCIAL CORPORATION ARE ADVISED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The proxy statements/prospectuses and other relevant materials (when they become available), and any other documents F.N.B. Corporation and Yadkin Financial Corporation have filed with the SEC, may be obtained free of charge at the SEC's website at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents F.N.B. Corporation has filed with the SEC by contacting James Orie, Chief Legal Officer, F.N.B. Corporation, One North Shore Center, Pittsburgh, PA 15212 , telephone: (724) 983-3317; and may obtain free copies of the documents Yadkin Financial Corporation has filed with the SEC by contacting Terry Earley, CFO, Yadkin Financial Corporation, 3600 Glenwood Avenue, Raleigh, NC 27612, telephone: (919) 659-9015. F.N.B. Corporation and Yadkin Financial Corporation and certain of their directors and executive officers may be deemed to be participants in the solicitation of proxies from shareholders of F.N.B. Corporation and Yadkin Financial Corporation in connection with the proposed merger. Information concerning such participants' ownership of F.N.B. Corporation and Yadkin Financial Corporation common shares will be set forth in the joint proxy statements/prospectuses relating to the merger when they become available. This communication does not constitute an offer of any securities for sale.

Compelling Strategic and Financial Rationale Extends FNB’s footprint into attractive high-growth metro markets in the Southeast Transforms FNB’s growth profile with nearly half of pro forma franchise in large, attractive markets Top 10 deposit market share in five major metro markets with population greater than 1 million (1) Nearly $30 billion in pro forma assets with increased scale and business opportunities Leverages FNB’s investments in technology and compliance Expertise and product set to deepen customer penetration Expect high retention rate of market leadership and customer-facing employees Empowers Yadkin’s experienced bankers Well-positioned to attract additional in-market talent Creates a Premier Middle Market Regional Bank in the Mid-Atlantic and Southeast Financially attractive transaction with conservative assumptions Mid-to-high single digit earnings accretion TBV per share earnback of 4.5 years Modeled to flat interest rates for next five years Drives positive operating leverage through organic growth of middle market C&I business, consumer banking and fee income and focused expense reductions Positions FNB for long-term growth in a challenging interest rate and regulatory environment Significant Long-Term Shareholder Value Creation Recent FNB acquisition of Metro has been closed and fully integrated Comprehensive due diligence review and conservative credit mark Pro forma capital ratios exceed well-capitalized levels and CRE concentration comfortably below regulatory guidance Experienced Acquirer and Proven Market Expansion Model (1) Includes Pittsburgh MSA, Baltimore MSA, Raleigh MSA, Charlotte MSA and the Piedmont Triad (Greensboro – High Point MSA and Winston – Salem MSA).

North Carolina – A Robust Banking Market, Well-Positioned For Growth North Carolina consistently ranks as one of the best business climates in the U.S., having ranked 2nd among Forbes “Best States for Business” in 2015 and top five for the last ten consecutive years Result of competitive tax climate (corporate income tax rate of 4%), low business costs, favorable legal and regulatory environment and the availability of skilled labor Headquarters for 12 Fortune 500 companies #1 state for corporate relocations in 2015 and has been for 8 of the past 9 years Since the beginning of 2015, 124 companies have announced relocations or expansions in Wake County (Raleigh / Durham area) 9th largest state based on 2015 GDP with the 5th highest growth rate Primary economic drivers are higher education, technology (e.g. IT and biotechnology), healthcare, finance, logistics, manufacturing, transportation Attractive Business Climate 9th largest state by population and recently surpassed 10 million having grown nearly 6% since 2010 Raleigh and Charlotte ranked #9 and #13 respectively on Forbes “Fastest Growing Cities” 2016 list based on population and economic growth among the nation’s 100 most populous metropolitan statistical areas Highly skilled and educated workforce, with 53 colleges and universities including three Tier 1 research universities Piedmont Triad has over 20 colleges and universities Large pool of banking talent due to deep history of large financial services companies based in North Carolina High Growth Markets with Significant Retail Banking Prospects Source: Forbes, Site Selection, SNL Financial, Nielson, Bureau of Economic Analysis U.S. Department of Commerce, North Carolina Department of Commerce, Economic Development Partnership of North Carolina, Fortune, Greater Raleigh Chamber of Commerce, U.S. Census Bureau.

