Form 10-K J M SMUCKER Co For: Apr 30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________________________

FORM 10-K

________________________________________________

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended April 30, 2016

or

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-5111

________________________________________________

THE J. M. SMUCKER COMPANY

(Exact name of registrant as specified in its charter)

________________________________________________

Ohio | 34-0538550 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

One Strawberry Lane | ||

Orrville, Ohio | 44667-0280 | |

(Address of principal executive offices) | (Zip code) | |

Registrant’s telephone number, including area code (330) 682-3000 | ||

Securities registered pursuant to Section 12(b) of the Act: | ||

Title of each class | Name of each exchange on which registered | |

Common shares, no par value | New York Stock Exchange | |

Rights to purchase preferred shares | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | x | Accelerated filer | o | |||

Non-accelerated filer | o | Smaller reporting company | o | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the common shares held by nonaffiliates of the registrant at October 31, 2015, was $13,168,504,516. As of June 14, 2016, 116,426,335 common shares of The J. M. Smucker Company were issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain sections of the registrant’s definitive Proxy Statement to be filed in connection with its Annual Meeting of Shareholders to be held on August 17, 2016, are incorporated by reference into Part III of this Report, and certain sections of the registrant’s 2016 Annual Report to Shareholders are incorporated by reference into Parts I and II of this Report.

PART I

Item 1. Business.

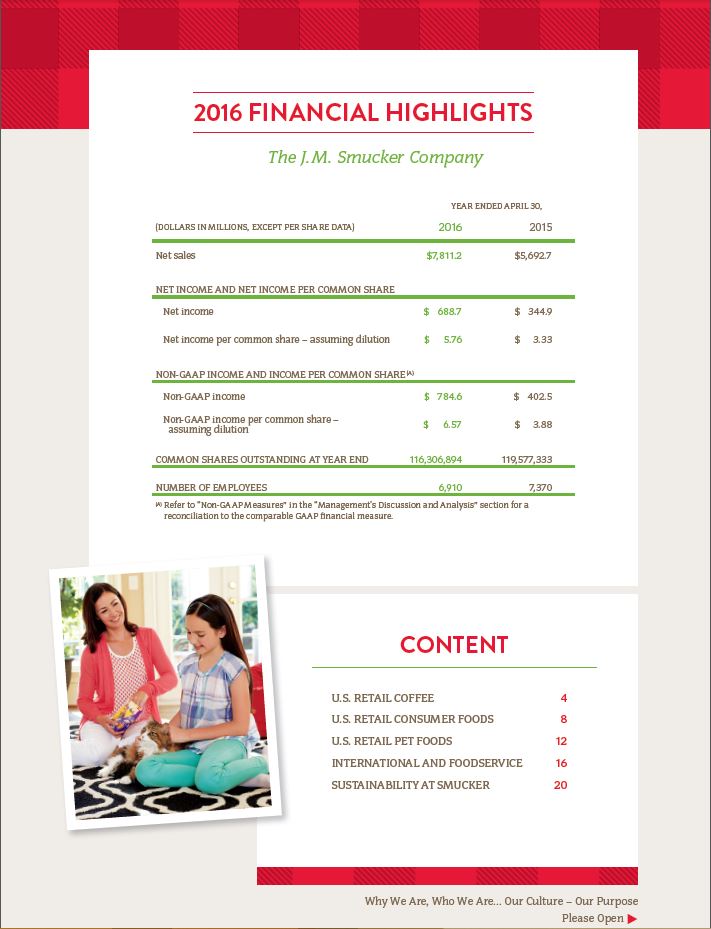

The Company. The J. M. Smucker Company (“Company,” “registrant,” “we,” “us,” or “our”) was established in 1897, was incorporated in Ohio in 1921, and is often referred to as Smucker’s (a registered trademark). We operate principally in one industry, the manufacturing and marketing of branded food and beverage products on a worldwide basis, although the majority of our sales are in the U.S. Our operations outside the U.S. are principally in Canada, although products are exported to other countries as well. Net sales outside the U.S., subject to foreign currency translation, represented 6 percent of consolidated net sales for 2016. Our branded food and beverage products include a strong portfolio of trusted, iconic, market-leading brands that are sold to consumers through retail outlets in North America.

On December 31, 2015, we sold our U.S. canned milk brands and operations to Eagle Family Foods Group LLC, a subsidiary of funds affiliated with Kelso & Company. The transaction included canned milk products that were primarily sold in U.S. retail and foodservice channels under the Eagle Brand® and Magnolia® brands, along with other branded and private label trade names, with annual net sales of approximately $200.0 million. For additional information on the U.S. canned milk transaction, see “Note 4: Divestiture” in our 2016 Annual Report to Shareholders.

On March 23, 2015, we completed the acquisition of Big Heart Pet Brands (“Big Heart”), a leading producer, distributor, and marketer of premium-quality, branded pet food and pet snacks in the U.S. The cash and stock transaction was valued at $5.9 billion, which included the issuance of 17.9 million shares of our common stock to the shareholders of Blue Acquisition Group, Inc., Big Heart’s parent company. After the closing of the transaction, we had approximately 120.0 million common shares outstanding. We assumed $2.6 billion in debt that we repaid at closing and paid an additional $1.2 billion in cash, net of a working capital adjustment. As part of the transaction, new debt of $5.5 billion was borrowed. For additional information on the Big Heart acquisition, see “Note 2: Acquisitions” in our 2016 Annual Report to Shareholders.

We have three reportable segments: U.S. Retail Coffee, U.S. Retail Consumer Foods, and U.S. Retail Pet Foods. The U.S. retail market segments in total comprised over 85 percent of 2016 consolidated net sales and represent a major portion of our strategic focus – the sale of branded food and beverage products with leadership positions to consumers through retail outlets in North America. Within our segment results, International and Foodservice represents a combination of the strategic business areas not included in the U.S. retail market segments.

Principal Products. Our principal products are coffee, pet food, pet snacks, peanut butter, fruit spreads, shortening and oils, baking mixes and ready-to-spread frostings, frozen sandwiches, flour and baking ingredients, juices and beverages, and portion control products.

Product sales information for the years 2016, 2015, and 2014 is incorporated herein by reference to information set forth in our 2016 Annual Report to Shareholders under “Note 5: Reportable Segments.”

In the U.S. retail market segments, our products are primarily sold through a combination of direct sales and brokers to food retailers, food wholesalers, drug stores, club stores, mass merchandisers, discount and dollar stores, military commissaries, natural foods stores and distributors, and pet specialty stores. In International and Foodservice, our products are distributed domestically and in foreign countries through retail channels and foodservice distributors and operators (e.g., restaurants, lodging, schools and universities, health care operators).

Sources and Availability of Raw Materials. The raw materials used in each of our segments are primarily commodities and agricultural-based products. Green coffee, grains, peanuts, edible oils, sweeteners, fruit, and other ingredients are obtained from various suppliers. The availability, quality, and costs of many of these commodities have fluctuated, and may continue to fluctuate, over time. Basis, futures, and options contracts are used to manage price volatility for a significant portion of our commodity costs. Green coffee, along with certain other raw materials, is sourced solely from foreign countries and its supply and price is subject to high volatility due to factors such as weather, global supply and demand, pest damage, investor speculation, and political and economic conditions in the source countries. We source grains, peanuts, and edible oils mainly from North America. The principal packaging materials we use are plastic, glass, metal cans, caps, carton board, and corrugate. For additional information on the commodities we purchase, see “Commodities Overview” in our 2016 Annual Report to Shareholders.

Raw materials are generally available from numerous sources, although we have elected to source certain plastic packaging materials from single sources of supply pursuant to long-term contracts. While availability may vary year-to-year, we believe that we will continue to be able to obtain adequate supplies and that alternatives to single-sourced materials are

2

available. We have not historically encountered significant shortages of key raw materials. We consider our relationships with key raw material suppliers to be in good standing.

