Form SC TO-C Sagent Pharmaceuticals, Filed by: Shepard Vision, Inc.

Paul, Weiss, Rifkind, Wharton & Garrison LLP

|

Transaction Valuation

|

Amount of Filing Fee

|

|

N/A

|

N/A

|

|

☐

|

Check box if any part of the fee is offset as provided by Rule 0—11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

Amount Previously Paid:

|

|

Not applicable.

|

|

Filing Party:

|

|

Not applicable.

|

|

Form or Registration No.:

|

|

Not applicable.

|

|

Date Filed:

|

|

Not applicable.

|

|

Index No.

|

|

|

|

|

|

|

|

(a)(5)(i)

|

|

IR presentation issued by Nichi-Iko Pharmaceutical Co., Ltd., dated as of July 11, 2016. |

EXHIBIT (a)(5)(i)

Agreement to acquire Sagent Pharmaceuticals July 11, 2016

Copyright 2016 Nichi - Iko Pharmaceutical Co., Ltd. P. 1 Important Information The Tender Offer for the outstanding shares of Sagent common stock has not yet commenced . This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares of Sagent common stock . The solicitation and offer to buy shares of Sagent common stock will only be made pursuant to the Tender Offer materials that Nichi - Iko and its acquisition subsidiary intend to file with the U . S . Securities and Exchange Commission (the “SEC”) . At the time the Tender Offer is commenced, Nichi - Iko will file a Tender Offer statement on Schedule TO with the SEC, and Sagent will file a solicitation/recommendation statement on Schedule 14 D - 9 with respect to the Tender Offer . SAGENT’S STOCKHOLDERS ARE ADVISED TO READ THE SCHEDULE TO (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND OTHER OFFER DOCUMENTS) AND THE SCHEDULE 14 D - 9 , AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BEFORE THEY MAKE ANY DECISION WITH RESPECT TO THE TENDER OFFER, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES THERETO . Both the Tender Offer statement and the solicitation/recommendation statement will be mailed to Sagent's stockholders free of charge . Investors and stockholders may obtain free copies of the Schedule TO and Schedule 14 D - 9 , as each may be amended or supplemented from time to time, and other documents filed by the parties (when available) at the SEC’s web site at www . sec . gov . Important Information

Copyright 2016 Nichi - Iko Pharmaceutical Co., Ltd. P. 2 Any statements made in this communication that are not descriptions of historical facts, including those relating to the anticipated timing, duration, closing conditions, completion and success of the proposed transaction, and the potential effects and benefits of the transaction on both Nichi - Iko and Sagent and any other statements about future expectations, are forward - looking statements that are based on management’s beliefs, certain assumptions and current expectations, and should be evaluated as such . Forward - looking statements also include statements that may relate to Nichi - Iko’s or Sagent’s plans, objectives, strategies, goals, future events, future financial and operating performance, and other information that is not historical information . These statements may be identified by their use of forward - looking terminology such as the words “anticipate,” “expect,” “suggest,” “plan,” “believe,” “intend,” “estimate,” “target,” “project,” “could,” “should,” “may,” “will,” “would,” “continue,” “forecast,” and other similar expressions . Forward - looking information is based on, among other things, opinions, assumptions, estimates and analyses that, while considered reasonable by us at the date the forward - looking information is provided, are inherently subject to significant risks, uncertainties, contingencies and other factors that may cause actual results and events to differ materially from those expressed or implied by the forward - looking information . There are a number of important factors that could cause actual results or events to differ materially from those indicated by such forward looking statements . These risks and uncertainties include, but are not limited to, general economic, business and market conditions, the satisfaction of the conditions to the consummation of the proposed transaction, the timing of the completion of the proposed transaction and the potential impact of the announcement or consummation of the proposed transaction on Sagent’s and Nichi - Iko’s important relationships, including with employees, suppliers and customers . For a further description of the risks and uncertainties that could cause actual results to differ from those expressed in these forward - looking statements, as well as risks relating to the business of Sagent in general, see Sagent’s Form 10 - K for the year ended December 31 , 2015 , subsequent reports on Form 10 - Q and 8 - K, and other filings by the Company with the SEC . Further, forward - looking statements speak only as of the date they are made, and neither Nichi - Iko nor Sagent undertakes any obligation to update or revise any forward - looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, except as required by law . All written and oral forward - looking statements attributable to us or persons acting on our behalf are qualified in their entirety by these cautionary statements . Cautionary Statement Regarding Forward - Looking Statements

Copyright 2016 Nichi - Iko Pharmaceutical Co., Ltd. P. 3 1. Outline of acquisition 2. Overview of Sagent 3. Rationale and reasons for the acquisition 4. Impact on financial position 5. Appendix