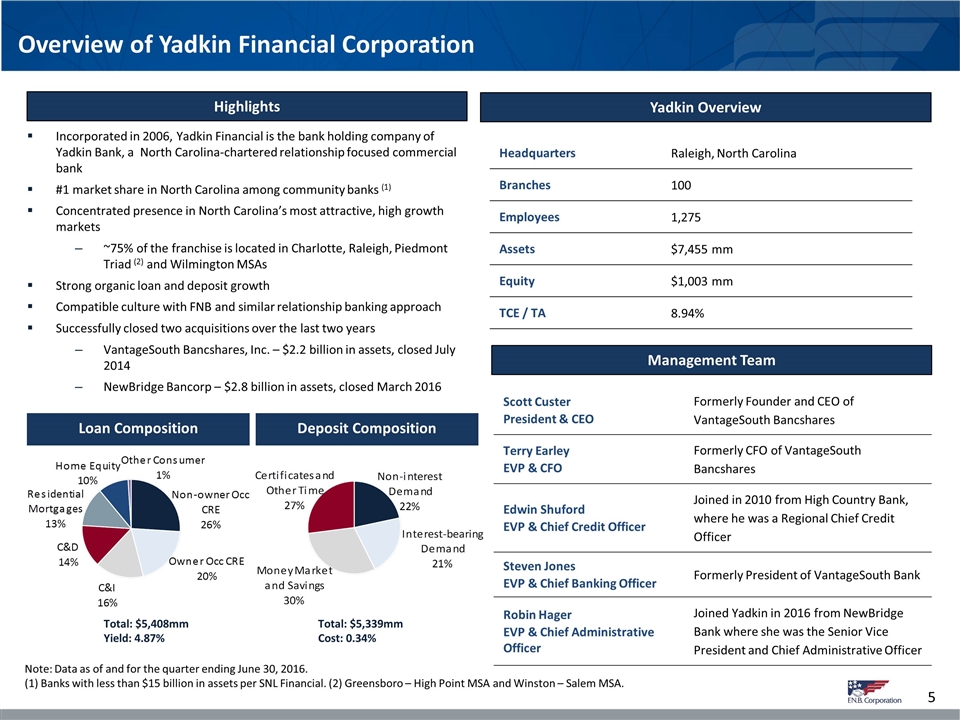

Scott Custer President & CEO Formerly Founder and CEO of VantageSouth Bancshares Terry Earley EVP & CFO Formerly CFO of VantageSouth Bancshares Edwin Shuford EVP & Chief Credit Officer Joined in 2010 from High Country Bank, where he was a Regional Chief Credit Officer Steven Jones EVP & Chief Banking Officer Formerly President of VantageSouth Bank Robin Hager EVP & Chief Administrative Officer Joined Yadkin in 2016 from NewBridge Bank where she was the Senior Vice President and Chief Administrative Officer Overview of Yadkin Financial Corporation Highlights Yadkin Overview Headquarters Raleigh, North Carolina Branches 100 Employees 1,275 Assets $7,455 mm Equity $1,003 mm TCE / TA 8.94% Loan Composition Deposit Composition Incorporated in 2006, Yadkin Financial is the bank holding company of Yadkin Bank, a North Carolina-chartered relationship focused commercial bank #1 market share in North Carolina among community banks (1) Concentrated presence in North Carolina’s most attractive, high growth markets ~75% of the franchise is located in Charlotte, Raleigh, Piedmont Triad (2) and Wilmington MSAs Strong organic loan and deposit growth Compatible culture with FNB and similar relationship banking approach Successfully closed two acquisitions over the last two years VantageSouth Bancshares, Inc. – $2.2 billion in assets, closed July 2014 NewBridge Bancorp – $2.8 billion in assets, closed March 2016 Note: Data as of and for the quarter ending June 30, 2016. (1) Banks with less than $15 billion in assets per SNL Financial. (2) Greensboro – High Point MSA and Winston – Salem MSA. Total: $5,408mm Yield: 4.87% Total: $5,339mm Cost: 0.34% Management Team

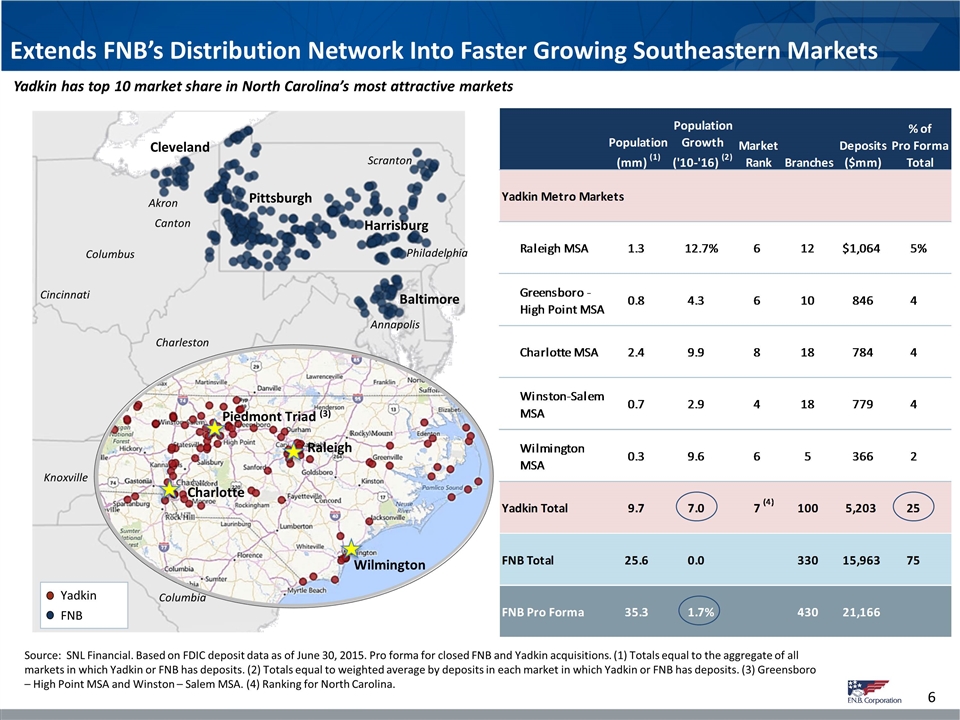

Yadkin FNB Cleveland Pittsburgh Baltimore Yadkin has top 10 market share in North Carolina’s most attractive markets Extends FNB’s Distribution Network Into Faster Growing Southeastern Markets Source: SNL Financial. Based on FDIC deposit data as of June 30, 2015. Pro forma for closed FNB and Yadkin acquisitions. (1) Totals equal to the aggregate of all markets in which Yadkin or FNB has deposits. (2) Totals equal to weighted average by deposits in each market in which Yadkin or FNB has deposits. (3) Greensboro – High Point MSA and Winston – Salem MSA. (4) Ranking for North Carolina. Wilmington Raleigh Piedmont Triad (3) Charlotte Harrisburg Scranton Philadelphia Canton Akron Columbus Cincinnati Charleston Annapolis Knoxville Columbia