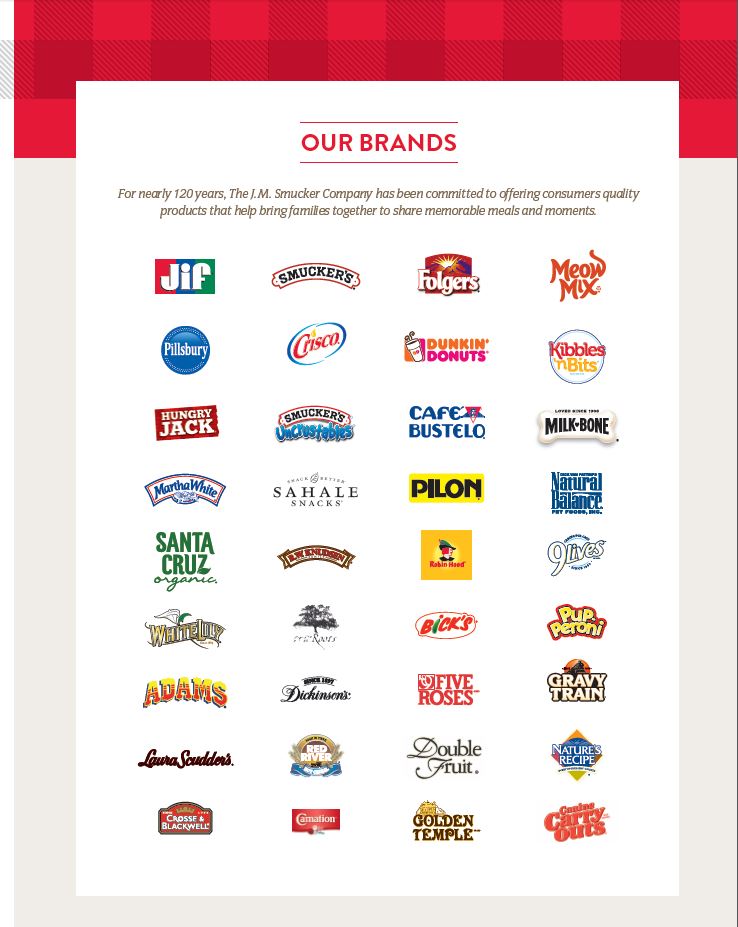

Trademarks and Patents. Our products are produced under certain patents and marketed under numerous trademarks owned or licensed by us or one of our subsidiaries. Our major trademarks are listed below.

Primary Reportable Segment/Business Area | Major Trademark | |

U.S. Retail Coffee | Folgers®, Dunkin’ Donuts®, and Café Bustelo® | |

U.S. Retail Consumer Foods | Jif®, Smucker’s®, Crisco®, Pillsbury®, and Uncrustables® | |

U.S. Retail Pet Foods | Meow Mix®, Milk-Bone®, Natural Balance®, Kibbles ‘n Bits®, 9Lives®, Pup-Peroni®, Nature’s Recipe®, and Gravy Train® | |

International and Foodservice | Folgers, Smucker’s, and Douwe Egberts® | |

Dunkin’ Donuts is a registered trademark of DD IP Holder LLC used under two licenses (the “Dunkin’ Licenses”) for packaged coffee products, including K-Cup® pods, sold in retail channels such as grocery stores, mass merchandisers, club stores, and drug stores. The Dunkin’ Licenses do not pertain to Dunkin’ Donuts coffee or other products for sale in Dunkin’ Donuts restaurants. The terms of the Dunkin’ Licenses include the payment of royalties to an affiliate of DD IP Holder LLC and other financial commitments by the Company. The Dunkin’ Licenses are in effect until January 1, 2039.

Pillsbury, the Barrelhead logo, and the Doughboy character are trademarks of The Pillsbury Company, LLC and are used under a 20-year, perpetually renewable, royalty-free license. Borden® and the Elsie design are trademarks used by our Canadian subsidiary on certain products under a perpetual, exclusive, and royalty-free license. Carnation® is a trademark of Société des Produits Nestlé S.A. used by our Canadian subsidiary for certain canned milk products in certain territories under an exclusive and royalty-free license with an initial term of 10 years which expires in October 2017, renewable for two successive 5-year terms, and which becomes perpetual at the end of the renewal terms under certain circumstances. Douwe Egberts and Pickwick® are registered trademarks of Jacobs Douwe Egberts and are used under a license which expires in January 2019. In accordance with a multi-year licensing and distribution agreement entered into with Cumberland Packing Corp. (“Cumberland”), we market and distribute Cumberland’s branded tabletop sweeteners sold under the Sweet‘N Low®, NatraTaste®, Sugar In The Raw®, and other “In The Raw” brands to foodservice customers in the U.S. and to retail and foodservice customers in Canada. Keurig® and K-Cup® are trademarks of Keurig Green Mountain, Inc. (“Keurig”), used with permission. In addition, we and our subsidiaries license the use of several other trademarks, none of which are individually material to our business.

Slogans or designs considered to be important trademarks include, without limitation, “With A Name Like Smucker’s, It Has To Be Good®,” “The Best Part of Wakin’ Up Is Folgers In Your Cup®,” “Choosy Moms Choose Jif®,” “Purely The Finest®,” “Crisco is Cooking®,” “Everybody’s Happy When It’s Hungry Jack®,” “Goodness Gracious, It’s Good®,” “The Only One Cats Ask For By Name®,” “Say It With Milk-Bone®,” the Smucker’s banner, the Crock Jar shape, the Gingham design, the Mountain Grown design, and the Smucker’s Strawberry, Milk-Bone, and 9Lives logos.

We own several hundred patents worldwide in addition to proprietary trade secrets, technology, know-how processes, and other intellectual property rights that are not registered.

We consider all of our owned and licensed intellectual property, taken as a whole, to be essential to our business.

Seasonality. The U.S. Retail Coffee and U.S. Retail Consumer Foods segments are particularly seasonal around the Fall Bake and Holiday period, which generally results in higher sales and profits in our second and third quarters. Our success in promoting and merchandising our coffee and baking brands during the Fall Bake and Holiday period has a significant impact on our results for a fiscal year. The Back to School period and the Spring Holiday season are two other important promotional periods, although their impact is not as significant as the Fall Bake and Holiday period.

Working Capital. Working capital requirements are greatest during the first half of our fiscal year mainly due to the timing of the buildup of coffee, oil, and baking inventories necessary to support the Fall Bake and Holiday period and the additional buildup of coffee inventory in advance of the Atlantic hurricane season. Although we still expect an inventory buildup during the first half of the fiscal year within the U.S. Retail Coffee and U.S. Retail Consumer Foods businesses, our working capital requirements have become less seasonal overall with the addition of the pet food business.

3

Customers. Sales to Wal-Mart Stores, Inc. and subsidiaries amounted to 30 percent, 28 percent, and 27 percent of net sales in 2016, 2015, and 2014, respectively. These sales are primarily included in the U.S. retail market segments. The increase in 2016 was driven by a full year of sales from the pet food business, in which sales to Wal-Mart Stores, Inc. and subsidiaries represent a larger portion of net sales, as compared to our business prior to the Big Heart acquisition. No other customer exceeded 10 percent of net sales during 2016, 2015, or 2014.

During 2016, our top 10 customers, collectively, accounted for approximately 70 percent of consolidated net sales. Supermarkets, warehouse clubs, and food distributors continue to consolidate, and we expect that a significant portion of our revenues will continue to be derived from a limited number of customers. Although the loss of any large customer for an extended length of time could negatively impact our sales and profits, we do not anticipate that this will occur to a significant extent due to strong consumer demand for our brands.

Orders. Generally, orders are filled within a few days of receipt, and the backlog of unfilled orders at any particular time has not been material on a historical basis.

Government Business. No material portion of our business is subject to renegotiation of profits or termination of contracts at the election of the government.

Competition. We are the branded market leader in the coffee, peanut butter, dog snacks, fruit spreads, shortening, natural beverage, and ice cream toppings categories in the U.S. In Canada, we are the branded market leader in the flour, pickles, canned milk, fruit spreads, shortening, and ice cream toppings categories. Our business is highly competitive as all of our brands compete for retail shelf space with other branded products as well as private label products.