Copyright 2016 Nichi - Iko Pharmaceutical Co., Ltd. P. 4 Outline of acquisition 買収価格 プレミアム 買収総額 買収ストラクチャー(過去案件の書きぶりを真 似てください。 買収資金 業績への営業。のれん Acquisition price • US$21.75 per share ( total consideration approx.$736 MM* ) • Premium of 40.3% to closing price of $15.50 on July 8, 2016 Acquisition method • All cash tender offer followed by second - step merger • Acquisition will proceed if more than 50% of outstanding Sagent shares (on a fully diluted basis) are tendered • After closing of the tender offer (TO), the acquisition vehicle established for the transaction will merge with Sagent , with Sagent as the continuing entity becoming a wholly - owned subsidiary of Nichi - Iko * Fully diluted Schedule • TO to commence within 15 business days from today; once commenced, it must remain open for a minimum of 20 business • After completion of the TO, Sagent will become a wholly - owned subsidiary • Transaction scheduled to close during second quarter of Nichi - Iko’s fiscal year ending March 2017 Friendly acquisition with the agreement of Sagent Pharmaceuticals, Inc. (hereafter Sagent ). Approved by the boards of both companies, with Sagent to become a wholly - owned subsidiary of Nichi - Iko

Copyright 2016 Nichi - Iko Pharmaceutical Co., Ltd. P. 5 1. Outline of acquisition 2. Overview of Sagent 3. Rationale and reasons for the acquisition 4. Impact on financial position 5. Appendix

Copyright 2016 Nichi - Iko Pharmaceutical Co., Ltd. P. 6 Sagent outline Company name Established Location CEO Business overview Results (FY2015 ) Employees Sagent Pharmaceuticals, Inc. ( NASDAQ: SGNT; HQ: State of Illinois, US ) 2006 HQ: Sagent Global Headquarters ( US ) Mfg., dev. site: Omega Laboratories ( Canada ) Allan Oberman Manufacture and marketing of generic pharmaceuticals, primarily injectables Net sales: US$318.3 million Adjusted EBITDA: $29.7 million 265* ( US HQ: 114; Canada: 151 ) * Source: FY2015 10K filing; excludes employees at Sagent China Pharmaceuticals which has been sold

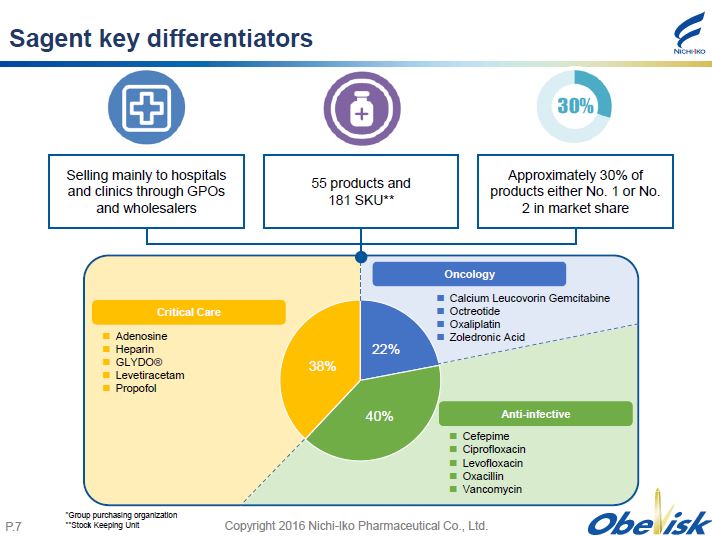

Copyright 2016 Nichi - Iko Pharmaceutical Co., Ltd. P. 7 Sagent key differentiators Selling mainly to hospitals and clinics through GPOs and wholesalers 55 products and 181 SKU** Approximately 30% of products either No. 1 or No. 2 in market share * Group purchasing organization **Stock Keeping Unit 22% 40% 38% Calcium Leucovorin Gemcitabine Octreotide Oxaliplatin Zoledronic Acid Adenosine Heparin GLYDO ® Levetiracetam Propofol Cefepime Ciprofloxacin Levofloxacin Oxacillin Vancomycin Anti - infective Oncology Critical Care

Copyright 2016 Nichi - Iko Pharmaceutical Co., Ltd. P. 8 Recent performance 152 184 245 289 318 0 100 200 300 400 2011 2012 2013 2014 2015 CAGR ( 2011 - 2015 ) 20.2% Main products Levofloxacin Gemcitabine Oxaliplatin Oxacillin Leucovorin Zoledronic Acid Docetaxel Propofol Adenosine GLYDO™ Vancomycin Number of new launches 12 16 12 7 2 (US$mm) Consistent high growth set to continue with steady launch of new products