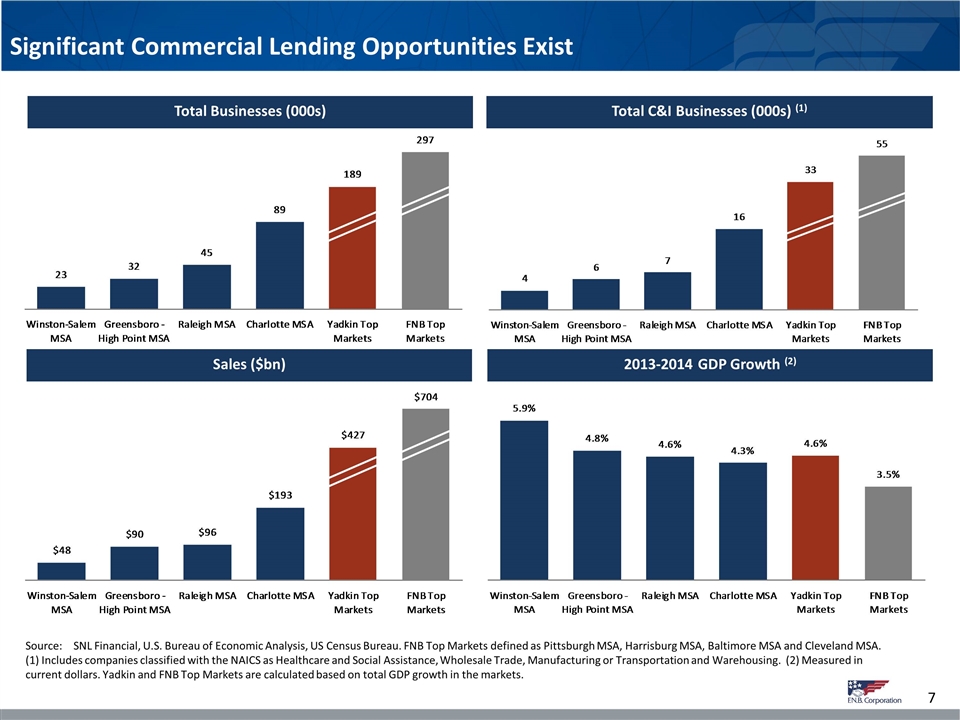

Significant Commercial Lending Opportunities Exist Total C&I Businesses (000s) (1) Total Businesses (000s) 2013-2014 GDP Growth (2) Sales ($bn) Source:SNL Financial, U.S. Bureau of Economic Analysis, US Census Bureau. FNB Top Markets defined as Pittsburgh MSA, Harrisburg MSA, Baltimore MSA and Cleveland MSA. (1) Includes companies classified with the NAICS as Healthcare and Social Assistance, Wholesale Trade, Manufacturing or Transportation and Warehousing. (2) Measured in current dollars. Yadkin and FNB Top Markets are calculated based on total GDP growth in the markets.

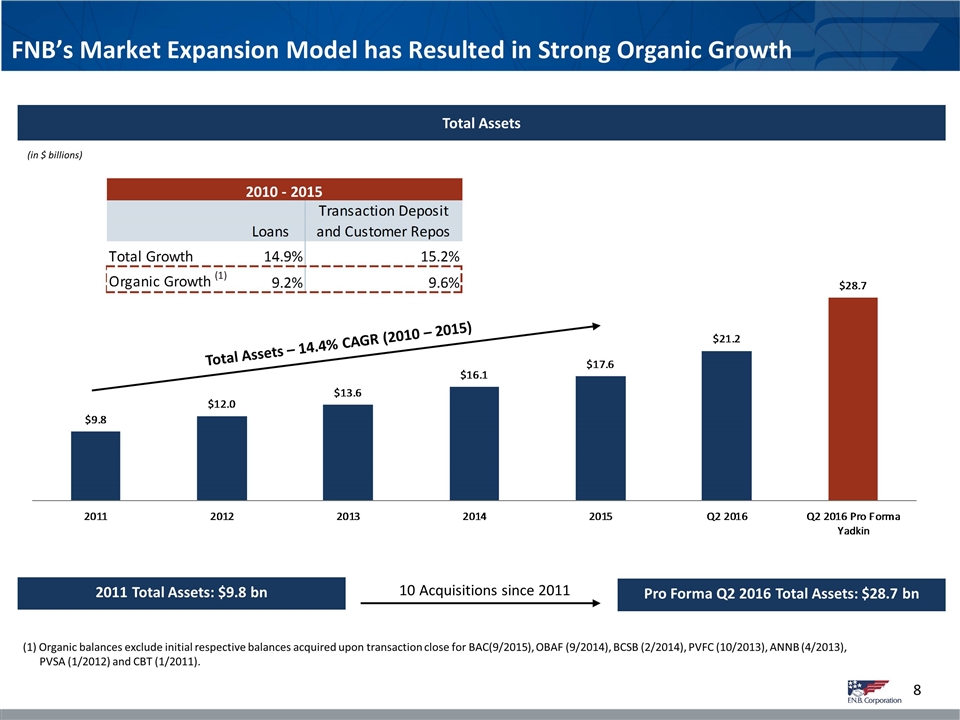

FNB’s Market Expansion Model has Resulted in Strong Organic Growth 2011 Total Assets: $9.8 bn Pro Forma Q2 2016 Total Assets: $28.7 bn 10 Acquisitions since 2011 Total Assets (in $ billions) (1) Organic balances exclude initial respective balances acquired upon transaction close for BAC(9/2015), OBAF (9/2014), BCSB (2/2014), PVFC (10/2013), ANNB (4/2013), PVSA (1/2012) and CBT (1/2011). Total Assets – 14.4% CAGR (2010 – 2015)