In order to remain competitive, companies in the food industry need to consider emerging consumer preferences, technological advances, product and packaging innovations, and the continued growth of alternative store formats, including warehouse clubs, convenience stores, and e-commerce. The primary ways in which products and brands are distinguished are brand recognition, product quality, price, packaging, new product introductions, nutritional value, convenience, advertising, promotion, and the ability to identify and satisfy consumer preferences. Positive factors pertaining to our competitive position include well-recognized brands, high-quality products, consumer trust, experienced brand and category management, a single national grocery broker in the U.S., varied product offerings, product innovation, good customer service, and an integrated distribution network.

The packaged foods industry has been challenged recently by a general decline in sales volume in the center of the store. Certain evolving consumer trends have contributed to the decline, such as a heightened focus on health and wellness, an increased desire for fresh foods, and the growing impact of social media and e-commerce on consumer behavior. To address these dynamics, we continue to focus on innovation with an increased emphasis on products that satisfy evolving consumer trends.

In addition, private label has grown in recent years due to general economic uncertainty, improvements in private label quality, and the increased emphasis of store brands by retailers in an effort to cultivate customer loyalty. We believe that both private label and leading brands play an important role in the food categories in which we compete, appealing to different consumer segments. We closely monitor the price gap or price premium between our brands and private label brands, with the view that value is about more than price and the expectation that number one brands will continue to be an integral part of consumers’ shopping baskets.

4

Our primary brands, the brands with which they compete, and our major competitors are listed below.

Our Primary Products | Our Primary Brands | Competing Brands | Competitors |

U.S. Retail Coffee | |||

Mainstream roast and ground coffee | Folgers(A) and Café Bustelo | Maxwell House and Yuban | The Kraft Heinz Company |

Chock full o'Nuts | Massimo Zanetti Beverage Group | ||

Cafe La Llave | Gaviña | ||

Private Label Brands | Various | ||

Single serve coffee - K-Cup® | Dunkin' Donuts, Folgers, and Café Bustelo | Green Mountain Coffee(A) | Keurig Green Mountain, Inc. |

Starbucks | Starbucks Corporation | ||

Eight O'Clock | Tata Global Beverages | ||

McCafe, Maxwell House, and Gevalia | The Kraft Heinz Company | ||

Private Label Brands | Various | ||

Premium coffee | Dunkin' Donuts and Folgers Gourmet Selections® | Starbucks(A) and Seattle's Best Coffee | Starbucks Corporation |

Peet's Coffee & Tea | JAB Holding Company | ||

Eight O'Clock | Tata Global Beverages | ||

Gevalia and McCafe | The Kraft Heinz Company | ||

Private Label Brands | Various | ||

U.S. Retail Consumer Foods | |||

Peanut butter and specialty spreads | Jif (A) | Private Label Brands | Various |

Skippy | Hormel Foods | ||

Nutella | Ferrero | ||

Peter Pan | ConAgra Foods, Inc. | ||

Fruit spreads | Smucker's(A) | Welch's | Welch Foods, Inc. |

Private Label Brands | Various | ||

Shortening and oils | Crisco(B) | Private Label Brands(B) | Various |

Wesson | ConAgra Foods, Inc. | ||

Dessert baking mixes and frosting | Pillsbury | Betty Crocker(A) | General Mills, Inc. |

Duncan Hines | Pinnacle Foods Inc. | ||

Private Label Brands | Various | ||

U.S. Retail Pet Foods | |||

Pet foods | Meow Mix, Kibbles 'n Bits, and 9Lives | Dog Chow(A), One, Beneful, Cat Chow(A), Friskies, Kit & Kaboodle, and Fancy Feast | Nestlé Purina PetCare Company |

Pedigree, Iams, and Sheba | Mars Petcare | ||

Rachael Ray Nutrish | Ainsworth Pet Nutrition | ||

Pet snacks | Milk-Bone(A) and Pup-Peroni | Beggin' Strips and Waggin' Train | Nestlé Purina PetCare Company |

Dentastix and Greenies | Mars Petcare | ||

Pet premium | Natural Balance and Nature's Recipe | Blue(A) | Blue Buffalo Pet Products Inc. |

Nutro | Mars Petcare | ||

Hill's | Hills Pet Nutrition, Inc. | ||

International and Foodservice | |||

Foodservice hot beverage | Folgers and Douwe Egberts | Nescafé | Société des Produits Nestlé S.A. |

Maxwell House | The Kraft Heinz Company | ||

Private Label Brands | Various | ||

Foodservice portion control | Smucker's | Heinz, Welch's, and Private Label Brands | The Kraft Heinz Company |

Private Label Brands | Various | ||

Canada coffee | Folgers | Maxwell House(A) | The Kraft Heinz Company |

Private Label Brands | Various | ||

Canada flour | Robin Hood®(A) and Five Roses® | Private Label Brands | Various |

(A) Identifies the current market leader within the product category. In certain categories, the market leader is not identified as two or more brands compete

for the largest share.

(B) Crisco is the market leader within the shortening category. In the oils category, private label brands, collectively, maintain the largest share.

5

Research and Development. We predominantly utilize in-house resources to both develop new products and improve existing products in each of our business areas. Amounts expensed for research and development were $58.8 million, $32.5 million, and $24.3 million in 2016, 2015, and 2014, respectively.

Environmental Matters. We consider environmental sustainability to be our responsibility as a good corporate citizen and a key strategic focus area. We have implemented and manage a variety of programs, including the utilization of renewable energy technology, wastewater management, the usage of sustainable raw materials including green coffee, and the reuse of resources rather than consuming new ones, in support of our commitment to environmental sustainability. We continue to evaluate and modify our processes on an ongoing basis to further reduce waste and limit our impact on the environment.

Compliance with the provisions of enacted or pending federal, state, and local environmental regulations regarding either the discharge of materials into the environment or the protection of the environment is not expected to have a material effect upon our capital expenditures, earnings, or competitive position in 2017.

Employees. At April 30, 2016, we had 6,910 full-time employees worldwide, of which 30 percent, located at 11 manufacturing facilities, are covered by union contracts. These contracts vary in term depending on the location, with one contract expiring in 2017, representing 8 percent of our total employees. We believe our relations with our employees are good.

Financial Information about Industry Segments and Geographical Areas. The financial information required to be included in this item concerning reportable industry segments and international operations for the years 2016, 2015, and 2014 is incorporated herein by reference to information set forth in our 2016 Annual Report to Shareholders under “Note 5: Reportable Segments.” Our international operations are primarily in Canada with risks similar to those associated with the U.S. retail markets. Approximately 40 percent of our 2016 Canada sales represented the sale of Canadian produced products to Canadian customers. The majority of the remaining Canada sales represented the sale of products produced in the U.S. to Canadian customers, primarily Folgers coffee, Bick’s® pickles, Smucker’s fruit spreads, and Crisco shortening and oils.

Forward-Looking Statements. This Report includes forward-looking statements that are based on current expectations and are subject to a number of risks and uncertainties that could cause actual results to differ materially from expected or projected results. The descriptions of risks and uncertainties relating to forward-looking statements are incorporated herein by reference to information set forth in our 2016 Annual Report to Shareholders under the caption “Forward-Looking Statements.”

Available Information. Access to all of our Securities and Exchange Commission (“SEC”) filings, including our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), is provided, free of charge, on our website (jmsmucker.com/investor-relations) as soon as reasonably practicable after such reports are electronically filed with, or furnished to, the SEC.

Item 1A. Risk Factors.

Our business, operations, and financial condition are subject to various risks and uncertainties. The risk factors described below should be carefully considered, together with the other information contained or incorporated by reference in this Report and our other filings with the SEC, in connection with evaluating the Company, our business, and the forward-looking statements contained in this Report. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may affect us. The occurrence of any of these known or unknown risks could have a material adverse impact on our business, financial condition, and results of operations.

• | We may be unable to grow market share of our products. |

We operate in the competitive food industry whose growth potential is generally correlated to population growth. Our success depends in part on our ability to grow our brands faster than the population in general. We consider our ability to build and sustain the equity of our brands critical to our market share growth. If we do not succeed in these efforts, our market share growth may slow, which could have a material impact on our results of operations.

