Form 8-K Western Refining, Inc. For: Jun 20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 20, 2016

WESTERN REFINING, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-32721 | 20-3472415 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification Number) |

123 West Mills Avenue, Suite 200

El Paso, Texas 79901

(Address of principal executive offices and Zip Code)

(915) 534-1400

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 8.01 | Other Events. |

On June 20, 2016, Western Refining, Inc. (the “Company”) issued a press release announcing that Company management will participate in the 2016 Wells Fargo West Coast Energy Conference in San Francisco, California on Tuesday, June 21, 2016. The presentation will be available on the Investor Relations section of the Company’s website at www.wnr.com beginning June 21, 2016 and will remain available in accordance with the Company’s investor presentation archive policy.

A copy of the press release and the presentation are attached hereto as Exhibit 99.1 and Exhibit 99.2, respectively, and are incorporated herein by reference.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit No. |

Description | |

| 99.1 | Press Release dated June 20, 2016 | |

| 99.2 | Investor Presentation | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| WESTERN REFINING, INC. | ||

| By: | /s/ Gary R. Dalke | |

| Name: | Gary R. Dalke | |

| Title: | Chief Financial Officer | |

Dated: June 20, 2016

EXHIBIT INDEX

| Exhibit No. |

Description | |

| 99.1 | Press Release dated June 20, 2016 | |

| 99.2 | Investor Presentation | |

Exhibit 99.1

| Investor and Analyst Contact: | Media Contact: | |||||

| Jeffrey S. Beyersdorfer | Gary Hanson | |||||

| (602) 286-1530 | (602) 286-1777 | |||||

Michelle Clemente

(602) 286-1533

WESTERN REFINING TO PARTICIPATE IN THE

2016 WELLS FARGO WEST COAST ENERGY CONFERENCE

EL PASO, Texas – June 20, 2016 – Western Refining, Inc. (NYSE: WNR) today announced that Company management will participate in the 2016 Wells Fargo West Coast Energy Conference in San Francisco, California on Tuesday, June 21, 2016. The presentation will be available on the Investor Relations section of Western Refining’s website at www.wnr.com beginning June 21, 2016, and will remain available in accordance with the Company’s investor presentation archive policy.

About Western Refining

Western Refining, Inc. is an independent refining and marketing company headquartered in El Paso, Texas. The refining segment operates refineries in El Paso, and Gallup, New Mexico. The retail segment includes retail service stations and convenience stores in Arizona, Colorado, New Mexico, and Texas.

Western Refining, Inc. also owns the general partner and approximately 61% of the limited partnership interest of Western Refining Logistics, LP (NYSE:WNRL) and the general partner and approximately 38% of the limited partnership interest in Northern Tier Energy LP (NYSE:NTI).

More information about Western Refining is available at www.wnr.com.