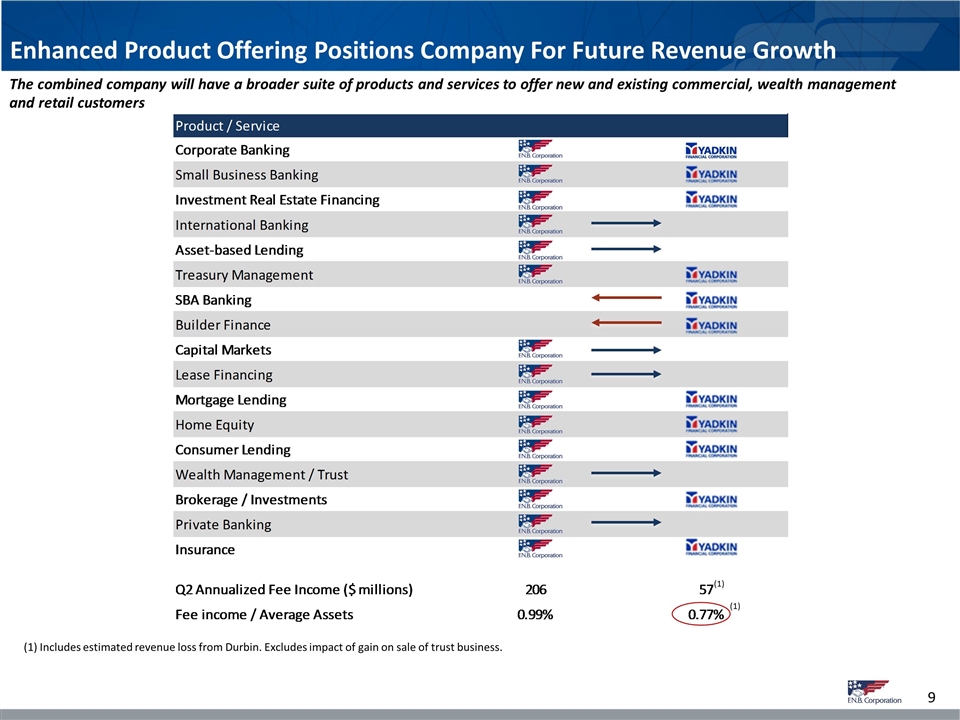

Enhanced Product Offering Positions Company For Future Revenue Growth The combined company will have a broader suite of products and services to offer new and existing commercial, wealth management and retail customers (1) Includes estimated revenue loss from Durbin. Excludes impact of gain on sale of trust business. (1) (1)

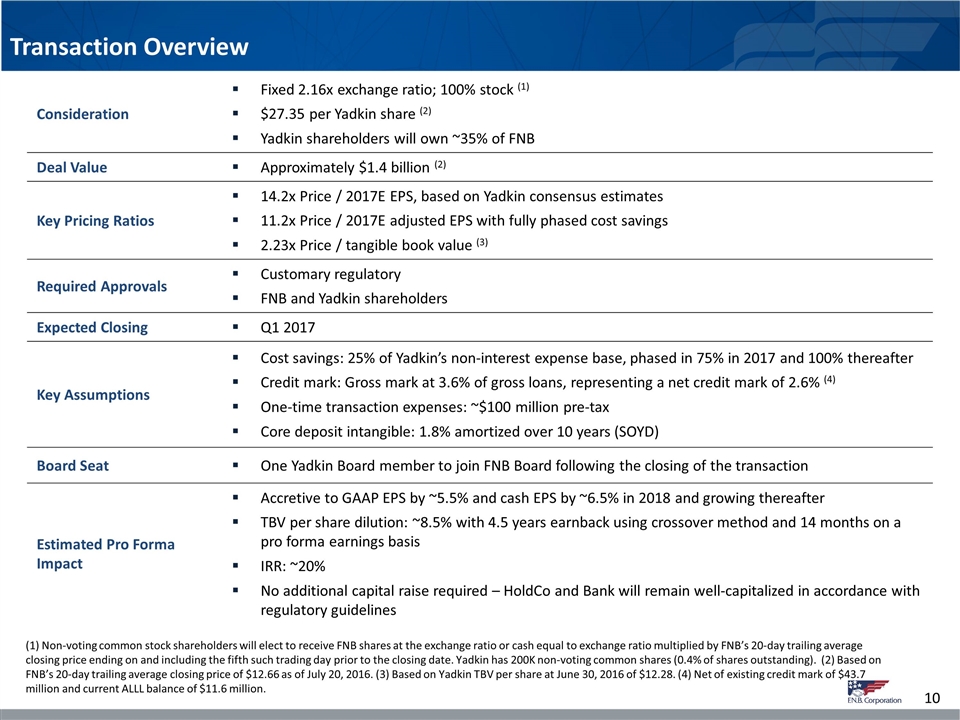

Transaction Overview (1) Non-voting common stock shareholders will elect to receive FNB shares at the exchange ratio or cash equal to exchange ratio multiplied by FNB’s 20-day trailing average closing price ending on and including the fifth such trading day prior to the closing date. Yadkin has 200K non-voting common shares (0.4% of shares outstanding). (2) Based on FNB’s 20-day trailing average closing price of $12.66 as of July 20, 2016. (3) Based on Yadkin TBV per share at June 30, 2016 of $12.28. (4) Net of existing credit mark of $43.7 million and current ALLL balance of $11.6 million. Consideration Fixed 2.16x exchange ratio; 100% stock (1) $27.35 per Yadkin share (2) Yadkin shareholders will own ~35% of FNB Deal Value Approximately $1.4 billion (2) Key Pricing Ratios 14.2x Price / 2017E EPS, based on Yadkin consensus estimates 11.2x Price / 2017E adjusted EPS with fully phased cost savings 2.23x Price / tangible book value (3) Required Approvals Customary regulatory FNB and Yadkin shareholders Expected Closing Q1 2017 Key Assumptions Cost savings: 25% of Yadkin’s non-interest expense base, phased in 75% in 2017 and 100% thereafter Credit mark: Gross mark at 3.6% of gross loans, representing a net credit mark of 2.6% (4) One-time transaction expenses: ~$100 million pre-tax Core deposit intangible: 1.8% amortized over 10 years (SOYD) Board Seat One Yadkin Board member to join FNB Board following the closing of the transaction Estimated Pro Forma Impact Accretive to GAAP EPS by ~5.5% and cash EPS by ~6.5% in 2018 and growing thereafter TBV per share dilution: ~8.5% with 4.5 years earnback using crossover method and 14 months on a pro forma earnings basis IRR: ~20% No additional capital raise required – HoldCo and Bank will remain well-capitalized in accordance with regulatory guidelines