6

• | Our proprietary brands, packaging designs, and manufacturing methods are essential to the value of our business, and the inability to protect these could harm the value of our brands and adversely affect our sales and profitability. |

The success of our business depends significantly on our brands, know-how, and other intellectual property. We rely on a combination of trademarks, service marks, trade secrets, patents, copyrights, and similar rights to protect our intellectual property. The success of our growth strategy depends on our continued ability to use our existing trademarks and service marks in order to maintain and increase brand awareness and further develop our brand. If our efforts to protect our intellectual property are not adequate, or if any third party misappropriates or infringes on our intellectual property, the value of our brand may be harmed, which could have a material adverse effect on our business. From time to time, we are engaged in litigation to protect our intellectual property, which could result in substantial costs as well as diversion of management attention.

In particular, we consider our proprietary coffee roasting methods essential to the consistent flavor and richness of our coffee products and, therefore, essential to our coffee brands. Because many of the roasting methods we use are not protected by patents, it may be difficult for us to prevent competitors from copying our roasting methods if such methods become known. We also believe that our packaging innovations, such as brick packaging technology and our AromaSeal™ canisters, are important to the coffee business’ marketing and operational efforts. If our competitors copy our roasting or packaging methods or develop more advanced roasting or packaging methods, the value of our coffee brands may be diminished, and we could lose customers to our competitors.

• | We use a single national broker to represent a portion of our branded products to the retail grocery trade and any failure by the broker to effectively represent us could adversely affect our business. |

We use a single national broker in the U.S. to represent a portion of our branded products to the retail grocery trade. Our business would suffer disruption if this broker were to default in the performance of its obligations to perform brokerage services or if this broker fails to effectively represent us to the retail grocery trade, which could adversely affect our business.

• | Loss or interruption of supply from single-source suppliers of raw materials and finished goods could have a disruptive effect on our business and adversely affect our results of operations. |

We have elected to source certain raw materials, such as packaging for our Folgers coffee products, as well as our Jif peanut butter and Crisco oil products, and finished goods, such as K-Cup® pods and our Pup-Peroni dog snacks, from single sources of supply. While we believe that, except as set forth below, alternative sources of these raw materials and finished goods could be obtained on commercially reasonable terms, loss or an extended interruption in supplies from a single-source supplier would result in additional costs, could have a disruptive short-term effect on our business, and could adversely affect our results of operations.

Keurig is our single-source supplier for K-Cup® pods which are used in its proprietary Keurig® K-Cup® brewing system. There are a limited number of manufacturers other than Keurig that are making cups that will work in such proprietary brewing system. If Keurig is unable to supply K-Cup® pods to us for any reason, it could be difficult to find an alternative supplier for such goods on commercially reasonable terms, which could have a material adverse effect on our results of operations.

• | Our results may be adversely impacted as a result of increased cost, limited availability, and/or insufficient quality of raw materials, including commodities and agricultural products. |

We and our business partners purchase and use large quantities of many different commodities and agricultural products in the manufacturing of our products, including green coffee, grains, peanuts, edible oils, sweeteners, and fruit. In addition, we and our business partners utilize significant quantities of plastic, glass, and cardboard to package our products and natural gas and fuel oil to manufacture, package, and distribute our products. The prices of these commodities, agricultural products, and other materials are subject to volatility and can fluctuate due to conditions that are difficult to predict, including global supply and demand, commodity market fluctuations, crop sizes and yield fluctuations, weather, natural disasters, foreign currency fluctuations, investor speculation, trade agreements, political unrest, consumer demand, and changes in governmental agricultural programs. In addition, we compete for certain raw materials, notably corn and soy-based agricultural products, with the biofuels industry, which has resulted in increased prices

7

for these raw materials. Additionally, farm acreage currently devoted to other agricultural products we purchase may be utilized for biofuels crops resulting in higher cost for the other agricultural products we utilize. Although we use basis, futures, and options contracts to manage commodity price volatility in some instances, commodity price increases ultimately result in corresponding increases in our raw material and energy costs.

Due to the significance of green coffee to our coffee business, combined with our ability to only partially mitigate future price risk through purchasing practices and hedging activities, significant increases or decreases in the cost of green coffee could have an adverse impact on our profitability. In addition, if we are not able to purchase sufficient quantities of green coffee due to any of the above factors or to a worldwide or regional shortage, we may not be able to fulfill the demand for our coffee, which could have a material adverse effect on our business, financial condition, and results of operations.

• | Our efforts to manage commodity, foreign currency exchange, and other price volatility through derivative instruments could adversely affect our results of operations and financial condition. |

We use derivative instruments, including commodity futures and options, to reduce the price volatility associated with anticipated commodity purchases. The extent of our derivative position at any given time depends on our assessment of the markets for these commodities. If we fail to take a derivative position and costs subsequently increase, or if we institute a position and costs subsequently decrease, our costs may be greater than anticipated or higher than our competitors’ costs and our financial results could be adversely affected. In addition, our liquidity may be adversely impacted by the cash margin requirements of the commodities exchanges or the failure of a counterparty to perform in accordance with a contract.

We currently do not qualify any of our commodity or foreign currency exchange derivatives for hedge accounting. We instead mark-to-market our derivatives through the Statement of Consolidated Income, which results in changes in the fair value of all of our derivatives being immediately recognized in consolidated earnings, resulting in potential volatility in both gross profit and net income. These gains and losses are reported in cost of products sold in our Statement of Consolidated Income but are excluded from our segment operating results and non-GAAP earnings until the related inventory is sold, at which time the gains and losses are reclassified to segment profit and non-GAAP earnings. Although this accounting treatment aligns the derivative gains and losses with the underlying exposure being hedged within segment results, it may result in volatility in our consolidated earnings.

• | We may be limited in our ability to pass cost increases on to our customers in the form of price increases or may realize a decrease in sales volume to the extent price increases are implemented. |

We may not be able to pass some or all of any increases in the price of raw materials, energy, and other input costs to our customers by raising prices. To the extent competitors do not also increase their prices, customers and consumers may choose to purchase competing products or may shift purchases to private label or other lower-priced offerings, which may adversely affect our results of operations.

Consumers may be less willing or able to pay a price differential for our branded products, and may increasingly purchase lower-priced offerings and may forego some purchases altogether, especially during economic downturns. Retailers may also increase levels of promotional activity for lower-priced offerings as they seek to maintain sales volumes during times of economic uncertainty. Accordingly, sales volumes of our branded products could be reduced or lead to a shift in sales mix toward our lower-margin offerings. As a result, decreased demand for our products may adversely affect our results of operations.

• | Certain of our products are sourced from single manufacturing sites. |

We have consolidated our production capacity for certain products, including substantially all of our coffee, Milk-Bone dog snacks, and fruit spreads, syrups, and toppings production, into single manufacturing sites. We could experience a production disruption at these or any of our manufacturing sites resulting in a reduction or elimination of the availability of some of our products. If we are not able to obtain alternate production capability in a timely manner, our business, financial condition, and results of operations could be adversely affected.

8

• | A significant interruption in the operation of any of our supply chain or distribution capabilities could have an adverse effect on our business, financial condition, and results of operations. |

Our ability and the ability of our third-party suppliers and service providers, distributors, and contract manufacturers to manufacture, distribute, and sell products is critical to our success. A significant interruption in the operation of any of our manufacturing or distribution capabilities, or the manufacturing or distribution capabilities of our suppliers, distributors, or contract manufacturers, or a service failure by a third-party service provider, whether as a result of adverse weather conditions or a natural disaster, work stoppage, terrorism, pandemic illness, or other causes, could significantly impair our ability to operate our business. Notably, substantially all of our coffee production takes place in New Orleans, Louisiana, which is subject to risks associated with hurricane and other weather-related events. Additionally, some of our production facilities are located in places where tornadoes can frequently occur, such as Alabama and Kansas. Failure to take adequate steps to mitigate the likelihood or potential impact of such events, or to effectively manage such events if they occur, could adversely affect our business, financial condition, and results of operations.