2016 Wells Fargo West Coast Energy Conference June 21, 2016 Exhibit 99.2 |

2 Cautionary Statements This presentation includes “forward-looking statements” by Western Refining, Inc. (“Western” or “WNR”) which are protected as forward-looking statements under the Private Securities Litigation Reform Act of 1995. The forward-looking statements reflect Western’s current expectations regarding future events, results or outcomes. Words such as “anticipate,” “assume,” “believe,” “budget,” “continue,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “position,” “potential,” “predict,” “project,” “strategy,” “will,” “future” and similar terms and phrases are used to identify forward-looking statements. The forward-looking statements contained herein include statements related to, among other things: WNR’s attractive refinery locations with pipeline access to advantaged crude oil production in the Permian Basin, Four Corners, Bakken and western Canada, and historically strong refined product regions; Western’s integrated distribution network including a fully integrated crude oil pipeline system to serve its refineries, refined product distribution to wholesale end-user, and extensive retail network; growth opportunities for WNR’s refining and logistics platforms, including enhancements to refining profitability and expansion of its logistics footprint; WNR’s capital allocation discipline, including reinvestment in its businesses to grow EBITDA / cash flows, debt reduction and shareholder friendly focus; Western and Northern Tier Energy LP’s (“NTI”) plans and expectations with respect to a merger, including the anticipated benefits of the merger such as a diversified asset base with pipeline access to advantaged crude oil combined with strong refined product regions, potential financial and operational synergies, easier-to-understand financial reporting and valuation of equity, flexibility for potential NTI logistics assets drop-downs to Western Refining Logistics, LP (“WNRL”), lower cost of capital, and more competitive acquisition currency; the sources and uses of funding for the merger, and associated anticipated debt to EBITDA ratios, assumed closing price and outstanding units at merger; WNR’s access to attractive refined product locations, including the influence of the Gulf Coast, West Coast and Mid-Continent areas on margins at WNR’s refined product locations; WNR’s strong gross margin in comparison to its peers; growth opportunities at NTI’s St. Paul Park refinery, including organic projects such as the replacement of the crude unit desalters, modification to the crude unit/hydrotreater and solvent deasphalter and the anticipated capital expenditure and estimated operating income associated with such improvements, ability to improve gross margins by replacing Syncrude with WCS or Bakken, ability to increase crude oil throughput and upgrade crude unit bottoms to enhance FCC utilization; potential WNR and NTI logistics asset sales to WNRL, including the estimated annual Operating Income from such sales, which may include NTI traditional logistics assets such as storage tanks, terminals, pipelines and trucking operations, the economics associated with crude oil throughput on the TexNew Mex pipeline above 13,000 bpd, the Bobcat crude oil pipeline and associated crude oil terminals, the Jal/Wingate/Clearbrook crude oil and liquefied petroleum gas storage and rail logistics facilities, and a proposed, but currently deferred, crude oil pipeline from Wink, Texas to Crane, Texas; ability of WNR to meet its capital allocation priorities including debt reduction, returning cash to shareholders and capital projects; and, WNR’s strong dividend growth. These statements are subject to the risk that a merger between Western and NTI is not consummated at all, including due to the inability of Western or NTI to obtain all approvals necessary or the failure of other closing conditions, as well as to the general risks inherent in Western’s and NTI’s businesses and the merged company’s ability to compete in a highly competitive industry. Such expectations may or may not be realized and some expectations may be based upon assumptions or judgments that prove to be incorrect. In addition, Western’s business and operations involve numerous risks and uncertainties, many of which are beyond Western’s control, which could materially affect its financial condition, results of operations and cash flows and those of the merged company. Additional information relating to the uncertainties affecting Western’s businesses is contained in its filings with the Securities and Exchange Commission (the “SEC”). The forward-looking statements are only as of the date made, and Western does not undertake any obligation to (and each expressly disclaims any obligation to) update any forward- looking statements to reflect events or circumstances after the date such statements were made, or to reflect the occurrence of unanticipated events. Important Notice to Investors This communication does not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy

any securities or a solicitation of any vote or approval in any jurisdiction where such an offer, solicitation or sale is unlawful. Any such offer will be made only by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as

amended, and pursuant to a registration statement filed with the

SEC. This communication may be deemed to be solicitation material

in respect of the proposed merger of NTI and a subsidiary of Western. In connection with the proposed merger, Western filed with the SEC a Registration Statement on Form S-4 that includes a proxy statement of NTI that also constitutes a prospectus of Western. The

Registration Statement was declared effective by the SEC on May 23, 2016. NTI commenced mailing to its security holders a definitive proxy statement/prospectus on or about May 23, 2016. Western and NTI

also plan to file other documents with the SEC regarding the

proposed transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO

CAREFULLY READ THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS THAT HAVE BEEN FILED OR WILL BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT/PROSPECTUS.

Investors and security holders may obtain free copies of the

proxy statement/prospectus and other documents containing

important information about Western and NTI once such documents are filed with the SEC through the website maintained by the SEC at www.sec.gov.

Copies of the documents filed with the SEC by Western will be available free of

charge on Western's website at www.wnr.com under the "Investor Relations" section or by contacting Western's Investor Relations

Department at (602) 286-1530.

Copies of the documents filed with the SEC by NTI will be available free of

charge on NTI's website at www.northerntier.com under the "Investors" section or by contacting NTI's Investor Relations Department at (651) 769-6700. Participants in Solicitation Relating to the Merger Western, NTI and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of

proxies from the common unitholders of NTI in connection with the proposed merger. Information about the directors and executive officers of Western is set forth in the Proxy Statement on Schedule

14A for Western's 2016 annual meeting of shareholders, which was

filed with the SEC on April 22, 2016. Information about the

directors and executive officers of the general partner of NTI is set forth in the 2015 Annual Report on Form 10-K for NTI, which was filed with the SEC on February 26,