Copyright 2016 Nichi - Iko Pharmaceutical Co., Ltd. P. 9 Pipeline 0 5 10 15 20 25 30 35 36 カ月以上 24 - 36 カ月 12 - 24 カ月 12 カ月以下 計 62 パイプラインについて ANDA を提出済 Number filed with ANDA 32 9 18 3 Months since filed with ANDA Strong 60+ product pipeline set to continue new market launches >36 months 24 - 36 12 - 24 <12 months Total of 62 drugs with ANDA filed

Copyright 2016 Nichi - Iko Pharmaceutical Co., Ltd. P. 10 1. Outline of acquisition 2. Overview of Sagent 3. Rationale and reasons for the acquisition 4. Impact on financial position 5. Appendix

Copyright 2016 Nichi - Iko Pharmaceutical Co., Ltd. P. 11 • As Japan’s largest generic pharmaceuticals company, this is an important step toward the goal of becoming a global Top 10 company in generics • Secures a platform in the US biosimilars market • Enables development and marketing of biosimilars in the US market, with ensuing synergies • Creates cost synergies and enhances product lineup through mutual licensing and joint procurement of APIs Rationale for acquisition

Positioning in 7 th Medium - term Management Plan Obelisk Use our creativity to establish a commanding presence and expand in the global marketplace Copyright 2016 Nichi - Iko Pharmaceutical Co., Ltd. P. 12 2019 Grow domestic market share to 15% Lift annual production capacity to 18.5 billion premium quality tablets Turn to the US market to develop the new business field of biosimilar products Strengthen our business foundation as a global Top 10 generics company Core strategies Expansion Production Development

2019 Planned approval 2018 File Trastuzumab (Orig. name: Herceptin®) 2021 Planned approval 2017/7 Start clinical trials Infliximab (Orig. name: Remicade ®) Rituximab (Orig. name: Rituxan ®) 2018 Start clinical trials Copyright 2016 Nichi - Iko Pharmaceutical Co., Ltd. P. 13 Positioning in 7 th Medium - term Management Plan Obelisk Drugs for U.S. market 2017 File 2018 Planned approval Sell biosimilars via Sagent , which has a strong presence in the US injectables market

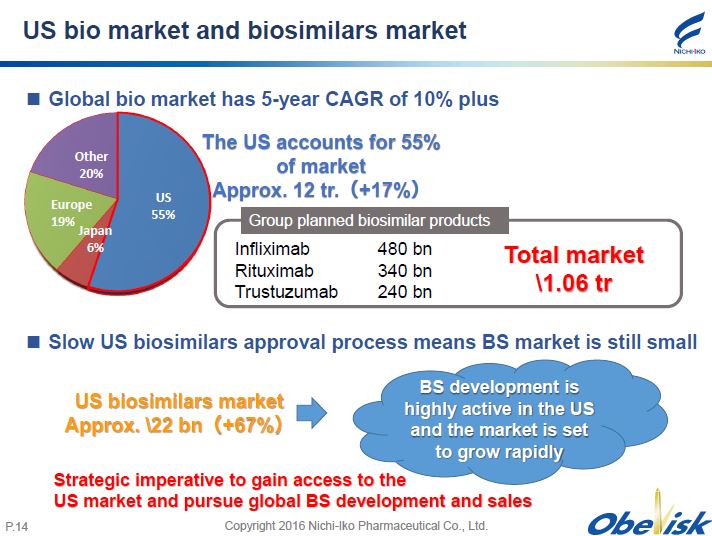

Copyright 2016 Nichi - Iko Pharmaceutical Co., Ltd. P. 14 US bio market and biosimilars market Global bio market has 5 - year CAGR of 10% plus US 55% Japan 6% Other 20% The US accounts for 55% of market Approx. 12 tr. ( +17% ) Infliximab 480 bn Rituximab 340 bn Trustuzumab 240 bn Total market \ 1.06 tr Group planned biosimilar products Slow US biosimilars approval process means BS market is still small US biosimilars market Approx. \ 22 bn ( +67% ) BS development is highly active in the US and the market is set to grow rapidly Strategic imperative to gain access to the US market and pursue global BS development and sales Europe 19%