• | Our business could be harmed by strikes or work stoppages. |

As of April 30, 2016, 30 percent of our employees, located at 11 manufacturing facilities, are covered by collective bargaining agreements. These contracts vary in term depending on location, with one contract expiring in 2017, representing 8 percent of our total employees. We cannot assure that we will be able to renew these collective bargaining agreements on the same or more favorable terms as the current agreements, or at all, without production interruptions caused by labor stoppages. If a strike or work stoppage were to occur in connection with negotiations of new collective bargaining agreements or as a result of disputes under collective bargaining agreements with labor unions, our business, financial condition, and results of operations could be materially adversely affected.

• | Our ability to competitively serve customers depends on the availability of reliable transportation. Increases in logistics and other transportation-related costs could adversely impact our results of operations. |

Logistics and other transportation-related costs have a significant impact on our earnings and results of operations. We use multiple forms of transportation, including ships, trucks, and railcars, to bring our products to market. Disruption to the timely supply of these services or increases in the cost of these services for any reason, including availability or cost of fuel, regulations affecting the industry, labor shortages in the transportation industry, service failures by third-party service providers, accidents, or natural disasters, which may impact the transportation infrastructure or demand for transportation services, could have an adverse effect on our ability to serve our customers, and could have a material adverse effect on our business, financial condition, and results of operations.

• | Our operations are subject to the general risks of the food industry. |

The food industry is subject to risks posed by food spoilage and contamination, product tampering, product recall, and consumer product liability claims. Our operations could be impacted by both genuine and fictitious claims regarding our products, as well as our competitors’ products. In the event of product contamination or tampering, we may need to recall some of our products. A widespread product recall could result in significant loss due to the cost of conducting a product recall, including destruction of inventory and the loss of sales resulting from the unavailability of product for a period of time. We could also suffer losses from a significant product liability judgment against us. A significant product recall or a product liability judgment, involving either us or our competitors, could also result in a loss of consumer confidence in our food products or the food category, and an actual or perceived loss of value of our brands, materially impacting consumer demand.

• | Changes in our relationships with significant customers, including the loss of our largest customer, could adversely affect our results of operations. |

Sales to Wal-Mart Stores, Inc. and subsidiaries amounted to 30 percent of net sales in 2016. These sales are primarily included in the U.S. retail market segments. Trade receivables at April 30, 2016, included amounts due from Wal-Mart Stores, Inc. and subsidiaries of $118.1 million, or 26 percent of the total trade receivables balance. During 2016, our top 10 customers, collectively, accounted for approximately 70 percent of consolidated net sales. We expect that a significant portion of our revenues will continue to be derived from a

9

limited number of customers. Our customers are generally not contractually obligated to purchase from us. These customers make purchase decisions based on a combination of price, promotional support, product quality, consumer demand, customer service performance, their desired inventory levels, and other factors. Changes in customers’ strategies, including a reduction in the number of brands they carry or a shift of shelf space to private label products, may adversely affect sales. Customers also may respond to price increases by reducing distribution, resulting in reduced sales of our products. Additionally, our customers may face financial or other difficulties that may impact their operations and their purchases from us, which could adversely affect our results of operations. A reduction in sales to one or more major customers could have a material adverse effect on our business, financial condition, and results of operations.

• | We operate in the competitive food industry and continued demand for our products may be affected by changes in consumer preferences. |

We face competition across our product lines from other food companies with the primary methods and factors in competition being product quality, price, packaging, product innovation, nutritional value, convenience, customer service, advertising, and promotion. Continued success is dependent on product innovation, the ability to secure and maintain adequate retail shelf space and to compete in new and growing channels, such as e-commerce, and effective and sufficient trade merchandising, advertising, and marketing programs. Some of our competitors have substantial financial, marketing, and other resources, and competition with them in our various markets, channels, and product lines could cause us to reduce prices, increase marketing or other expenditures, or lose category share. Category share and growth could be adversely impacted if we are not successful in introducing new products. In order to generate future revenues and profits, we must continue to sell products that appeal to our customers and consumers. Specifically, there are a number of trends in consumer preferences that may impact us and the food industry as a whole, including convenience, flavor variety, an emphasis on protein and snacking, and the desire for transparent product labeling and simple and natural ingredients.

Prolonged negative perceptions concerning the health implications of certain food products could influence consumer preferences and acceptance of some of our products and marketing programs. Although we strive to respond to consumer preferences and social expectations, we may not be successful in these efforts. Increasing public concern regarding health issues and failure to satisfy consumer preferences could decrease demand for certain of our products and adversely affect our profitability.

• | The success of our business depends substantially on consumer perceptions of our brands. |

We are the branded market leader in several categories both in the U.S. and Canada. We believe that maintaining and continually enhancing the value of our brands is critical to the success of our business. Brand value is based in large part on consumer perceptions. Success in promoting and enhancing brand value depends in large part on our ability to provide high-quality products. Brand value could diminish significantly as a result of a number of factors, such as if we fail to preserve the quality of our products, if we are perceived to act in an irresponsible manner, if the Company or our brands otherwise receive negative publicity, if our brands fail to deliver a consistently positive consumer experience, or if our products become unavailable to consumers. The growing use of social and digital media by consumers increases the speed and extent that information and opinions can be shared. Negative posts or comments about us or our brands or products on social or digital media could damage our brands and reputation. If our brand values are diminished, our revenues and operating results could be materially adversely affected. In addition, anything that harms the Pillsbury, Dunkin’ Donuts, Carnation, Douwe Egberts, Sweet‘N Low, or Sugar In The Raw brands could adversely affect the success of our exclusive licensing agreements with the owners of these brands.

• | We could be subject to adverse publicity or claims from consumers. |

Certain of our products contain ingredients, the health effects of which are the subject of public scrutiny, including the suggestion that consumption may have adverse health effects. An unfavorable report on the health effects of ingredients present in our products, product recalls, or negative publicity or litigation arising from other health risks could significantly reduce the demand for our products.

We may also be subject to complaints from or litigation by consumers who allege food and beverage-related illness, or other quality, health, or operational concerns. Adverse publicity resulting from such allegations

10

could materially adversely affect us, regardless of whether such allegations are true or whether we are ultimately held liable. A lawsuit or claim could result in an adverse decision against us, which could have a material adverse effect on our business, financial condition, and results of operations.

• | Our operations are subject to the general risks associated with acquisitions and divestitures. Specifically, we may not realize all of the anticipated benefits of the acquisition of Big Heart or those benefits may take longer to realize than expected. |

Our stated long-term strategy is to own and market leading North American food brands sold in the center of the store while maintaining a global perspective. We have historically made strategic acquisitions of brands and businesses and intend to do so in the future in support of this strategy. If we are unable to complete acquisitions or to successfully integrate and develop acquired businesses, including the effective management of integration and related restructuring costs, we could fail to achieve the anticipated synergies and cost savings, or the expected increases in revenues and operating results, either of which could have a material adverse effect on our financial results. In addition, we have made strategic divestitures of brands and businesses and we may do so in the future. If we are unable to complete divestitures or to successfully transition divested businesses, our business or financial results could be negatively impacted.

• | Weak financial performance, downgrades in our credit ratings, or disruptions in the financial markets may adversely affect our ability to access capital in the future. |

We may need new or additional financing in the future to conduct our operations, expand our business, or refinance existing indebtedness, which would be dependent upon our financial performance. Any downgrade in our credit ratings, particularly our short-term rating, would likely impact the amount of commercial paper we could issue and increase our commercial paper borrowing costs. The liquidity of the overall capital markets and the state of the economy, including the food and beverage industry, may make credit and capital markets more difficult for us to access, even though we have an established revolving credit facility. From time to time, we have relied, and also may rely in the future, on access to financial markets as a source of liquidity for working capital requirements, acquisitions, and general corporate purposes. In particular, our access to funds under our revolving credit facility is dependent on the ability of the financial institutions that are parties to that facility to meet their funding commitments. The obligations of the financial institutions under our revolving credit facility are several and not joint and, as a result, a funding default by one or more institutions does not need to be made up by the others. In addition, long-term volatility and disruptions in the capital and credit markets as a result of uncertainty, changing or increased regulation of financial institutions, reduced alternatives, or the failure of significant financial institutions could adversely affect our access to the liquidity needed for our businesses in the longer term. Such disruptions could require us to take measures to conserve cash until the markets stabilize or until alternative credit arrangements or other funding for our business needs can be arranged. Disruptions in the capital and credit markets could also result in higher interest rates on publicly issued debt securities and increased costs under credit facilities. Continuation of these disruptions would increase our interest expense and capital costs and could adversely affect our results of operations and financial position.