2016. These documents can be obtained free of charge from the sources indicated

above. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is contained in the proxy statement/prospectus and may be contained in other relevant

materials to be filed with the SEC when they become available. |

3 Investment Considerations Pipeline access to advantaged crude oil production Permian, Four Corners, Bakken and western Canada Historically strong refined product regions Attractive Refinery Locations Fully integrated crude oil pipeline system to serve refineries

Refined product distribution to wholesale

end-user Extensive retail network

Integrated

Distribution

Network

Two growth platforms: Refining and Logistics

Enhance refining profitability

Expand logistics footprint

Growth

Opportunities

Debt reduction

Reinvest in business to grow EBITDA/ cash flow

Shareholder friendly

Capital

Allocation

Discipline

Pipeline access to advantaged crude oil production

Permian, Four Corners, Bakken and western Canada

Historically strong refined product regions

Attractive

Refinery

Locations

Fully integrated crude oil pipeline system to serve

refineries Refined product distribution to wholesale

end-user Extensive retail network

Integrated

Distribution

Network

Two growth platforms: Refining and Logistics

Enhance refining profitability

Expand logistics footprint

Growth

Opportunities

Debt reduction

Reinvest in business to grow EBITDA/ cash flow

Shareholder friendly

Capital

Allocation

Discipline |

4 WNR/NTI Combination On December 21, 2015, WNR and Northern Tier Energy announced a merger on the

following terms:

Key benefits of the combination:

Diversified asset base with pipeline access to advantaged crude

oil combined with strong refined product

regions $10+ million in identified potential

financial/operational synergies Facilitates

easier-to-understand financial reporting and valuation of equity Provides more flexibility around pace of NTI logistic asset drop-downs to WNRL

Expected lower cost of capital and more competitive acquisition

currency WNR Shares per NTI Unit

0.2986

WNR Price (Oct 23, 2015)

44.68

$

Equity Value per NTI Unit

13.34

$

Cash per NTI Unit

15.00

$

Implied Consideration

28.34

$

Premium to NTI 20-day Undisturbed VWAP Price, as of October

23, 2015, was 18% |

5 Sources and Uses / Pro Forma Capitalization Table WNR Standalone Capitalization Table ($mm) As of 3-31-16 Adjustments Pro Forma 3-31-16 Cash & Cash Equivalents 1 566 $ (386) 180 $ $900 million Revolving Credit Facility - $

-

$

Term Loan Due 2020

538

538

Total Secured Debt

538

1,038

6.25% Senior Unsecured Note due 2021

350

350

New Term Loan

500

500

Total Debt

888

$

1,388

$

Credit Metrics

Total Debt/LTM Adjusted EBITDA

2

1.1x

1.4x

Net Debt/LTM Adjusted EBITDA

2

0.4x

1.2x

Total Secured Debt/LTM Adjusted EBITDA

2

0.7x

1.1x

1 Assumes 57,469,596 NTI units at a merger price of $15.00 plus

17,160,421 WNR shares to be issued assuming a closing price

of $19.10 on June 13, 2016.

($ in millions)

$

Sources

($mm)

Equity Issued to NTI Public Unitholders

328

$

New Term Loan

500

WNR Cash Used

386

Total Sources

1,214

$

Uses

Purchased Equity

1,190

$

Fees

24

Total Uses

1,214

1

($mm)

Note: Debt levels shown exclude unamortized financing

costs. 1

Includes restricted cash of $37 million

2

Adjusted EBITDA includes cash distributions from NTI and WNRL,

see Appendix for reconciliation and

definition of Adjusted EBITDA. Pro Forma Adjusted EBITDA

includes $214 million of distributions to non-

controlling interest.