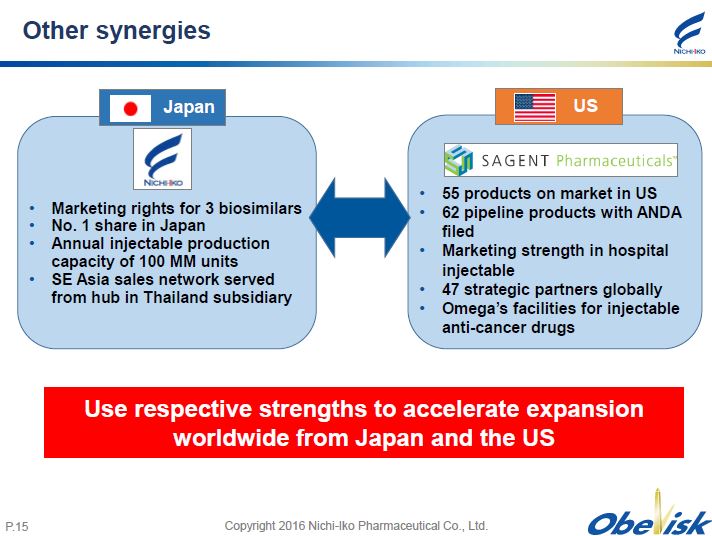

Copyright 2016 Nichi - Iko Pharmaceutical Co., Ltd. P. 15 Other synergies • 55 products on market in US • 62 pipeline products with ANDA filed • Marketing strength in hospital injectable • 47 strategic partners globally • Omega’s facilities for injectable anti - cancer drugs • Marketing rights for 3 biosimilars • No. 1 share in Japan • Annual injectable production capacity of 100 MM units • SE Asia sales network served from hub in Thailand subsidiary Japan US Use respective strengths to accelerate expansion worldwide from Japan and the US

Copyright 2016 Nichi - Iko Pharmaceutical Co., Ltd. P. 16 1. Outline of acquisition 2. Overview of Sagent 3. Rationale and reasons for the acquisition 4. Impact on financial position 5. Appendix

Copyright 2016 Nichi - Iko Pharmaceutical Co., Ltd. P. 17 Impact on financial position 買収価格 プレミアム 買収総額 買収ストラクチャー(過去案件の書きぶりを真 似てください。 買収資金 業績への営業。のれん Impact on financial position • Based on balance sheet at end of 2015, Net D/E ratio will increase to around 0.90x • Details on goodwill & intangibles, etc. will be disclosed as they become available Financing method • Planning to use bank loans and available cash Changes to dividend policy • No plans to change dividend policy as a result of this transaction; will continue to pursue stable dividend increases in line with performance

Copyright 2016 Nichi - Iko Pharmaceutical Co., Ltd. P. 18 1. Outline of acquisition 2. Overview of Sagent 3. Rationale and reasons for the acquisition 4. Impact on financial position 5. Appendix

Copyright 2016 Nichi - Iko Pharmaceutical Co., Ltd. P. 19 6/16/2016 Tea 製品の権利購入契約 12/31/2015 中国子会社を売却 8/3/2015 Allan Oberman 氏が CEO に就任 4/13/2015 Vancomycin Hydrochloride の発売を発表 10/1/2014 Omega Laboratories を買収 5/6/2013 中国生産拠点の JV を完全子会社化 11/19/2012 デロイトにより北米の「最も成長が速い企業」 3 位に選出 4/26/2011 NASDAQ に上場 5/4/2010 Actavis と米国におけるスペシャリティ注射剤製品の開発、供給及び 販売について提携 5/8/2008 Spectrum Pharmaceuticals より注射剤ジェネリック事業を取得 11/26/2007 Arcola と抗生剤の開発と製造について提携 2006 創業 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2011/4 : Listed on NASDAQ 2010/5 : Agreement with Actavis for development, supply and marketing of specialty injectables in the US 2012/11 : Ranked 3 rd in Deloitte’s Fastest Growing Company list 2007/11 : Formed alliance with Arcola for development and sale of antibody drugs 2008/5 : Acquired generic injectables business of Spectrum Pharmaceuticals 2006/1 : Established 2015/4 : Launched Vancomycin Hydrochloride 2016/6 : Announced agreement on acquisition rights for Teva products Sagent milestones 2015/8 : Appointed Allan Oberman , former CEO of Teva Americas Generics, as CEO 2014/10 : Acquired Omega Laboratories 2013/5 : Made wholly - owned subsidiary of JV Kington Sagent (Chengdu) Pharmaceutical* *Subsequently renamed Sagent (China) Pharmaceutical 2016/2 : Agreed on sale of Sagent (China) Pharmaceutical Co.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Center for Independence of the Disabled, New York Announces Continuing Education Courses for New York’s Mental Health Professionals

- STUDIO PILATES INTERNATIONAL ANNOUNCES 100TH STUDIO, WITH CONTINUED EXPANSION AND MILESTONE OPENING

- CHATTANOOGA WHISKEY RELEASES FOUNDER'S 12th ANNIVERSARY BLEND

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share