• | Our substantial debt obligations could restrict our operations and financial condition. |

As of April 30, 2016, we had approximately $5.4 billion of short-term borrowings and long-term debt. We may also incur additional indebtedness in the future. Our substantial indebtedness could have adverse consequences, including:

• | making it more difficult for us to satisfy our financial obligations; |

• | increasing our vulnerability to adverse economic, regulatory, and industry conditions, and placing us at a disadvantage compared to our competitors that are less leveraged; |

• | limiting our ability to compete and our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; |

• | limiting our ability to borrow additional funds for working capital, capital expenditures, acquisitions, and general corporate or other purposes; and |

11

• | exposing us to greater interest rate risk to the extent that the interest rate on the applicable borrowings is variable. |

Our debt service obligations will require us to use a portion of our operating cash flow to pay interest and principal on indebtedness instead of for other corporate purposes, including funding future expansion of our business and ongoing capital expenditures, which could impede our growth. If our operating cash flow and capital resources are insufficient to service our debt obligations, we may be forced to sell assets, seek additional equity or debt financing, or restructure our debt, which could harm our long-term business prospects. Our failure to comply with the terms of any existing or future indebtedness could result in an event of default which, if not cured or waived, could result in the acceleration of all of our debt.

• | Servicing our indebtedness will require a significant amount of cash. Our ability to generate cash depends on many factors beyond our control. |

Our ability to make payments on, and to refinance, our indebtedness and to fund planned capital expenditures will depend on our ability to generate cash in the future. This is subject to general economic, financial, competitive, legislative, regulatory, and other factors, many of which are beyond our control. Our business may not generate sufficient cash flow from operations, and we may not have available to us future borrowings in an amount sufficient to enable us to pay our indebtedness or to fund our other liquidity needs. In these circumstances, we may need to refinance all or a portion of our indebtedness on or before maturity. Any refinancing of our debt could be at higher interest rates and may require make-whole payments and compliance with more onerous covenants, which could further restrict our business operations. Our ability to refinance our indebtedness or obtain additional financing would depend on, among other things, our financial condition at the time, restriction in the agreements governing our indebtedness, and the condition of the financial markets and the industry in which we operate. As a result, we may not be able to refinance any of our indebtedness on commercially reasonable terms or at all. Without this financing, we could be forced to sell assets to make up for any shortfall in our payment obligations under unfavorable circumstances. In addition, we may not be able to sell assets quickly enough or for sufficient amounts to enable us to meet our obligations.

• | A material impairment in the carrying value of acquired goodwill or other intangible assets could negatively affect our consolidated operating results and net worth. |

A significant portion of our assets is goodwill and other intangible assets, the majority of which are not amortized but are reviewed at least annually for impairment. At April 30, 2016, the carrying value of goodwill and other intangible assets totaled $12.6 billion, compared to total assets of $16.0 billion and total shareholders’ equity of $7.0 billion. If the carrying value of these assets exceeds the current estimated fair value, the asset is considered impaired and this could result in a noncash charge to earnings. Any such impairment charge would reduce earnings and could be material. Events and conditions that could result in impairment include a sustained drop in the market price of our common shares, increased competition or loss of market share, obsolescence, or product claims that result in a significant loss of sales or profitability over the product life. As a result of the Big Heart acquisition in 2015, we recognized $3.0 billion of goodwill. We also recorded $1.5 billion of indefinite-lived intangible assets based on their estimated fair values on the acquisition date. Since these assets were recently acquired, they could be more susceptible to future impairment. A change to the assumptions regarding the future performance of the pet food business, or a portion of it, a change to other assumptions, or the failure of any of our reporting units to achieve its anticipated synergies related to the Big Heart acquisition could result in significant impairment losses in the future.

• | Changes in tax, environmental, or other regulations and laws, or their application, or failure to comply with existing licensing, trade, and other regulations and laws could have a material adverse effect on our financial condition. |

Our operations are subject to various regulations and laws administered by federal, state, and local government agencies in the U.S., as well as to regulations and laws administered by government agencies in Canada and other countries in which we have operations and our products are sold. In particular, the manufacturing, marketing, packaging, labeling, and distribution of food products are each subject to governmental regulation that is increasingly extensive, encompassing such matters as ingredients (including whether a product contains genetically modified ingredients), packaging, advertising, relations with

12

distributors and retailers, health, safety, and the environment. Additionally, we are routinely subject to new or modified tax and securities regulations, other laws and regulations, and accounting and reporting standards.

In the U.S., we are required to comply with federal laws, such as the Food, Drug and Cosmetic Act, the Food Safety Modernization Act, the Occupational Safety and Health Act, the Clean Air Act, the Clean Water Act, the Resource Conservation and Recovery Act, the Tariff Act, laws governing equal employment opportunity, and various other federal statutes and regulations. We are also subject to various state and local statutes and regulations. For instance, the California Safe Drinking Water and Toxic Enforcement Act of 1986 (commonly referred to as “Proposition 65”) requires that a specific warning appear on any product sold in the State of California that contains a substance listed by that state as having been found to cause cancer or birth defects. This law exposes all food and beverage producers to the possibility of having to provide warnings on their products. The detection of even a trace amount of a listed substance can subject an affected product to the requirement of a warning label. Products containing listed substances that occur naturally or that are contributed to such products solely by a municipal water supply are generally exempt from the warning requirement. If we are required to add warning labels to any of our products or place warnings in certain locations where our products are sold as a result of Proposition 65, sales of those products could suffer not only in those locations but elsewhere.

Complying with new regulations and laws, or changes to existing regulations and laws, or their application could increase our production costs or adversely affect our sales of certain products. In addition, our failure or inability to comply with applicable regulations and laws could subject us to civil remedies, including fines, injunctions, recalls or seizures, as well as potential criminal sanctions, which could have a material adverse effect on our business and financial condition.

• | Our operations in certain developing markets expose us to regulatory risks. |

In many countries outside of the U.S., particularly in those with developing economies, it may be common for others to engage in business practices prohibited by laws and regulations applicable to us, such as the U.S. Foreign Corrupt Practices Act or similar local anti-bribery or anti-corruption laws. These laws generally prohibit companies and their employees, contractors, or agents from making improper payments to government officials for the purpose of obtaining or retaining business. Failure to comply with these laws could subject us to civil and criminal penalties that could have a material adverse effect on our financial condition and results of operations.

• | Changes in climate or legal, regulatory, or market measures to address climate change may negatively affect our business and operations. |

There is significant political and scientific concern that emissions of carbon dioxide and other greenhouse gases may alter the composition of the global atmosphere in ways that are affecting and are expected to continue affecting the global climate. The emission of such greenhouse gases may have an adverse impact on global temperatures, weather patterns, and the frequency and severity of extreme weather and natural disasters. In the event that climate change has a negative effect on agricultural productivity, we may be subject to decreased availability or less favorable pricing for certain commodities that are necessary for our products, such as green coffee, grains, peanuts, edible oils, sweeteners, and fruit. We may also be subjected to decreased availability or less favorable pricing for water as a result of such change, which could impact our manufacturing and distribution operations. In addition, natural disasters and extreme weather conditions may disrupt the productivity of our facilities or the operation of our supply chain.