|

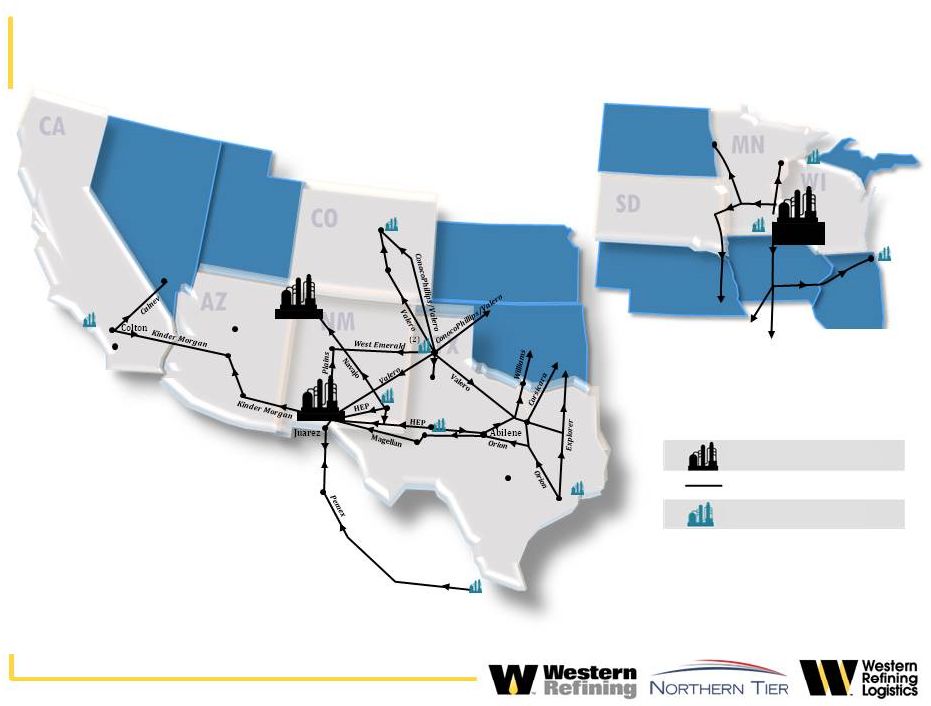

6 Diversified Asset Base WNR/ WNRL Combined with NTI Refineries 2 3 Capacity (bpd) 156,000 253,800 Basin Exposure Permian, Four Corners Bakken, Canada, Permian, Four Corners Retail Stores 1 258 541 Pipelines (miles) 2 725 1,025 Storage (mm bbls) 8.2 12.0 1 Includes 114 NTI franchised SuperAmerica Stores. 2 NTI has a 17% interest in the Minnesota Pipeline. Bakken Formation Permian Basin San Juan Basin El Paso Gallup St. Paul Park Clearbrook Phoenix WNR/WNRL/NTI Pipelines 2 Crane Mason Station Wink Excellent Access to Advantaged Crude Basins |

7 St. Paul Park Attractive Refined Product Locations Gulf Coast (28) Wichita Falls Midland Dallas Cadereyta Abilene Houston Mexico Chihuahua Austin Colorado Springs Albuquerque Flagstaff Tuscon Odessa Lubbock Artesia Bloomfield Los Angeles Area Las Vegas San Diego Amarillo Crane (6) El Paso Gallup WNR/NTI Refinery Third-Party Refinery Third party Product Pipeline Phoenix Williams Magellan Pipeline System Chicago Area Gulf Coast, West Coast and Mid-Continent Areas Strongly Influence Margins |