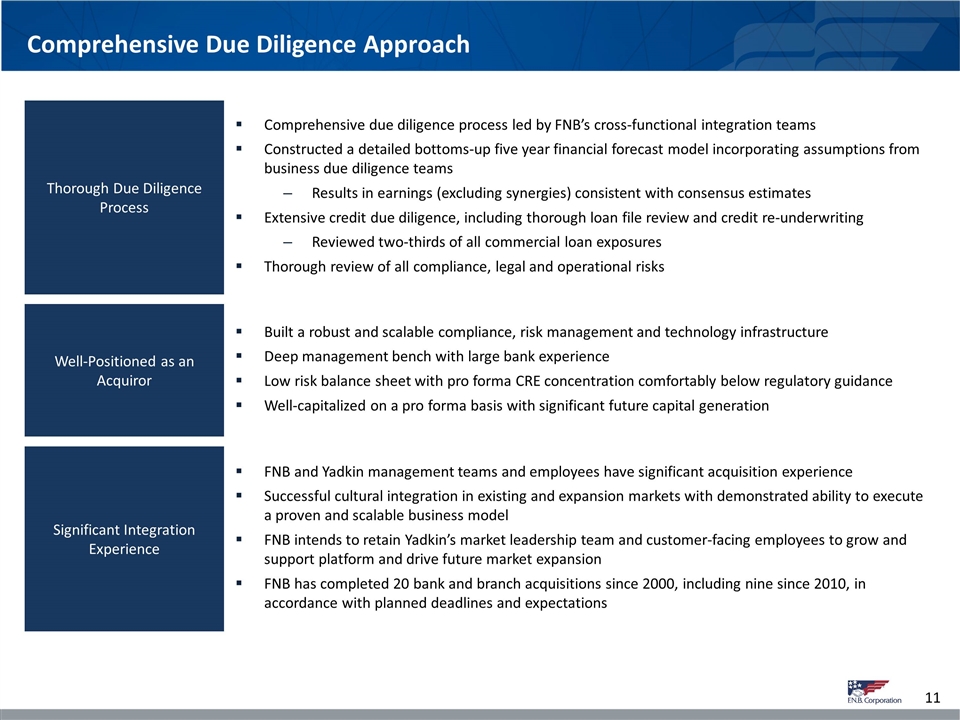

Comprehensive Due Diligence Approach Comprehensive due diligence process led by FNB’s cross-functional integration teams Constructed a detailed bottoms-up five year financial forecast model incorporating assumptions from business due diligence teams Results in earnings (excluding synergies) consistent with consensus estimates Extensive credit due diligence, including thorough loan file review and credit re-underwriting Reviewed two-thirds of all commercial loan exposures Thorough review of all compliance, legal and operational risks Thorough Due Diligence Process Built a robust and scalable compliance, risk management and technology infrastructure Deep management bench with large bank experience Low risk balance sheet with pro forma CRE concentration comfortably below regulatory guidance Well-capitalized on a pro forma basis with significant future capital generation Well-Positioned as an Acquiror FNB and Yadkin management teams and employees have significant acquisition experience Successful cultural integration in existing and expansion markets with demonstrated ability to execute a proven and scalable business model FNB intends to retain Yadkin’s market leadership team and customer-facing employees to grow and support platform and drive future market expansion FNB has completed 20 bank and branch acquisitions since 2000, including nine since 2010, in accordance with planned deadlines and expectations Significant Integration Experience

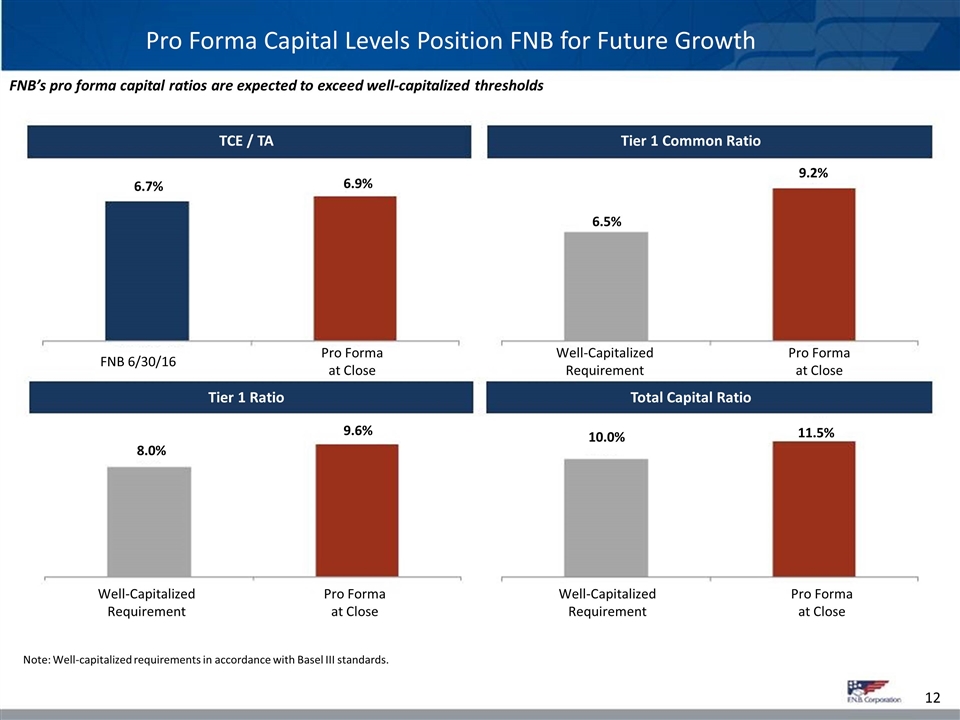

12 Note: Well-capitalized requirements in accordance with Basel III standards. FNB’s pro forma capital ratios are expected to exceed well-capitalized thresholds Total Capital Ratio Tier 1 Common Ratio TCE / TA Tier 1 Ratio Pro Forma Capital Levels Position FNB for Future Growth 6.7% 6.9% 6.5% 9.2% 8.0% 9.6% 10.0% 11.5% FNB 6/30/16 Pro Forma at Close Well-Capitalized Requirement Pro Forma at Close Pro Forma at Close Well-Capitalized Requirement Pro Forma at Close Well-Capitalized Requirement