Increasing concern over climate change also may result in more regulatory requirements to reduce or mitigate the effects of greenhouse gases. In the event that such regulations are enacted and are more rigorous than existing regulations, we may experience significant increases in costs of operation and delivery. In particular, increased regulation of utility providers, fuel emissions, or suppliers could substantially increase our operating, distribution, or supply chain costs. We could also face increased costs related to defending and resolving legal claims and other litigation related to climate change. As a result, climate change could negatively affect our results of operations, cash flows, or financial position.

13

• | If our information technology systems fail to perform adequately or we are unable to protect such information technology systems against data corruption, cyber-based attacks, or network security breaches, our operations could be disrupted, and we may suffer financial damage or loss because of lost or misappropriated information. |

We rely on information technology networks and systems, including the Internet, to process, transmit, and store electronic information. In particular, we depend on our information technology infrastructure to effectively manage our business data, supply chain, logistics, finance, and other business processes and for digital marketing activities and electronic communications between Company personnel and our customers and suppliers. If we do not allocate and effectively manage the resources necessary to build, sustain, and protect an appropriate technology infrastructure, or we do not effectively implement system upgrades, our business or financial results could be negatively impacted. Security breaches or system failures of our infrastructure, whether due to attacks by hackers, employee error, or other causes, can create system disruptions, shutdowns, or unauthorized disclosure of confidential information. If we are unable to prevent such breaches or failures, our operations could be disrupted, or we may suffer financial damage or loss because of lost or misappropriated information.

In addition, we have outsourced several information technology support services and administrative functions, including benefit plan administration and other functions, to third-party service providers, and may outsource other functions in the future to achieve cost savings and efficiencies. If the service providers to which we outsource these functions do not perform effectively, we may not be able to achieve the expected cost savings and may have to incur additional costs to correct errors made by such service providers. Depending on the function involved, such errors may also lead to business disruption, processing inefficiencies, the loss of or damage to intellectual property through security breach, the loss of sensitive data through security breach, or otherwise.

Item 1B. Unresolved Staff Comments.

None.

14

Item 2. Properties.

The table below lists all of our manufacturing and processing facilities at April 30, 2016. All of our properties are maintained and updated on a regular basis, and we continue to make investments for expansion and safety and technological improvements. We believe that existing capacity at these facilities is sufficient to sustain current operations and anticipated near-term growth.

We own all of the properties listed below, except as noted. Additionally, our principal distribution centers in the U.S. include three that we own, nine that we lease, and two that are leased and operated by third parties with whom we have agreements. We also lease our principal distribution center in Canada. Our distribution facilities are in good condition, and we believe that they have sufficient capacity to meet our distribution needs in the near future. We lease nine sales and administrative offices in the U.S., and one each in China, Canada, and Mexico. Our corporate headquarters are located in Orrville, Ohio, and our Canadian headquarters are located in Markham, Ontario. We lease the principal headquarters of our pet food business located in San Francisco, California, as well as additional administrative facilities dedicated to that business in Pittsburgh, Pennsylvania, and Burbank, California. We plan to close the Pittsburgh office during the first quarter of 2017.

U.S. Locations | Products Produced/Processed/Stored | Primary Reportable Segment/Business Area | ||

Bloomsburg, Pennsylvania | Wet dog and cat food and dry dog and cat food | U.S. Retail Pet Foods | ||

Buffalo, New York | Dog snacks | U.S. Retail Pet Foods | ||

Chico, California | Fruit and vegetable juices and beverages | U.S. Retail Consumer Foods | ||

Cincinnati, Ohio | Shortening and oils | U.S. Retail Consumer Foods | ||

Decatur, Alabama | Dry dog and cat food | U.S. Retail Pet Foods | ||

Grandview, Washington | Fruit | U.S. Retail Consumer Foods | ||

Harahan, Louisiana (B) | Coffee | International and Foodservice | ||

Havre de Grace, Maryland | Fruit and vegetable juices and beverages | U.S. Retail Consumer Foods | ||

Lawrence, Kansas | Dry dog food | U.S. Retail Pet Foods | ||

Lexington, Kentucky | Peanut butter | U.S. Retail Consumer Foods | ||

Livermore, California (A) | Grain products | U.S. Retail Consumer Foods | ||

Memphis, Tennessee | Peanut butter and fruit spreads | U.S. Retail Consumer Foods | ||

New Bethlehem, Pennsylvania | Peanut butter and combination peanut butter and jelly products | U.S. Retail Consumer Foods | ||

New Orleans, Louisiana (four facilities) (A) | Coffee | U.S. Retail Coffee | ||

Orrville, Ohio | Fruit spreads, toppings, and syrups | U.S. Retail Consumer Foods | ||

Oxnard, California | Fruit | U.S. Retail Consumer Foods | ||

Ripon, Wisconsin | Fruit spreads, toppings, syrups, and condiments | U.S. Retail Consumer Foods | ||

Scottsville, Kentucky | Frozen sandwiches and ready-to-eat waffles | U.S. Retail Consumer Foods | ||

Seattle, Washington (A) | Nut mix products | U.S. Retail Consumer Foods | ||

Suffolk, Virginia | Coffee | International and Foodservice | ||

Toledo, Ohio | Baking mixes, frostings, and flour | U.S. Retail Consumer Foods | ||

Topeka, Kansas | Dry dog and cat food and dog and cat snacks | U.S. Retail Pet Foods | ||

Canada Location | Product Produced | Primary Business Area | ||

Sherbrooke, Quebec | Canned milk | International and Foodservice | ||

(A) | We lease our facilities in Livermore and Seattle, as well as our coffee silo facility in New Orleans. We plan to exit our Livermore facilities during 2017 as a result of our plan to move production into our existing facility in Chico, as described in our 2016 Annual Report to Shareholders under “Note 3: Integration and Restructuring Costs.” |

(B) | Our Harahan location is expected to close during 2018 as a result of our plan to consolidate production into one of our existing facilities in New Orleans, as described in our 2016 Annual Report to Shareholders under “Note 3: Integration and Restructuring Costs.” |

15

Item 3. Legal Proceedings.

We are a defendant in a variety of legal proceedings. While we cannot predict with certainty the ultimate results of these proceedings, we do not believe that the final outcome of these proceedings will have a material adverse effect on our financial position, results of operations, or cash flows.

Item 4. Mine Safety Disclosures.

Not applicable.

Executive Officers of the Registrant.

The names, ages as of June 15, 2016, and current positions of the executive officers are listed below. All executive officers serve at the pleasure of the Board of Directors, with no fixed term of office.

Name | Age | Years with Company | Position | Served as an Officer Since | ||||

Richard K. Smucker | 68 | 43 | Executive Chairman (A) | 1974 | ||||

Mark T. Smucker | 46 | 18 | President and Chief Executive Officer (B) | 2001 | ||||

Mark R. Belgya | 55 | 31 | Vice Chair and Chief Financial Officer (C) | 1997 | ||||

Barry C. Dunaway | 53 | 29 | President, Pet Food and Pet Snacks (D) | 2001 | ||||

Jeannette L. Knudsen | 46 | 13 | Senior Vice President, General Counsel and Secretary (E) | 2009 | ||||

David J. Lemmon | 48 | 22 | President, Canada and International (F) | 2012 | ||||

Steven Oakland | 55 | 33 | Vice Chair and President, U.S. Food and Beverage (G) | 1999 | ||||

Jill R. Penrose | 43 | 12 | Senior Vice President, Human Resources and Corporate Communications (H) | 2014 | ||||

(A) | Mr. Richard Smucker was elected to his present position in May 2016, having served as Chief Executive Officer since August 2011. Prior to that time, he served as Executive Chairman, Co-Chief Executive Officer and President since August 2008. |

(B) | Mr. Mark Smucker was elected to his present position in May 2016, having served as President and President, Consumer and Natural Foods since April 2015. Prior to that time, he served as President, U.S. Retail Coffee since May 2011 and President, Special Markets since August 2008. |

(C) | Mr. Belgya was elected to his present position in May 2016, having served as Senior Vice President and Chief Financial Officer since October 2009. Prior to that time, he served as Vice President and Chief Financial Officer since October 2008. |