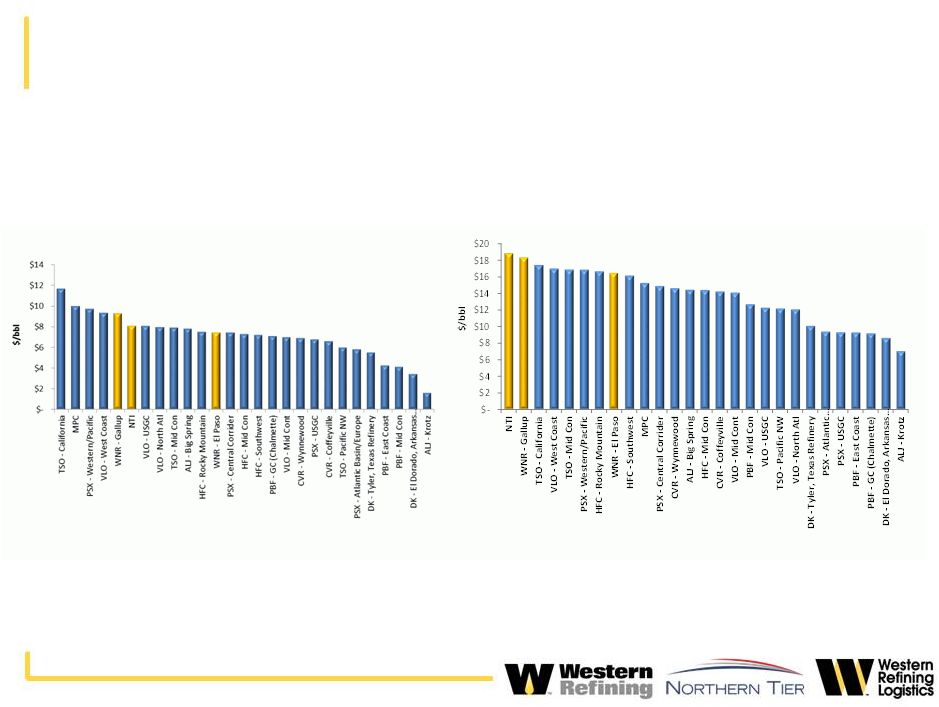

8 Independent Refineries Gross Profit Comparison Source: Company Filings Western and NTI have top quartile refineries FY 2015 Gross Profit Per Throughput Barrel Q1 2016 Gross Profit Per Throughput Barrel |

9 WNRL Asset Base • 685 miles of pipelines and gathering systems in the Southwestern U.S. • 8.2 million barrels of active storage capacity for refined products, crude oil and other products • Four refined products terminals • Four fee-based asphalt terminalling facilities • Wholesale fuel / lubricant distribution • Crude oil / asphalt trucking Refined Products Terminal WNRL Pipelines Third Party Pipeline WNR Refineries Asphalt Plant/Terminal Transportation & Storage |

10 Growth Opportunities Refinery Investments Project Capital ($ mm) Est Operating Income ($ mm) Replace Crude Unit Desalters $ 30 $ 22 Crude Unit/Hydrotreater Modification 19 10 Solvent Deasphalter 63 27 $ 112 $ 59 St. Paul Park organic projects -5 0 5 10 15 20 25 30 35 Jan-11 Jul-11 Jan-12 Jul-12 Jan-13 Jul-13 Jan-14 Jul-14 Jan-15 Jul-15 Jan-16 $/bbl Historic Incremental Crude Margins Syncrude & North Dakota Light Syncrude North Dakota Light Avg Syncrude Avg North Dakota Light Replace 10mbpd Syncrude with WCS or Bakken Increase crude oil throughput by 4mbpd and diesel recovery by 2% Upgrade crude unit bottoms to gas/diesel to fill underutilized FCC unit Note: Operating income excludes depreciation and amortization.

$5 -

$7/bbl

gross margin

improvement |

11 Growth Opportunities WNR/NTI Potential Logistics Sales to WNRL Project Description Northern Tier (Traditional Logistics) Storage tanks / Terminals / Pipelines / Trucking TexNew Mex Crude Oil Pipeline (WNR) Economics associated with crude oil throughput on TexNew Mex

pipeline above 13,000 bpd (TexNew Mex Units)

Bobcat Crude Oil

Pipeline

(WNR)

40 mile crude oil pipeline flowing from Mason Station, TX to

Wink, TX plus two crude oil terminals

Jal / Wingate /

Clearbrook

(WNR)

Crude oil and LPG storage; rail logistics

Wink to Crane

Crude Oil Pipeline

(WNR)

Proposed ~60 mile crude oil pipeline connecting Wink Jackrabbit

Station to Crane, TX [Project currently

deferred] $100 -

$125 mm annual Operating Income potential

Note: Operating income excludes depreciation and

amortization. |

12 Capital Allocation Priority Debt reduction Operational cash flow Asset sales to WNRL WNRL/ NTI distributions Returning cash to shareholders Dividends Share repurchase Capital projects |

13 Investment Considerations Pipeline access to advantaged crude oil production Permian, Four Corners, Bakken and western Canada Historically strong refined product regions Attractive Refinery Locations Fully integrated crude oil pipeline system to serve refineries