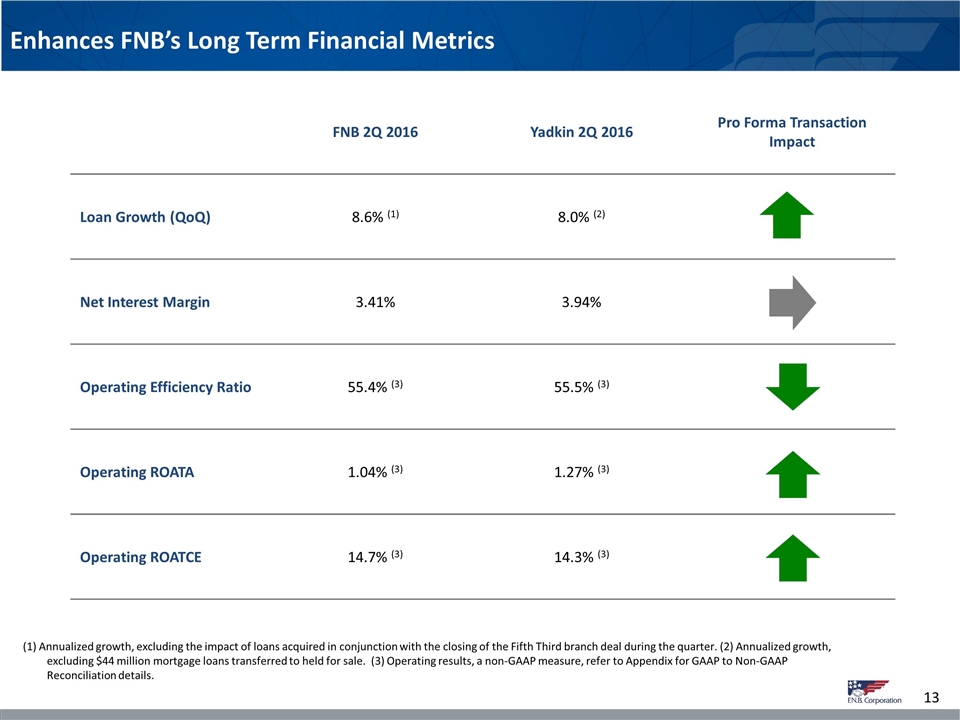

Enhances FNB’s Long Term Financial Metrics (1) Annualized growth, excluding the impact of loans acquired in conjunction with the closing of the Fifth Third branch deal during the quarter. (2) Annualized growth, excluding $44 million mortgage loans transferred to held for sale. (3) Operating results, a non-GAAP measure, refer to Appendix for GAAP to Non-GAAP Reconciliation details. FNB 2Q 2016 Yadkin 2Q 2016 Pro Forma Transaction Impact Loan Growth (QoQ) 8.6% (1) 8.0% (2) Net Interest Margin 3.41% 3.94% Operating Efficiency Ratio 55.4% (3) 55.5% (3) Operating ROATA 1.04% (3) 1.27% (3) Operating ROATCE 14.7% (3) 14.3% (3)