(D) | Mr. Dunaway was elected to his present position in March 2016, having served as President, International and Chief Administrative Officer since April 2015. Prior to that time, he served as Senior Vice President and Chief Administrative Officer since May 2011, and Senior Vice President, Corporate and Organizational Development since August 2008. |

(E) | Ms. Knudsen was elected to her present position in May 2016, having served as Vice President, General Counsel and Corporate Secretary since August 2010. Prior to that time, she served as Vice President, Deputy General Counsel and Corporate Secretary since April 2010, and as Corporate Secretary since April 2009. |

(F) | Mr. Lemmon was elected to his present position in May 2016, having served as Vice President and Managing Director, Canada and International since April 2015. Prior to that time, he served as Vice President and Managing Director, Canada since May 2012, and Managing Director, Canada since May 2007. |

16

(G) | Mr. Oakland was elected to his present position in May 2016, having served as President, Coffee and Foodservice since April 2015. Prior to that time, he served as President, International, Foodservice, and Natural Foods since May 2011, and President, U.S. Retail - Smucker’s, Jif and Hungry Jack since August 2008. |

(H) | Ms. Penrose was elected to her present position in May 2016, having served as Vice President, Human Resources since June 2014. Prior to that time, she served as Vice President, Strategy and Organization Development since April 2010, and Director, Corporate Strategy and Organization Development since March 2009. |

17

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

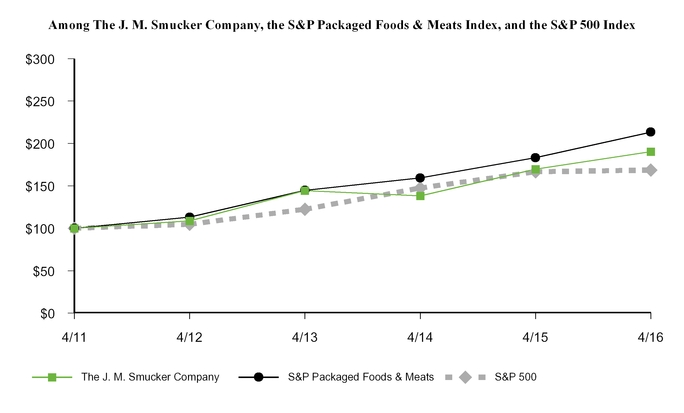

(a) The information pertaining to the market for our common shares and other related shareholder information is incorporated herein by reference to the information set forth in our 2016 Annual Report to Shareholders under the captions “Stock Price Data” and “Comparison of Five-Year Cumulative Total Shareholder Return.”

(b) Not applicable.

(c) Issuer Purchases of Equity Securities

Period | (a) | (b) | (c) | (d) | |||||||||

Total number of shares purchased | Average price paid per share | Total number of shares purchased as part of publicly announced plans or programs | Maximum number (or approximate dollar value) of shares that may yet be purchased under the plans or programs | ||||||||||

February 1, 2016 - February 29, 2016 | 1,582 | $ | 127.05 | — | 10,004,661 | ||||||||

March 1, 2016 - March 31, 2016 | 1,419,243 | 128.88 | 1,418,063 | 8,586,598 | |||||||||

April 1, 2016 - April 30, 2016 | 2,003,825 | 127.54 | 2,000,000 | 6,586,598 | |||||||||

Total | 3,424,650 | $ | 128.10 | 3,418,063 | 6,586,598 | ||||||||

Information set forth in the table above represents the activity in our fourth fiscal quarter.

(a) | This column includes shares repurchased as part of publicly announced plans as well as shares repurchased from stock plan recipients in lieu of cash payments. |

(c) During the fourth quarter, we repurchased 3,418,063 common shares, which included 2,000,000 common shares under the 10b5-1 trading plan entered into on March 31, 2016.

(d) As of April 30, 2016, there were 6,586,598 common shares remaining available for future repurchase pursuant to our Board of Directors' authorizations.

Item 6. Selected Financial Data.

Five-year summaries of our selected financial data and discussions of items which materially affect the comparability of the selected financial data are incorporated herein by reference to the information set forth in our 2016 Annual Report to Shareholders under the following captions: “Five-Year Summary of Selected Financial Data,” “Management’s Discussion and Analysis,” “Note 1: Accounting Policies,” “Note 2: Acquisitions,” and “Note 3: Integration and Restructuring Costs.”

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

Management’s discussion and analysis of financial condition and results of operations, including a discussion of liquidity and capital resources and critical accounting estimates and policies, is incorporated herein by reference to the information set forth in our 2016 Annual Report to Shareholders under the caption “Management’s Discussion and Analysis.”

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

Quantitative and qualitative disclosures about market risk are incorporated herein by reference to the information set forth in our 2016 Annual Report to Shareholders under the caption “Derivative Financial Instruments and Market Risk.”

18

Item 8. Financial Statements and Supplementary Data.

Consolidated financial statements at April 30, 2016 and 2015, and for each of the years in the three-year period ended April 30, 2016, with the report of independent registered public accounting firm and selected unaudited quarterly financial data, are incorporated herein by reference to the information set forth in our 2016 Annual Report to Shareholders under the caption “Summary of Quarterly Results of Operations” and beginning with “Report of Management on Internal Control Over Financial Reporting” through “Note 17: Common Shares.”

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

None.

Item 9A. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures. Management, including the principal executive officer and principal financial officer, evaluated the effectiveness of our disclosure controls and procedures (as defined in Rule 13a-15(e) or 15d-15(e) under the Exchange Act), as of April 30, 2016 (the “Evaluation Date”). Based on that evaluation, the principal executive officer and principal financial officer have concluded that, as of the Evaluation Date, our disclosure controls and procedures were effective in ensuring that information required to be disclosed in reports that we file or submit under the Exchange Act is (1) recorded, processed, summarized, and reported within the time periods specified in SEC rules and forms, and (2) accumulated and communicated to management, including the chief executive officer and chief financial officer, as appropriate to allow timely decisions regarding required disclosure.

Changes in Internal Controls. There were no changes in internal control over financial reporting that occurred during the fourth quarter ended April 30, 2016, that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

Management’s report on internal control over financial reporting and the attestation report of our independent registered public accounting firm are set forth in our 2016 Annual Report to Shareholders under the headings “Report of Management on Internal Control Over Financial Reporting” and “Report of Independent Registered Public Accounting Firm on Internal Control Over Financial Reporting,” which reports are incorporated herein by reference.

Item 9B. Other Information.

None.

19

PART III

Item 10. Directors, Executive Officers and Corporate Governance.

The information required by this Item as to the directors of the Company, the Audit Committee, the Audit Committee financial expert, and compliance with Section 16(a) of the Exchange Act is incorporated herein by reference to the information set forth under the captions “Election of Directors,” “Corporate Governance,” “Board and Committee Meetings,” and “Ownership of Common Shares” in our definitive Proxy Statement for the Annual Meeting of Shareholders to be held on August 17, 2016. Information required by Item 10 as to the executive officers of the Company is included in Part I of this Annual Report on Form 10-K as permitted by Instruction 3 to Item 401(b) of Regulation S-K.

The Board of Directors has adopted a Code of Business Conduct and Ethics, last revised February 2015, which applies to our directors, principal executive officer, and principal financial and accounting officer. The Board of Directors has adopted charters for each of the Audit, Executive Compensation, and Nominating and Corporate Governance committees and has also adopted Corporate Governance Guidelines. Copies of these documents are available on our website (jmsmucker.com/investor-relations).

Item 11. Executive Compensation.

The information required by this Item is incorporated by reference to the information set forth under the captions “Executive Compensation,” “Board and Committee Meetings,” and “Compensation Committee Interlocks and Insider Participation” in our definitive Proxy Statement for the Annual Meeting of Shareholders to be held on August 17, 2016.

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

The information required by this Item is incorporated by reference to the information set forth under the captions “Ownership of Common Shares” and “Equity Compensation Plan Information” in our definitive Proxy Statement for the Annual Meeting of Shareholders to be held on August 17, 2016.

Item 13. Certain Relationships and Related Transactions, and Director Independence.