Refined product distribution to wholesale

end-user Extensive retail network

Integrated

Distribution

Network

Two growth platforms: Refining and Logistics

Enhance refining profitability

Expand logistics footprint

Growth

Opportunities

Debt reduction

Reinvest in business to grow EBITDA/ cash flow

Shareholder friendly

Capital

Allocation

Discipline

Pipeline access to advantaged crude oil production

Permian, Four Corners, Bakken and western Canada

Historically strong refined product regions

Attractive

Refinery

Locations

Fully integrated crude oil pipeline system to serve

refineries Refined product distribution to wholesale

end-user Extensive retail network

Integrated

Distribution

Network

Two growth platforms: Refining and Logistics

Enhance refining profitability

Expand logistics footprint

Growth

Opportunities

Debt reduction

Reinvest in business to grow EBITDA/ cash flow

Shareholder friendly

Capital

Allocation

Discipline |

Appendix |

15 WNR Consolidated Adjusted EBITDA Reconciliation Three Month Period Ending Twelve Months Ended (In thousands) Consolidated Western Refining, Inc. June 2015 Sep 2015 Dec 2015 Mar 2016 Mar 2016 Net income attributable to Western Refining, Inc. $ 133,919 $ 153,303 $ 13,545 $ 30,538 $ 331,305 Net income attributable to non-controlling interests 79,948 64,795 (6,047) 9,047 147,743 Interest and debt expense 27,316 26,896 26,434 26,681 107,327 Provision for income taxes 78,435 92,117 (6,034) 18,629 183,147 Depreciation and amortization 51,143 51,377 52,845 52,651 208,016 Maintenance turnaround expense 593 490 836 125 2,044 Loss (gain) on disposal of assets, net (387) (52) 208 (130 (361) Net change in lower of cost or market inventory reserve (38,204) 36,795 113,667 (51,734 60,524 Unrealized (gain) loss on commodity hedging transactions 22,287 (271) 8,160 12,483 42,659 Adjusted EBITDA 1 $ 355,050 $ 425,450 $ 203,614 $ 98,290 $ 1,082,404 1 See page 18 for definition of Adjusted EBITDA |

16 WNR Standalone Adjusted EBITDA Reconciliation Three Month Period Ending Twelve Months Ended (In thousands) Jun-15 Sep-15 Dec-15 Mar-16 Mar-16 Net income attributable to Western Refining, Inc. $ 74,904 $ 102,279 $ 9,840

$

18,010

$

205,033 Net income attributable to

non-controlling interest -

-

-

-

-

Interest and debt expense

14,321

13,960

14,310

13,879

56,470

Provision for income taxes

78,287

92,114

(5,727)

18,368

183,042

Depreciation and amortization

26,891

26,648

26,257

25,538

105,334

Maintenance turnaround expense

593

490

836

125

2,044

Loss (gain) on disposal of assets, net

69

(6)

176

(26)

213

Net change in lower of cost or market inventory

reserve -

-

40,689

(40,689)

-

Unrealized (gain) loss on commodity hedging

transactions 22,795

(1,531)

3,024

16,271

40,559

Adjusted EBITDA

1

217,860

233,954

89,405

51,476

592,695

Distributions from WNRL

10,902

11,628

12,611

13,392

48,533

Distributions from NTI

38,472

42,391

37,047

13,537

131,447

Adjusted EBITDA plus distributions

$ 267,234

$ 287,973

$ 139,063

$ 78,405

$

772,675

1 See page 18 for definition of Adjusted EBITDA |

17 NTI Adjusted EBITDA Reconciliation Three Month Period Ending Twelve Months Ended (In thousands) Jun-15 Sep-15 Dec-15 Mar-16 Mar-16 Net income attributable to Western Refining, Inc. $ 48,490 $ 40,117 $ (6,141) $ 3,224 $

85,690

Net income attributable to non-controlling

interest 74,558

59,209

(11,043)

4,344

127,068

Interest

and debt expense

6,747

6,732

5,433

5,750

24,662

Provision for income taxes

-

-

-

-

-

Depreciation and amortization

19,515

19,746

20,111

19,969

79,341

Maintenance turnaround expense

-

-

-

-

-

Loss on extinguishment of debt

-

-

-

-

-

Loss (gain) on disposal of assets, net

(296)

(33)

53

(5)

(281)

Net change in lower of cost or market inventory

reserve (38,204)

36,795

72,978

(11,045)

60,524

Unrealized (gain) loss on commodity hedging

transactions (508)

1,260

5,136

(3,788)

2,100

Adjusted EBITDA

1

$

110,302

$ 163,826

$

86,527

$

18,449

$

379,104 1

See page 18 for definition of

Adjusted

EBITDA |

18 Adjusted EBITDA Adjusted EBITDA represents earnings before interest and debt expense, provision for income taxes, depreciation,

amortization, maintenance turnaround expense and

certain other non-cash income and expense items. However, Adjusted EBITDA is not a recognized measurement under U.S. generally accepted accounting principles ("GAAP"). Our management believes that the

presentation of Adjusted EBITDA is useful to

investors because it is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry. In addition, our management believes that Adjusted EBITDA is useful in evaluating our

operating performance compared to that of other

companies in our industry because the calculation of Adjusted EBITDA generally eliminates the effects of financings, income taxes, the accounting effects of significant turnaround activities (that many of our

competitors capitalize and thereby exclude from

their measures of EBITDA) and certain non-cash charges that are items that may vary for different companies for reasons unrelated to overall operating performance. The tables on the previous pages reconcile net income to Adjusted EBITDA for the periods presented. • Adjusted EBITDA does not reflect our cash expenditures or future requirements for significant turnaround activities, capital

expenditures or contractual

commitments; •

Adjusted EBITDA does not reflect the interest expense or the cash

requirements necessary to service interest or principal payments on our debt; • Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs; and