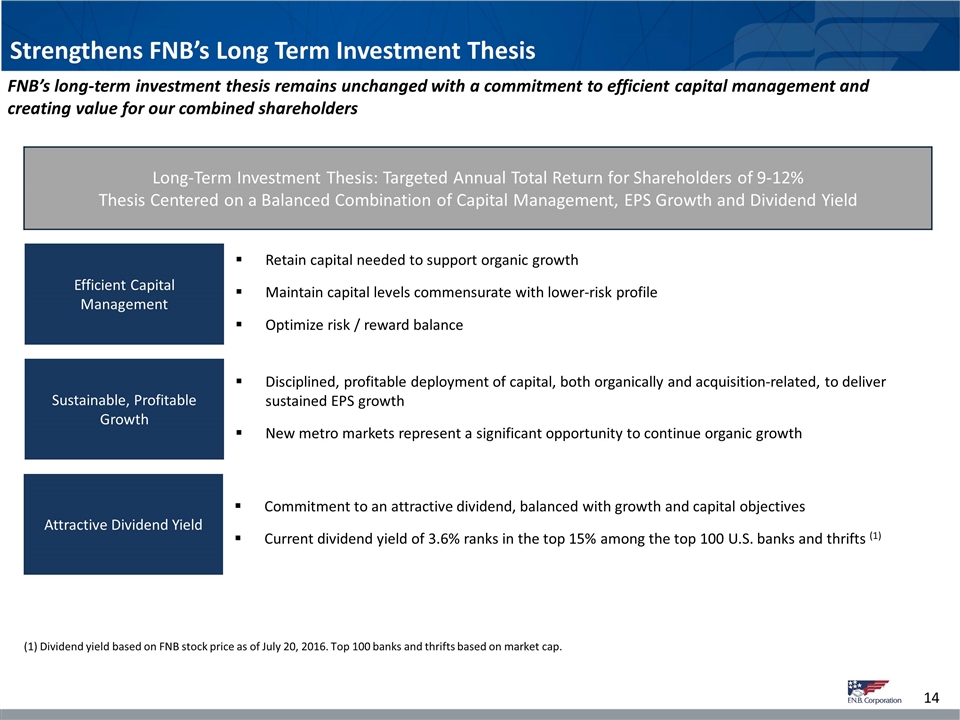

Strengthens FNB’s Long Term Investment Thesis FNB’s long-term investment thesis remains unchanged with a commitment to efficient capital management and creating value for our combined shareholders Long-Term Investment Thesis: Targeted Annual Total Return for Shareholders of 9-12% Thesis Centered on a Balanced Combination of Capital Management, EPS Growth and Dividend Yield Retain capital needed to support organic growth Maintain capital levels commensurate with lower-risk profile Optimize risk / reward balance Efficient Capital Management Disciplined, profitable deployment of capital, both organically and acquisition-related, to deliver sustained EPS growth New metro markets represent a significant opportunity to continue organic growth Sustainable, Profitable Growth Commitment to an attractive dividend, balanced with growth and capital objectives Current dividend yield of 3.6% ranks in the top 15% among the top 100 U.S. banks and thrifts (1) Attractive Dividend Yield (1) Dividend yield based on FNB stock price as of July 20, 2016. Top 100 banks and thrifts based on market cap.

Together, FNB and Yadkin are Well-Positioned to Deliver Superior Long-Term Shareholder Value Creates a $30 billion asset bank with increased scale and business opportunities Extends FNB’s distribution network into faster growing metro markets in the Southeast Pro forma company will have top 10 market share in five major metro markets (1) Leverages FNB’s proven business model of delivering strong organic growth and expanding fee income Financially compelling transaction with conservative assumptions Significantly enhances FNB’s long-term growth prospects and financial metrics Strong pro forma capital generation to support future growth and dividend Lower risk balance sheet due to geographical and asset diversification Includes Pittsburgh MSA, Baltimore MSA, Raleigh MSA, Charlotte MSA and the Piedmont Triad (Greensboro – High Point MSA and Winston – Salem MSA).

Appendix

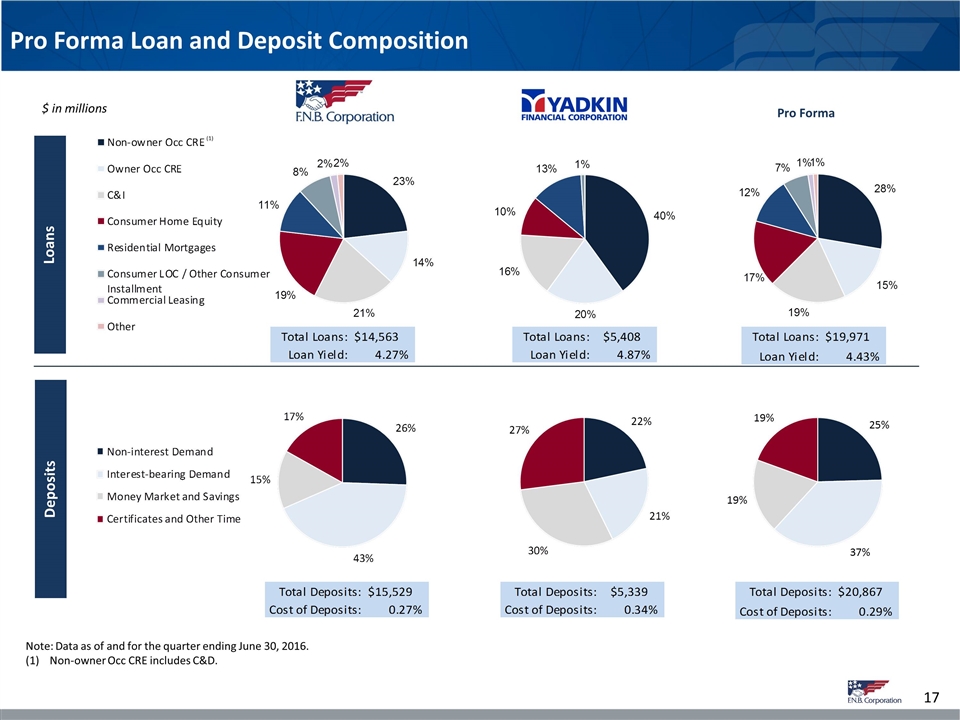

Pro Forma Loan and Deposit Composition Note: Data as of and for the quarter ending June 30, 2016. Non-owner Occ CRE includes C&D. Loans Pro Forma $ in millions Deposits (1)

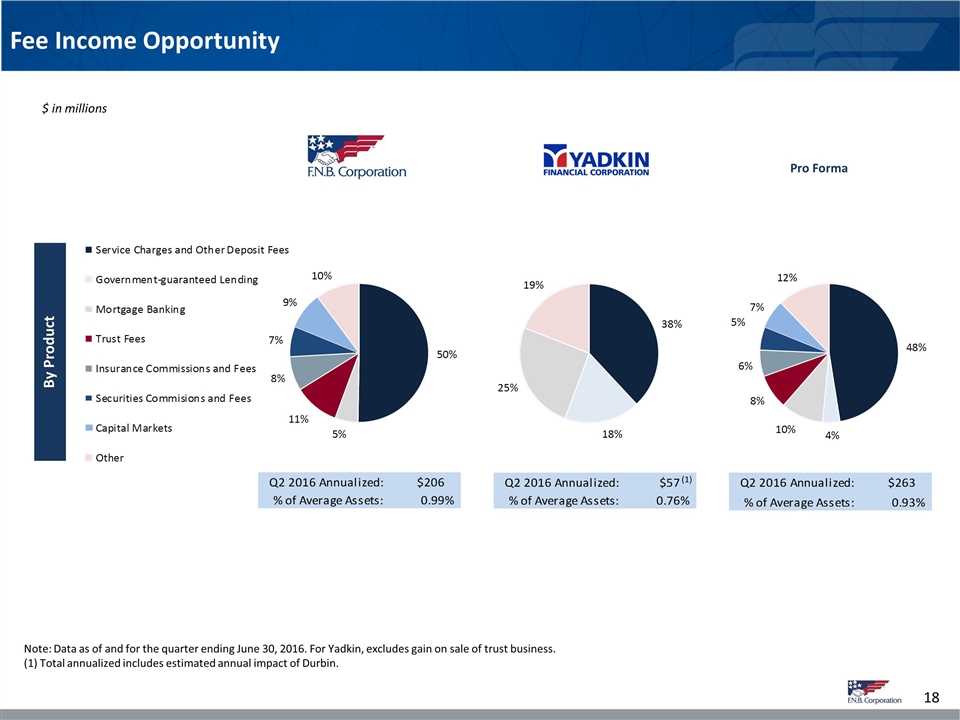

Fee Income Opportunity Note: Data as of and for the quarter ending June 30, 2016. For Yadkin, excludes gain on sale of trust business. (1) Total annualized includes estimated annual impact of Durbin. Pro Forma $ in millions By Product (1)