• Adjusted EBITDA, as we calculate it, may differ from the Adjusted EBITDA calculations of other companies in our industry,

thereby limiting its usefulness as a comparative

measure. Adjusted EBITDA has limitations as an

analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

Because of these limitations, Adjusted EBITDA should not be considered a measure of discretionary cash available to us to

invest in the growth of our business. We compensate

for these limitations by relying primarily on our GAAP results and using Adjusted EBITDA only supplementally. |

19 WNRL EBITDA Reconciliation Three Month Period Ending Twelve Months Ended (In thousands) Jun-15 Sep-15 Dec-15 Mar-16 Mar-16 Net income attributable to Western Refining, Inc. $ 10,525 $ 10,907 $ 9,846

$

9,304

$

40,582 Net income

attributable to non-controlling interest

5,390

5,586

4,996

4,703

20,675

Interest and debt expense

6,248

6,204

6,691

7,052

26,195

Provision for income taxes

148

3

(307)

261

105

Depreciation and amortization

4,737

4,983

6,477

7,144

23,341

Loss (gain) on disposal of assets, net

(160)

(13)

(21)

(99)

(293)

EBITDA

1

$ 26,888

$ 27,670

$ 27,682

$ 28,365

$

110,605 1

See page 20 for definition of

EBITDA |

20 EBITDA We define EBITDA as earnings before interest and debt expense, provision for income taxes and depreciation and amortization.

We define Distributable Cash Flow as EBITDA plus the

change in deferred revenues, less debt interest accruals, income taxes paid, maintenance capital expenditures and distributions declared on our TexNew Mex units. EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are: • EBITDA does not reflect our cash expenditures or future requirements for capital expenditures or contractual

commitments; •

EBITDA does not reflect the interest expense or the cash

requirements necessary to service interest or principal payments on our debt; • EBITDA does not reflect changes in, or cash requirements for, our working capital needs; and

• EBITDA, as we calculate it, may differ from the EBITDA calculations of our affiliates or other companies in our industry,

thereby limiting its usefulness as a comparative

measure. EBITDA and Distributable Cash Flow are used

as supplemental financial measures by management and by external users of our financial statements, such as investors and commercial banks, to assess:

• our operating performance as compared to those of other companies in the midstream energy industry, without regard to

financial methods, historical cost basis or capital

structure; •

the ability of our assets to generate sufficient cash to make

distributions to our unitholders; •

our ability to incur and service debt and fund capital

expenditures; and •

the viability of acquisitions and other capital expenditure

projects and the returns on investment of various investment opportunities. Distributable Cash Flow is also a quantitative standard used by the investment community with respect to publicly traded

partnerships because

the

value

of

a

partnership

unit

is,

in

part,

measured

by

its

yield.

Yield

is

based

on

the

amount

of

cash

distributions

a

partnership

can

pay to a unitholder.

We believe that the presentation of these non-GAAP measures

provides useful information to investors in assessing our financial condition and results of operations. The GAAP measure most directly comparable to EBITDA and Distributable Cash Flow is net income

attributable to limited partners. These non-GAAP

measures should not be considered as alternatives to net income or any other measure of financial performance presented in accordance with GAAP. EBITDA excludes some, but not all, items that affect net income attributable

to limited partners. These non-GAAP measures may

vary from those of other companies. As a result, EBITDA and Distributable Cash Flow as presented herein may not be comparable to similarly titled measures of other companies. |

|

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- 420 with CNW — Study Enumerates Therapeutic Effects, Quality of Life Benefits of Medical Cannabis

- USCB Financial Holdings, Inc. Reports Diluted EPS of $0.23 for Q1 2024 and Announces Adoption of New 500,000 Share Repurchase Program

- Phillips Edison & Company Reports First Quarter 2024 Results and Affirms Full Year Earnings Guidance

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share