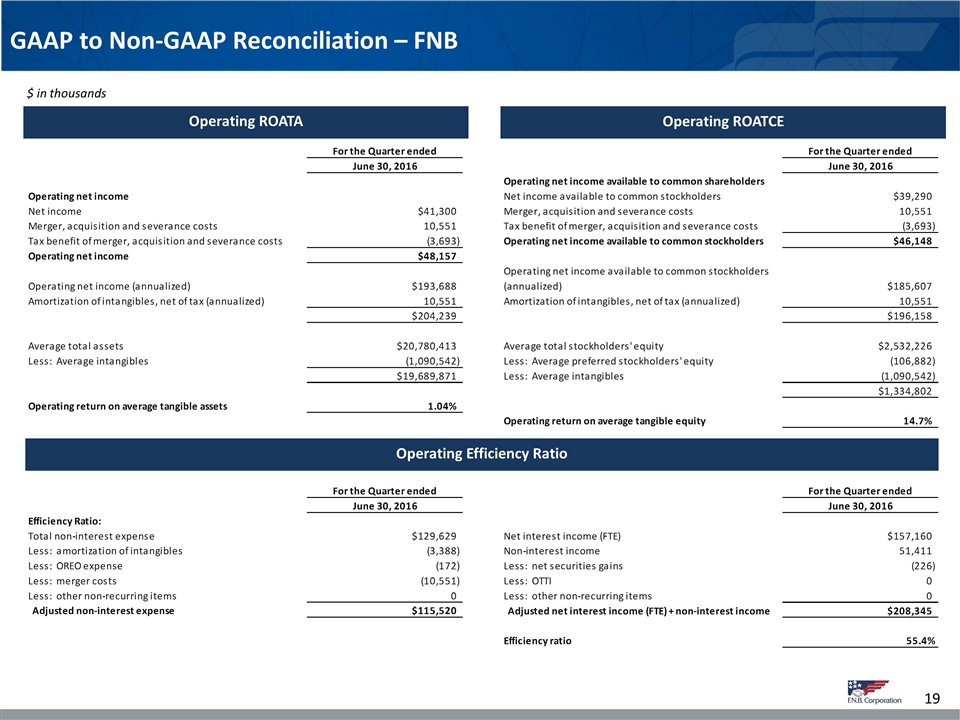

GAAP to Non-GAAP Reconciliation – FNB Operating ROATA Operating ROATCE $ in thousands Operating Efficiency Ratio

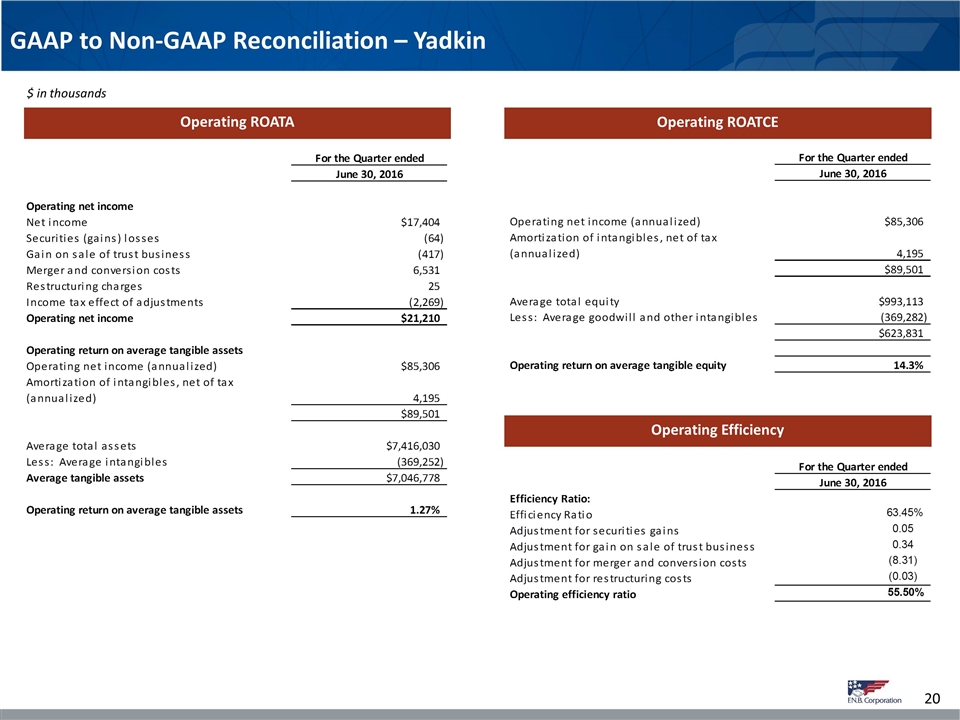

GAAP to Non-GAAP Reconciliation – Yadkin Operating ROATA Operating ROATCE Operating Efficiency $ in thousands

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- F.N.B. Corporation (FNB) PT Lowered to $15 at Stephens

- High Wire Reports 2023 Revenue of $27.0 Million, with Annualized Recurring Revenue at $12.0 Million

- Implementing AIOps: Blueprint for Enhanced IT Operations and Business Efficiency Published by Info-Tech Research Group

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share